Artificial Intelligence (AI) is playing an increasingly important role in the finance industry, with a wide range of applications that are transforming the way financial institutions operate.

The biggest wager in the financial world right now may be on artificial intelligence (AI).

By enabling financial institutions and banks to maximize their services in this constantly shifting, uncertain world, smart solutions can give them a significant competitive advantage over their rivals.

AI and Finance Industry

Artificial Intelligence (AI) is revolutionizing the finance industry, transforming the way financial institutions operate and providing new opportunities for innovation and growth. With the ability to analyze vast amounts of data, make predictions, and automate decision-making, AI is being used to improve fraud detection, credit scoring, investment management, customer service, and risk management in the finance industry. As AI technology continues to evolve and mature, it is becoming an increasingly important tool for financial institutions looking to stay competitive and provide better services to their customers. In this context, this essay will explore the role of AI in revolutionizing the finance industry, examining its impact on different aspects of finance and the opportunities and challenges it presents.

AI is now being used in real-world use cases after moving past its experimental phase. Banks are deploying AI bots to automatically identify borrower risk and onboard new clients. To find inefficiencies in the process, they are employing deep learning, pattern matching, and computer vision. Among many other use cases, AI-based anti-money laundering technologies are assisting them in preventing fraud.

Role of AI in Finance Industry

Here are some of the main roles of AI in finance:

Fraud Detection: AI can be used to analyze large volumes of financial data and identify patterns and anomalies that may indicate fraud. Machine learning algorithms can learn from historical data to detect fraudulent transactions in real-time, reducing the risk of financial losses for banks and other financial institutions.

Credit Scoring: AI can help banks and lenders to assess creditworthiness more accurately and efficiently. By analyzing a range of data sources, including financial records, credit history, and social media activity, AI algorithms can predict the likelihood of default and assign a credit score accordingly.

Investment Management: AI can be used to automate investment decisions, analyzing market data and using machine learning algorithms to make predictions about future market trends. This can help to optimize investment portfolios, reduce risk, and increase returns.

Customer Service: AI-powered chatbots can be used to provide customer service 24/7, answering common queries and resolving issues without the need for human intervention. This can improve customer satisfaction and reduce the workload on customer service team.

AI is playing an increasingly important role in the finance industry, providing new opportunities for fraud detection, credit scoring, investment management, customer service, and risk management. As AI technology continues to evolve, it is likely to become an even more integral part of the finance industry, driving innovation and transforming the way financial institutions operate. This blog will talk about how AI has transformed finance industry and is leading the financial sector.

Cover Slide

The cover slide of your presentation has the ability to set the tone for your entire presentation and this is why we have curated this visually appealing slide. Capture your audience attention with this AI revolutionizing finance industry PowerPoint slide. With clear and appealing design the template gives you enough space to add an image and your company’s name. With this presentation at your disposal you can talk how AI is becoming the future of finance industry.

Download this PowerPoint Template Now

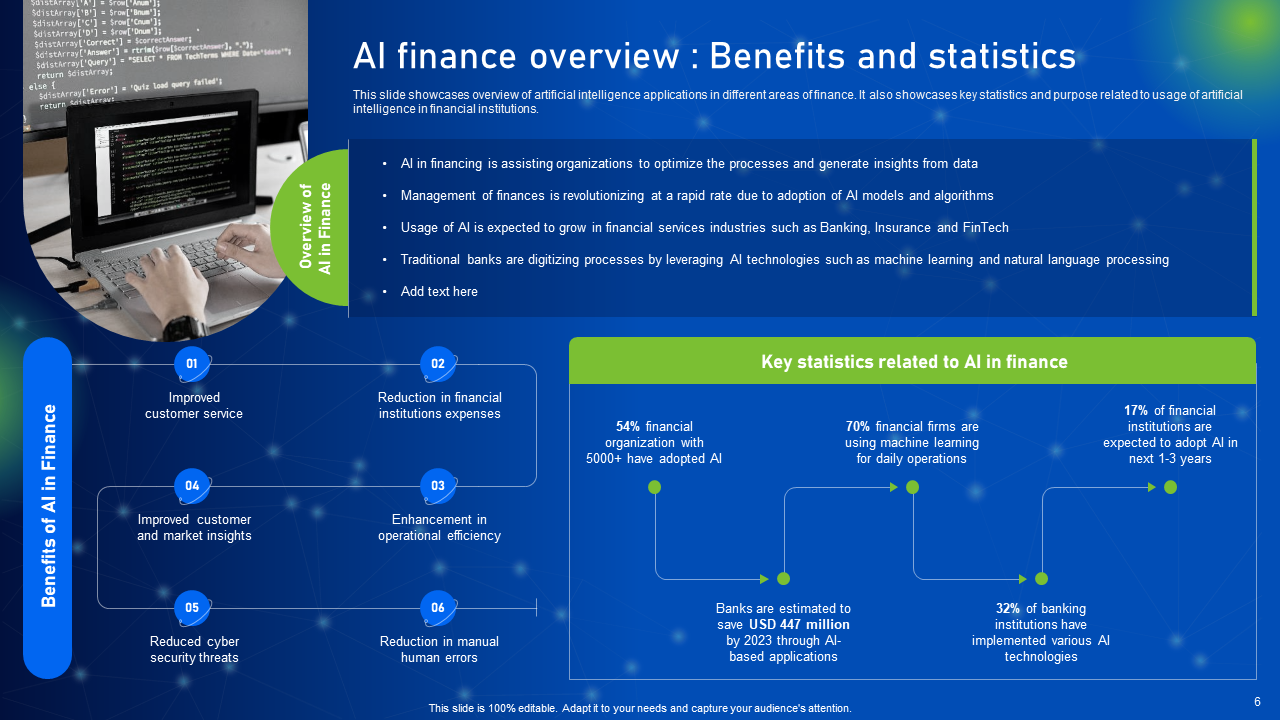

AI Finance Overview

An overview of artificial intelligence applications in several financial fields is shown on this presentation. It also provides pertinent data and information about the use of AI in financial institutions. The template can be used to talk about the benefits of AI in finance which are as follows –

- Improved customer service

- Reduction in financial institutions expenses

- Enhancement in operational efficiency

- Improved customer and market insights

- Reduced cyber security threats

Not only this, you can shed light on the major stats related to AI in finance sector that can be attention grabbing for your audience.

Download this PowerPoint Template Now

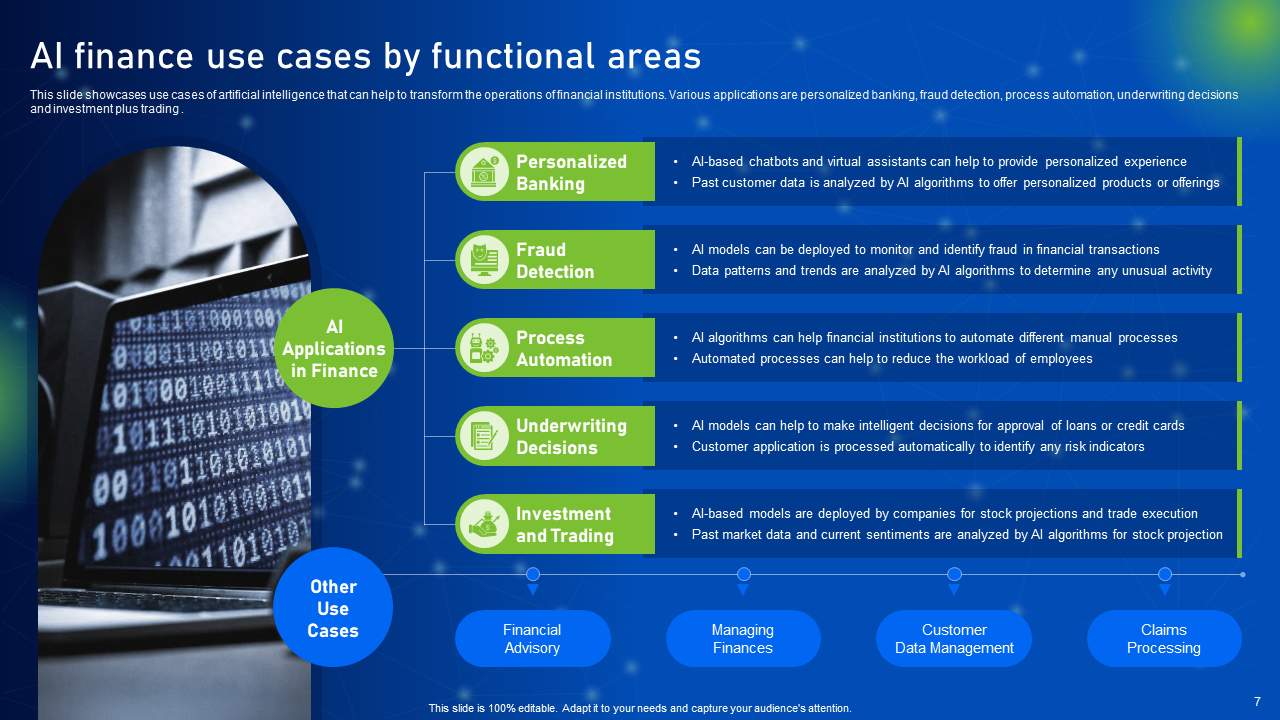

AI Finance Use Cases By Functional Areas

This presentation displays examples of how artificial intelligence can be used to change how financial organizations operate. Personalized banking, fraud detection, process automation, underwriting choices, investment, and trading are some examples of uses. This slide helps to illustrate the practical applications of AI in the finance industry. By showcasing specific examples of how AI is being used to solve real-world problems, presenters can help the audience understand the potential benefits and limitations of AI in finance. Taking the assistance of this slide you can demonstrate the value of AI in finance, showing how it can improve processes, reduce costs, and increase revenue.

Download this PowerPoint Template Now

AI Trends Transforming Financial Sector

This presentation presents a number of artificial intelligence trends that are revolutionizing the financial industry. The most recent developments in the banking industry include hyper automation, AI-powered automation, financial security, and individualized product offerings.

The given template will help you create awareness among the stakeholders about the potential of AI in finance. It highlights the ways in which AI can transform the finance sector, its benefits and limitations, and the impact it can have on the industry. This presentation can help financial institutions and businesses to create a strategic plan that integrates AI into their operations. By understanding the trends, companies can determine the best AI solutions for their specific needs and make informed decisions about how to implement them.

Download this PowerPoint Template Now

Importance of AI in Real Time Stock Trading

This slide highlights the advantages of using AI solutions for stock trading and making money off the market. Benefits include less time spent on research, pattern recognition, cost savings, and increased stock projection accuracy. The slide can make people aware that AI can analyze vast amounts of data in real-time and make decisions faster than humans. This can result in more efficient stock trading, which can lead to higher profits.

Business people can get benefitted from this slide as it can lead to more informed trading decisions and better investment outcomes. I can analyze data and make decisions at a much larger scale than humans, which can be particularly useful for large-scale trading operations. This can help traders to expand their operations and take advantage of new market opportunities. All of this and more can be presented using this slide.

Download this PowerPoint Template Now

Importance of AI in Stock Market

This slide illustrates the advantages of using AI tools to forecast the stock market. The use of AI for market forecasts has several key advantages, including increased accuracy, quicker analysis, risk management, and cost savings.

Use this slide to present how AI can analyze vast amounts of data and identify patterns that are difficult for humans to see, which can lead to more accurate stock market predictions. This can help investors make informed decisions about buying and selling stocks, which can result in higher profits.

AI can analyze data much faster than humans, which can improve the efficiency of stock market projections. This can help investors to make quick decisions based on real-time data and react to changes in the market more quickly which is what can be presented using this slide.

Use this template to present how AI can help investors to manage risk by analyzing market trends, identifying potential risks, and making real-time adjustments to investment strategies. This can help to minimize losses and maximize profits.

Download this PowerPoint Template Now

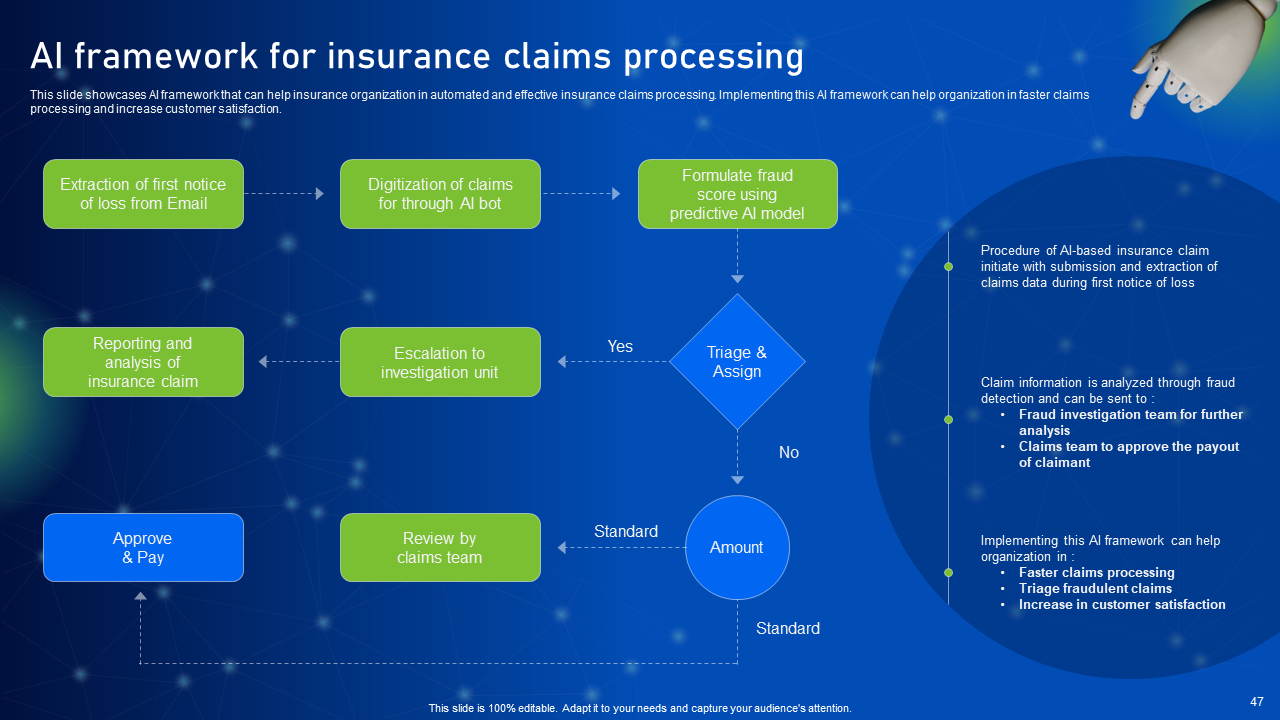

AI Framework for Insurance Claims Processing

This slide displays an AI framework that can aid insurance companies in processing insurance claims in an automated and efficient manner. By putting an AI framework in place, an organisation may process claims more quickly and improve customer satisfaction. The template depicts step by step procedure for insurance claim processing. It can help insurers to improve their claims processing efficiency, accuracy, and fraud detection capabilities. Also, it assists in inspiring innovation and creativity in the insurance industry.

Download this PowerPoint Template Now

AI In Banking: Market Size, Growth Drivers and Restraints

This slide provides an overview of the size predictions for the future of AI in banking. It also emphasises a number of other crucial components, including market restraints, growth drivers, and significant players in the sector. The template depicts growth drivers, growth restraints and major players along with the market size which you can present using the line chart given in the slide. Present the key takeaways from the entire slide to make it easy for your audience to get an in-depth knowledge of AI in banking industry.

Download this PowerPoint Template Now

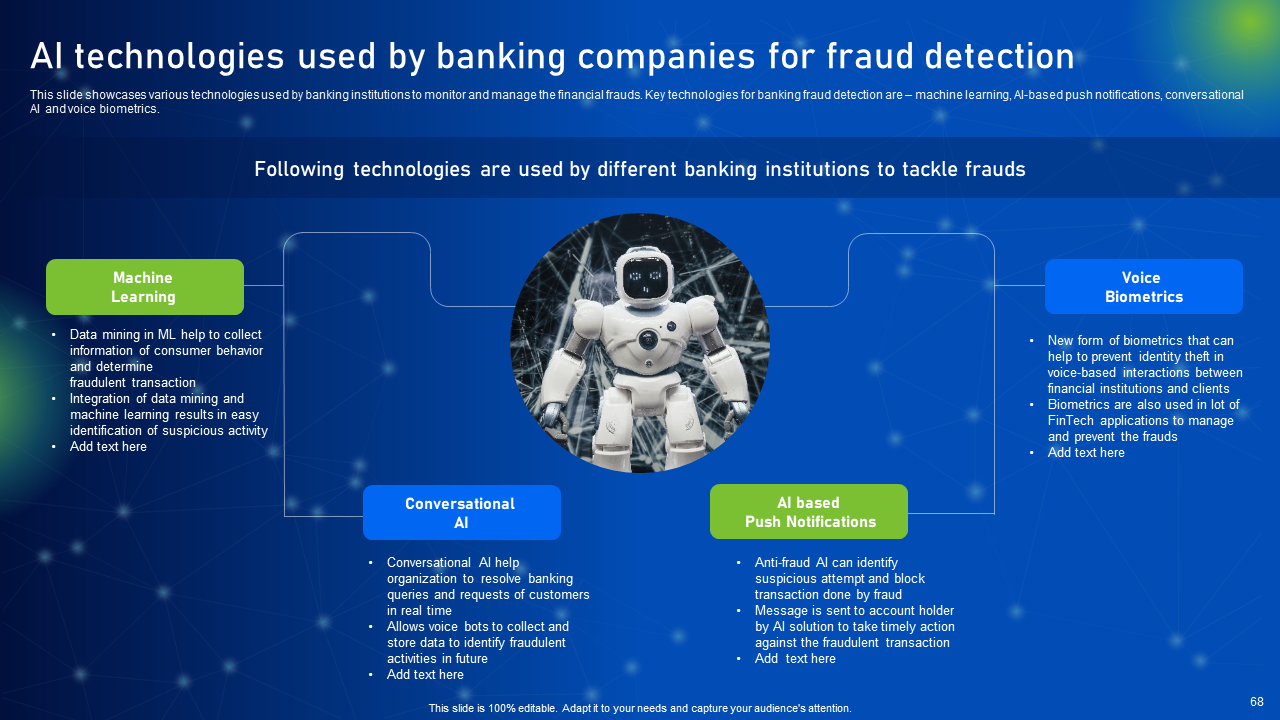

AI Technologies Used by Banking Companies for Fraud Detection

This slide displays the numerous technologies that banking organisations use to keep an eye on and control financial scams. Machine learning, AI-based push alerts, conversational AI, and voice biometrics are important technologies for banking fraud detection.

Machine Learning – Data mining to help collect information of customer behaviour and determine fraudulent transactions.

Push notifications – Anti- fraud AI can help identify suspicious attempt and block transactions done by fraud.

Conversational AI – It helps organizations to resolve banking queries and requests from customers in real time.

Voice biometrics- It can help prevent identity theft in voice based interactions between financial institutions and clients.

Download this PowerPoint Template Now

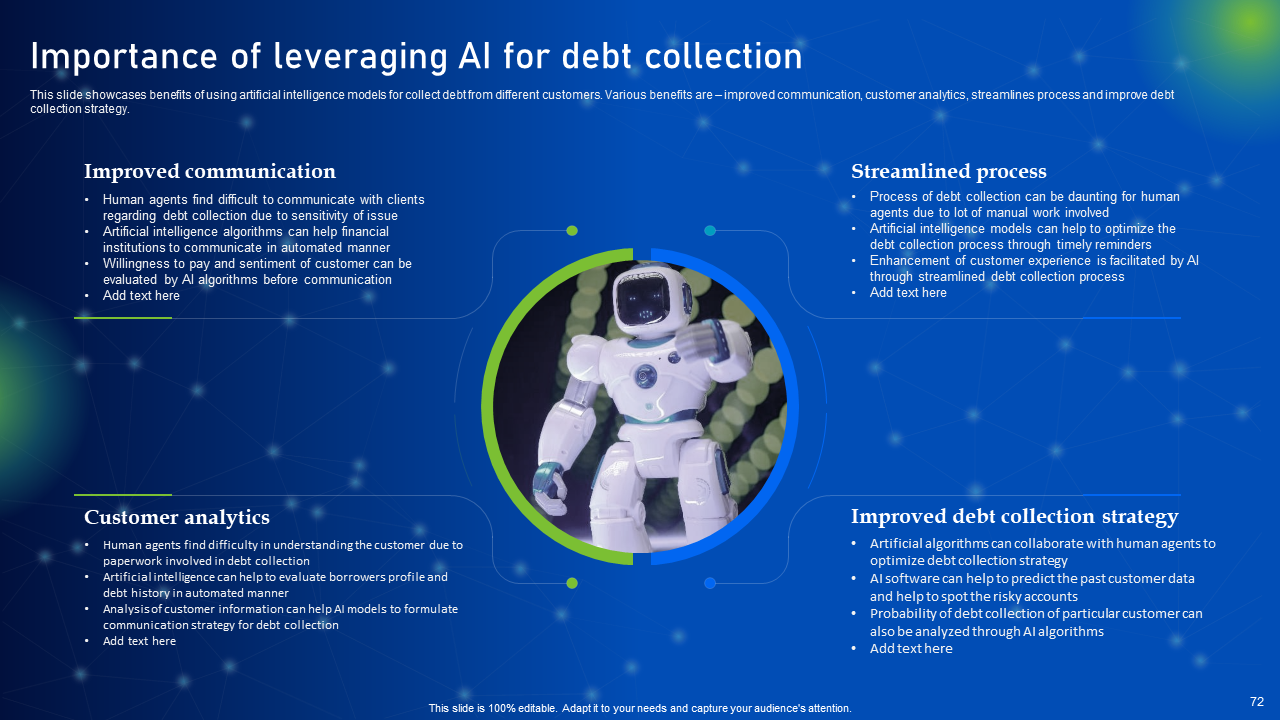

Importance of Leveraging AI for Debt Collection

This slide illustrates the advantages of utilizing artificial intelligence models to recover debt from various consumers. Numerous advantages include enhanced customer data, streamlined processes, and improved debt collection tactics. AI can be used to automate the debt collection process, which can lead to improved efficiency and reduced costs for collection agencies. By analyzing data from multiple sources, AI can also help to identify the most effective collection strategies for individual debtors, increasing the likelihood of successful collections.

This template can help you present how AI can help to reduce human error in debt collection by providing accurate and unbiased data analysis. This can help to ensure that collections are carried out fairly and in compliance with legal and ethical standards. By showcasing the latest advancements and innovations in AI, the presentation can encourage collection agencies to think creatively and develop new solutions that leverage AI to improve their debt collection operations.

Download this PowerPoint Template Now

Benefits of AI deployment in Fintech Sector

This presentation illustrates a number of benefits of implementing artificial intelligence technology in the fintech industry. Benefits include better customer service, automated workflows, increased security, lower operating expenses, etc.

The deployment of Artificial Intelligence (AI) in the FinTech sector has become increasingly significant due to the numerous benefits it offers. AI has the potential to revolutionize financial services by improving customer experience, reducing costs, and enhancing efficiency.

One of the significant benefits of AI deployment in FinTech is improved customer experience. AI algorithms can analyze vast amounts of customer data to personalize financial services, provide customized investment advice, and automate routine tasks such as opening accounts or processing loan applications. This can lead to faster and more accurate service, which can improve customer satisfaction and loyalty. You can present this with the help of this readily-available template. You can use this slide to highlight the advantages that financial institutions can gain from this technology.

Download this PowerPoint Template Now

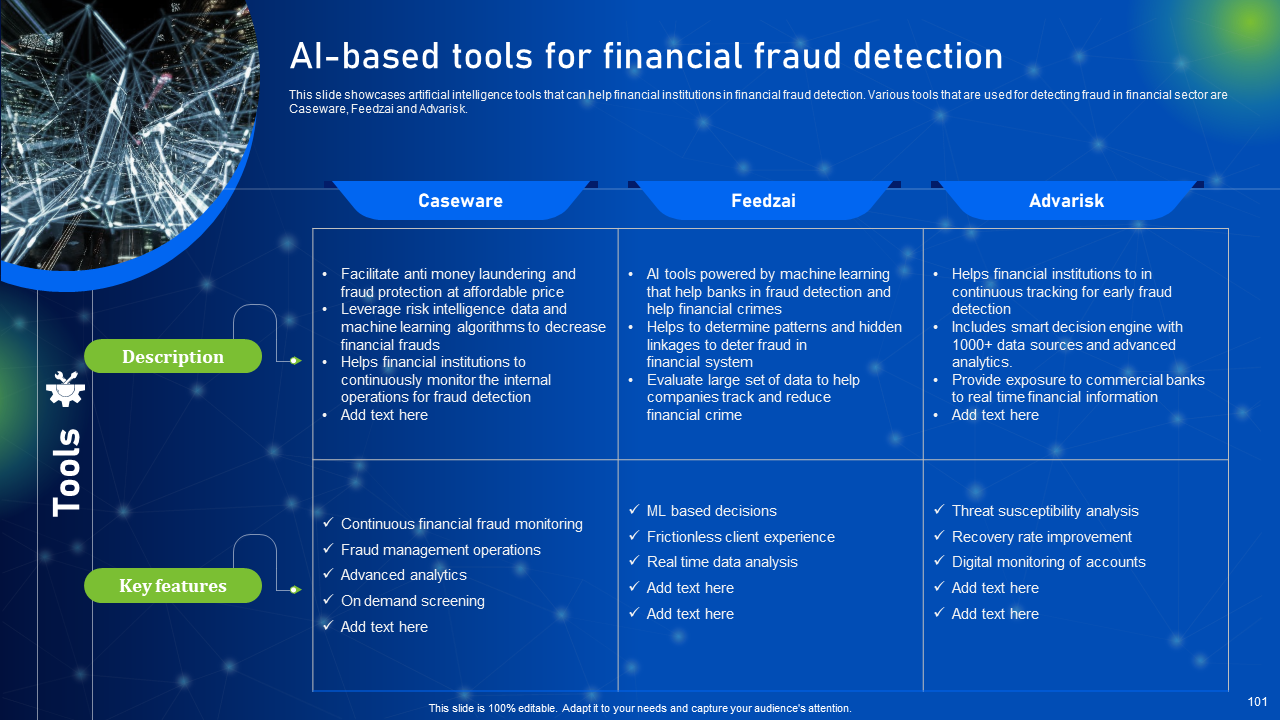

AI Based tools for Financial Fraud Detection

The rapid advancement in technology has led to an increase in the prevalence of financial frauds. These frauds have far-reaching consequences on individuals, institutions, and society at large. In response to this challenge, Artificial Intelligence (AI) has emerged as a promising solution for detecting fraudulent activities.

This slide displays some of the artificial intelligence techniques that financial organisations can use to detect financial fraud. Some of the tools one can use to identify fraud in the financial sector Caseware, Feedzai, and Advarisk.

These tools can analyze vast amounts of data in real-time, and provide accurate and timely alerts, thereby minimizing the impact of fraudulent activities. Additionally, AI-based tools are continuously learning and improving, making them an effective and efficient solution for the dynamic and evolving nature of financial frauds.

Presenting of all this using this template can help prevent financial loss, mitigate risk, and ensure trust and confidence in the financial system.

Download this PowerPoint Template Now

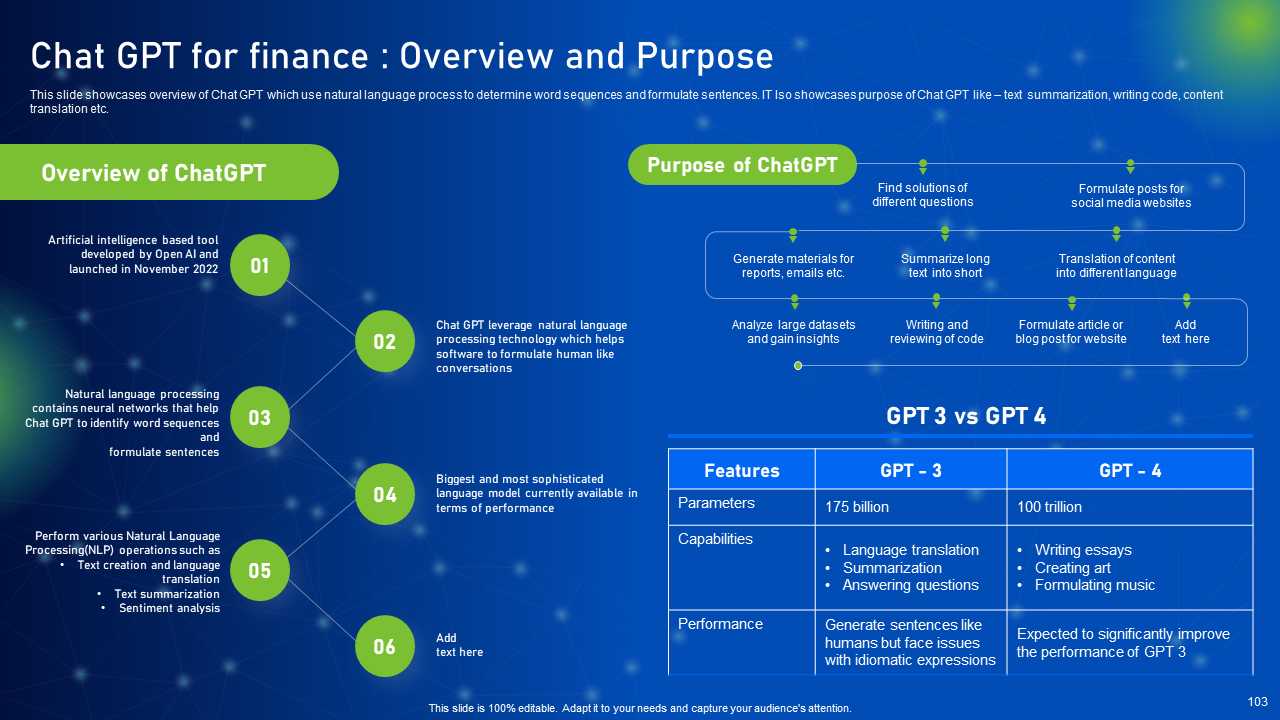

ChatGPT for Finance: Overview and Purpose

This slide displays a general overview of the Chat GPT, which creates phrases and word sequences using natural language processing. It also illustrates Chat GPT's objectives, such as text summarising, coding, content translation, etc. By presenting an overview of ChatGPT for the finance industry, businesses can leverage its capabilities to enhance their customer engagement and operational efficiency. ChatGPT can assist in a variety of financial tasks, such as answering customer inquiries, providing personalized recommendations, and even generating financial reports. Use ChatGpt Ppt slides to talk about the purpose of chatGPT along with presenting the features of GPT 3 and GPT 4.

Download this PowerPoint Template Now

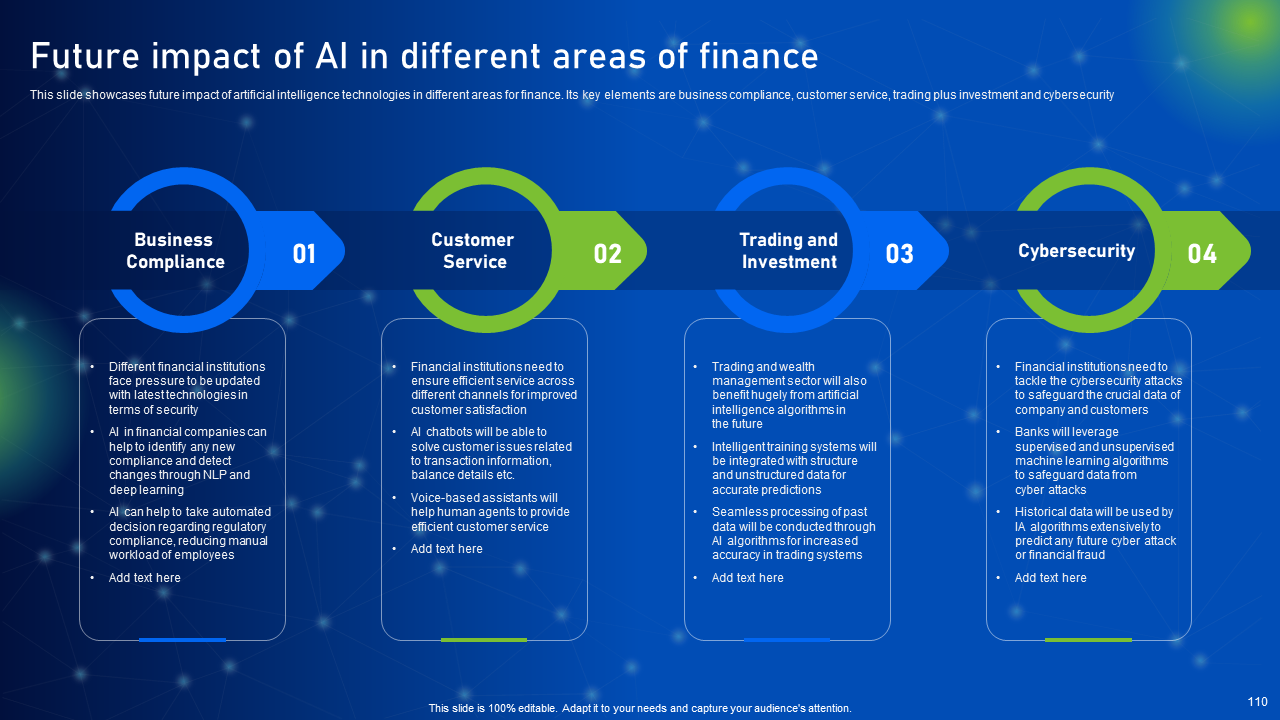

Future Impact of AI in Different Areas of Finance

This slide illustrates how artificial intelligence technology will affect various facets of banking in the future. Business compliance, customer service, trading + investing, and cybersecurity make up its main components. AI can help detect fraudulent claims, automate claims processing, and provide more accurate pricing based on individual risk profiles. Moreover, AI can play a vital role in regulatory compliance by automating compliance-related tasks, reducing the risk of human error. It can also help provide real-time monitoring and reporting. Presenting the future impact of AI in different areas of finance using this slide can provide insights into the potential benefits of AI-powered tools, enabling businesses to plan and prepare for the future of finance.

Download this PowerPoint Template Now

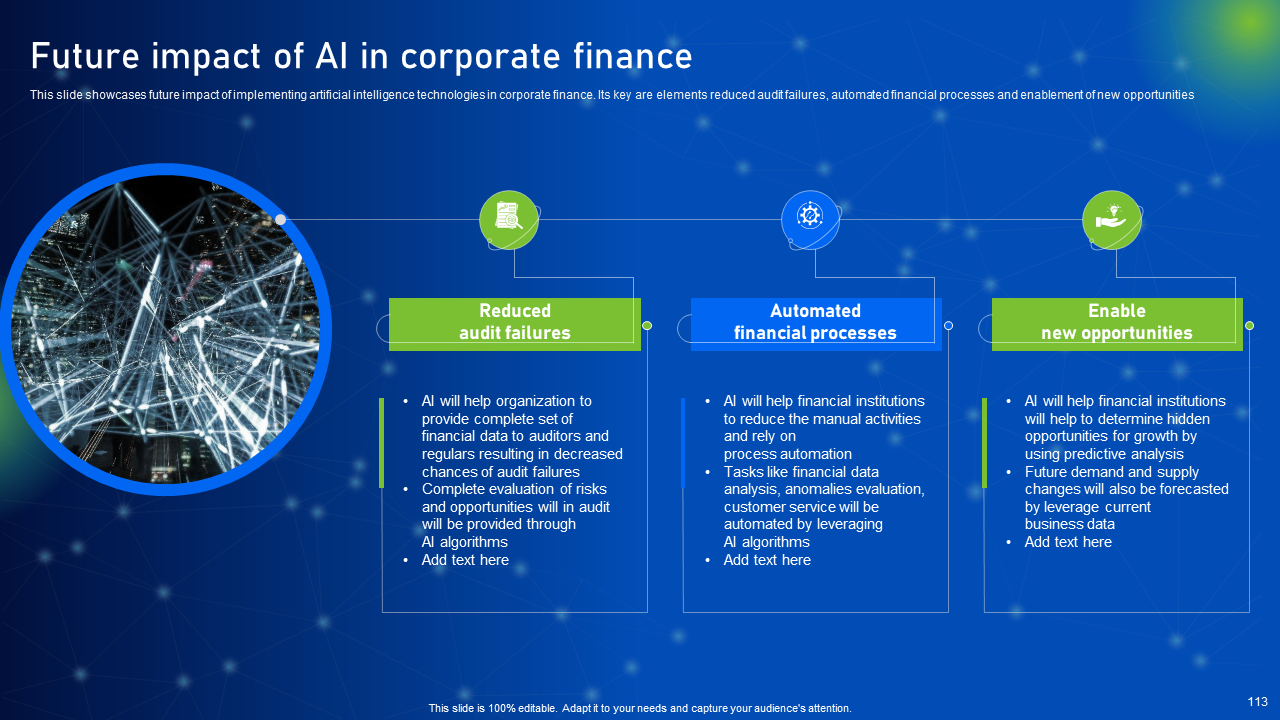

Future Impact of AI in Corporate Finance

The implementation of artificial intelligence technology in corporate finance will have the effects shown on this slide. Reduced audit failures, automated financial procedures, and the creation of new opportunities are its essential components.

AI will provide complete set of financial data to auditors and regulars resulting in decreased chances of audit failures. Al will help financial institutions to reduce the manual activities and rely on process automation. It will also help to determine hidden opportunities for growth by using predictive analysis. Use this slide to precisely present the impact of AI in corporate finance.

Download this PowerPoint Template Now

Conclusion

This blog delve into the profound impact of AI on the finance sector. It explores the applications across various domains such as risk assessment, fraud detection, algorithmic trading, customer service, and personalized financial advice. We have discussed how AI-powered technologies, including machine learning, natural language processing, and predictive analytics, are empowering financial institutions to make data-driven decisions, enhance operational efficiency, minimize risks, and deliver superior customer experiences. Join us as we unravel the AI revolution and its potential to shape the future of finance.

Click Here to Get Access to Free PPT & Free PDF

FAQs

1. How is AI revolutionizing the finance industry?

Answer: AI is transforming the finance industry by automating repetitive tasks, enhancing risk assessment models, improving fraud detection, enabling personalized financial services, and optimizing investment strategies. It analyzes vast amounts of data at high speeds, allowing financial institutions to make more informed decisions and deliver enhanced customer experiences.

2. What are some specific applications of AI in the finance industry?

Answer: AI is being utilized in various areas of finance, including algorithmic trading, portfolio management, credit scoring, chatbots for customer service, fraud detection systems, anti-money laundering (AML) compliance, voice and image recognition for identity verification, and natural language processing (NLP) for sentiment analysis in market research.

3. How does AI improve risk assessment in the finance industry?

Answer: AI enhances risk assessment by analyzing historical data, market trends, and real-time information to identify potential risks and predict future outcomes. Machine learning algorithms can assess creditworthiness, evaluate investment risks, detect anomalies in financial transactions, and provide early warnings for potential market fluctuations, enabling financial institutions to make more accurate risk management decisions.

4. Can AI replace human financial professionals in the industry?

Answer: While AI has the potential to automate many repetitive tasks and augment human capabilities, it is unlikely to replace financial professionals entirely. Instead, AI is likely to work alongside humans, enhancing their abilities, improving decision-making processes, and freeing up their time to focus on more complex tasks such as strategic planning, relationship building, and providing personalized financial advice.

Customer Reviews

Customer Reviews