Due Diligence Process In M And A Transactions Powerpoint Presentation Slides

Grab our efficiently designed Due Diligence Process in M and A Transactions template that will be helpful to the company to introduce its existing product in the new market by merging with or acquiring a company. Due diligence refers to an investigating process used by a buying company to understand better the pertinent information. At first, the company can use a performance glimpse of the firm section to highlight its valuable information such as key financials, financial ratios, etc. The M and A lifecycle overview section will help the company illustrate the activities related to its pre-deal, pre-announcement, and post-announcement stages. The due diligence process section covers financial, IT, intellectual property, legal, commercial, human resource, EHS, and tax diligence information. The service delivery operating model framework will illustrate the companys functioning post-merger and integration. The company can implement its integration plan with the post-merger integration plan section. Finally, the company can show the possible challenges during the M And A process and the proper measures to overcome them. Customize this 100 percentage editable template now.

Grab our efficiently designed Due Diligence Process in M and A Transactions template that will be helpful to the company to..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver an informational PPT on various topics by using this Due Diligence Process In M And A Transactions Powerpoint Presentation Slides. This deck focuses and implements best industry practices, thus providing a birds eye view of the topic. Encompassed with sixty eight slides, designed using high quality visuals and graphics, this deck is a complete package to use and download. All the slides offered in this deck are subjective to innumerable alterations, thus making you a pro at delivering and educating. You can modify the color of the graphics, background, or anything else as per your needs and requirements. It suits every business vertical because of its adaptable layout.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Due Diligence Process in M&A Transactions. State Your Company Name and begin.

Slide 2: This slide states Agenda of the presentation.

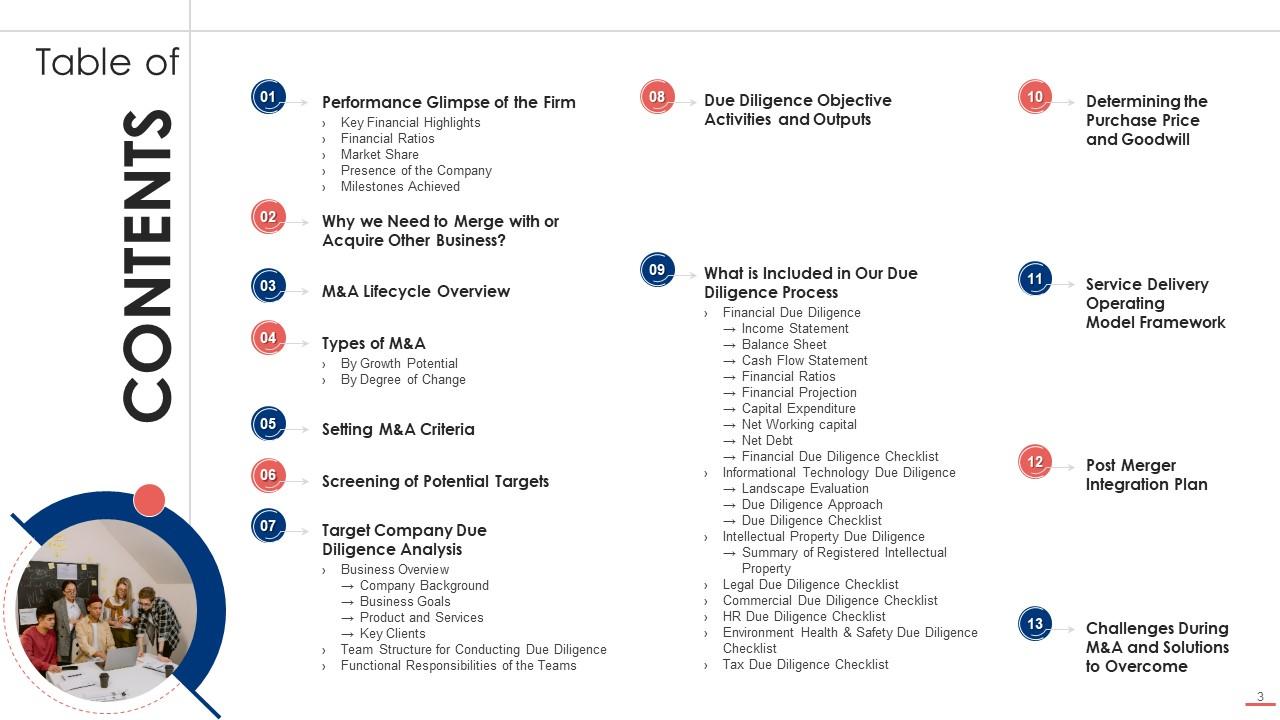

Slide 3: This slide presents Table of Content for the presentation.

Slide 4: This slide shows title for topics that are to be covered next in the template.

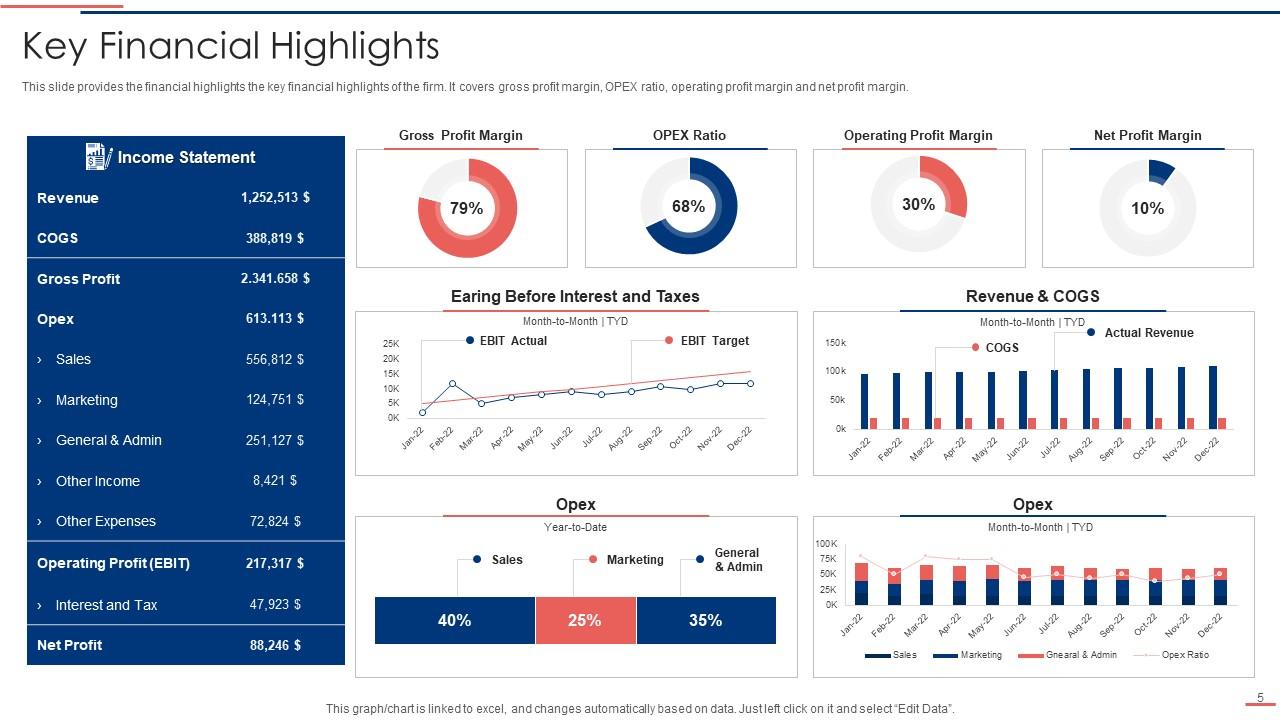

Slide 5: This slide provides the financial highlights covering gross profit margin, OPEX ratio, etc.

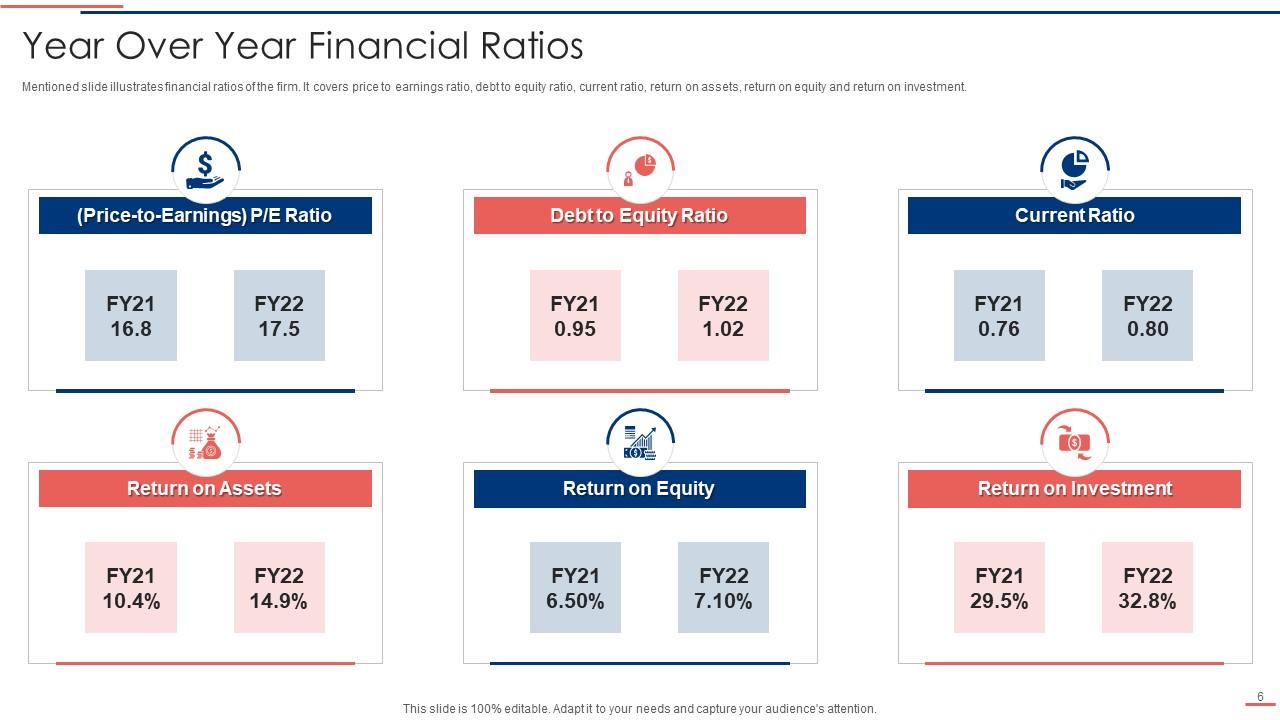

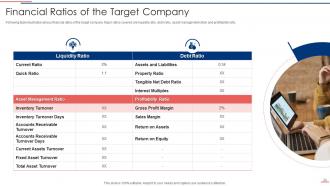

Slide 6: This slide displays financial ratios of the firm covering price to earnings ratio, debt to equity ratio, etc.

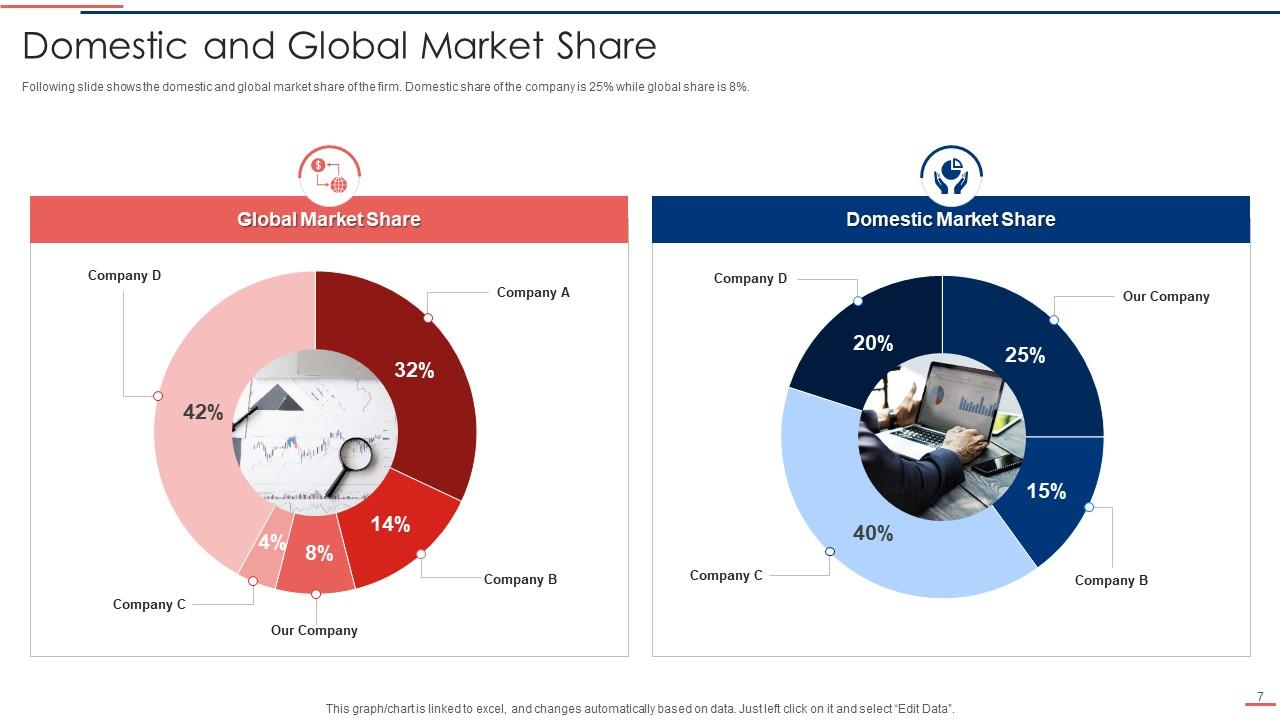

Slide 7: This slide presents domestic and global market share of the firm.

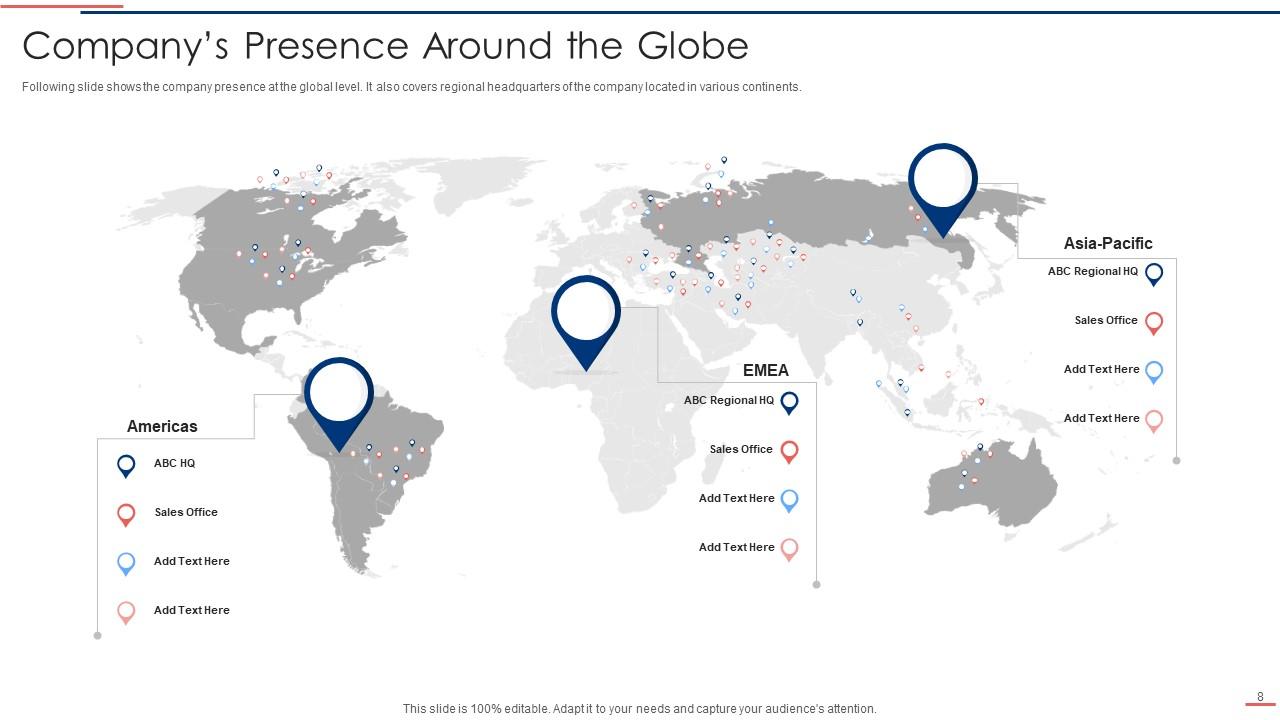

Slide 8: This slide showcases company presence at the global level.

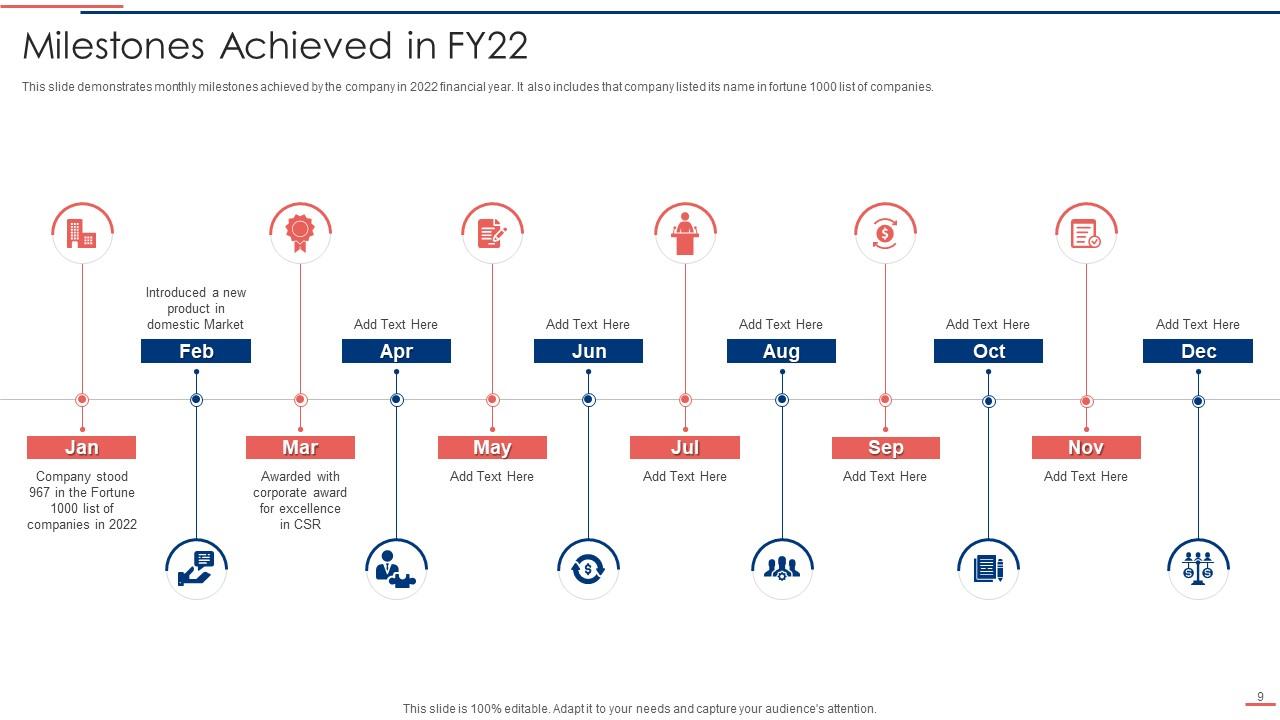

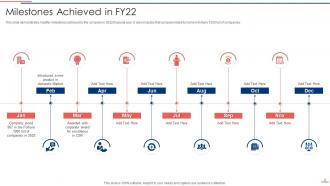

Slide 9: This slide demonstrates monthly milestones achieved by the company in 2022 financial year.

Slide 10: This slide presents Table of Content for the presentation.

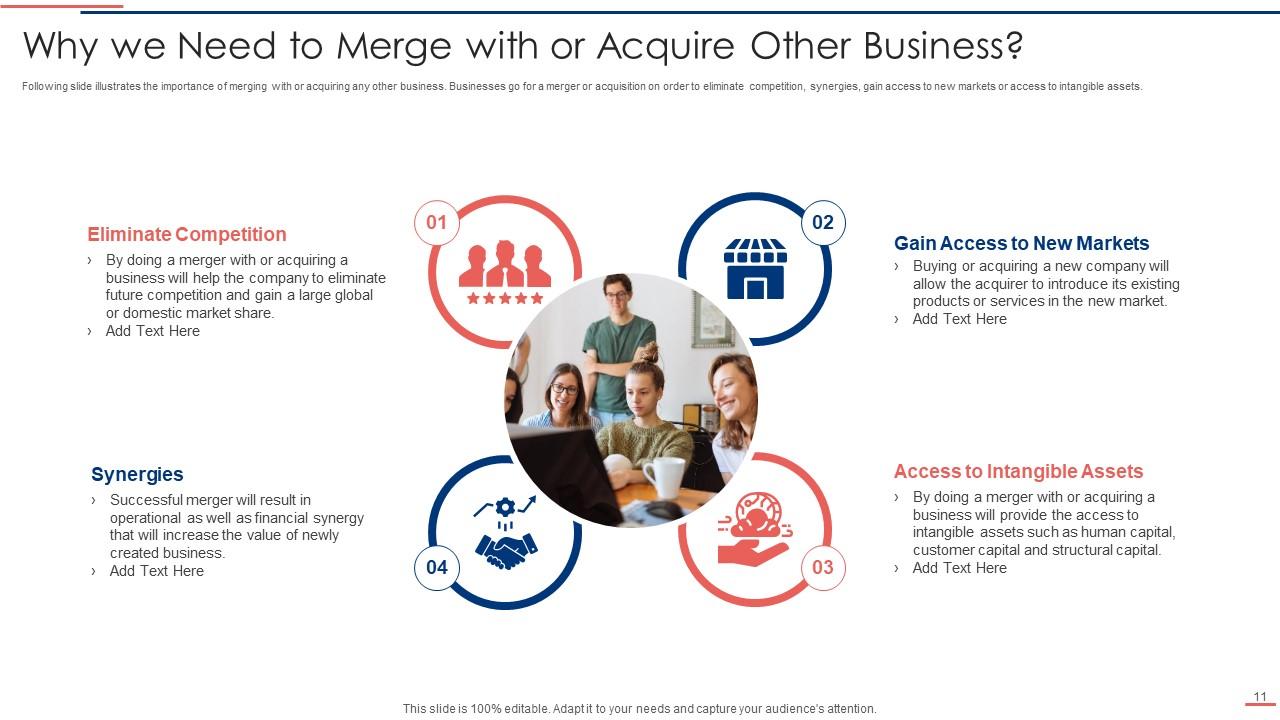

Slide 11: This slide presents importance of merging with or acquiring any other business.

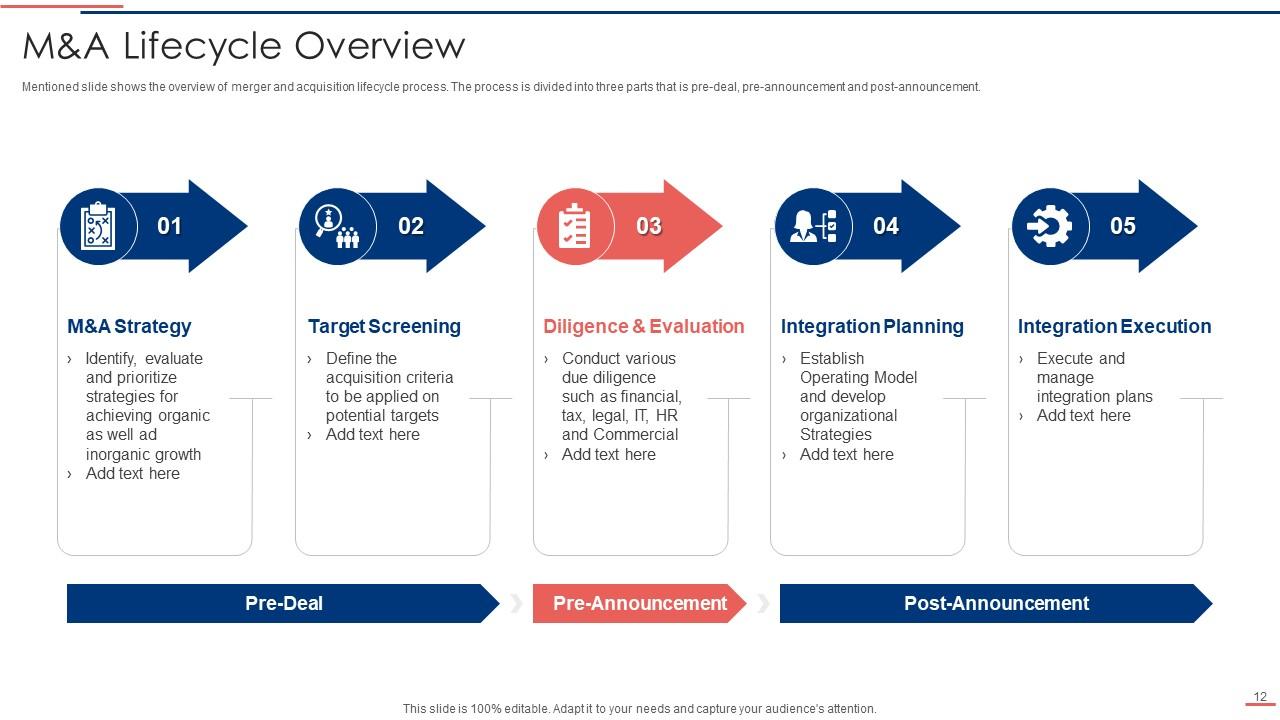

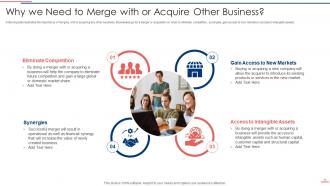

Slide 12: This slide represents overview of merger and acquisition lifecycle process.

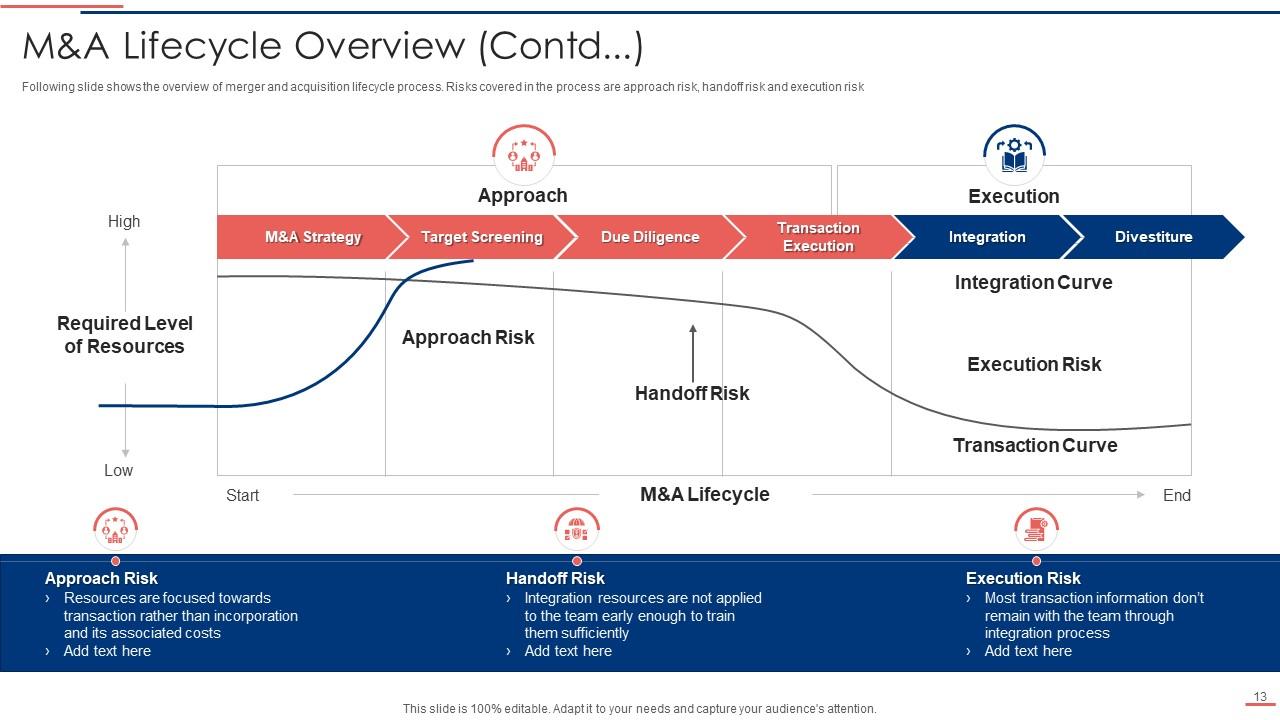

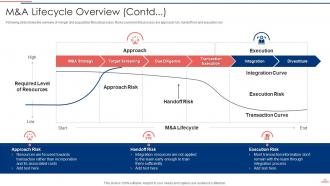

Slide 13: This slide displays overview of merger and acquisition lifecycle process.

Slide 14: This slide presents Table of Content for the presentation.

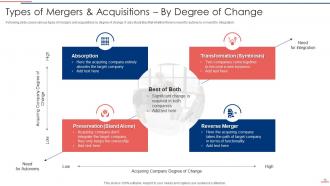

Slide 15: This slide represents various types of mergers and acquisitions by growth.

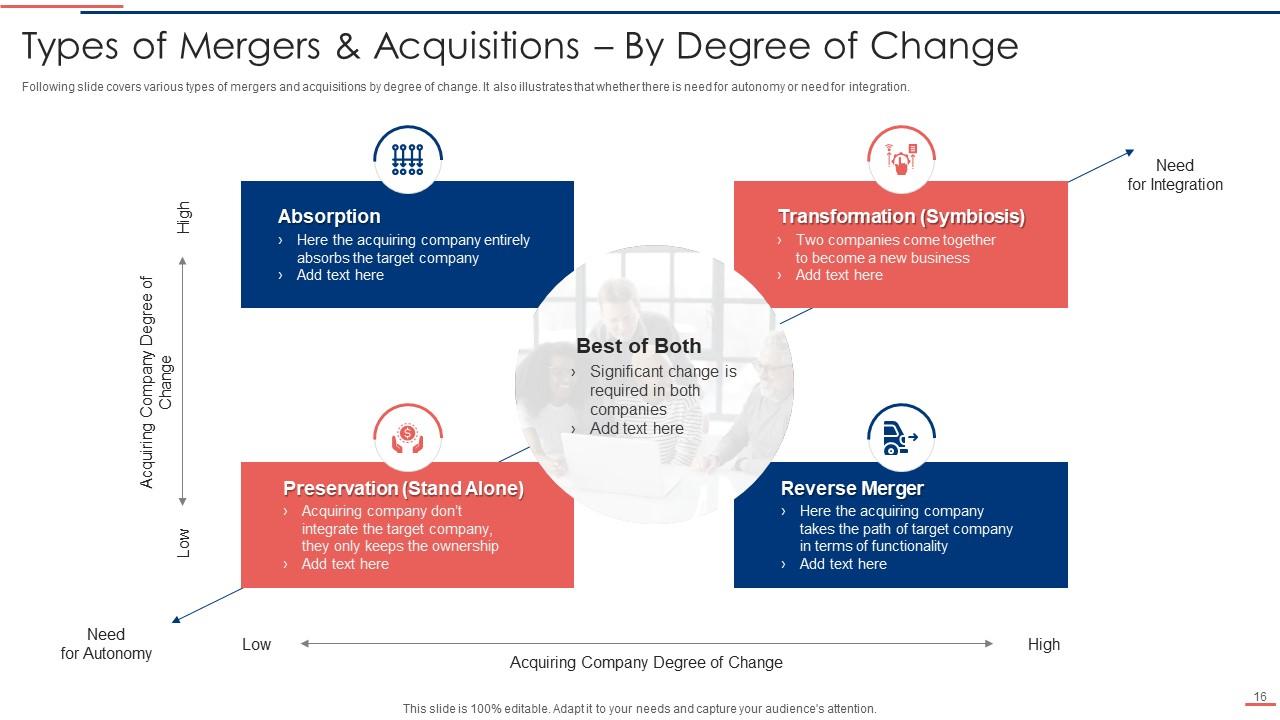

Slide 16: This slide showcases various types of mergers and acquisitions by degree of change.

Slide 17: This slide presents Table of Content for the presentation.

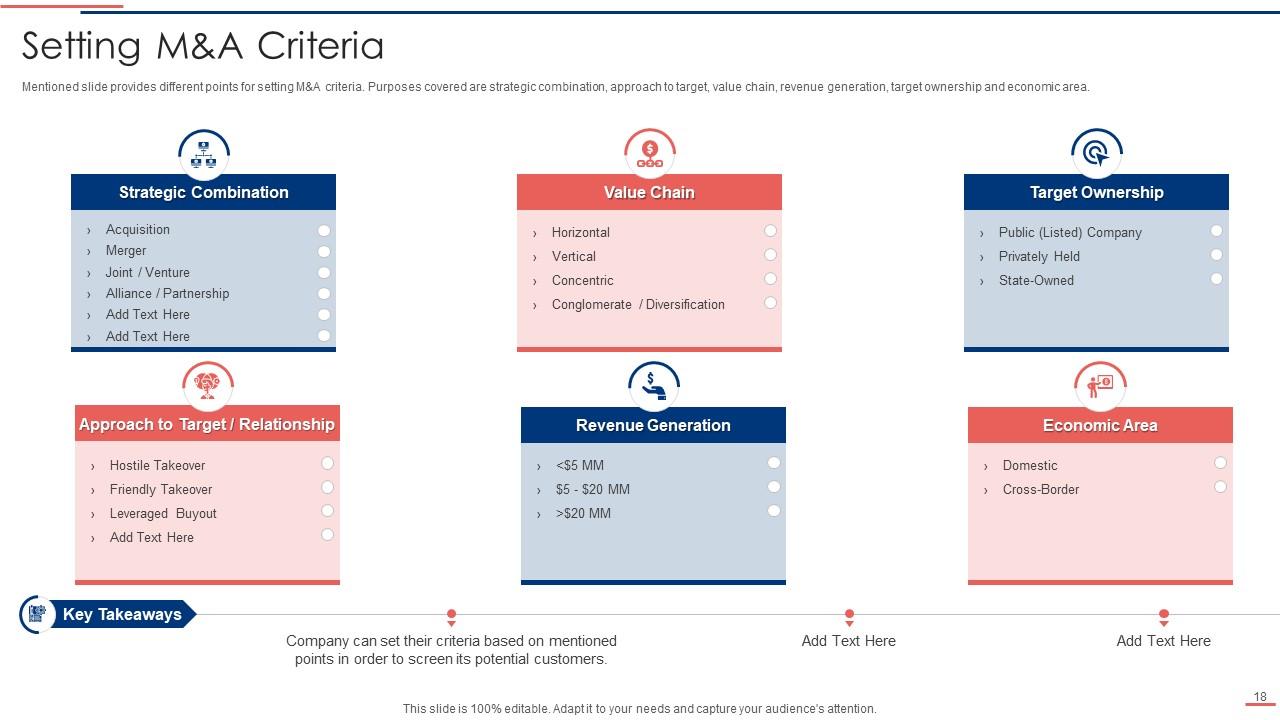

Slide 18: This slide shows different points for setting M&A criteria.

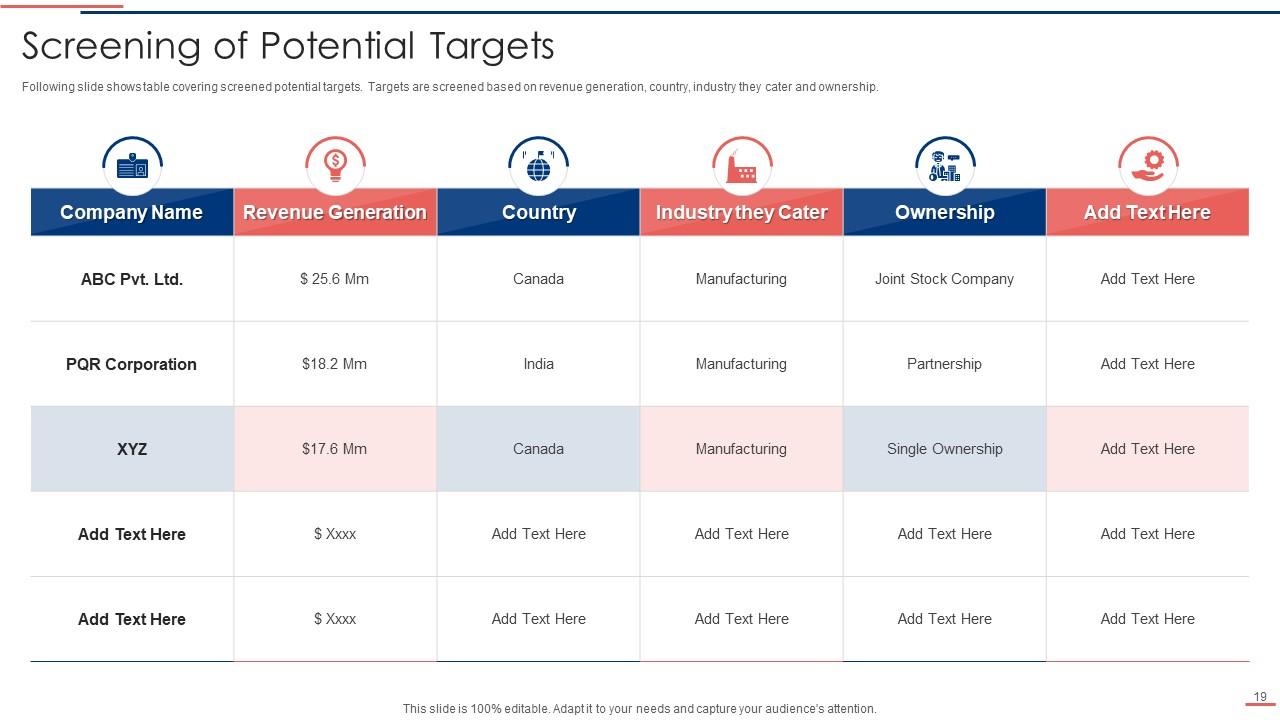

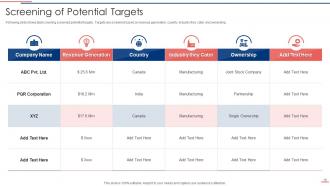

Slide 19: This slide displays table covering screened potential targets.

Slide 20: This slide shows title for topics that are to be covered next in the template.

Slide 21: This slide covers the background of target company including company’s vision, mission and its history.

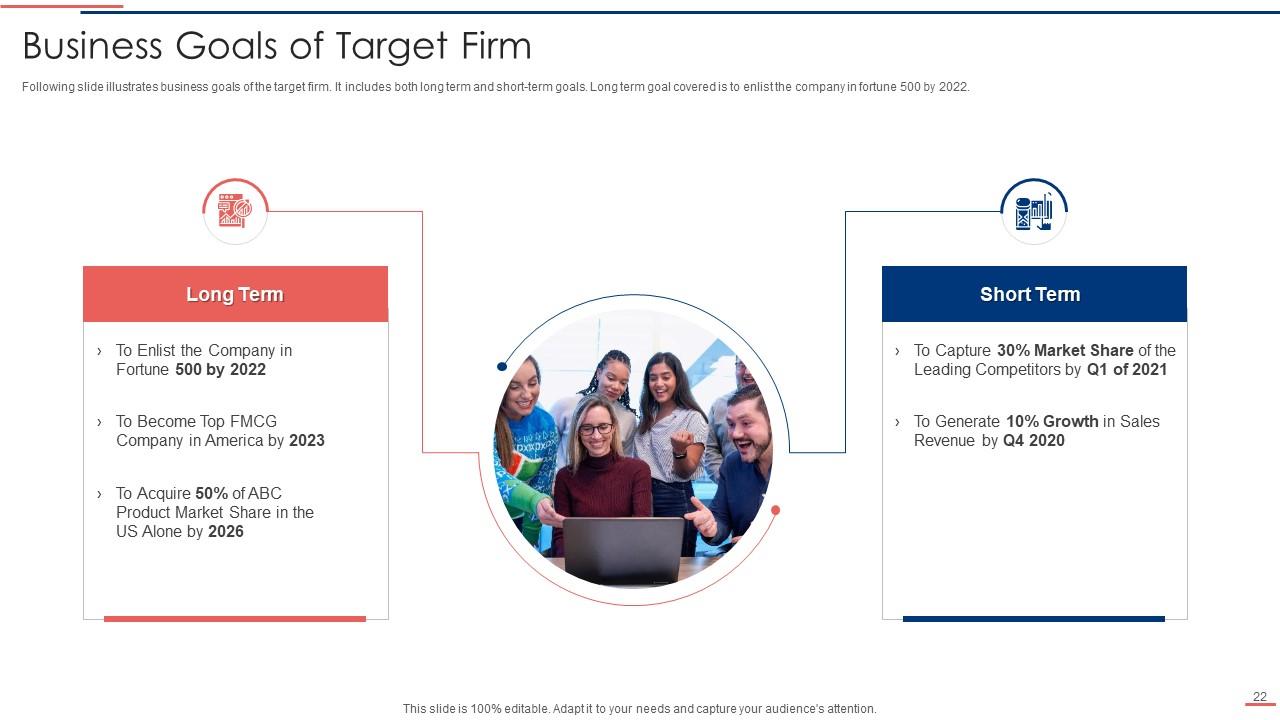

Slide 22: Following slide illustrates business goals of the target firm.

Slide 23: Mentions slide shows various products and services offered by the target company.

Slide 24: This slide shows information about major key clients catered by the target company.

Slide 25: This slide shows title for topics that are to be covered next in the template.

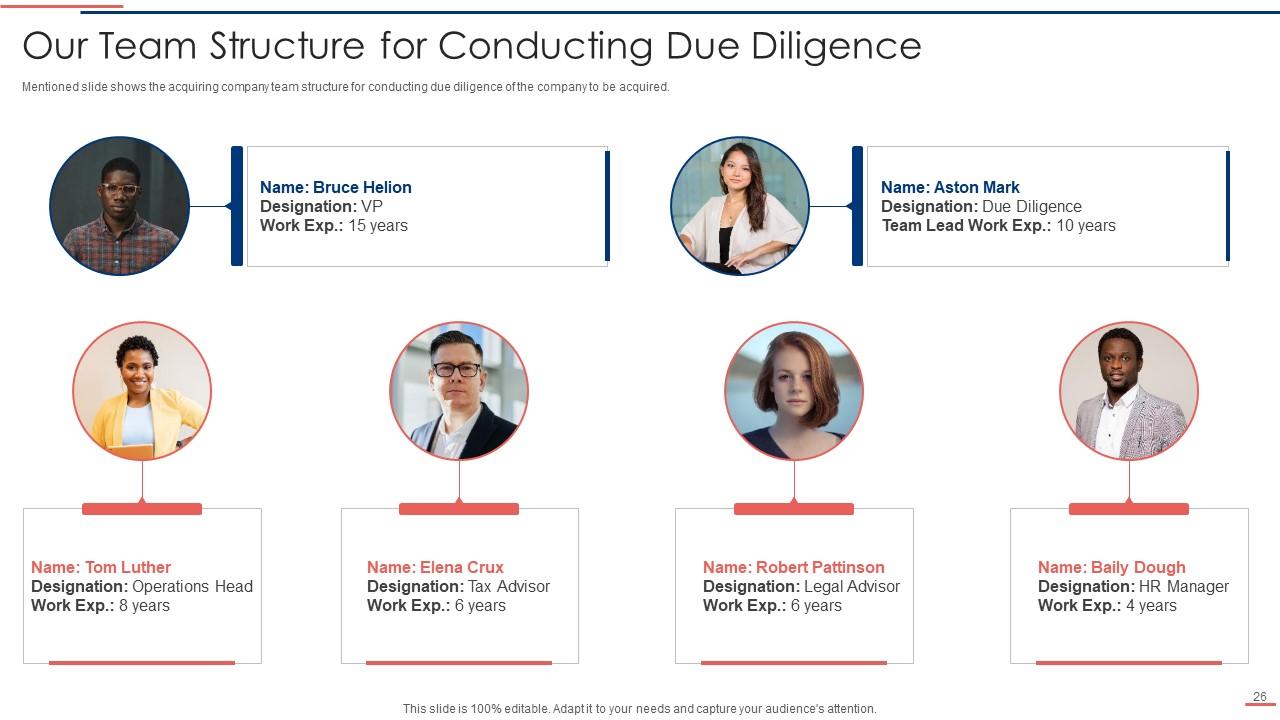

Slide 26: Mentioned slide shows the acquiring company team structure for conducting due diligence of the company.

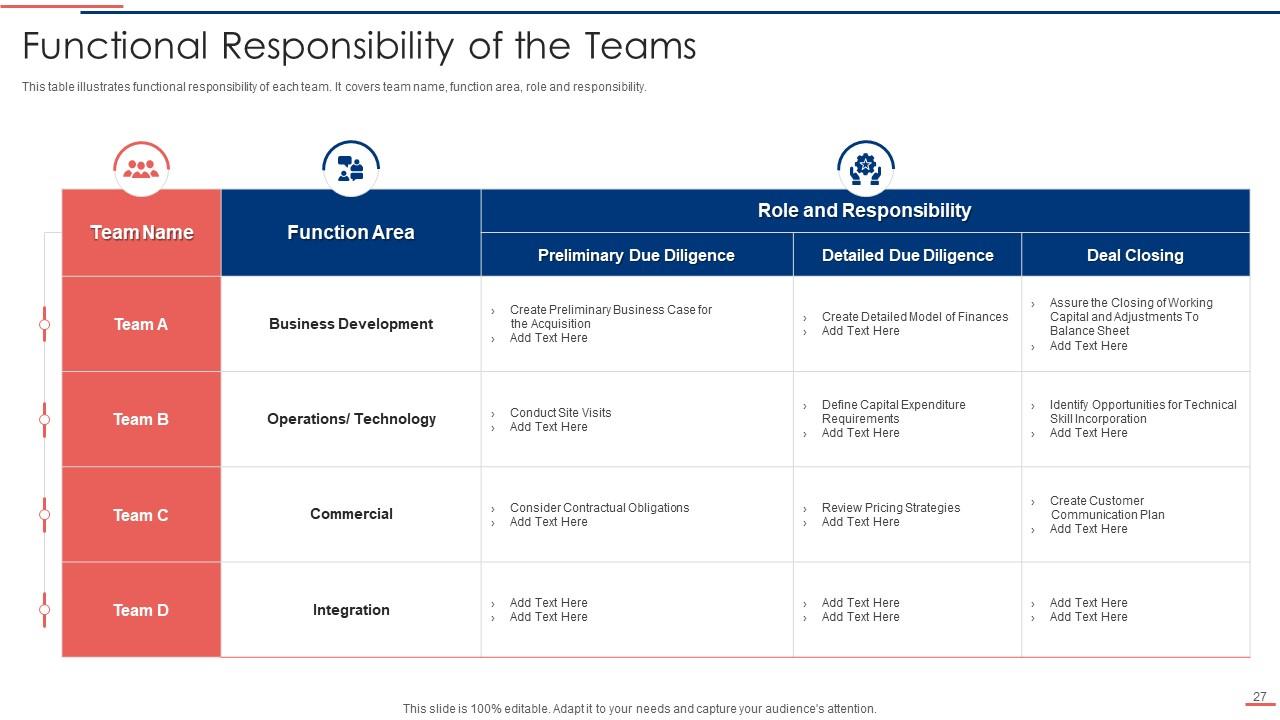

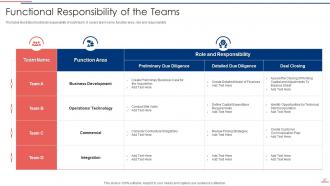

Slide 27: This table illustrates functional responsibility of each team.

Slide 28: This slide shows title for topics that are to be covered next in the template.

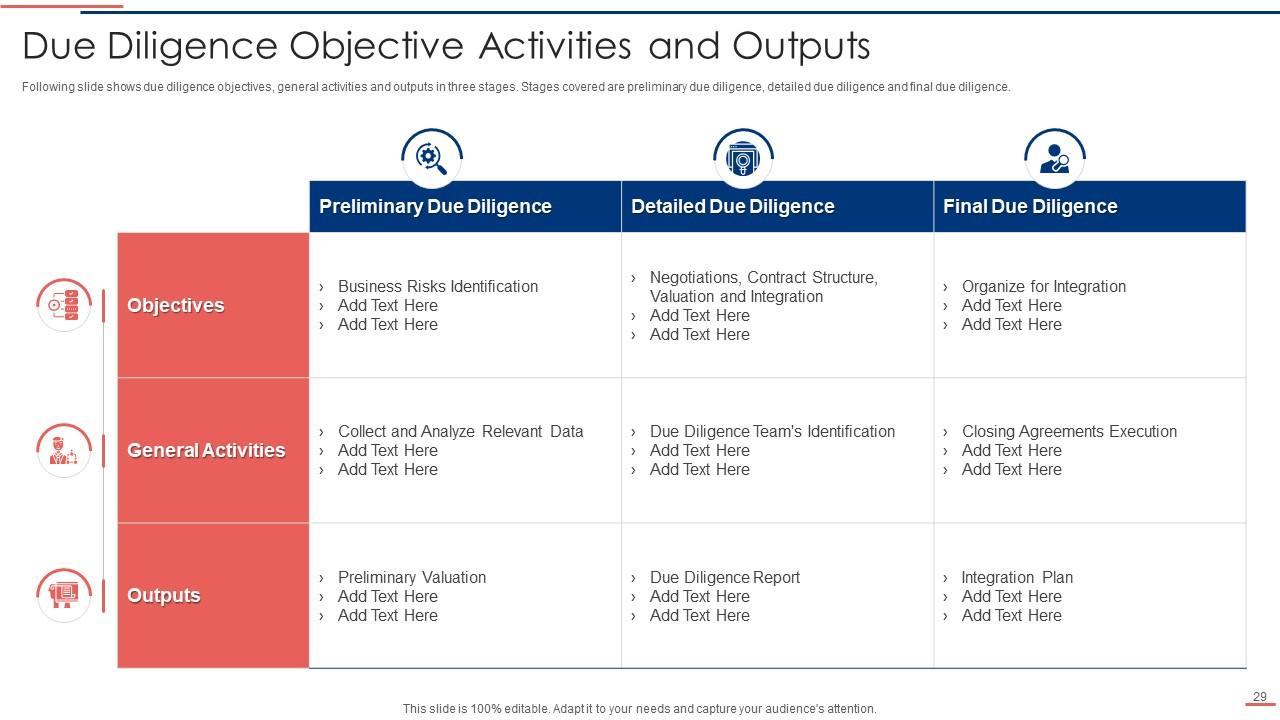

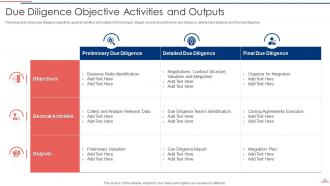

Slide 29: Following slide shows due diligence objectives, general activities and outputs in three stages.

Slide 30: This slide shows title for topics that are to be covered next in the template.

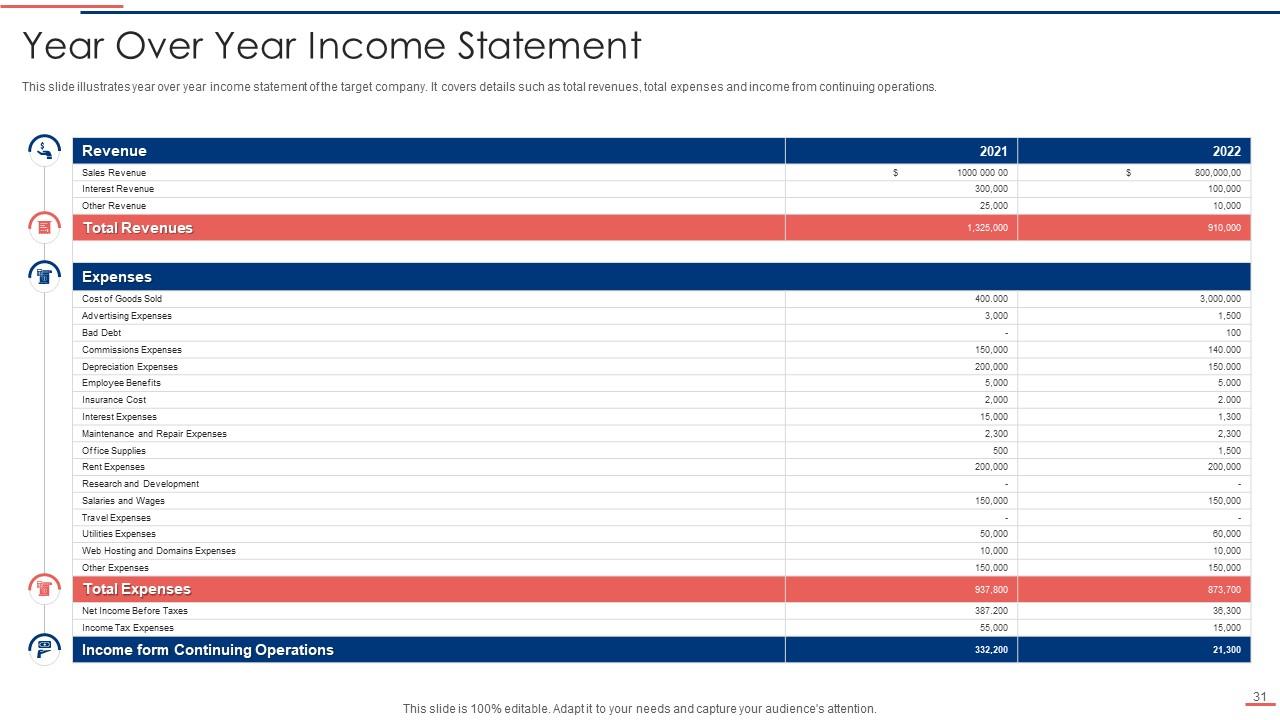

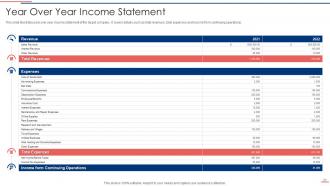

Slide 31: This slide illustrates year over year income statement of the target company.

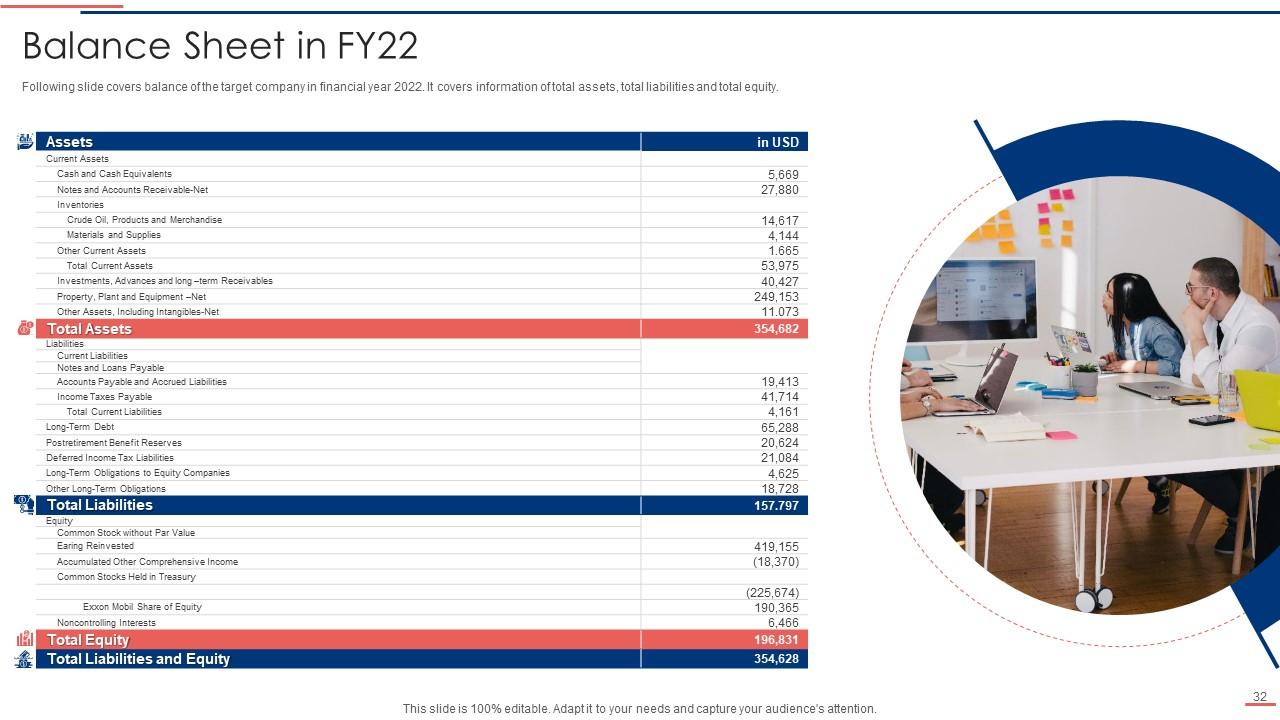

Slide 32: Following slide covers balance of the target company in financial year 2022.

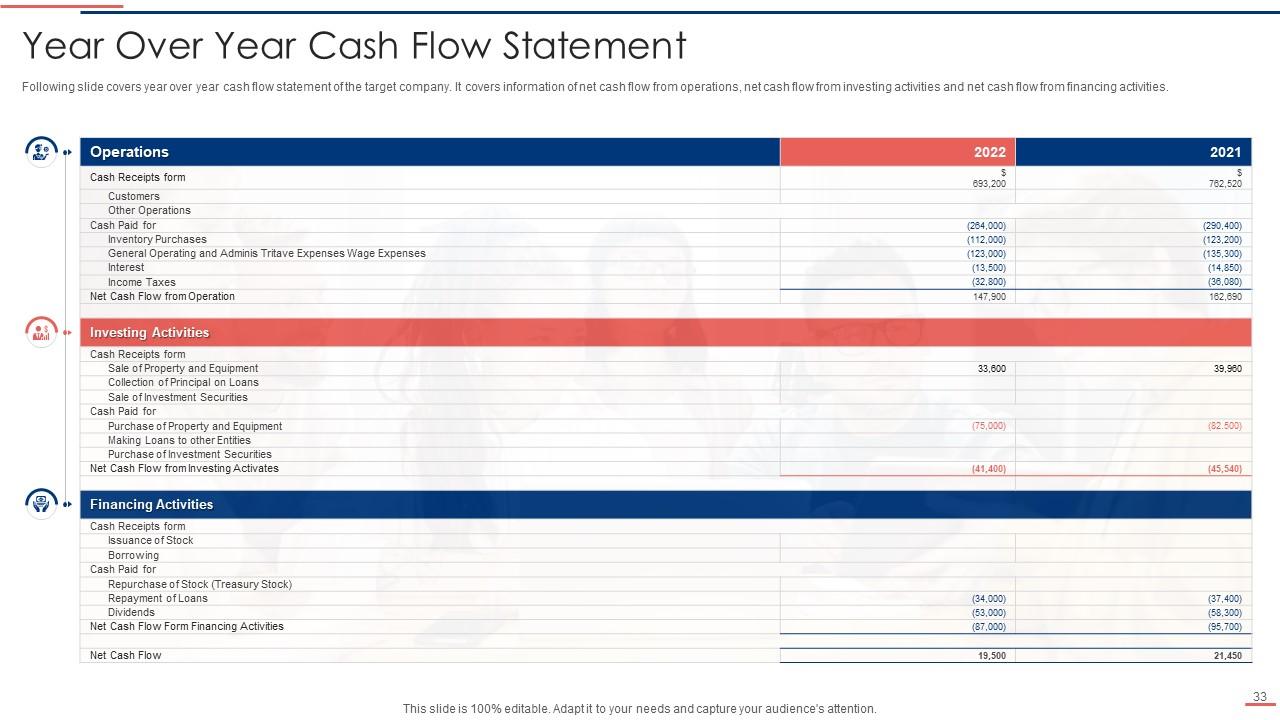

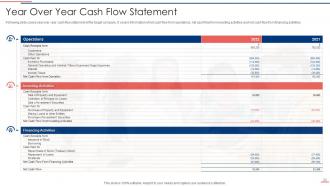

Slide 33: Following slide covers year over year cash flow statement of the target company.

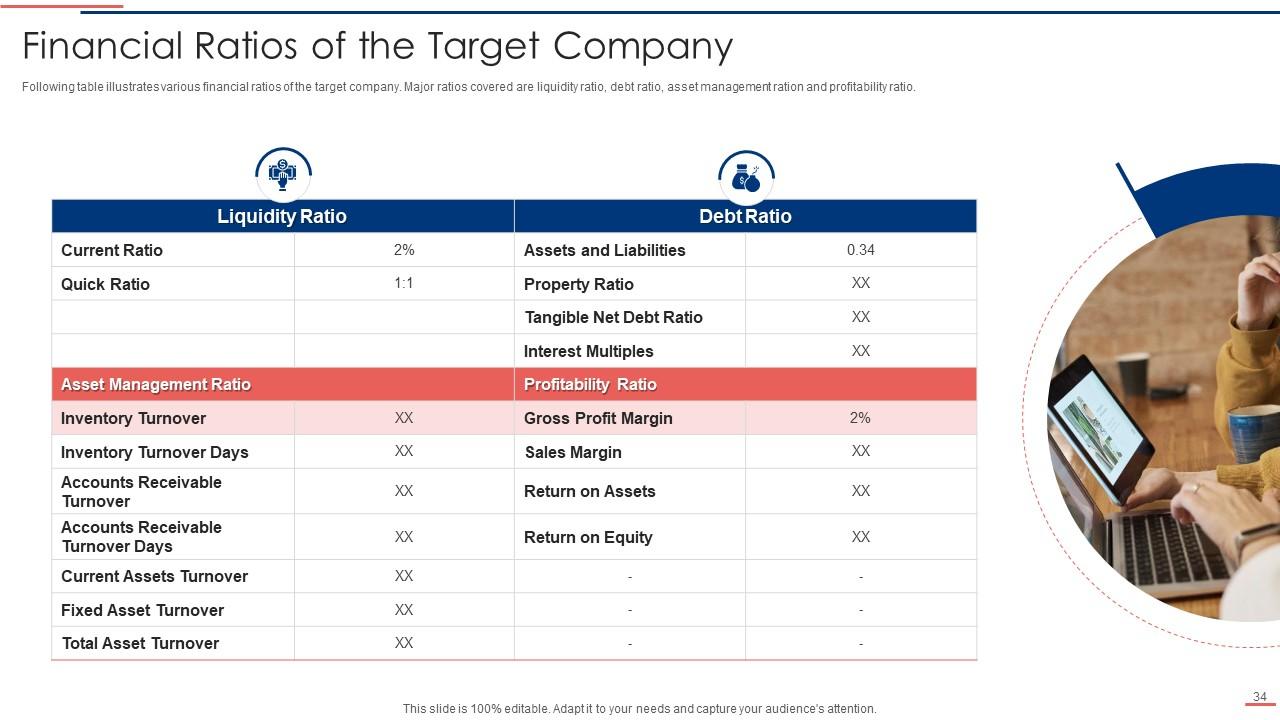

Slide 34: Following table illustrates various financial ratios of the target company.

Slide 35: This slide shows title for topics that are to be covered next in the template.

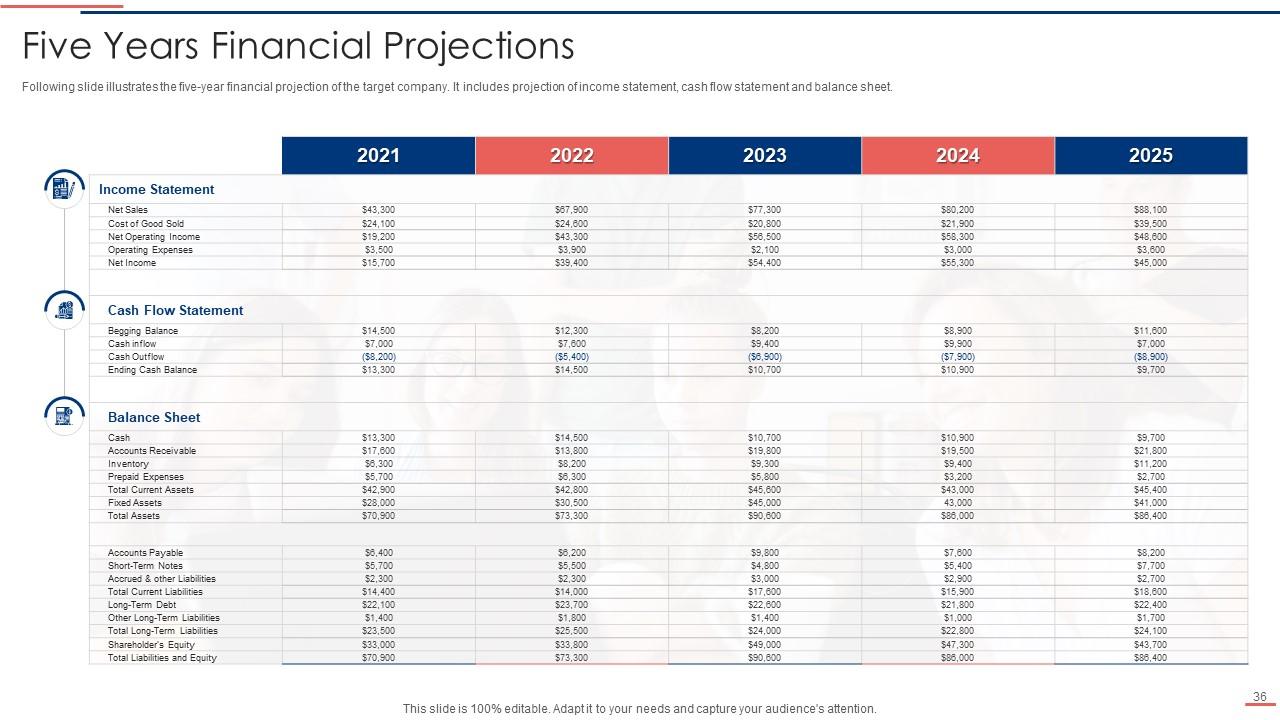

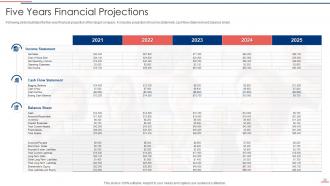

Slide 36: Following slide illustrates the five-year financial projection of the target company.

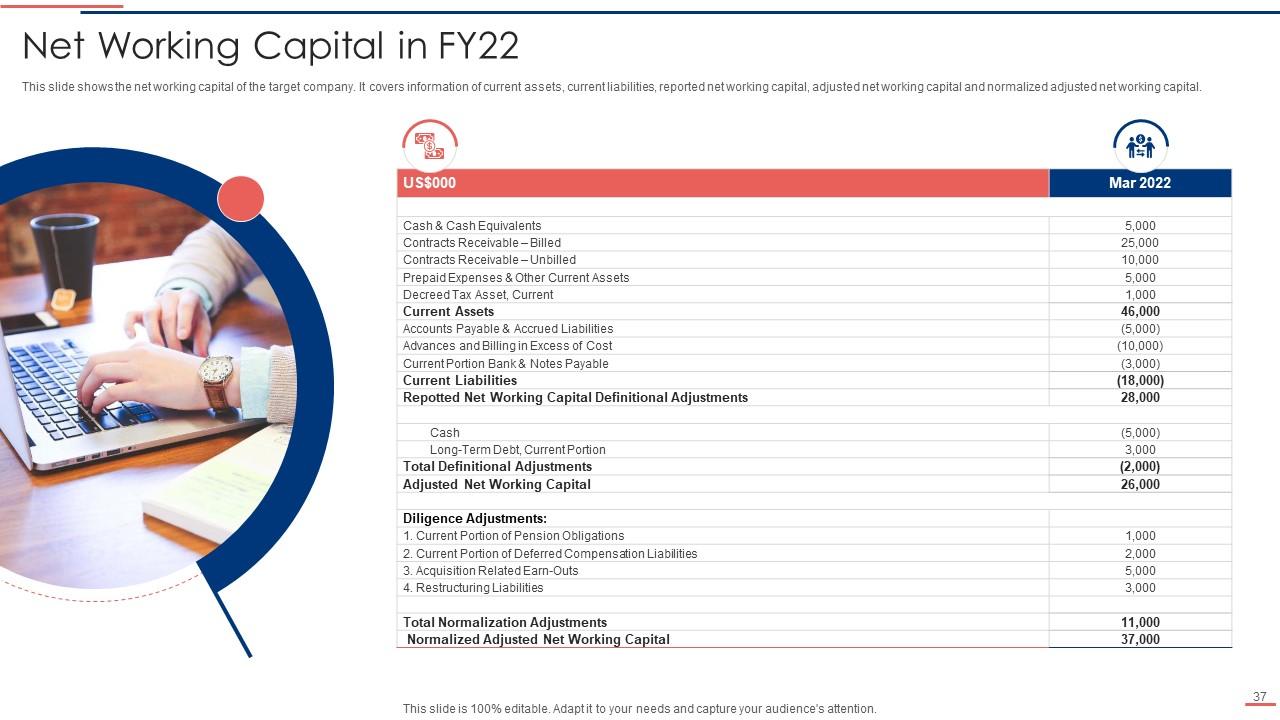

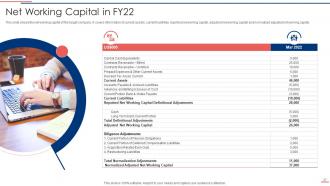

Slide 37: This slide shows the net working capital of the target company.

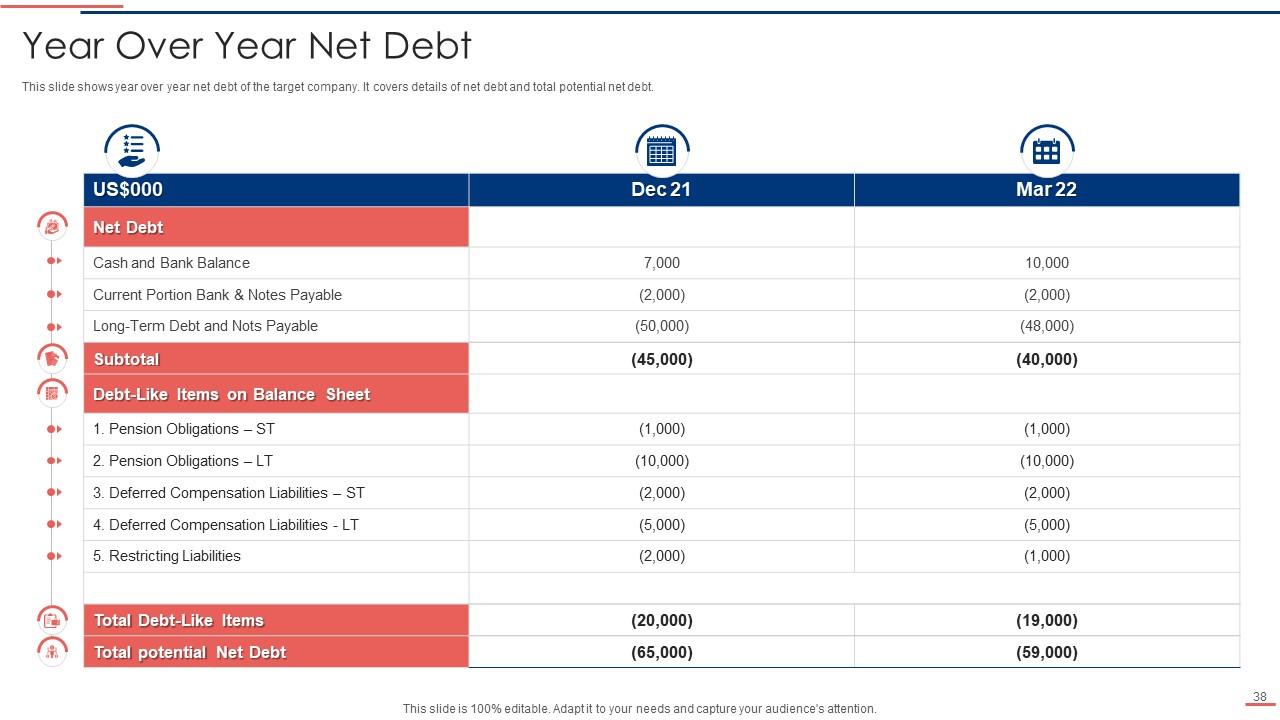

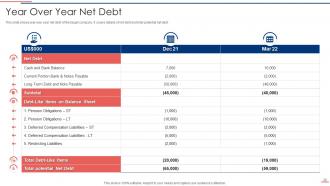

Slide 38: This slide shows year over year net debt of the target company.

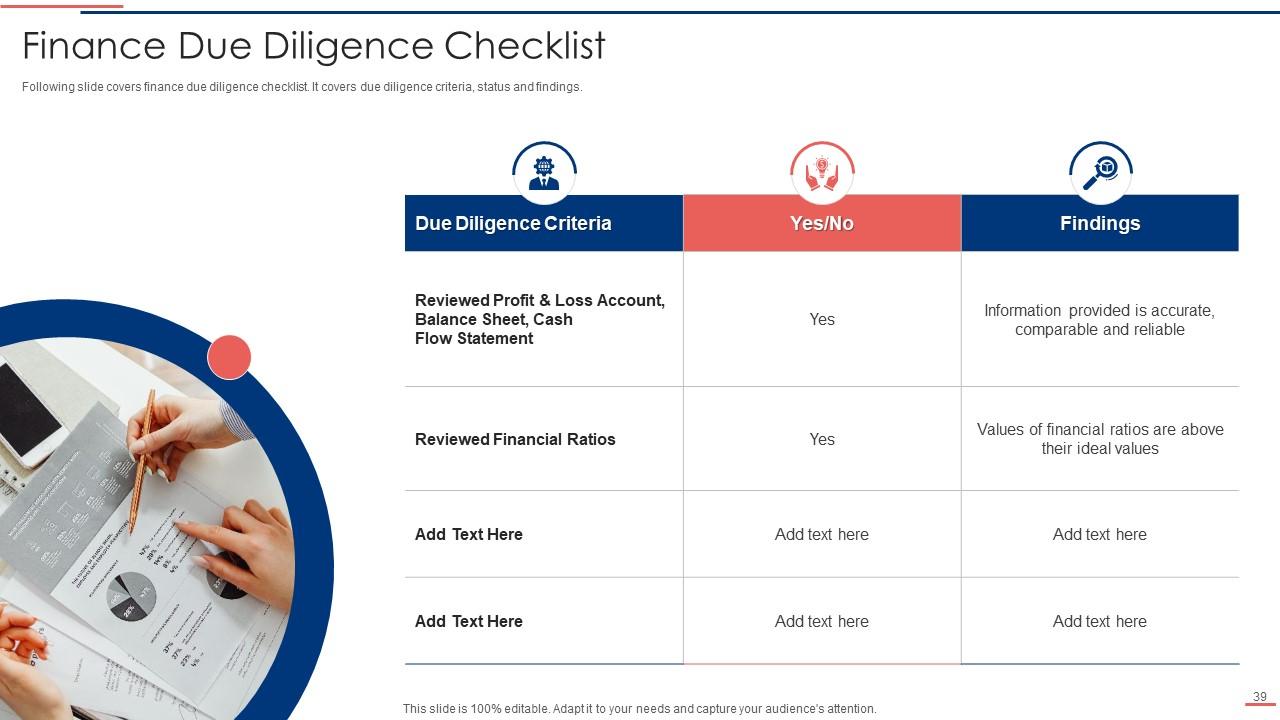

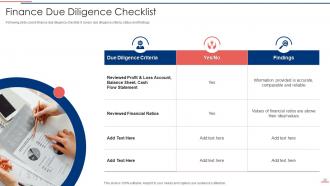

Slide 39: Following slide covers finance due diligence checklist covering due diligence criteria, status and findings.

Slide 40: This slide shows title for topics that are to be covered next in the template.

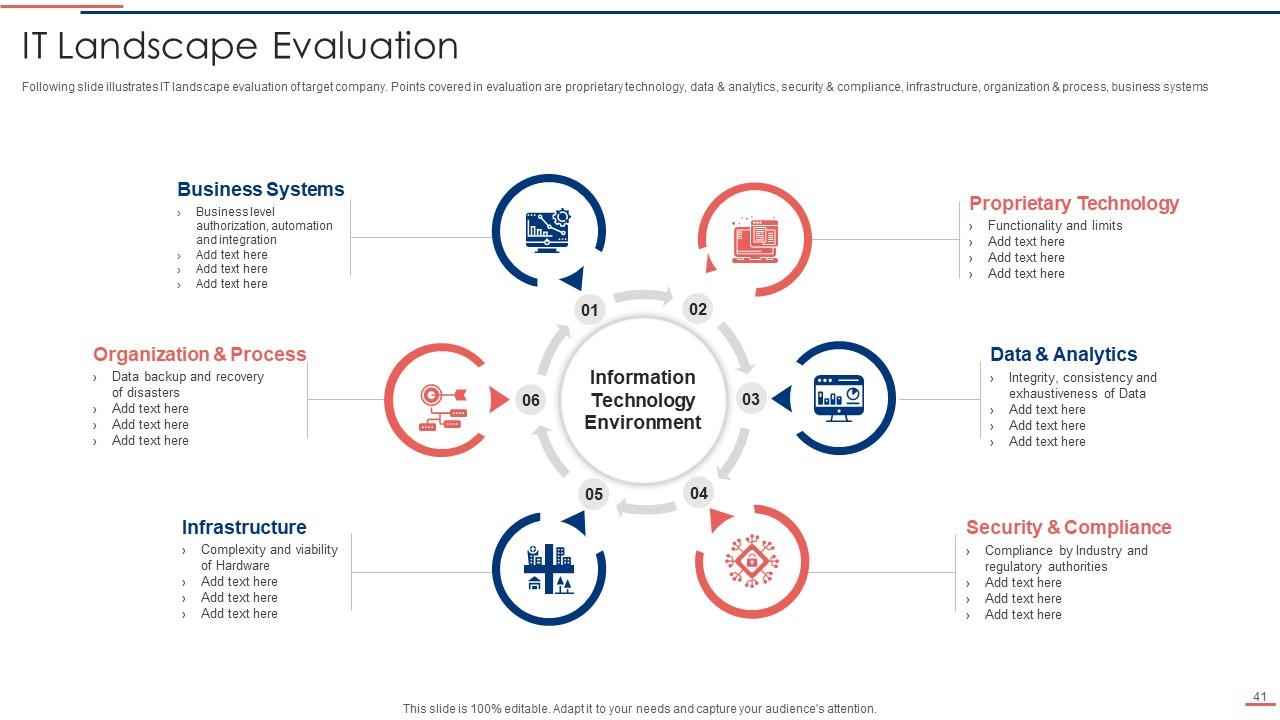

Slide 41: Following slide illustrates IT landscape evaluation of target company.

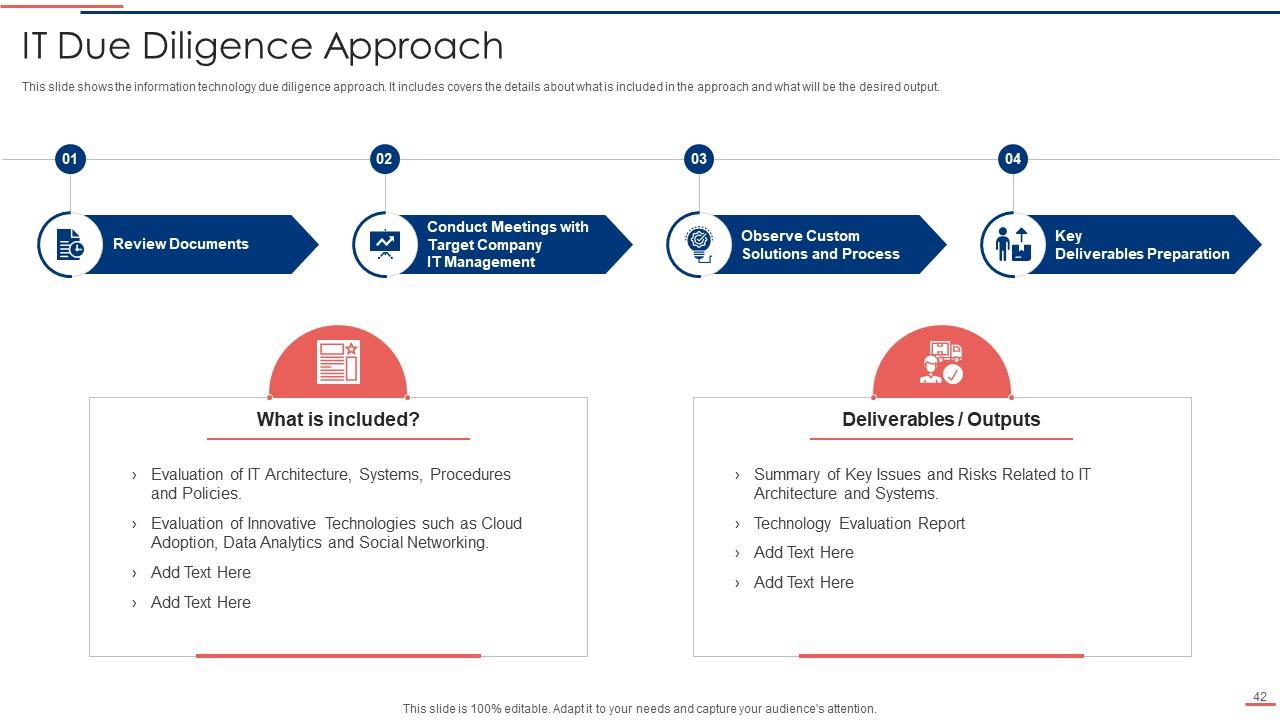

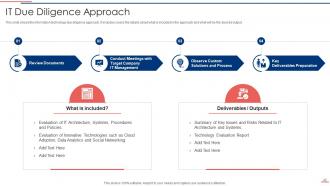

Slide 42: This slide shows the information technology due diligence approach.

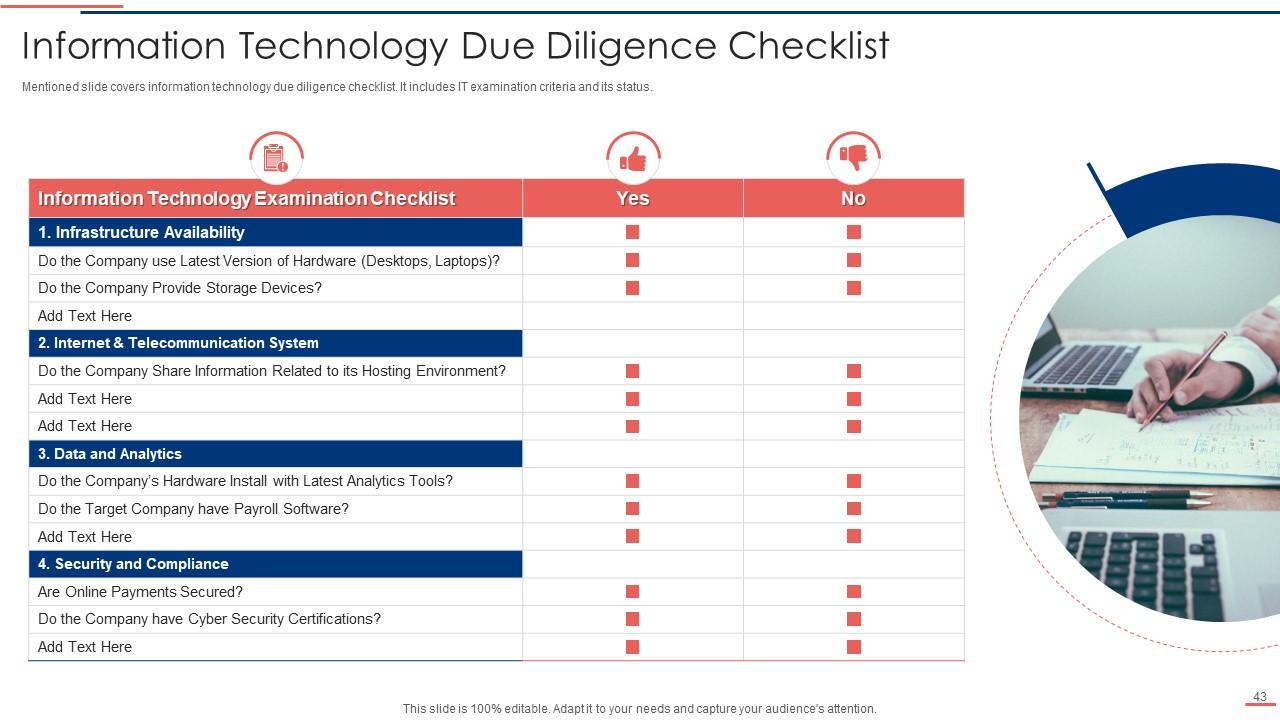

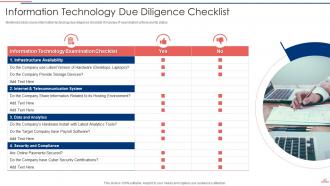

Slide 43: Mentioned slide covers information technology due diligence checklist.

Slide 44: This slide shows title for topics that are to be covered next in the template.

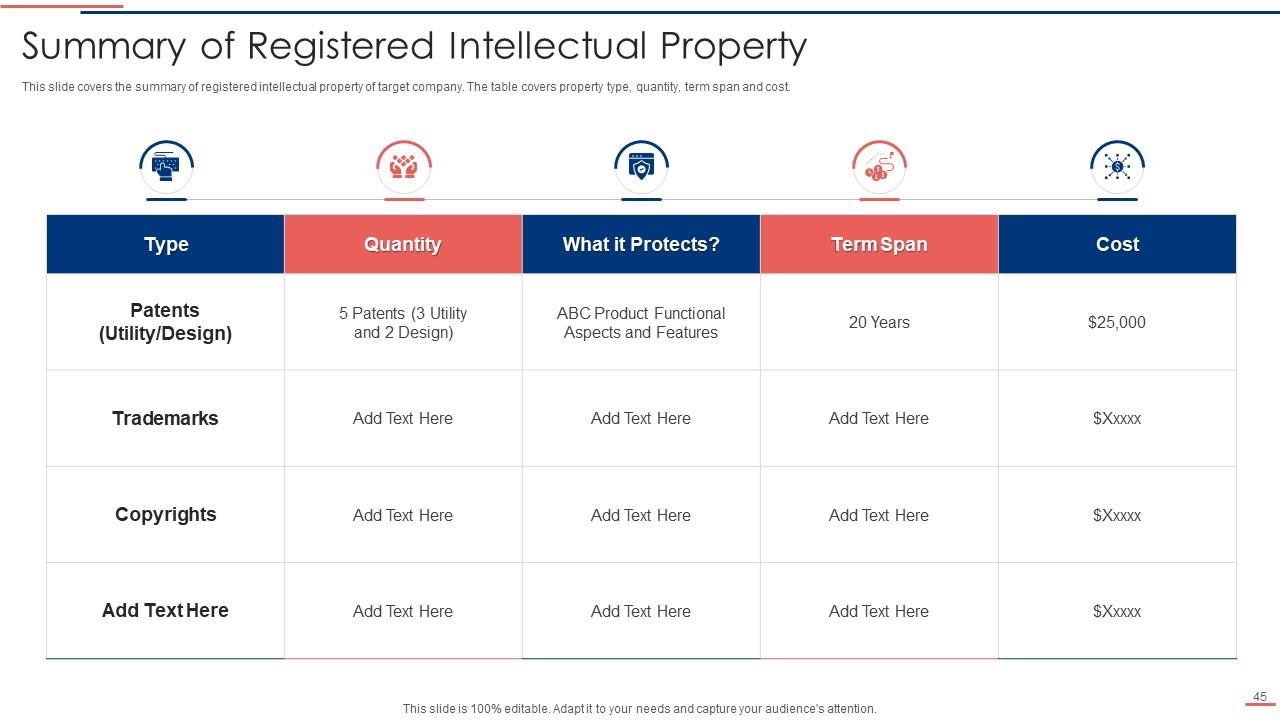

Slide 45: This slide covers the summary of registered intellectual property of target company.

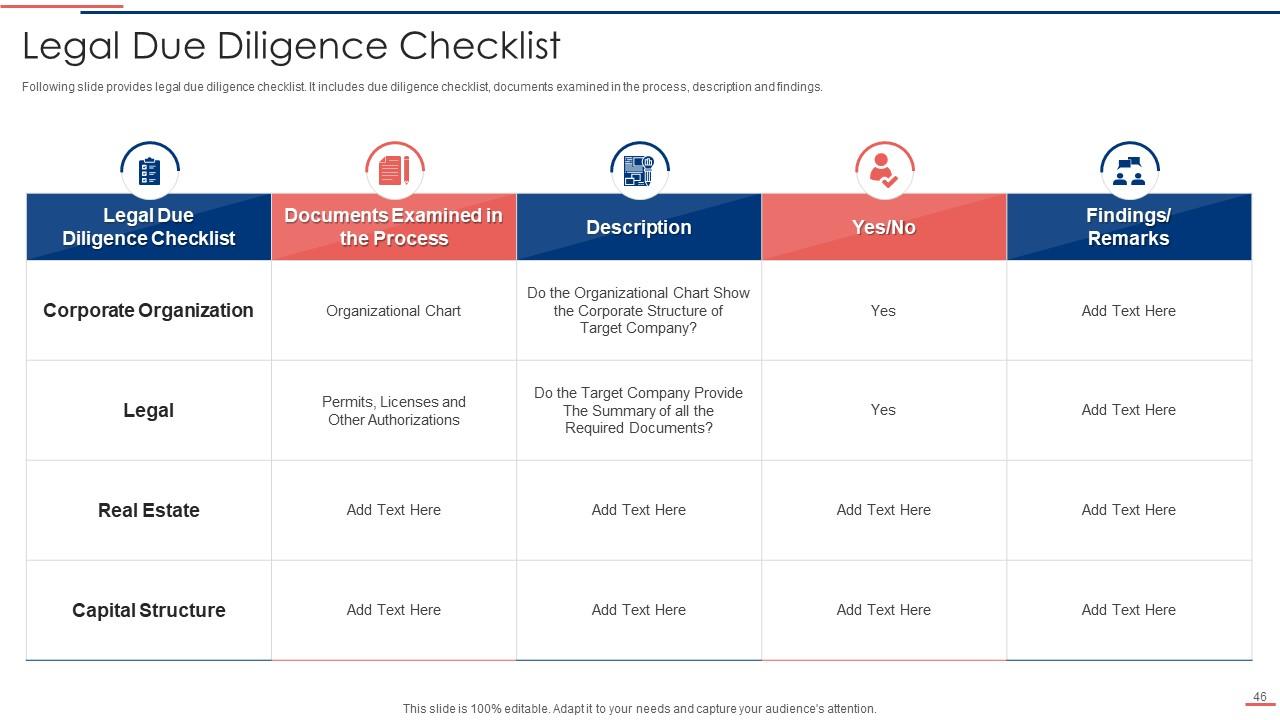

Slide 46: Following slide provides legal due diligence checklist.

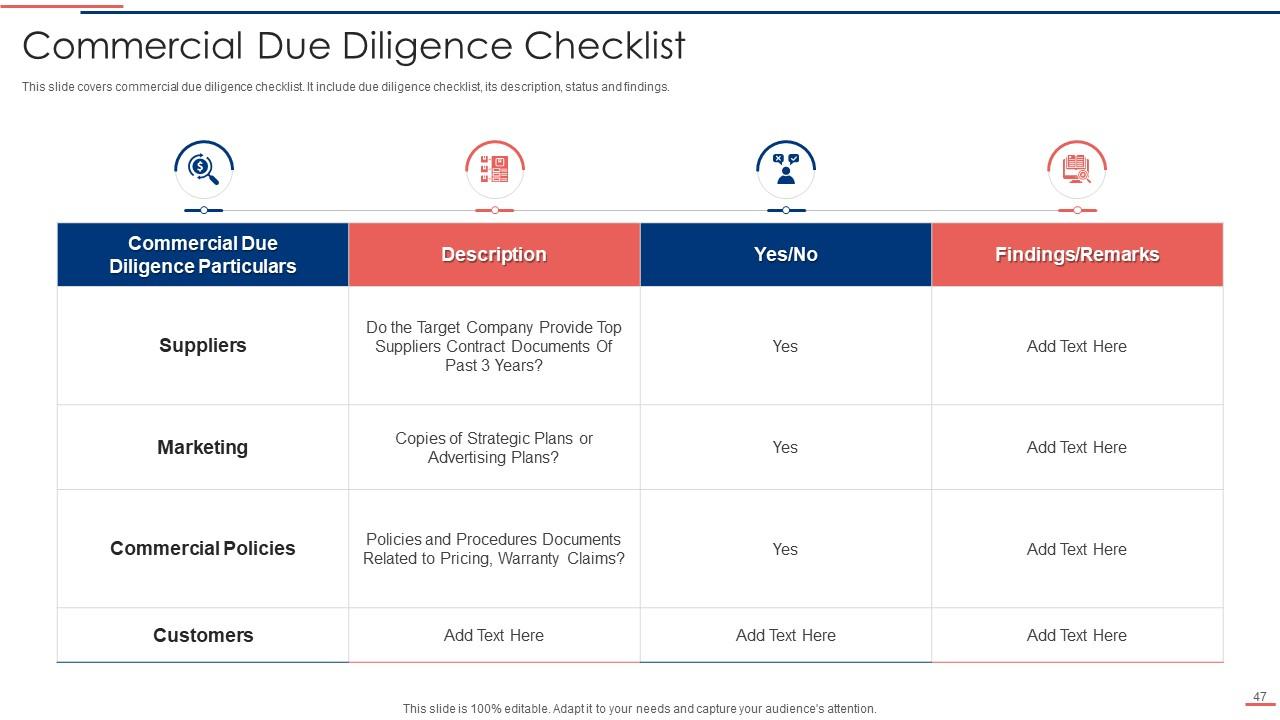

Slide 47: This slide covers commercial due diligence checklist including due diligence checklist, its description, status and findings.

Slide 48: This slide shows title for topics that are to be covered next in the template.

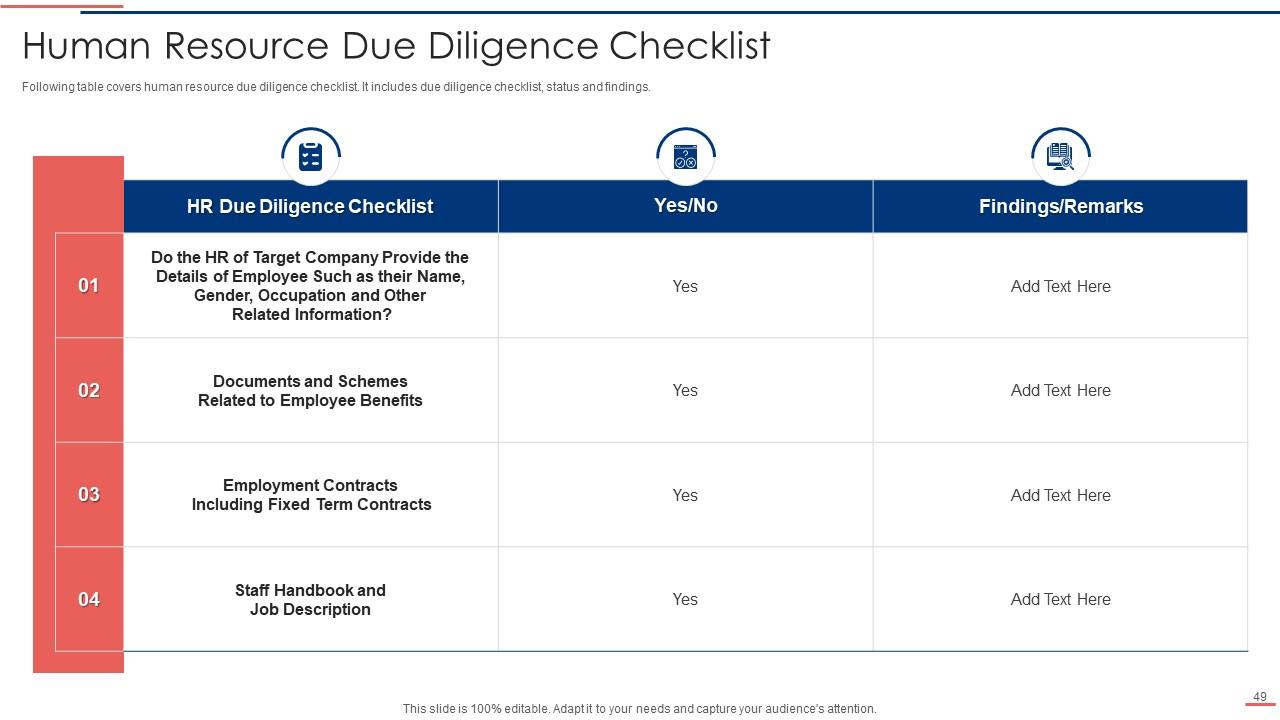

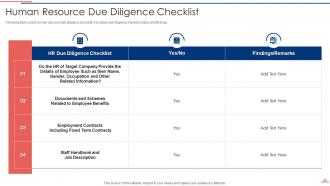

Slide 49: Following table covers human resource due diligence checklist.

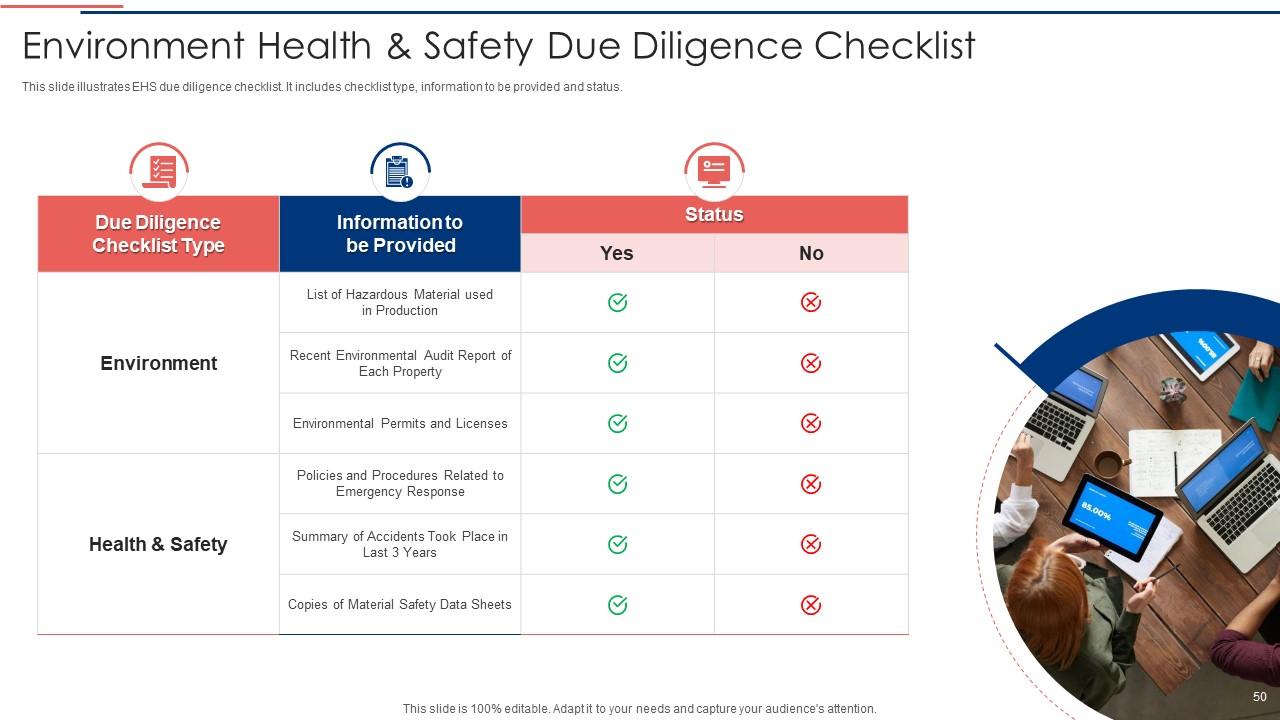

Slide 50: This slide illustrates EHS due diligence checklist including checklist type, information to be provided and status.

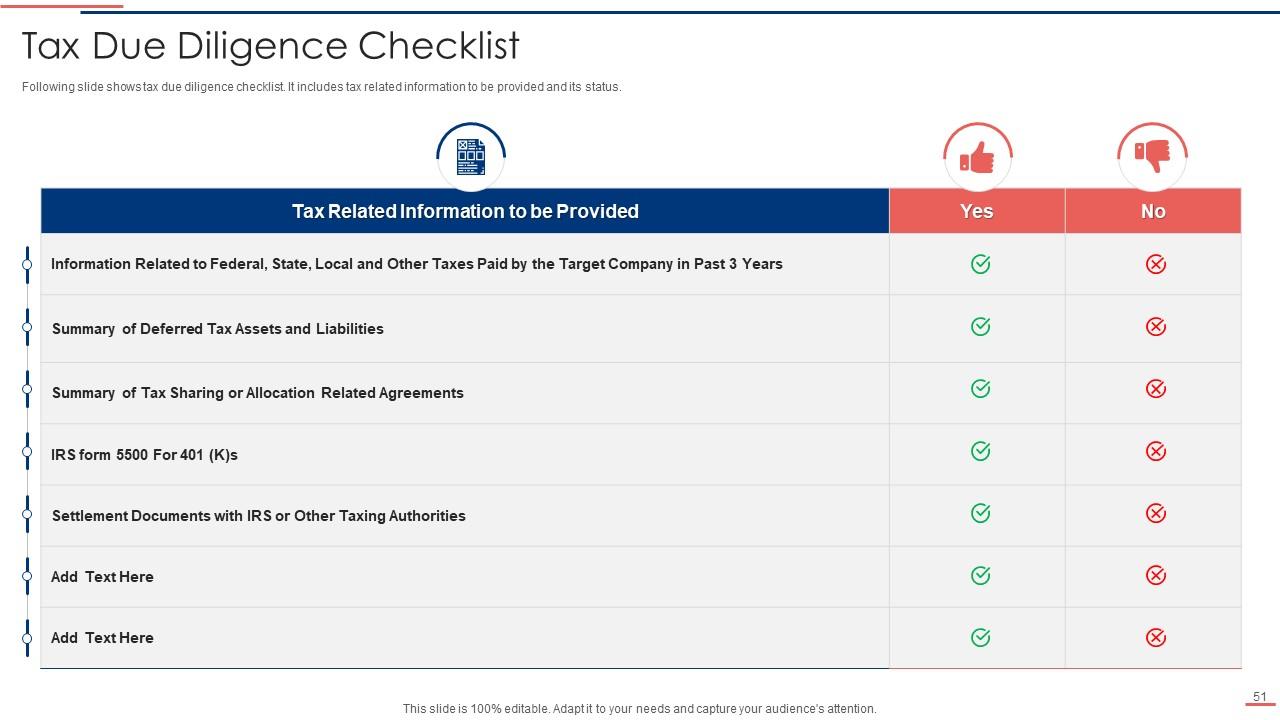

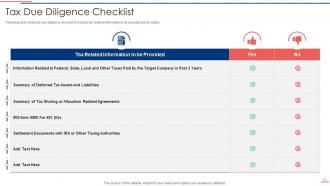

Slide 51: This slide presents tax related information to be provided and its status.

Slide 52: This slide shows title for topics that are to be covered next in the template.

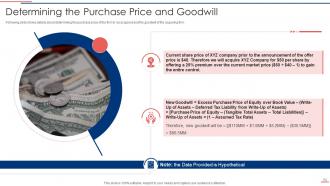

Slide 53: Following slide shows details about determining the purchase price of the firm to be acquired.

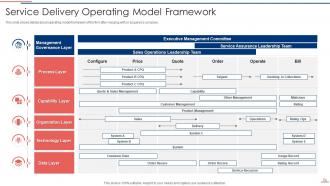

Slide 54: This slide shows details about operating model framework of the firm.

Slide 55: This slide shows title for topics that are to be covered next in the template.

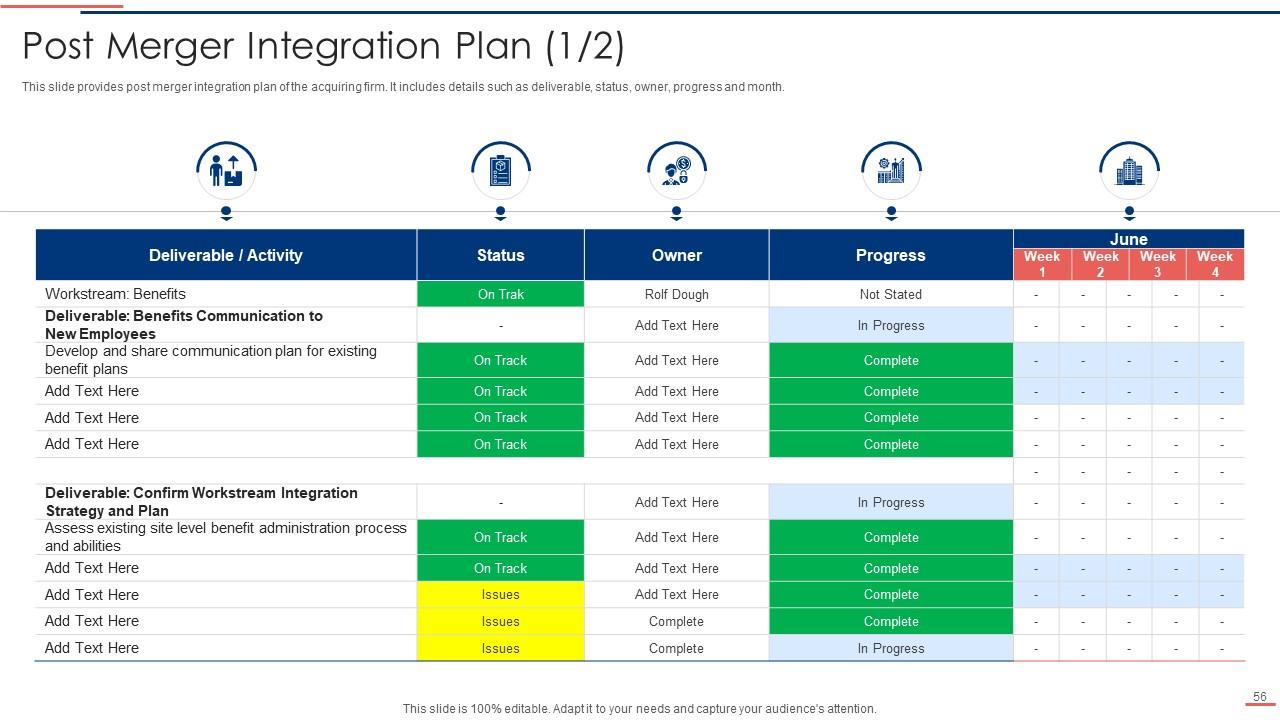

Slide 56: This slide provides post merger integration plan of the acquiring firm.

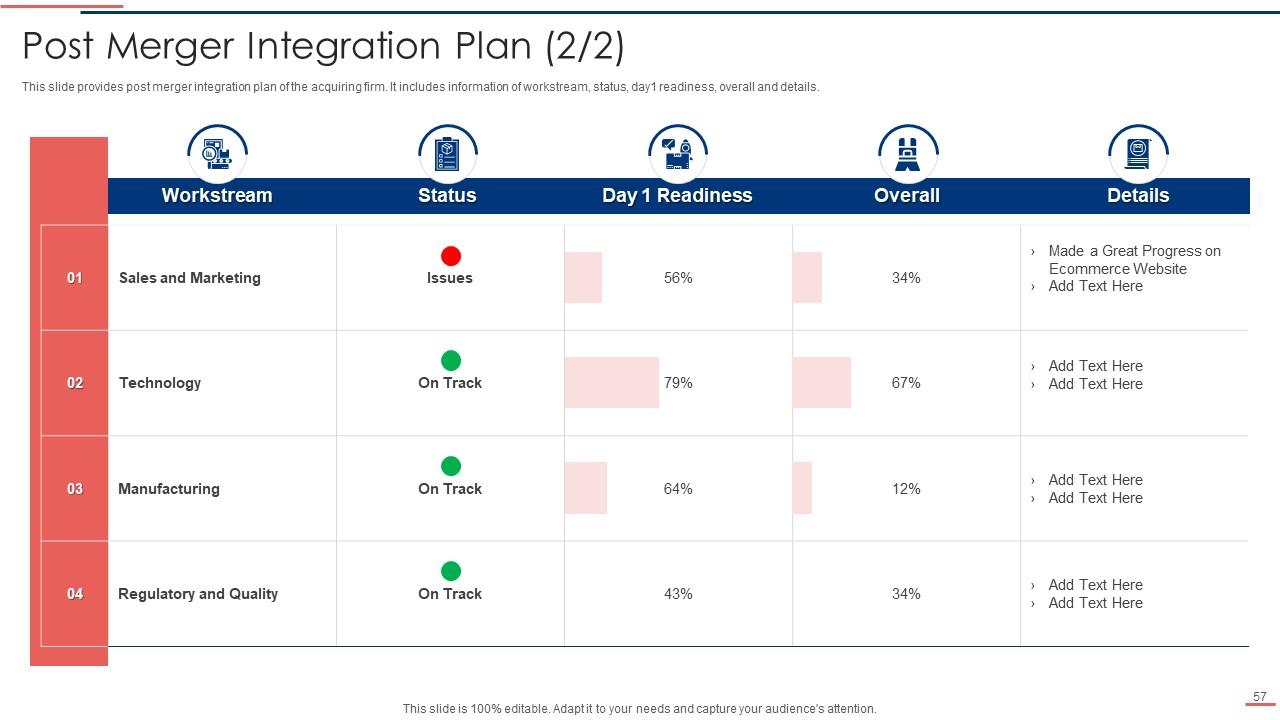

Slide 57: This is another slide continuing post merger integration plan of the acquiring firm.

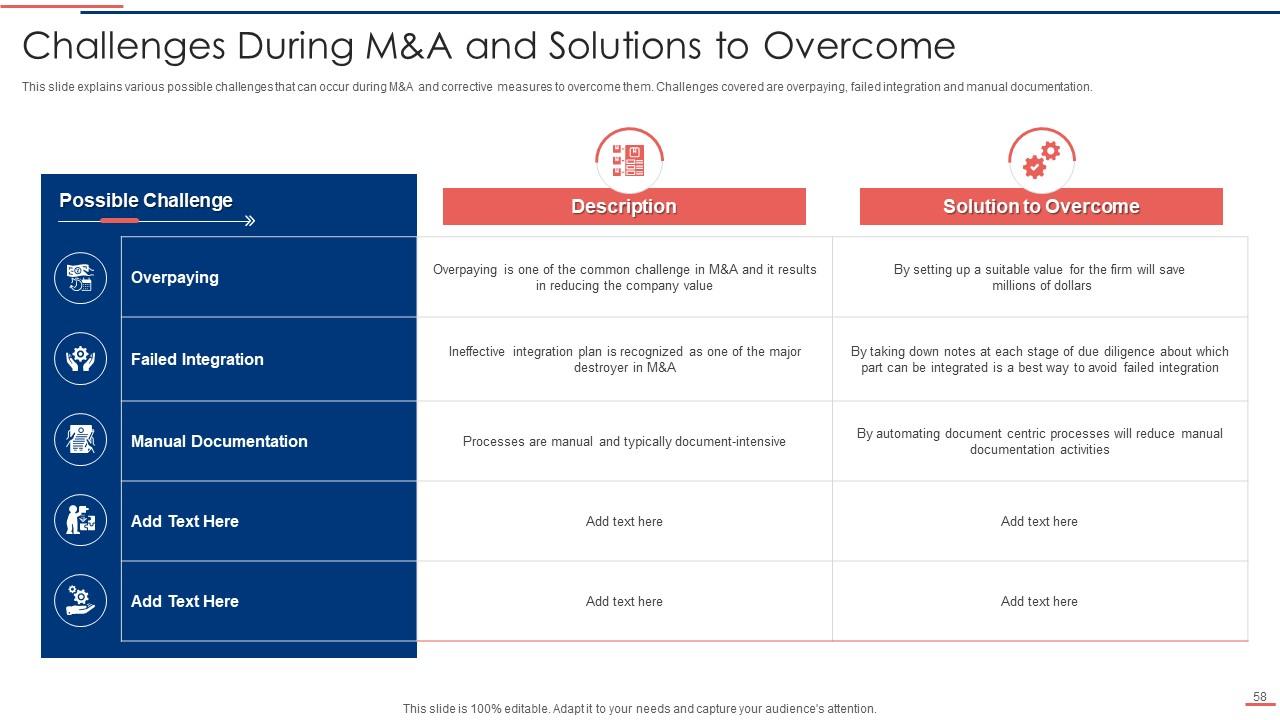

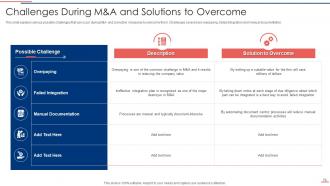

Slide 58: This slide explains various possible challenges that can occur during M&A.

Slide 59: This slide displays Icons for Due Diligence Process in M&A Transactions.

Slide 60: This slide is titled as Additional Slides for moving forward.

Slide 61: This is Our Team slide with names and designation.

Slide 62: This is a Timeline slide. Show data related to time intervals here.

Slide 63: This is a Comparison slide to state comparison between commodities, entities etc.

Slide 64: This slide contains Puzzle with related icons and text.

Slide 65: This slide shows Post It Notes. Post your important notes here.

Slide 66: This slide depicts Venn diagram with text boxes.

Slide 67: This slide showcases Roadmap for Process Flow.

Slide 68: This is a Thank You slide with address, contact numbers and email address.

Due Diligence Process In M And A Transactions Powerpoint Presentation Slides with all 73 slides:

Use our Due Diligence Process In M And A Transactions Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Visually stunning presentation, love the content.

-

Use of icon with content is very relateable, informative and appealing.