With the fever of Bitcoin worldwide upsurging daily, discussing what Bitcoin is would be of no use here. Let’s just dive right into other essential elements of Bitcoin like their implications, conditions, etc. Consequently, all this data can be accessed through our competent Bitcoin playbook.

What Can Bitcoin Do for Your Company?

The broad picture says that most companies are currently using Bitcoin because it may provide access to new demographic information. Furthermore, in this emerging phase of the digital future, Bitcoin investment will help companies position themselves in the global market.

Additionally, Bitcoin aids companies and their internal environment gain more information about the new technology. It enables them to access their liquidity pools and capital assets to new & modern asset classes, from traditional token investments.

Bitcoin – Pros & Cons

Unlike other investment options, Bitcoin also has some good signs and repercussions that must be kept in mind. Henceforth, check out some of the advantages and disadvantages related to bitcoin. They are as follows:

Pros:

- Low transaction costs

- Protection from some political risk and inflation

- International transfer-ability and convertibility, etc.

Cons:

- Currently volatile value

- Lack of trusted intermediaries to challenge fraud

- Uncertainty about security and operational resiliency, etc.

Business Implications of Bitcoin for Financial Services Company

Consequently, top three business implications include:

- Retail and investment banking - Financial services companies and firms like these may begin looking at the use of Bitcoin as collateral, their acceptance as deposits, Bitcoin trading, and pursuit of business with Bitcoin-related companies.

- Hedging & investment services - Financial firms may consider building new investment offerings focused on Bitcoin, such as exchange-traded funds and index funds.

- Payments - Financial services companies may need to innovate their dominance to retain in this space. Also, the transfer of payments via Bitcoin between individuals is simpler, faster, and less expensive than those offered by many firms.

Conditions of Bitcoin (Digital Currency) for Mainstream Adoption

Bitcoin is a traditional digital alternative currency that relies heavily on cryptocurrency for its operations. Moreover, there are three major conditions for mainstream adoption. Hence, the conditions are explained below:

- Trust - Lack of investor protection may further inhibit trust. Trust is challenging, given Bitcoin’s complexity, a decentralized system, volatile with illicit uses, etc.

- Stability - Until stability is reached, Bitcoin’s utility as a medium of exchange, value store, and account unit will be limited. To enter mainstream adoption, Bitcoin’s volatility needs to be moderate.

- Acceptance - Bitcoin’s use is limited because of the lack of acceptance by traditional financial institutions. Likewise, the currency remains a niche phenomenon; still, many businesses are accepting Bitcoin. Also, widespread acceptance appears to be unlikely without price stability.

Tear Down of Efficient Bitcoin Playbook

The next big billion-dollar question is, “What is Bitcoin Playbook, and Why do Corporate need such Playbooks”?

Henceforth, main aim of the playbook is to guide you through the investment process. Moreover, it highlights critical details related to Bitcoin’s history, market size, key strategies, diversification, etc.

So what are some of the most essential guidelines one should include in the Bitcoin playbook?

Continue reading to get this crucial information at your fingertips.

Slide 1: Cover Page

Cover page of the Bitcoin playbook has a fascinating image that aligns with the theme and color of the playbook. One can even include their company name on this cover page.

Consequently, the playbook’s cover slide serves the purpose of defining the agenda behind building this bitcoin playbook.

Download this 100% Editable Slide from Bitcoin Playbook

Slide 2: Overview of Bitcoin Playbook

This slide provide an overview of Bitcoin for corporations. Furthermore, it highlights the essential parts or sections of the playbook along with its description & page numbers. Moreover, key points related to cryptocurrency mentioned in the slide are as follows:

- It is the newest trend that has taken the world by storm. Today each & every individual & corporate investor is investing in them.

- This playbook will give you an overview of Bitcoin as an investment tool.

- Different parts of the playbook include an introduction to Bitcoin as an investment tool, an industry overview, an investment scenario, critical strategies for investing in Bitcoin, etc.

Download this 100% Editable Slide from Bitcoin Playbook

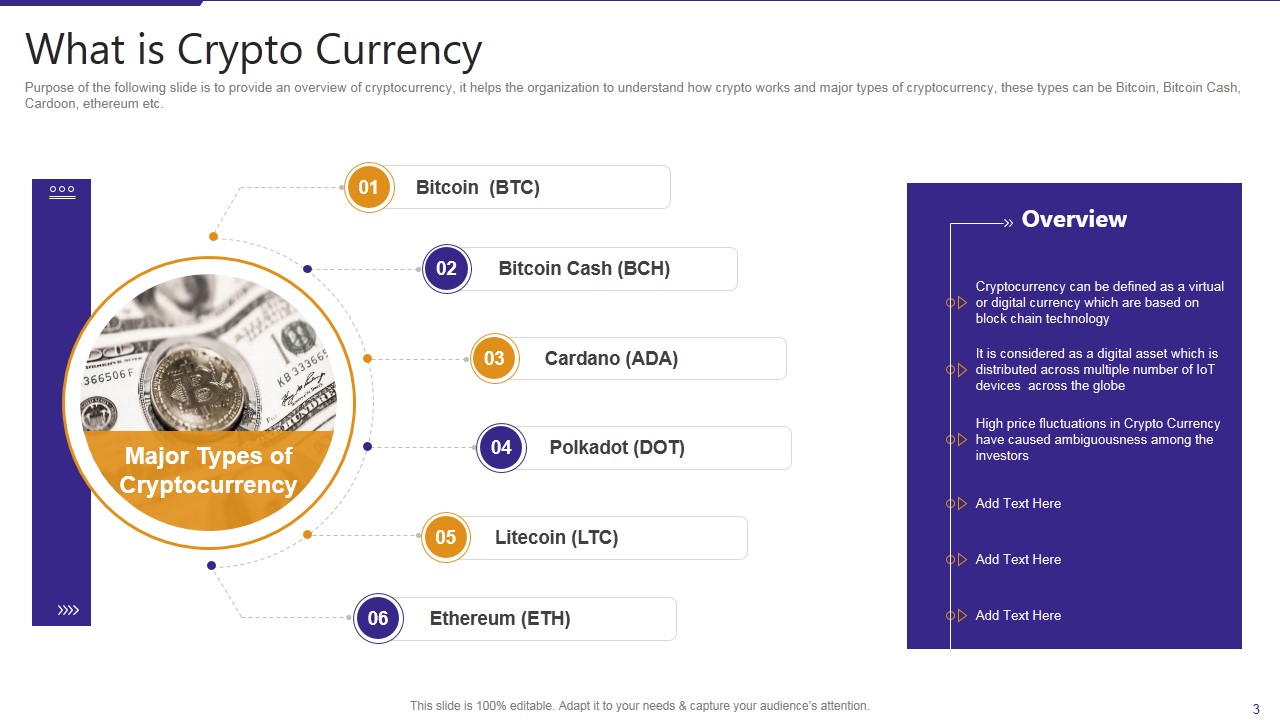

Slide 3: What is Crypto Currency

Purpose of this slide is to define Cryptocurrency. Additionally, it will even help the organization to understand how crypto works and the major types of Cryptocurrency. These types are as follows:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Polkadot (DOT)

- Litecoin (LTC)

- Ethereum (ETH)

Furthermore, an overview of Cryptocurrency includes the following key highlights:

- It can be defined as a virtual or digital currency that is based on blockchain technology

- It is considered a digital asset that is distributed across multiple no. of IoT devices across the globe

- High price fluctuations in Cryptocurrency have caused ambiguousness among investors, etc.

Download this 100% Editable Slide from Bitcoin Playbook

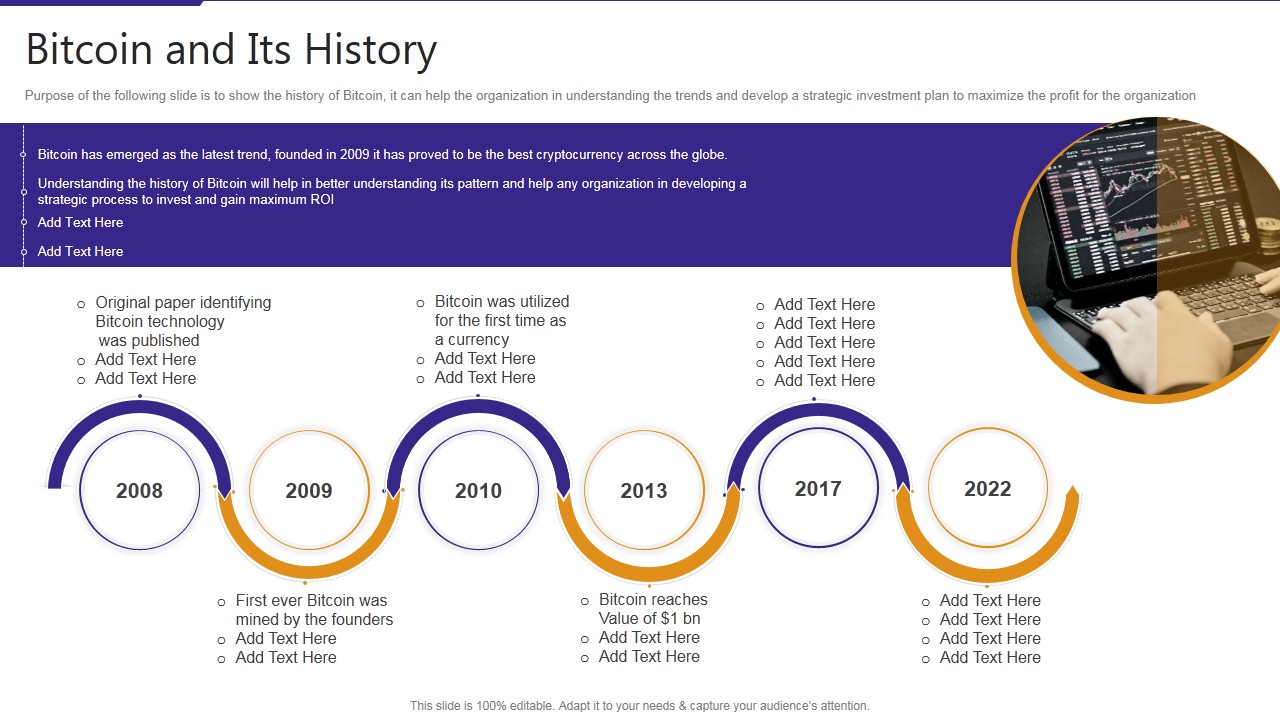

Slide 4: Bitcoin and Its History

This becomes an integral part of your Bitcoin playbook. Consequently, it shows the history of Bitcoin and can help the organization understand the trends & develop a strategic investment plan.

Moreover, Bitcoin has emerged as the latest trend, founded in 2009. It has proved to be the best cryptocurrency across the globe. Understanding the history of Bitcoin will help in better understanding its pattern & assist any company in developing a strategic process to invest & gain maximum ROI.

Furthermore, year-wise history details of Bitcoin are showcased as follows:

● 2008 - original paper identifying Bitcoin technology was published

● 2009 - the founders mined the first-ever Bitcoin

● 2010 - Bitcoin was utilized for the first time as a currency

● 2013 - Bitcoin reaches the value of $1Bn

Likewise, one must illustrate the history details of Bitcoin in the playbook.

Download this 100% Editable Slide from Bitcoin Playbook

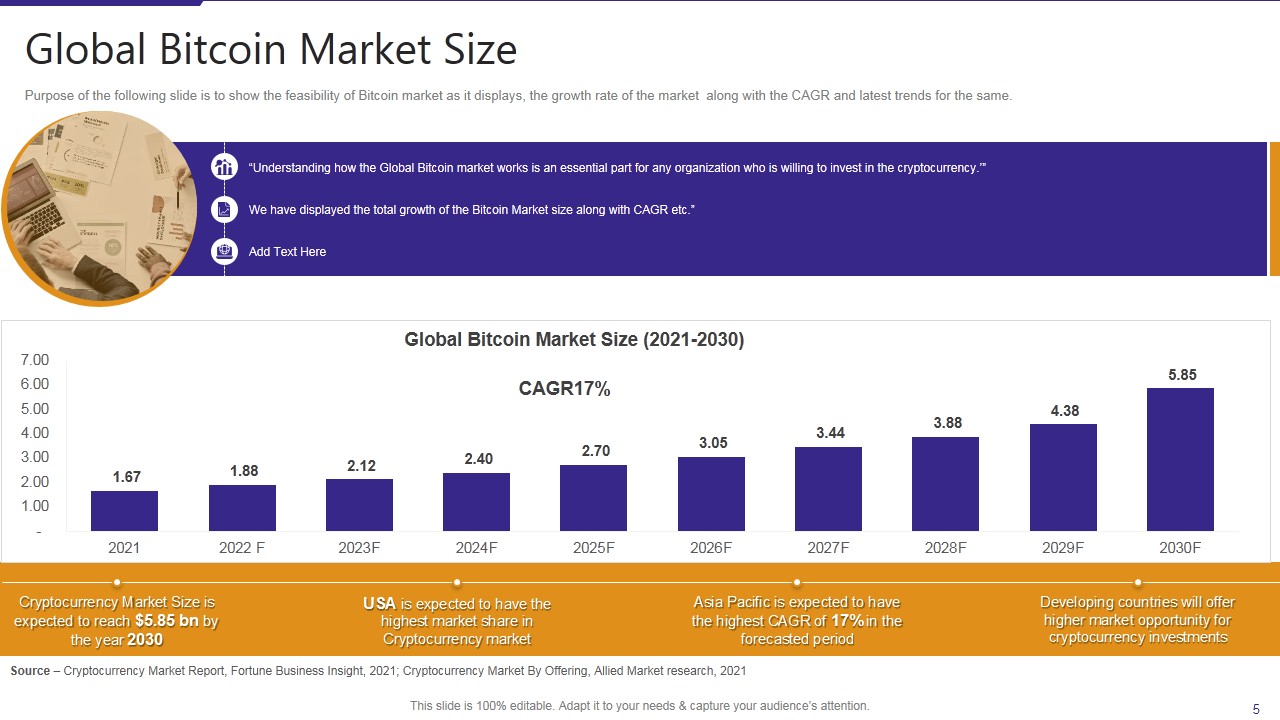

Slide 5: Global Bitcoin Market Size

This slide depicts the feasibility of the Bitcoin market as it showcases the market's growth rate along with the CAGR and latest trends for the same.

Henceforth, key highlights mentioned related to the global Bitcoin market size include:

● We need to understand how the global Bitcoin market works. It is an essential part of any firm willing to invest in cryptocurrency.

● Bar chart highlights yearly (2021-2030) global Bitcoin market size in billions along with CAGR.

● The cryptocurrency market size is expected to reach $5.85 bn by the year 2030

● The USA is expected to have the highest market share in the Cryptocurrency market.

● Asia Pacific is expected to have the highest CAGR of 17% in the forecasted period.

● Developing countries will offer higher & efficient market opportunities for cryptocurrency investments.

Download this 100% Editable Slide from Bitcoin Playbook

Slide 6: Key Strategies to Invest in Cryptocurrency

One of the most vital guidelines for the Bitcoin playbook is displaying key strategies to invest in cryptocurrencies. Moreover, these strategies help the investor by minimizing the risk & ensuring hiked returns. The strategy to invest in cryptocurrencies can be:

● Prioritizing Liquidity in your Portfolio

● Purchasing standalone Bitcoin

● Diversifying Investment by choosing the right mix

● Bitcoin Investment Trust

● Other key strategies, etc.

Additionally, Investment in Bitcoin is a very tricky task. It requires a detailed planning process and a strategic approach to minimize the risk.

Download this 100% Editable Slide from Bitcoin Playbook

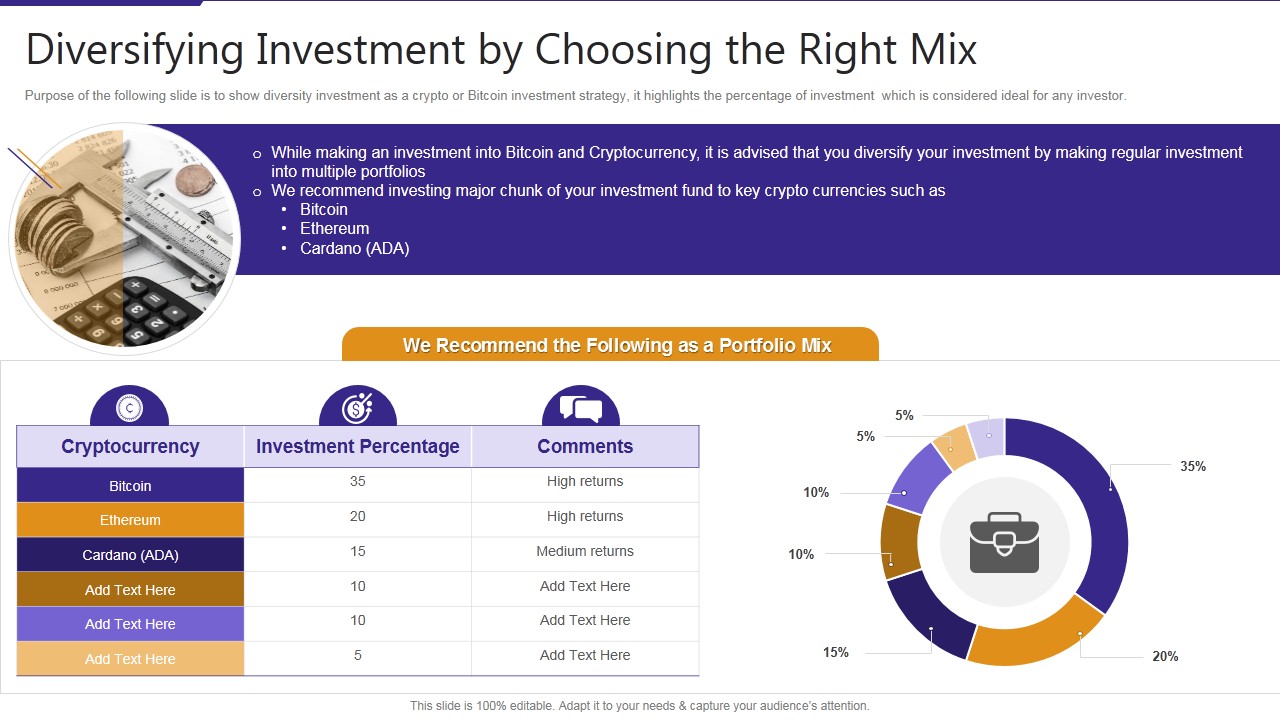

Slide 7: Diversifying Investment by Choosing Right Mix

Individual investors and corporates investing in cryptocurrency must know that diversifying the portfolio will give them higher returns. This slide shows diversity investment as a crypto or Bitcoin investment strategy. It highlights the percentage of investment that is considered ideal for any investor.

Consequently, key points related to diversifying investment are as follows:

● While investing in Bitcoin, it is advised that you diversify your investment by making regular investments into multiple portfolios.

● We recommend investing a significant chunk of your investment fund in key cryptocurrencies such as Bitcoin, Ethereum, and Cardano (ADA)

● Investment percentage you can give to each of these 3 cryptocurrencies is in this way: Bitcoin - 35% (higher returns), Ethereum - 20% (high returns), Cardano - 15% (medium returns), rest 30% to other investment options.

Download this 100% Editable Slide from Bitcoin Playbook

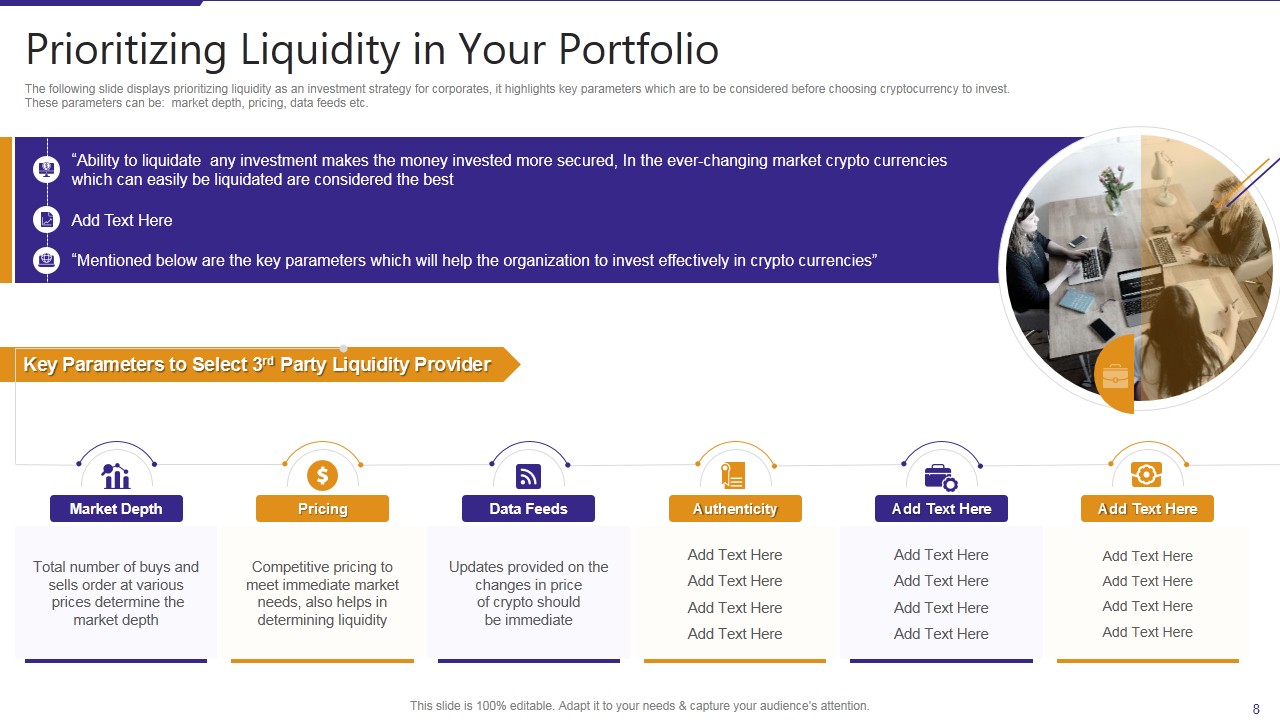

Slide 8: Prioritizing Liquidity in your Portfolio

No matter how sound you are as an individual or organization with funds, prioritize liquidity in your investment portfolio. This slide displays critical parameters to consider before choosing a cryptocurrency to invest. Furthermore, these parameters to select 3rd party liquidity provider can be:

● Market depth - total no. of buys and sells order at various prices determine the market depth

● Pricing - competitive pricing to meet immediate market needs also helps in determining liquidity

● Data feed - updates on the price changes of crypto should be immediate, etc.

The ability to liquidate any investment makes money invested more secure. In the ever-changing market, easily liquidating crypto-currencies are the best. Hence, mentioned above are the key parameters which will help the organization invest effectively in cryptocurrencies.

Download this 100% Editable Slide from Bitcoin Playbook

Slide 9: Multiple Set of Strategies to Increase ROI from Bitcoin

This slide showcases key strategies for investing in Bitcoin. These strategies can reduce the investors' risk by diversifying their investment & increase the ROI. The strategies include:

● Purchasing standalone Bitcoin reduces the risk of market volatility, invests and purchases only a single Bitcoin, and does not invest in any other cryptocurrency.

● Bitcoin investment trust - this strategy increases the ROI by diversifying the investment portfolio and outsourcing the investments made in Bitcoin to a reliable partner.

● Other vital strategies - include buying & hold Bitcoin, holding Bitcoin for long-term investment, trading Bitcoin on short-term volatility, etc.

Multiple small strategies can help in investing in Bitcoin and other cryptocurrencies. These strategies aim at increasing ROI for the organization. The above strategies provide you with a clear vision of how you should invest in Bitcoin or any other cryptocurrency.

Download this 100% Editable Slide from Bitcoin Playbook

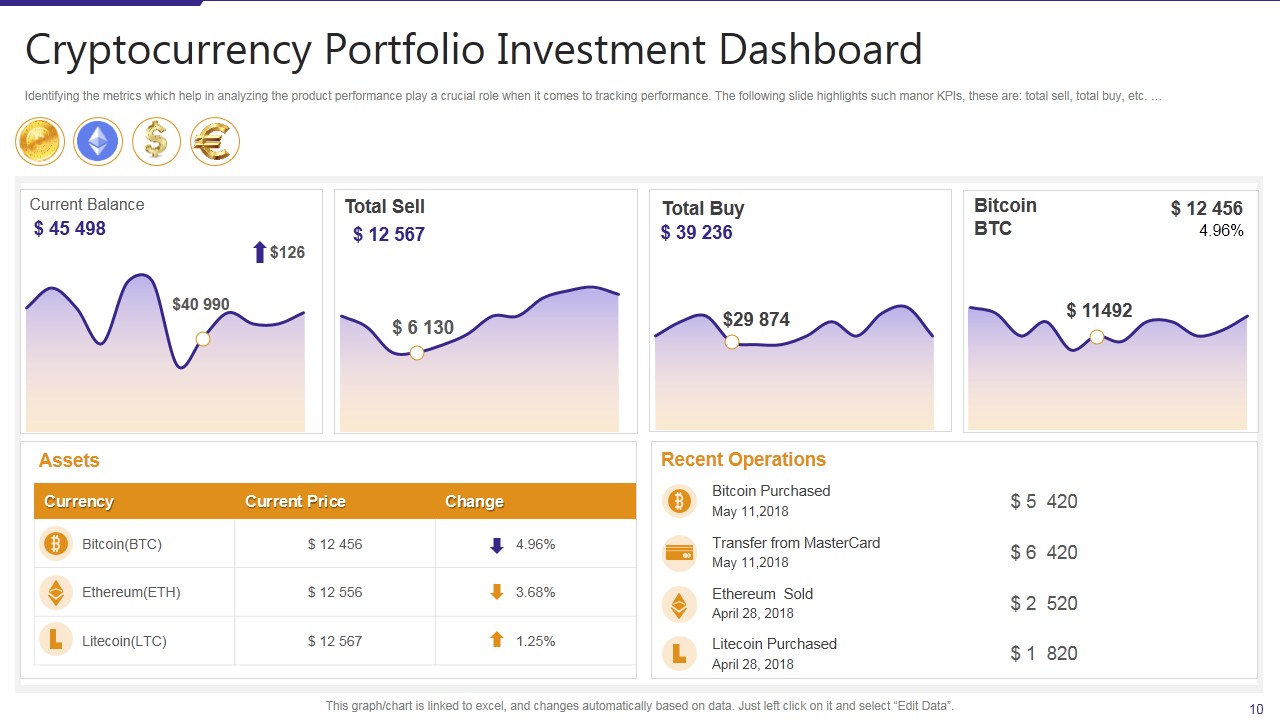

Slide 10: Cryptocurrency Portfolio Investment Dashboard

Most important guideline includes a dashboard for cryptocurrency portfolio investment. This slide will identify the metrics which help in analyzing the product performance. It plays a crucial role when it comes to tracking performance. The following slide highlights major KPIs, such as:

● Current balance, total sell, total buy, Bitcoin BTC balance - all figures in dollars

● Tabular representation of all the currency assets along with their current price & change

● Recent operations details - Bitcoin purchased (date & amount), transfer from MasterCard (date & amount), Ethereum sold (date & amount), etc.

Download this 100% Editable Slide from Bitcoin Playbook

End Notes

Whether an individual or corporate firm, you need a Bitcoin playbook that guides you through the complete process of investment. If you don't have this playbook, drawing up guidelines for yourself & executing them effectively can be challenging.

Download this competently designed Bitcoin Playbook drafted by SlideTeam.

In case you need assistance, feel free to call us at 408-659-4170. You can even inbox us your query.

Moreover, start a chat by signup for our PPT membership, starting at $49.99.

Customer Reviews

Customer Reviews

![All You Need to Know About an Efficient IT Infrastructure Playbook [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/06/39-1013x441.png)

![Netflix’s Original Pitch Deck [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/06/32-1-1013x441.jpg)