How Blockchain Can Transform Trade Finance Training Ppt

These slides provide information about the working of trade finance and its significance in risk reduction. It also covers concerns of traditional trade finance,such as delayed payments,invoice factoring,document duplication,and tampering with financial records,and the capability of blockchain technology to overcome these.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting How Blockchain can Transform Trade Finance. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation,add your content,and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide gives an overview of trade finance. Businesses' financial tools and products to facilitate international trade and commerce are referred to as trade finance. It helps importers and exporters streamline their dealings with both efficiency and speed.

Slide 2

This slide discusses the working of trade finance. Conventional finance and credit issuance are not the same as trade financing. General finance is used to maintain solvency or liquidity, although trade financing does not always mean a buyer is short on cash. Trade finance may be used to safeguard against risks unique to international commerce, such as currency fluctuations, political instability, non-payment concerns, or credit worthiness of one of the parties.

Instructor’s Notes:

There are multiple players in the trade finance ecosystem. These are Importers, Exporters, Banks, Insurers, Trade Finance Companies, and Export Credit Companies.

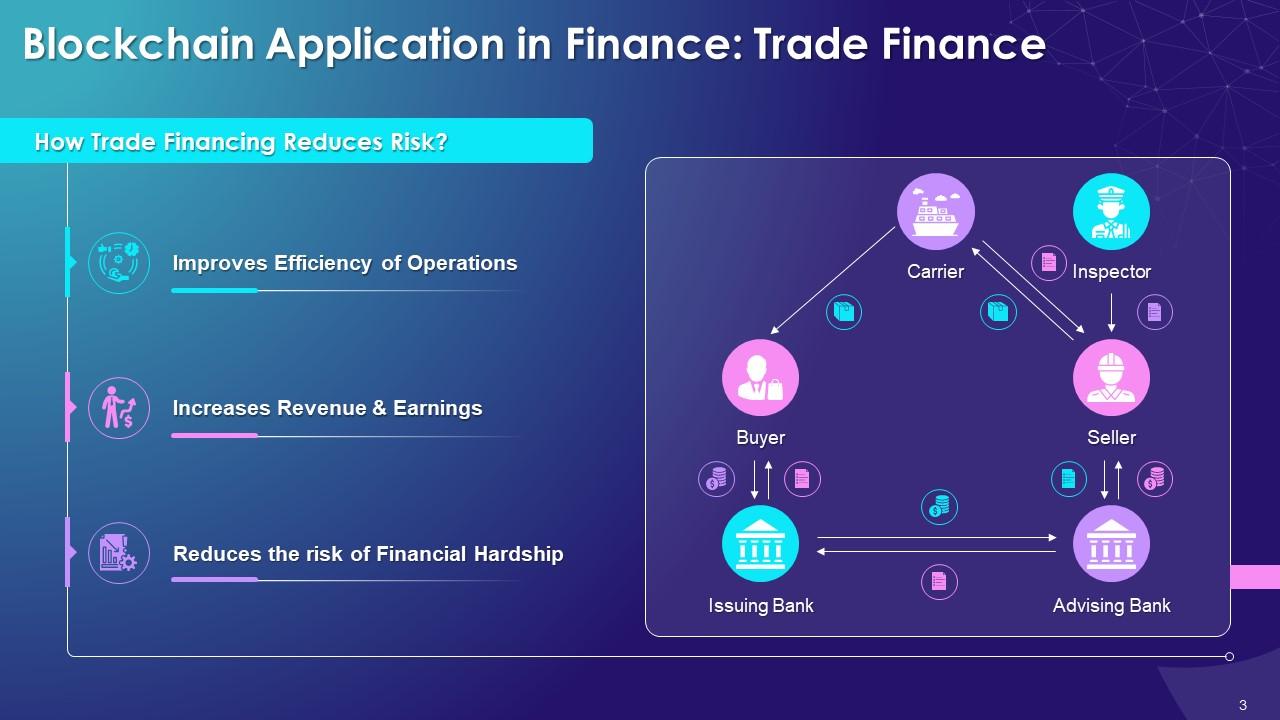

Slide 3

This slide lists benefits of trade finance. These advantages include improved efficiency of operations, increased revenue & earnings, and reduced financial risk.

Instructor’s Notes:

- Improves Efficiency of Operations: Importers and exporters can manage their operations and organize their cash flow with trade financing, as it leads to curbing delays in payments and final delivery of shipments. Trade finance can be considered a way to fund a company's expansion with the collateral on offer being the shipment of products

- Increases Revenue & Earnings: Trade finance enables businesses to grow their revenue and income as the managements can focus on increasing the trade. Continuous cash flow provides businesses with the working capital they require, allowing them to operate more effectively. This comes from the knowledge that their business can meet overheads and other such expenses with ease. Ultimately, this results in more revenue

- Reduces the Risk of Financial Hardship: A firm that does not have trade finance may fall behind on payments and lose a large proportion of clients of suppliers, which might have long-term consequences for the organization. Options such as revolving credit and accounts receivables factoring can assist businesses in transacting abroad, even in times of financial difficulty

Slide 4

This slide lists the pain-points of Trade Finance. The limitations include manual processes, delayed payments, invoice factoring, multiple communication channels, document duplication, and tampering with financial records.

Instructor’s Notes:

- Manual Processes: The issuing bank's manual processes for examining sales contracts and import paperwork, ensuring that there are no irregularities, and providing financials to the exporter's bank or correspondent bank can take time and are prone to human error

- Delayed Payments: Payments are delayed due to financial intermediaries checking to determine if the documents supplied comply with the documentary credit or guarantee requirements. This procedure might take a long time depending on the number of intermediates in the correspondent banking network

- Invoice Factoring: Invoice factoring, which exporters use to present their invoices to banks to get financial leverage, increases the risk profile in the case of a failure on products delivery

- Multiple Communication Channels: Communication routes, techniques, and formats are routinely utilized for trade finance, with underlying papers supplied either electronically or on paper. Businesses and banks are vulnerable to misinterpretation and fraud due to this

- Document Duplication: Duplicate paperwork can be given to banks, this process results in the same transaction being processed twice or more, as well as difficulty in determining whether another financial institution has previously insured a trade

- Tampering with Financial Records: Financial records might be tampered with when the communication route is not verified or safeguarded against unauthorized access

Slide 5

This slide discusses the scope of blockchain technology as a solution for problems that mark trade financing. Companies can use this technology to safely and digitally prove their country of origin, product, and transaction data

How Blockchain Can Transform Trade Finance Training Ppt with all 21 slides:

Use our How Blockchain Can Transform Trade Finance Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Excellent design and quick turnaround.

-

Fantastic and innovative graphics with useful content. The templates are the best and latest in the industry.