Successfully completing a business merger or acquisition deal is an appreciable step. But seamless integration of the participant companies is a challenge in itself. Each brand brings with it a separate set of cultural and functional expectations. A corporate merger or acquisition deal is based on numbers and statistics, but its execution lies in employee compliance and cultural integration. Combining two formerly distinct work spheres into a single functional ecosystem is not an easy task. In the most basic sense, combining the assets of two or more companies to form a new single corporation is a merger, whereas taking over the assets of a company and adding them to your firm’s portfolio is an acquisition. The consolidation of companies or assets occurs via various types of financial transactions, including tender offers, purchase of assets, and management acquisitions. A well-composed integration plan is necessary to keep track of every detail. Therefore, this blog will introduce you to the nuances of merger and acquisition integration while offering handy PowerPoint templates to keep everyone on the same page. Read on.

Key elements of effective M&A integration

In addition to consolidating finances and data, a successful integration process depends on several non-corporate factors. You should start your preparation as early as the project is introduced and continue your research well after the deed is signed. Let’s take a look at the most critical elements of an effective M&A integration:

-

Early preparation

The ideal time to begin developing the post-acquisition integration process is when the buyer company has decided to pursue the deal. All the potential stakeholders involved in a deal’s due diligence process - bankers, lawyers, consultants, etc. - should have open communication from the start about the details of the post-merger integration.

-

Communication strategy

Delivering clear information in a timely order about the acquisition and its consequences on stocks minimizes confusion and anxiety of the stakeholders and fosters faith in the company. You must employ an effective internal communication strategy the day the acquisition is announced and continued through the post-acquisition integration process.

-

Cultural alignment

Every company has its own unique work culture. Enforcing changes to the acquired company’s culture can generate resistance from their leaders and employees. To mitigate such issues before they arise, you can do an audit to study the professional environment of the company to be acquired in the planning stage of the merger.

-

Integration action plan

Merger and acquisition integration stakeholders should set up an action plan containing specific and detailed objectives. Some of the elements that you should address in the action plan are a time frame for the central goals, the roles and responsibilities of involved staff, and the methods to track their progress.

-

Due diligence team

You should also include the team involved in the pre-merger diligence later in the integration process of the company's assets. The most straightforward approach is to have common members in the diligence and the integration team. This model also increases the likelihood that the team will maintain its momentum and capture synergies.

-

HR management

The executives should be prepared to share all the relevant information about the company’s change with their employees. From outlining targets to redefining employees’ positions and benefits, they should address any shifts in the company’s employee policy at the earliest. This is a vital factor in maintaining their morale and workplace confidence.

-

Change management experts

It is a good idea to have a dedicated change management expert on your post-merger integration team. This way, the buyer gains insight into the target company, which can help in maximizing the deal’s potential. Also, the target company feels cared for and confident in surrendering control of management, thereby retaining its efficiency and productivity.

Related read: Top 25 Strategic Change Management Templates to Evolve and Survive

A pre-designed presentation template is bound to save you a lot of time better spent on devising productive business methodologies. We have handpicked our best PowerPoint templates to help you better organize your research and agendas of business integration after a merger and acquisition deal. Here are our top 10 picks. Take a look.

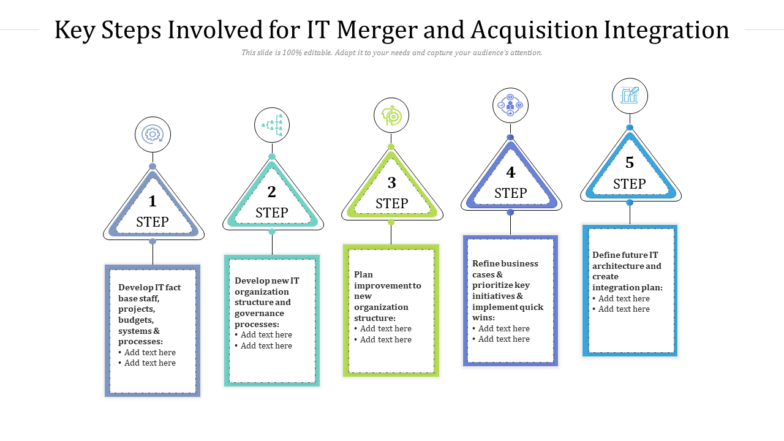

Template 1

Provide reliable solutions and manage strategic changes in your organization optimally with this professionally designed PPT template. Specially crafted for IT mergers and acquisition deals, this template highlights the key steps involved in the integration process like fact development, organization structure improvements, business case refinements, and future IT architecture.

Download Key Steps for IT M&A Integration PPT Template

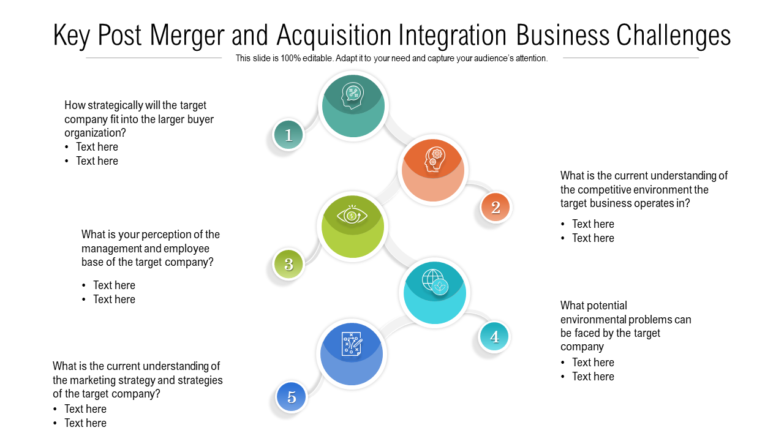

Template 2

Use this well-structured post-M&A business challenges PPT template to address the possible business challenges arising from a merger. You can effectively showcase your company’s productivity vitals, strategy for employee acclimatization, and the revamped competition analysis with this PowerPoint layout.

Download Key Post M&A Integration Challenges PPT Template

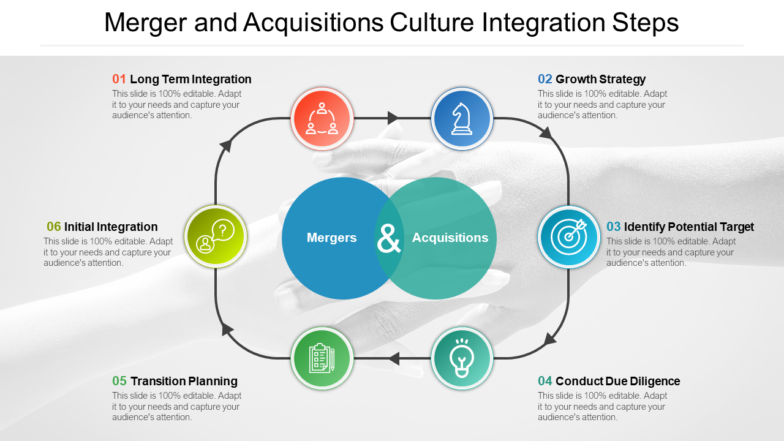

Template 3

How well a company adjusts its strategies and changes in the work culture determines its growth and success. Pinpoint the key areas of concern like long-term integration, growth strategy, target identification, due diligence, transition planning, and initial integration with this business presentation slide template.

Download Merger and Acquisition Culture Integration Steps PPT Template

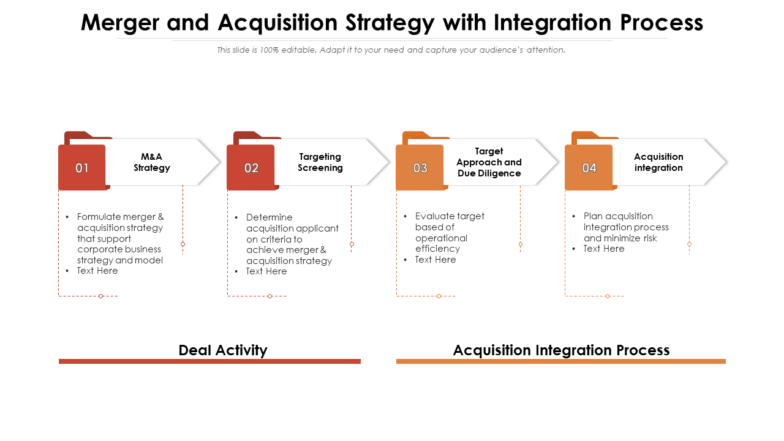

Template 4

Devise an effective integration strategy with this merger and acquisition strategy PPT template. You can use this PowerPoint slide layout to put forth the relevant processes of M&A strategy, target screening, target approach and diligence, and acquisition integration. Also, this template gives you total freedom to edit and customize, ranging from the font to the background color.

Download M&A Strategy with Integration Process PPT Template

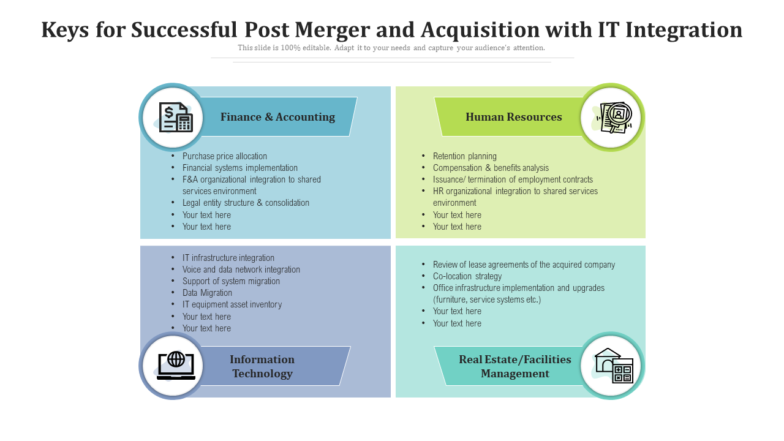

Template 5

With this M&A integration PowerPoint template slide, you can stay on top of purchase price allocation as well as legal entity consolidation. HR management of employee guidelines, IT setup for voice and data network integration, and infrastructure management for your company's tangible assets can also be presented with this PPT slide.

Download Keys for Successful M&A with IT Integration PPT Template

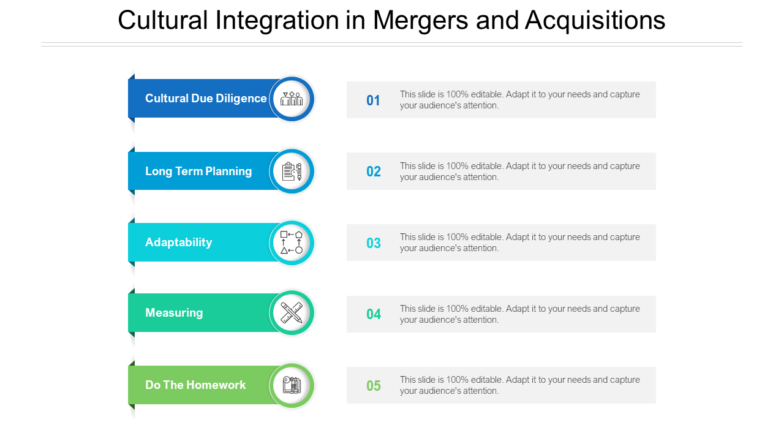

Template 6

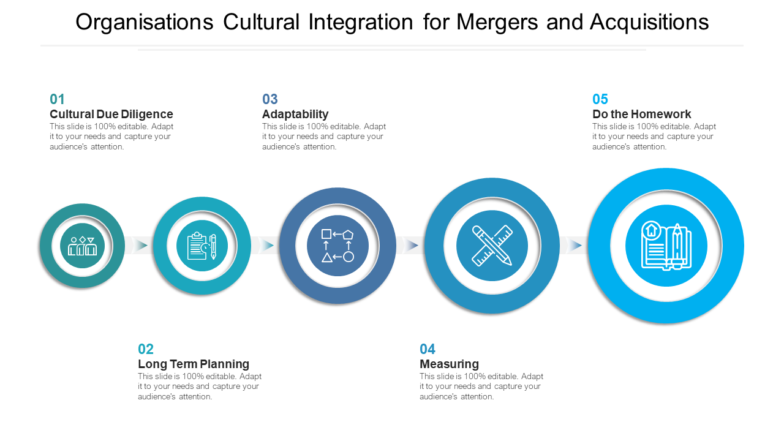

Download this PPT template on cultural integration to compose efficient methodologies for a seamless transition in the employee work environment. You can pinpoint the relevant factors for cultural due diligence, long-term planning, adaptability, measurement, and actionable conclusions with this PowerPoint slide layout.

Download Cultural Integration in Mergers and Acquisitions PPT Template

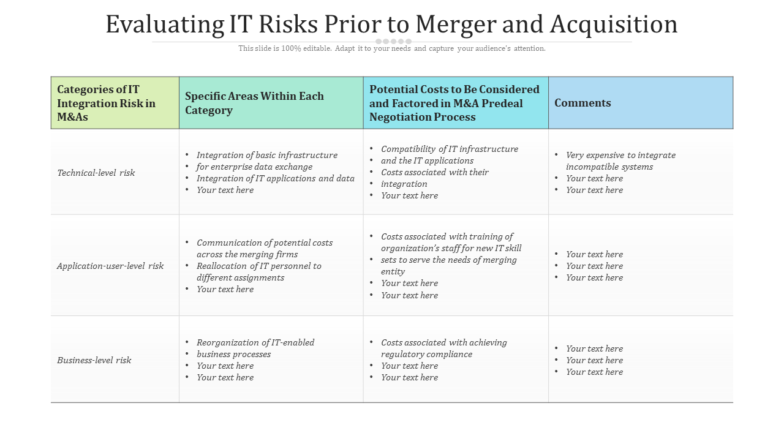

Template 7

Implementing and evaluating a business merger involves various steps, but it all begins with risk evaluation. This can be easily explained using this well-crafted PPT. Categorize the risks involved with the IT integration at technical, application, and business levels to better understand and formulate recovery and mitigation plans for possible business emergencies.

Download Evaluating IT Risks Prior to Merger and Acquisition PPT Template

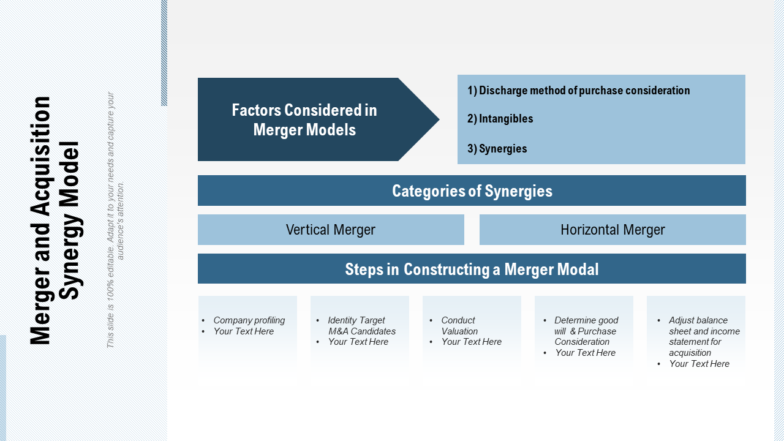

Template 8

Keep your team updated on the latest developments in your merger and acquisition project with this PPT slide template. You can present the purchase considerations, intangible assets, and co-working synergies in your merger model with this PowerPoint layout. There are specialized sections in this template to showcase the steps in the construction of a merger model.

Download M&A Synergy Model PPT Template

Template 9

Make a successful transition from one phase to another using this well-crafted organization’s cultural integration template. You can easily compose the perfect strategy to ease the cultural changes for your new employees with this PPT slide layout. Organize the elements of due diligence, planning, and adaptability through the earmarked sections of this slide template.

Download Organizations Cultural Integrations for M&A PPT Template

Template 10

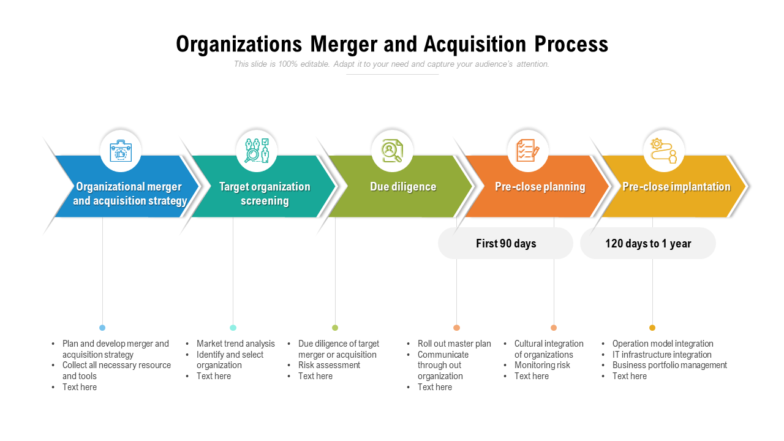

Plan and develop your merger and acquisition strategy with this PPT template. You can depict the stages and elements of an M&A process through the well-designed sections of this PowerPoint template. Explain the steps for target organization, due diligence, pre-close planning, and implementation with this template.

Download Organizations M&A Process PPT Template

In conclusion

Developing a sound strategy for your company’s post-merger functionality can only begin after implementing a well-researched integration procedure. Being conscious about the different work environments of two companies and developing policies to allow for a seamless transition for employees ensures continued efficacy and productivity in the workplace. Organizing an integration process best suited to your company can become tedious and dull very quickly. To ease your journey, you can use our pre-designed merger and acquisition templates. You can also get in touch with our design team to get personalized assistance for your post-merger integration strategies.

Customer Reviews

Customer Reviews

![[Updated 2023] 10 Hospital Management Templates for Delivering Better Healthcare Services](https://www.slideteam.net/wp/wp-content/uploads/2021/05/02_1013x441-493x215.png)