Introduction To Cryptocurrency Training Module On Blockchain Technology Application Training Ppt

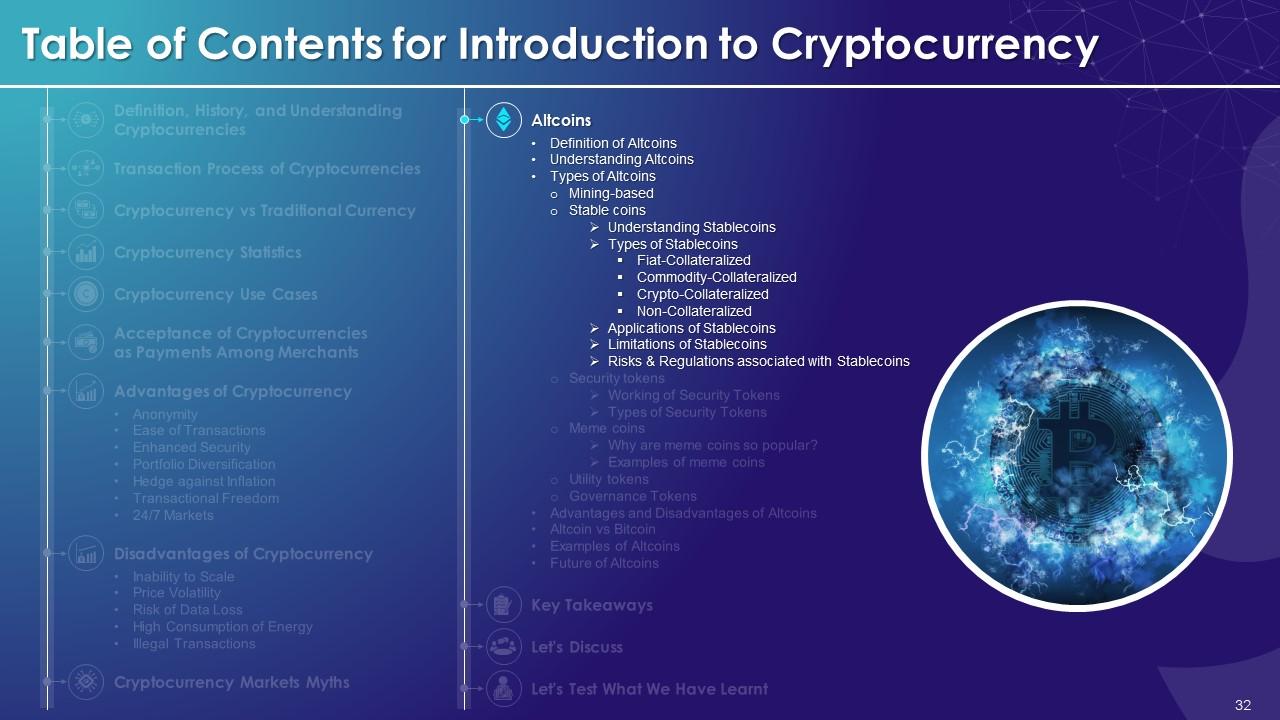

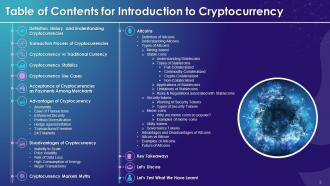

Cryptocurrencies stand as the most popular trend in the market, providing the banking sector with enhanced efficiency, reduced bureaucracy, and increased transparency. Many startups are currently working on digital currency-based solutions as a substitute for conventional banking. Moreover, Cryptocurrency ppt is best for your business. Moreover, the PPT training deck provides a comprehensive introduction to cryptocurrency. It covers the brief history, major statistics, use cases, and transaction process of cryptocurrencies, along with the difference between cryptocurrency and traditional currency and major cryptocurrency market myths. The PowerPoint module in detail covers cryptocurrencys advantages anonymity, ease of transactions, enhanced security, portfolio diversification, hedge against inflation, transactional freedom, and 24 x 7 markets. It also covers the cryptocurrencys disadvantages inability to scale, price volatility, risk of data loss, high consumption of energy, and illegal transactions. Further, the training deck contains PPT slides on the altcoins covering applications and examples of each of its types, i.e. mining-based, stable, security, meme, utility, and governance tokens. It contains discussion questions and MCQs related to the topic to make the training session interactive. The PowerPoint module also includes additional slides on about us, vision, mission, goal, 30-60-90 days plan, timeline, roadmap, training completion certificate, and energizer activities.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

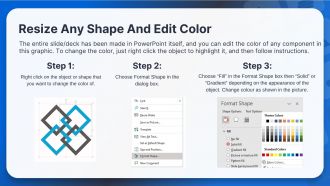

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Training Session on Introduction to Cryptocurrency. This deck comprises of 94 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts and every slide consists of an appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 4

This slide gives the definition of cryptocurrency. It is a type of digital asset that is based on a network that spans a large number of computers. These can exist outside the control of governments and central authorities because of their decentralized structure.

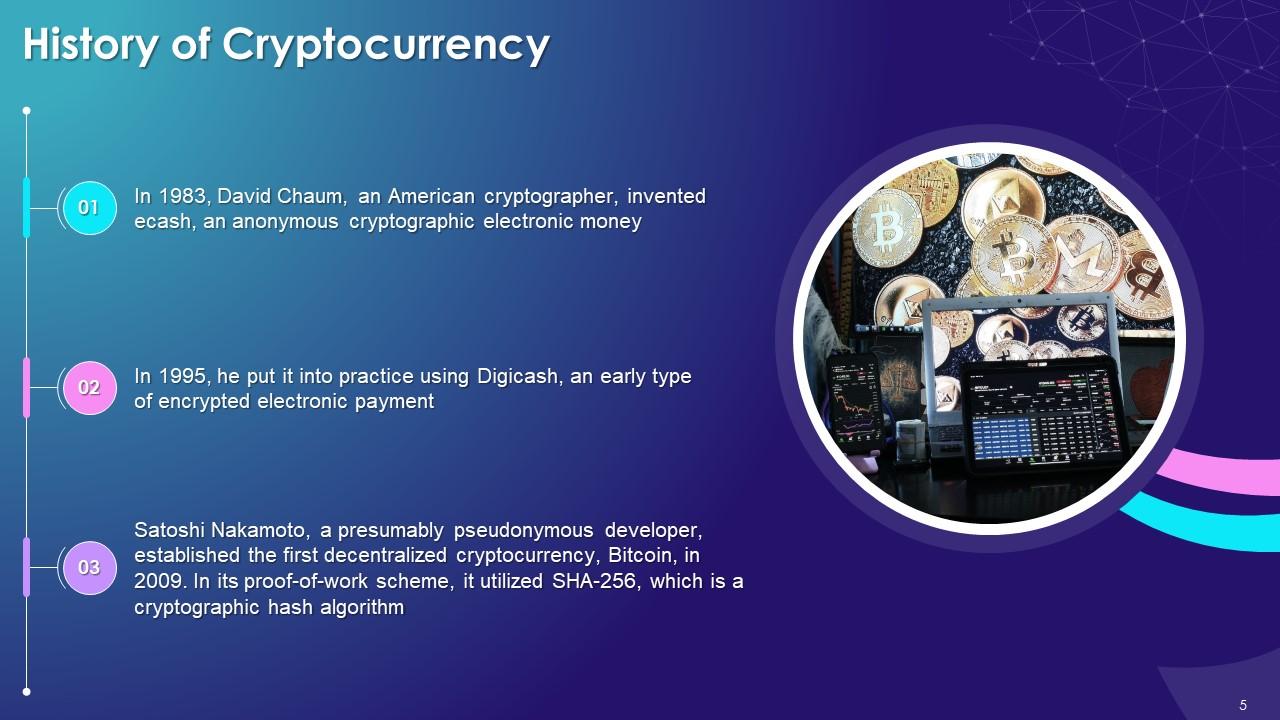

Slide 5

This slide provides an overview of the history of cryptocurrency. Digicash was one of the early types of encrypted electronic payment which required user software to withdraw notes from a bank and select particular encrypted keys that makes it impossible for the government, the issuing bank, or any other third party to track the digital currency

Slide 6

This slide tells us about the functioning of cryptocurrencies, where are mined and the main logic for inventing such a mechanism.

Instructor’s Notes:

Cryptocurrencies are mined or bought on cryptocurrency exchanges and their main reason for existence is to make online payments safe and without the presence of a third-party intermediary.

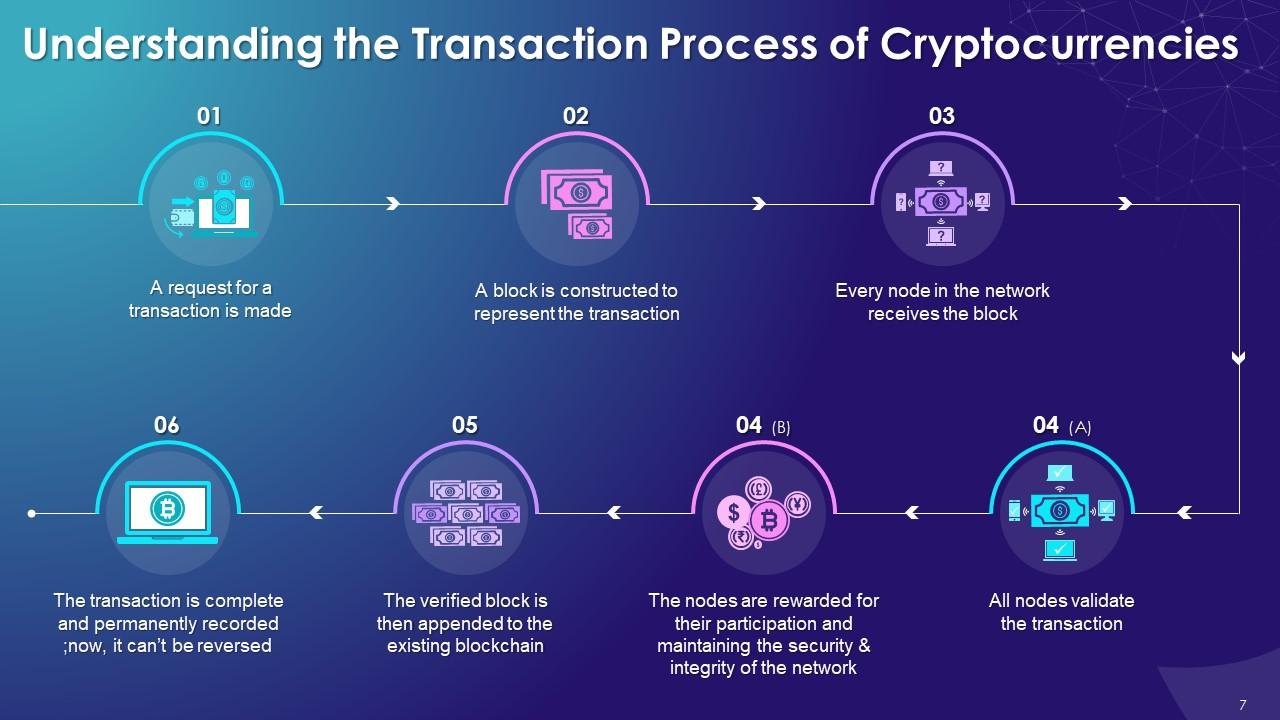

Slide 7

This slide depicts the transaction process of a cryptocurrency using blockchain technology. The process starts with a request for a transaction, a block represents. After all nodes on the network validate the transaction, the validated block is added to the blockchain.

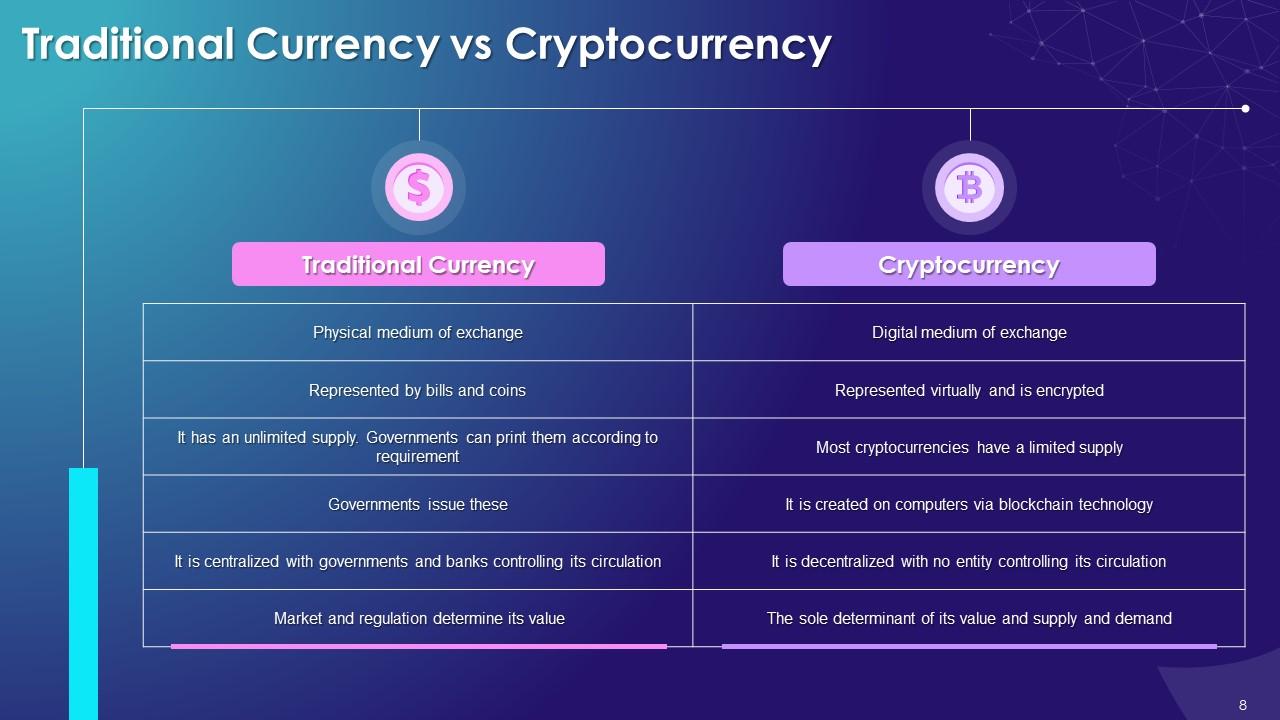

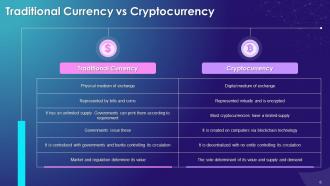

Slide 8

This slide draws a comparison between traditional currency and cryptocurrency. Traditional currencies are tangible, represented by bills and coins, have an unlimited supply, are issued by governments, are centralized, and their value is driven by market and regulation. Cryptocurrencies, on the other hand, are intangible. These digital currencies, have a limited supply, are created on computers, are decentralized, and demand and supply determine how much value these stores.

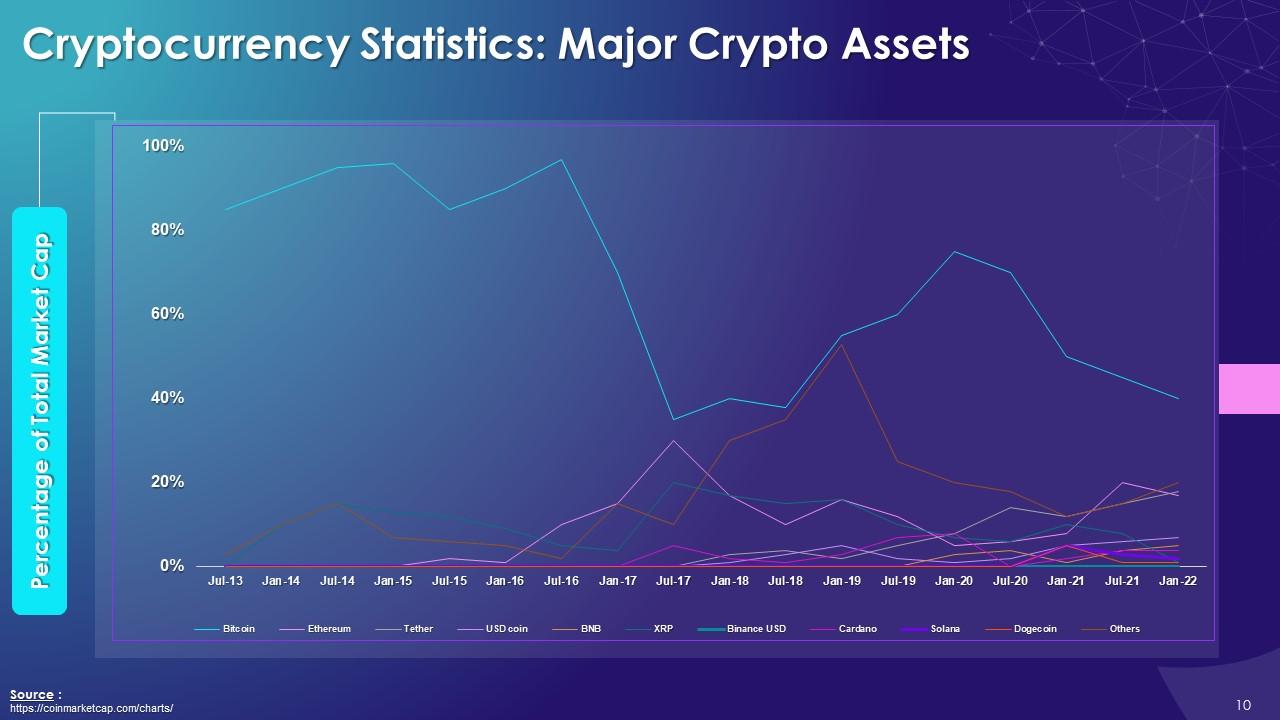

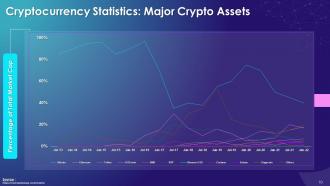

Slide 10

This slide showcases the major cryptocurrencies such as Bitcoin, Ethereum, Tether, etc. by percentage of total market capitalization. Bitcoin is, by far, the leader of the pack, with Ethereum a distant second; the gap appears to be narrowing between the two cryptocurrencies.

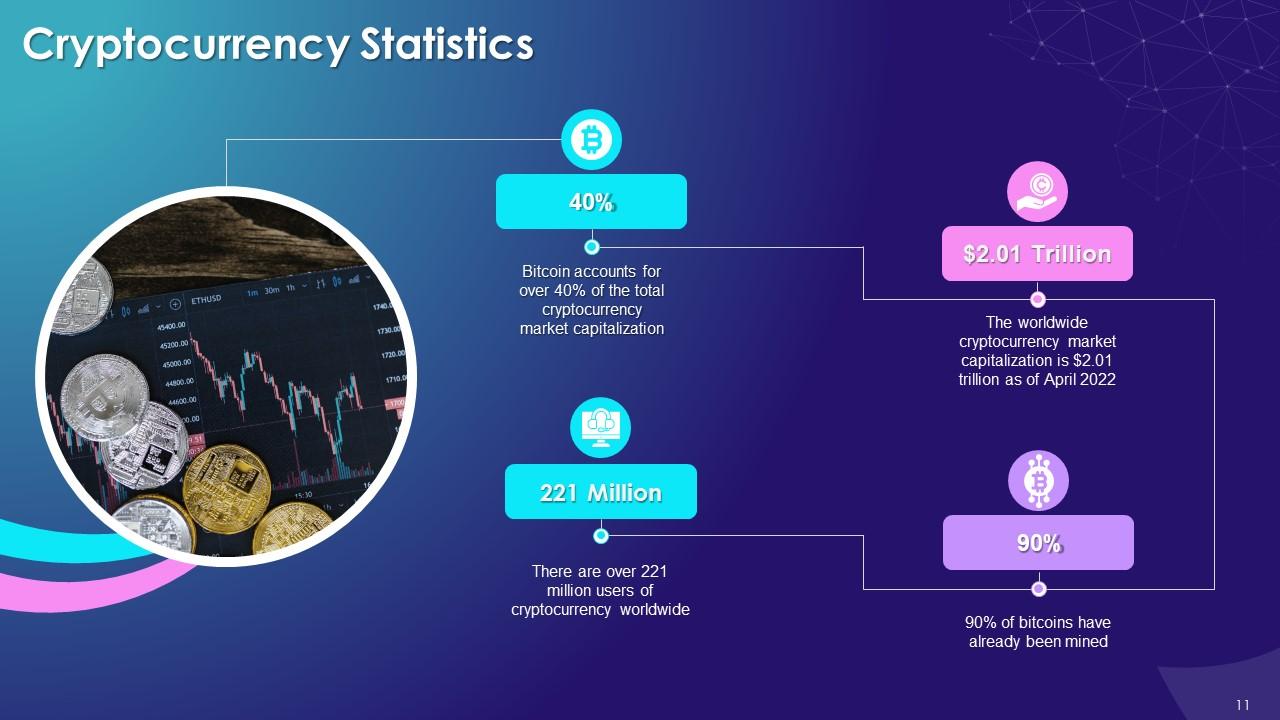

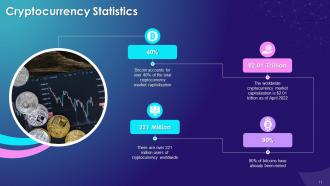

Slide 11

This slide highlights some interesting and important cryptocurrency statistics. Bitcoin accounts for over 40% of the total cryptocurrency market capitalization and 90% of bitcoins have already been mined. The worldwide cryptocurrency market cap is $2.01 trillion as of April 2022.

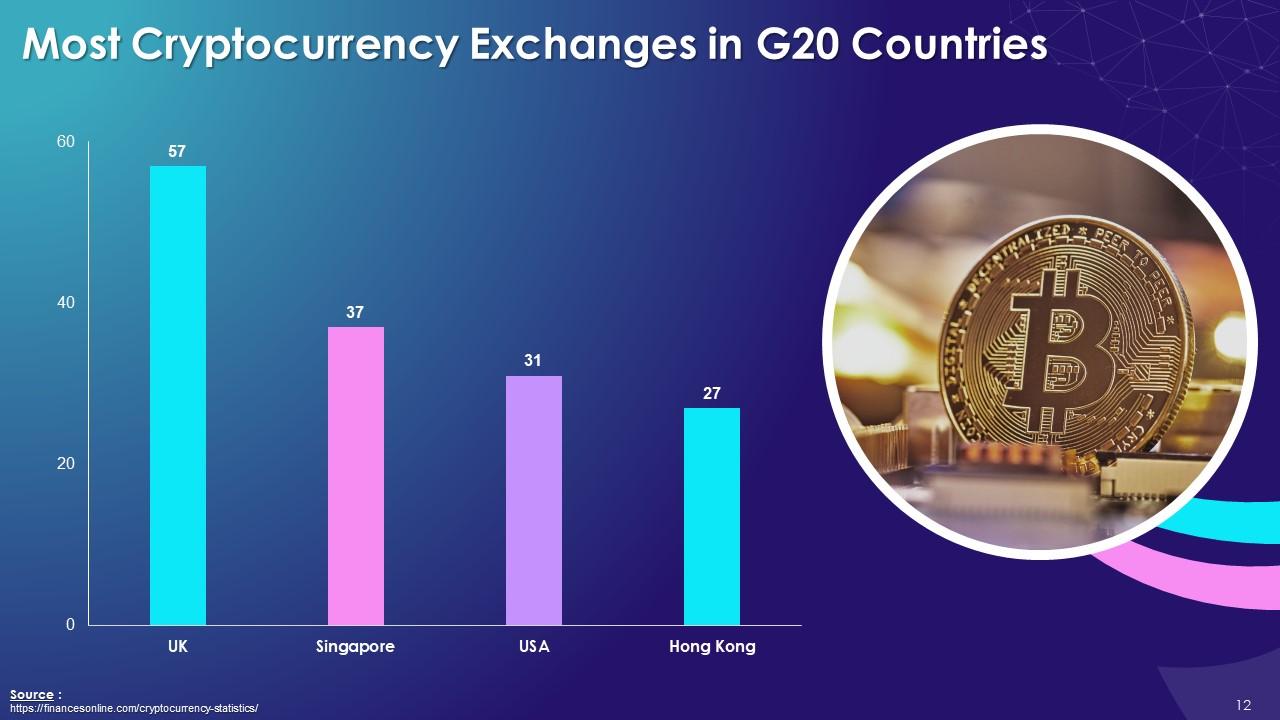

Slide 12

This slide depicts the G20 countries with the most cryptocurrency exchanges in 2020. These include the United Kingdom (57 exchanges), Singapore (37 exchanges), the United States (31 exchanges), and Hong Kong (27 exchanges).

Slide 13

This slide depicts the two main uses of cryptocurrencies. Cryptocurrencies can be used as a mode of payment and as an investment.

Instructor’s Notes:

- Mode of payment: Bitcoin was designed to be a currency for day-to-day transactions, allowing users to buy everything from a cup of coffee to a computer and even big-ticket items like in real estate. Cryptocurrencies can be used to purchase a wide range of items from e-commerce platforms

- Investment: Cryptocurrencies, particularly bitcoin, are currently one of the mainstream investment possibilities available

Disclaimer: Invest at your own risk.

Slide 14

This slide lists companies that accept cryptocurrencies as a payment option. These companies include Microsoft, Paypal, Wikipedia, and AT&T

Instructor’s Notes:

- Microsoft: Apart from using cryptocurrency to top up your Microsoft account, the software giant also allows users to use cryptocurrency for other purposes. With Bitcoin, you may pay for Xbox Live, Microsoft software, games, and other digital content

- Paypal: In addition to buying and selling cryptocurrency, Paypal clients in the US can also use cryptocurrencies at merchants who accept Paypal payments. Bitcoin, Bitcoin Cash, Litecoin, and Ethereum are all accepted cryptocurrencies

- Wikipedia: Wikipedia, the world's most comprehensive open-source encyclopedia, welcomes bitcoin payments and financial contributions. Wikimedia, the company that manages Wikipedia, uses BitPay as its payment platform

- AT&T: AT&T is the first major US mobile phone carrier to accept cryptocurrency payments using BitPay, a third-party payment processor

Slide 16

This slide lists the advantages of cryptocurrency. These include anonymity, ease of transactions, enhanced security, portfolio diversification, hedge against inflation, transactional freedom, and 24/7 markets.

Slide 17

The slide depicts anonymity as an advantage of cryptocurrency. The capacity to conduct anonymous transactions is a key feature of cryptocurrencies that has endeared the technology to consumers. Confidentiality and transaction security are enhanced from establishing such anonymity with the distributed ledger technology.

Slide 18

The slide talks about ease of transactions as an advantage of cryptocurrency. Crypto transactions are simple, affordable, and more private than most other types of transactions. Anyone may send and receive cryptocurrency using a simple smartphone app, hardware wallet, or exchange wallet.

Instructor’s Notes:

To use cryptocurrency, you don't always need a bank account. One of the main advantages of cryptocurrencies is that it provides access to people who don't have access to traditional financial systems

Slide 19

The slide talks about enhanced security as an advantage of cryptocurrency. Decentralized cryptocurrencies are secure forms of payment since they are built and based on cryptography and blockchain security.

Slide 20

The slide discusses portfolio diversification as an advantage of cryptocurrency. Cryptocurrency can allow investors to diversify their portfolios away from traditional financial assets like equities and bonds.

Slide 21

The slide talks about hedge against inflation as an advantage of cryptocurrency. Most cryptocurrencies, unlike fiat currencies, have restricted supply allows these (cryptos) to be used as a hedge against inflation.

Slide 22

The slide discusses transactional freedom as an advantage of cryptocurrency. One of the most significant advantages of cryptocurrency is that it may be used to transfer value between two parties. This can be accomplished without the involvement of a third party, making the transaction more open and resistant to censorship.

Slide 23

The slide talks about 24/7 markets as an advantage of cryptocurrency. Crypto markets are open for business 24 hours a day, seven days a week.

Slide 25

This slide lists the disadvantages of cryptocurrency. These include inability to scale, price volatility, risk of data loss, high consumption of energy, and illegal transactions.

Slide 26

The slide talks about poor scalability as a disadvantage of cryptocurrency. The scalability issues that cryptocurrencies pose are probably the most serious ones. While the number of digital coins and their usage is fast-growing, it is still dwarfed by the number of transactions that payment giants like VISA, Alipay, Amazon etc.

Slide 27

The slide discusses price volatility as a disadvantage of cryptocurrency. Cryptocurrency is seen as volatile since it is a newer asset class with the potential for big upward and downward moves over shorter periods

Slide 28

The slide talks about risk of data loss as a disadvantage of cryptocurrency. Cryptocurrency creators sought to create invisible ASCII documents and robust hacking defenses, and impenetrable authentication processes. It is safer to keep money in cryptocurrency rather than cash or bank vaults. However, if a user loses their wallet's private key, there is no way to recover it.

Slide 29

The slide talks about high consumption of energy as a disadvantage of cryptocurrency. Cryptocurrency mining is energy-intensive as it requires a lot of processing power and electricity.

Instructor’s Notes:

Bitcoin miners are concentrated in countries where coal is used to generate electricity, such as China. Such mining of bitcoins has increased China's carbon footprint.

Slide 30

The slide discusses illegal transactions as a disadvantage of cryptocurrency. Since cryptocurrency transactions are private and secure, it's difficult for authorities to track down or monitor any person by their wallet address. Bitcoin has previously been used as a means of payment (exchanging money) in unlawful transactions, such as buying narcotics on the dark web.

Slide 31

This slide highlights myths about cryptocurrency markets. Some of these are that cryptocurrencies are used for illicit activities, are insecure, can’t be used for making payments, are easy to hack, and have no real money value.

Slide 33

This slide introduces the concept of Altcoins. Altcoins refer to cryptocurrencies other than bitcoin. They have some similarities to bitcoin, but differ in other ways.

Slide 34

This slide highlights similarities and differences between Bitcoin and altcoins. Even as both have a similar structure, altcoins build on bitcoin’s perceived drawbacks to gain a competitive advantage.

Slide 35

This slide lists types of altcoins such as coins that are mining based, stable coins, security tokens, meme coins, utility tokens, and governance tokens

Slide 36

This slide talks about mining-based altcoins. These coins, as the name suggests, are created through mining. Proof of Work (PoW) is a mechanism through which systems generate new coins by solving cryptographic problems to build blocks. Most mining-based Altcoins are using this.

Slide 37

This slide introduces the concept of stablecoins. Stablecoins are digital assets linked to the value of another currency, commodity, or financial instrument.

Slide 38

This slide discusses the main aim of stablecoins, which is to ensure that value of cryptocurrency remains stable.

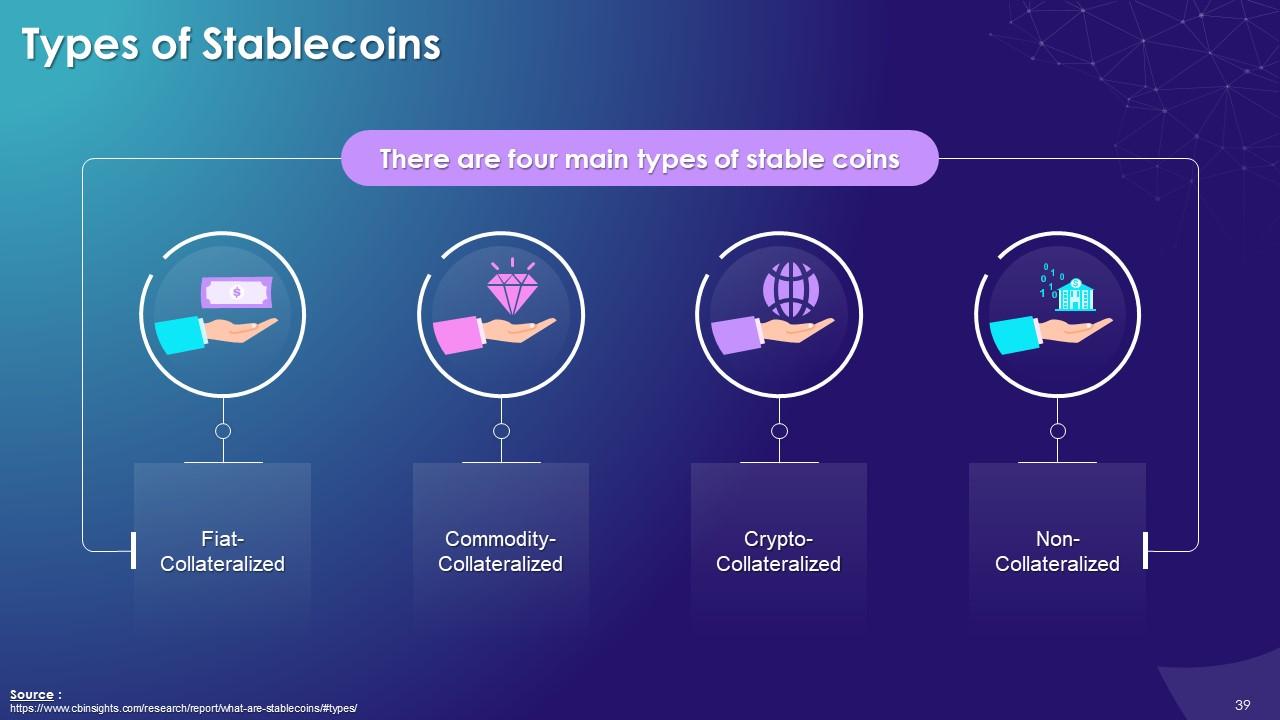

Slide 39

This slide highlights the four types of stablecoins. These are fiat-collateralized, commodity-collateralized, crypto-collateralized, and non-collateralized.

Slide 40

This slide discusses Fiat-Collateralized Coins which are a type of stablecoins. Fiat-collateralized stablecoins are backed by sovereign money such as the Pound Sterling or the US Dollar. To issue a specific number of cryptocurrency tokens, the issuer must provide dollar reserves in the same amount as the collateral

Slide 41

This slide discusses Commodity-Collateralized Coins which are a type of stablecoins. Transferable assets like precious metals, oil, real estate etc can back Stablecoins with collateral. Among these, Gold is the most commonly collateralized asset.

Instructor’s Notes:

The value of a real-world asset is also, essentially, exposed to the behaviour of holders of commodity-collateralized stablecoins. These assets can appreciate or depreciate over time, which might impact trade incentives.

Slide 42

This slide discusses Crypto-Collateralized Coins which are a type of stablecoins. Crypto-collateralized stablecoins are backed by other cryptocurrencies and are over-collateralized.

Instructor’s Notes:

For example, to obtain $500 in stablecoins, you must invest $1,000 in Ether (ETH). The stablecoins are now 200 percent collateralized in this situation, and even if the price drops by 25%, the $500 worth of stablecoins is secured by $750 worth of the ETH.

Slide 43

This slide discusses Non-Collateralized Coins which are a type of stablecoins. Non-Collateralized or Algorithmic stablecoins may or may not hold reserve assets. They keep the stablecoin's value stable. This is done through an algorithm, essentially, a computer program that runs a preset formula to control the stablecoin's supply.

Instructor’s Notes:

For example, to obtain $500 in stablecoins, you must invest $1,000 in Ether (ETH). The stablecoins are now 200 percent collateralized in this situation, and even if the price drops by 25%, the $500 worth of stablecoins is secured by $750 worth of the ETH.

Slide 44

This slide lists applications of stablecoins. These include the use of stablecoins as a day-to-day currency which is fast & affordable, streamlining recurrent and P2P payments, and providing protection from local currency crashes & market volatility.

Instructor’s Notes:

- A day-to-day currency: Well-designed stablecoins have the potential to be used in commerce just like any other currency. Since no conversion of multiple fiat currencies is required, stablecoins might be used for international money transfers

- Fast & affordable remittances for migrant workers: Many migrant workers currently rely on businesses to transfer money back to their families, which is time-consuming and expensive. Stablecoins can be a better alternative. Workers and their families can use digital wallets to receive stablecoins almost instantaneously from anywhere globally, with low fees and no price volatility

- Streamlining recurrent and P2P payments: Enforcement of smart contracts is also possible with stablecoins. An employer, for example, may set up a smart contract that automatically transfers stablecoins to its employees at the end of each month

- Improve cryptocurrency exchanges: Due to rigorous rules, only a few cryptocurrency exchanges presently offer fiat currencies. However, by simply employing a USD-backed stablecoin instead of actual dollars, exchanges can get past this obstacle and provide crypto-fiat trading pairings. This encourages the general acceptance of cryptocurrency trading since it simplifies the process and allows them to continue thinking in terms of dollars or euros rather than fluctuating bitcoin values

- Protection from local currency crashes & market volatility: Local citizens may instantly trade their crashing currency for comparatively safe USD-backed, EUR-backed, or even gold-backed stablecoins, shielding themselves from further value erosion

Slide 45

This slide highlights the limitations of Stablecoins. The major ones are people’s trust in the solvency of the organization backing the stablecoin, lower probability of making gains by trading in stablecoins etc

Slide 46

This slide discusses risks and regulations associated with Stablecoins. These are: systematic risk & loss of value, threat to market integrity & investor protection, illicit activity, and tighter regulations.

Instructor’s Notes:

- Systematic risk & loss of value: Economic power would be excessively concentrated in a single entity with centralized coins, such as thosethose having fiat backing and that private entities produce. Tether, for example, with its current market share of more than 50%, poses such a threat. Tether's failure could jeopardize an entire ecosystem of apps, businesses, and users who rely on it. Investors may try to cash out their stablecoins if the economy overheats and the value of Tether's non-cash collateral plummets, only to discover that the issuer is unable to return the entire money invested (referred to as 1:1 ratio)

- Threats to market integrity & investor protection: According to the US Treasury Department, the ease and speed of transacting with stablecoins encourage speculative trading of digital assets, endangering market integrity and investor protection

- Illicit activity: Stablecoins could be misused to break laws on Anti-Money Laundering (AML) and Counter-terrorist Financing Legislation (CFT). The increased use of stablecoins for cross-border transactions, the lack of international standards for stablecoin providers, the irregular implementation of AML/CFT standards among different countries, and the possibility of anonymity while transacting in stablecoin are all factors that contribute to the risk of the currency being misused for illicit activity

- Tighter regulation: To address the prudential risks of stablecoins, the US Treasury advocated stricter regulation in 2021. These recommendations included that the stablecoin issuers must be insured depository institutions, custodial wallet providers must be subject to "appropriate federal oversight," and interoperability standards must be implemented across stablecoins, among other requirements.

Slide 48

This slide discusses security tokens as a type of altcoin. Security tokens are digital assets that are traded on stock exchanges. The transfer of value from an asset to a token made available to investors is known as tokenization.

Slide 49

This slide describes how a security token works. A security token could represent fractional ownership in almost any asset, including business shares, commercial real estate, fine art, and even antique cars. The issuer fractionalizes the asset into a certain number of tokens, which are then sold to investors in a regulated offering.

Instructor’s Notes:

The adoption of blockchain technology removes roadblocks to the process of issuing security tokens and allows for a greater variety of securities to be launched into the market.

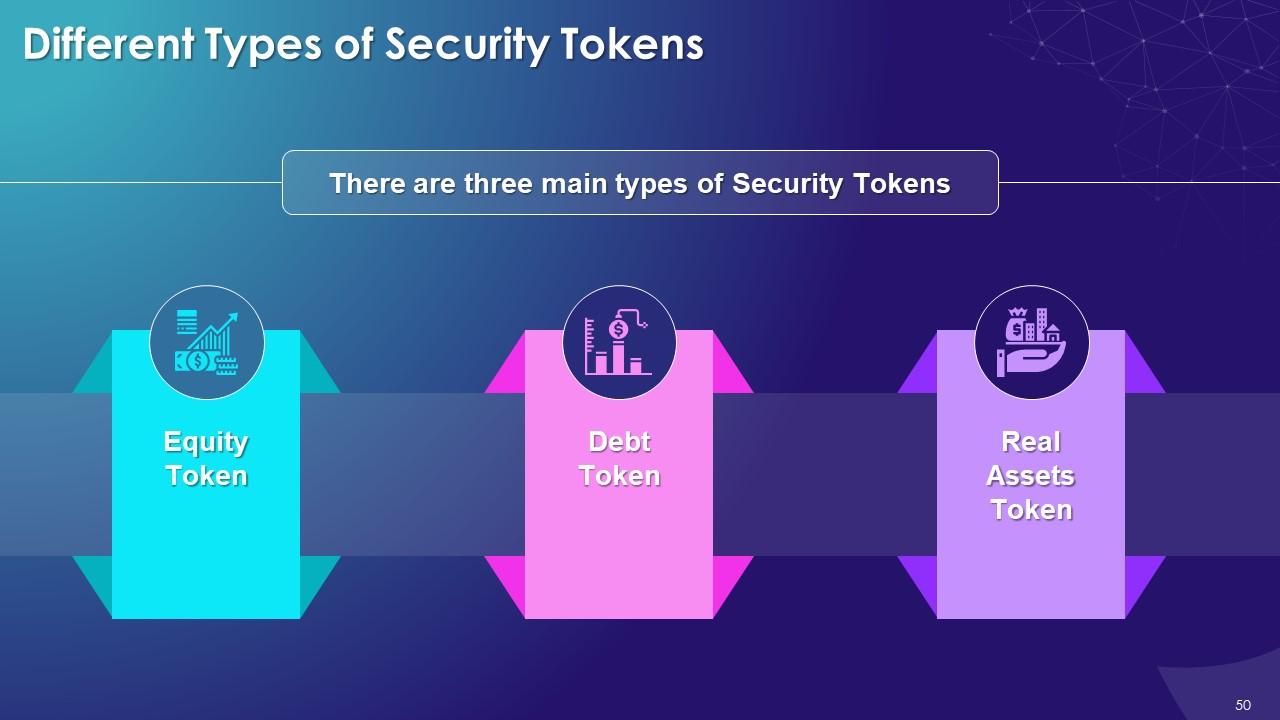

Slide 50

This slide depicts types of Security Tokens. The three main types are equity tokens, debt tokens, and real assets tokens.

Instructor’s Notes:

- Equity Token: Equity tokens represent the value of a company's shares on the blockchain. The technique of registering ownership distinguishes an equity token from a standard stock. A traditional stock is entered into a database and is represented by a paper certificate. On the other hand, an equity token is recorded on an immutable blockchain

- Debt Token: These tokens represent real estate mortgages, corporate bonds, and other debt instruments. These tokens typically pay a regular interest based on the underlying debt instrument's payments. In debt valuation, a debt token is exposed to the risk of debt default. A smart contract can represent the security token, which contains repayment terms and risk indicators related to the underlying debt

- Real Assets Token: They represent ownership of any real-life asset, like commodities, real estate, artwork, etc. Blockchain technology enables transparent records of complex transactions and aids in tracking entities, lowering the risk of fraud

Slide 51

This slide talks about meme coins as a type of altcoin. Meme coins are cryptocurrencies inspired by the Internet and social media memes or jokes. They are highly volatile and are primarily community-driven.

Slide 52

This slide discusses the reason behind meme coins’ popularity. It is difficult to identify particular reasons, some claim that the crypto market grew during the COVID-19 pandemic as retail investors sought to hedge against inflation. Meme coins grew in market valuation due to the hype.

Slide 53

This slide lists popular meme coins. These are: Dogecoin (DOGE), Shiba Inu (SHIB), Dogelon Mars (ELON), and Samoyedcoin (SAMO).

Instructor’s Notes:

- Dogecoin (DOGE): Software programmers Billy Markus and Jackson Palmer founded Dogecoin (DOGE) in 2013. It was designed as a joke cryptocurrency to grab mainstream attention and was inspired by a Shiba Inu dog meme. DOGE uses the same Proof of Work (PoW) process as Litecoin (LTC) and has no limit on supply

- Shiba Inu (SHIB): Shiba Inu (SHIB) is DOGE's main competitor, known as the "Dogecoin killer." A Japanese dog breed inspired SHIB, and in August 2020, an anonymous developer named Ryoshi produced it. The primary distinction between DOGE and SHIB is that the latter has a finite quantity of 1 quadrillion tokens, of which 50% were burned and donated to charity

- Dogelon Mars (ELON): ELON is named after the CEO of Tesla, Elon Musk. It is a fork of Dogecoin with a 557 trillion token circulating supplyLaunched in April 2021, ELON had risen 3780% in value by November 2021, ELON has increased by nearly 3,780% as of November 2021

- Samoyedcoin (SAMO): Samoyedcoin is a Solana blockchain-based dog meme coin project. Over 13% of SAMO supply was airdropped to community members upon launch. SAMO's roadmap includes burning events (sending cryptocurrency to an unusable wallet to remove that amount of it from circulation), airdrop tools, a decentralized exchange, and the construction of NFTs. Within a month, SAMO had grown by nearly 4,300%. In 30 days in October 2021, the price skyrocketed from $0.005 to almost $0.22

Slide 54

This slide discusses utility tokens as a type of altcoin.Utility tokens are used to deliver network services. They could be used to buy services, pay network costs, or redeem rewards.

Slide 55

This slide discusses governance tokens as a type of altcoin. Governance tokens grant holders certain privileges on a blockchain, such as voting on protocol modifications or having a role in Decentralized Autonomous Organization decisions (DAO). Examples are: Uniswap (UNI) and Compound (COMP).

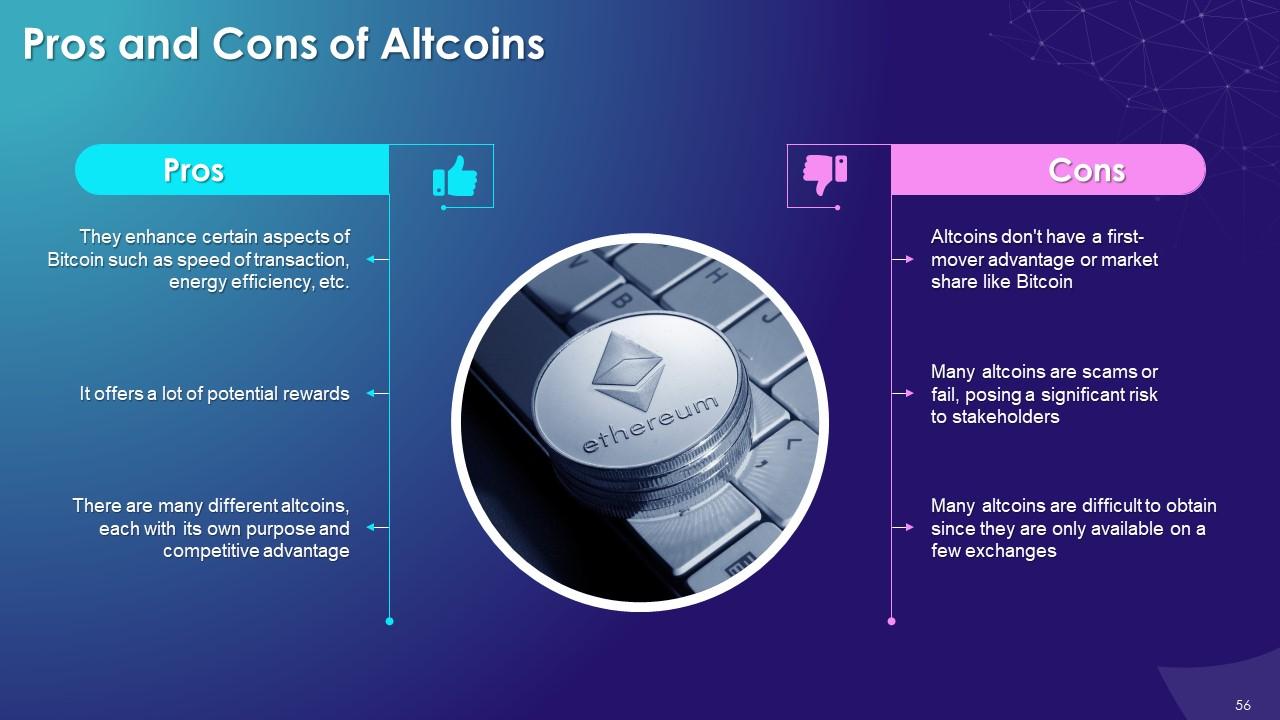

Slide 56

This slide lists advantages and disadvantages of altcoins. The benefits include high potential rewards, certain advantages over Bitcoin, and the presence of multiple coins that bring different competitive advantages. The drawbacks are that they don’t have a first-mover advantage, many of them are scams or fail, and that they are difficult to obtain being available only on a few exchanges.

Slide 57

This slide discusses governance tokens as a type of altcoin. Governance tokens grant holders certain privileges on a blockchain, such as voting on protocol modifications or having a role in Decentralized Autonomous Organization decisions (DAO). Examples are: Uniswap (UNI) and Compound (COMP).

Slide 58

This slide lists popular Altcoins. These include Ethereum, Cardano, Solana, and USD Coin

Instructor’s Notes:

- Ethereum: Ethereum was the first cryptocurrency to introduce a programmable blockchain for developers in July 2015. It rapidly overtook Bitcoin as the most popular cryptocurrency

- Cardano: Cardano is a two-layer solution with a difference. The platform has a control layer and a unit of account that manages the use of smart contracts, recognizes identity, and maintains a degree of separation from the money it supports

- Solana: Solana is an open-source project founded and managed by the Solana Foundation in Geneva in 2017. Solana Labs in San Francisco developed the blockchain. Compared to other blockchains like Ethereum, Solana is substantially faster in transaction processing and has significantly cheaper transaction costs

- USD Coin: USD Coin, a stablecoin launched in September 2018 is linked to the US dollar. Centre, a consortium that includes Coinbase Global, Inc., founded this coin

Slide 59

This slide discusses the future of Altcoins. The current status of the altcoin marketplaces suggests that a single cryptocurrency is unlikely to dominate. However, most of the hundreds of altcoins listed on crypto exchanges are unlikely to survive. The altcoin market will ultimately be reduced to a handful of these that will dominate the markets.

Instructor’s Notes:

Altcoins are likely to be less expensive than Bitcoin. Regardless of the coin type, the cryptocurrency market is new and volatile. With cryptocurrencies still figuring out their place in the global economy, it's advisable to proceed with caution while dealing with it.

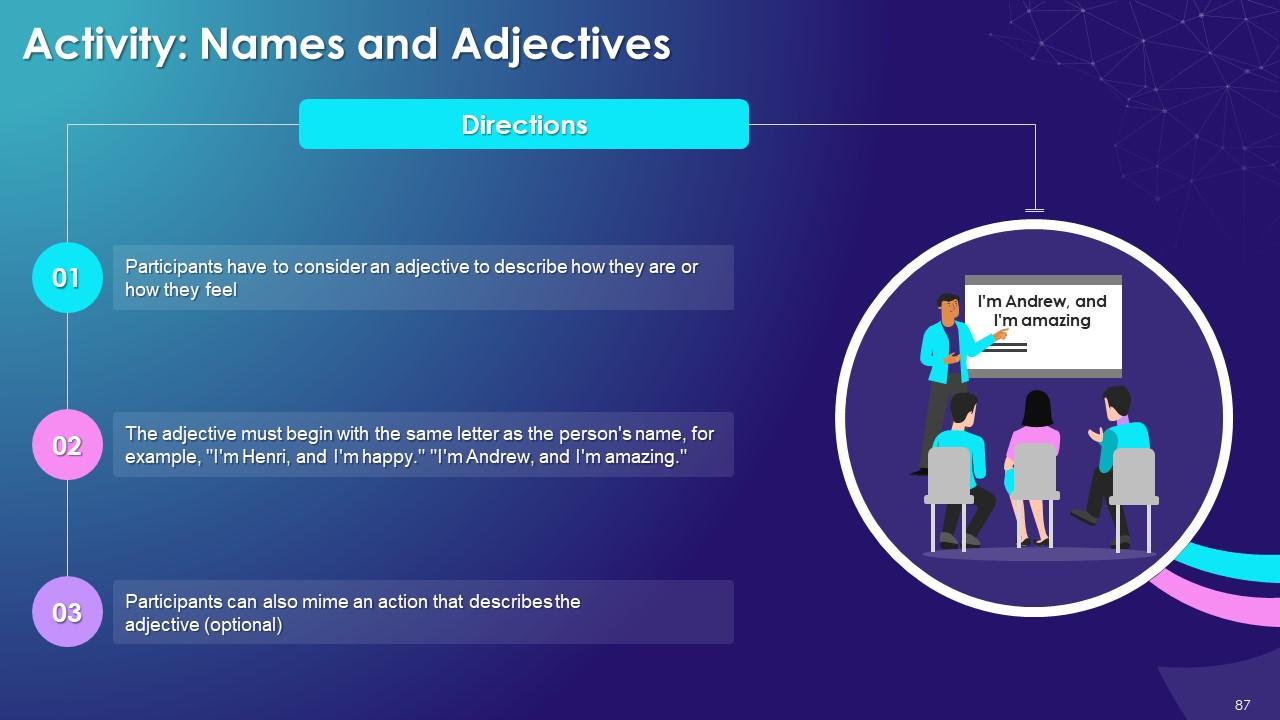

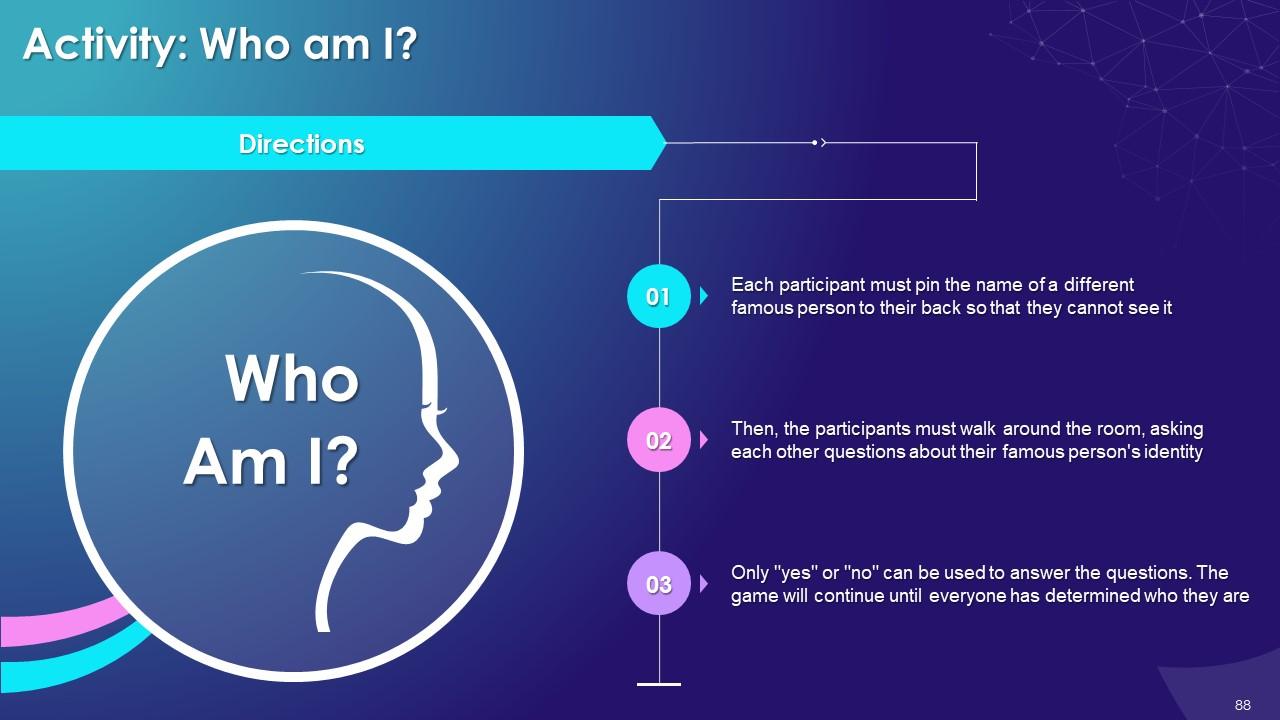

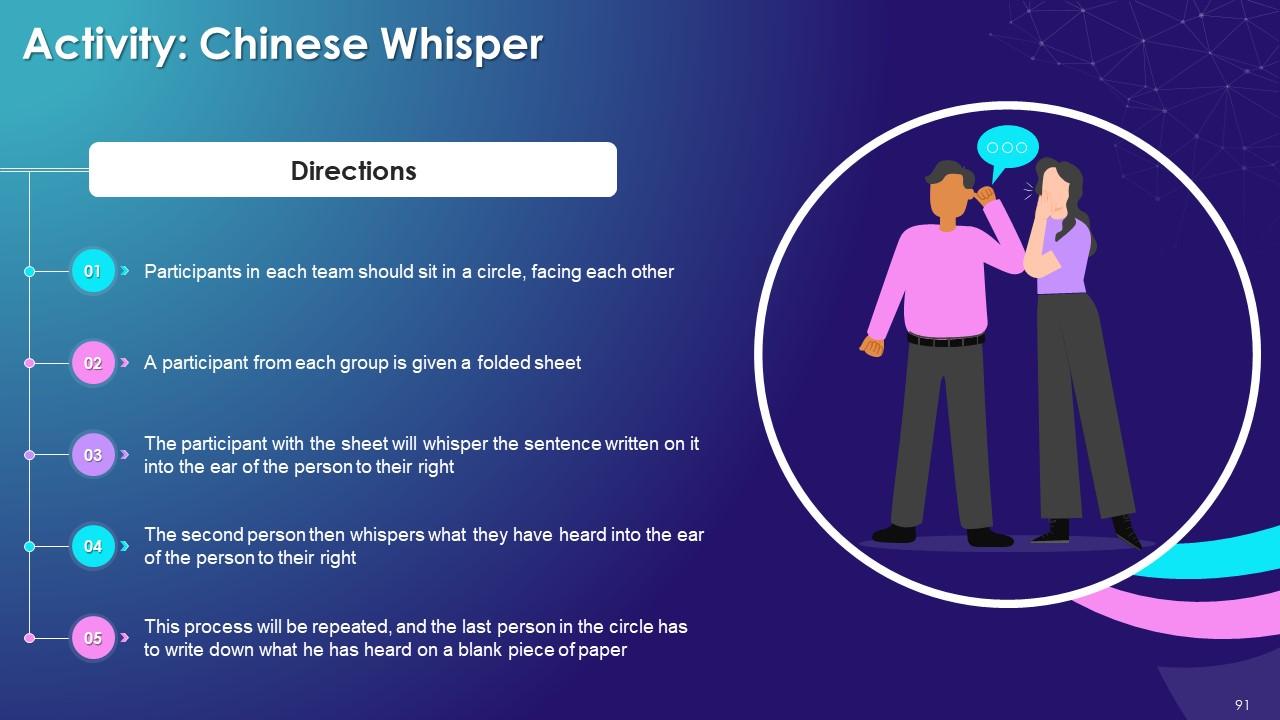

Slide 80 to 95

These slides depict energizer activities to engage the audience of the training session.

Introduction To Cryptocurrency Training Module On Blockchain Technology Application Training Ppt with all 99 slides:

Use our Introduction To Cryptocurrency Training Module On Blockchain Technology Application Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Great designs, Easily Editable.

-

They saved me a lot of time because they had exactly what I was looking for. Couldn’t be happier!