Comprehensive Training Curriculum on Blockchain in Finance Training Ppt

What is it

- EduDecks are professionally-created comprehensive decks that provide complete coverage of the subject under discussion

- These are also innovatively-designed for a powerful learning experience and maximum retention

Who is it for?

- EduDecks are for Trainers who want to add punch and flair to program and leave a lasting impact on their trainees

- They are also for Teachers who want to win over their students with content as well design

Why EduDecks?

- EduDecks provide an A-Z coverage of courses on any topic and covers it in both great depth and wide scope

- These slides are also professionally-designed to deliver a punch to your programs

Create an Immersive Training Experience

Created by Subject Matter Experts

Professionally Designed Slides

Structured Sessions

Comprehensive Curriculum

Detailed Teaching Notes

Real-Life Case Studies

Assessment Questions

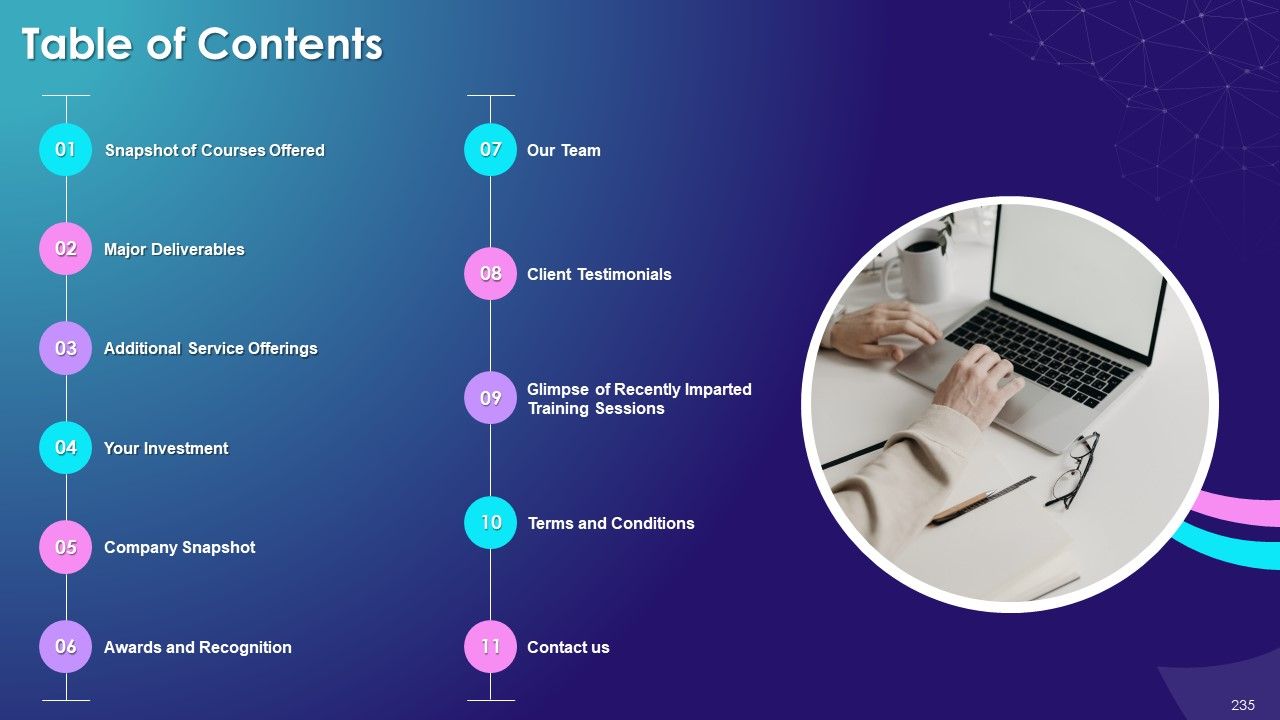

Client Proposal

Complete Curriculum

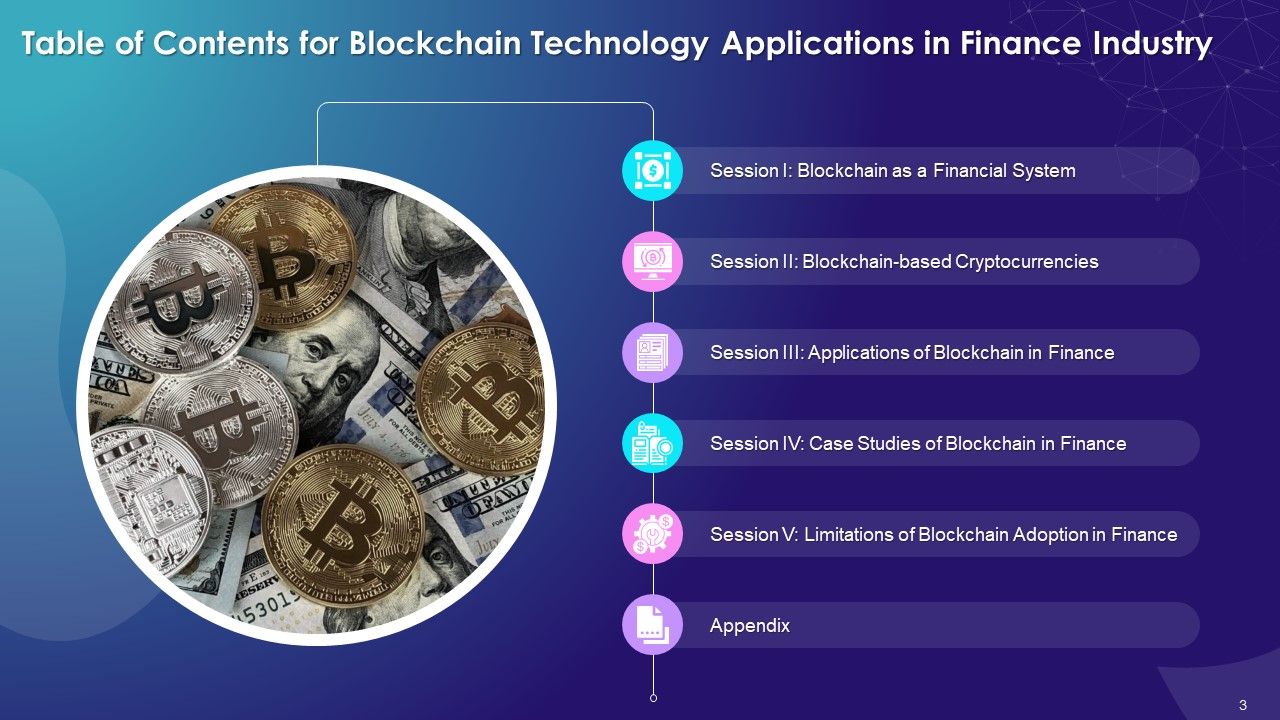

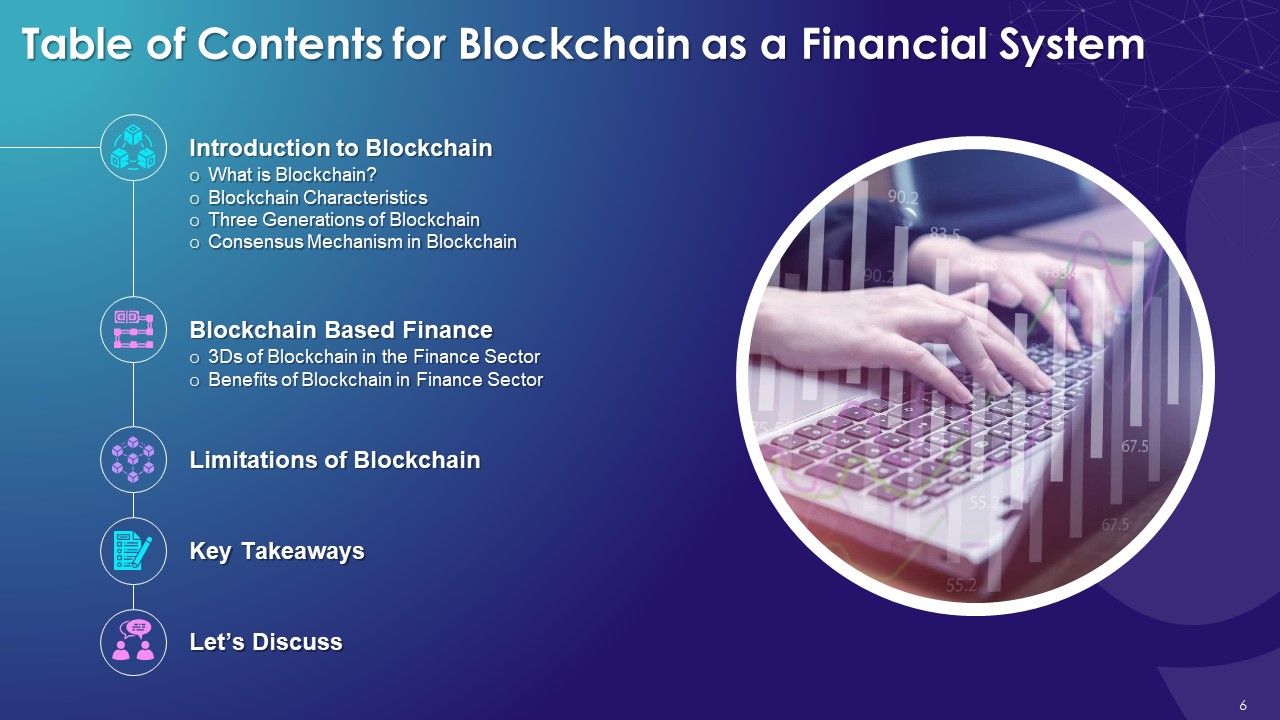

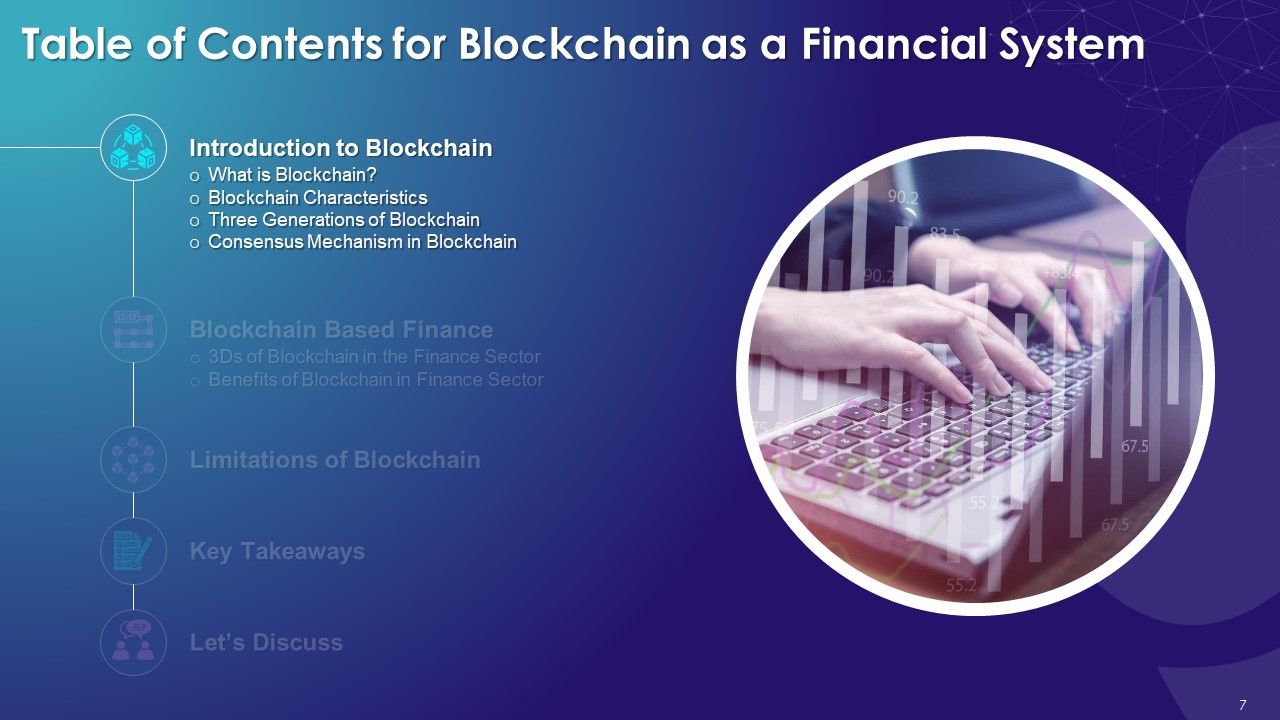

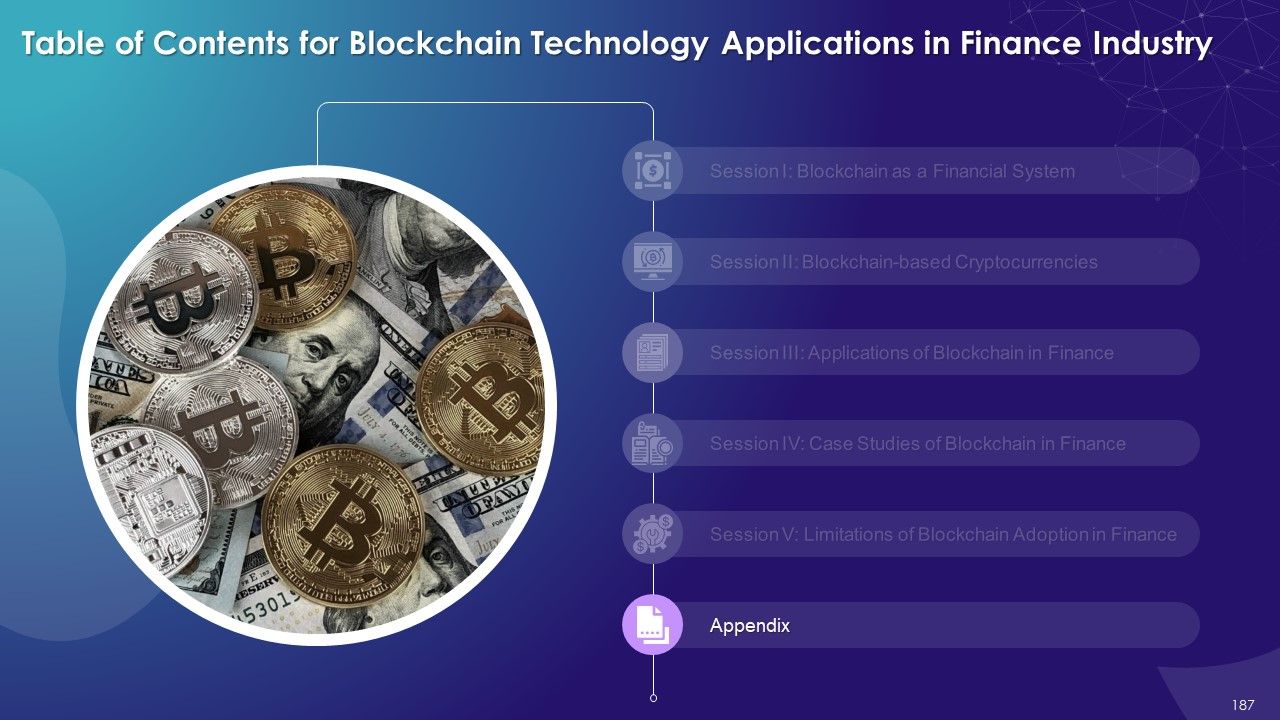

- Introduction to Blockchain

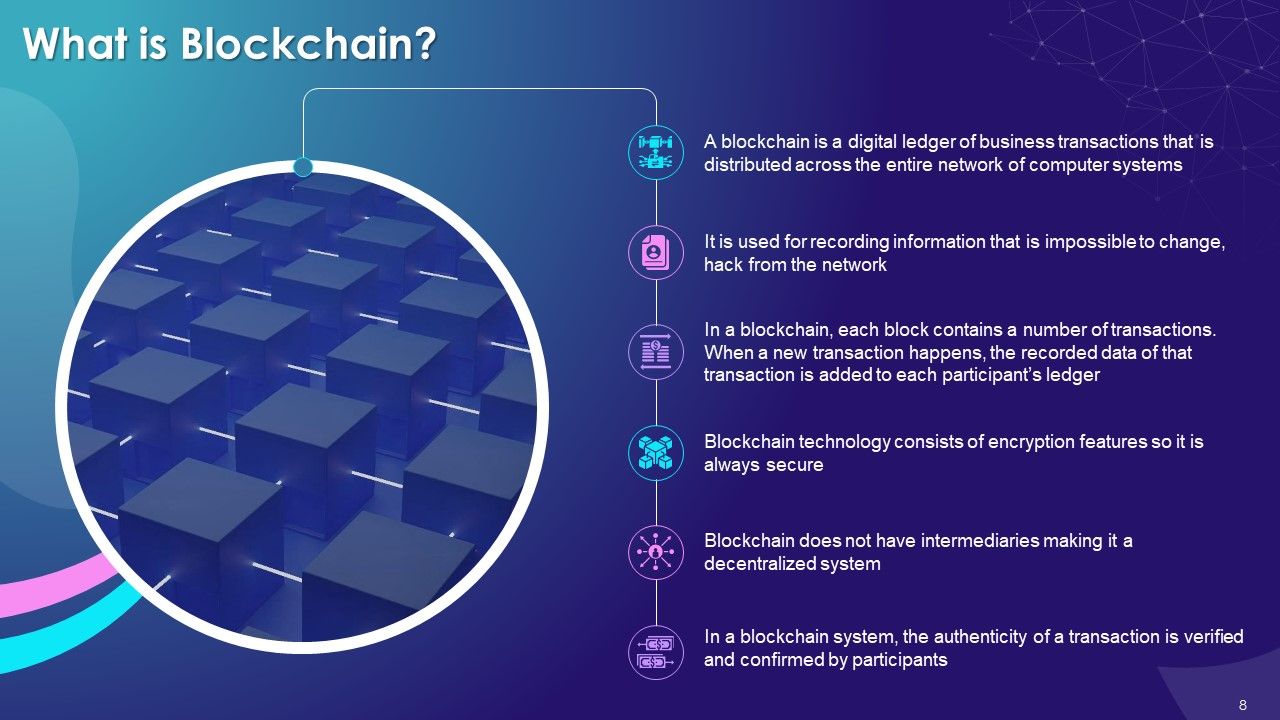

- What is Blockchain?

- Blockchain Characteristics

- Three Generations of Blockchain

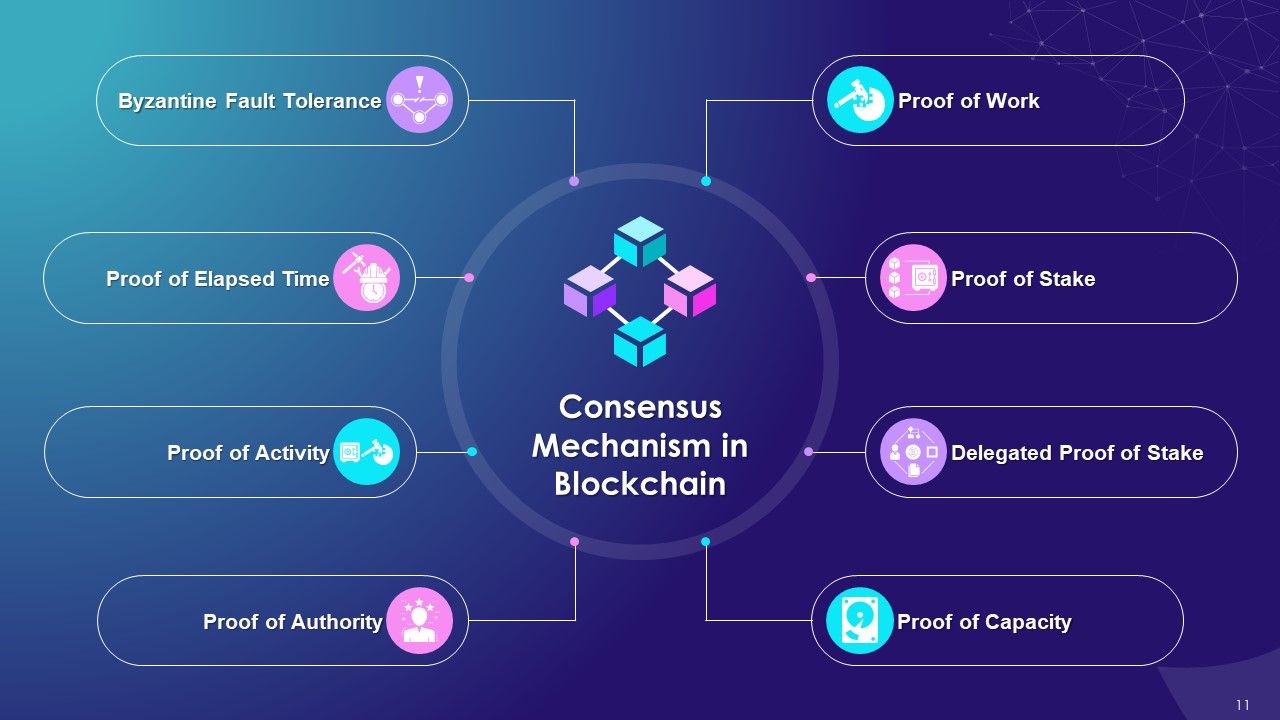

- Consensus Mechanism in Blockchain

- Blockchain Based Finance

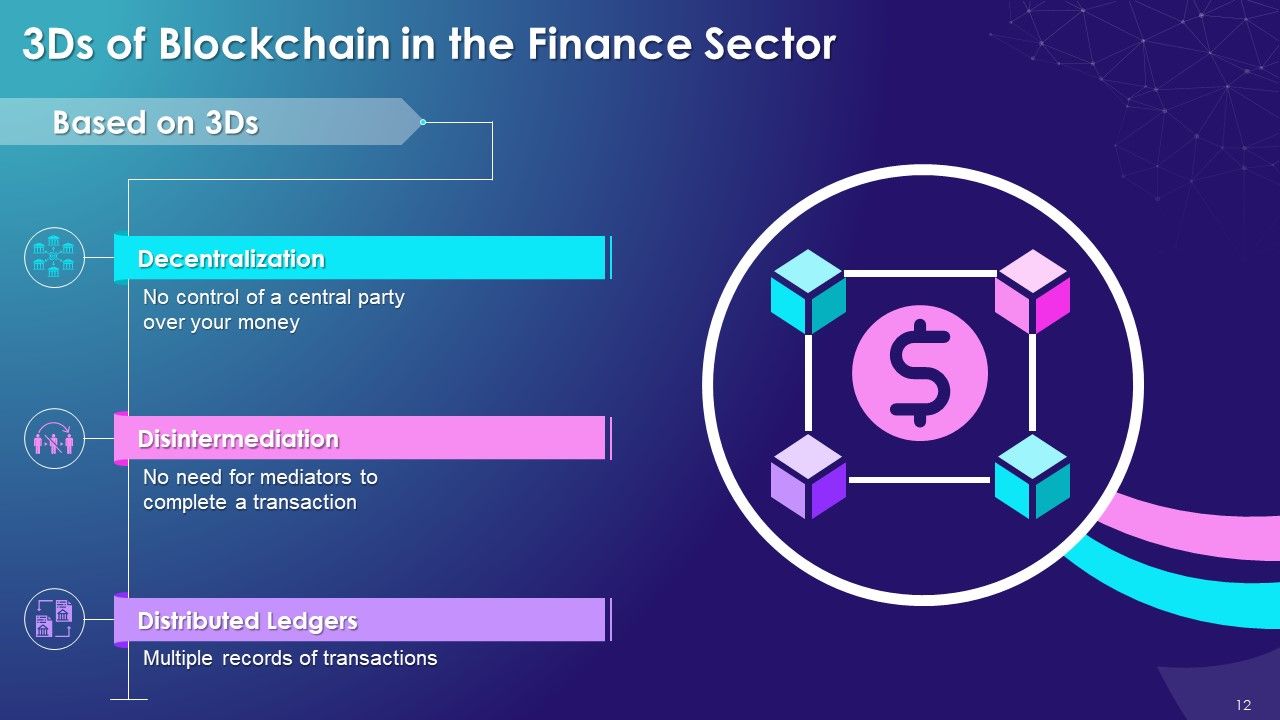

- 3Ds of Blockchain in the Finance Sector

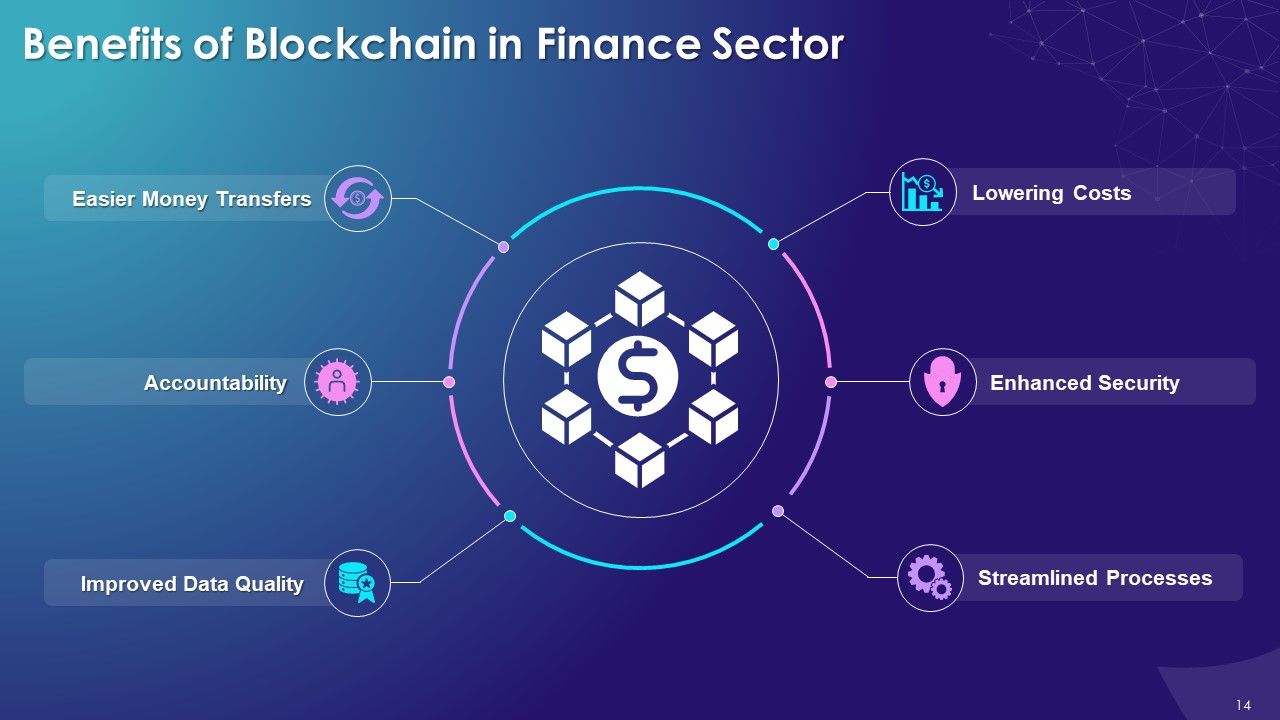

- Benefits of Blockchain in Finance Sector

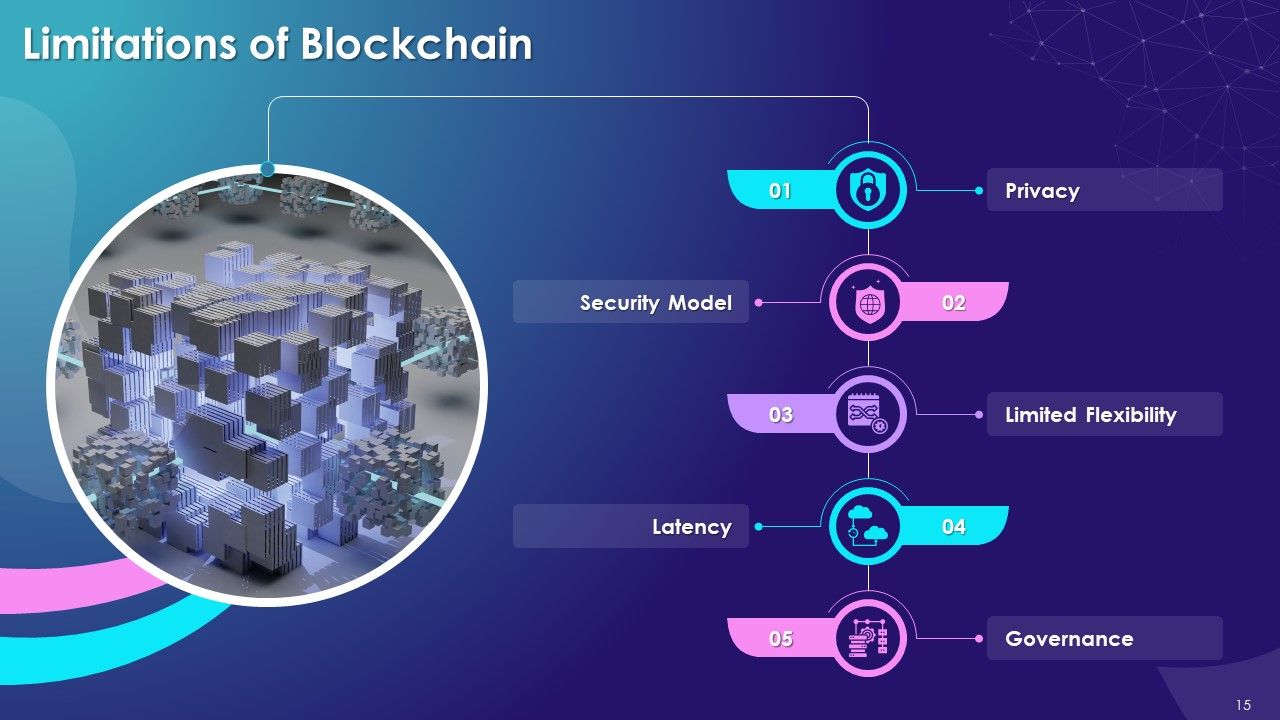

- Limitations of Blockchain

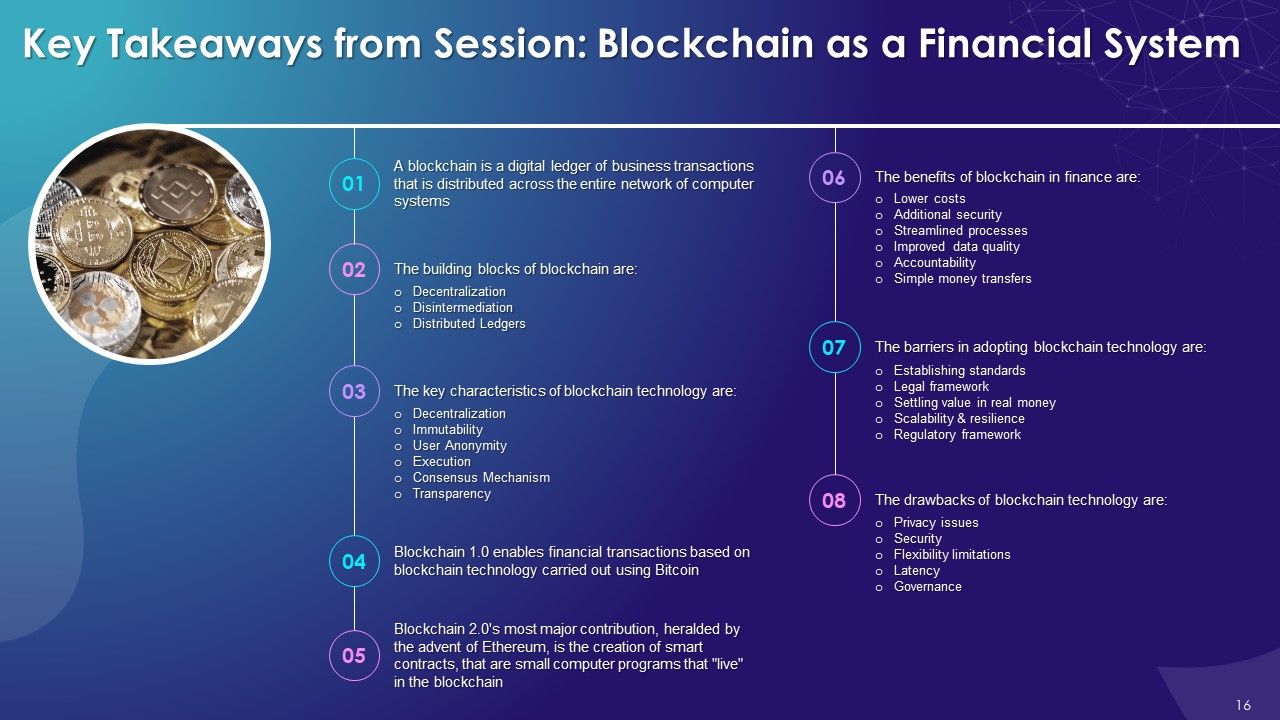

- Key Takeaways

- Let’s Discuss

- Introduction to Cryptocurrency

- What is Cryptocurrency?

- Understanding Cryptocurrencies

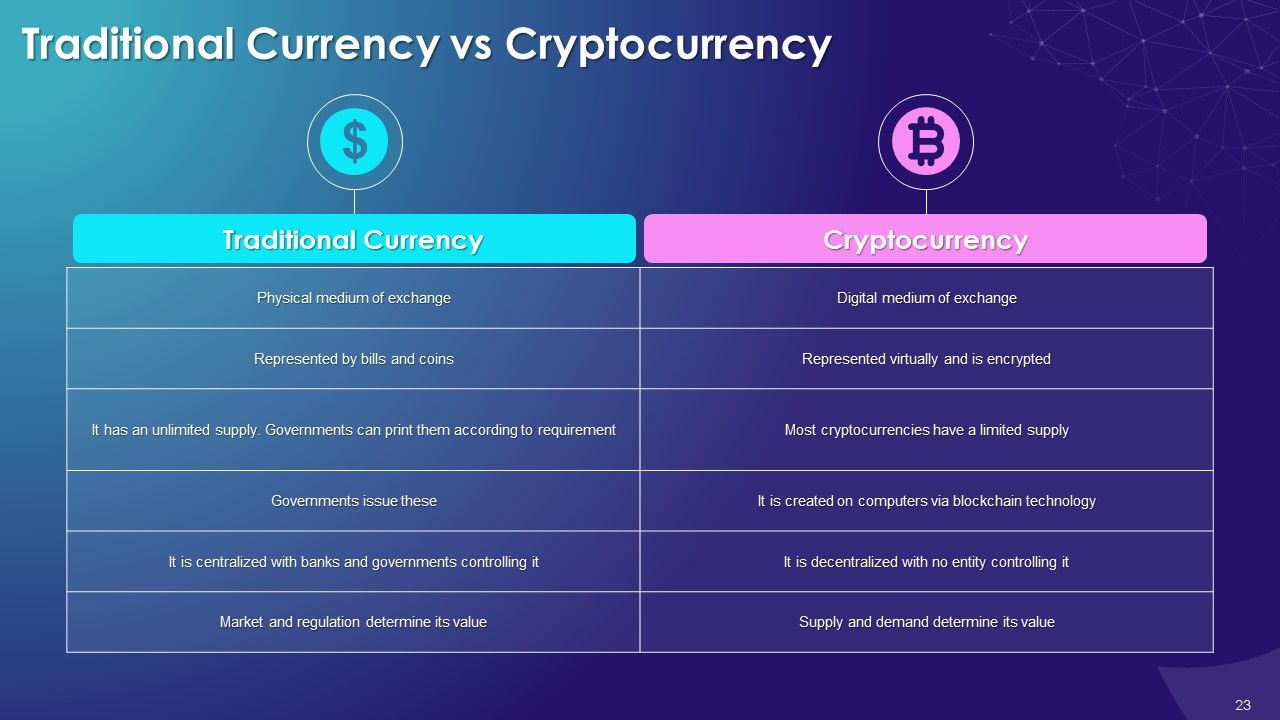

- Traditional Currency vs Cryptocurrency

- Cryptocurrency: Bitcoin

- Introduction to Bitcoin

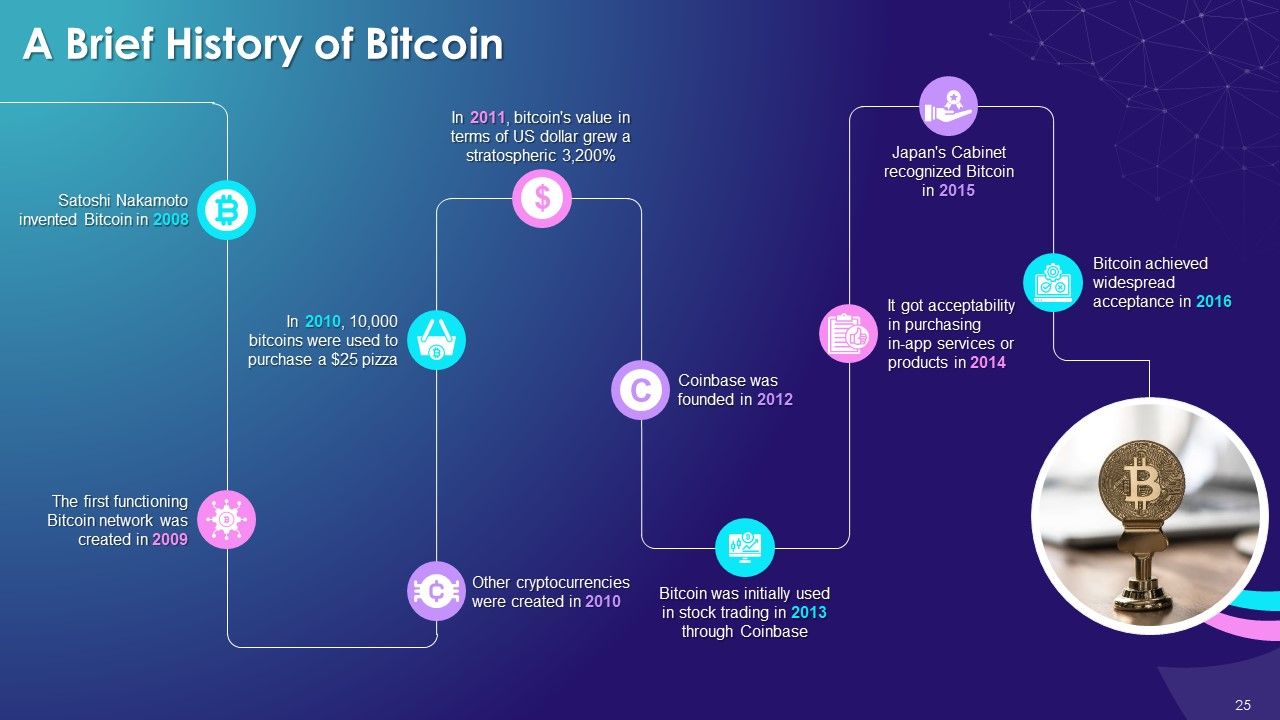

- A Brief History of Bitcoin

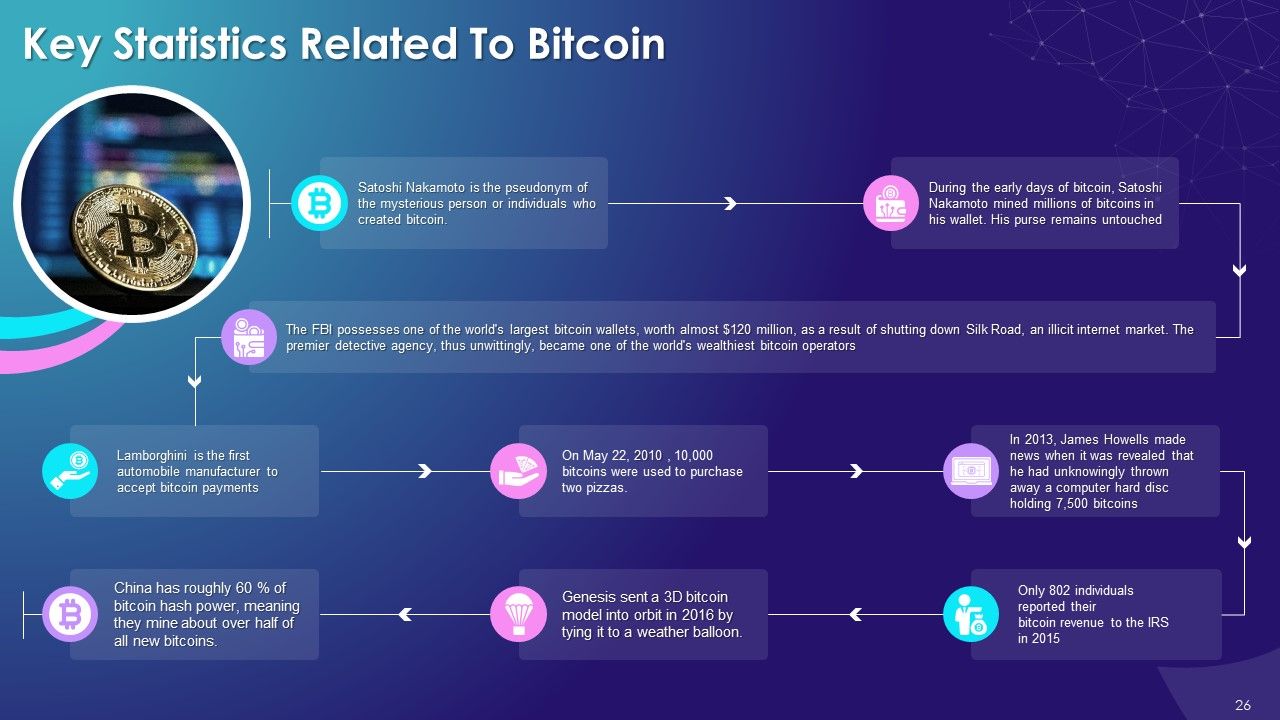

- Key Statistics of Bitcoin

- Key Takeaways

- Let’s Discuss

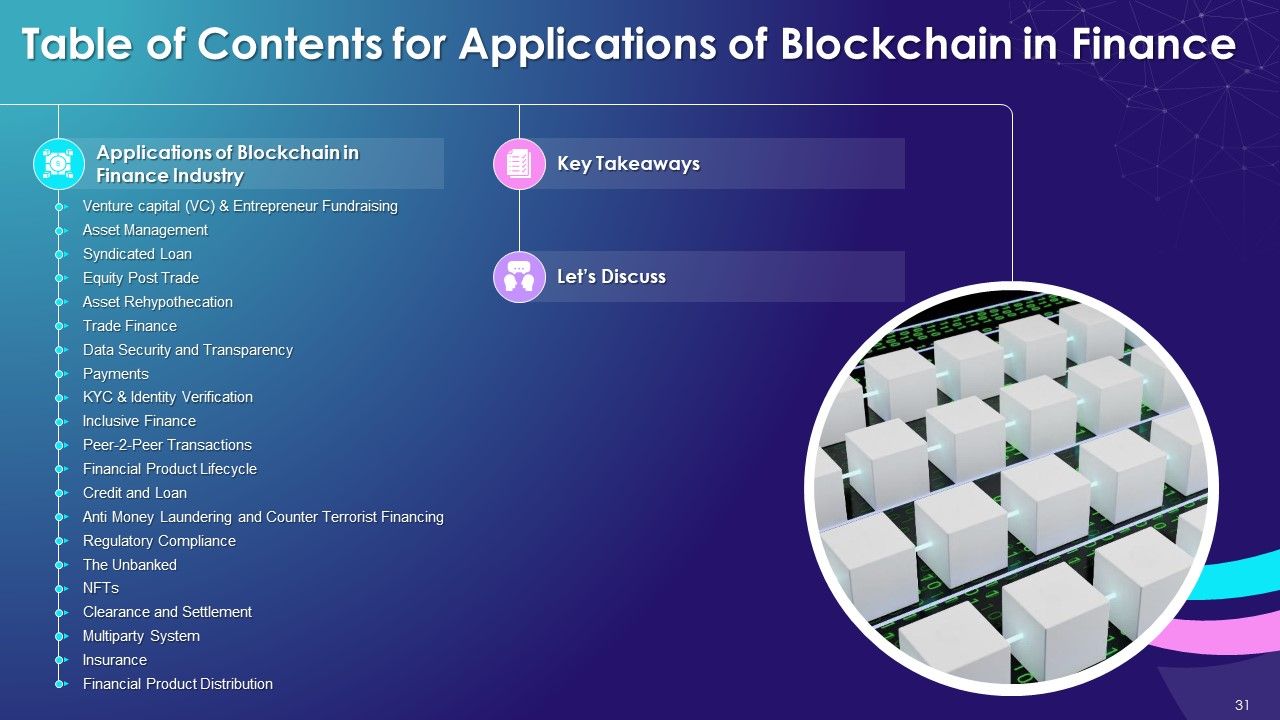

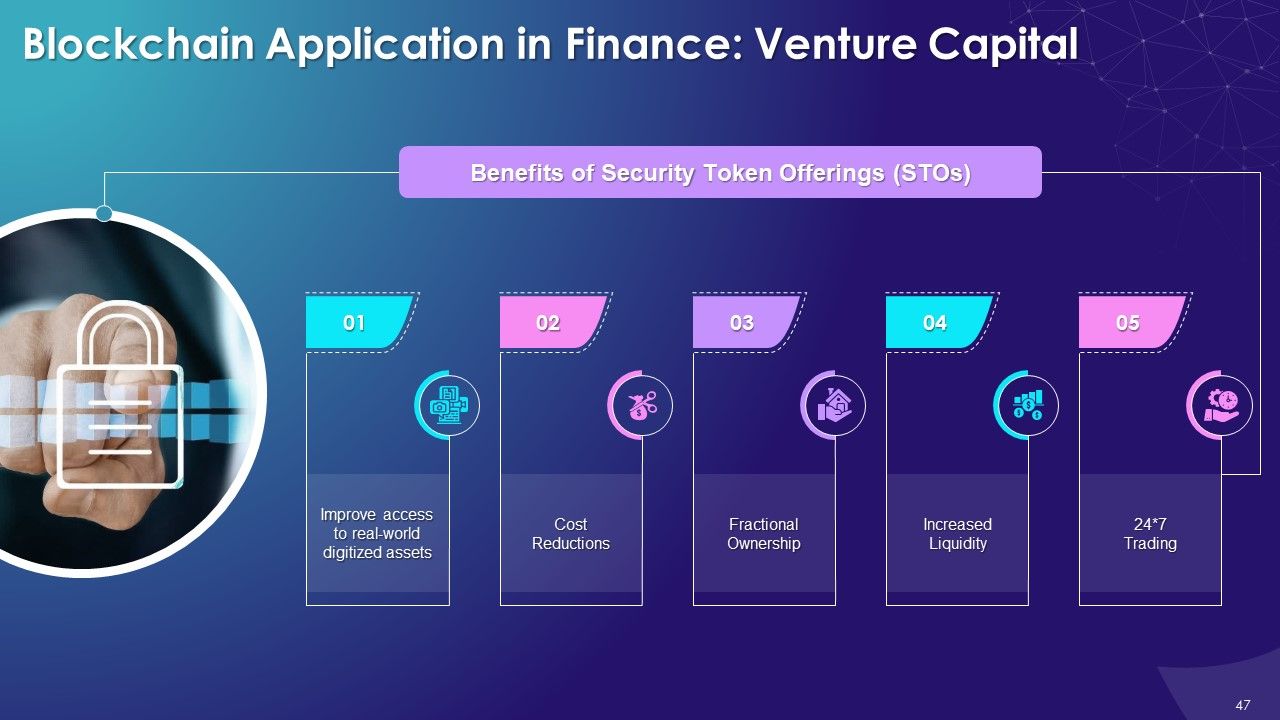

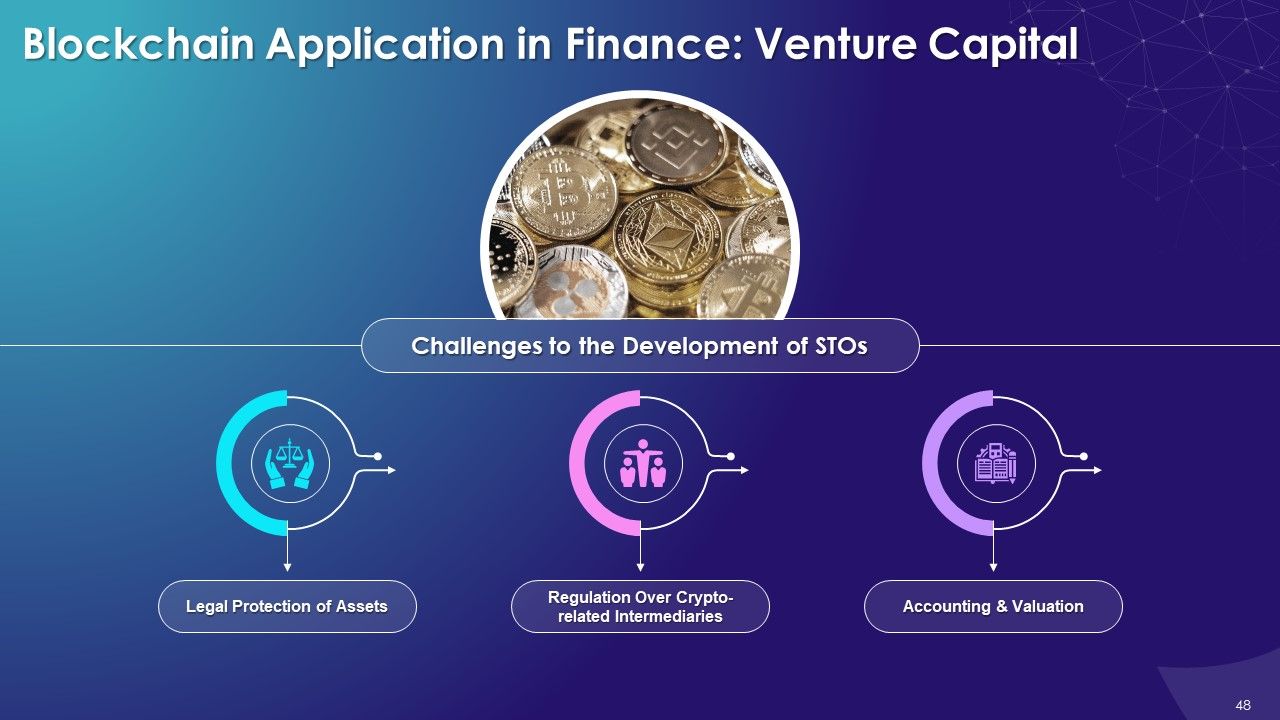

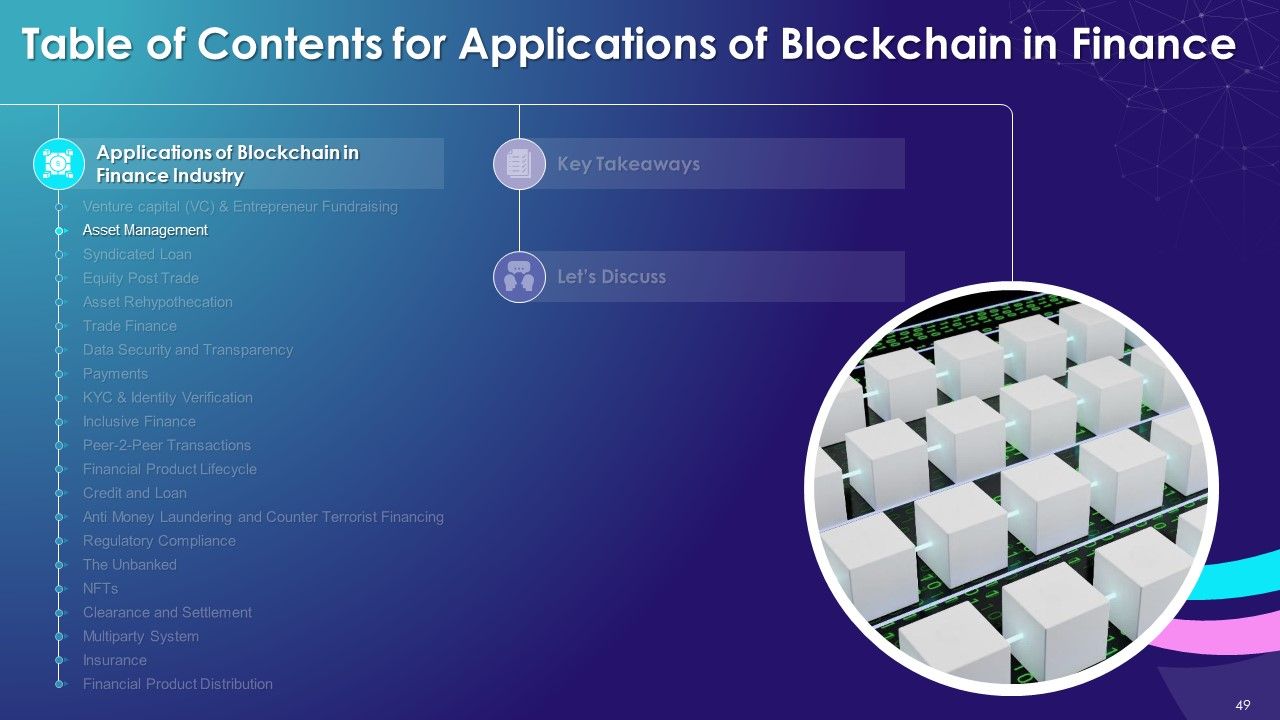

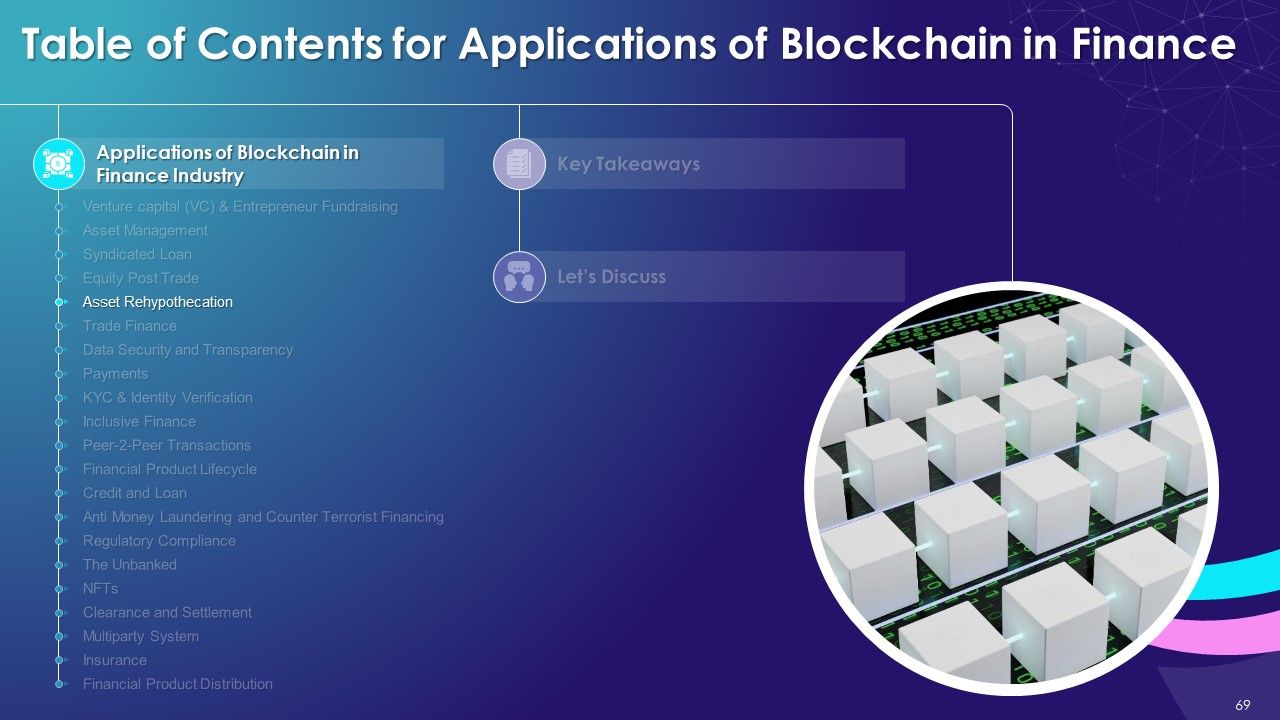

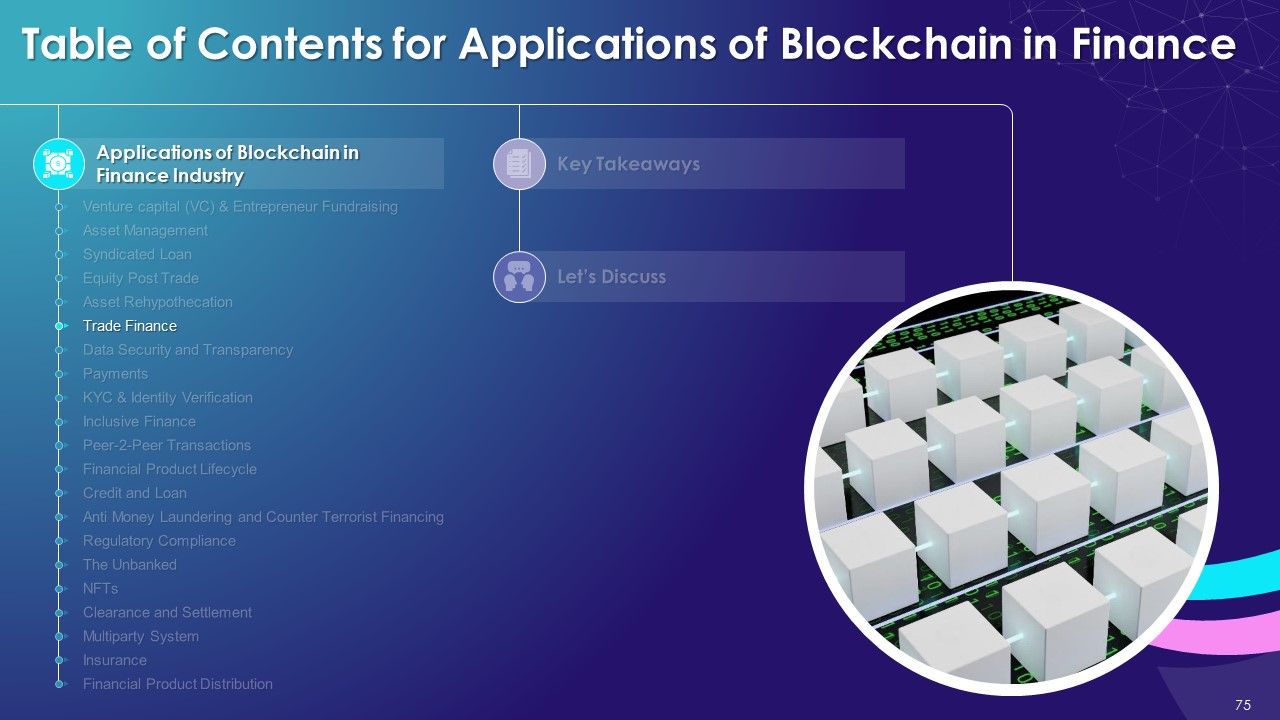

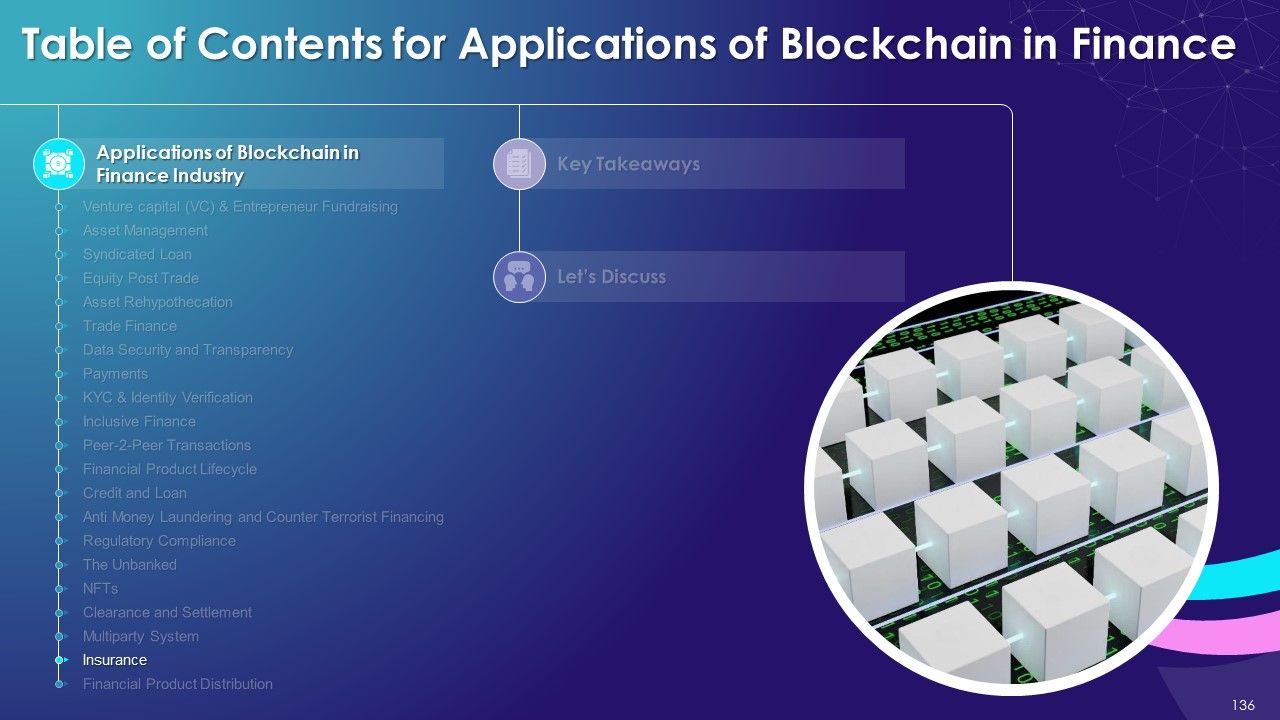

- Venture capital (VC) & Entrepreneur Fundraising

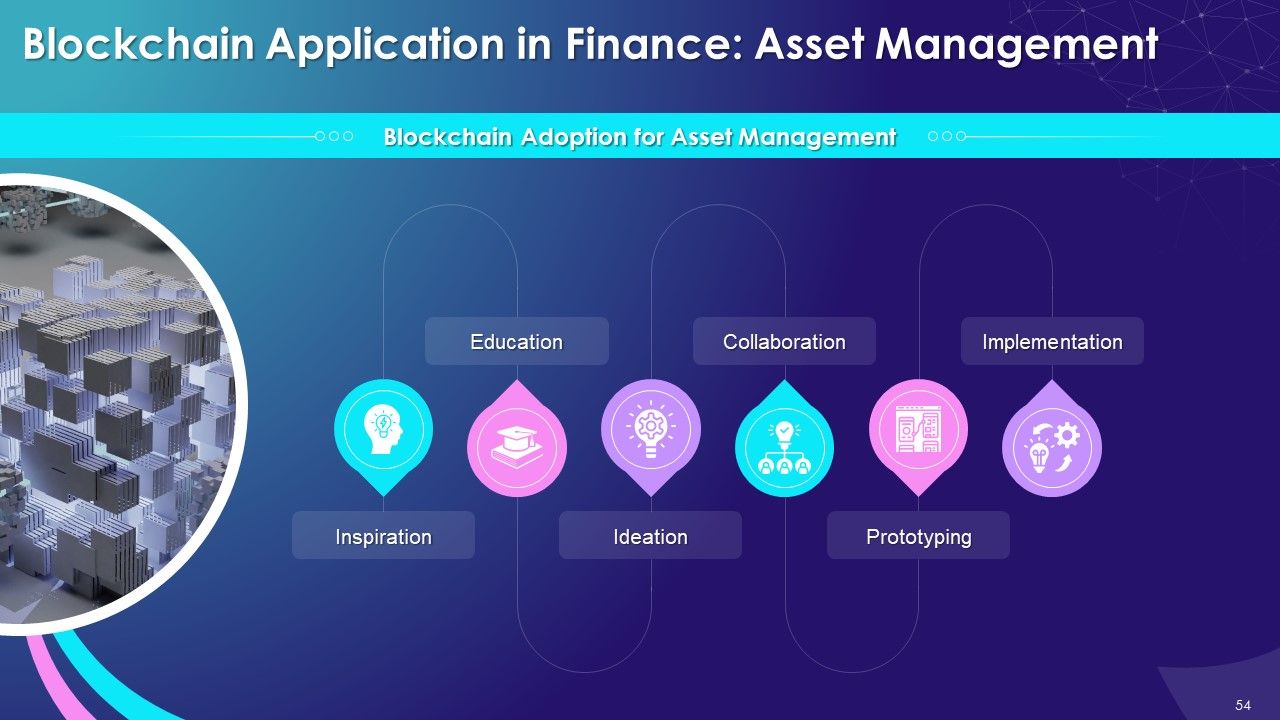

- Asset Management

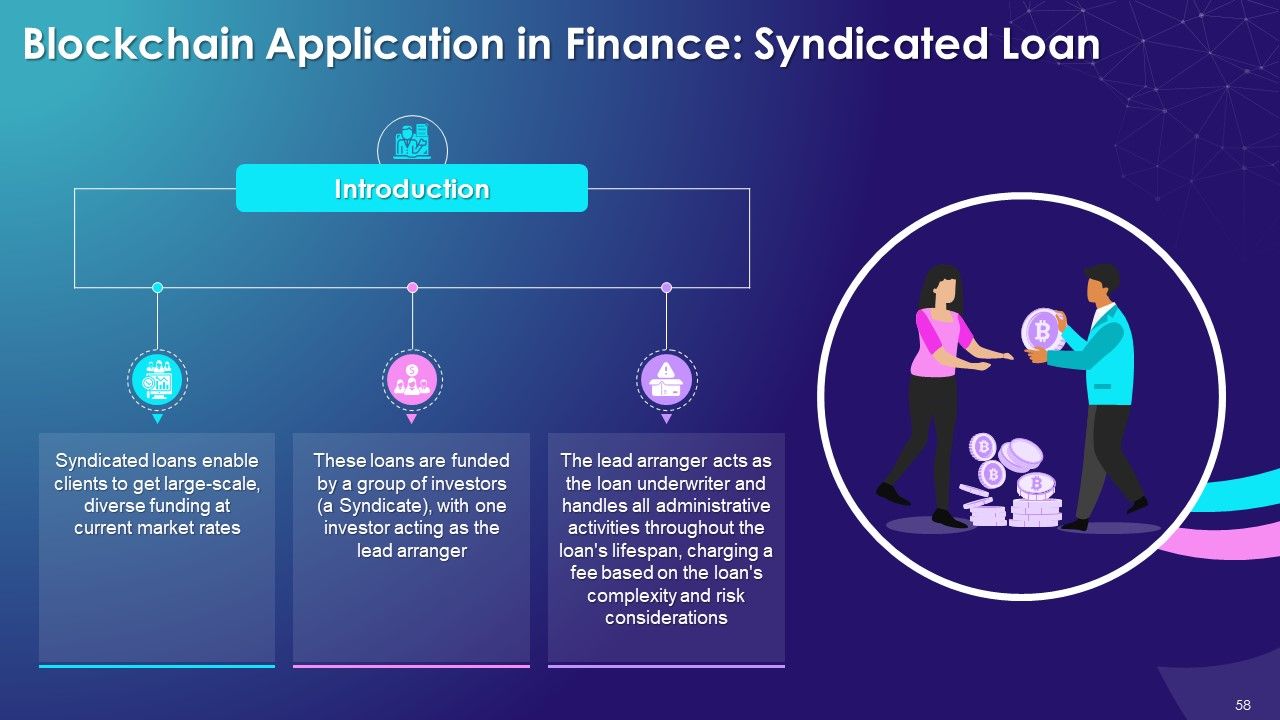

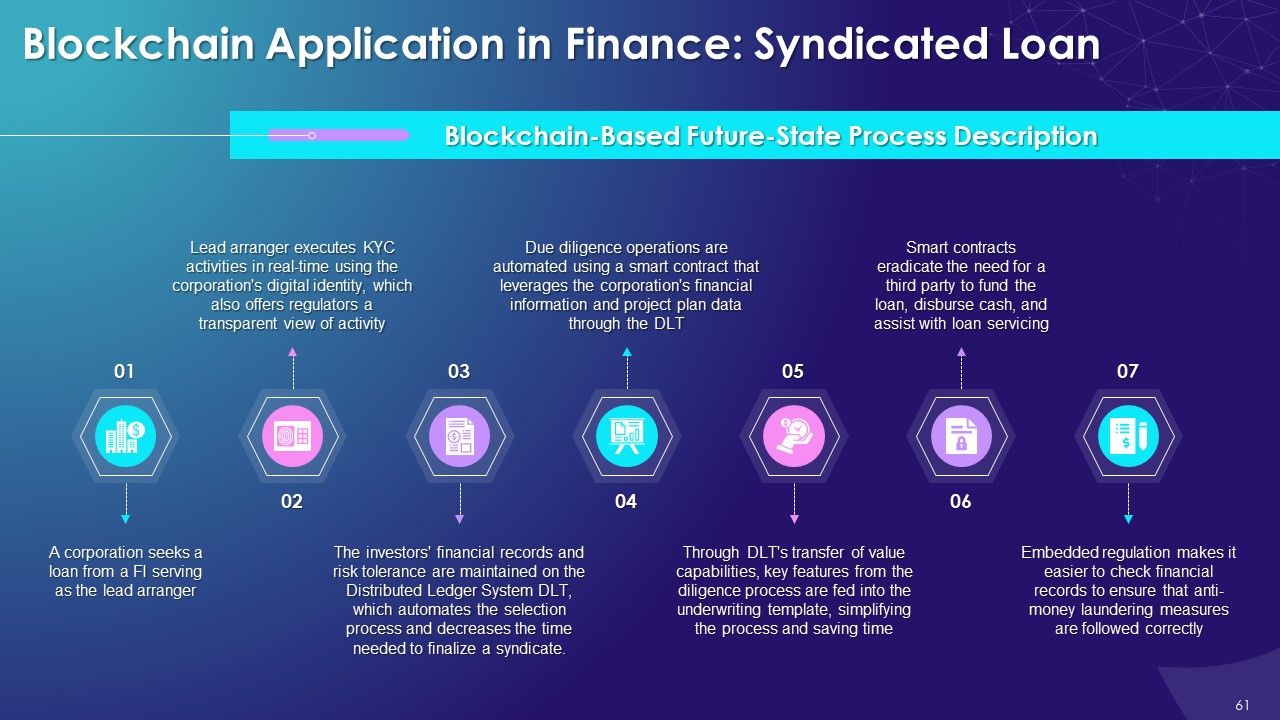

- Syndicated Loan

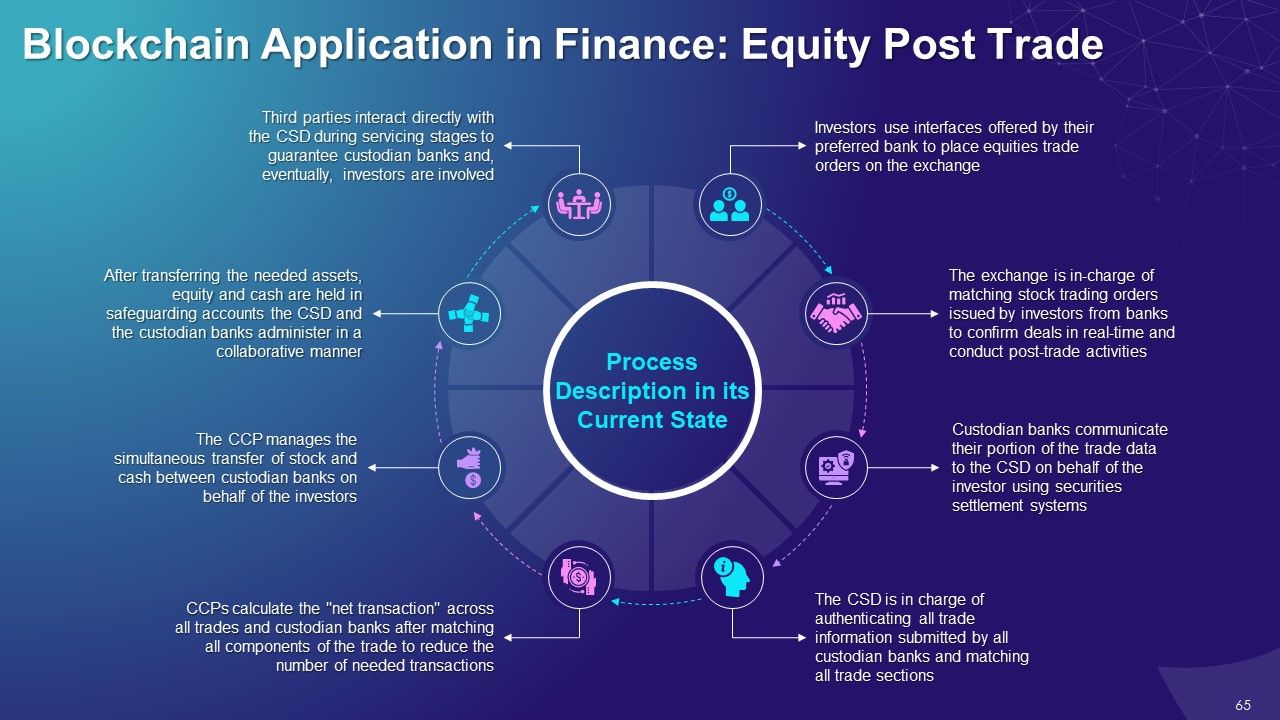

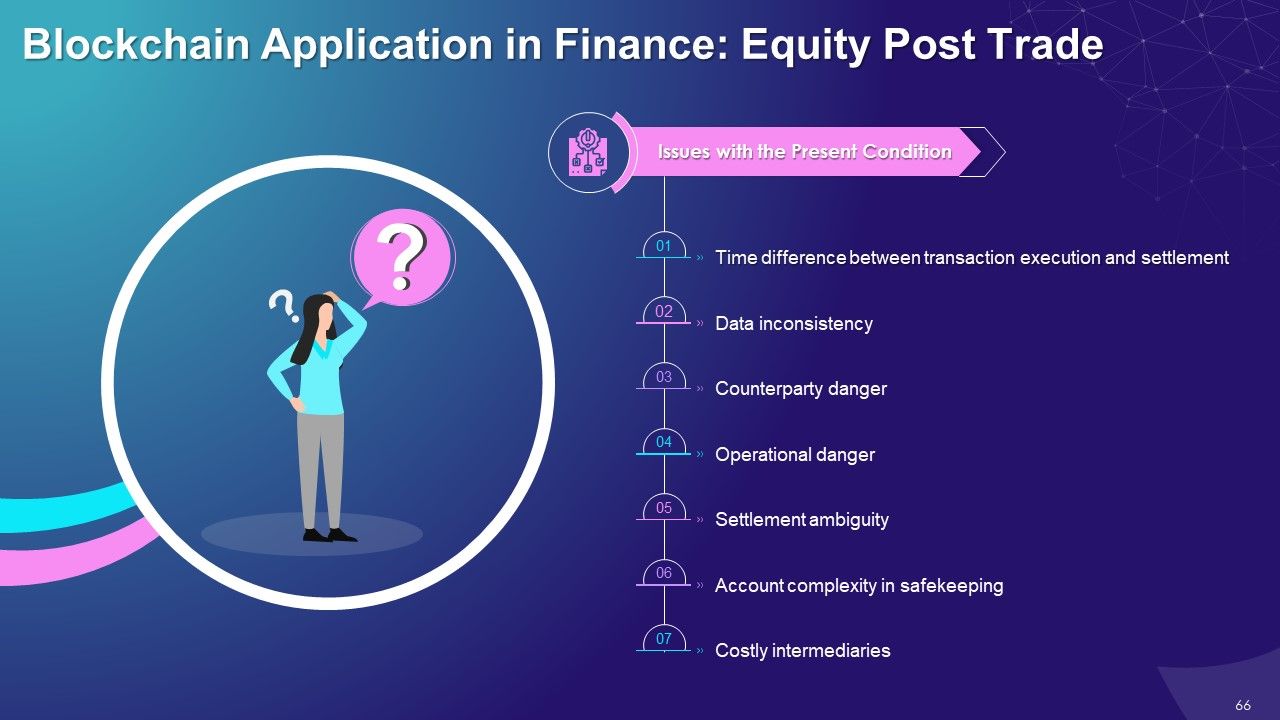

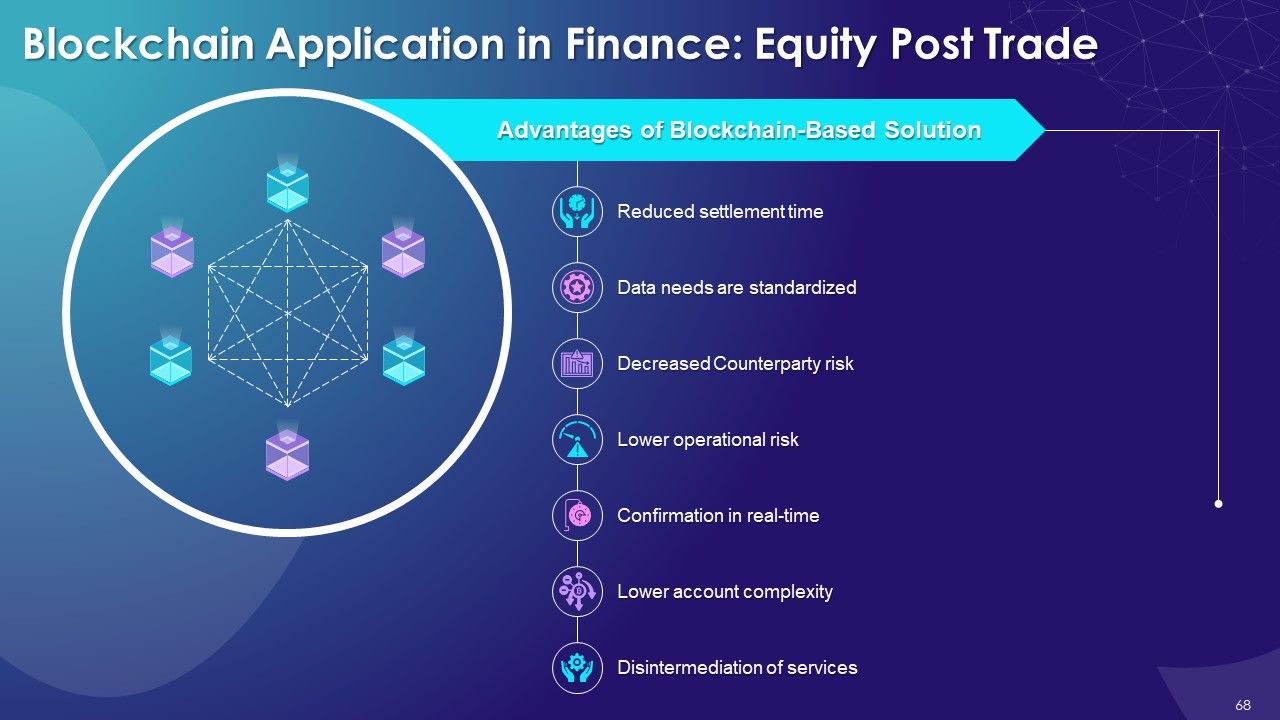

- Equity Post Trade

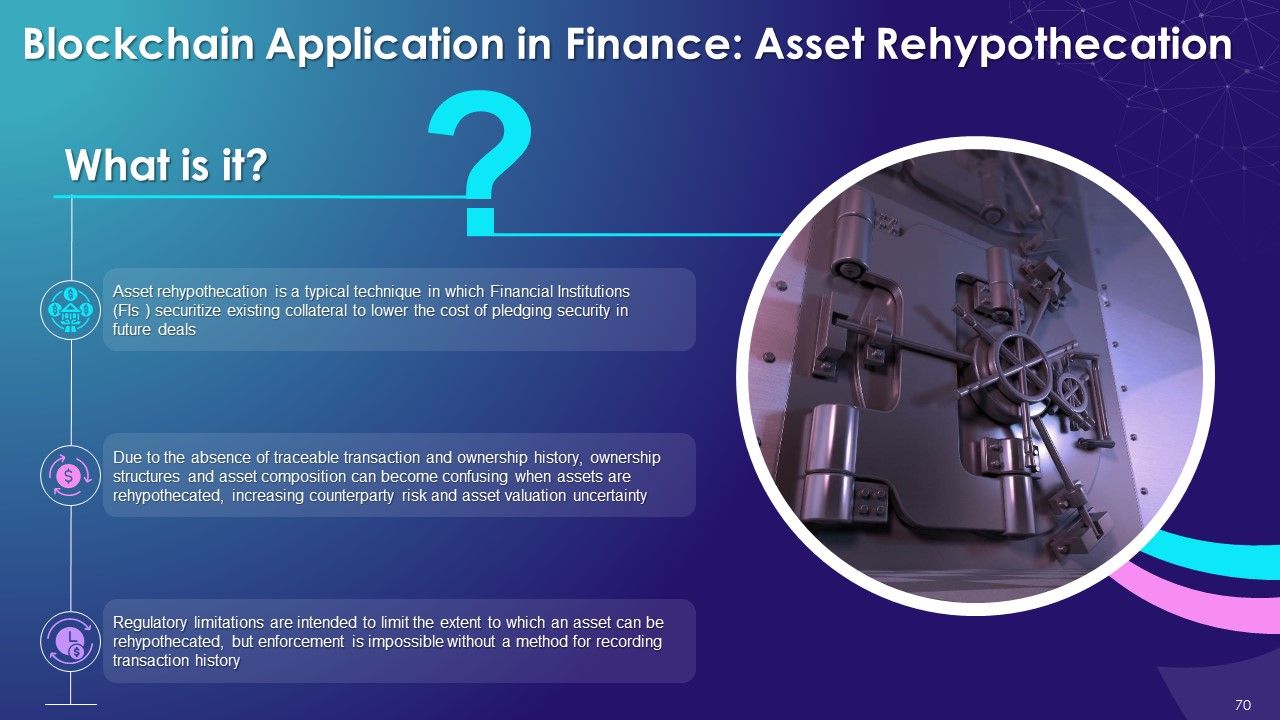

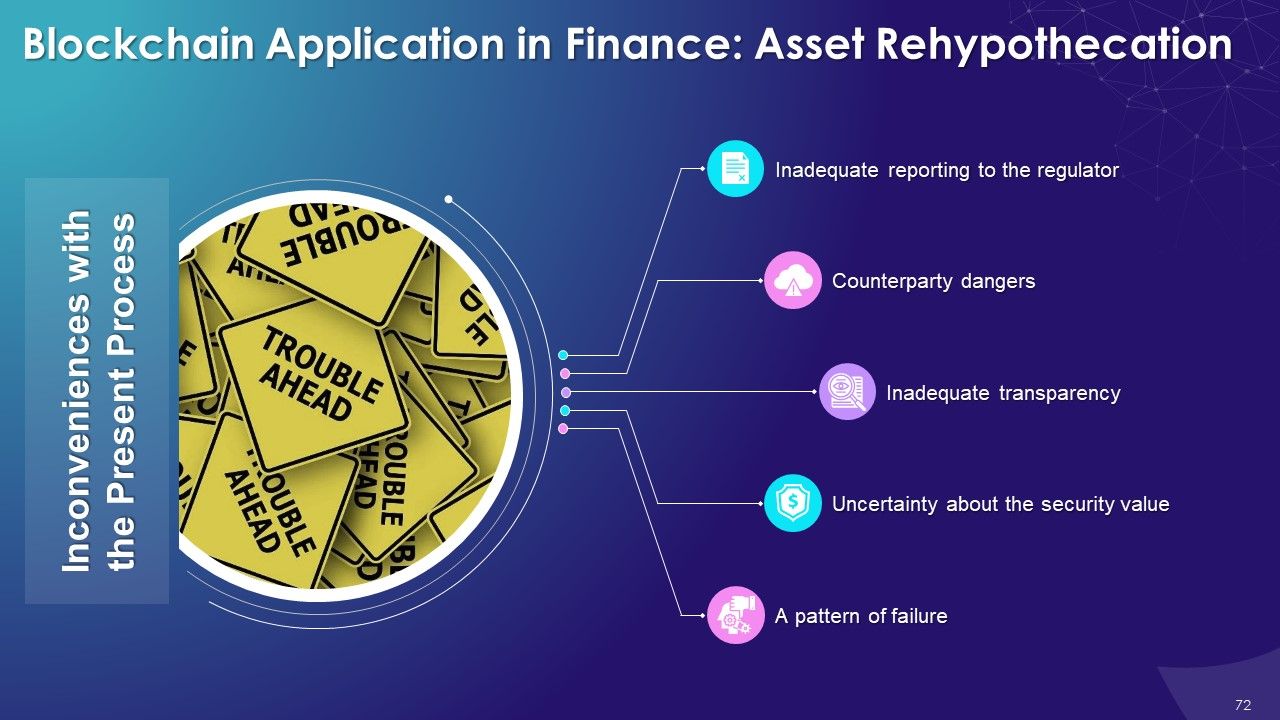

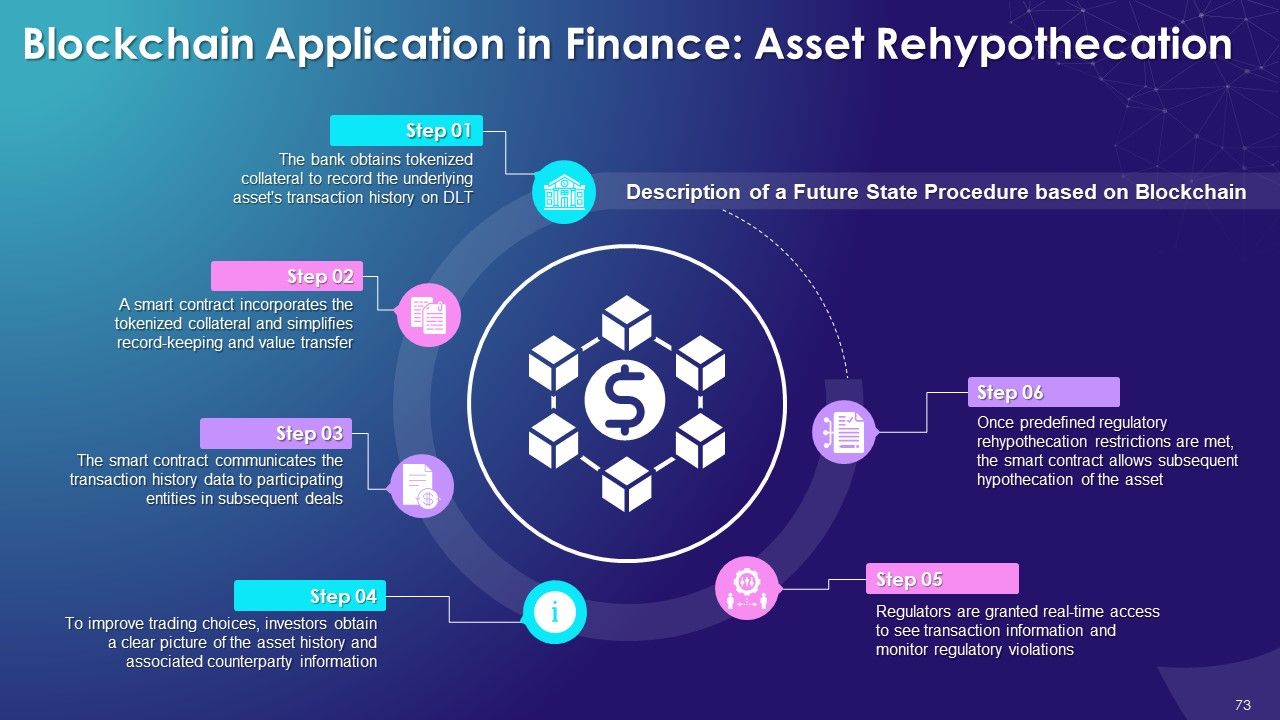

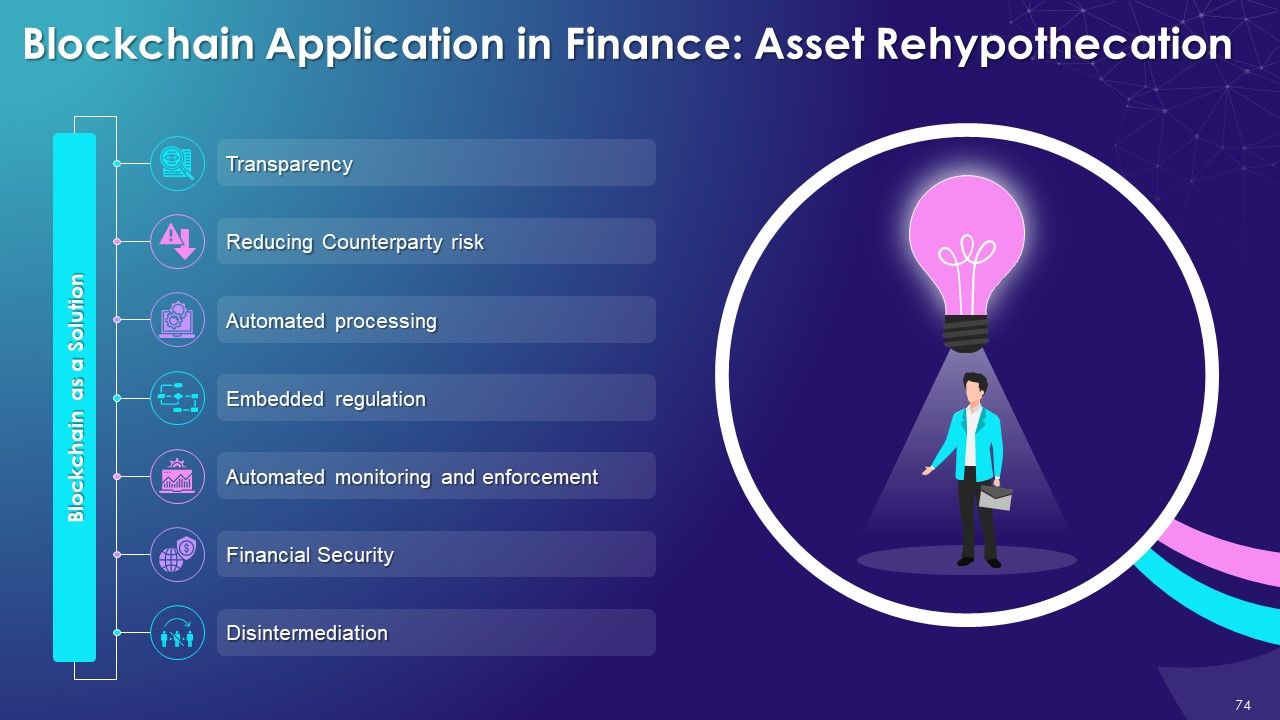

- Asset Rehypothecation

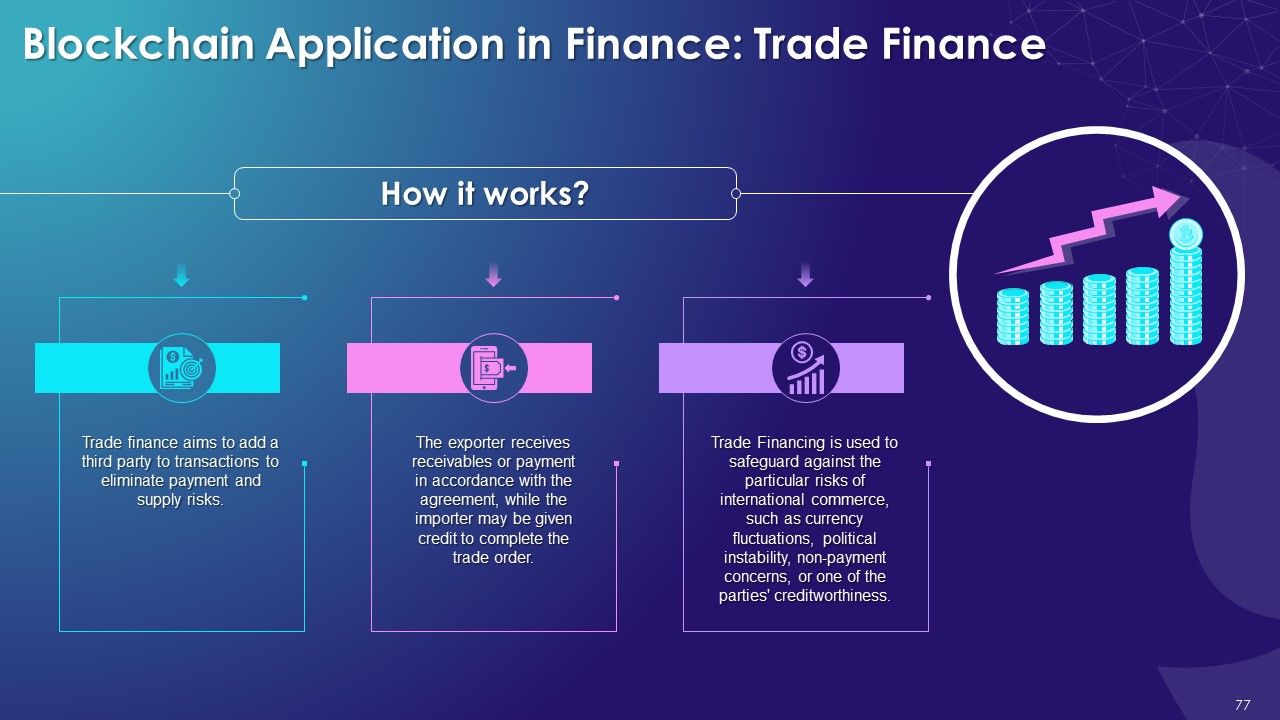

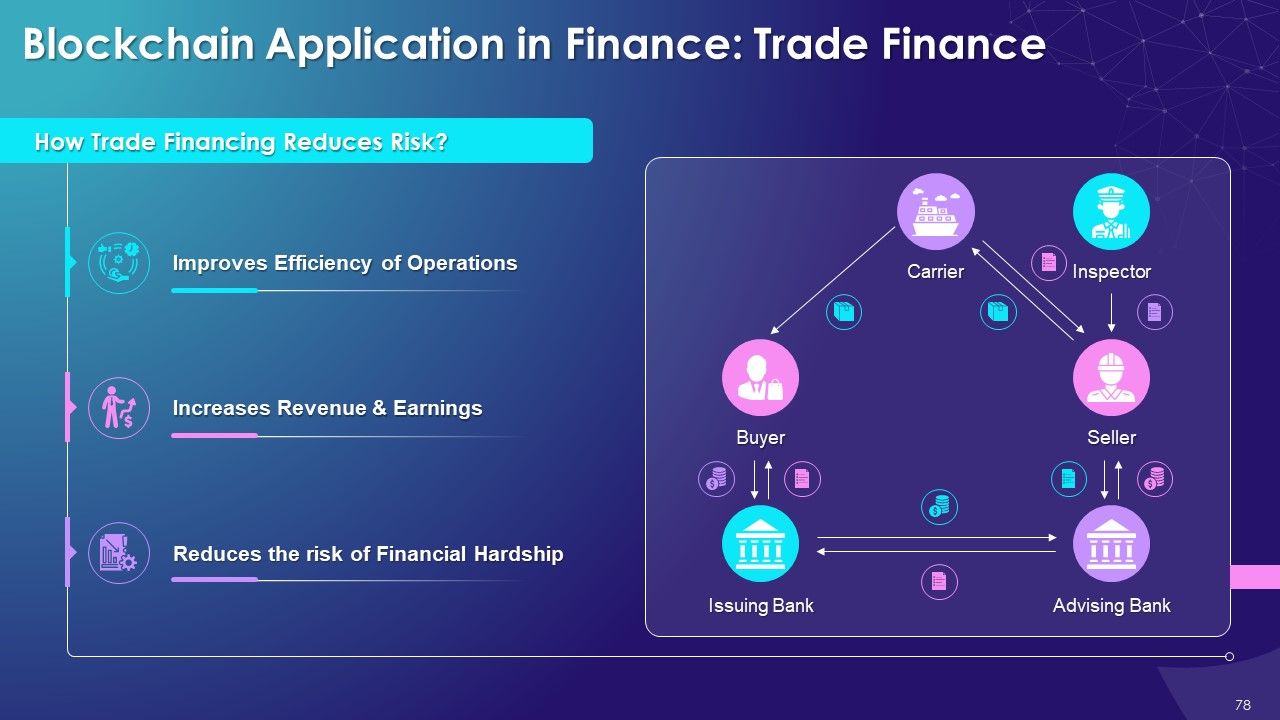

- Trade Finance

- Data Security and Transparency

- Payments

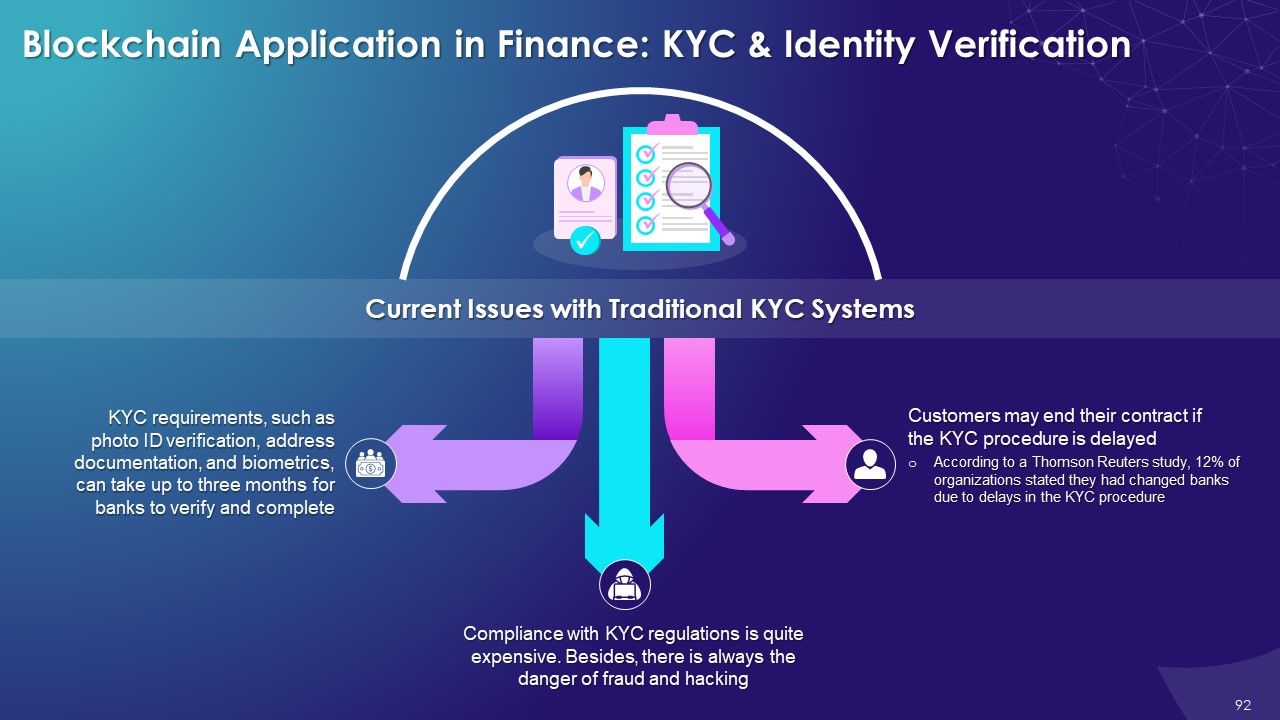

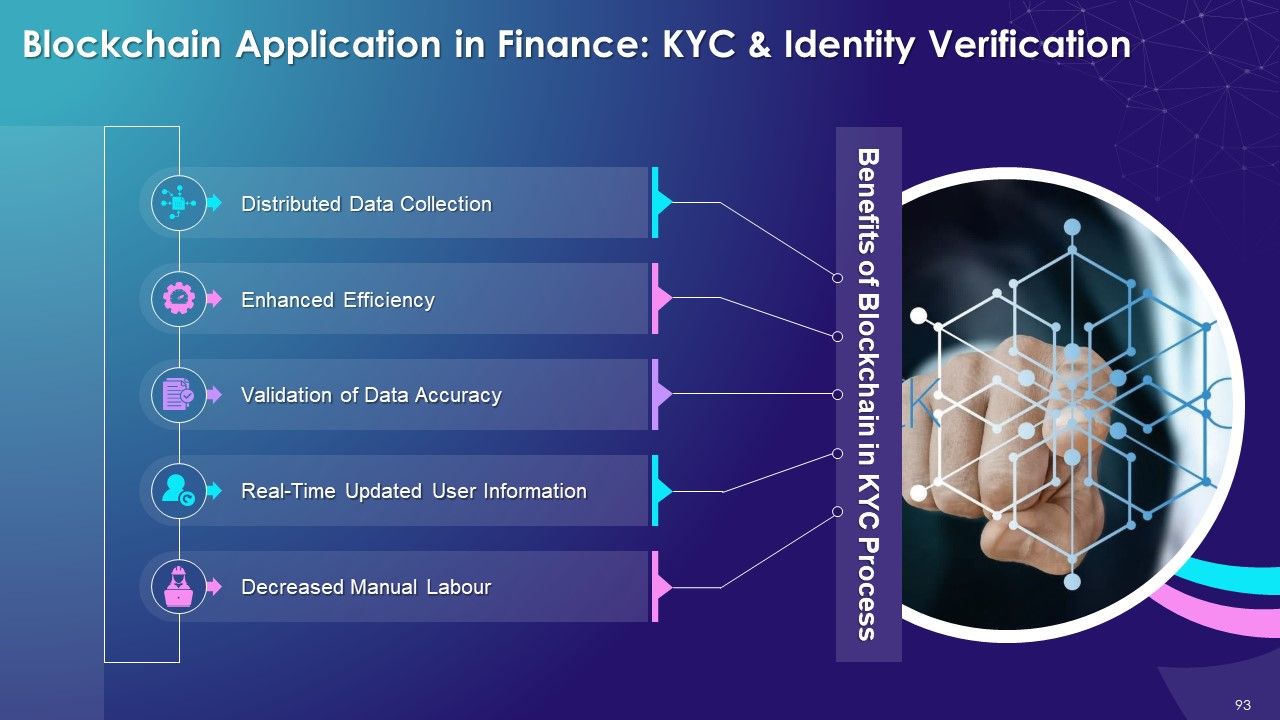

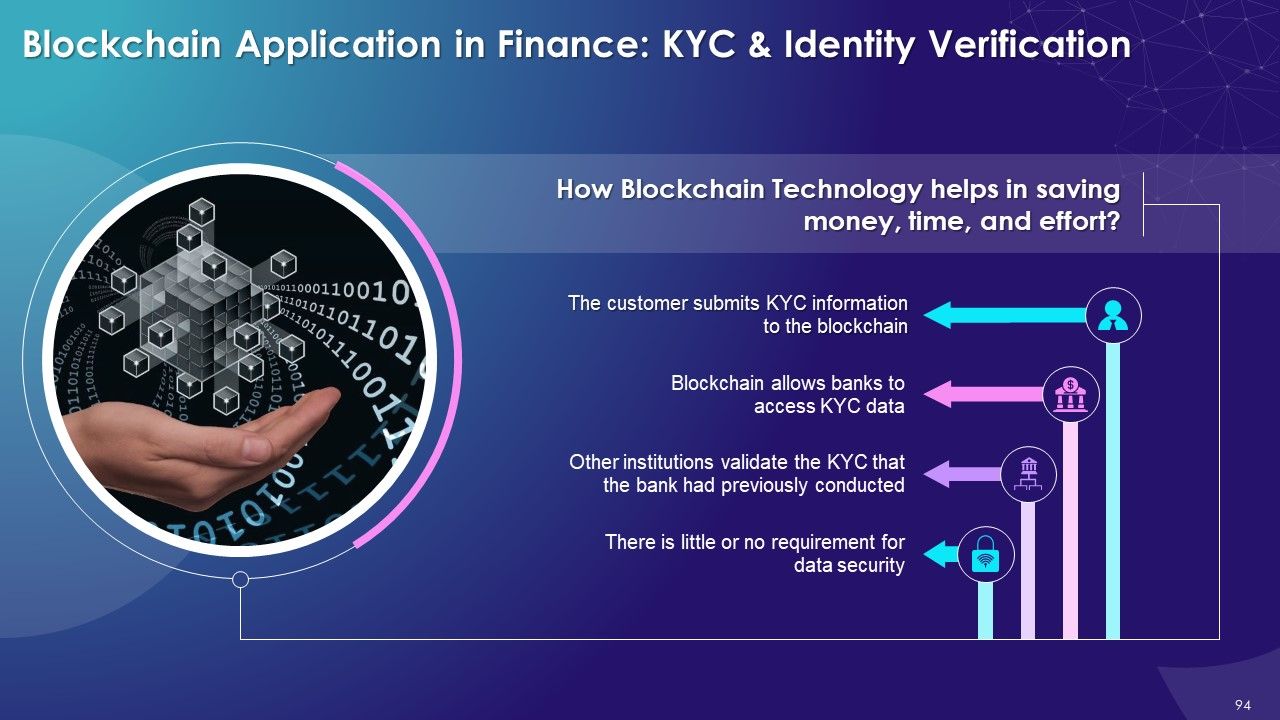

- KYC & Identity Verification

- Inclusive Finance

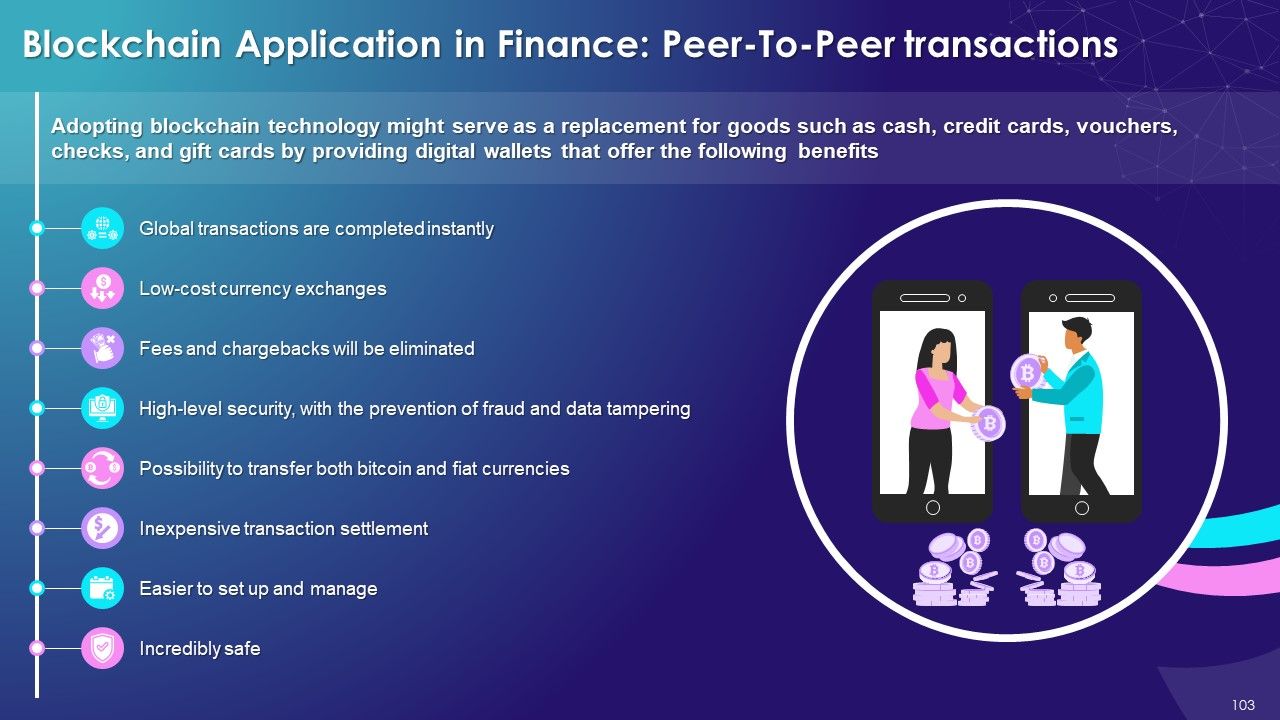

- Peer-2-Peer Transactions

- Financial Product Lifecycle

- Credit and Loan

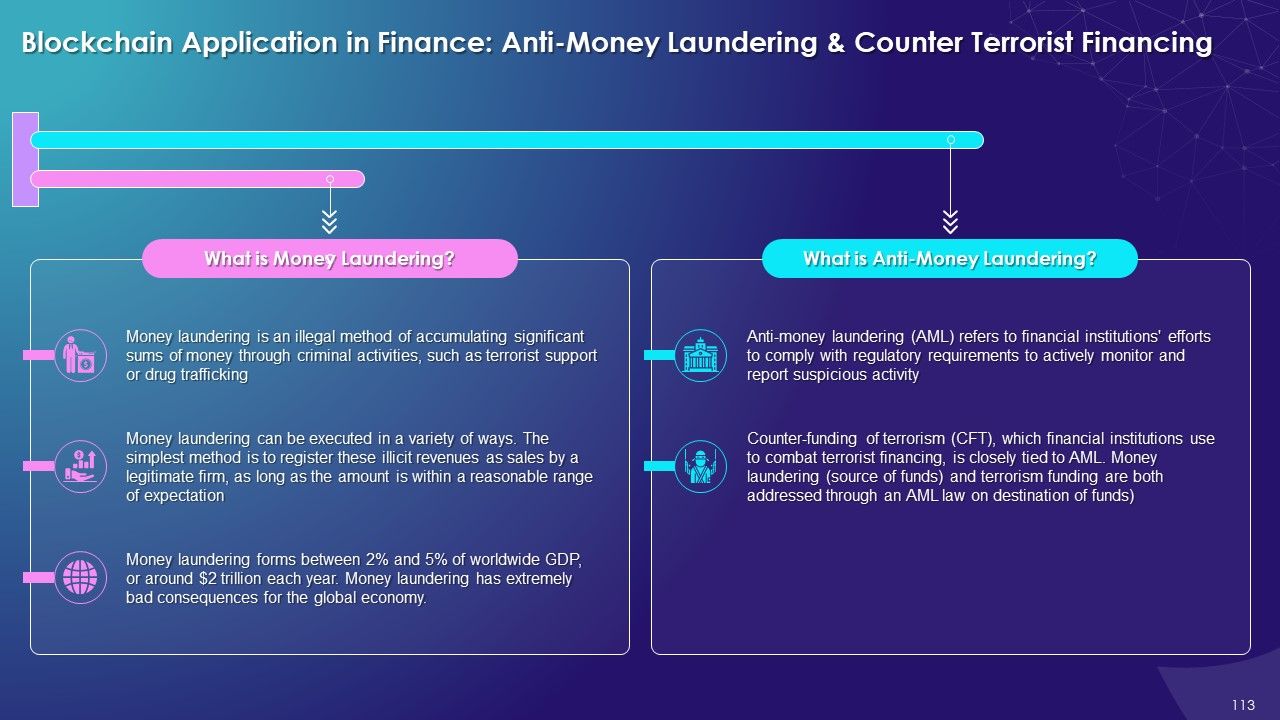

- Anti-Money Laundering and Counter Terrorist Financing

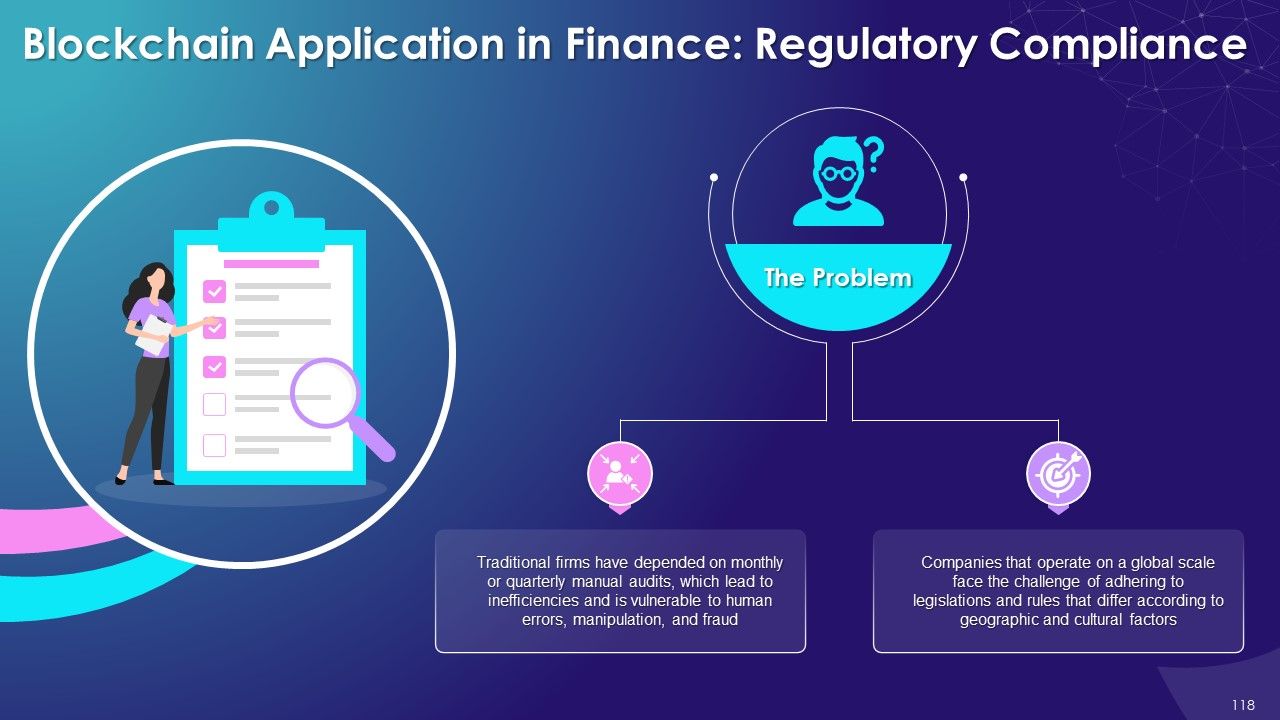

- Regulatory Compliance

- The Unbanked

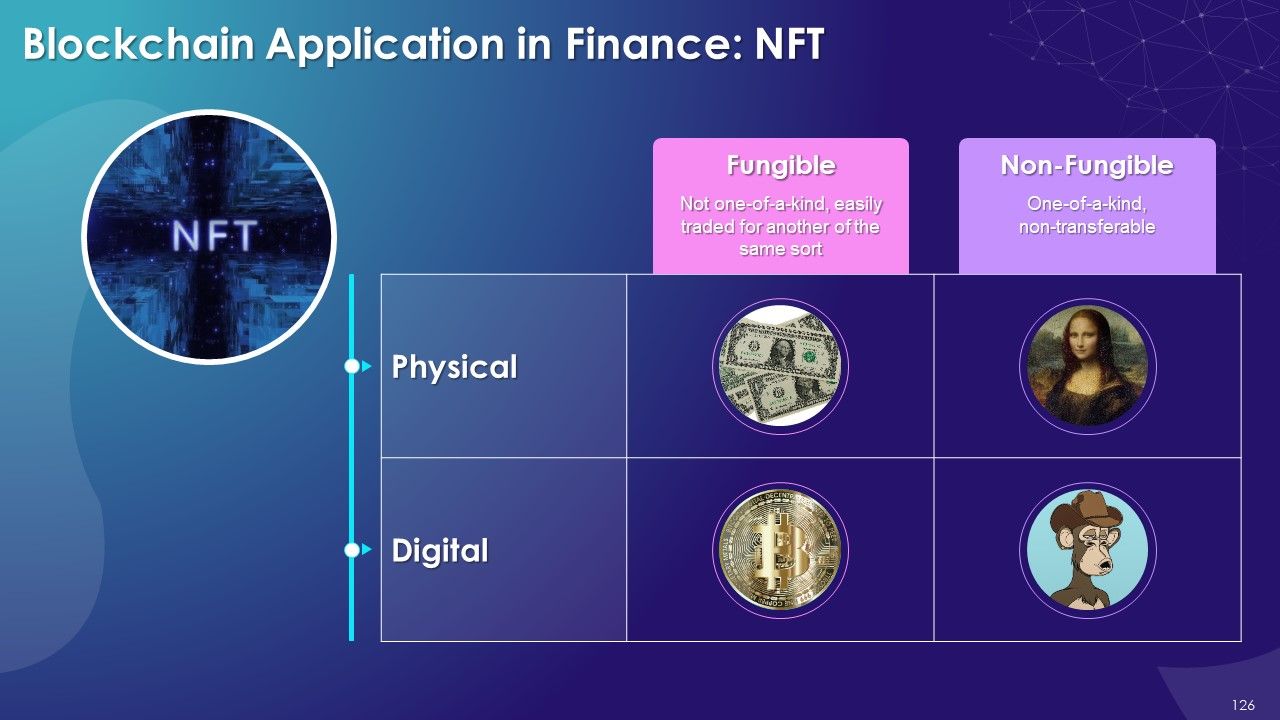

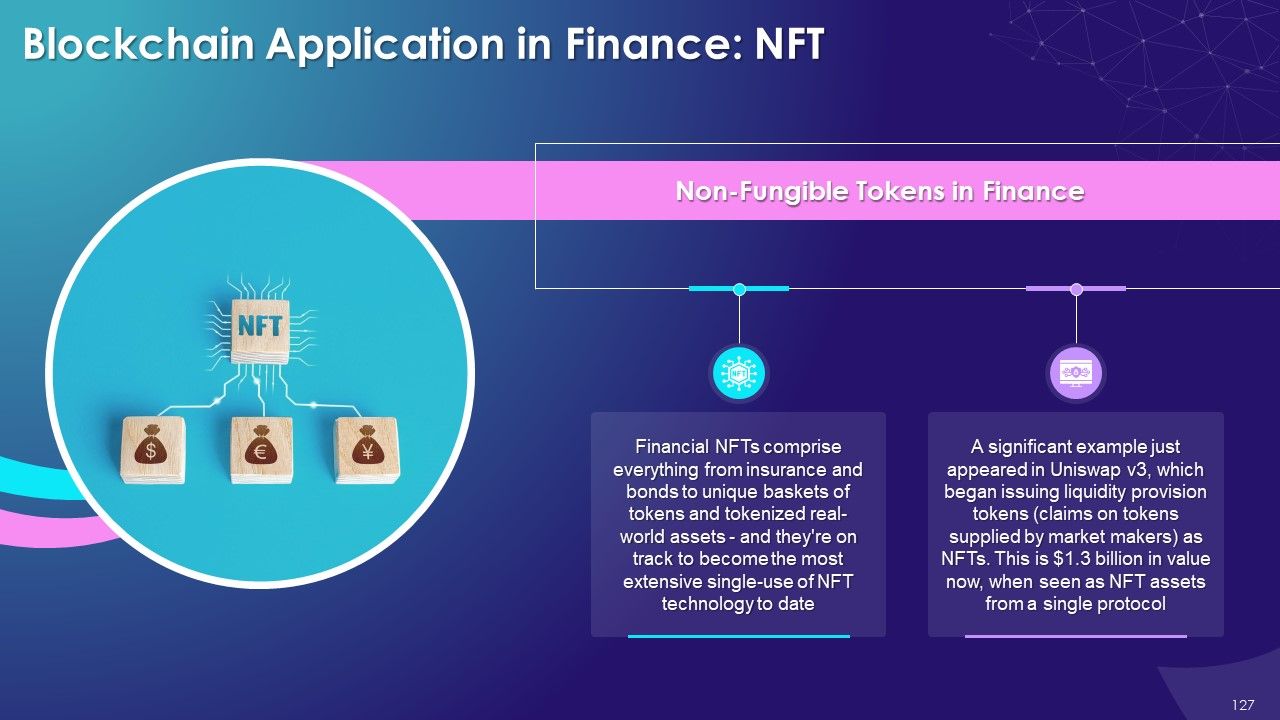

- NFTs

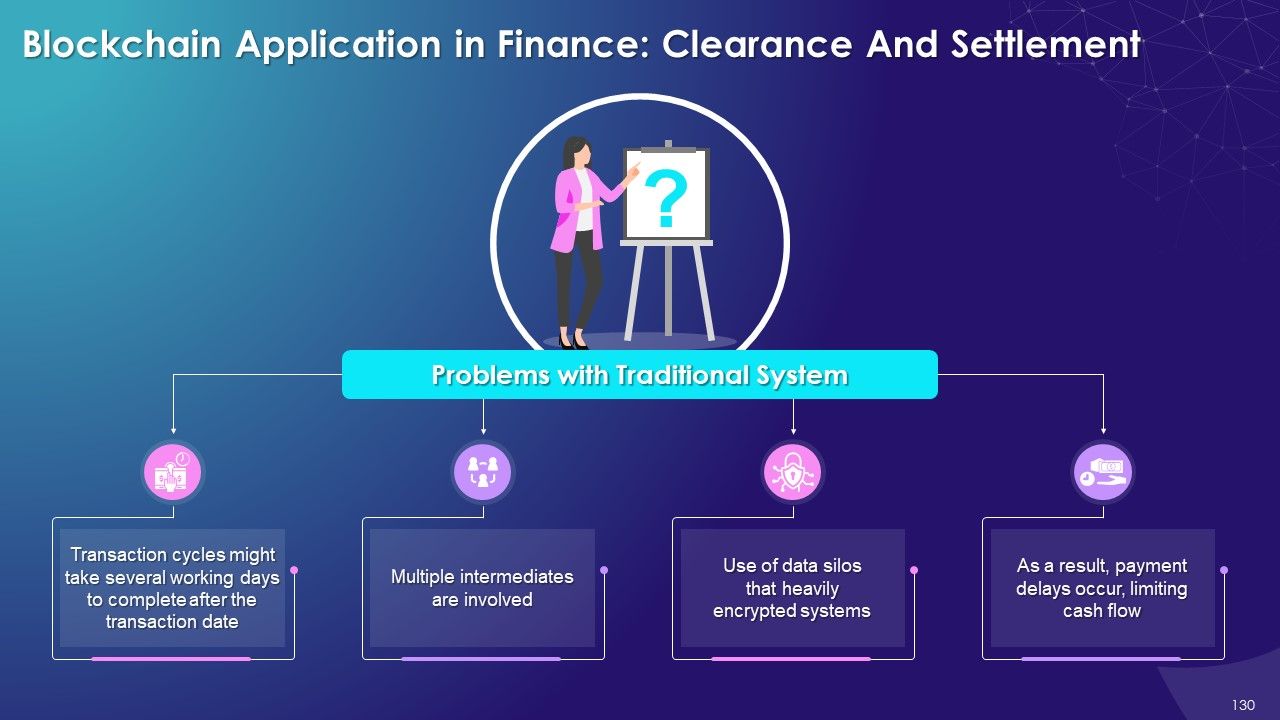

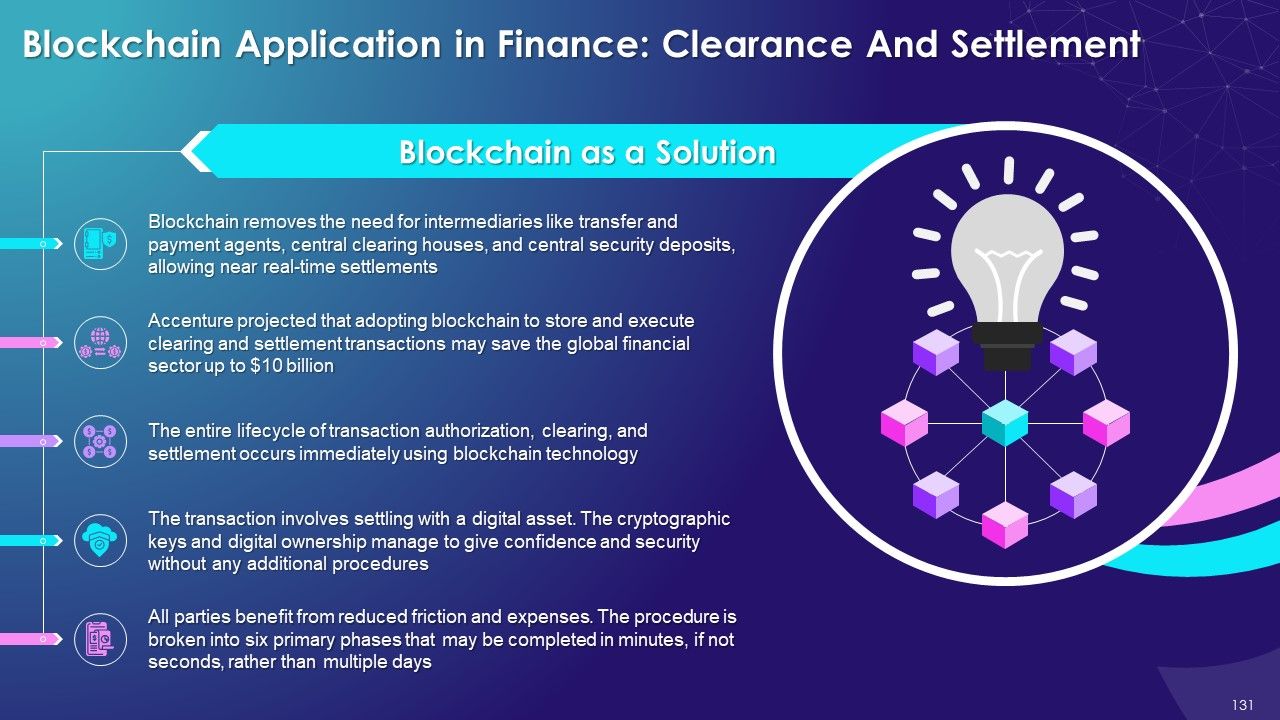

- Clearance and Settlement

- Multiparty System

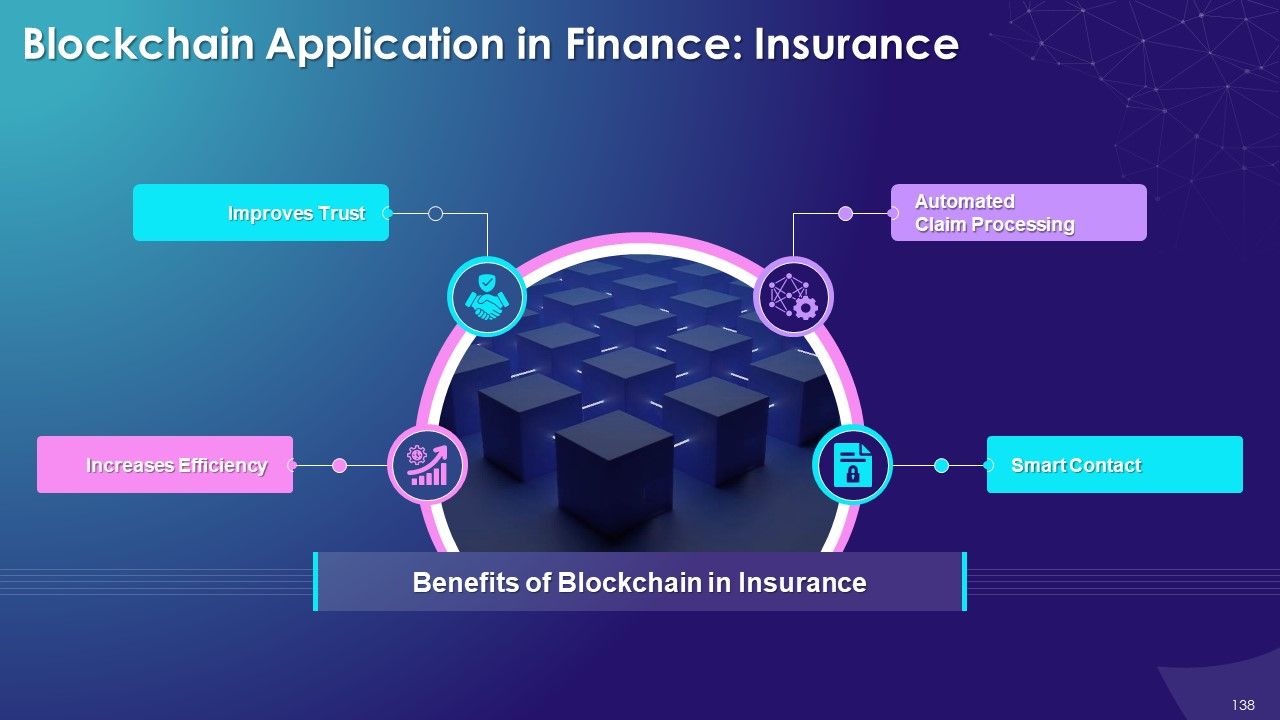

- Insurance

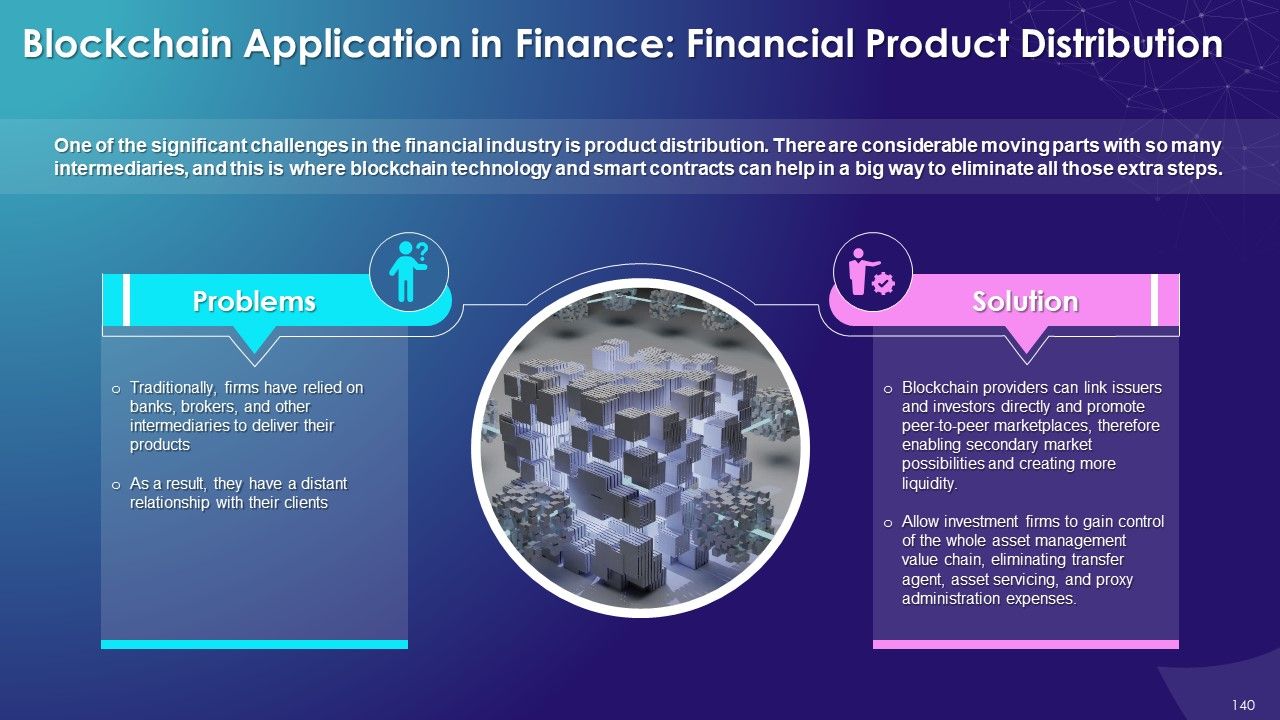

- Financial Product Distribution

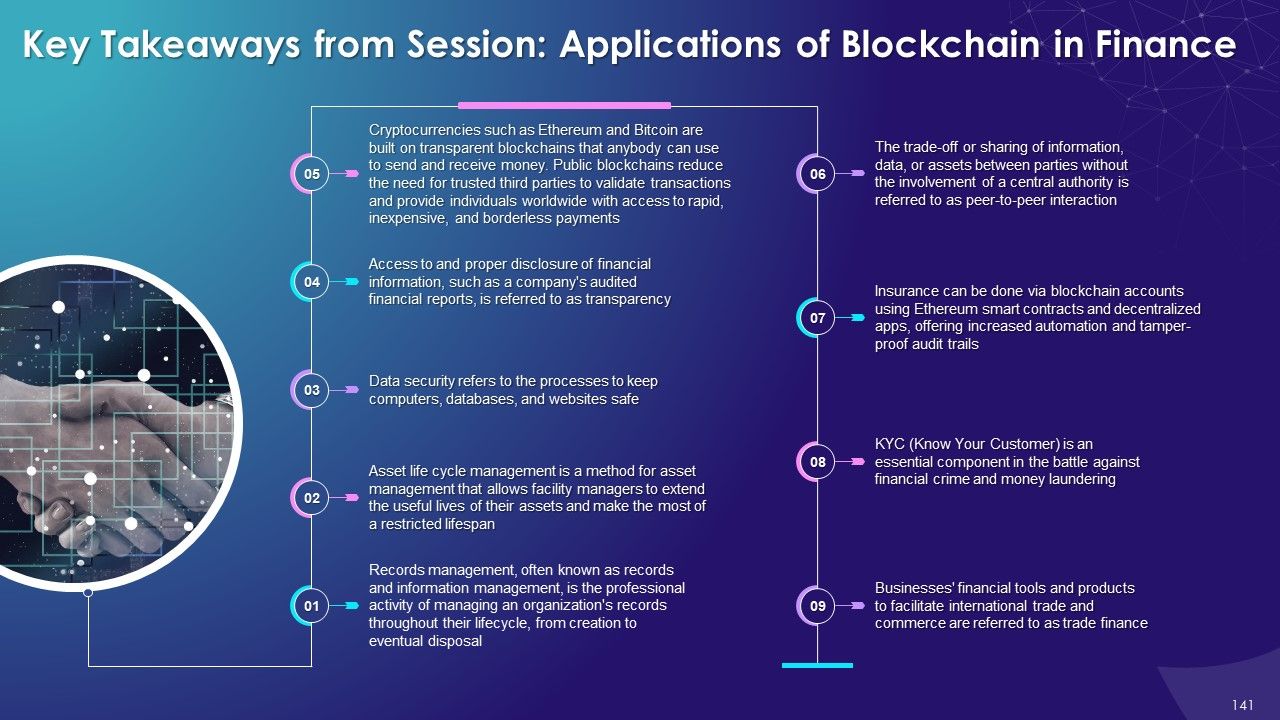

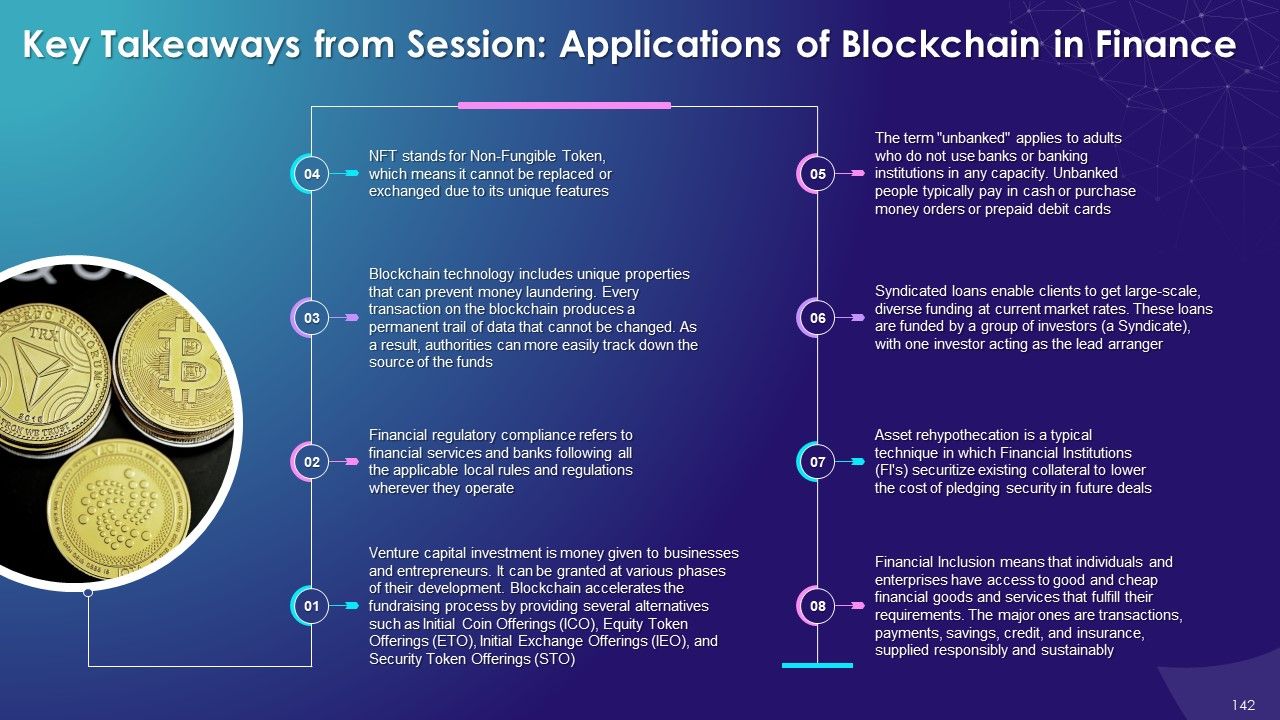

- Key Takeaways

- Let’s Discuss

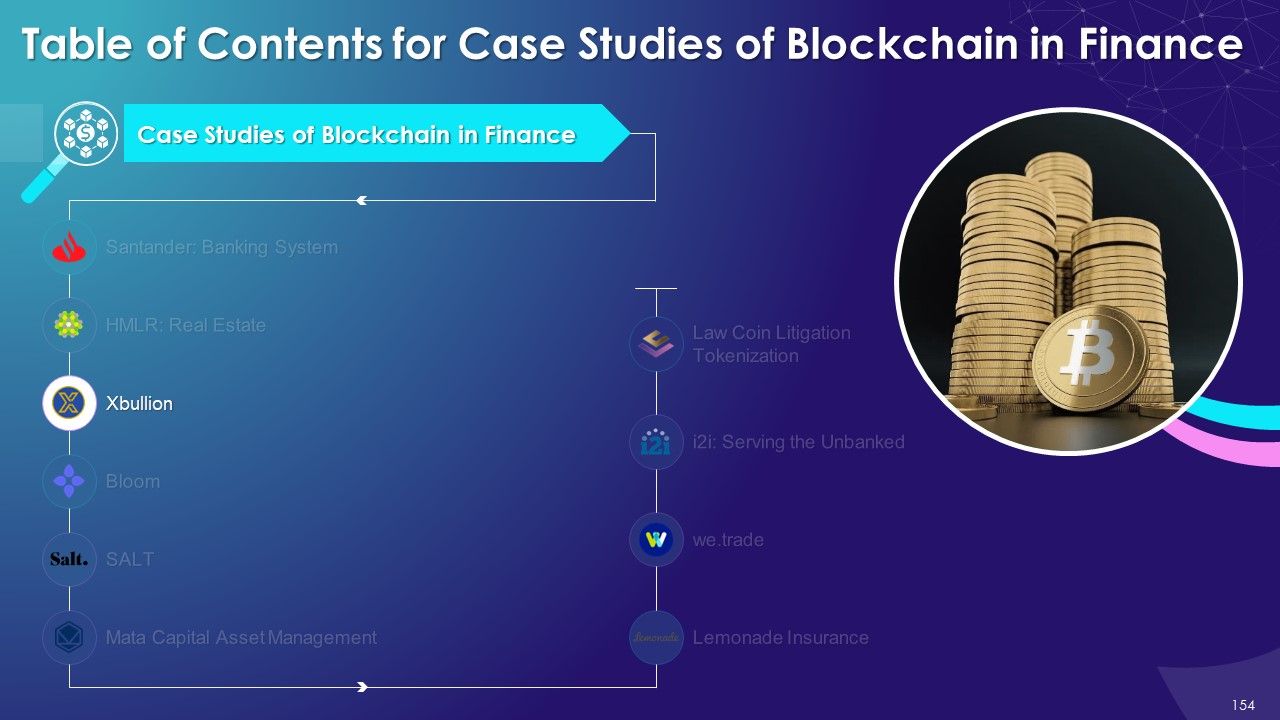

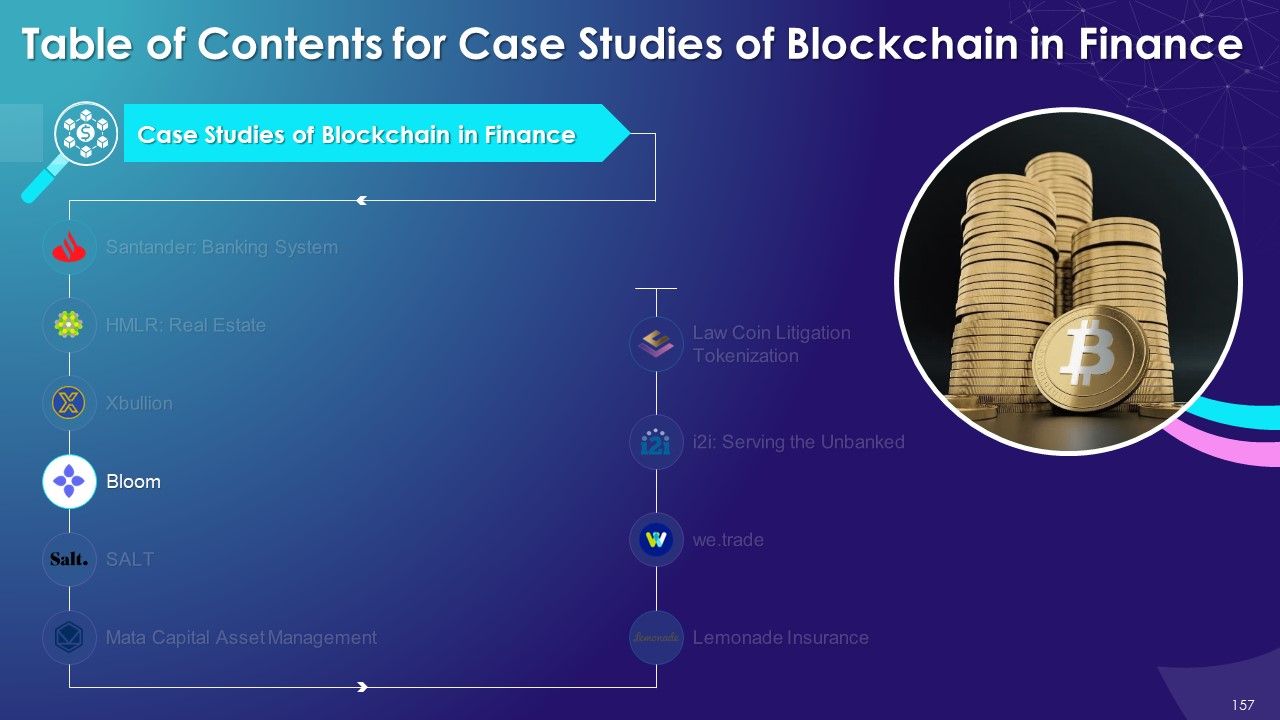

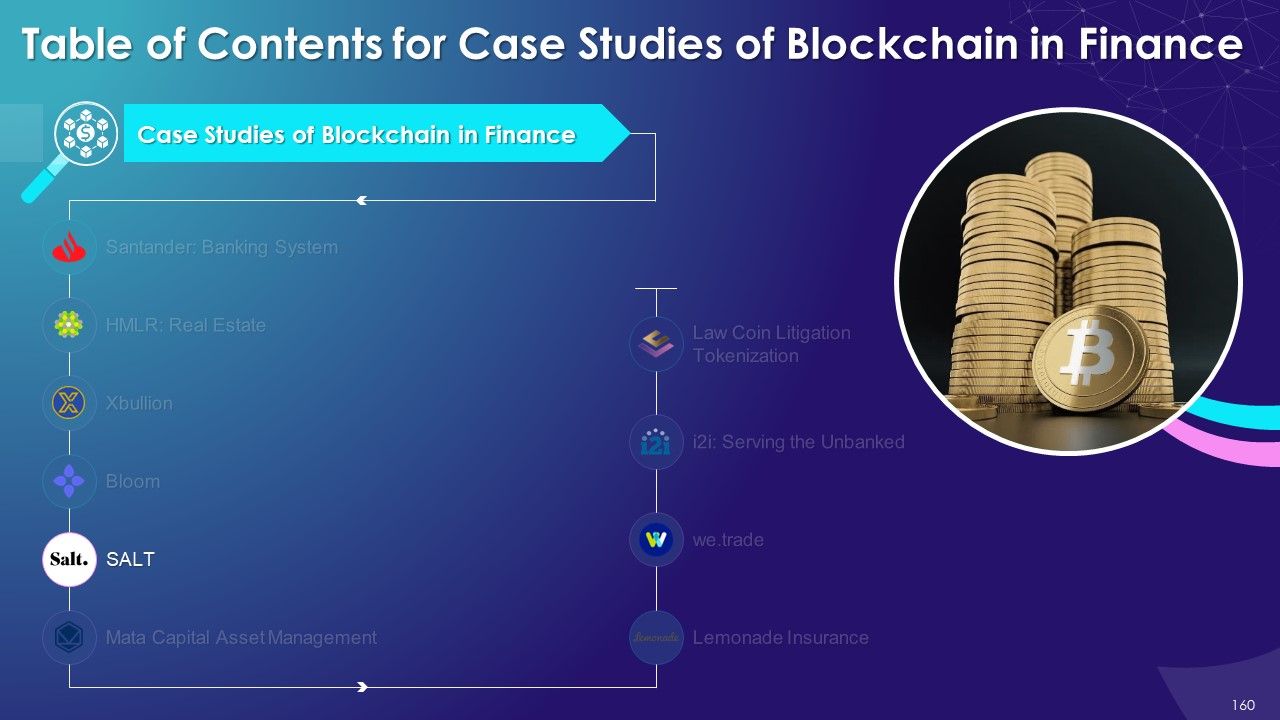

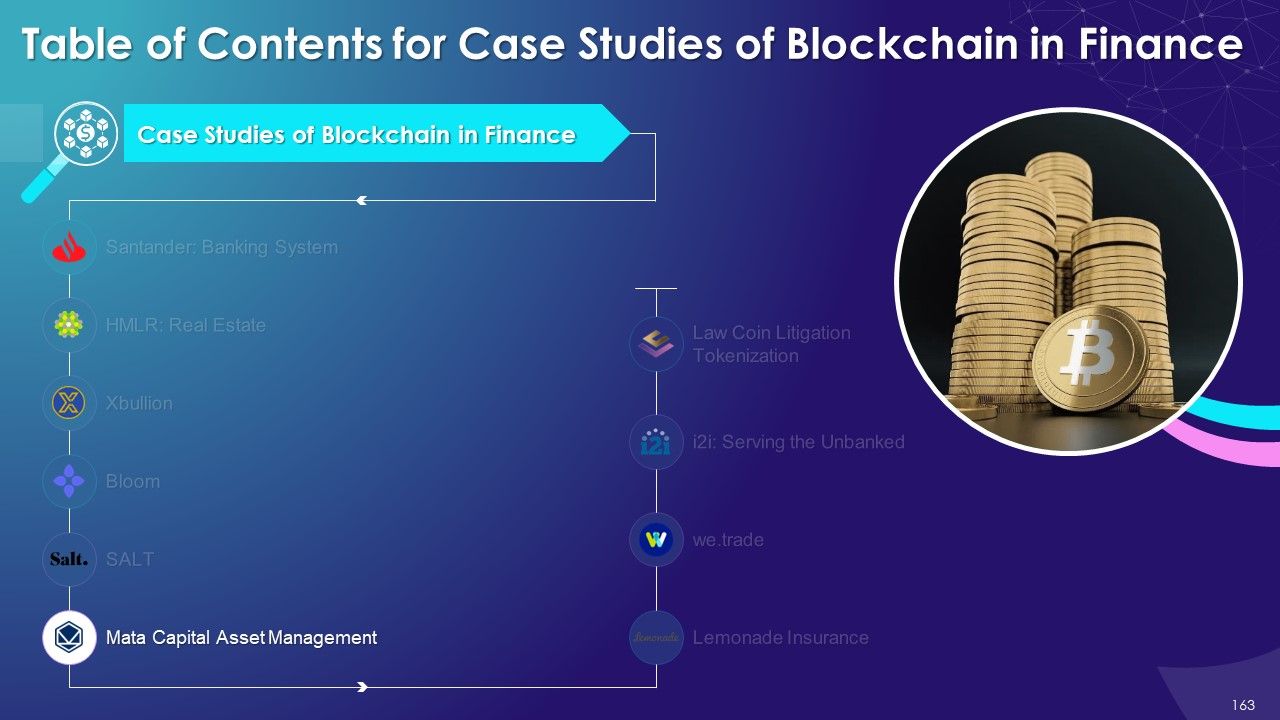

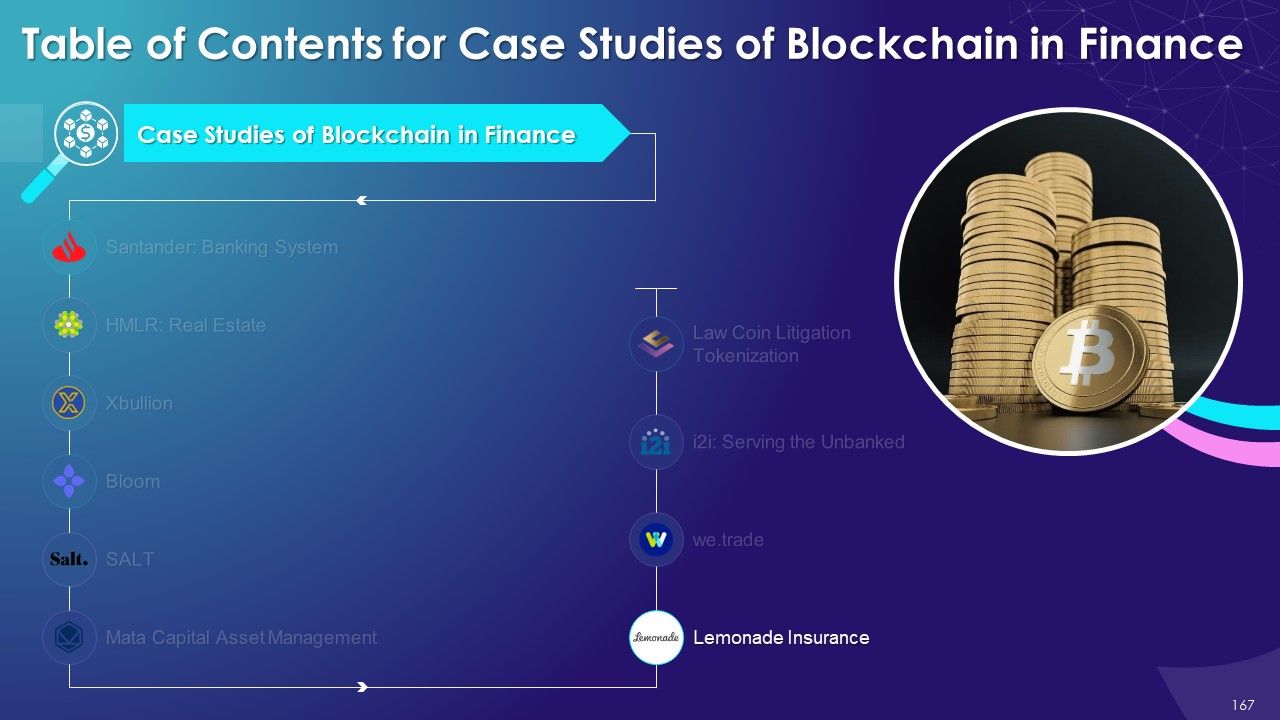

- Santander: Banking System

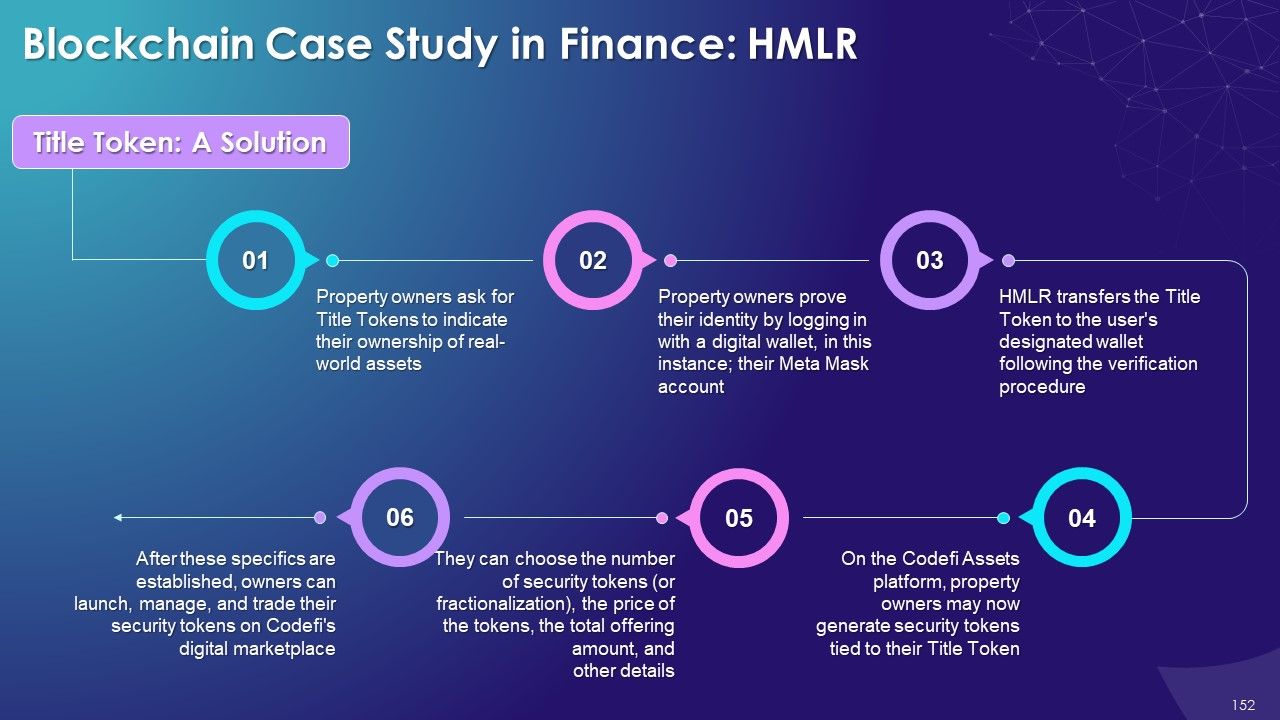

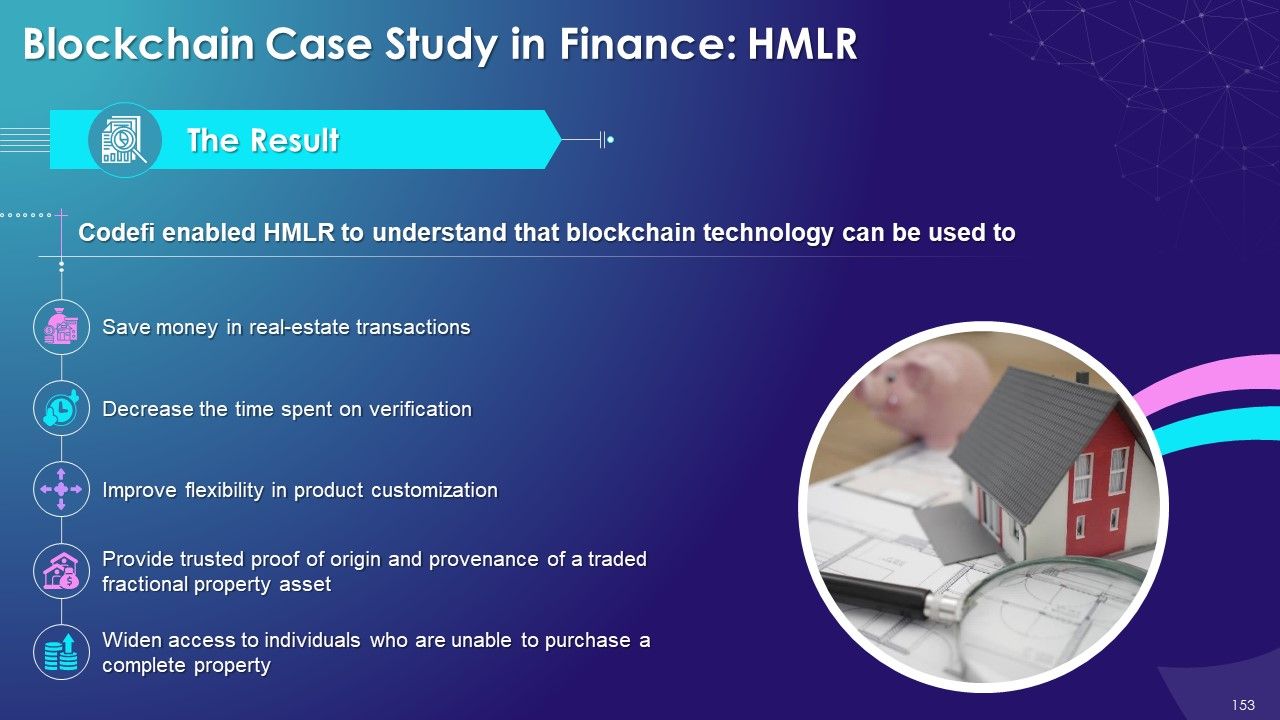

- HMLR: Real Estate

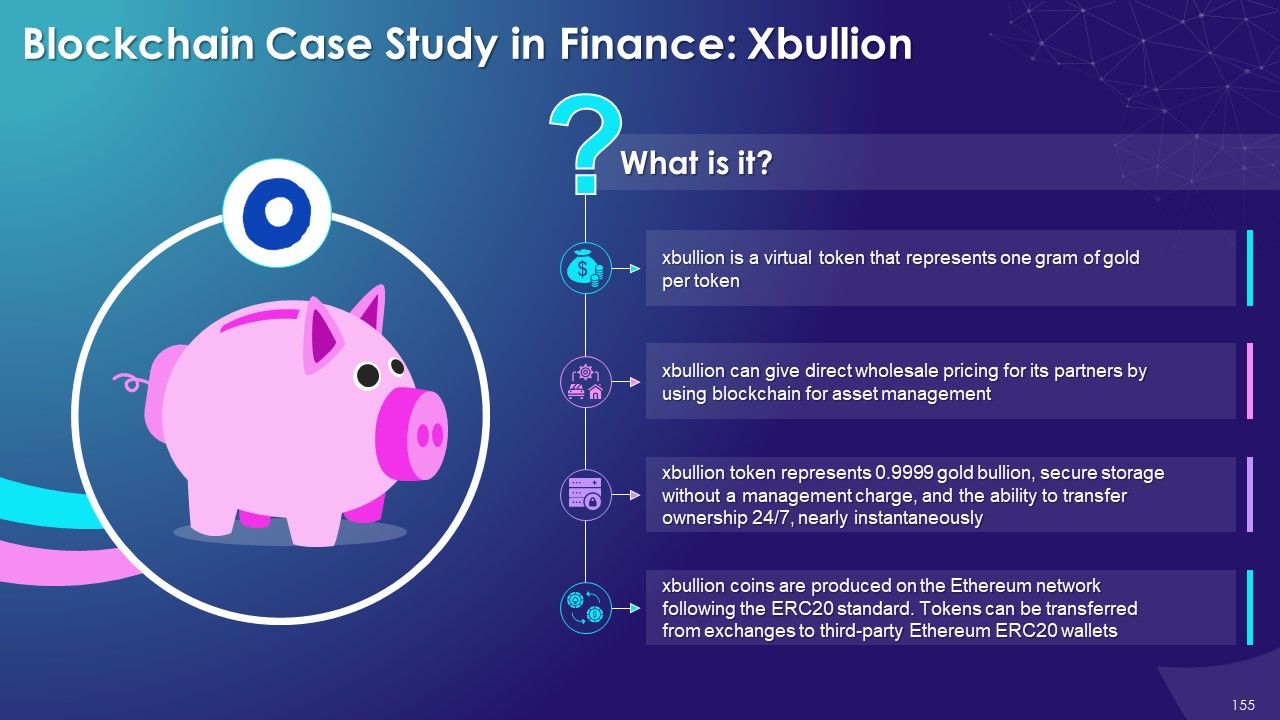

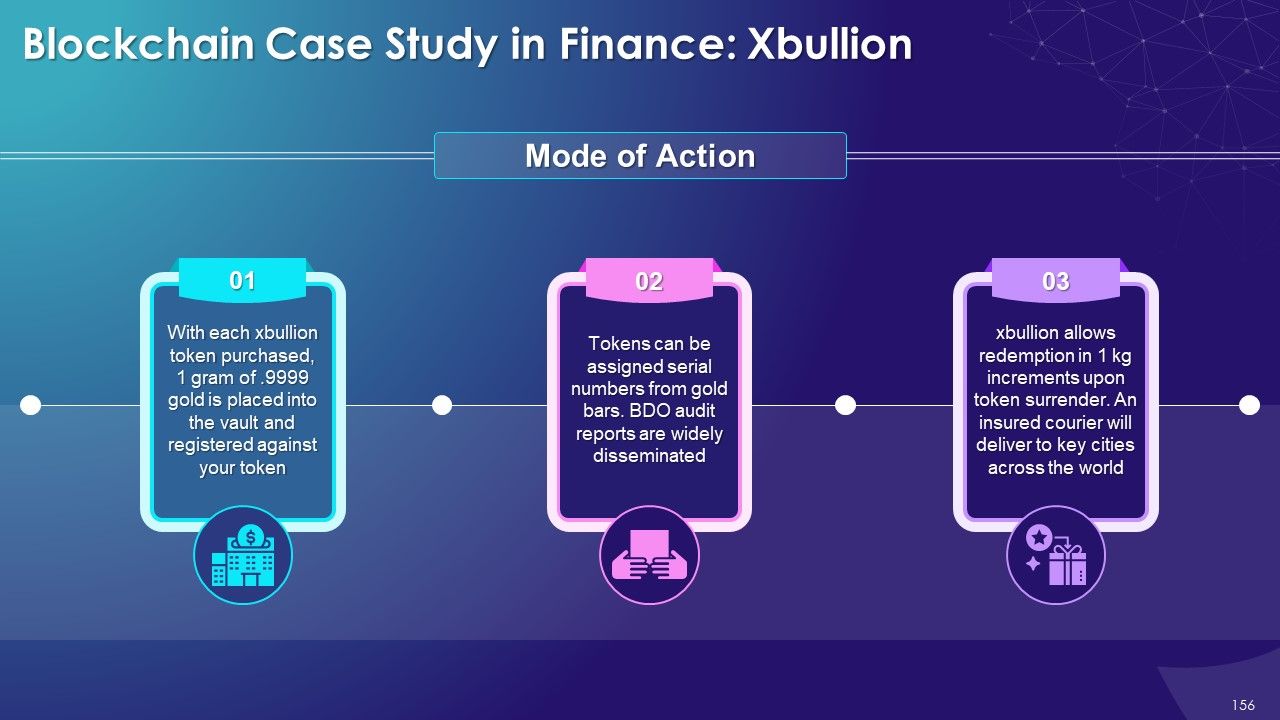

- Xbullion

- Bloom

- SALT

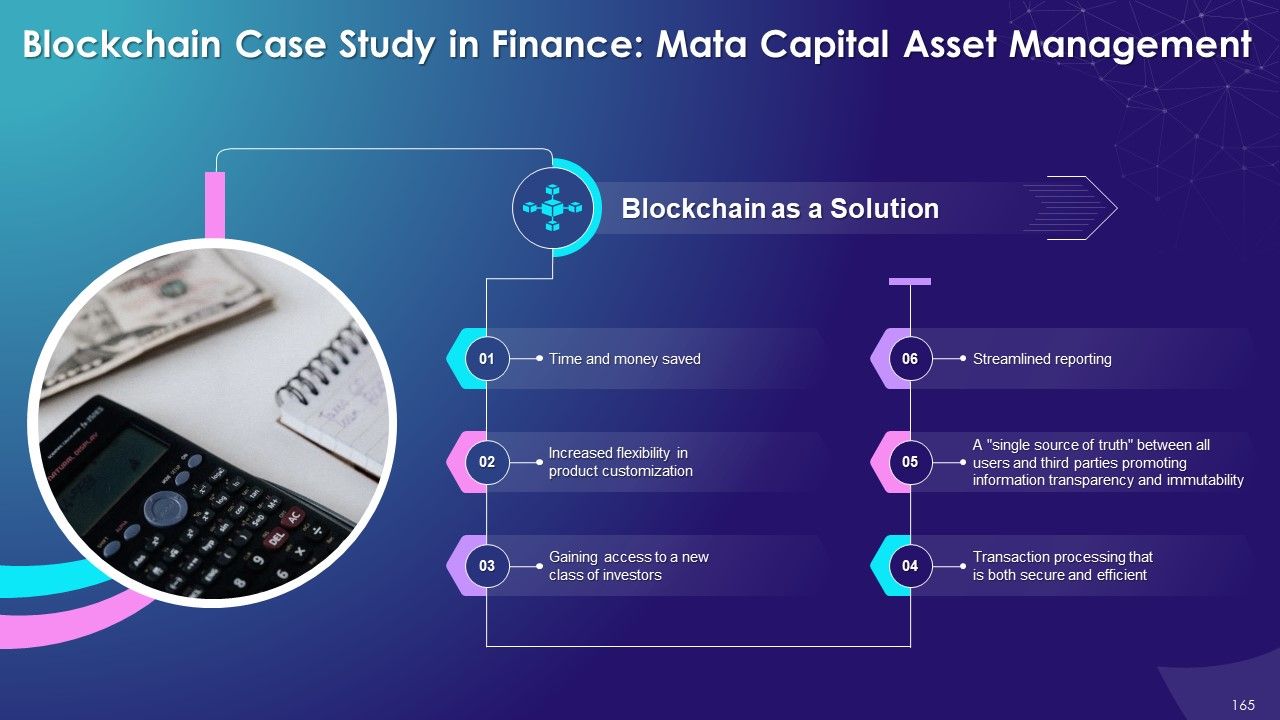

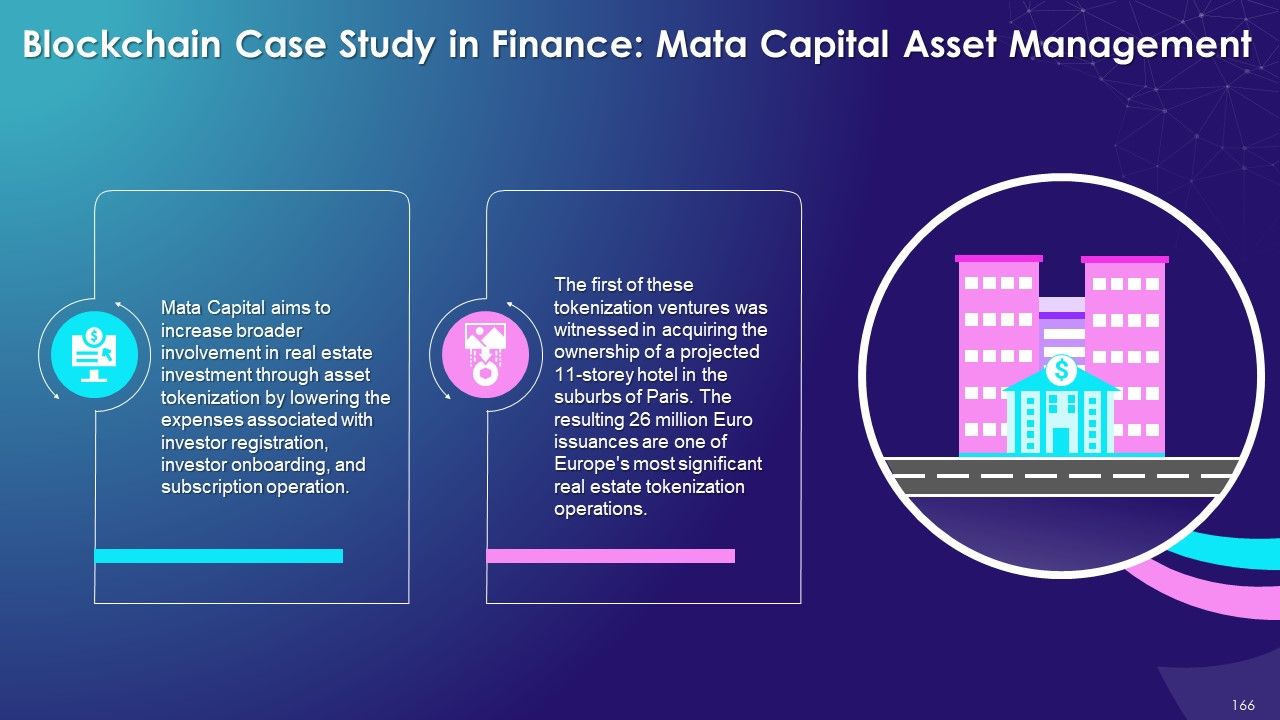

- Mata Capital Asset Management

- Lemonade Insurance

- We trade

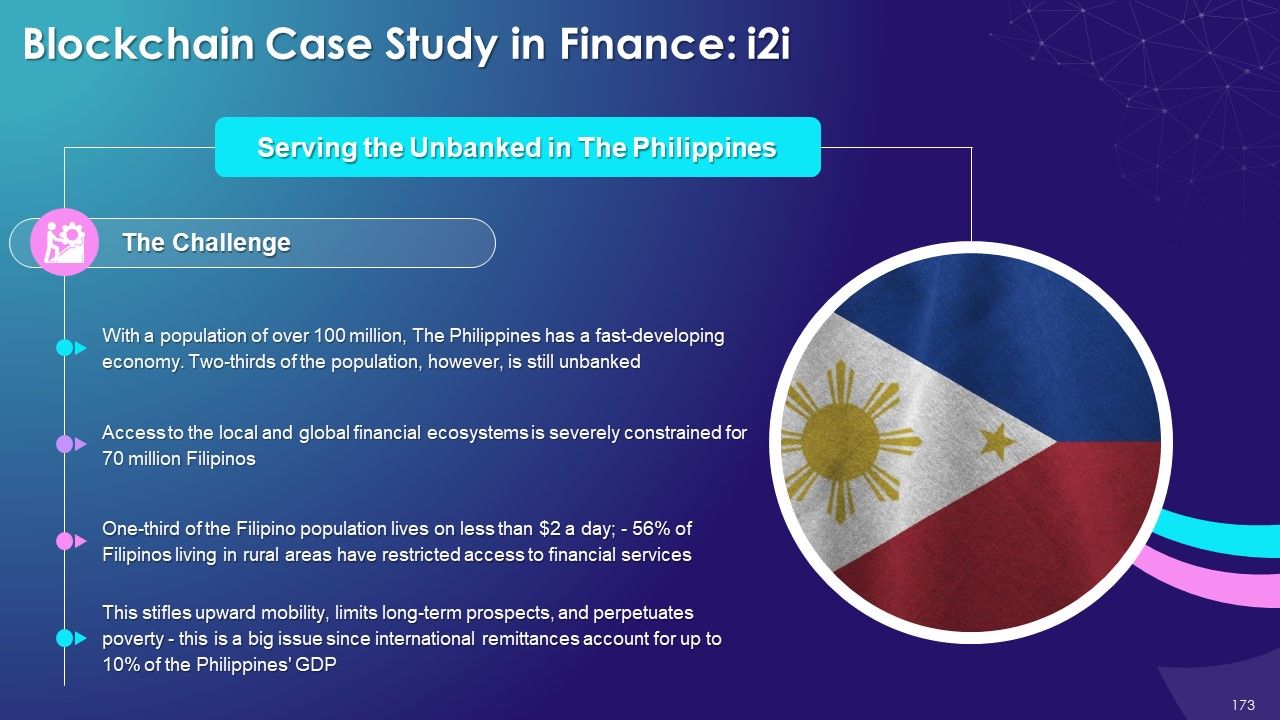

- i2i: Serving the Unbanked

- Law Coin Litigation Tokenization

- Co-operation & Establishing Standards

- Legal Framework

- Settling Value in Real Money

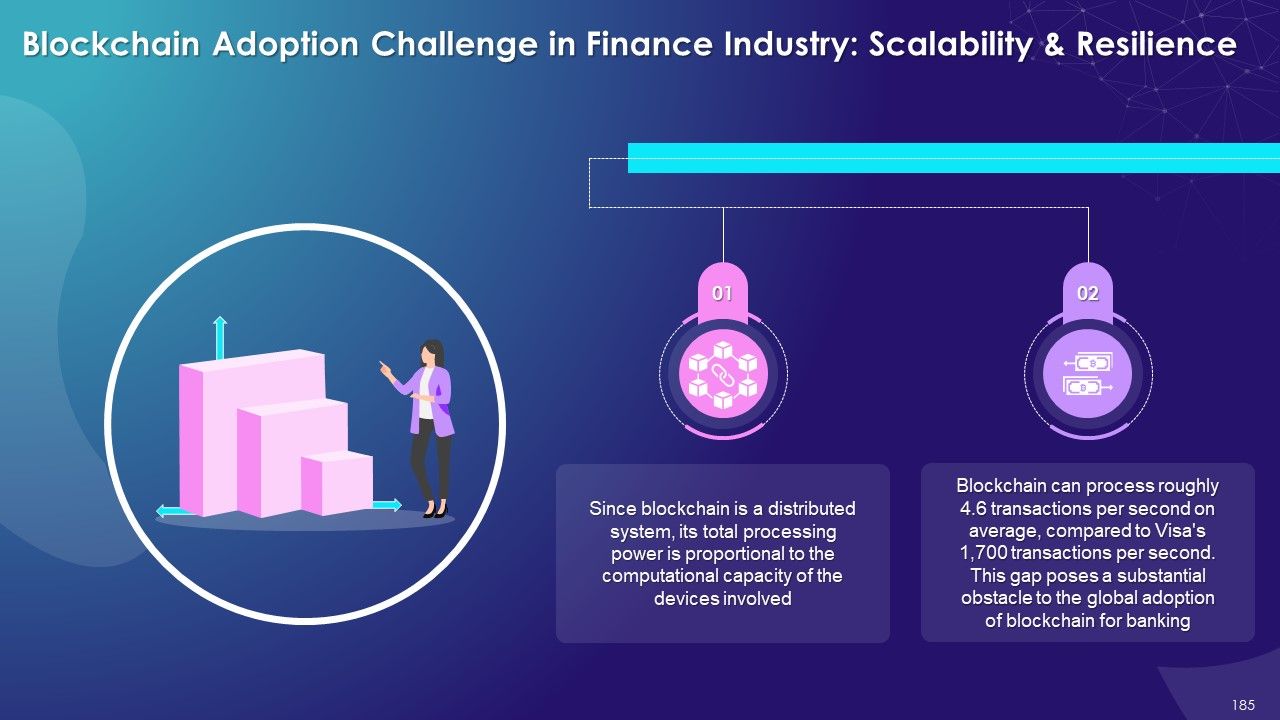

- Scalability & Resilience

- Regulatory Framework

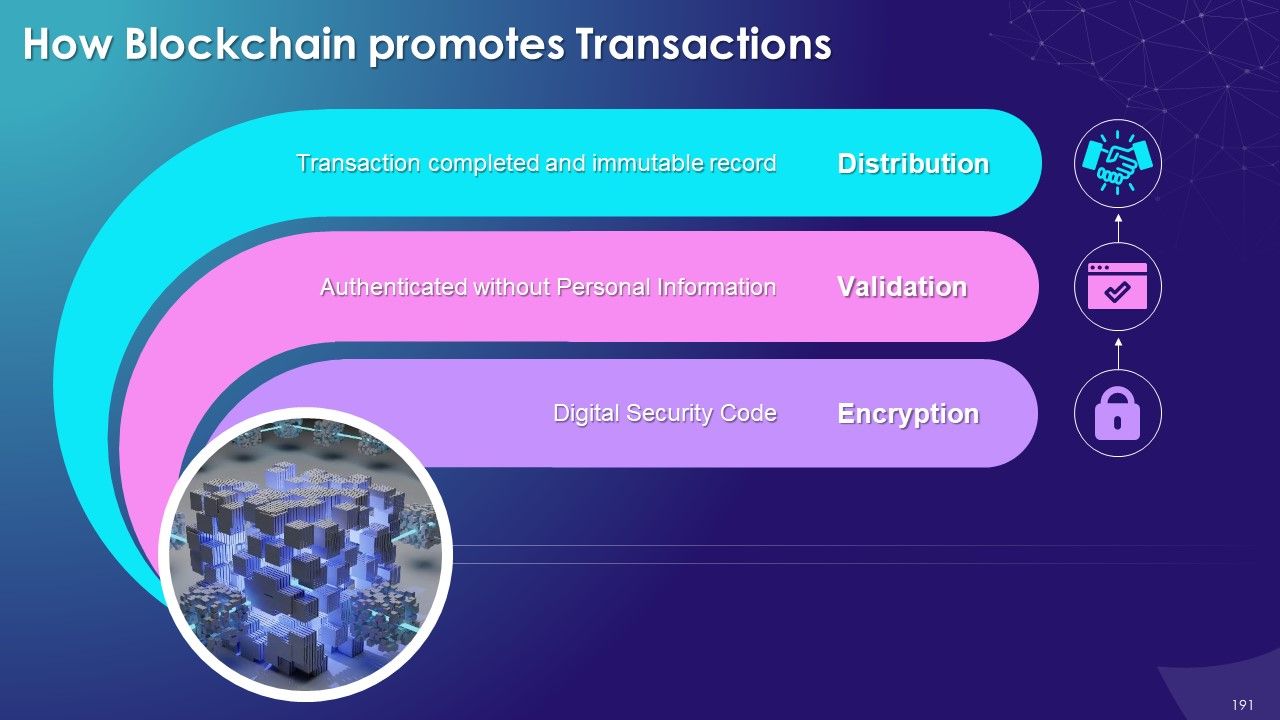

- How Blockchain promotes Transactions

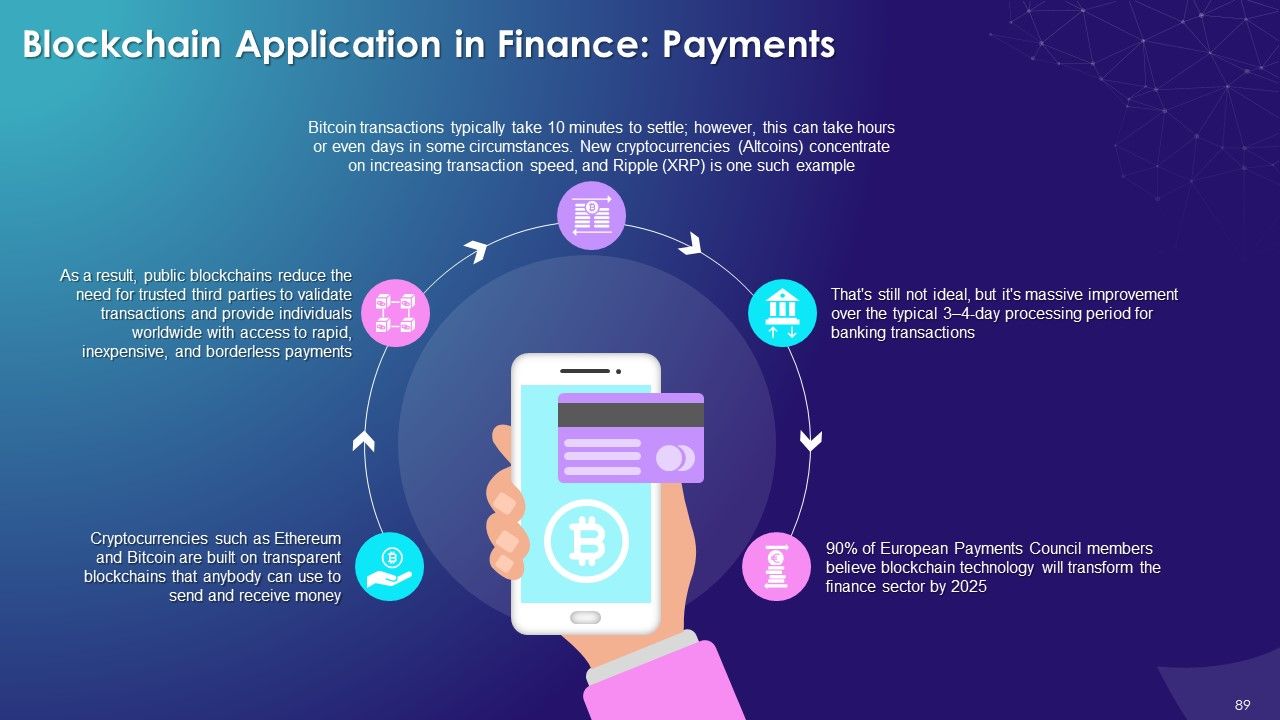

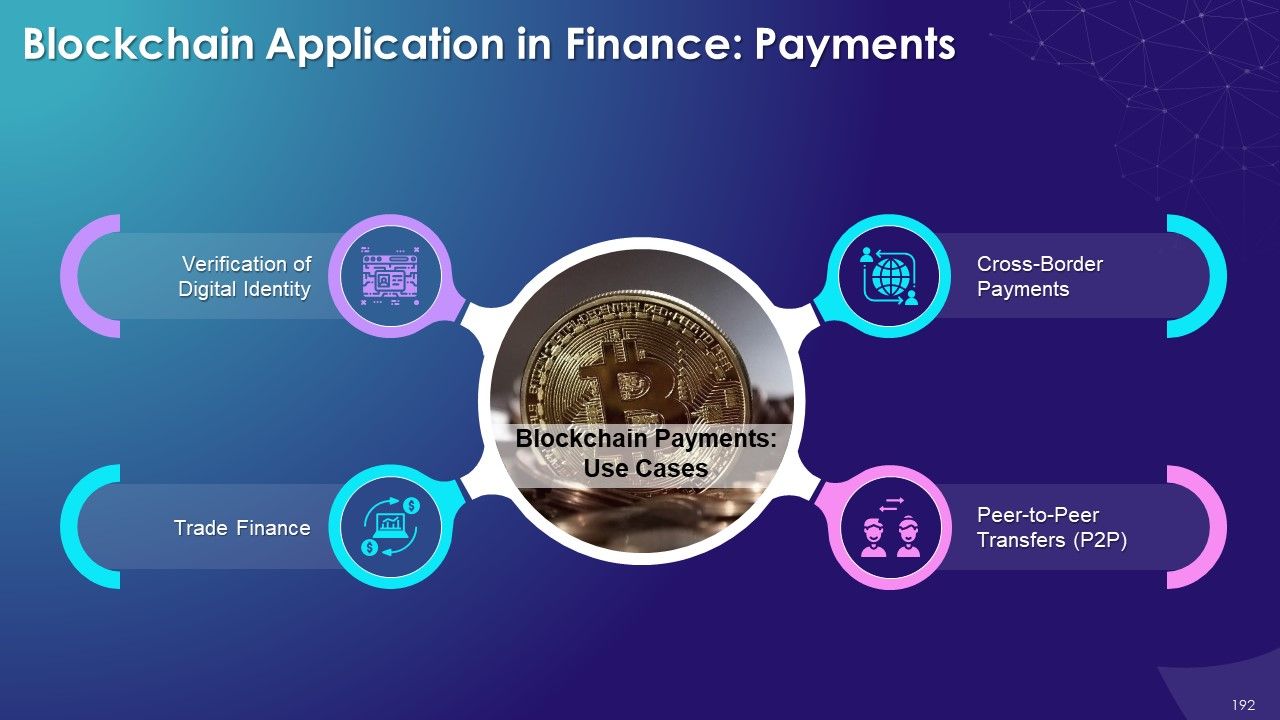

- Blockchain Application in Finance Payments

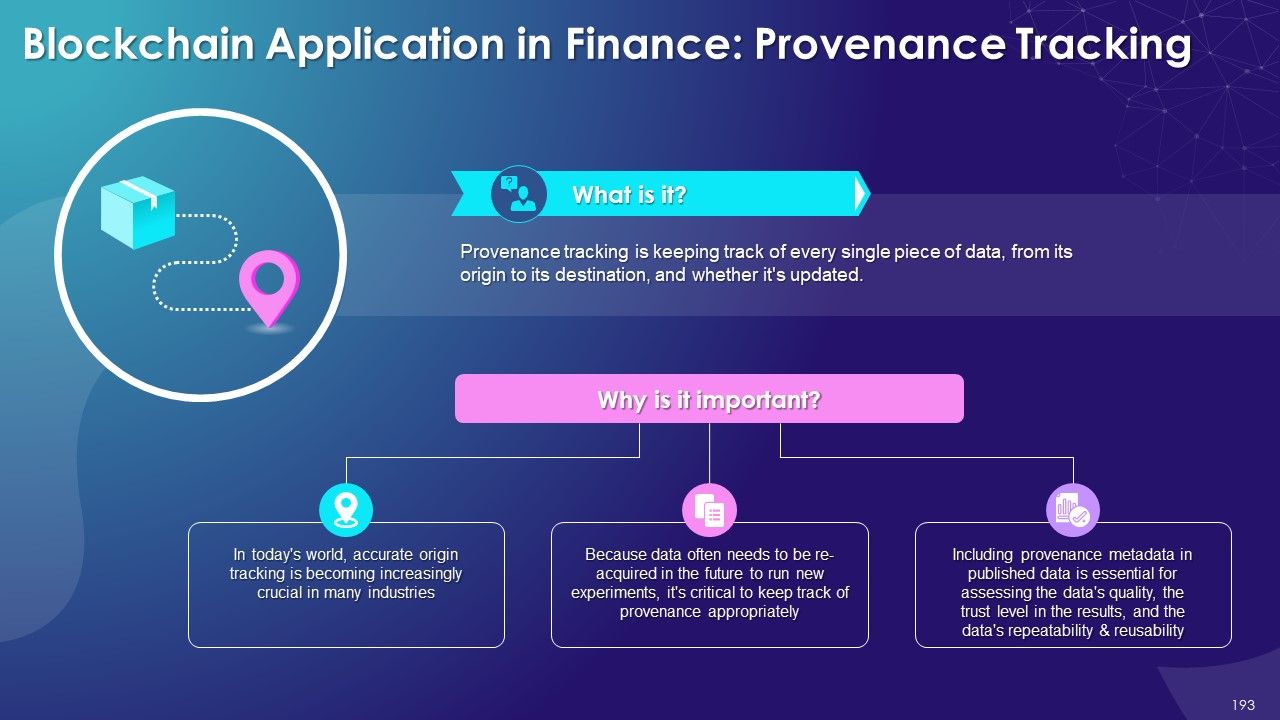

- Blockchain Application in Finance: Provenance Tracking

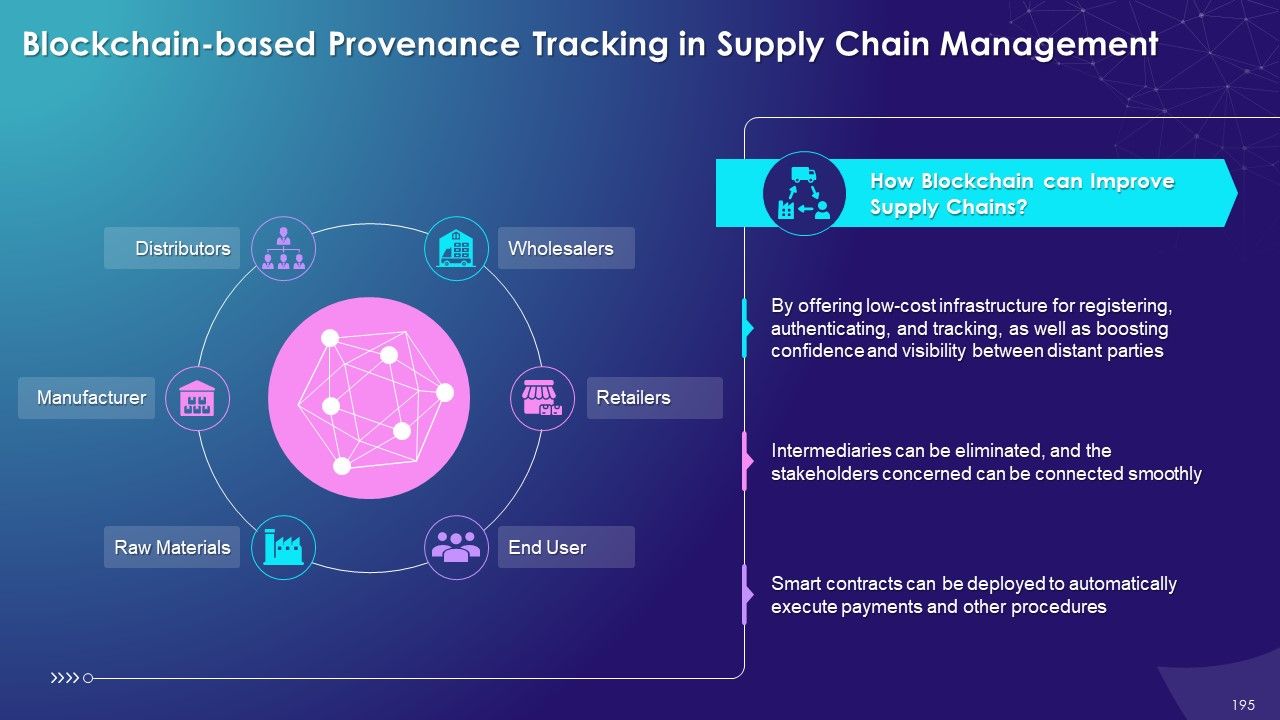

- Blockchain based Provenance Tracking in Supply Chain Management

- Blockchain Application in Finance: Anti-Money Laundering & Counter Terrorist Funding

- Centralized Finance (CeFi)

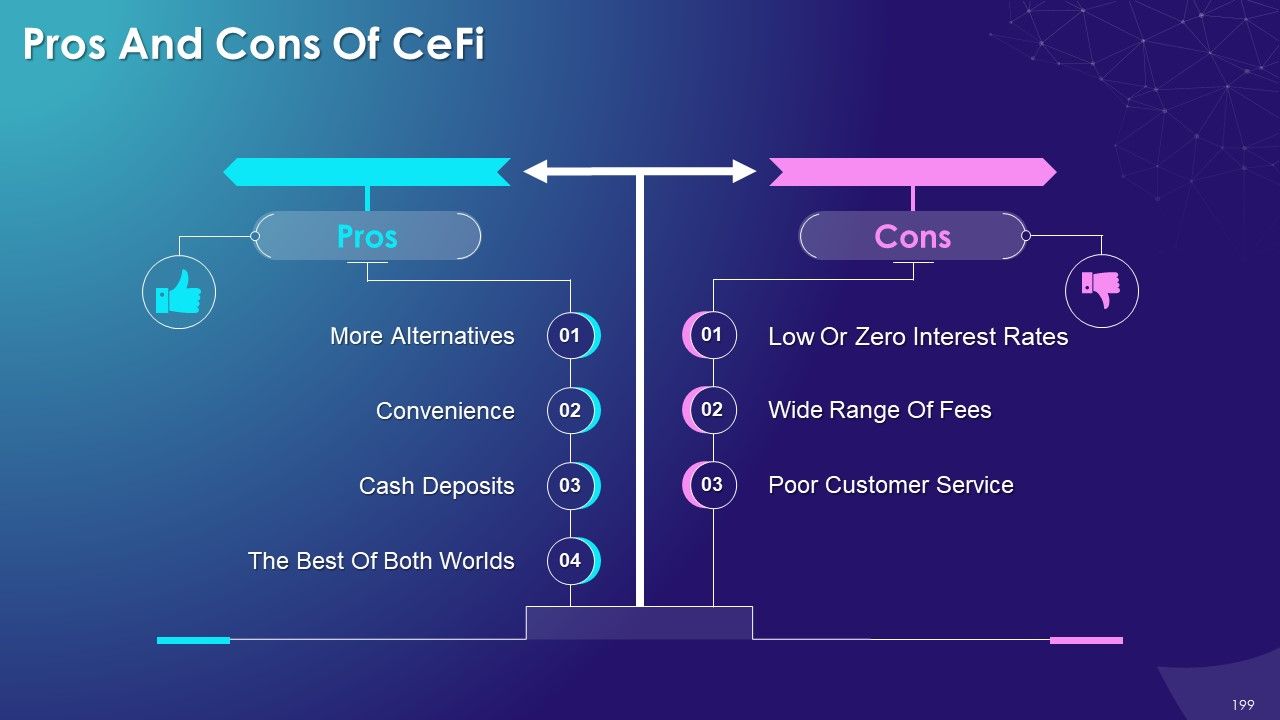

- Pros and Cons of CeFi

- Decentralized Finance (DeFi)

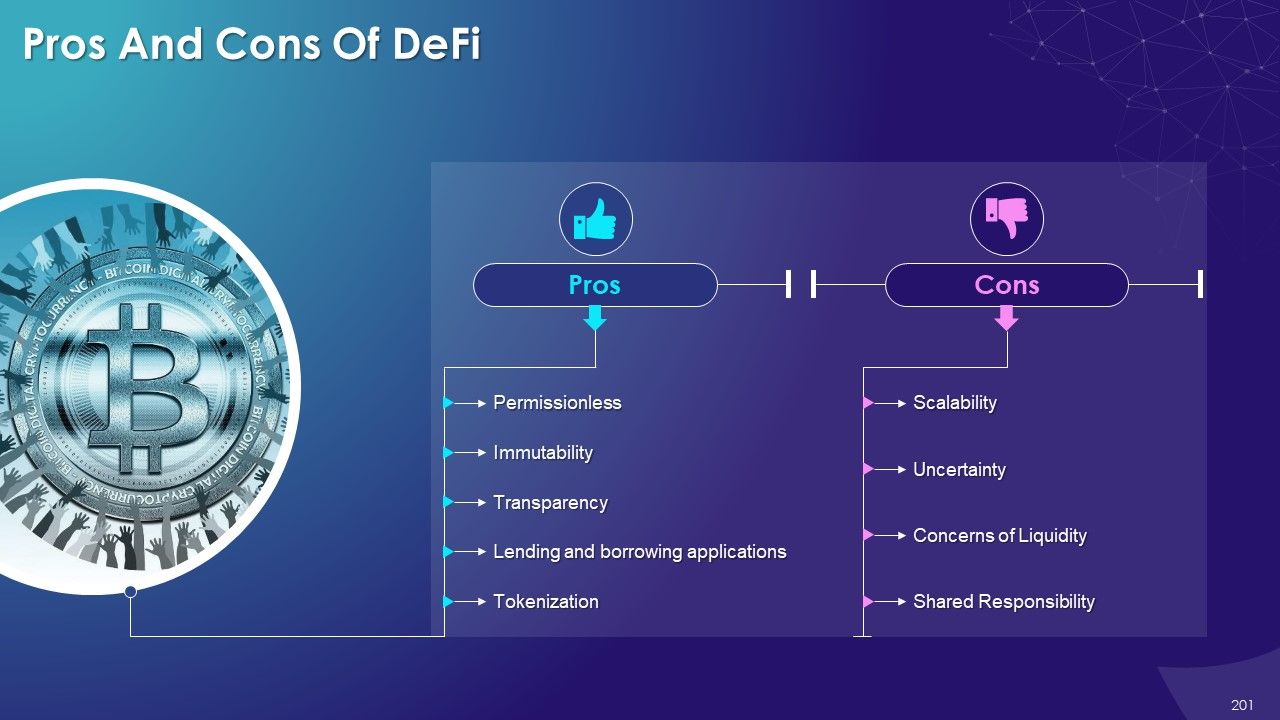

- Pros and Cons of DeFi

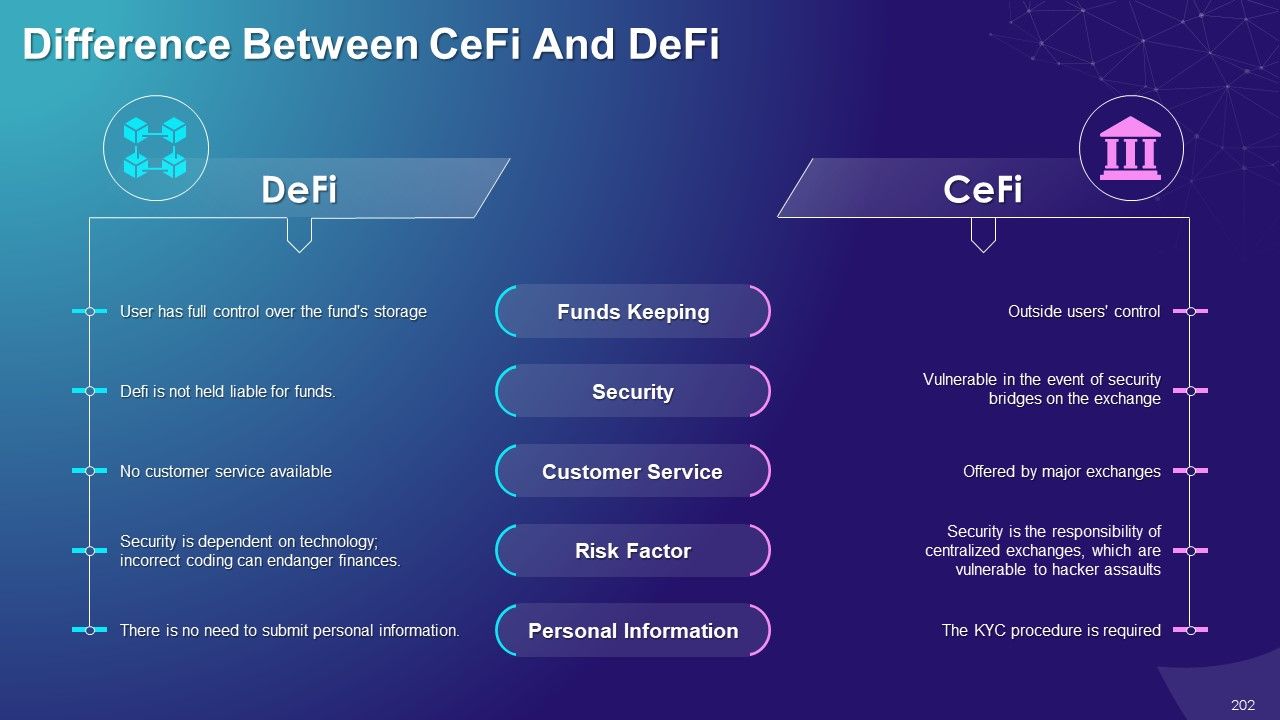

- Difference Between CeFi and DeFi

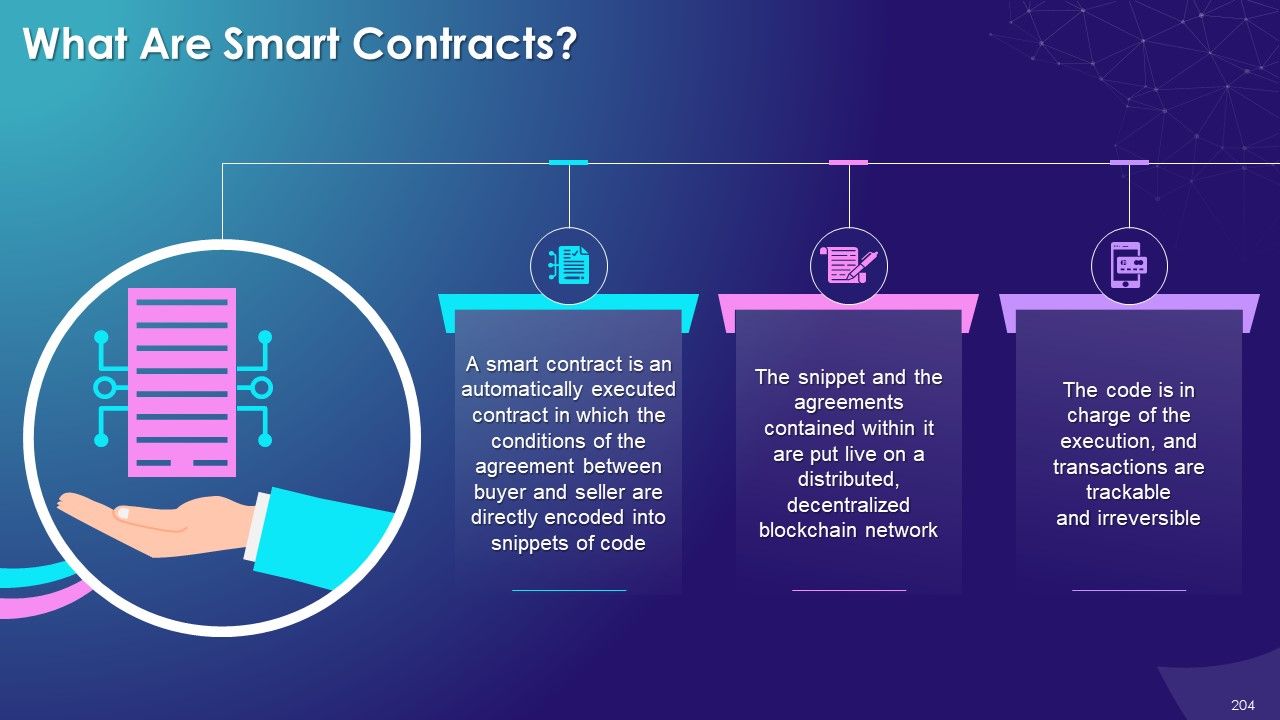

- What are Smart Contracts?

- Benefits of Smart Contracts

Sample Instructor Notes

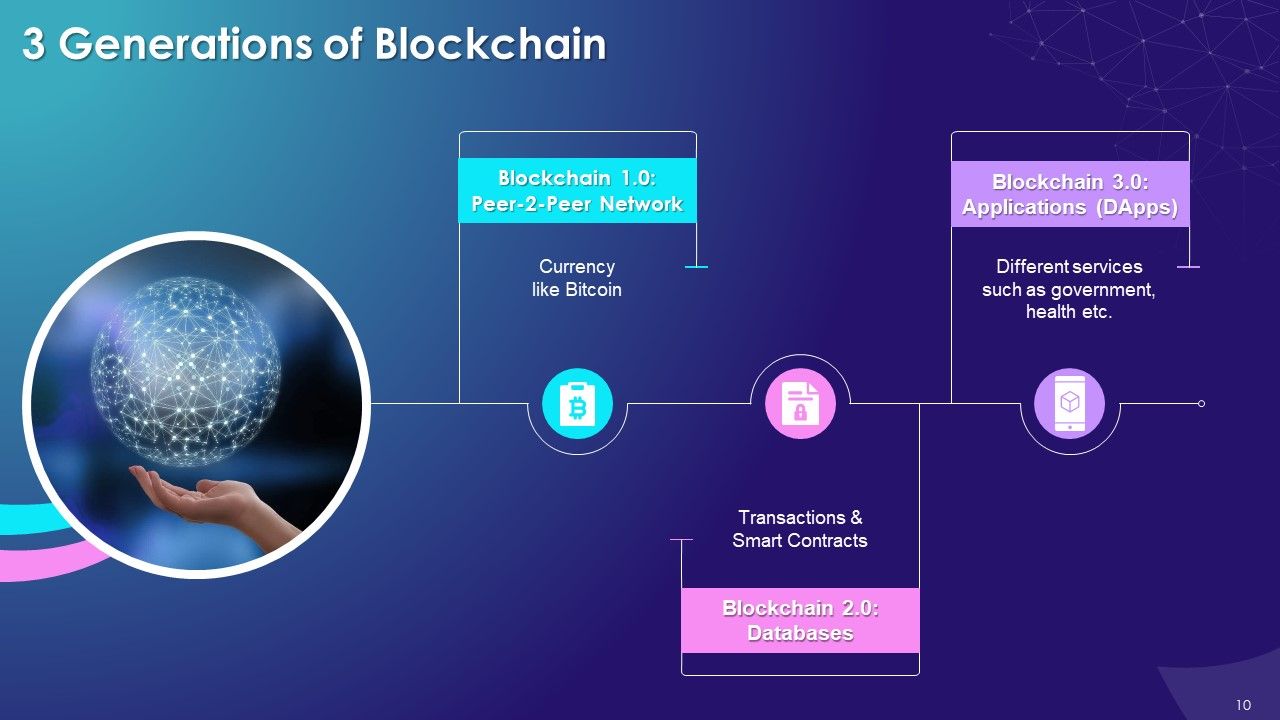

What is this slide for: Three Generations of Blockchain

This slide covers: This slide depicts the three levels of blockchain, namely cryptocurrencies, smart contracts, and governance mechanisms.

Instructor’s Notes:

- Blockchain 1.0: Blockchain 1.0 enabled/is still enabling financial transactions based on blockchain technology using Bitcoin. This version is permissionless; thus, any participant can conduct a legitimate bitcoin transaction. Currency and payments are the most common applications

- Blockchain 2.0: Blockchain 2.0's major contribution, that Ethereum has heralded, is the creation of smart contracts. These are small computer programs that 'live’; in the blockchain. They are self-contained systems that perform autonomously under predetermined conditions, such as facilitating, verifying, or enforcing contract execution. Smart Contracts lower the cost of verification, implementation, arbitration, and fraud protection and allow for clear contract definition, eliminating the moral hazard issue

- Blockchain 3.0: The abbreviation DApp refers to a decentralized application that does not rely on centralized infrastructure. As it relies on decentralized storage and communication, most DApps execute their backend code on a decentralized peer-to-peer network, such as a blockchain

What is this slide for: Benefits of Blockchain in Asset Management

This slide covers: This slide discusses the scope of blockchain technology as a tool for asset management. It lists benefits like client onboarding, operational efficiency, regulatory compliance, open collaboration, and improved security that can help forge the future of asset management in the financial sector.

Instructor’s Notes:

- Client Onboarding: Confirming that the persons involved are who they claim they are is the first step in starting any financial relationship. It's becoming increasingly difficult to do so in a method that's both efficient and fool-proof due to data leaks, hacking, and malware attacks. Given that blockchain promises to dramatically decrease, if not eliminate, such problems, identity management or client onboarding and data security are likely to become the most common blockchain applications for asset management organizations

- Operational Efficiency: In an industry where corporations are increasingly investing hundreds of millions of dollars to lower trade execution time from milliseconds to microseconds, data communication speed is critical. Aside from reducing order processing times, faster data transmission speeds mean managers will be alerted to news affecting their clients' portfolios much faster, giving them those precious few additional seconds in dealing with difficulties as they emerge

- Regulatory Compliance: When it comes to investor engagement, management reporting, and regulatory compliance, blockchain's secure and transparent nature of gathering transaction data might be helpful. Using technology rather than teams of people to comply with anti-money laundering programs, information security requirements, and privacy laws can help save costs, enhance efficiency, and lower the chance of individual errors or fraudulent conduct

- Open Collaboration: Blockchain enables you to build a system that combines third-party technology and processes with internal systems to provide one source of truth for asset management activities. This facilitates the addition of new partners using blockchain-assisted transactions

- Improved Security: Blockchain enhances data security. It is simply far superior to traditional security approaches, as it provides an immutable record of all transactions. Before each block is linked to others, it is encrypted, and distributing the records across nodes reduces the impact of a data breach

What is this slide for: Blockchain Use Cases in Anti-Money Laundering and Counter Terrorist Funding

This slide covers: This slide showcases blockchain applications in anti-money laundering and counter-terrorist financing.

Instructor Notes:

- Loan Application: Law mandates KYC for a loan application. Other checks are also made on credit worthiness. A Blockchain ledger enables the institution's numerous service divisions to evaluate the applicant’s genuineness and creditworthiness

- KYC Verification: Financial institutions will not need to ask current consumers to disclose their certificates again for KYC if the institutions adopt blockchain. The blockchain ledger will contain all necessary papers, data, activities, and analyses. The automated KYC verification procedure pulls out expiry dates and automatically sends reminders to the consumer to provide updated documents

- Opening a Bank Account: To prevent terrorist or money-laundering threats, every bank must verify an individual's identification and complete the KYC due diligence before opening a bank account. The advantages of blockchain are eliminating data silos, risk classification, and time-stamped records. The AML/KYC platform runs checks to know if the authorized owners are bona fide persons or entities when a company account is opened

What is this slide for: Ways to use Blockchain for Financial Inclusion

This slide covers: This slide discusses how blockchain technology can be used to promote financial inclusion. It can help in payment services, savings, credit, and insurance.

Instructor’s Notes:

- Payment Services: Unbanked people have a more challenging time sending and receiving money, and they typically lack the necessary documents to create an account, such as a passport or evidence of income. Blockchain applications are becoming a popular choice of technology for remittances, especially for transfer of small amounts of money, since they offer quick, inexpensive, traceable transactions that can store many currencies and be sent across numerous mobile networks, nationally and globally

- Saving: Xcapit, located in Argentina, uses blockchain's decentralized ledger to create an alternative platform that makes savings and investing more accessible for individuals without a bank account, credit, or financial literacy. The blockchain enables Xcapit to create a simple investing interface where consumers can depend on the network's security to know their funds are secure, while benefiting from a faster and affordable investment procedure

- Credit: Credit scores, which banks have historically used to assess credit eligibility, significantly impact economic growth. Grassroots Economics, a blockchain-based initiative established in Kenya and financed by UNICEF's Innovation Fund, attempts to bridge the credit gap in low-income areas

FAQs

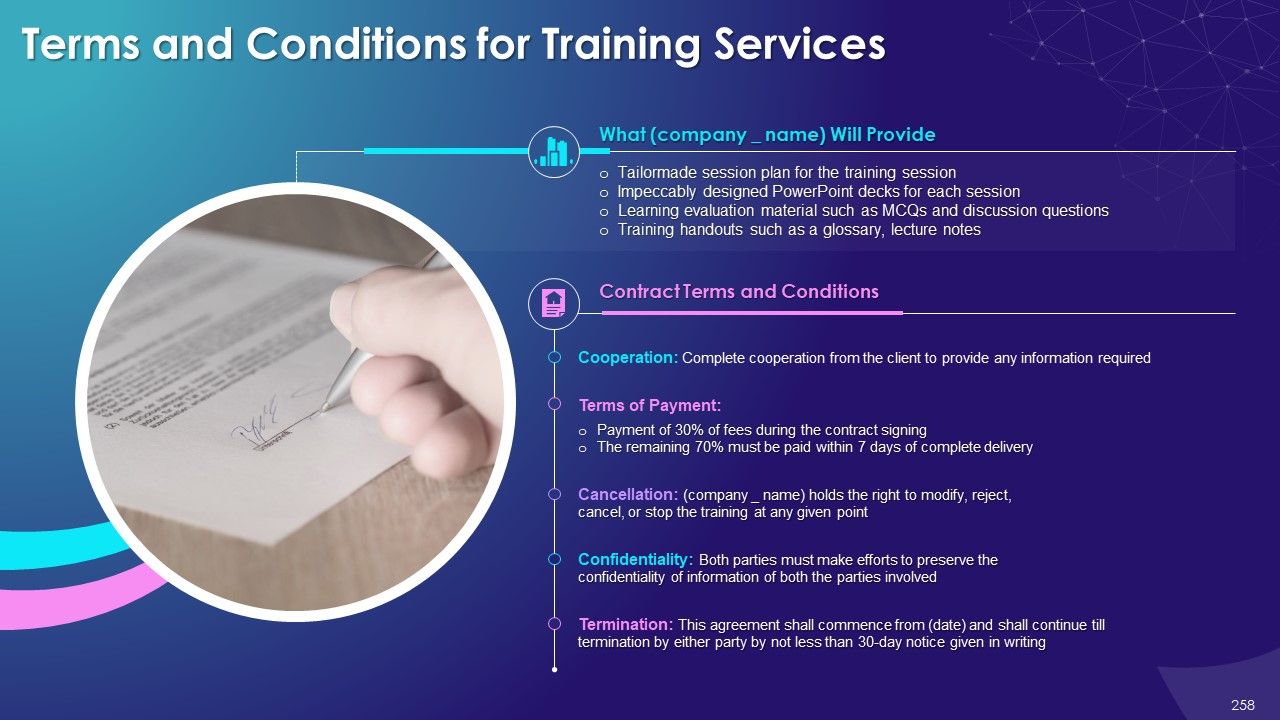

We provide training decks on a wide variety of business and technical topics such as Diversity & Inclusion, Customer Service, Search Engine Optimization, Blockchain Technology, and many more. These are ready-to-present decks that can be downloaded and presented in their current form. These decks are carefully created by industry experts, designed by professionals to deliver a power packed training session.

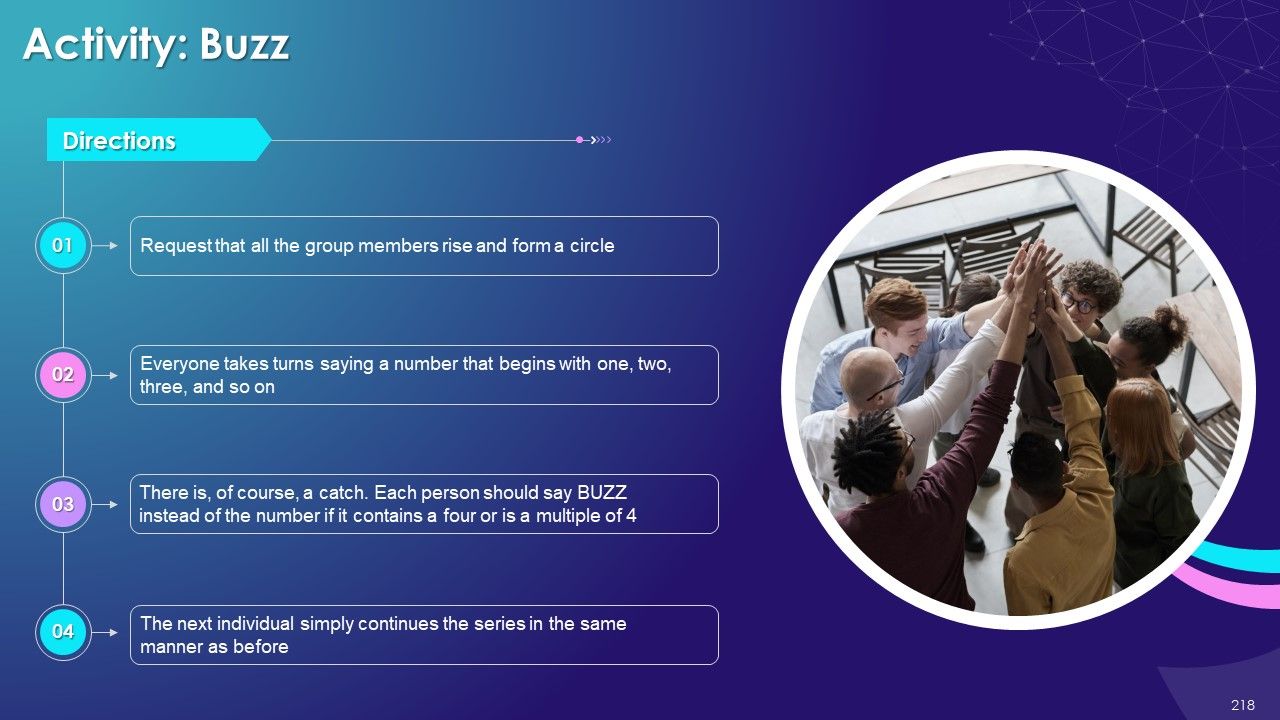

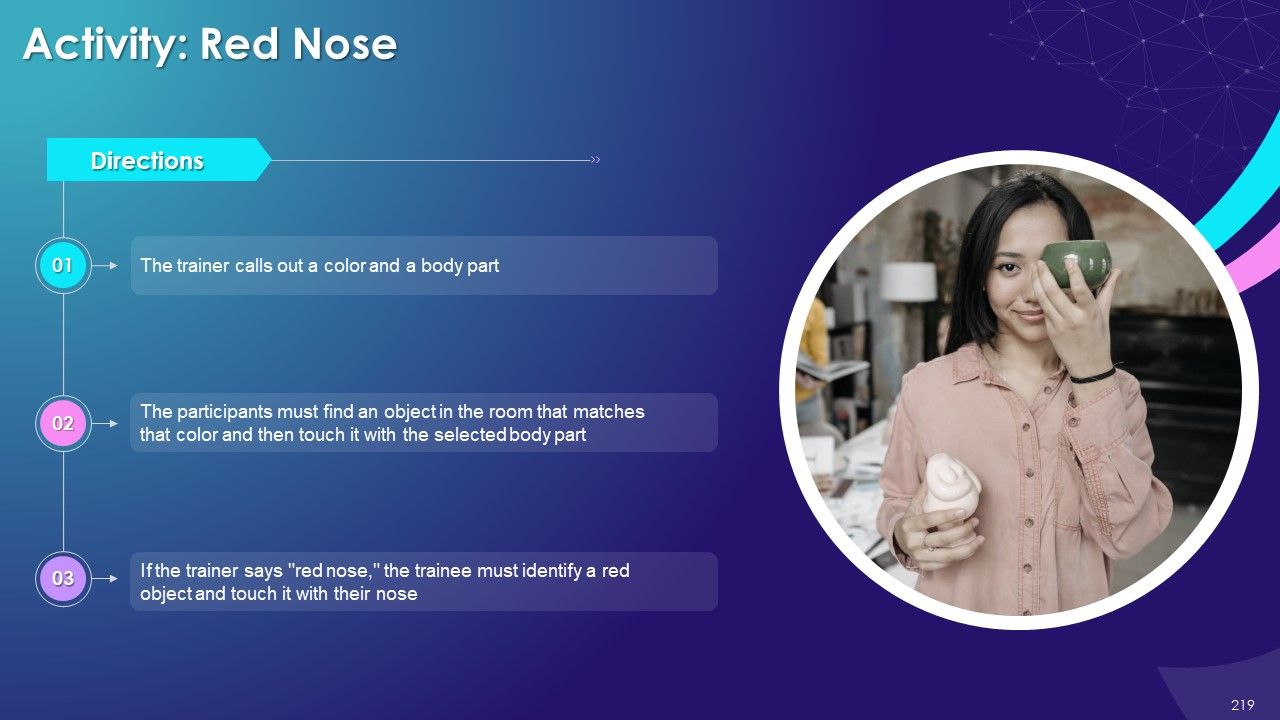

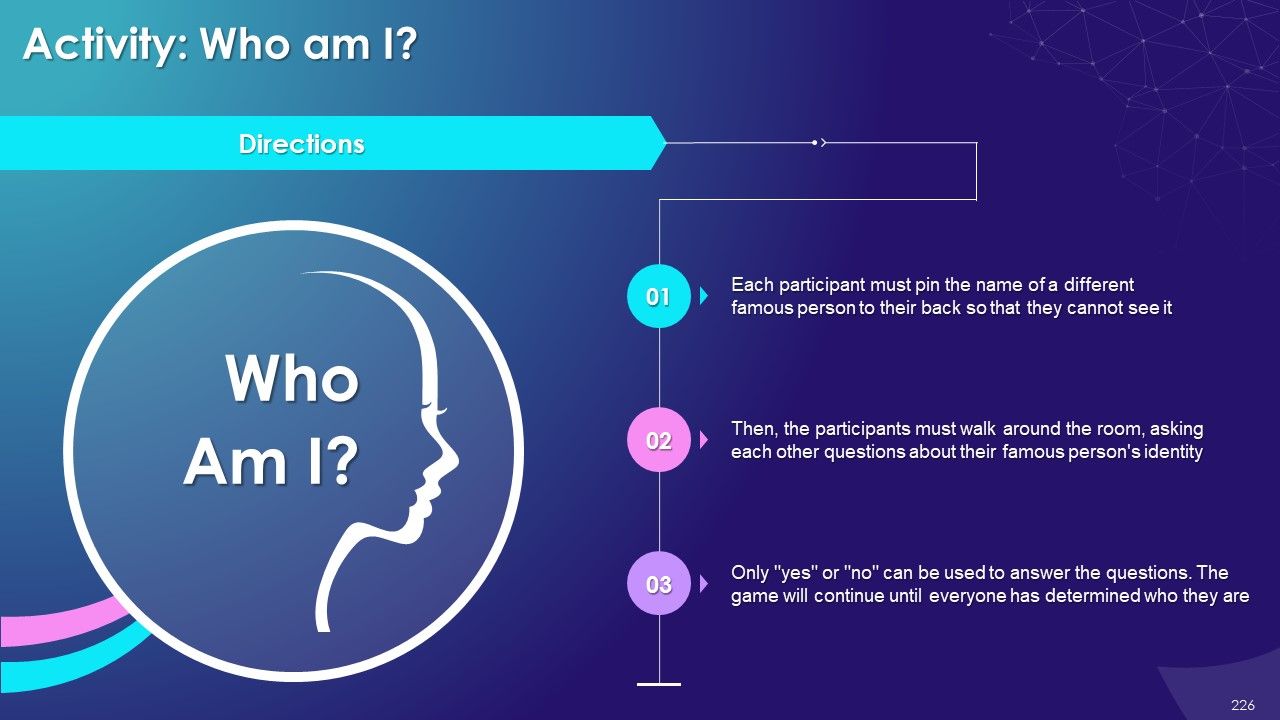

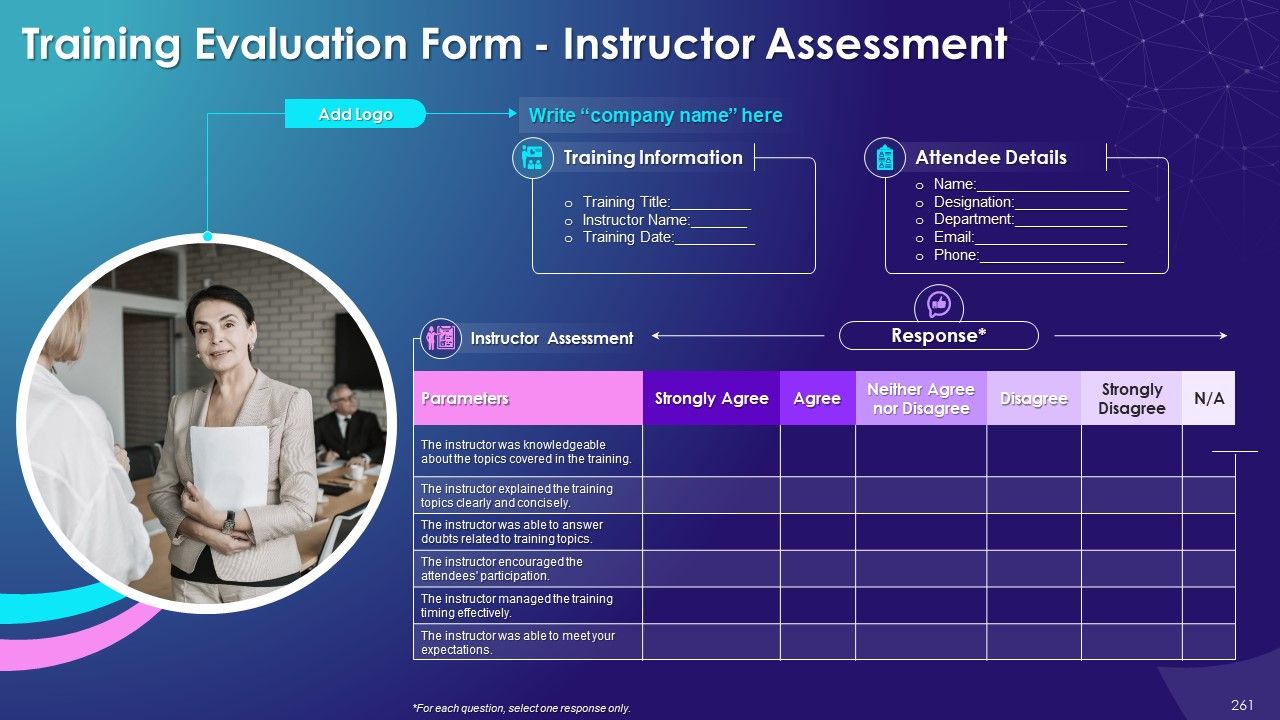

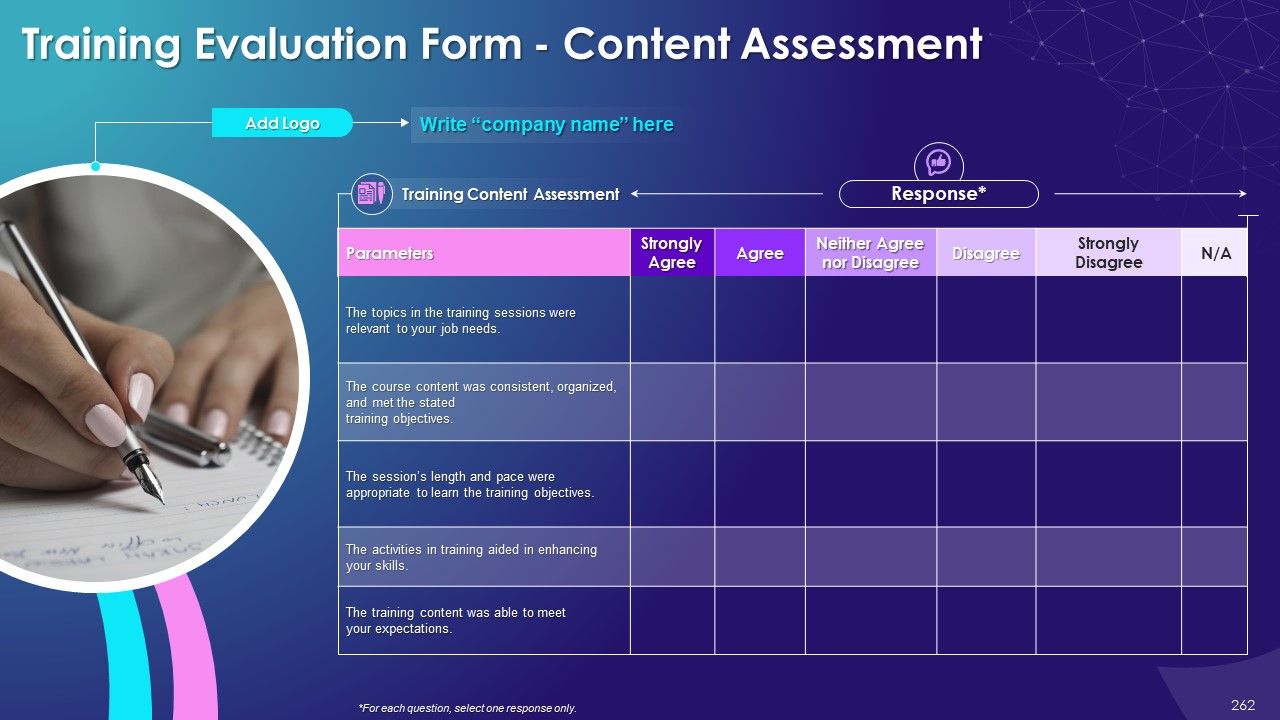

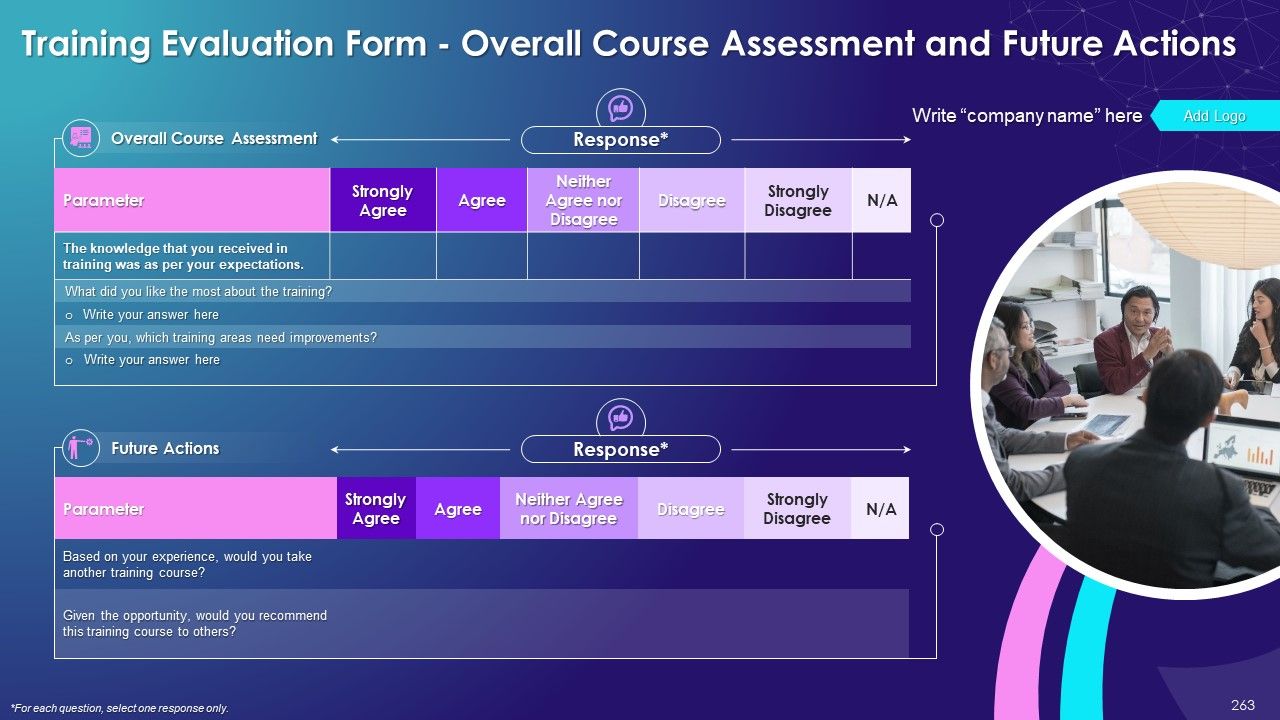

We want our training decks to evoke curiosity and inspire passion for learning. Each training deck consists of multiple sessions with impeccably designed slides to explain concepts in-depth, key takeaways to summarize sessions, discussions, and multiple-choice questions to assess trainees’ learning. The deck also contains activities and memes to break the monotony and make the training more interactive. Each training deck comes with an assessment form and editable proposal to help pitch your training to clients with success.

It depends on the trainer's content delivery pace, but each deck is created to ensure that training content is for a minimum of 16 hours.

Yes. A significant segment of our customers are professional mentors, coaches and teachers. You can create presentations with our content and distribute these to your trainees. The only caveat is that you cannot share your subscription to our content with others; the license is not transferable. Also, you cannot resell SlideTeam content to others.

Each slide is 100% editable in PowerPoint. Every element of the slide – text, icons, images, vectors, color scheme, etc. can be modified to build an effective PowerPoint presentation. Simply DOWNLOAD, EDIT, and PRESENT!

All PPT slides are compatible with PowerPoint 2007 and above. Some diagrams will not show up correctly with older versions of PowerPoint, like PowerPoint 2003 or lower, because of rendering issues. Yes, they work with PowerPoint for MAC, and decks are compatible with Google Slides too.

Absolutely yes! Our decks are yours to keep and build upon even after your subscription expires. You will not be able to download any additional decks once your subscription expires, but the ones you've downloaded are yours to keep forever.

Our entire website is HTTPS secure, and our payment system is managed by PayPal and Stripe, two of the world's leaders in credit card payment systems and very respected companies in online payments. This makes our systems 100% secure. We do not store or have access to any credit card information ourselves. We direct you to these third-party secure sites with 100% secure SSL connections where you can safely purchase a subscription and then direct you back to our site to download products.

You are allowed to log in and download content from 3 computers. Our website keeps track of login IP addresses, MAC Address Usage, and Browser and Computer Operating System fingerprinting, and you will not be able to log in from more than three computers.