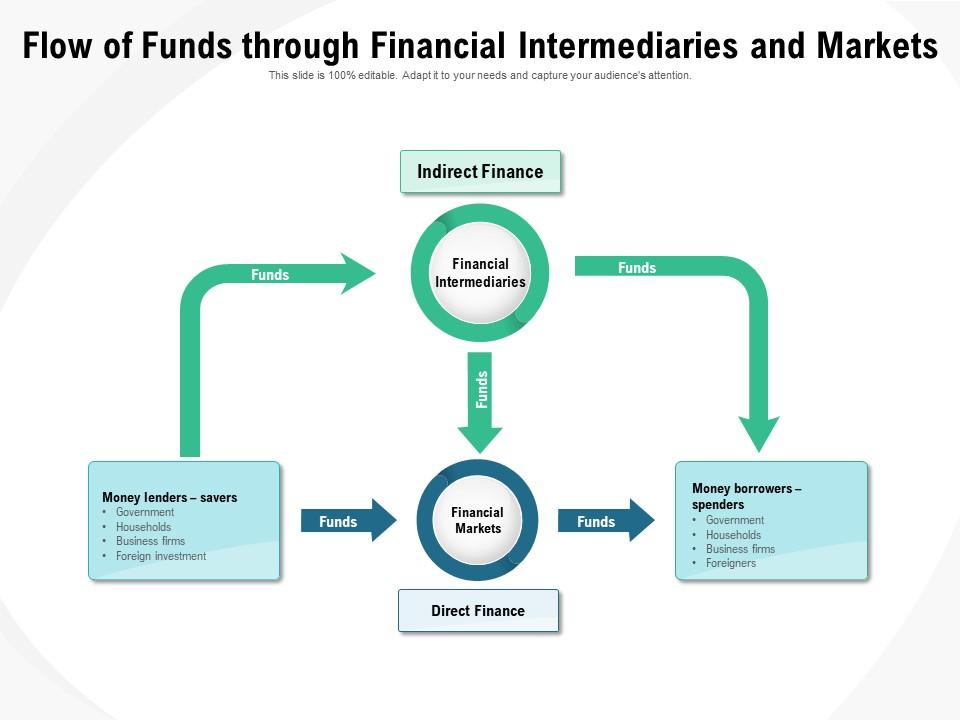

Flow of funds through financial intermediaries and markets

Being forthright is your forte. Our Flow Of Funds Through Financial Intermediaries And Markets embody that attitude.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting this set of slides with name Flow Of Funds Through Financial Intermediaries And Markets. This is a one stage process. The stages in this process are Indirect Finance, Funds, Financial Intermediaries, Financial Markets, Direct Finance, Money Borrowers, Money Lenders. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

The image depicts a graphical representation of the flow of funds through financial intermediaries and markets. The main title, "Flow of Funds through Financial Intermediaries and Markets," sets the context for the information presented on the slide, which is about the movement of funds in the financial sector.

There are two main paths indicated: Indirect Finance and Direct Finance. In the Indirect Finance path, funds flow from savers to financial intermediaries marked in the diagram as a green circle with overlapping arrows. Savers, here termed "money lenders," include households, government, business firms, and foreign investment. Financial intermediaries then direct the funds to borrowers (spenders), which include the government, households, business firms, and foreigners depicted in a blue rectangle on the right.

The Direct Finance flow shows funds moving straight from savers to financial markets and then to borrowers, bypassing financial intermediaries. This signifies that in direct finance, financial markets play a key role in connecting savers and borrowers directly.

Use Cases:

Different industries can make use of the slide to explain their role in the financial ecosystem, the flow of capital, or the function of markets and intermediaries within their operations or to their stakeholders.

1. Banking:

Use: To explain the role of banks as financial intermediaries.

Presenter: Financial Analyst

Audience: Bank Employees

2. Education:

Use: Teaching the concept of finance and capital flow.

Presenter: Professor

Audience: Students majoring in Finance

3. Investment Services:

Use: Illustrating how investment funds channel investor capital.

Presenter: Investment Advisor

Audience: Potential Investors

4. Government Finance:

Use: Describing public financing operations.

Presenter: Treasury Official

Audience: Policymakers

5. Corporate Finance:

Use: Explaining how corporations access capital.

Presenter: CFO

Audience: Shareholders

6. Non-Profit Sector:

Use: Demonstrating fund allocation and investment strategy.

Presenter: Finance Director

Audience: Board Members

7. Financial Technology:

Use: Showcasing the impact of fintech on direct and indirect finance models.

Presenter: Fintech Product Manager

Audience: Industry Experts

Flow of funds through financial intermediaries and markets with all 2 slides:

Display fortitude with our Flow Of Funds Through Financial Intermediaries And Markets. They encourage a fearless disposition.

No Reviews