Strategic acquisition by third party as exit option powerpoint presentation slides

Our Strategic Acquisition By Third Party As Exit Option Powerpoint Presentation Slides are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

It covers all the important concepts and has relevant templates which cater to your business needs. This complete deck has PPT slides on Strategic Acquisition By Third Party As Exit Option Powerpoint Presentation Slides with well suited graphics and subject driven content. This deck consists of total of fifty nine slides. All templates are completely editable for your convenience. You can change the colour, text and font size of these slides. You can add or delete the content as per your requirement. Get access to this professionally designed complete deck presentation by clicking the download button below.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Strategic Acquisition by Third Party as Exit Option. Mention your company name here.

Slide 2: This slide shows Objectives with outlining exit strategy for a startup. It will allow owners in liquidating their stake in the business.

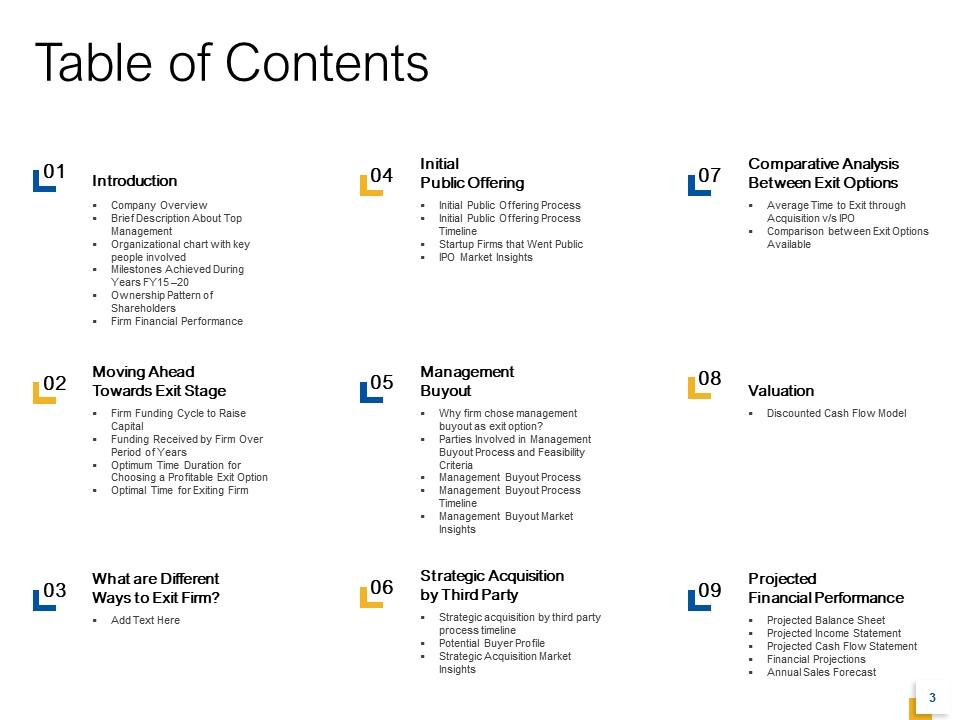

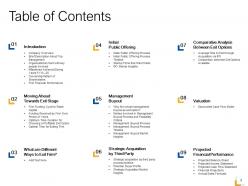

Slide 3: This slide presents a Table of Contents with Comparative Analysis Between Exit Options, Average Time to Exit through Acquisition v/s IPO, Comparison between Exit Options Available, etc.

Slide 4: This slide shows Introduction with Company Overview, Brief Description About Top Management, Organizational Chart with Key People Involved, etc.

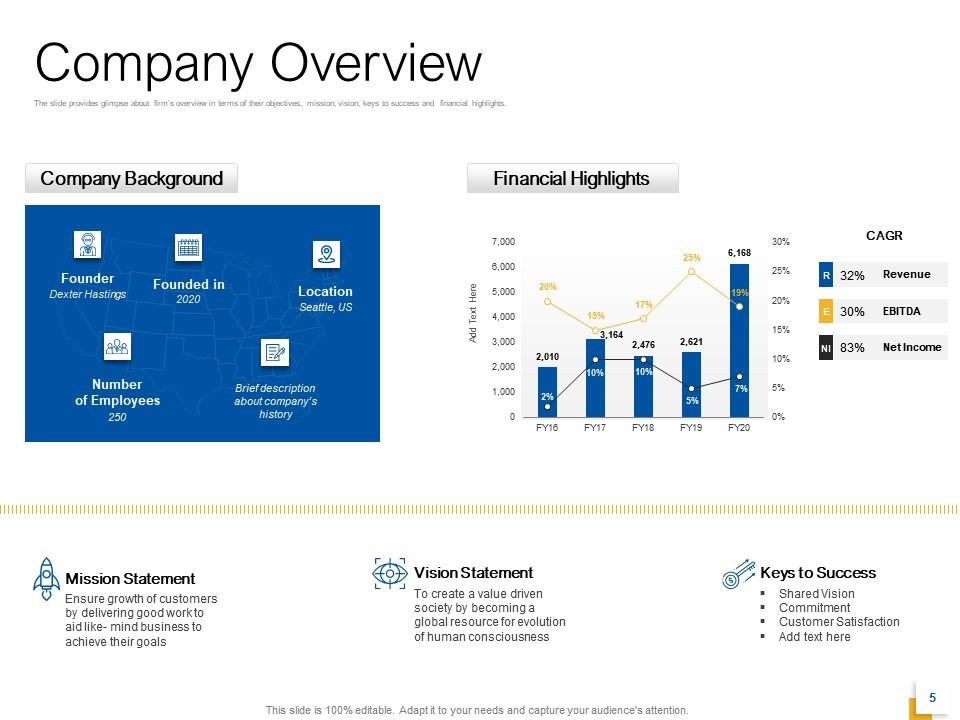

Slide 5: This slide shows the Company Overview with Financial Highlights and Company Background.

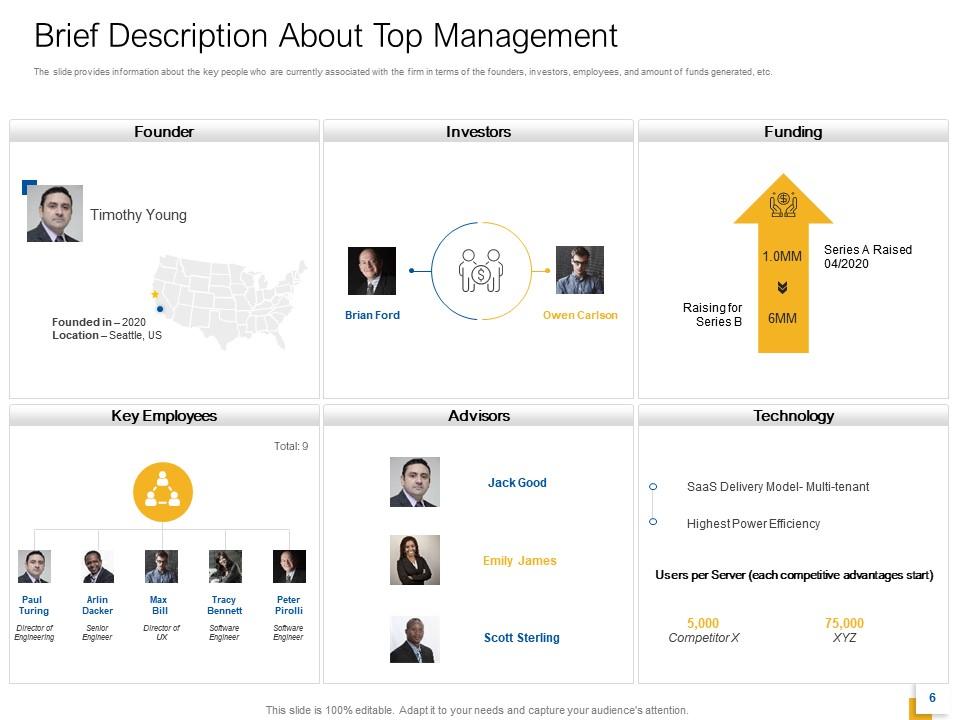

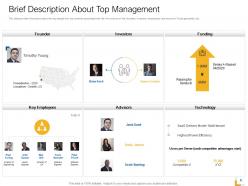

Slide 6: The slide provides a Brief Description About Top Management who are currently associated with the firm in terms of the founders, investors, employees, and amount of funds generated, etc.

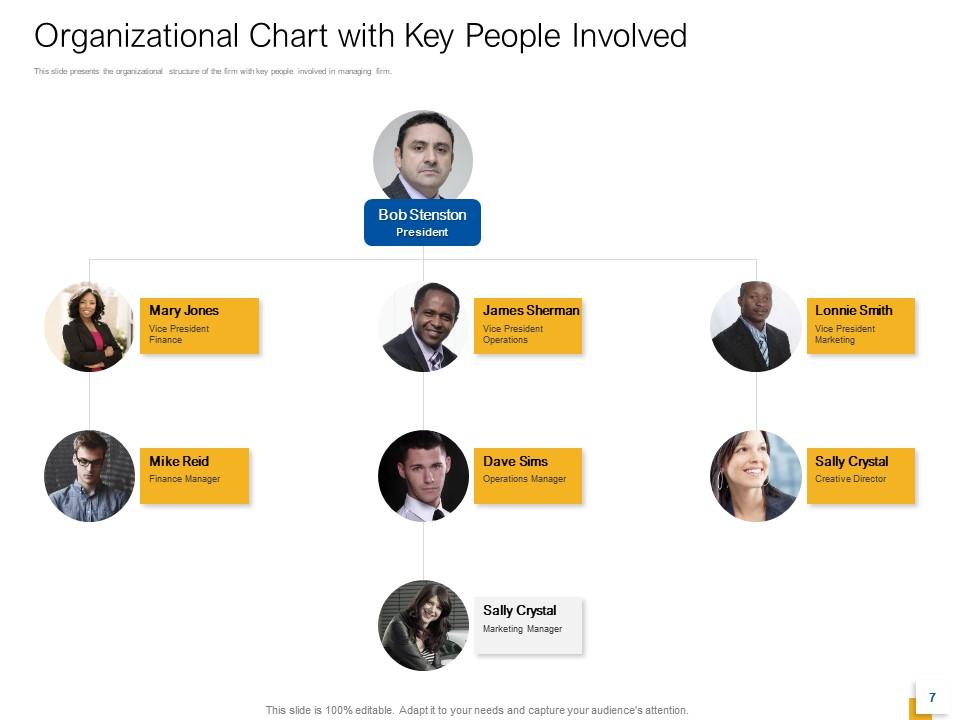

Slide 7: This slide presents the organizational structure of the firm with key people involved in managing the firm.

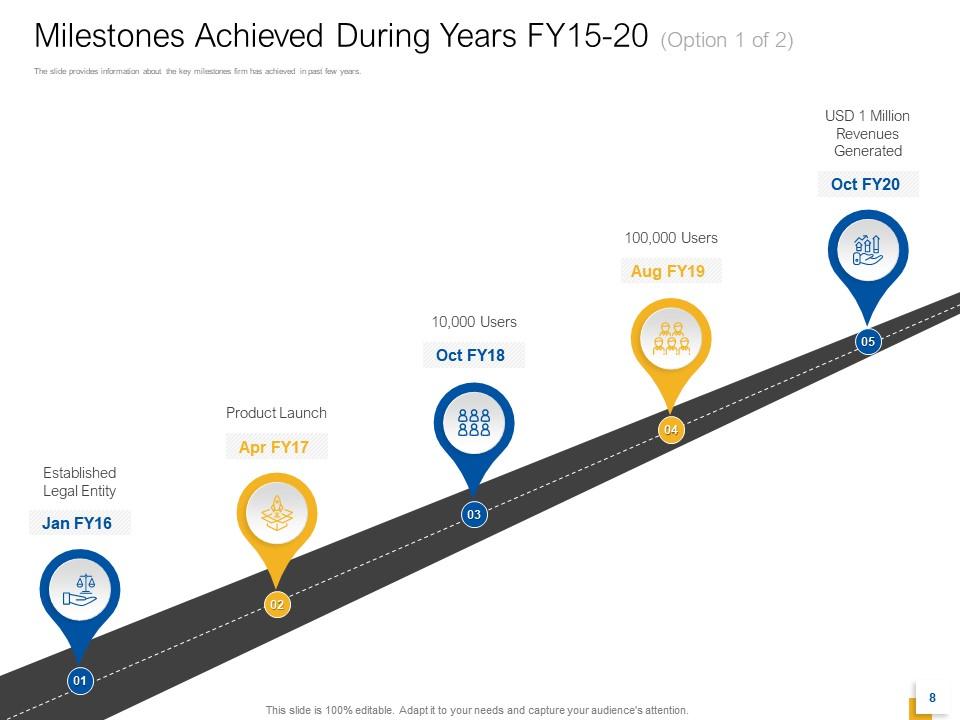

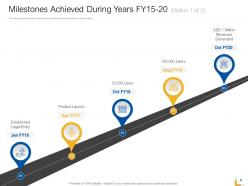

Slide 8: The slide provides information about Milestones Achieved During Years FY15-20 (Option 1 of 2).

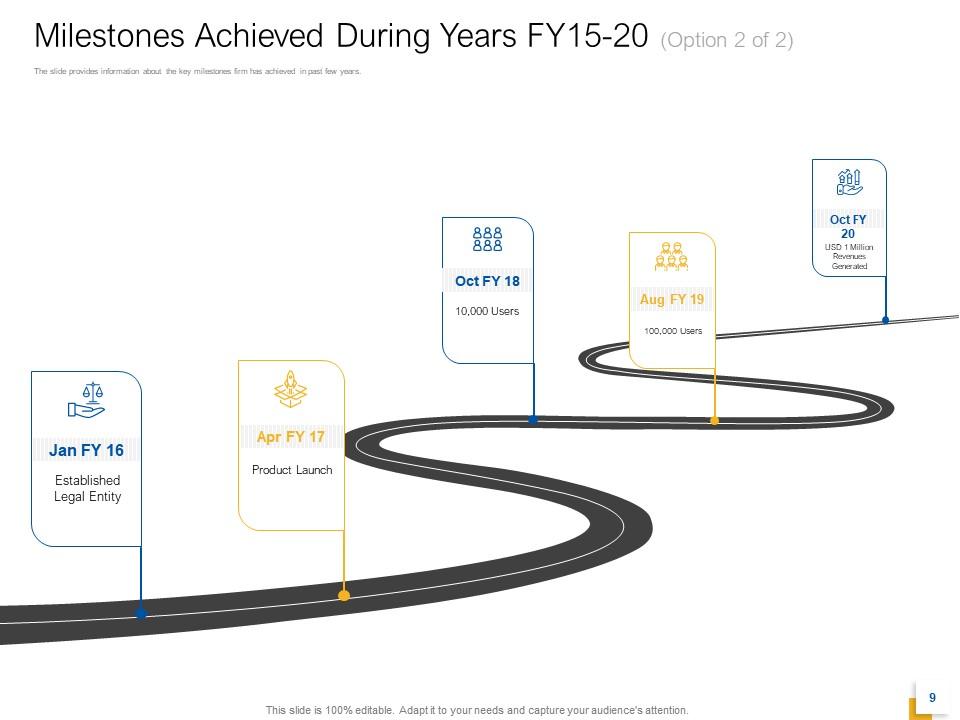

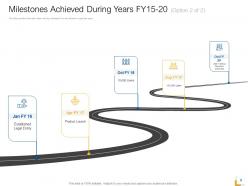

Slide 9: The slide provides information about the key milestones firm has achieved in past few years.

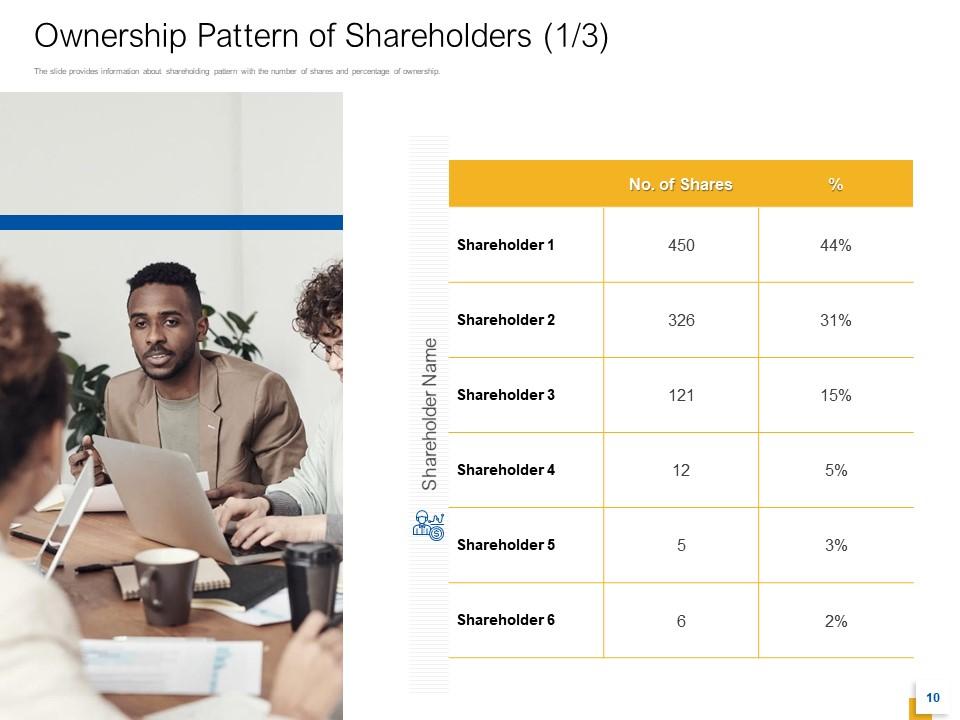

Slide 10: The slide provides information about the Ownership Pattern of Shareholders (1/3) with the number of shares and percentage of ownership.

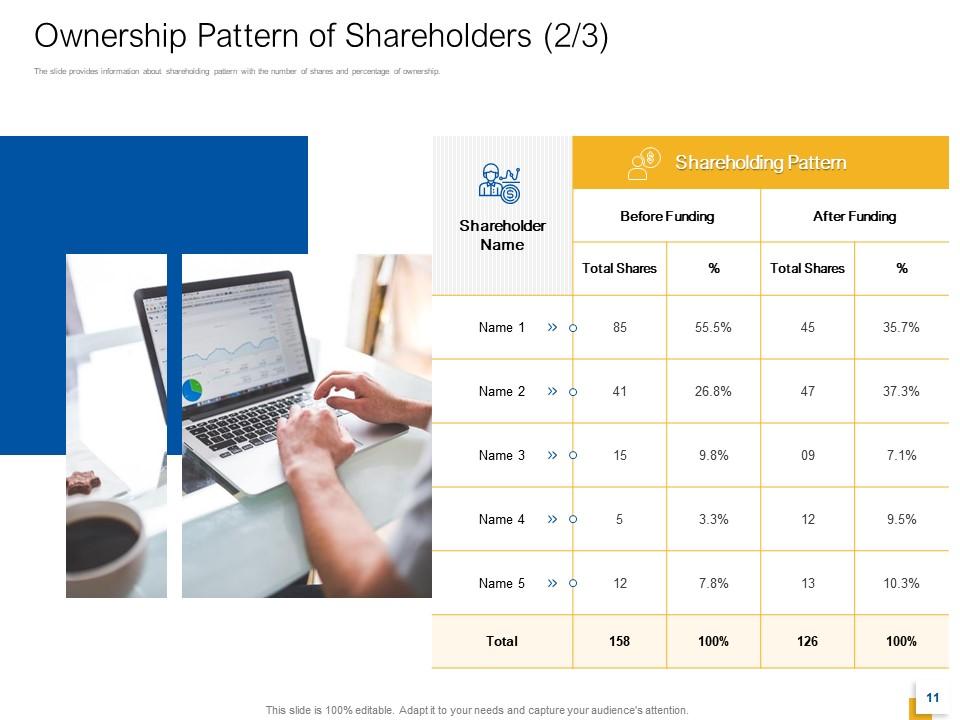

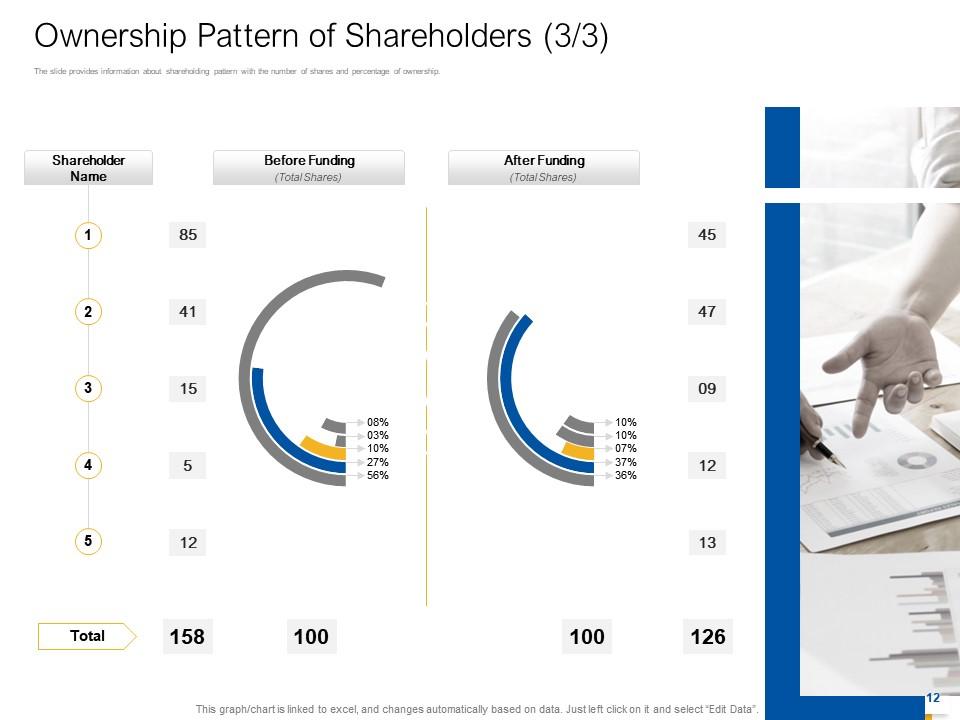

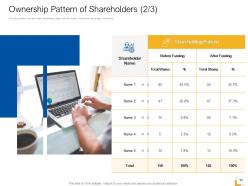

Slide 11: The slide provides information about the Ownership Pattern of Shareholders (2/3) with Patterns.

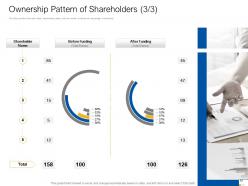

Slide 12: The slide provides information about the Ownership Pattern of Shareholders (3/3) with before and after funding.

Slide 13: This slide provides information about Firm Financial Performance in terms of revenues earned, gross profit generated, net profit earned, and earnings per share.

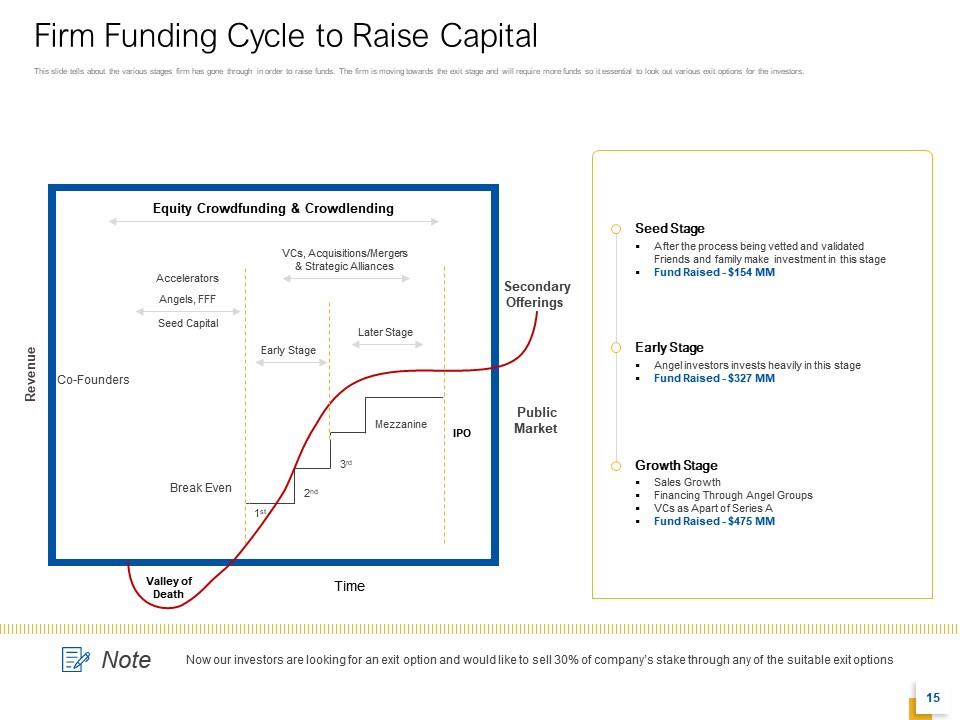

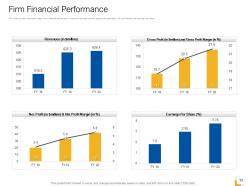

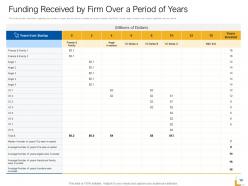

Slide 14: This slide presents Moving Ahead Towards Exit Stage with Firm funding cycle to raise capital and Funding received by the firm over a period of years.

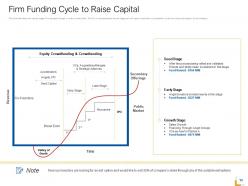

Slide 15: This slide provides information regarding the Firm Funding Cycle to Raise Capital and the amount invested by various investors like family, friends, angel investors, and venture capitalists over the period.

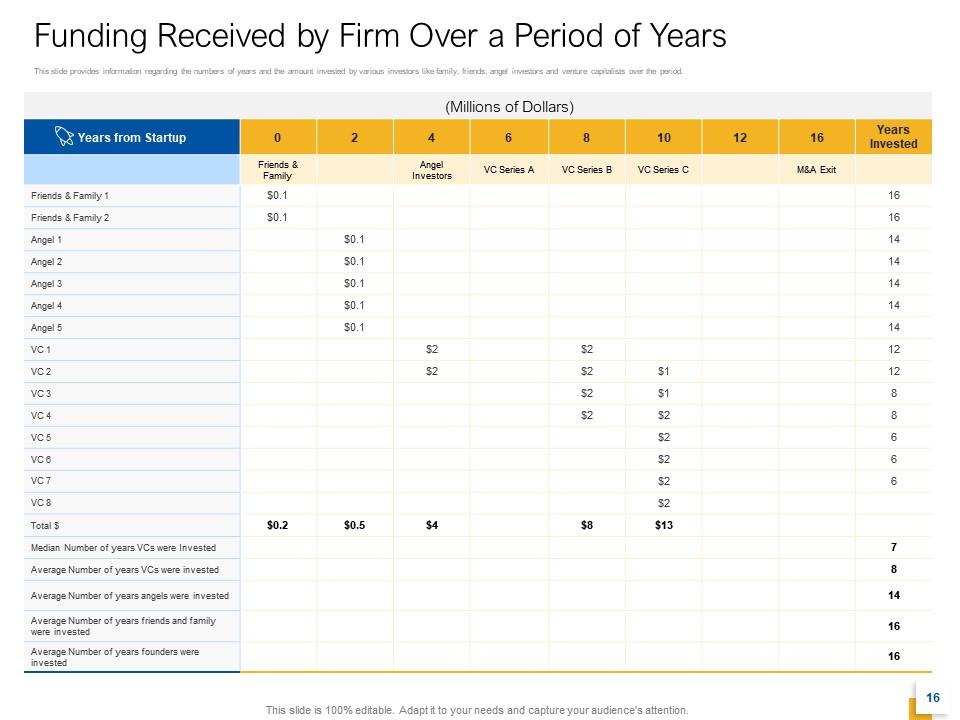

Slide 16: This slide provides information regarding Funding Received by the Firm Over a Period of Years.

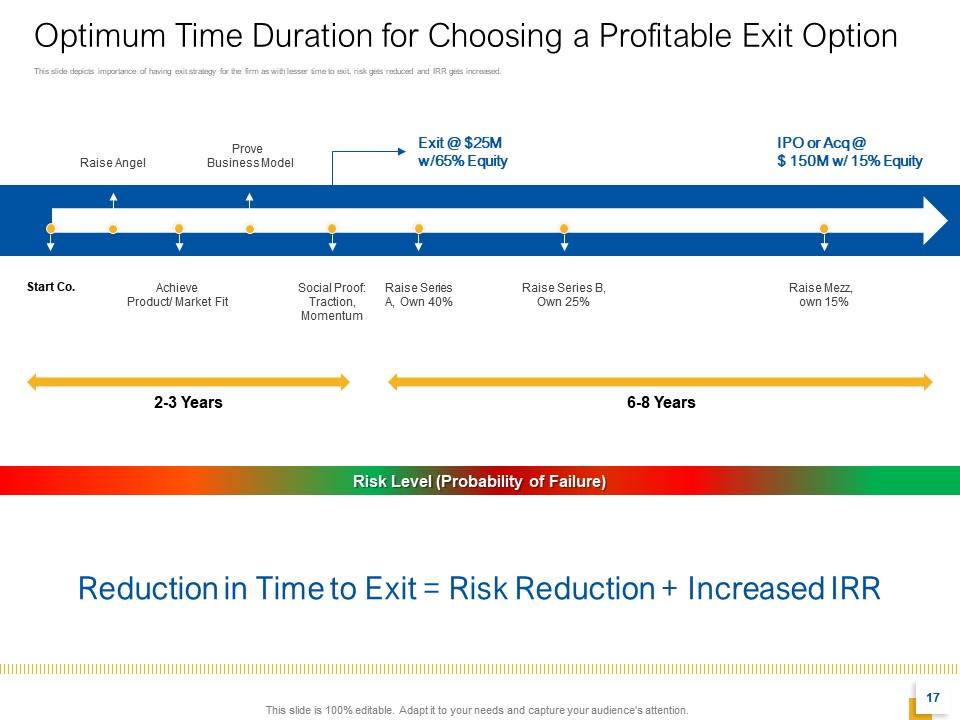

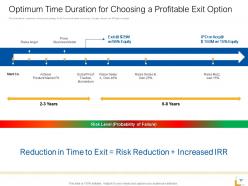

Slide 17: This slide depicts Optimum Time Duration for Choosing a Profitable Exit Option for the firm as with lesser time to exit, the risk gets reduced, and IRR gets increased.

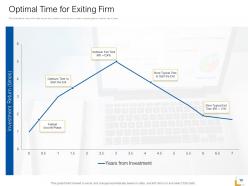

Slide 18: This slide depicts Optimal Time for Exiting Firm in order to secure optimum internal rate of return.

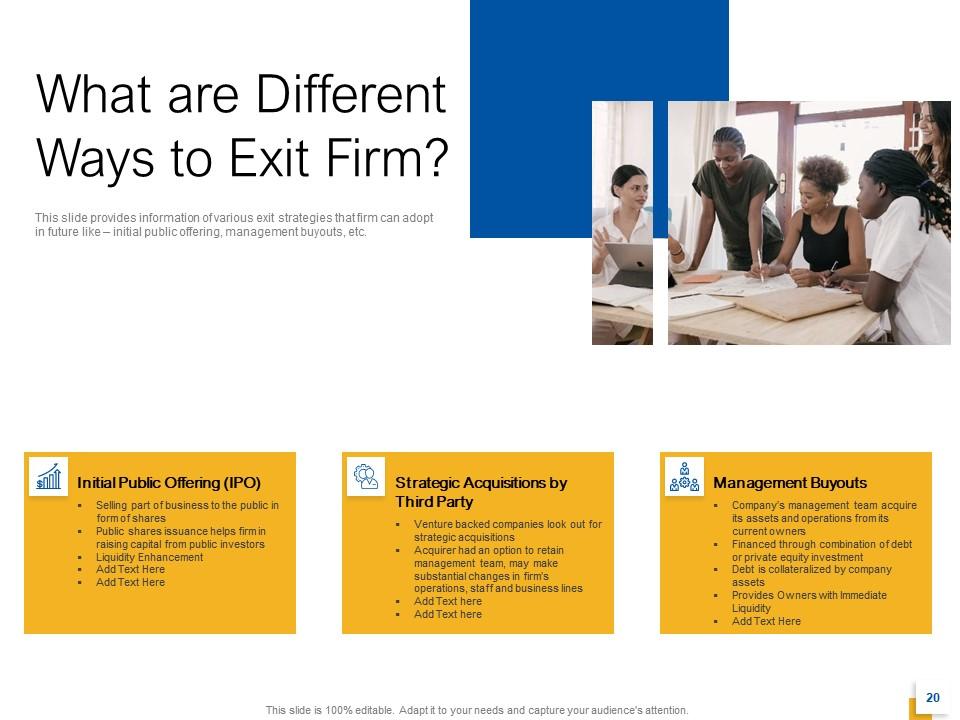

Slide 19: This slide depicts What are Different Way Exit Firm?

Slide 20: This slide provides information on What are Different Ways to Exit a Firm that can adopt in the future like – initial public offering, management buyouts, etc.

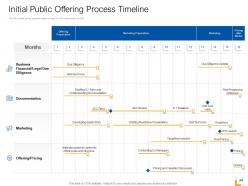

Slide 21: This slide depicts Initial Public Offering with process and timeline.

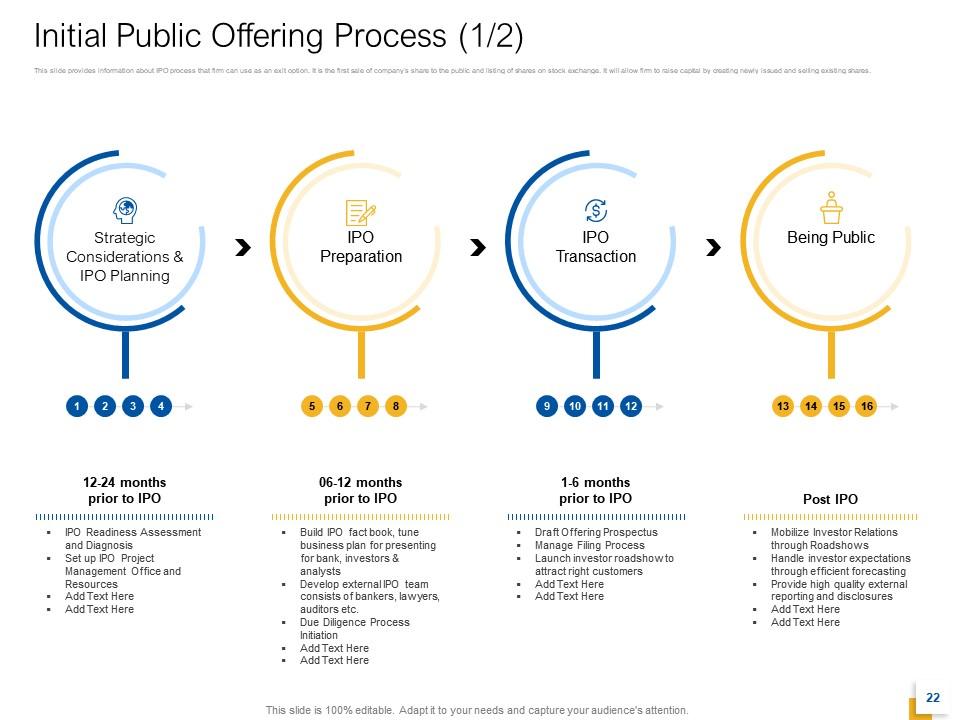

Slide 22: This slide provides information about the Different Ways to Exit Firm Initial Public Offering Process (1/2). It will allow firms to raise capital by creating newly issued and selling existing shares.

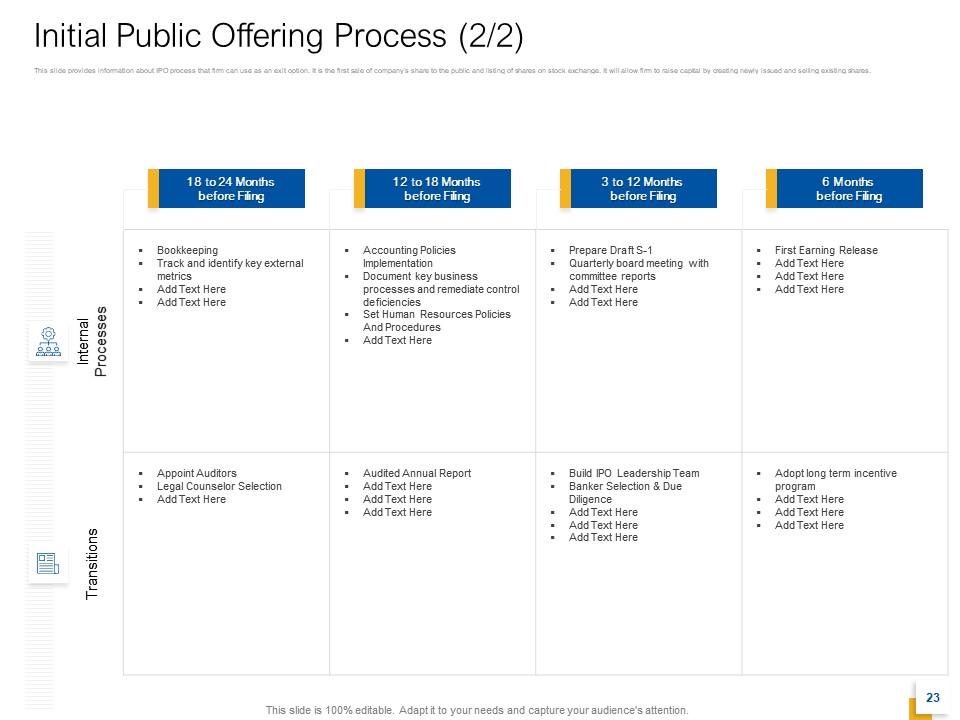

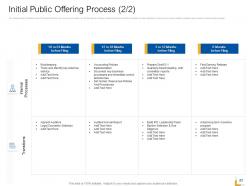

Slide 23: This slide provides information about Different Ways to Exit Firm Initial Public Offering Process (2/2) that the firm can use as an exit option.

Slide 24: This slide depicts Initial Public Offering Process Timeline with Due Diligence.

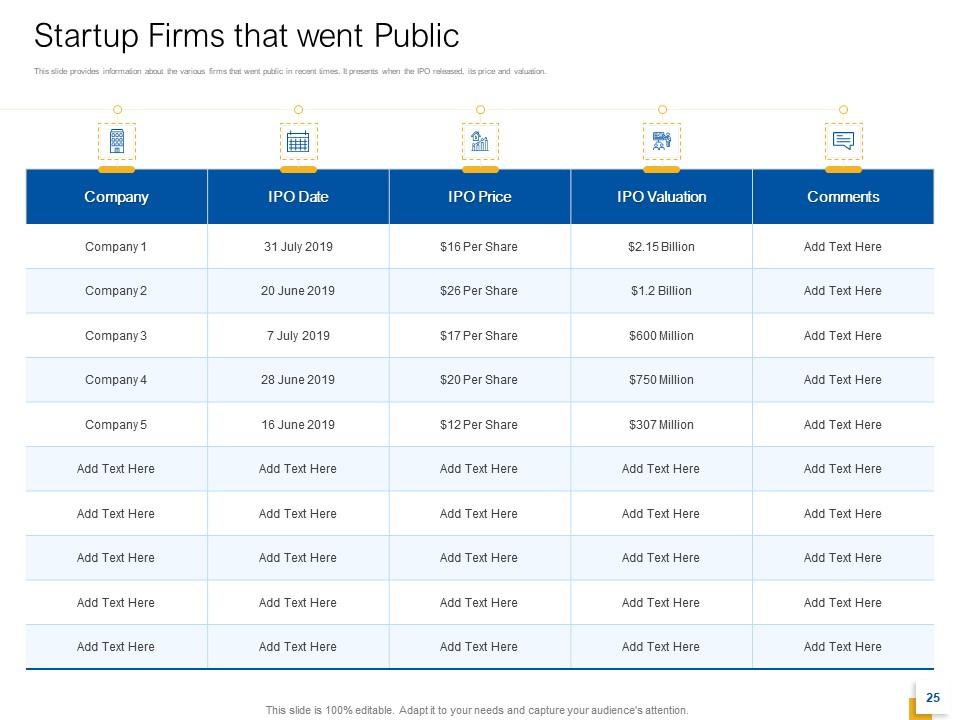

Slide 25: This slide depicts Startup Firms that went Public in recent times. It presents when the IPO is released, its price, and valuation.

Slide 26: This slide depicts IPO Market Insights raised in various sectors and their success rate.

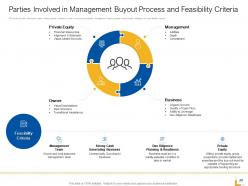

Slide 27: This slide depicts Management Buyout with Process, Timeline, and Market Insights.

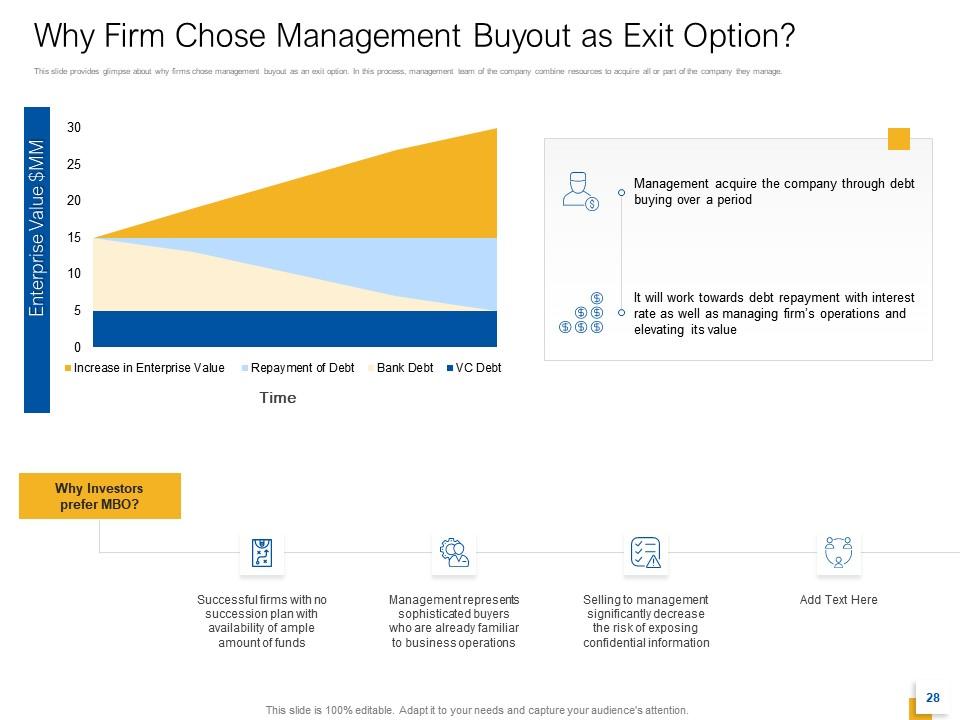

Slide 28: This slide depicts Why Firms Chose Management Buyout as an Exit Option?

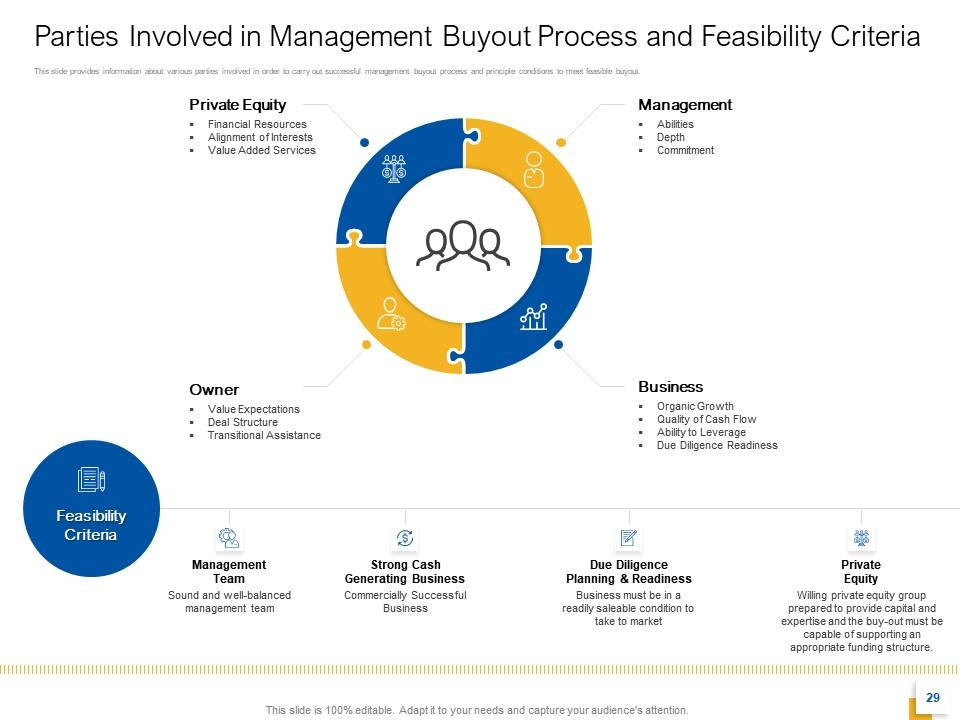

Slide 29: This slide provides information about Parties Involved in Management Buyout Process and Feasibility Criteria and principle conditions to meet feasible buyout.

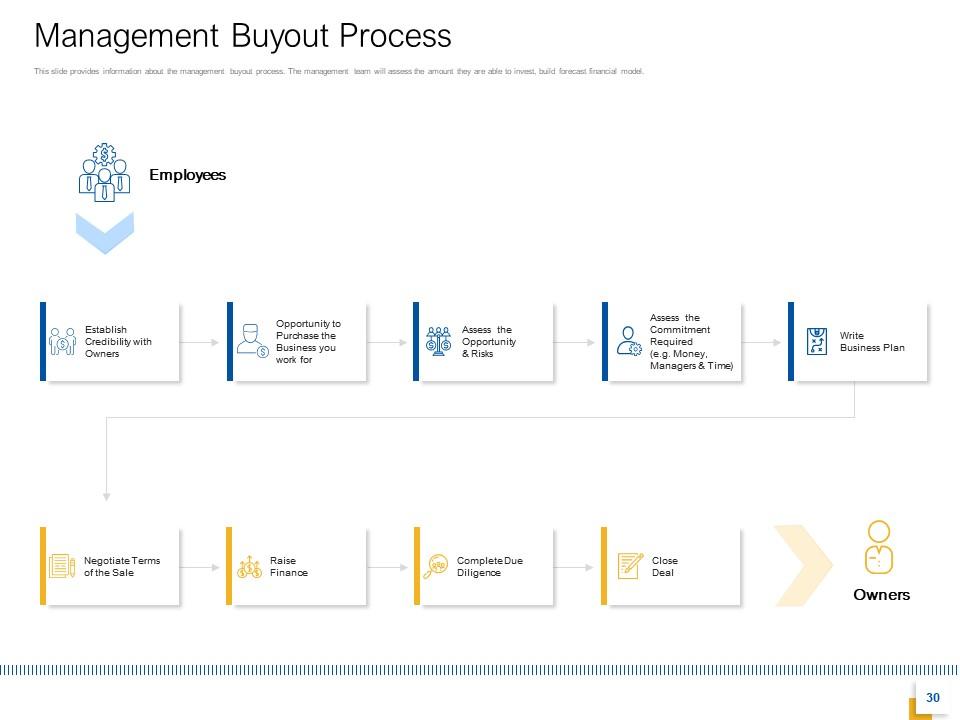

Slide 30: This slide depicts Management Buyout Process.

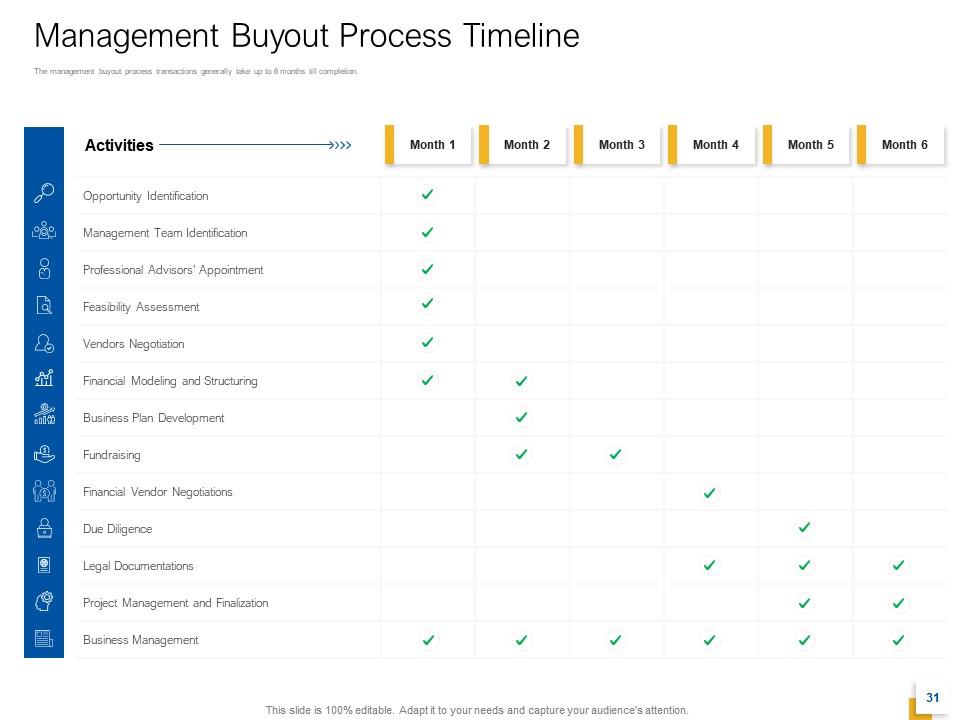

Slide 31: This slide depicts Management Buyout Process Timeline with activities.

Slide 32: This slide provides a glimpse about the Management Buyouts Market Insights deals across various sectors like manufacturing, industries, technology firms, etc. with the success and failure rate of MBO.

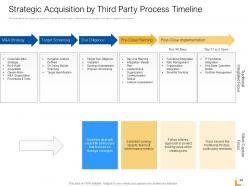

Slide 33: This slide depicts Strategic Acquisition by Third Party with Potential Buyer Profiles and Market Insights.

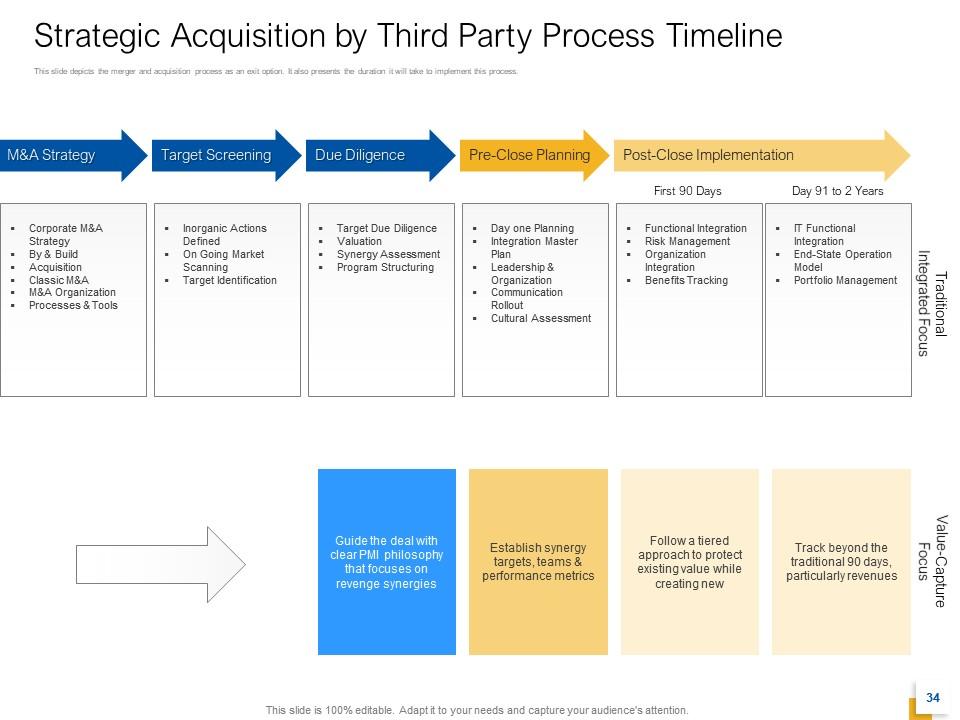

Slide 34: This slide depicts the Strategic Acquisition by Third Party Process Timeline. It also presents the duration it will take to implement this process.

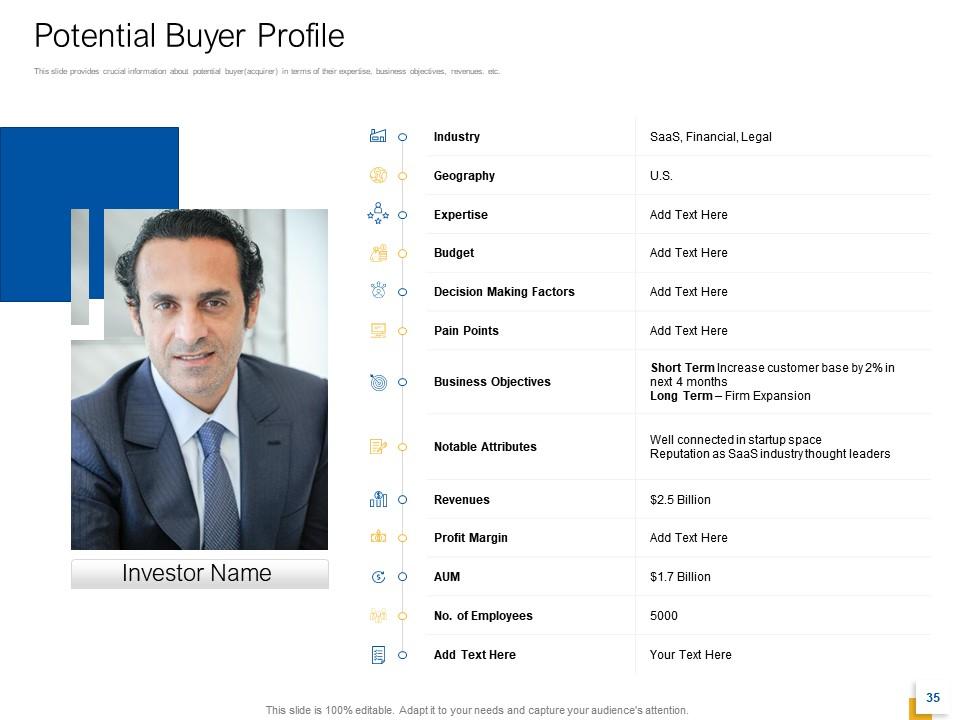

Slide 35: This slide depicts Potential Buyer Profile with Investor Name.

Slide 36: This slide depicts Strategic Acquisition by Third Party Market Insights.

Slide 37: This slide depicts Comparative Analysis Between Exit Options.

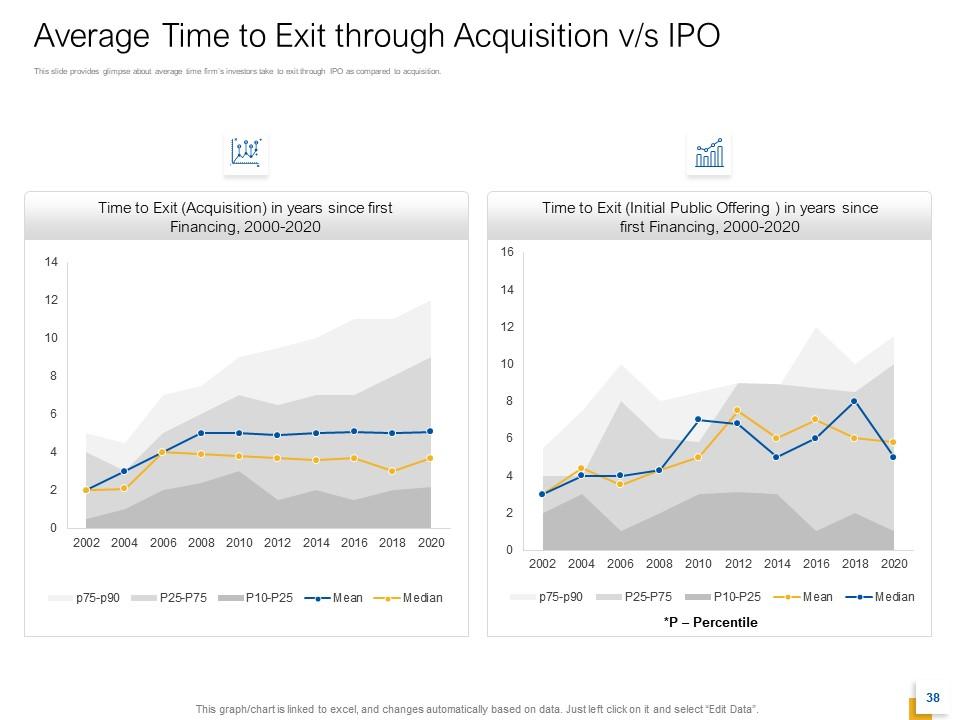

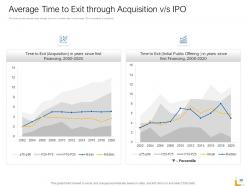

Slide 38: This slide provides a glimpse of the Average Time to Exit through Acquisition v/s IPO.

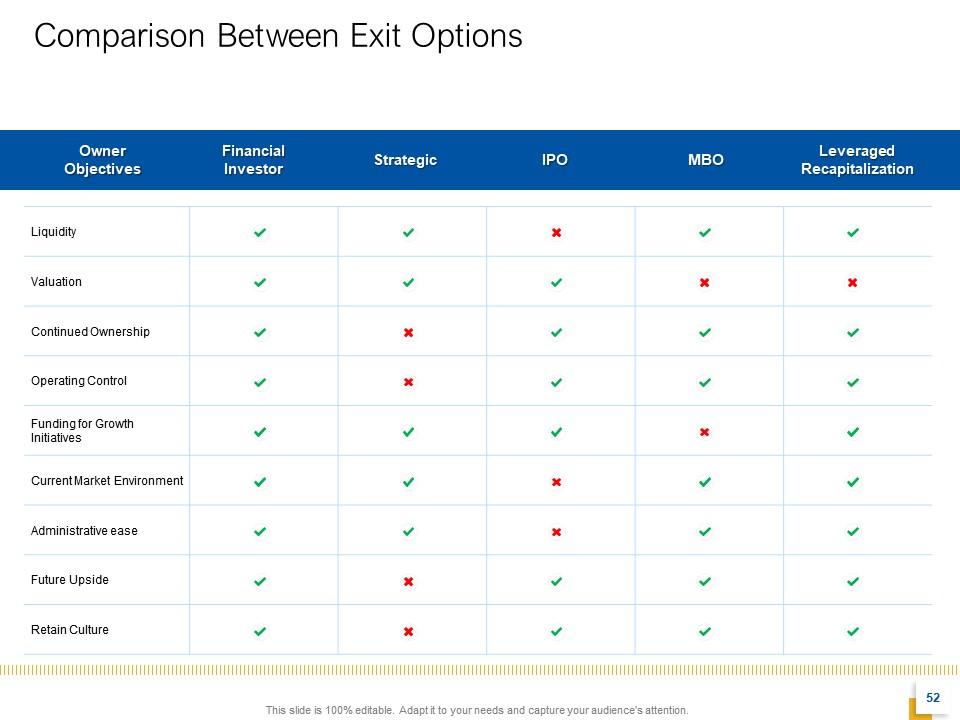

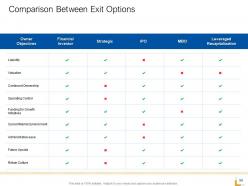

Slide 39: This slide portrays various Comparison between Exit Options Available.

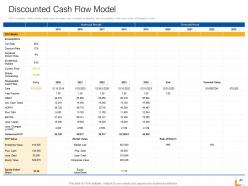

Slide 40: This slide depicts Valuation with Discounted Cash Flow Model.

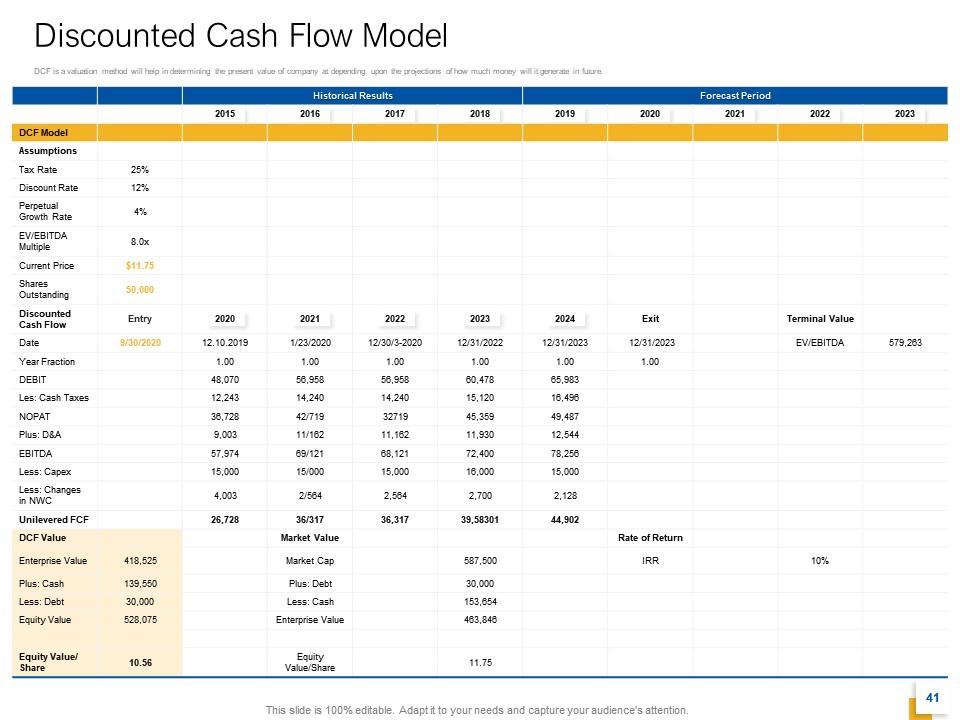

Slide 41: This slide depicts Discounted Cash Flow Model will help in determining the present value of the company depending upon the projections of how much money will it generate in the future.

Slide 42: This slide depicts Projected Financial Performance.

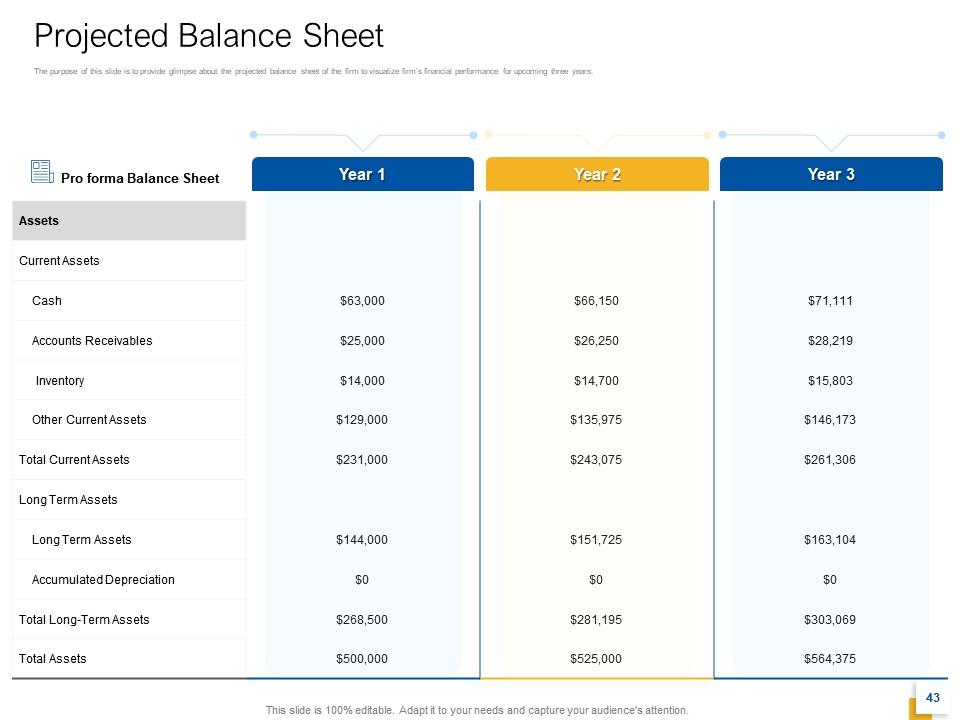

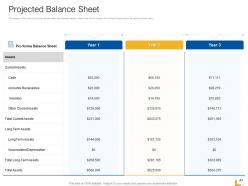

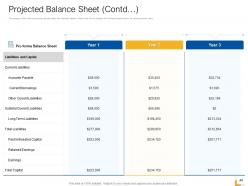

Slide 43: This slide depicts Projected Balance Sheet for three years.

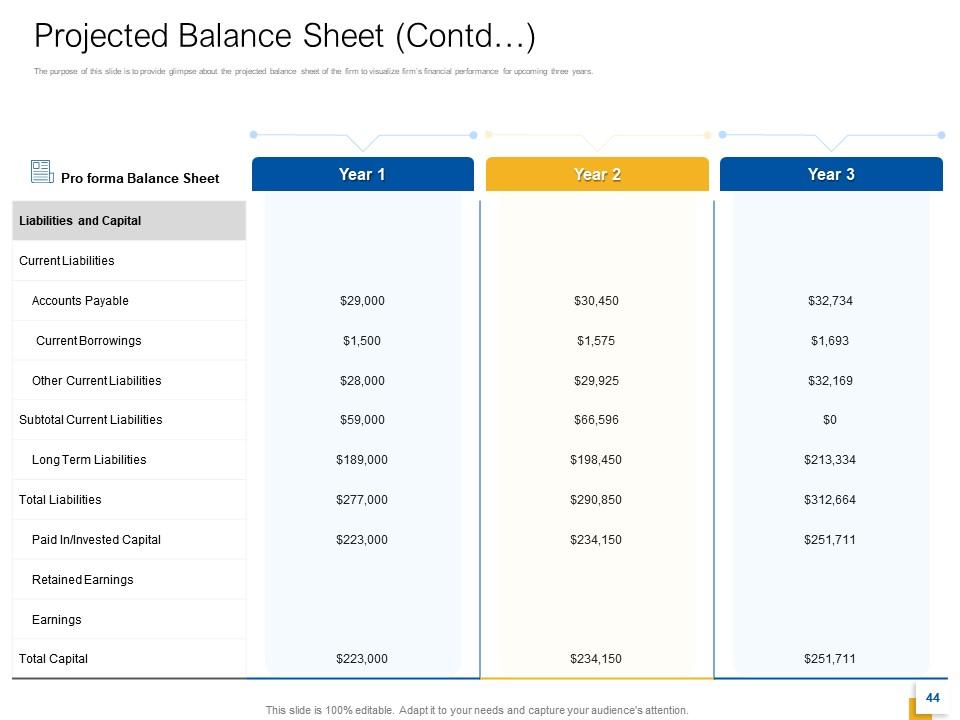

Slide 44: The purpose of this slide is to provide a glimpse of the Projected Balance Sheet of the firm to visualize the firm’s financial performance for the upcoming three years.

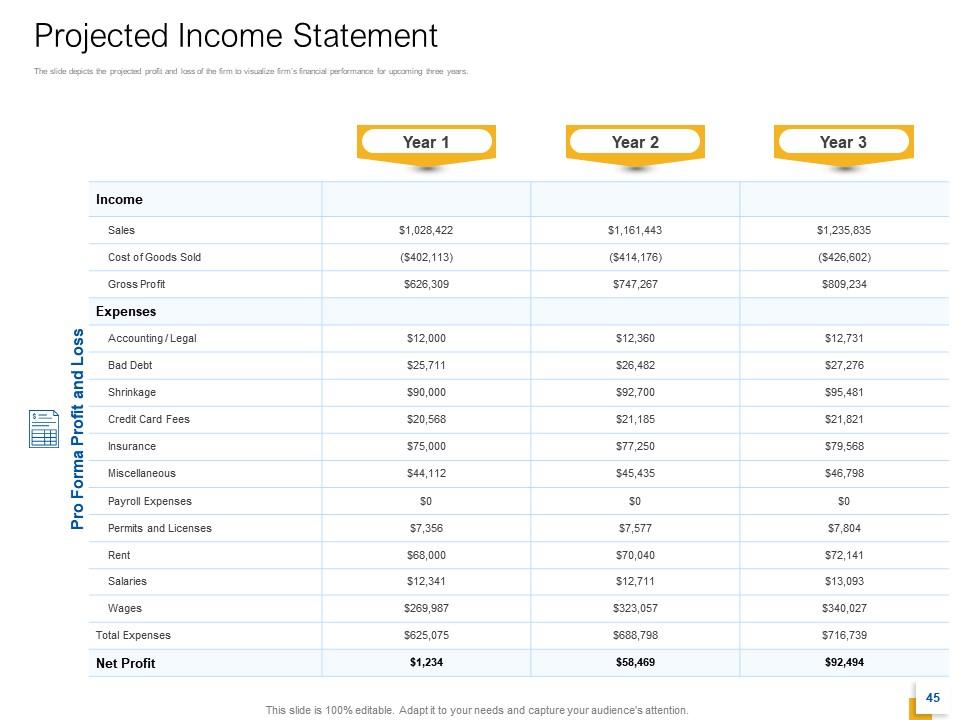

Slide 45: The slide depicts the Projected Income Statement of the firm to visualize the firm’s financial performance for the upcoming three years.

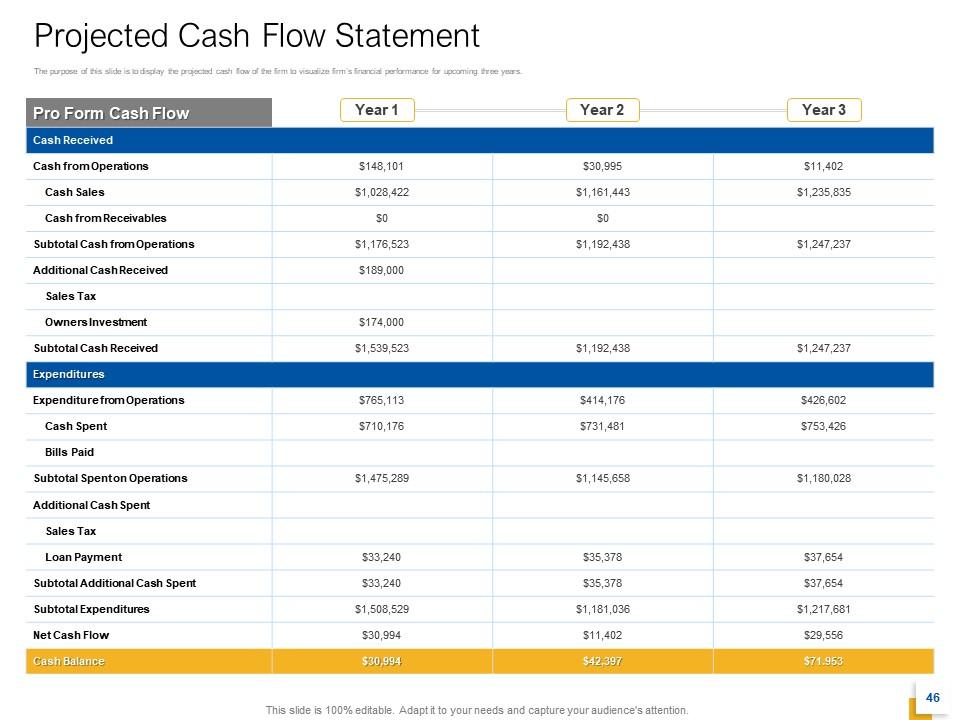

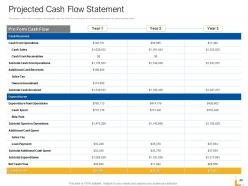

Slide 46: The purpose of this slide is to display the Projected Cash Flow Statement of the firm to visualize the firm’s financial performance for the upcoming three years.

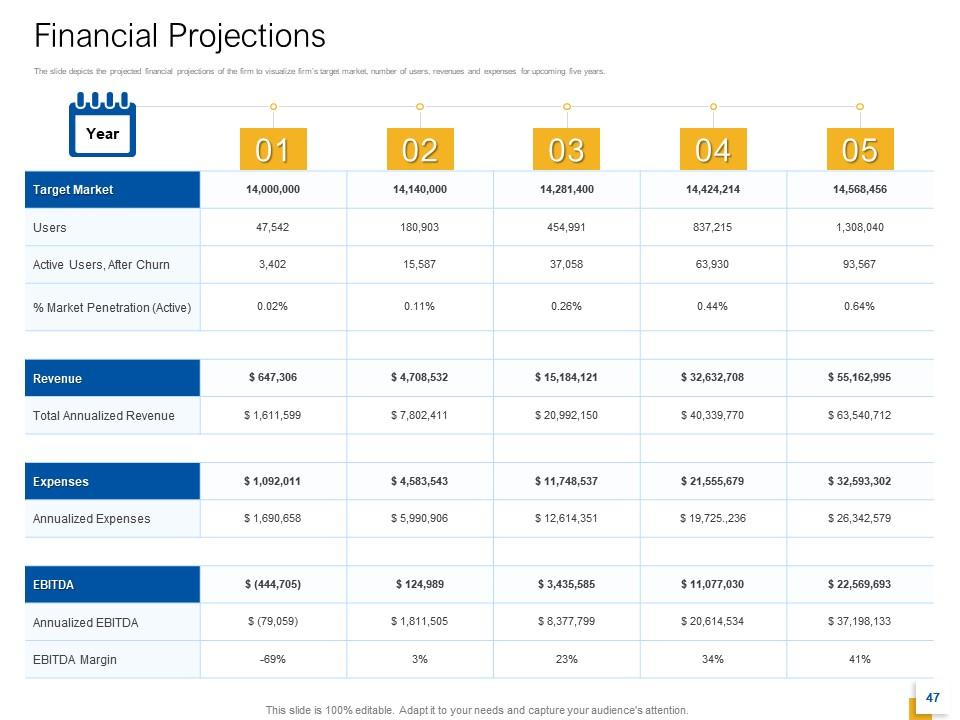

Slide 47: the projected Financial Projections of the firm to visualize the firm’s target market, the number of users, revenues, and expenses for the upcoming five years.

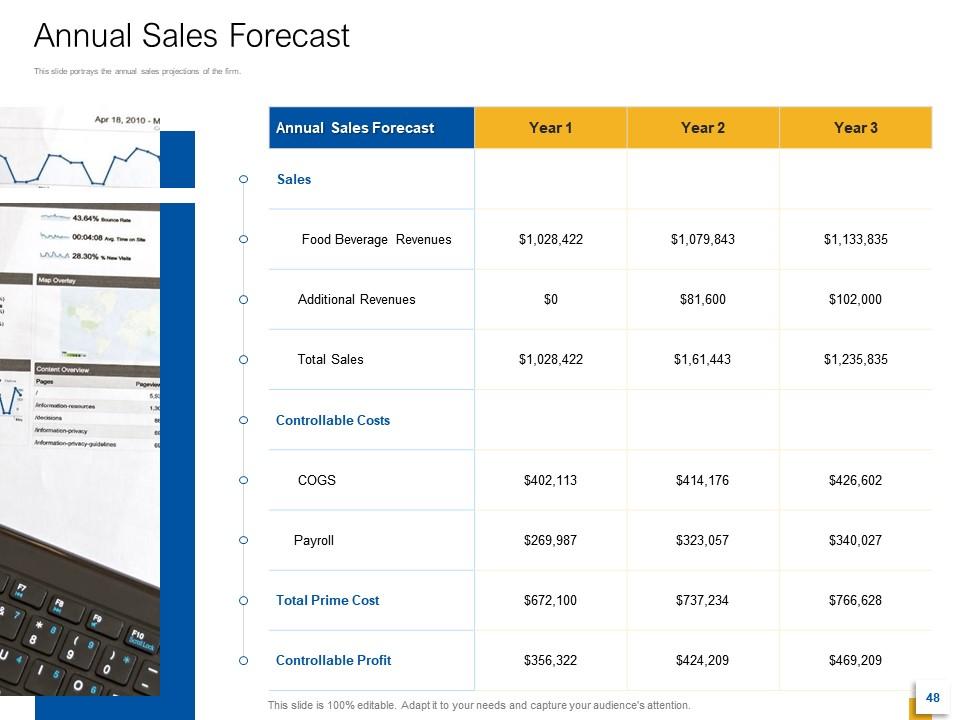

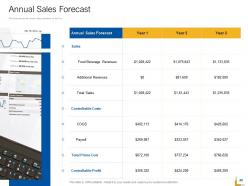

Slide 48: This slide portrays the Annual Sales Forecast of the firm.

Slide 49: The slide depicts Icons for Strategic Acquisition by Third Party as Exit Option.

Slide 50: The slide introduces Additional Slides.

Slide 51: This is Our Team slide with names and designations.

Slide 52: The slide depicts Comparison Between Exit Options.

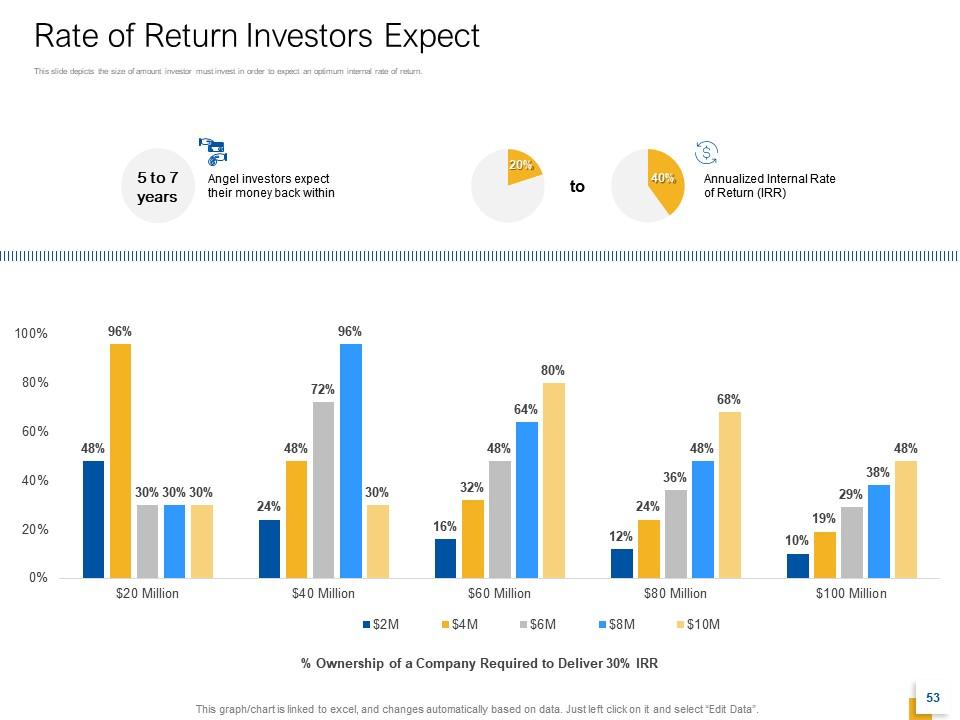

Slide 53: The slide depicts the Rate of Return Investors Expect with the % Ownership of a Company Required to Deliver 30% IRR.

Slide 54: The slide depicts 30 60 90 Days Plan.

Slide 55: The slide depicts Weekly Timeline with Task Name.

Slide 56: The slide depicts Roadmap for Process Flow.

Slide 57: The slide depicts Our Mission with Goals and Vision.

Slide 58: This is About Us slide with Value Clients, Target Audiences, and Preferred by Many.

Slide 59: This is Thank You slide with contact details.

Strategic acquisition by third party as exit option powerpoint presentation slides with all 59 slides:

Use our Strategic Acquisition By Third Party As Exit Option Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Innovative and Colorful designs.

-

Commendable slides with attractive designs. Extremely pleased with the fact that they are easy to modify. Great work!

-

Very unique and reliable designs.