Valuation ebitda method ppt powerpoint presentation file inspiration

Acquire elegance and articulateness with our Valuation EBITDA Method Ppt Powerpoint Presentation File Inspiration. Explain with accuracy and elan.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting this set of slides with name Valuation EBITDA Method Ppt Powerpoint Presentation File Inspiration. The topics discussed in these slides are Valuation, Growth, Market, Stabilization, Financial. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

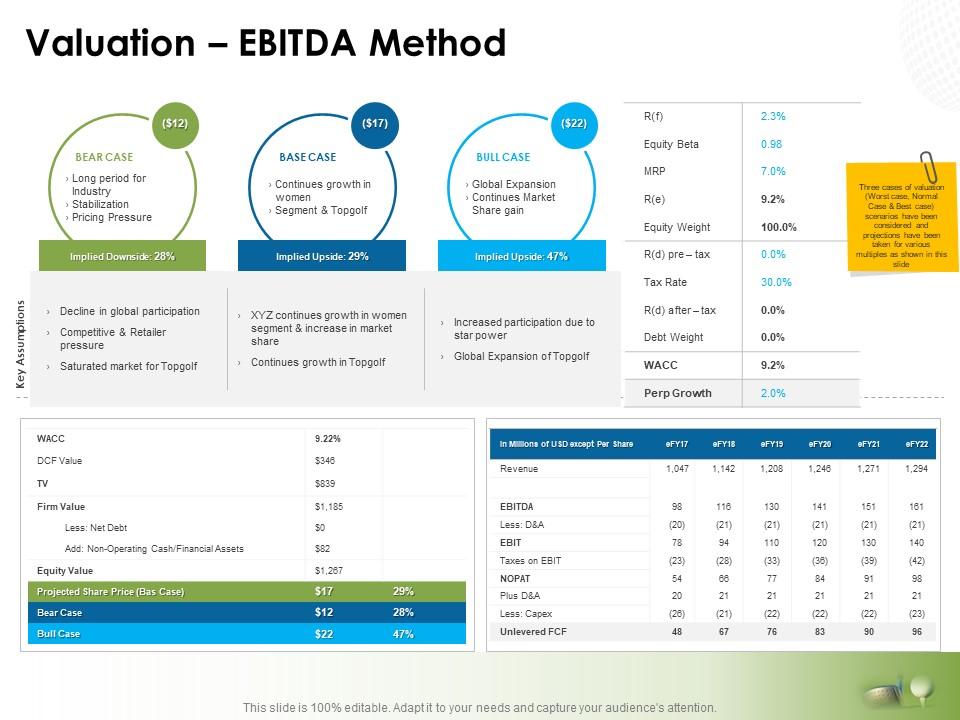

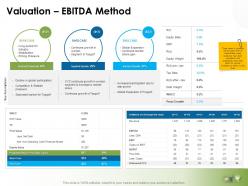

The image displays a slide on Valuation using the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) Method, which focuses on company valuation based on projected financial outcomes under different scenarios: Bear Case, Base Case, and Bull Case. In the Bear Case scenario, the valuation expected decrease (implied downside) is 28% due to a long period for industry stabilization, competitive and retailer pressure, and saturated market for Topgolf. The Base Case scenario assumes a 29% implied upside, considering the continuation of growth in the women's segment and Topgolf. The Bull Case projects an implied upside of 47%, factoring in a global market expansion and increased participation due to star power.

The right side of the slide details various financial metrics such as the Weighted Average Cost of Capital (WACC), Discounted Cash Flow (DCF) value, Terminal Value (TV), and Firm Value after accounting for net debt and adding non-operating cash/financial assets to establish Equity Value. The projected share price in the Base Case is $17, with variations for the Bear Case and Bull Case scenarios.

Below this, the table outlines historical and projected financial data including Revenue, EBITDA, and Unlevered Free Cash Flow (FCF), providing a structured financial overview spanning five fiscal years.

Use Cases:

This slide can be applied in various industries, such as:

1. Finance:

Use: Teaching valuation methods

Presenter: Finance Instructor

Audience: Finance Students

2. Investment Banking:

Use: Presenting valuation analyses to clients

Presenter: Investment Banker

Audience: Corporate Clients

3. Private Equity:

Use: Justifying investment decisions

Presenter: Private Equity Analyst

Audience: Firm Partners or Investment Committee

4. Management Consulting:

Use: Advising on company valuations during strategic decision-making

Presenter: Management Consultant

Audience: C-level Executives

5. Venture Capital:

Use: Assessing startup valuations for potential investments

Presenter: Venture Capitalist

Audience: Venture Partners

6. Corporate Finance:

Use: Internal presentations for M&A or fundraising activities

Presenter: Corporate Finance Manager

Audience: Board of Directors

7. Accounting:

Use: Demonstrating EBITDA calculations and its impact on valuations

Presenter: Accountant or Auditor

Audience: Accounting Trainees or Clients

Valuation ebitda method ppt powerpoint presentation file inspiration with all 5 slides:

Our Valuation EBITDA Method Ppt Powerpoint Presentation File Inspiration are among the fancied breeds. They belong to the chic firmament.

No Reviews