Mergers and Acquisitions: A corporate strategy consists of buying, selling or combining of business entities which results in the growth of a company faster and quicker. Mergers and acquisitions process have innumerable advantages such as improved financial position, program and service expansion, enhanced competitive position, increased market share, profits and influence in industry, and more.

However, this process has its own challenges and hurdles. It is a critical process and need a lot of time for corporate restructuring. It needs a proper plan and a structure to execute the merging and acquiring of two companies.

Download Ready-Made Mergers and Acquisitions PowerPoint Templates

To make this complex process simple, we have outlined a plan which will help you go through the process step by step. Also, it comprises of templates that are necessary to consider while making a huge decision of acquiring and merging with another company.

17 Must Have Mergers and Acquisitions PowerPoint Templates:

- Template 1: Company Overview PPT Template

This is a ready-made PPT Template to provide an overview of your company's history, mission, products or services, target market, competitive landscape, and financial performance. The purpose of a company overview Template is to give stakeholders, such as investors, employees, and customers, a clear understanding of what the company does, how it operates, and what its future plans are. Download now!

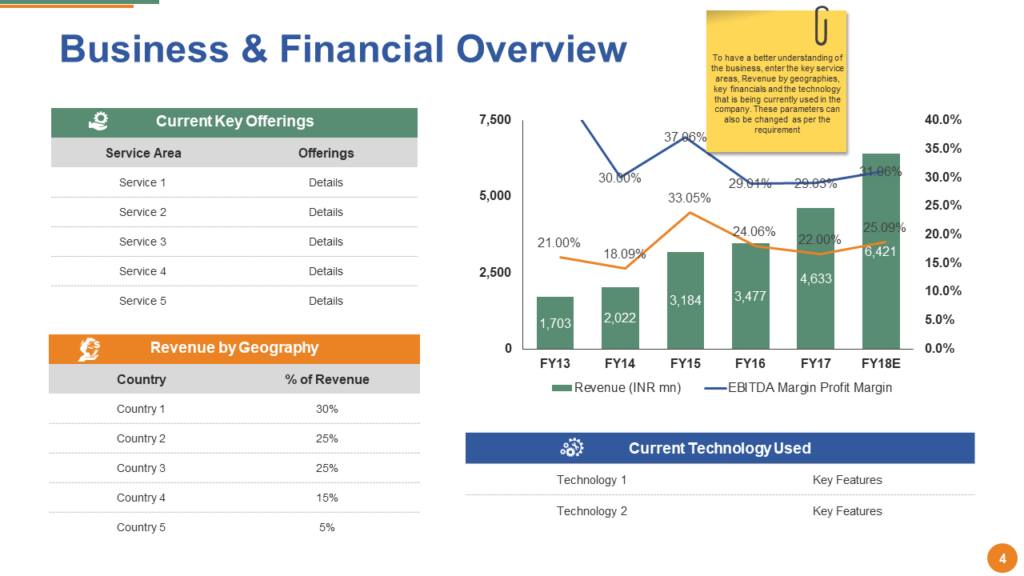

- Template 2: Business and Financial Overview Template

Use this ready-made PowerPoint Template to document a summary of your business’s financial performance, key metrics, and strategic objectives. Deploy this pre-designed PPT Template to give your clients an overview of the market size, growth trends, and competition. Showcase your company’s products, services, target market, competitive advantage, and more to outline an expansion plan. Download now!

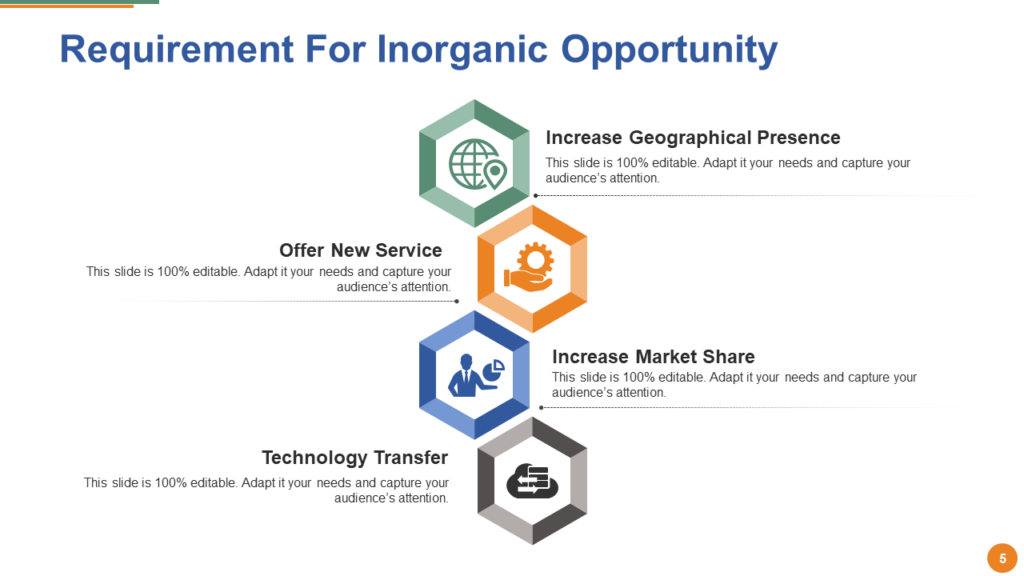

- Template 3: Types of Inorganic Opportunities PPT Slide

This is a top-notch PPT Template to showcase external growth opportunities. Incorporate this content-ready PPT Template to expand your market presence, increase revenue streams, and gain access to new technologies. This PowerPoint Slide highlights varied reasons to opt for inorganic opportunities to grow quickly and efficiently. Grab this ready to use PowerPoint Template to diversify your revenue streams and reduce the dependence on a single product or market. Download now!

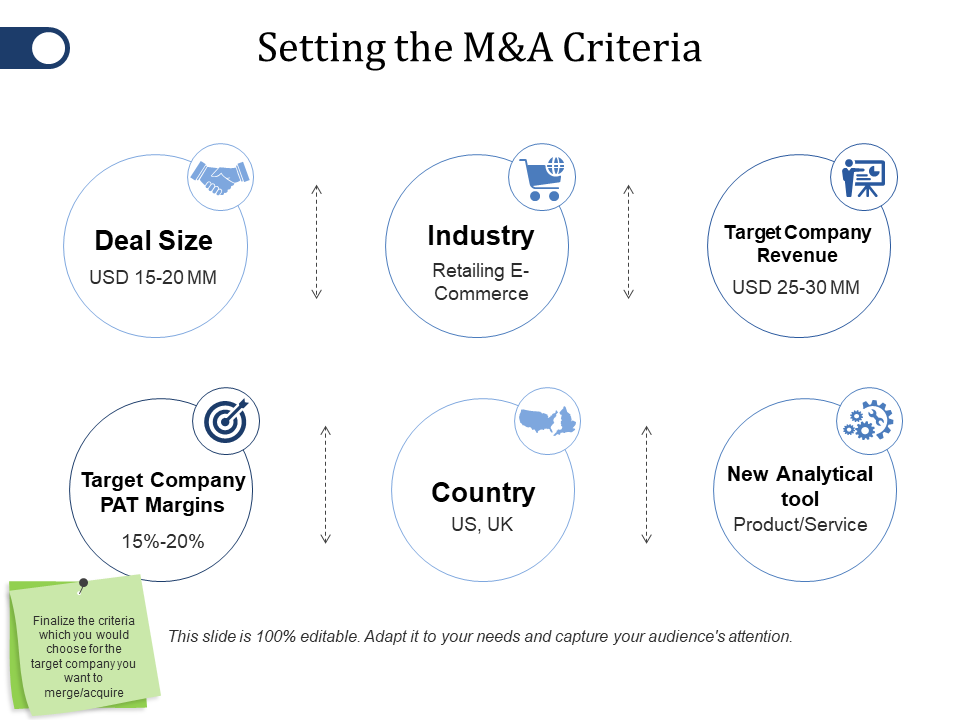

- Template 4: Setting the M&A Criteria Slide

Finalize the criteria which you would choose for the target company you want to merge/acquire.

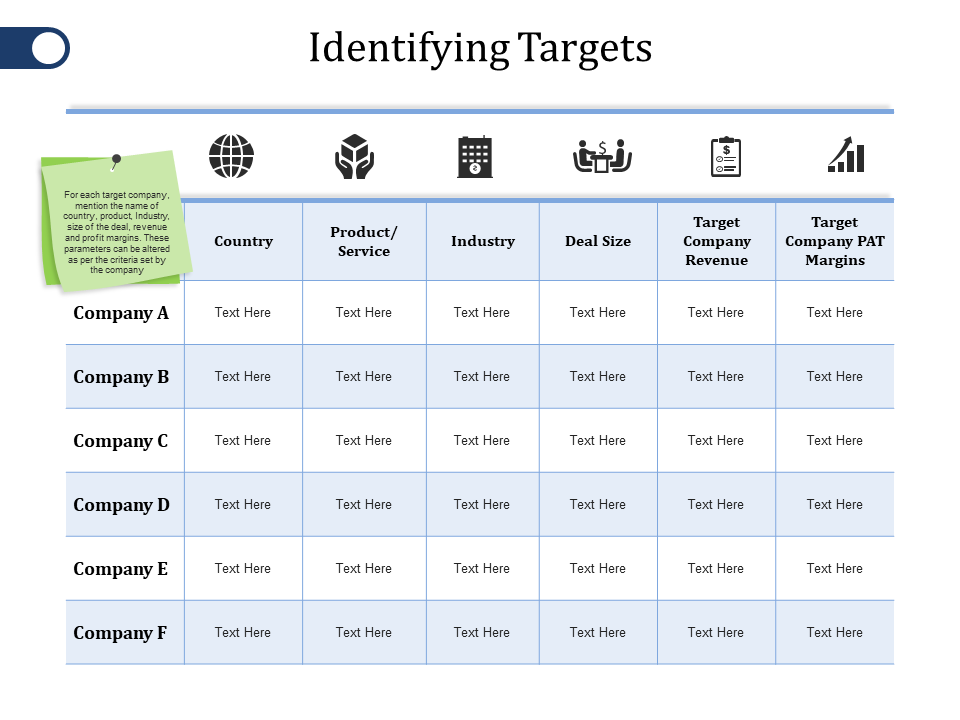

- Template 5: Identifying Targets Slide

Identify the companies that you want to target. For each target company, mention the name of country, product, Industry, size of the deal, revenue and profit margins. These parameters can be altered as per the criteria set by the company.

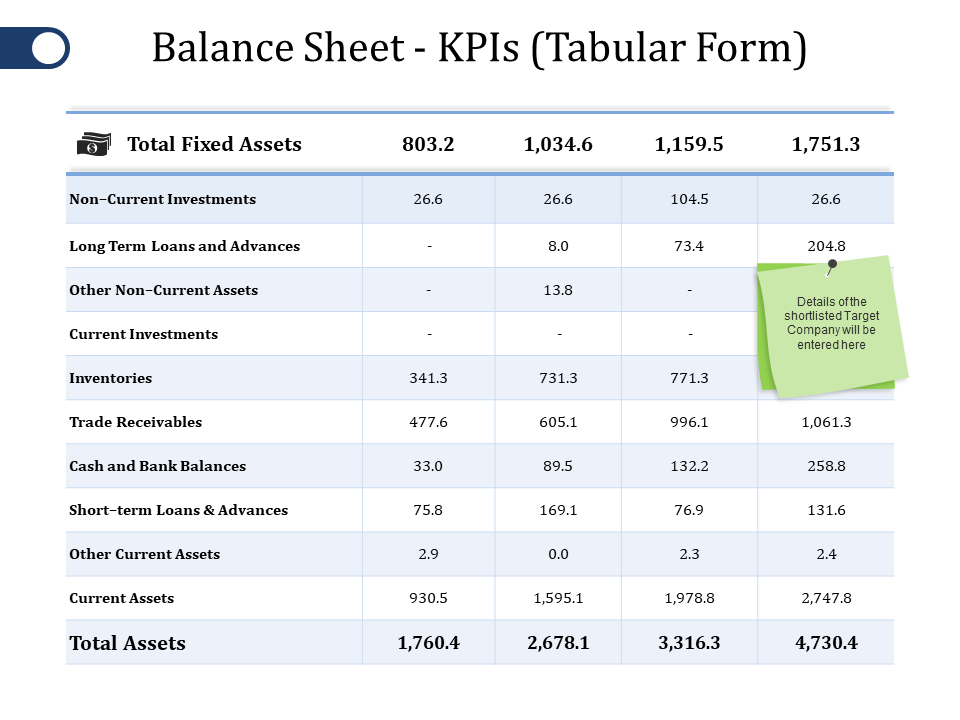

Financial Analysis: A comprehensive evaluation of the financial position of the target company is a must. It comprises of detailed analysis of financial status of the company in the market. We have covered all the essential financial analysis PowerPoint templates of the company that you would need while merging or acquiring with the company.

- Template 6: Balance Sheet PowerPoint Template

Enter the details of the shortlisted target company. Their current liabilities, shareholders equity, short term borrowings, current investments and assets, inventories, trade receivables, and more. You can add your own points as per the requirement.

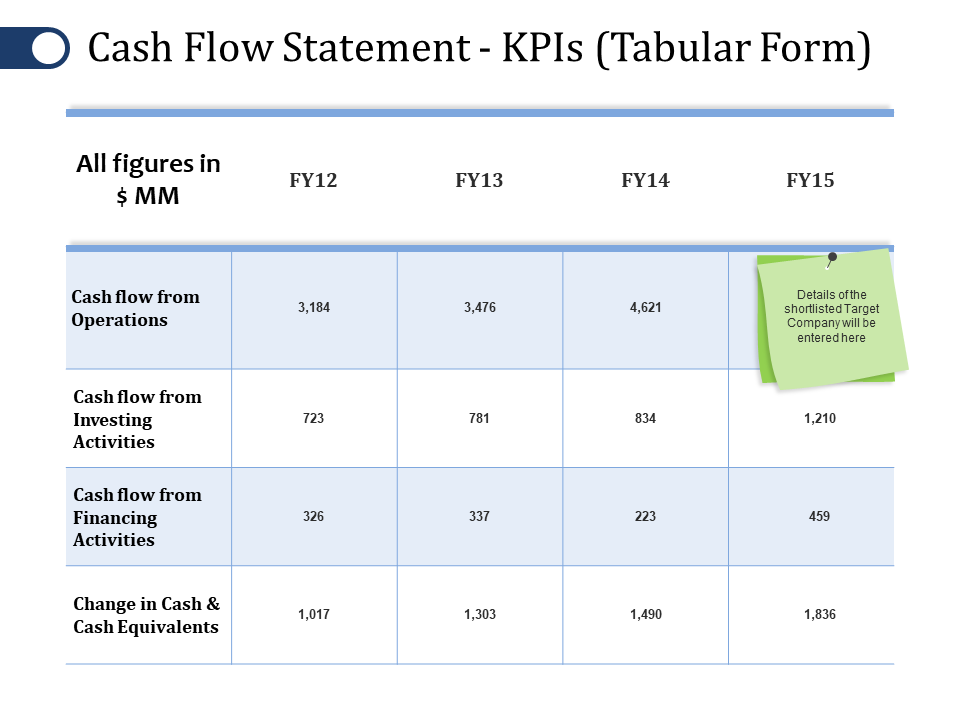

- Template 7: Cash Flow Statement PPT Diagram

Details of the shortlisted target company will be entered here such as cash flow from operations, cash flow from investing activities, cash flow from investing activities, and more.

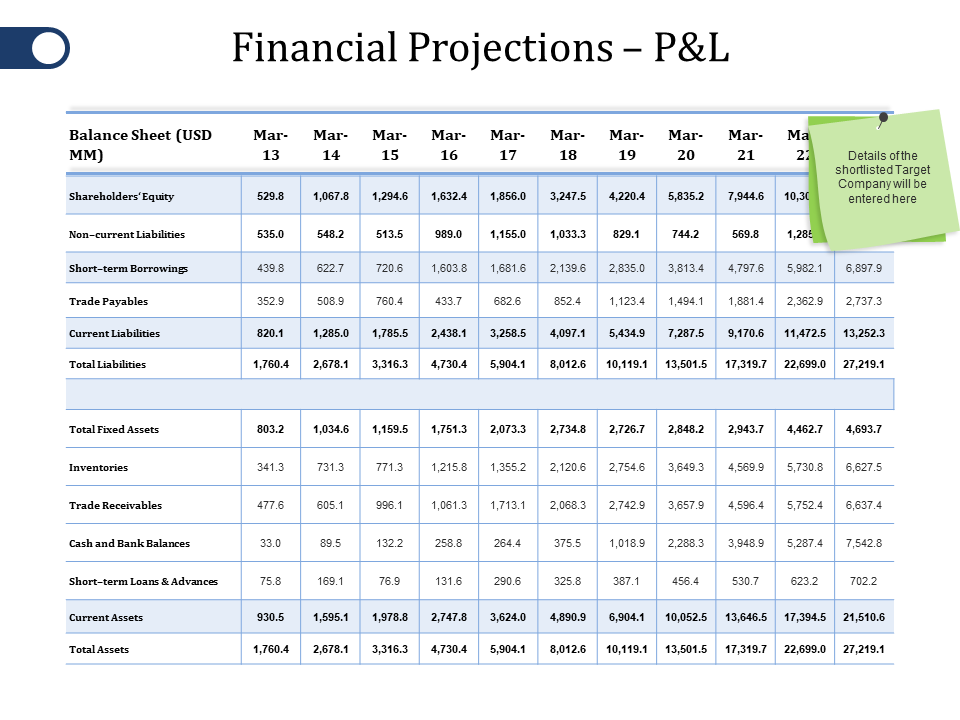

- Template 8: Financial Projections PPT Template

Evaluate the financial projections of the target companies using this template. Add your own points to the templates as per the requirement.

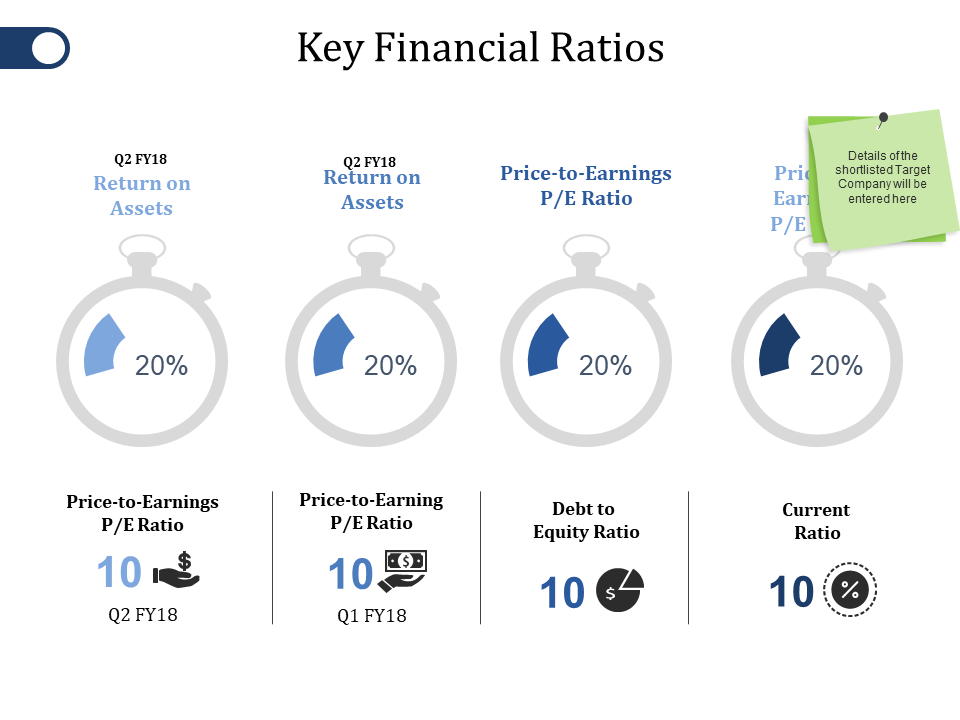

- Template 9: Key Financial Ratios Slide

Monitor quarterly return on assets of the target companies with this template.

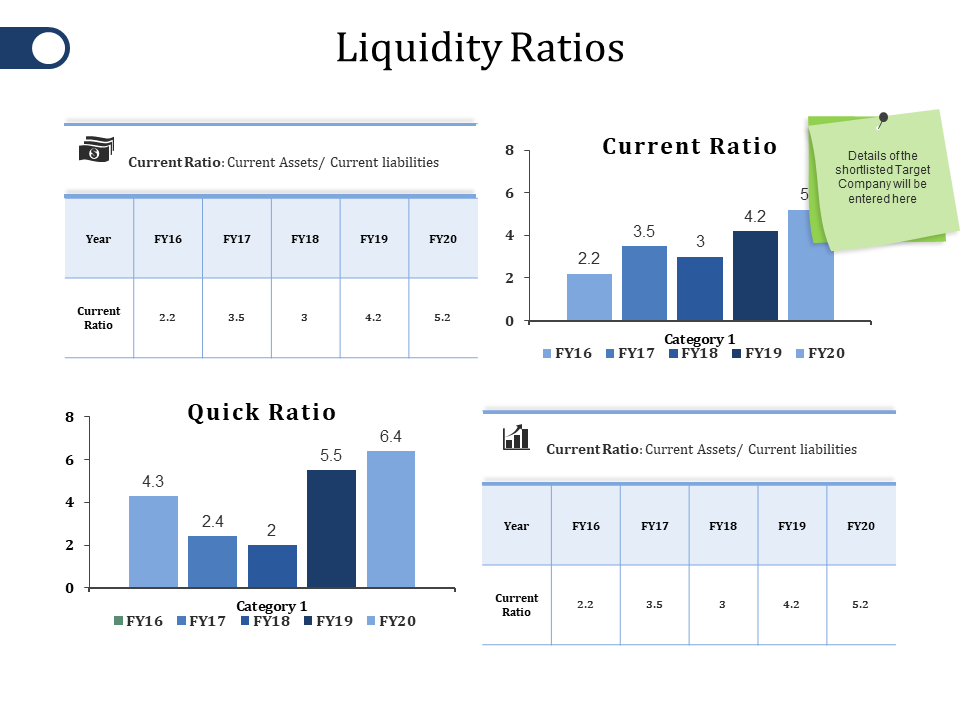

- Template 10: Liquidity Ratios PPT Template

Measure the current assets and liabilities with liquidity ratio PowerPoint template. Enter the details and evaluate the liquidity ratio of the targeted company.

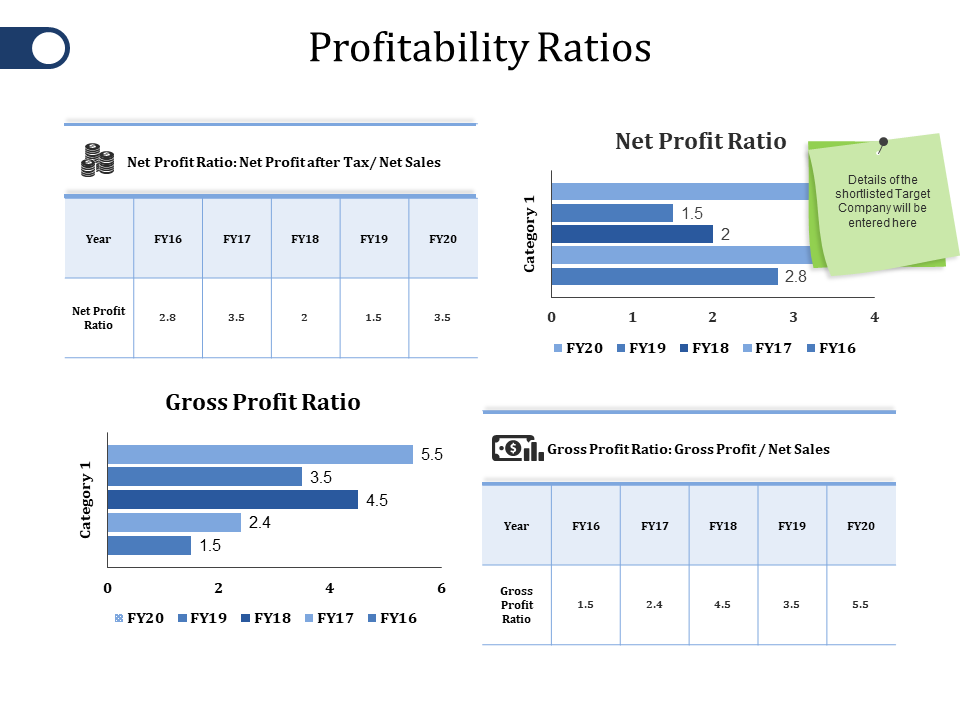

- Template 11: Profitability Ratios PPT Slide

Measure the net profit with profitability ratio PowerPoint template. Enter the details and evaluate the gross profit ratio of the targeted company.

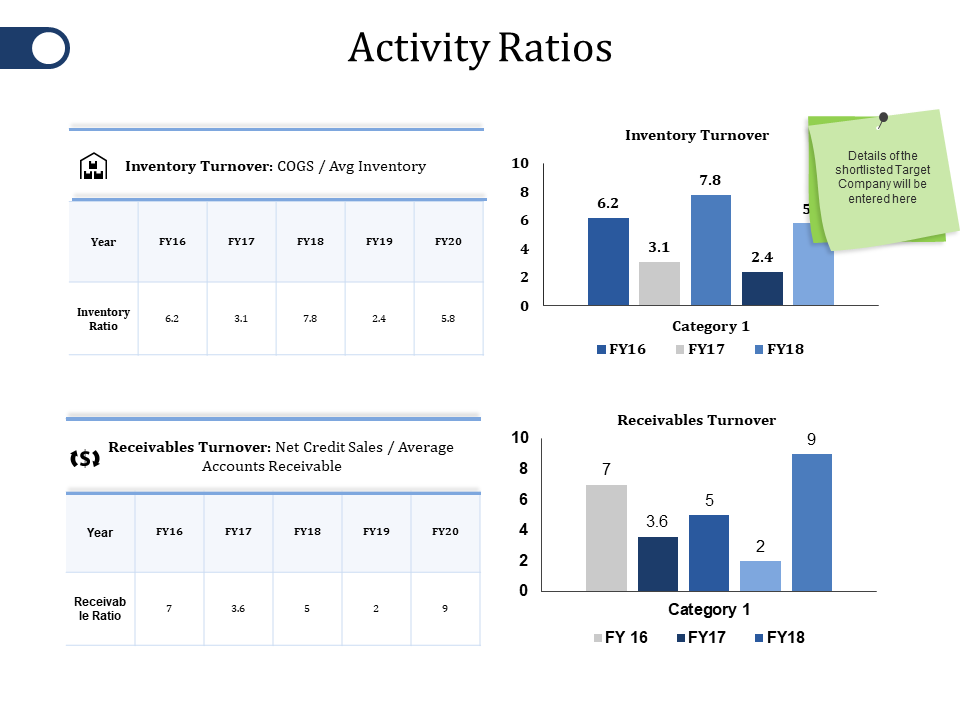

- Template 12: Activity Ratios Slide

Measure the inventory turnover with activity ratio PowerPoint template. Jot down the details and evaluate the activity ratio of the targeted company.

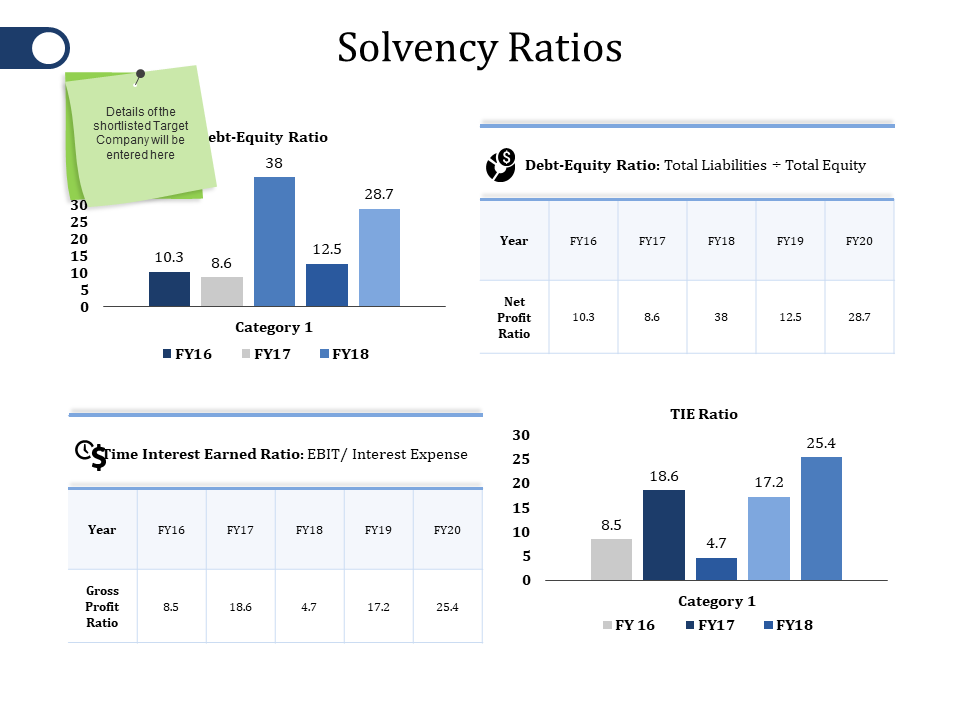

- Template 13: Solvency Ratios PPT Graphic

Measure the debt equity ratio with solvency ratio PowerPoint template. Enter the details and evaluate the time interest earned ratio of the targeted company.

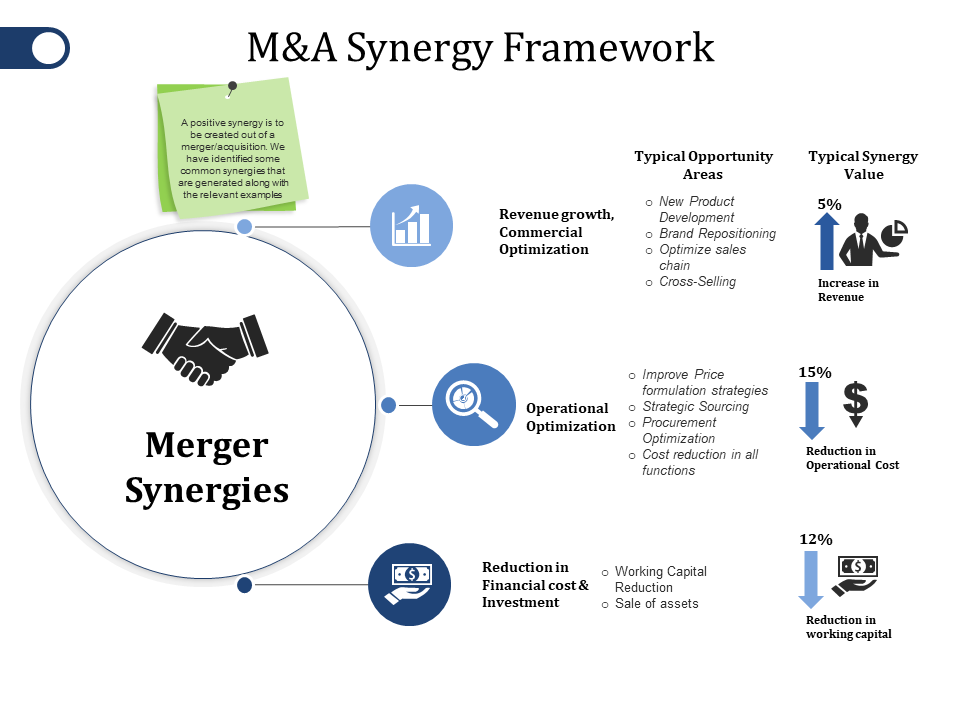

- Template 14: M&A Synergy PowerPoint Layout

A positive synergy is to be created out of a merger/acquisition. We have identified some common synergies that are generated along with the relevant examples such as new product development, procurement optimization, sales of assets, etc.

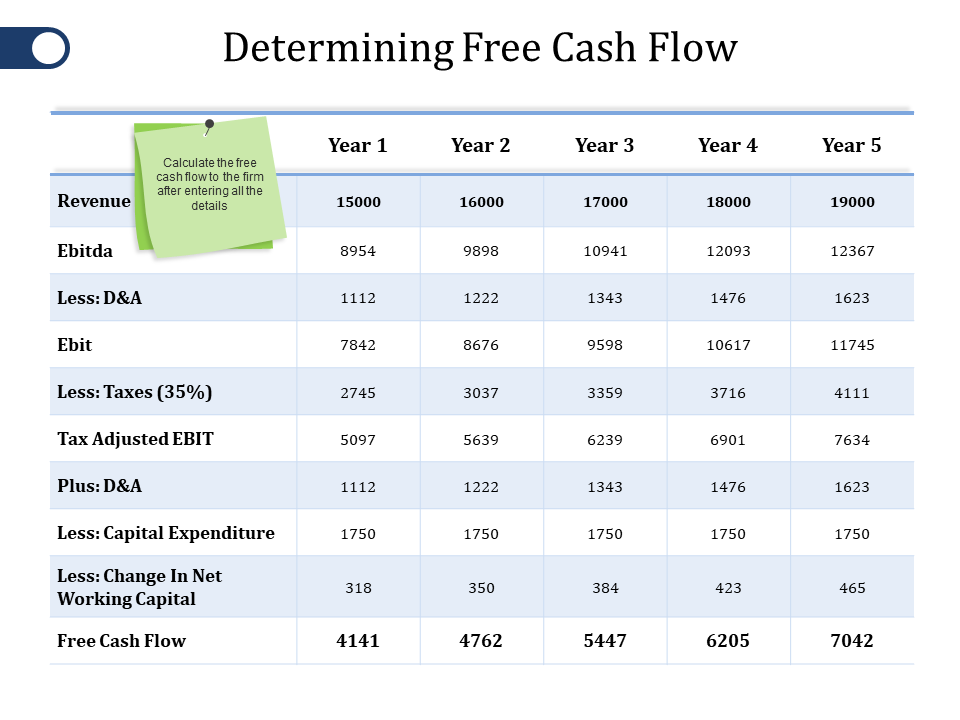

- Template 15: Determining Free Cash Flow Template

Calculate the free cash flow to the firm after entering all the details.

- Template 16: Post-Merger Integration Framework Slide

Measure the positives and negatives after post merging. Under each function of an organization, there would be an effect due to the merger/acquisition process. We are showcasing few examples which are affected after post-merger integration. You can alter it as per the requirement.

- Template 17: M&A Performance Tracker PPT Template

Track the performance of the company after merging. Measure and monitor the sales and financial performance of the company.

Download Content-Ready Mergers and Acquisitions Complete Deck

With mergers and acquisitions, capture a greater section of market share. Gain maximum benefits with deals, increase profit and grow rapidly.

FAQs on Mergers and Acquisitions

What are the 4 types of M&A?

There are generally four types of M&A (mergers and acquisitions):

Horizontal merger: A horizontal merger involves two companies that operate in the same industry and offer similar products or services. This type of merger is typically aimed at achieving economies of scale, reducing competition, and expanding market share.

Vertical merger: A vertical merger involves two companies that operate at different stages of the same supply chain, such as a manufacturer and a supplier. This type of merger is typically aimed at improving efficiency, reducing costs, and gaining greater control over the supply chain.

Conglomerate merger: A conglomerate merger involves two companies that operate in unrelated industries. This type of merger is typically aimed at diversifying the company's revenue streams and reducing risk.

Reverse merger: A reverse merger involves a private company merging with a public company, usually with the aim of going public without going through the traditional initial public offering (IPO) process.

It's important to note that while these are the four main types of M&A, there are often variations and combinations of these types depending on the specific circumstances and goals of the companies involved. Additionally, mergers and acquisitions can also be classified based on the structure of the transaction, such as asset acquisitions, stock acquisitions, and mergers of equals.

What are the two examples in mergers and acquisitions?

Here are two examples of mergers and acquisitions:

The acquisition of WhatsApp by Facebook: In 2014, Facebook acquired WhatsApp, a popular messaging app, for $19 billion. The acquisition was aimed at expanding Facebook's user base and strengthening its position in the mobile messaging market.

The merger of Exxon and Mobil: In 1999, Exxon and Mobil, two of the largest oil companies in the world, announced a merger valued at $81 billion. The merger was aimed at achieving cost savings and efficiencies through economies of scale, as well as expanding the companies' global reach and enhancing their ability to compete in the rapidly-changing energy market.

These are just two examples of many mergers and acquisitions that have taken place over the years, and illustrate the different motivations and goals that companies may have for pursuing such transactions.

What are the 3 stages of mergers and acquisitions?

The three stages of mergers and acquisitions are as follows:

Pre-deal stage: In this stage, the acquirer identifies a target company and begins to evaluate its financial and operational performance, as well as potential synergies and risks associated with the transaction. The pre-deal stage also involves negotiations between the two companies and the signing of a letter of intent (LOI) or memorandum of understanding (MOU) outlining the terms of the transaction.

Deal execution stage: Once the LOI or MOU has been signed, the deal enters the execution stage, which involves conducting due diligence, drafting legal agreements, and obtaining regulatory approvals. This stage may also involve arranging financing and setting up a framework for integrating the two companies' operations, systems, and cultures.

Post-deal integration stage: After the transaction has closed, the post-deal integration stage involves the actual integration of the two companies' operations, systems, and cultures. This stage may involve significant challenges and risks, such as managing employee and customer transitions, resolving cultural clashes, and achieving operational efficiencies and synergies.

Each of these stages requires careful planning, execution, and management in order to successfully complete a merger or acquisition and realize its potential benefits.

![[Updated 2023] 17 Major Mergers And Acquisitions PowerPoint Templates for Every Business!!](https://www.slideteam.net/wp/wp-content/uploads/2019/04/MA-1001x436.png)

Customer Reviews

Customer Reviews