There’s a very thin line between maintaining a budget and just having one. If your budget planning or maintenance does not go well, it is possible for you to get trapped in a debt cycle. And we are sure that you wish not to! Therein lies the role of “Budget Planner Templates” in the picture.

Budget planner templates are necessary tools for any business, regardless of size or nature. They are used to plan, manage, and control financial resources. The document helps businesses with forecasting and tracking their source of income and expenses over a specific period of time. It can also be used to track a company's financial performance, identify potential risks and opportunities, and make informed decisions.

The budget planner template can be used to determine how much money is available for spending and where it should be spent. Using these PPT Templates, you can ensure that the company is on track to meet its goals and objectives.

With our these “Top 5 Budget Planner Templates”, businesses can maximize their financial resources, avoid overspending, and stay on track to achieve their goals and objectives.

Let us check some more benefits of having Budget Planner Templates-

- Increased Financial Visibility: Budget planner templates help businesses understand their finances, including expenses and revenue streams.

- Budget planner templates save time because they are pre-designed with common categories and formatting, and you only need to input the necessary financial data to create a budget.

- Improved Decision Making: By providing a detailed breakdown, budget planner templates facilitate business owners in making productive decisions. This data can be used to identify areas where expenses can be cut and revenue streams must be expanded for increased profits.

- Financial goals: Budget planner templates empower companies to establish and track financial goals. Businesses stay motivated and focused on achieving their goals by defining specific and measurable financial goals.

- Accurate Record-Keeping: With accurate record-keeping, companies can track their progress toward their financial goals and make necessary adjustments to their budget accordingly.

Now, without further ado, let SlideTeam take you through the “Top 5 Budget Planner Templates with Examples and Samples” that will add more value to your business.

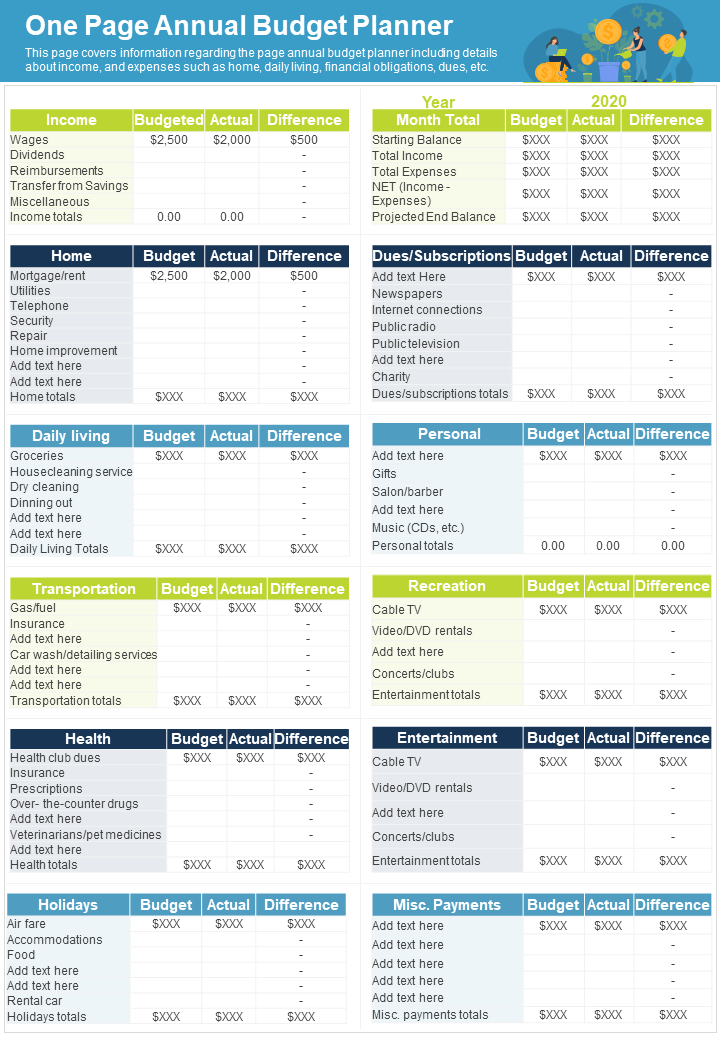

Template 1: One-Page Annual Budget Planner

This PPT Slide is a powerful business tool which allows them to plan and track their finances for the coming defined period. This budget planner typically includes projected revenue and expenses, cash flow projections, and a breakdown of budgeted amounts by category.

An effective feature of this template is that you can maintain your data on a single page which will help you ne up-to-date at a glance. Download this template to assess your financial position, identify potential shortfalls, and adjust spending plans.

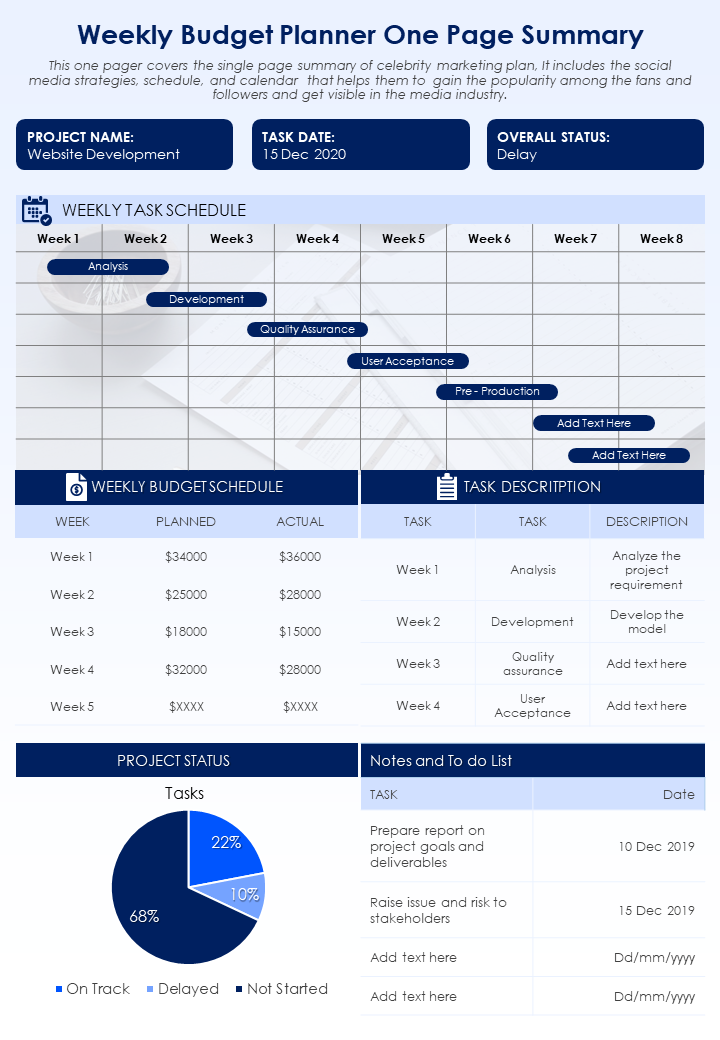

Template 2: Weekly Budget Planner One-Page Summary

Here comes the weekly budget planner. The planner includes a breakdown of expected expenses, a revenue projection or income, and a comparison of actual revenue and expenses to the projections, for a given week. With the use of SlideTeam's budget template, businesses can identify any differences between projected and actual cash flows, allowing them to take appropriate action as needed. Download this weekly budget planner to stay on top of your finances and make informed decisions on spending and revenue management.

Template 3: Bi-fold Weekly Budget Planner Summary

This PPT Template helps businesses provide a detailed yet concise look into their weekly finances. It showcases metrics such as task and budget schedule, task description, project status, notes and a to-do list. You can also add the contact details of relevant parties.

Businesses can adjust their financial plans too to reflect changes in the market, adapt to unexpected events, and ensure long-term financial stability. Download this template to stay financially healthy and successful.

Template 4: One-Page Monthly Budget Planner

This PPT Layout guides businesses in staying on track when it comes to monthly expenses, profits, and savings and provides a quick overview of their financial situation. It also allows businesses to predict their cash flow, plan for upcoming expenses, and make intelligent choices regarding investments. Businesses can ensure that they are staying within their financial means, maintaining a healthy cash flow, and achieving their long-term financial objectives with a download of this budget planner.

Template 5: One-Page Financial Retirement Budget Planner

You can use this minimalist PPT Template to calculate your savings and expenses after retirement. This is one of the most popular SlideTeam Templates and helps you in creating a realistic budget based on your post-retirement income. It will guide you in determining your retirement objectives, estimating your retirement investments, and developing a realistic plan to achieve your financial goals.

It also allows businesses to calculate how much they need to save and invest each month in order to meet their retirement goals.

Ending Note!

Budget planner templates are key instruments for businesses that wish to manage their finances efficiently and effectively. These PPT Templates provide a comprehensive overview of the company's financial situation, making it simple for businesses to track their expenses, income, and savings. Businesses can make informed decisions about their financial goals with SlideTeam's budget planner templates. These templates, whether a bi-fold weekly budget planner or a one-page monthly budget planner provide businesses with the techniques they need to plan and achieve their financial goals.

In today's fast-paced corporate world, where competition is fierce, and economic uncertainty is common our budget planner templates along with "Top 10 Financial Budget Examples With Templates and Examples" guide businesses with the tools they need to make profitable financial decisions.

FAQs ON Budget Plan

What is budget planning?

Budget planning is the process of creating a financial plan for a specific time period, such as a month, quarter, or year. It involves predicting income, estimating expenses, and allocating resources accordingly. The goal of budget planning is to ensure that enough money is available to cover all necessary expenses while also saving for future goals.

It helps individuals and organizations in determining areas where they may be overspending or where they can cut costs. Effective budget planning necessarily requires a thorough examination of past financial data as well as a realistic assessment of future financial requirements.

What's in a budget planner?

A budget planner typically consists of a list of your regular finances like- rent, income, salary, investments, savings, passive income, etc. A budget planner also includes-

- A prepared list of your monthly or annual fixed expenses

- Income records for everything you earn each month, including your salary, business income, etc.

Why is a budget planner important?

A budget planner is important because it will help you manage your expenses and lead a successful debt-free life.

In simpler terms, using a weekly, monthly, or annual budget planner you can set your money investment salary goals in advance, resulting in a sufficient amount of money in the future for run your daily personal or professional life.

What is the 50-30-20 budget rule?

The 50-30-20 budget rule is a popular personal finance strategy in which after-tax income is divided into three categories. The first category is 50% of essential expenses, which include housing, utilities, groceries, and transportation. The second category is 30% of income for luxuries such as entertainment, dining out, and vacations.

The final category which is 20%, is for saving and debt repayment, which includes commitments to retirement accounts, emergency funds, and debt repayment. This budgeting rule provides individuals with a simple framework for managing their finances and ensuring that they are spending within their financial limits while also saving for the future. It can be altered based on personal circumstances and financial goals.

Which is the best budget planner?

There are so many budget planners you can find on the web, and, you will opt for one that will save you time and expenses. If you looking for one, try and use SlideTeam’s Top 5 budget planner templates to add more comfort and productivity to your life.

Customer Reviews

Customer Reviews