Mergers And Acquisitions Project Plan Powerpoint Presentation Slides

Mergers and Acquisitions is a common practice for business growth, companies see this as an opportunity to improve their competitive edge. Download our Mergers And Acquisitions Project Plan PowerPoint Presentation Slides to highlight your M&A strategy. Business valuation PowerPoint complete deck assist you in presenting each step in detail as it includes a set of slides like key steps, company overview, business, and financial overview, determining new growth market, types of inorganic opportunities, M&A criteria, identify targets, balance sheet KPIs, cash flow statement, financial projections, key financial ratios, liquidity and profitability ratios, activity and solvency ratios, M&A synergy framework, company valuation methodologies, valuation results, business due diligence process, post-merger integration framework, challenges and performance tracker etc. This strategic alliance Presentation template can benefit professionals from different industries. Download M&A strategy PPT slide to give a presentation on corporate finances, management, and strategy Our mergers and acquisitions presentation ensure focused attention to your thoughts. They get exclusive handling.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Mergers And Acquisitions Project Plan PowerPoint Presentation Slides. This PowerPoint complete deck contains 64 professionally designed PPT templates. These PPT Slides are 100 % editable. Users can change the fonts, colors, and slide background as per their need. You can download the presentation in both widescreen and standard screen. The presentation is supported with Google Slides and can be changed in JPG or PDF format.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Mergers And Acquisitions Project Plan. Add your company name and begin.

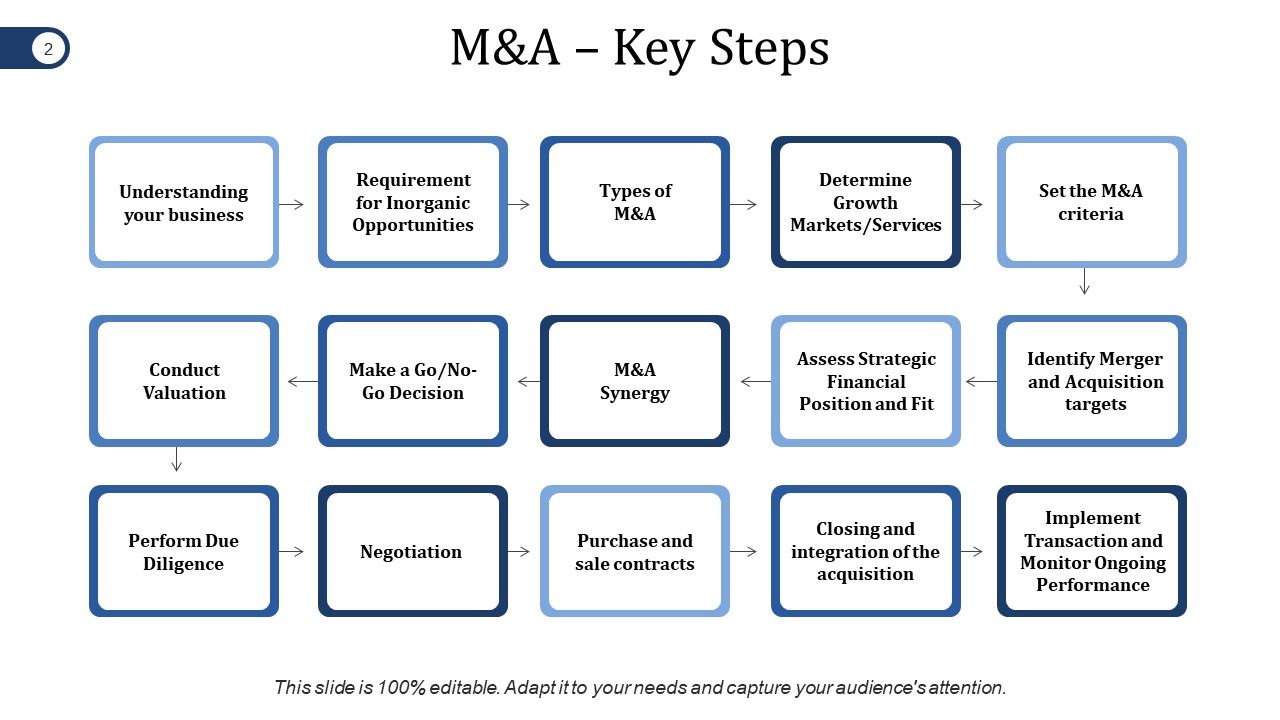

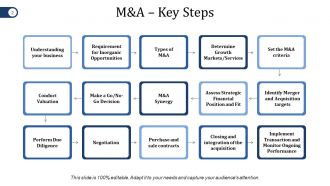

Slide 2: This slide states M&A – Key Steps involving- Understanding your business, Requirement for Inorganic Opportunities, Types of M&A, Determine Growth Markets/Services, Set the M&A criteria, Identify Merger and Acquisition targets, Assess Strategic Financial Position and Fit, M&A Synergy, Make a Go/No-Go Decision, Conduct Valuation, Perform Due Diligence, Negotiation, Purchase and sale contracts, Closing and integration of the acquisition, Implement Transaction and Monitor Ongoing Performance.

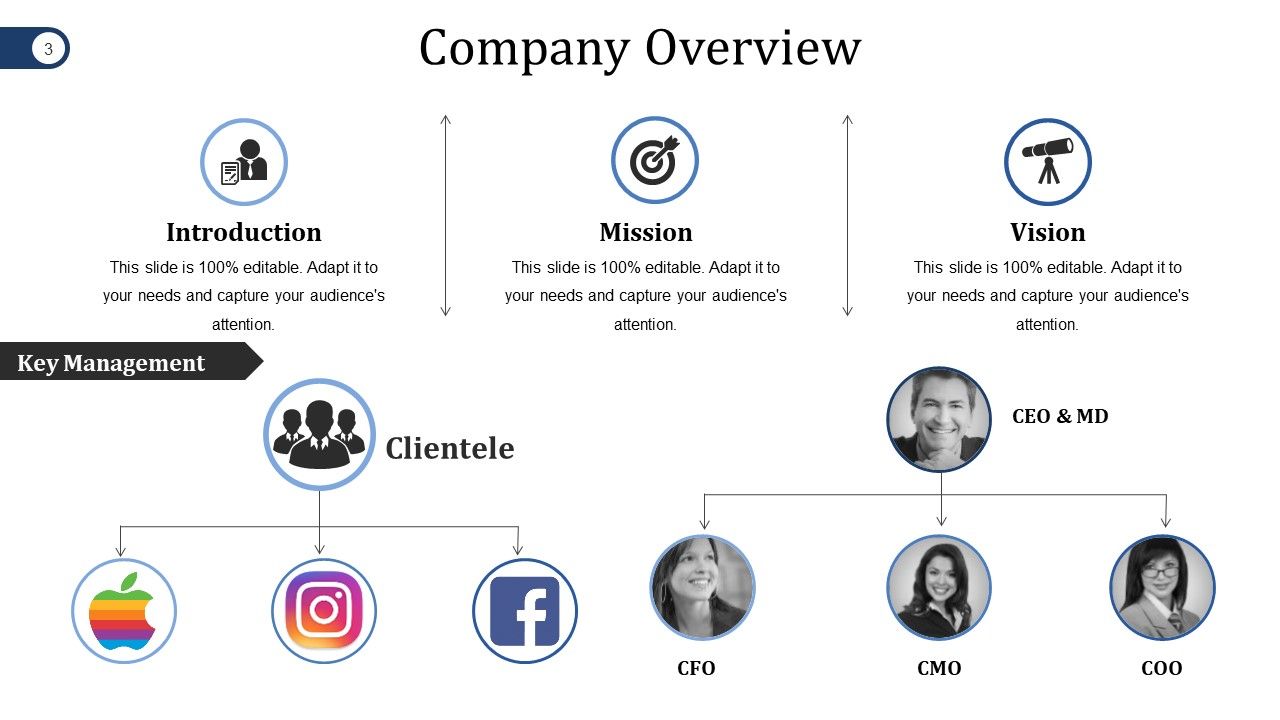

Slide 3: This slide presents Company Overview with Introduction, Vision and Mission. Use it to state your Key Management in a flow chart form here.

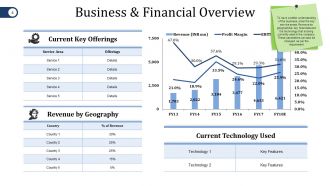

Slide 4: This slide presents Business & Financial Overview in charts and graphs. To have a better understanding of the business, enter the key service areas, Revenue by geographies, key financials and the technology that is being currently used in the company. These parameters can also be changed as per the requirement.

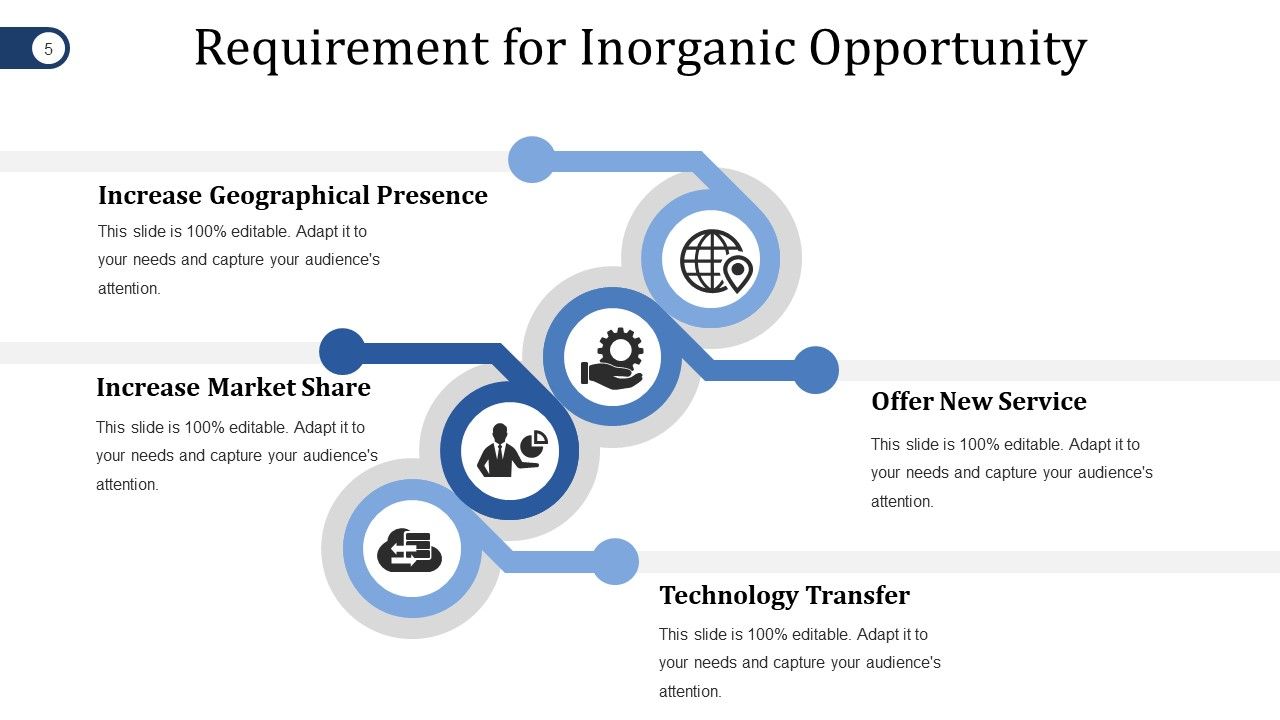

Slide 5: This slide showcases Requirement for Inorganic Opportunity infographic. These requirements are- Increase Geographical Presence, Increase Market Share, Offer New Service, Technology Transfer.

Slide 6: This is Determining New Growth Market/Services slide with the following parameters- Mention Geographies You Want To Expand, New Technology You Want To Bring, Benefits Of Acquiring New Company, Product/Service You Want To Include. After identifying the requirement for inorganic opportunities, this slide goes in detail about each of the discussed parameters. You can alter them as per your requirement.

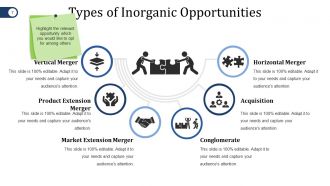

Slide 7: This slide states the Types of Inorganic Opportunities in a semi circular infographic. These opportunities are- Conglomerate, Market Extension Merger, Acquisition, Product Extension Merger, Horizontal Merger, Vertical Merger, Highlight the relevant opportunity which you would like to opt for among others.

Slide 8: This slide also states the Types of Inorganic Opportunities with icon imagery.

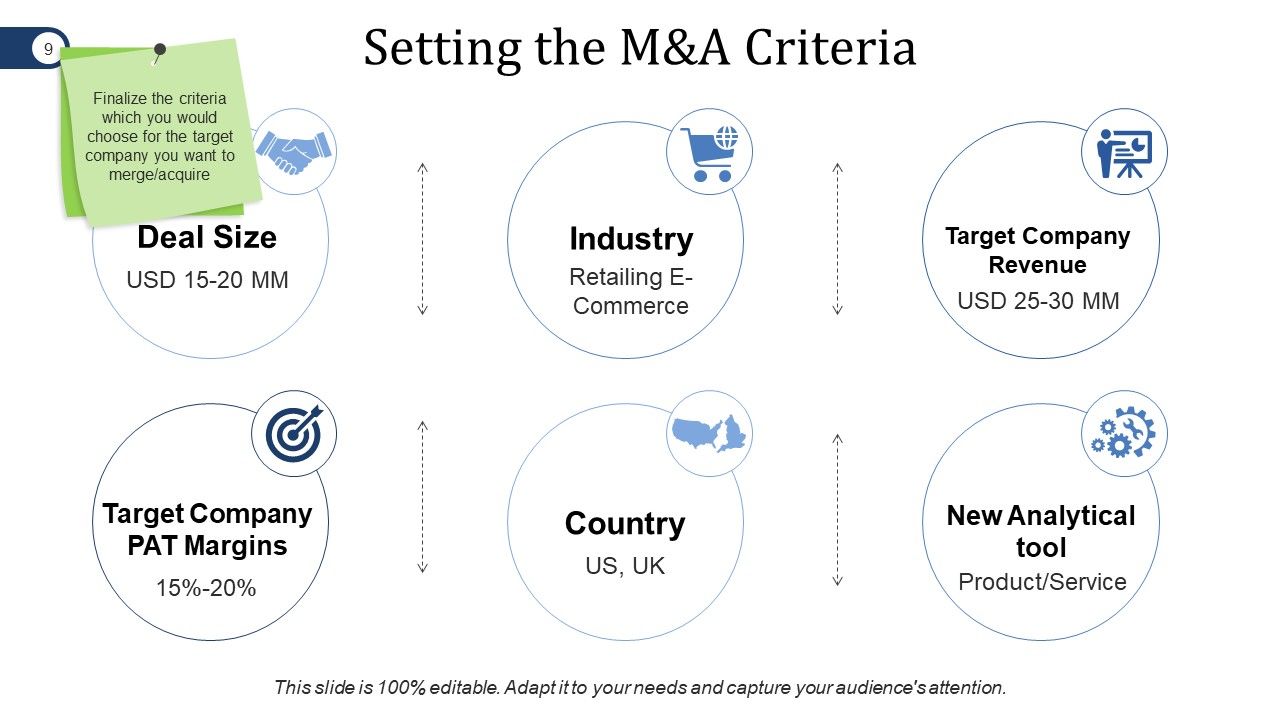

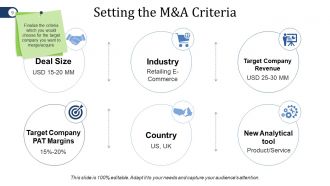

Slide 9: This is Setting the M&A Criteria.Its component are- Deal Size Industry Retailing E-Commerce Target Company Revenue New Analytical tool Country New Analytical tool Product/Service Target Company PAT Margins Finalize the criteria which you would choose for the target company you want to merge/acquire.

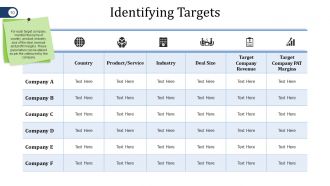

Slide 10: This is an Identifying Targets slide in a tabular form. For each target company, mention the name of country, product, Industry, size of the deal, revenue and profit margins. These parameters can be altered as per the criteria set by the company.

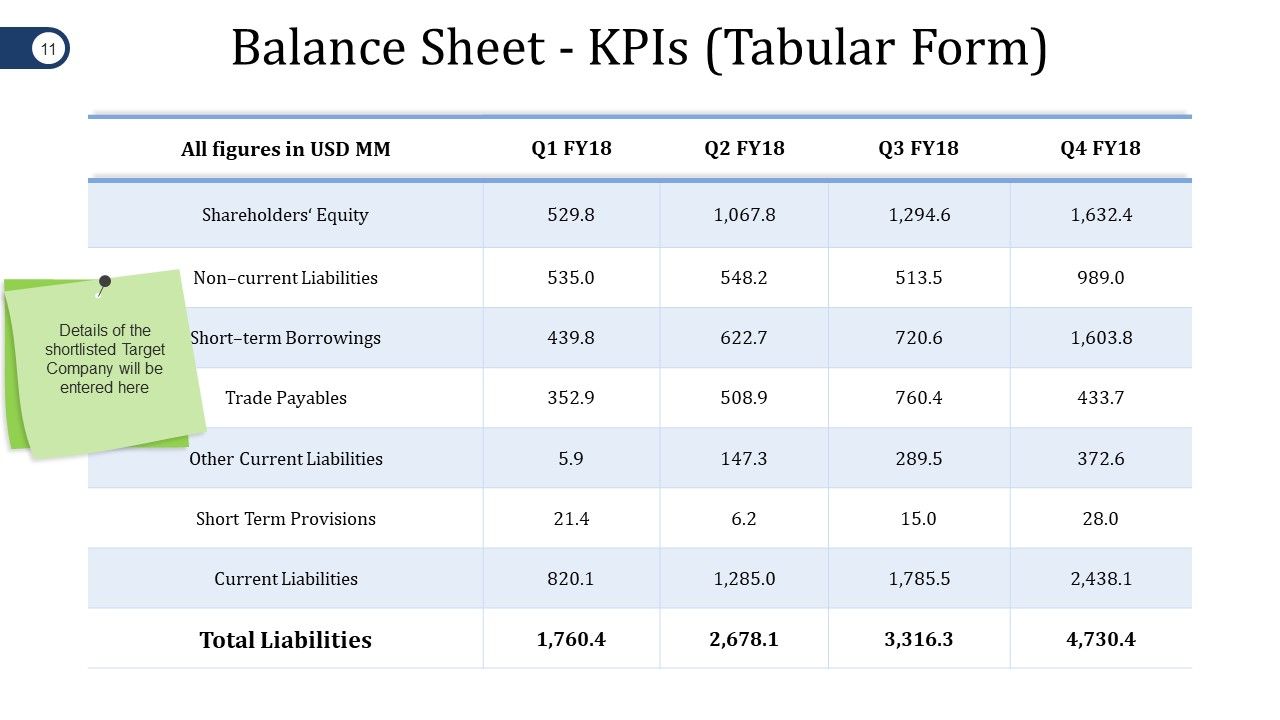

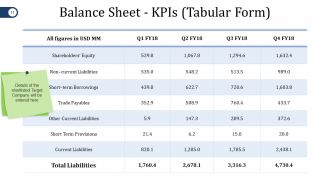

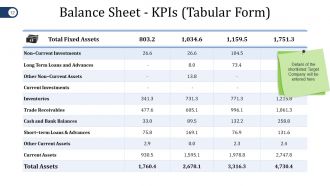

Slide 11: This slide shows Balance Sheet - KPIs in a Tabular form. Details of the shortlisted Target Company will be entered here. Alter them on the basis of your requirement.

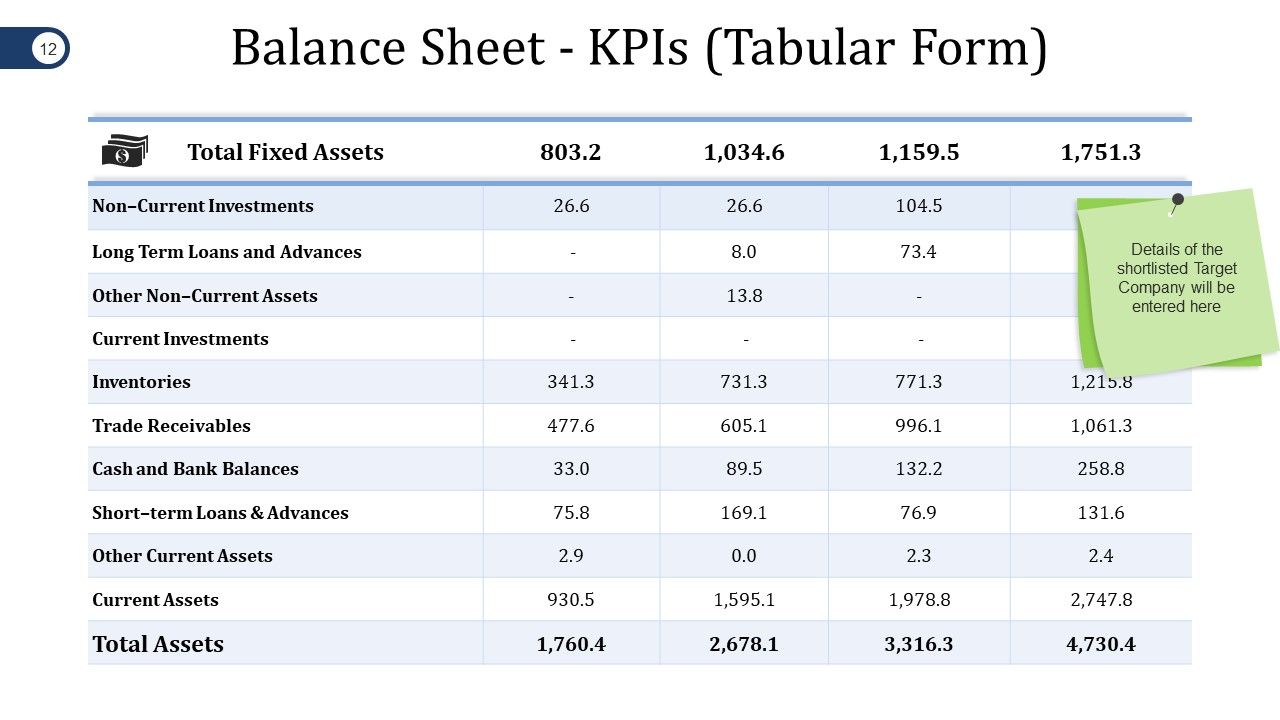

Slide 12: This slide also shows the Balance Sheet - KPIs in a Tabular form.

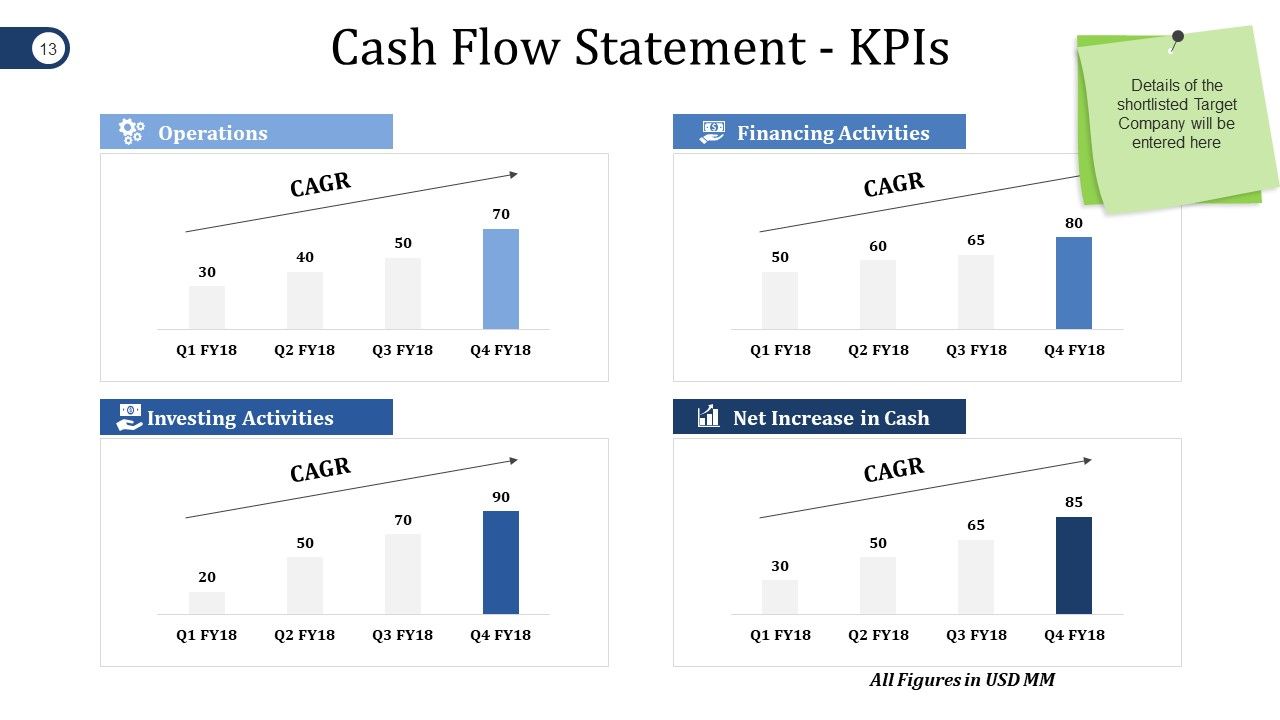

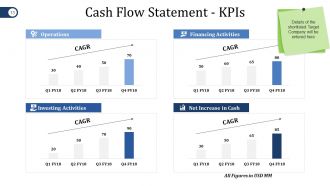

Slide 13: This slide showcases Cash Flow Statement - KPIs in a graph form. Use it to state the following- Financing Activities, Net Increase in Cash, Investing Activities, Operations.

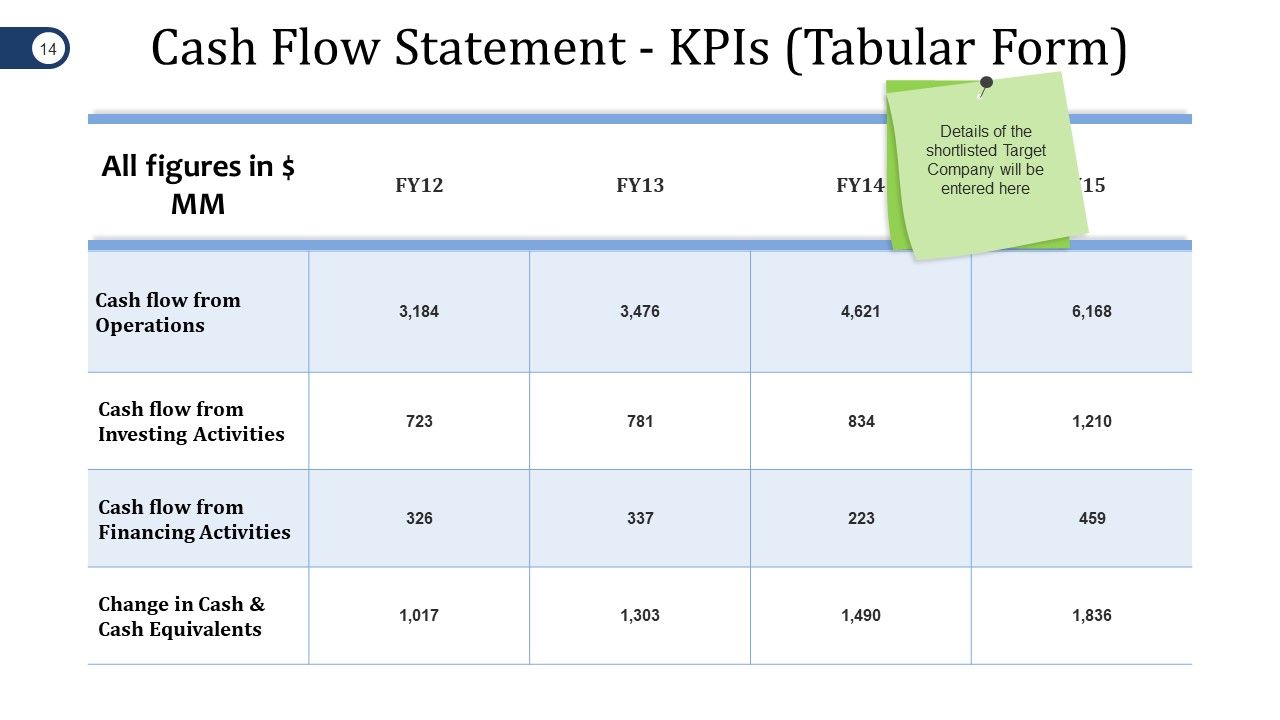

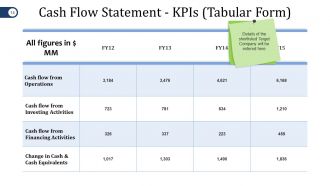

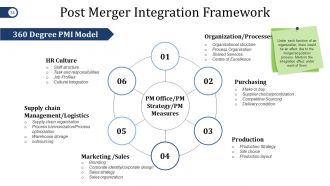

Slide 14: This slide also showcases Cash Flow Statement - KPIs in a Tabular Form.

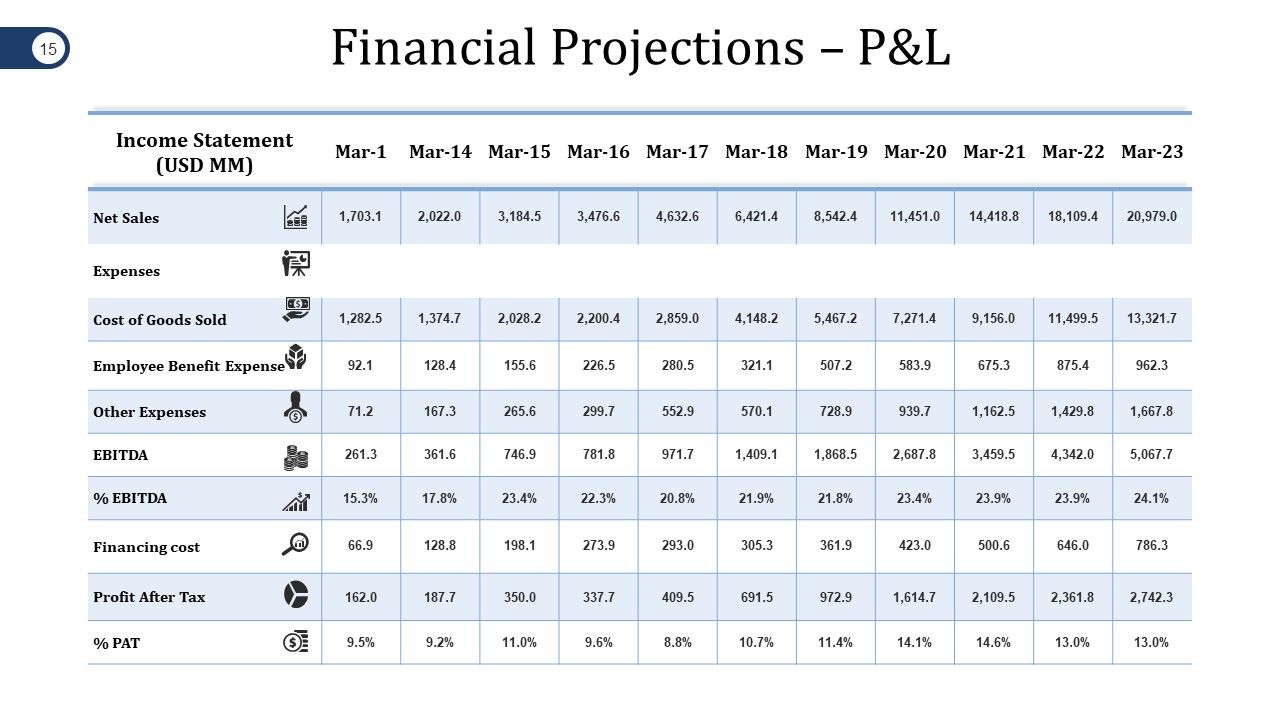

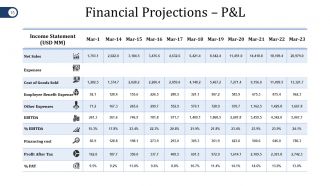

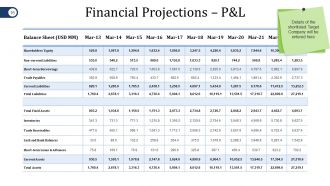

Slide 15: This slide showcases Financial Projections – P&L table. State your financial aspects here.

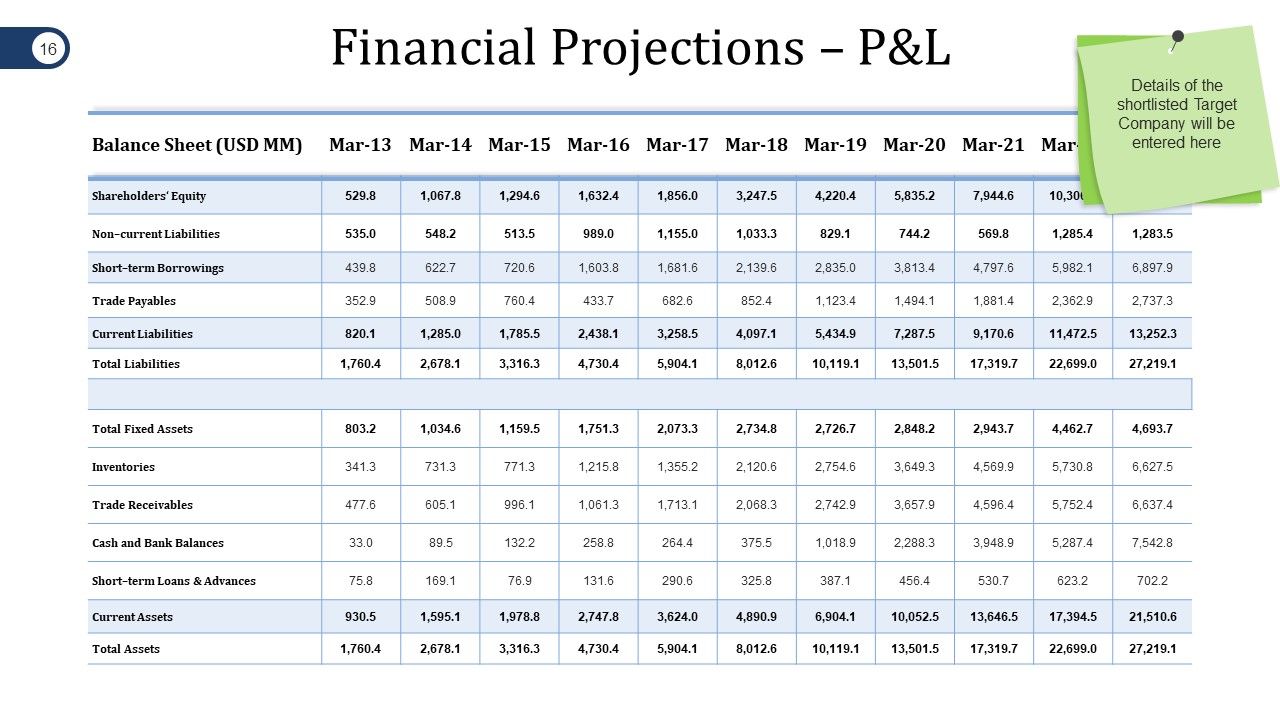

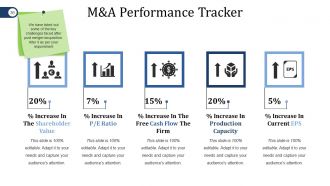

Slide 16: This slide also shows Financial Projections – P&L in a tabular form.

Slide 17: This slide states Key Financial Ratios. Details of the shortlisted Target Company will be entered here.

Slide 18: This slide also showcases Key Financial Ratios infographic. These are- Liquidity Ratio, Profitability Ratio, Activity Ratio, Solvency Ratio,

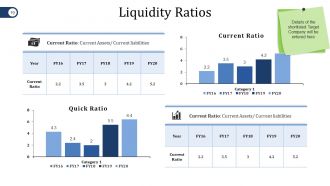

Slide 19: This slide states Liquidity Ratios in a bar graph/ chart form. Present Current Ratio and Quick Ratio in a bar graph here.

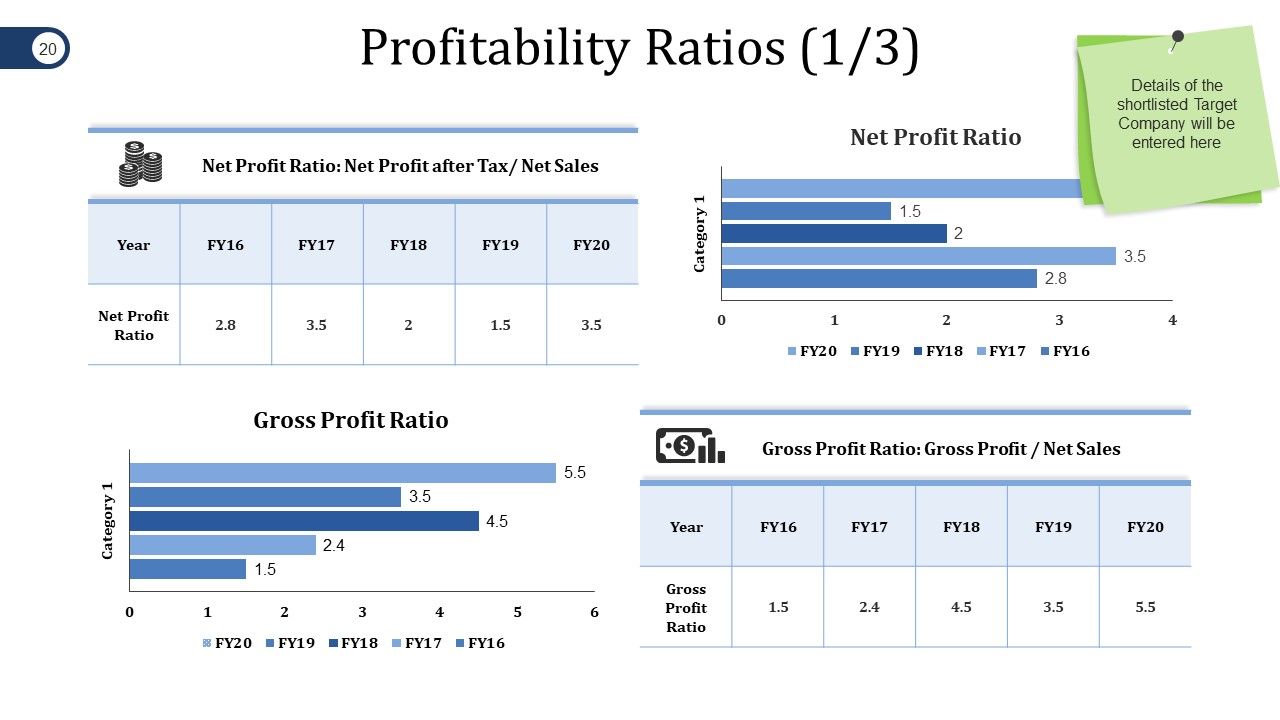

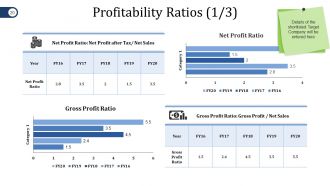

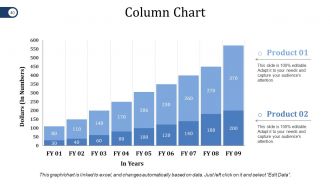

Slide 20: This slide states Profitability Ratios. Use it to present Net Profit Ratio and Gross Profit ratio in a bar graph/ chart form here.

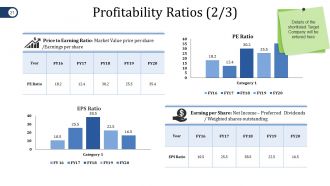

Slide 21: This slide also shows Profitability Ratios in a bar graph/ chart form. Use it to present PE Ratio and EPS Ratio here.

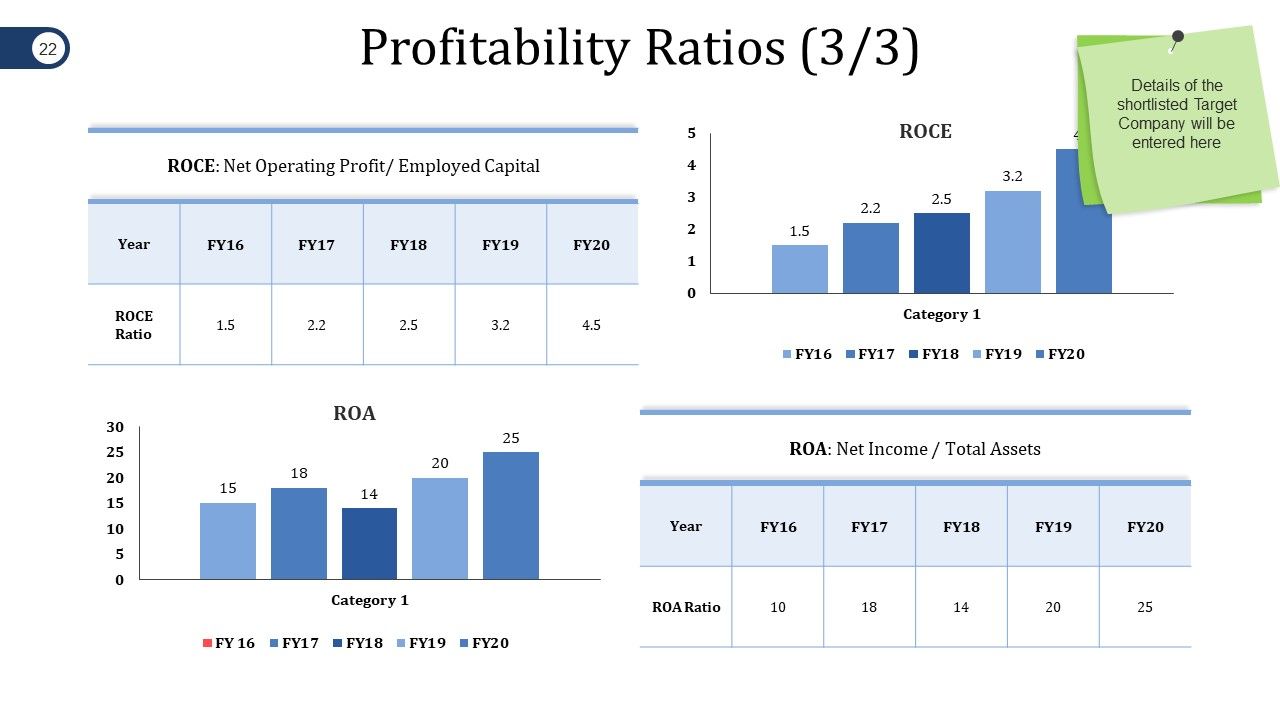

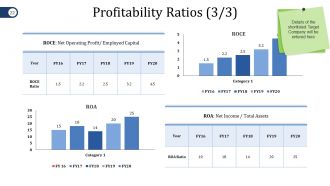

Slide 22: This slide also showcases Profitability Ratios such as - ROCE and ROA in a bar graph/ chart form.

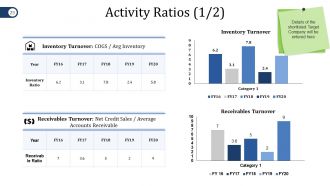

Slide 23: This slide showcases Activity Ratios such as Inventory Turnover, Receivables Turnover etc. in a bar graph/ chart form.

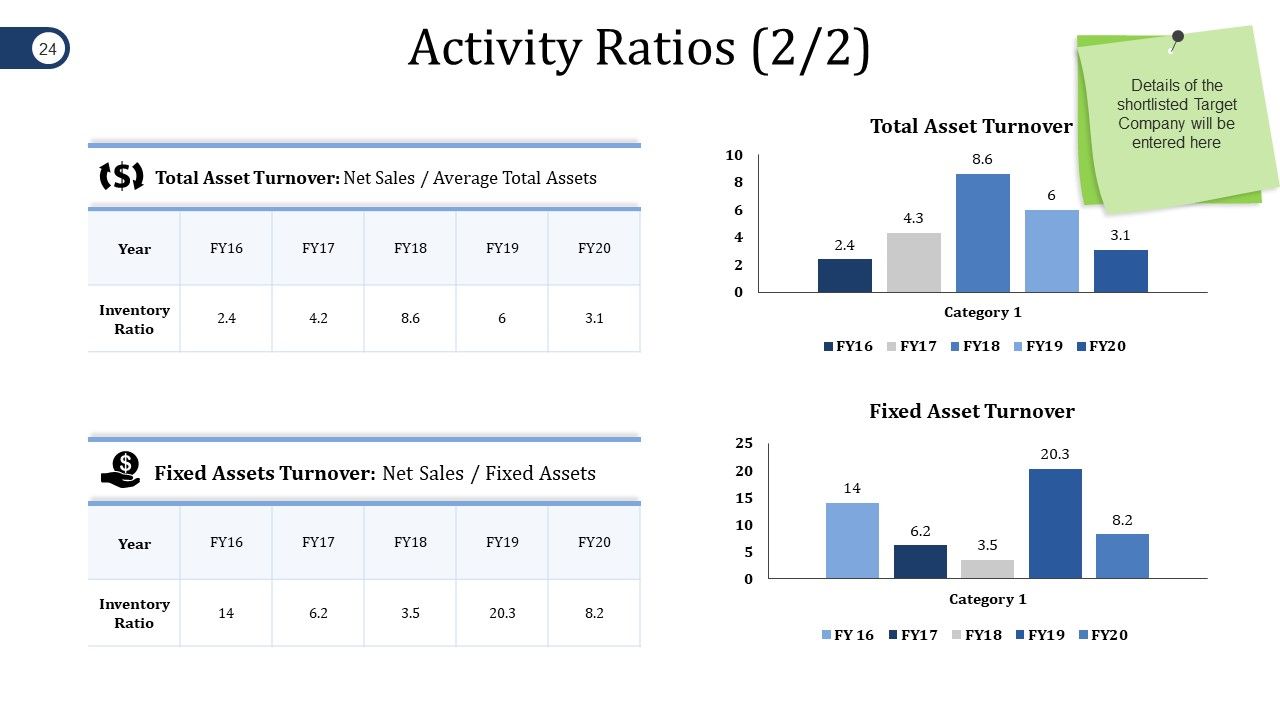

Slide 24: This is another Activity Ratios slide showing- Fixed Asset Turnover, Total Asset Turnover.

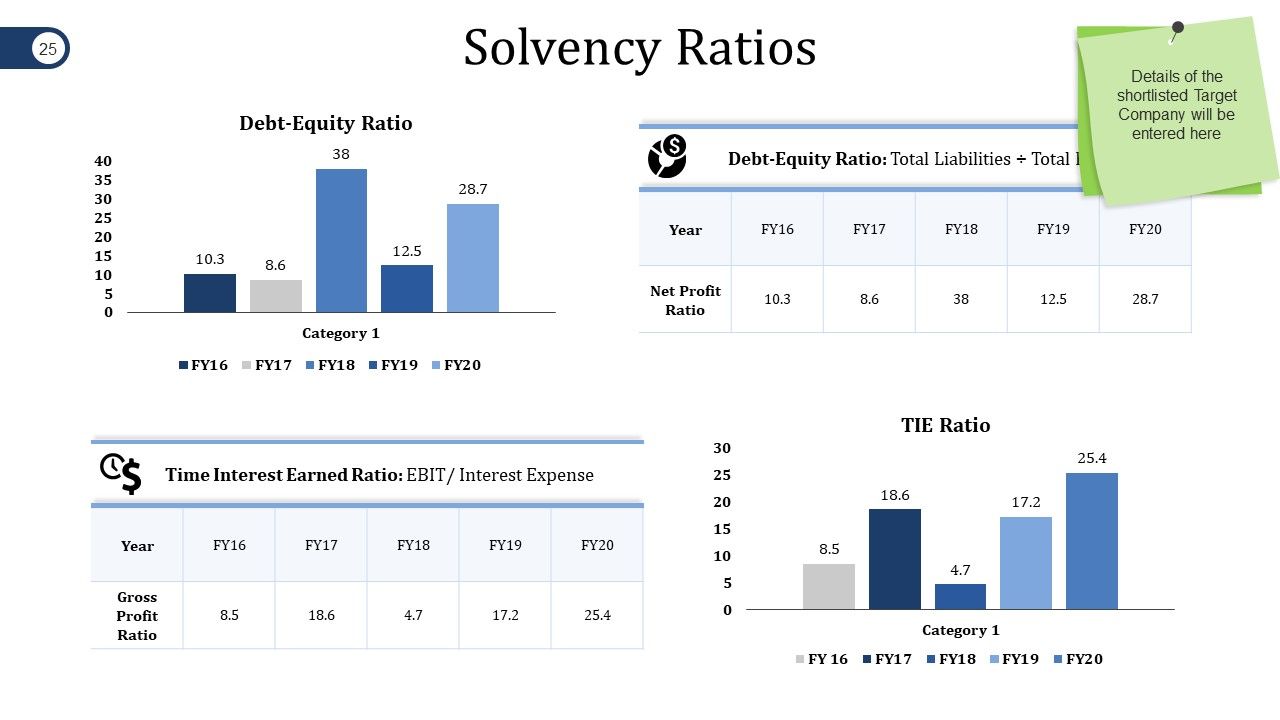

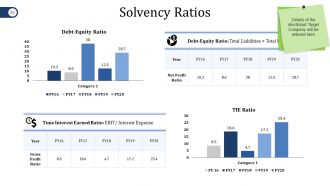

Slide 25: This is Solvency Ratios slide showing the following in a bar graph/ chart form. Debt-Equity Ratio, TIE Ratio.

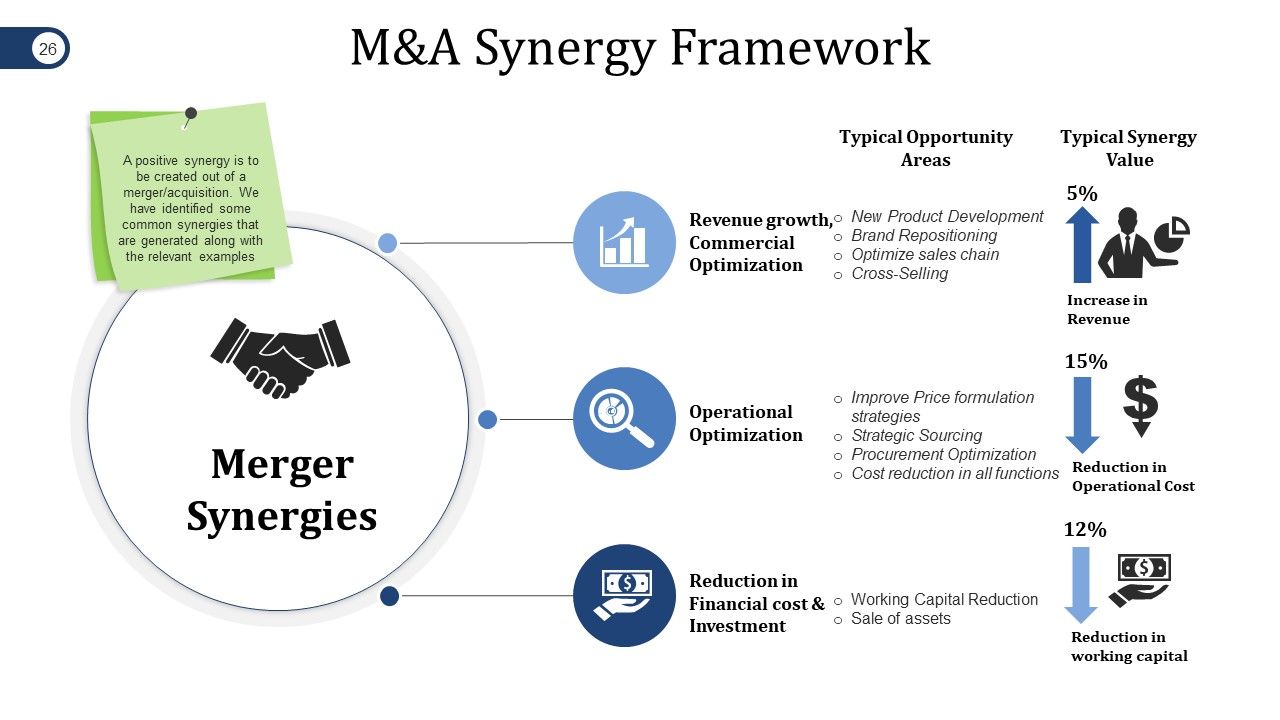

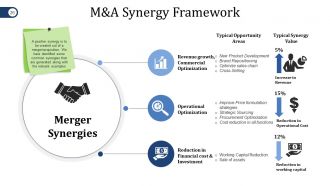

Slide 26: This slide showcases M&A Synergy Framework with icon imagery. A positive synergy is to be created out of a merger/acquisition. We have identified some common synergies that are generated along with the relevant examples.

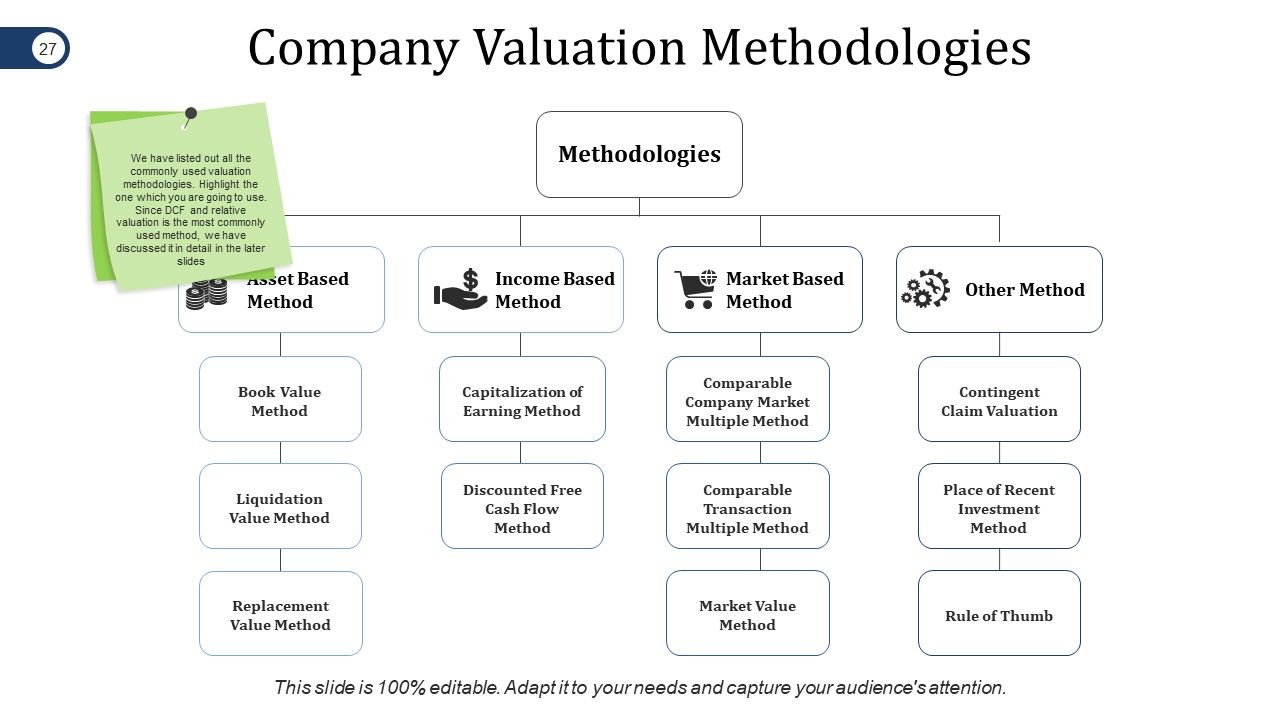

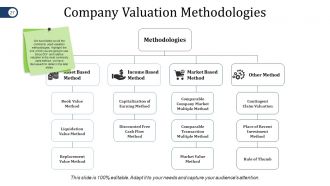

Slide 27: This slide presents Company Valuation Methodologies in a flow chart form. These methodologies are- Asset Based Method, Income Based Method, Market Based Method, Other Method. We have listed out all the commonly used valuation methodologies. Highlight the one which you are going to use.

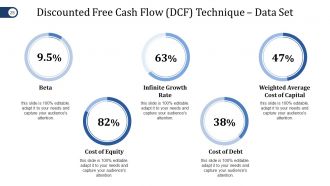

Slide 28: This slide showcases Discounted Free Cash Flow (DCF) Technique – Data Set with- Beta, Infinite Growth Rate, Weighted Average Cost of Capital, Cost of Debt, Cost of Equity.

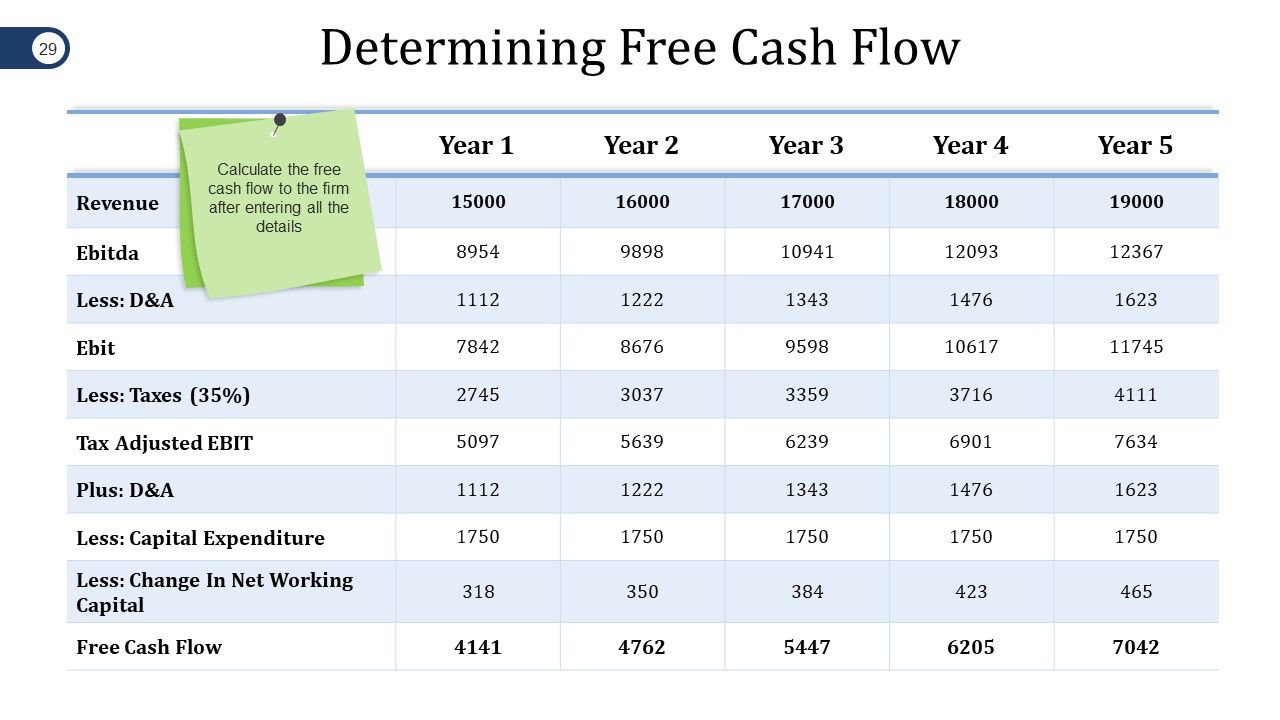

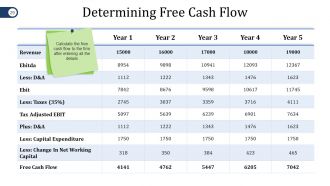

Slide 29: This slide shows Determining Free Cash Flow table. Calculate the free cash flow to the firm after entering all the details here.

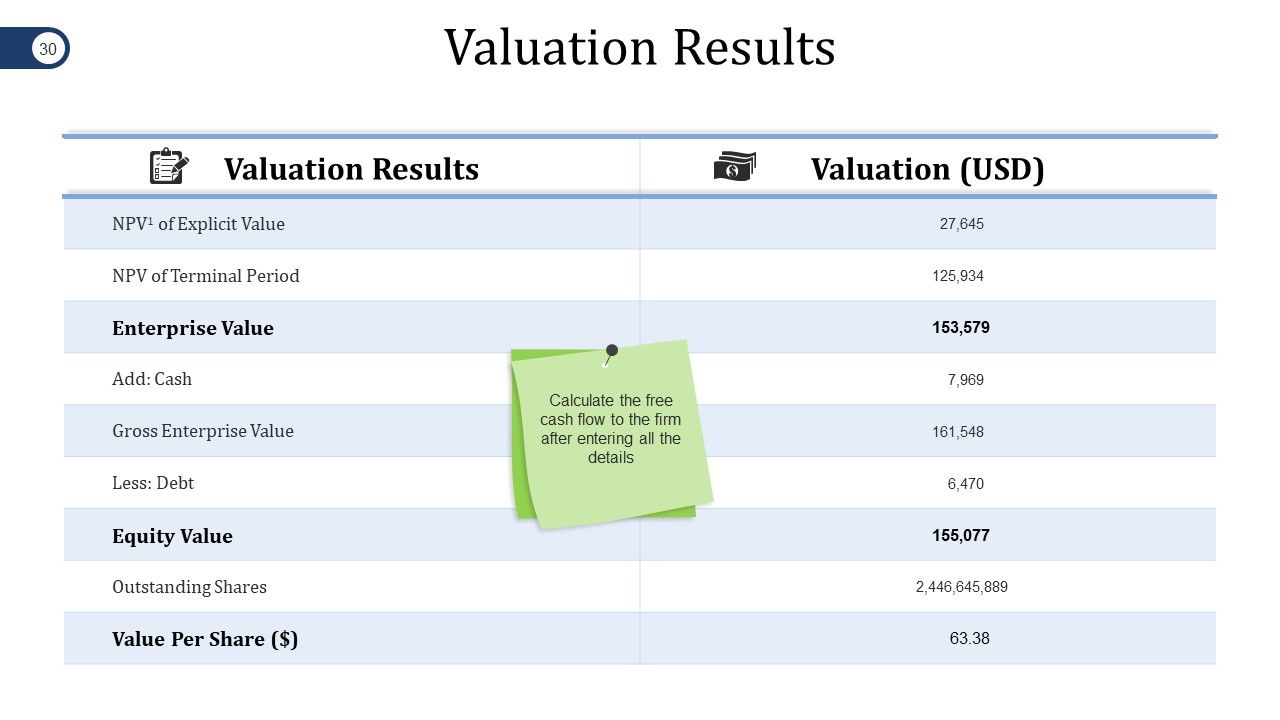

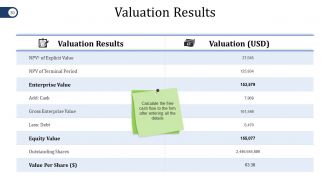

Slide 30: This slide presents Valuation Results in a tabular form.

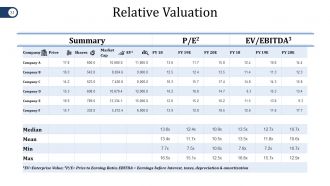

Slide 31: This is Relative Valuation slide in a tabular form with the following sub headings- Summary, P/E2, EV/EBITDA3.

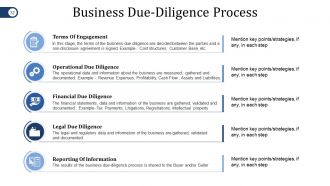

Slide 32: This slide states Business Due-Diligence Process with the folowing steps- Terms Of Engagement, Operational Due Diligence, Financial Due Diligence, Legal Due Diligence, Reporting Of Information.

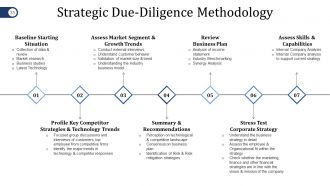

Slide 33: This slide showcases Strategic Due-Diligence Methodology with the following points- Baseline Starting Situation, Profile Key Competitor Strategies & Technology Trends, Assess Market Segment & Growth Trends, Summary & Recommendations, Review Business Plan, Stress Test Corporate Strategy, Assess Skills & Capabilities.

Slide 34: This slide shows Post Merger Integration Framework with PM Office/ PM Strategy/ PM Measures in a circular form. These are- Organization/Processes, Purchasing, Production, Marketing /Sales, Supply chain Management/Logistics, HR Culture. Under each function of an organization, there would be an effect due to the merger/acquisition process. Mention the integration effect under each of them.

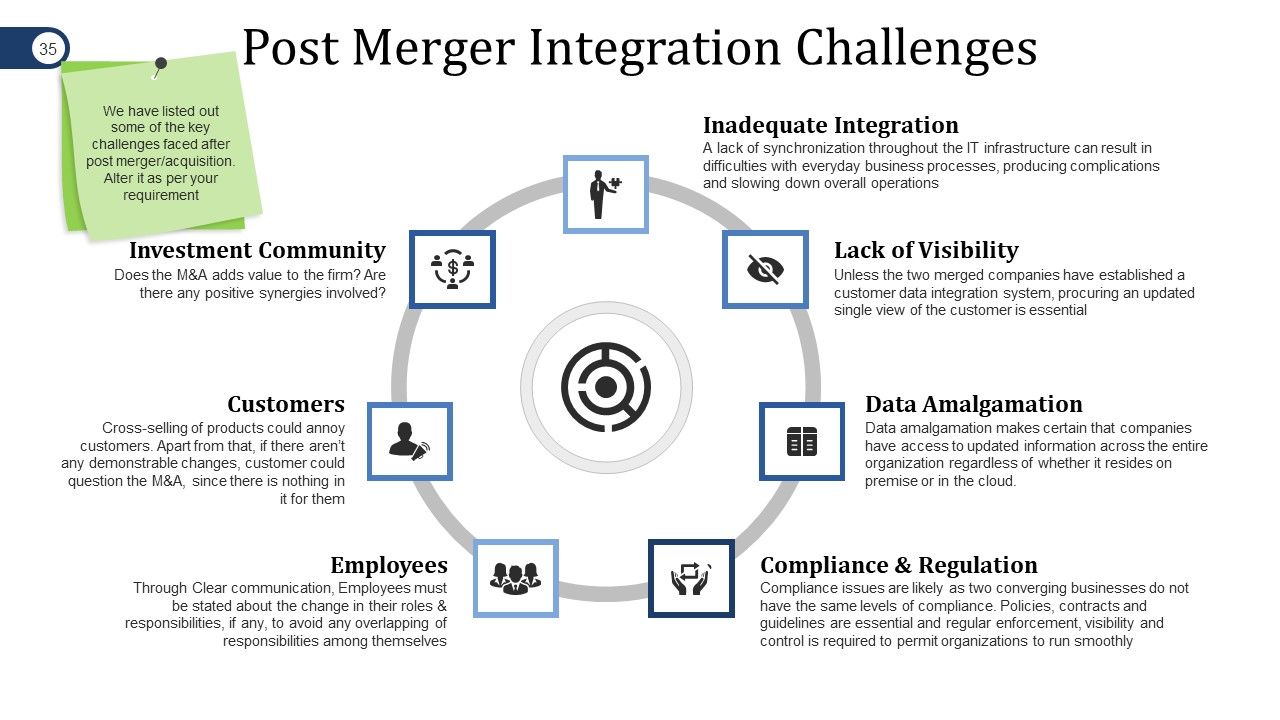

Slide 35: This slide states Post Merger Integration Challenges in a circular form. These are- Inadequate Integration, Lack of Visibility, Data Amalgamation, Compliance & Regulation, Investment Community, Customers, Employees. We have listed out some of the key challenges faced after post merger/ acquisition. Alter it as per your requirement.

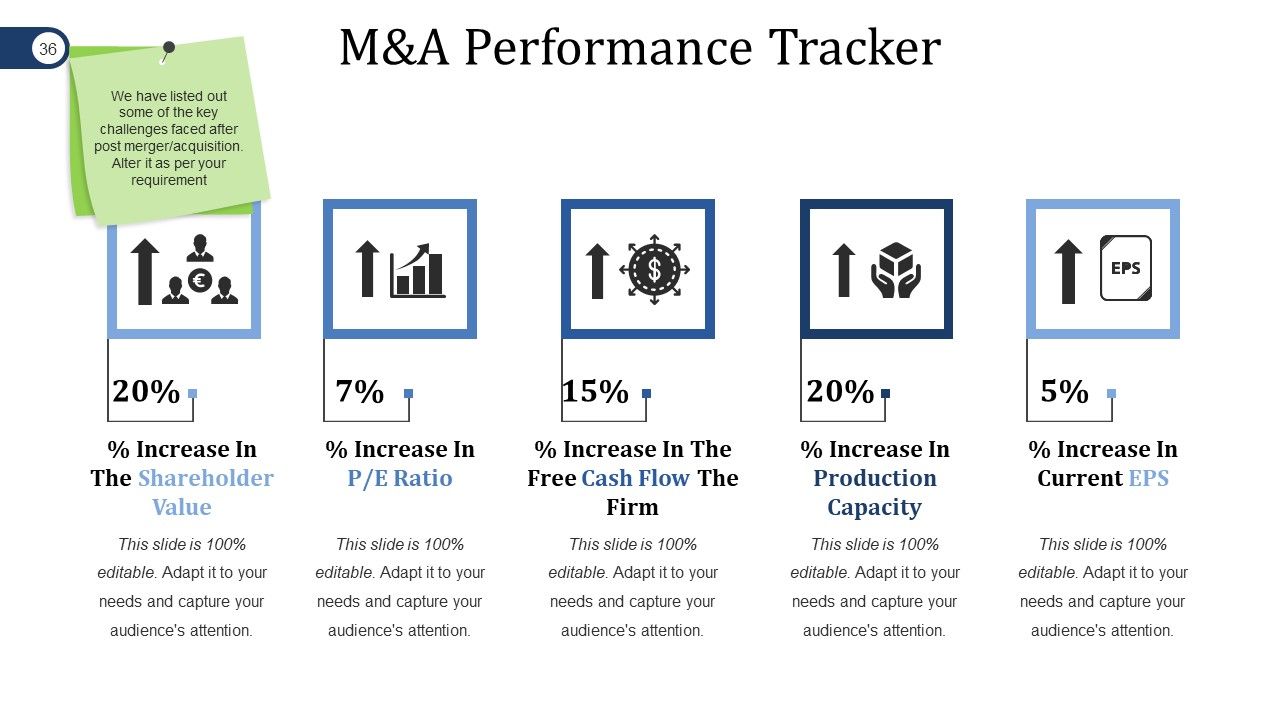

Slide 36: This slide presents M&A Performance Tracker.

Slide 37: This slide states Mergers And Acquisitions Project Plan with Icons. Use icons as per need.

Slide 38: This is a Coffee Break image slide to halt. Modify/ alter the content as per need.

Slide 39: This slide is titled Our Chats & Graph to move forward. You may alter the content as per need.

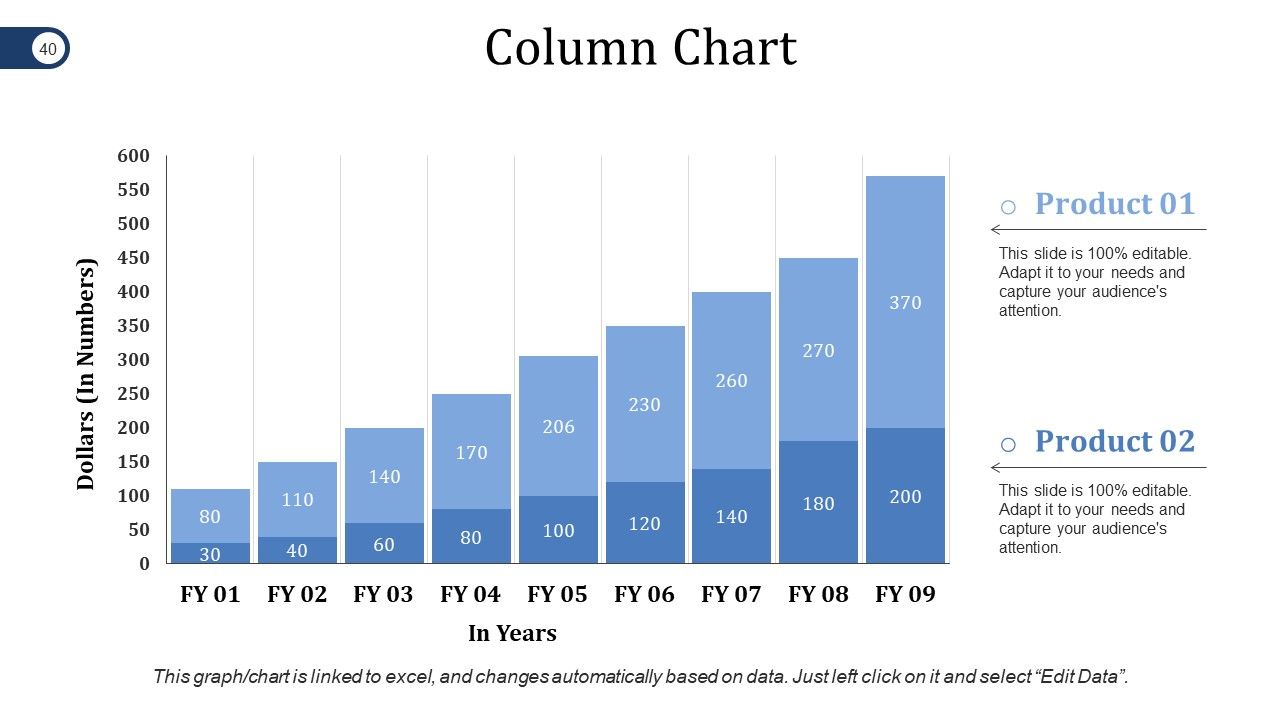

Slide 40: This slide presents a Column Chart for showcasing product/ company growth, comparison etc.

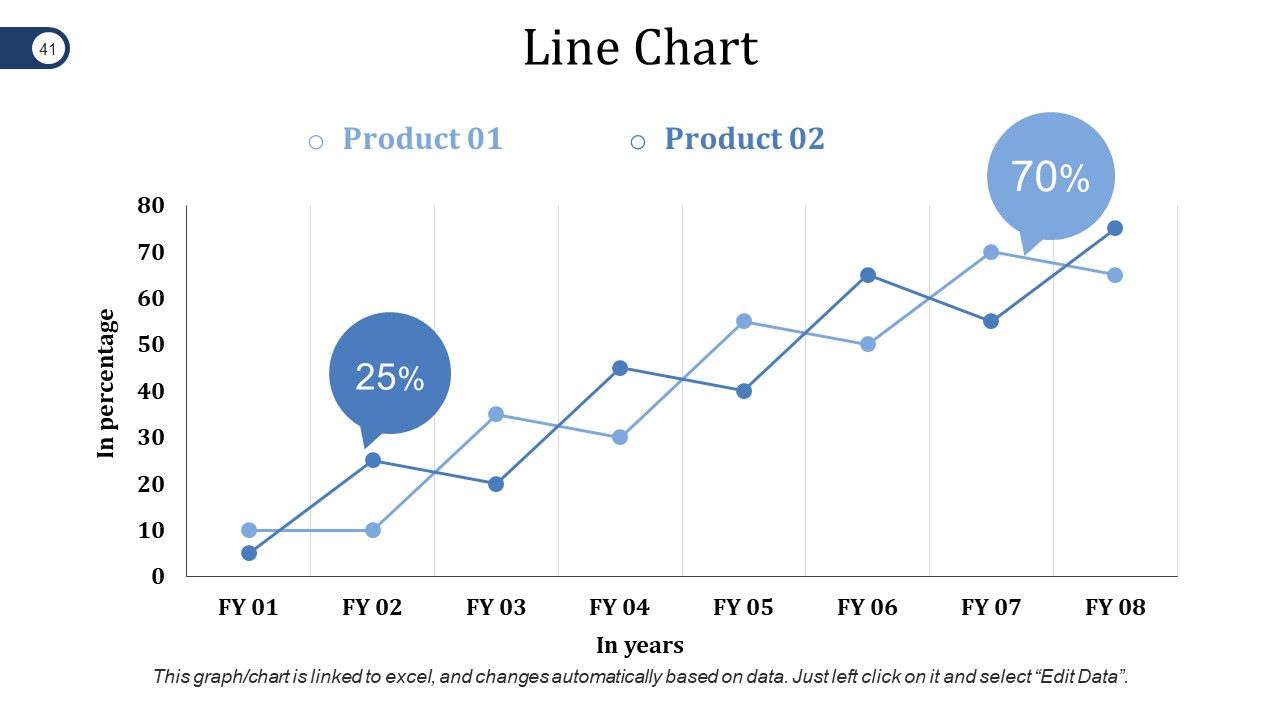

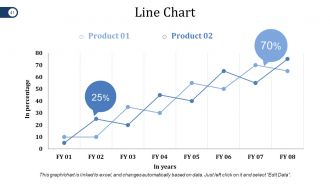

Slide 41: This slide presents a Line Chart for showcasing product/ company growth, comparison etc.

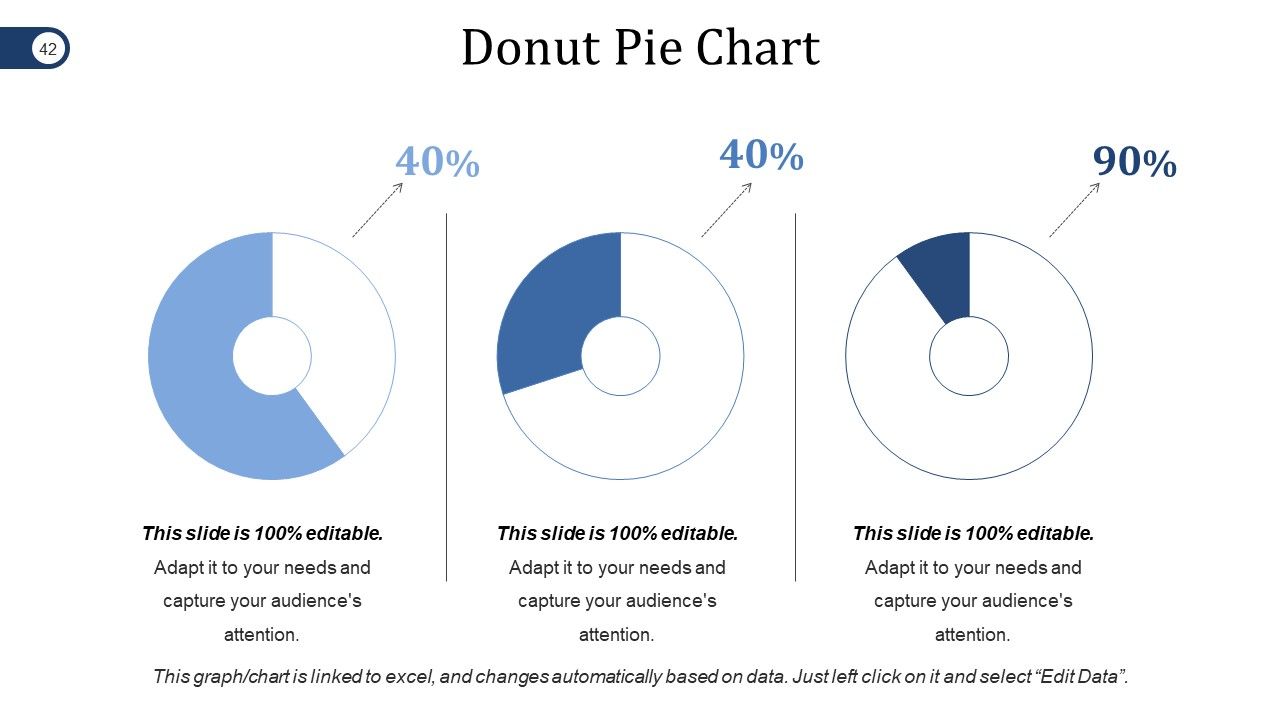

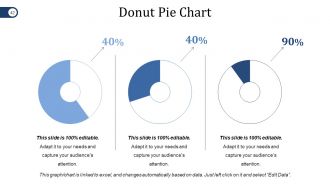

Slide 42: This is a Donut Pie Chart slide to present product/ entity comparison, specifications etc.

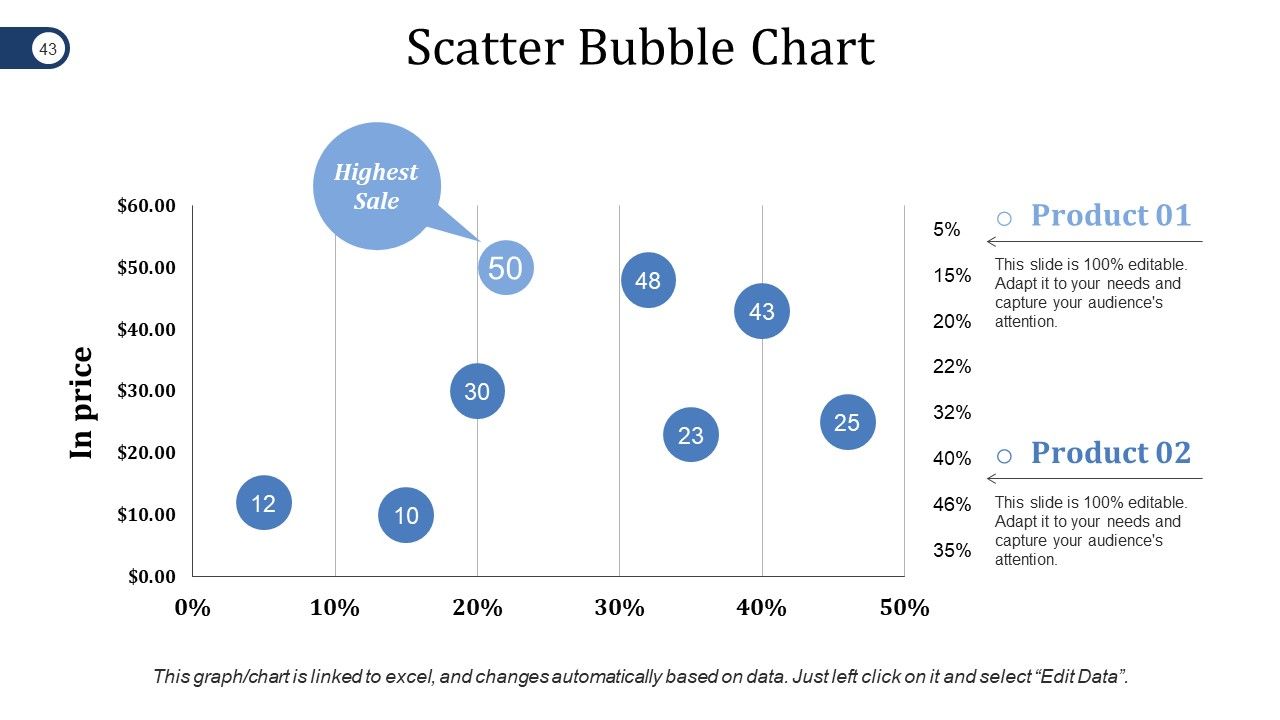

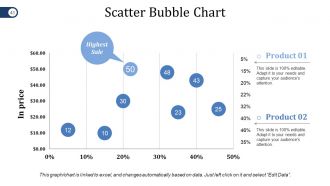

Slide 43: This is a Scatter Bubble Chart slide to present product/ entity comparison, specifications etc.

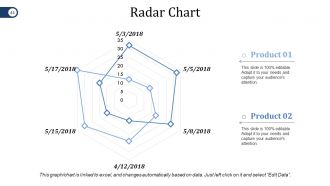

Slide 44: This is a Radar Chart slide for product/ entity comparison.

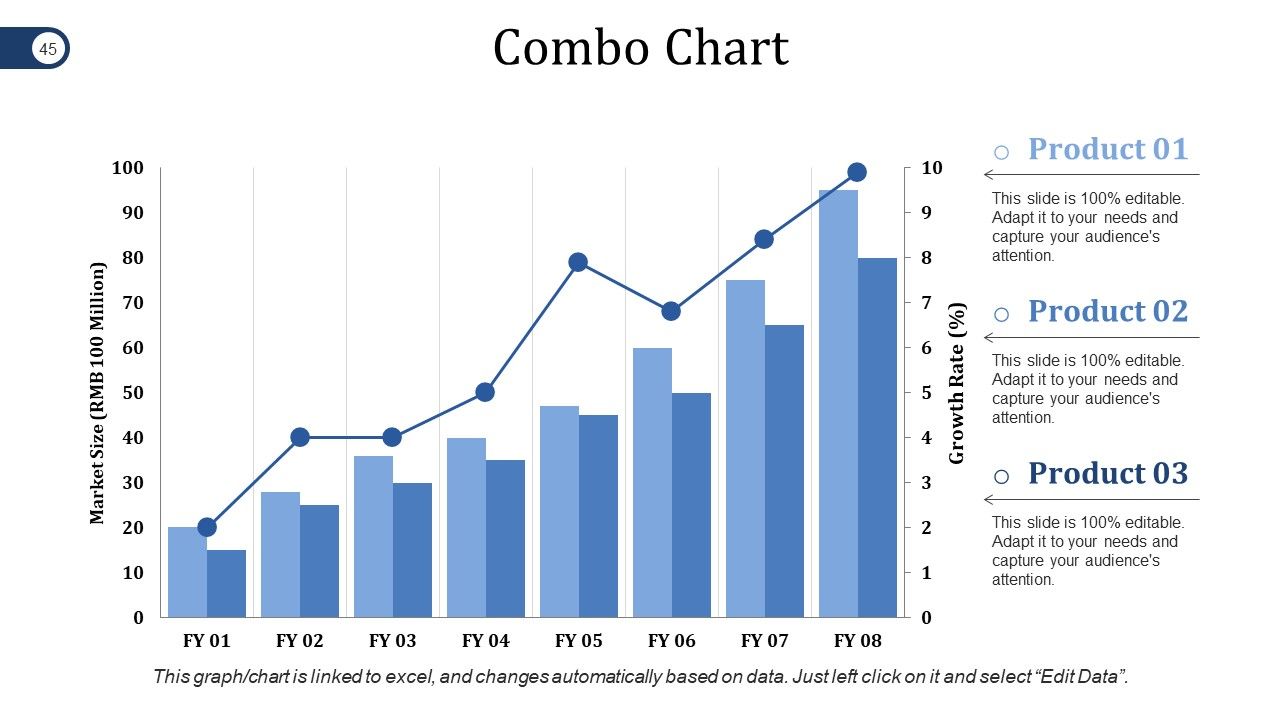

Slide 45: This slide shows Combo Chart for product/ entity comparison.

Slide 46: This slide is titled Additional Slides to move forward. You can change the slide content as per need.

Slide 47: This slide showcases Our Mission. Show your company mission, goals etc. here.

Slide 48: This slide showcases Our Team with name and designation to fill.

Slide 49: This is an About Us slide. State team/ company specifications here.

Slide 50: This is Our Goal slide. State your goals here.

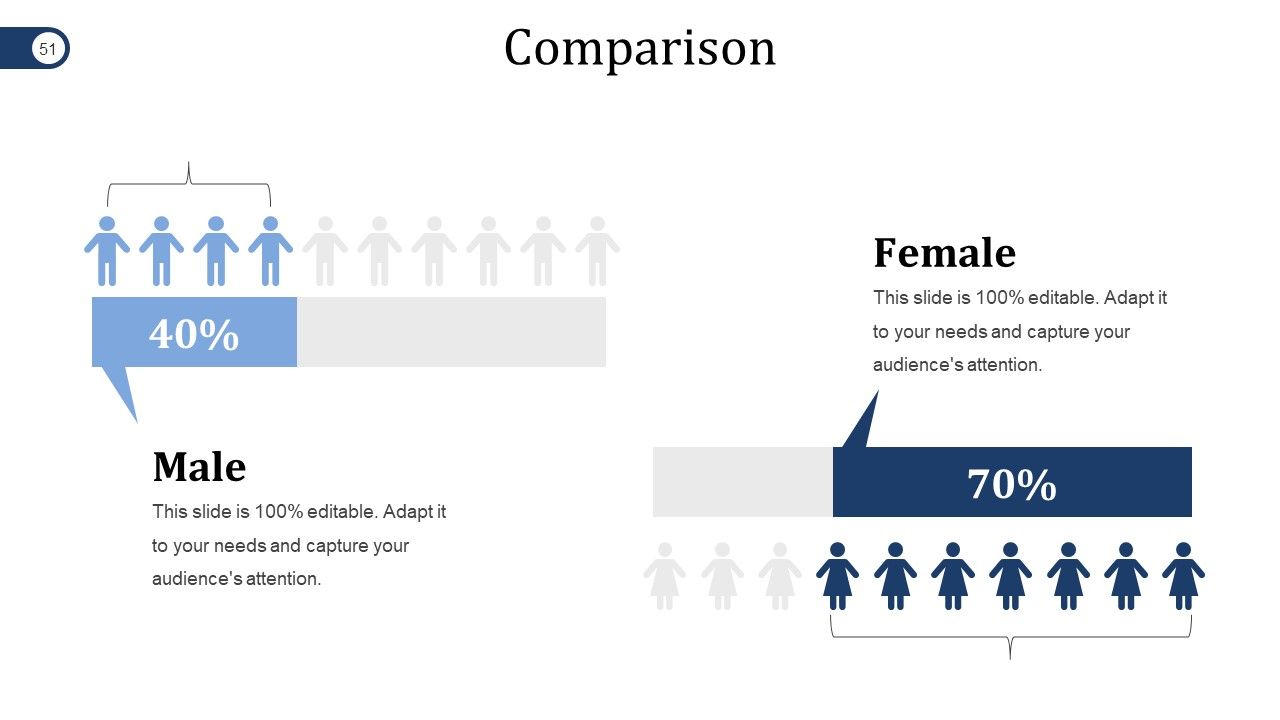

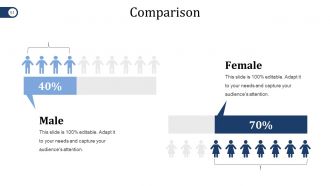

Slide 51: This is a Comparison slide to show comparison of two entities.

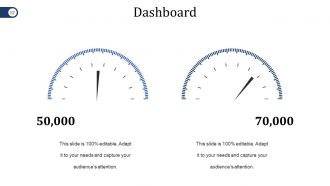

Slide 52: This is a Dashboard slide to state metrics, kpis etc.

Slide 53: State your Financial score in this slide with relevant text.

Slide 54: This is a Quotes slide to convey message, beliefs etc.

Slide 55: This is a Puzzle pieces image slide to show information, specifications etc.

Slide 56: This is a Target image slide. State targets, etc. here.

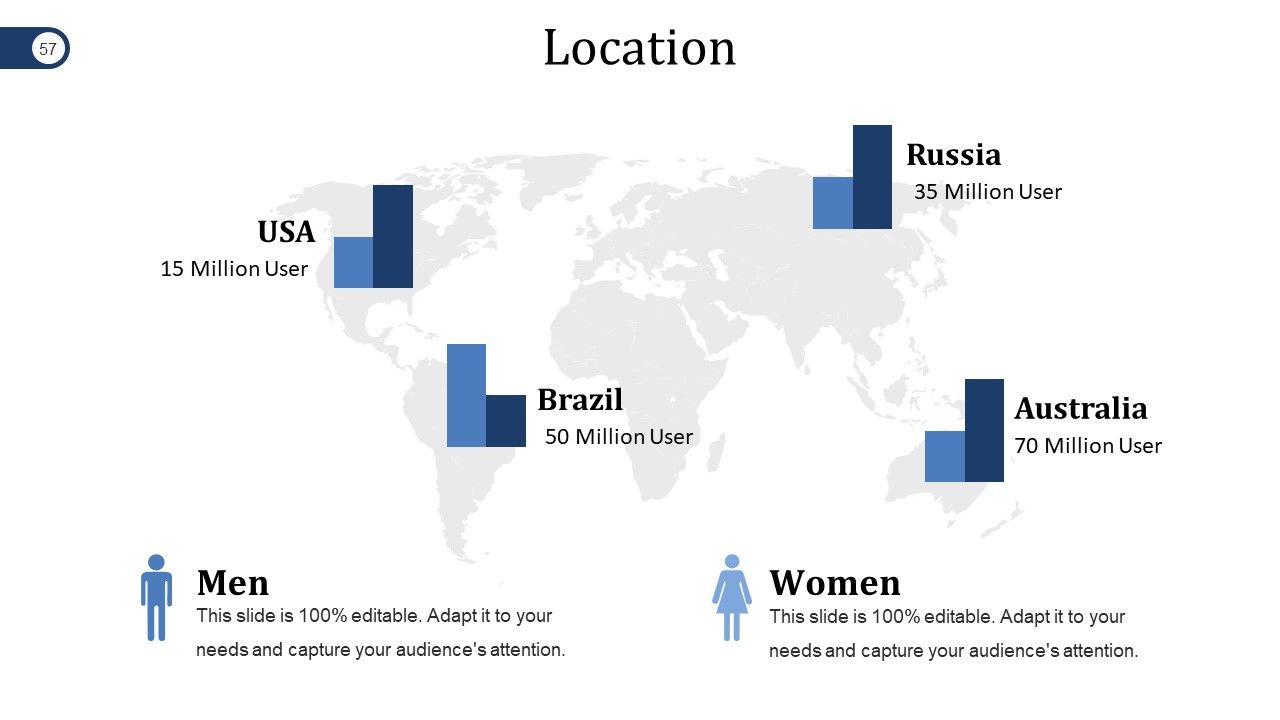

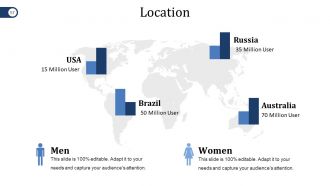

Slide 57: This slide showcases Global Project Locations on a World map image and text boxes to make it explicit.

Slide 58: This is a Circular slide to show information, specification etc.

Slide 59: This is a Venn Diagram image slide to show information, specifications etc.

Slide 60: This is a Mind map image slide to show information, segregation, specifications etc.

Slide 61: This is a Silhouettes slide to show people related information, specifications etc.

Slide 62: This slide shows a Magnifying glass image with text boxes. State information etc. here.

Slide 63: This is a Bulb or Idea slide to show information, ideas, specifications etc.

Slide 64: This is a Thank You slide with Address# street number, city, state, Contact Numbers, Email Address.

Mergers And Acquisitions Project Plan Powerpoint Presentation Slides with all 64 slides:

Act flawlessly with our Mergers And Acquisitions Project Plan Powerpoint Presentation Slides. They will keep your finger out.

FAQs

The Mergers and Acquisitions Project Plan is a plan that companies follow when they are considering a merger or acquisition. It consists of several steps that the company must undertake before the merger or acquisition is finalized.

The types of inorganic opportunities are Conglomerate, Market Extension Merger, Acquisition, Product Extension Merger, Horizontal Merger, and Vertical Merger.

The key financial ratios are Liquidity Ratio, Profitability Ratio, Activity Ratio, and Solvency Ratio.

M&A Synergy is the positive outcome that results from a merger or acquisition. It is created when the combined company is worth more than the sum of its parts.

The company valuation methodologies are Asset Based Method, Income Based Method, Market Based Method, and Other Method.

-

Thanks for all your great templates they have saved me lots of time and accelerate my presentations. Great product, keep them up!

-

Editable templates with innovative design and color combination.