Suppose you're a seasoned commercial property investor or just dipping your toes into the exciting world of real estate. In that case, you already know the critical role that budgeting plays in your success. But let's face it - crunching numbers and managing finances can be daunting, even for the most experienced property tycoons. That's where our game-changing templates come in to save the day!

Picture this: No more endless hours spent grappling with complex spreadsheets, no more struggling to keep track of expenses, and no more second-guessing your financial decisions. With our meticulously designed PPTs, you'll be well on your way to masterful budgeting that leads to maximum profits!

What Makes Our Budget Templates Unbeatable?

Gone are the days of generic, one-size-fits-all templates that leave you with more questions than answers. We understand that every commercial property venture is unique, so our templates are built with one word in mind: Customization.

Our templates offer unparalleled flexibility, empowering you to tailor each template to your requirements. Whether you're analyzing cash flows for a bustling office complex, evaluating expenses for a trendy retail space, or budgeting for a promising industrial site, these templates have covered you!

Why You'll Love Our Budget Templates?

- User-Friendly Interface: No finance degree required! Our templates are designed with simplicity, making budgeting a breeze for all skill levels.

- Comprehensive Expense Tracking: From leasing costs and property management fees to renovations and marketing expenses, our templates leave no financial stone unturned.

- Real-Time Insights: Gain a crystal-clear view of your cash flow and financial health, empowering you to make informed decisions.

Ready to take control of your commercial property investments like a pro? Say goodbye to financial uncertainty and embrace the power of customizable budgeting with our templates.

Let's turn your property dreams into a lucrative reality!

Template 1: Budget Variance Analysis PPT Template

This a comprehensive and powerful tool designed to streamline your financial analysis and reporting in the commercial real estate industry and allows you to present annual financial data, including projected figures, budgeted amounts, and budget variances, all in a clear and organized manner.

With this PPT, you can effectively showcase critical financial metrics and performance indicators for your commercial real estate property. It provides a structured format to present crucial information such as Total Revenue, Total Operating Expenses, Real Estate Taxes, and Net Operating Income. By using this template, you can easily highlight the financial health of your property, identify areas of improvement, and make informed decisions to maximize profitability. Download now and take your financial analysis and reporting capabilities to new heights, enabling you to drive success and profitability in your real estate ventures.

Looking for popular top real estate proposal templates? Click here.

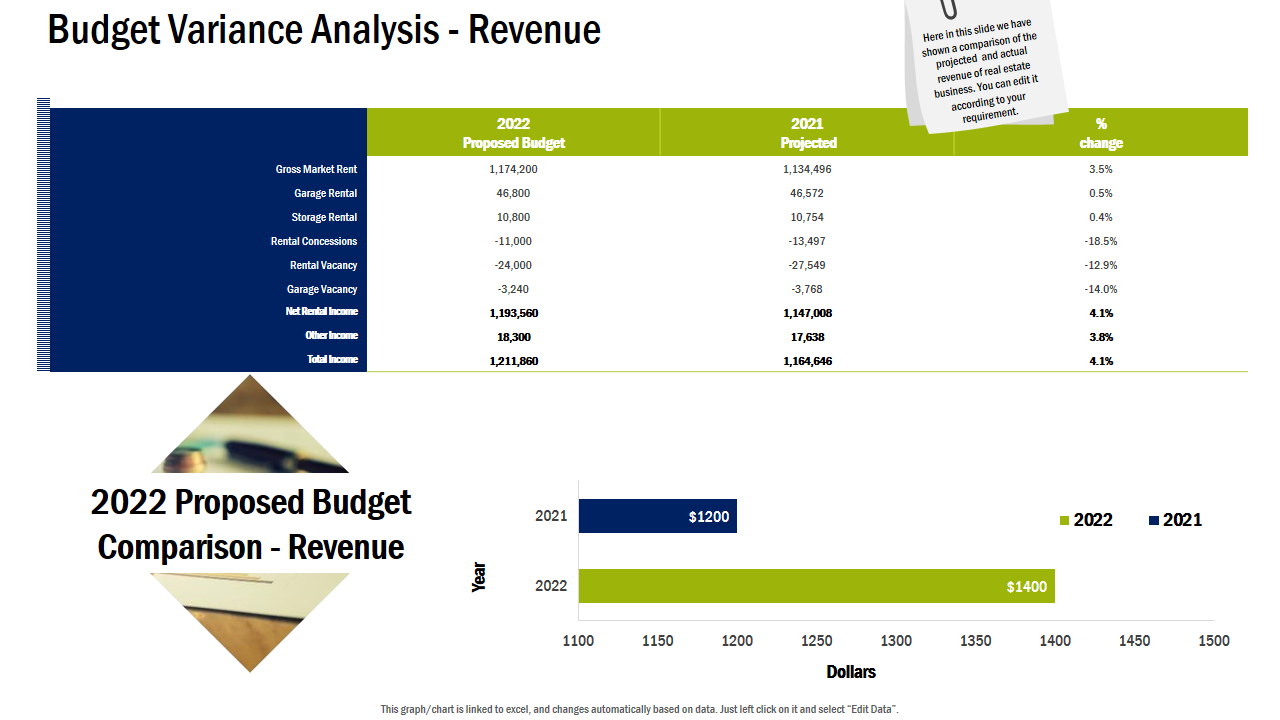

Template 2: Budget Variance Analysis Revenue Commercial Real Estate Property

This analytical presentation is designed to assist commercial real estate property managers understanding and evaluating revenue performance. This powerful tool provides a detailed breakdown of total revenue for two years, specifically the proposed year and the projected year.

The presentation calculates various revenue streams, including Gross Market Rent, Garage Rental, Storage Rental, Rental Concessions, Rental Vacancy, Garage Vacancy, Net Rental Income, and Other Income. This PPT slide is a reliable resource for assessing revenue trends and making informed decisions. It helps property managers determine the effectiveness of their pricing strategies, evaluate the impact of rental concessions, and identify potential rental and garage vacancies. This comprehensive presentation is a valuable tool for property management professionals seeking to optimize revenue performance in the commercial real estate sector.

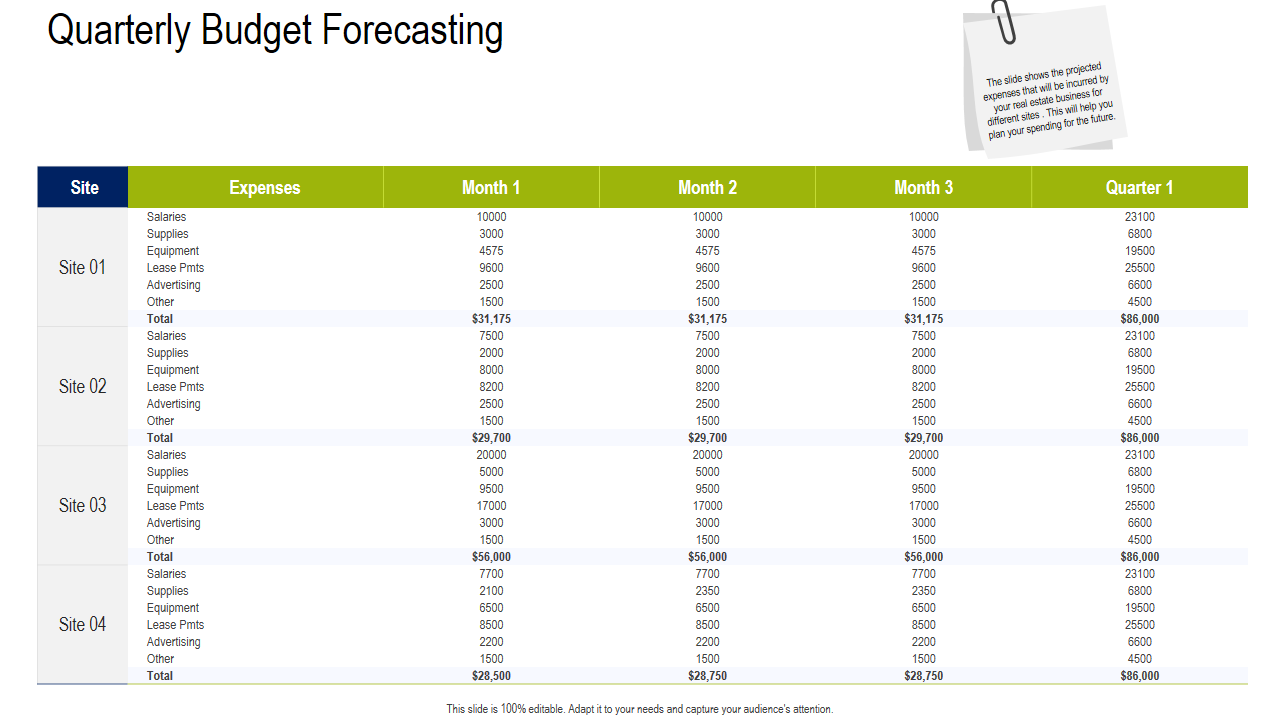

Template 3: Quarterly Budget Forecasting Commercial Real Estate Property

This powerful PPT is designed to streamline and simplify budget planning and analysis for commercial real estate property management and allows you to effectively summarize and analyze the total expenses of multiple sites for multiple months and quarters at once, empowering you to make informed financial decisions quickly.

With our user-friendly PPT format, you can conveniently input and organize all essential financial data for each site and month, including salaries, supplies, equipment, advertising, and other expenses. The template offers a clear and structured layout, ensuring a comprehensive quarterly financial performance and forecasts overview. Take your commercial real estate property management to the next level with our PPT. Download this powerful tool now and gain the financial insights you need to drive success in your business.

Get Started Now

Optimize your commercial property's financial management with the Commercial Property Budget Template. Track expenses, manage revenues, and make informed decisions. Take control of your property's financial health today - download the template now to get started!

FAQs on Commercial Property Budget

Which is an example of a commercial property?

Commercial property is real estate used for business purposes or profit generation. An example of a commercial property is an office building. These buildings are designed to accommodate various businesses, such as corporate offices, professional services, or coworking spaces. Commercial properties can also include retail areas, such as shopping malls, strip malls, or standalone stores, where goods and services are sold to the public. Additionally, warehouses and industrial buildings used for manufacturing or storage are considered commercial properties. Hotels, restaurants, and entertainment venues like theaters or concert halls also fall under commercial properties. The primary purpose of commercial properties is to generate revenue by leasing or renting the space to businesses operating in different sectors.

How do you calculate the price of a commercial building?

Calculating the price of a commercial building involves considering several factors. First, evaluate the property's size, location, and condition. The square footage is multiplied by a per-square-foot value based on the area's real estate market. Additionally, consider the property's zoning and potential use, as certain areas may have higher demand or restrictions.

Next, assess the income generated by the building if it is leased. Deduct the operating expenses from the rental income to determine the net operating income. Apply a capitalization rate (cap rate) to the NOI to determine its value based on the market's prevailing rates.

Furthermore, consider any additional features or amenities that contribute to the property's value, such as parking, accessibility, or special architectural elements.

Lastly, engage with real estate professionals, appraisers, and market analysis tools to gather more accurate and up-to-date information. Remember, pricing a commercial building is a complex process that requires careful analysis and consideration of various factors.

How do you calculate profit on a commercial property?

To calculate profit on a commercial property, you need to consider several factors. First, determine the property's annual rental income by multiplying the total leasable square footage by the rental rate per square foot. Subtract the property's operating expenses, such as property taxes, insurance, maintenance, and management fees, from the rental income. The resulting figure is the property's net operating income (NOI).

To calculate profit, subtract the property's annual debt service, which includes mortgage interest and principal payments, from the NOI. This will give you the property's cash flow. Finally, consider additional factors such as appreciation, tax benefits, and potential equity buildup through loan amortization.

Remember that profit calculation can vary depending on the specific circumstances, financing terms, and market conditions. It's advisable to consult with a financial professional or utilize specialized real estate investment software to ensure accurate calculations.

Customer Reviews

Customer Reviews