Role Of Big Data In Digital Transformation Of Banks Training Ppt

These slides, in detail, cover the use cases of big data in the banking sector, such as personalized customer experience, process optimization automation, enhanced security, and improved employee performance management. The PPT deck also covers the advantages and challenges of utilizing big data in banks.

These slides, in detail, cover the use cases of big data in the banking sector, such as personalized customer experience, p..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Role of Big Data in Digital Transformation of Banks. Our PowerPoint experts have included all the necessary templates, designs, icons, graphs, and other essential material. This deck is well crafted by extensive research. Slides consist of amazing visuals and appropriate content. These PPT slides can be instantly downloaded with just a click. Compatible with all screen types and monitors. Supports Google Slides. Premium Customer Support is available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

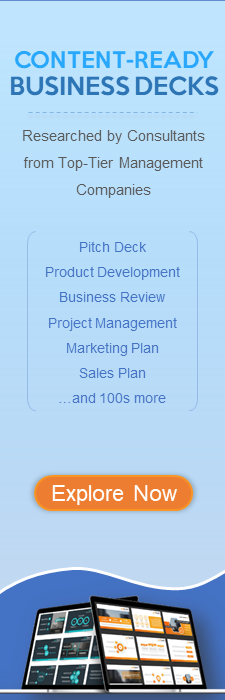

Slide 1

This slide illustrates information about big data in the banking industry. It mentions that as digital technology advances, data has become increasingly important, and banks are embracing and adapting to this change. It also shows that banks and financial institutions generate and manage massive amounts of data. Banks and financial institutions are actively using big data to store data and improve scalability as the number of electronic records grows.

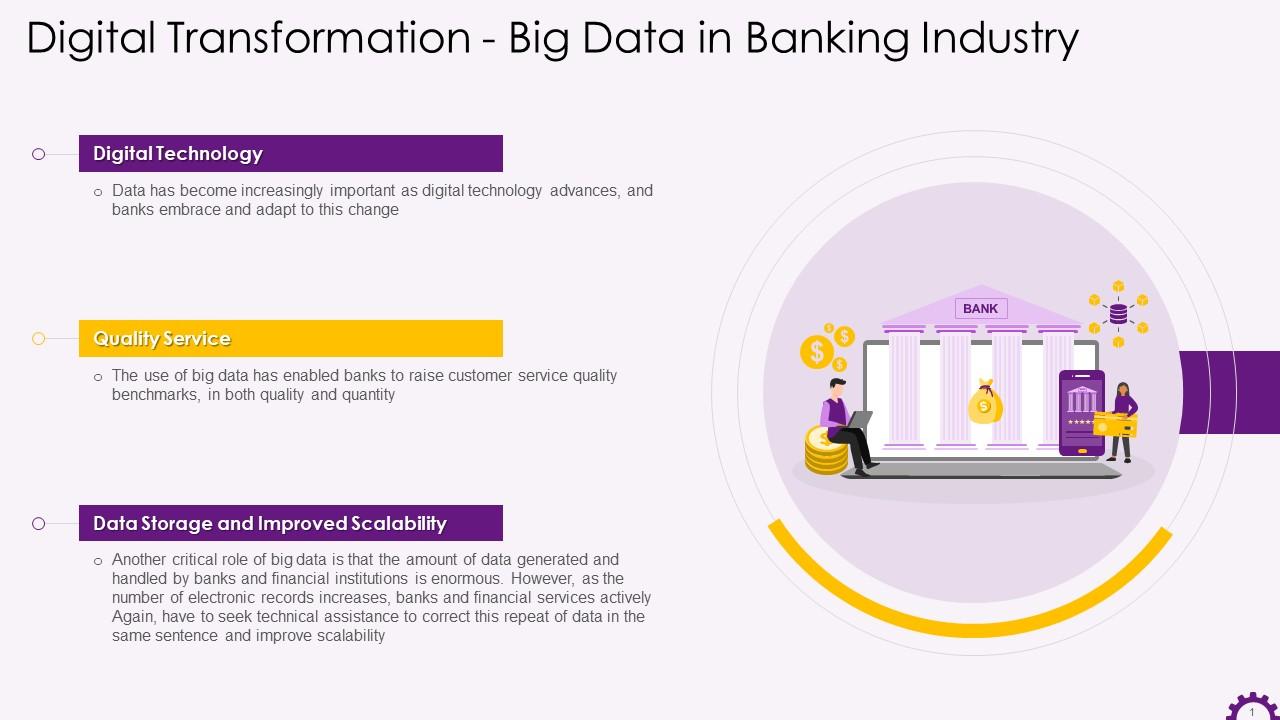

Slide 2

This slide depicts that by analyzing data, banks can listen to its customers and create personalized financial services. It highlights that banks can use data from various sources, including online and mobile payments. It also mention the sources from which data is taken. These are bank application, third-party credit scoring, chatbots, call center, social media etc.

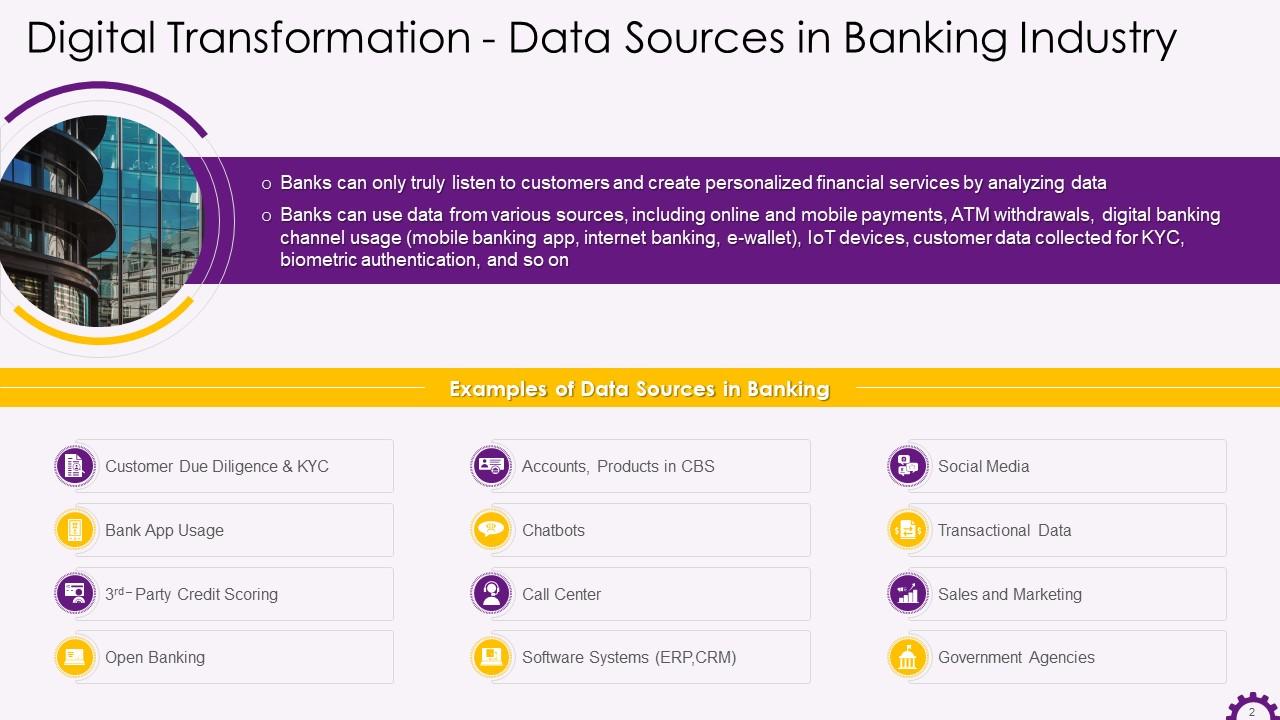

Slide 3

This slide illustrates the use cases of big data in the banking industry. The use cases are personalized customer experience, user segmentation and targeting, business process optimization automation, improved cyber security, and employee performance and management.

Slide 4

This slide depicts the implementation of personalized customer experiences in the banking industry using big data. It states that banks use big data to learn more about their customers. This knowledge is used to find new ways to cater to their needs, connect with them more meaningfully, and provide more value.

Slide 5

This slide illustrates the adoption of big data for user segmentation and targeting in the banking industry. It highlights that big data can save the banks' marketing budget and mentions how using big data, banks can better understand their customers' needs, identify issues with their product targeting, and determine the best way to solve existing problems.

Slide 6

This slide depicts the use of big data to optimize and automate business processes in the banking industry. It emphasizes that all banking work can be automated using technology, and big data holds the key to this. By removing the human element from certain critical processes, banks can save money. Advanced automation reduces the risk of failure due to advanced automation.

Slide 7

This slide illustrates the application of big data in employee performance and management in the banking industry. It demonstrates how companies can use Big Data to collect, interpret, and share branch and employee performance metrics across departments in real-time. Branch managers and CEOs can view the branch's performance on metrics, such as customer acquisition and retention, employee efficiency and turnover, and so on, using data analytics software.

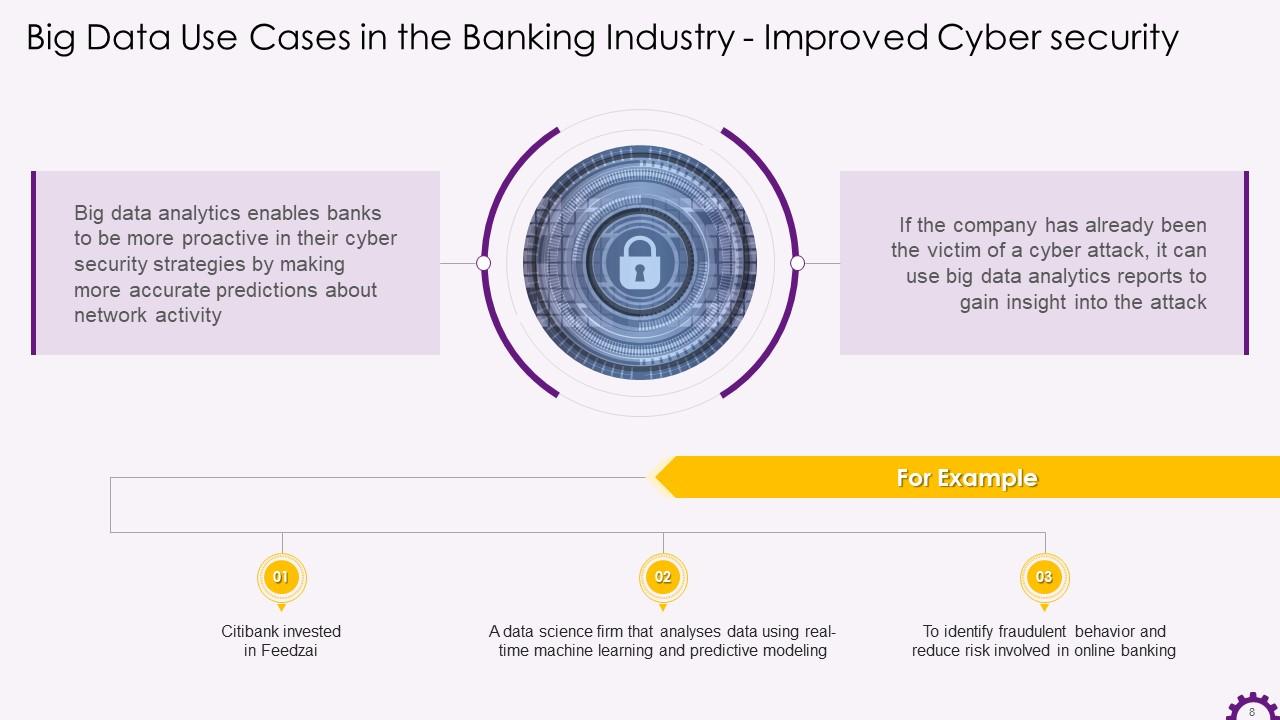

Slide 8

This slide provides information about big data analytics in the banking industry. It emphasizes how big data analytics allows banks to be more proactive in their cyber security strategies by making more accurate predictions about network activity. It also states that big data analytics reports help gain insight into cyber security and even prevent an attack.

Slide 9

This slide illustrates the advantages of big data for the banking industry. The advantages are risk management, personalized banking solutions, streamlining and optimization of internal processes, analysis of customer feedback, and raising overall performance.

Instructor’s Notes: The advantages of big data for the banking industry are:

- Risk Management - Big data can be used by banks to analyze market trends and determine whether to lower or raise interest rates. Banks can quickly identify customers with poor credit scores and refuse loans. Using fraud detection algorithms banks can detect fraud and prevent potentially malicious activities

- Personalized Banking Solutions- Big data analytics can help banks understand customer behavior based on inputs from their investments, shopping trends, or financial background. It aids banks in customer retention. Personalized banking solutions can help you gain customer loyalty

- Streamlining and Optimization of Internal Processes- Banks can use big data to optimize and streamline their internal processes, improving performance and lowering operating costs

- Analysis of Customer Feedback- Customer service phone lines at bank remain overburdened. Big data tools can assist in sorting through large amounts of data and responding to each of them in a timely and adequate manner. Customers will feel valued because their complaints are being addressed with speed

- Raises Overall Performance- Employee performance can also be assessed using performance analytics to determine whether or not they have met the targets. Big data can assist in determining how it can help them scale more effectively

Slide 10

This slide illustrates the challenges with the use of big data in the banking industry. The challenges are legacy systems, security concerns, and massive proportion of big data.

Instructor’s Notes: The challenges with the use of big data in banking are:

- Legacy Systems- The banking industry has been a little slow to innovate. The majority of legacy systems are incapable of handling the increasing workload. Its process of collecting, storing, and analyzing data with outdated infrastructure may put additional strain on the system and jeopardize its stability

- Security Concerns- If we consider using legacy systems, there may be a risk of dealing with vast amounts of data. Banking providers must make sure that use data and the processes of handling it remains secure at all times. Only a small percentage of banks worldwide can handle the threat

- Massive Proportion of Big Data- Banks may struggle to coherently deal with a large volume of different types of data

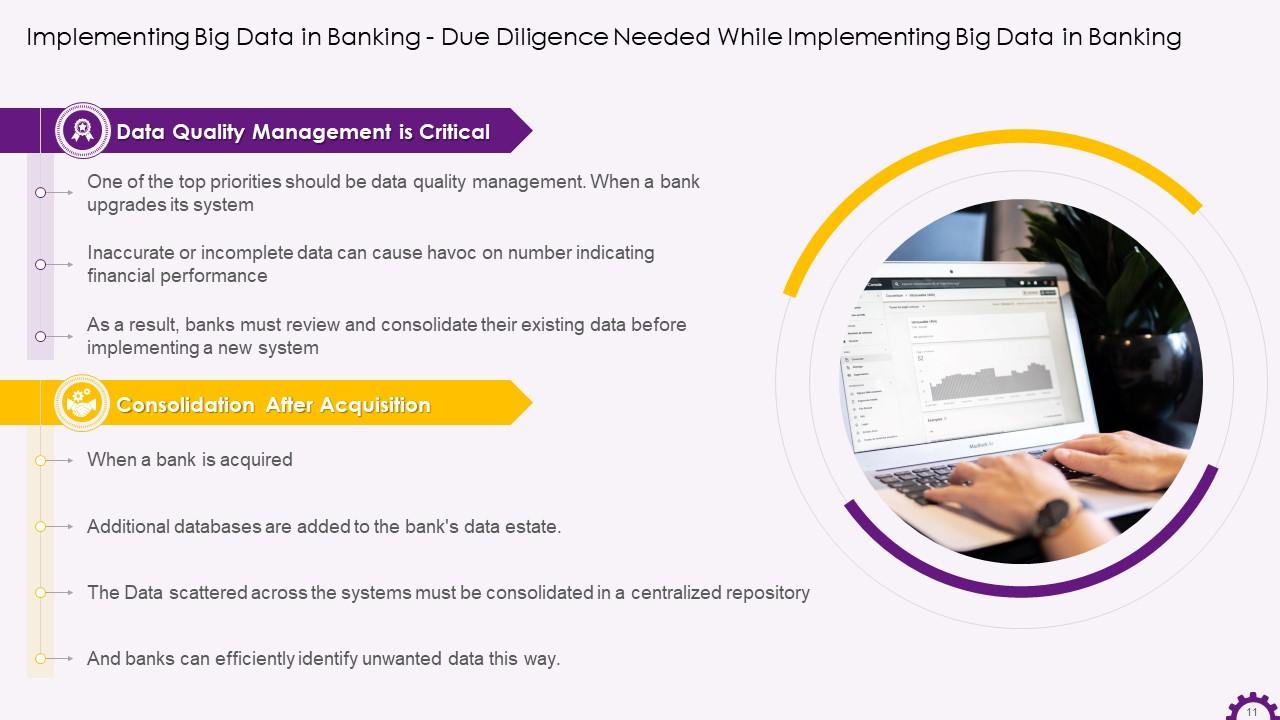

Slide 11

This slide showcases the factors that need to be ensured while implementing big data in banking industry. The elements are data quality management and consolidation after acquisition.

Role Of Big Data In Digital Transformation Of Banks Training Ppt with all 27 slides:

Use our Role Of Big Data In Digital Transformation Of Banks Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

SlideTeam just saved my project! Thank you so much. The variety of templates helped me showcase multiple perspectives easily.

-

I am so thankful for all of the templates I've found on your site. They have saved me hours every week and helped make my presentations come alive. Keep up with these amazing product releases!