Structure for private equity fund

Decide on your actions with our Structure For Private Equity Fund. Choose the course you desire to follow.

Decide on your actions with our Structure For Private Equity Fund. Choose the course you desire to follow.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting this set of slides with name Structure For Private Equity Fund. This is a four stage process. The stages in this process are General Partner, Outside Investors, Investment, Individual Fund. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

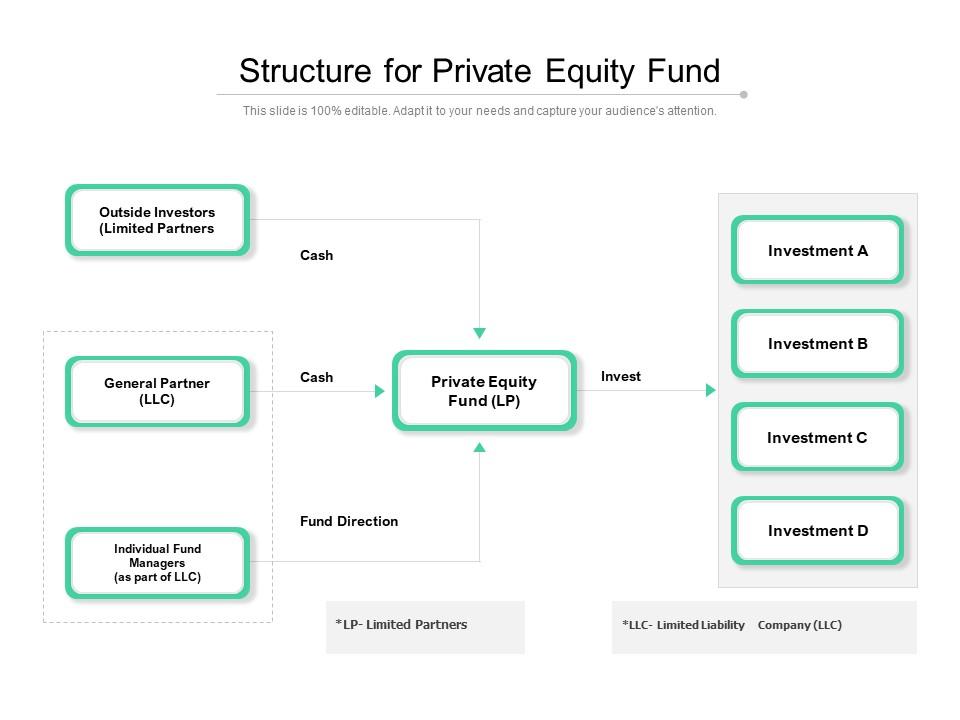

The image depicts the organizational and financial structure of a private equity fund. The elements show the flow of funds from investors to various investments and the roles of different entities within the fund.

The text elements explained:

1. Structure for Private Equity Fund:

This is the title of the slide, clearly stating its purpose.

2. Outside Investors (Limited Partners):

These are the sources of capital for the fund, contributing cash to the private equity fund (LP).

3. General Partner (LLC):

This entity manages the private equity fund and typically has unlimited liability.

4. Individual Fund Managers (as part of LLC):

They are responsible for making decisions on investments and managing the private equity fund's portfolio.

5. Private Equity Fund (LP):

This is the main fund where the capital from Limited Partners and the General Partner is pooled.

6. Investment A, Investment B, Investment C, Investment D:

These represent the individual assets or companies that the private equity fund invests in.

7. Fund Direction:

This signifies the strategic management and oversight of the fund, usually exercised by the general partner.

8. *LP Limited Partners and *LLC Limited Liability Company (LLC):

Denote the abbreviations used in the diagram for clarity.

Use Cases:

Seven industries where this slide could be relevant:

1. Finance:

Use: Illustrating private equity fund structure.

Presenter: Financial analyst or fund manager.

Audience: Potential investors or finance students.

2. Consulting:

Use: Advising on private equity setups.

Presenter: Senior consultant.

Audience: Investment or wealth management firms.

3. Education:

Use: Teaching financial concepts.

Presenter: Professor or finance instructor.

Audience: Business or finance students.

4. Legal:

Use: Explaining legal structuring of investments.

Presenter: Attorney specializing in business law.

Audience: Clients or junior attorneys.

5. Fundraising:

Use: Demonstration of funds' operational mechanisms.

Presenter: Professional fundraiser or capital raising specialist.

Audience: High-net-worth individuals or institutional investors.

6. Venture Capital:

Use: Comparing venture capital and private equity structures.

Presenter: Venture capitalist.

Audience: New entrepreneurs or startup owners.

7. Corporate Training:

Use: Training new employees on company investment strategies.

Presenter: Corporate trainer or internal financial advisor.

Audience: New hires or internal team members.

Structure for private equity fund with all 2 slides:

Choose the course you desire with our Structure For Private Equity Fund. They enable you to decide your actions.

No Reviews