Blockchain Technology For KYC Training Ppt

This set of slides provides information on the capability of blockchain technology to improve KYC and identity verification in a financial system with distributed data collection,validation of data accuracy,and real-time updated user information.

This set of slides provides information on the capability of blockchain technology to improve KYC and identity verification..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Blockchain Technology for KYC. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation,add your content,and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide provides an overview of KYC which an essential component in the battle against financial crime and money laundering. Customer identification is critical as it is the first step in participating in the subsequent phases of the process

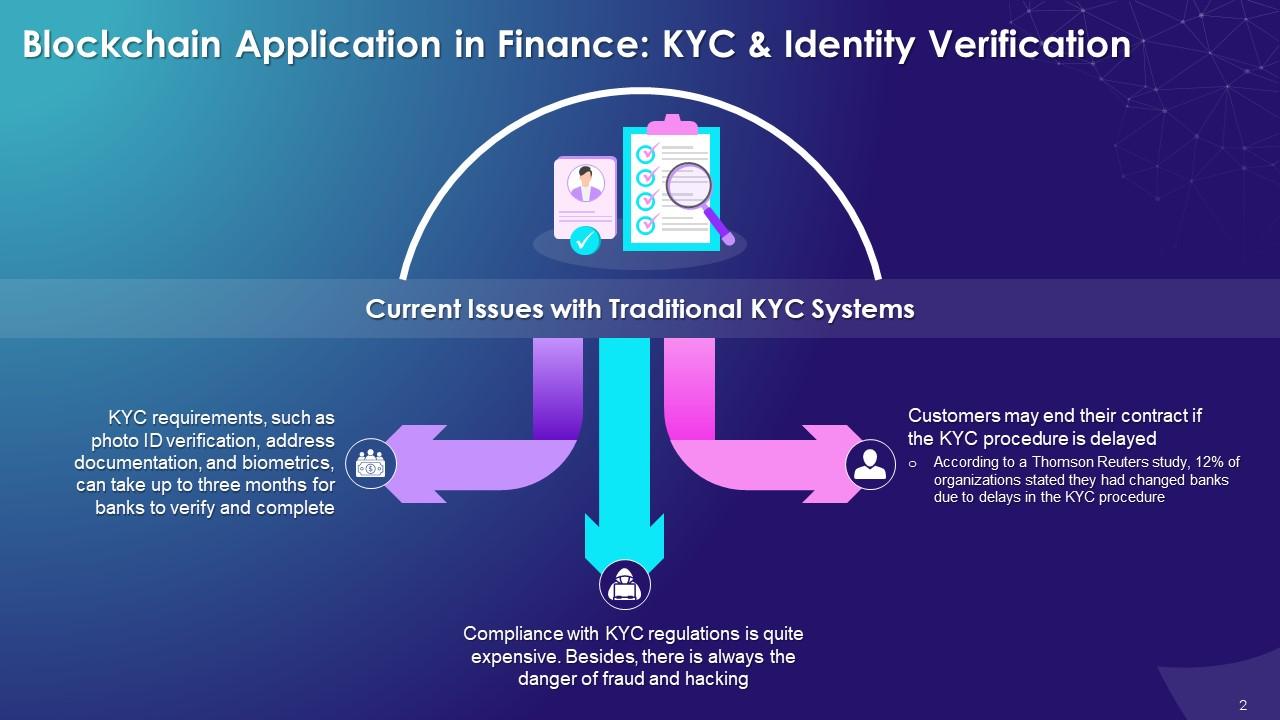

Slide 2

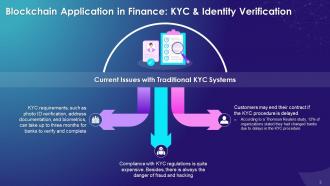

This slide lists current issues with the traditional KYC systems. KYC requirements, such as photo ID verification, address documentation, and biometrics, can take up to three months for banks to verify and complete. Compliance with KYC regulations is, thus, quite expensive. Besides, there is a danger of fraud and hacking

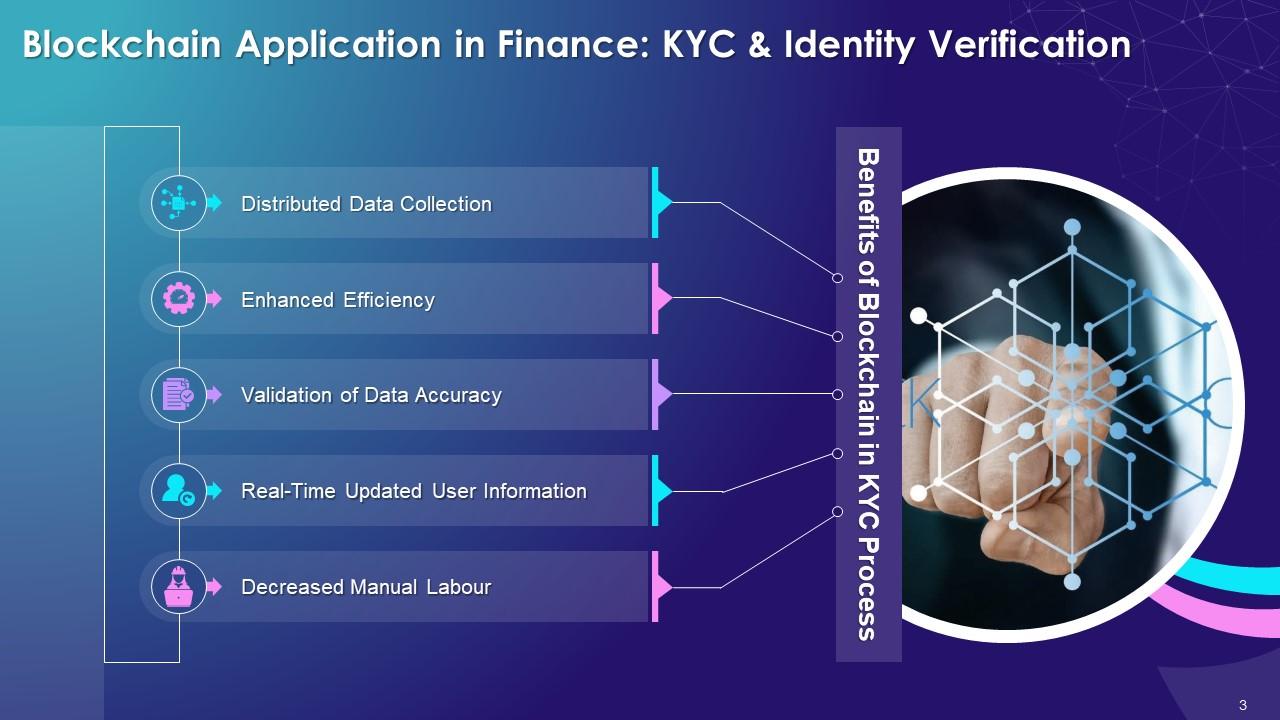

Slide 3

This slide depicts the advantages of using blockchain systems for KYC.

Instructor Notes:

Distributed Data Collection: Blockchain in KYC places data on a decentralized network, where only those authorization can access it

- Enhanced Efficiency: Capabilities such as an unhackable digital procedure and the exchange of user information over a permissioned network can significantly reduce the effort and time required in the early stages of the KYC process

- Validation of Data Accuracy: Blockchain-based KYC technologies provide transparency and immutability, allowing financial institutions to assess data reliable on the DLT(Distributed Ledger Technology) platform. The decentralized KYC procedure streamlines acquiring safe and timely access to updated user data

- Real-Time Updated User Information: When a KYC transaction is completed at a financial institution, the data is shared on a distributed ledger. This blockchain technology KYC system allows other participating institutions to access real-time updated information with the assurance that they will be alerted if there is a new addition or change made to the record

- Decreased Manual Labour: KYC on Blockchain reduces the need for paperwork

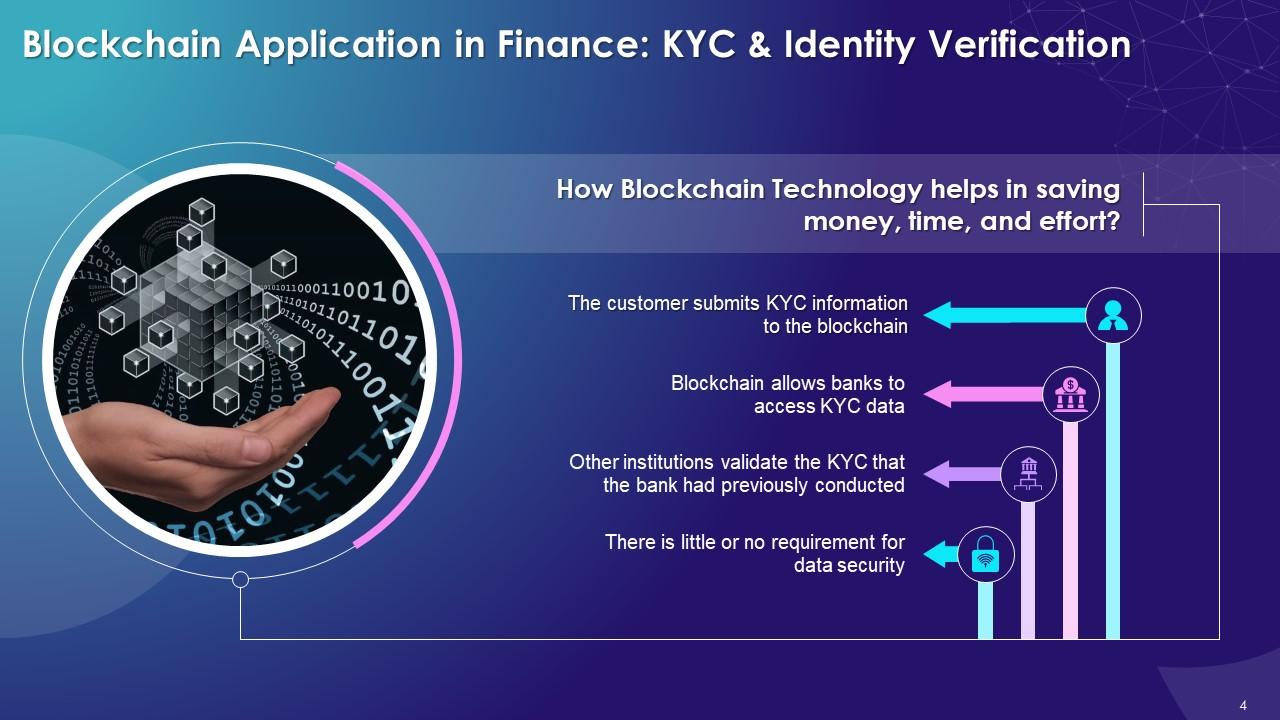

Slide 4

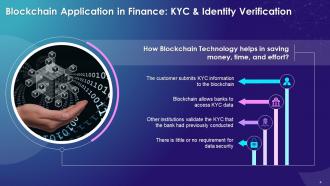

This slide illustrates how Blockchain Technology helps save money, time, and effort. The customer submits KYC information to the blockchain. Blockchain allows banks to access KYC data, and other institutions validate the KYC that the bank had previously conducted.

Blockchain Technology For KYC Training Ppt with all 20 slides:

Use our Blockchain Technology For KYC Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

The templates are easy to get, and the chat customer support is excellent.

-

It's always a delight to see new templates from you! I am extremely pleased with the fact that they are easy to modify and fit any presentation layout in seconds!