Blockchain Application In Finance Venture Capital Training Ppt

This set of slides provides information on blockchain technology applications in venture capital. It covers the key features of venture capital investments and their existing problems time-consuming and high cost. Further,it includes how blockchain as a solution can help in overcoming these with ICO Initial Coin Offerings,IEO Initial Exchange Offerings,ETO Equity Token Offerings,and STO Security Token Offerings.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

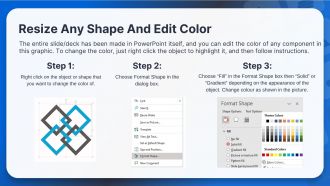

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

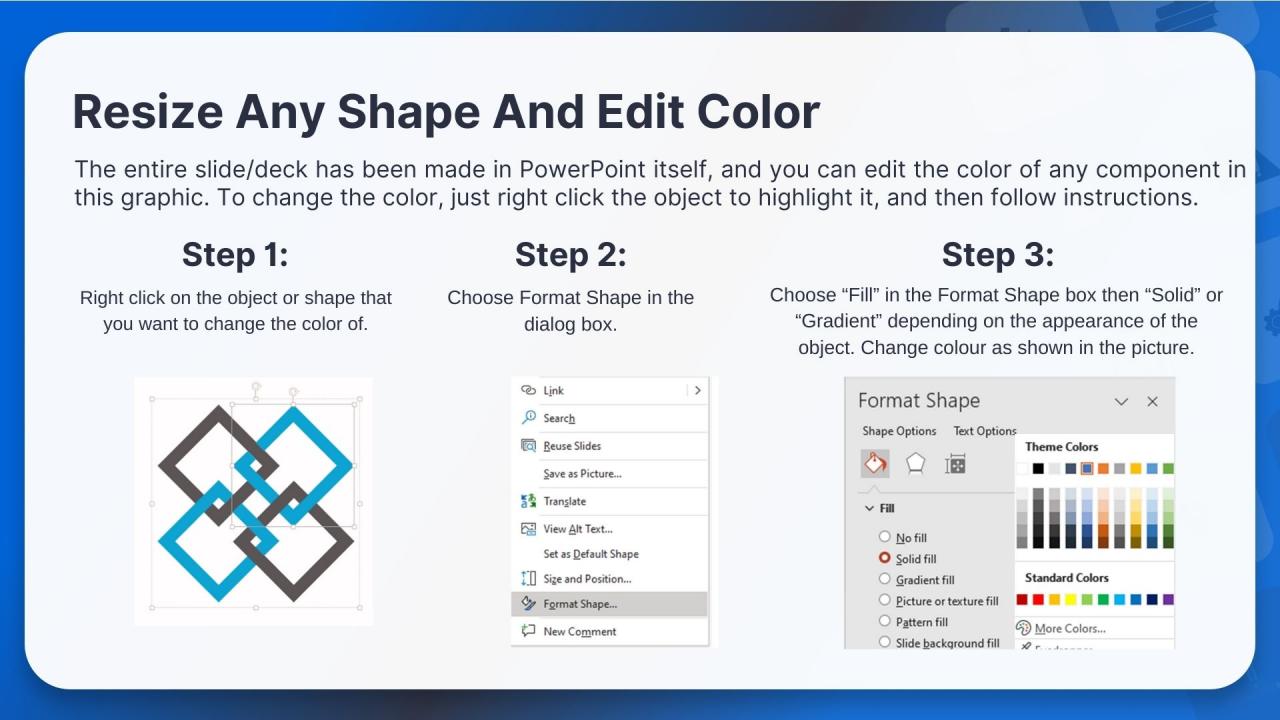

PowerPoint presentation slides

Presenting Blockchain Application in Finance Venture Capital. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. You can add or delete the content as per your need.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide describes the concept of Venture Capital. It is a type of financing to businesses and entrepreneurs as an investment. Venture capitalists provide it to businesses which they think have long-term growth potential. This is usually a process that runs in phases.

Instructor’s Notes:

Venture capital has grown from a marginal activity at the end of World War II to a complex business with actors who play a crucial role in fostering innovation.

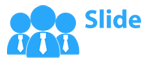

Slide 2

This slide lists the various benefits of investments made by venture capitalists for start-ups. The advantages include equity participation & capital gains, base for building networks, help in raising additional capital, providing opportunities for expansion of business, and valuable guidance.

Slide 3

This slide lists the two major issues the traditional venture capital industry faces, which makes it highly inefficient. These issues are that the entire fundraising process is highly time-consuming and costly.

Instructor’s Notes:

The traditional venture capital sector has an inefficient structure steeped in secrecy and mystery. A group of investors with access to proprietary deal flow spend a lot of time soliciting and deploying funds that authorized investors (LPs) provide. This causes a lot of unwarranted delay at every stage of the approval process. In the end, it costs both time and money.

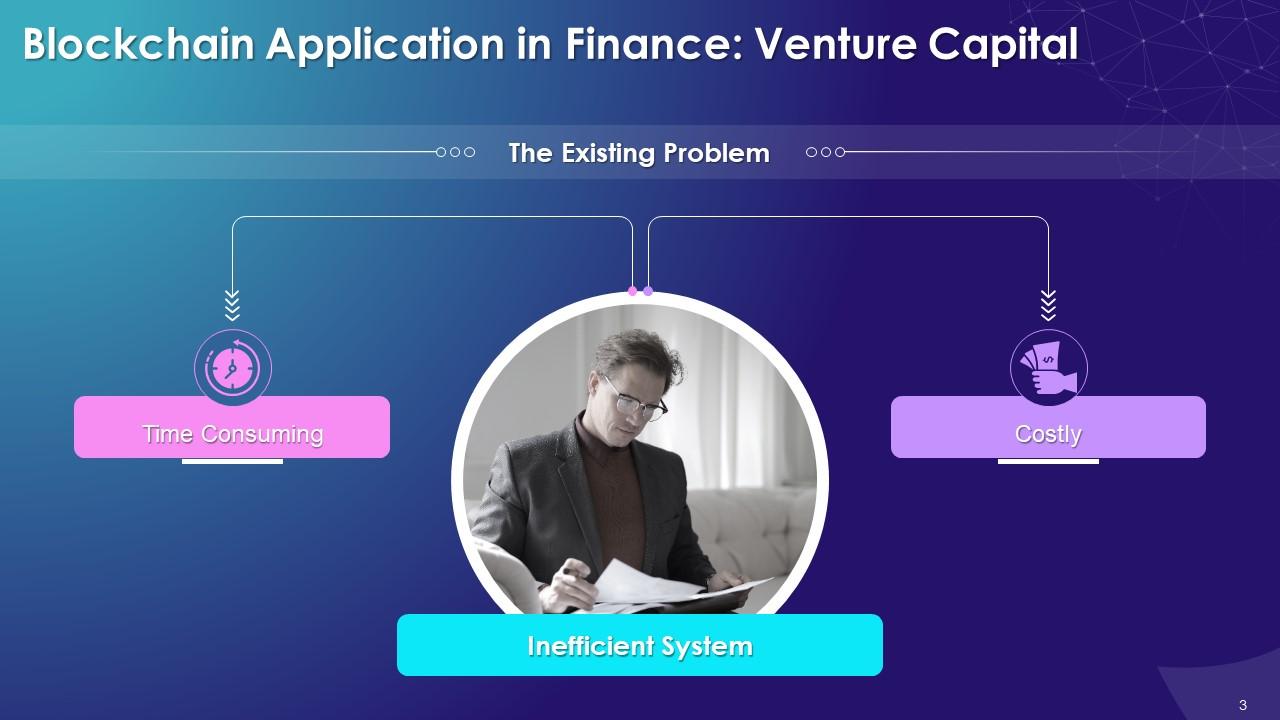

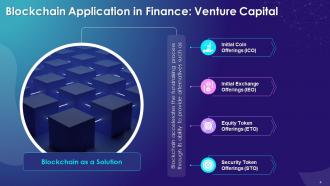

Slide 4

This slide discusses the scope of blockchain technology as a solution to the that the traditional venture capital industry is plagued with. Blockchain accelerates the fundraising process as it provides alternatives for raising capital. These are initial coin offerings (ICO), equity token offerings (ETO), initial exchange offerings (IEO), and security token offerings (STO).

Slide 5

This slide gives an overview of Initial Coin Offerings (ICO) and the companies that are using it to raise funds. The ICOs are similar to initial public offerings (IPOs), except that the coins created in an ICO may also be used to purchase a software service or commodity.

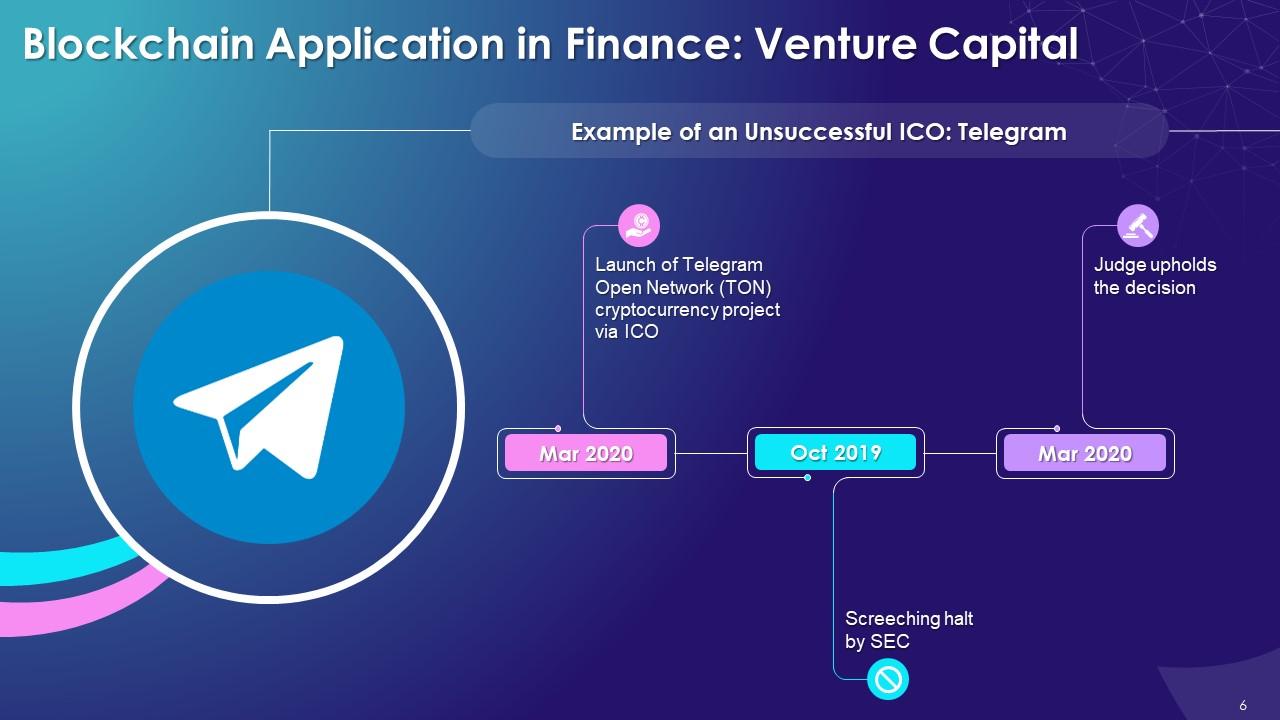

Slide 6

This slide depicts the timeline of an unsuccessful ICO that Telegram Open Network launched. The TON ICO came into being in January 2018, before folding up in March 2020.

Instructor’s Notes:

- After the first announcement, the Telegram Open Network (TON) cryptocurrency project around $1.7 billion from private investors in its ICO

- Thanks to the Securities and Exchange Commission (SEC), the TON project came to an abrupt halt. In an inquiry it conducted in October 2019, the SEC concluded that Gram, the cryptocurrency connected with TON, was an unregistered security

- In March 2020, a judge upheld the SEC ruling on not allowing an ICO linked to Gram. The impact of the ruling meant that Gram could no longer be disseminated not only in the US, but across the globe

- The SEC also ordered the Telegram Group to refund more than $1.2 billion to investors and pay $18.5 million in civil penalty

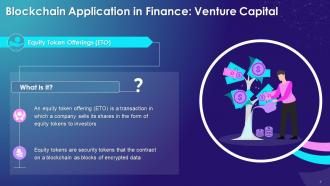

Slide 7

This slide discusses the concept of Equity Token Offerings (ETO) as an implementation of blockchain technology in Venture Capital. An ETO is a security token that holds the contract on a blockchain.

Slide 8

This slide illustrates Equity Token Offering as a hybrid investment model, which combines the advantages of an Initial Public Offering (IPO), an Initial Coin Offering (ICO), and Venture Capital (VC).

Slide 9

This slide discusses the advantages of an ETO and how it can allow firms to quickly reach out to investors and acquire funds for their growth plans.

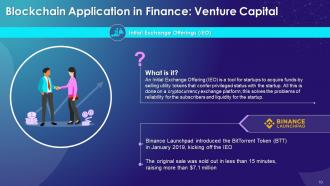

Slide 10

This slide gives an overview of Initial Exchange Offerings (IEO) that start-ups use to raise funds. These utility tokens confer privileged status with the startup. All this is done on a cryptocurrency exchange platform. This solves the problems of reliability for subscribers and liquidity. In IEO, crypto exchanges assist in token sale as these ensure that the project vetting process has been thoroughly followed, in both letter and spirit.

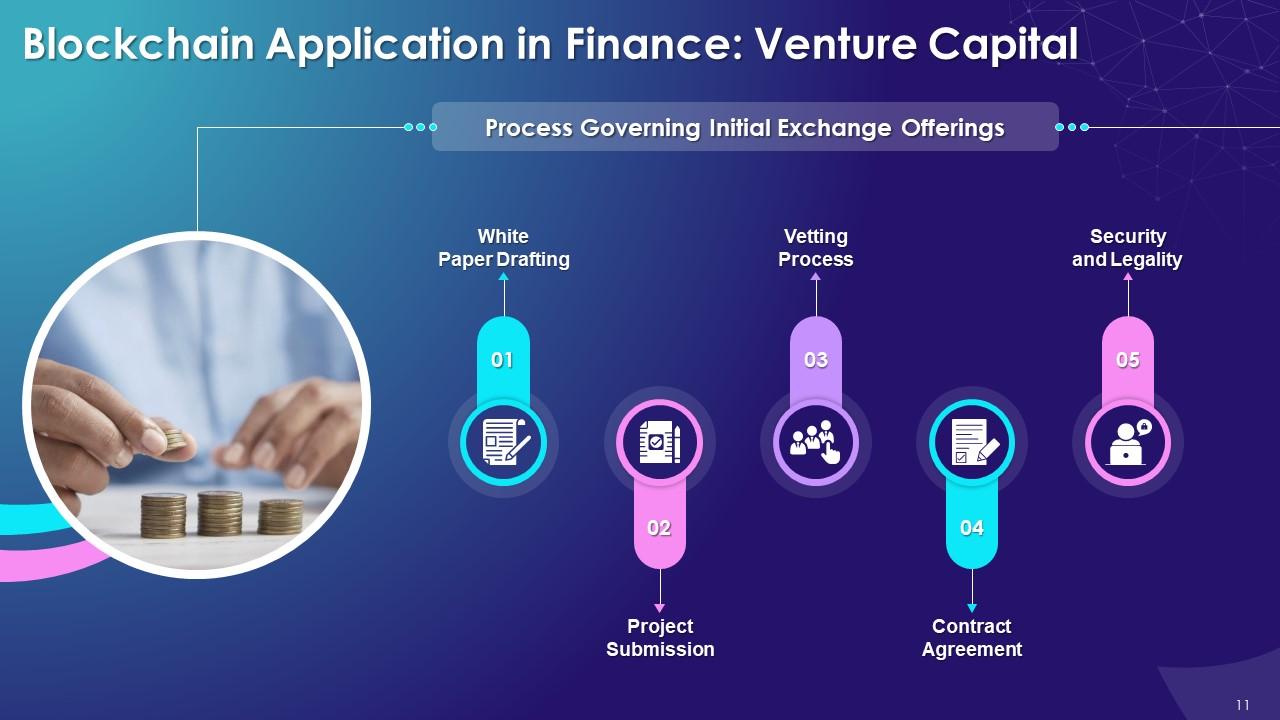

Slide 11

This slide illustrates the five-step process for the working of initial exchange offerings. The steps include white paper drafting, project submission, vetting process, contract agreement, and security & legality.

Instructor’s Notes:

- White Paper Drafting: Start-ups create a white paper that details how tokens will be supported and the funding sources and payment infrastructure that will be available for transfers and transactions using the new cryptocurrency

- Project Submission: The firm or project registers with a platform that they wish to sell their tokens from

- Vetting Process: Now, crypto exchange platform conducts its own due diligence to ensure that the project and token issuer are creditworthy. This comprises a review of the project's unique selling features, a tokenomics analysis, a team background check, and drawing up projections about the business

- Contract Agreement: If the cryptocurrency exchange platform accepts the IEO, the project is expected to pay a percentage of its utility tokens to the forum and a listing fee before the tokens are put up for sale

- Security & Legality: The Securities and Exchange Commission (SEC) does not supervise IEO investments since they do not provide an investment stake in the firm. This might make the process of selling and issuing IEO tokens easier for organizations looking to raise seed money for their new cryptocurrency

Slide 12

This slide lists the advantages of Initial Exchange Offerings as an application of venture capital. An IEO is simple for users to engage and promises instant user-base. Investor confidence is high as an exchange is allowing its platform to be used to raise IEOs.

Slide 13

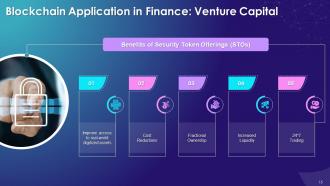

This slide gives an overview of Security Token Offerings (STOs) as an application of blockchain technology for venture capital. An STO is a regulated security offering that is built on blockchain.

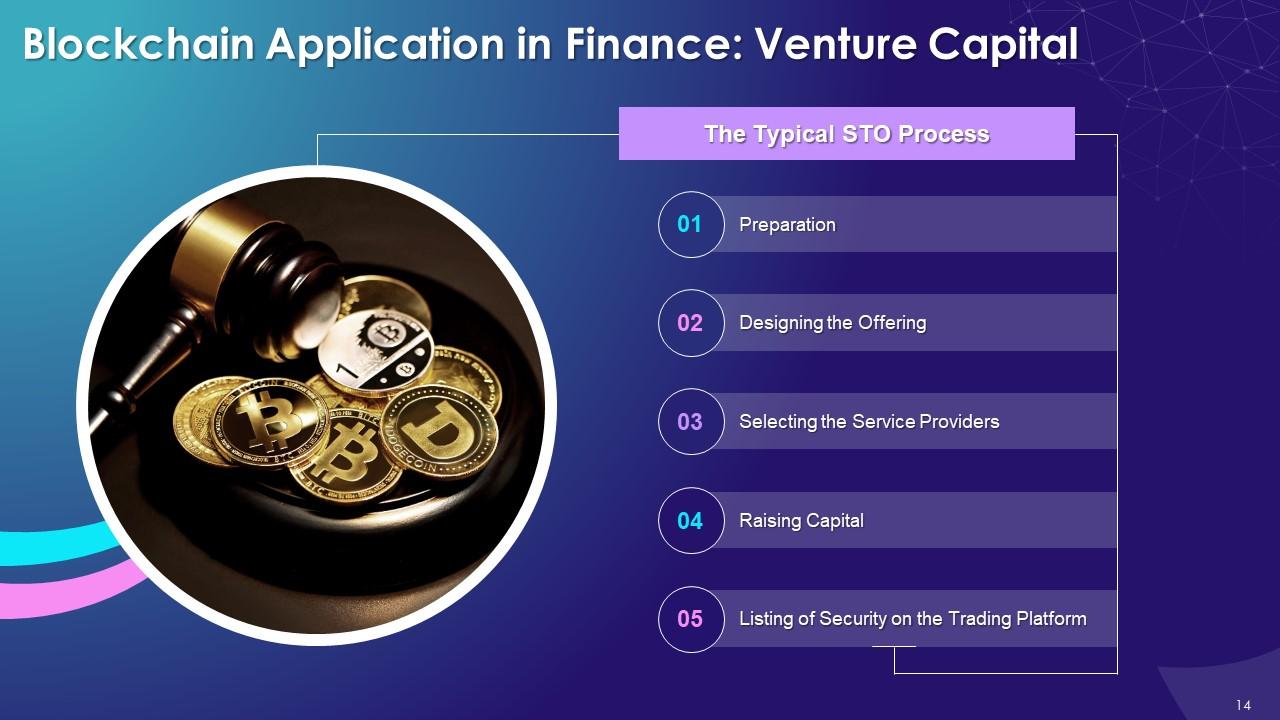

Slide 14

This slide depicts the typical process that needs to be followed to launch a Security Token Offering. These steps include preparation, designing the offering, selecting service providers, raising capital, and listing of security on the trading platform.

Instructor’s Notes:

- Preparation: Following the development of an idea/business plan, the issuer provides investor data for its target investors. The investor presentation should include information on the company's operational plan, profit forecast, capital requirements, and independent appraisal

- Designing the Offering: The issuers determine the amount, value of each token, soft capitalization, embedded rights, and duration of the offering

- Selection of Service Providers: Issuers choose a blockchain platform, construct the security token, and reissue it to the intended investors at this point. Investors can store their tokens in digital wallets provided by some blockchain systems. Issuers would also have to evaluate the blockchain platform's listing rules at this stage

- Raising Capital: The issuer determines their target investors with the help of the brokers, holds meetings and distributes the STOs to target investors

- Listing of Security on the Trading Platform: The issued token is, often, sold to a Special Purpose Vehicle ("SPV") and reissued on the trading platform. Issuers may perform additional marketing operations and employ a market maker to boost liquidity

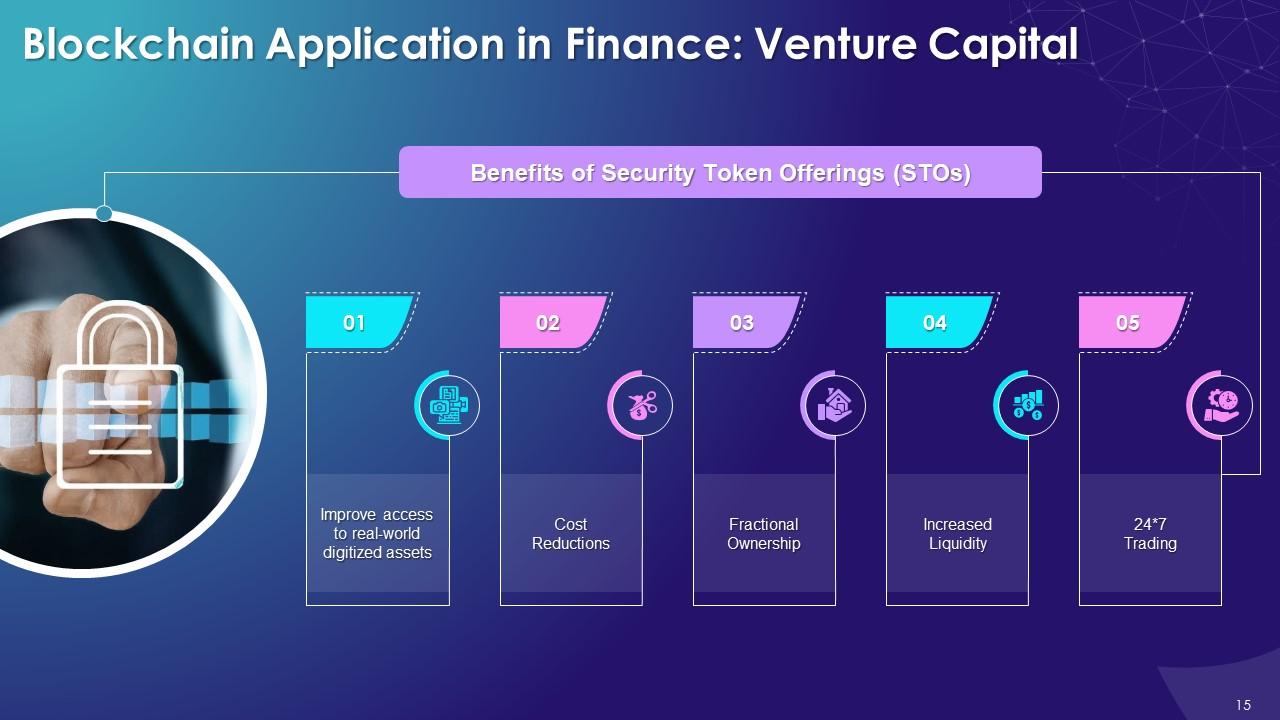

Slide 15

This slide lists various benefits of Security Token Offering to raise venture capital using the blockchain technology. The advantages include improved access to real-world digitized assets, cost reductions, increased liquidity, etc.

Instructor’s Notes: Security tokens act as a doorway for traditional finance to venture into the blockchain realm due to the regulated structure of Security Token Offerings (STOs). These may be used to raise money from all around the world. As the blockchain environment is decentralized, the post-STO liquidity is greater than tokens that are restricted to a single country.

Slide 16

This slide discusses the challenges to the development of STOs. The barriers include legal protection of assets, regulation over crypto-related intermediaries, and accounting & valuation.

Instructor’s Notes:

- Legal Protection of Assets: Although the investor's name may be documented in the smart contract, the legal stance on whether virtual assets are "property," may be unclear or include overlapping and even contradictory regulations across geographies

- Regulation over Crypto-related Intermediaries: Even though an increasing number of digital asset intermediaries, market infrastructure providers, issuers, and promoters are regulated, critical aspects of the crypto industry remain unregulated

- Accounting & Valuation: Despite the fact that real-world assets, more often that not, back STOs, determining the value of virtual assets is challenging. Accounting professionals have difficulties determining the fair value of STOs

Blockchain Application In Finance Venture Capital Training Ppt with all 32 slides:

Use our Blockchain Application In Finance Venture Capital Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

I joined SlideTeam last month and there’s no doubt that I tend to find our bond only strengthening over time. Best place to find world-class themes, templates, and icons.

-

SlideTeam is my one-stop solution for all the presentation needs. Their templates have beautiful designs that are worth every penny!