Finance Sector Transformation With Blockchain Technology Training Ppt

These slides provide information about the 3Ds Decentralization,Disintermediation,and Distributed Ledger and the advantages enhanced security,streamlined processes,accountability,and easier money transfers of blockchain in the finance sector. It also covers the limitations of blockchain technology,such as limited flexibility,latency,and governance.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Finance Sector Transformation with Blockchain Technology. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. You can add or delete the content as per your need.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

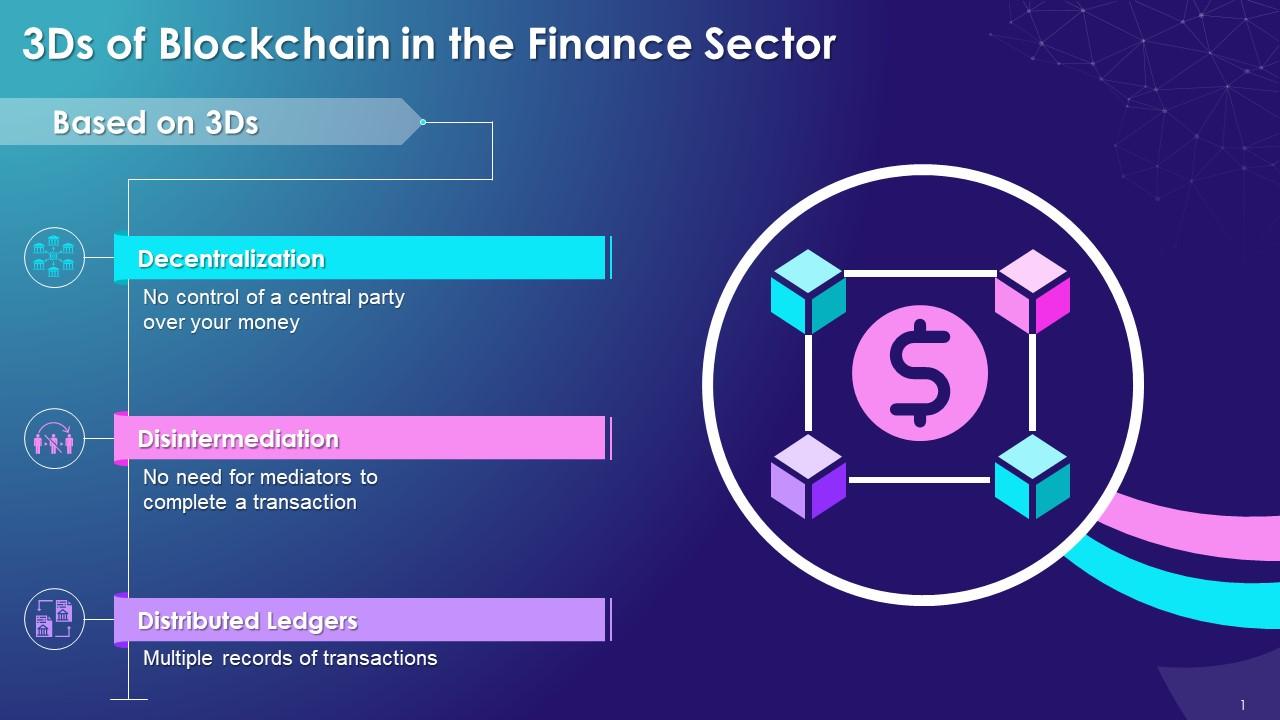

This slide discusses the foundation of the blockchain technology that allows it to be integrated into the financial sector. The building blocks of blockchain are the 3Ds of Decentralization, Disintermediation and a Distributed Ledger.

Slide 2

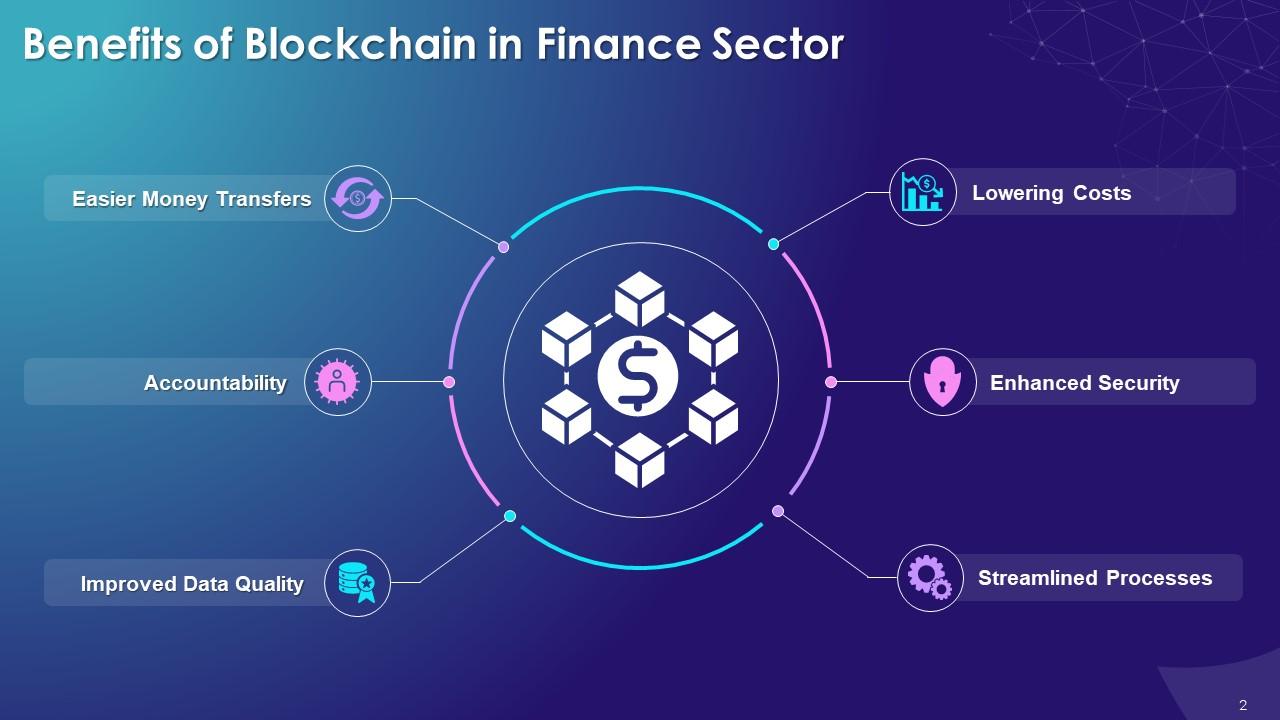

This slide talks about the general influence of blockchain technology on the finance sector along with the benefits it offers, such as lower costs, enhanced security, streamlined processes, improved data quality, accountability, and easier money transfers.

Instructor’s Notes:

- Lowering Costs: Banking institutions can save a considerable amount of money by implementing blockchain technology. Smart blockchain contracts can lower intermediary cost, while also lowering maintenance and implementation costs

- Enhanced Security: Improved security is another advantage of adopting blockchain for financial services. When transactions happen faster, hackers have less time to obtain transaction data or reroute payments

- Streamlined Processes: Increased automation improves the overall efficiency. It allows for real-time settlement, monitoring, and reporting, along with a decrease in processing times, the risk of errors and latency. It reduces the number of intermediaries needed to attain the same levels of assurance that traditional processes offer

- Improved Data Quality: All sorts of information can be stored on a blockchain, all the information can be accessed, provided the seeker follows specific rules and procedures. Smart contracts are used in the technology to automatically validate and execute a transaction, which enhances data integrity and makes it immune to outside intervention

- Accountability: Institutions can prevent the misuse of their funds and all sorts of fraud. Banks can handle and monitor transactions better since blockchain makes transactions traceable and easier to verify

- Easier Money Transfers: Blockchain technology has the potential to ease international money transfers. Businesses and customers endure delays, additional costs, and bureaucracy while sending money using the conventional approach. Blockchain provides a more straightforward, faster, and efficient way to implement cross-border transactions

Slide 3

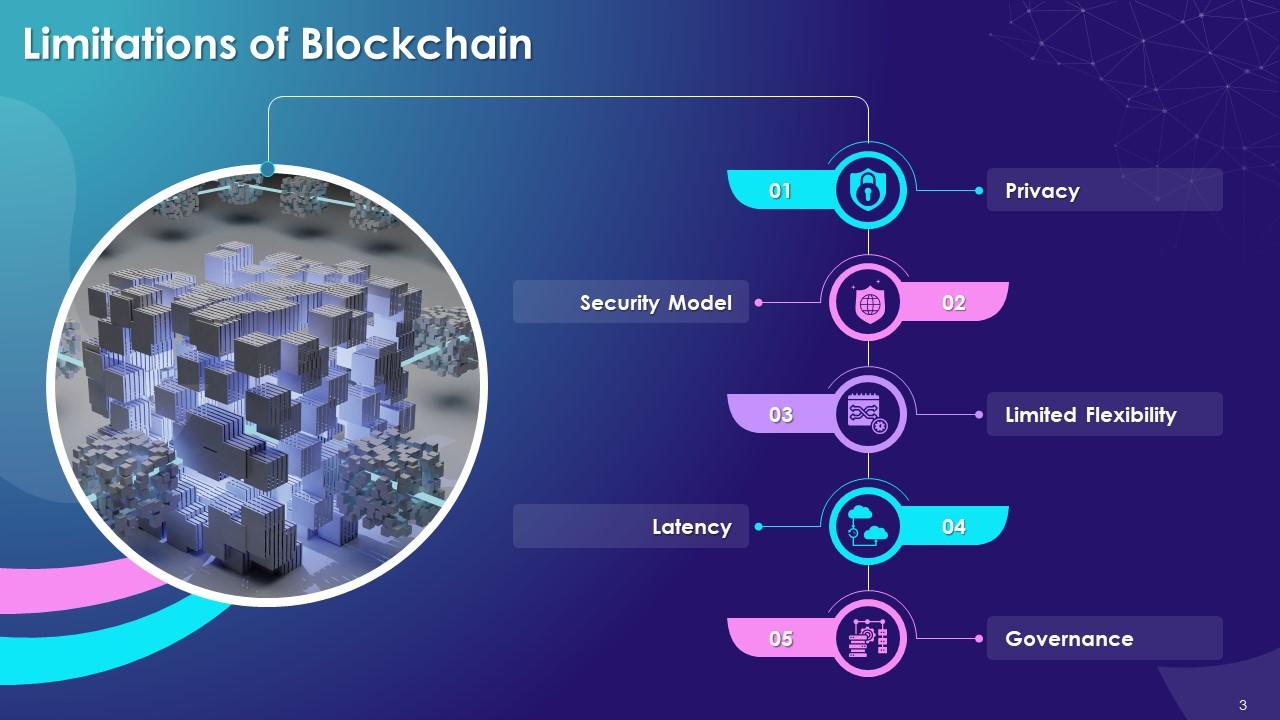

This slide lists the drawbacks of blockchain technology such as privacy issues, security, limited flexibility, latency and governance.

Instructor’s Notes:

- Privacy: All network participants may see, trace, and monitor transactions that have been validated and added to the blockchain. This feature ensures transaction transparency and security, while also blocking any transactions requiring complete privacy protection

- Security Model: Participants in the chain use public or private key cryptography to verify and validate transactions recorded into the blockchain. The key that grants access to the blockchain is kept on a physical device that might be misplaced, broken, or stolen. The system would be unable to safeguard one or more subjects if they inadvertently lost or released their private key

- Flexibility Limitations: The blockchain's immutability ensures transaction integrity, but it can make it challenging to deploy the technology in situations when transactions must be modified

- Latency: Due to network latency, a decentralized blockchain is not always consistent. Different blocks may arrive at different nodes at different times, resulting in temporary blockchain inconsistencies known as forks. If transaction verification is delayed, the organization may not see the benefit of implementing blockchain

- Governance: Blockchain's decentralization provides a benefit in terms of transaction disintermediation. The dispersed nature of the blockchain, on however, maybe a constraint in terms of network control and surveillance

Slide 4

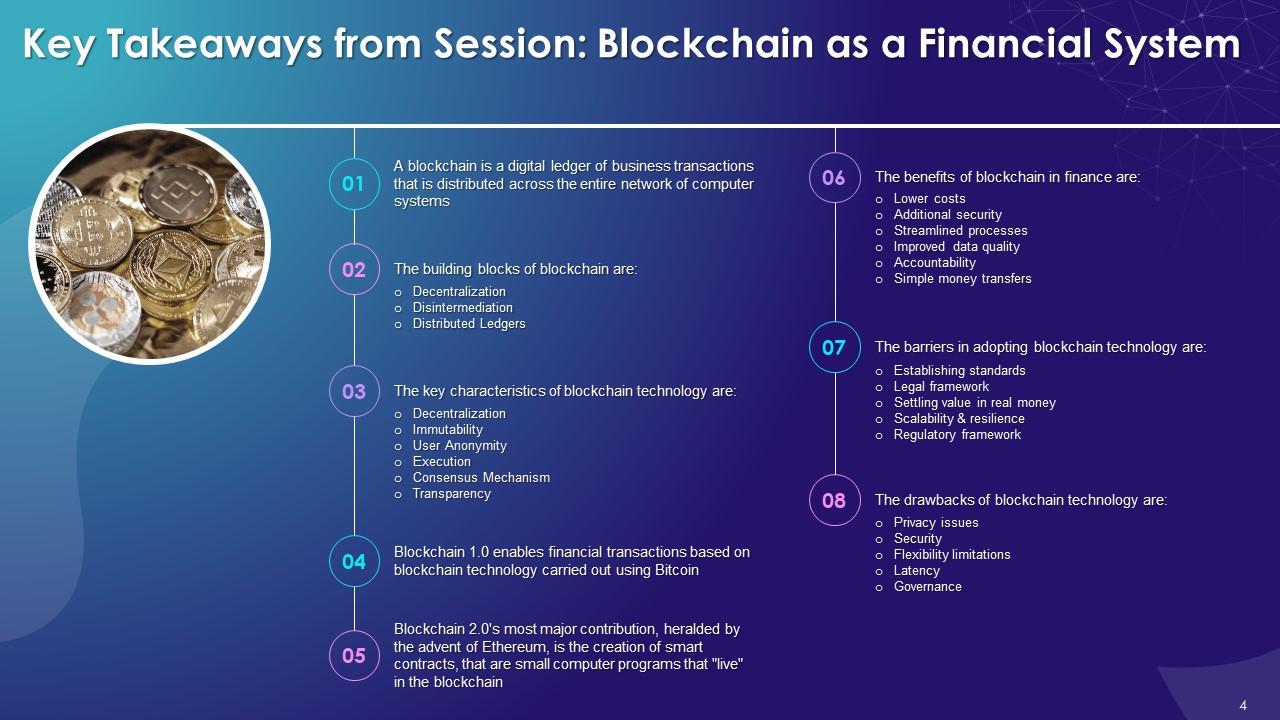

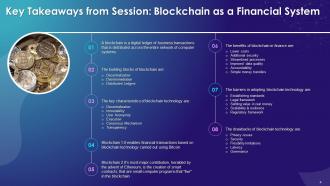

This slide summarizes the session on Blockchain as a Financial System in the form of key takeaways; the major one that must be remembered is the 3Ds of the technology and some of its drawbacks. Overall, we have to take home a balanced view on this important issue that has ramifications for all of us.

Finance Sector Transformation With Blockchain Technology Training Ppt with all 21 slides:

Use our Finance Sector Transformation With Blockchain Technology Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Content of slide is easy to understand and edit.

-

“Ample and amazing variety of templates available, really helpful for making professional PPT for day to day workings.”