Legal Aspects Of Cryptocurrency Training Module On Blockchain Technology Application Training Ppt

This PowerPoint training deck in-depth covers different legal aspects of cryptocurrencies, such as advertising bans, taxes, and money laundering via cryptocurrencies. It also contains details of cryptocurrencies as a tool to evade sanctions, darknet markets, and wash trades. The PPT module also includes key takeaways, discussion questions, and MCQs along with the additional slides on about us, vision, mission, goal, 30-60-90 days plan, timeline, roadmap, training completion certificate, energizer activities, detailed client proposal, and training assessment form.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Training Session on Legal Aspects of Cryptocurrency. This presentation deck contains 81 well researched and uniquely designed slides. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support available. Suitable for use by managers, employees and organizations. These slides are easily customizable. You can edit the color, text, icon and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 4

This slide highlights the legal aspect of cryptocurrencies. The legal position of cryptocurrencies varies significantly from one jurisdiction to another, and many of them are still undecided or evolving. While cryptocurrency is not illegal in most nations, its status and utility as a means of payment (or a commodity) differ, with varying regulatory implications.

Slide 5

This slide discusses advertising bans that have been imposed on cryptocurrencies. Cryptocurrencies are highly volatile, and trading them without a comprehensive understanding of market dynamics, like any other asset, can be risky. Some governments worldwide have announced plans to crack down on deceptive crypto advertising and enact regulations to protect naive investors.

Slide 6

This slide talks about the taxes on cryptocurrencies. Cryptocurrencies like Bitcoin and Ethereum are subject to capital gains tax rules. The Internal Revenue Service (IRS) considers cryptocurrencies a capital asset. When you sell cryptocurrencies for a profit, you must pay taxes on the gain

Slide 7

This slide highlights how cryptocurrencies have caused an unregulated global economy. Since the inception of bitcoin in 2009, the popularity and demand for online currencies have grown, raising fears that the unregulated person-to-person global market that cryptocurrencies provide could pose a threat to society. There are fears that anonymous web criminals will misuse cryptocurrency.

Instructor’s Notes:

Regular bank transactions can also be used in money laundering, although with bank-to-bank wire transfers, for example, the account holder must at least show proof of identity.

Slide 8

This slide depicts information about money laundering through cryptocurrencies. According to Chainanalysis, a blockchain data business, criminals laundered $8.6 billion in cryptocurrencies in 2021. According to the data, instead of managing a large number of unlawful havens, cybercriminals employ a small number of purpose-built centralized exchanges to transfer and receive illicit cryptocurrencies.

Slide 9

This slide talks about darknet markets. Cryptocurrencies gained popularity in applications such as becoming a safe haven for money laundering, which also led to the use of cryptocurrency in the online darknet markets, such as Silk Road.

Slide 11

This slide discusses wash trades that take place on cryptocurrency exchanges. Wash trading is a practice that involves buyers and sellers being the same person or group and can be used to artificially boost volume or influence the price of a cryptocurrency. According to a 2019 study, up to 80% of trades on unregulated cryptocurrency exchanges may be wash trades.

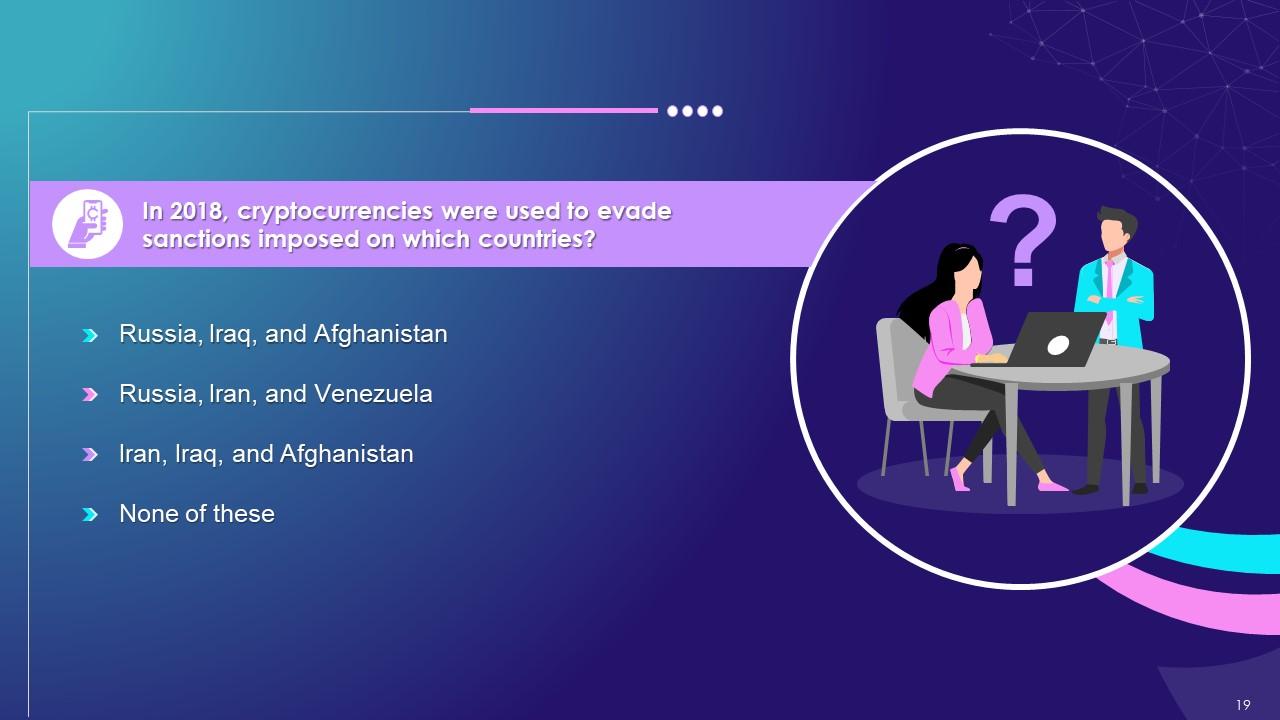

Slide 12

This slide depicts how countries have used cryptocurrencies to evade sanctions. Cryptocurrencies were mentioned in 2018 as a means of evading economic sanctions, such as those imposed on Russia, Iran, and Venezuela. In April that year, Russian and Iranian economic representatives discussed ways to use decentralized blockchain technology to bypass the worldwide SWIFT system.

Instructor’s Notes:

When Western nations imposed severe economic sanctions on Russia in the aftermath of its invasion of Ukraine in February 2022, cryptocurrencies again drew attention. American sources warned that some crypto-transactions could be used to circumvent economic sanctions imposed on Russia and Belarus in March.

Slide 13

This slide talks about the future of cryptocurrency. Several economists foresee a significant changes in legal status of cryptocurrencies as institutional money enters the market. There is also a chance that crypto will be listed on the Nasdaq, which would provide legitimacy to cryptocurrencies and its use as a substitute for traditional currencies.

Instructor’s Notes:

Some believe a cryptocurrency needs a validated Exchange-Traded Fund (ETF). Although an ETF would make it easier for consumers to invest in bitcoin, there must still be a demand for cryptocurrency. This may not be generated automatically by a fund.

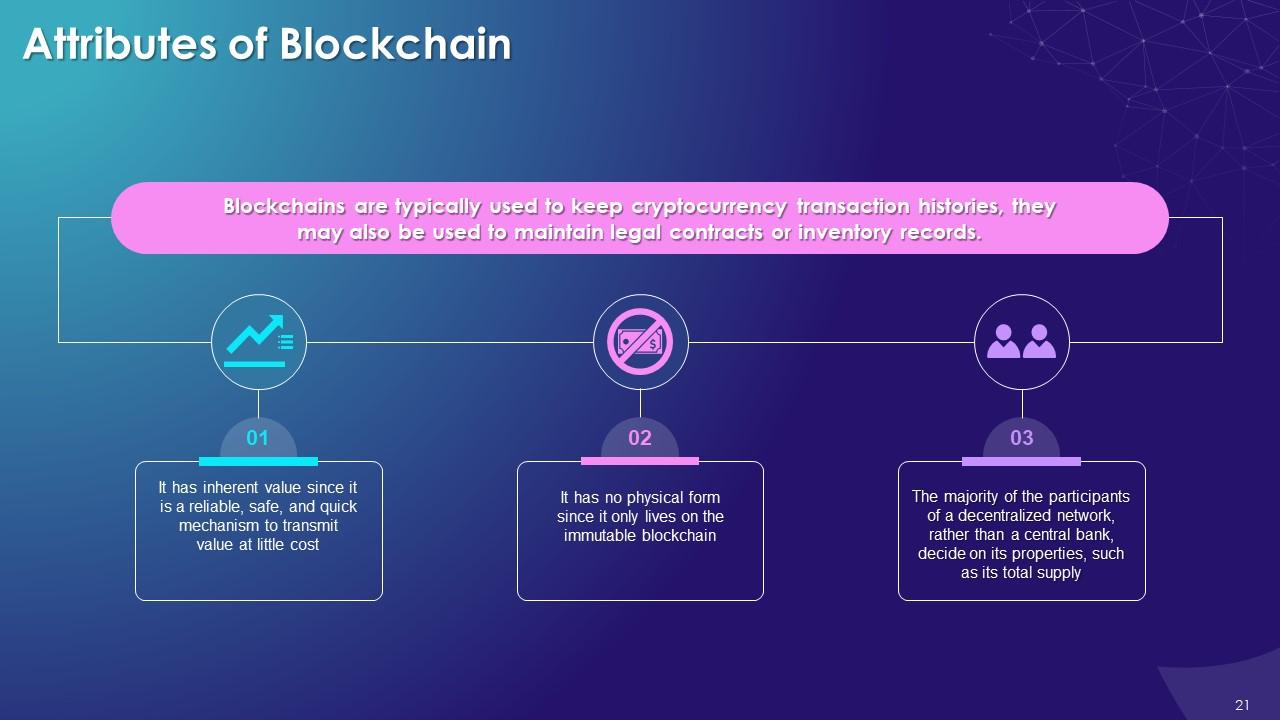

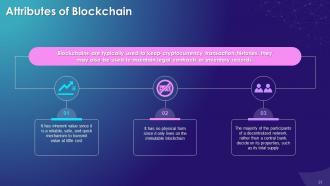

Slide 21

This slide states that while blockchains are typically used to keep cryptocurrency transaction histories, they may also be used to maintain legal contracts or inventory records.

Slide 22

This slide lists the points that should be understood while learning about currencies, like not investing in anything you are unsure of, not jumping on the bandwagon, and implementing what other people are doing only because you fear missing out (FOMO) and so on.

Slide 23

This slide demonstrates that cryptocurrency can allow access to new demographic groups. Users are frequently younger clients who seek openness in their interactions. According to a survey, up to 40% of clients who pay with cryptocurrency are new customers, and their acquisition portions are double those of credit card users.

Instructor Notes:

- Certain alternatives are accessible with cryptocurrency, which is not possible with traditional cash. Programmable finances, for example, can allow real-time and precise revenue sharing while increasing transparency to assist back-office reconciliation

- More businesses discover that critical clients and vendors want to engage via cryptocurrency. As a result, your enterprise may need to be ready to manage and circulate cryptocurrency to ensure smooth transactions with essential stakeholders

- Cryptocurrency opens up a new channel for improving a variety of more traditional treasury tasks, such as:

- Simple, real-time, and secure money transfers

- Helping to consolidate control over the enterprise's capital

- Managing risks and opportunities associated with investing in digital technology

Slide 36 to 50

These slides depict energizer activities to engage the audience of the training session.

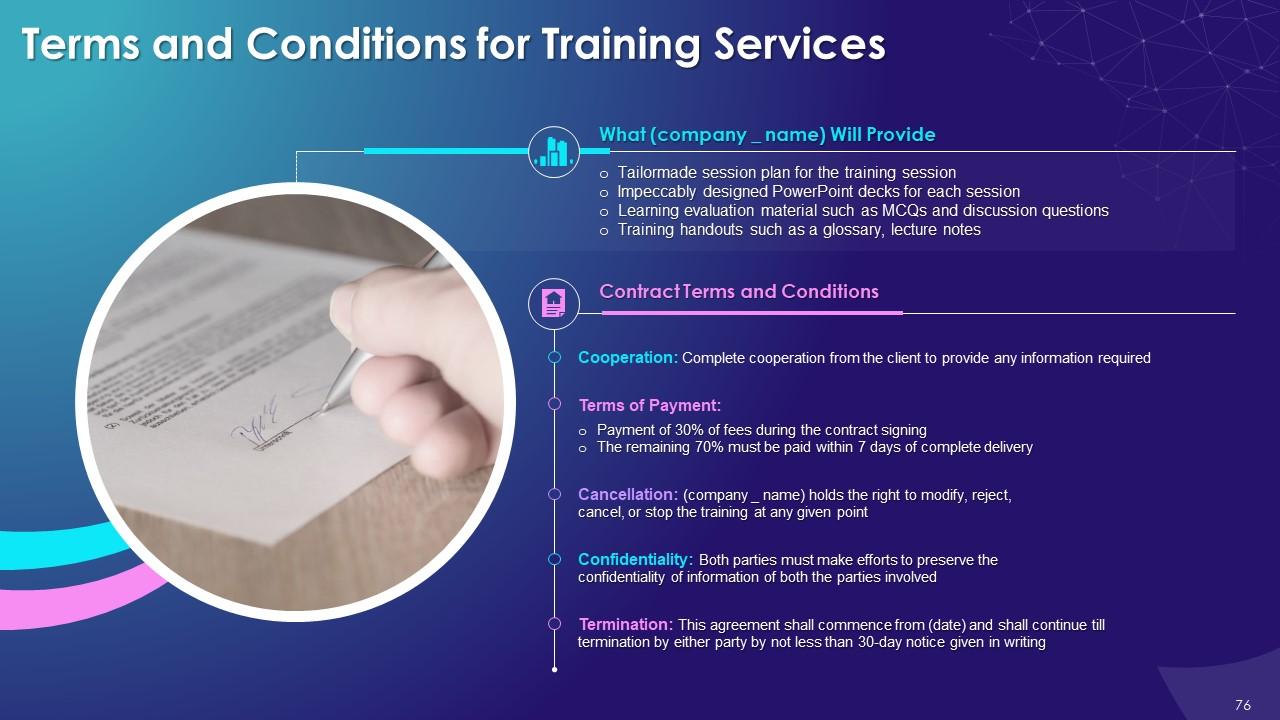

Slide 52 to 78

These slides include a client training proposal showcasing what the company providing corporate training can accomplish for the client.

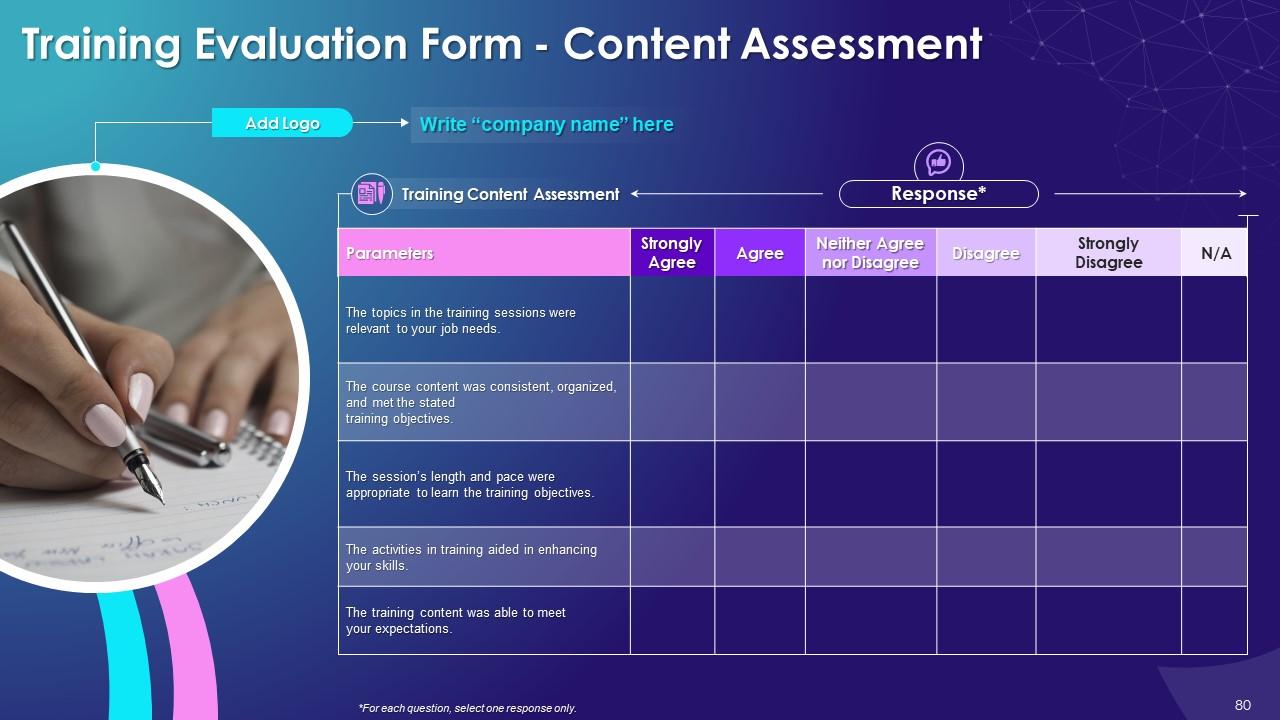

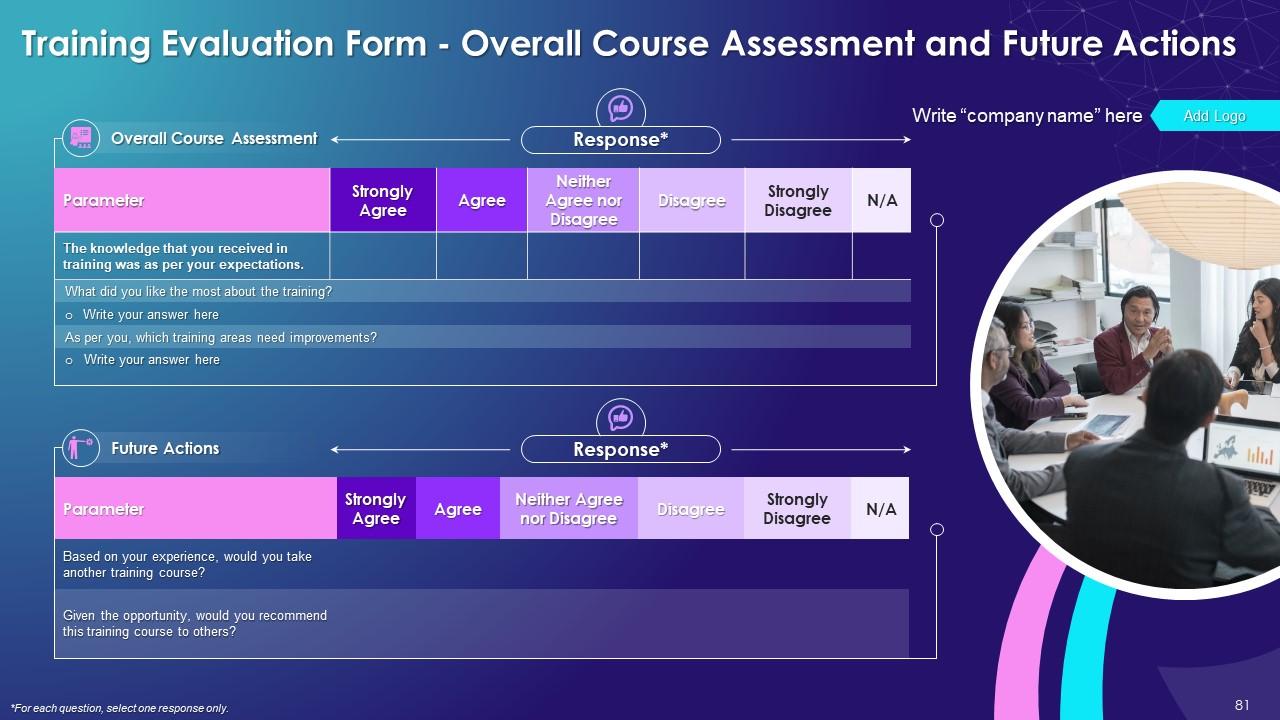

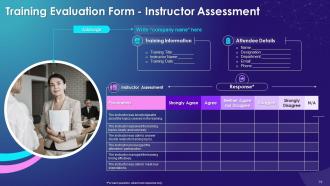

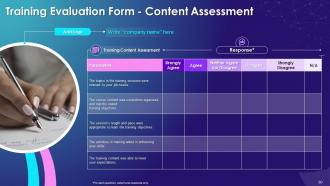

Slide 79 to 81

These slides contain training evaluation form for instructor, content and course assessment.

Legal Aspects Of Cryptocurrency Training Module On Blockchain Technology Application Training Ppt with all 86 slides:

Use our Legal Aspects Of Cryptocurrency Training Module On Blockchain Technology Application Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Amazing product with appealing content and design.

-

Content of slide is easy to understand and edit.