Finance is the art of applying the art and science of management to money. Financial objectives are the end result of the management and what it can do for businesses and individuals. These objectives, when met, ensure that most other business objectives will be met.

What Are Financial Objectives and How Do These Rescue Us?

Businesses need to imbibe the habit of judicious expenditure and saving for the rainy day. Whether you are a CEO or an entry-level employee, there are three things you can subject your money to:

- Save it in a bank

- Invest it

- Allocate it judiciously among asset classes

Each of these strategies to achieve your financial objectives will have varying effects. You need to plan your financial objectives and then take your pick. You must monitor the economic situation of the world and in light of how the market outlook is, devise your financial objectives accordingly.

For e.g. to aim for profits, there must be a demand in the market, and if the market is down, you must conserve your investments. Similarly saving shouldn’t be an option when there is scope of multiplying your wealth. But again, in order to stay afloat, you must also do a mix of saving and investing.

The key takeaway is to arrive at feasible financial objectives for you or your organization to stick to so that money flows in when opportunity emerges and you don’t run out of liquidity either in the event of a misfortune.

Ready to check our presentation templates to frame your company's financial objectives? Presenting our top 5 PPT Designs:

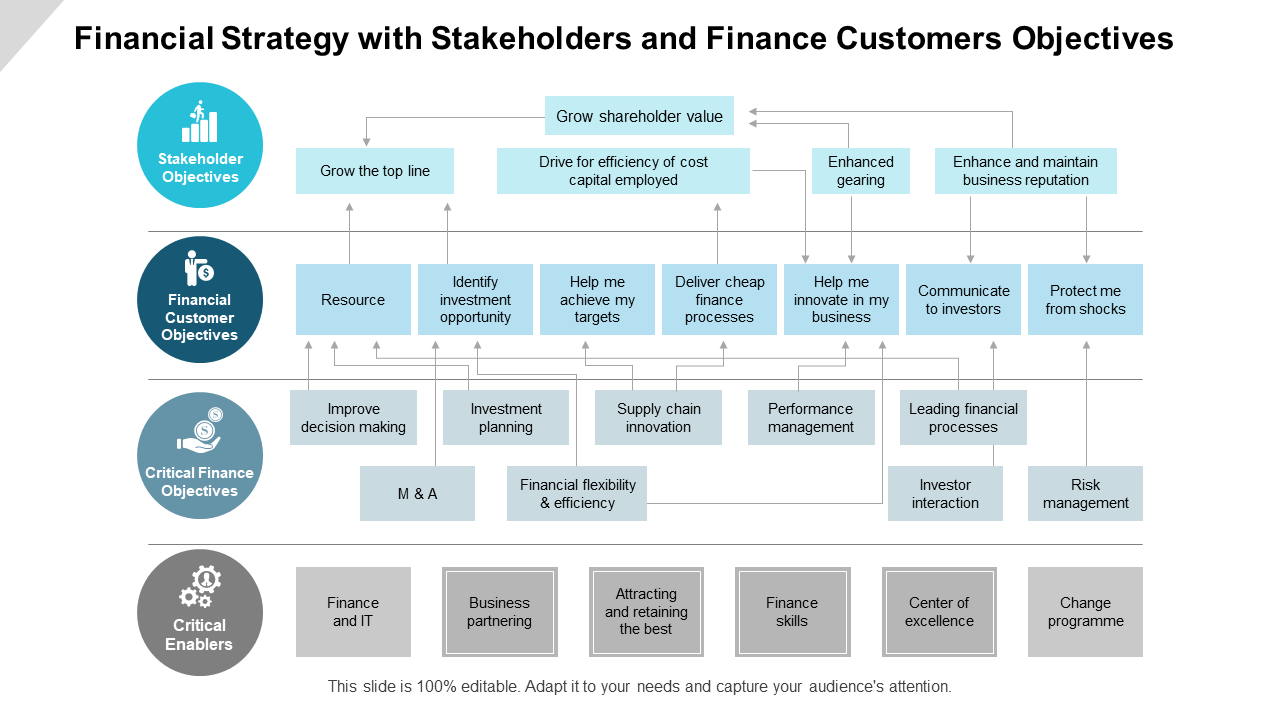

Template 1: Financial Strategy With Stakeholders and Finance Customers Objectives

Here is an all-inclusive structure to help you frame your ideal financial strategy keeping in mind the stakeholders and the finance objectives. Assort the different finance objectives that you aim such as those pertaining to the stakeholders, customers, business, and the critical enablers. Establish correlation between these targeted objectives so as to deliver on them efficiently. Download this intuitive PPT Diagram now.

Template 2: Financial Management Objectives Template PPT Graphic

Here is a PPT Layout to keep your major financial objectives on your fingertips. Using these vibrant sticky notes, point out as many as six objectives that you are eyeing for the particular day, week, month, or year. The editability of this PPT Slide allows you to alter these goals so that you don’t have to look for another template to demonstrate your financial objectives every time. Grab it now!

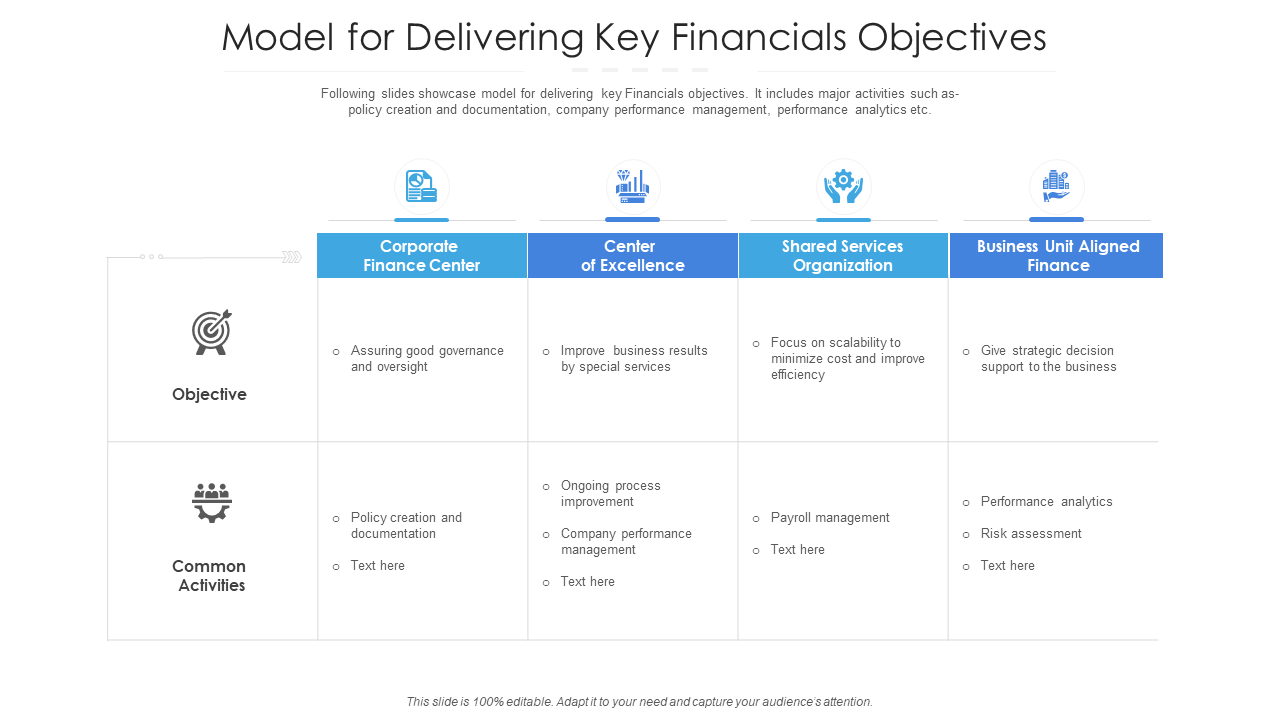

Template 3: Model for Delivering Key Financials Objectives

Compile your financial objectives for various sectors within your business organizations such as for the corporate finance sector, center of excellence, shared services finance organization, etc. List your individual financial objectives pertaining to them and the overall goals for these units to work in unison. Get your goals and objectives under one roof with this single-slide presentation template. Download it now!

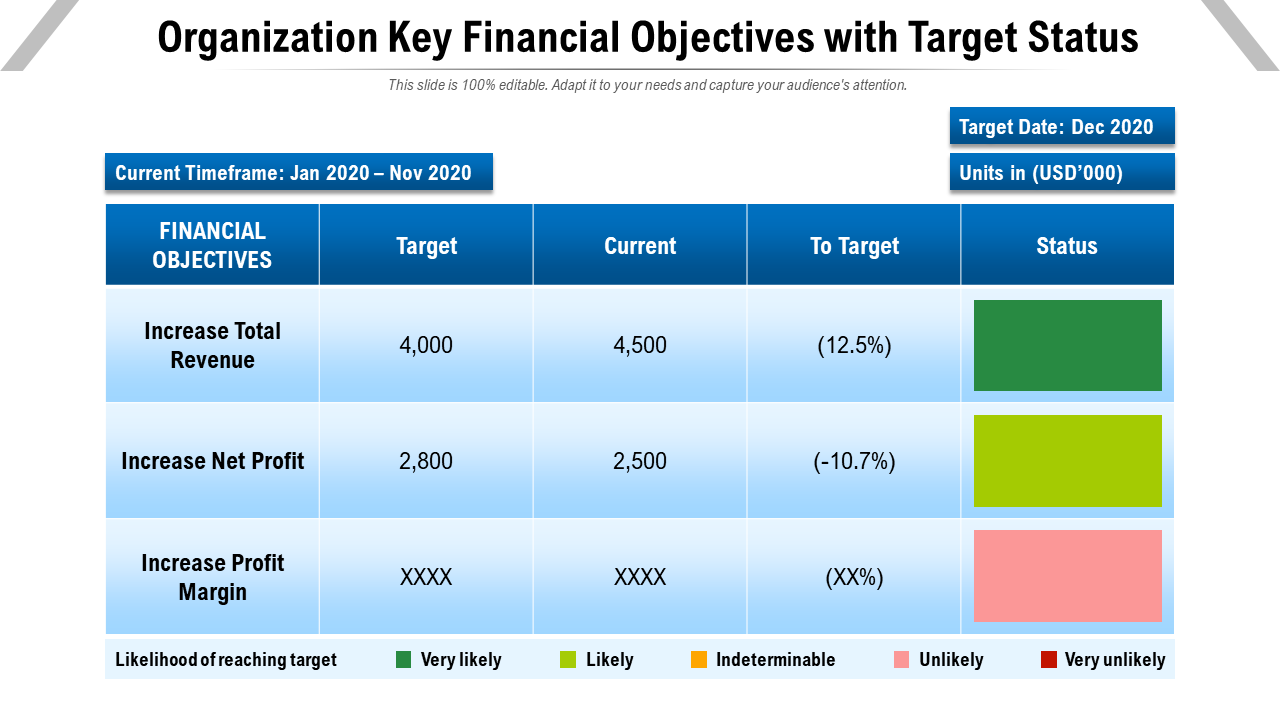

Template 4: Organization Key Financial Objectives With Target Status

List your key financial objectives and measure them against the planned target with this tabular single-slide template. Use this slide to track the real-time progress of your pursuit and keep on renewing this PPT Presentation as many times as you like. The top metrics you can track are increase in revenue, profit, margin, etc and depict the status numerically as well. So grab this PPT Layout now.

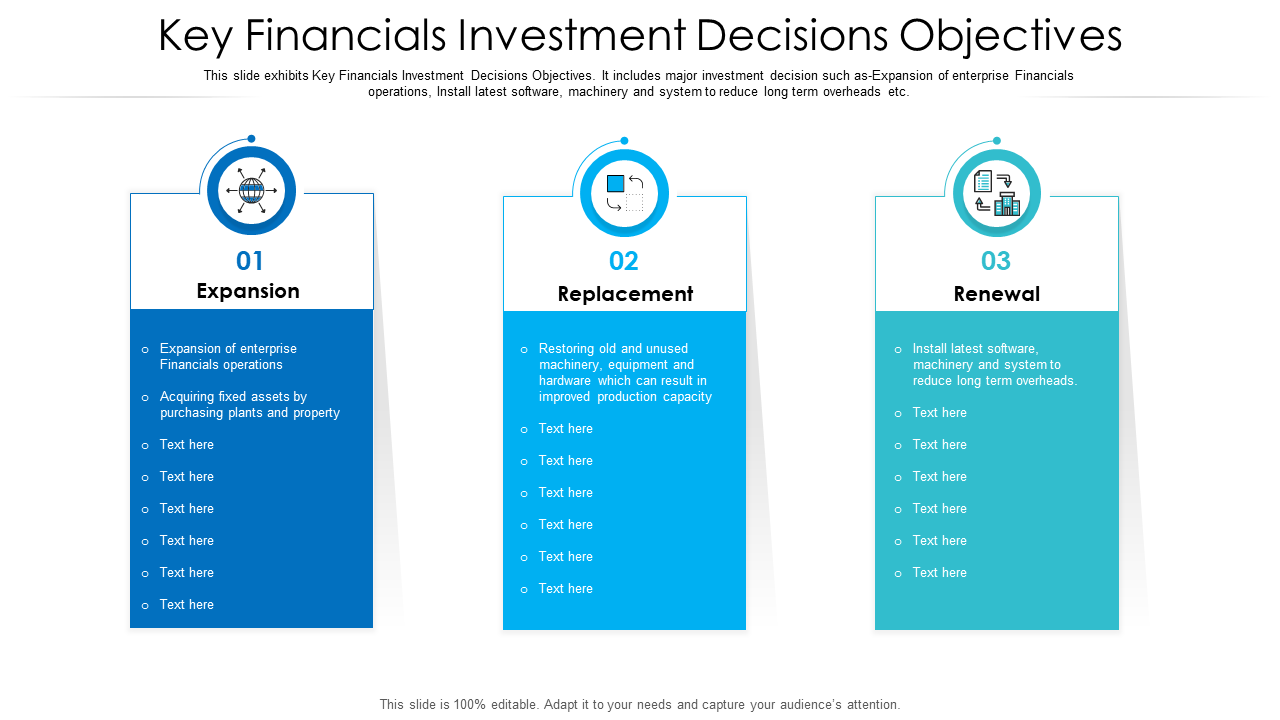

Template 5: Key Financials Investment Decisions Objectives

Here is a slide to enlist and checklist the primary financial investment goals that business organizations should chase. These are expansion of the financial enterprises, replacement of worn out machinery with better ones, renewal and updation of existing hardware and software. Align likewise key financial objectives and direct your team to efficiency with this PPT Layout. Grab it now.

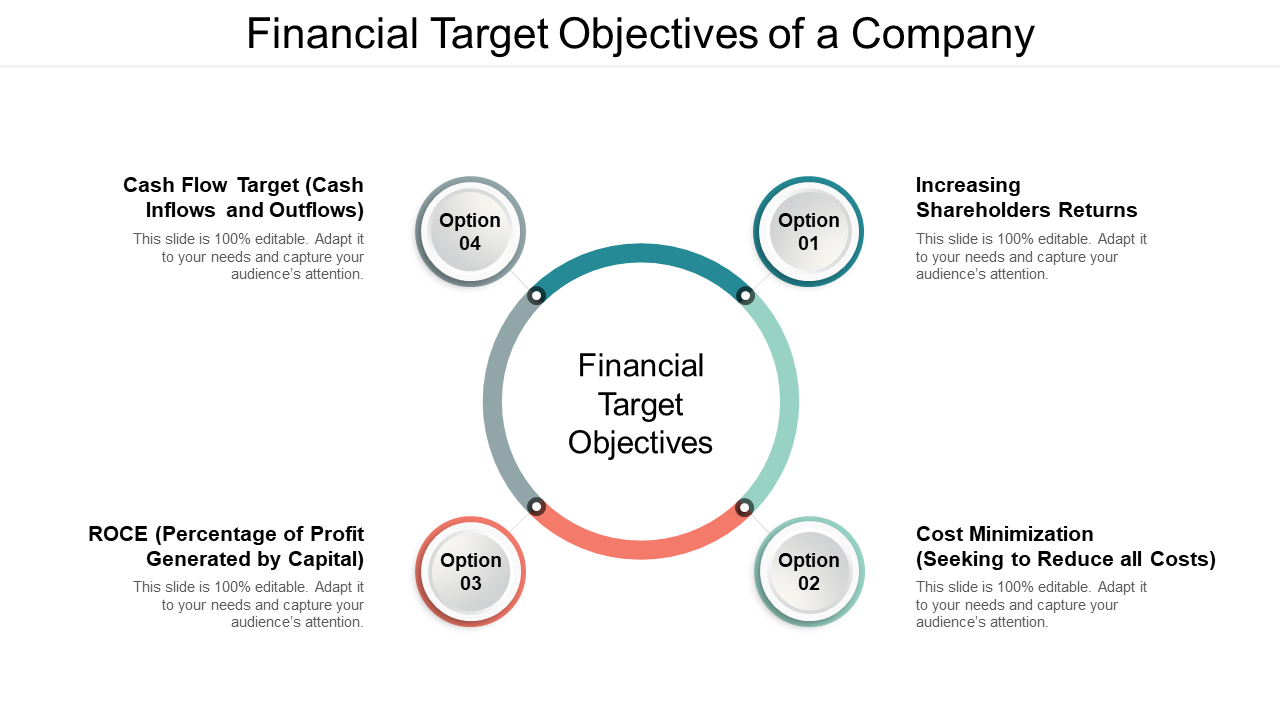

Template 6: Financial Target Objectives of a Company

Looking for a more impressionable template to guide your team in the effective management of finance? Use this slide to point out the four major financial objectives of your business related to cash flow, profit generated, increasing shareholder returns, and cost minimization. If there’s a special technique that your company wants to apply, specify those too and share this slide with your team to follow. Download it from the link below.

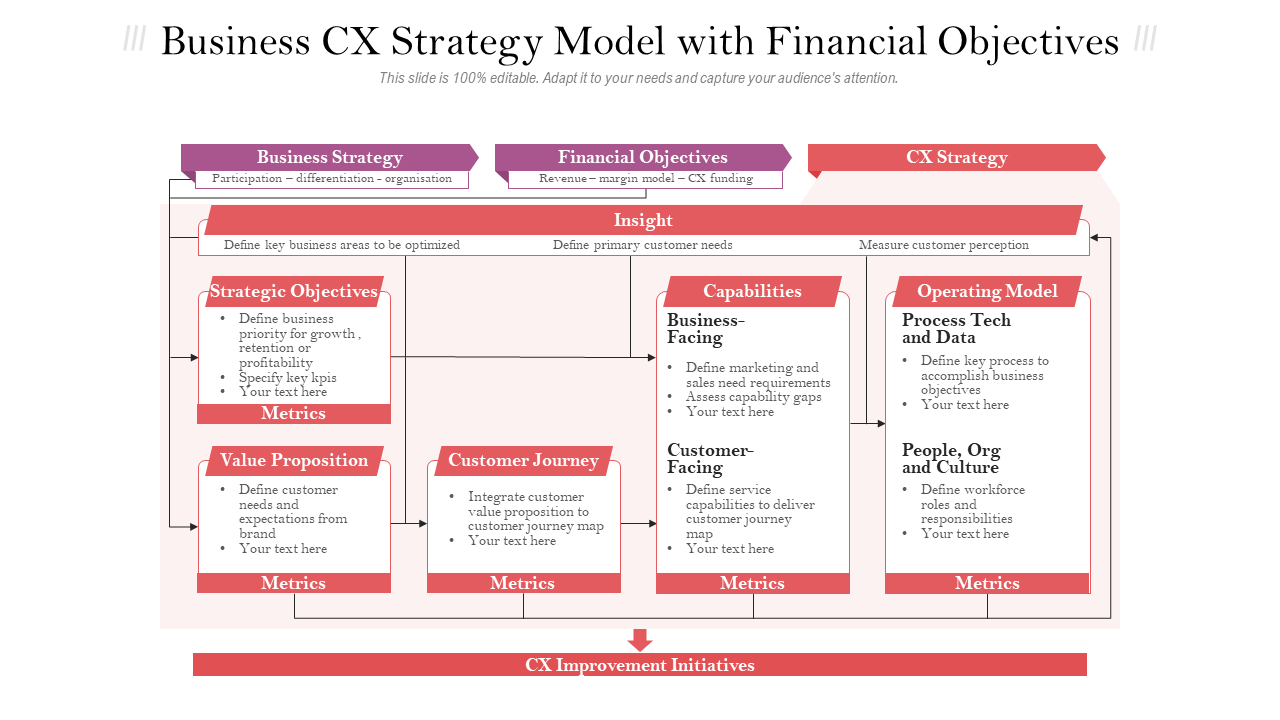

Template 7: Business CX Strategy Model With Financial Objectives

Share extensive plan of addressing customer experience and ways to improve it by laying down feasible financial objectives with this detailed diagrammatic PPT slide. Devise your objective in line with the overall business strategy, gather insights, and deduce the effective customer experience initiatives that complement your financial goals. Download this editable layout now!

Create a list of achievable financial objectives today with our presentation templates.

PS: Are you facing any difficulty tracing expenses and storing them? You need our financial receipt templates to track your purchases and manage your finances. Check this guide in this regard.

FAQs on Financial Objectives

What are the four basic financial objectives that everyone should aim for?

Once the money comes in, it is crucial to manage it well so that it comes to the aid when we need it the most while paying off our bills and also help us grow our wealth. As such every individual or business firm should enlist four basic financial objectives. These are:

Profitability: One of the primary financial objectives should be to maximize profits or at least maintain a breakeven point,wherein the amount of money earned is enough to pay for expenses. Personal or business finances should be aimed towards growth rather than degeneration.

Liquidity: What is the purpose of wealth if it can’t pay off our expenses? Financial planning should cover this yet another important objective of maintaining a quantitative cash in hand, rather than concentrating your wealth in assets and properties only.

Efficiency: Another major objective in finance management should be to efficiently manage funds and wealth so that both the quality of life and business is maintained and savings is also done at the end of each spending period.

Stability: Lastly, yet equally important financial objective is to aim for stability. This can involve having a steady source of income, a budget that allows you to pay for your necessities and save for the future, and a financial plan that helps you to achieve your long-term financial goals. In addition to saving, it's also important to consider investing as a way to grow your wealth and achieve your long-term financial goals. However, it's important to carefully evaluate the risks involved in any investment before making a decision.

How long should financial objectives be created for?

Financial objectives can be created at various time frames depending on the situation and needs of the individual or organization. For example, a company may have long-term financial objectives that are aligned with its strategic plan, such as increasing profitability or expanding into new markets. At the same time, the company may also have shorter-term financial objectives that are designed to help it achieve its long-term goals, such as reducing costs or improving cash flow.

For individuals, financial objectives may also vary in time frame. For example, someone may have a short-term financial objective of saving up for a down payment on a house, while also working towards a long-term financial goal of retiring comfortably. It's important to note that financial objectives should be specific, measurable, achievable, relevant, and time-bound (SMART) in order to be effective. This means that they should be clear, quantifiable, and achievable within a specific time frame. This helps to ensure that progress can be tracked and adjustments can be made as needed to achieve the desired result.

What are the ill-effects of not having financial objectives?

It's important for individuals and organizations to have financial objectives in order to manage their money effectively and achieve their financial goals. Without financial objectives, it can be difficult to make informed decisions about how to allocate resources and make investments. This can lead to financial instability and potentially even financial failure.

Having well-defined financial objectives helps to provide direction and focus for financial planning and decision-making. It allows individuals and organizations to prioritize their spending and allocate resources in a way that aligns with their financial goals. It also ensures that investments are made with a clear understanding of the potential risks and returns. In short, having financial objectives is essential for financial stability and success. It helps individuals and organizations to manage their money effectively and make informed decisions that support their long-term financial goals.

Customer Reviews

Customer Reviews

![Top 10 Investment Banking Templates to Attract a Loyal Base of Investors [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/07/Top-10-Investment-Banking-Templates_1-1013x441.png)

![Top 12 Personal Goal Template Ideas to Take Control of Your Life; Bruce Lee Style [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/07/Top-12-Personal-Goal-Templates_2-1013x441.png)

![[Updated 2023] Top 15 One-Page Project Management Templates to Make Your Planning Go Smooth!](https://www.slideteam.net/wp/wp-content/uploads/2020/09/size1001-436-2-335x146.jpg)