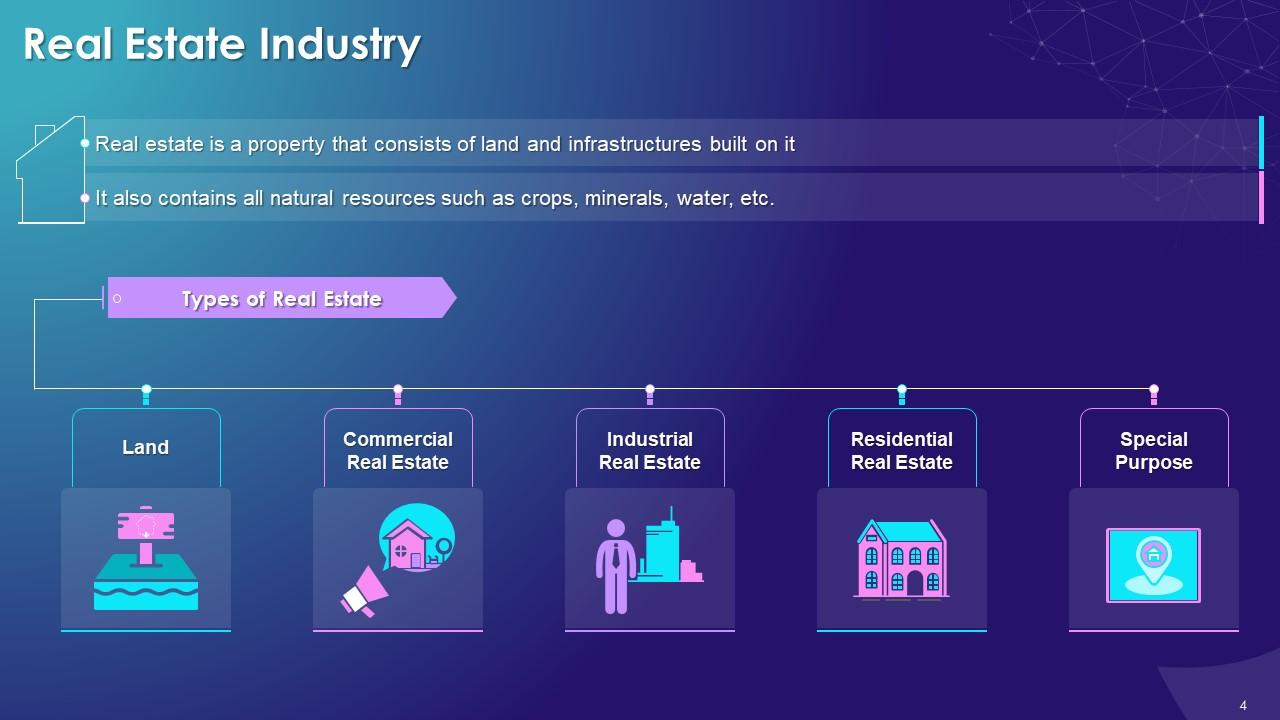

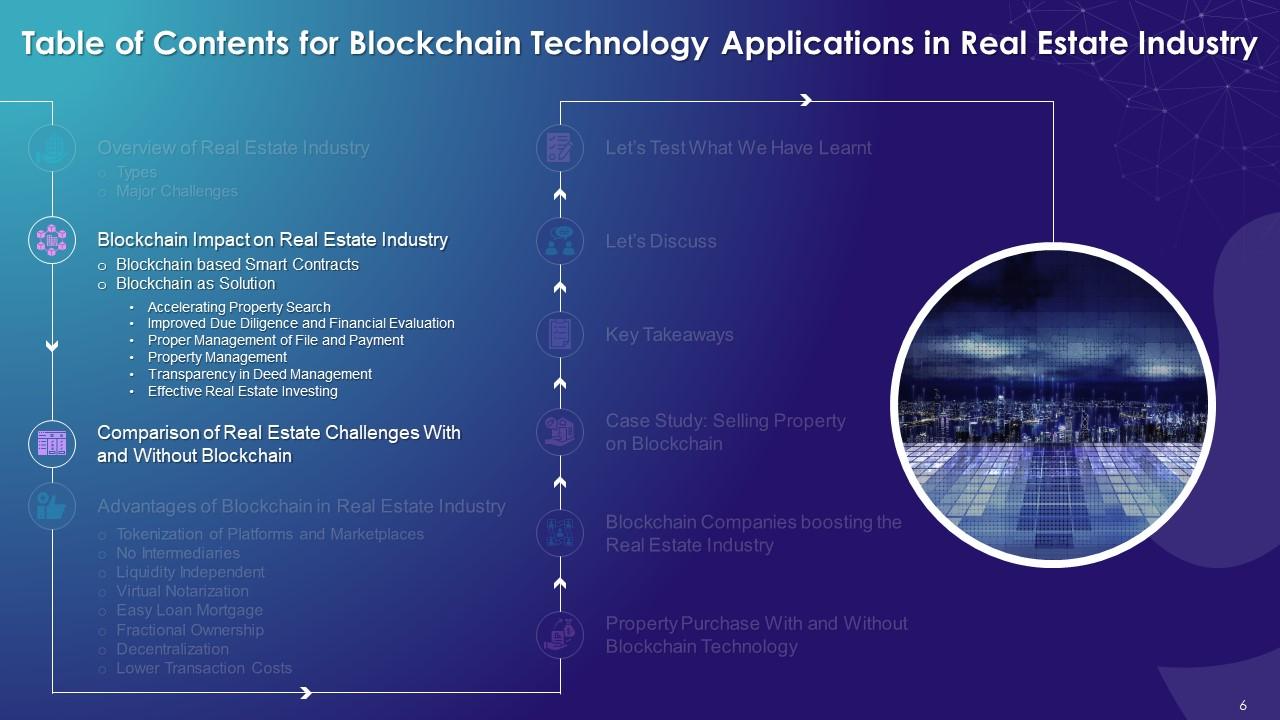

Blockchain Technology Applications in Real Estate Industry Training Ppt

This PPT training module covers blockchain technology applications in the real estate industry. It covers the real estate industrys challenges and how blockchain helps overcome them with the tokenization of platforms and marketplaces, no intermediaries, liquidity independence, virtual notarization, fractional ownership, decentralization, and lower transaction costs. It also compares the property purchase process with and without blockchain technology. The PowerPoint module also has key takeaways, discussion questions, and MCQs related to the topic to make the training session interactive. It also includes additional slides on about us, vision, mission, goal, 30-60-90 days plan, timeline, roadmap, training completion certificate, energizer activities, detailed client proposal, and training assessment form.

This PPT training module covers blockchain technology applications in the real estate industry. It covers the real estate i..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

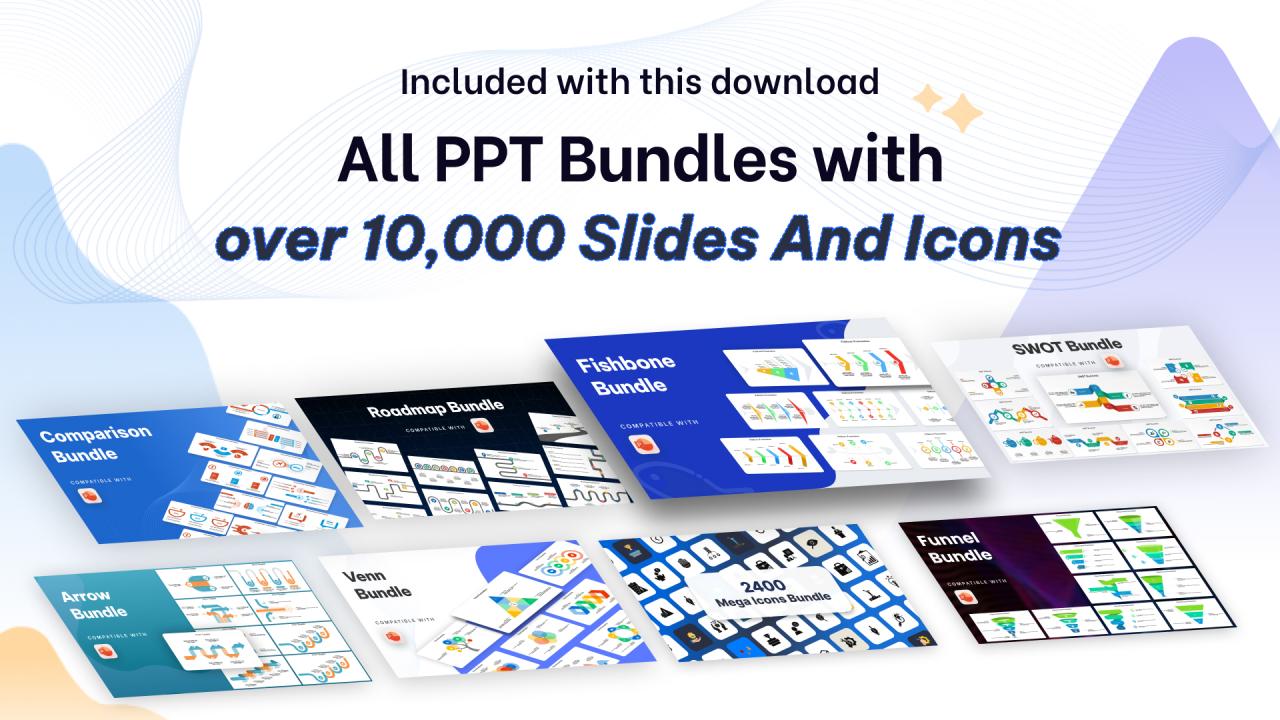

Presenting Training Session on Blockchain Technology Applications in Real Estate Industry. This deck comprises of 87 plus slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts and every slide consists of an appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

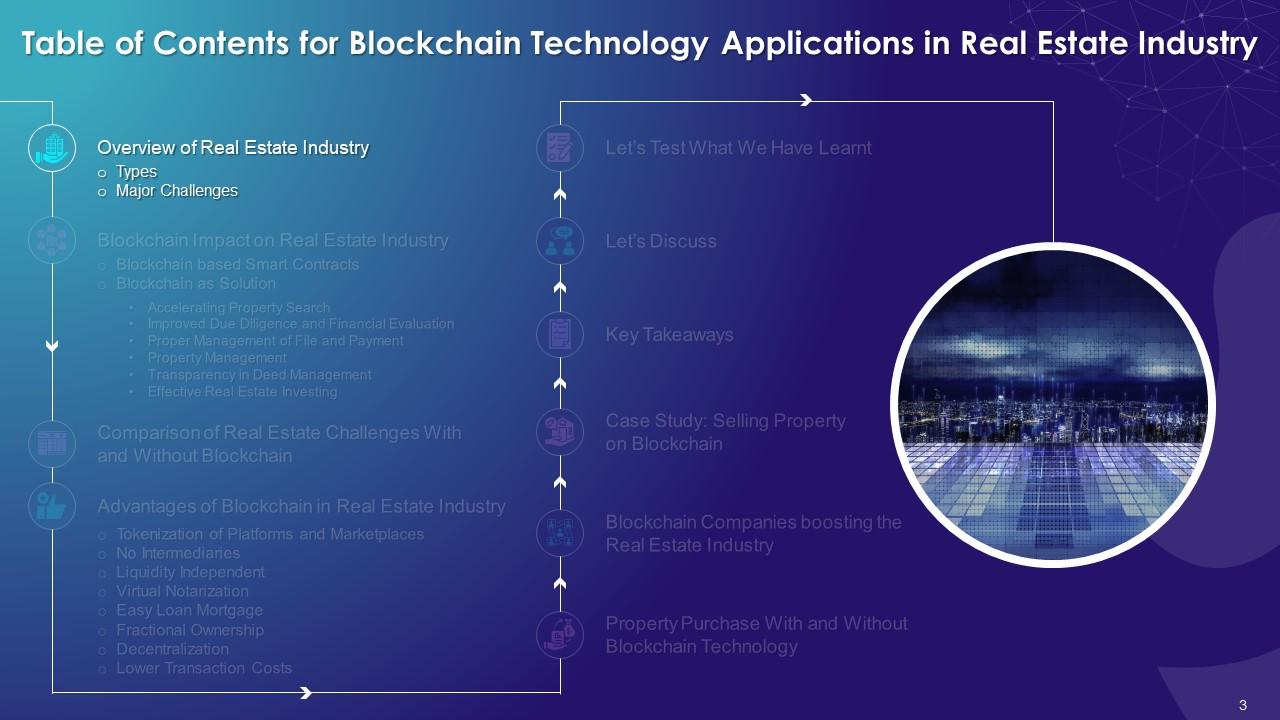

Slide 4

This slide highlights the concept of real estate. It also determines the different types of real estate such as residential, commercial, industrial, land, and special purpose.

Instructor’s Notes:

Types of real estate industry are as follows:

Land:

- It includes undeveloped, vacant, and agricultural land, e.g., farms, orchards, ranches, and timberland

Commercial real estate:

- Properties used for business purposes, such as gas stations, grocery stores, hospitals, hotels, offices, etc., all come under commercial real estate

Industrial real estate:

- The properties used for manufacturing, production, distribution, storage, etc., are all industrial real estate properties, including factories, power plants, and warehouses

Residential real estate:

- These types of real estate properties are used for residential purposes

- It includes single-family homes, condos, cooperatives, duplexes, townhouses etc.

Special purpose:

- All properties developed by the government for public use, such as cemeteries, parks, schools, etc., all come under special

Slide 5

This slide illustrates the different challenges faced by real estate industry. It also determines difficulties plaguing the real sector such as property search, due diligence and financial evaluation, file and payments, property management, deed management, and real estate investing.

Instructor’s Notes:

The challenges plaguing real estate industry are as follows:

Property Search:

- Buyers, brokers, owners, and tenants explore multiple apps to find a suitable property as per their requirements

- These online apps charge subscription fee

- The property data provided in these apps is often inaccurate, outdated, or partially distorted

- These wrong pieces of information can lead to disputes between the parties

Due Diligence and Financial Evaluation:

- People spend major time on diligence activities such as inspecting property documents to avoid legal, technical, or financial issues

- All the documentation process is done on paper that anyone can change or corrupt

File and Payment:

- In present times, buying or selling property involves extensive documentation and the involvement of intermediaries

- These involvements make the process lengthy, troublesome, and costly

Property Management:

- The traditional process of real estate is complex when multiple stakeholders are involved

- The management of documents is done either on paper, or some independent software is used, and the information remains confined to a particular database or person

Deed Management:

- All deeds are executed on paper, increasing the risk of errors and fraud

- According to the American :Land Title Association,25% of all property-related agreements, are found to be defective in the transaction stage itself

- The presence of any defect makes the agreement illegal, and it cannot be processed unless the issue has been resolved

Real Estate Investing:

- In the current real estate investment process, there is no track of finances in the system

- All transactions are done on paper and in person, leading to fraud

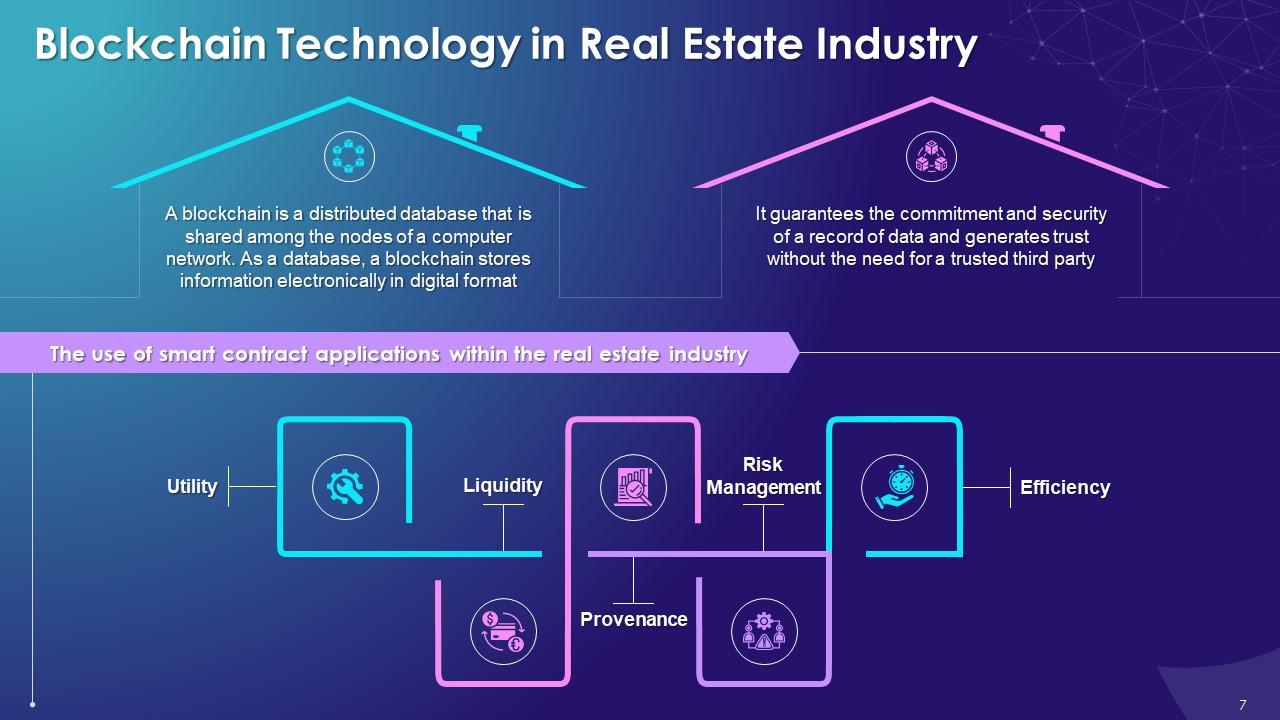

Slide 7

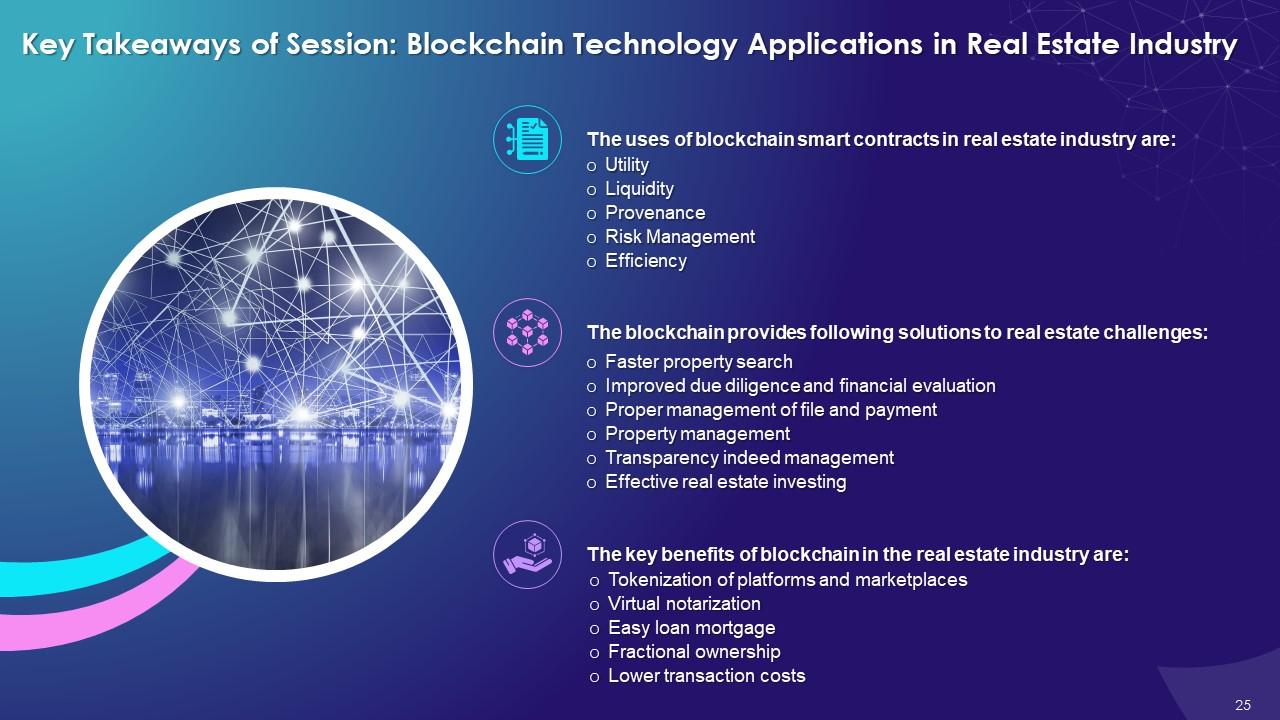

This slide highlights the concept of blockchain. It also showcases the multiple uses of smart contract applications within the real estate industry, such as utility, liquidity, provenance, risk management, and efficiency.

Instructor’s Notes:

The uses of smart contracts in real estate industry are:

Utility:

- Blockchain-based financial products can be used for real estate assets without the manual overhead

Liquidity:

- With the use of smart contracts in real estate, the assets can become more accessible globally. It creates additional liquidity and less slippage for buyers and sellers

Provenance:

- It provides an immutable audit trail of ownership for a real estate asset such as

- Entire transaction history

- Metadata on further improvements

Risk Management:

- The smart contract helps homeowners or real estate agents protect themselves against a decline in the projected value of homes within geographic regions

- It can be achieved by building on-chain derivative products

Efficiency:

- The use of smart contracts in real estate transaction process can be fully automated by integrating these with the existing system to reduce overhead and speed up settlement process

Slide 8

This slide illustrates the solutions provided by blockchain in real estate related problems. It also determines types of difficulties in real estate in which blockchain helps such as expediting the process of searching for property, improved due diligence and financial evaluation, proper management of file and payments, property management, transparency in deed management, and effective real estate investing.

Instructor’s Notes:

The solutions blockchain provides in meeting real estate challenges are:

Faster Property Search:

- Blockchain technology-based system helps decentralize data and enables data sharing in a P2P network

- It helps cut down associated costs by facilitating the brokers in receiving additional data monitoring options

Improved Due Diligence and Financial Evaluation:

- The use of blockchain technology helps to store all the property-related papers digitally and can be accessed publicly, but cannot be changed

- This makes due diligence and financial evaluation process automated, accurate, and fast

Proper Management of File and Payment:

- The filing process can be simplified by using blockchain-based application

- It helps in bringing transparency in real estate processes by introducing verifiable digital identities for properties

Property Management:

- With the use of blockchain in the property transaction process, real estate industry can be transformed

- Blockchain property management system uses smart contracts to ease the process, from signing lease agreements to regulating cash flow and filing maintenance requests

- It helps automate the payment process between the landlord and a tenant from the start of lease agreement to the end; then, it automatically returns the security deposit back to the tenant

Transparency in Deed Management:

- Deed management issues can be easily resolved using blockchain, as it is an immutable digital record that makes the whole process transparent and secure

Effective Real Estate Investing:

- Blockchain-based system helps the investing process by using the tokenization and fractional ownership concept

- Tokenization is a digital token provided to the owner having a share in the property

- Fractional Ownership is the process of making all the unrelated parties come together to analyze the risk related to investing in real estate

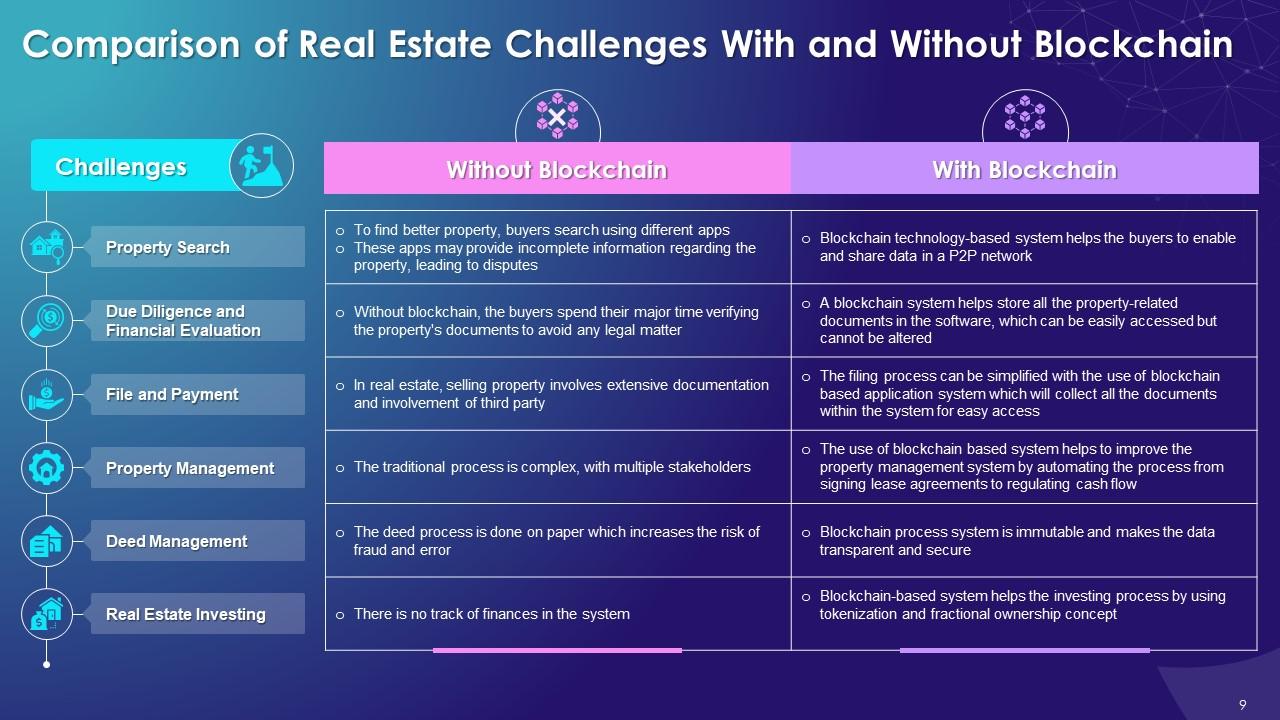

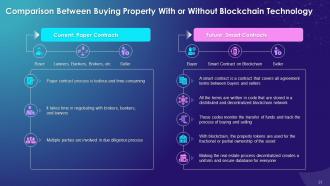

Slide 9

This slide illustrates the comparison between the different challenges of real estate with or without the use of blockchain technology. They are compared on parameters such as property search, due diligence and financial evaluation, file and payment, property management, deed management, and real estate investment.

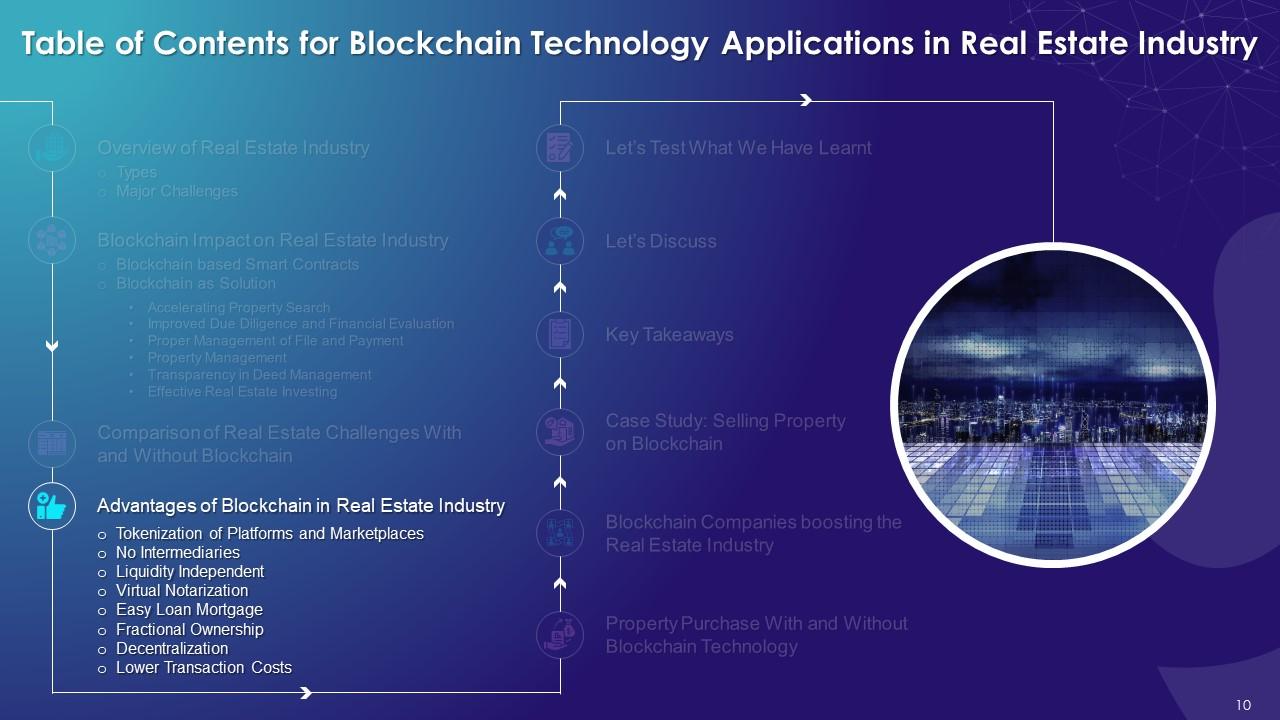

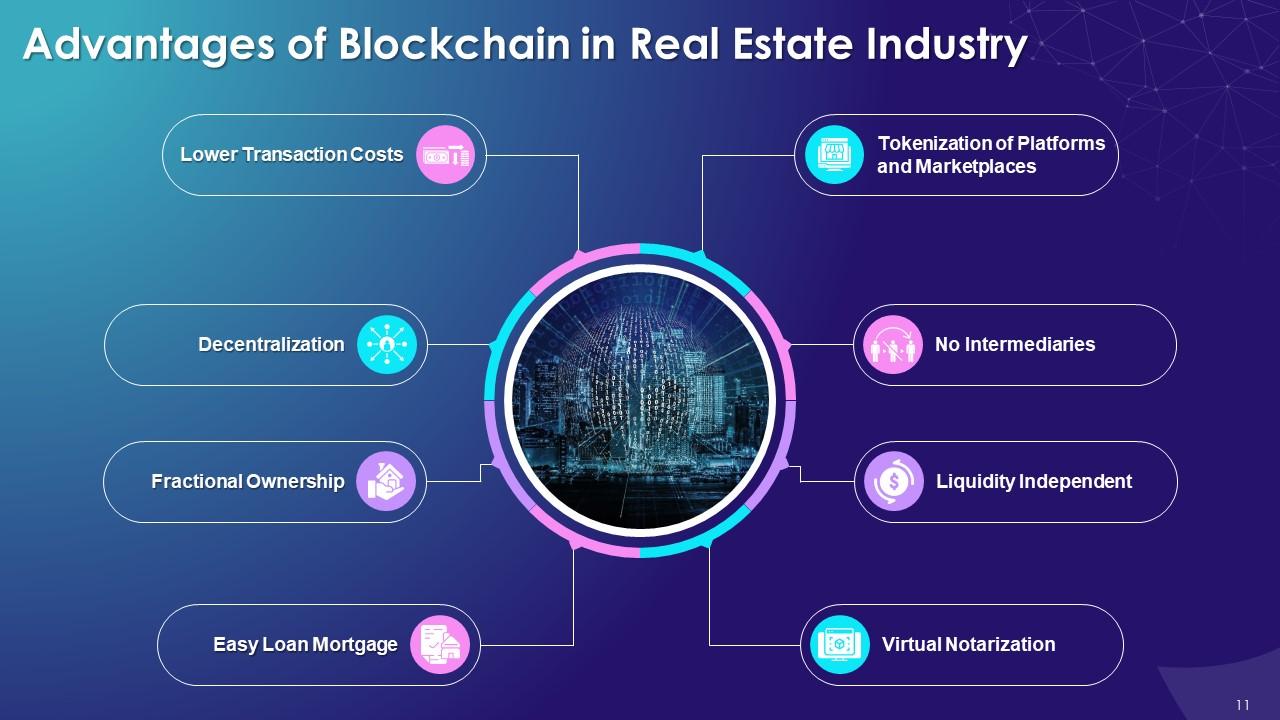

Slide 11

This slide highlights advantages of blockchain in real estate industry such as tokenization of platforms and marketplaces, no intermediaries, liquidity independent, virtual notarization, easy loan mortgage, fractional ownership, decentralization, and lower transaction costs.

Instructor’s Notes:

The key benefits of blockchain in real estate industry are:

Tokenization of Platforms and Marketplaces:

- With the introduction of blockchain in real estate, new methods enable trading platforms and online marketplaces to support real estate transactions

- Different platforms have been developed by ATLANT in tokenizing the real property assets

- These tokens can be used as the stock sale and liquidating that asset with the use of a blockchain-based platform

No Intermediaries:

- The role of intermediaries such as brokers, lawyers, and banks in the real estate ecosystem will change with the adoption of the blockchain technology

- Due to the elimination of these intermediaries, buyers and sellers can spend more money on the property as they will save money from commissions and fee that these intermediaries charge

Liquidity Independent:

- Real estate is considered an illiquid asset because it takes time to get sold

- With the use of tokens in real estate, property can be readily traded as the seller don't have to wait for the buyer to have the money

Virtual Notarization:

- It is an official fraud prevention process that helps parties with documentation and can be completely trusted

- Use of blockchain in virtual notarization provides numerous benefits in real estates, as explained below

- It helps secure documents and deeds; these are stored digitally in the form of a blockchain

- It helps stakeholders in accessing their private key

- It helps to secure data in the blocks with a proper timestamp

- It helps to transfer documents ownership digitally

- It helps in the transaction verification process on the network

Easy Loan Mortgage:

- The use of the blockchain-based system in loan mortgage helps eradicate issues like security, improved transparency, lower transaction costs, etc.

- A blockchain based system improves customer experience as below:

- It helps in improving loan search and check credit qualification and approvals

- It helps in faster asset appraisal, insurance and improves loan security

- It makes exchange of documents, disclosures, and due diligence easier

- It helps in reducing fee along the mortgage value chain

- It also helps reduce fraud during loan funding approval, cash transactions, and completion of assets and title exchange

Fractional Ownership:

- With the help of the fractional ownership concept, it will be easy to trade in the real estate industry

- By using blockchain, the investors will have to use apps to make a trade on any property they want to buy or sell

- The fractional ownership technique would also help them avoid managing the properties themselves, such as maintenance and leasing

Decentralization:

- Trust and security in blockchain are accrued due to the decentralized nature of technology

- The information stored in the blockchain-based system will be accessible to all, and it is immutable too

- The decentralized system technique will help in peer-to-peer verification of documents and transactions, improving confidence in making transactions

Lower Transaction Costs:

- Transparency related to the decentralization network system also cuts down the costs associated with real estate transactions

- Other than transaction fee, there are some additional charges in the real estate, such as fee for registration and loan, which can also be eliminated by automating these processes and making them part of the system

Slide 12

This slide highlights the benefits of blockchain in real estate with marketplace tokenization. It explains that with the help of blockchain in real estate new methods enables trading platforms and online marketplaces to support real estate transactions. It takes the help of ATLANT in developing platforms for tokenizing the real property assets.

Slide 13

This slide illustrates the benefit of blockchain to eliminate the intermediaries from the real estate industry. It also explains that different brokers, lawyers, and banks act as intermediaries in the real estate. The use of blockchain in real estate helps to remove these intermediaries by making the entire ecosystem decentralized.

Slide 14

This slide showcases the use of blockchain in real estate industry i.e., liquidity independent. It explains that the real estate is considered as illiquid asset as it takes time to be disposed of, when on sale. By using tokens in real estate, the property can be readily traded as the seller does not need to wait for buyer to have the money.

Slide 15

This slide highlights the benefit of blockchain in real estate with virtual notarization. It explains that it is an official fraud prevention process that helps parties in the transaction of documents and can be fully trusted.

Slide 16

This slide highlights the benefit of blockchain in real estate with loan mortgage. It explains that the use of blockchain-based system in loan mortgage helps resolve issues like security, improved transparency, lower transaction costs, etc.

Slide 17

This slide illustrates the effect of blockchain on real estate with fractional ownership. The slide also explains that the fractional ownership concept makes it easier to trade in real estate industry. The use of blockchain will help investors to use apps in making trade on any property they want to buy or sell.

Slide 18

This slide highlights the benefit of blockchain in real estate with decentralization. It also explains that the decentralization process will help in Peer-to-Peer verification of documents and transactions. Trust and security in blockchain are considered as decentralized.

Slide 19

This slide highlights the benefit of blockchain in real estate of lower transaction cost. It explains that the transparency related to decentralization network helps to reduce the costs associated with real estate transactions.

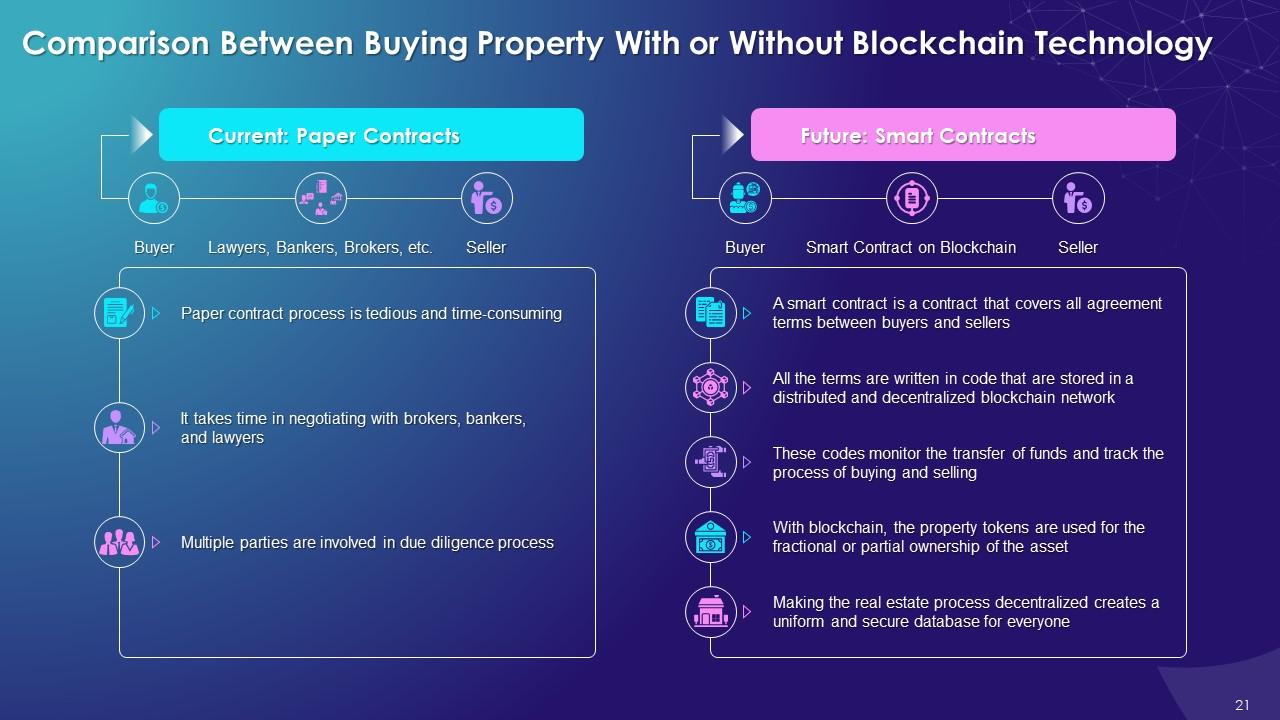

Slide 21

This slide illustrates the comparison between buying property with or without blockchain. They are compared on the bases parameters such as time taken, multiple intermediaries, centralized and decentralized system.

Slide 22

This slide illustrates the top blockchain based companies that are playing a major role in boosting the real estate industry such as Republic, Safewire, Realt, Property Club, Mangego, and Propy inc.

Instructor’s Notes:

Different blockchain companies improving real estate industry are as follows:

Republic:

- It helps customers invest in multiple real estate opportunities

- It also allows investors to build new projects, places, and currencies and later reap the rewards

SafeWire:

- It helps real estate firms, agents, clients, and industries in providing solutions on the rapidly emerging threat of wiring payments

- It operates with the help of a blockchain network to ensure security and avoid unsecure transactions

- Verifying each transaction reduces the risk of money loss, client loss, and time loss due to wire fraud

RealT:

- This company allows users to invest in US-based real estate market via a fully-compliant token-based blockchain network

- This process of tokenized property allows users to buy property in the US in the form of tokens

- It helps maintain access to cash flow by using real tokens that allow owners to access rent payments regularly

Property Club:

- It is a platform that uses blockchain to help users search for buying, selling, and investing in properties

- With the help of smart contracts, the company conducts real estate transactions digitally with different cryptocurrencies like Bitcoin or Property Club Coin (PCC)

ManageGo:

- It helps property managers and owners process payments, thoroughly complete credit background checks, and manage ticketing

- Distributed Ledger Technology (DLT) helps owners get a more transparent, thorough view of payment history and tenant background

Propy Inc:

- It is a real estate marketplace that uses smart contracts in passing international property transactions

- The company helps speed up the real estate process that faces speed-breakers in the form of legal issues

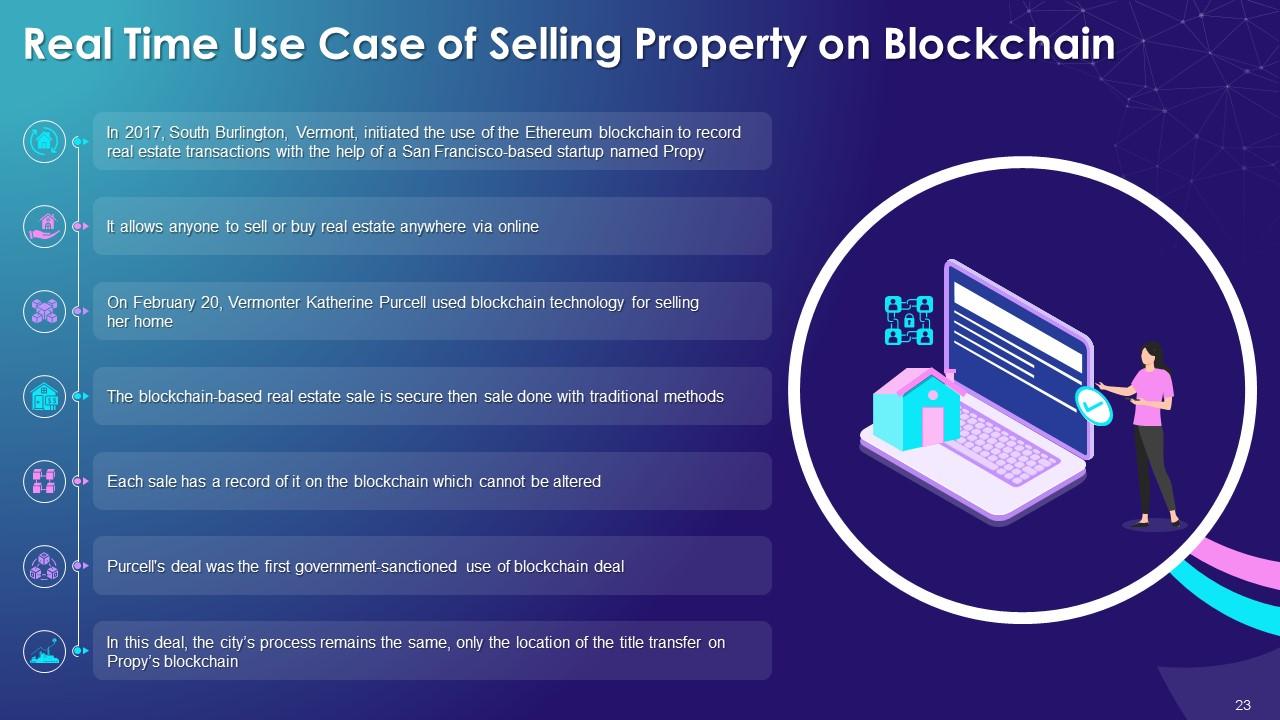

Slide 23

This slide illustrates the use case of selling property by using blockchain technology. It explains that the Vermont state initiated the Ethereum blockchain process to record its real estate transactions with the help of start-up named Propy. It initiated a pilot project on selling the property of Vermonter Katherine Purcell with the use of blockchain technology.

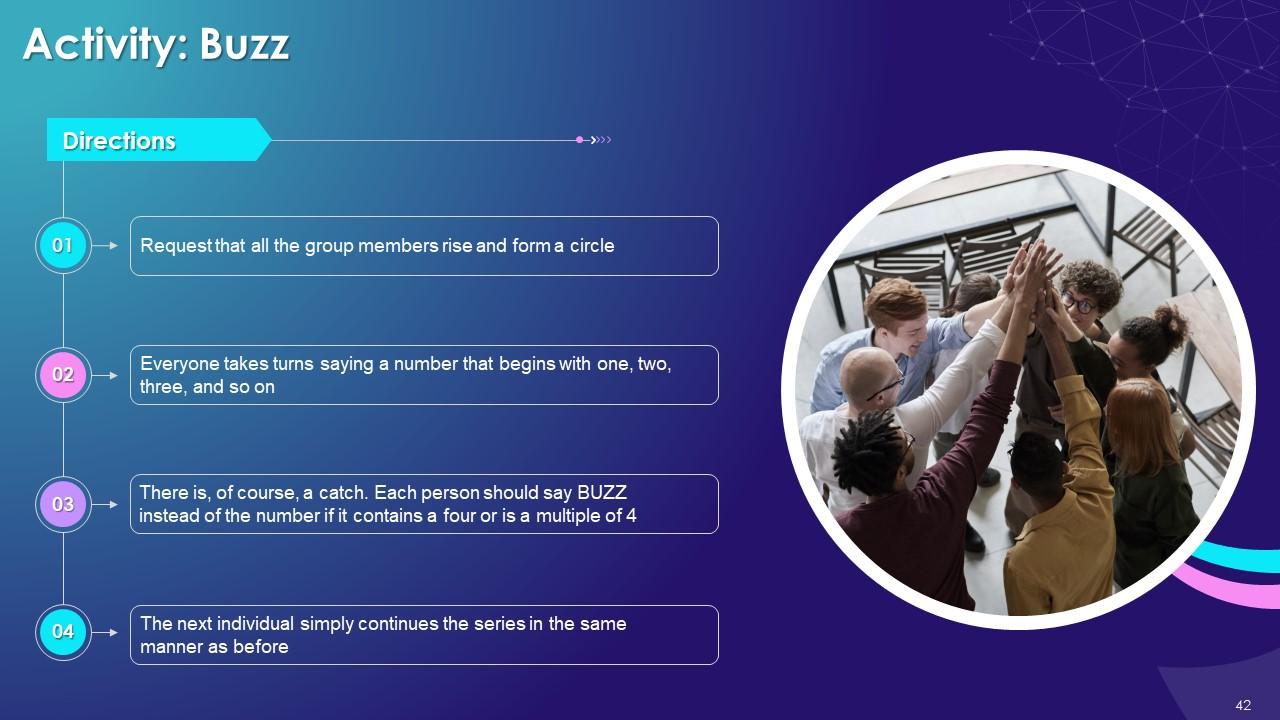

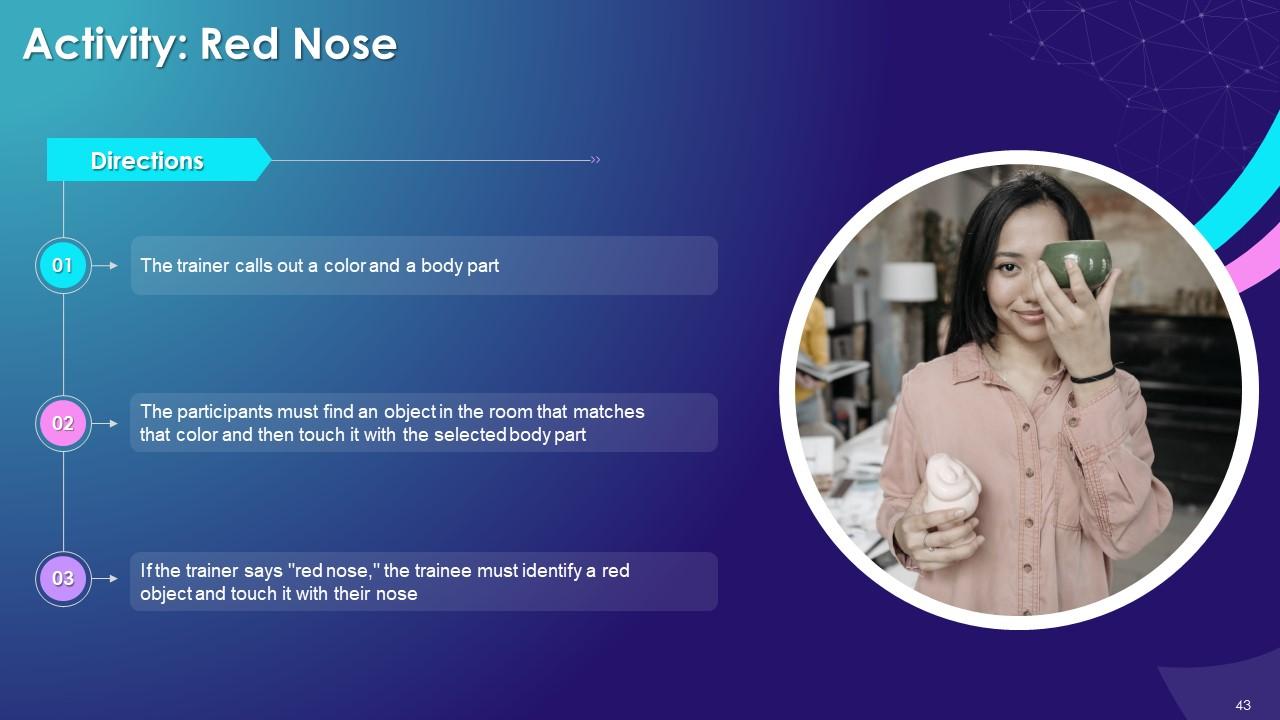

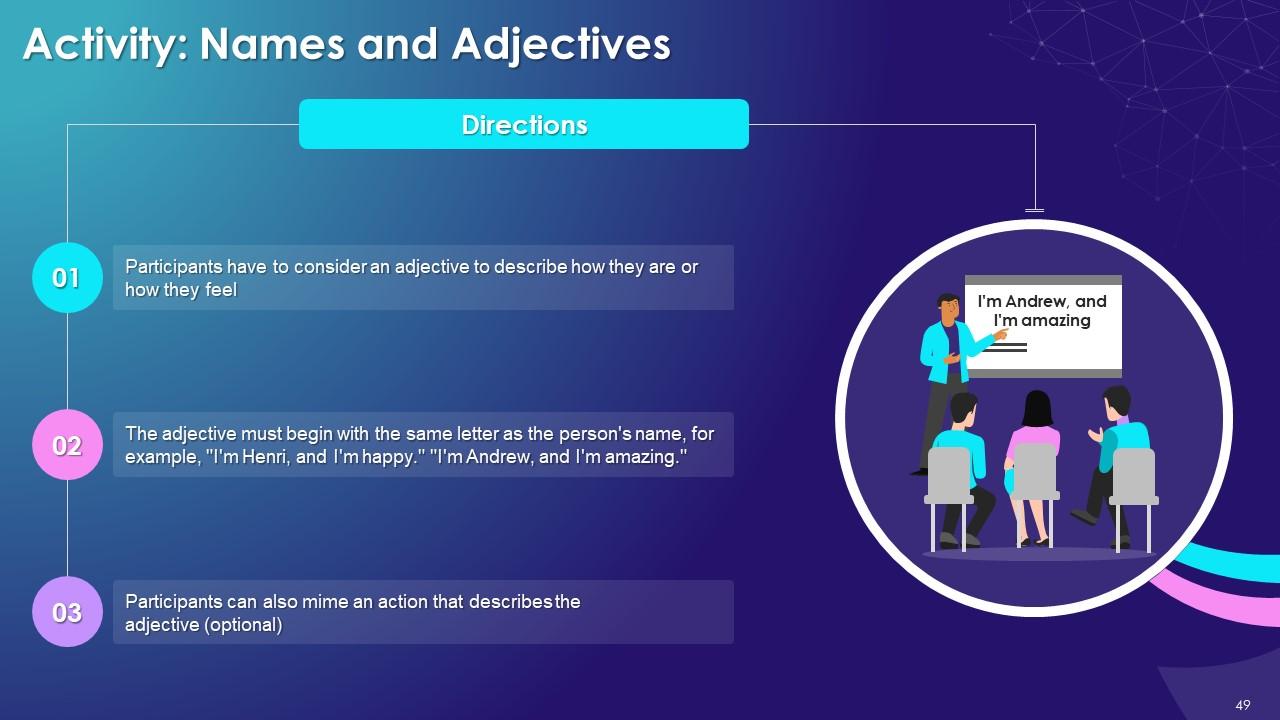

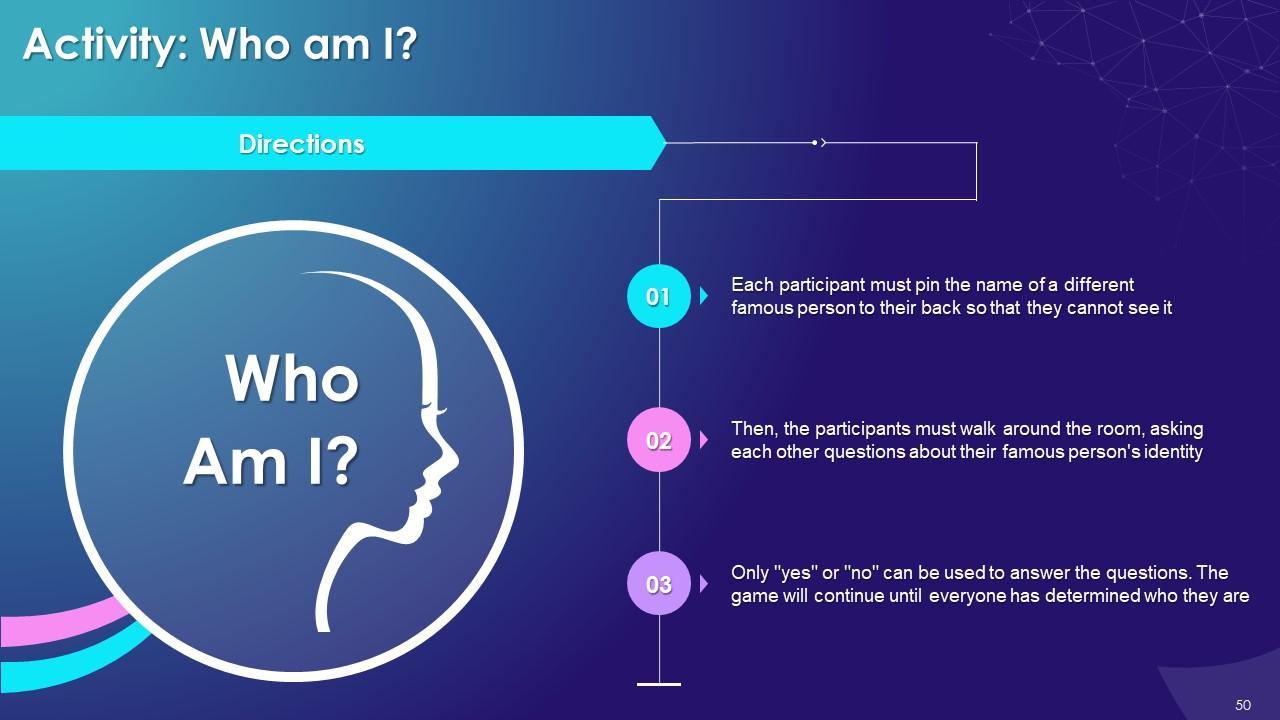

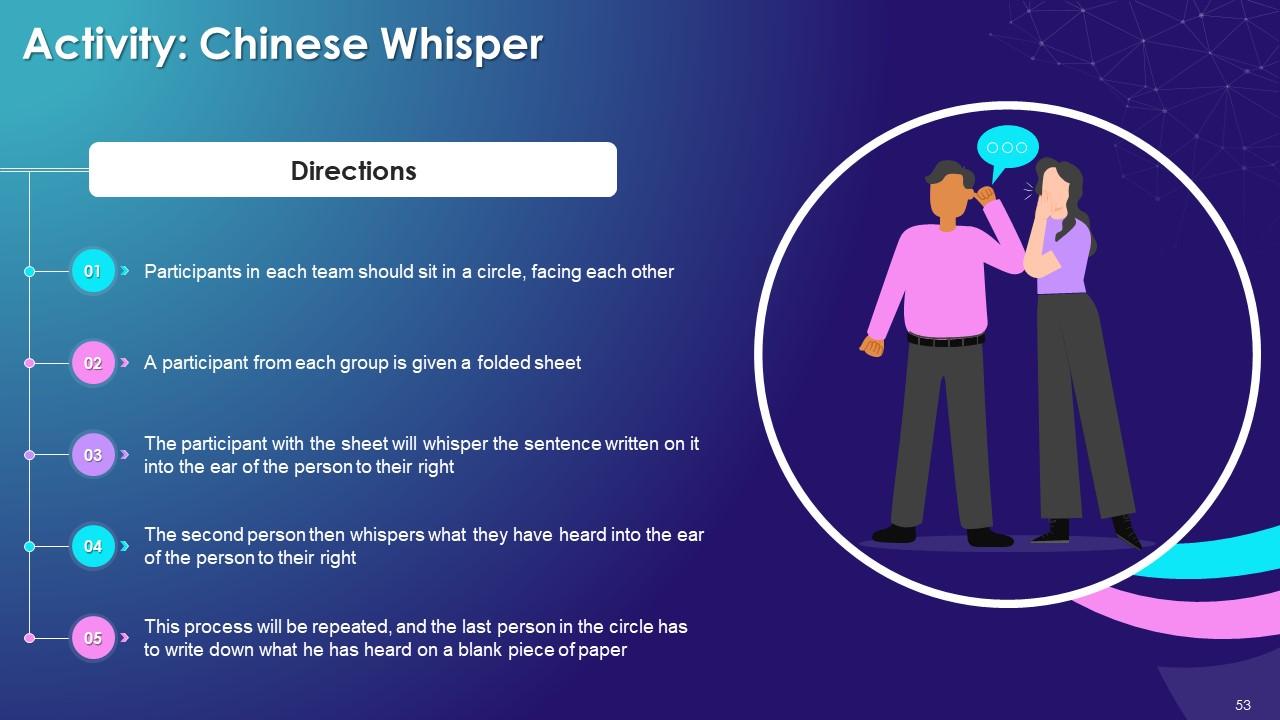

Slide 42 to 56

These slides depict energizer activities to engage the audience of the training session.

Slide 58 to 84

These slides consist of a client training proposal highlighting what the company providing corporate training can accomplish for the client.

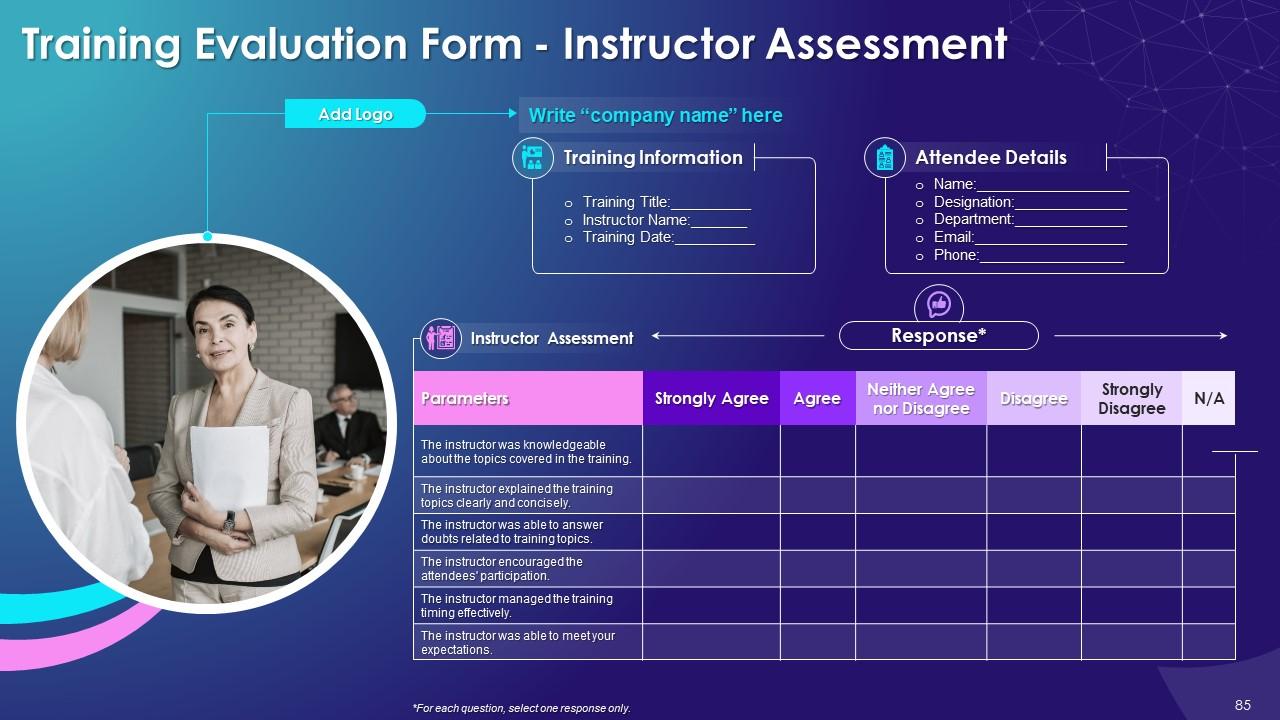

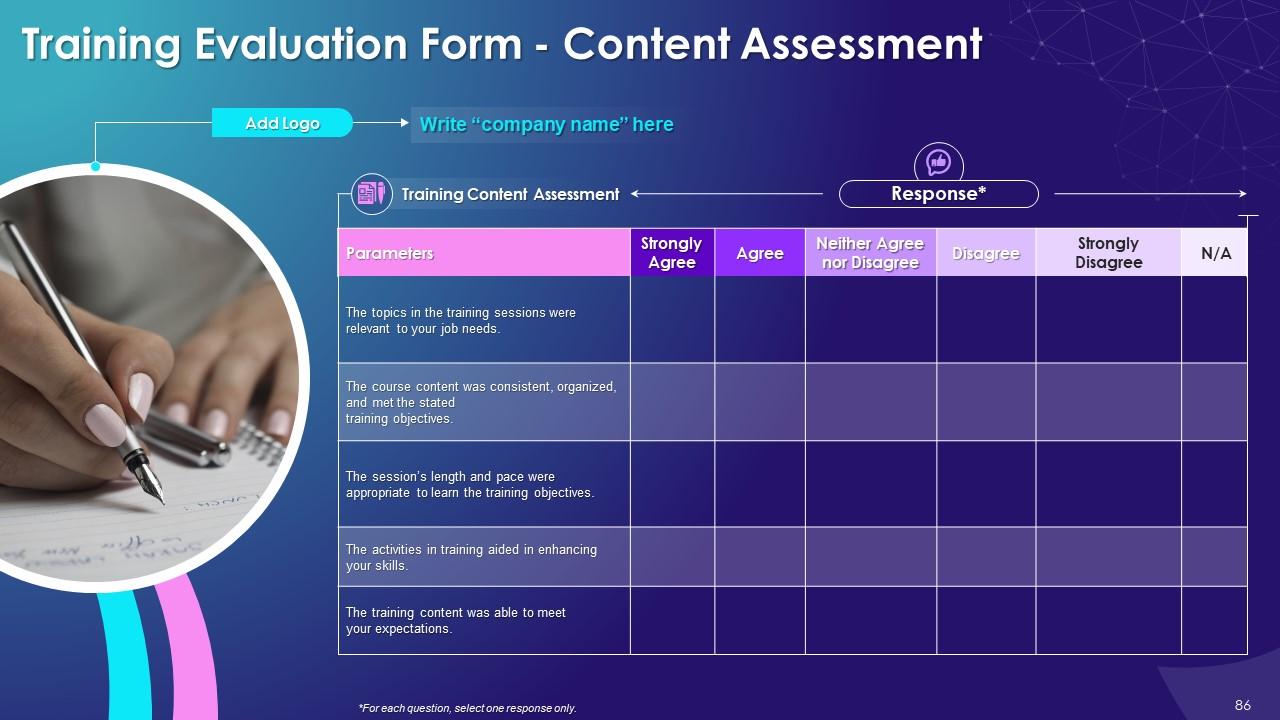

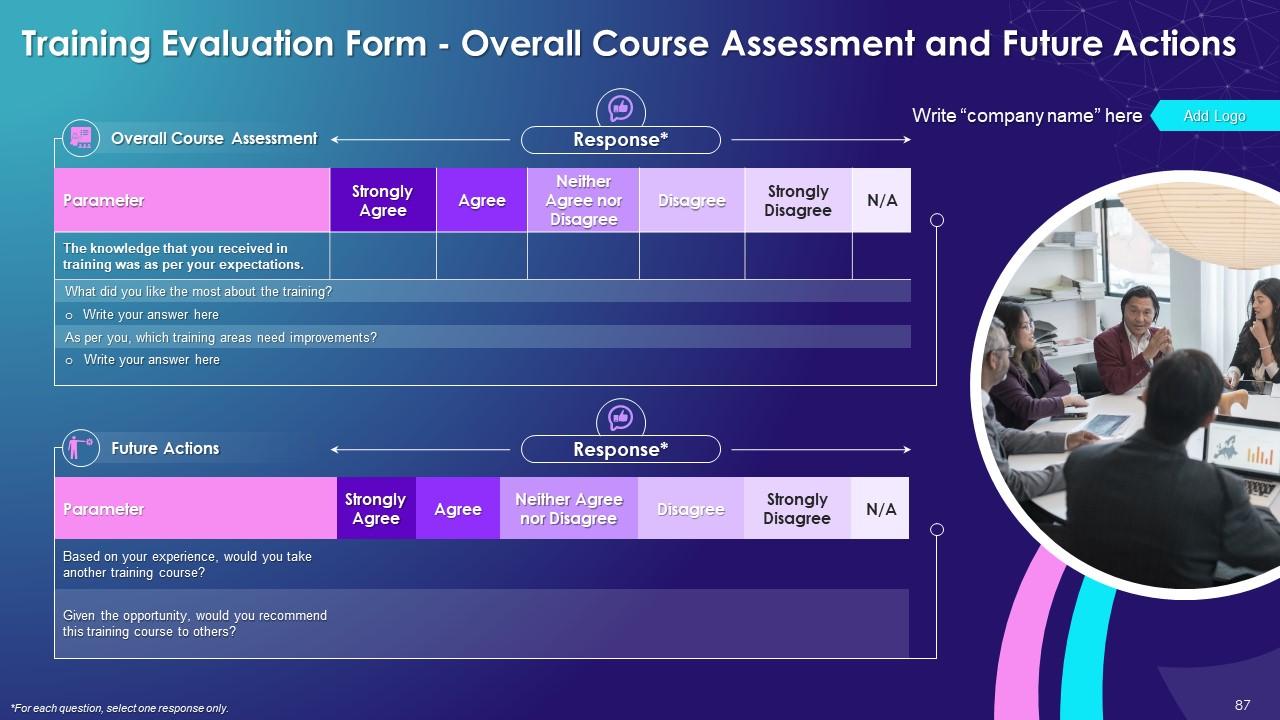

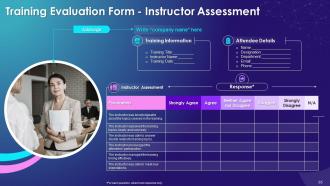

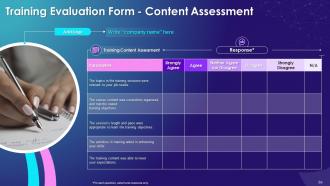

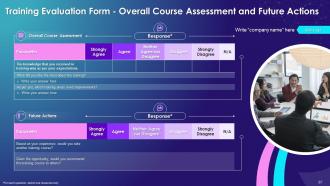

Slide 85 to 87

These slides highlight the training evaluation form for instructor, content, and course assessment.

Blockchain Technology Applications in Real Estate Industry Training Ppt with all 92 slides:

Use our Blockchain Technology Applications in Real Estate Industry Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Huge collection of high-quality templates. Worth each penny.

-

I came across many PowerPoint presentations with excellent creatives and I believe they would be beneficial to my work.