Pitch deck to raise funding from mezzanine debt powerpoint presentation slides

Pitch Deck To Raise Funding From Mezzanine Debt PowerPoint Presentation Slides features compelling content to help you raise the finances required. This thorough mezzanine capital PPT theme is designed to highlight all the core aspects that facilitate a convincing pitch deck. Use the mezzanine financing PowerPoint slideshow’s stunning visuals to squeeze sophisticated information in a concise format without losing its significance. Present a crisp company introduction followed by a unique selling proposition for customers by the means of mezzanine fundraising PPT template. Use impact data visualization tools to present facts supporting investment in your company, through our mezzanine loans PowerPoint template. Demonstrate competitive analysis, market opportunities, present organizational value, financial projections, and your marketing strategy using debt and equity financing PPT slideshow. Mezzanine debt PowerPoint theme helps you outline essential components like fund requirement for acquisition and allocation of raised funds. So, download the mezzanine financing PPT presentation and present a professionally crafted pitch deck to raise capital successfully.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

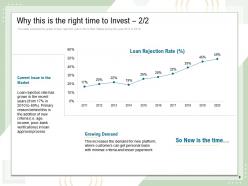

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

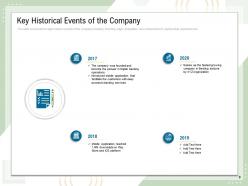

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Pitch Deck To Raise Funding From Mezzanine Debt PowerPoint Presentation Slides. This complete deck consists of 41 professionally crafted PPT slides. All the templates are completely customizable. You can edit font, text, background, patterns, and colors. This PowerPoint slideshow supports widescreen and standard screen resolutions. It also works well with Google Slides. Moreover, it is also possible to convert and save this PPT file into PDF, PNG, and JPG formats.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Pitch Deck to Raise Funding from Mezzanine Debt. State your Company name and begin.

Slide 2: This slide displays Agenda for Mezzanine Debt

Slide 3: This slide shows Table of Content of the presentation.

Slide 4: The slide provides a brief overview of the company’s operations along with its key products, clientele, mission and vision

Slide 5: The slide provides key figures about the size and growth of the company. It includes Revenue, Employees Strength, Customer & borrowers base, ATM Network, State Presence etc.

Slide 6: The slide explains the key pain points of the customers along with the solutions which the company offers through its products

Slide 7: The slide shows the graph of market share of banks, credit unions, Fintech and other traditional finance segments in US Personal Loan market from the year 2013 to 2018

Slide 8: The slide presents the graph of loan rejection rate in the United States during the year 2010 to 2019.

Slide 9: The slide covers all the major historic events of the company including founding, major acquisition, new product launch, partnership, expansion etc.

Slide 10: The slide covers the key Recognitions of the company such as awards, milestone related to revenue & user base, rating, certification etc.

Slide 11: The slides covers the key points to explain the business model of the company. Key points include: value proposition, market opportunities, revenue and cost model, competitive environment etc.

Slide 12: The slide shows the details about company’s product differentiation comparing to its competitors. It also provides key pain points or requirements of the consumers

Slide 13: The slide provides the details about major sources of revenue i.e. interest on loan, investment income, fee income etc.

Slide 14: The slide provides the name, designation and brief biography of key senior level executives (C-level employees and head of Departments)

Slide 15: The slide provides the market overview of the United States which includes total addressable market, serviceable available market and serviceable obtainable market. Additionally, the slide covers target market (key sector and categories which comes under the company’ serviceable available market)

Slide 16: The slide provides the details about the target customers of the company by geography (country, area, climate), Demography (Age, gender, Nationality etc.), and Psychography (Personality, values, interest etc.)

Slide 17: The slide cover the key opportunities in the market related to growing demand, less competition, latest technologies etc.

Slide 18: The slide covers key strategic steps which the company follows for its future growth. Major strategies includes, Agreements, Digital marketing, product differentiation

Slide 19: The slide provides the Competitive landscape of the company on the basis of products’ features i.e. online availability, cost, customers, criteria etc

Slide 20: The slide provides the Competitive landscape of the company on the basis of company’s size i.e. number of users, revenue, app downloads, user traffic, social media followers etc.

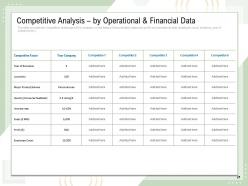

Slide 21: The slide provides the Competitive landscape of the company on the basis of financial data (sales and profit) and operational data (employee count, locations, year of existence etc.)

Slide 22: The slide provides the Competitive landscape of the company on the basis of ratings of the products as per their usefulness, usability, desirability, availability etc.

Slide 23: The slide provides the historical (last 5 years) and forecasted (coming 4 years) numbers of the company’s income statement (including revenue, gross profit, expenses, operating profit, net profit etc.)

Slide 24: The slide provides the graph of company’s financials (revenue, operating income and net income) for last 5 years (historical) and coming 4 years (forecasted)

Slide 25: The slide provides the revenue forecast of the company on the basis of number of subscribers estimation, average revenue per user and churn rate

Slide 26: The slide provides the table of End Subscribers (historical and forecasted) on the basis of various factors including churn rate. New addition of subscribers, cancelled subscription etc.

Slide 27: The slide provides the graph of company’s funding details. Graph includes he funding amount (in $ MM) and the valuation of the company (in $ MM) after each funding round

Slide 28: The slide provides the company’s valuations through discounted free cash flows from next five years

Slide 29: The slide provides the detail points related to company’s future growth plans. The company is expected to raise new funds, sign new partnerships, acquire new businesses, product launch and expand its operations in new geographies

Slide 30: The slide provides the detail about company’s funding requirement (amount and purpose), raised funding, and use of funds

Slide 31: The slide provides the details about use of funding. The company spend its funding amount on product development, marketing, expansion through acquisition and new hiring

Slide 32: The slide provides the Return on Mezzanine Investment through three different methods: fixed rate of interest, payable in kind, and equity ownership

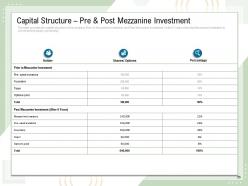

Slide 33: The slide provides the capital structure of the company Prior to Mezzanine Investment and Post Mezzanine Investment (After 5 Years when the Mezzanine Investment is converted into equity ownership)

Slide 34: The slide provides most profitable/feasible ways for investors to exit from their investment in the company. It includes, financials buyer, acquisition, IPO, Preference share redemption, Issuer’s Tender Offer, Privately negotiated sales etc.

Slide 35: This is Pitch Deck to Raise Funding from Mezzanine Debt Icons Slide

Slide 36: This slide is titled as Additional Slides for moving forward.

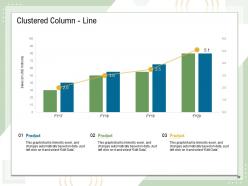

Slide 37: This slide displays Clustered Column - Line chart for product comparison.

Slide 38: This slide displays Column Chart with product comparison.

Slide 39: This is Idea Generation slide to highlight important message and facts.

Slide 40: This is Venn slide.

Slide 41: This is Thank You slide with Email address, Contact number and Address.

Pitch deck to raise funding from mezzanine debt powerpoint presentation slides with all 41 slides:

Use our Pitch Deck To Raise Funding From Mezzanine Debt Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

No Reviews