Types of mutual funds ppt powerpoint presentation file influencers

Build the confidence to explore beyond with our Types Of Mutual Funds Ppt Powerpoint Presentation File Influencers. Bolster intrepid individuals.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

This is a four stages process. The stages in this process are Finance, Marketing, Management, Investment, Analysis.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

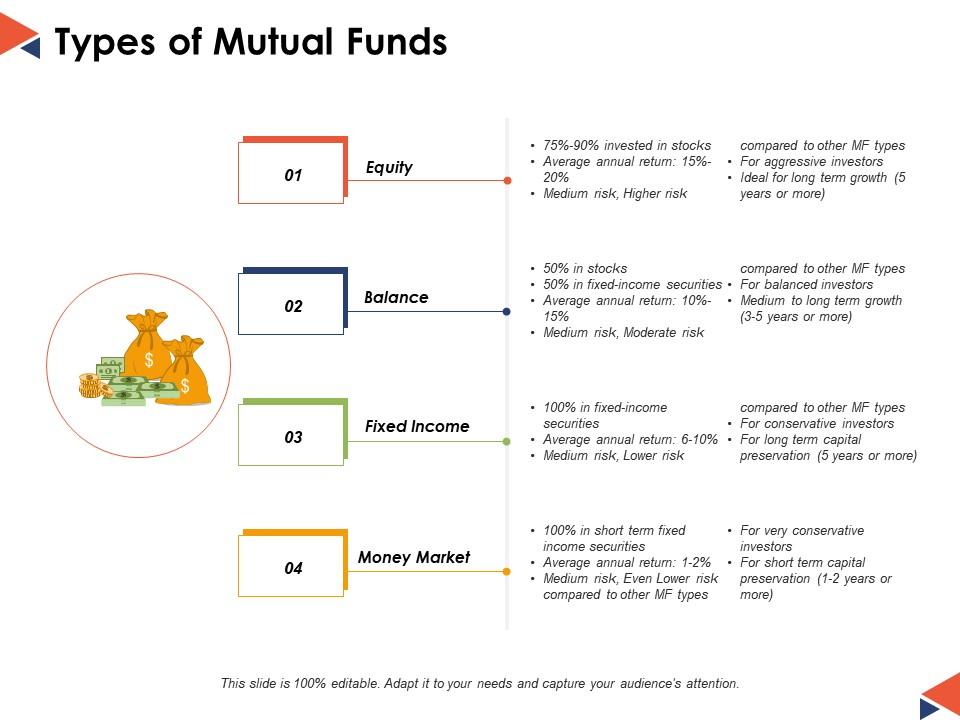

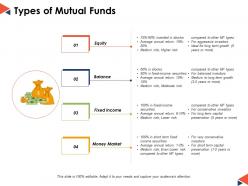

The image is a PowerPoint slide titled "Types of Mutual Funds," designed to provide a snapshot of different categories of mutual funds based on their investment strategies and associated risk profiles. The slide is segmented into four key sections, each representing a different type of mutual fund:

1. Equity:

a). 75-90% invested in stocks

b). Average annual return: 15-20%

c). Medium risk, Higher risk

d). Suited for aggressive investors aiming for long-term growth (5 years or more)

2. Balance:

a). 50% in stocks, 50% in fixed-income securities

b). Average annual return: 10-15%

c). Medium risk, Moderate risk

d). Targeted towards balanced investors for medium to long-term growth (3-5 years or more)

3. Fixed Income:

a). 100% in fixed-income securities

b). Average annual return: 6-10%

c). Medium risk, Lower risk

d). Ideal for conservative investors focused on long-term capital preservation (5 years or more)

4. Money Market:

a). 100% in short term fixed income securities

b). Average annual return: 1-2%

c). Medium risk, Even lower risk compared to other MF types

Recommended for very conservative investors for short-term capital preservation (1-2 years or more)

Each fund type is color-coded and aligned with a specific risk and return profile, making it easy to understand at a glance.

Use Cases:

This slide can be effectively utilized in various industries:

1. Financial Services:

Use: Educating clients on investment options.

Presenter: Financial Advisor

Audience: Investors, clients

2. Banking:

Use: Offering mutual fund products to customers.

Presenter: Bank Branch Manager

Audience: Bank customers, personal banking clients

3. Education:

Use: Teaching investment strategies in finance courses.

Presenter: Finance Professor

Audience: Students, finance professionals

4. Corporate Training:

Use: Training employees on managing their 401(k) plans.

Presenter: HR Benefits Coordinator

Audience: Company employees

5. Insurance:

Use: Integrating investment products with insurance offerings.

Presenter: Insurance Agent

Audience: Policyholders, financial planners

6. Retirement Planning:

Use: Advising on fund selections for retirement accounts.

Presenter: Retirement Planner

Audience: Individuals planning for retirement

7. Wealth Management:

Use: Crafting diversified investment portfolios for clients.

Presenter: Wealth Manager

Audience: High-net-worth individuals, family offices

Types of mutual funds ppt powerpoint presentation file influencers with all 5 slides:

Give folks an insight into your expectations with our Types Of Mutual Funds Ppt Powerpoint Presentation File Influencers. Explain what you intend to do.

No Reviews