Organizing Anti Money Laundering Strategy To Reduce Financial Frauds Complete Deck

Anti-money laundering AML policies are implemented to deter criminals from integrating illicit funds into the financial system. Grab our blueprint for Organizing an Anti-Money Laundering Strategy to Reduce Financial Fraud. Quickly evaluating risk levels helps financial organizations know their customers and take legal action against any risk of money laundering or financial crime. The importance, advantages, process flow, and transaction monitoring industry data are covered in our AML System Deck, along with a timeline for implementation. Additionally, it covers a comparison of manual and automated methods of transaction monitoring. Further, our TM System PPT provides enhancement strategies for transaction monitoring systems that can assist businesses and financial organizations lower risks such as financial crimes and fraud. These include careful management, threshold management, behavioral analytics, suspected activity reporting SAR, anti-money laundering tactics, suspicious activity reporting SAR, and customer segmentation. The entire deck outlines the financial security departments roles, tasks, training schedule, communication schedule, etc. Lastly, our Automatic Transaction Monitoring module displays metrics, effect analysis, costs, and other transaction monitoring-related KPI dashboards. Get access right away.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver an informational PPT on various topics by using this Organizing Anti Money Laundering Strategy To Reduce Financial Frauds Complete Deck. This deck focuses and implements best industry practices, thus providing a birds-eye view of the topic. Encompassed with sixty seven slides, designed using high-quality visuals and graphics, this deck is a complete package to use and download. All the slides offered in this deck are subjective to innumerable alterations, thus making you a pro at delivering and educating. You can modify the color of the graphics, background, or anything else as per your needs and requirements. It suits every business vertical because of its adaptable layout.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Organizing Anti Money Laundering Strategy to Reduce Financial Frauds. Commence by stating Your Company Name.

Slide 2: This slide depicts the Agenda of the presentation.

Slide 3: This slide incorporates the Table of contents.

Slide 4: This slide continues the Table of contents.

Slide 5: This slide mentions the Heading for the Components to be discussed further.

Slide 6: This slide showcases global scenario of financial crimes and frauds.

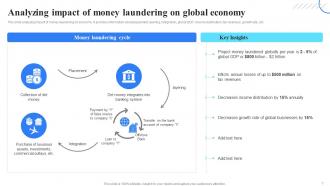

Slide 7: This slide deals with Analyzing impact of money laundering on global economy.

Slide 8: This slide shows the reasons why transaction monitoring is essential.

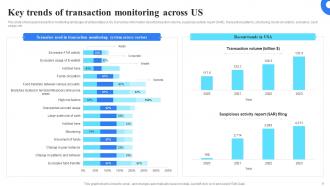

Slide 9: This slide exhibits the Key trends of transaction monitoring across US.

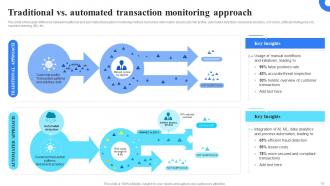

Slide 10: This slide showcases the difference between traditional and automated transaction monitoring method.

Slide 11: This slide states the Importance of regular financial activity observation.

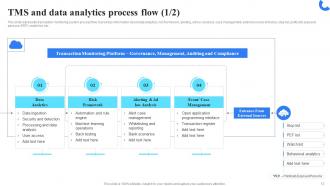

Slide 12: This slide represents transaction monitoring system process flow.

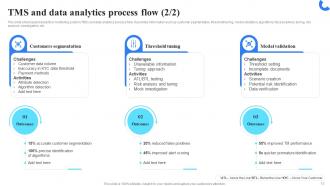

Slide 13: This slide continues the TMS and data analytics process flow.

Slide 14: This slide displays the Title for the Ideas to be covered further.

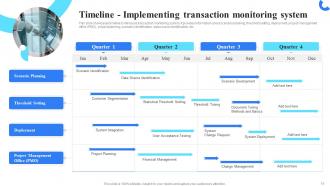

Slide 15: This slide showcases timeline to introduce transaction monitoring system.

Slide 16: This slide elucidates the Heading for the Ideas to be discussed in the following template.

Slide 17: This slide portrays the Risks identified during transaction monitoring.

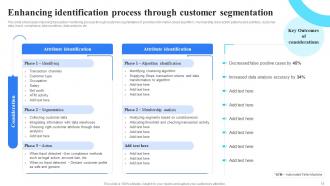

Slide 18: This slide deals with Enhancing identification process through customer segmentation.

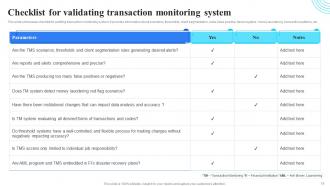

Slide 19: This slide exhibits the Checklist for validating transaction monitoring system.

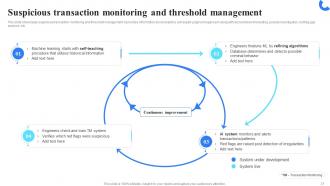

Slide 20: This slide showcases suspicious transaction monitoring and threshold management.

Slide 21: This slide talks about the Suspicious transaction monitoring and threshold management.

Slide 22: This slide reveals the Title for the Components to be covered further.

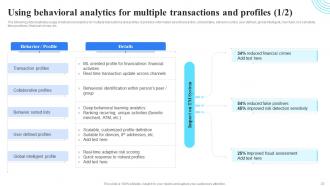

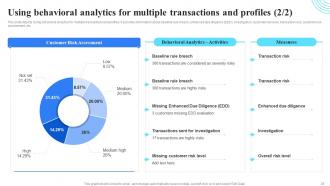

Slide 23: The following slide illustrates usage of behavioral analytics for multiple transactions and profiles.

Slide 24: This slide depicts Using behavioral analytics for multiple transactions and profiles.

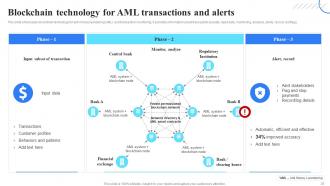

Slide 25: This slide shows blockchain technology for anti money laundering (AML) and transaction monitoring.

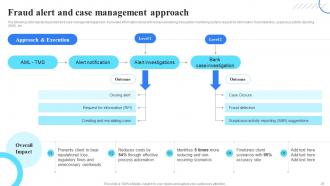

Slide 26: This slide displays the Fraud alert and case management approach.

Slide 27: This slide shows the Control measures for anti money laundering.

Slide 28: This slide presents the Heading for the Topics to be discussed next.

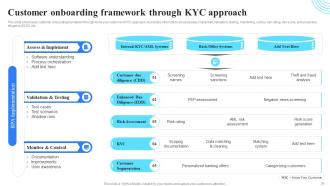

Slide 29: This slide illustrates the Customer onboarding framework through KYC approach.

Slide 30: This slide reveals the Real time onboarding processing and monitoring.

Slide 31: This slide focuses on Identifying inherent risk factors and measures.

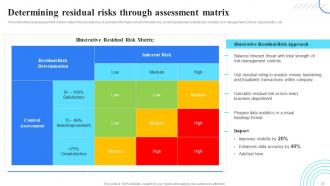

Slide 32: This slide deals with Determining residual risks through assessment matrix.

Slide 33: This slide shows the Mitigating transaction risks through policies and procedures.

Slide 34: This slide depicts the Title for the Ideas to be covered in the following template.

Slide 35: This slide states the Effective ways to report fraudulent transactions.

Slide 36: This slide reveals the MIS report highlighting risk and fraud metrics.

Slide 37: This slide exhibits the Heading for the Ideas to be discussed in the forth-coming template.

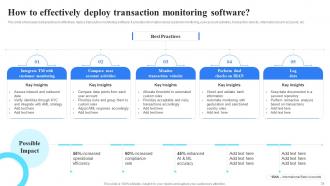

Slide 38: This slide showcases best practices to effectively deploy transaction monitoring software.

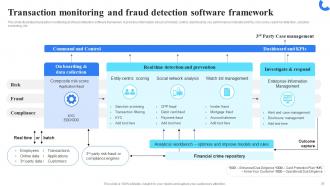

Slide 39: This slide illustrates transaction monitoring and fraud detection software framework.

Slide 40: This slide reveals the working of a transaction monitoring software.

Slide 41: This slide continues the working of a transaction monitoring software.

Slide 42: This slide mentions the Real time ATM fraud and crime detection.

Slide 43: This slide elucidates the Title for the Components to be discussed next.

Slide 44: The following slide highlights key members of financial security department.

Slide 45: This slide exhibits the Major roles and responsibilities of financial security team.

Slide 46: The following slide represents training program for transaction monitoring and anti money laundering (AML).

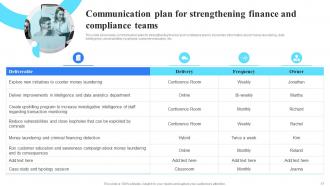

Slide 47: This slide showcases communication plan for strengthening finance and compliance teams.

Slide 48: This slide indicates the Heading for the Topics to be covered in the forth-coming template.

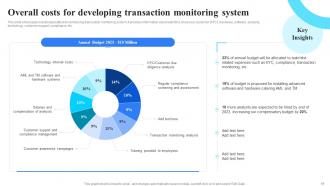

Slide 49: This slide presents the overall expenditure for enhancing transaction monitoring system.

Slide 50: This slide focuses on Selecting suitable solution for monitoring transactions.

Slide 51: This slide incorporates the Title for the Topics to be covered next.

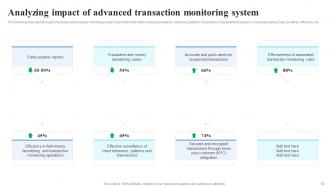

Slide 52: The following slide depicts impact of advanced transaction monitoring system.

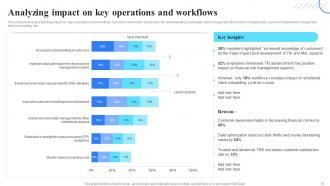

Slide 53: This slide mentions about assessing impact on major operations and workflows.

Slide 54: This slide contains the Heading for the Contents to be discussed further.

Slide 55: This slide illustrates the Dashboard for monitoring fraud and money laundering transactions.

Slide 56: This slide indicates the Dashboard to monitor bank transactions and activities.

Slide 57: This is the Icons slide containing all the Icons used in the plan.

Slide 58: This slide is used for showcasing some Additional information.

Slide 59: This slide emphasizes on Cryptocurrency transaction monitoring with alerts status.

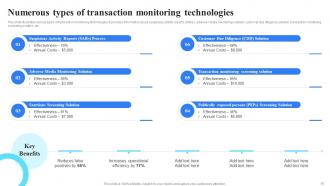

Slide 60: This slide states the various types of transaction monitoring technologies.

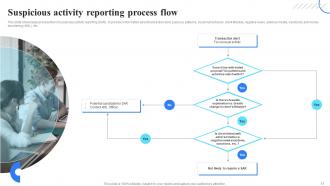

Slide 61: This slide presents the Suspicious activity reporting process flow.

Slide 62: This slide represents the Column chart.

Slide 63: This is Our team slide. State your team-related information here.

Slide 64: This is the About us slide for depicting the company-related information.

Slide 65: This slide contains the Post it notes for reminders and deadlines.

Slide 66: This is the 30 60 90 days plan slide for efficient planning.

Slide 67: This is the Thank you slide for acknowledgement.

Organizing Anti Money Laundering Strategy To Reduce Financial Frauds Complete Deck with all 72 slides:

Use our Organizing Anti Money Laundering Strategy To Reduce Financial Frauds Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

I looked at their huge selection of themes and designs. They appeared to be ideal for my profession. I'm sure I'll grab a few of them.

-

“Love it! I was able to grab an exciting proposal because of SlideTeam.”