“Gone are the days when you have to go manually to get information related to credit, make decisions, collect and print lots of paperwork just to get a signature.”

All this has become possible with Technological evolution, which has changed the lending industry. Moreover companies have started advertising their loans through websites and phones. And now, everything has been automated and simplified, including electronic signatures, pricing, credit analysis, loan applications, document management, and decision-making.

Advantages of Digital Lending

More options for loans:

In digital lending, the opportunities for loans are not restricted to those with bad or no credit scores, as options like short-term loans are provided, which was not the case in traditional lending.

Uniformity in the process:

Digital Lending shows uniformity in the procedure as humans do not do the lending. In the case of digital lending, everything is set according to the regulatory framework’s credit rules. Therefore, the lending process should be kept error-free and continuous.

Quick Procedure and decision making:

Through Digital Lending, the procedure becomes quick as the lender can get all the information about the customer through a centralized location. At the same time, borrowers get all the information required from other financial sources, reducing the chances of decision-making errors. Additionally, this makes the approval and verification process easier for both the lender and the customer.

If you want to know more details, we have carefully created a well-thought-out and expertly designed "Digital Lending" PowerPoint Presentation. This resource will provide you with the knowledge and tactics required for effective implementation.

Also, we provide free access to a PDF and a PowerPoint (PPT) version to improve your experience.

Are you looking for what this presentation includes?

Let me present a few of the templates for you:

Digital Lending Templates

Cover Slide

Unlock the essential components for a remarkable presentation on digital lending with our all-inclusive template guide. Download it now to ensure you have all you need for an effective presentation and to make full use of this valuable resource!

Download this PowerPoint Template now.

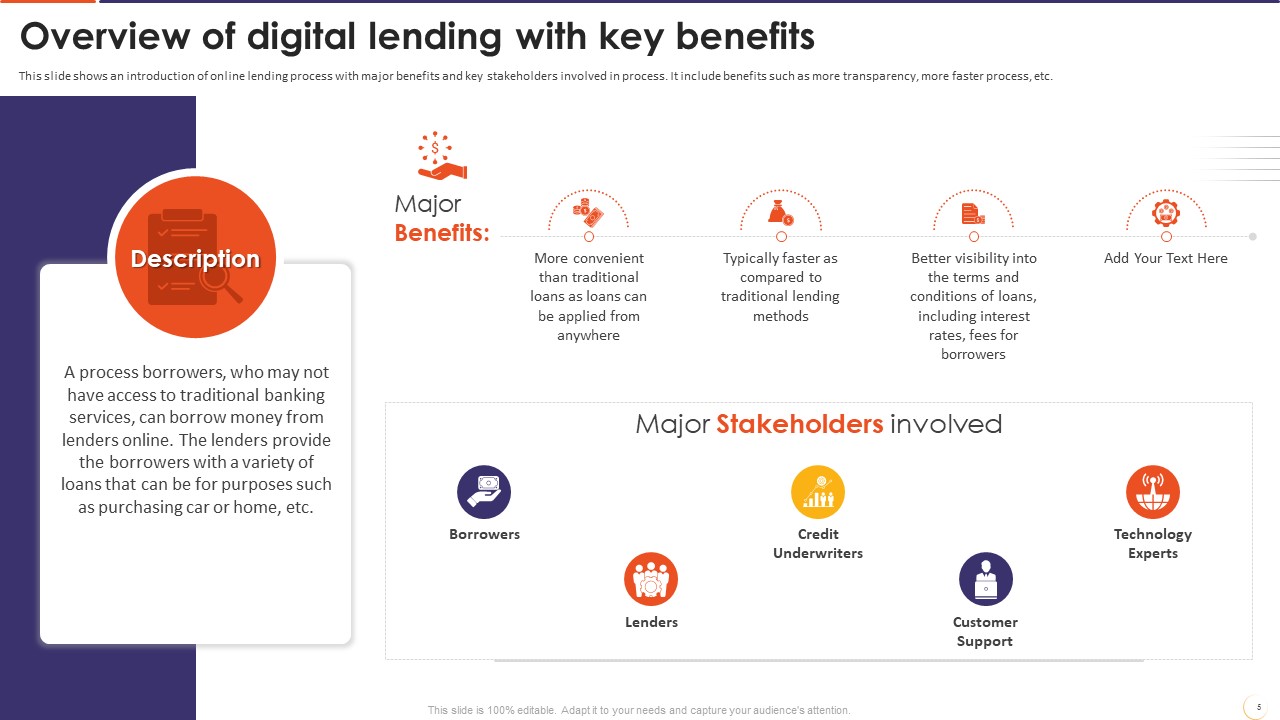

#Overview of Digital Lending with Key Benefits

The slide briefs an overview of the online lending process, including its main advantages, which are as follows:

- Increased Speed: Digital Lending is typically faster than traditional lending methods.

- Flexibility: Digital Lending is more convenient than traditional loans as loans can be applied anywhere.

- Transparency: Digital Lending gives greater insight into loan terms and conditions, including interest rates and borrower fees.

Additionally, it highlights the important stakeholders that are:

- Borrowers

- Lenders

- Credit Underwriters

- Customer Support

- Technology Experts

It is essential to outline digital lending and its main advantages as this development satisfies evolving consumer wants and promotes financial accessibility.

Download this PowerPoint Template now.

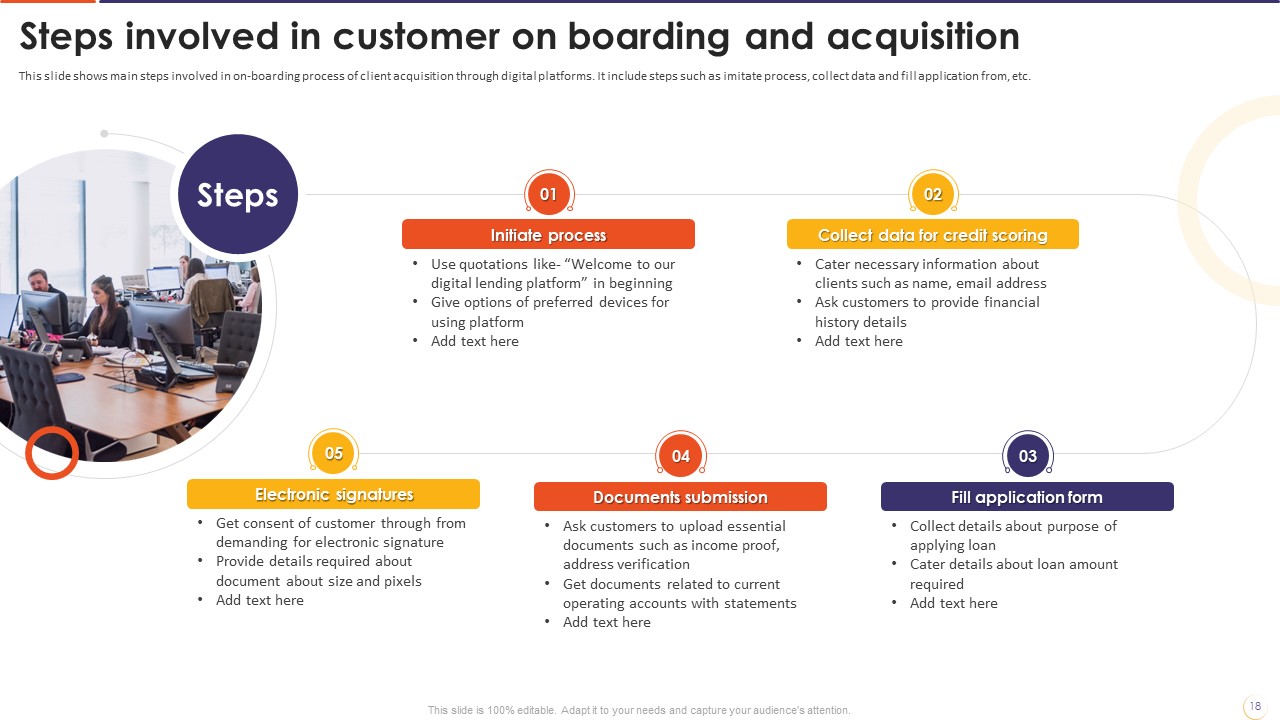

#Steps Involved in Customer on Boarding and Acquisition

The slide illustrates significant steps in the initial onboarding process of client acquisition through online platforms, which are explained in the subsequent paragraph:

Start the process:

- Start your sentences with a quote, such as "Welcome to our digital lending platform."

- Offer a variety of recommended device alternatives for utilizing the platform.

Gather information for credit scoring:

- Gather client data (name, email address, etc.) and request financial history information from them.

Digital signatures:

- Request permission from the consumer by asking for an electronic signature

- Provide the necessary information about the document, such as its size and pixel count.

Submission of Documents:

- Request clients to upload necessary papers, such as proof of income and residence verification.

- Obtain current operating account documentation, including statements.

Complete the application:

- Gather information on the objective of the loan application.

- Provide information about the desired loan amount.

It is essential to represent each step involved in client acquisition and onboarding, as these components emphasize the value of developing trust and reducing friction in the onboarding process. Further, it improves long-term happiness and ultimately leads to a solid basis for creating long-lasting connections with consumers.

Download this PowerPoint Template now.

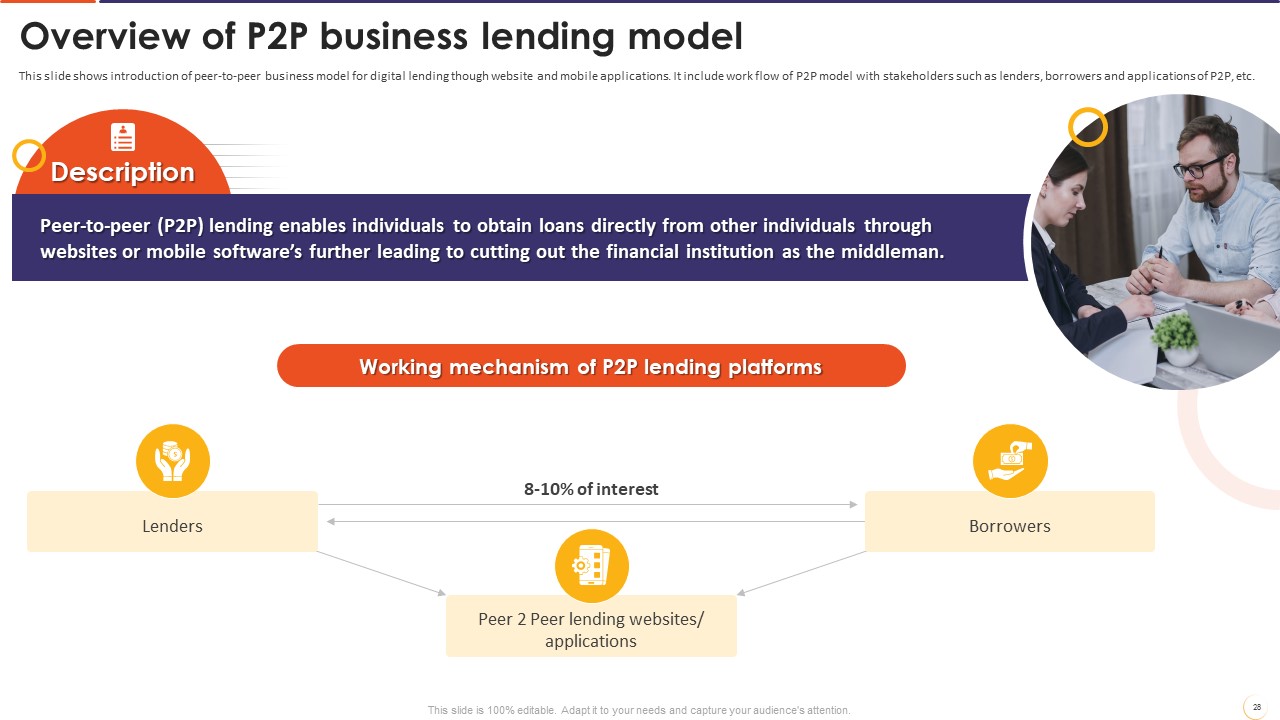

#Overview of P2P Business Lending Model

The slide describes the peer-to-peer business model for digital lending via websites and mobile applications.

Now, you must be wondering what P2P Lending is.

Let's discuss.

What exactly is Peer-to-Peer Lending?

It is all about lending money directly, either by using mobile applications or websites. Consequently, the financial institution acting as a mediator is removed.

This slide also covers how peer-to-peer (P2P) programs operate, including how lenders and borrowers are involved.

It is essential to briefly overview the P2P Business Lending Model as it creates a decentralized platform that connects lenders and borrowers directly, improving capital availability and flexibility. Ultimately, this strategy gives both land borrowers more power in the ever-changing world of business financing.

Download this PowerPoint Template now.

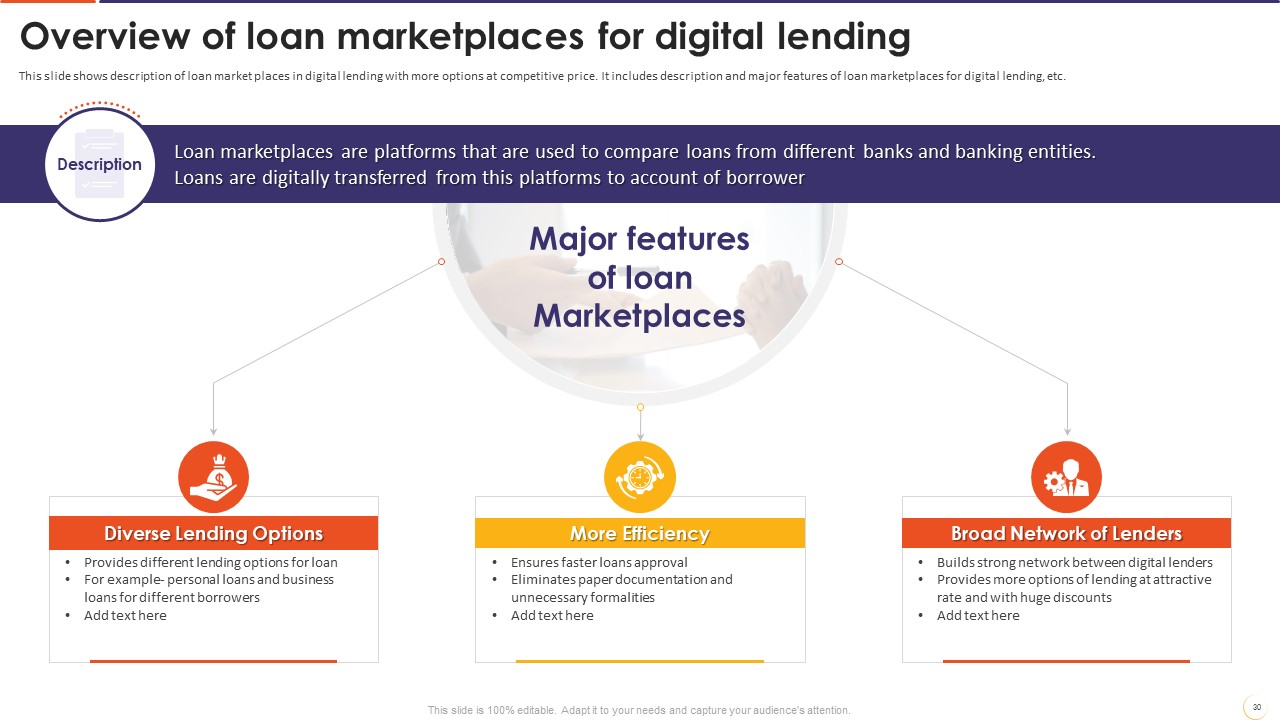

#Overview of Loan Marketplaces for Digital Lending

The slide provides an overview of digital lending markets that offer a more excellent selection of loans at competitive rates.

Let’s first understand what Loan Marketplaces are.

What are Loan Marketplaces?

Loan marketplaces are those platforms that compare loans offered by various banks and financial institutions. Also, the loans are virtually transferred from these sites to the borrower's account.

Moreover, the slide contains an overview of the key characteristics of loan markets:

- Various Lending choices: Loan Marketplace offers a range of loan choices. For instance, separate borrowers may be eligible for commercial and personal loans.

- Increased Efficiency: Loan Marketplace ensures quicker acceptance of loans and assists us in getting rid of paper records and unnecessary procedures.

- Effective Network of Lenders: The Loan Marketplace establishes an effective connection among digital lenders, offering a greater variety of loan alternatives at competitive rates with significant offers.

It is essential to provide an overview of Loan Marketplaces for Digital Lending as these marketplaces play a vital role in creating a more consumer-focused, competitive, and easily accessible digital lending environment.

Download this PowerPoint Template now.

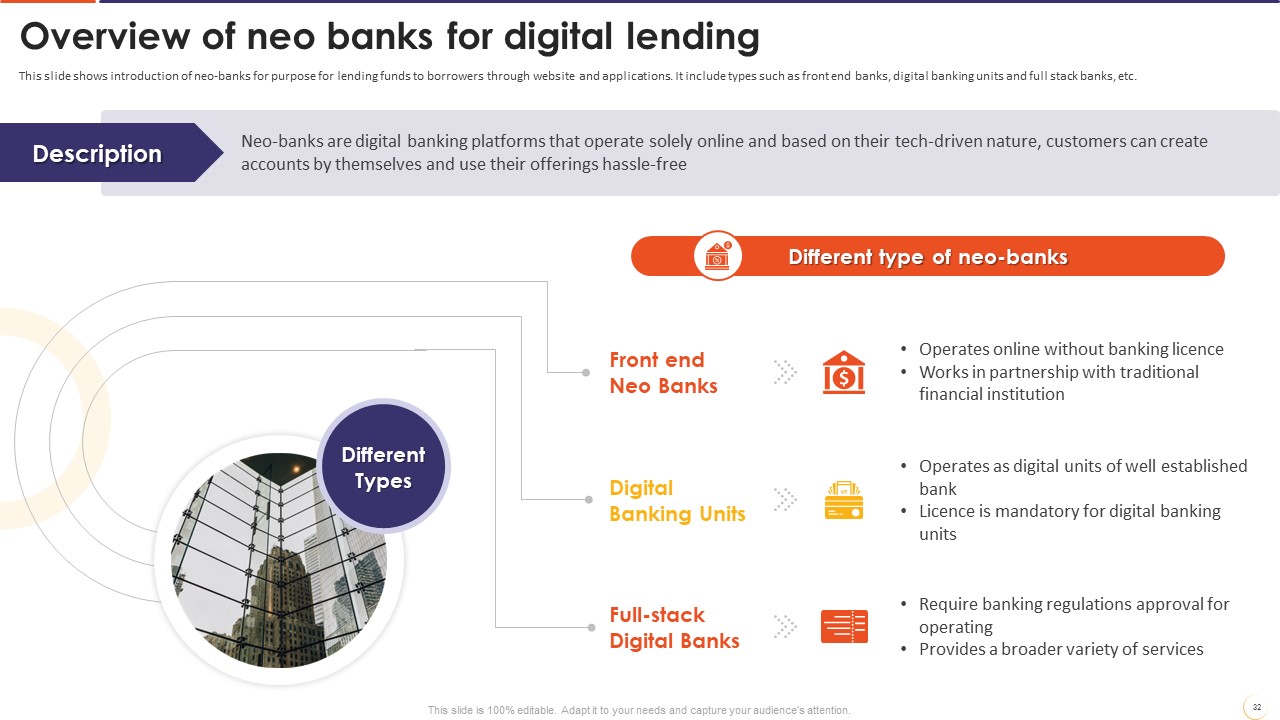

#Overview of Neo Banks for Digital Lending

The slide provides a quick overview of neo-banks, both online and mobile lending platforms used to offer loans to borrowers.

Let’s first discuss Neo Banks.

What are Neo Banks?

Neo-banks are online-only digital banking platforms that allow users to open accounts and make use of their services without difficulty because they are technology-driven.

Additionally, this slide covers a variety of Neo Bank types:

Banks at the front end: These banks operate online without a license from a bank. Moreover, it works in collaboration with conventional banking institutions.

Digital banking divisions: Neo-banks function as a well-established bank's digital divisions. Moreover, a license is required for digital banking establishments.

Banks with full stacks: Neo Banks need permission from banking rules to operate and offer a greater range of services.

It is essential to display an overview of neo-banks for Digital Lending as neo-banks promote a customer-centric strategy in the digital lending space by questioning established banking rules. Therefore, improving financial inclusion and competition.

Download this PowerPoint Template now.

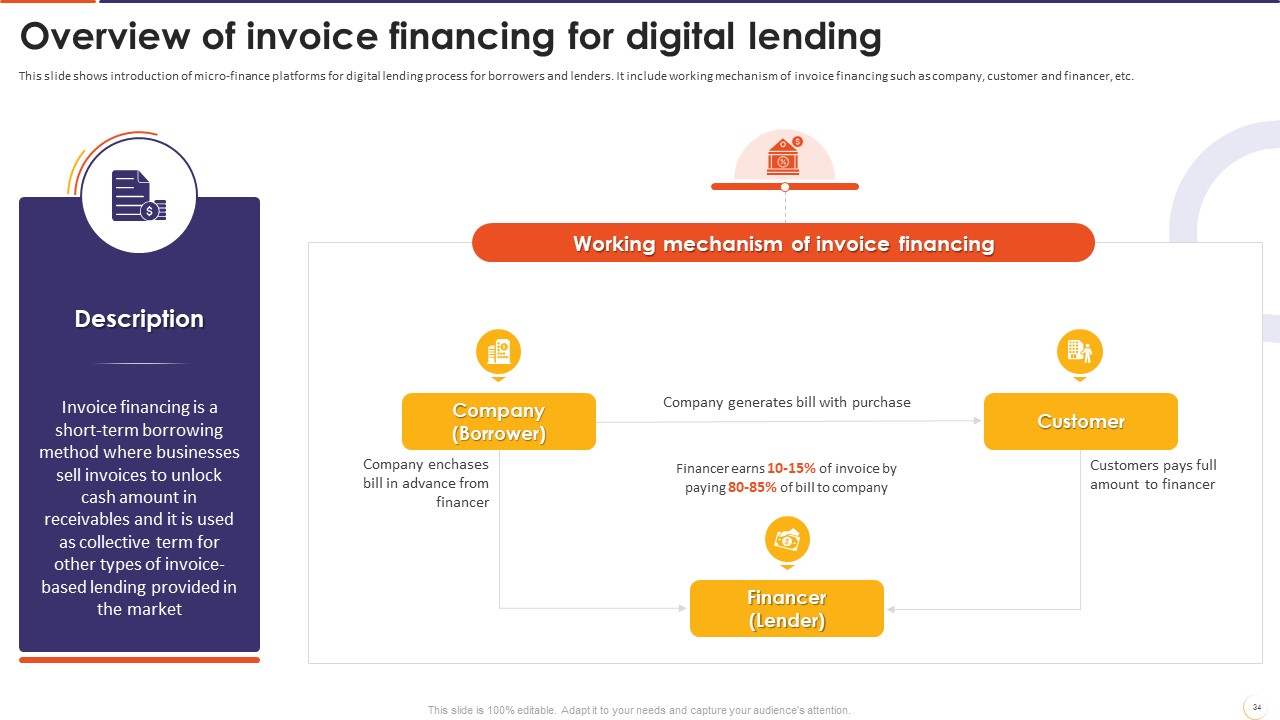

#Overview of Invoice Financing for Digital Lending

The slide briefly introduces Microfinance solutions for a online lending procedure for lenders and borrowers.

What is Invoice Financing?

The phrase "invoice financing" refers to various invoice-based loan options available. It is a short-term borrowing technique where companies sell invoices to release cash quantities in accounts.

Further, this slide renders how invoice financing operates, which is discussed as follows:

- An invoice is created and sent to the financier in the first stage.

- The second phase involves the Financer reviewing the provided information and lending a portion of its market value to a company in two to three days.

- Further, the company must wait for the customer to pay the remaining invoice.

- Finally, the businesses receive the remaining portion of their invoice value whenever the customer settles this invoice, excluding the specified service charge imposed by the financier.

Invoice financing is necessary for digital lending as it allows businesses to obtain quick funding in response to invoices.

Download this PowerPoint Template now.

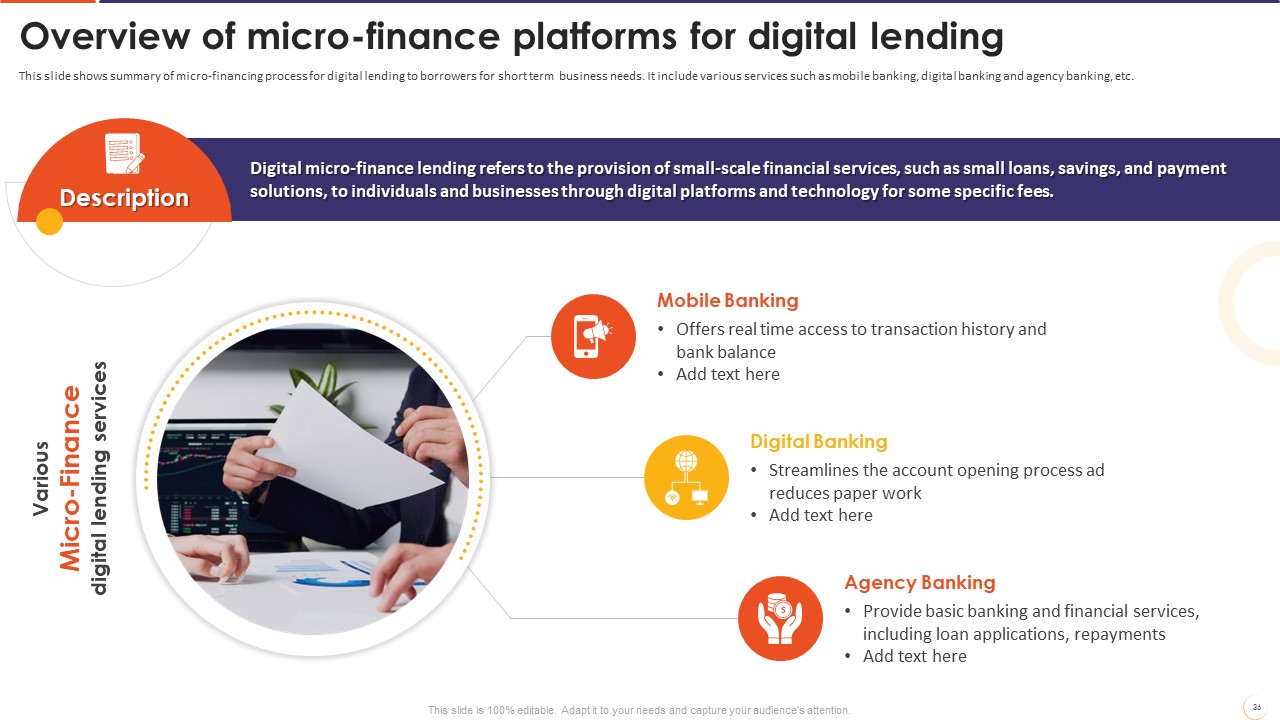

#Overview of Micro-Finance Platforms for Digital Lending

The slide briefs microfinance methods for digital lending to borrowers for short-term business requirements.

What is Micro-Finance?

Digital micro-finance lending offers small-scale financial services to individuals and businesses using digital platforms and technology for a charge. These services include modest loans, savings accounts, and payment solutions.

Additionally, this slide illustrates a range of digital financing options related to microfinance:

Mobile Banking: Mobile Banking gives real-time access to transaction history and bank balance.

Digital banking: Through Digital Banking, there would be less paperwork, which becomes a more efficient way to open accounts.

Agency Banking: Agency Banking offers standard financial and banking services, such as loan applications and repayments.

It is essential to highlight the overview of micro-finance platforms for digital lending as they encourage economic growth and eliminate poverty. This, in turn, offers easily accessible and customized microfinance solutions, which help to create a fairer financial environment.

Download this PowerPoint Template now.

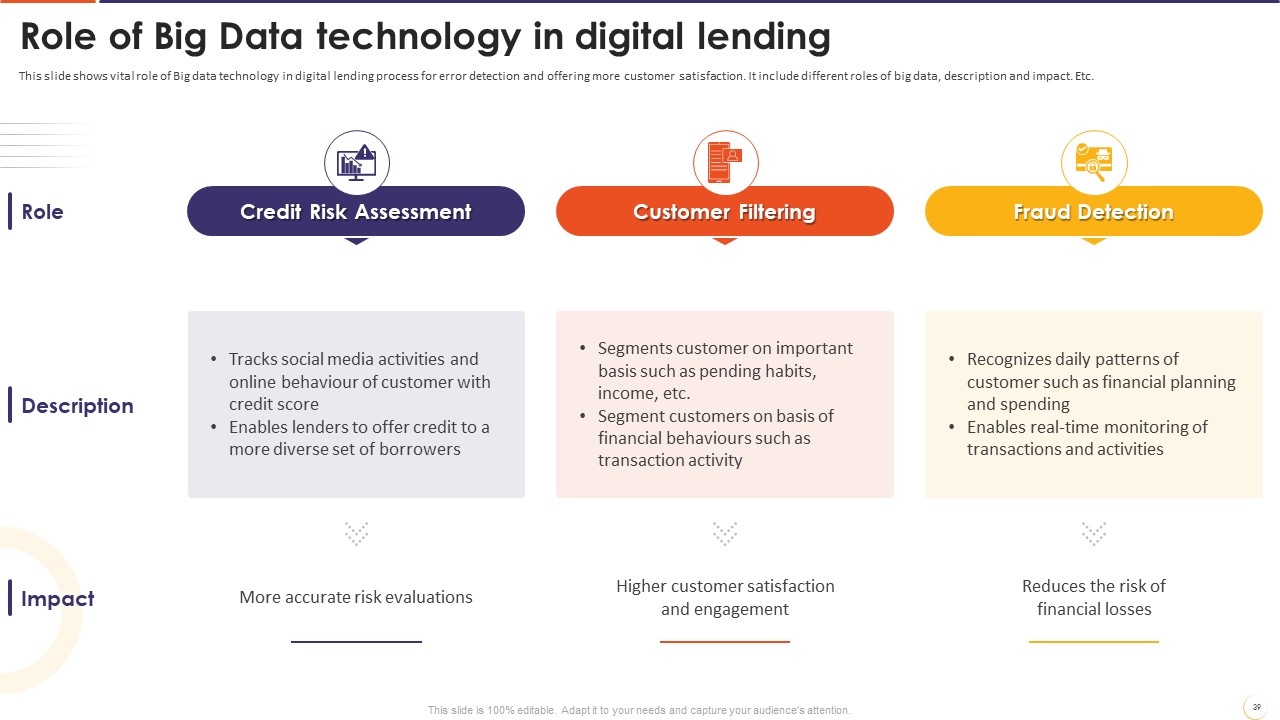

#Role of Big Data Technology in Digital Lending

The slide illustrates big data technology’s role in the digital lending process regarding error identification and increased client satisfaction.

The following are the various functions that big data plays:

Credit Risk Assessment:

- Monitors customers' internet and social media activity and provides a credit score.

- Permits lenders to provide loans to a broader range of applicants

Customer filtering:

- Customer Filtering divides customers into crucial categories based on wealth and past-due behaviors.

- Divide up your clientele based on their financial habits, such as how often they transact.

Fraud Detection:

- Identifies regular client behaviors, including budgeting and spending.

- Permits the real-time tracking of activities and transactions.

Adding Big Data Technology in digital lending is vital as it uses data-driven insights to maximize operational effectiveness, reduce risks, and offer customized financial solutions in the constantly changing world of digital Lending.

Download this PowerPoint Template now.

Conclusion

With the revolution in the lending industry, individual and lender roles have been reshaped in accessing credit. Additionally, digital lending has protected individuals’ sensitive data confidentially, which might improve efficiency, increase income per loan, and accelerate service delivery of financial institutions.

Explore these templates and design them to your needs. Your journey to Online Lending success begins with a click on the download now button.

For more information, check out SlideTeam's offers for excellent PowerPoint presentations, or call us at

+1-408-659-4170.

Click here to get a Free Digital Lending PPT and Digital Lending PDF.

FAQs

How does digital lending differ from traditional lending?

- Digital lending streamlines the loan application and approval process by leveraging technology. It often involves algorithms and data analytics to assess creditworthiness quickly. Traditional lending typically involves a more manual and paperwork-intensive process.

What types of loans are available through digital lending platforms?

- Digital lending platforms offer various types of loans, including personal, business, student, and even specific loans for home improvement or medical expenses.

Customer Reviews

Customer Reviews