Financial Asset Management With Blockchain Technology Training Ppt

This set of slides provides information on financial asset management and its significance for businesses,such as accuracy,accountability risk management,and elimination of ghost assets. It also covers the problem of existing asset management systems and how blockchain technology can help overcome them. Further,it includes the benefits of blockchain-based asset management systems operational efficiency,regulatory compliance,and improved security and challenges in adopting blockchain for asset management.

This set of slides provides information on financial asset management and its significance for businesses,such as accuracy,..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Financial Asset Management with Blockchain Technology. Our PowerPoint experts have included all the necessary templates,designs,icons,graphs,and other essential material. This deck is well crafted by extensive research. Slides consist of amazing visuals and appropriate content. These PPT slides can be instantly downloaded with just a click. Compatible with all screen types and monitors. Supports Google Slides. Premium Customer Support is available. Suitable for use by managers,employees,and organizations. These slides are easily customizable. You can edit the color,text,icon,and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide introduces the concept of Records Management as a part of asset. We also internalize the reasons on how it is an essential requirement in the financial sector.

Instructor’s Notes:

- Records Management: Identifying, classifying, storing, retrieving, tracking, and discarding or permanently preserving records is part of this process

- Importance: Effective management of your latest records (both paper and digital); reduced/eliminated record-keeping discrepancies; lower costs for records storage equipment; and creation of more usable office space by eliminating unnecessary file storage are a few benefits of Records Management. The process also ensures institutional accountability and timely information access

Slide 2

This slide showcases the value that asset management brings to the table. It needs to be a top priority for an organization within the finance sector as it ensures that the business is accountable, can manage its risks, has accuracy in tracking its assets and eliminates ghost assets.

Instructor’s Notes:

- Accountability: Successful management of assets makes it simple for businesses to maintain track of their assets. With greater visibility of where assets are situated, how they are being used, and whether they have been modified, asset recovery can be more effective, resulting in higher profits

- Accuracy: As assets are verified continuously, the procedure itself guarantees that they are appropriately recorded in the financial statements, ensuring the accuracy of amortization rates

- Risk Management: Asset management encompasses the process of identifying and managing risks associated with the use and ownership of specific assets

- Elimination of Ghost Assets: There have been occasions where assets that were lost, destroyed, or stolen were documented incorrectly on the books. The organization's owners need to be informed of any assets that have been lost as a result of a strategic asset management plan and these be removed from the live assets book

Slide 3

This slide discusses problems associated with the existing system of asset management it being a slow and complex process, presence of multiple intermediaries, and the inability to meet market demands.

Instructor’s Notes:

- Slow & Complex: The asset management sector has increased significantly in size and complexity during the last few decades. As a result, managing assets in a timely and effective manner can be challenging

- Multiple Intermediaries: The presence of intermediaries at practically every step of the process signals overreliance on people, which can lead to errors and discrepancies, slowing down and complicating the process

- Slow to Respond to Market Demand: Institutions are slow to respond to shifting investor demands and stringent financial regulations imposed around legacy systems

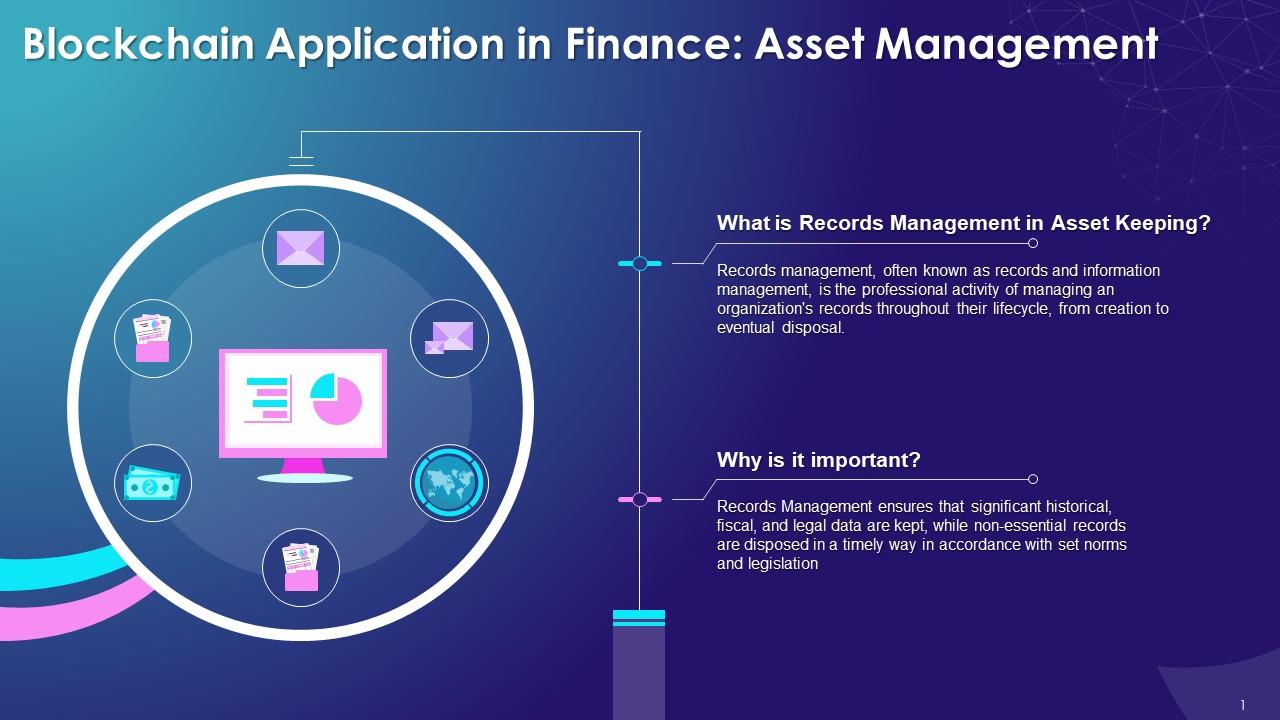

Slide 4

This slide discusses the scope of blockchain technology as a solution to problems that the conventional approach to asset management poses within the financial sector.

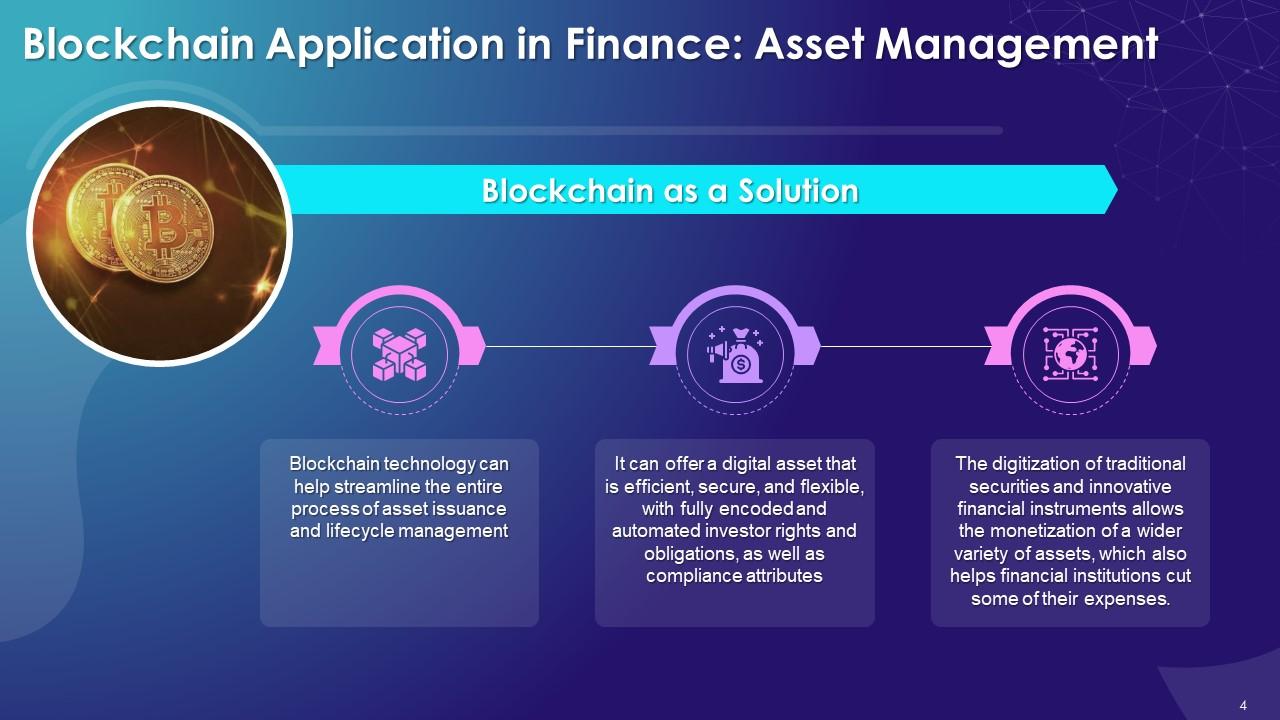

Slide 5

This slide showcases the step-by-step process for successful implementation of a blockchain-based asset management system that financial institutions may adopt. With this pathway, they can choose a transformative implementation plan that also mitigates risks.

Instructor’s Notes:

- Inspiration: To get inspired about blockchain and choose to gather information from sources that have a better understanding of the technology

- Education: The inspiration phase engages the imagination, while the education phase focuses on the practical. Creativity gives way to the gathering and assimilation of information during the educational phase

- Ideation: When a critical mass of personnel is inspired and educated on blockchain, organizations can move into ideation. Effective ideation yields action and brings order to chaos without ignoring good ideas that may arise

- Collaboration: Asset management organizations might go on to the collaboration stage after their ideas have been tested. Often, companies form alliances with industry groups and blockchain developers during this stage

- Prototyping: At this point, investment management businesses developing a custom solution are ready to construct a functioning prototype of leading projects with the knowledge and relationships gained

- Implementation: Compared to the possible danger involved with solutions, an organization's risk investigating, testing, and prototyping is relatively low. Throughout the development and launch of a product, businesses should be prepared to invest in security and risk mitigation. The system's verification and validation prior to launch are essential steps in the implementation process

Slide 6

This slide discusses the scope of blockchain technology as a tool for asset management. It lists benefits like client onboarding, operational efficiency, regulatory compliance, open collaboration, and improved security that can help forge the future of asset management in the financial sector.

Instructor’s Notes:

- Client Onboarding: Confirming that the persons involved are who they claim they are is the first step in starting any financial relationship. It's becoming increasingly difficult to do so in a method that's both efficient and fool-proof due to data leaks, hacking, and malware attacks. Given that blockchain promises to dramatically decrease, if not eliminate, such problems, identity management or client onboarding and data security are likely to become the most common blockchain applications for asset management organizations

- Operational Efficiency: In an industry where corporations are increasingly investing hundreds of millions of dollars to lower trade execution time from milliseconds to microseconds, data communication speed is critical. Aside from reducing order processing times, faster data transmission speeds mean managers will be alerted to news affecting their clients' portfolios much faster, giving them those precious few additional seconds in dealing with difficulties as they emerge

- Regulatory Compliance: When it comes to investor engagement, management reporting, and regulatory compliance, blockchain's secure and transparent nature of gathering transaction data might be helpful. Using technology rather than teams of people to comply with anti-money laundering programs, information security requirements, and privacy laws can help save costs, enhance efficiency, and lower the chance of individual errors or fraudulent conduct

- Open Collaboration: Blockchain enables you to build a system that combines third-party technology and processes with internal systems to provide one source of truth for asset management activities. This facilitates the addition of new partners using blockchain-assisted transactions

- Improved Security: Blockchain enhances data security. It is simply far superior to traditional security approaches, as it provides an immutable record of all transactions. Before each block is linked to others, it is encrypted, and distributing the records across nodes reduces the impact of a data breach

Slide 7

This slide talks about the barriers to adoption of blockchain technology in asset management. Asset managers and financial services industry are gradually embracing the technology's benefits. Yet, some roadblocks continue to persist in the full-fledged adoption of blockchain for asset management.

Instructor’s Notes:

- Lack of familiarity: Despite the tremendous benefits that blockchain technology offers to the banking industry, it has been reluctant to adopt it. One of the causes is a lack of familiarity of the market with the technology

- Regulatory Framework: Other difficulties include an emerging regulatory framework and a lack of experience in managing vast amounts of data. While there haven't been any verified data breaches of blockchain backbones so far, there have been flaws in smart contract implementation, usually owing to coding errors

Financial Asset Management With Blockchain Technology Training Ppt with all 23 slides:

Use our Financial Asset Management With Blockchain Technology Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

You guys are life-saver when it comes to presentations. Honestly I cannot do much without your services. Thank you!!!

-

Easily Understandable slides.