Asset Allocation Investment Strategy To Balance Risk And Reward Complete Deck

Here is a competently designed Asset Allocation Investment Strategy to Balance Risk and Reward PowerPoint Presentation. The Asset Allocation Strategy Implementation Guide is an all-encompassing tool crafted to assist investors in realizing their investment goals by efficiently executing asset allocation strategies. This PowerPoint furnishes an in-depth understanding of the strategy, highlighting its significance and outlining the steps for devising an effective plan. Additionally, the Investment Diversification Approach deck slides steer investors through establishing investment objectives and ascertaining an appropriate asset mix based on risk tolerance levels. It delves into various asset classes, dissecting their attributes and equipping investors with the requisite knowledge to make informed allocation choices. Furthermore, it encompasses the crucial aspect of portfolio rebalancing, elucidating its significance and the periodic steps involved in recalibrating an investment portfolio. It offers an overview of diverse asset allocation strategies strategic, tactical, dynamic, constant-weight, insured, and integrated asset allocation. Lastly, Our Asset Allocation Strategy Implementation Guide adopts a comprehensive approach to aid investors in optimizing their investment returns while mitigating risks. It analyzes the impact on returns and incorporates monitoring dashboards to track asset performance in the long run. Get access to this 100 percent editable template now.

Here is a competently designed Asset Allocation Investment Strategy to Balance Risk and Reward PowerPoint Presentation. The..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Asset Allocation Investment Strategy To Balance Risk And Reward Complete Deck is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the eighty two slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Asset Allocation Investment Strategy to Balance Risk and Reward. State your company name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide shows title for topics that are to be covered next in the template.

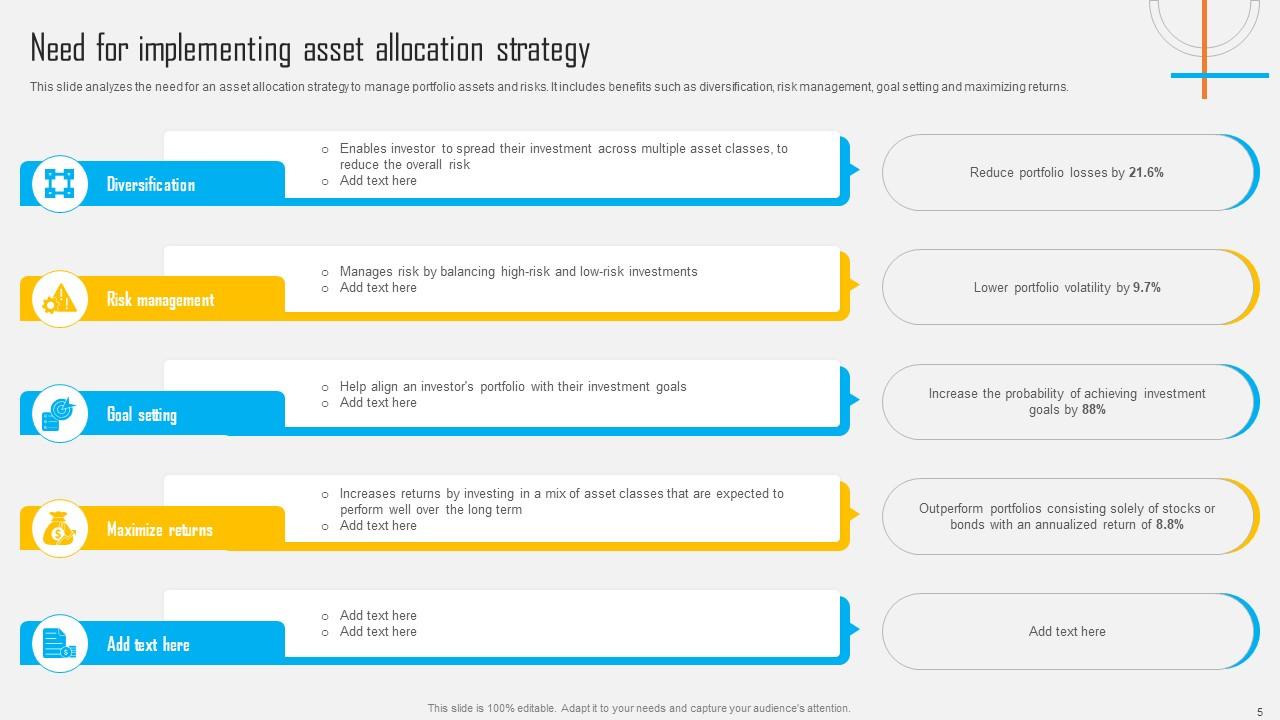

Slide 5: This slide analyzes the need for an asset allocation strategy to manage portfolio assets and risks.

Slide 6: This slide shows title for topics that are to be covered next in the template.

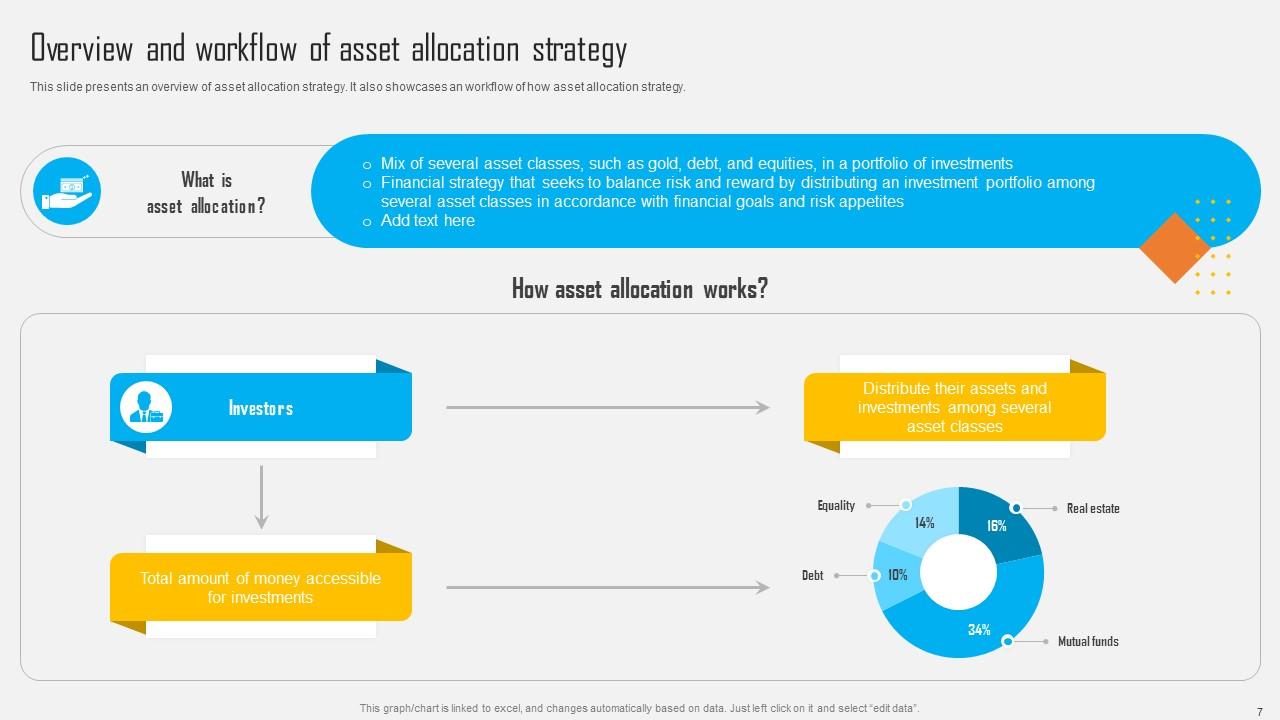

Slide 7: This slide presents an overview of asset allocation strategy. It also showcases an workflow of how asset allocation strategy.

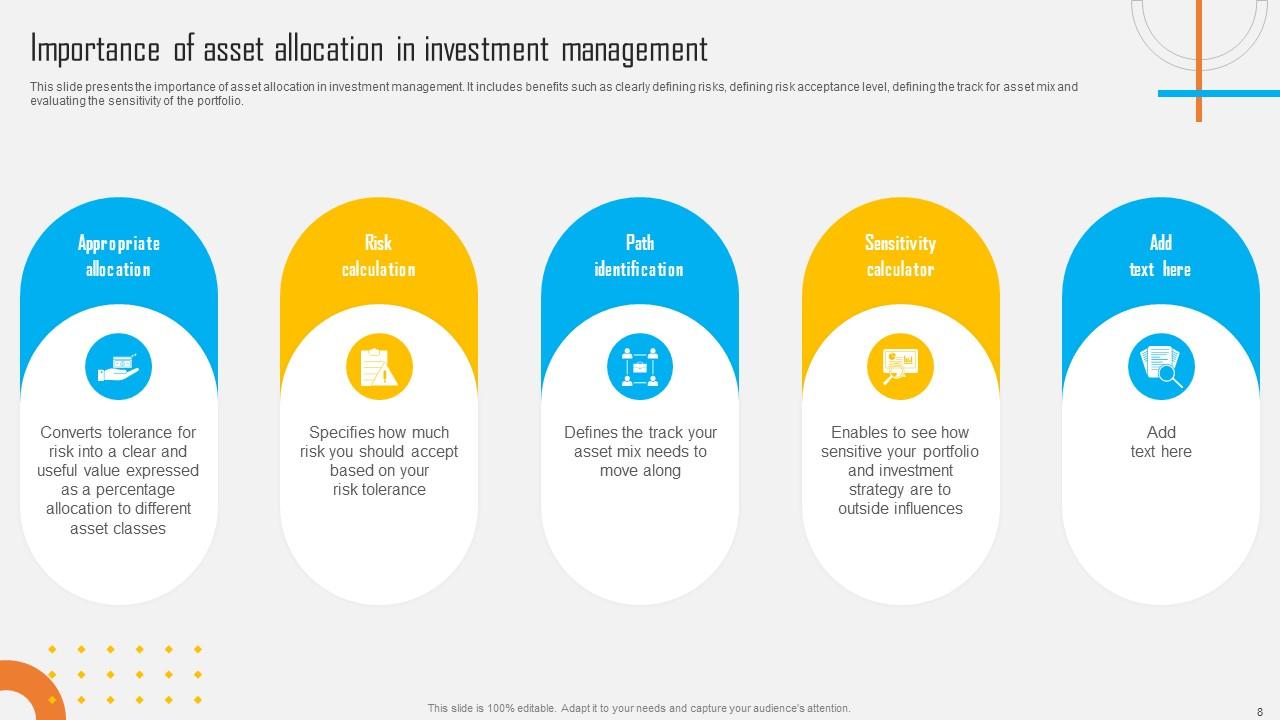

Slide 8: This slide displays the importance of asset allocation in investment management. It includes benefits such as clearly defining risks, defining risk acceptance level etc.

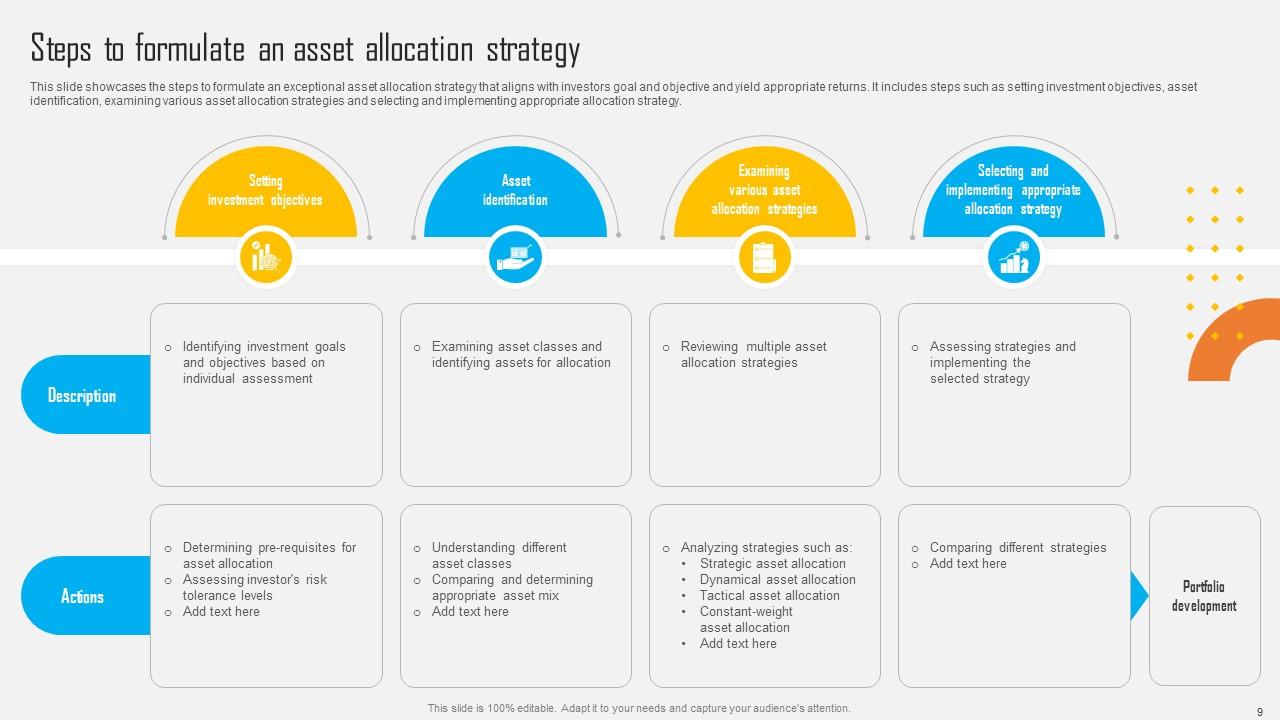

Slide 9: This slide showcases the steps to formulate an exceptional asset allocation strategy that aligns with investors goal and objective and yield appropriate returns.

Slide 10: This slide shows title for topics that are to be covered next in the template.

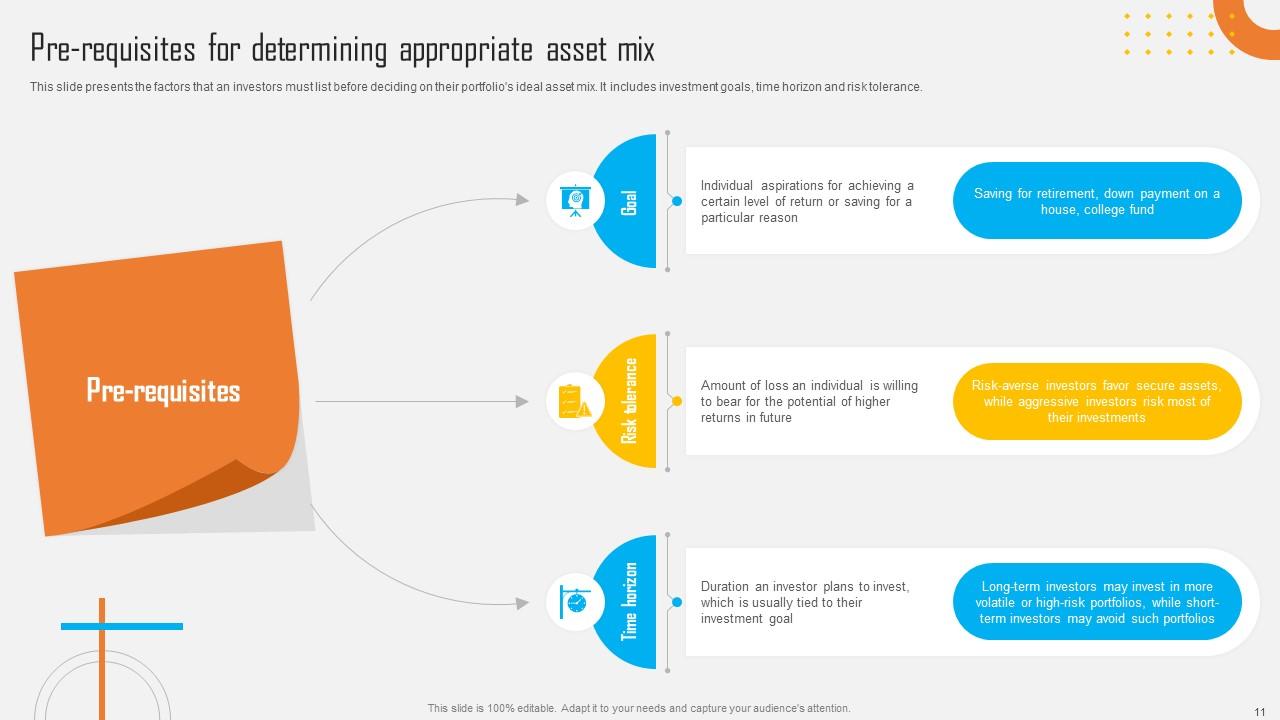

Slide 11: This slide presents the factors that an investors must list before deciding on their portfolio's ideal asset mix.

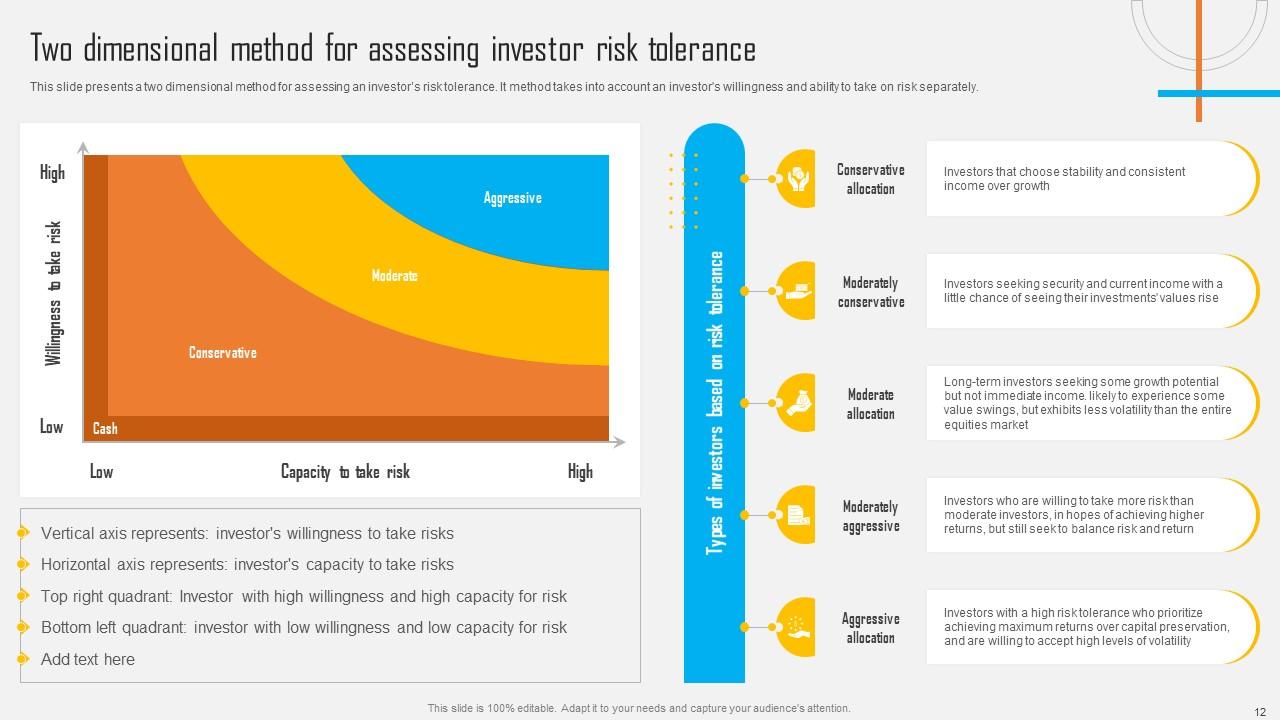

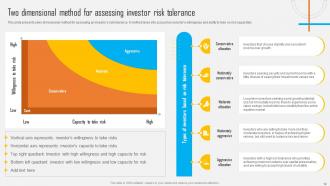

Slide 12: This slide displays a two dimensional method for assessing an investor’s risk tolerance.

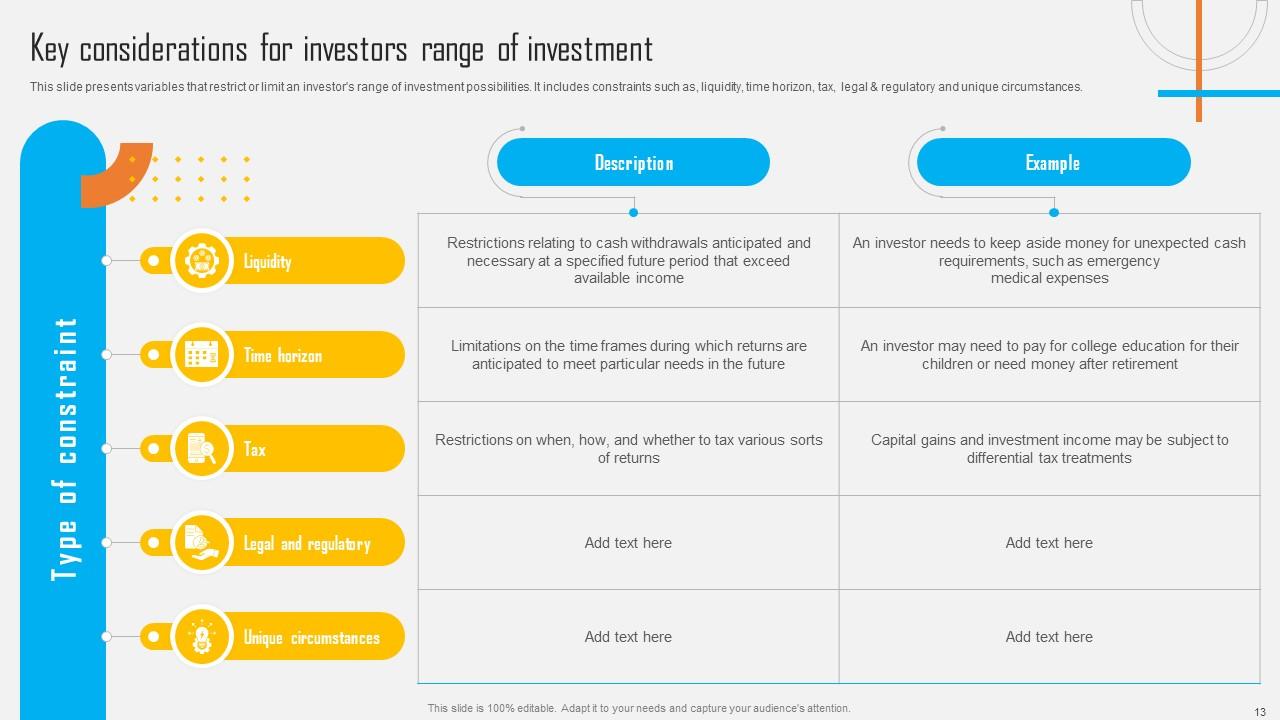

Slide 13: This slide presents variables that restrict or limit an investor's range of investment possibilities.

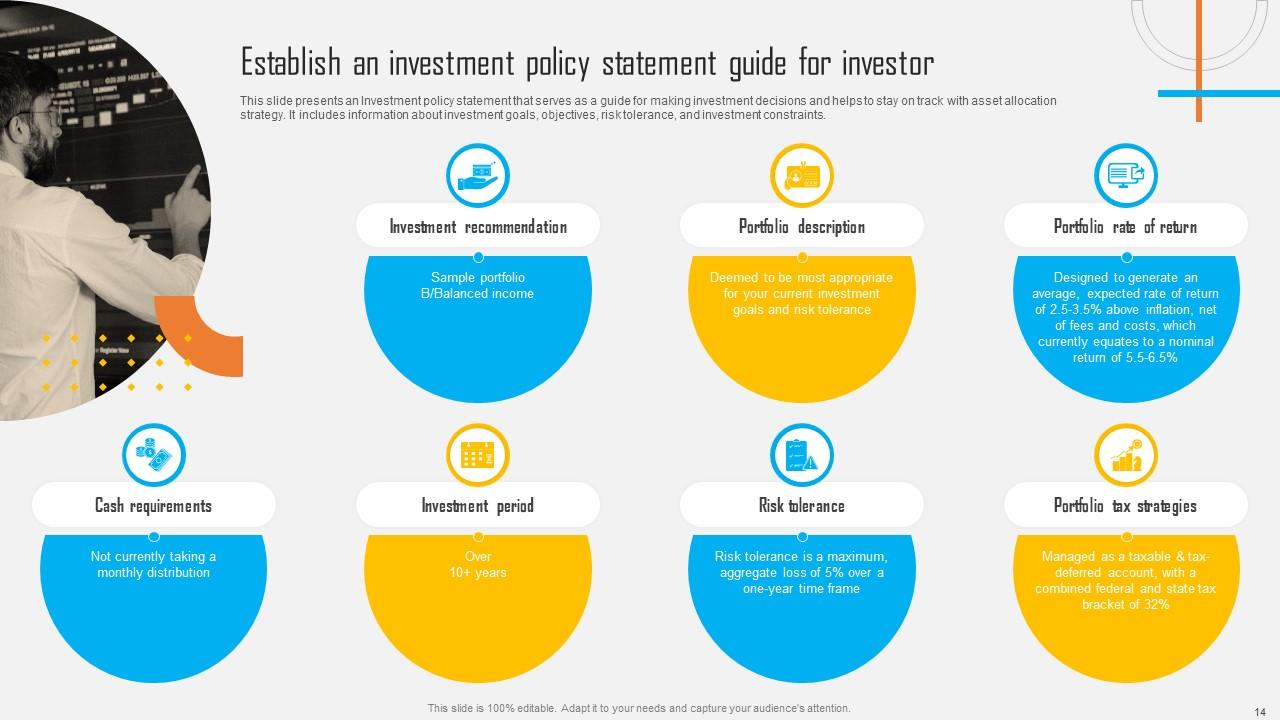

Slide 14: This slide displays an Investment policy statement that serves as a guide for making investment decisions and helps to stay on track with asset allocation strategy.

Slide 15: This slide shows title for topics that are to be covered next in the template.

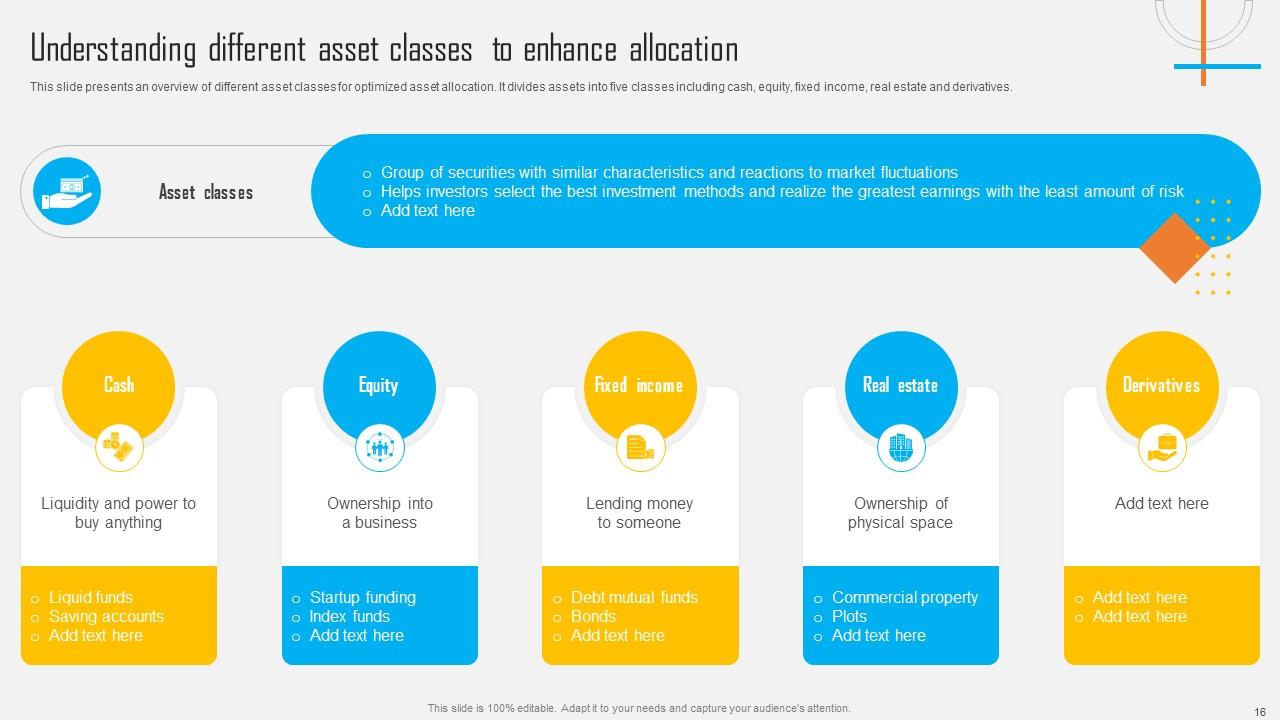

Slide 16: This slide presents an overview of different asset classes for optimized asset allocation. It divides assets into five classes including cash, equity, fixed income etc.

Slide 17: This slide displays the characteristics of various asset classes, resources sharing similar characteristics.

Slide 18: This slide presents a comparison of different asset classes to help select the optimum options.

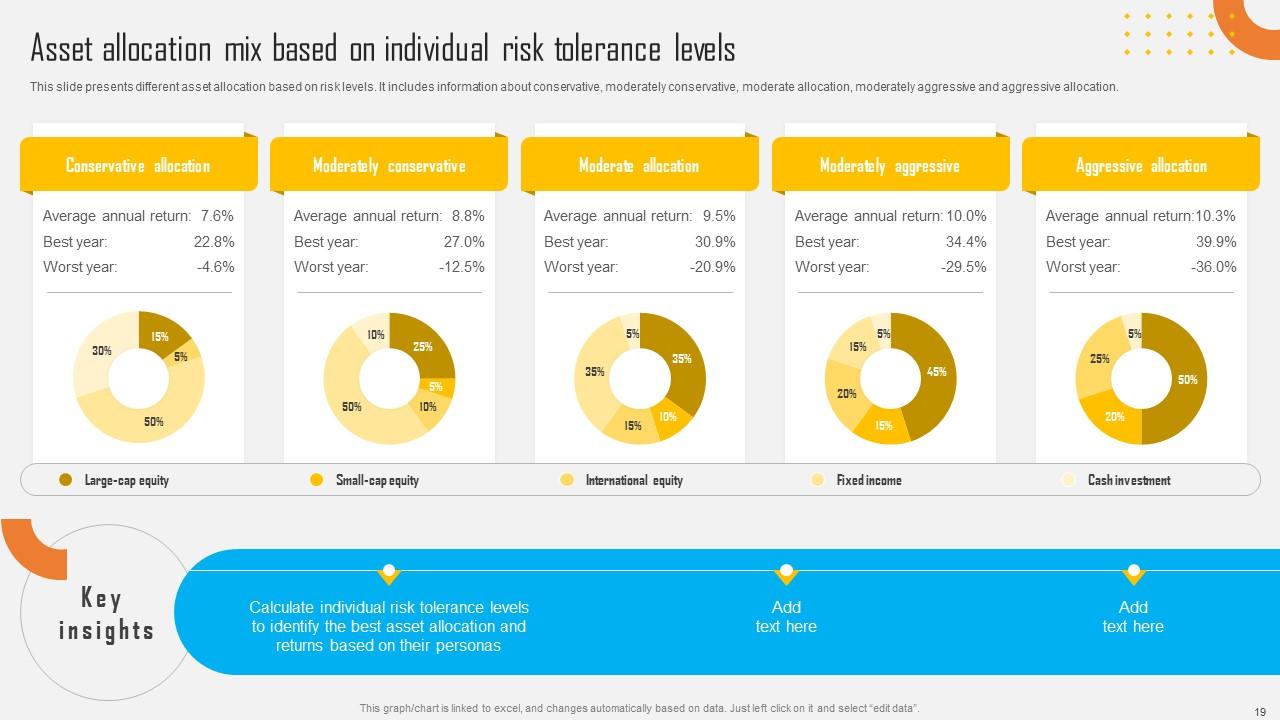

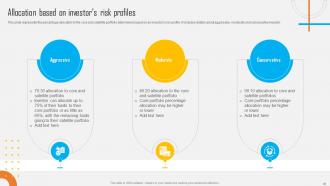

Slide 19: This slide displays different asset allocation based on risk levels. It includes information about conservative, moderately conservative etc.

Slide 20: This slide shows title for topics that are to be covered next in the template.

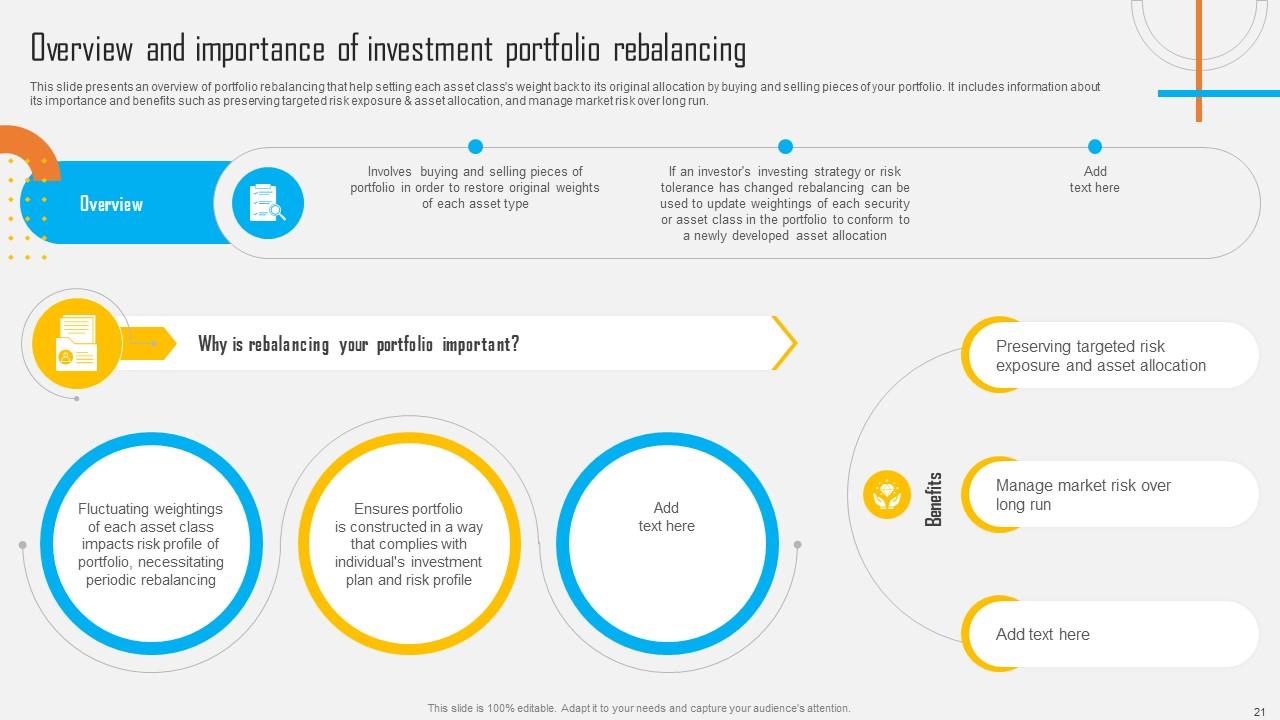

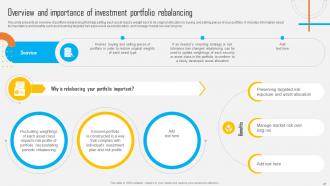

Slide 21: This slide presents an overview of portfolio rebalancing that help setting each asset class's weight back to its original allocation.

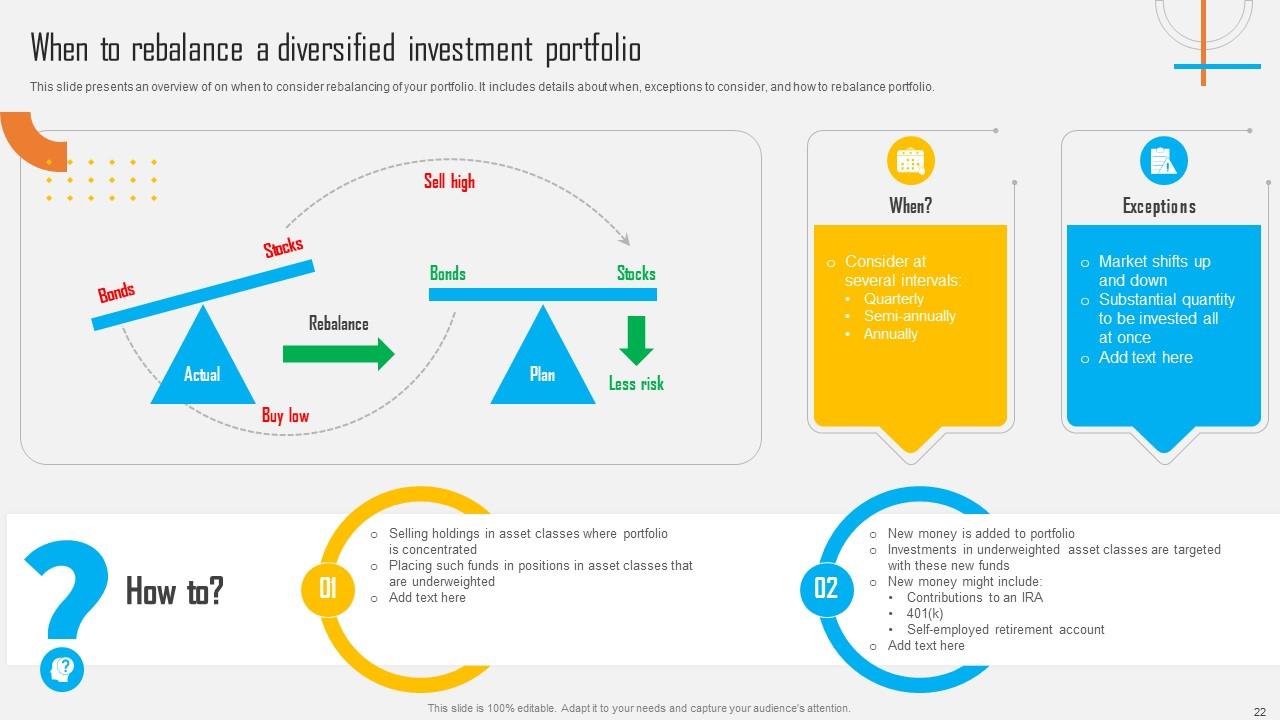

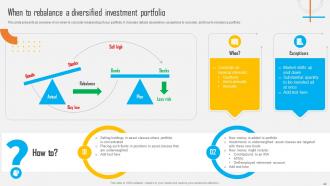

Slide 22: This slide displays an overview of on when to consider rebalancing of your portfolio. It includes details about when, exceptions to consider, and how to rebalance portfolio.

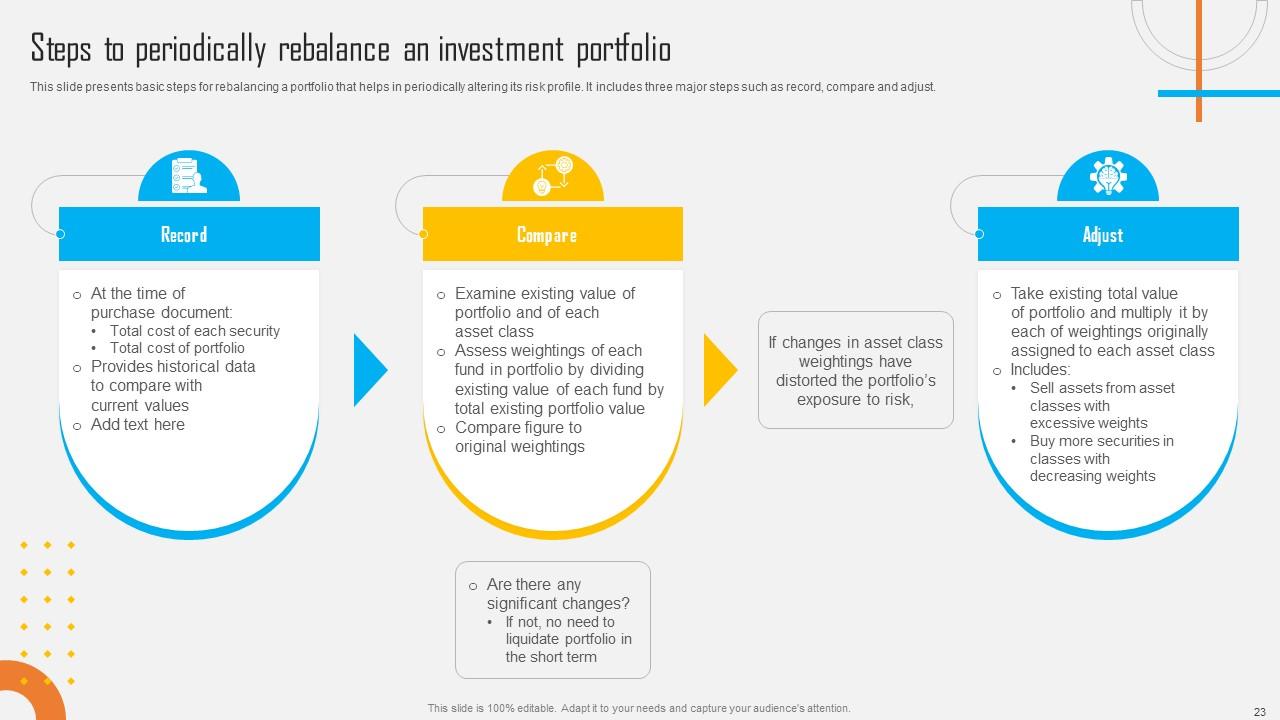

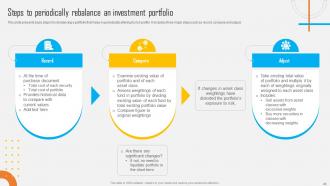

Slide 23: This slide presents basic steps for rebalancing a portfolio that helps in periodically altering its risk profile.

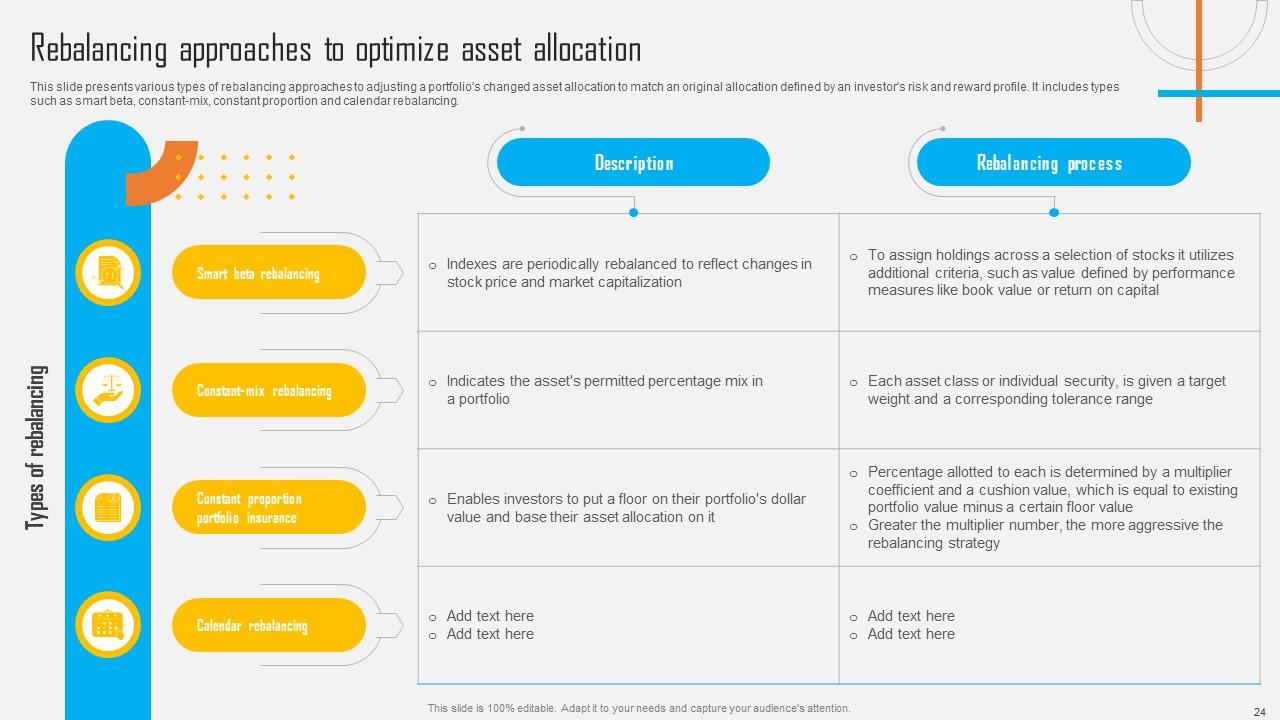

Slide 24: This slide displays various types of rebalancing approaches to adjusting a portfolio's changed asset allocation to match an original allocation.

Slide 25: This slide shows title for topics that are to be covered next in the template.

Slide 26: This slide presents an overview of strategic asset allocation strategy for optimal investment.

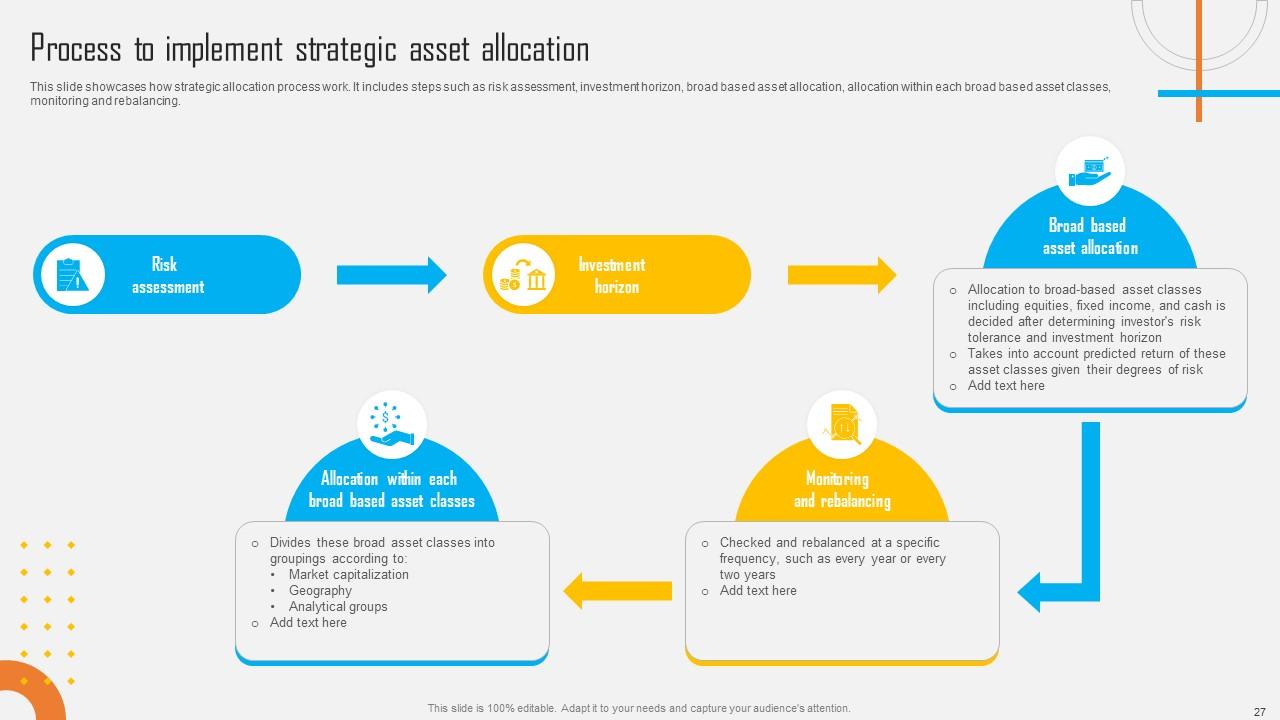

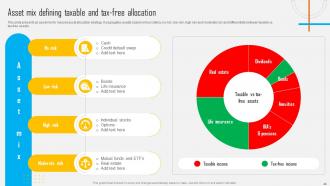

Slide 27: This slide showcases how strategic allocation process work. It includes steps such as risk assessment, investment horizon, broad based asset allocation etc.

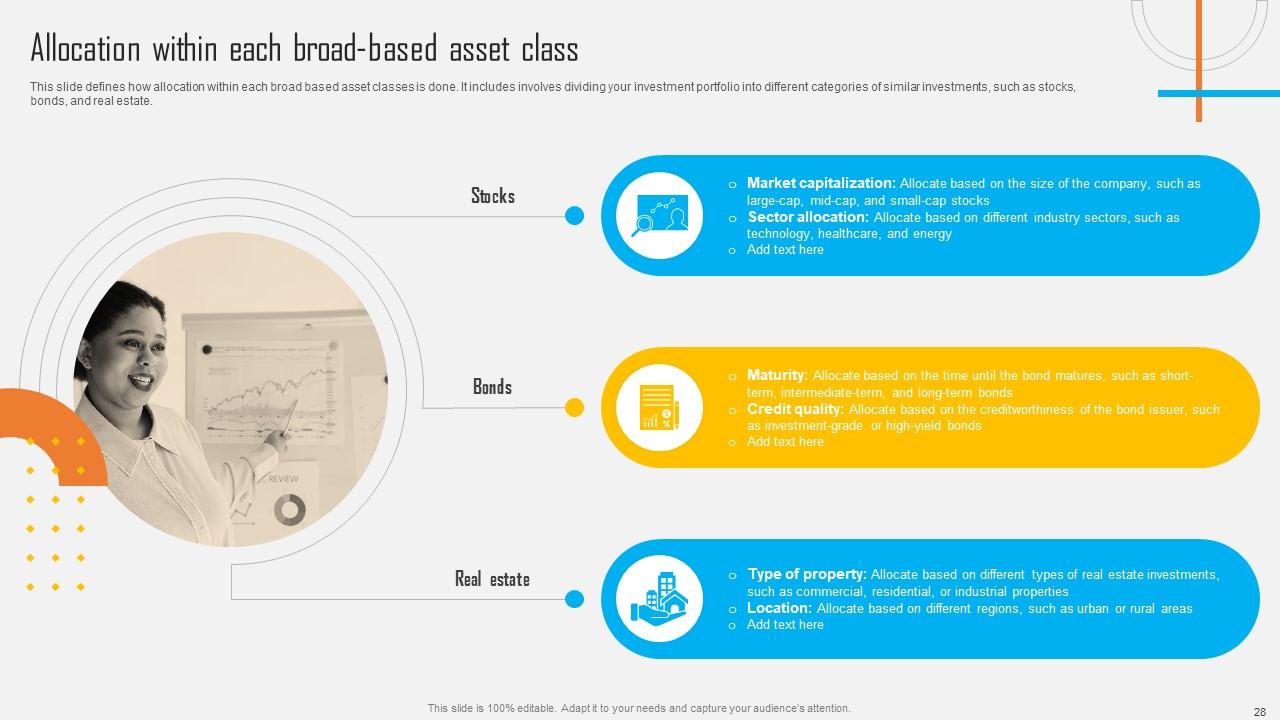

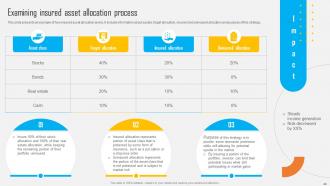

Slide 28: This slide defines how allocation within each broad based asset classes is done.

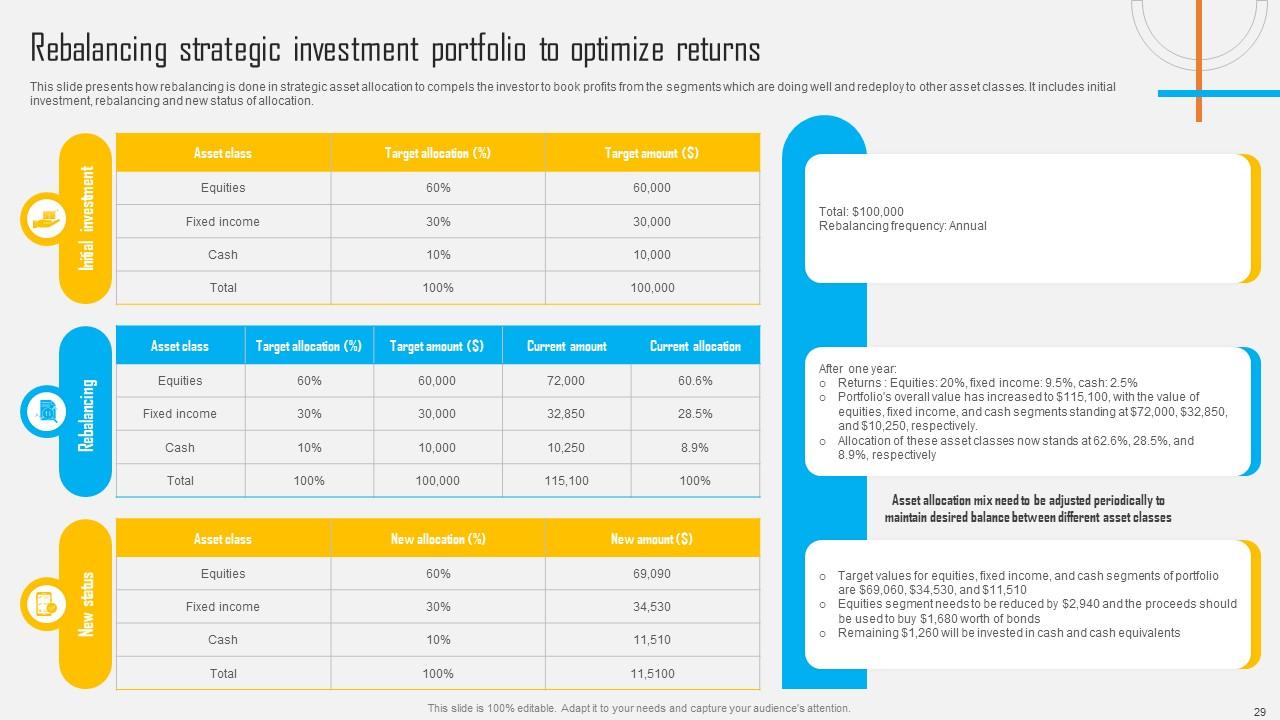

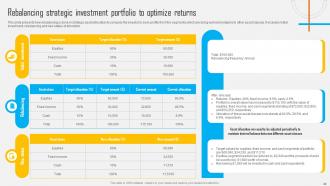

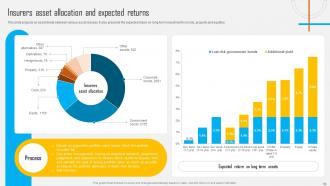

Slide 29: This slide presents how rebalancing is done in strategic asset allocation to compels the investor to book profits from the segments.

Slide 30: This slide shows title for topics that are to be covered next in the template.

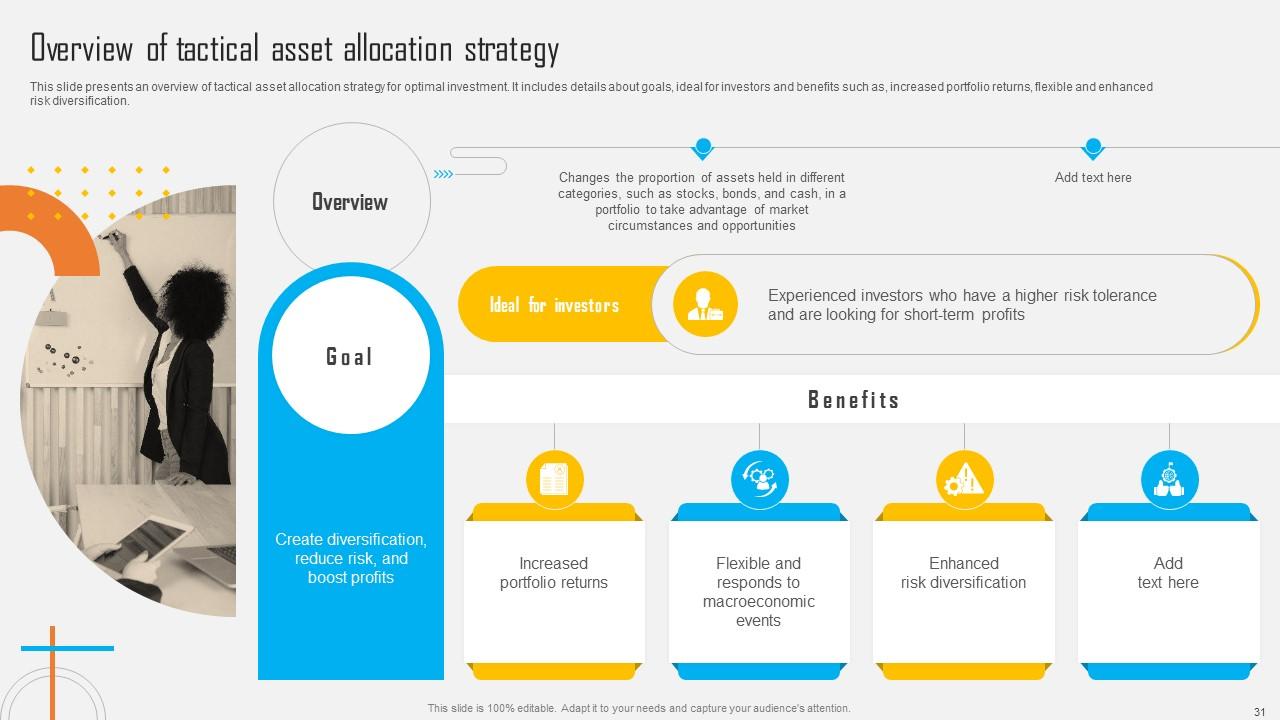

Slide 31: This slide presents an overview of tactical asset allocation strategy for optimal investment.

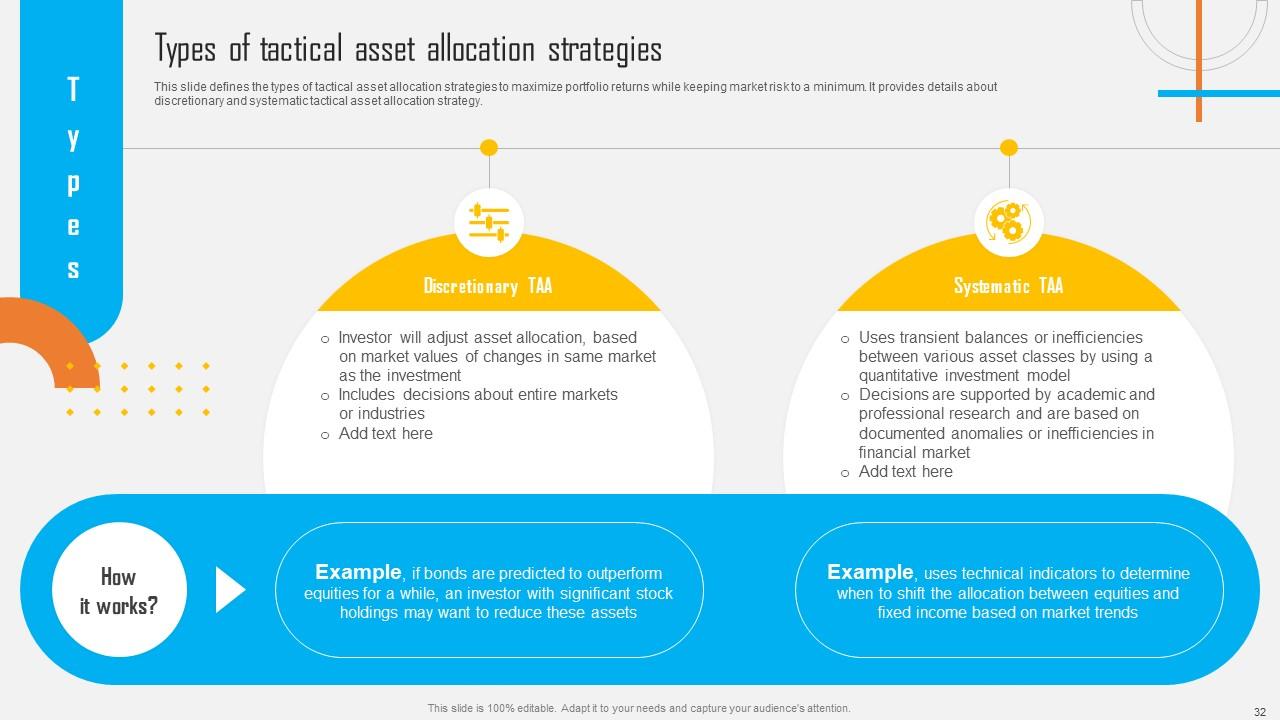

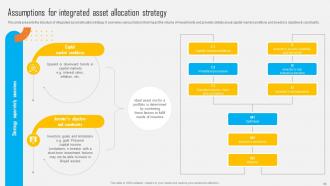

Slide 32: This slide defines the types of tactical asset allocation strategies to maximize portfolio returns while keeping market risk to a minimum.

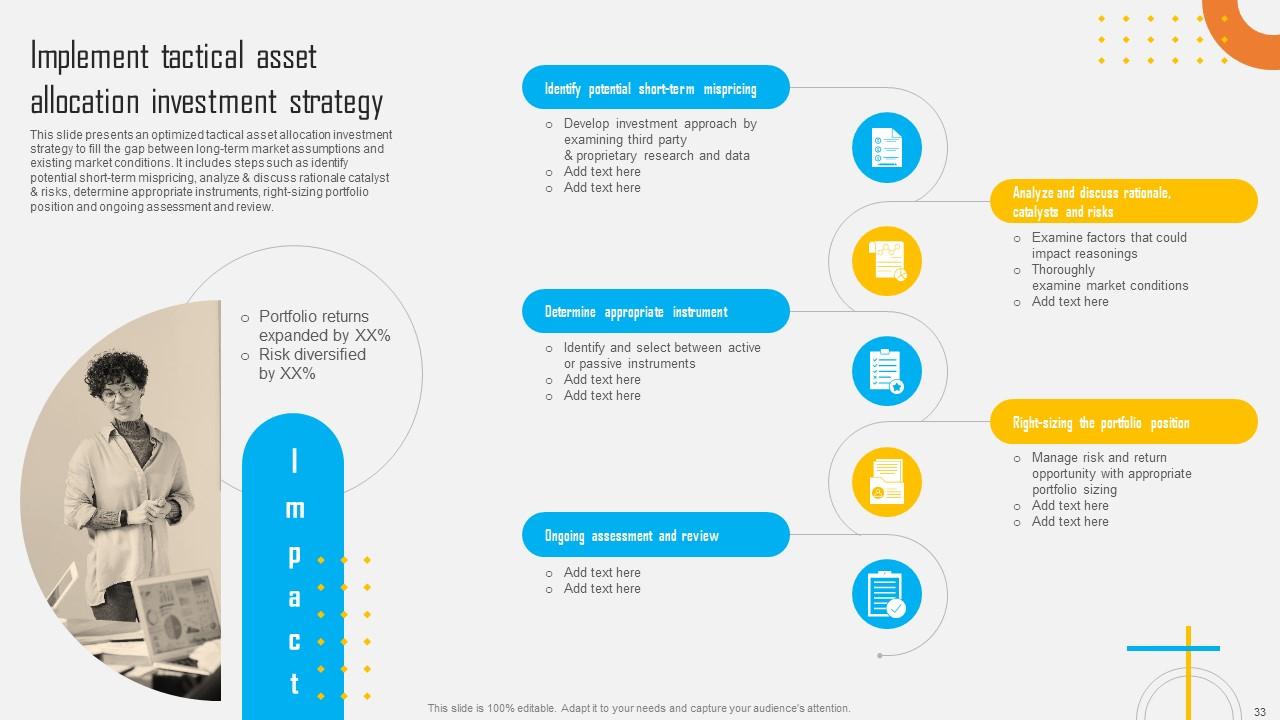

Slide 33: This slide presents an optimized tactical asset allocation investment strategy to fill the gap between long-term market assumptions and existing market conditions.

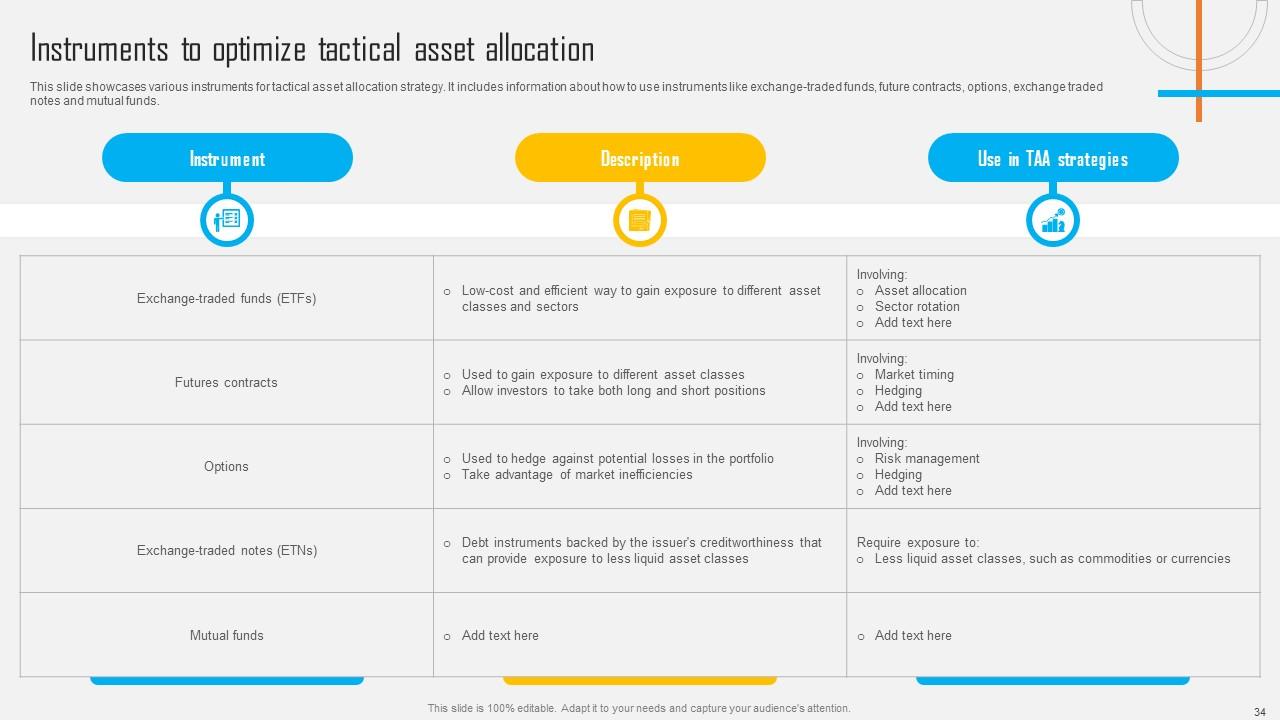

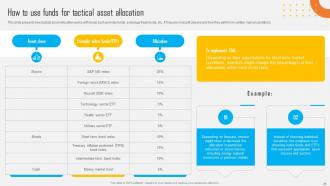

Slide 34: This slide showcases various instruments for tactical asset allocation strategy.

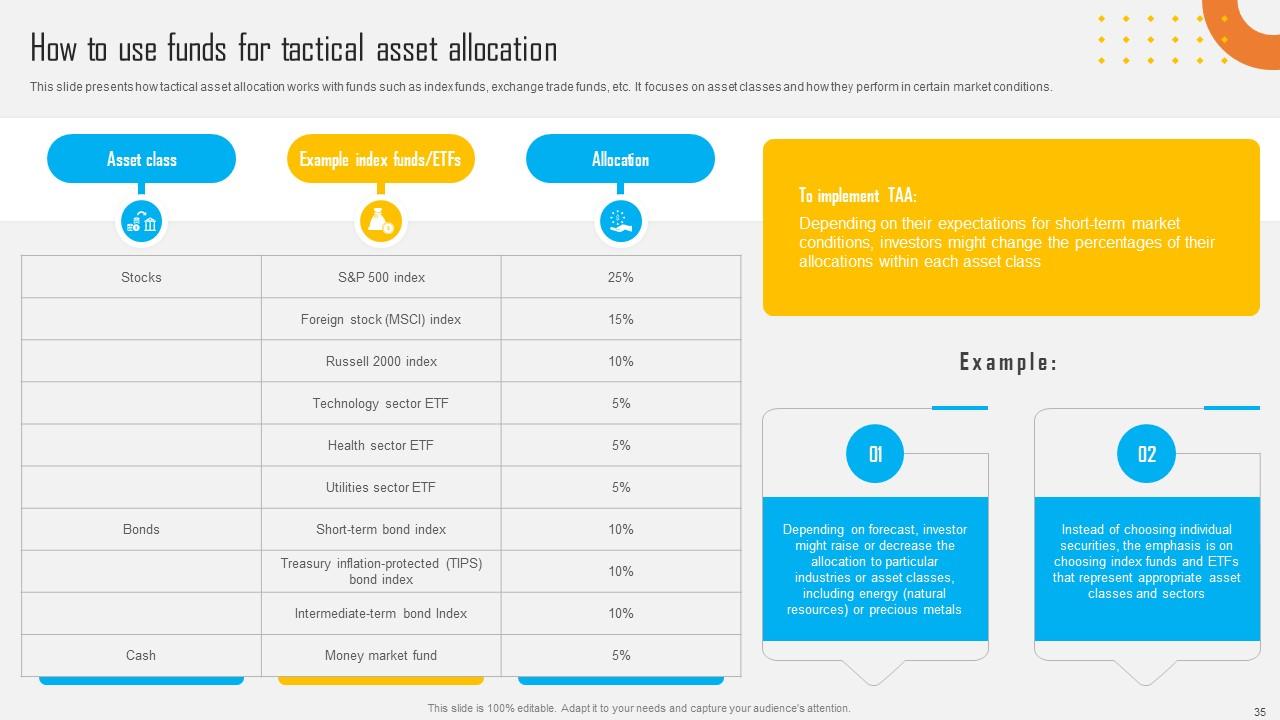

Slide 35: This slide presents how tactical asset allocation works with funds such as index funds, exchange trade funds, etc.

Slide 36: This slide shows title for topics that are to be covered next in the template.

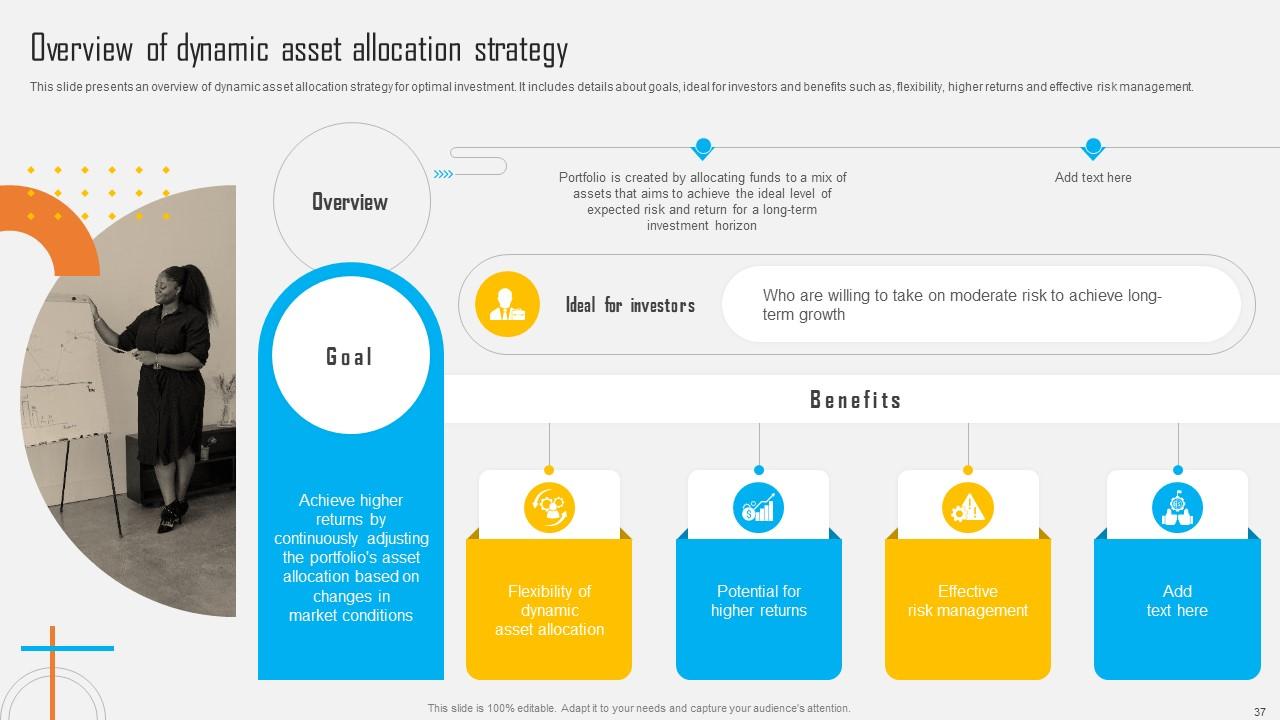

Slide 37: This slide presents an overview of dynamic asset allocation strategy for optimal investment. It includes details about goals, ideal for investors.

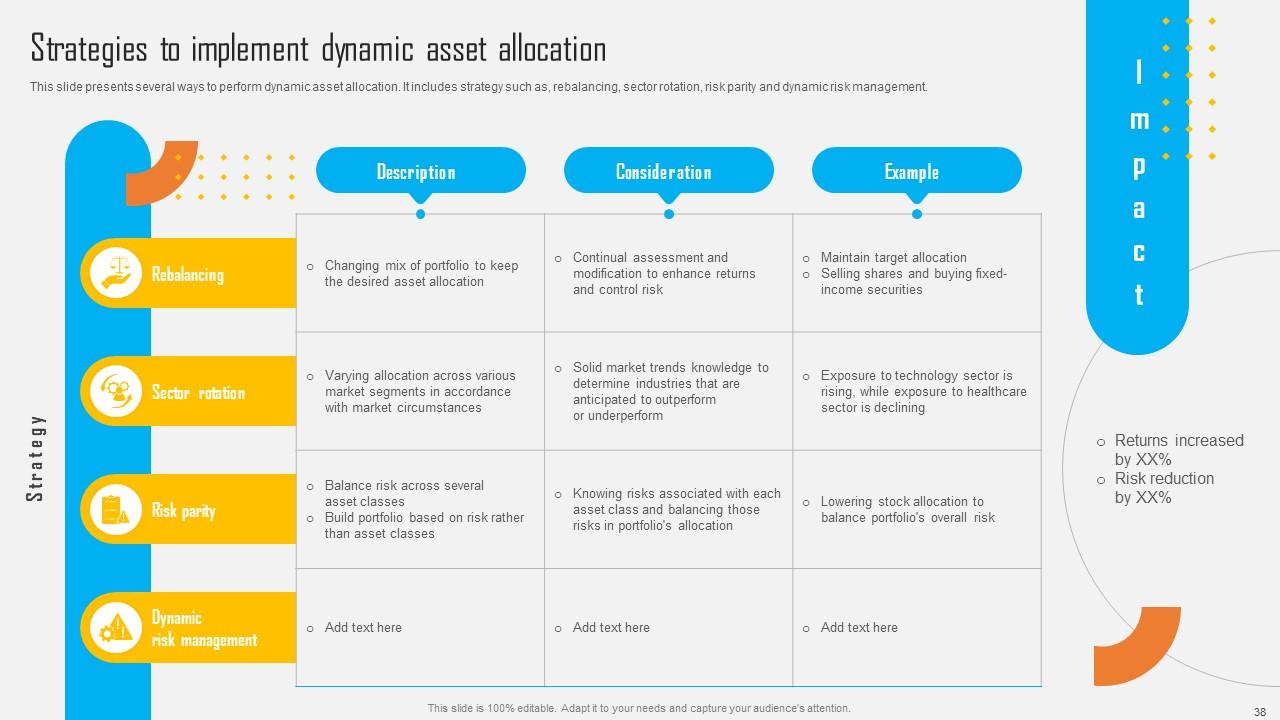

Slide 38: This slide displays several ways to perform dynamic asset allocation. It includes strategy such as, rebalancing, sector rotation, risk parity and dynamic risk management.

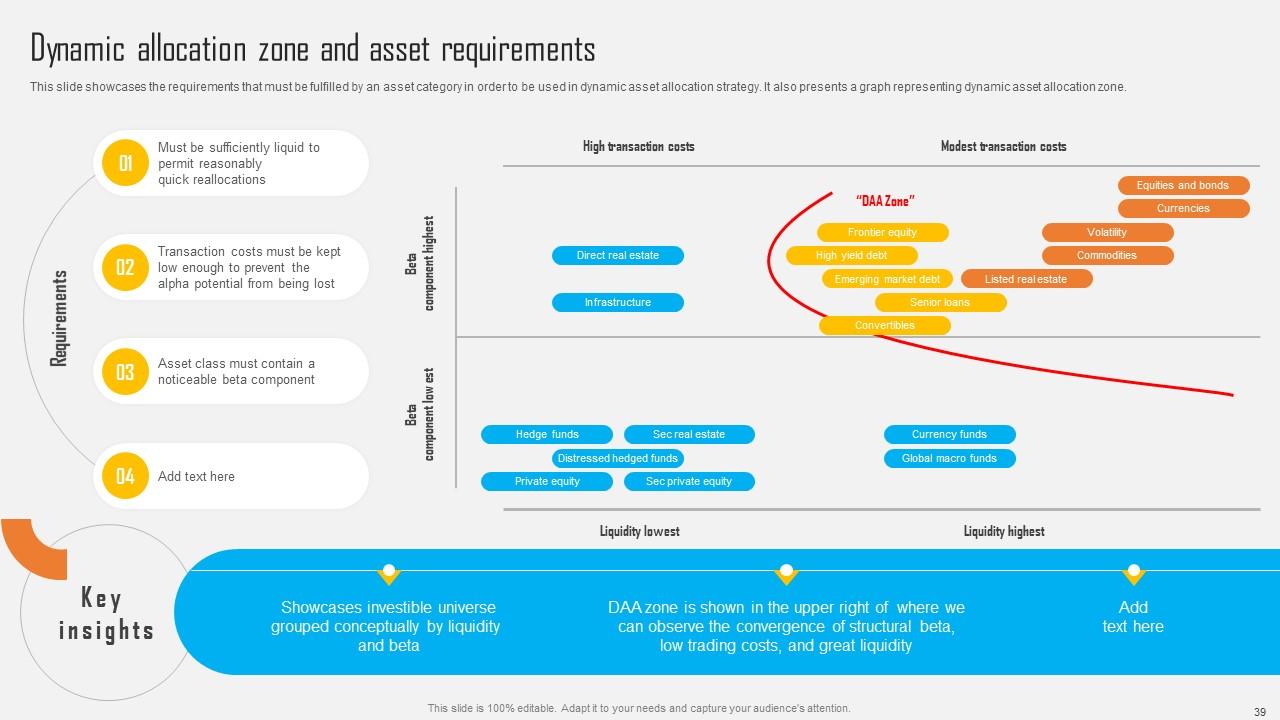

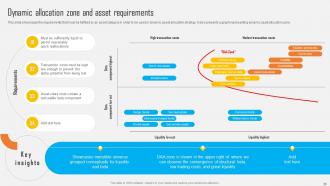

Slide 39: This slide showcases the requirements that must be fulfilled by an asset category in order to be used in dynamic asset allocation strategy.

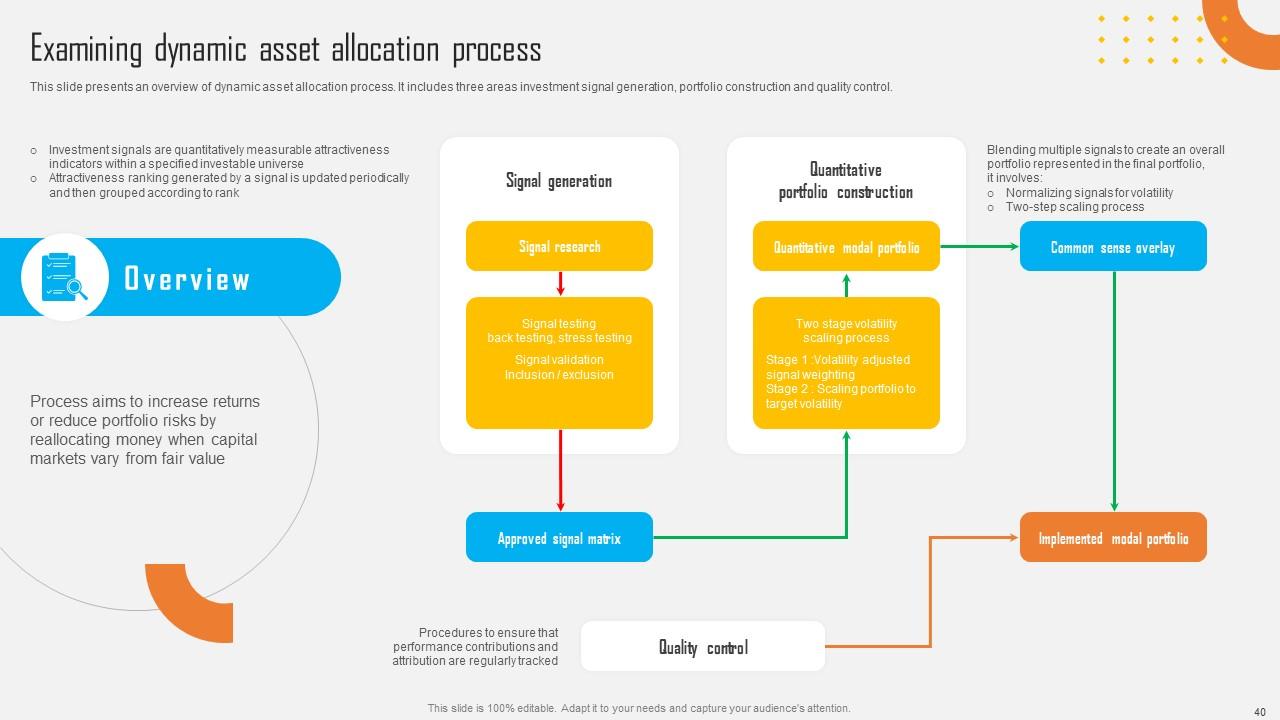

Slide 40: This slide presents an overview of dynamic asset allocation process. It includes three areas investment signal generation, portfolio construction and quality control.

Slide 41: This slide shows title for topics that are to be covered next in the template.

Slide 42: This slide presents an overview of constant-weight asset allocation strategy for optimal investment.

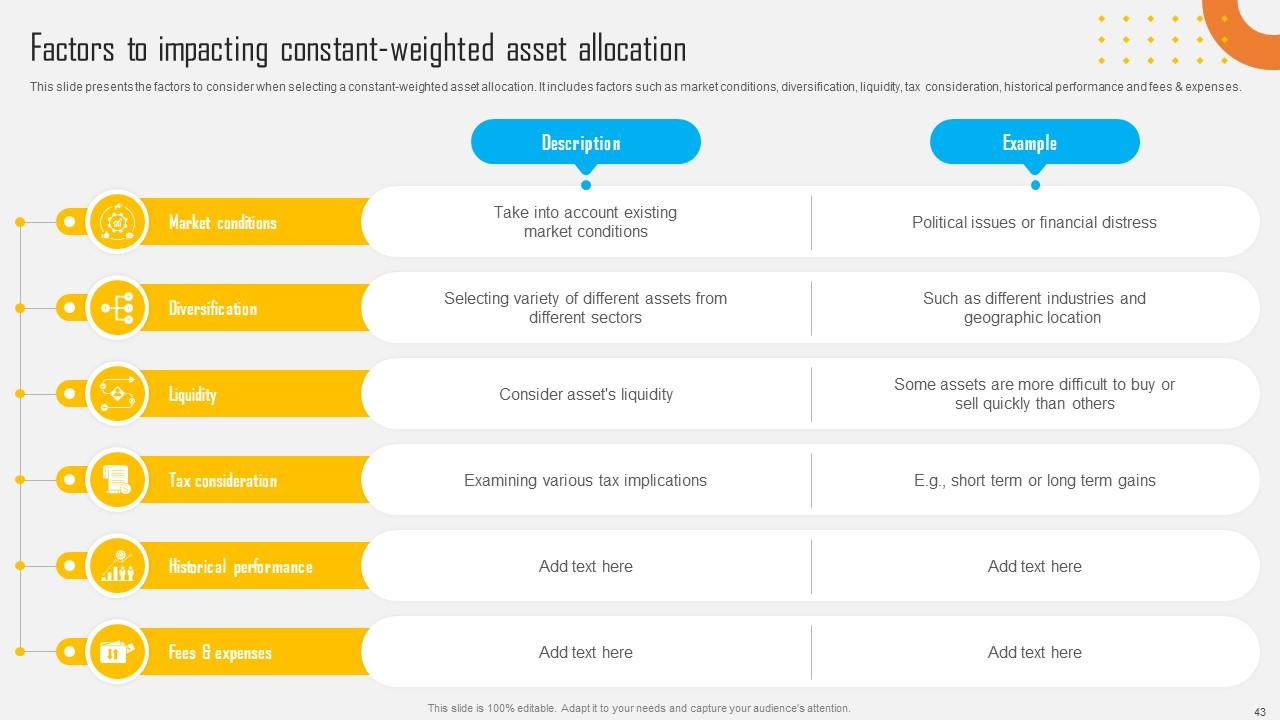

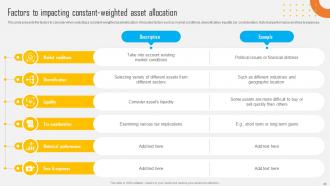

Slide 43: This slide displays the factors to consider when selecting a constant-weighted asset allocation. It includes factors such as market conditions, diversification etc.

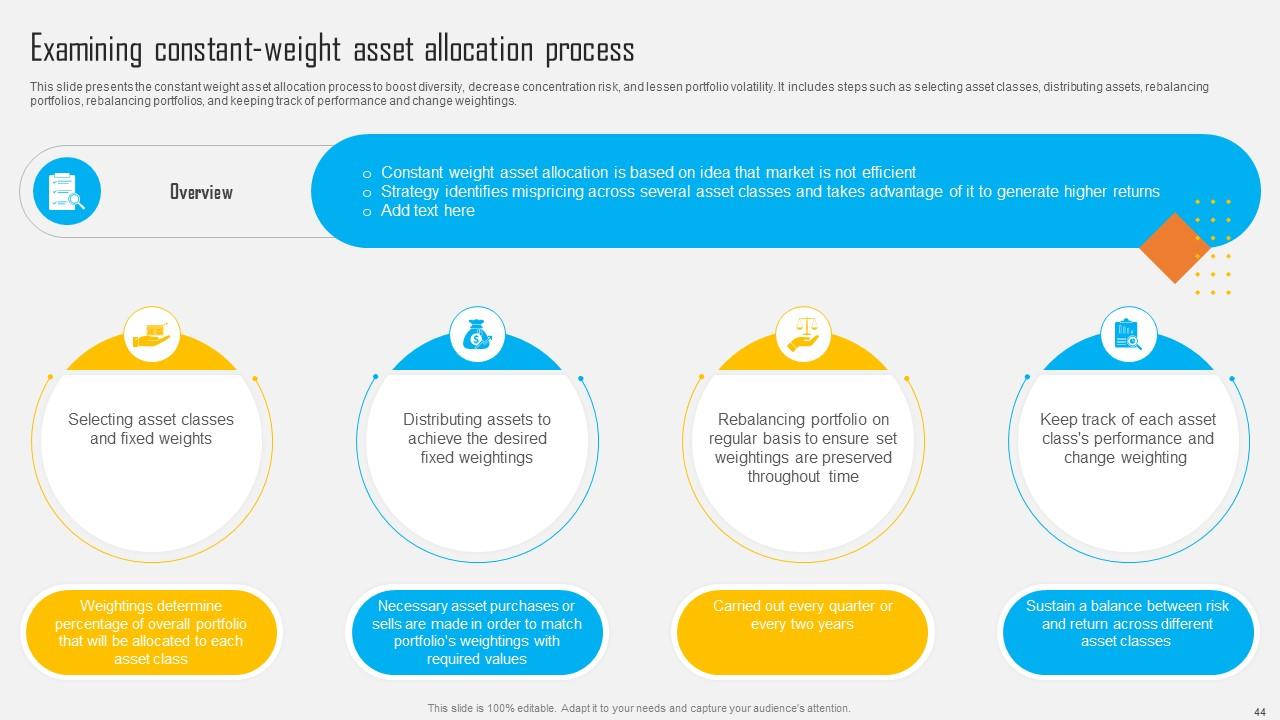

Slide 44: This slide presents the constant weight asset allocation process to boost diversity, decrease concentration risk, and lessen portfolio volatility.

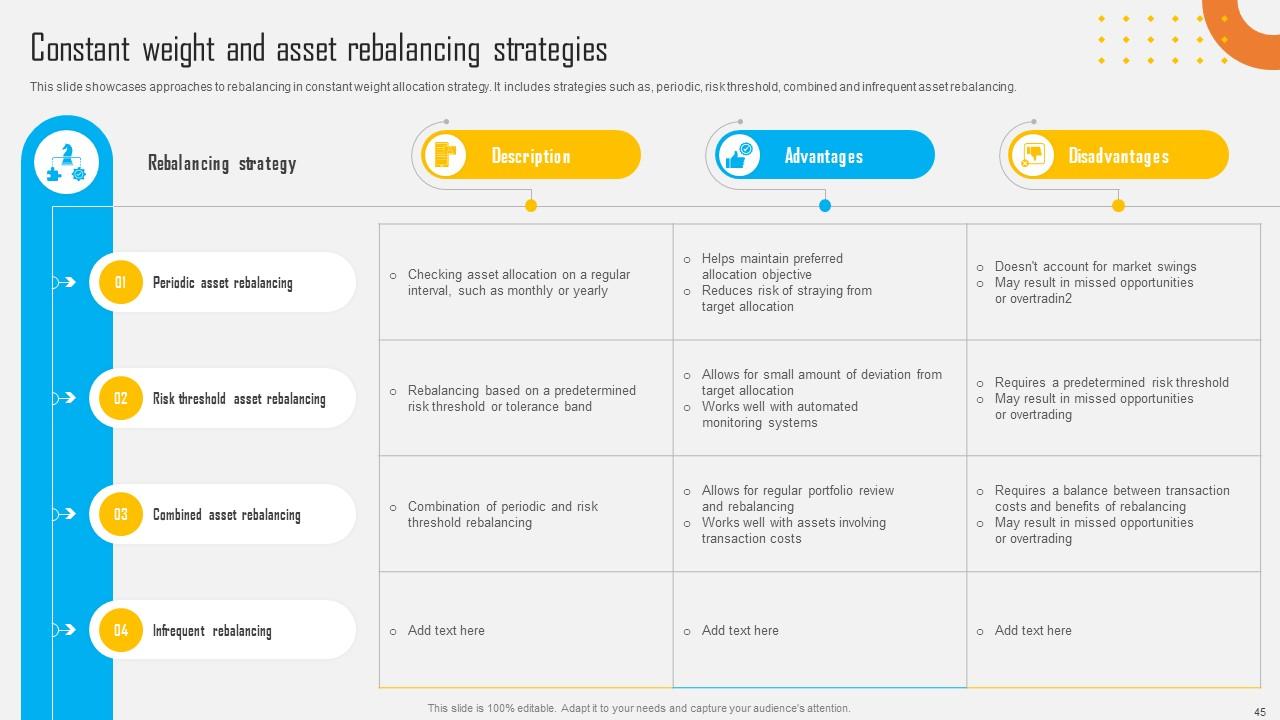

Slide 45: This slide showcases approaches to rebalancing in constant weight allocation strategy. It includes strategies such as, periodic, risk threshold etc.

Slide 46: This slide shows title for topics that are to be covered next in the template.

Slide 47: This slide presents an overview of insured asset allocation strategy for optimal investment. It includes details about goals.

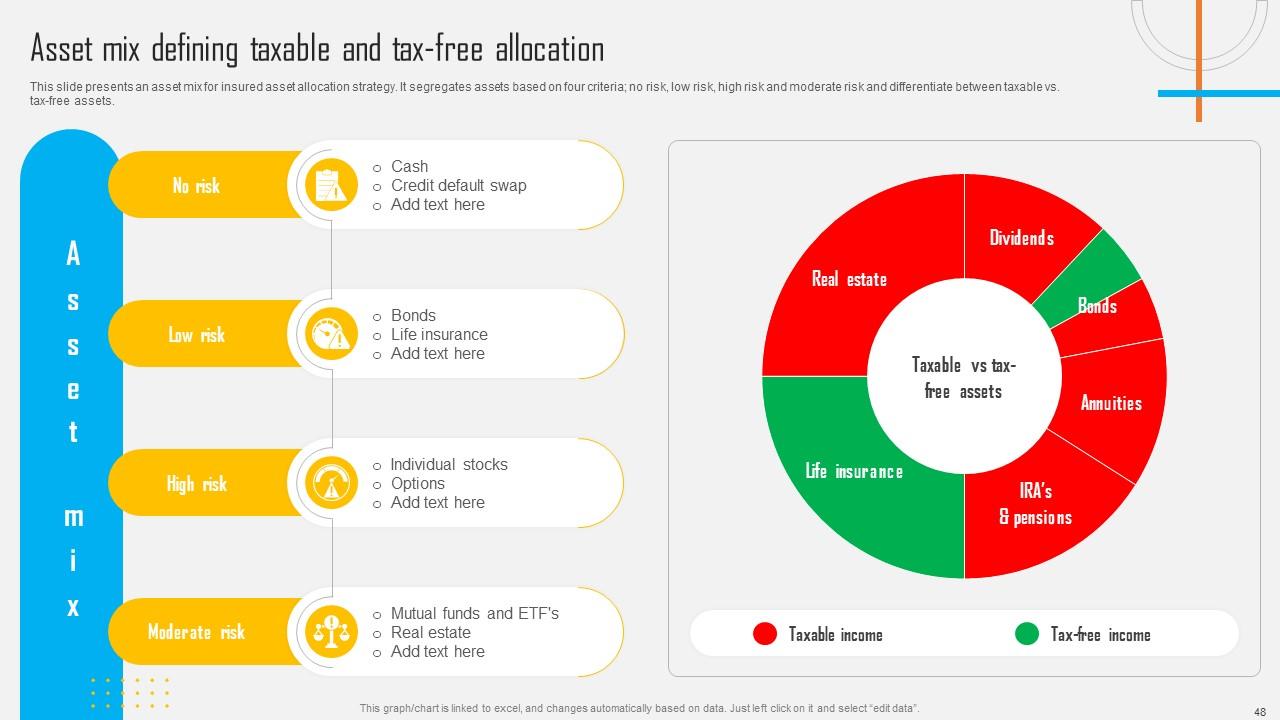

Slide 48: This slide presents an asset mix for insured asset allocation strategy. It segregates assets based on four criteria; no risk, low risk, high risk and moderate risk etc.

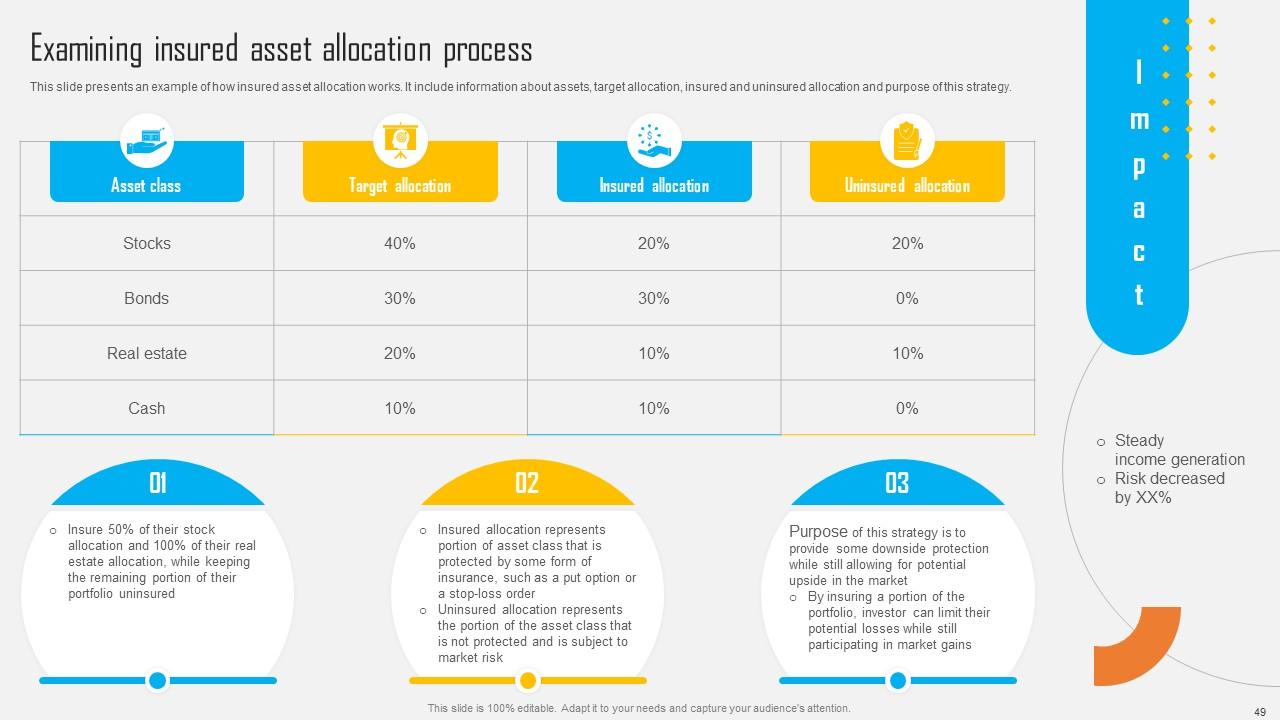

Slide 49: This slide displays an example of how insured asset allocation works. It include information about assets, target allocation, insured and uninsured allocation etc.

Slide 50: This slide projects an asset divide between various asset classes. It also presents the expected return on long-term investment in bonds, property and equities.

Slide 51: This slide shows title for topics that are to be covered next in the template.

Slide 52: This slide presents an overview of the integrated asset allocation strategy for optimal investment.

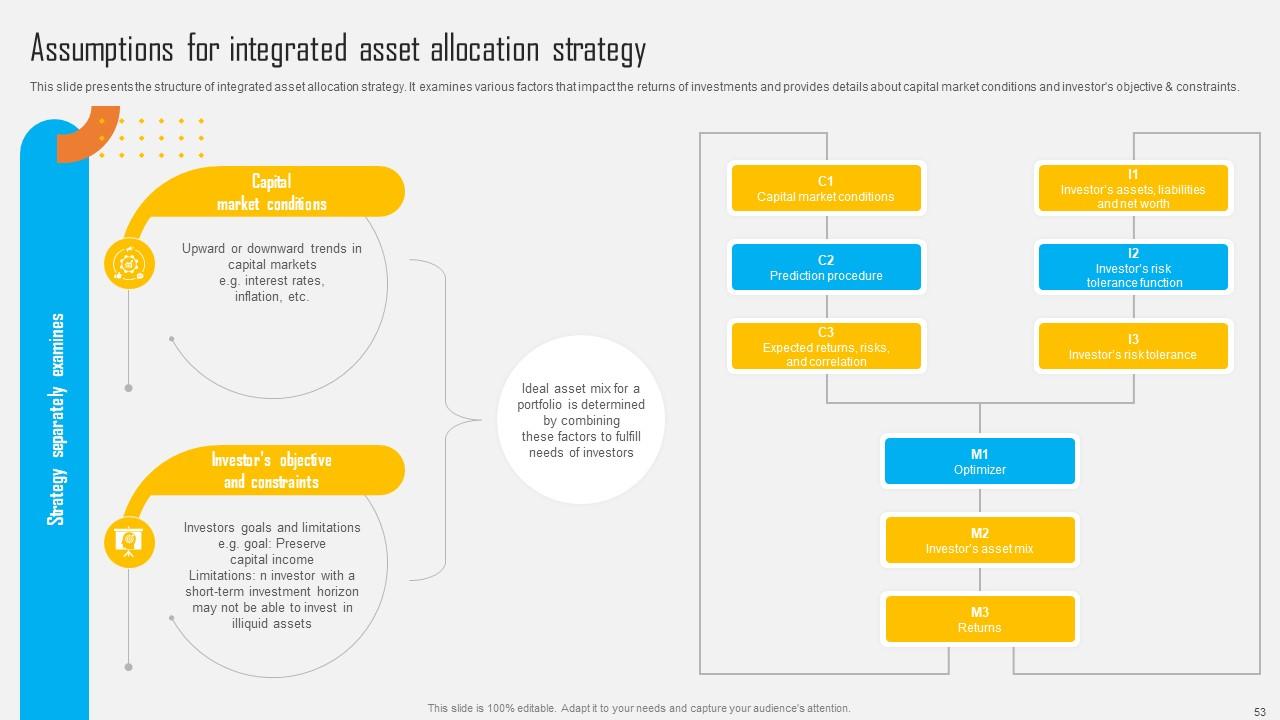

Slide 53: This slide displays the structure of integrated asset allocation strategy. It examines various factors that impact the returns of investments.

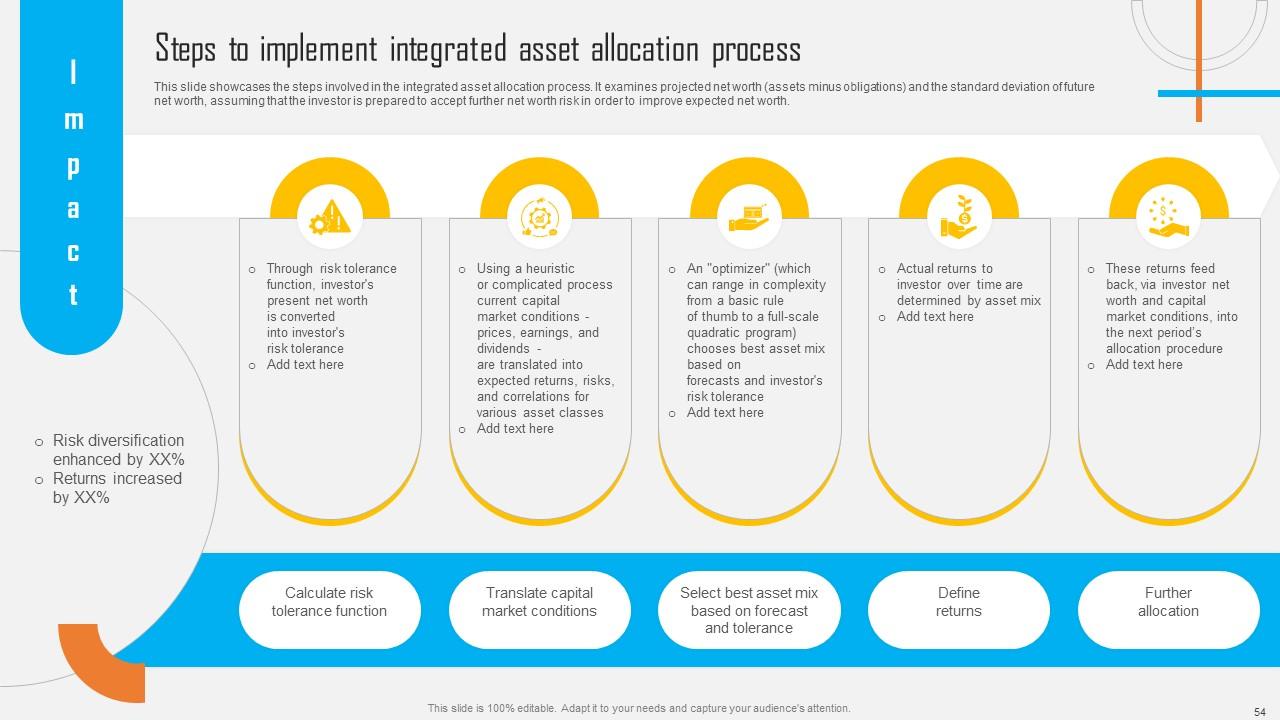

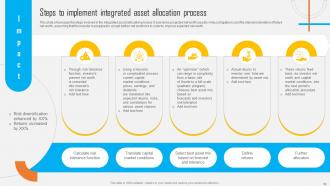

Slide 54: This slide showcases the steps involved in the integrated asset allocation process. It examines projected net worth.

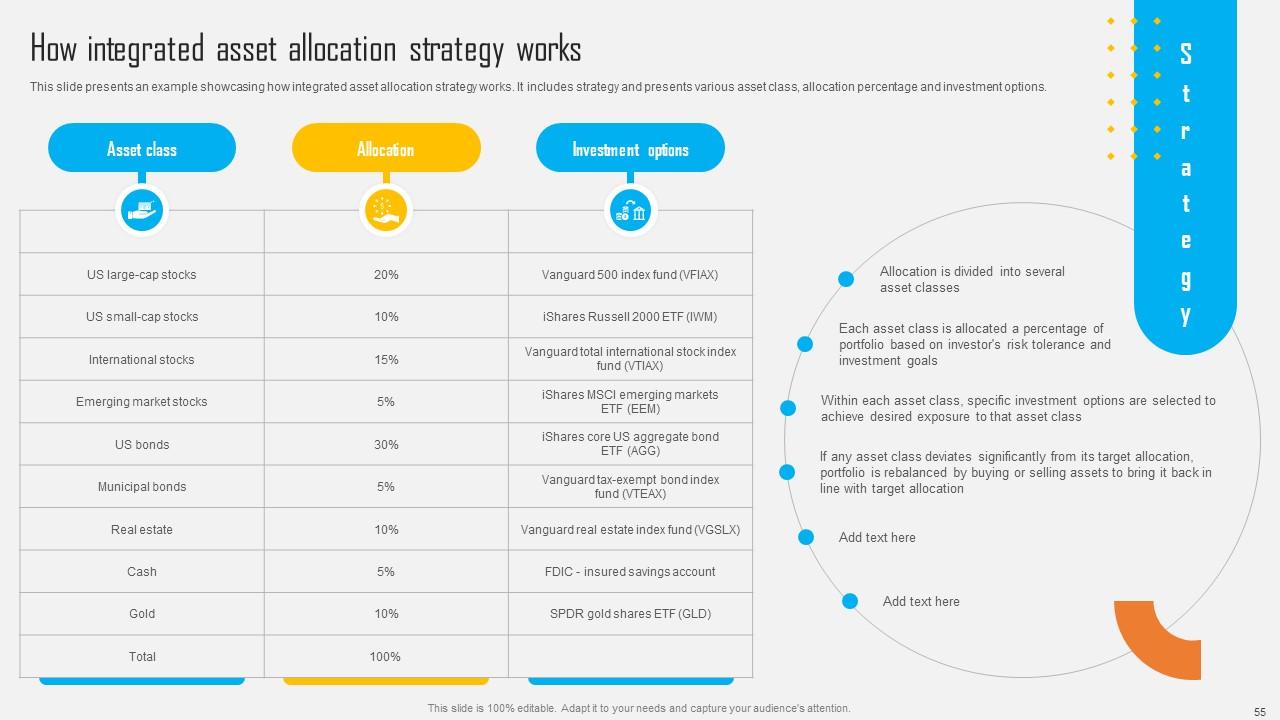

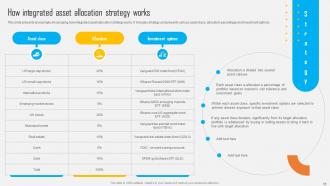

Slide 55: This slide presents an example showcasing how integrated asset allocation strategy works. It includes strategy and presents various asset class etc.

Slide 56: This slide shows title for topics that are to be covered next in the template.

Slide 57: This slide presents an overview of core-satellite asset allocation strategy for optimal investment.

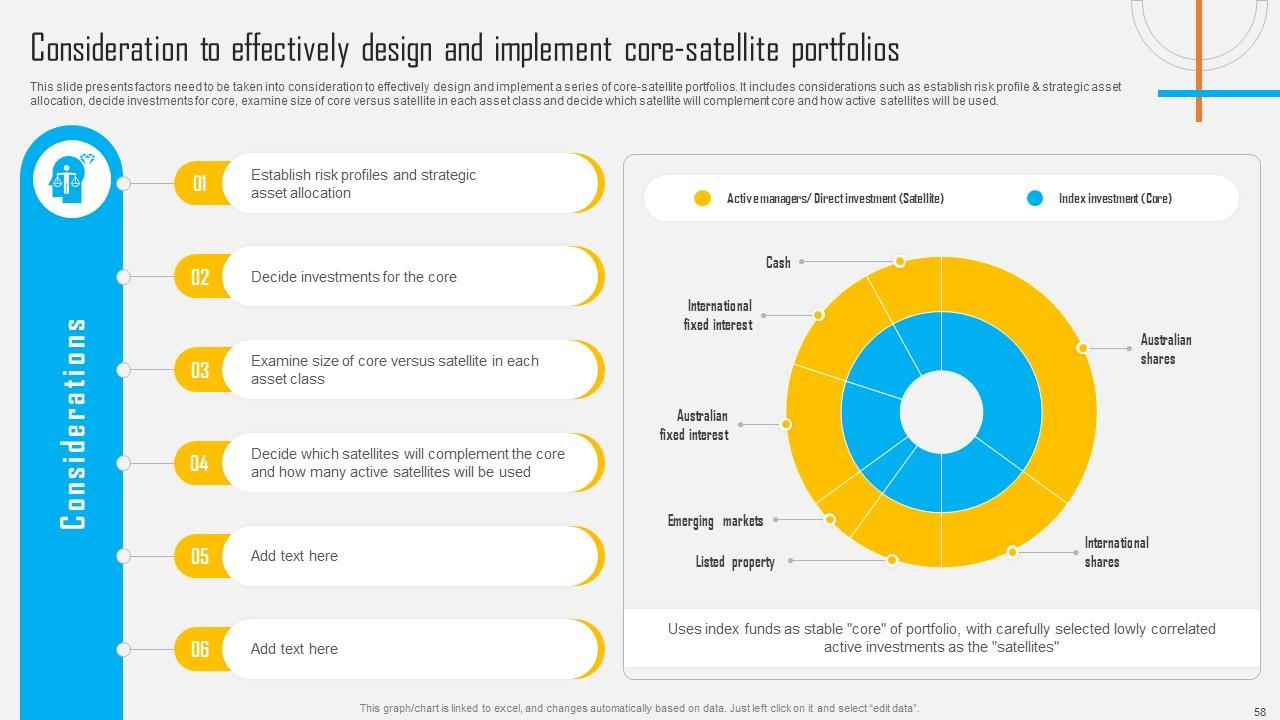

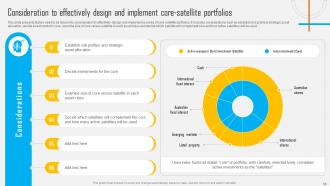

Slide 58: This slide displays factors need to be taken into consideration to effectively design and implement a series of core-satellite portfolios.

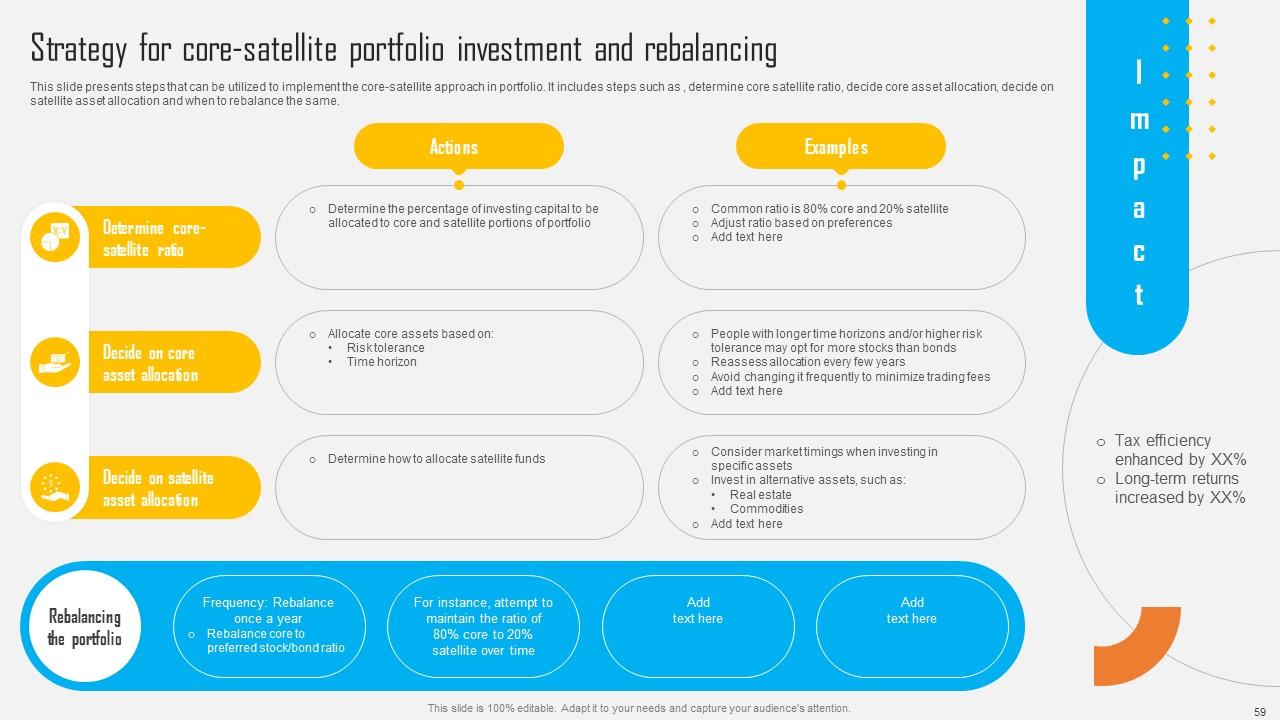

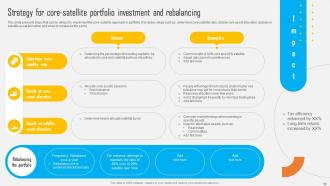

Slide 59: This slide presents steps that can be utilized to implement the core-satellite approach in portfolio. It includes steps such as , determine core satellite ratio etc.

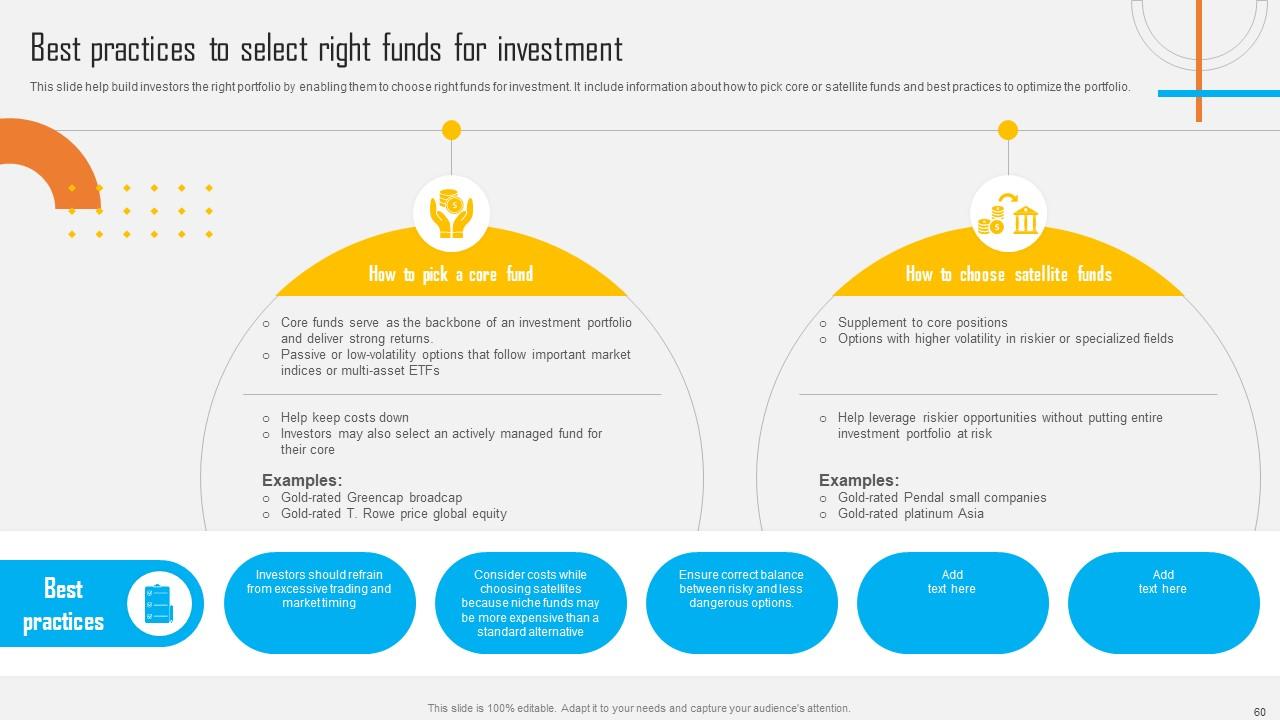

Slide 60: This slide help build investors the right portfolio by enabling them to choose right funds for investment.

Slide 61: This slide represents the percentage allocation to the core and satellite portfolio determined based on an investor's risk profile.

Slide 62: This slide shows title for topics that are to be covered next in the template.

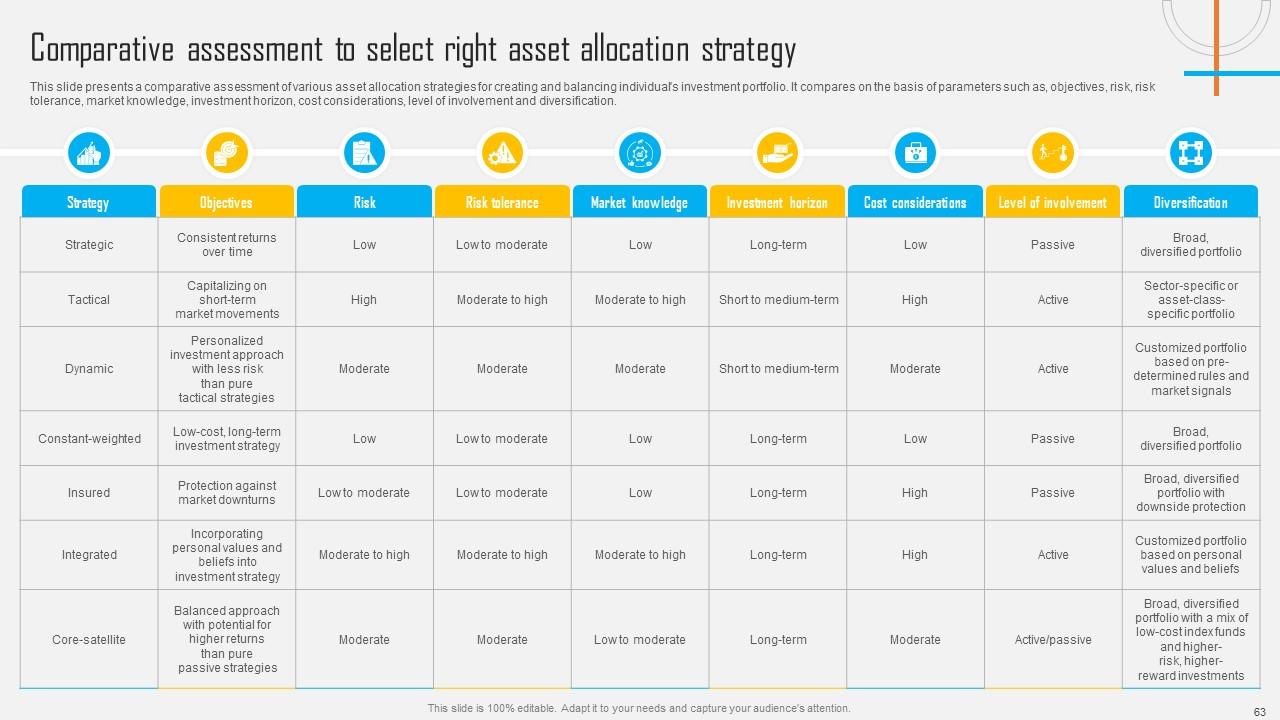

Slide 63: This slide presents a comparative assessment of various asset allocation strategies for creating and balancing individual's investment portfolio.

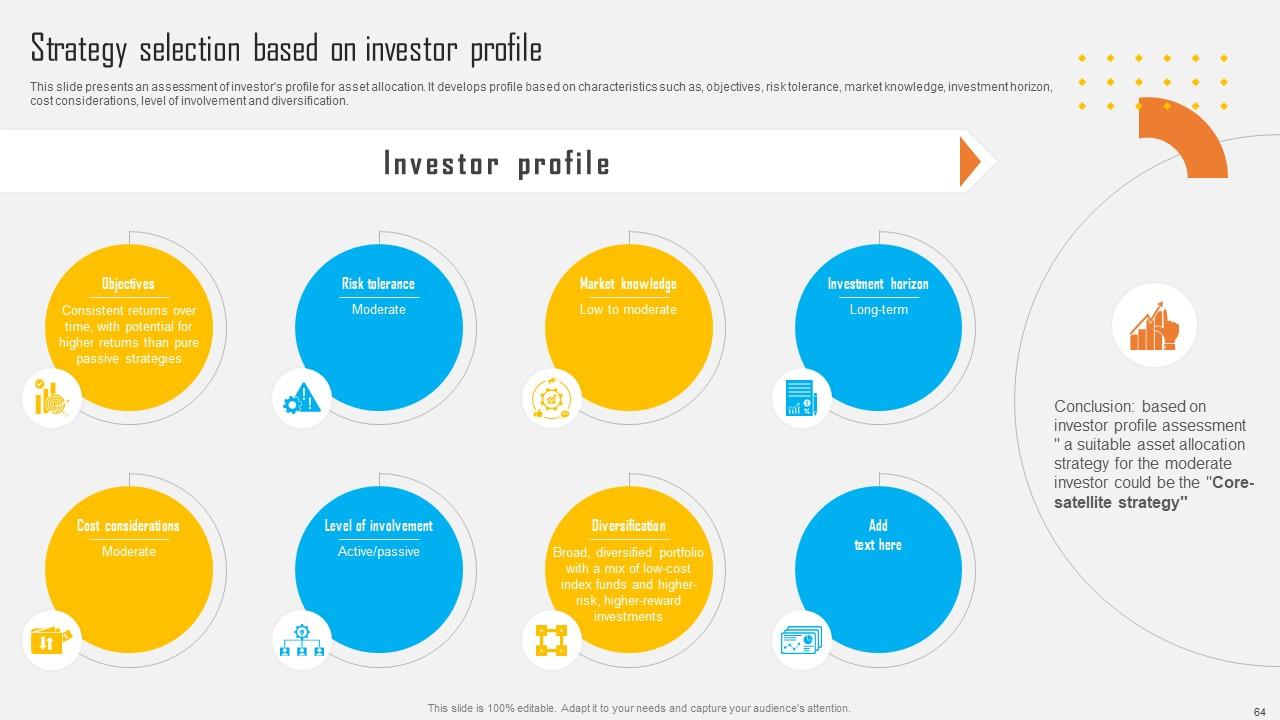

Slide 64: This slide displays an assessment of investor's profile for asset allocation. It develops profile based on characteristics such as, objectives, risk tolerance etc.

Slide 65: This slide provides an overview on how core-satellite approach works and is the best suited strategy for an moderate investor profile.

Slide 66: This slide shows title for topics that are to be covered next in the template.

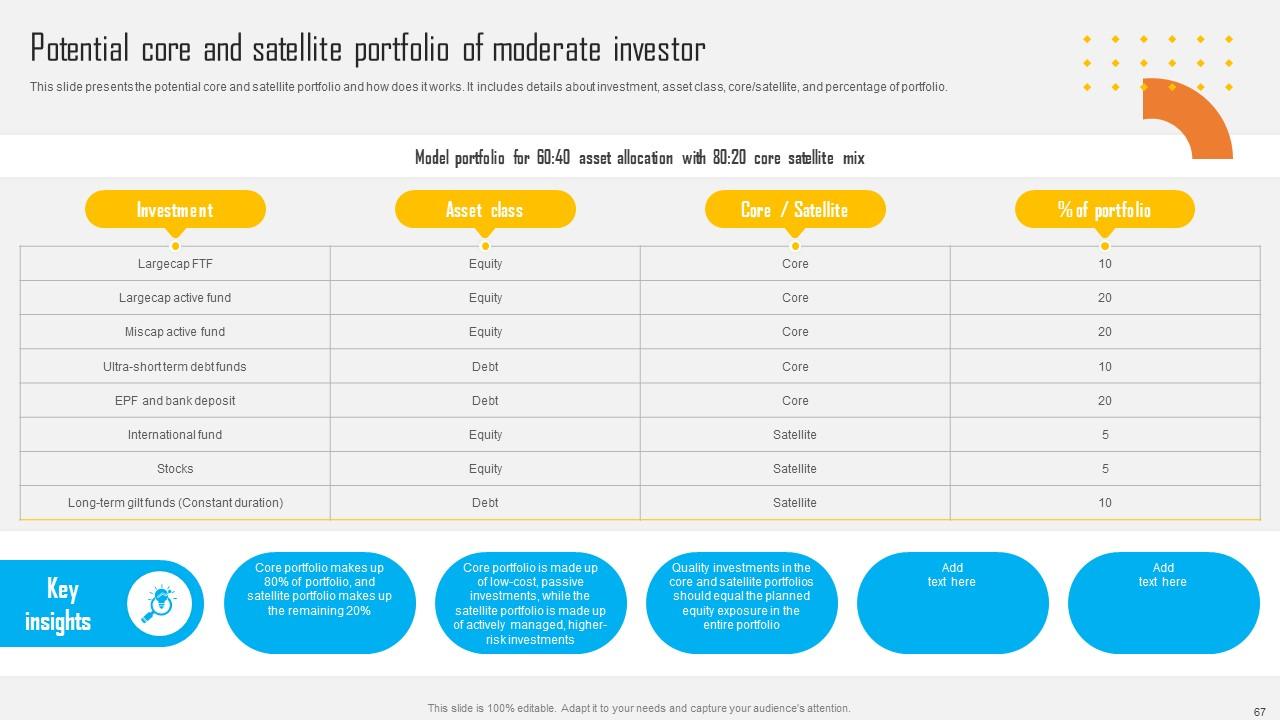

Slide 67: This slide presents the potential core and satellite portfolio and how does it works. It includes details about investment, asset class, core/satellite etc.

Slide 68: This slide shows title for topics that are to be covered next in the template.

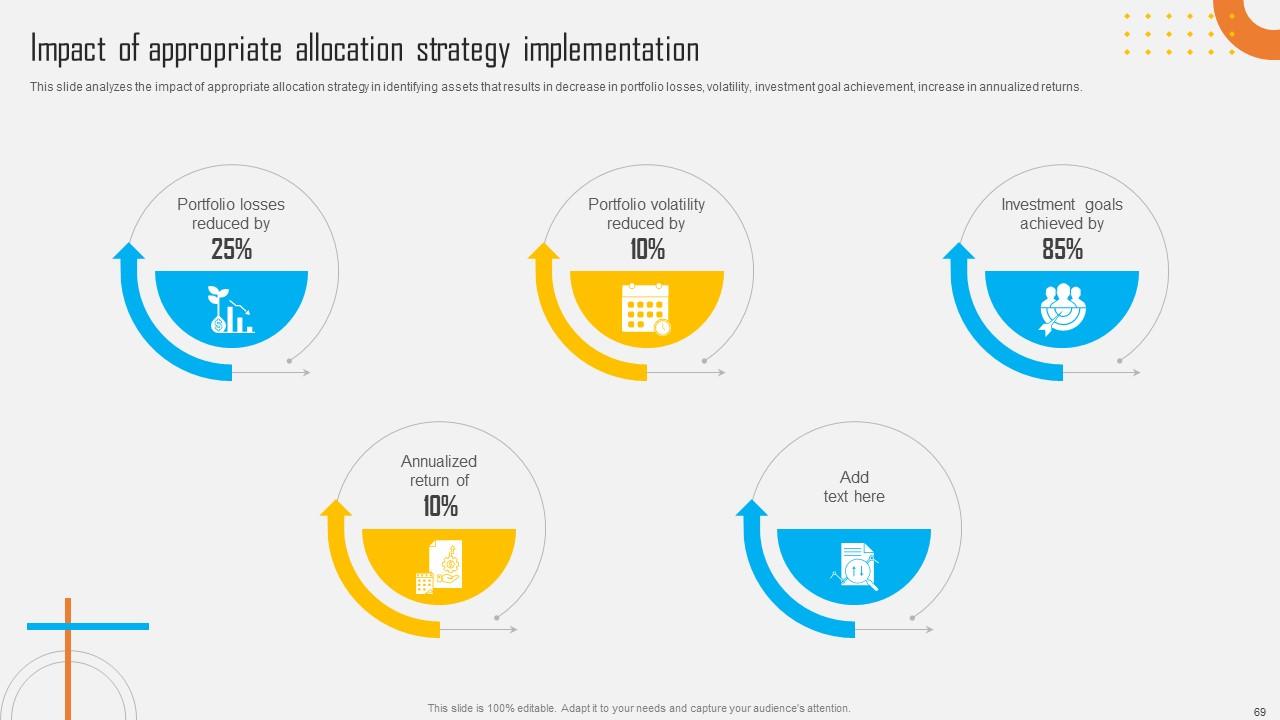

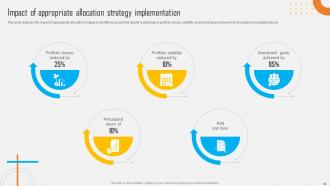

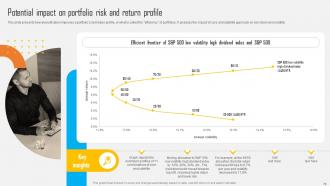

Slide 69: This slide analyzes the impact of appropriate allocation strategy in identifying assets that results in decrease in portfolio losses, volatility, investment goal achievement etc.

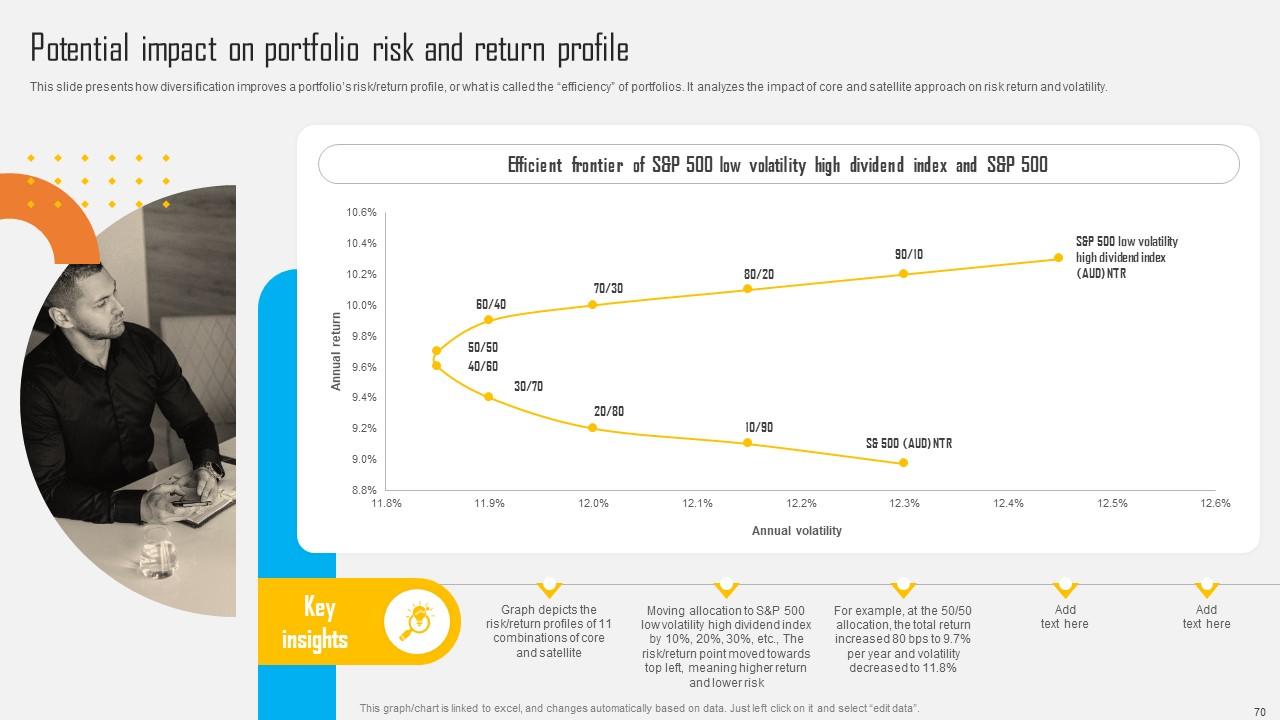

Slide 70: This slide presents how diversification improves a portfolio’s risk/return profile, or what is called the “efficiency” of portfolios.

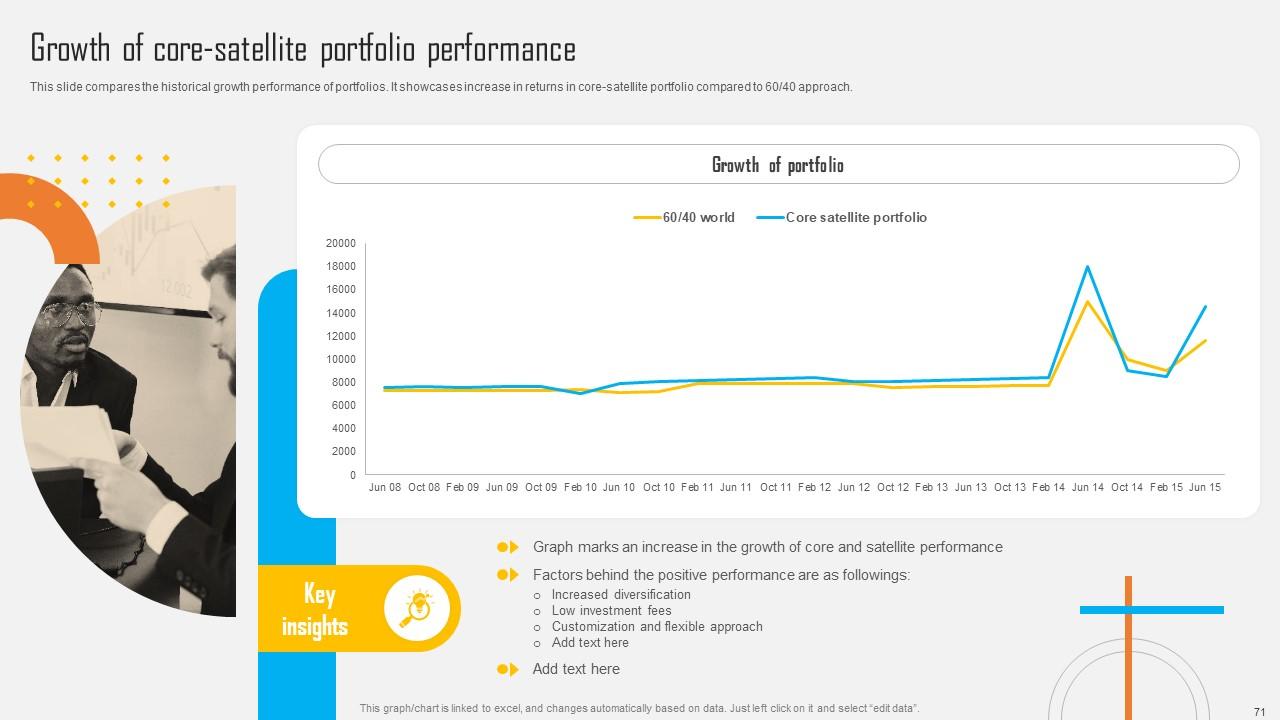

Slide 71: This slide compares the historical growth performance of portfolios. It showcases increase in returns in core-satellite portfolio compared to 60/40 approach.

Slide 72: This slide shows title for topics that are to be covered next in the template.

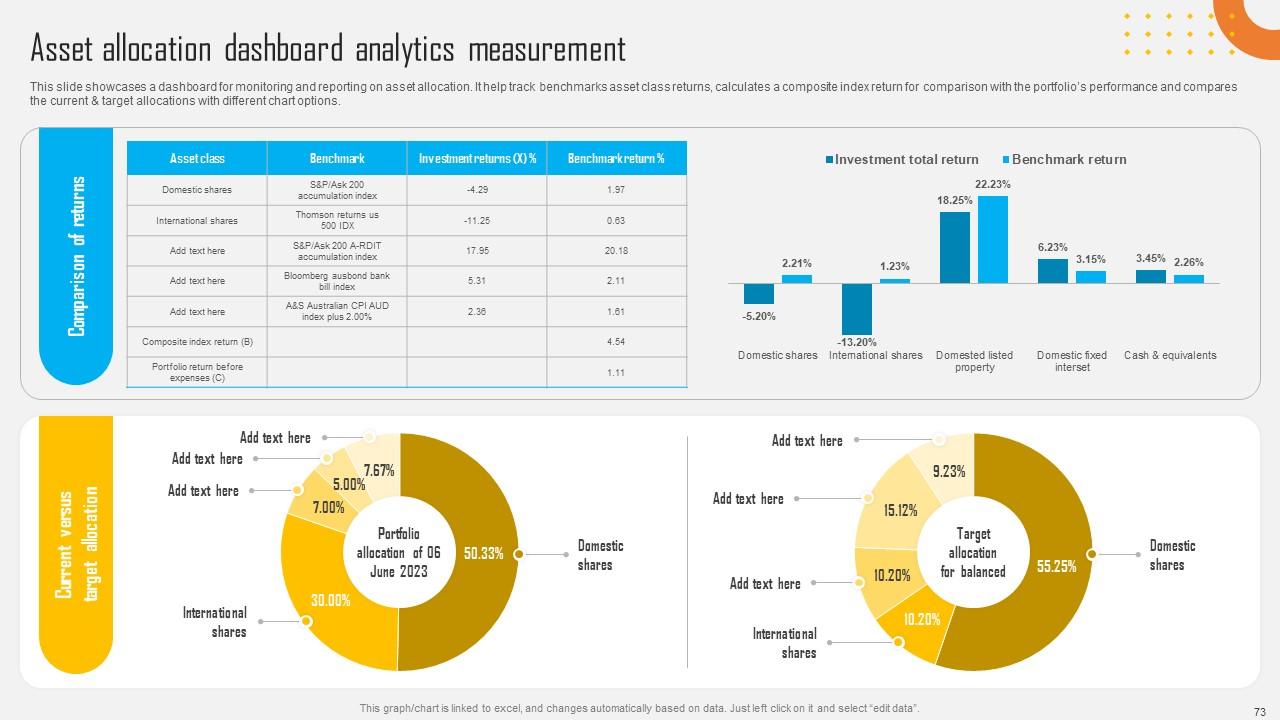

Slide 73: This slide showcases a dashboard for monitoring and reporting on asset allocation. It help track benchmarks asset class returns.

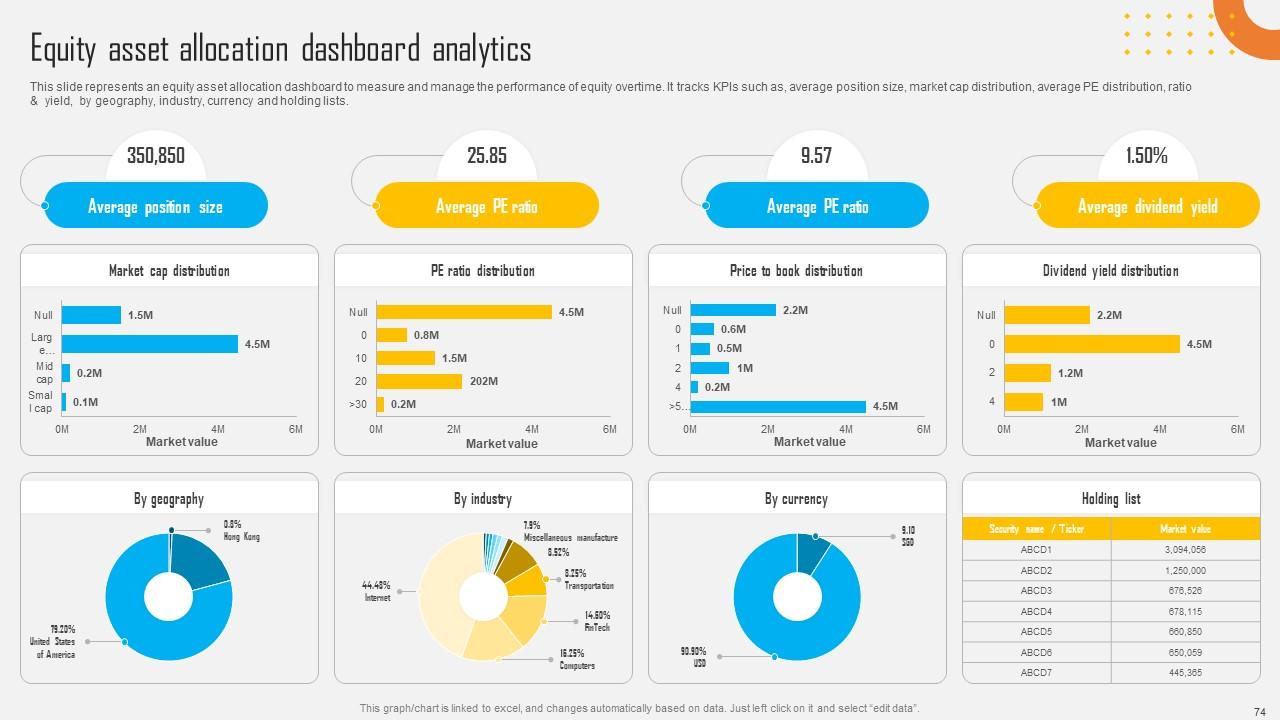

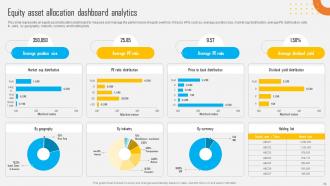

Slide 74: This slide represents an equity asset allocation dashboard to measure and manage the performance of equity overtime.

Slide 75: This slide shows all the icons included in the presentation.

Slide 76: This slide is titled as Additional Slides for moving forward.

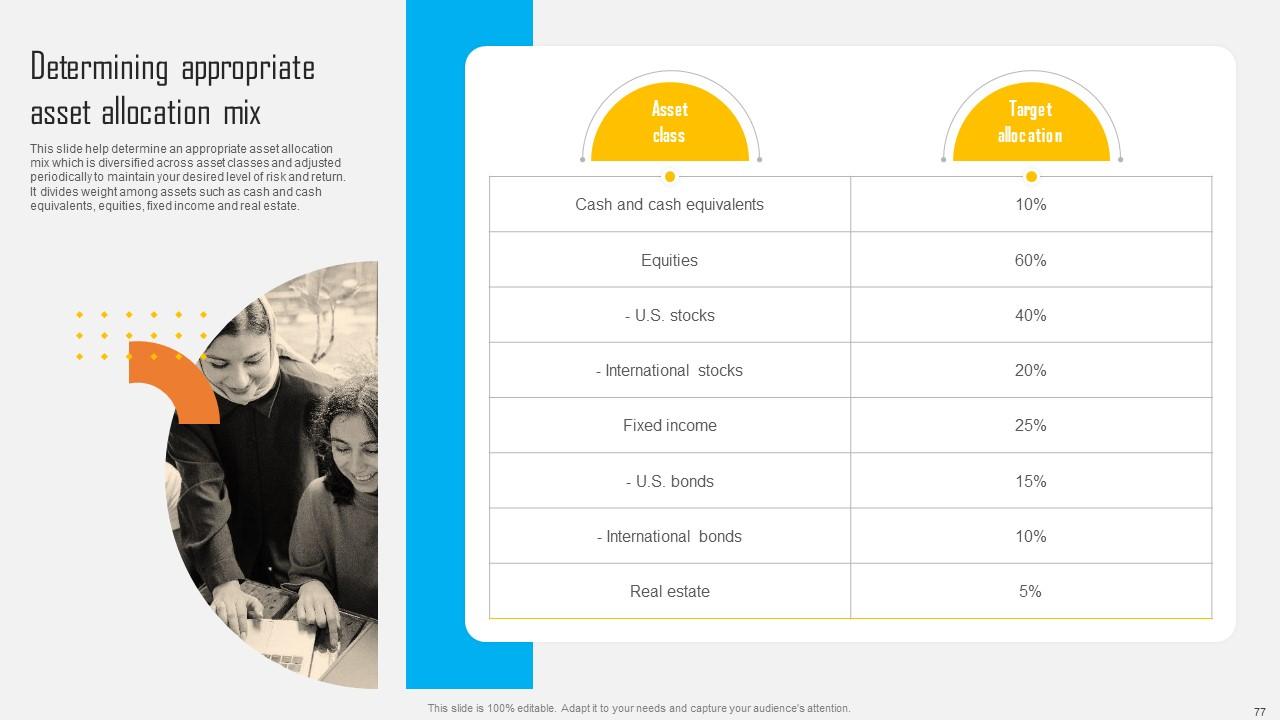

Slide 77: This slide help determine an appropriate asset allocation mix which is diversified across asset classes and adjusted periodically.

Slide 78: This is About Us slide to show company specifications etc.

Slide 79: This is Our Vision, Mission & Goal slide.

Slide 80: This is Our Team slide with names and designation.

Slide 81: This slide provides 30 60 90 Days Plan with text boxes.

Slide 82: This is a Thank You slide with address, contact numbers and email address.

Asset Allocation Investment Strategy To Balance Risk And Reward Complete Deck with all 91 slides:

Use our Asset Allocation Investment Strategy To Balance Risk And Reward Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Impressive templates. Designing a presentation is fun now!

-

Spacious slides, just right to include text. SlideTeam has also helped us focus on the most important points that need to be highlighted for our clients.