The 1930s global economic downturn, the fall of Enron Corporation, or the #DeleteUber boycott wave are uncertain but there are imminent risks businesses face every day. A small incident somewhere and the ramifications can just destroy businesses.

Iconic global businesses of today such as McDonalds, PepsiCo, Toyota, Apple, Nestle and many others have also faced similar episodes where it appeared they were on the brink of oblivion.

These crises that such risks engender, undoubtedly, had a negative impact on businesses, creating many barriers for them to overcome. The barriers manifested in the form of unsold goods or services, financial crises (bankruptcy), etc.

Warren Buffett, chairman and CEO of Berkshire Hathaway, has said, “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.” This vital life lesson has found many businesses broaden their perception of risk. Political changes, cybersecurity threats, threats to reputation, mergers and acquisitions, health crisis, and location hazards are major business risks which disrupt business operations. Many policies and frameworks are being incorporated into risk management strategies to ensure a level of protection to businesses.

Check out our Operational Risk Management Pitch Deck to simplify your company's operations with a well-defined risk assessment and evaluation.

What is Risk Management Strategy?

A risk management strategy entails carrying out procedures and tasks to guarantee a methodical response to potential threats. It serves as a buffer for operational effectiveness and company continuity by employing effective methods for recognizing, evaluating, and managing risks.

This blog will help you to keep a pulse on all internal and external threats. The internal control metrics provided in our PPT Templates will help you mitigate the likelihood of risks and unavoidable events. We, at SlideTeam, have compiled a list of Top 10 Risk Management Strategy Templates to help businesses develop a comprehensive framework to resolve strategic, operating, and financial breakdowns. This will assist you in remaining responsive to ever-changing industry regulations.

The mitigation plan identifies and analyses the risk at an early stage to ensure the project stays on track. Click here to read more.

Use these professional templates to devise a plan to mitigate current and future risks to your business.

Assess, manage, and mitigate the risks your business is up against with SlideTeam’s powerful and knowledgeable PowerPoint Templates!

Template 1: Implementing Risk Management Strategy in Organization PPT

Create an iterative process to ensure the safety of your company’s personnel, assets, and resources. Use this PPT Template to create a potential risk management plan for your company. The deck provides a breakdown of the mitigation plan, with a focus on risk acceptance, risk transference, risk avoidance, risk reduction, and risk assessment. The aim to let a risk-management culture evolve within your organization. This PowerPoint Presentation is ideal for displaying types of crises, their severity levels, a directory of crisis communication teams, and emergency phone numbers for appropriate authorities. Create a risk assessment matrix that maps low, medium, and high-risk levels to highlight benefits of managing it, such as lower costs, longer lead times, and a centralized information platform. Use this download to assess the gravity of business threats.

Template 2: Investment Risk Management Strategies PPT

Don’t want to risk losing a large portion of your investment capital? Use this PowerPoint Template to create investment risk management strategies for reducing losses and lowering risk in the first place. This comprehensive deck will insulate your financial goals from the ups and downs of risk and markets. Employ this presentation to allocate capital to asset classes based on the company’s desired risk-return profile. It can also be used to train employees on how to identify and assess uncertainty and risks, with a special focus on the portfolio management process, risk tolerance objectives, risk reward matrix and target modelling. This PowerPoint Slide allows users to customize your company's investment objective, time horizon, and risk profile. Save it now!

Template 3: Financial Risk Management Strategies PPT

Use this PPT Template to create financial risk management strategies. It helps you forecast investment returns, project credit rating processes, maintain appropriate credit administration, and set up a credit management system. This comprehensive deck will assist in the preparation of risk descriptions and loss mitigation strategies by determining the adequacy of a bank’s capital and loan loss reserves at a given time. Manage the financial risks that come with doing business in the economy and financial markets.

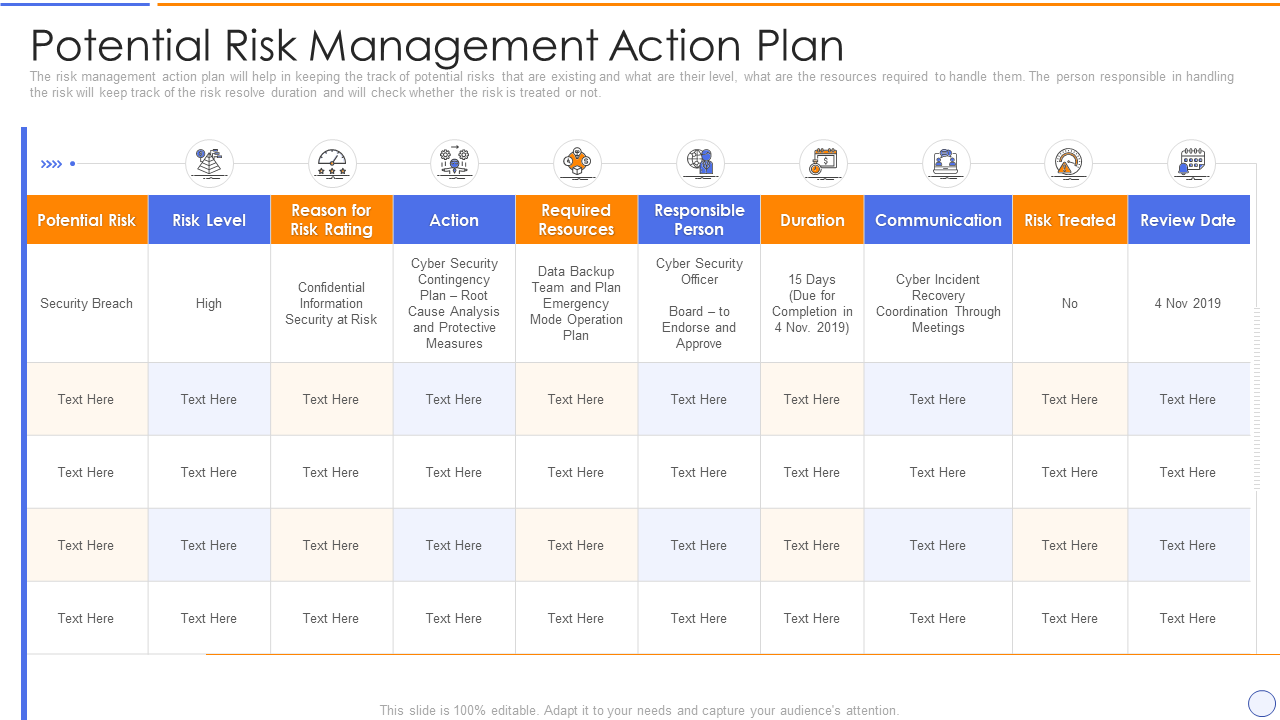

Template 4: Building Organizational Security Risk Management Plan Template

Outline steps required for your organization to identify, remediate, and manage risks. Use this PPT Template to create a potential risk management action plan to track potential risks, their severity, and resources needed. This template can be used to structure types of risks and appropriate mitigation strategies. The aim, here, is to help your organization chart a course toward a more mature security environment. The table presents a clear and concise strategic plan that allows management, and employees to see where they are expected to go, focus their efforts in the right direction, and know when they have met their objectives. This PowerPoint Presentation will help you review your company’s security risk assessment to understand the data protection processes and systems you plan to implement.

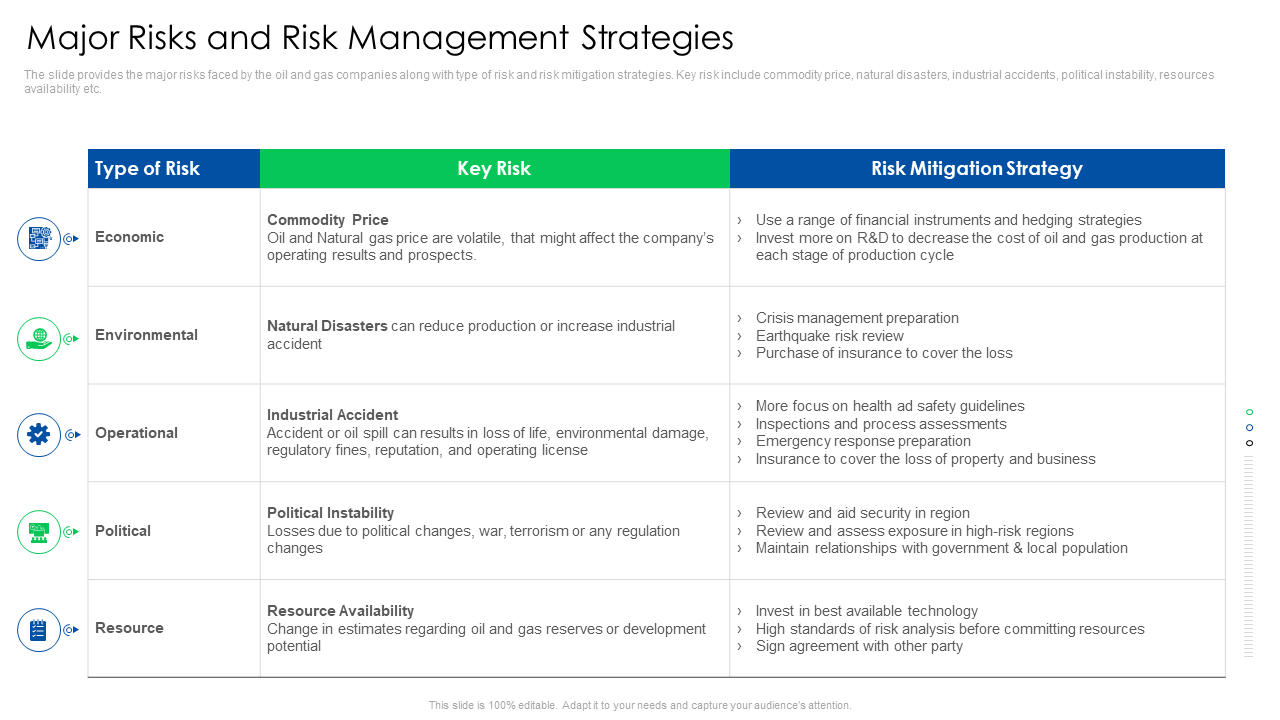

Template 5: Major Risks and Risk Management Strategies Template

Use this PPT Template to provide a thorough categorization of risk types as well as the mapped risk mitigation strategy. The slide provides an overview of the internal and external risks for businesses. Commodity prices, natural disasters, industrial accidents, political instability, resource availability, and other key risks are included to assist you in developing an effective risk assessment policy to mitigate, reduce, or eliminate the risks. This sample PowerPoint Presentation is intended for oil and gas companies to assess their business standing in terms of assumptions, constraints, priorities, tolerance, and acceptance to risk.

Template 6: Risks and Risk Management Strategies for Technology Segment PPT

IT risk, error, or threat can affect every business aspect. This pre-made PPT Template can be used to calculate, mitigate, and manage risks in the information technology sector. The slide provides a comprehensive design to offer risk description and mitigation strategy for technology segments, such as hardware or software, IT services, semiconductors, network equipment, and so on. This PowerPoint Presentation provides a structured approach to risk assessment, as well as the process for updates and review. Create supportive controls, preventive controls, and detection and recovery controls to reduce threats and vulnerabilities from software and hardware failures, spam, viruses, and human error.

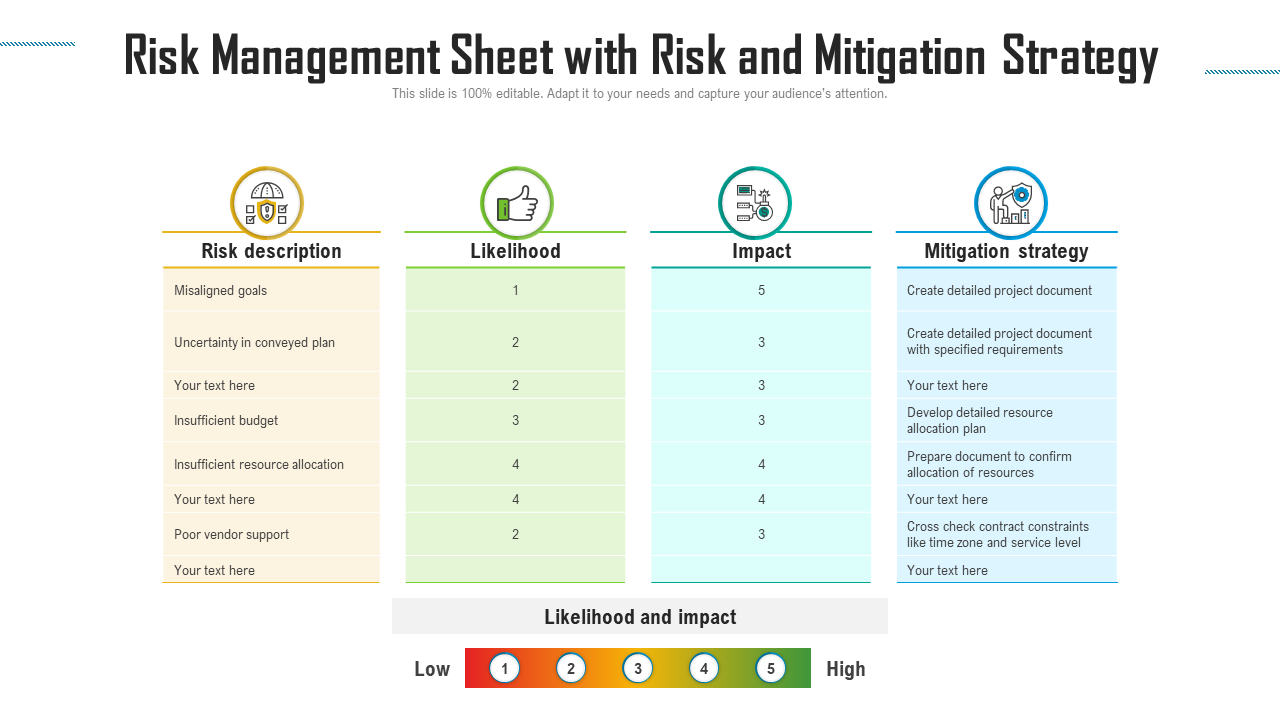

Template 7: Risk Management Sheet with Risk and Mitigation Strategy PPT

Use this PowerPoint Template to create a crisis management policy to mitigate the impact of potential risk. The sheet summarizes metrics such as risk description, likelihood, impact, and mitigation strategy. This PowerPoint Presentation combines risk acceptance and reduction elements to help your company evaluate the risks of completing a specific project. Prepare a mitigation plan by estimating the impact of each risk and planning a way around it.

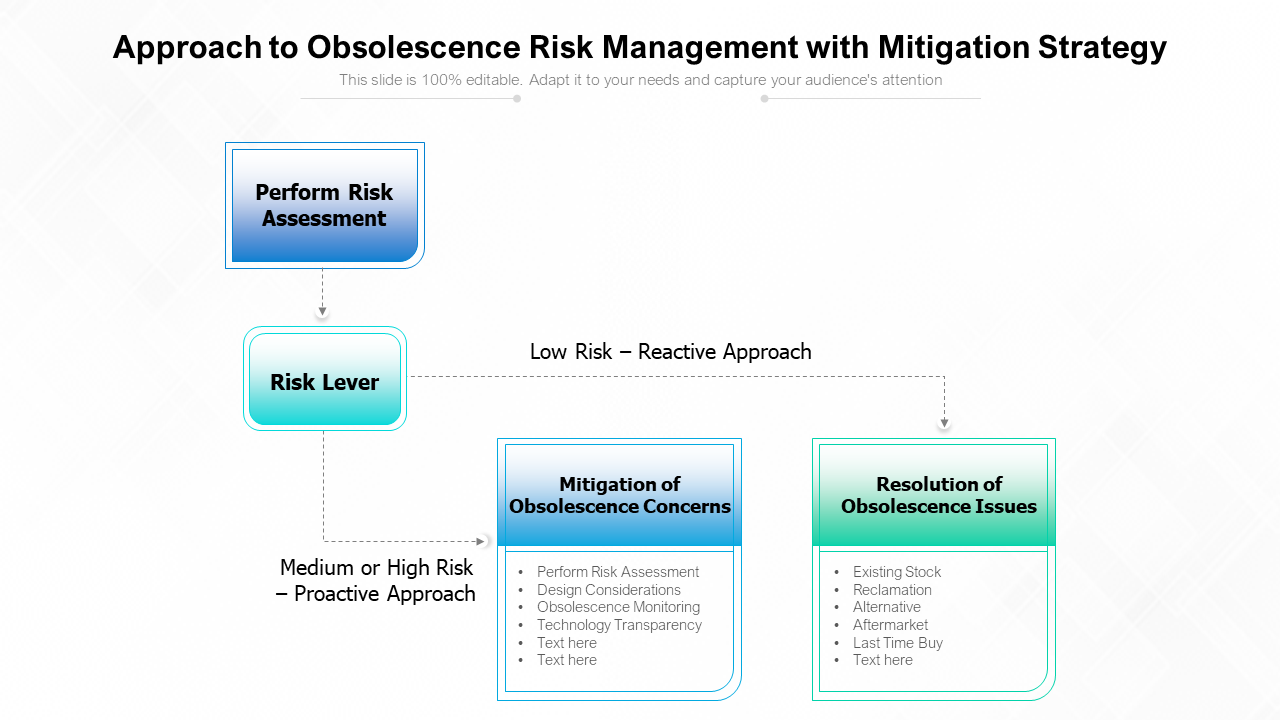

Template 8: Approach to Obsolescence Risk Management with Mitigation Strategy Template

Long-term use renders technologies obsolete (and unavailable), making it impossible to maintain your old operational system. Use this pre-made PPT Template to create a risk assessment strategy for proactive and cost-effective obsolescence management. The slide assists you in preparing a crisis inventory with a focus on metrics such as risk assessment, risk lever, obsolescence mitigation, and obsolescence resolution. The template is perfect for developing a structured approach that accounts for planning mid-life upgrade and identifies which subsystems will be modified or replaced.

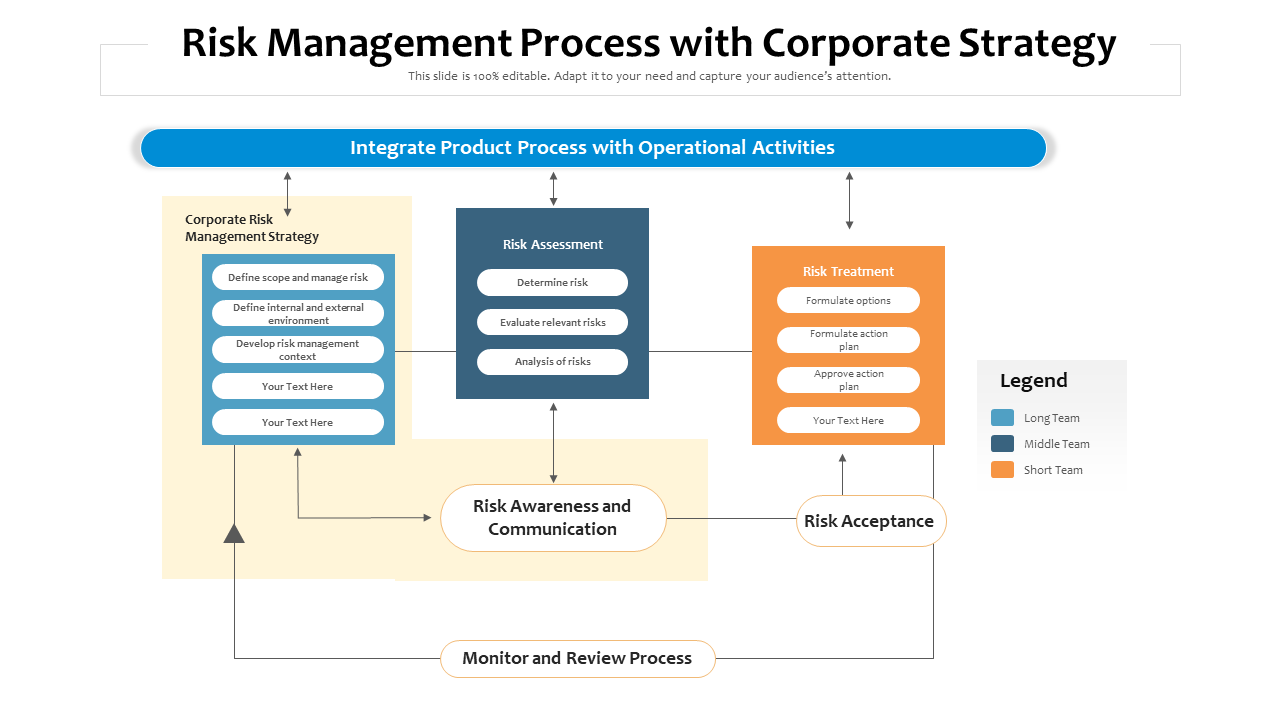

Template 9: Risk Management Process with Corporate Strategy PPT

Use this pre-designed PowerPoint Template to create a potential risk management plan that addresses a wide range of risks. This slide contains the corporate risk management strategy, risk assessment, and risk treatment to figure out the causes of risk, as well as the appropriate strategic and tactical responses. Use the example as part of your company’s systematic and ongoing process for identifying major risks and regularly reviewing your strategic goals.

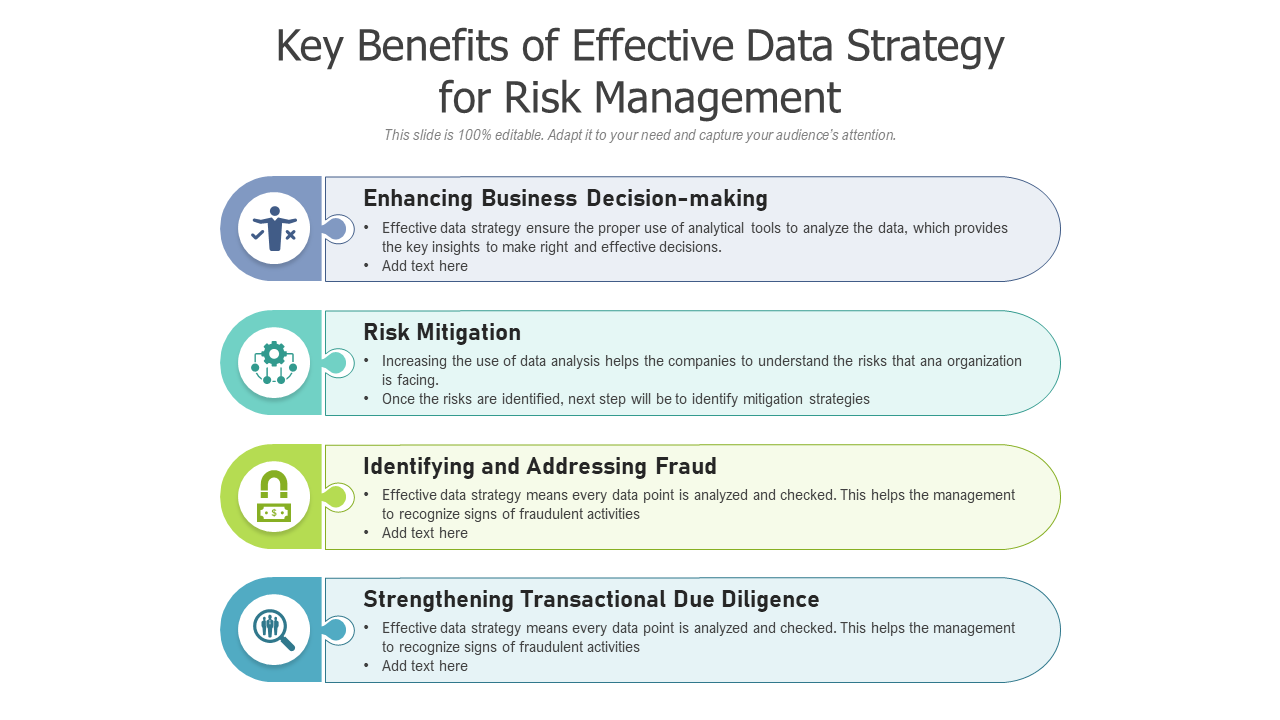

Template 10: Key Benefits of Effective Data Strategy for Risk Management Template

Storing and accessing relevant information allows businesses to improve decision-making. Use this pre-made PPT Template to explain the advantages of implementing a comprehensive data strategy that is in sync with risk management. This slide will assist you in developing an effective reporting, analytics, and information delivery framework to monitor and mitigate risks. This well-designed PowerPoint Presentation will help management and team members understand the value of data analytics in making data-driven decisions and streamlining your organizational culture.

Minimize downside exposure

The financial world is in a constant state of flux. This makes the process of identifying, evaluating, and mitigating risks paramount. Businesses should customize their risk management procedures to counter the inevitable stumbling blocks. With SlideTeam's PPT templates, evaluate the impact of a particular decision or action on the business.

Are you looking for more assistance with PowerPoint Presentations? Speak to our experts at SlideTeam.

PS: Explore our guide on risk management techniques to develop a workable framework to eliminate or get rid of losses in your company.

FAQs ON RISK MANAGEMENT STRATEGY

What are the five risk management strategies?

Businesses must develop effective risk management strategies to prepare for both internal (technology, human resources, informational, and legal) and external risks (politics, financial, contractual, natural). Addressing these risks is critical in preparing for the rebuilding or recovery phase.

These five risk management strategies are of help to businesses in the following ways:

- Risk avoidance focuses on removing practices or activities that may pose a threat. Businesses have put in place a comprehensive framework to assess any situation and recommend the best alternatives quickly (almost in real-time).

- Risk Acceptance or Retention focuses on doing nothing to prevent or mitigate risk probability. It is used when businesses have run out of options and must brace themselves for the consequences. It is also known as the ‘Do Nothing’ approach.

- Risk Transfer allows businesses to redistribute the consequences of unfavorable events to multiple parties. This strategy is used for low-probability business risks. Risks can be shared by businesses with employees, outsourced entities, partners, or insurance companies.

- Risk reduction or mitigation refers to measures taken to reduce the impact or likelihood of risk occurrence. The goal of risk reduction is to lower the severity of consequences to acceptable levels

- Risk retention is a contentious risk management strategy that should be used sparingly. It is the recognition and acceptance of a risk as a given; this risk, then, serves as a cost to help offset larger risks in the future.

What are the seven principles of risk management?

The crucial principles of risk management are:

a) Ensure that the risk management strategy for your company is in line with the aims and objectives of the organization. This customized framework is useful for managing potential hazards as well as outlining culture and objectives.

b) Be sure to acknowledge risks before they materialize.

c) Involve stakeholders in the process of identifying and gaining necessary information about potential hazards to your company. This will ensure that the management, staff, and investors know about the company’s strategic framework of risk management.

d) Your risk management process should consider both internal and external settings during the planning stage to assist the team in responding to an adverse situation successfully and methodically. To build a suitable channel of communication, the escalation, reporting, and other processes can be prepared and shared among other departments.

e) Establish a cycle for reviewing risks to assess how effectively the plan addresses potential hazards.

f) Assure that everyone in your organization has a clear understanding of duties and responsibilities when it comes to implementing a successful risk management strategy.

g) Carefully examine the risk management plan and decide where improvements might be made to guarantee the success of your future projects.

Important terms:

a) Compliance Risk Profile: It is the present and future risk to profits or capital posed by breaking or failing to abide by laws, rules, regulations, suggested practices, internal policies and procedures, or ethical standards.

b) Mitigation Actions: The steps required to lessen the likelihood and/or impact of a possible risk.

c) Residual Risk: Risk that still exists after the current control environment has been considered.

d) Risk Appetite: A description of the kind of risks that management generally thinks acceptable.

e) Vulnerability: The degree to which an entity is susceptible to a risk occurrence based on its level of readiness, flexibility, and adaptability.

Customer Reviews

Customer Reviews