Retail lending process framework with risk management

Our Retail Lending Process Framework With Risk Management are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

Our Retail Lending Process Framework With Risk Management are topically designed to provide an attractive backdrop to any s..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting this set of slides with name Retail Lending Process Framework With Risk Management. The topics discussed in these slides are Busines, Process, Management. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

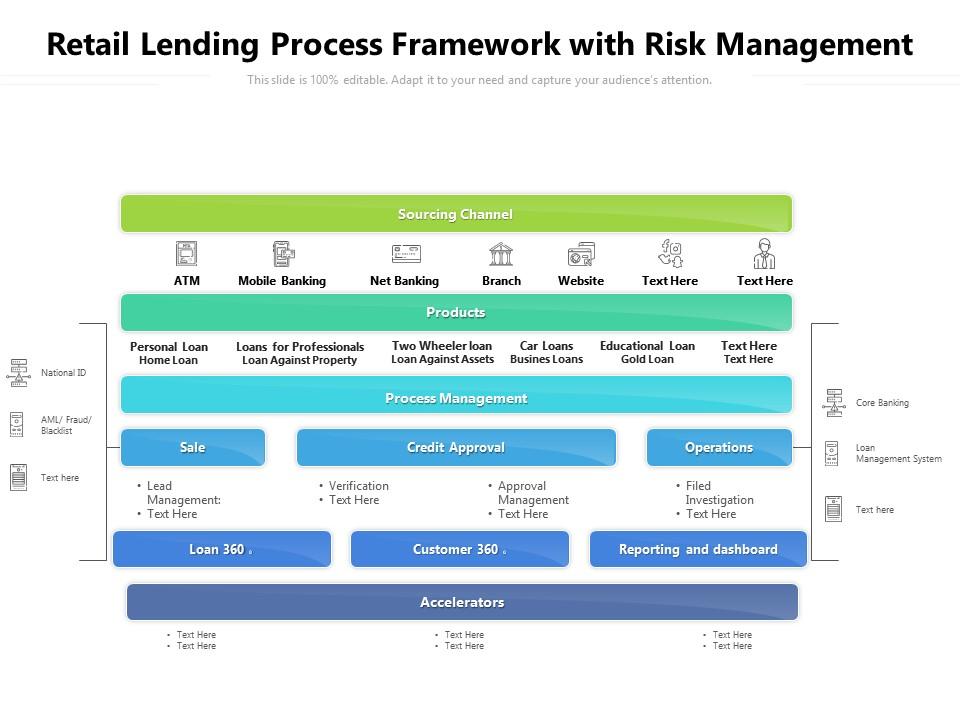

The PowerPoint slide is titled "Retail Lending Process Framework with Risk Management." It illustrates a comprehensive framework for managing the lending process in retail banking. The framework is divided into multiple components:

1. Sourcing Channel:

Lists various channels through which loan applications can be sourced such as ATM, Mobile Banking, Net Banking, Branch, Website, and two additional unnamed channels.

2. Products:

Various loan products include Personal Loan, Home Loan, Loans for Professionals, Loan Against Property, Two-Wheeler Loan, Car Loans, Educational Loan, Gold Loan, and two placeholders for additional products.

3. Process Management:

The process flow is divided into three main stages – Sale, Credit Approval, and Operations. Each stage has specific actions:

4. Sale:

Focuses on lead management.

5. Credit Approval:

Involves verification and approval management.

6. Operations:

Includes filed investigation and text placeholders for other operations.

7. Customer 360°:

This seems to represent a holistic view of the customer throughout the lending process.

8. Reporting and Dashboard:

Indicates that there is a system in place for reporting and analytics, though specific details are not provided.

9. Accelerators:

This section has placeholders for text, suggesting tools or methods to expedite the lending process.

10. Additional Notes:

There are references to "Loan 360°", "Customer 360°", AML/Fraud/Blacklist considerations, and a Loan Management System, indicating a technology-driven and compliance-aware process framework.

Use Cases:

This slide can be adapted for use in various industries related to financial services and risk management:

1. Commercial Banking:

Use: Managing retail loan processes.

Presenter: Retail Banking Manager.

Audience: Banking Staff, Risk Management Team.

2. Financial Services Consulting:

Use: Advising clients on lending process optimization.

Presenter: Financial Consultant.

Audience: Bank Executives, Financial Analysts.

3. Risk Management Software Development:

Use: Demonstrating software solutions for loan processing.

Presenter: Software Product Manager.

Audience: IT Department, Compliance Officers.

4. Compliance and Regulatory Bodies:

Use: Training on best practices for retail lending.

Presenter: Compliance Trainer.

Audience: Regulatory Staff, Bank Compliance Teams.

5. Credit Unions:

Use: Streamlining loan processing.

Presenter: Credit Union Officer.

Audience: Credit Union Members, Staff.

6. Mortgage Companies:

Use: Overseeing mortgage loan processing.

Presenter: Mortgage Broker.

Audience: Mortgage Processors, Underwriters.

7. Fintech Startups:

Use: Introducing innovative lending models.

Presenter: Startup Founder.

Audience: Investors, Technological Partners.

Retail lending process framework with risk management with all 2 slides:

Use our Retail Lending Process Framework With Risk Management to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Excellent template with unique design.

-

Informative presentations that are easily editable.