The global rise of Islamic Finance in recent decades reflect a growing need for financial services with respect for different cultural and religious values. As this industry develops, it will significantly advance ethical and thorough financial procedures in the international market.

What is Islamic Finance?

Ethical finance emphasizes managing money with Islamic values and includes lending, investing, and saving methods that follow the rules established by Islam.

Importance of Islamic investment

Shariah finance is significant because of its commitment to advancing equality throughout the financial services industry. The teachings of Islam establish clear limits and regulations on economic activities, which may be in opposition to conventional financial tools. Therefore, preventing the discrimination of people based on their religious beliefs.

Understanding this significance, the templates included in this blog provide organizations with a valuable tool to manage the difficulties of Islamic financing.

These wholly editable and customizable Islamic Investment Templates from SlideTeam are made to make this process easier by offering a structured approach to recognizing and resolving financial concerns in line with Islamic principles. It is essential for those companies looking to strengthen their Islamic finance strategy and maintain competitiveness in today’s ever-changing market.

Let's examine how you might handle financial management within the context of Islamic principles by using these top Islamic Finance PowerPoint Templates.

Islamic Finance PowerPoint Templates

Cover Slide

Begin on a financial voyage with our Shariah Finance, led by the values of equality and transparency. Our services follow Sharia law, guaranteeing moral behavior, avoiding charging high-interest rates, and supporting investments that benefit society. Our mission is to give your money stability and actual value through risk-sharing and asset-backed lending.

Join us on a journey where your monetary objectives link with equality and transparency, generating benefits for your successes as well as the health of our community.

Download this PowerPoint Template now.

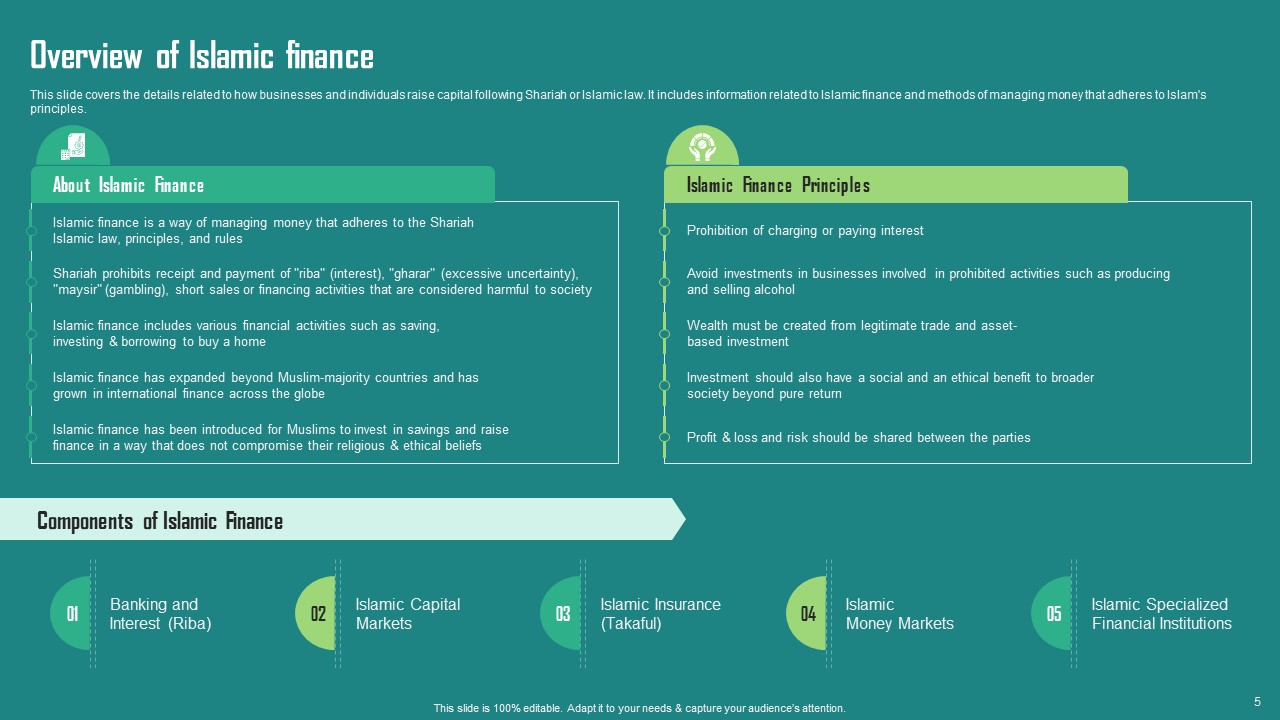

# Overview of Islamic Finance

The slide highlights the information on how capital is raised by businesses and individuals by following Islamic law. Moreover, it covers details that are related to Shariah finance, which are as follows:

- Islamic finance is a way of managing money that adheres to the Shariah Islamic law, principles, and rules.

- Shariah prohibits receipt and payment of "riba" (interest), "gharar" (excessive uncertainty), "maysir" (gambling), short sales or financing activities that are considered harmful to society.

- Islamic finance includes various financial activities such as saving, investing & borrowing to buy a home.

- Islamic finance has expanded beyond Muslim-majority countries and has grown in international finance across the globe.

- Islamic finance has been introduced for Muslims to invest in savings and raise finance in a way that does not compromise their religious & ethical beliefs.

Furthermore, this slide illustrates Islam’s Principles that are:

- Prohibition of charging or paying interest.

- Avoid investments in businesses involved in prohibited activities, such as producing and selling alcohol.

- Wealth must be created from legitimate trade and asset-based investment

- Investment should also have a social and ethical benefit to broader society beyond pure return.

- Profit & loss and risk should be shared between the parties.

Additionally, the slide displays the Components of Ethical Finance, i.e., Banking and Interest (Riba), Islamic capital market, Islamic Insurance (Takaful), Islamic Money Markets, and Islamic specialized financial institutions.

Shariah finance is essential because it provides a distinct framework that follows Shariah principles, avoiding conflict and giving environmentally friendly investments a higher priority. Additionally, Islamic finance actively supports moral and financial behavior along with economic stability, which helps to promote community-based and sustainable growth.

Download this PowerPoint Template now.

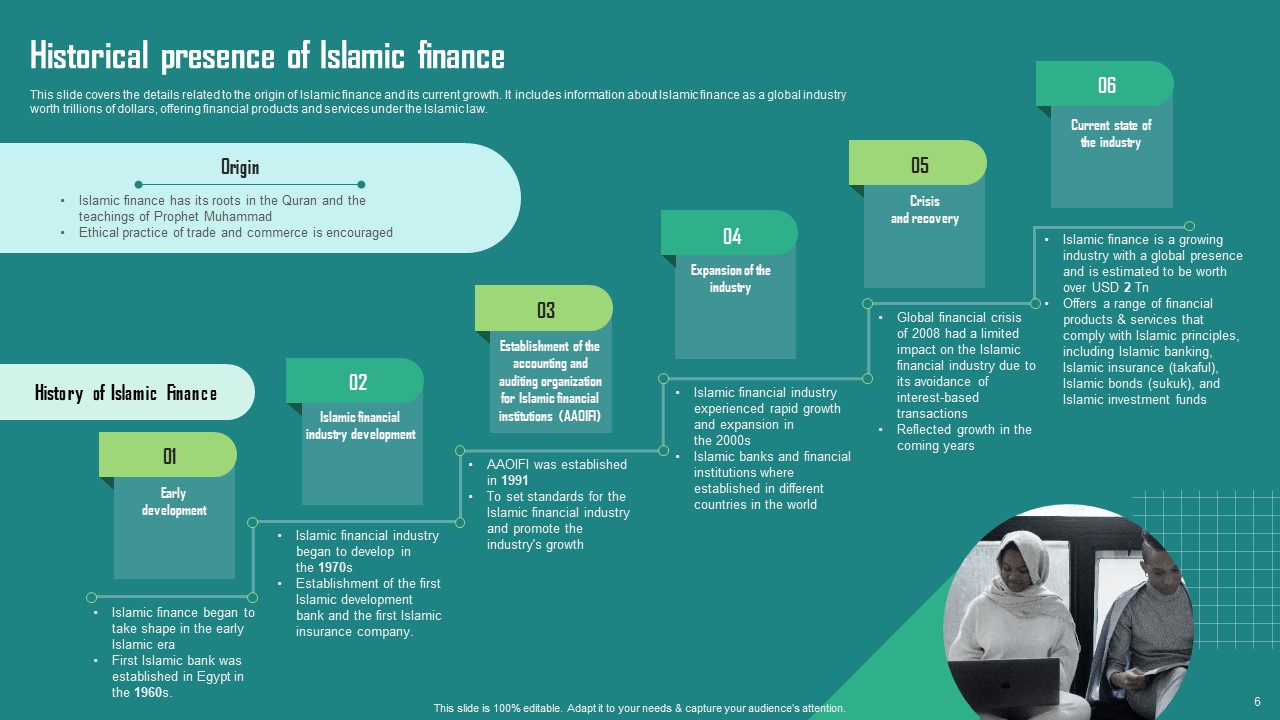

# Historical Presence of Islamic Finance

The slide illustrates the origin of Islamic finance and its growth in present times.

Let’s discuss the Origin of Islamic Finance:

- Islamic finance has its roots in the Quran and the teachings of Prophet Muhammad.

- Here, the ethical practice of trade and commerce is encouraged.

Furthermore, the slide highlights the historical developments in Islamic Finance, which are explained as follows:

- Initial Development: Islamic finance began to take shape in the early Islamic era, and the first Islamic bank was established in Egypt in the 1960s.

- Industrial Development of Islamic Finance: The Islamic financial industry began to develop in

In the 1970s, the first Islamic development bank and the first Islamic insurance company were established. - Establishment of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI): AAOIFI was established in 1991 to set the standards for the Islamic financial industry and promote its growth.

- Industry’s Expansion: Islamic financial industry experienced rapid growth and expansion in

the 2000s. However, Islamic banks and financial institutions were established in different countries. - Crisis: The global financial crisis 2008 had a limited impact on the Islamic financial industry due to its avoidance of interest-based transactions.

- Recovery: After the global financial crisis 2008, the growth was reflected in the coming years.

- Present Scenario: Islamic finance, in present times, is a growing industry with a global presence and is estimated to be worth over USD 2 Tn. Moreover, it offers a range of financial products & services that comply with Islamic principles, including Islamic banking, Islamic insurance (takaful), Islamic bonds (sukuk), and Islamic investment funds.

It is essential to have the Historical Presence of Ethical Finance as it shows a commitment to fair and welcoming economic practices, providing an alternative to traditional finance.

Download this PowerPoint Template now.

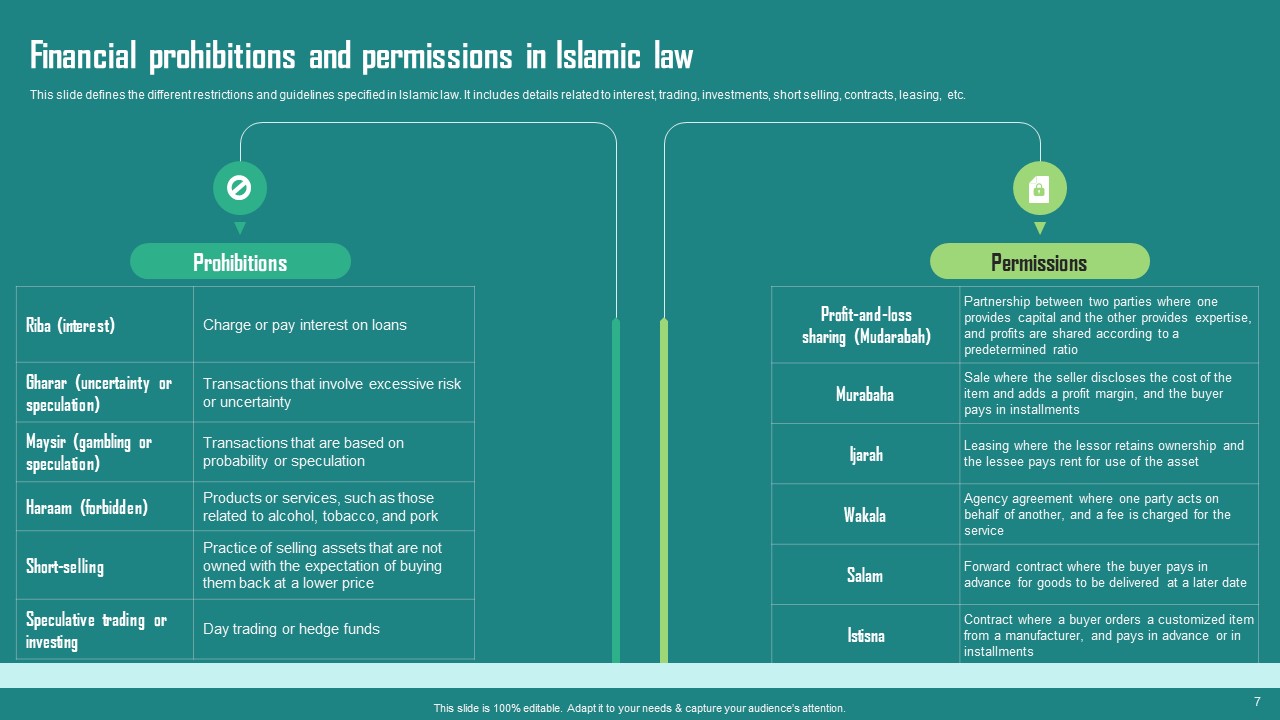

# Financial Prohibitions and Permissions in Islamic Law

The slide illustrates the rules and regulations mentioned in Islamic law. Further, it differentiates rules that need to be condemned and followed. All of them are explained in the subsequent paragraphs:

Rules condemned:

- Riba (Interest): No interest should be paid or charged on loans.

- Gharar (uncertainty or speculation): Transactions that involve excessive risk or uncertainty should be avoided.

- Maysir (gambling or speculation): Transactions based on probability or speculation.

- Haraam (forbidden): Products or services, such as those related to alcohol, tobacco, and pork, are restricted.

- Short-selling: Practice of selling assets that are not owned with the expectation of repurchasing them at a lower price.

Rules that need to be taken into consideration:

- Profit-and-loss sharing (Mudarabah): Profits and losses are shared between two parties in a predetermined ratio where one provides capital and expertise.

- Murabaha: It is advised for a sale where the seller discloses the cost of the item and adds a profit margin, and the buyer pays in installments.

- Ijarah: Leasing is promoted where the lessor retains ownership, and the lessee pays rent for the use of the asset.

- Wakala: Agency agreement is recommended where one party acts on behalf of another and charges a fee for the service.

- Salam: It is suggested to forward a contract where the buyer pays in advance for goods to be delivered later.

- Istisna: A contract should be made where a buyer orders a customized item from a manufacturer and pays in advance or installments.

It is vital to have financial prohibitions and permissions in Islamic law as principles in Islamic finance, guided by Sharia, specifying what is allowed and prohibited. Further, this guarantees fairness and acceptance in financial dealings.

Download this PowerPoint Template now.

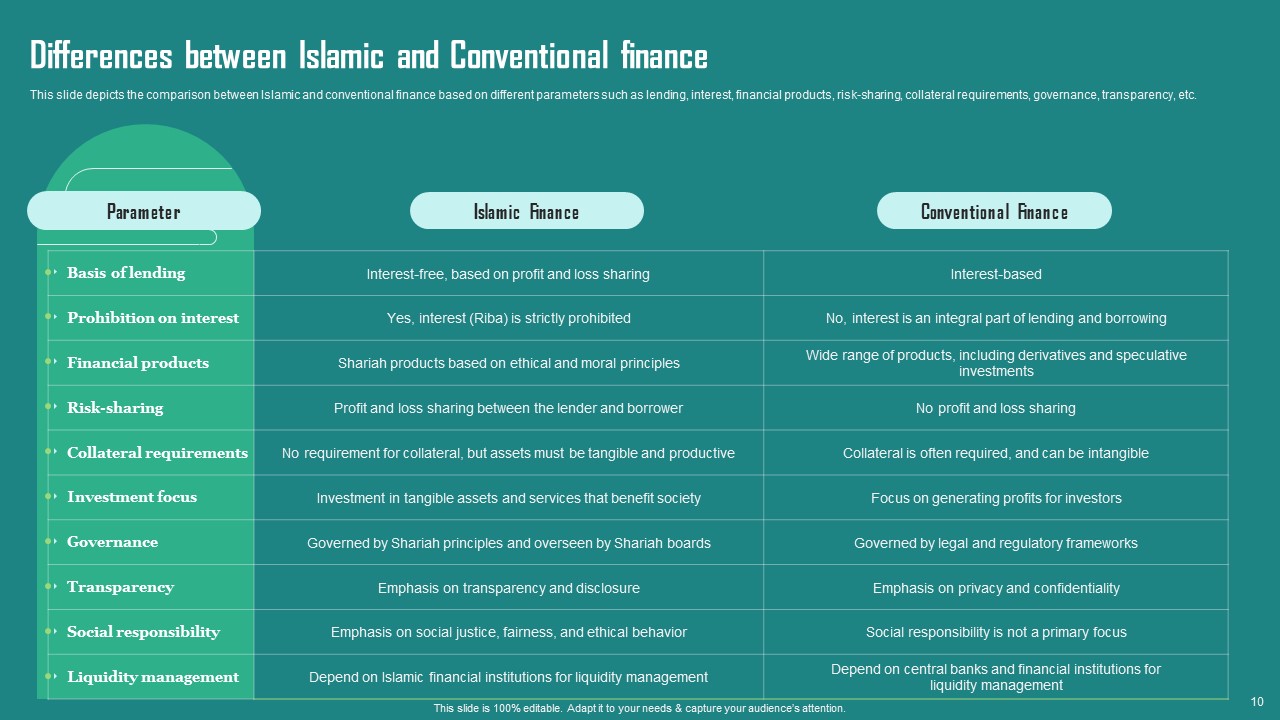

# Differences between Islamic and Conventional Finance

The slide highlights the distinction between Islamic and conventional Finance based on the following:

- Bases of Lending: In Shariah finance, the basis of lending is interest-free and is dependent on Profit and loss sharing. Whereas traditional finance is based on interest.

- Prohibition on Interest: In Ethical finance, interest is strictly condemned, but in traditional finance, it plays an important role.

- Financial products: Islamic finance has Shariah products based on ethical and moral principles, whereas in conventional Finance, there is a wide range of products, including derivatives and speculative

- Risk-sharing: In Shariah finance, there is a sharing of Profit and loss between the lender and the borrower, while there is no such case in Traditional Finance.

- Collateral requirements: There is no requirement for collateral, but assets must be tangible and productive in Islamic finance. The reverse happens for old finance, as Collateral is often required and can be intangible.

Similarly, there are many differences, for instance, Investment focus, Governance, Transparency, Social responsibility, and Liquidity management, which are highlighted in the slide to get a better overview.

Knowing the difference between Shariah and Conventional Investment is essential as they reveal different methods for conducting financial transactions that benefit individuals and the community.

Download this PowerPoint Template now.

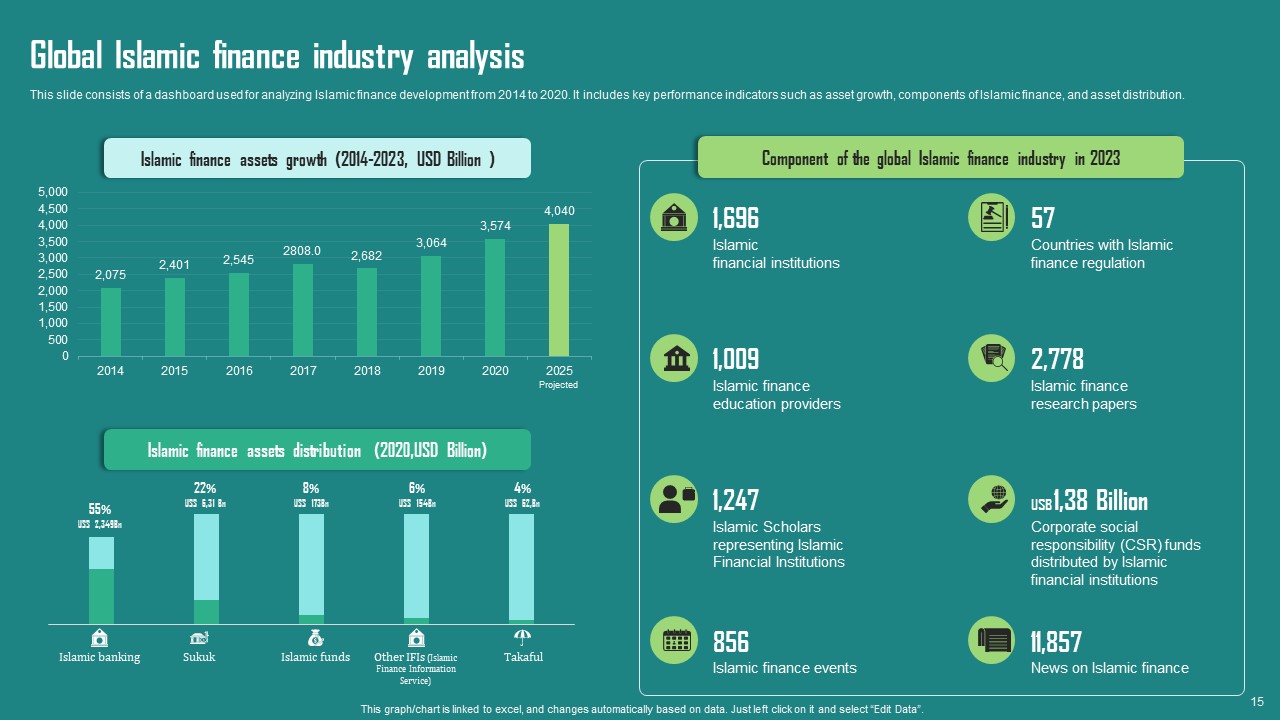

# Global Islamic Finance Industry Analysis

This slide represents a dashboard for analyzing Shariah finance expansion from 2014 to 2020.

Additionally, it contains key performance indicators such as Asset growth, components of Ethical Finance, and Asset distribution.

It is essential to do a Global Shariah Finance Industry Analysis as it enables the Companies and investors to identify trends, obstacles, and opportunities within the industry.

Download this PowerPoint Template now.

# Future Outlook for Islamic Financing

This slide gives insight into the details related to Ethical financing and its upcoming outcome, with the industry anticipated to continue showing growth and expansion shortly. Further, it illustrates information related to technology, population growth, etc.

A Future Outlook for Shariah Financing is crucial because it estimates market trends and fits plans into the changing environment. Therefore, it is done to support innovation and guarantee steady growth while adhering to moral and universal standards.

Download this PowerPoint Template now.

Conclusion

Our templates for Ethical financing are more than just tools.they are valuable resources for companies trying to understand the various aspects of Islamic financing.

Incorporating these PowerPoint slides into your company plan may improve your decision-making and prepare for unexpected events. Take advantage of expansion prospects in Islamic finance. Don't allow unexpected financial difficulties disrupt your company's goals.

Visit SlideTeam right now to have access.

Click here to get a Free Islamic Finance PPT & Islamic Finance PDF.

FAQs on Islamic Finance

Is there a global regulatory body for Shariah finance?

The Islamic Financial Services Board (IFSB) is an international regulatory body that sets standards and guidelines for Islamic finance. Additionally, various countries have regulatory bodies to oversee and regulate Islamic financial institutions.

Is Ethical finance only about avoiding interest?

While the prohibition of interest is fundamental, Islamic finance is about much more than that. It also emphasizes fairness, ethical conduct, and risk-sharing in financial transactions.

Can Shariah finance be integrated with conventional finance?

Integrating Islamic finance with conventional finance through structures like Islamic windows in traditional banks is possible. And all this allows both systems to coexist and cater to diverse customers.

Customer Reviews

Customer Reviews