Portfolio management powerpoint presentation slides

Create an investment plan with our content ready Portfolio Management Powerpoint Presentation Slides. The topic-specific asset allocation management presentation deck has various content ready PPT slides such as introduction to investments, objectives of portfolio management, types of investment, market scenario overview investment instruments, securities portfolio, analysis and valuation of equity securities, industry analysis PESTEL, SWOT analysis, discounted cash flow method, financial statement analysis, company cash flow statement, investment in special situations, fixed income and leveraged securities, bond valuation system, reinvestment risk table, type of convertible securities, options analysis, warrants summarization overview, derivative products, put and call options, stock index futures and options, stock indexes comparison table, broaden the investment perspective, international security market highlights, global market trends, mutual funds investment criteria overview, investment in real estate, diversified real estate classification, KPIs and dashboards, etc. Download the professionally designed investment analysis & portfolio management PowerPoint complete deck for portfolio risk and return analysis. Our Portfolio Management Powerpoint Presentation Slides team are like a bunch of cowboys. They enjoy being fast off the draw.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting this set of slides with name - Portfolio Management Powerpoint Presentation Slides. Our creatively crafted slides come with apt research and planning. This exclusive deck with seventy-three slides is here to help you to strategize, plan, analyze, or segment the topic with clear understanding and apprehension. Utilize ready to use presentation slides on Portfolio Management Powerpoint Presentation Slides with all sorts of editable templates, charts and graphs, overviews, analysis templates. Download PowerPoint templates in both widescreen and standard screen. The presentation is fully supported by Google Slides. It can be easily converted into JPG or PDF format.n.

Content of this Powerpoint Presentation

Slide 1: This slide introduces Portfolio Management. State Your Company Name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide presents Introduction to Investments describing- Objectives of Portfolio Management, Investment Instruments, Types of Investment, Market Scenario Overview.

Slide 5: This slide displays Objectives of Portfolio Management describing- Capital Growth, Marketability, Liquidity, Consistency of Returns, Diversification of Portfolio, Objective.

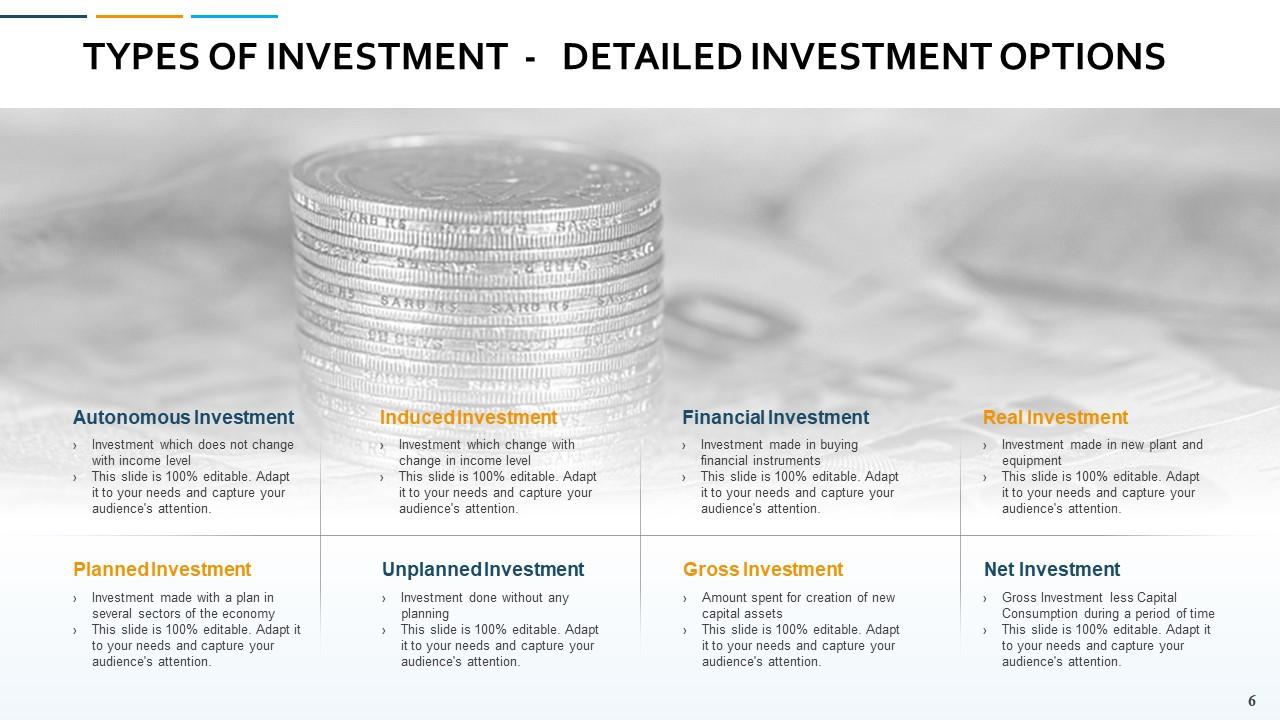

Slide 6: This slide represents Types of Investment - Detailed Investment Options describing- Autonomous Investment, Induced Investment, Financial Investment, Real Investment, Planned Investment, Unplanned Investment, Gross Investment, Net Investment.

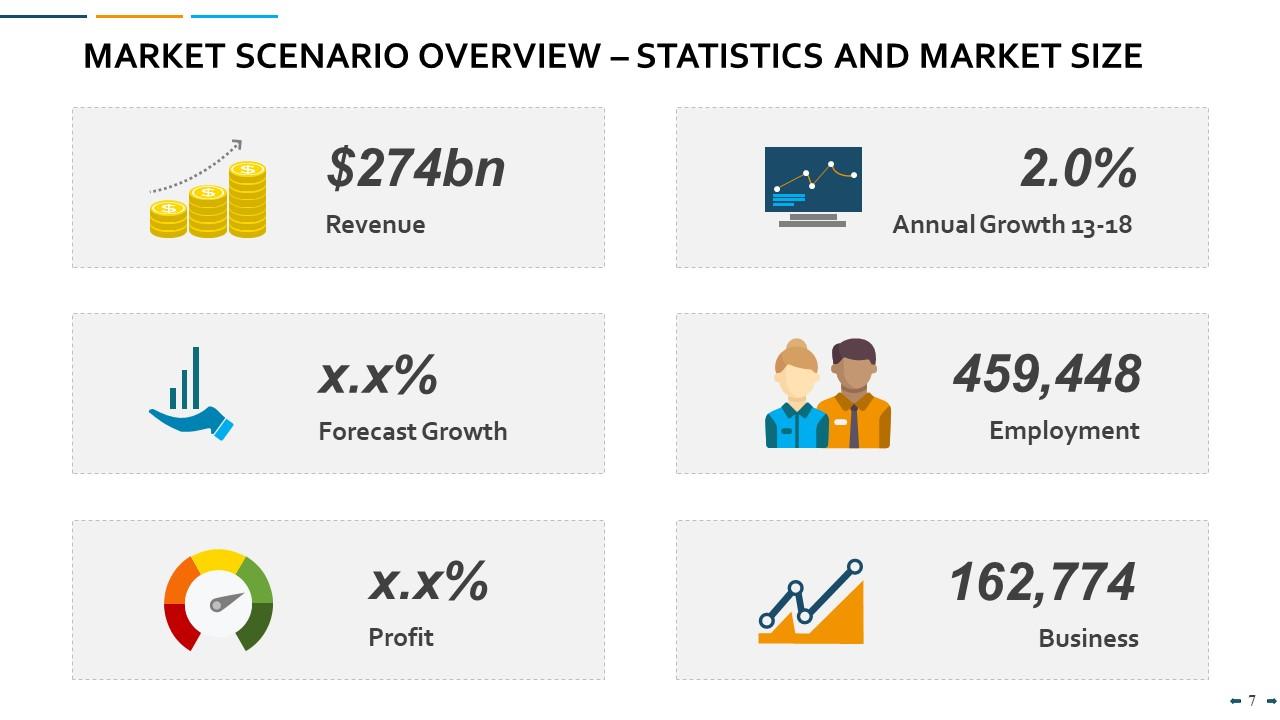

Slide 7: This slide showcases Market Scenario Overview - Statistics and Market Size describing- Revenue, Annual Growth 13-18, Forecast Growth, Profit, Employment, Business.

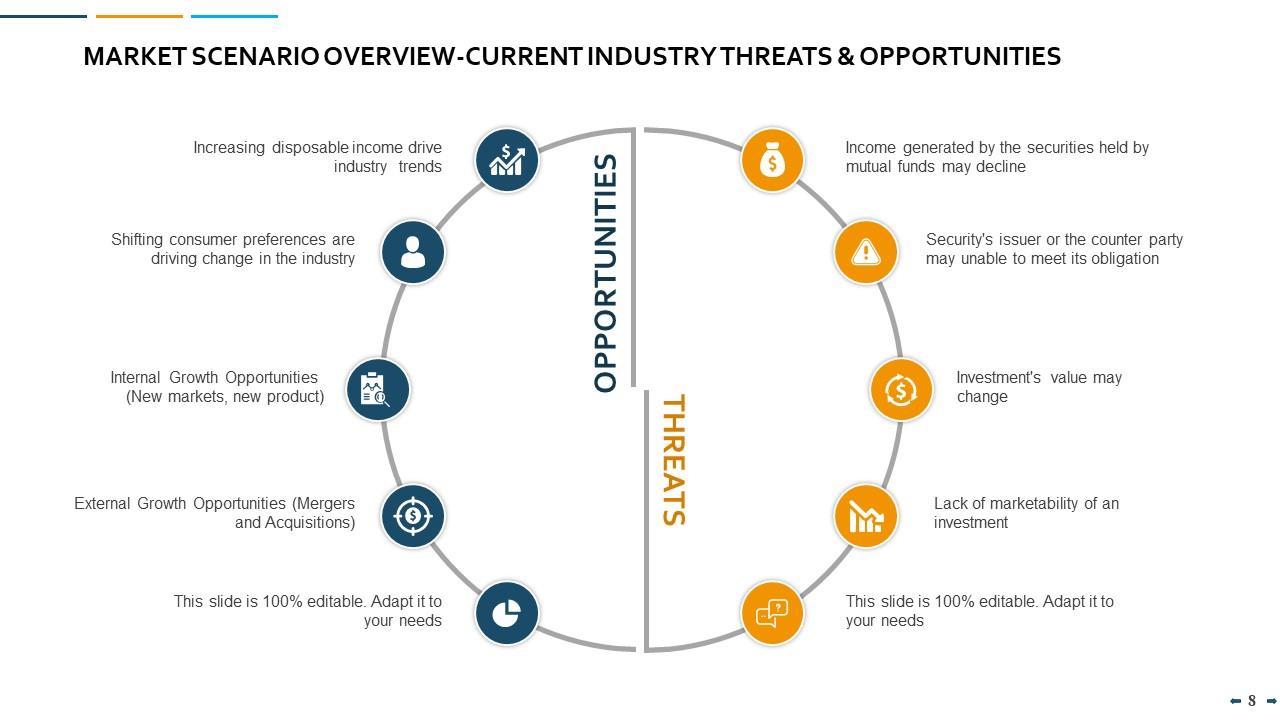

Slide 8: This slide shows Market Scenario Overview - Current Industry Threats & Opportunities with related text to elaborate.

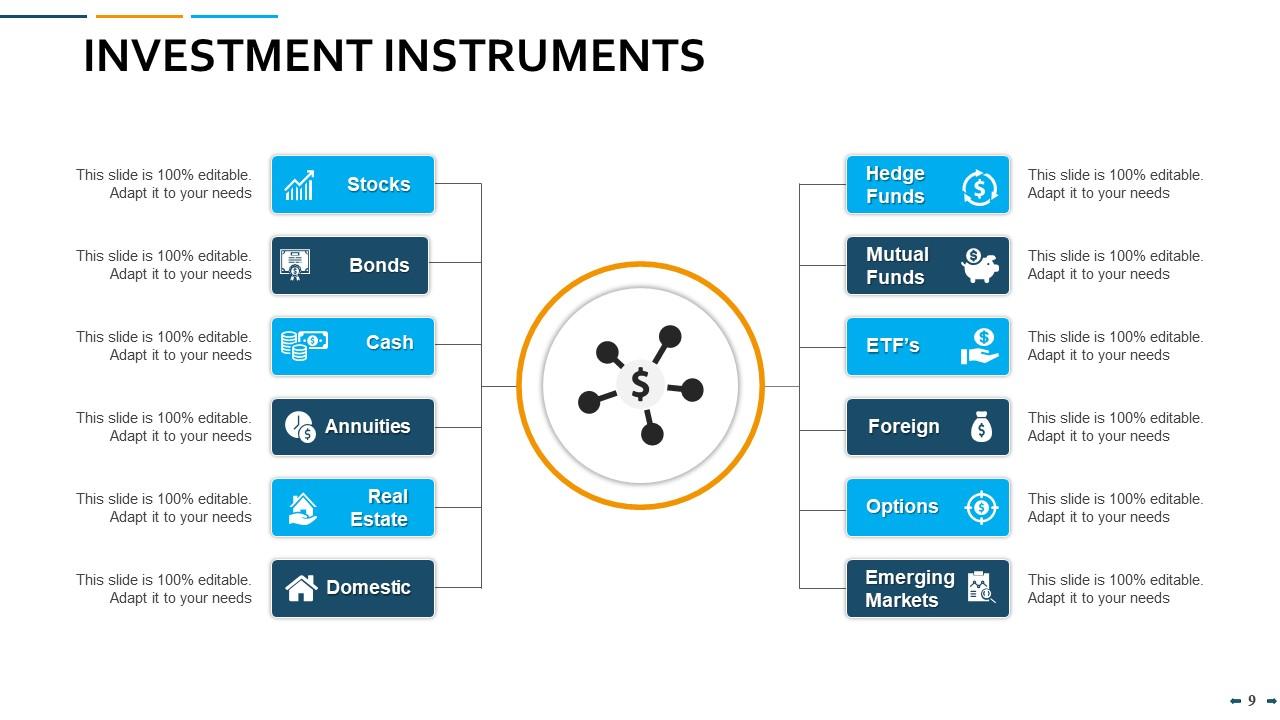

Slide 9: This slide presents Investment Instruments which includes- Stock, Annuities, Bond, Cash, Real Estate, Mutual Funds, Domestic, Hedge Funds, ETF’s, Emerging Markets, Foreign Options.

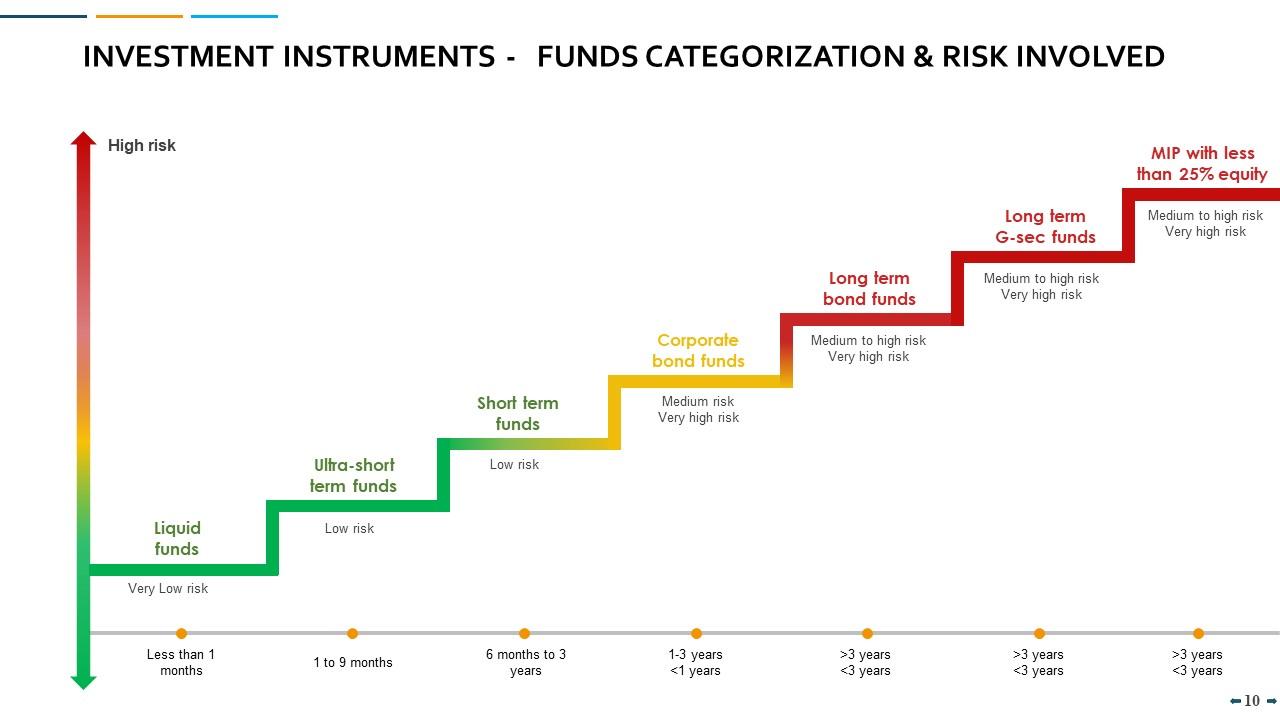

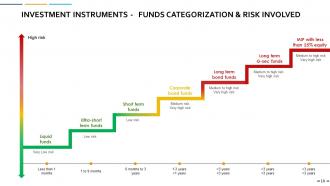

Slide 10: This slide displays Investment Instruments - Funds Categorization and Risk Involved as- Liquid funds, Ultra - short term funds, Short term funds, Corporate bond funds, Long term bond funds, Long term G-sec funds, MIP with less than 25% equity.

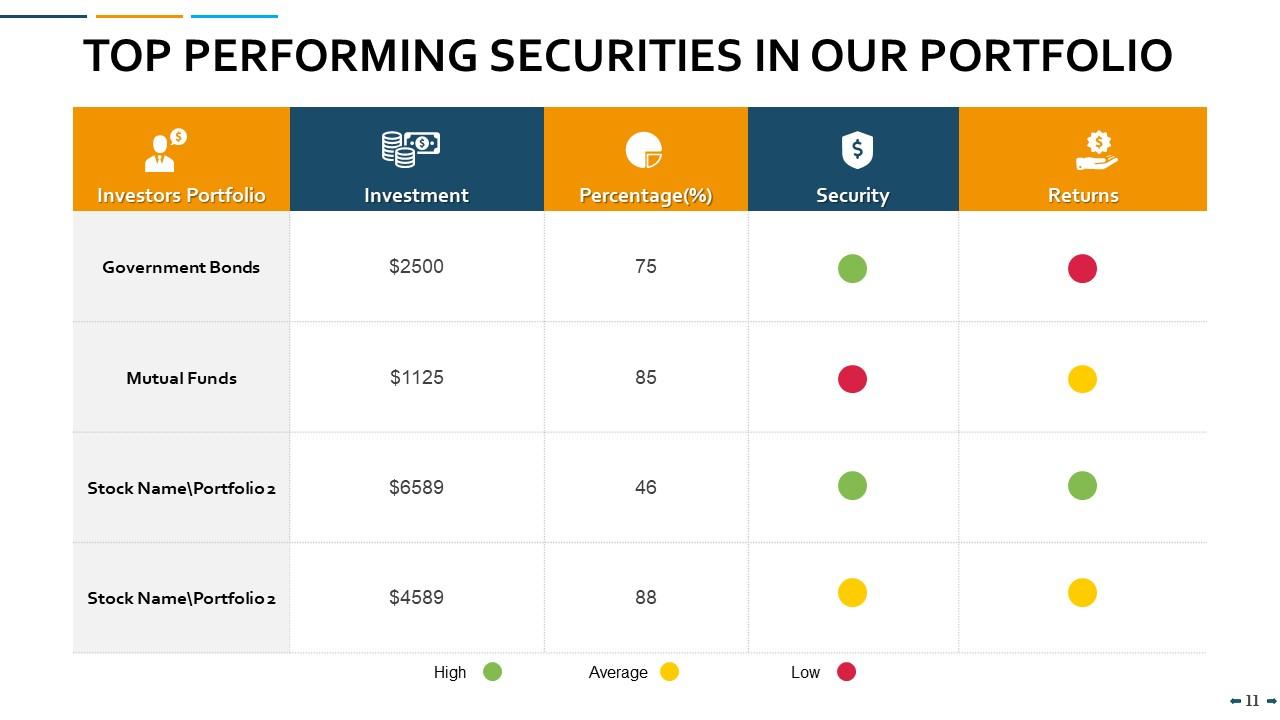

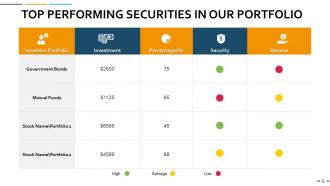

Slide 11: This slide represents Top Performing Securities in Our Portfolio with categories as- Investor’s Portfolio, Investment, Percentage, Security, Returns.

Slide 12: This slide showcases Analysis and Valuation of Equity Securities describing- Industry Analysis, Financial Statement Analysis, Valuation of Equity Securities.

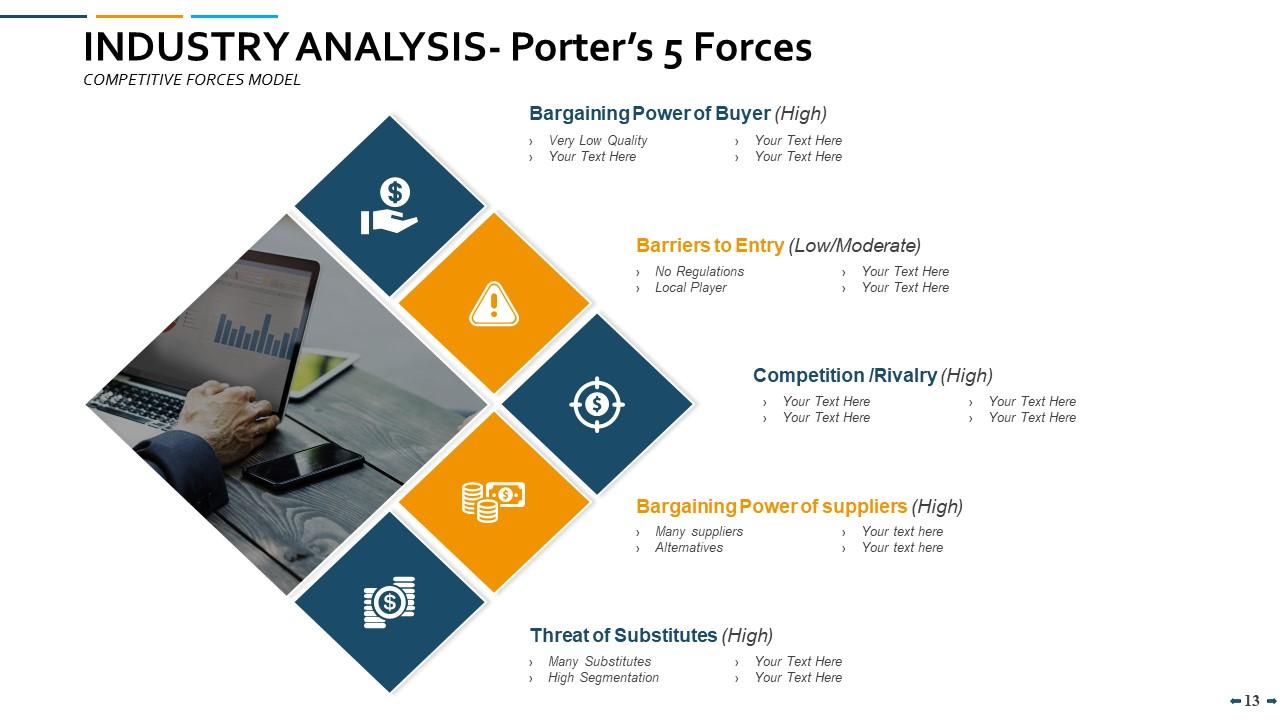

Slide 13: This slide shows Industry Analysis - Porter’s 5 Forces as- Competition/Rivalry, Bargaining Power -Suppliers, Barriers To Entry, Threat of Substitutes, Bargaining Power Buyers.

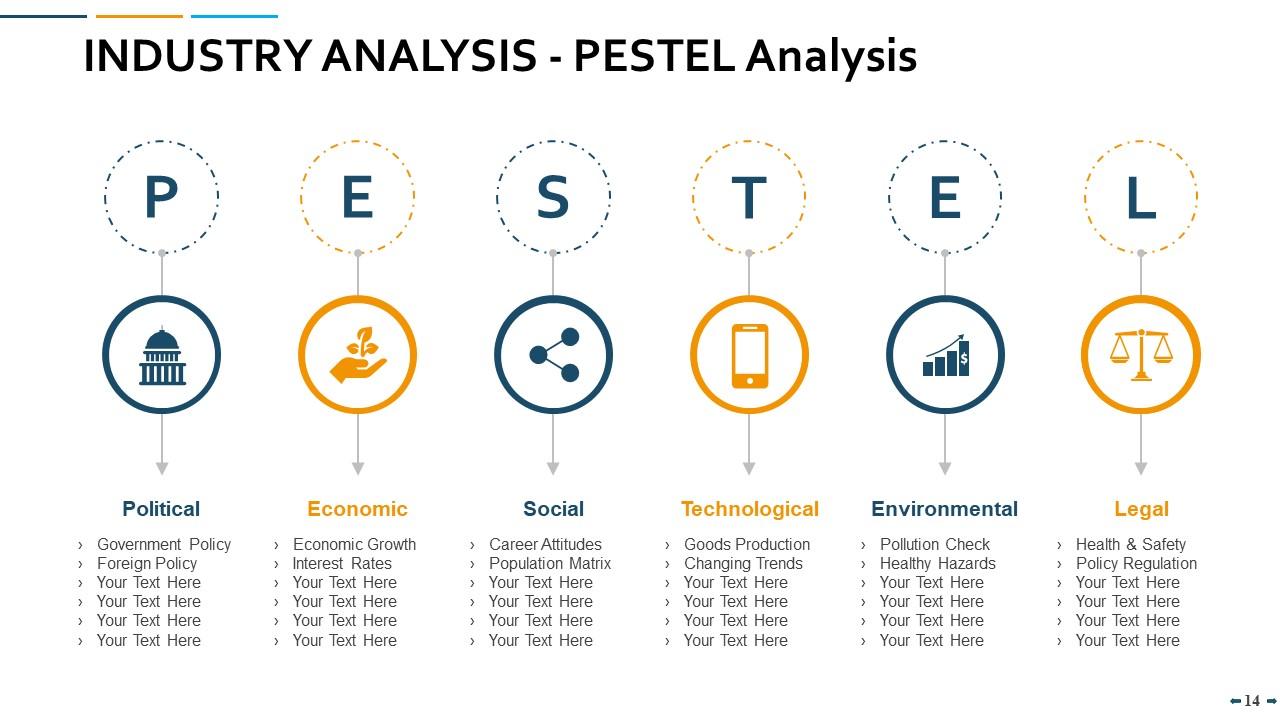

Slide 14: This slide presents Industry Analysis - PESTEL Analysis which include Political, Economic, Social, Technological, Environment and Legal analysis.

Slide 15: This slide displays Industry Analysis - SWOT Analysis as- Strengths, Weaknesses, Opportunities and Threats analysis.

Slide 16: This slide represents Valuation of Equity Securities describing- Net Asset Value Method, Maintainable Profit Method or Discounted Cash Flows Method, Comparable Company Market Multiple, Price / Earnings multiple, Market Cap/ Sales Multiple, Industry Valuation Benchmarks.

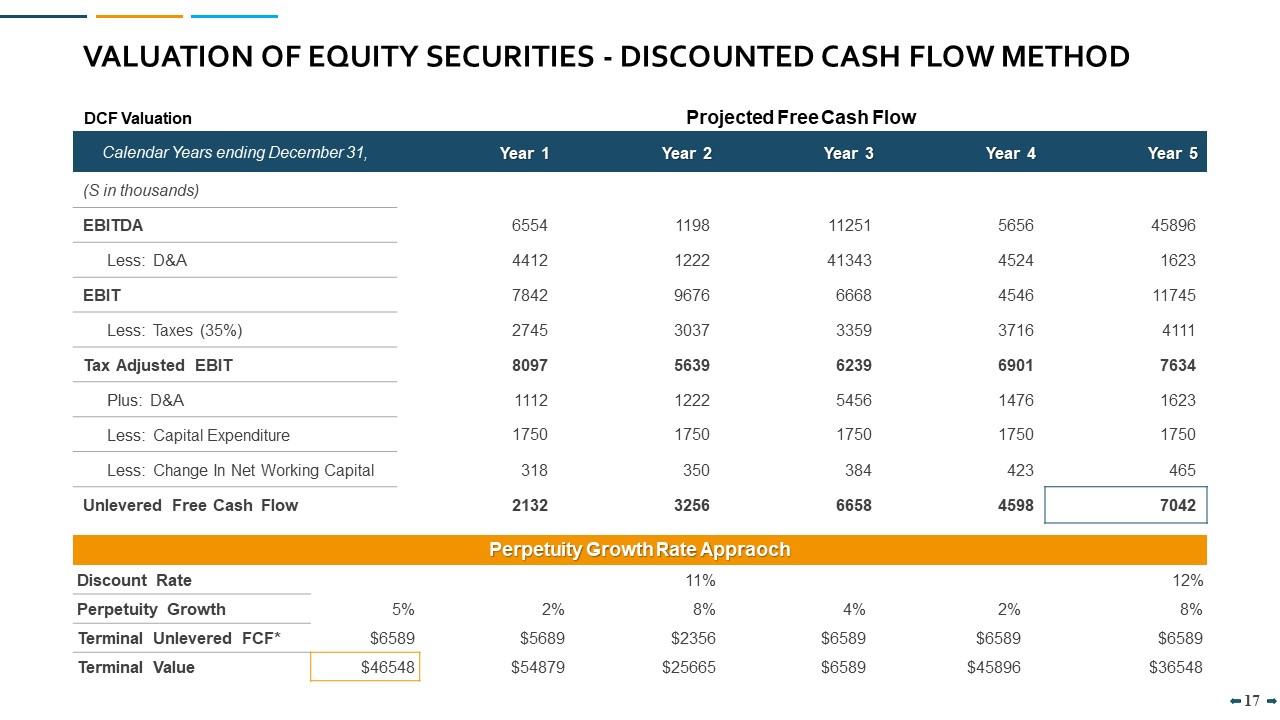

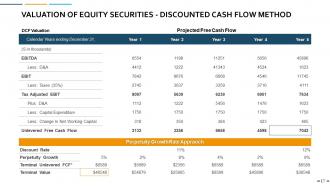

Slide 17: This slide showcases Valuation of Equity Securities - Discounted Cash Flow Method describing- DCF Valuation, Projected Free Cash Flow, Perpetuity Growth Rate Approach.

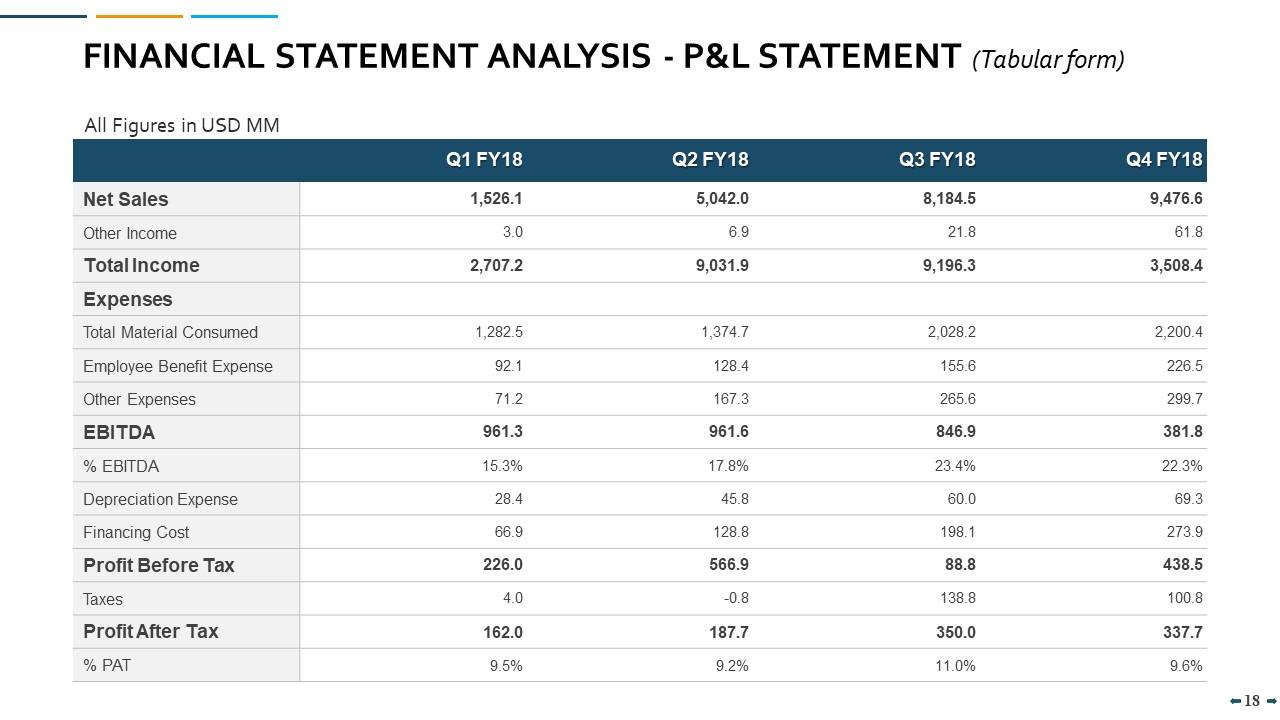

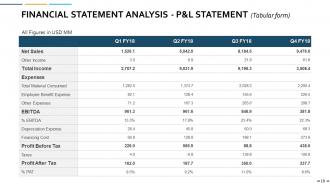

Slide 18: This slide shows Financial Statement Analysis - P&I Statement in Tabular form with net sales, total income, total expenses, profit before and after tax etc.

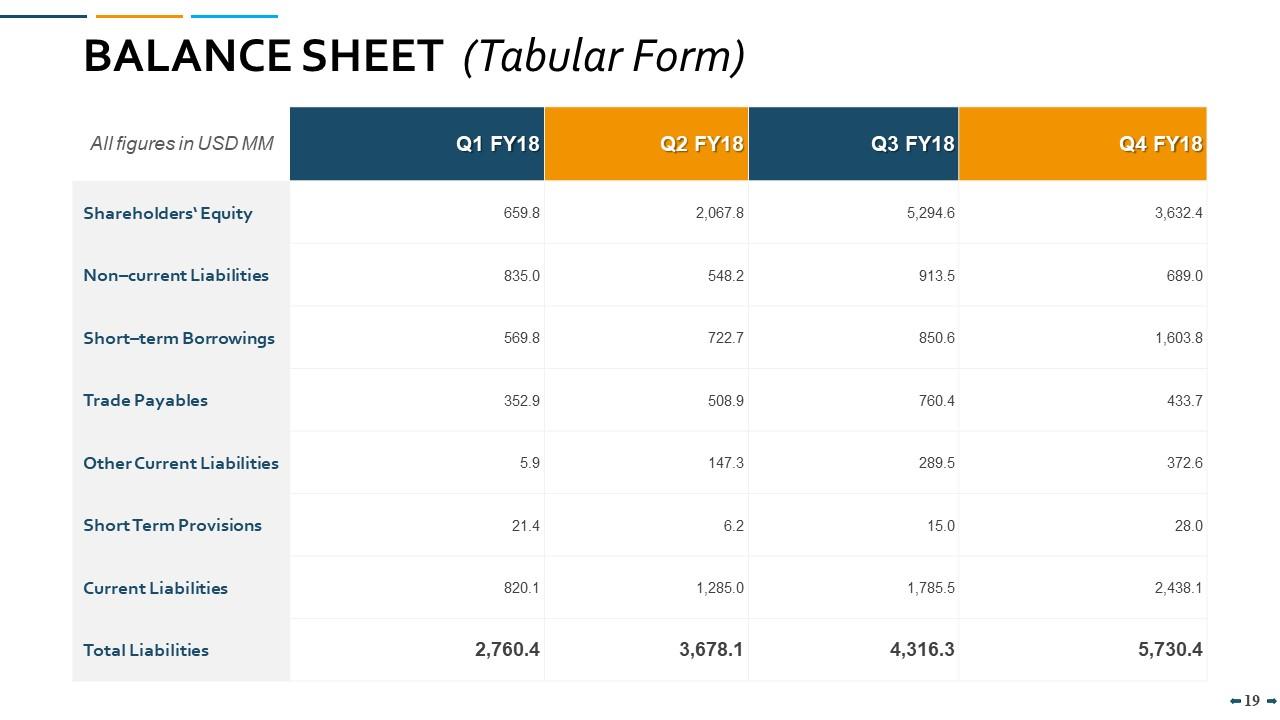

Slide 19: This slide presents Balance Sheet in Tabular form with total liabilities.

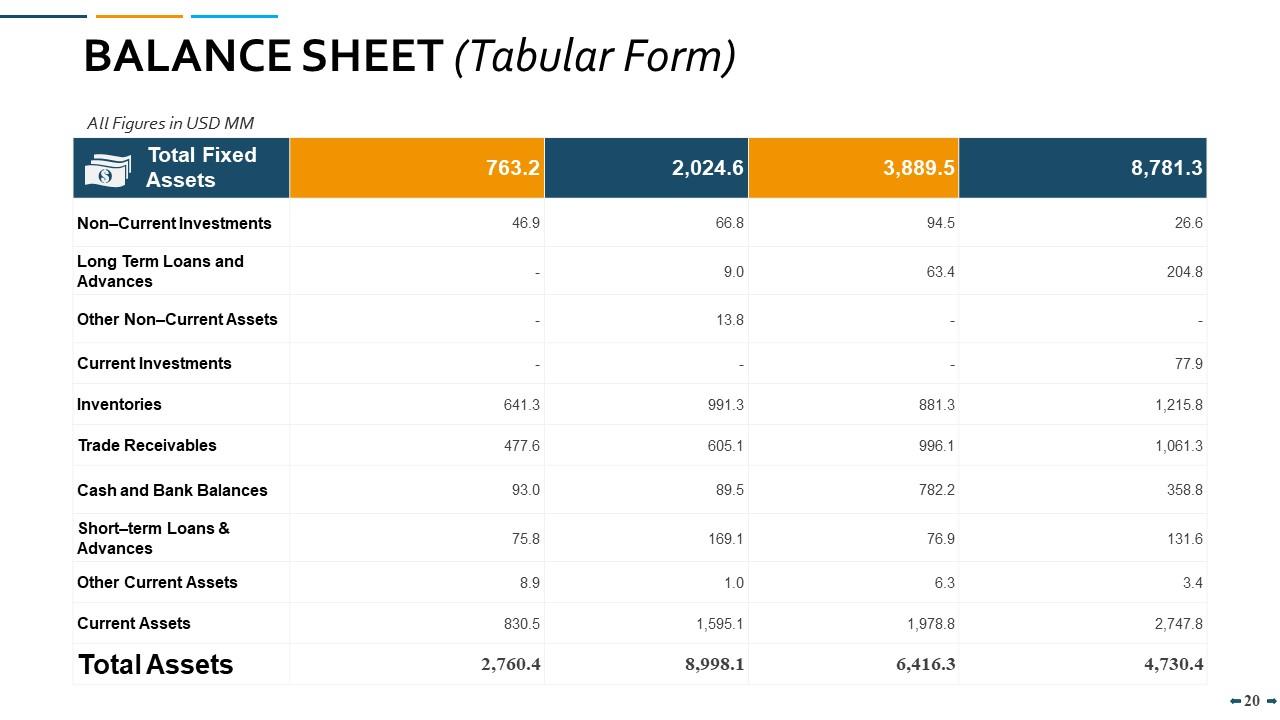

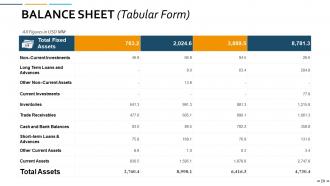

Slide 20: This slide presents Balance Sheet in Tabular form with total assets.

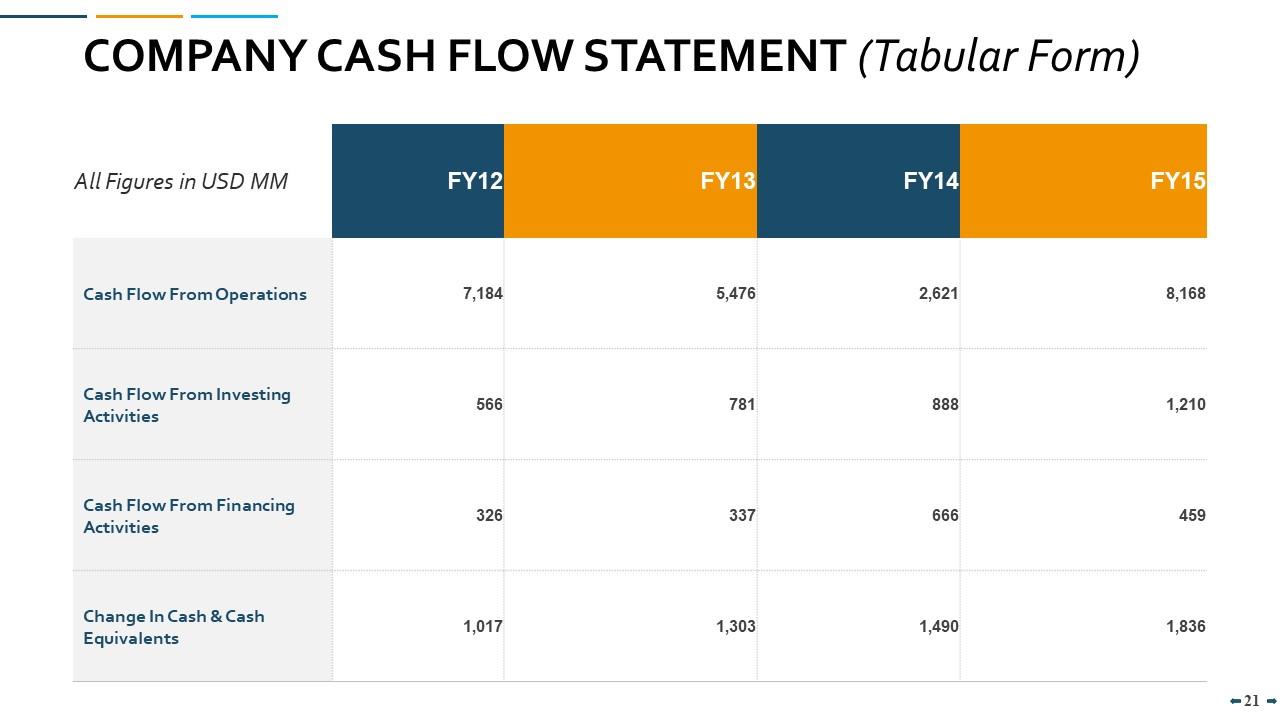

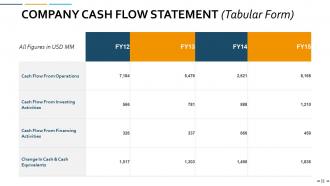

Slide 21: This slide displays Company Cash Flow Statement in Tabular form describing- Cash flow from operations, cash flow from investing activities, cash flow from financing activities, change in cash and cash equivalents etc.

Slide 22: This slide represents Issues in Efficient Markets describing- Major Efficient Market Issues, Investments in Special Situation, Basic View of Technical Analysis.

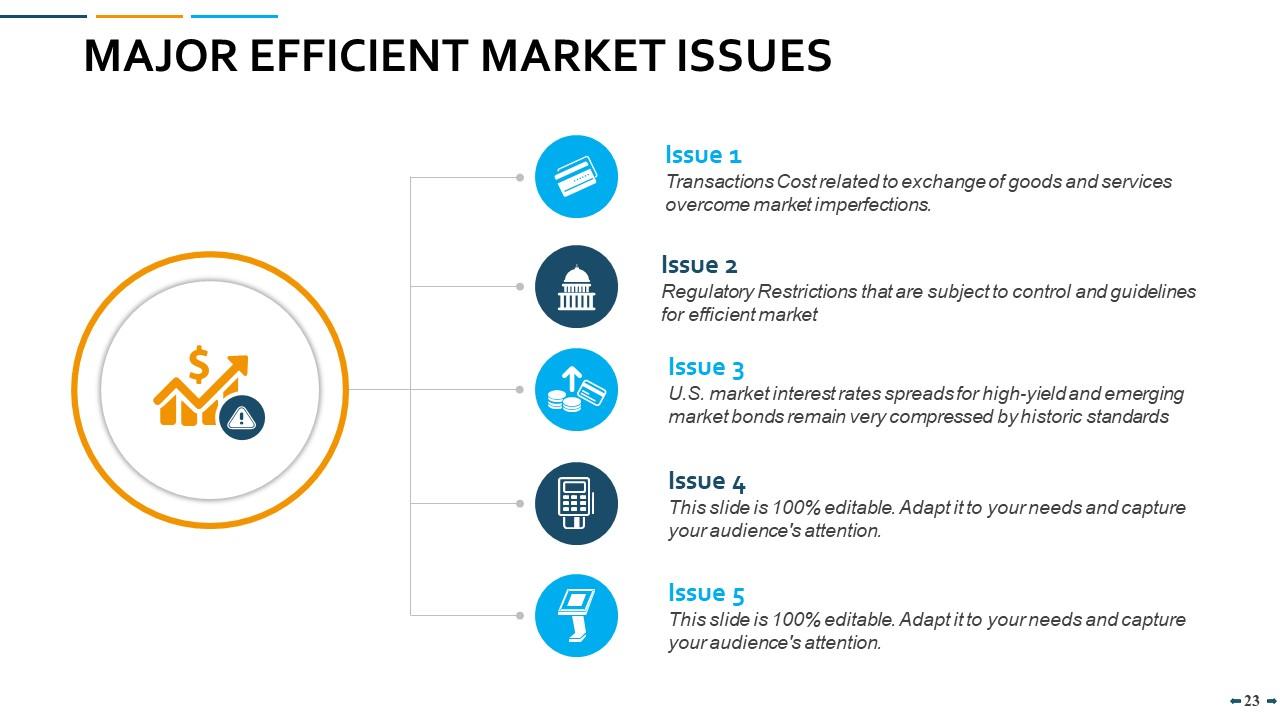

Slide 23: This slide showcases Major Efficient Market Issues as- Transactions Cost related to exchange of goods and services overcome market imperfections, Regulatory Restrictions that are subject to control and guidelines for efficient market etc.

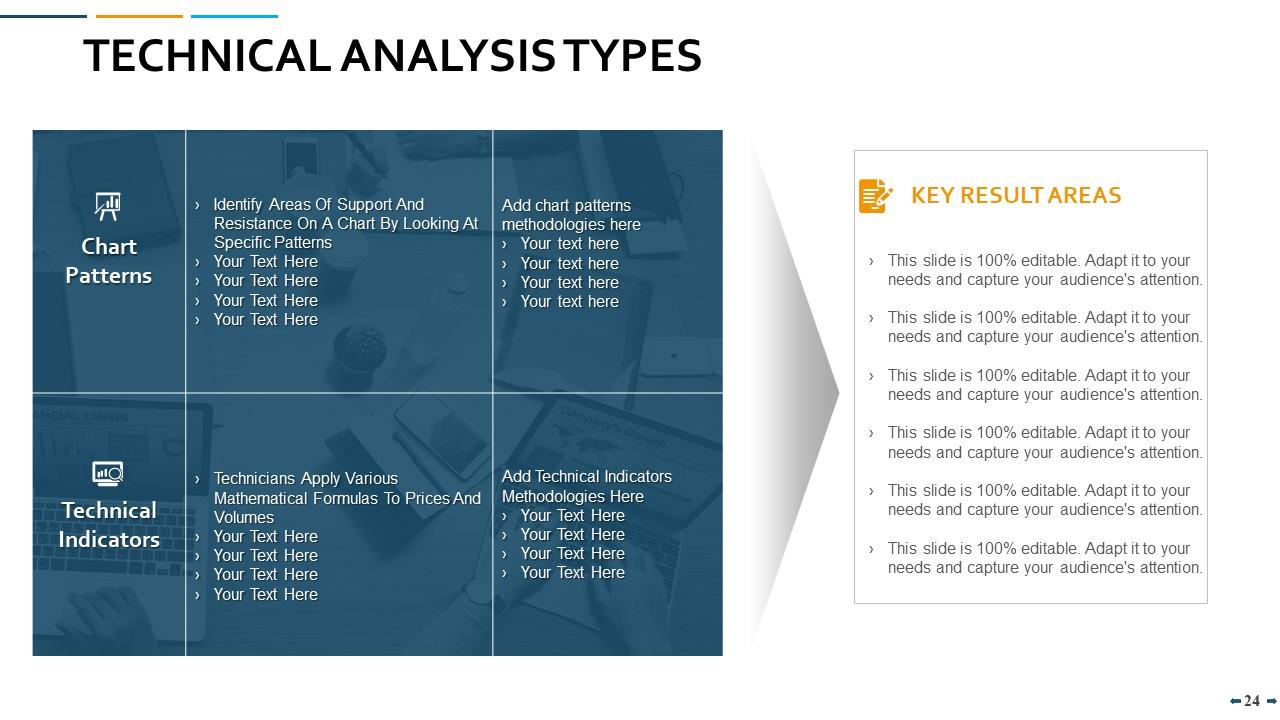

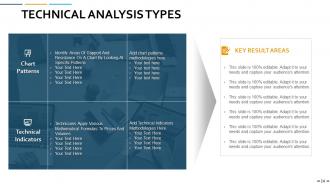

Slide 24: This slide shows Technical Analysis Types with chart patterns, technical indicators and key result areas.

Slide 25: This slide presents Investments in Special Situations with icons and text boxes to show information.

Slide 26: This slide displays Fixed-Income and Leveraged Securities describing- Bond and Fixed-Income Securities, Convertible Securities & Warrants, Duration & Reinvestment, Bond Valuation.

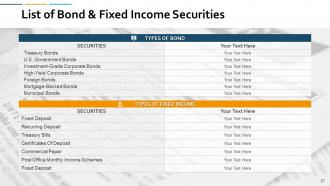

Slide 27: This slide represents List of Bond & Fixed Income Securities in a tabular form with related text.

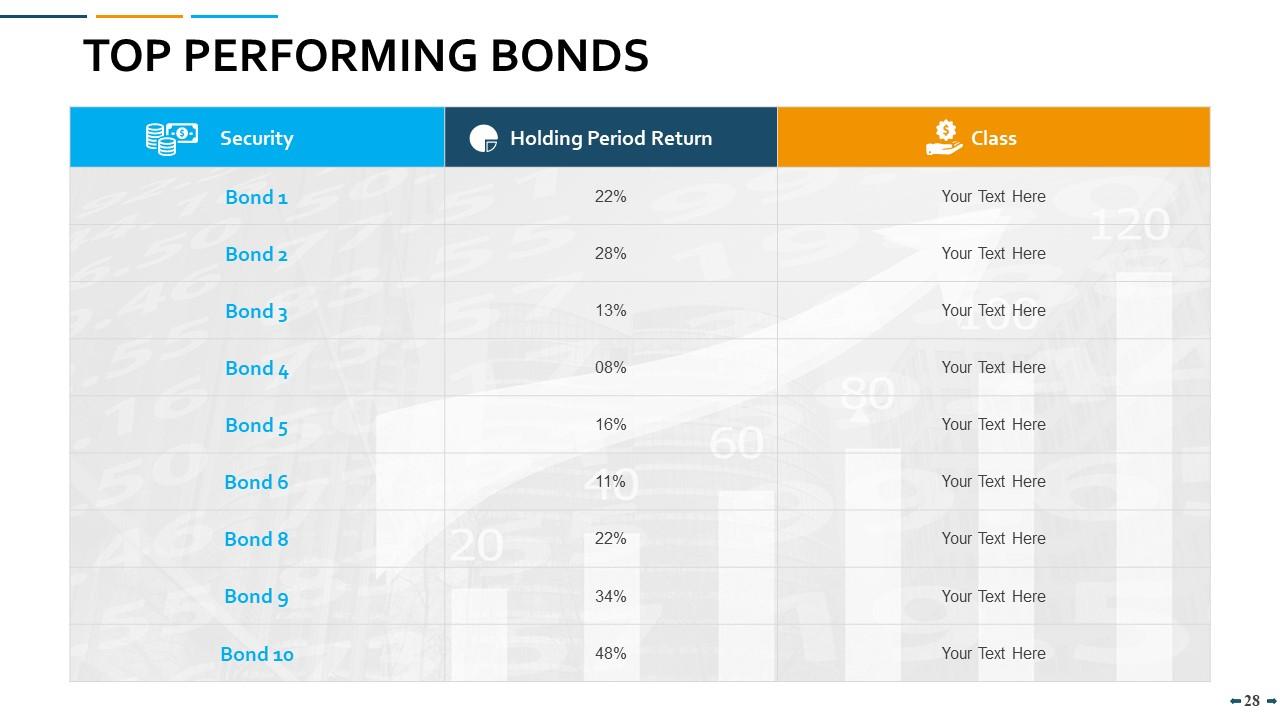

Slide 28: This slide showcases Top Performing Bonds with categories as- Security, Holding Period Returns, Class.

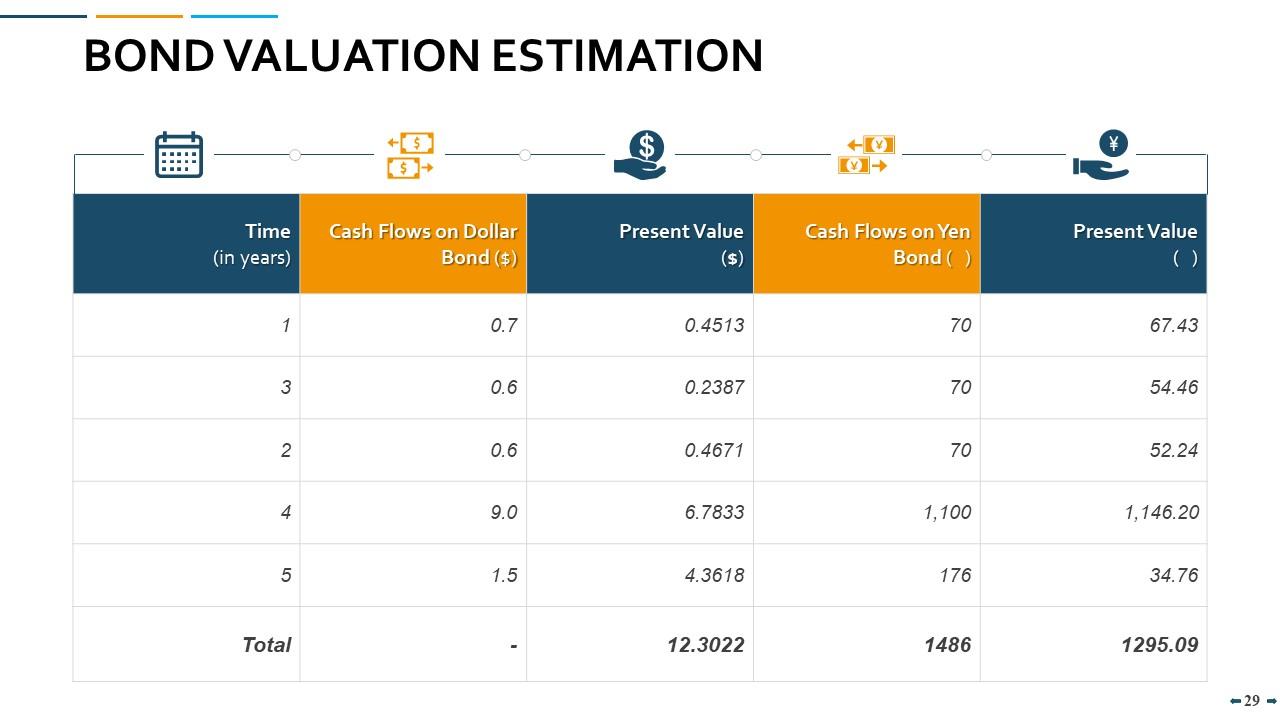

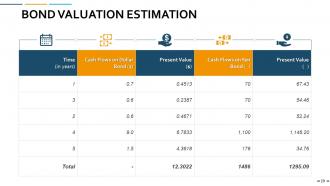

Slide 29: This slide shows Bond Valuation Estimation with categories as- Time, Cash Flows on Dollar Bond, Present Value, Cash Flows on Yen Bond, Present Value.

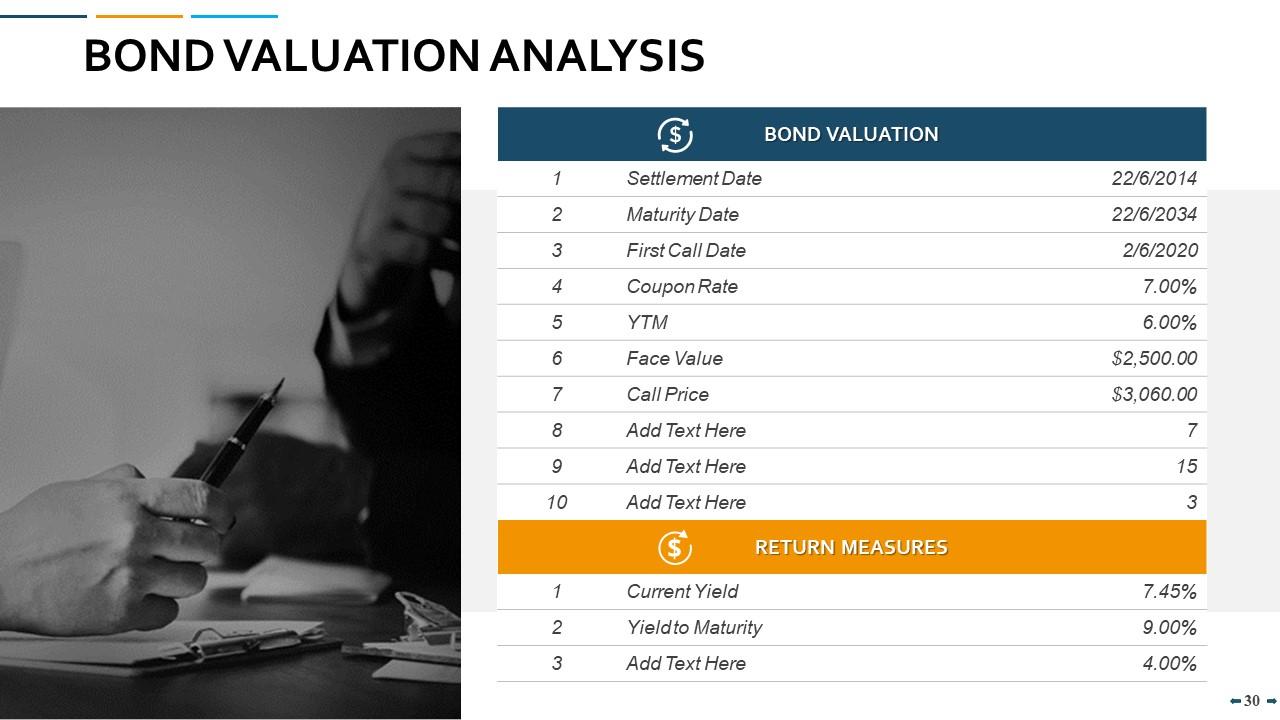

Slide 30: This slide presents Bond Valuation Analysis describing- Bond Valuation and Return Measures.

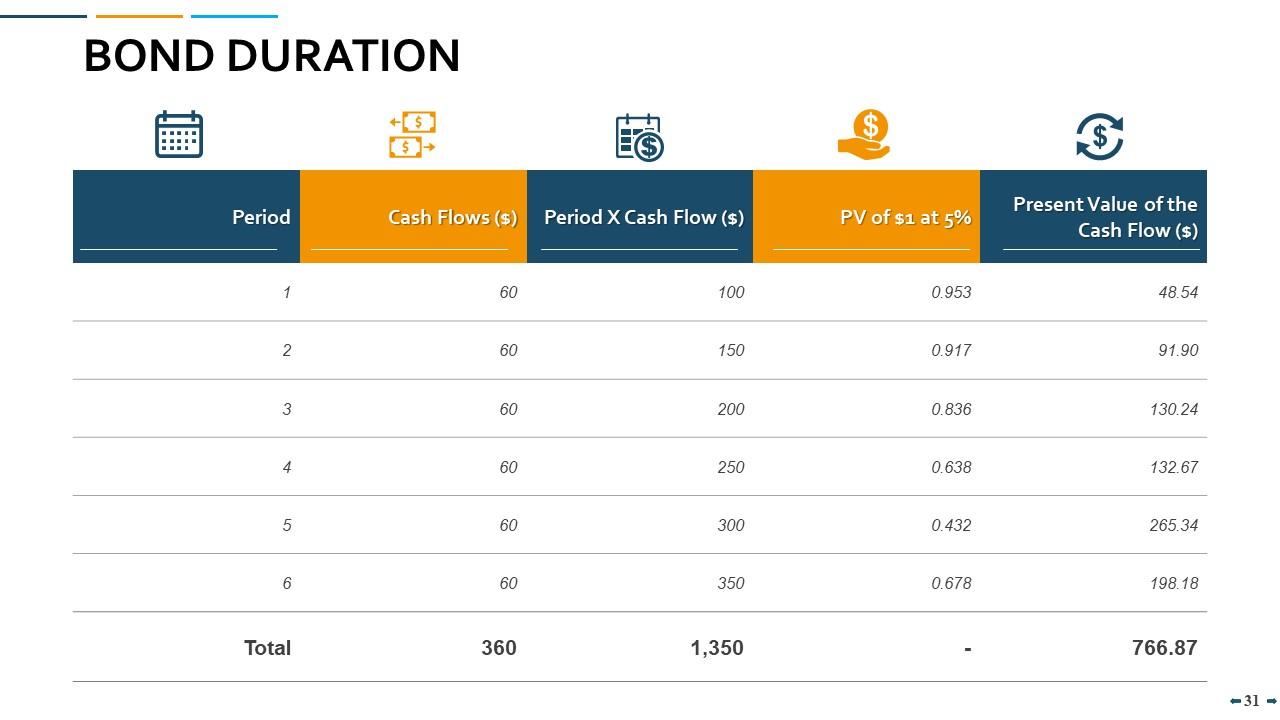

Slide 31: This slide displays Bond Duration with categories as- Period Cash Flows ($) Period X Cash Flow ($) PV of $1 at 5% Present Value of the Cash Flow ($)

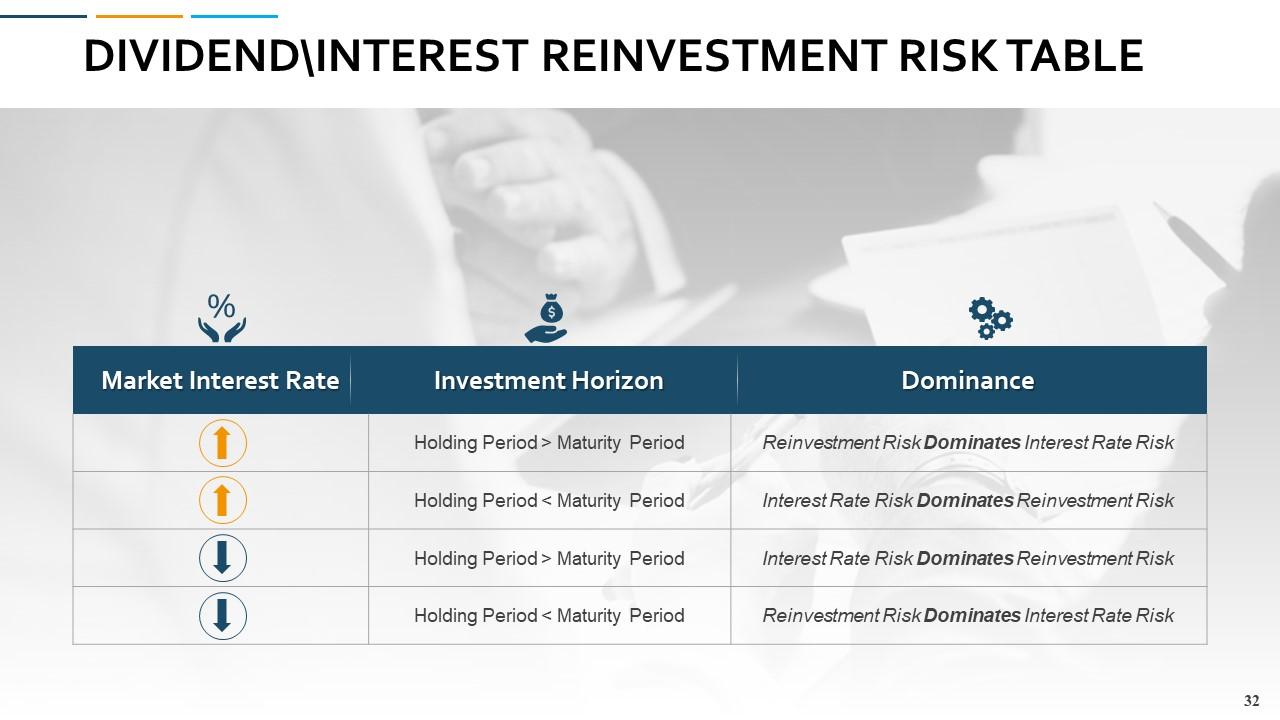

Slide 32: This slide represents Dividend \ Interest Reinvestment Risk Table with categories as- Market Interest Rate, Investment Horizon, Dominance.

Slide 33: This slide showcases Types of Convertible Securities describing- Convertible Bond, Convertible Preferred Stock, Warrant, Capital Note, Right Issue.

Slide 34: This slide shows Options Analysis in tabular form with related text.

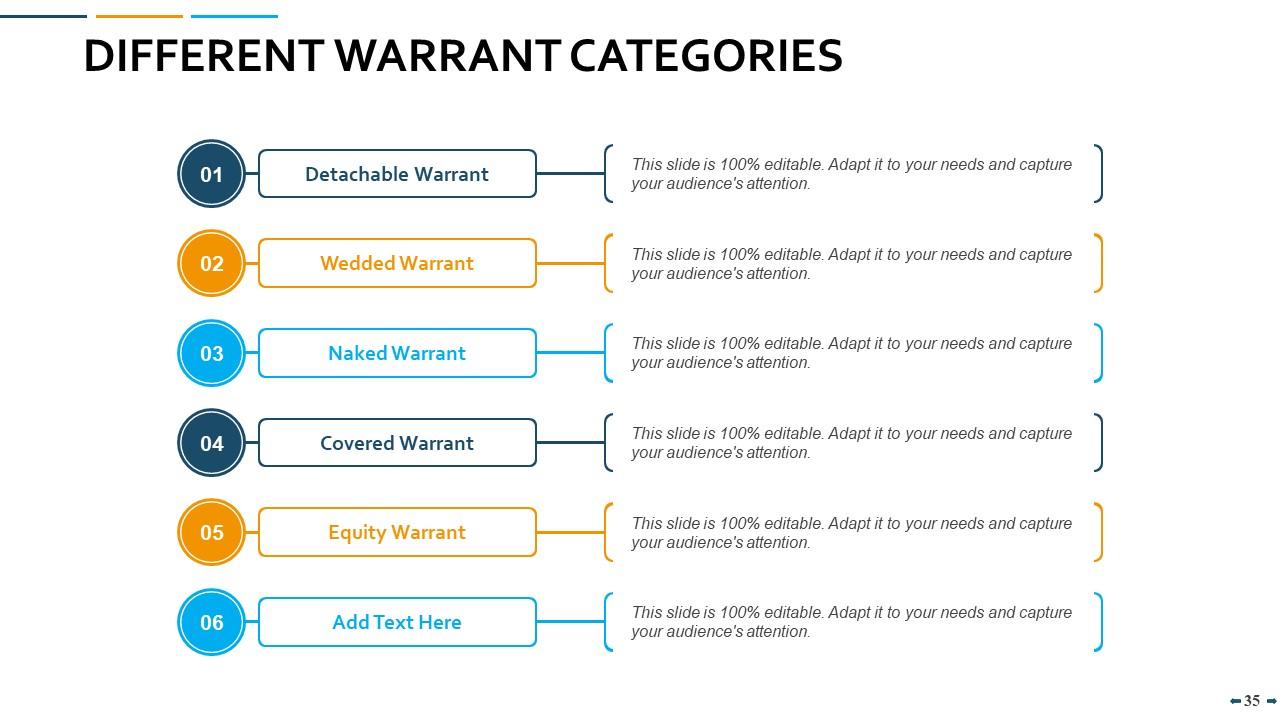

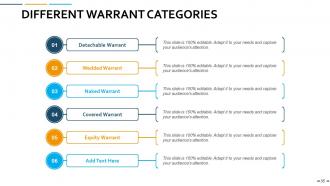

Slide 35: This slide presents Different Warrant Categories as- Detachable Warrant, Wedded Warrant, Naked Warrant, Covered Warrant, Equity Warrant etc.

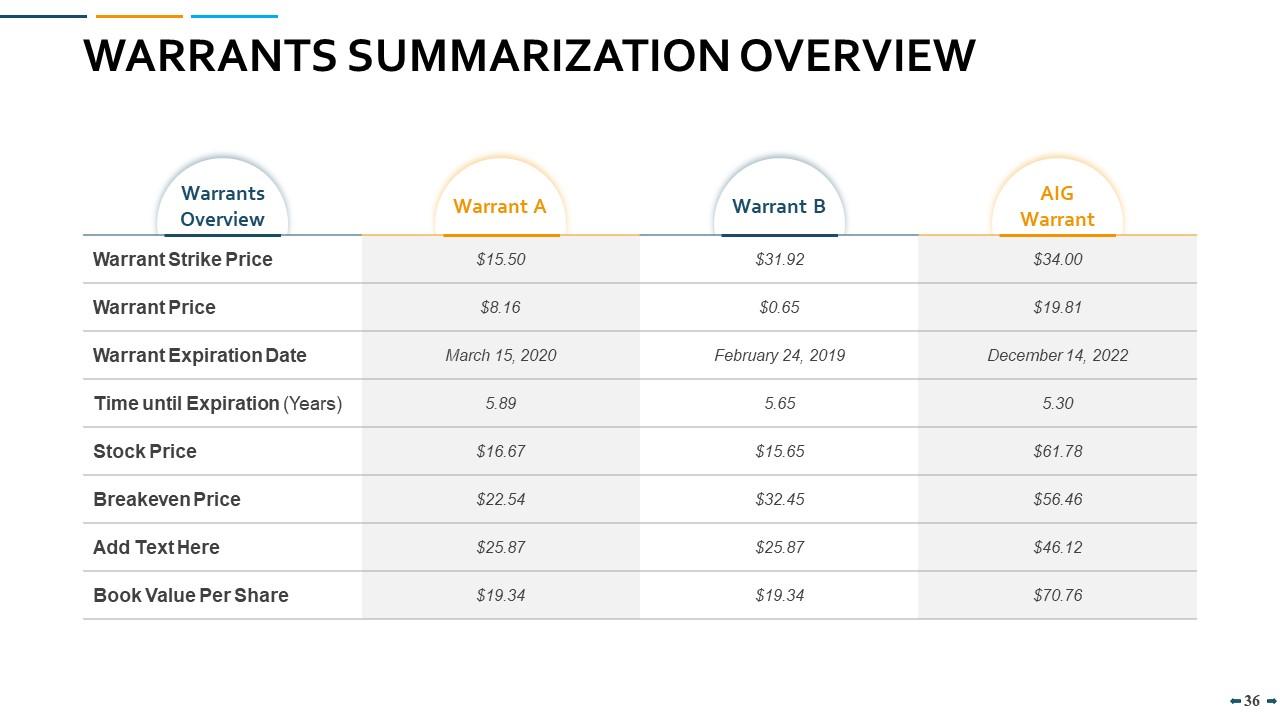

Slide 36: This slide displays Warrants Summarization Overview with warrant price, warrant expiration date, stock price etc.

Slide 37: This slide represents Derivative Products such as- Put and Call Options and Stock Index Futures and Options.

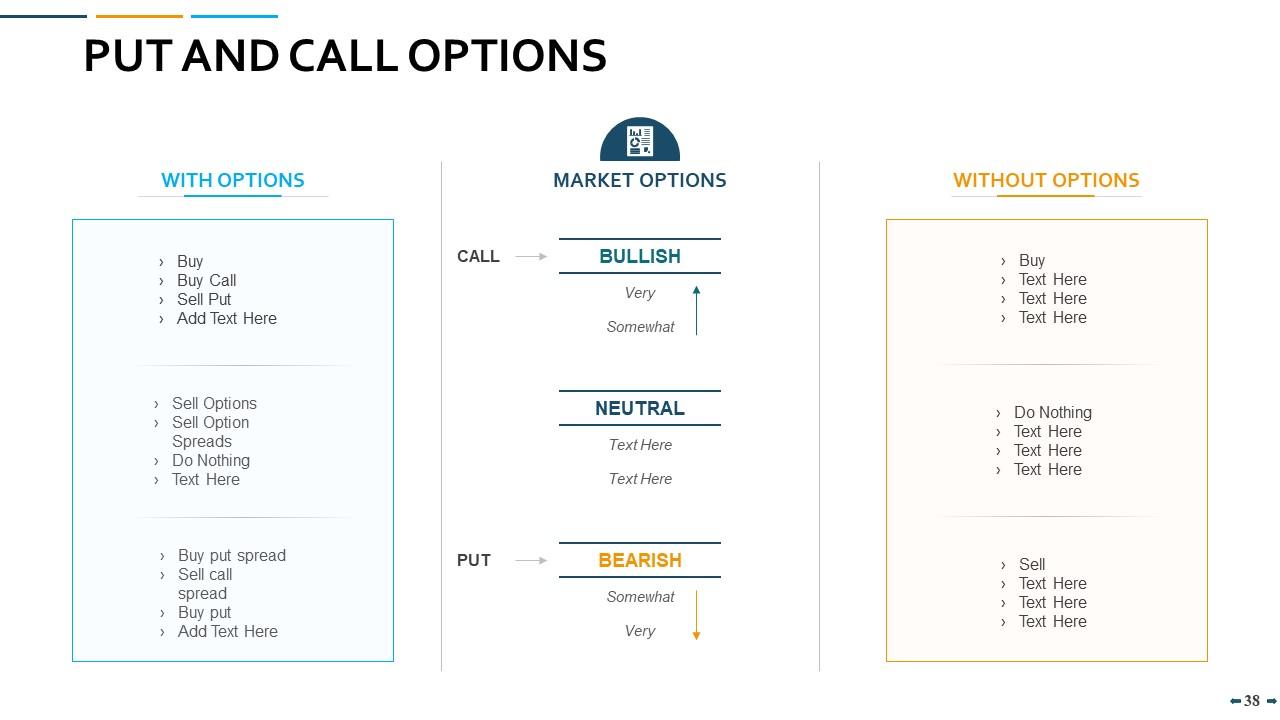

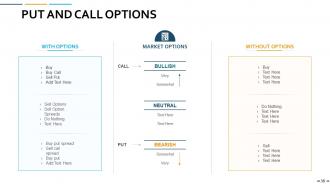

Slide 38: This slide showcases Put and Call Options with categories as Bullish, Neutral, Bearish.

Slide 39: This slide shows Put and Call Options Time Value in tabular form with categories as- Total Value, Time Value, Intrinsic Value, Strike Price, Intrinsic Value, Time Value, Total Value.

Slide 40: This slide presents Stock Index Futures and Options with categories as- Contract, Ticker Symbol, Futures, Options, Globex.

Slide 41: This slide displays Stock Indexes Comparison Table comparing exchanges such as- Korea exchange, Australia exchange, Hong kong stock exchange, bombay stock exchange etc.

Slide 42: This slide represents Broadening the Investment Perspective describing- International Security Markets, Investments in Real Assets, Mutual Funds.

Slide 43: This slide showcases International Security Market Highlights describing- Market Growth, Market Trend, Market Driver.

Slide 44: This is an optional slide for International Security Market Highlights.

Slide 45: This slide shows Recent Global Security Market Trends\Behavior describing- Inflation to Make a Comeback - But Only in the Us, Global Growth to Remain in Autopilot, Monetary Stimulus To Become Less Prevalent, Reduced Reward for Risk, Geopolitical Risks etc.

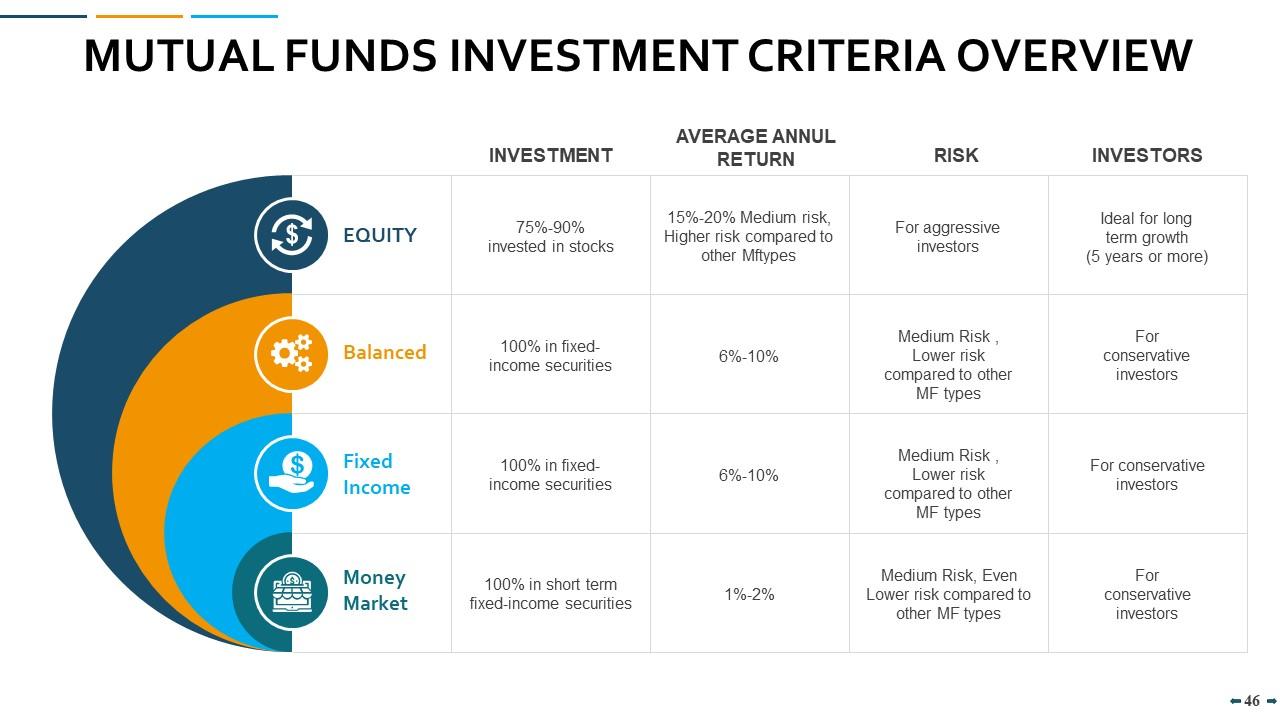

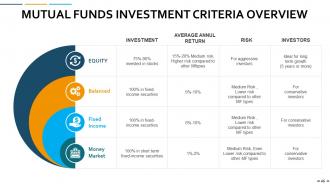

Slide 46: This slide presents Mutual Funds Investment Criteria Overview with parameters as- Equity, Balanced, Fixed Income, Money Market.

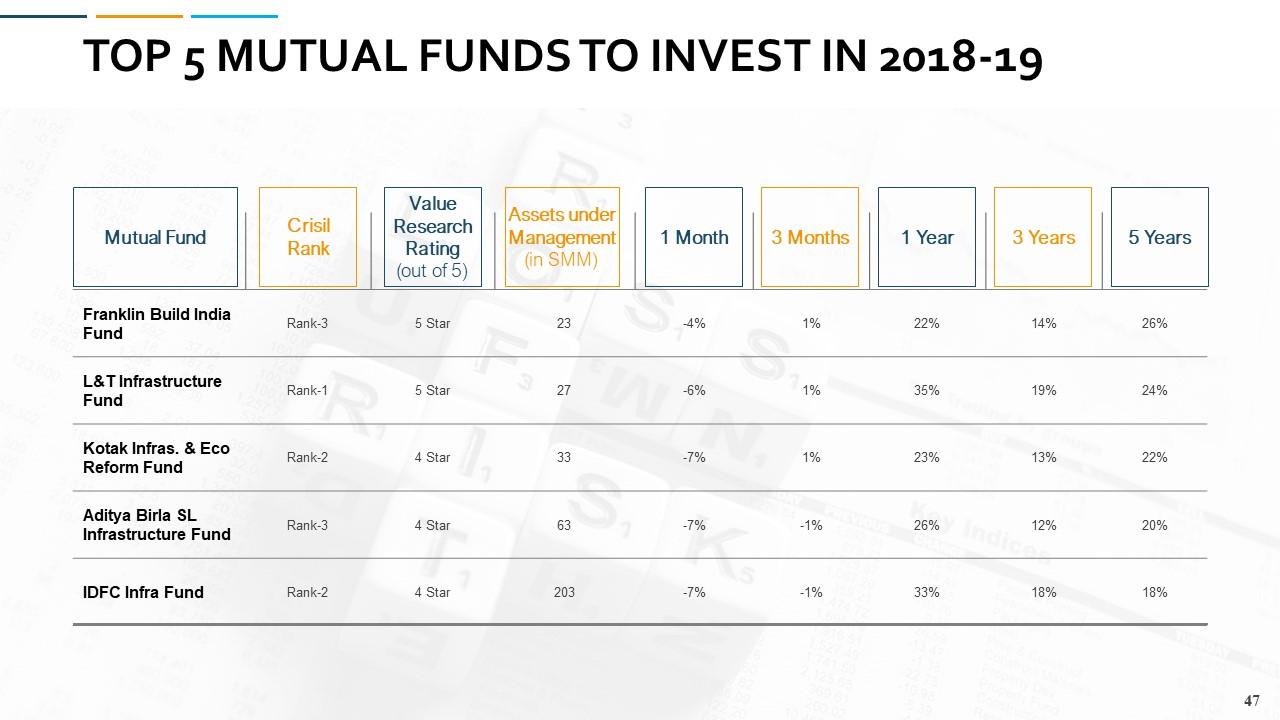

Slide 47: This slide displays Top 5 Mutual Funds to Invest in 2018-19 witch categories as- MUTUAL FUND, Crisil rank, Value research rating, Assets under management etc.

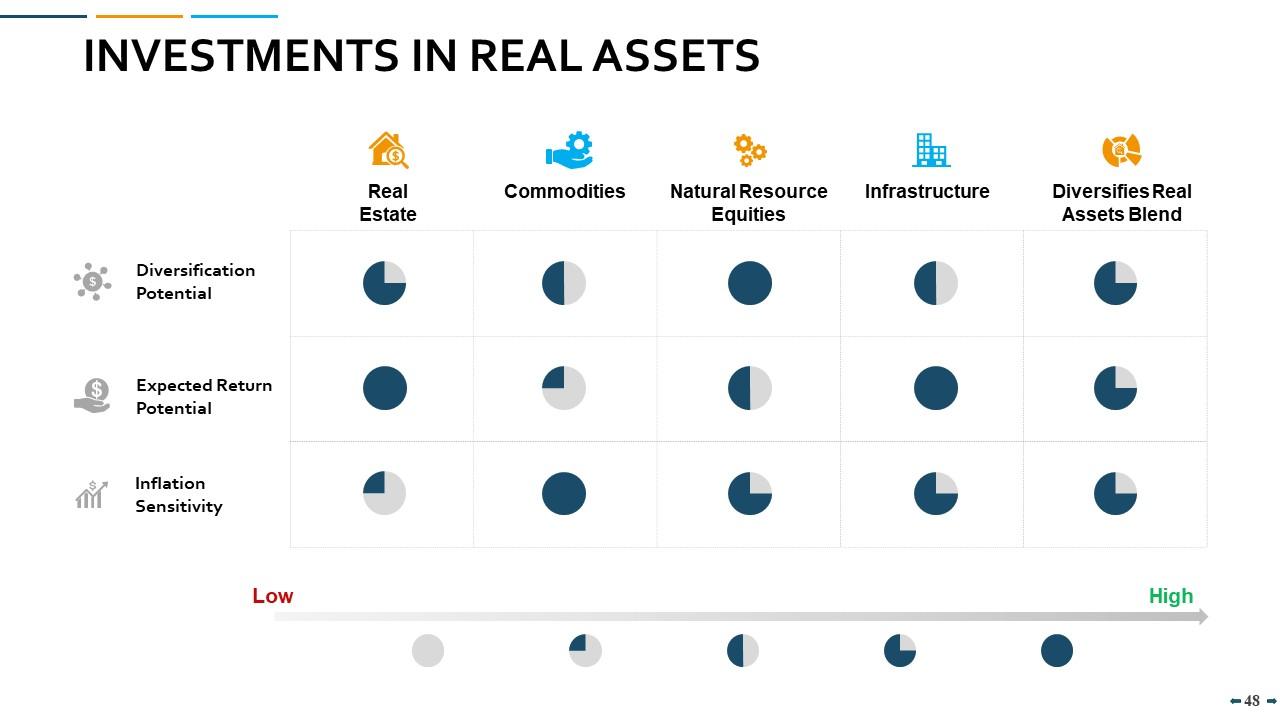

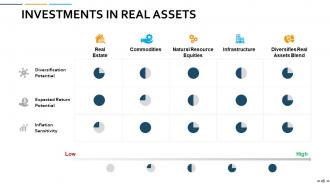

Slide 48: This slide represents Investments in Real Assets such as- Real Estate, Commodities, Natural Resource Equities, Infrastructure, Diversifies Real Assets Blend.

Slide 49: This is an optional slide for Investments in Real Assets.

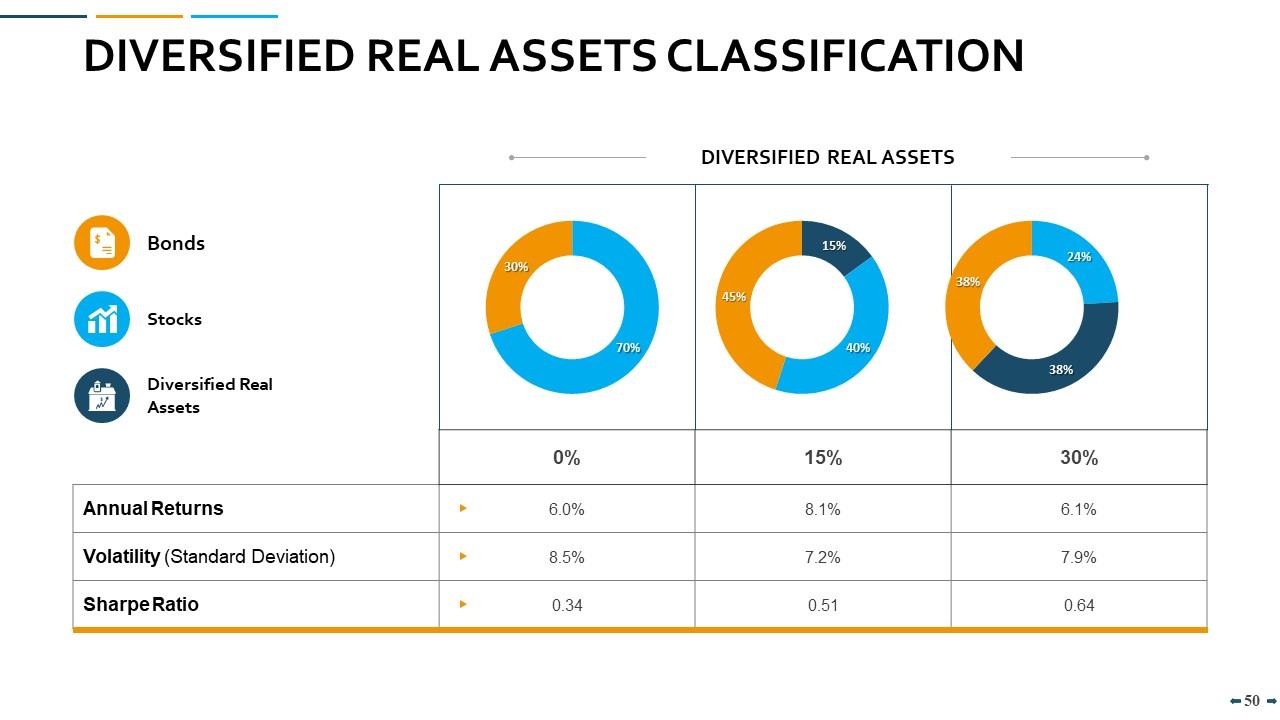

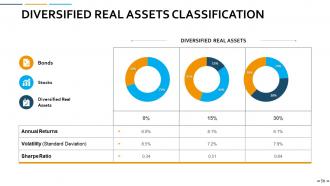

Slide 50: This slide showcases Diversified Real Assets Classification describing- annual returns, Volatility, Shape ratio etc.

Slide 51: This slide shows Risk & Return Analysis in a tabular form with text boxes to show information.

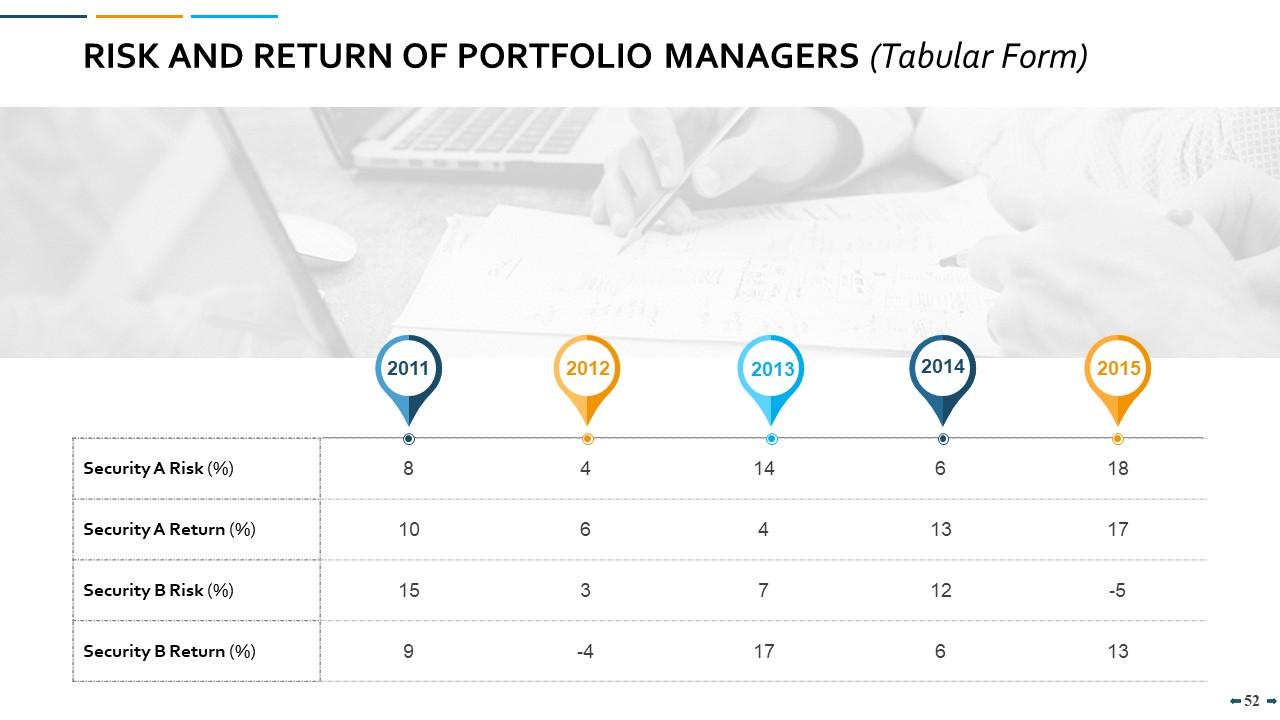

Slide 52: This slide presents Risk and Return of Portfolio Managers in Tabular form with years, security risk, security return etc.

Slide 53: This slide displays KPI & Dashboard describing- KPI Dashboard and KPI Metrics.

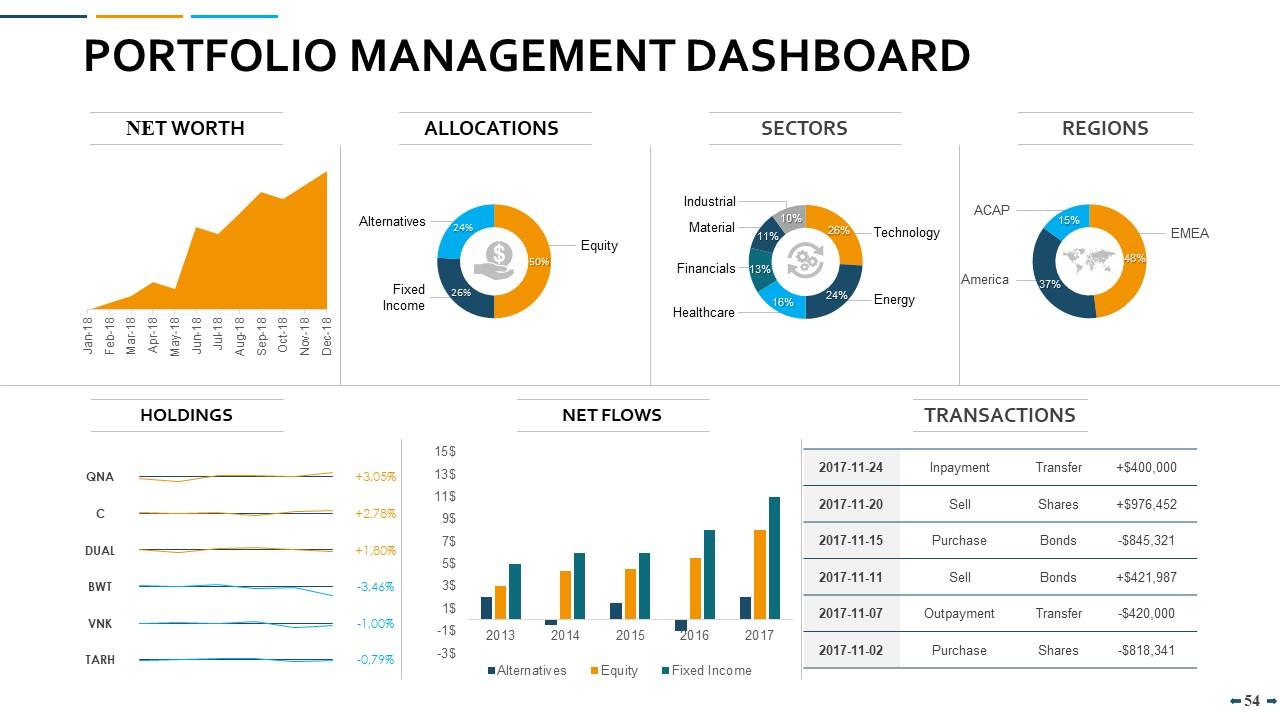

Slide 54: This slide represents Portfolio Management Dashboard with- Allocations, Sectors, Regions, Net Worth, Holdings, Net Flow, Transactions.

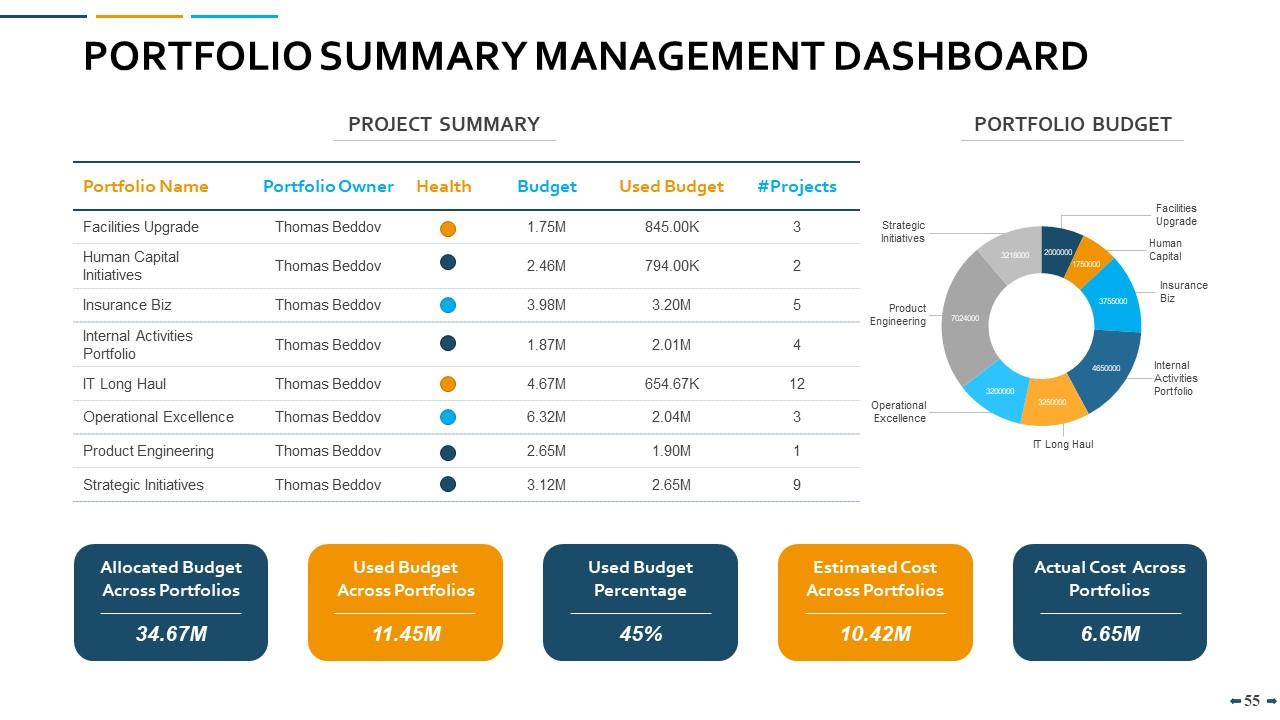

Slide 55: This slide showcases Portfolio Summary Management Dashboard with- Portfolio Name, Portfolio Owner, Health, Budget, Used Budget, Projects.

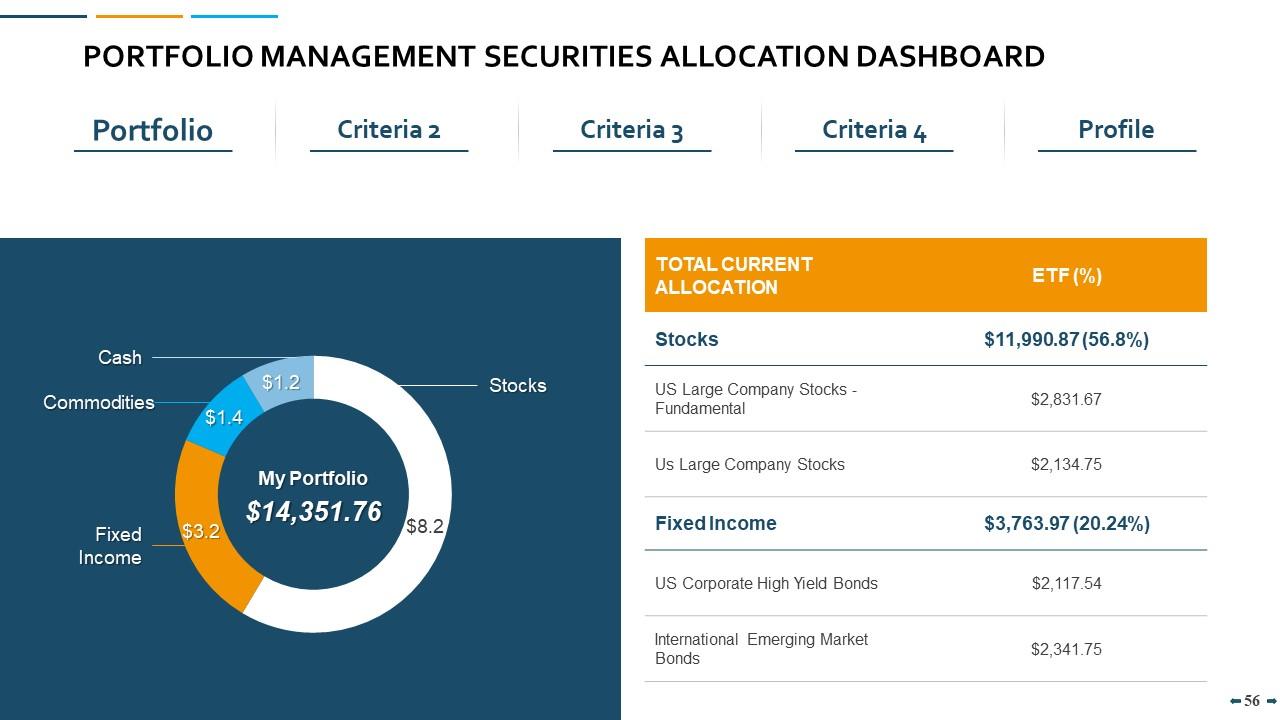

Slide 56: This slide shows Portfolio Management Securities Allocation Dashboard with Portfolio, Criterias, Profile etc.

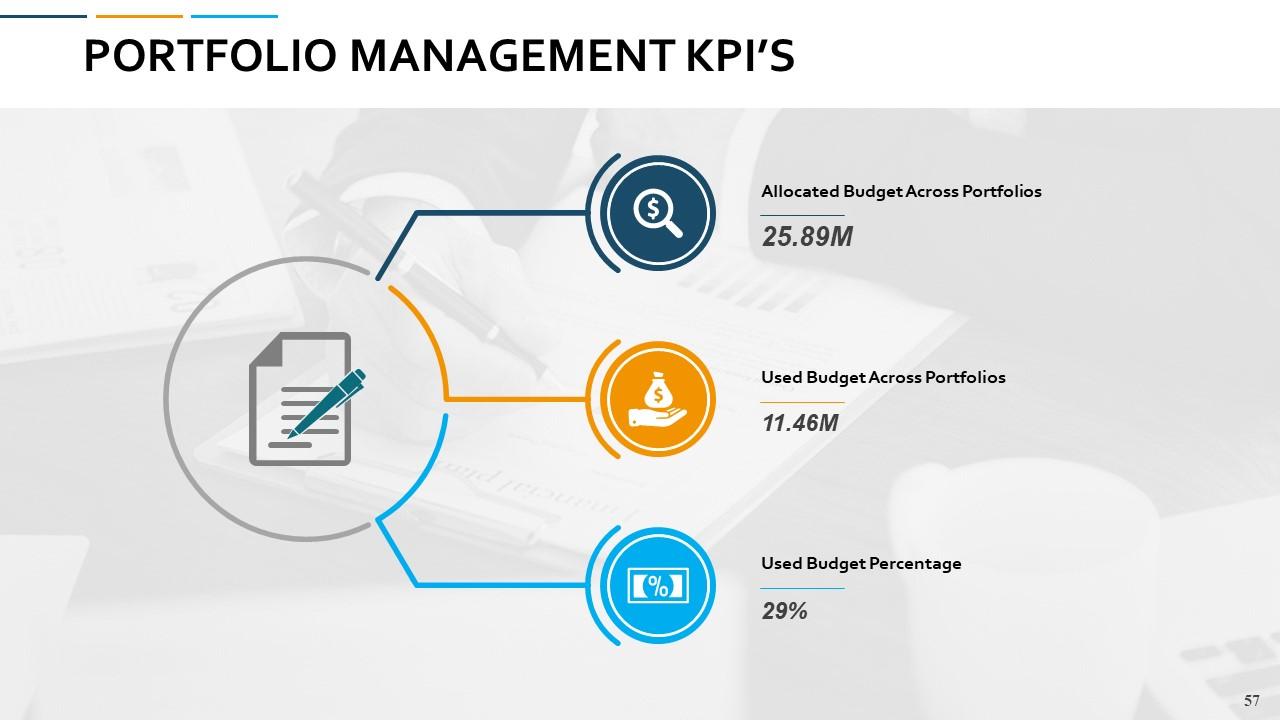

Slide 57: This slide presents Portfolio Management KPI’s describing- Allocated Budget Across Portfolios, Used Budget Percentage, Used Budget Across Portfolios.

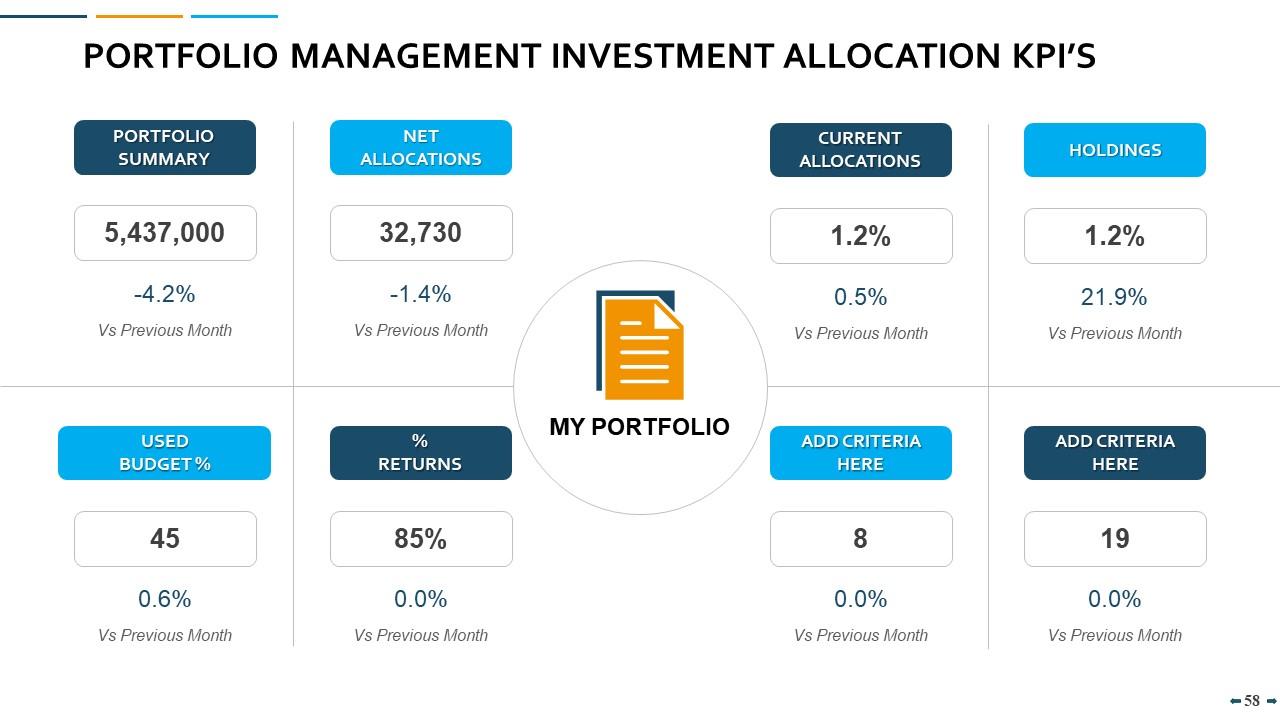

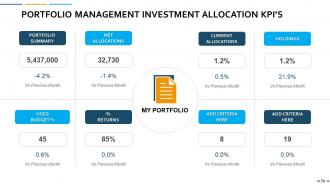

Slide 58: This slide displays Portfolio Management Investment Allocation KPI’s Portfolio Summary Net Allocation Used Budget percentage, Current allocations etc.

Slide 59: This slide showcases Portfolio Management icons.

Slide 60: This slide is titled as Additional Slides for moving forward.

Slide 61: This slide reminds about a 20 minutes Coffee Break.

Slide 62: This is Meet Our specialists slide with names and designation.

Slide 63: This is About Us slide to show company specifications etc.

Slide 64: This is Our Goal slide. Show your firm's goals here.

Slide 65: This is a Comparison slide to state comparison between commodities, entities etc.

Slide 66: This is a Quotes slide to convey message, beliefs etc.

Slide 67: This is a timeline slide to show information related with time period.

Slide 68: This is a Puzzle slide with text boxes.

Slide 69: This slide shows Mind Map for representing entities.

Slide 70: This is a Creative Idea slide to state a new idea or highlight information, specifications etc.

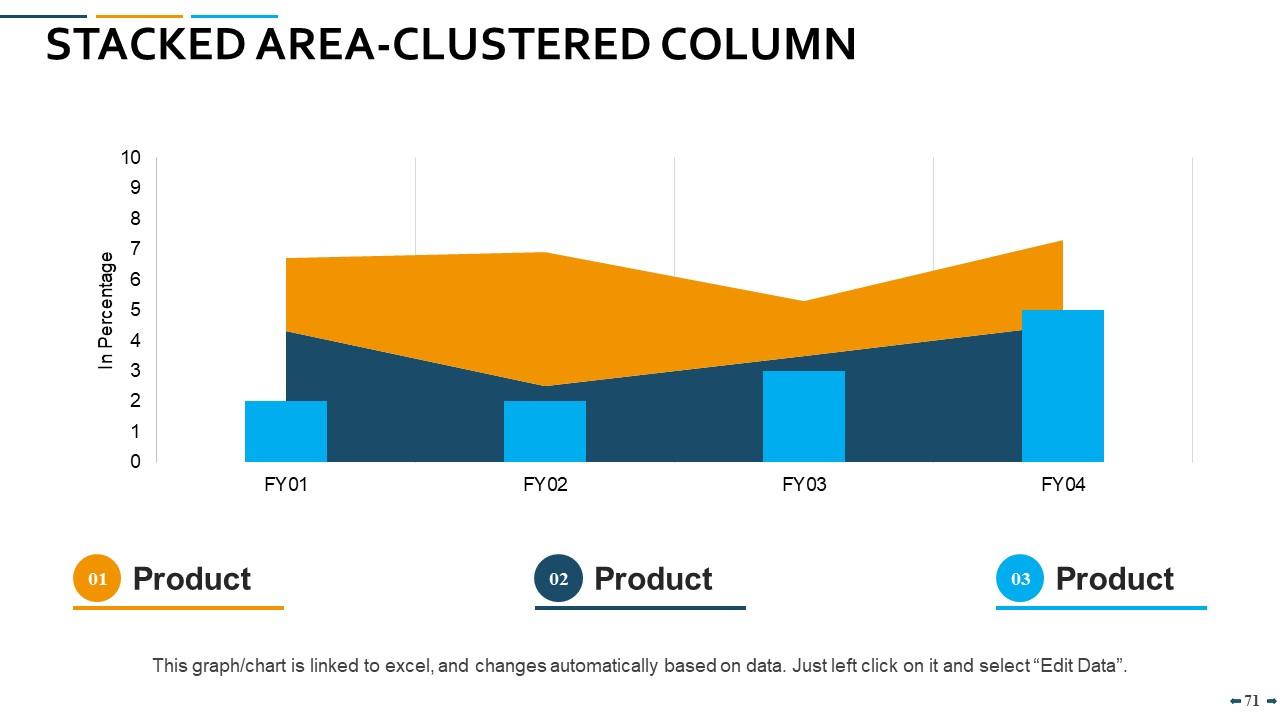

Slide 71: This slide showcases Stacked Area – Clustered Column chart with three products comparison.

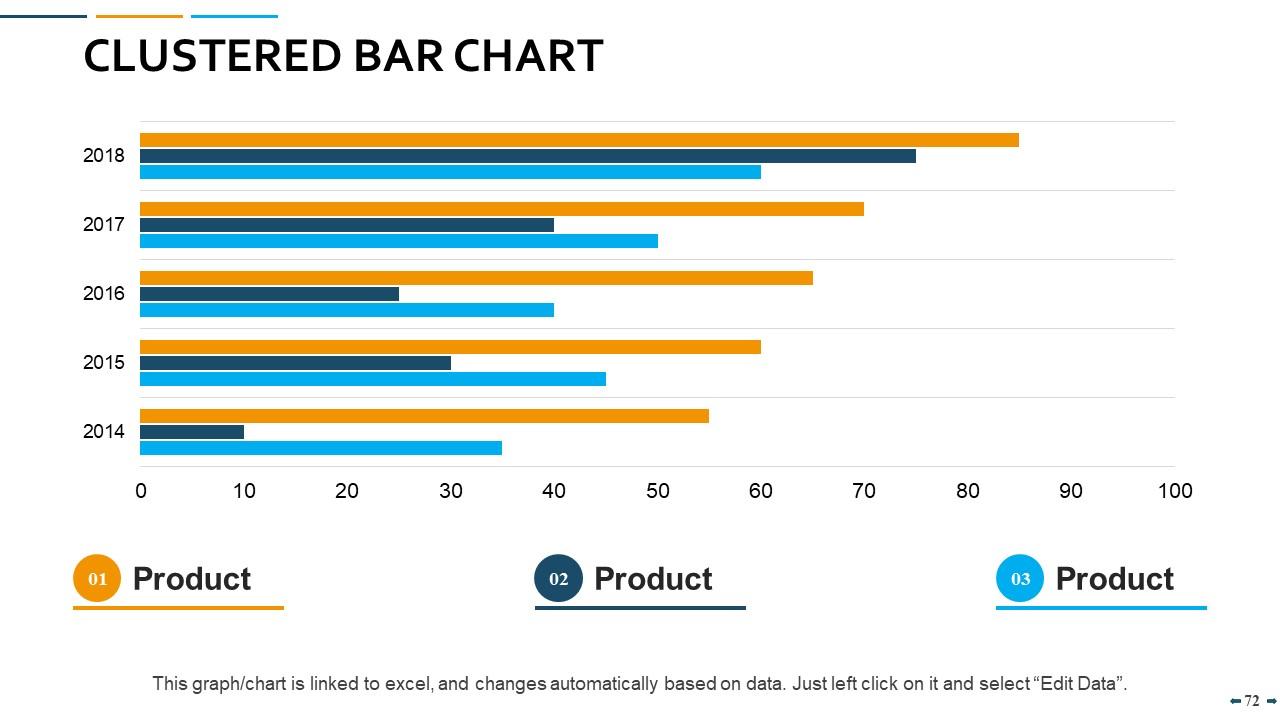

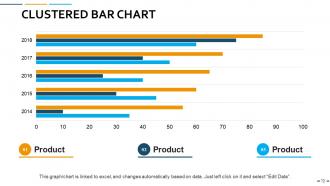

Slide 72: This slide displays Clustered bar chart with three products comparison.

Slide 73: This is a Thank you slide for acknowledgement.

Portfolio management powerpoint presentation slides with all 73 slides:

Assess how the deal goes in your favour with our Portfolio Management Powerpoint Presentation Slides. Be able to identify a good bargain.

No Reviews