Assessment of capital requirements powerpoint presentation slides

Understand the need for fixed capital investment by employing Assessment Of Capital Requirements PowerPoint Presentation Slides. The presentation explains the topics like current situation analysis of the company and the need for fixed capital evaluation in an effective way. Display the factors affecting the requirements of fixed capital with these PPT slides. Techniques considered to evaluate fixed capital, and implementation plans can also be showcased with the help of these PPT templates. Showcase the factors affecting the requirement of fixed capital by using financial adequacy assessment PPT visuals. Discuss sources of fixed capital, and techniques to evaluate it by using our professionally designed assessment PPT templates. You can present the sources of fixed capital with its features. The sources include issues of shares, issues of right shares, private placement of shares, issues of debentures, term loans, and lease financing. Hence download the readily available financial assessment PPT slideshow to discuss factors affecting the capital requirements of your company.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

It covers all the important concepts and has relevant templates which cater to your business needs. This complete deck has PPT slides on Assessment Of Capital Requirements Powerpoint Presentation Slides with well suited graphics and subject driven content. This deck consists of total of fourty four slides. All templates are completely editable for your convenience. You can change the colour, text and font size of these slides. You can add or delete the content as per your requirement. Get access to this professionally designed complete deck presentation by clicking the download button below.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Assessment of Capital Requirements. State your Company name and begin.

Slide 2: This slide showcases Agenda.

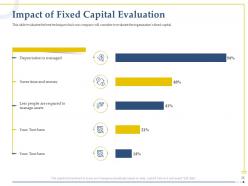

Slide 3: This slide displays Table of Contents.

Slide 4: This slide displays Table of Contents of the presentation.

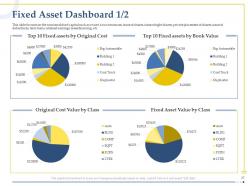

Slide 5: The purpose of this slide is to provide a glimpse of the problems faced by our company at present due to capital budgeting, fixed asset turnover ratio, asset management practices, etc.

Slide 6: This graph illustrates the decreasing fixed asset turnover ratio of the company over past years due to underutilization of fixed assets.

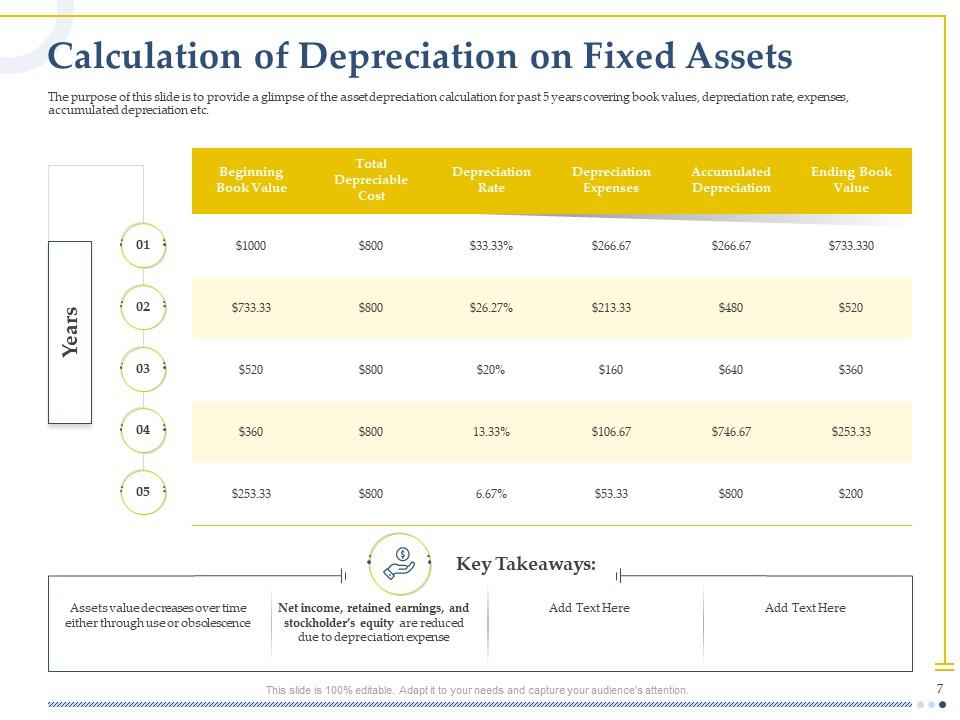

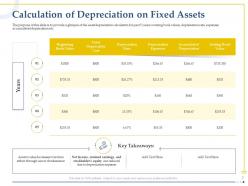

Slide 7: The purpose of this slide is to provide a glimpse of the asset depreciation calculation for past 5 years covering book values, depreciation rate, expenses, accumulated depreciation etc.

Slide 8: This slide displays Table of Contents.

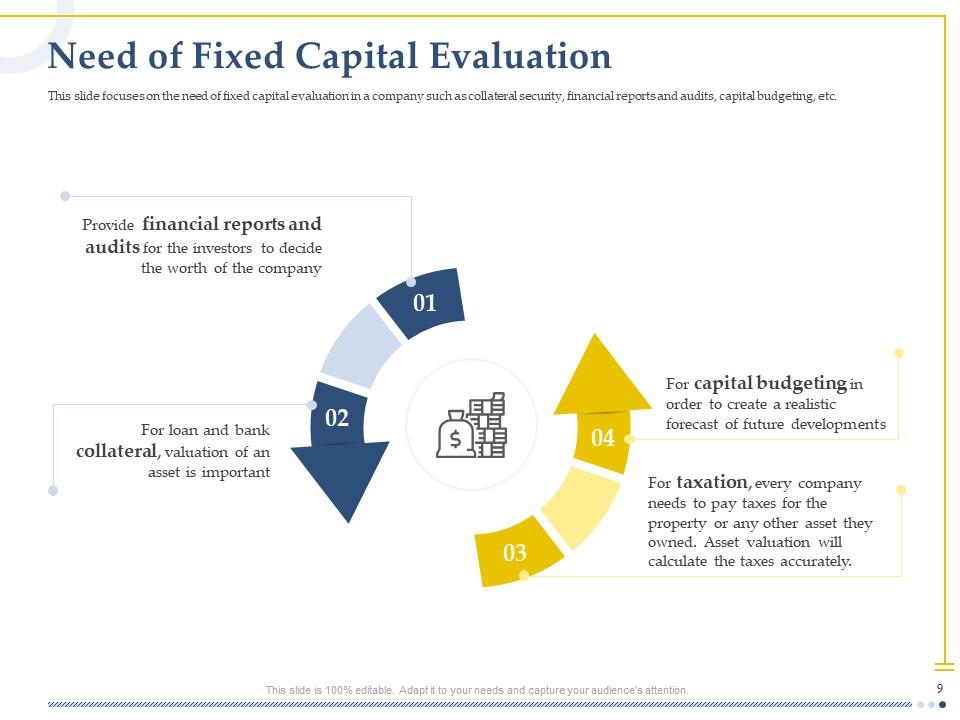

Slide 9: This slide focuses on the need of fixed capital evaluation in a company such as collateral security, financial reports and audits, capital budgeting, etc.

Slide 10: This slide shows Table of Contents

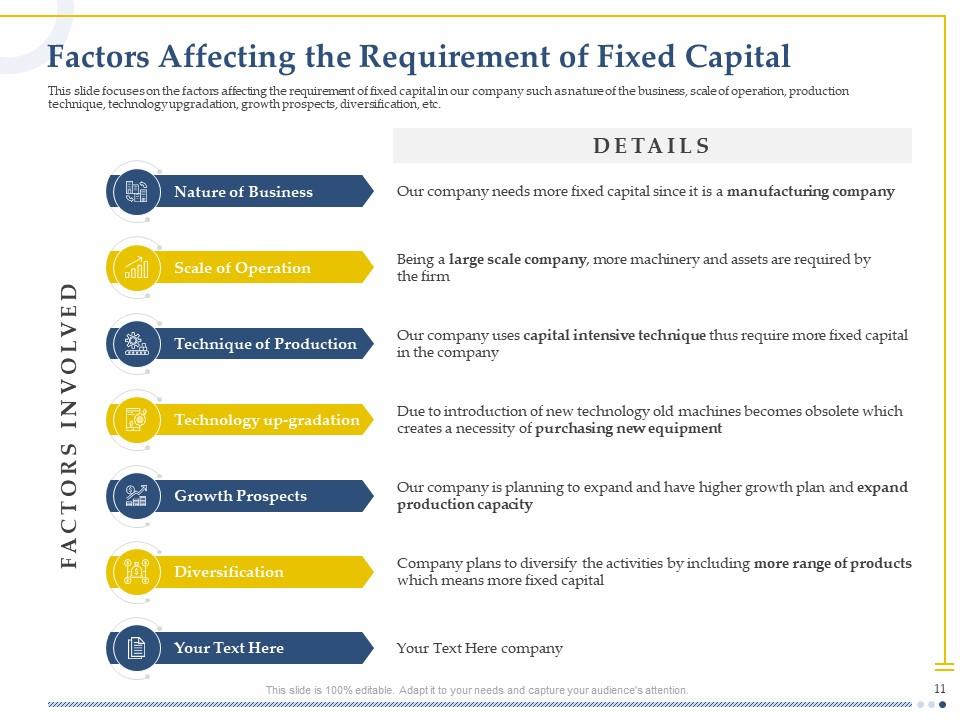

Slide 11: This slide focuses on the factors affecting the requirement of fixed capital in our company such as nature of the business, scale of operation, production technique, technology upgradation, growth prospects, diversification, etc.

Slide 12: This slide displays Table of Contents

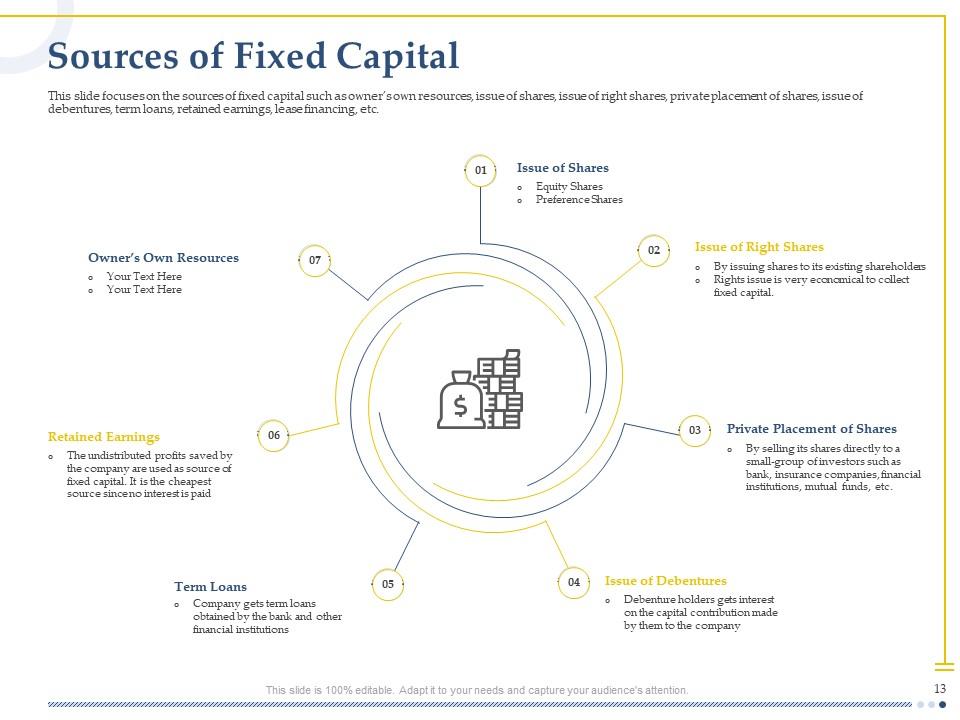

Slide 13: This slide focuses on the sources of fixed capital such as owner’s own resources, issue of shares, issue of right shares, private placement of shares, issue of debentures, term loans, retained earnings, lease financing, etc.

Slide 14: This slide displays Table of Contents

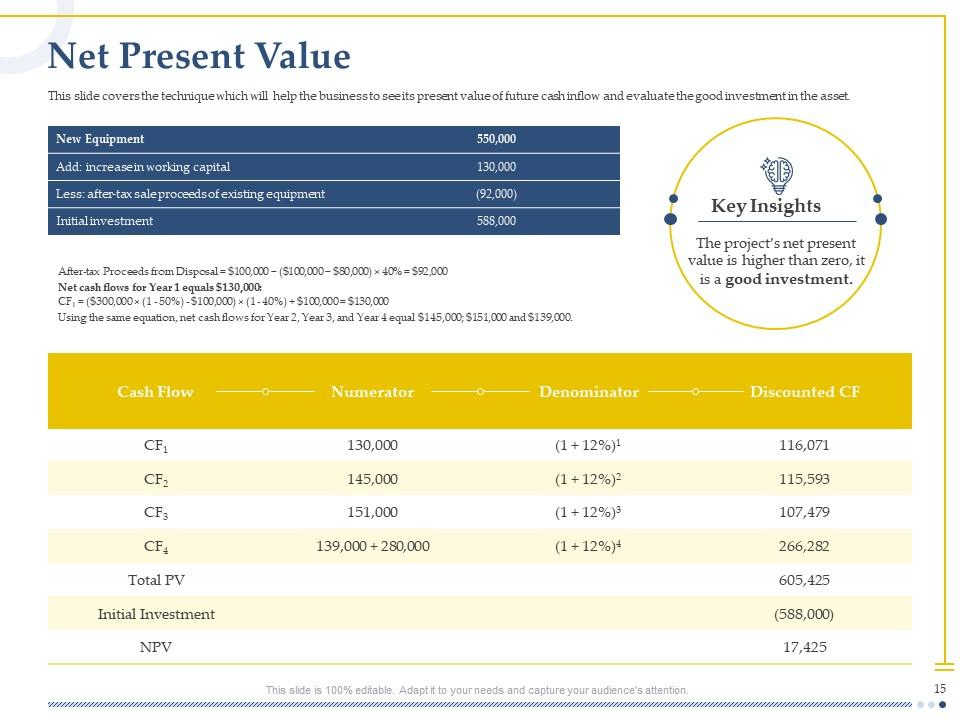

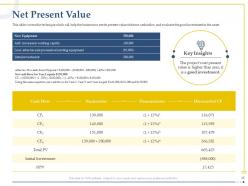

Slide 15: This slide covers the technique which will help the business to see its present value of future cash inflow and evaluate the good investment in the asset.

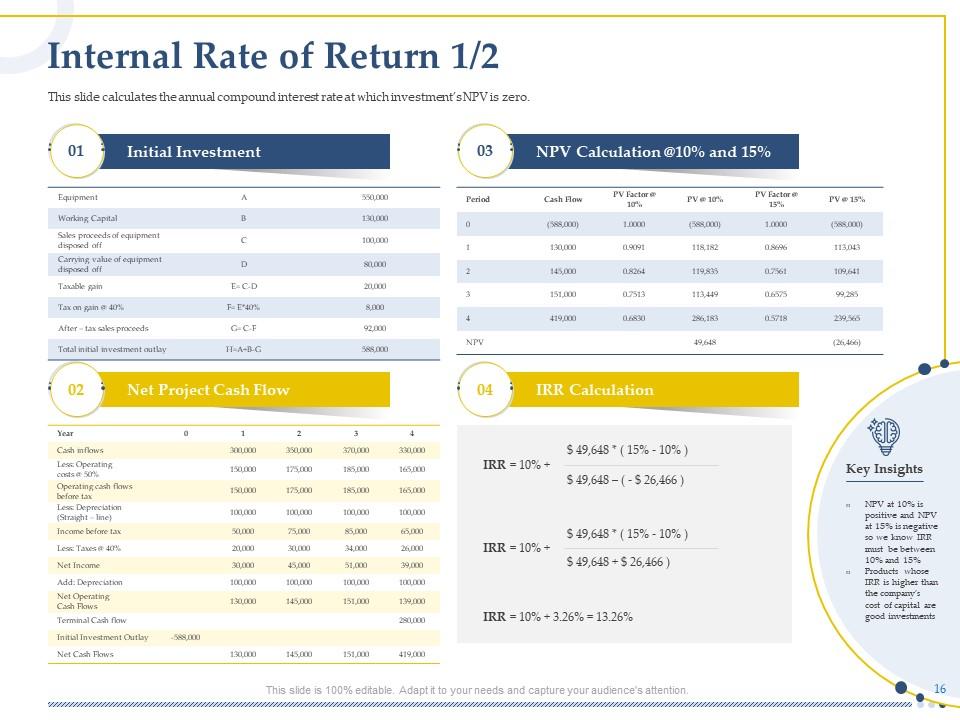

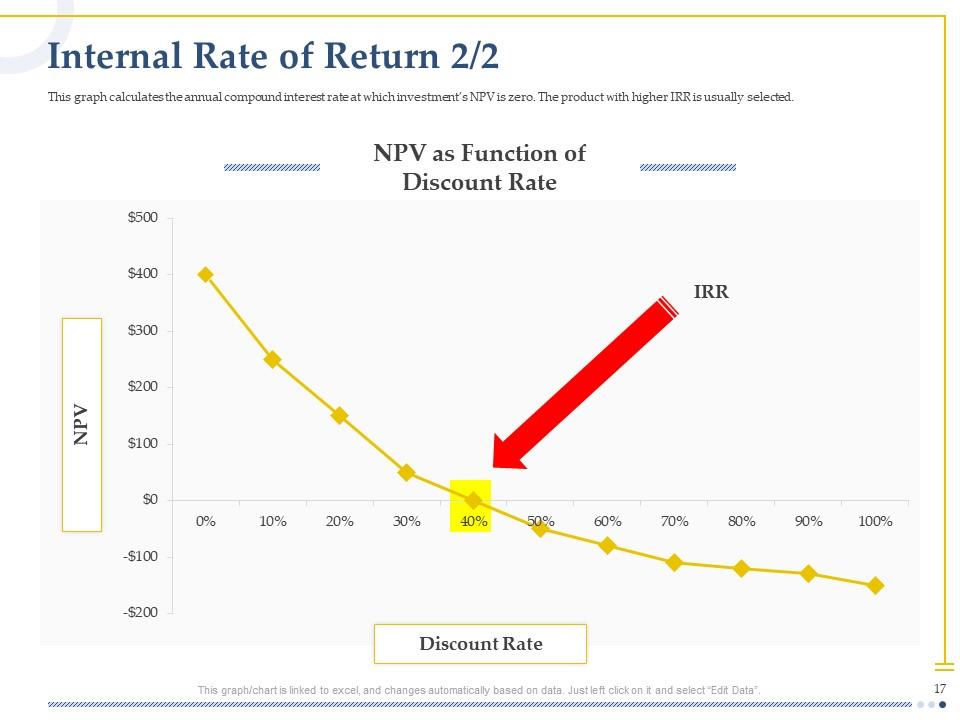

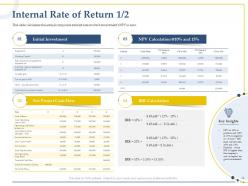

Slide 16: This slide calculates the annual compound interest rate at which investment’s NPV is zero.

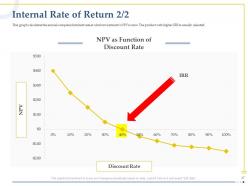

Slide 17: This graph calculates the annual compound interest rate at which investment’s NPV is zero. The product with higher IRR is usually selected.

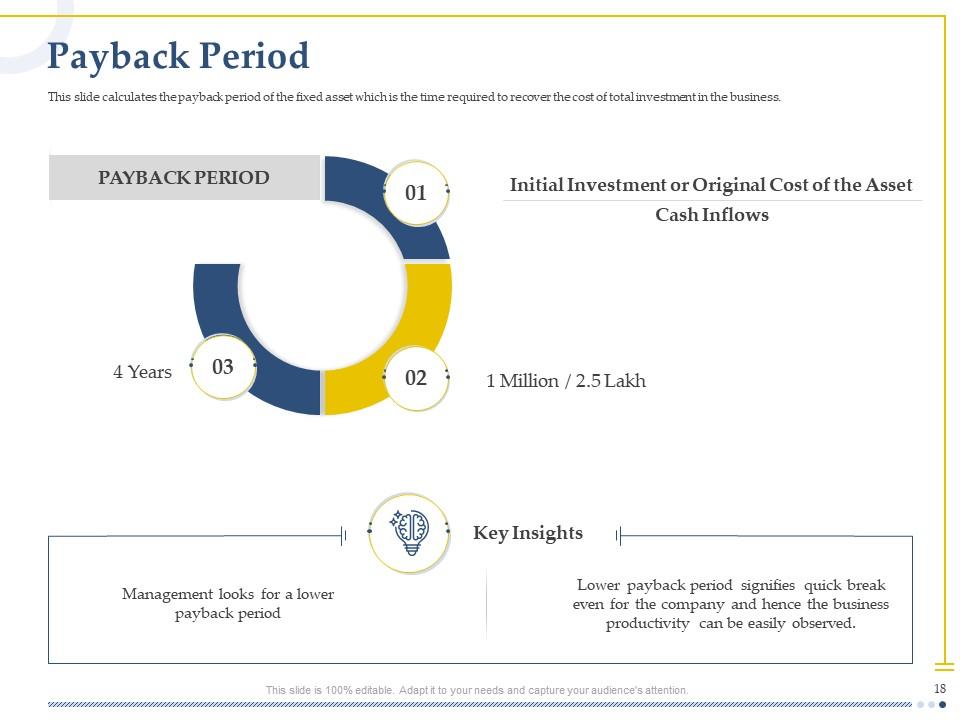

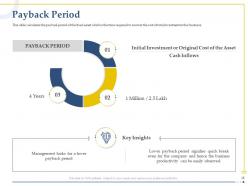

Slide 18: This slide calculates the payback period of the fixed asset which is the time required to recover the cost of total investment in the business.

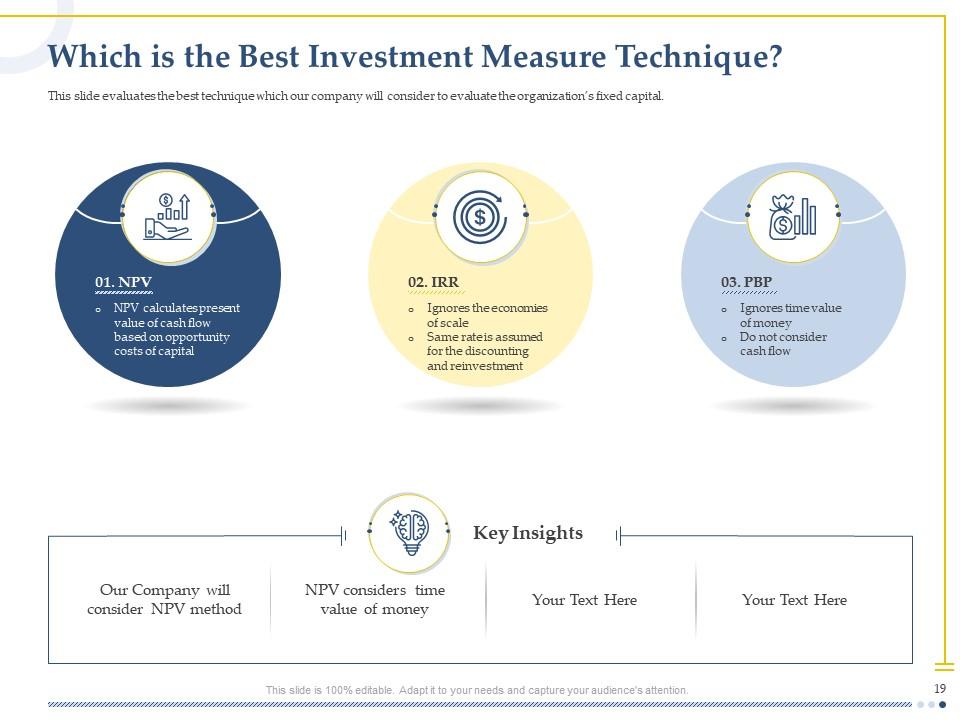

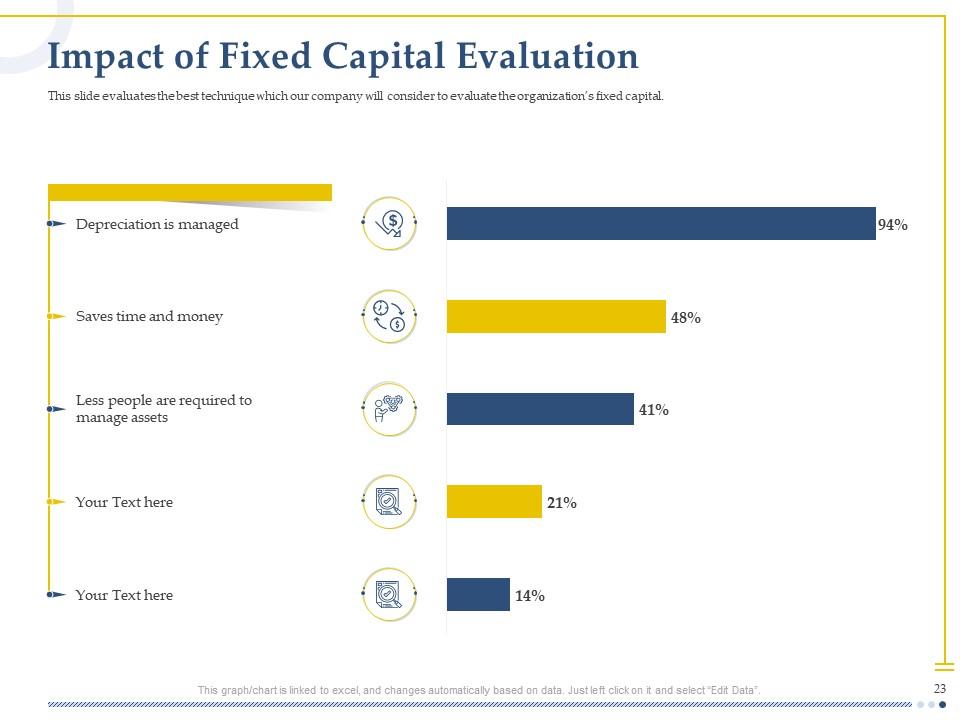

Slide 19: This slide evaluates the best technique which our company will consider to evaluate the organization’s fixed capital.

Slide 20: This slide displays Table of Contents.

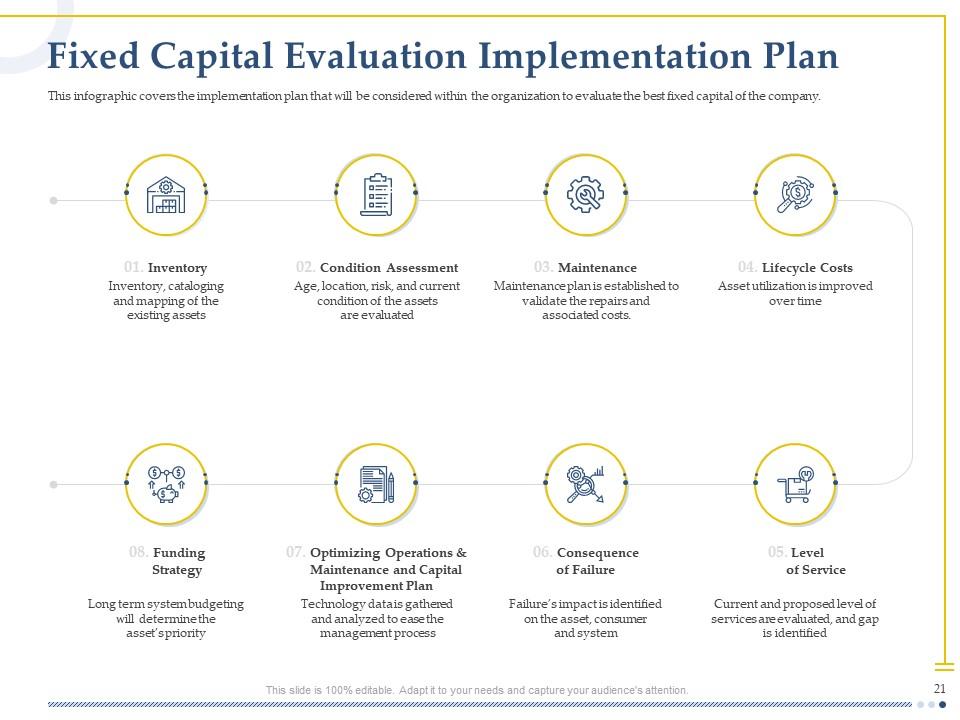

Slide 21: This infographic covers the implementation plan that will be considered within the organization to evaluate the best fixed capital of the company.

Slide 22: This slide displays Table of Contents.

Slide 23: This slide evaluates the best technique which our company will consider to evaluate the organization’s fixed capital.

Slide 24: This slide displays Table of Contents.

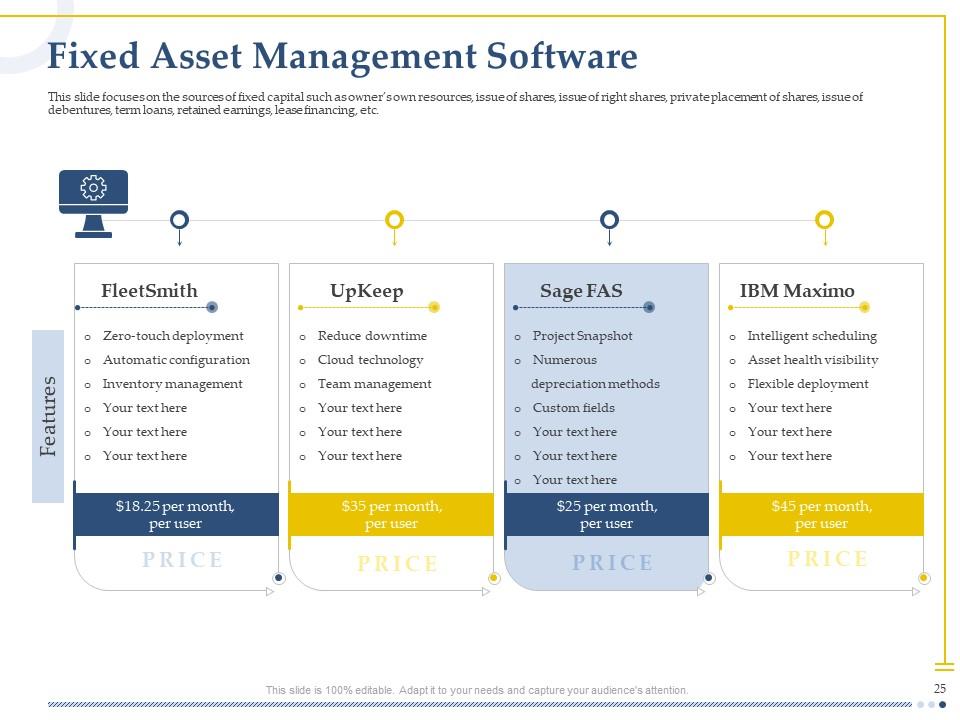

Slide 25: This slide focuses on the sources of fixed capital such as owner’s own resources, issue of shares, issue of right shares, private placement of shares, issue of debentures, term loans, retained earnings, lease financing, etc.

Slide 26: This slide displays Table of Contents.

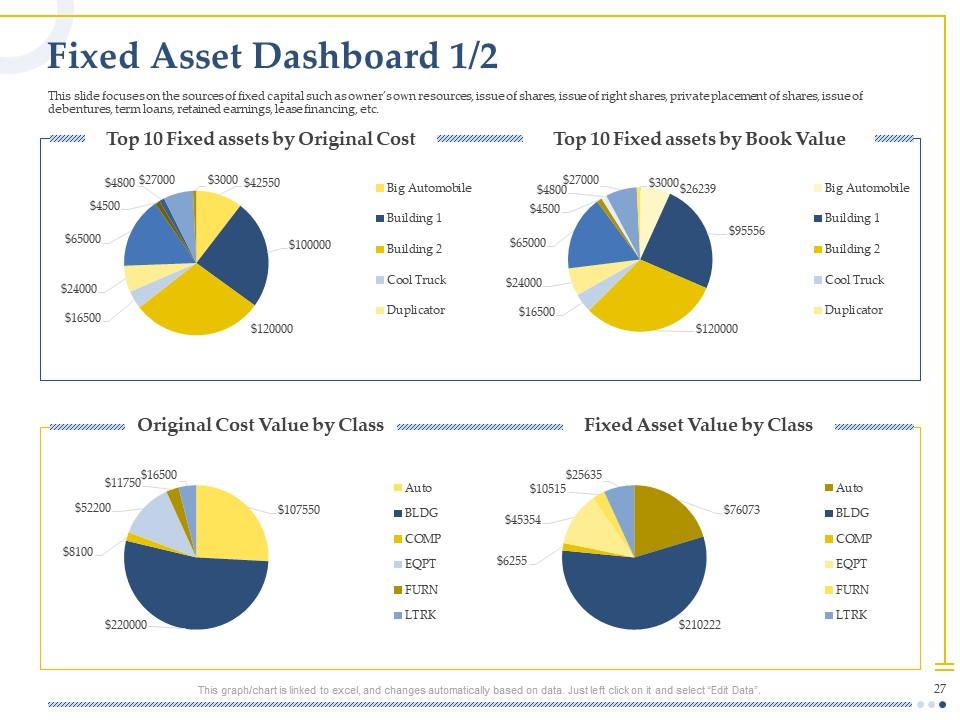

Slide 27: This slide focuses on the sources of fixed capital such as owner’s own resources, issue of shares, issue of right shares, private placement of shares, issue of debentures, term loans, retained earnings, lease financing, etc.

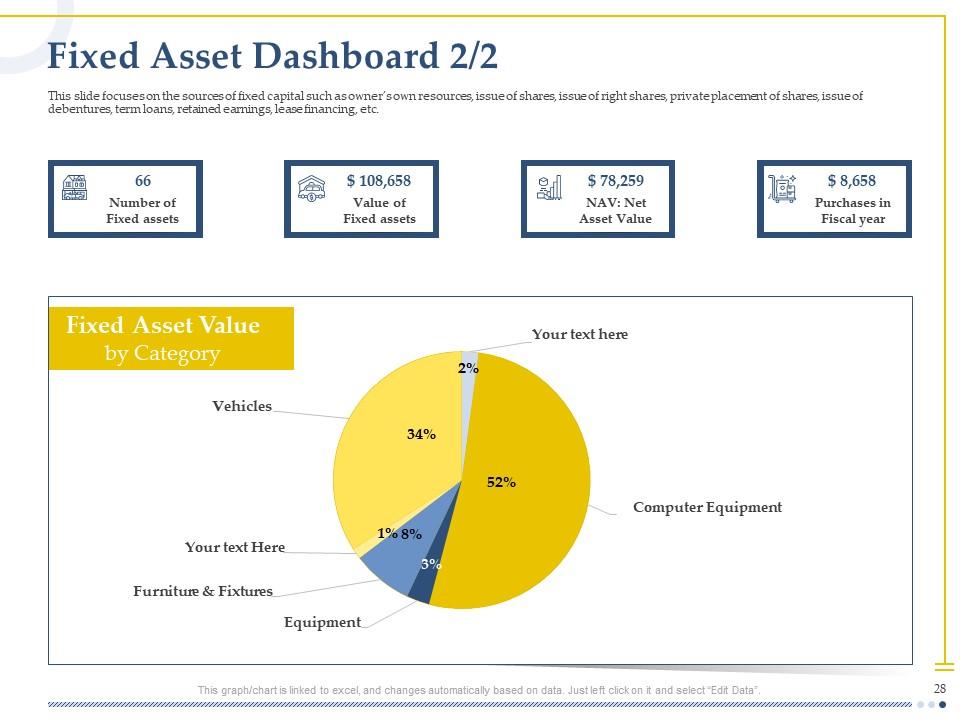

Slide 28: This slide focuses on the sources of fixed capital such as owner’s own resources, issue of shares, issue of right shares, private placement of shares, issue of debentures, term loans, retained earnings, lease financing, etc.

Slide 29: This is Icons Slide for Assessment of Capital Requirements.

Slide 30: This slide is titled as Additonal Slides for moving forward.

Slide 31: This slide displays Bar Graph with Product Comparison.

Slide 32: This slide displays Mission, Vision and Goals.

Slide 33: This is About Us slide to showcase Company specifications.

Slide 34: This is Our team slide with Names and Designations.

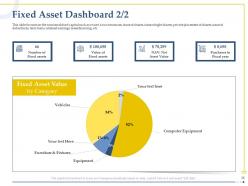

Slide 35: This slide shows Finance related stuff.

Slide 36: This slide displays Timeline process.

Slide 37: This slide shows Circular Diagram

Slide 38: This is Idea Generation slide.

Slide 39: This slide is titled as Post It Notes. Post your important notes.

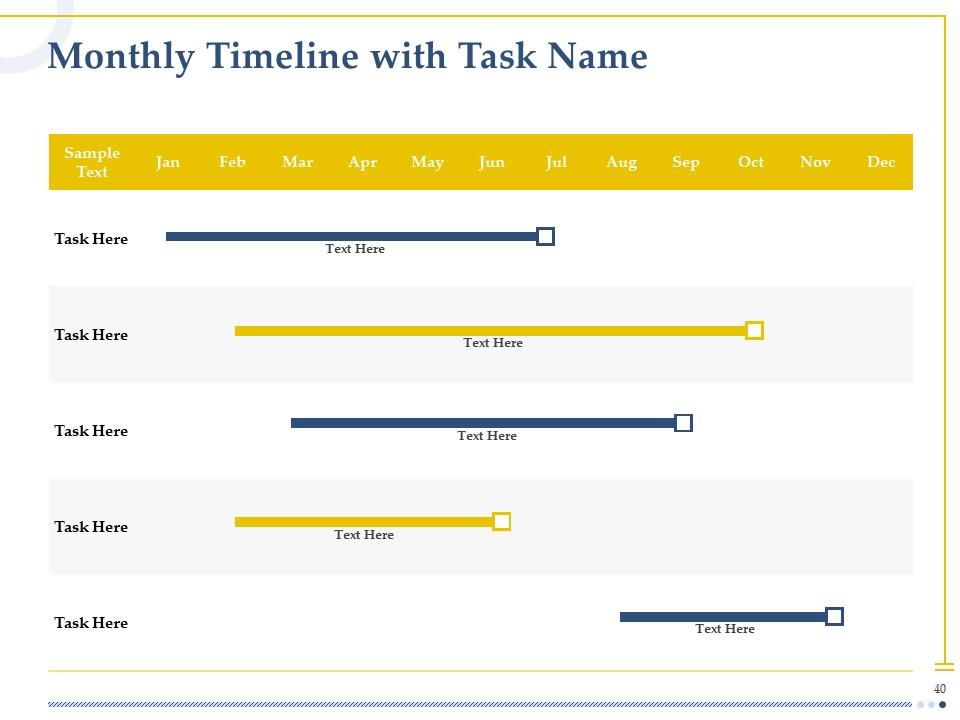

Slide 40: This slide shows Monthly Timeline with Task Name

Slide 41: This is 30 60 90 Days Plan slide.

Slide 42: This slide displays Comparison between Male and female users.

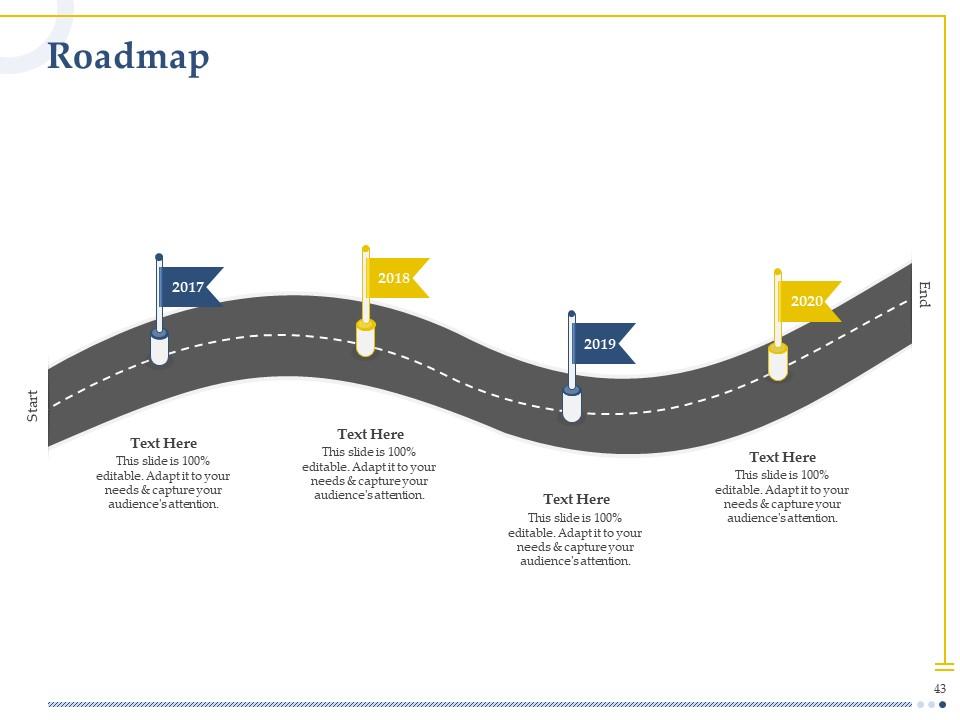

Slide 43: This slide shows Roadmap process.

Slide 44: This is Thank you slide with Contact details.

Assessment of capital requirements powerpoint presentation slides with all 44 slides:

Use our Assessment Of Capital Requirements Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Qualitative and comprehensive slides.

-

Good research work and creative work done on every template.

-

Good research work and creative work done on every template.

-

Helpful product design for delivering presentation.

-

Great product with effective design. Helped a lot in our corporate presentations. Easy to edit and stunning visuals.