Evaluating Debt And Equity Fundraising Options For Business Expansion Powerpoint Presentation Slides

A fundraising strategy can help the organization formulate a plan for raising market funds and help startups compare and evaluate their funding options. Check out our efficiently designed presentation on Evaluating Debt and Equity Fundraising Options for Business Expansion. This PPT showcases the need to raise funds from the market and estimate the net funding required for the organization. It provides sources for raising funds from debt financing and shows the advantages and disadvantages of debt as an option for fundraising. The PowerPoint offers an overview of fundraising using equity financing. It also showcases drawbacks and compares equity fundraising options based on startup failure rate. Furthermore, the PPT includes a process of raising capital using venture capitalist financing. It also illustrates raising funds impact on shareholding patterns and financial ratios. Lastly, it showcases return expectations and strategies to exit from a startup for investors. Download our 100 percent editable and customizable template, which is also compatible with Google Slides.

A fundraising strategy can help the organization formulate a plan for raising market funds and help startups compare and ev..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

This complete deck covers various topics and highlights important concepts. It has PPT slides which cater to your business needs. This complete deck presentation emphasizes Evaluating Debt And Equity Fundraising Options For Business Expansion Powerpoint Presentation Slides and has templates with professional background images and relevant content. This deck consists of total of seventy seven slides. Our designers have created customizable templates, keeping your convenience in mind. You can edit the color, text and font size with ease. Not just this, you can also add or delete the content if needed. Get access to this fully editable complete presentation by clicking the download button below.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Evaluating Debt and Equity Fundraising Options for Business Expansion. State your company name and begin.

Slide 2: This slide states Agenda of the presentation.

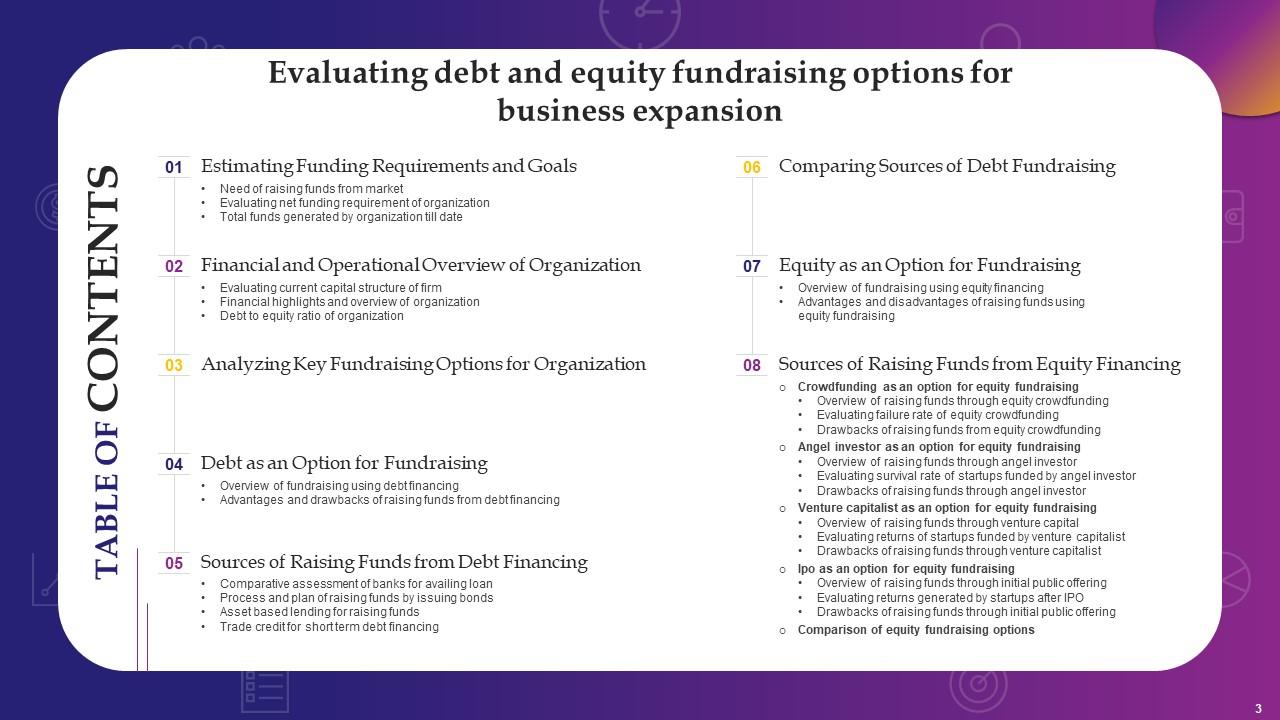

Slide 3: This slide presents Table of Content for the presentation.

Slide 4: This is another slide continuing Table of Content for the presentation.

Slide 5: This slide highlights title for topics that are to be covered next in the template.

Slide 6: This slide showcases reasons due to which organization wants to raise funds from equity and debt market.

Slide 7: This slide showcases current valuation of company and capital needed to expand operations of organization.

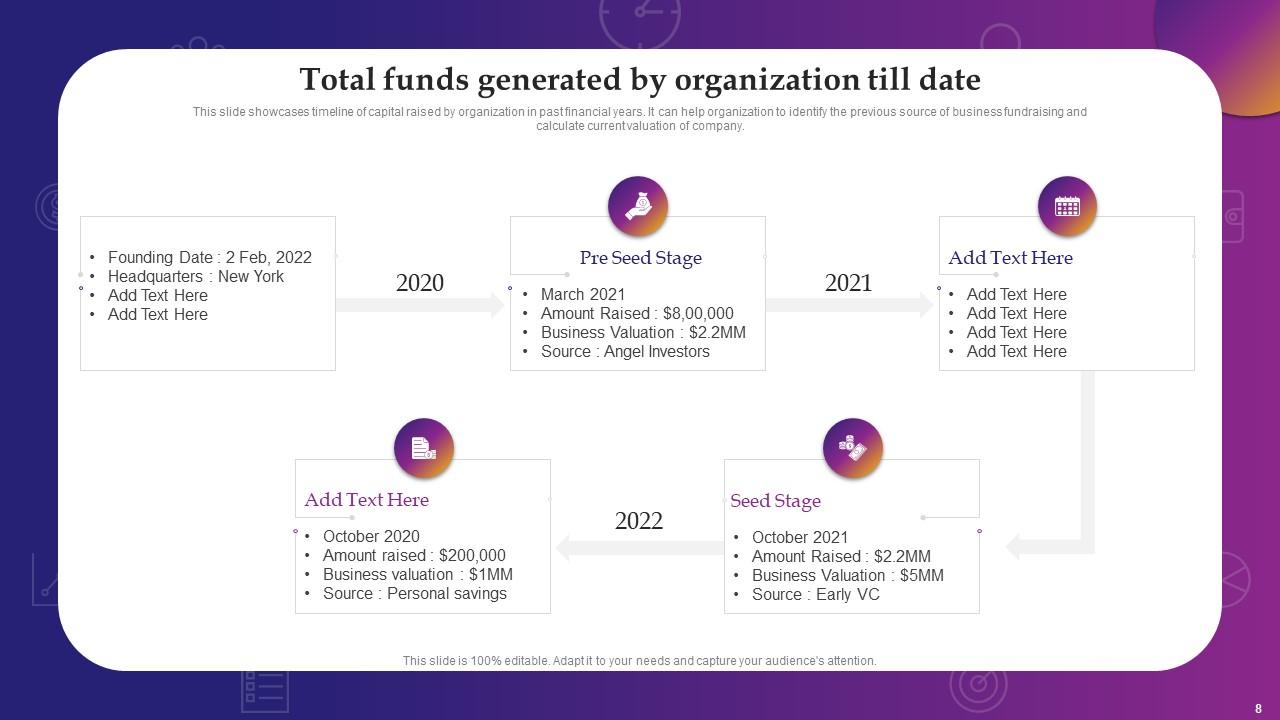

Slide 8: This slide presents Total Funds Generated by Organization Till Date.

Slide 9: This slide highlights title for topics that are to be covered next in the template.

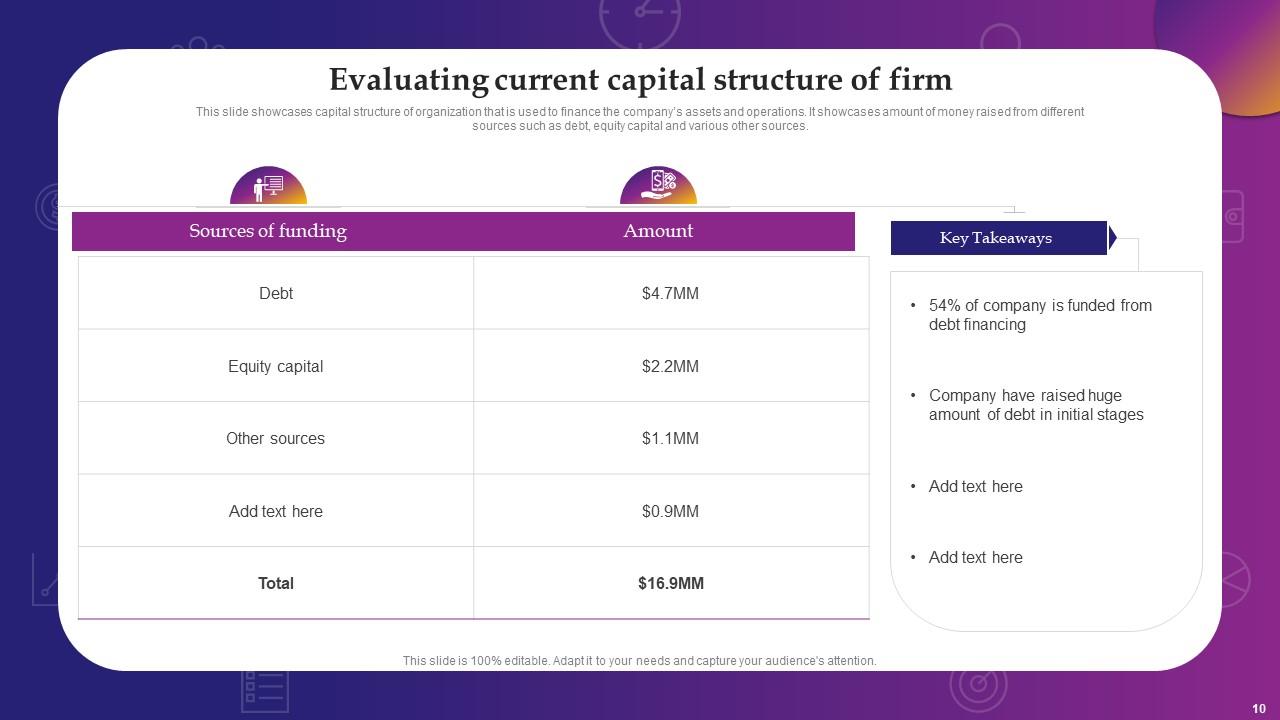

Slide 10: This slide showcases capital structure of organization that is used to finance the company’s assets.

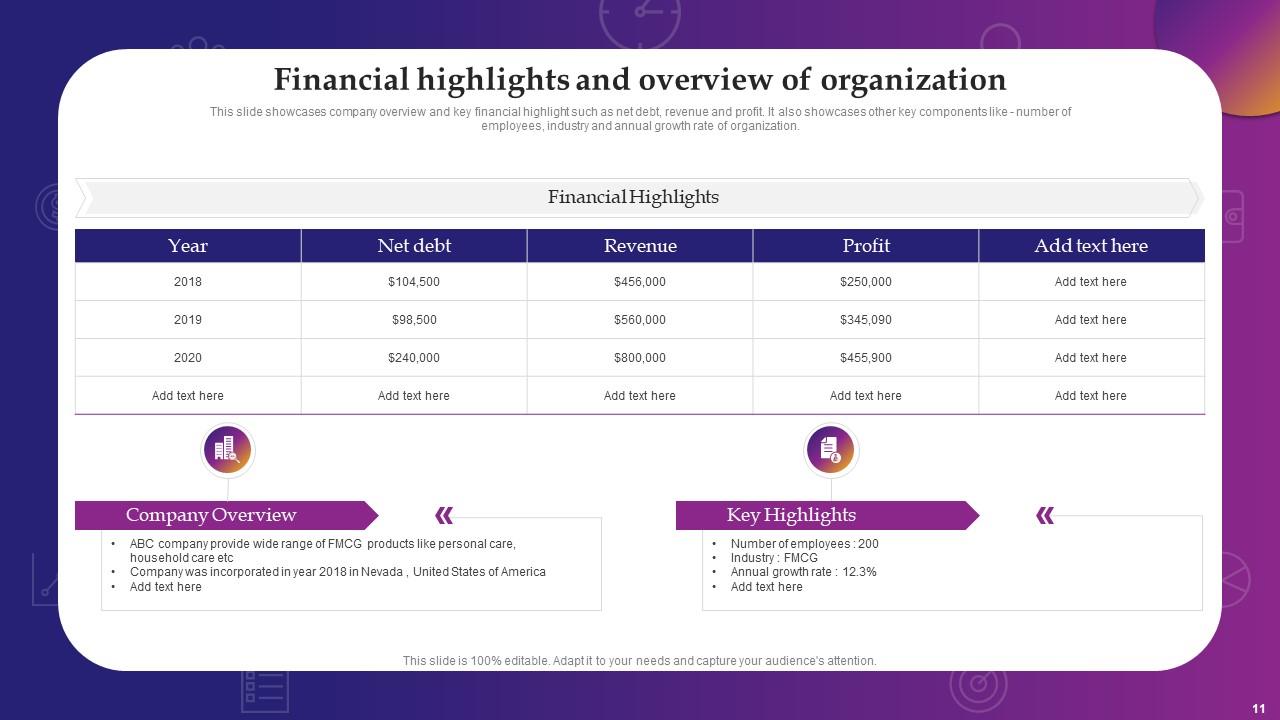

Slide 11: This slide shows Financial Highlights and Overview Of Organization.

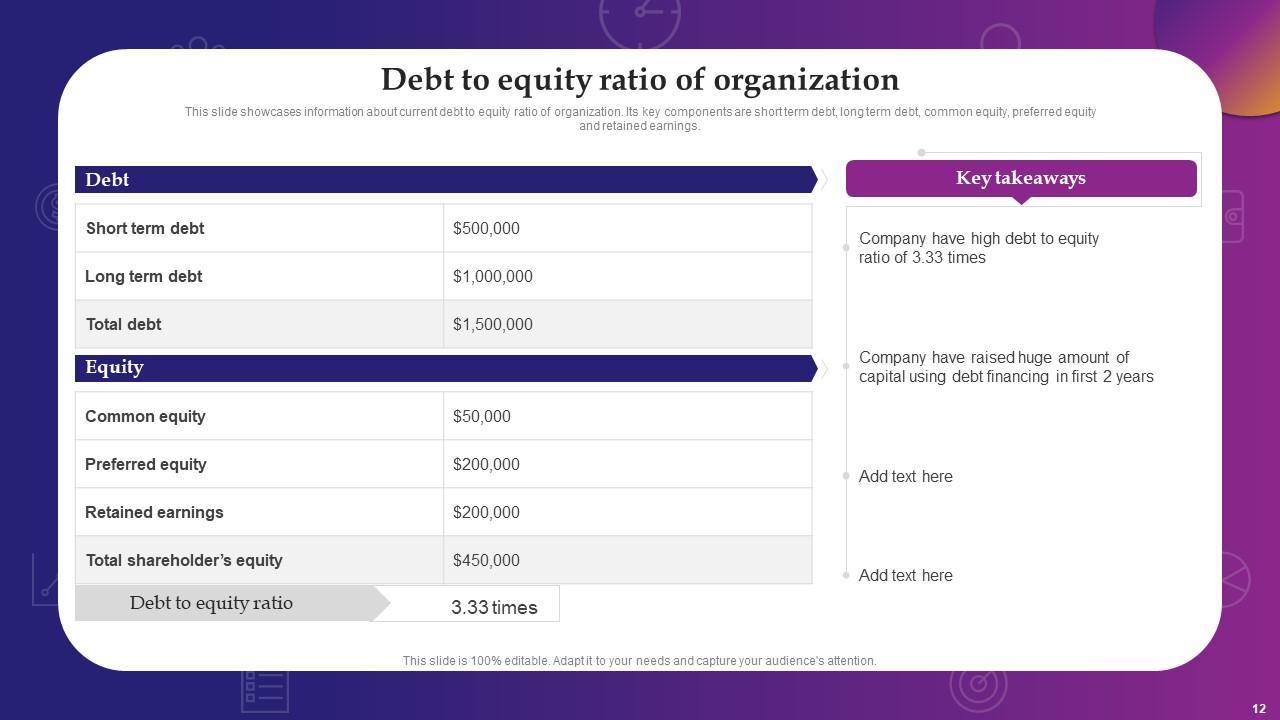

Slide 12: This slide presents information about current debt to equity ratio of organization.

Slide 13: This slide highlights title for topics that are to be covered next in the template.

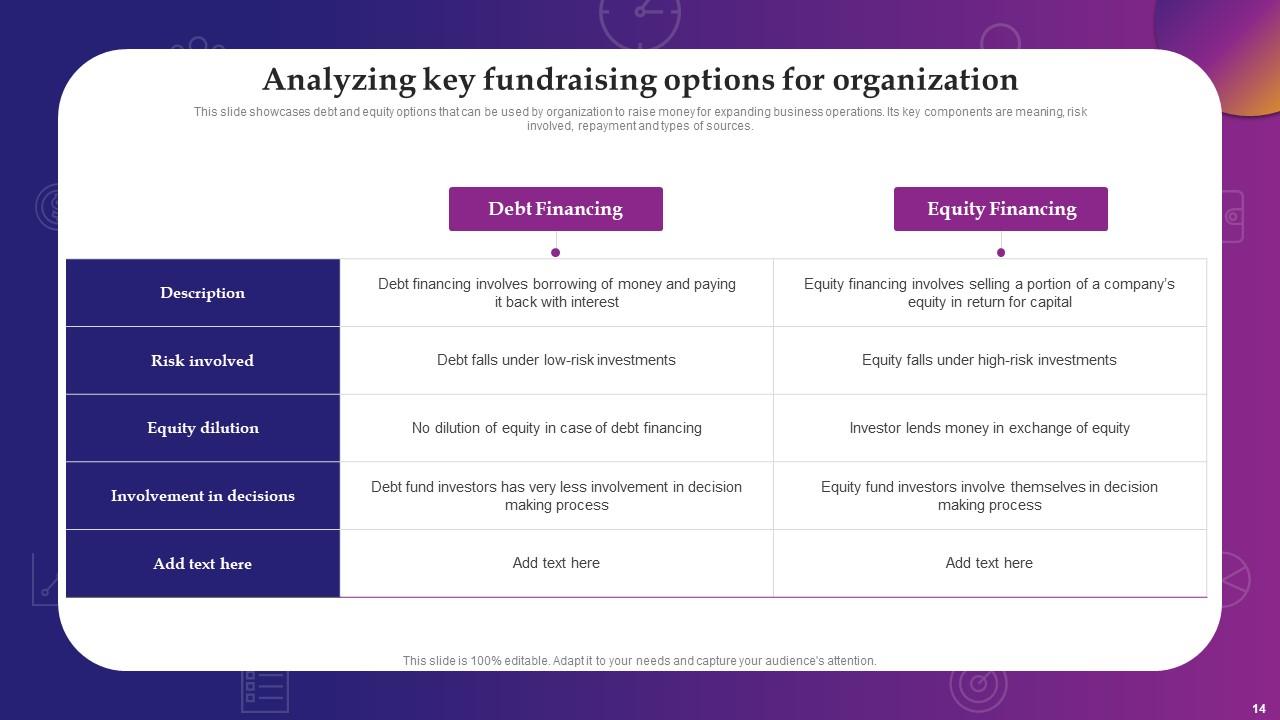

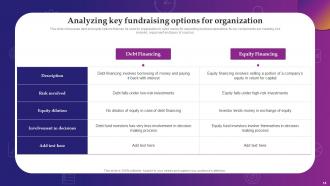

Slide 14: This slide displays Analyzing Key Fundraising Options for Organization.

Slide 15: This slide highlights title for topics that are to be covered next in the template.

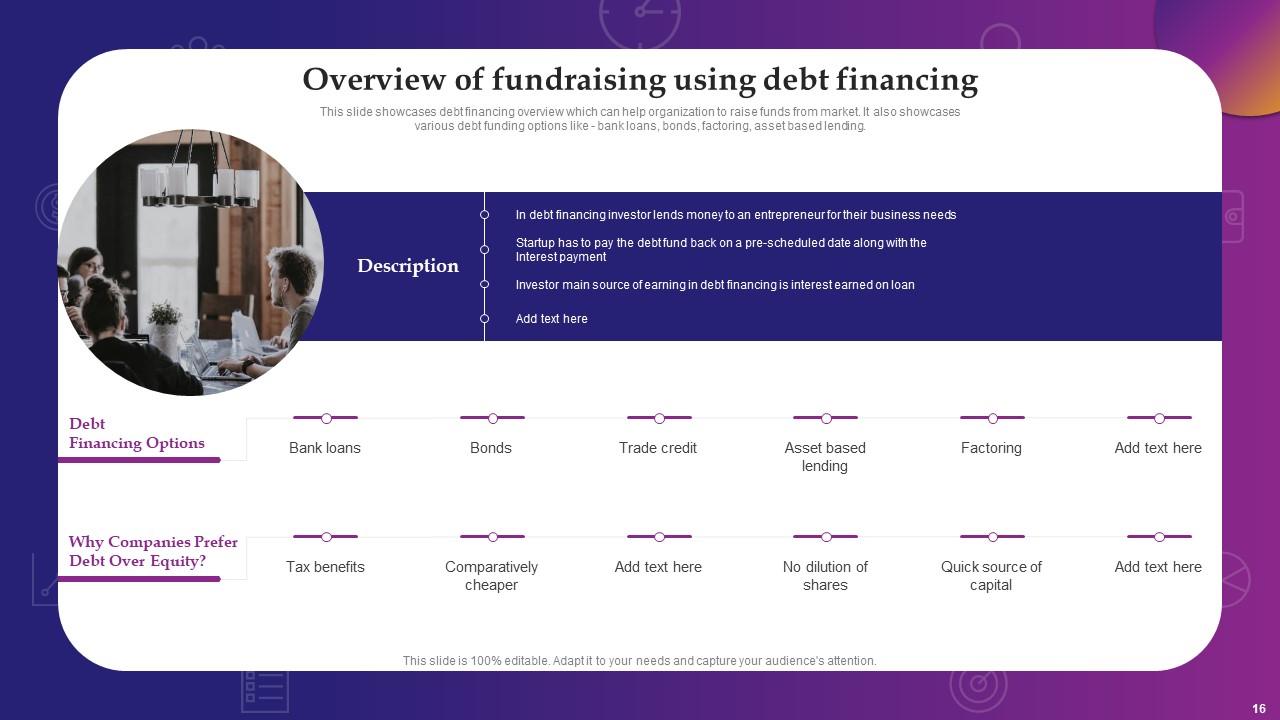

Slide 16: This slide showcases debt financing overview which can help organization to raise funds from market.

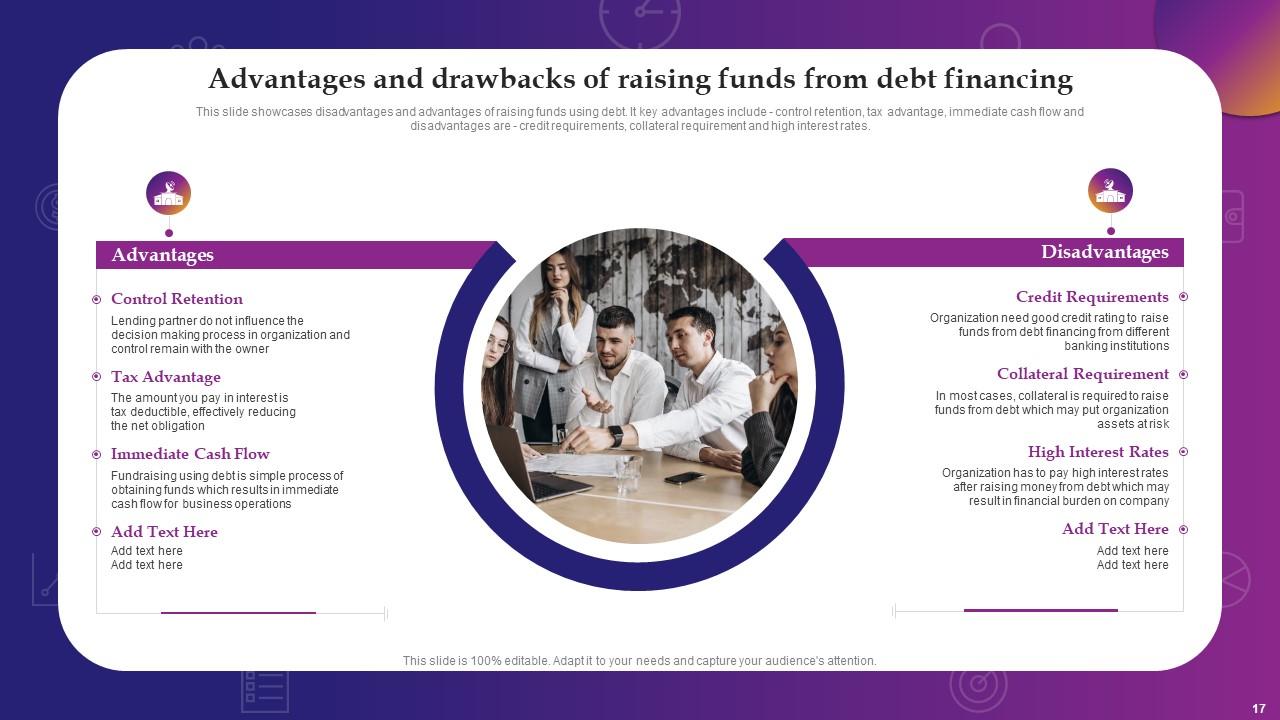

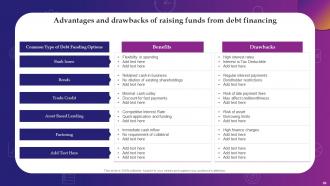

Slide 17: This slide shows Advantages and Drawbacks of Raising Funds from Debt Financing.

Slide 18: This slide highlights title for topics that are to be covered next in the template.

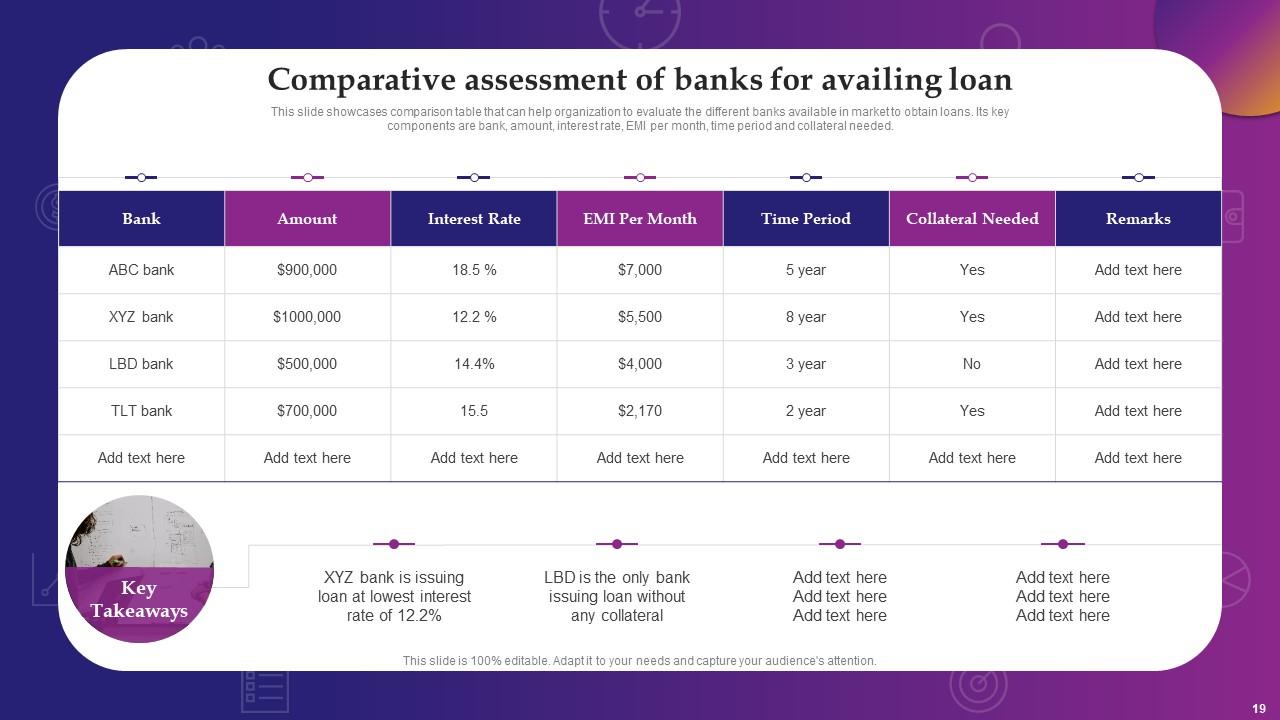

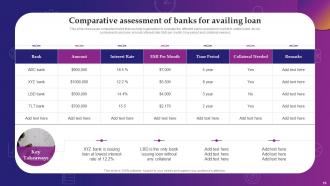

Slide 19: This slide presents Comparative Assessment of Banks for Availing Loan.

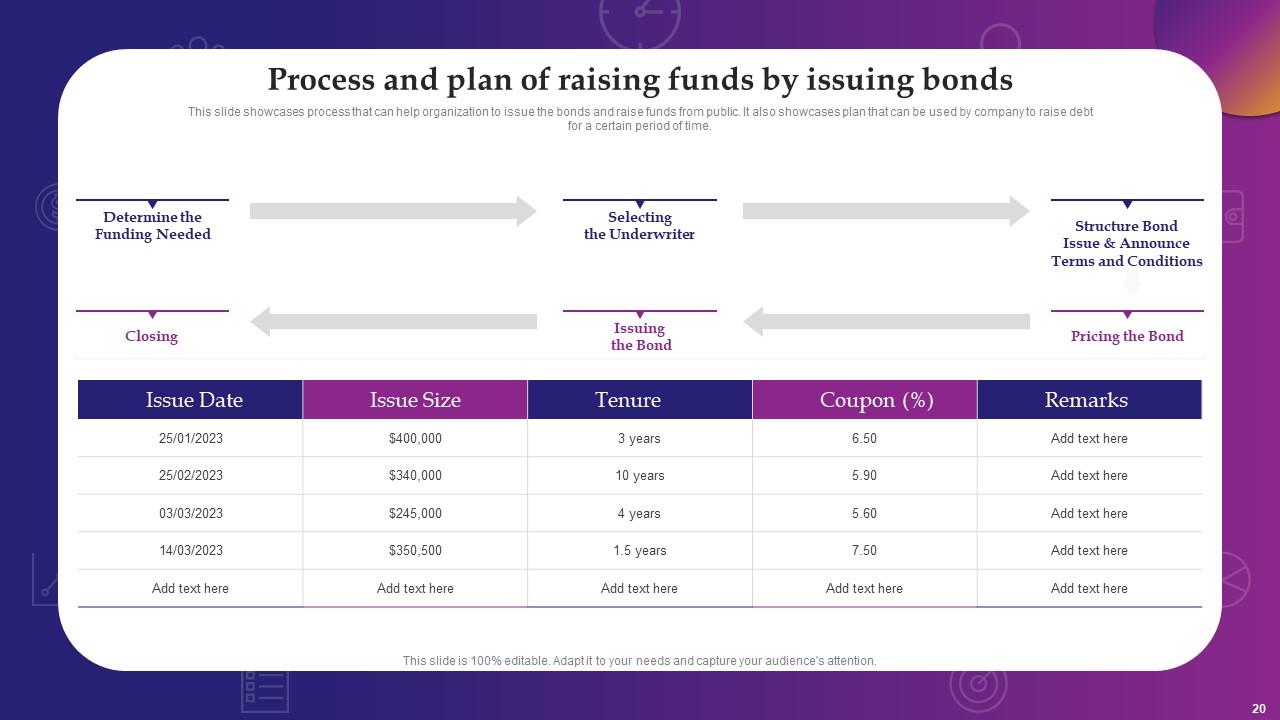

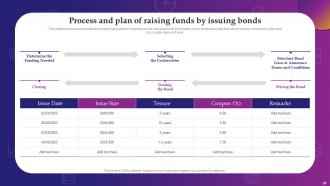

Slide 20: This slide displays Process and Plan of Raising Funds by Issuing Bonds.

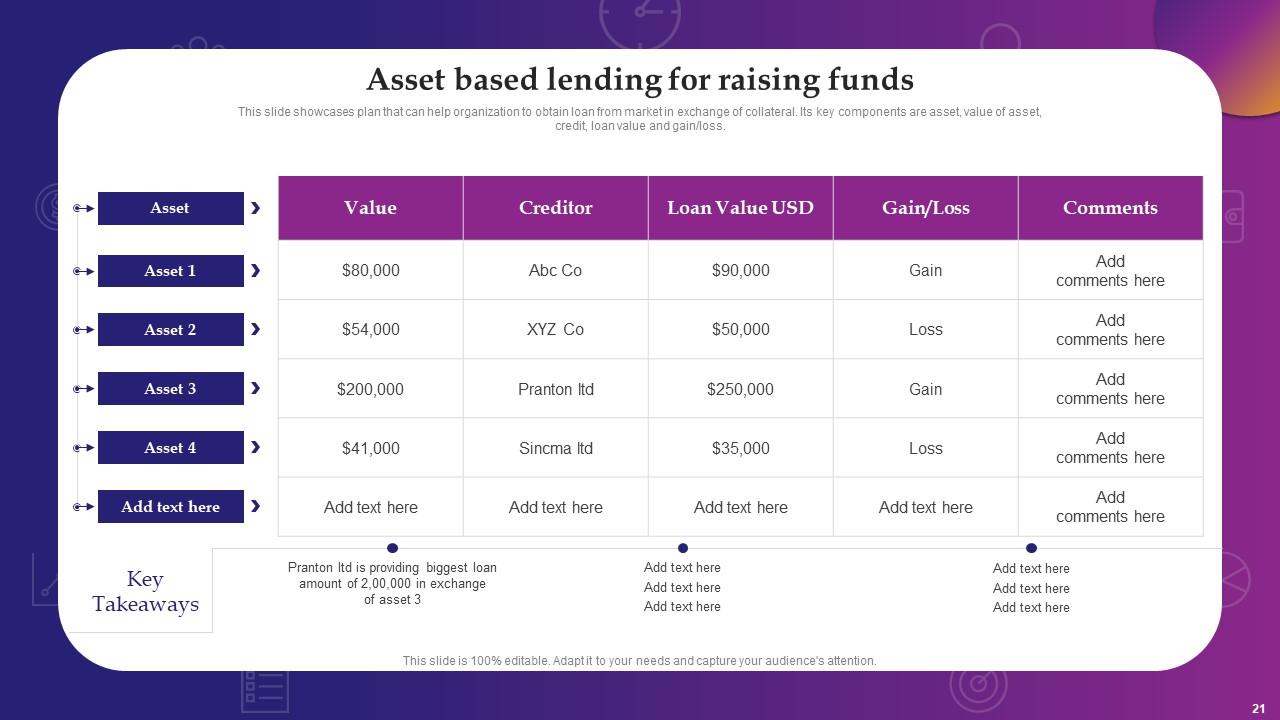

Slide 21: This slide showcases plan that can help organization to obtain loan from market.

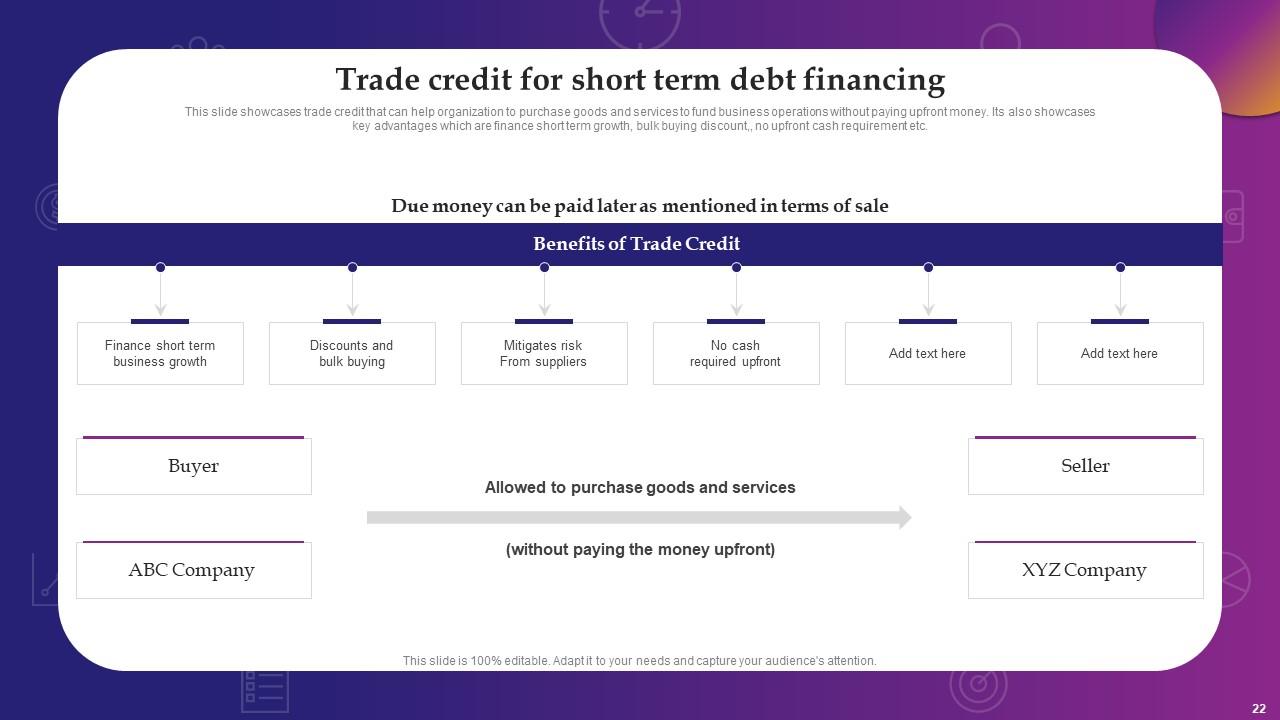

Slide 22: This slide shows trade credit that can help organization to purchase goods and services.

Slide 23: This slide highlights title for topics that are to be covered next in the template.

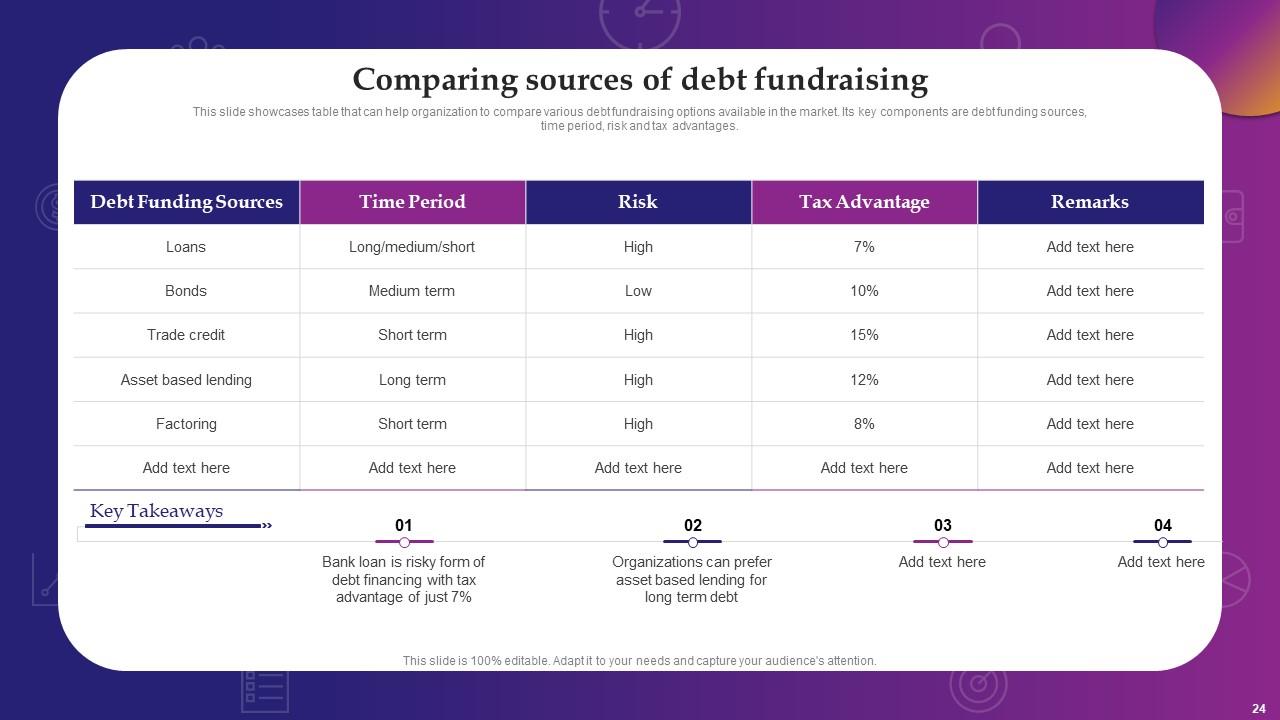

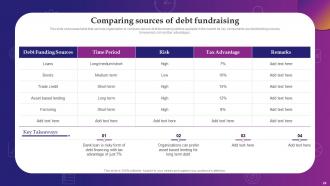

Slide 24: This slide presents Comparing Sources of Debt Fundraising.

Slide 25: This slide highlights title for topics that are to be covered next in the template.

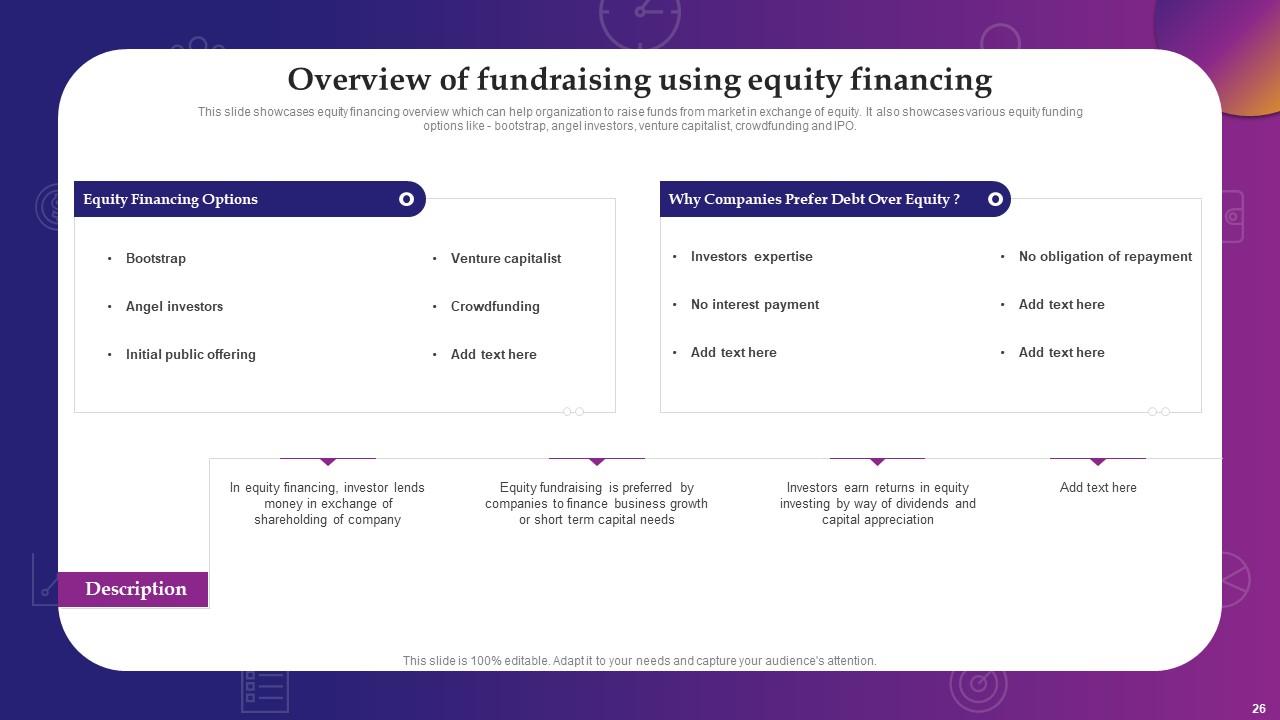

Slide 26: This slide displays Overview of Fundraising Using Equity Financing.

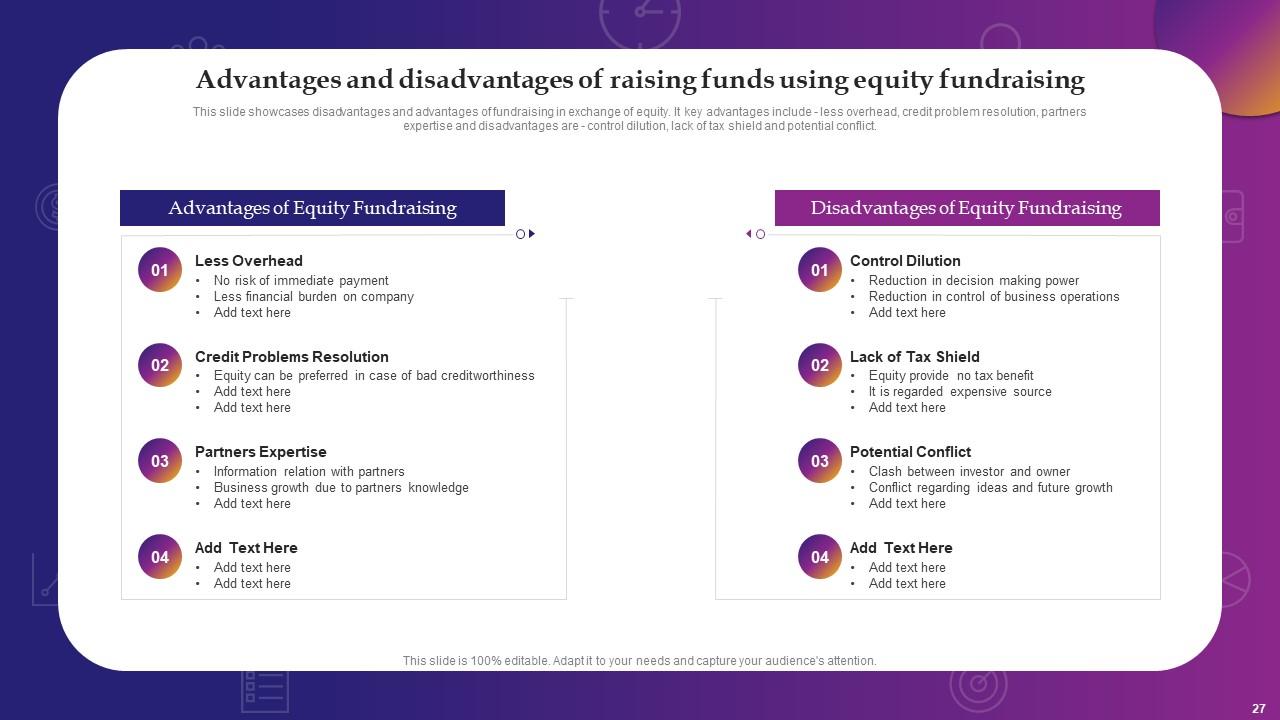

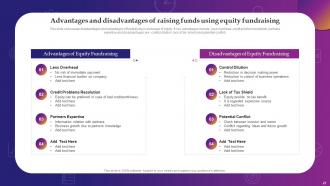

Slide 27: This slide represents Advantages and Disadvantages of Raising Funds Using Equity Fundraising.

Slide 28: This slide highlights title for topics that are to be covered next in the template.

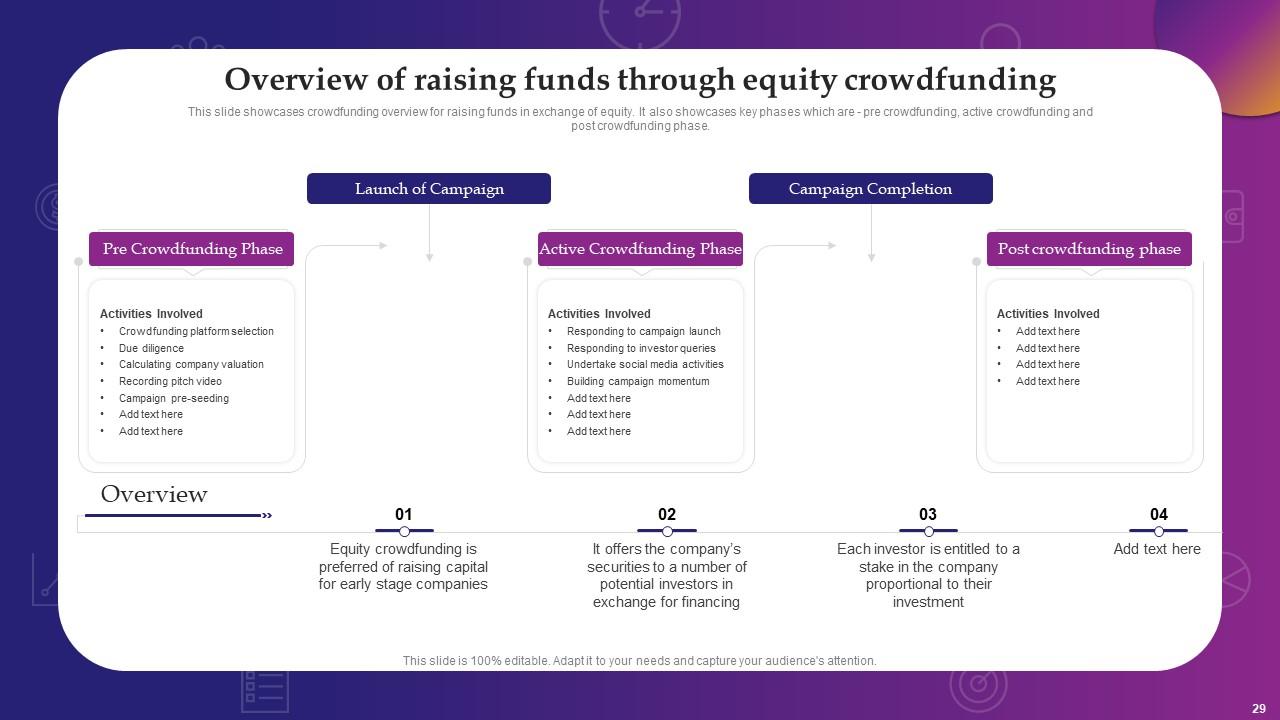

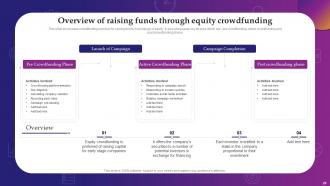

Slide 29: This slide showcases Overview Of Raising Funds Through Equity Crowdfunding.

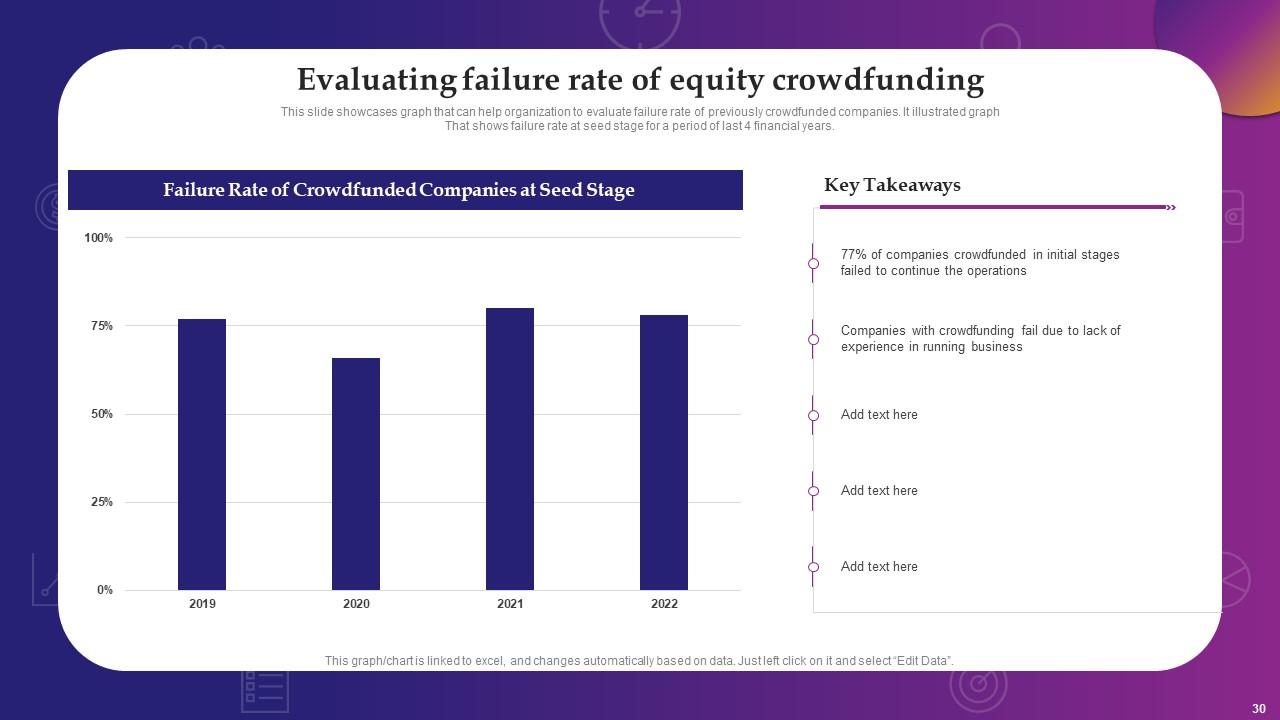

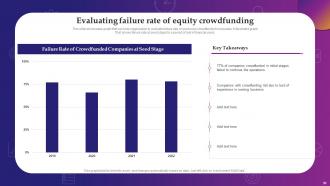

Slide 30: This slide shows Failure rate of crowdfunded companies at seed stage.

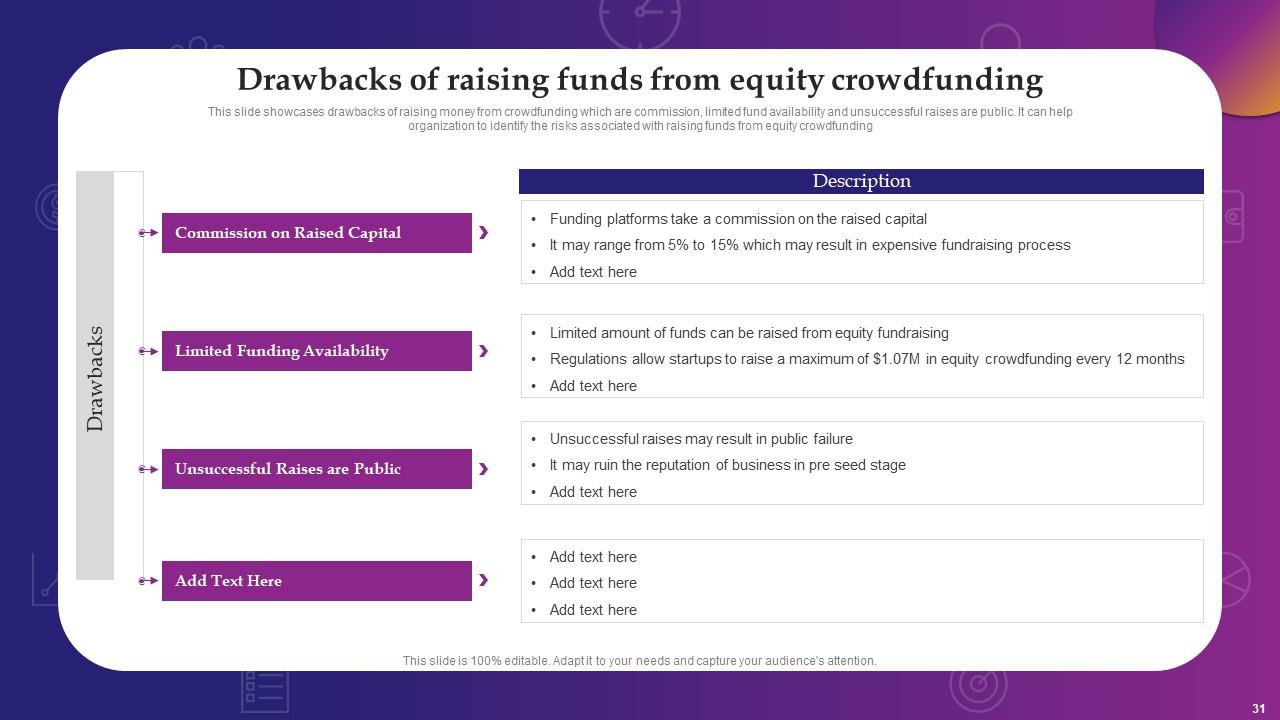

Slide 31: This slide presents Drawbacks of Raising Funds from Equity Crowdfunding.

Slide 32: This slide highlights title for topics that are to be covered next in the template.

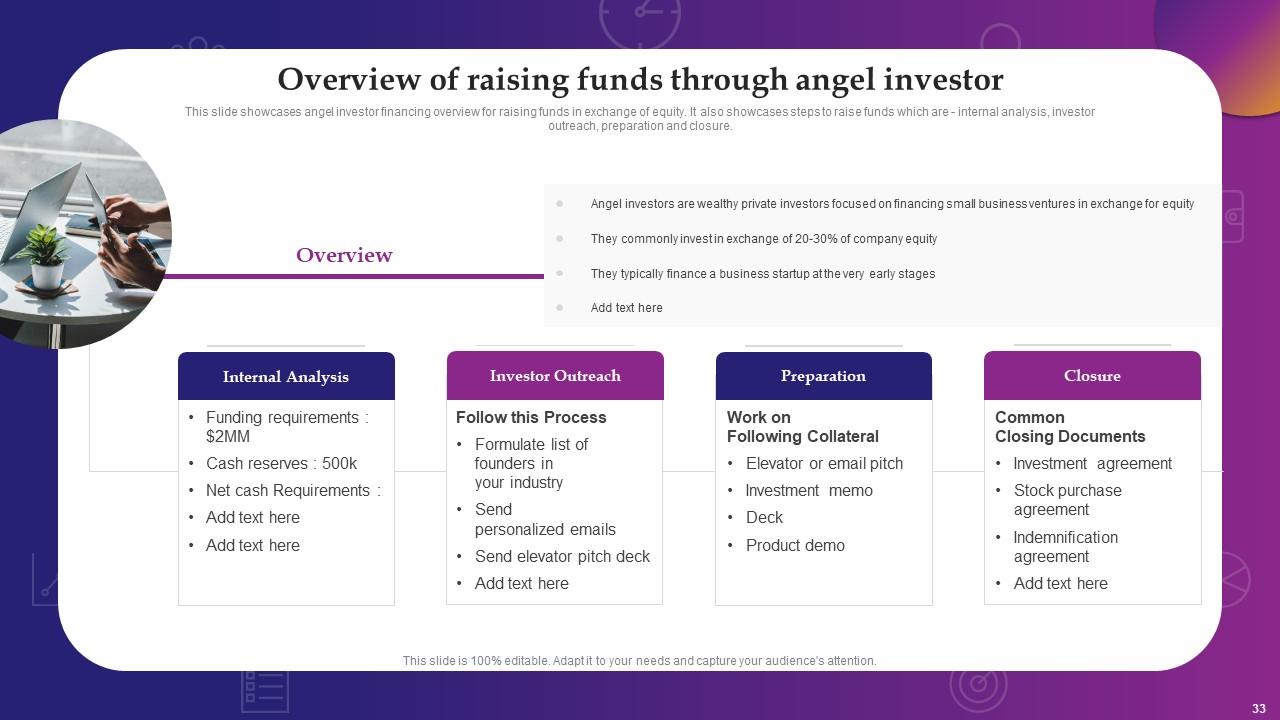

Slide 33: This slide displays Overview Of Raising Funds Through Angel Investor.

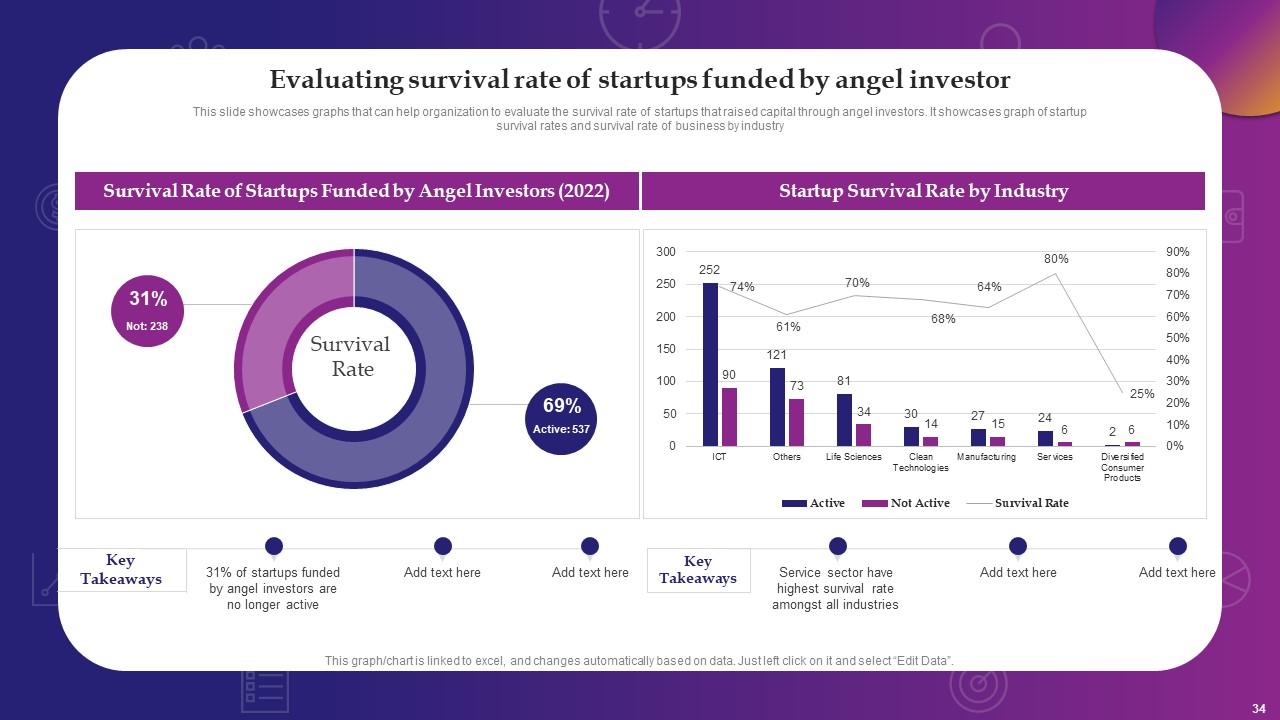

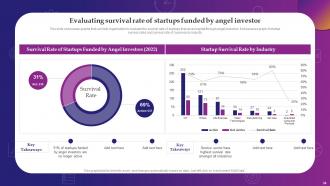

Slide 34: This slide represents Evaluating Survival Rate of Startups Funded by Angel Investor.

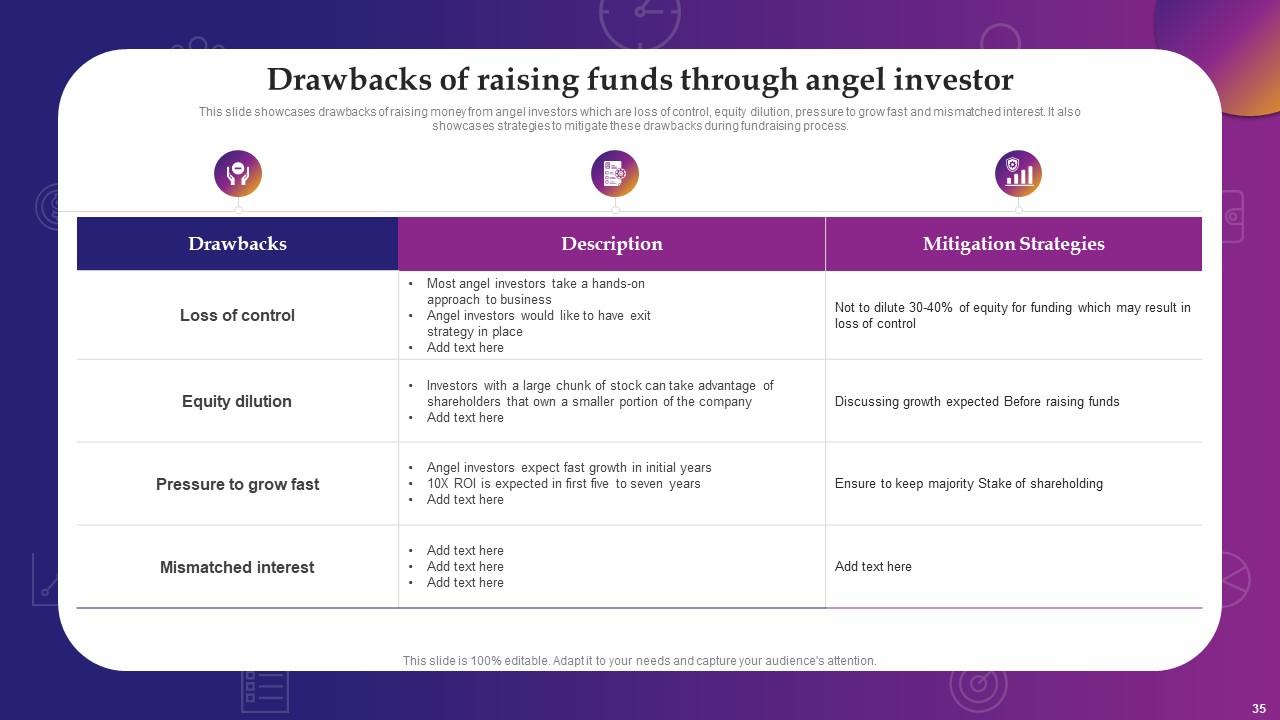

Slide 35: This slide showcases Drawbacks of Raising Funds Through Angel Investor.

Slide 36: This slide highlights title for topics that are to be covered next in the template.

Slide 37: This slide shows Overview of Raising Funds Through Venture Capital.

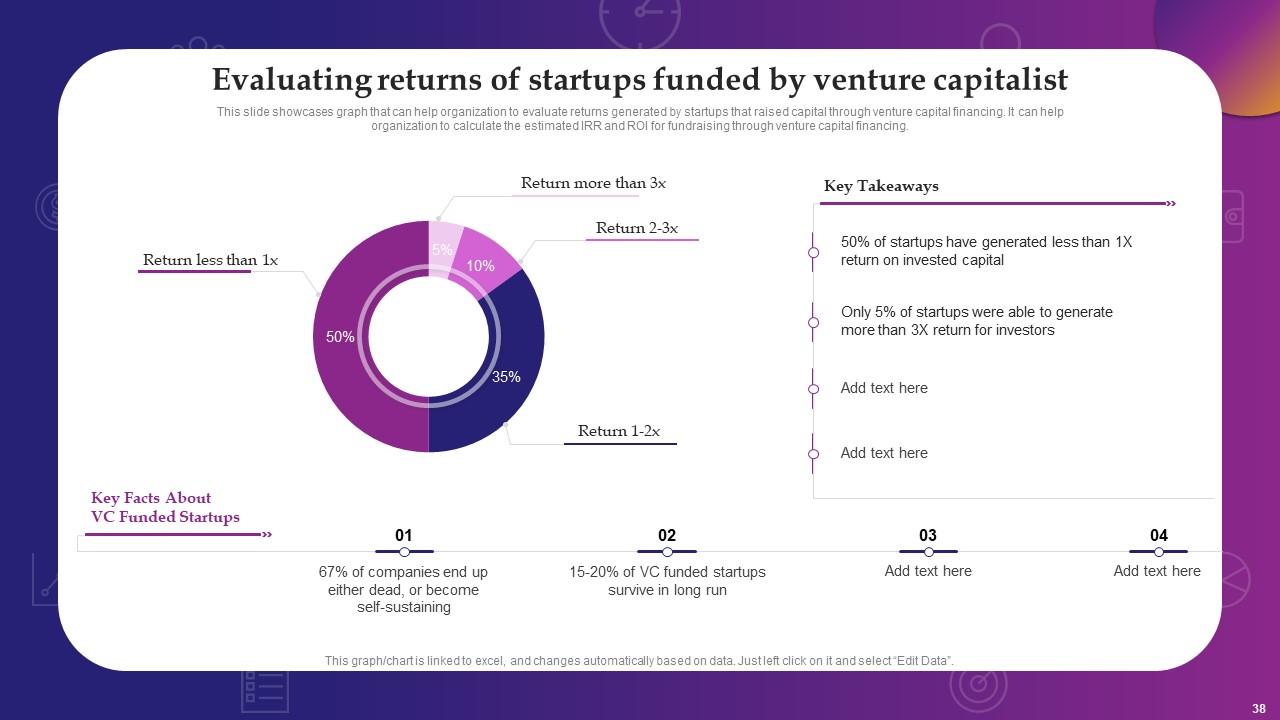

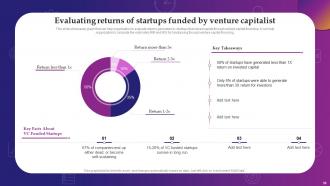

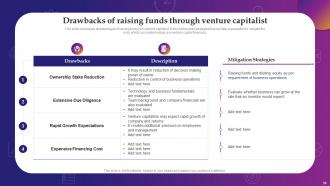

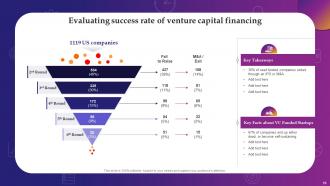

Slide 38: This slide presents Evaluating Returns of Startups Funded by Venture Capitalist.

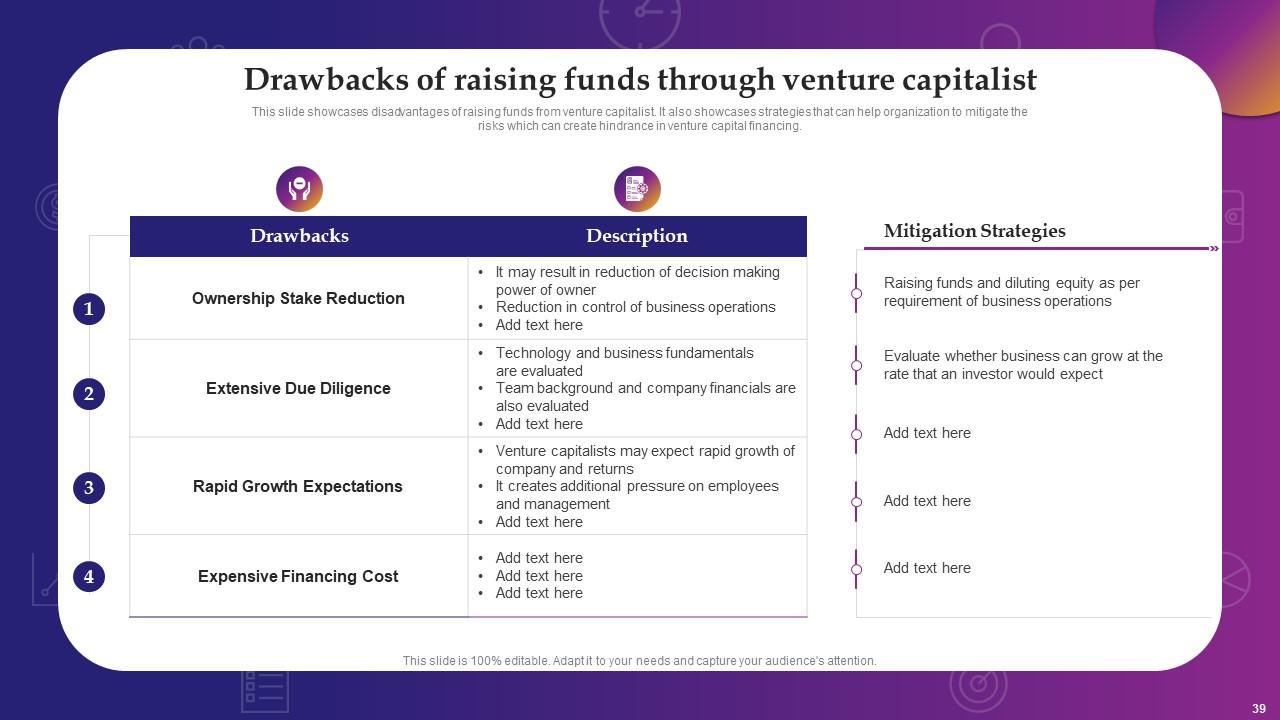

Slide 39: This slide showcases disadvantages of raising funds from venture capitalist.

Slide 40: This slide highlights title for topics that are to be covered next in the template.

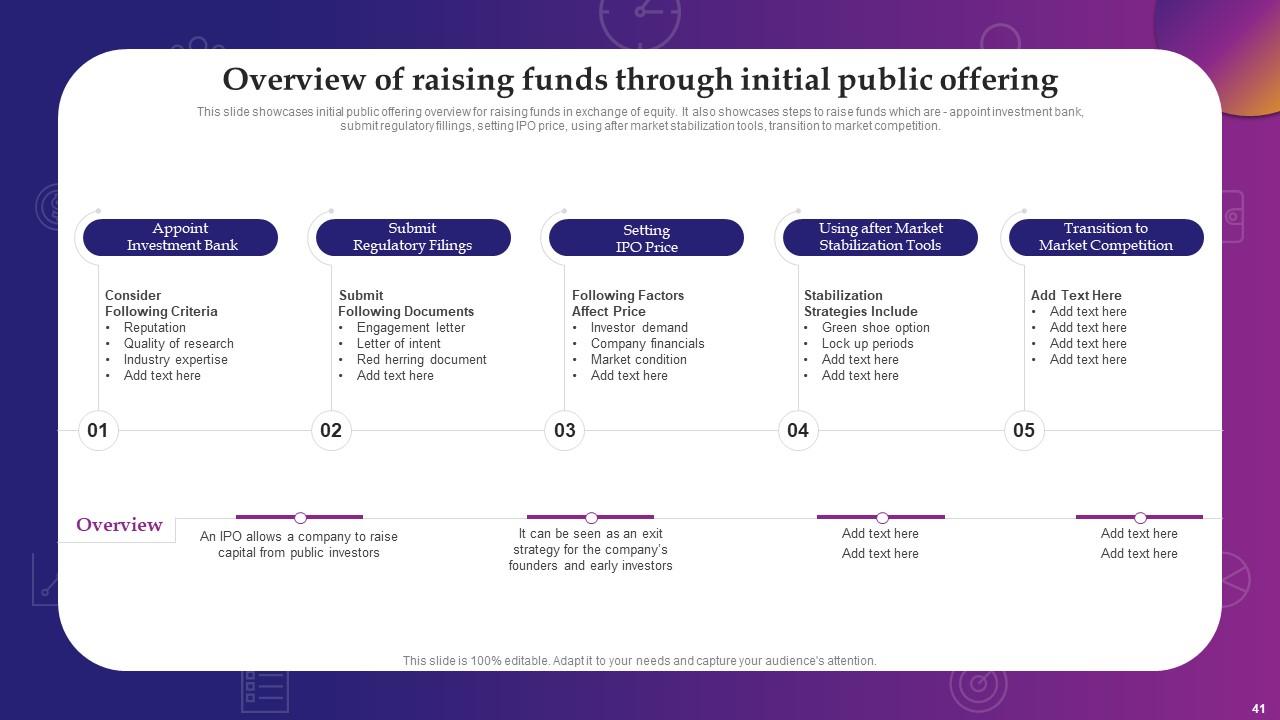

Slide 41: This slide represents Overview Of Raising Funds Through Initial Public Offering.

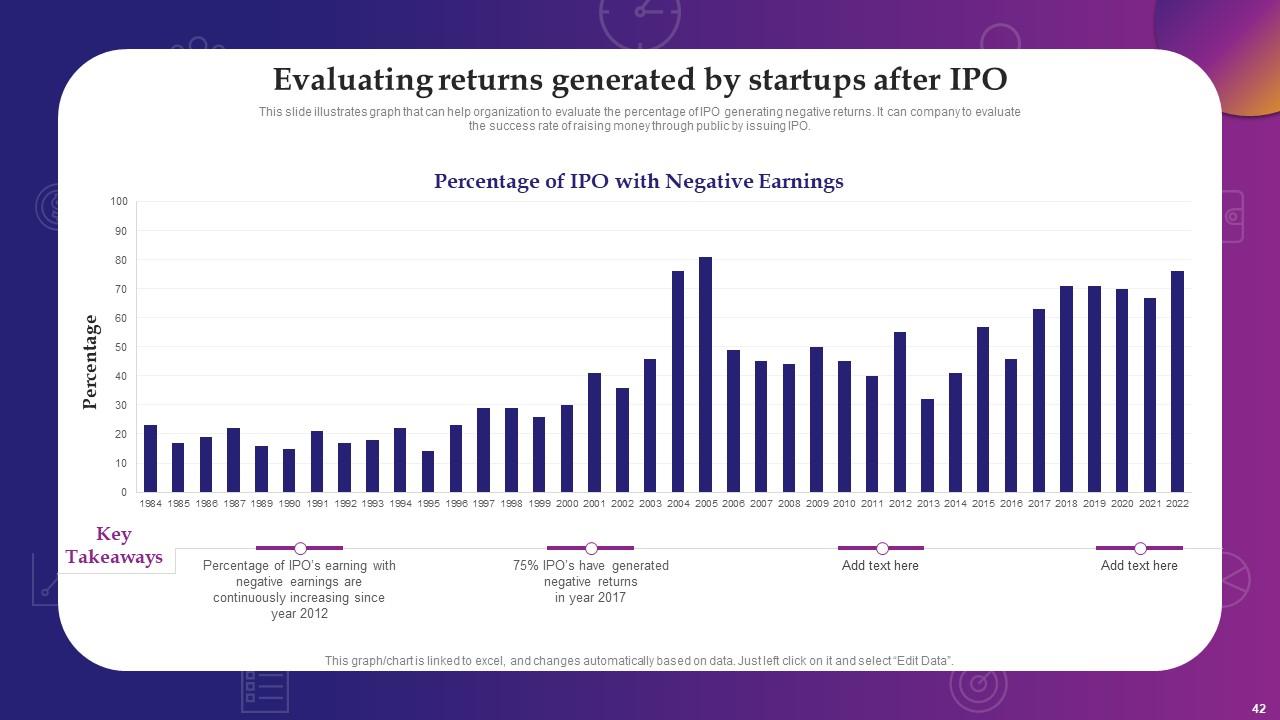

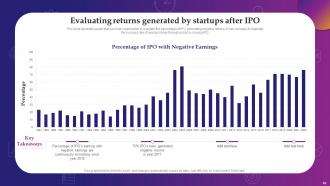

Slide 42: This slide shows Evaluating Returns Generated by Startups After IPO.

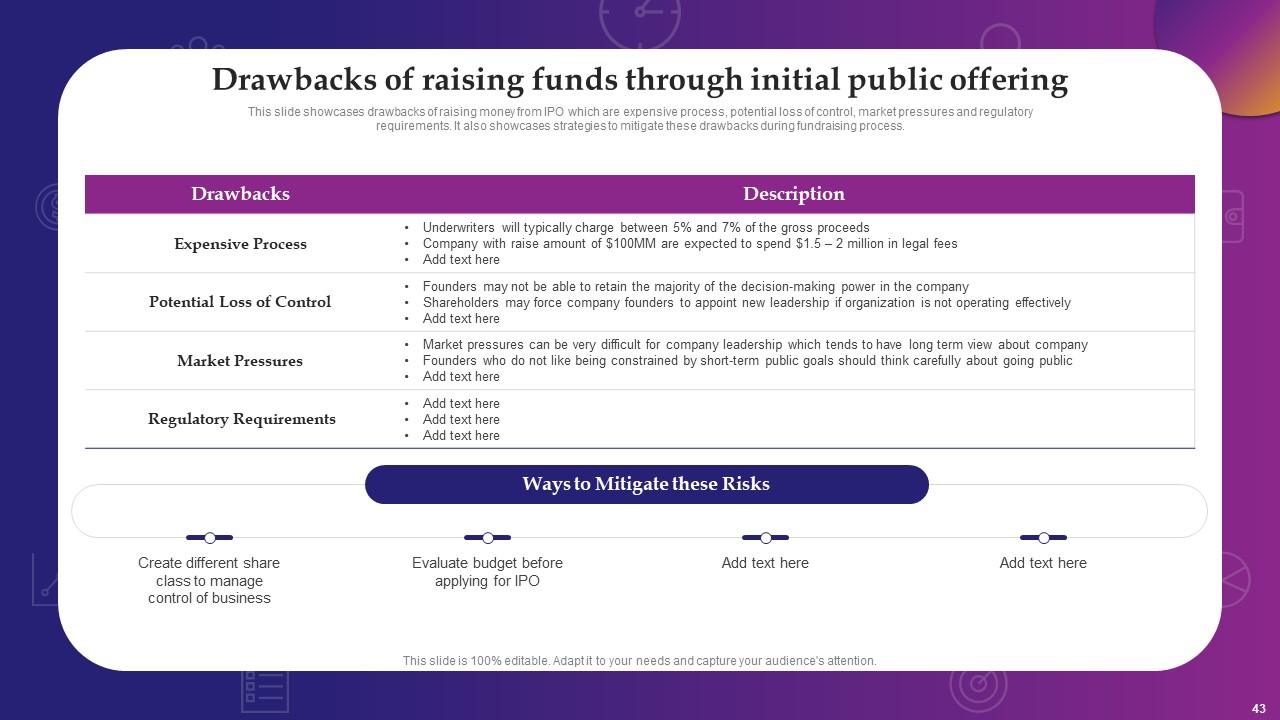

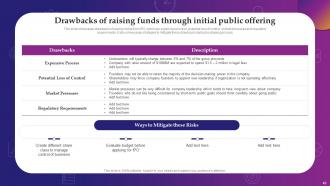

Slide 43: This slide showcases drawbacks of raising money from IPO.

Slide 44: This slide highlights title for topics that are to be covered next in the template.

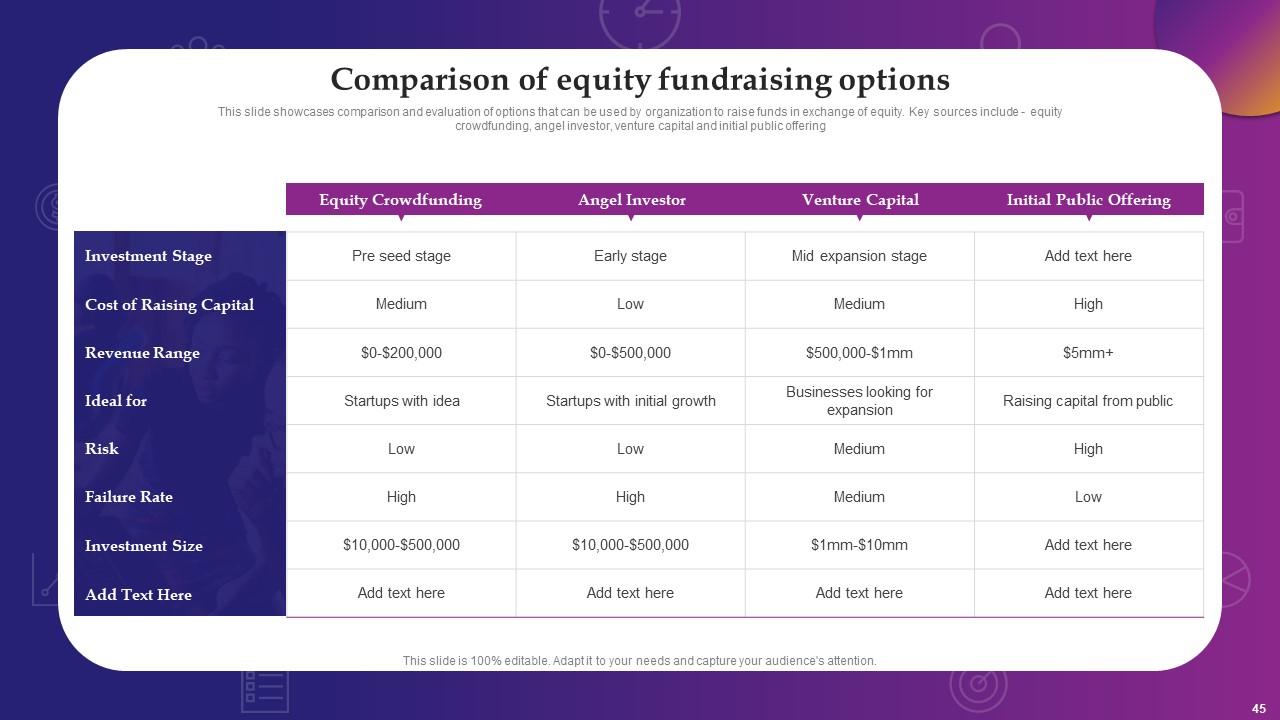

Slide 45: This slide showcases comparison and evaluation of options.

Slide 46: This slide highlights title for topics that are to be covered next in the template.

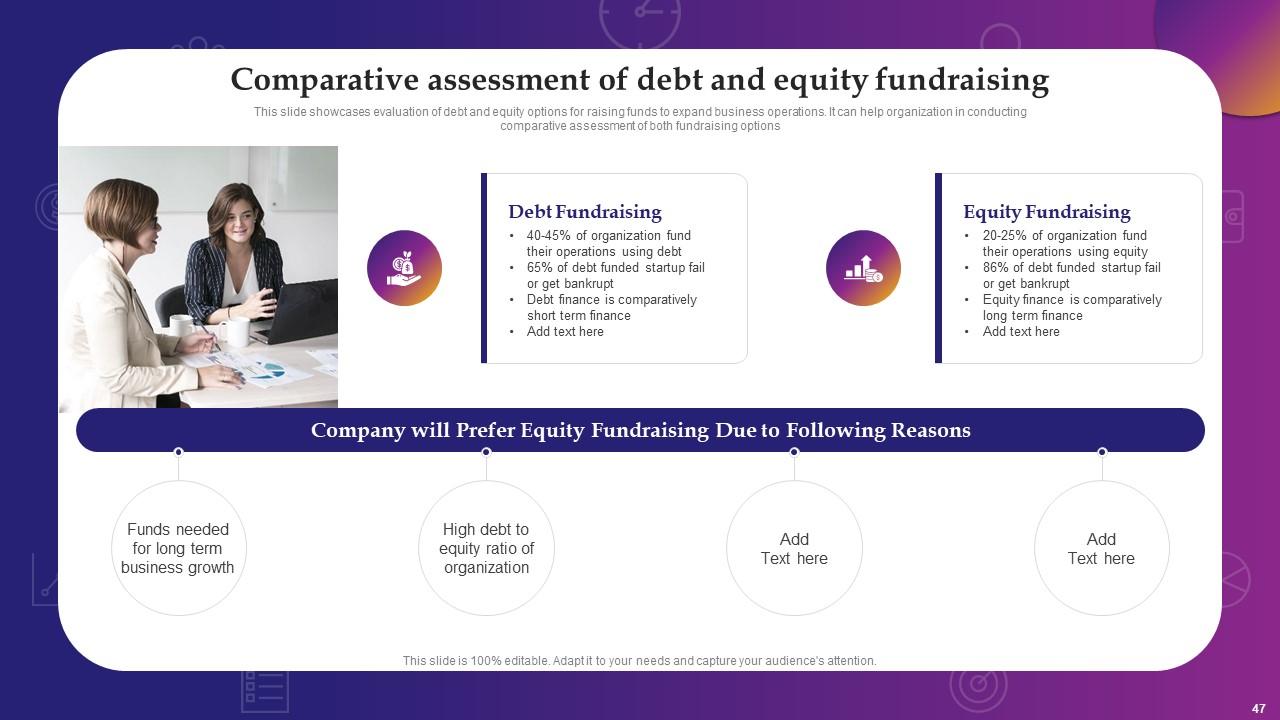

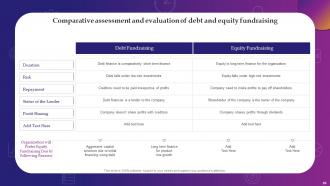

Slide 47: This slide shows Comparative Assessment of Debt and Equity Fundraising.

Slide 48: This slide highlights title for topics that are to be covered next in the template.

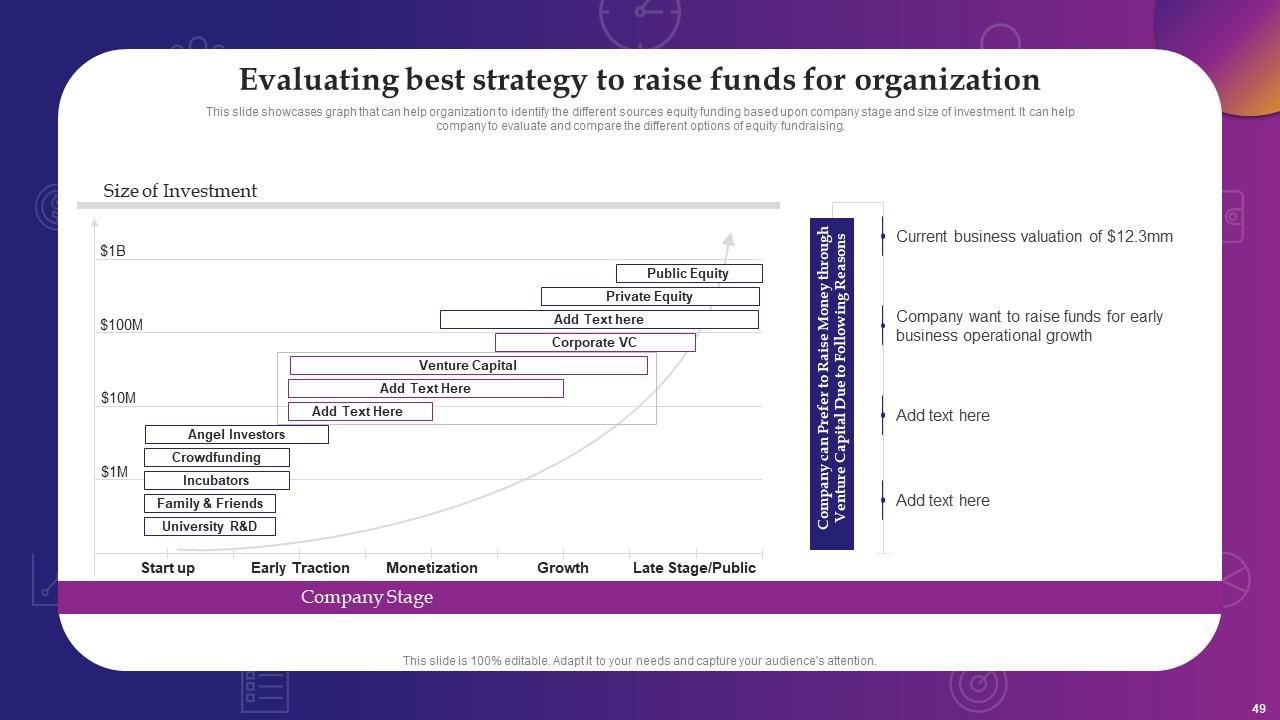

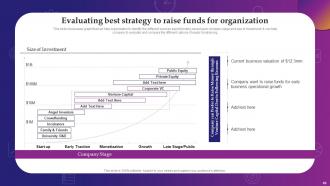

Slide 49: This slide presents Evaluating Best Strategy to Raise Funds for Organization.

Slide 50: This slide highlights title for topics that are to be covered next in the template.

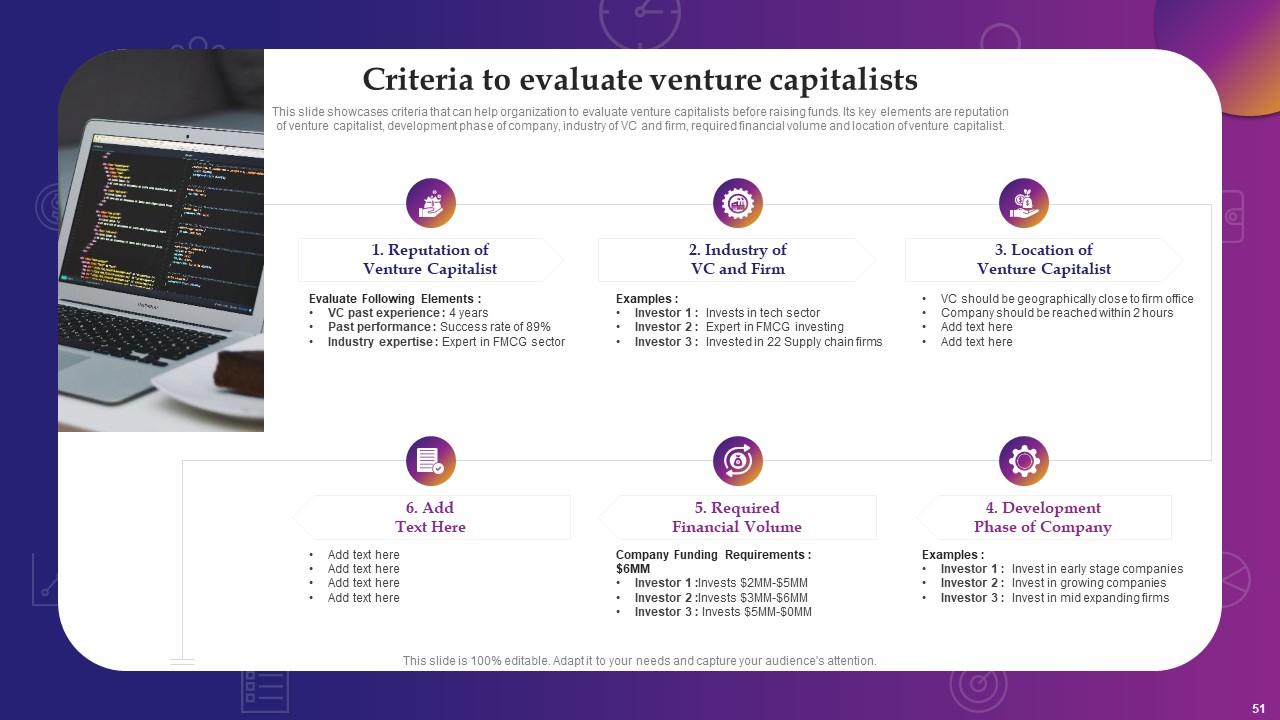

Slide 51: This slide showcases criteria that can help organization to evaluate venture capitalists.

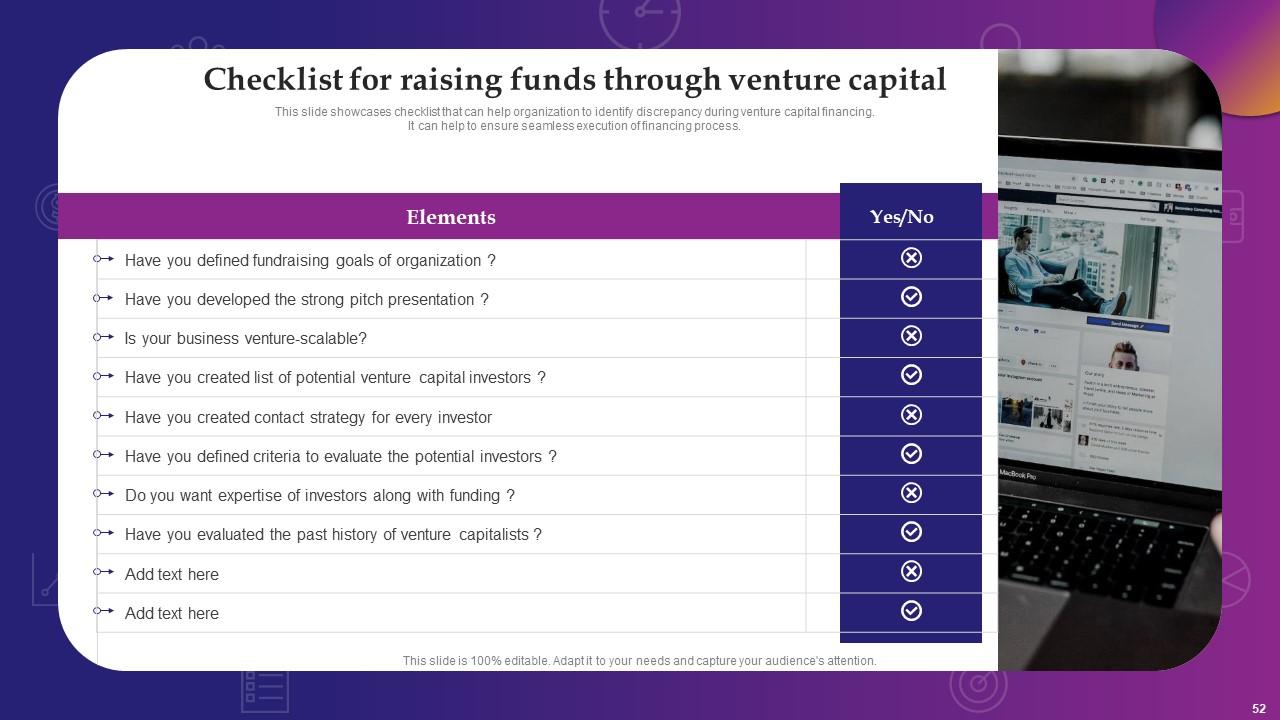

Slide 52: This slide presents Checklist for Raising Funds Through Venture Capital.

Slide 53: This slide highlights title for topics that are to be covered next in the template.

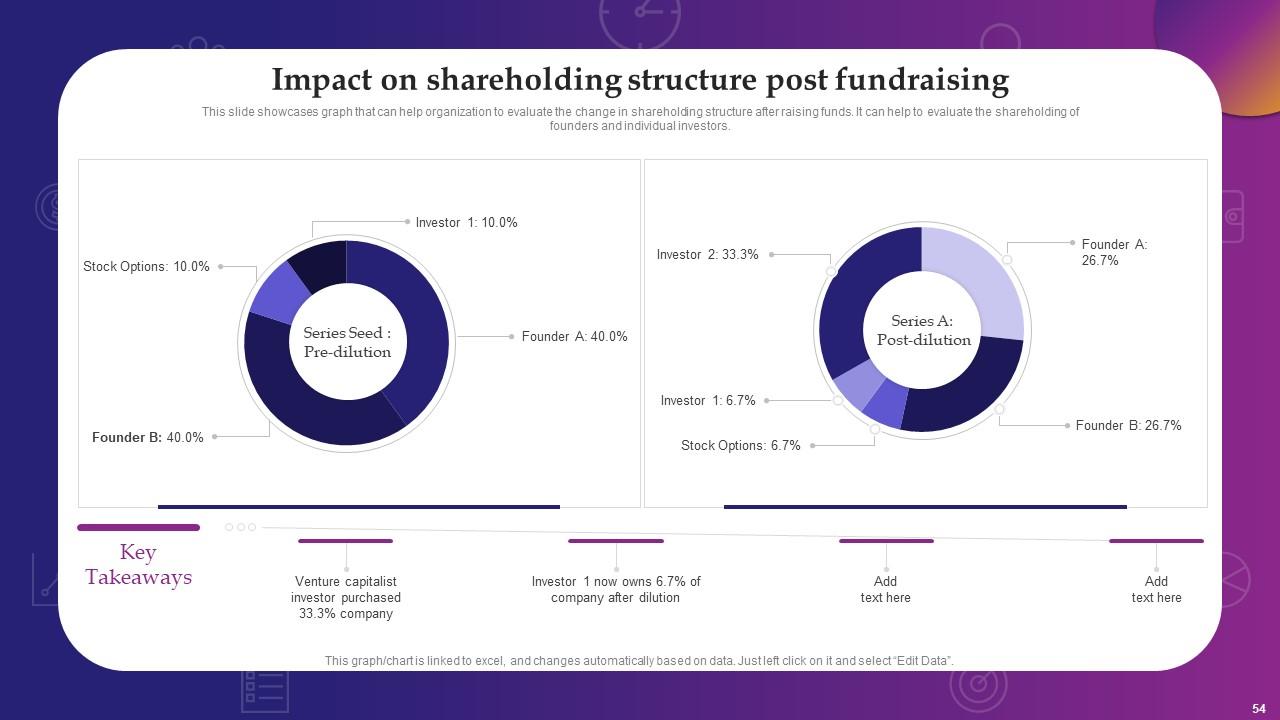

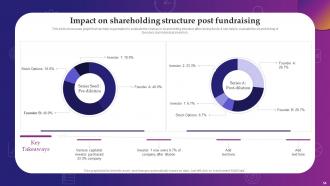

Slide 54: This slide displays Impact on Shareholding Structure Post Fundraising.

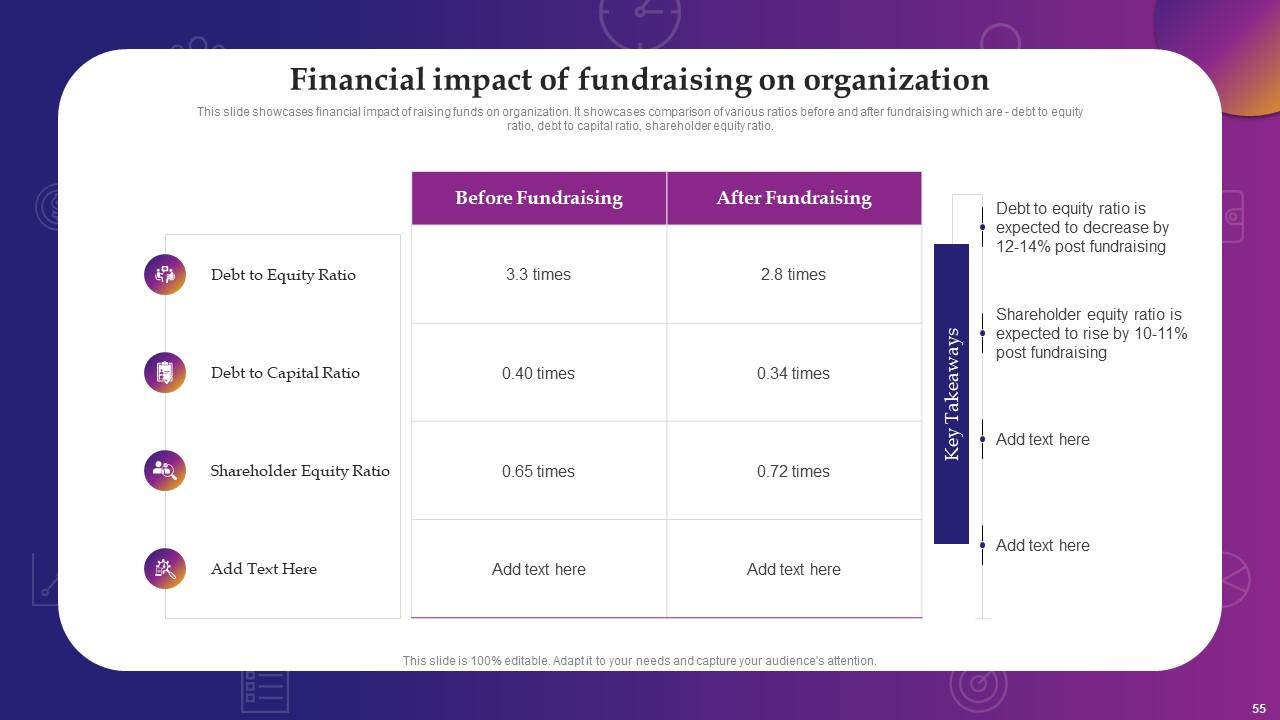

Slide 55: This slide showcases financial impact of raising funds on organization.

Slide 56: This slide highlights title for topics that are to be covered next in the template.

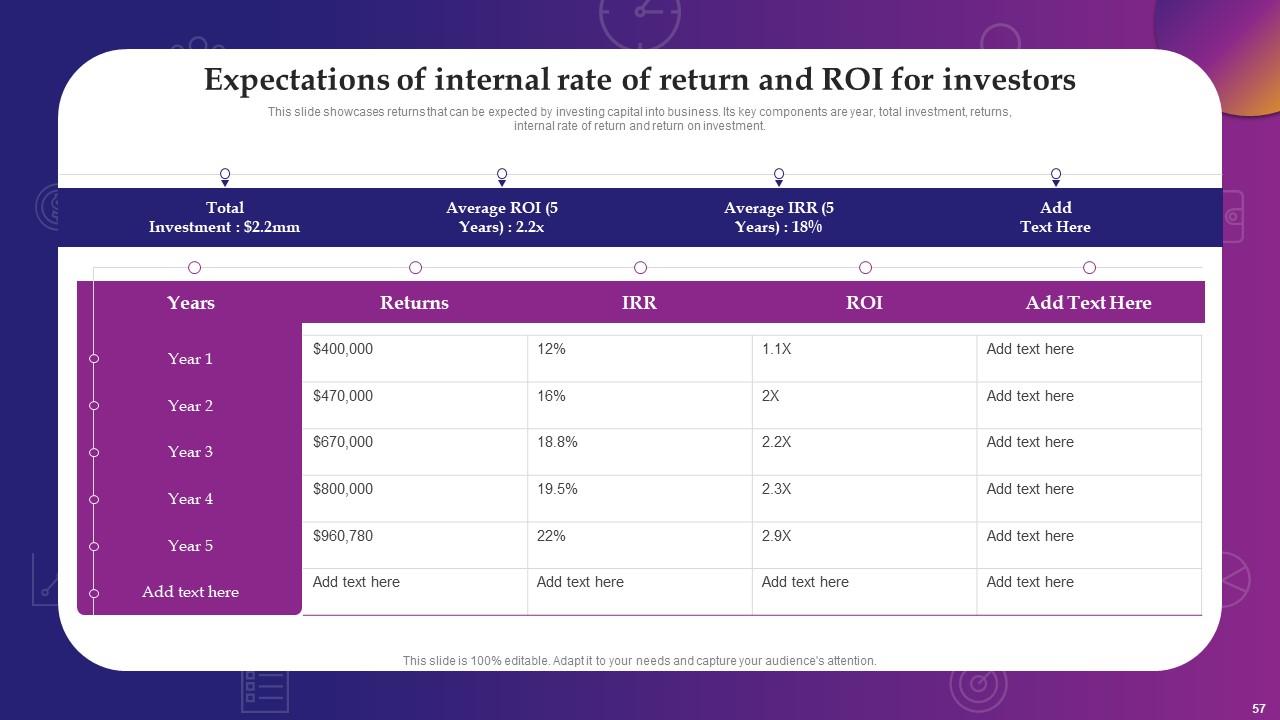

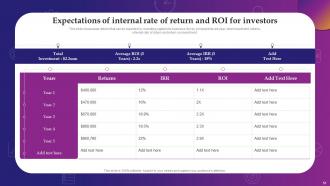

Slide 57: This slide shows Expectations of Internal Rate of Return and ROI for Investors.

Slide 58: This slide highlights title for topics that are to be covered next in the template.

Slide 59: This slide presents utilization of funds into different business operations.

Slide 60: This slide highlights title for topics that are to be covered next in the template.

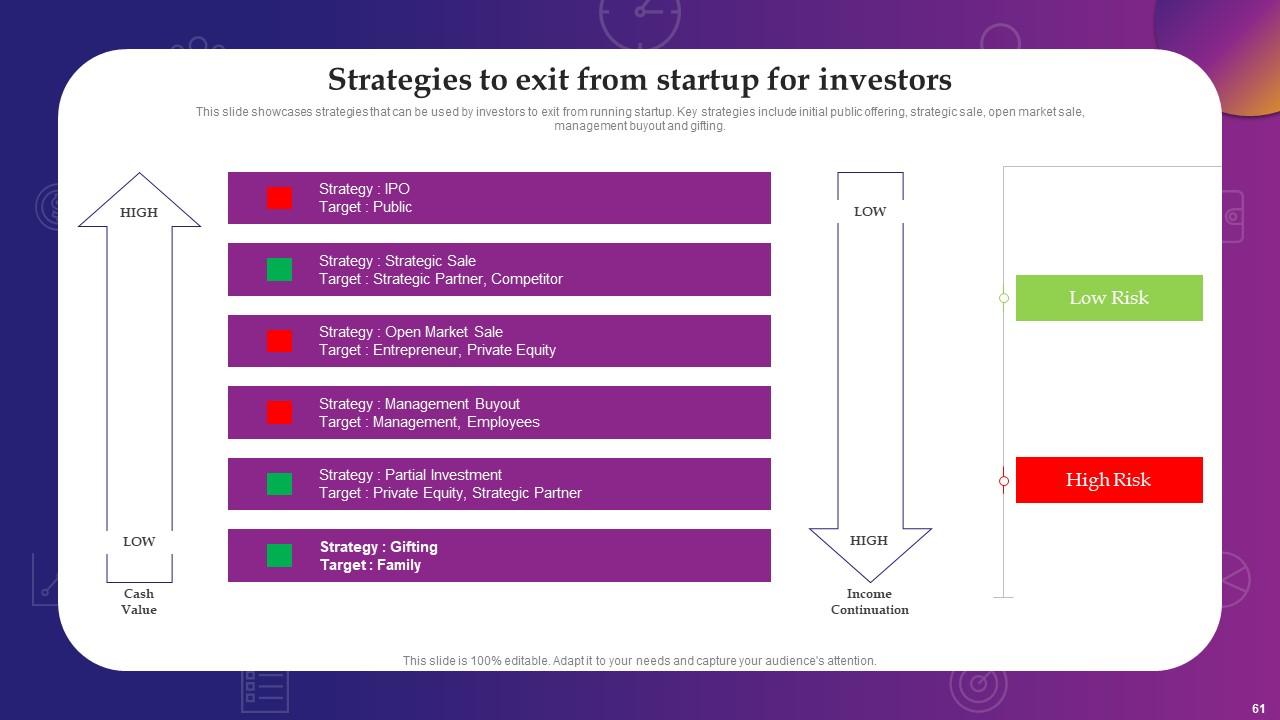

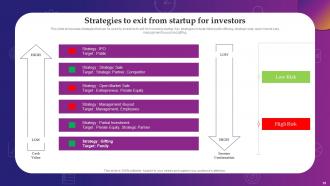

Slide 61: This slide represents Strategies to Exit from Startup for Investors.

Slide 62: This slide highlights title for topics that are to be covered next in the template.

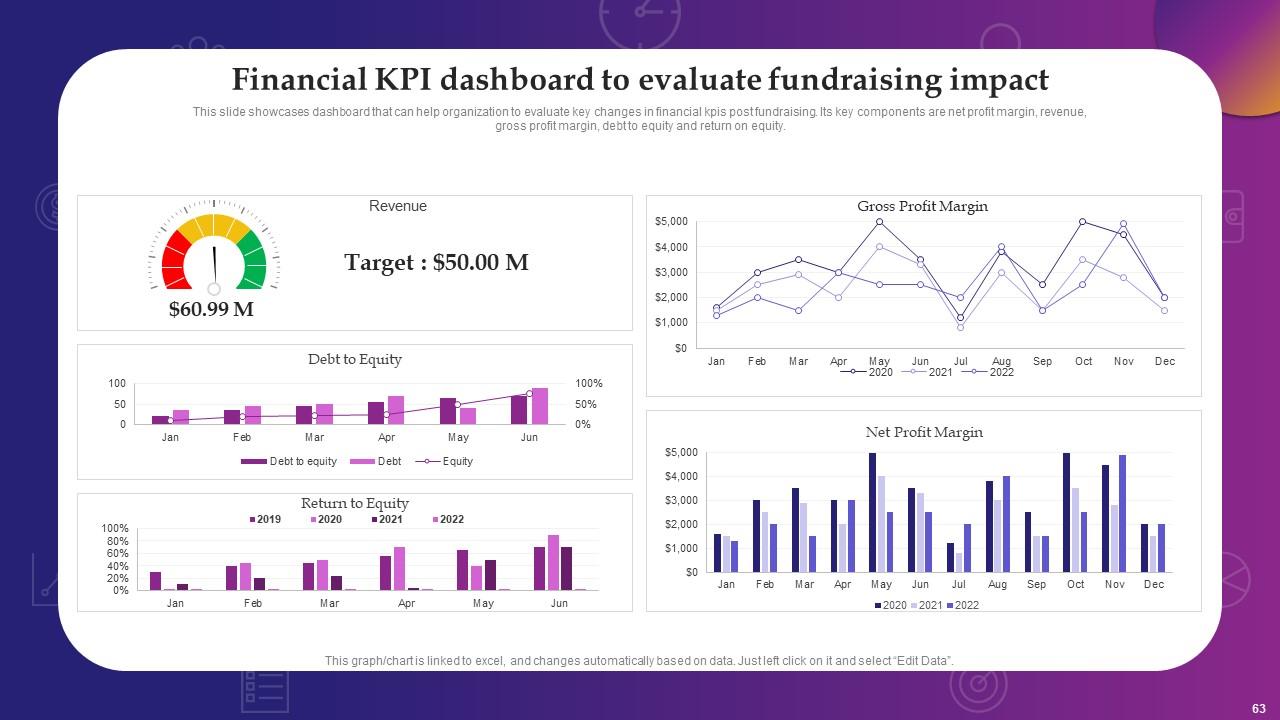

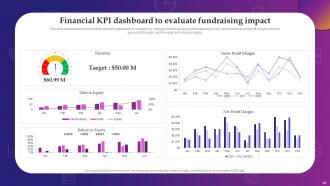

Slide 63: This slide showcases Financial KPI Dashboard to Evaluate Fundraising Impact.

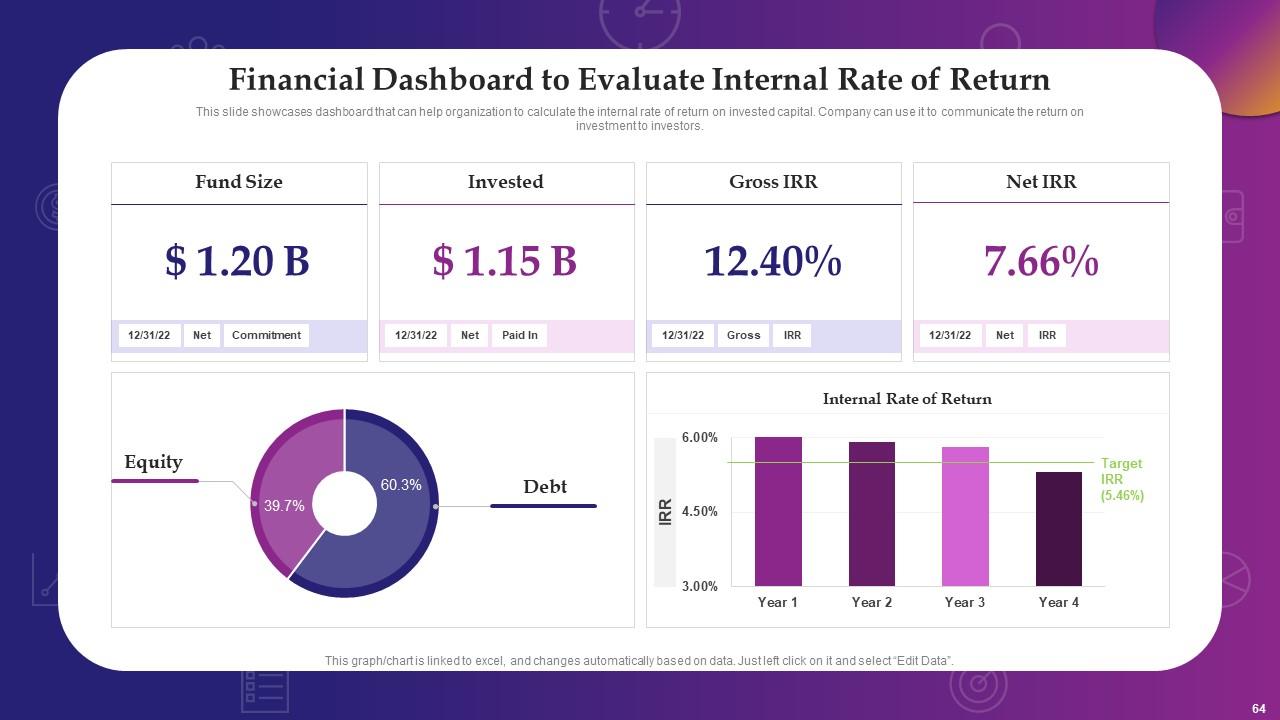

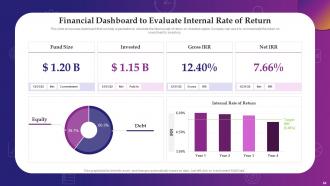

Slide 64: This slide shows Financial Dashboard to Evaluate Internal Rate of Return.

Slide 65: This slide contains all the icons used in this presentation.

Slide 66: This slide is titled as Additional Slides for moving forward.

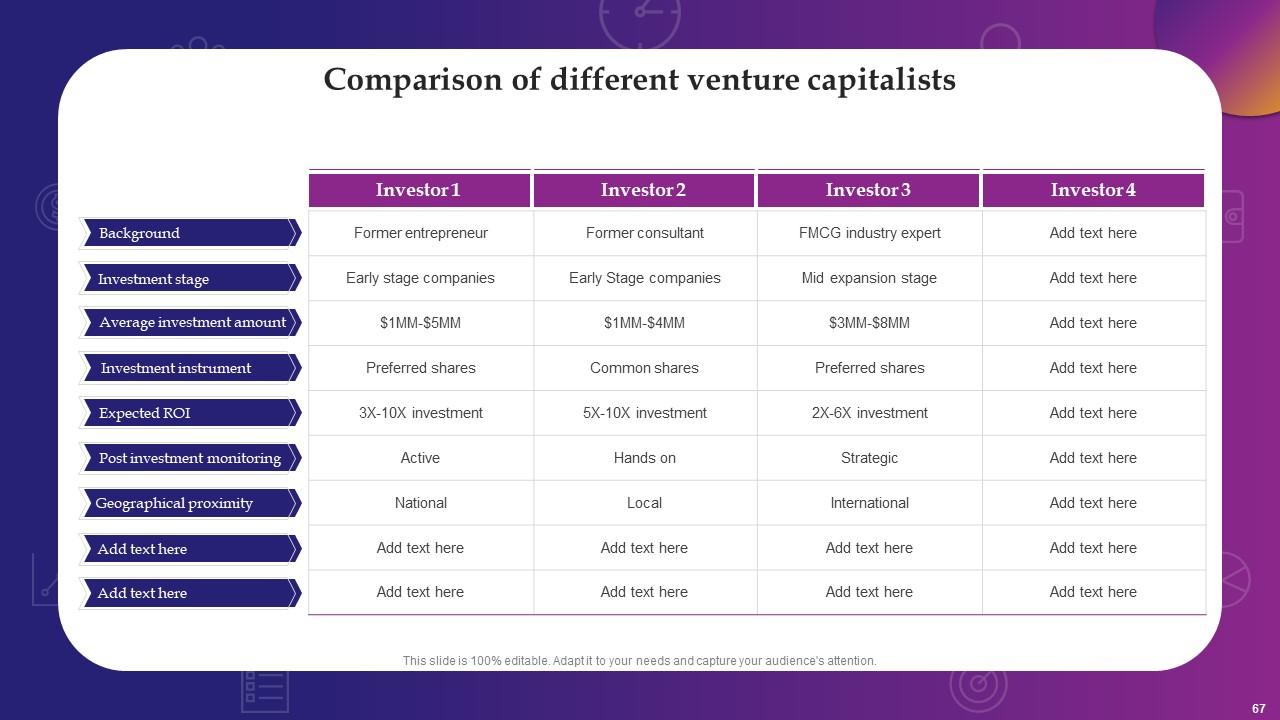

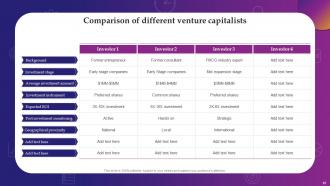

Slide 67: This slide showcases Comparison of Different Venture Capitalists.

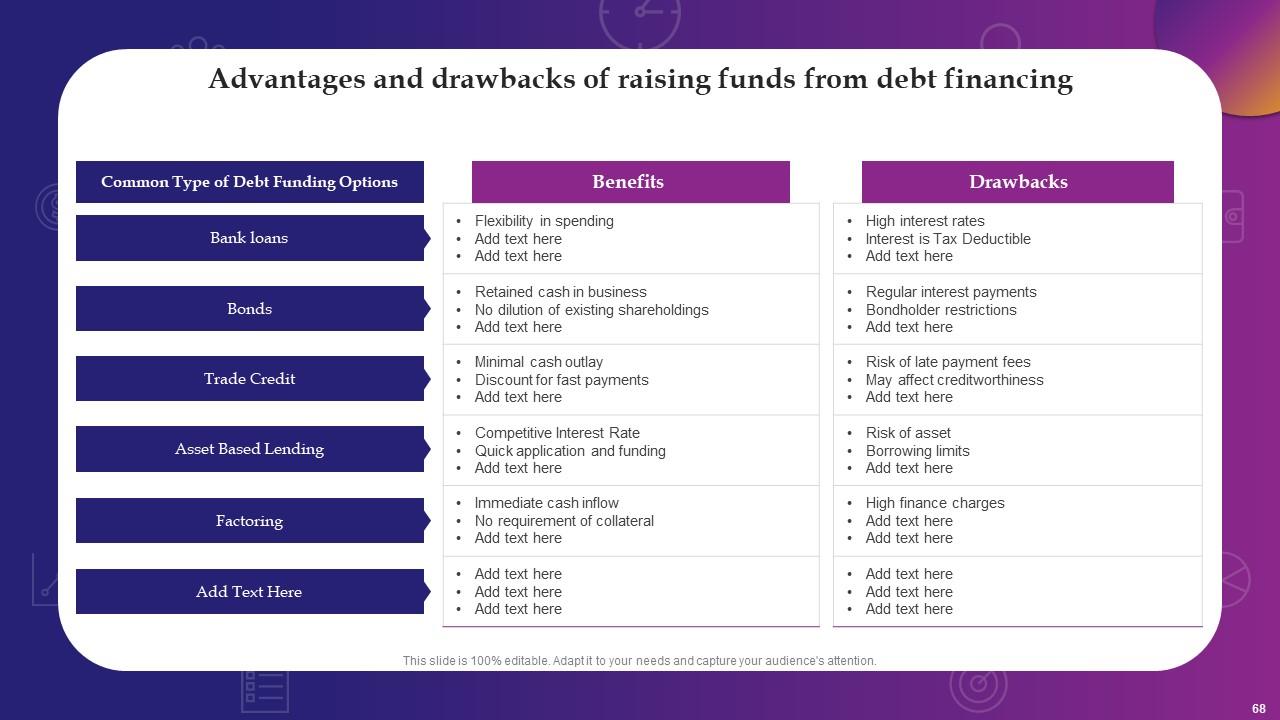

Slide 68: This slide presents Advantages and Drawbacks of Raising Funds from Debt Financing.

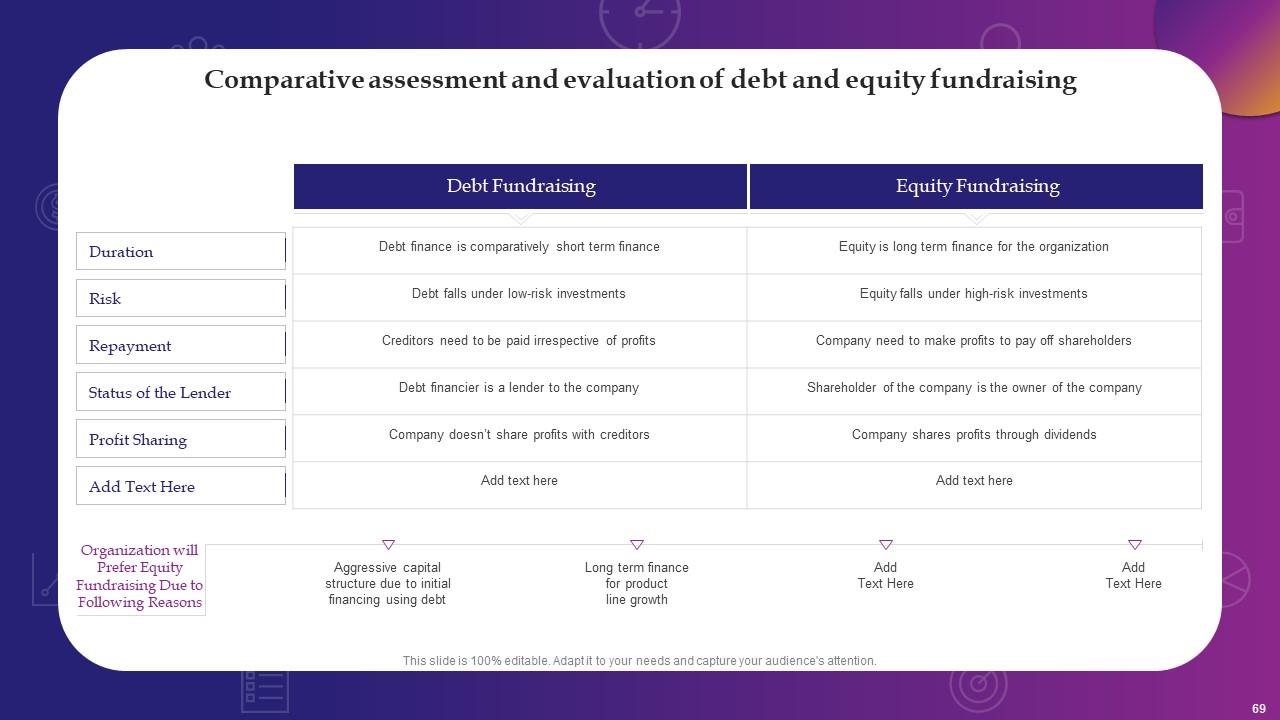

Slide 69: This slide shows Comparative Assessment and Evaluation of Debt and Equity Fundraising.

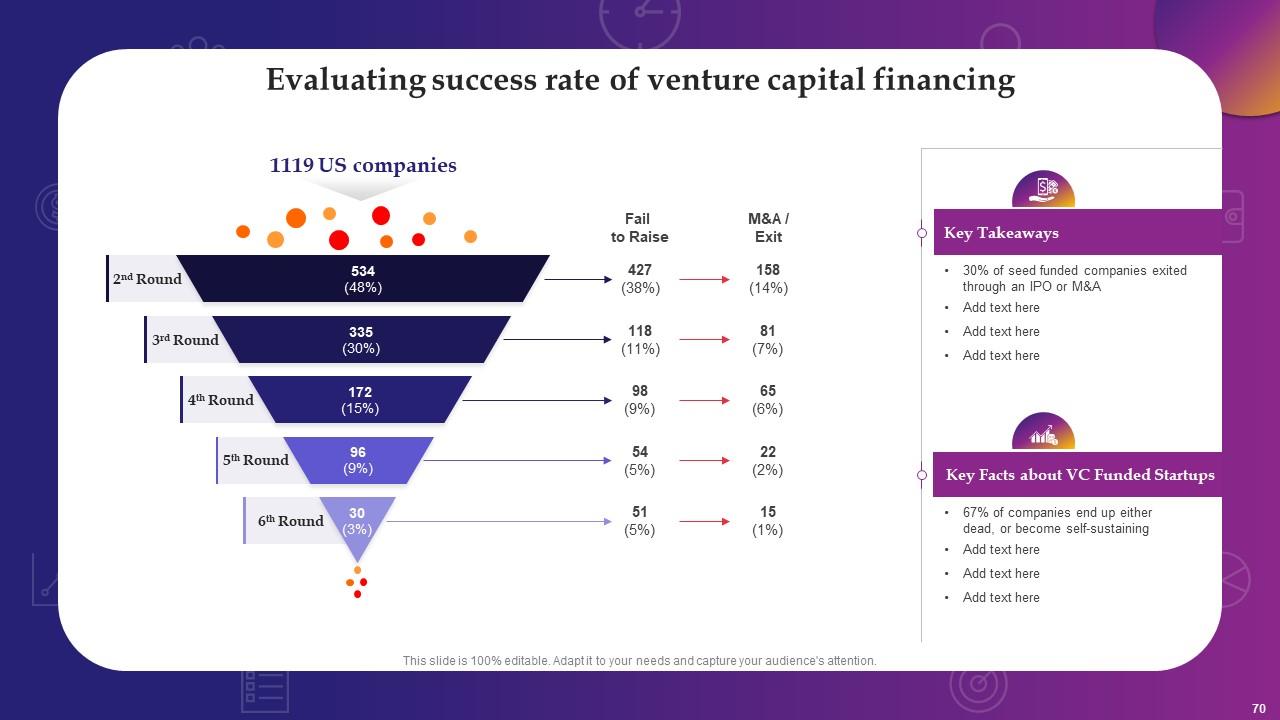

Slide 70: This slide displays Evaluating Success Rate of Venture Capital Financing.

Slide 71: This is a Timeline slide. Show data related to time intervals here.

Slide 72: This slide presents Bar chart with two products comparison.

Slide 73: This slide provides 30 60 90 Days Plan with text boxes.

Slide 74: This is Our Goal slide. State your firm's goals here.

Slide 75: This slide contains Puzzle with related icons and text.

Slide 76: This slide shows Post It Notes. Post your important notes here.

Slide 77: This is a Thank You slide with address, contact numbers and email address.

Evaluating Debt And Equity Fundraising Options For Business Expansion Powerpoint Presentation Slides with all 82 slides:

Use our Evaluating Debt And Equity Fundraising Options For Business Expansion Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Amazing slides! Unique, attractive, and easy to understand.

-

Extensive range of templates! Highly impressed with the quality of the designs.