Cash conversion cycle to measure the overall number of days to convert trade

Address fears arising from false information with our Cash Conversion Cycle To Measure The Overall Number Of Days To Convert Trade. It will explain the jitters.

Address fears arising from false information with our Cash Conversion Cycle To Measure The Overall Number Of Days To Conve..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

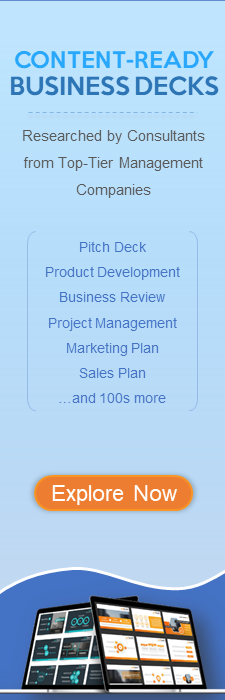

Presenting this set of slides with name - Cash Conversion Cycle To Measure The Overall Number Of Days To Convert Trade. This is a four stage Process. The stages in this process are Cash Conversion Cycle, Business Operating Cycle, Process.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

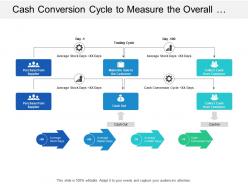

The image shows a PowerPoint slide titled "Cash Conversion Cycle to Measure the Overall..." which seems to be truncated but likely refers to measuring the overall efficiency of a company's cash flow process. The Cash Conversion Cycle (CCC) is a financial metric that quantifies the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

The diagram illustrates the three components of the CCC:

1. Purchase from Supplier:

This represents the beginning of the cycle where a company buys inventory from suppliers. Below, it is indicated as "Average Stock Days = XX Days", signifying the time inventory remains unsold.

2. Make the Sale to Customer:

This phase covers the period from when the inventory is sold until the end of the sales cycle. It's also marked with "Average Stock Days = XX Days".

3. Collect Cash from Customer:

The final stage is collecting payment from customers, completing the cash conversion cycle. This is highlighted with "Cash Conversion Cycle = XX Days".

The numbers (+60, +40, -30) represent the days associated with each stage of the cycle:

1. +60 Average Stock Days:

The average time inventory is held before it is sold.

2. +40 Average Debtor Days:

The average time taken to collect payment from debtors after a sale.

3. -30 Average Creditor Days:

The average time a company takes to pay its suppliers.

These elements are used to calculate the Cash Conversion Cycle, which in the example given is 70 days (though this number is an example and would be specific to a company's operations). A lower CCC indicates a more efficient management of cash flow.

Use Cases:

This CCC concept is crucial across various industries:

1. Manufacturing:

Use: Monitoring inventory turnover and cash flow.

Presenter: Financial Controller

Audience: Management team, investors

2. Retail:

Use: Analyzing cash flow efficiency in retail operations.

Presenter: CFO

Audience: Finance department, store managers

3. Pharmaceuticals:

Use: Managing the cash flow in R&D and sales.

Presenter: Finance Director

Audience: R&D managers, executives

4. Automotive:

Use: Tracking the cash flow from parts inventory to sales.

Presenter: Operations Manager

Audience: Production and sales departments

5. Technology:

Use: Understanding cash flow in product development cycles.

Presenter: Financial Analyst

Audience: Project managers, investors

6. Construction:

Use: Measuring cash flow from procurement to project completion.

Presenter: Commercial Manager

Audience: Project managers, financial planners

7. Food and Beverage:

Use: Optimizing cash flow in a high inventory turnover industry.

Presenter: Supply Chain Director

Audience: Supply chain and finance teams

Cash conversion cycle to measure the overall number of days to convert trade with all 5 slides:

Find an essential aid in our Cash Conversion Cycle To Measure The Overall Number Of Days To Convert Trade. They deliver critical assistance.

No Reviews