A bank is a type of financial institution that accepts deposits and extracts money from customers' accounts. The banking industry, like other businesses, needed a large capital expenditure to get off the ground.

A business plan for the banking sector is essential for starting and growing banks. Financial institutions need a business plan for banks because their regulations are based on similar ones. So, it should be designed to grab the interest of lenders, stakeholders, and investors.

Business plans for the banking sector must include clear and attainable goals for the future, marketing strategies, timeliness, ways to use the investments and information about the organization. For the company to achieve its objectives, it must project the estimations of the commercial operations that have been planned during the previous three fiscal years and evaluate their viability.

Guidelines for Writing a Business Plan for the Banking Sector

Prepare a thorough banking business plan by going through all the relevant topics in depth. Provide the reasons for starting the firm and the goals that demonstrate the entrepreneur's skill and pique the interest of venture capitalists. Before creating a business plan for the banking industry, there are a few questions that should be adequately addressed. As follows:

What kind of market do you have, and where?

What is the likely range of your industrial expansion?

Who are your intended customers?

What types of regulations will you put in place to lure consumers?

How will you carry out your carefully thought-out policies and take the appropriate measures in response?

So, here are a few of the essential slides that you must incorporate into your business plan to make it stand out.

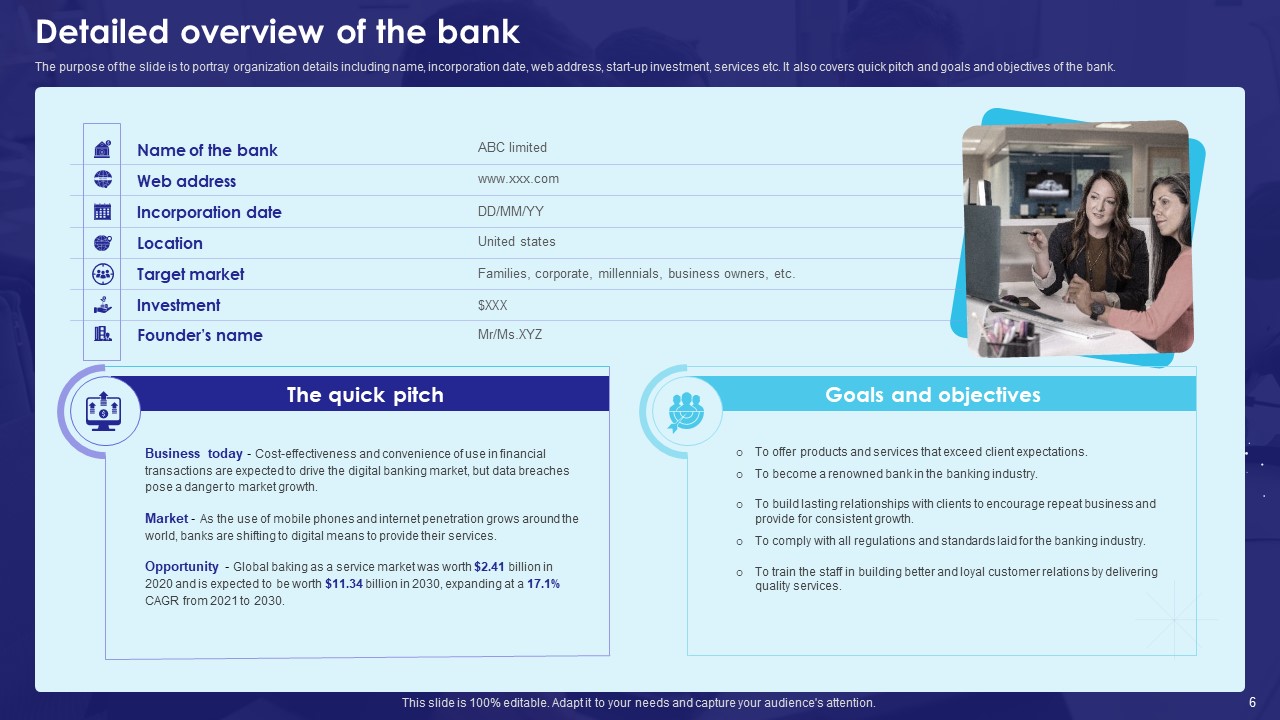

#Detailed overview of the bank

This slide is to portray organization details including name, incorporation date, web address, start-up investment, services, etc. It also covers the quick pitch and goals and objectives of the bank.

The company overview is part of your business plan that gives the basics and background of your business. It's the foundation on which you will build the rest of your business plan. You need the reader to be well-informed about your business to entice investors or future customers.

This slide is 100% editable, so download it right now.

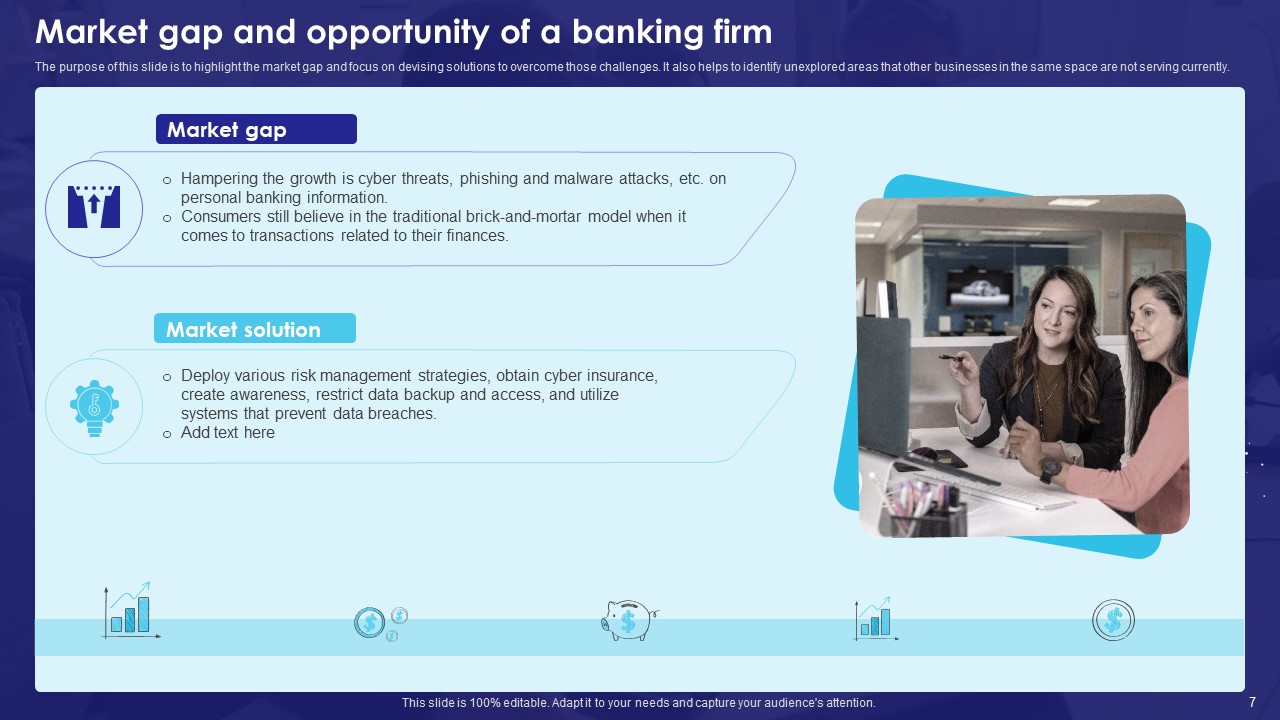

#Market gap and opportunity of a banking firm

The purpose of this slide is to highlight the market gap and focus on devising solutions to overcome those challenges. It also helps to identify unexplored areas that other businesses in the same space are not serving currently.

A market gap is an area where there is a need from customers but where businesses do not already fill the void. A market gap opportunity is a chance to create and offer something currently unavailable.

So, highlight the market gap along with its solution in the slide to give a glimpse to the investor.

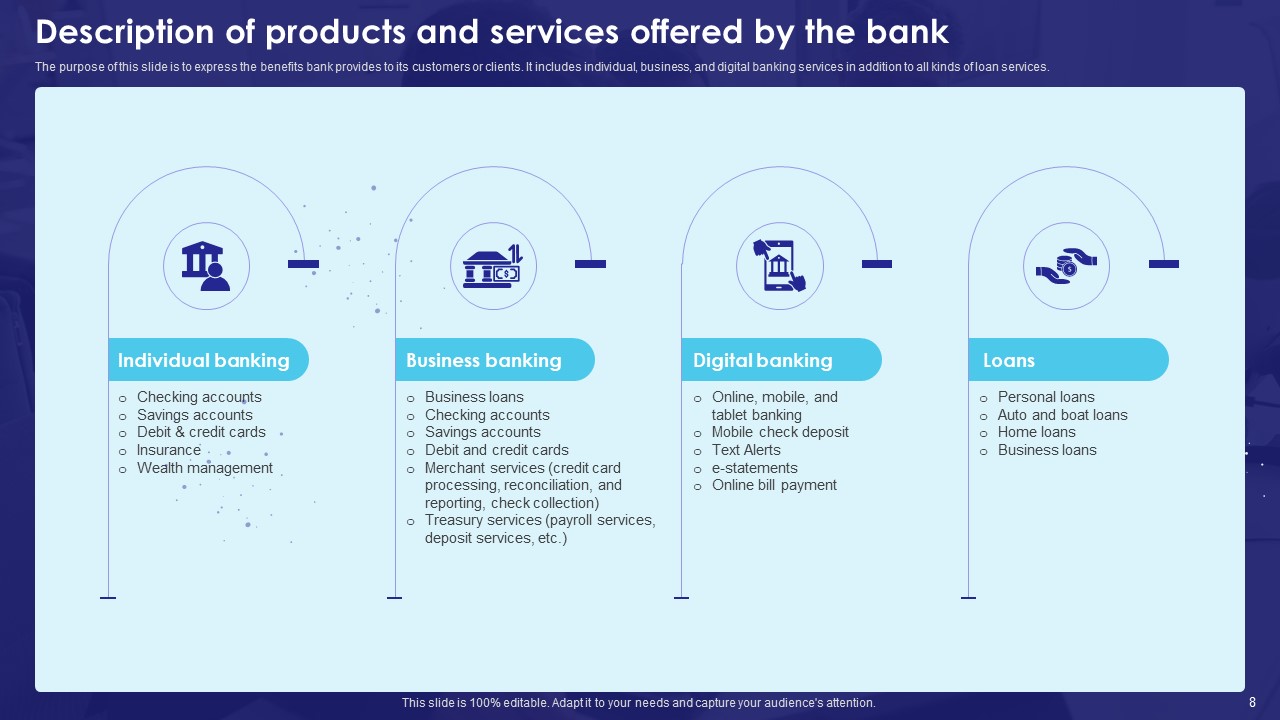

#Description of products and services offered by the bank

This slide is to express the benefits the bank provides to its customers or clients. It includes individual, business, and digital banking services in addition to all kinds of loan services.

Your business plan's section on products and services helps the reader understand why you're in business, what you sell, how you compete with existing options, or how you fill a market gap that no one else is filling.

So, highlight the different services your bank is offering to you.

# Choosing an ideal business location for the bank

This slide portrays an ideal business location for the bank that minimizes the risk of failure. It covers gathering and analyzing data in order to select the optimal location in terms of feasibility, economy, and future sustainability.

Choosing an apt location for your business not only helps you in retaining employees but also makes you more accessible in attracting target customers.

So, highlight the few things you are considering while choosing the location to make the users of the business plan aware.

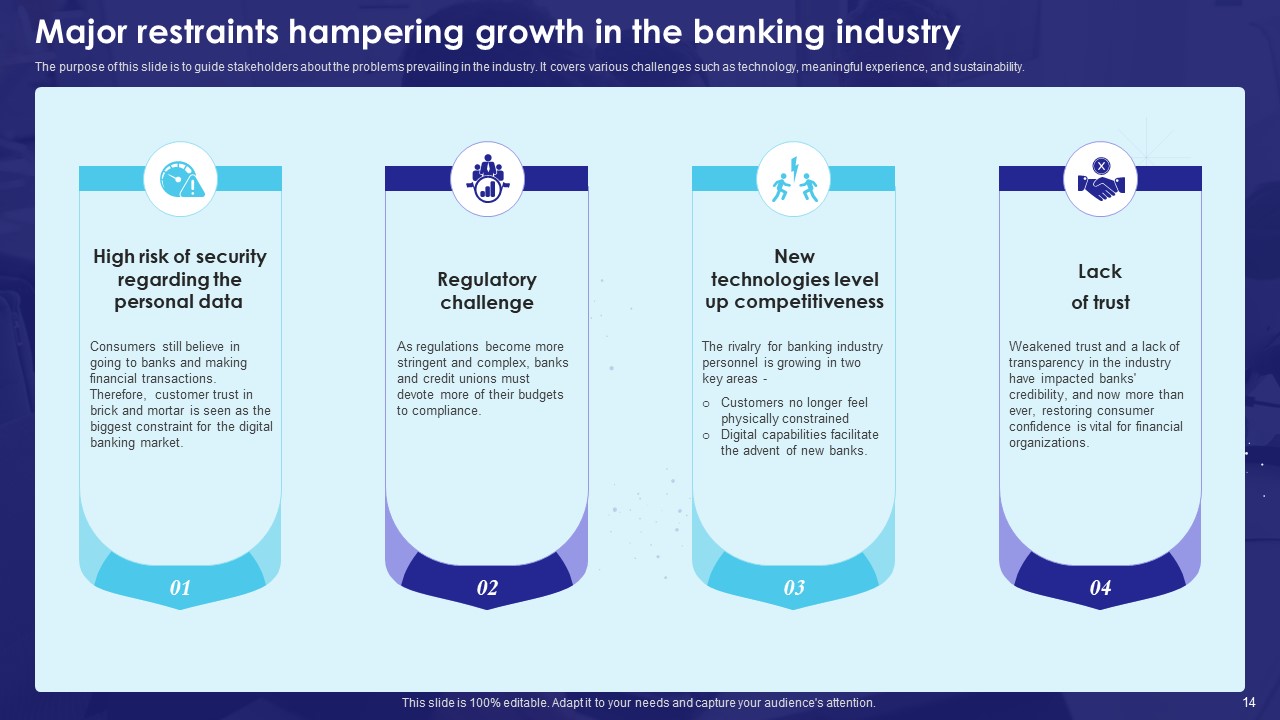

# Major restraints hampering growth in the banking industry

The idea behind this slide is to guide stakeholders about the problems prevailing in the industry. It covers various challenges such as technology, meaningful experience, and sustainability.

However, highlighting the major restraints in a business plan will make you understand the clear-cut challenges that they have to overcome.

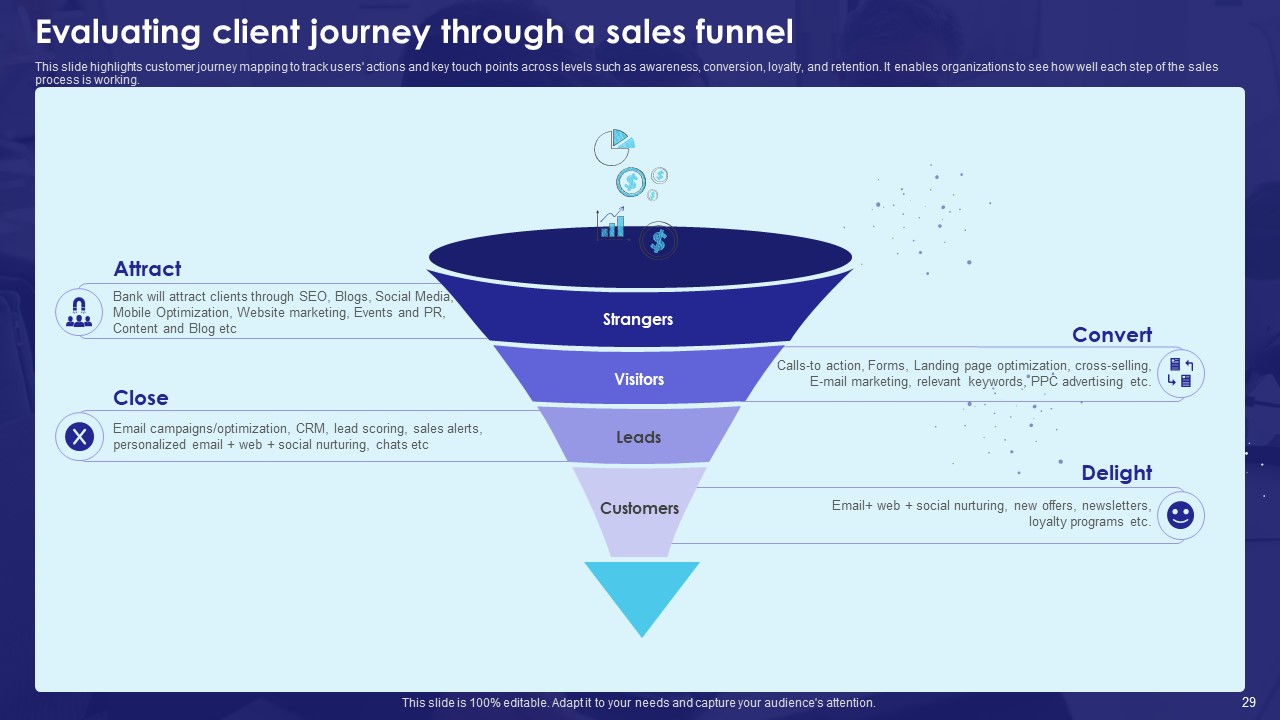

# Evaluating client journey through a sales funnel

This slide highlights customer journey mapping to track users' actions and key touch points across levels such as awareness, conversion, loyalty, and retention. It enables organizations to see how well each step of the sales process is working.

A sales funnel is a word used in marketing, to sum up and define the path taken by potential clients from prospecting to purchase.

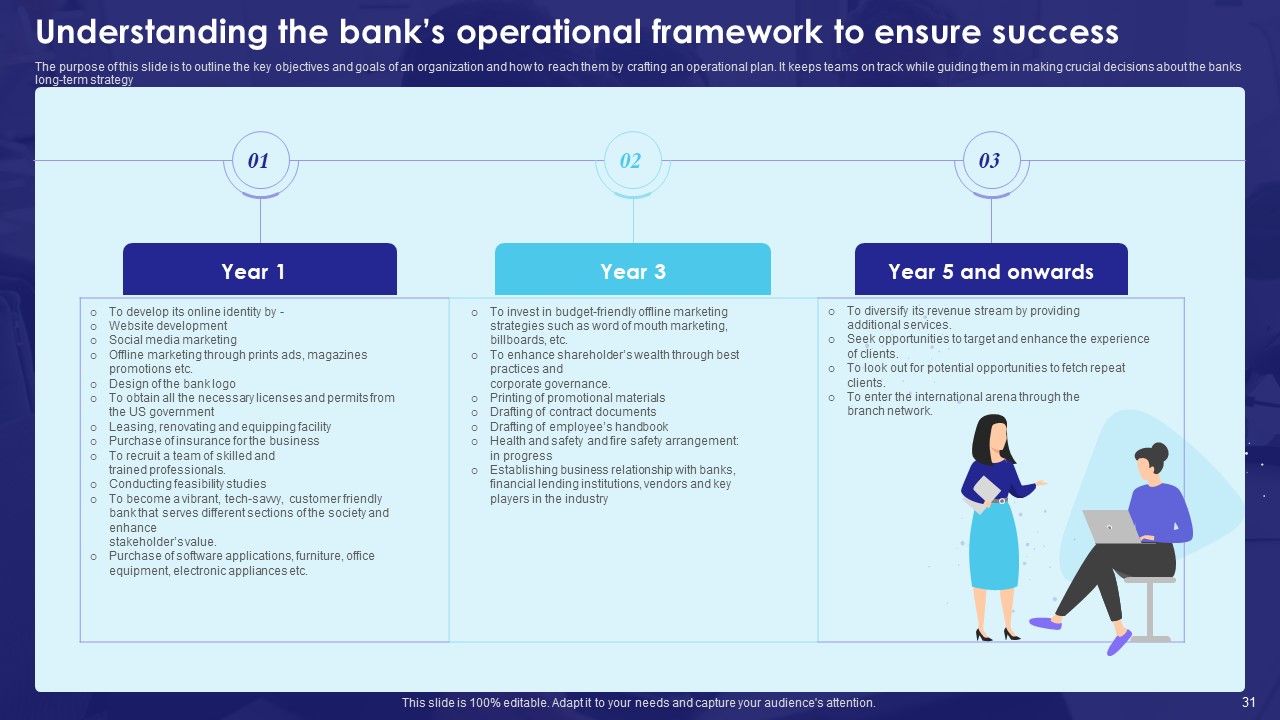

# Understanding the bank’s operational framework to ensure success

The purpose of this slide is to outline the key objectives and goals of an organization and how to reach them by crafting an operational plan. It keeps teams on track while guiding them in making crucial decisions about the banks’ long-term strategy.

In this slide, you can highlight the 1-YEAR plan, 3-YEAR plan, and 5-YEAR onwards plan to achieve the goals and objectives.

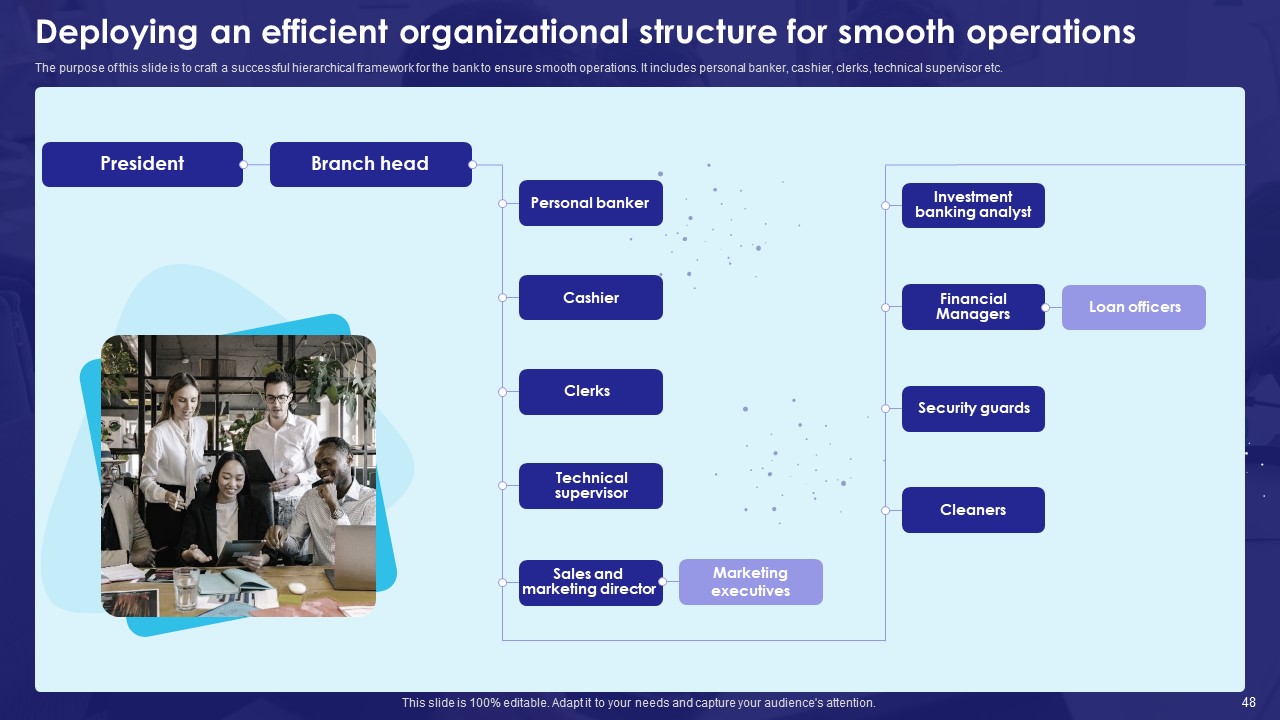

# Deploying an efficient organizational structure for smooth operations

The purpose of this slide is to craft a successful hierarchical framework for the bank to ensure smooth operations. It includes personal bankers, cashiers, clerks, technical supervisors, etc.

An organizational structure is a system that defines how specific tasks are directed in order to fulfill the goals of an organization.

So, highlight the organizational chart in the slide to make it clear to the audience, how the pattern is being followed in the organization.

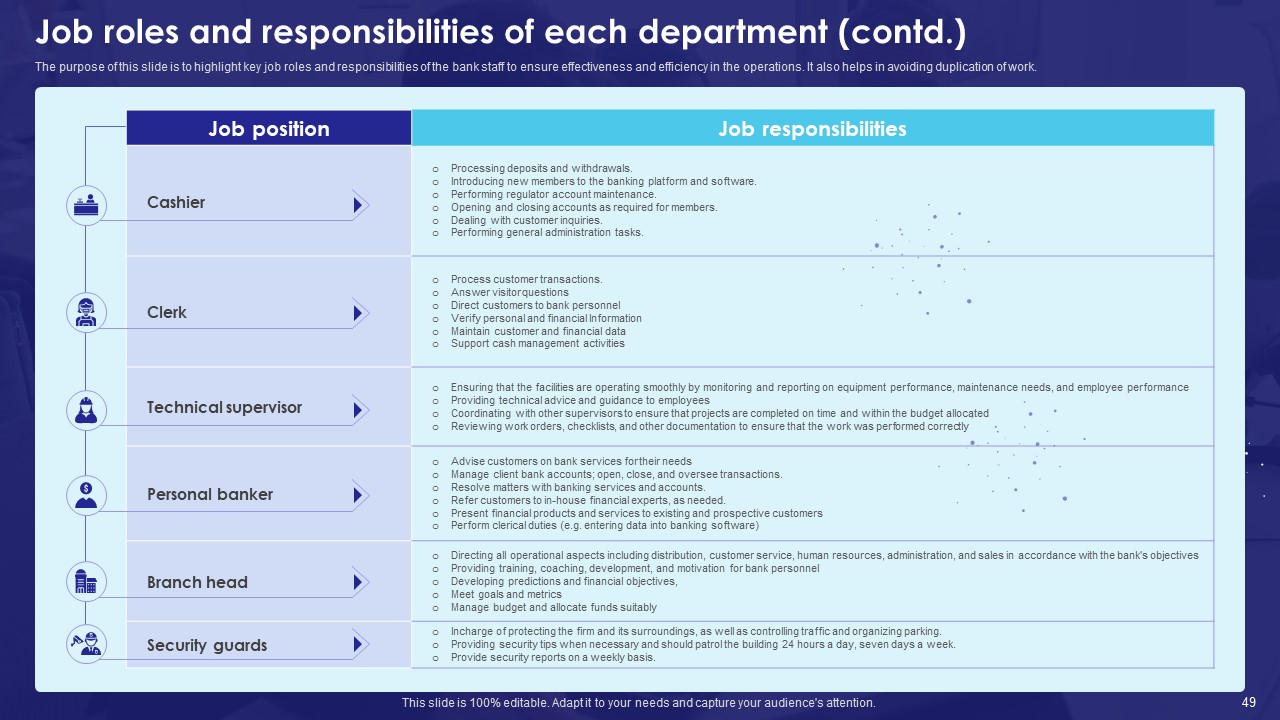

# Job roles and responsibilities of each department (contd.)

This slide aims to highlight key job roles and responsibilities of the bank staff to ensure effectiveness and efficiency in the operations. It also helps in avoiding duplication of work. Job responsibilities refer to the duties and tasks of their particular roles.

Companies that identify roles and responsibilities can streamline their hiring processes. It may encourage their employees to perform better and pay closer attention at work. It also helps enhance operational efficiency by removing confusion and redundancy.

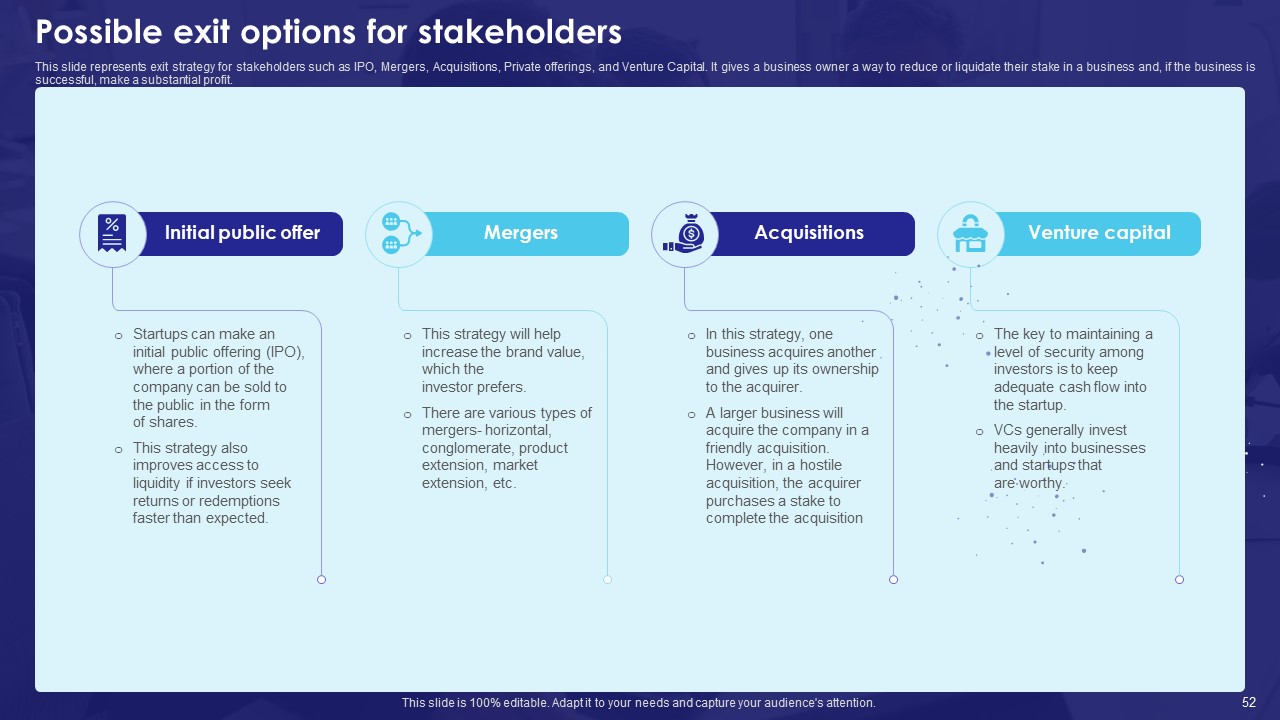

# Possible exit options for stakeholders

This bank business plan slide represents exit strategy for stakeholders such as IPO, Mergers, Acquisitions, Private offerings, and Venture Capital. It gives a business owner a way to reduce or liquidate their stake in a business and make a substantial profit if the business is successful.

An exit option is a clause in a business plan or project that enables a corporation to abandon the venture with only minor financial repercussions.

So download this ready-to-use PowerPoint presentation and edit the text as per your requirement.

Wrapping up

You can get all the information you need to understand the market, the industry, and both at once for the bank business plan in this PowerPoint.

At SlideTeam, a group of researchers and designers work together on projects to create material that satisfies customer requirements. You alter our business plan ppt to suit a person's unique professional needs.

FAQ

What is the purpose of a business plan for a bank?

A business plan outlines your growth strategy for the next five years and gives a current picture of your bank. It outlines your company's objectives and your plans for achieving them. Market research is also included to help you with your plans.

Which three business models do banks typically use?

A commercial bank with retail funding, a commercial bank with wholesale funding, and a bank focused on the capital markets are the three business models we identify. While the third type stands out principally due to banks' growing involvement in trading activities, the first two models differ primarily in how banks choose to fund their operations.

Customer Reviews

Customer Reviews