A Guide To ICO Cryptocurrency Training Ppt

This set of slides covers the concept of ICO Initial Coin Offering in cryptocurrency. It includes the ICO process, advantages, disadvantages, and the difference between ICO and IPO. Further, in detail, it covers ICO scams such as bounty, exit or rug pull, white paper plagiarism, exchange scam, and URL scams.

This set of slides covers the concept of ICO Initial Coin Offering in cryptocurrency. It includes the ICO process, advantag..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting A Guide to ICO Cryptocurrency. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. You can add or delete the content as per your need.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide gives an introduction to an Initial Coin Offering (ICO). The cryptocurrency industry's equivalent of an IPO is an Initial Coin Offering (ICO). A firm can use an ICO to acquire funding to develop a new coin, app, or service

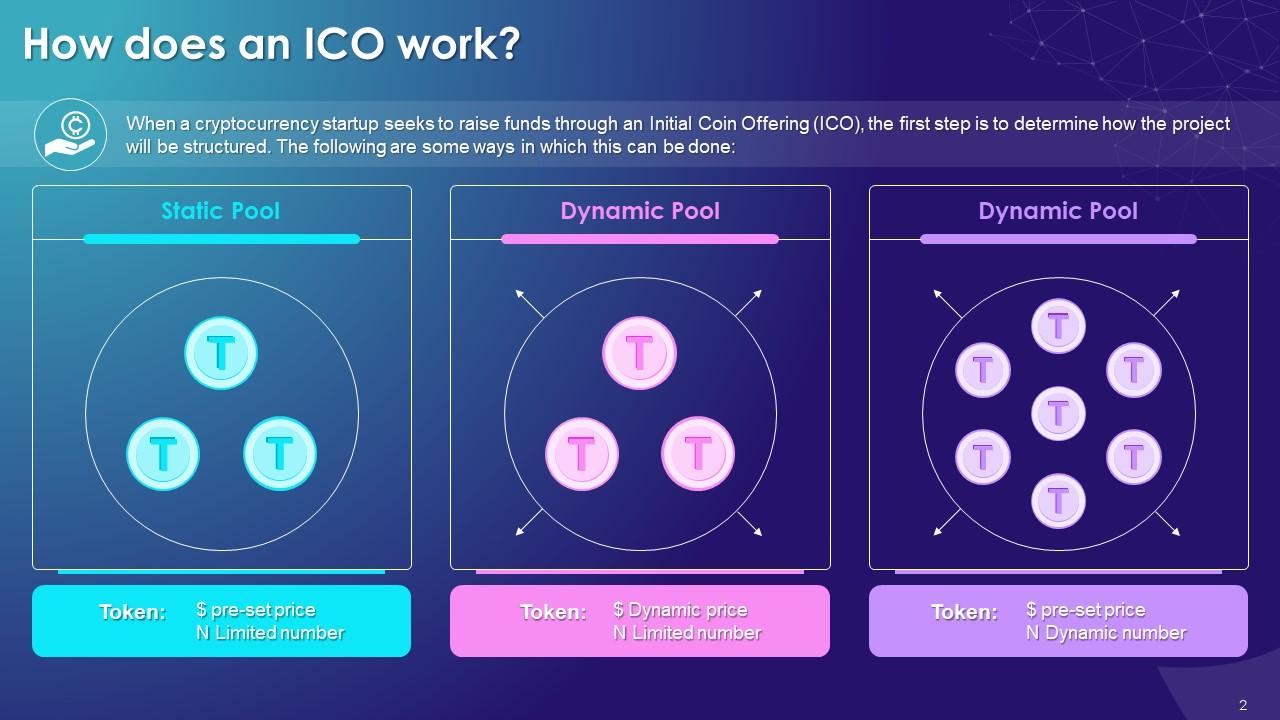

Slide 2

This slide discusses the types of ICO structures. When a cryptocurrency startup seeks to raise funds through an ICO, the first step is to determine how the project will be structured. These structures are static supply & static price, static supply & dynamic price, and dynamic supply & static price.

Instructor’s Notes:

- Static Supply & Static Price: A company can establish a specified financial goal or limit, which means that the price of each token sold in the ICO is predetermined, and the total token supply is fixed

- Static Supply & Dynamic Price: An ICO can have a fixed supply of tokens and a dynamic financing goal, which means that the overall price per token is determined by the amount of money raised in the ICO

- Dynamic Supply & Dynamic Price: Sometimes ICOs have a dynamic token supply but a fixed price, which means that the supply is determined by the money to be raised

Slide 3

This slide showcases the step by step process of how an ICO works. The first step involves the identification of investment targets, followed by creation of tokens, promotion campaigns, and finally the initial offering.

Instructor’s Notes:

- Identification of Investment Targets: Each ICO begins with a company's desire to raise funds. The company decides the fundraising campaign's target audience and prepares the required material for potential investors to learn more about the company

- Creation of Tokens: The generation of tokens is the next step in ICO. In other words, the tokens are blockchain representations of an asset or utility, and are tradeable and fungible

- Promotion Campaign: A corporation will typically undertake a promotion campaign at the same time to attract possible investors. It's worth noting that most campaigns are run online to reach as many investors as possible. ICO advertising is now prohibited on significant web platforms, including Facebook and Google

- Initial Offering: The tokens are then offered to investors. It is possible that the offering may be divided into numerous rounds. The company can then use the ICO money to create a new product or service. At the same time, investors may use the tokens they bought to benefit from this product or service or wait for the tokens' value to increase

Slide 4

This slide discusses prerequisites for launching an ICO. Anyone with access to technology can launch an ICO. Since ICOs are currently unregulated in the United States, anyone with access to the necessary technology is allowed to float a new cryptocurrency.

Slide 5

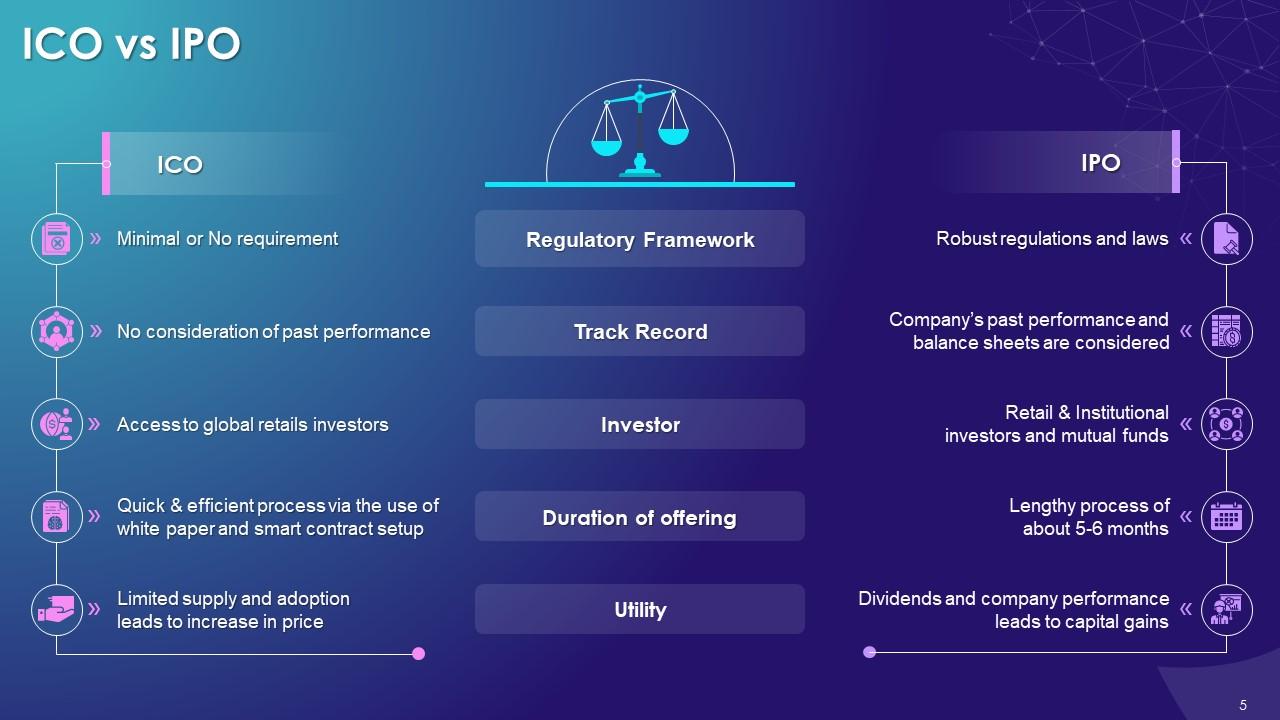

This slide depicts the difference between an Initial Coin Offering and an Initial Public Offering based on parameters such as regulatory framework, track record, investors, duration of offering, and utility.

Slide 6

This slide showcases the procedure of participating in an ICO. The first step is registering with a cryptocurrency exchange, followed by exchanging fiat currency for cryptocurrency, setting up your wallet, transferring cryptocurrency to your wallet, buying ICO tokens, and finally securing your tokens.

Instructor’s Notes:

- Register with a Crypto Exchange: Cryptocurrencies, such as Ether or Bitcoin, are required to participate in an ICO. Fiat currency cannot be used to participate in an ICO, and online exchanges are the most convenient way to buy Bitcoin

- Exchange Fiat Currency for Cryptocurrency: You can swap EUR, USD, and other currencies for the cryptocurrency you wish to buy once you've created an account with an exchange

- Setup Wallet: The Ethereum network hosts the majority of today's token sales. As a result, you'll need an Ethereum wallet to participate in the token sale. Not all wallets are appropriate for ICOs, and MetaMask and MyEtherWallet are the most user-friendly and generally approved Ethereum wallets

Transfer cryptocurrency from exchange to your wallet: Your cryptocurrencies will be transferred to an online wallet the exchange you registered with for token sale participation will provide. Move your funds to a wallet that is under your control

- Buy ICO Tokens: When the token sale begins, you must pay ETH to the company's designated address. You'll need to set an appropriate gas limit, which the MetaMask interface will govern

- Secure Tokens: Make sure to move your tokens from your MetaMask – or MyEtherWallet, or Parity – address to a safer wallet after you receive your tokens. You'll need some additional ETH (a little amount) in your wallet to cover the fees of transmitting money from one wallet to another

Slide 7

This slide lists the types of ICO scams such as bounty scam, exit/rug pull scam, white paper plagiarism scam, exchange scam, URL scam, and ponzi scheme.

Slide 8

This slide talks about bounty scam as a type of ICO scam. In this very often scam, the ICO fails to pay out promoters who were promised monetary benefits for their public relations efforts.

Slide 9

This slide talks about exit/rug pull scam as a type of ICO scam. An exit scam is a fraudulent activity perpetrated by unethical cryptocurrency promoters who collect funds for an ICO and then vanish without providing investors with any information.

Slide 10

This slide talks about white paper plagiarism as a type of ICO scam. In a white paper plagiarism scam, a scammer attempts to copy a prospective ICO's white paper and launch it under a similar or different name

Slide 11

This slide talks about exchange scam as a type of ICO scam. An "exchange scam" occurs when scamsters intend to deceive investors into believing that their ICO has been launched on an authentic exchange, whereas it is fake.

Slide 12

This slide talks about URL scam as a type of ICO scam. Another common technique is to create fraudulent ICO websites and advise consumers to deposit money into a compromised wallet. Due to such phony websites, naive investors, ignorant of legitimate websites are misled and lose their ICOs.

Slide 13

This slide talks about the ponzi scheme as a type of ICO scam. Scamsters lure new investors to invest funds in high-return possibilities, claiming that there is little or no risk. Such fraudsters offer unrealistic returns and at a later time to entice more investors.

Slide 14

This slide talks about the advantages of Initial Coin Offering. These include online accessibility, high liquidity, high return on investment, and less paperwork.

Instructor’s Notes:

- Online Accessibility: A significant benefit of an ICO is that all transactions are completed online, and everything can be easily researched and traced via the internet

- High Liquidity: The quality of an item to be promptly bought or sold in the market without significantly influencing its value is referred to as high liquidity. Crypto coins are comparatively more liquid than other assets and can move faster because they are safe and do not require a physical form to be swapped

- High Return on Investment: Most successful ICOs began with a low market value and progressively gained more value. What makes these ICOs so successful is that they were able to offer investors something different and exciting that other ICOs couldn't

- Negligible Paperwork: Traditional assets like Initial Public Offerings (IPOs), stocks, bonds, and other exchange forms rely on different regulatory filings, taking up a lot of time and effort. ICOs rely on blockchain technology to keep a ledger of their transactions, making them more attractive than IPOs and other traditional assets

Slide 15

This slide talks about the disadvantages of an Initial Coin Offering. These include volatility, lack of accountability, and potential fraud.

Instructor’s Notes:

- Volatility: Blockchain in a dynamic technology and evolves dramatically. This means that the value of the asset fluctuates very fast

- Lack Accountability: Many ICOs are the result of start-up enterprises and other private entities lacking the capital to launch their potential ideas. While investors can anticipate significant investment returns, there is no guarantee that the companies in question will be able to deliver on their promises

- Potential Fraud: Many ICOs are not regulated in the same way that IPOs and other traditional assets are. This makes them easier to get and more accessible,but it also makes them more open to fraud and other nefarious acts. All of this means that unlawful players may defraud unsuspecting investors

Slide 16

This slide highlights successful ICOs. The ICO of Ethereum in 2014 was an early and now a well-known example of an Initial Coin Offering. Over a period of 42 days, the Ethereum ICO raised $18 million. A two-phase ICO was launched in 2015 for a firm called Antshares, which was eventually rebranded as Neo. This ICO had two phases, the first of which finished in October 2015 and the second of which ran until September 2016. Neo made around $4.5 million. Another example is Dragon Coin, which raised $13 million in a one-month ICO that closed in March 2018.

A Guide To ICO Cryptocurrency Training Ppt with all 32 slides:

Use our A Guide To ICO Cryptocurrency Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

I want to thank SlideTeam for the work that they do, especially their customer service.

-

Love the template collection they have! I have prepared for my meetings much faster without worrying about designing a whole presentation from scratch.