Guide On Defining Roles Of Stablecoins And Central Bank Digital Currencies CBDC Complete Deck BCT CD

Get our readily accessible and professionally crafted Guide on Defining Roles of Stablecoins and Central Bank Digital Currencies CBDC PowerPoint presentation. This professionally crafted and informative deck elucidates the intricate functions of stablecoins and Central Bank Digital Currencies CBDCs in the context of the modern financial landscape. The Virtual digital assets PPT templates present a foundational understanding of stablecoins and CBDCs, establishing a solid groundwork for subsequent exploration. Furthermore, the PowerPoint presentation offers a comparative analysis of various virtual-based currencies and delves into three key trends shaping stablecoin projects. Lastly, the Digital currency PPT slides also provide insights into different types of stablecoins available for investors. Download our 100 percent editable and customizable PowerPoint, compatible with Google Slides, to streamline your presentation process.

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Guide On Defining Roles Of Stablecoins And Central Bank Digital Currencies CBDC Complete Deck BCT CD is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the forty seven slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

Content of this Powerpoint Presentation

Slide 1: This slide introduces Guide on Defining Roles of Stable coins and CENTRAL BANK DIGITAL CURRENCIES (CBDC). State your company name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide shows title for topics that are to be covered next in the template.

Slide 5: This slide covers brief summary of stablecoins with benefits such as price stability, reduced volatility, fast & low cost transactions, risk hedging etc.

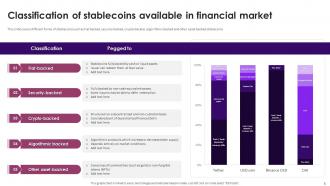

Slide 6: This slide presents different forms of stablecoins such as Fiat backed, security backed, crypto-backed, algorithmic backed and other asset backed stable coins.

Slide 7: This slide covers process to initiate investments in stablecoins from choosing a stablecoin, setting up a digital wallet, purchasing stablecoins etc.

Slide 8: This slide displays basic attributes of an effective high return generating stablecoin such as attestation, nature of reserve holdings etc.

Slide 9: This slide covers major roles played by stablecoins in financial market such as facilitating fast & low cost transactions, storage value etc.

Slide 10: This slide displays major comparisons between fiat, crypto and algo backed stablecoins on basis such as collateral types, collateralization level etc.

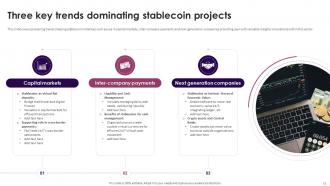

Slide 11: This slide covers prevailing trends shaping stablecoin initiatives such as use in capital markets, inter-company payments and next generation companies.

Slide 12: This slide presents various categories of stablecoins available in financial market such as Tether, USD coin, Binance USD etc.

Slide 13: This slide covers network of teams such as developers, blockchain experts, regulatory specialists contributing to development and maintenance of stablecoins worldwide.

Slide 14: This slide displays positions of different stablecoins in financial market allowing investors, analysts etc.

Slide 15: This slide covers insights into Tether United States Department of the Treasury.

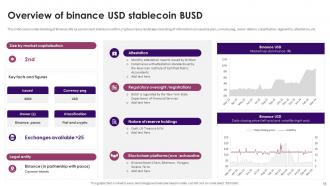

Slide 16: This slide presents understanding of Binance USD as a prominent stablecoin within cryptocurrency landscape consisting of information on issuance year etc.

Slide 17: This slide covers risks involved in using stablecoins within the digital currency ecosystem such as counterparty risk, lack of transparency etc.

Slide 18: This slide shows title for topics that are to be covered next in the template.

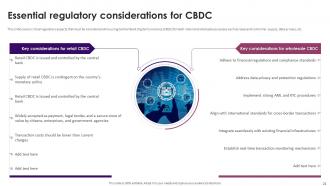

Slide 19: This slide covers brief summary of CBDC associated with types consisting of major aspects including digital assets, central bank backed & controlled.

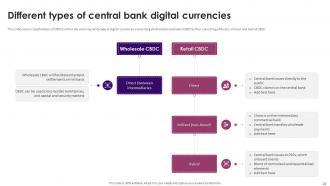

Slide 20: This slide displays classifications of CBDCs within the evolving landscape of digital currencies comprising of wholesale and retail CBDC further consisting of direct etc.

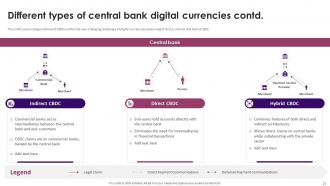

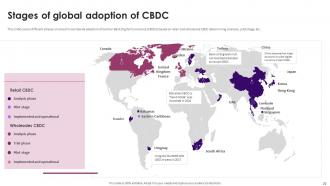

Slide 21: This slide covers categorizations of CBDCs within the ever-changing landscape of digital currencies comprising of direct, indirect and hybrid CBDC.

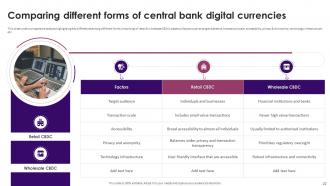

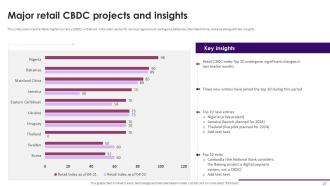

Slide 22: This slide displays comparative analysis highlighting key differences among different forms comprising of retail & wholesale CBDCs based on factors such as target audience etc.

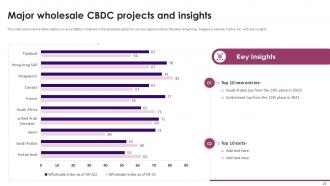

Slide 23: This slide covers advantages associated with adoption and implementation of retail and wholesale CBDCs such as financial inclusions, reduced transaction costs etc.

Slide 24: This slide presents critical regulatory aspects that must be considered while using Central Bank Digital Currencies (CBDC).

Slide 25: This slide covers critical design considerations influencing CBDC deployment success such as security & performance, competition & innovation etc.

Slide 26: This slide displays different phases involved in worldwide adoption of Central Bank Digital Currencies (CBDCs).

Slide 27: This slide covers Central Bank Digital Currency (CBDC) initiatives in the retail sector for various regions such as Nigeria, Bahamas, Mainland China etc.

Slide 28: This slide also covers Central Bank Digital Currency (CBDC) initiatives in the wholesale sector for various regions such as Thailand, Hong Kong, Singapore, Canada etc.

Slide 29: This slide shows title for topics that are to be covered next in the template.

Slide 30: This slide covers understanding of significant retail Central Bank Digital Currency (CBDC) initiatives within the Nigerian financial landscape.

Slide 31: This slide displays exploration of significant retail Central Bank Digital Currency (CBDC) initiatives within Bahamian financial landscape.

Slide 32: This slide covers detailed overview of progress in implementing retail CBDCs in Mainland China such as comprising of information such global ranking, index value etc.

Slide 33: This slide covers challenges and solutions associated with CBDC implementation comprising of Central Bank Control and Economic Impact etc.

Slide 34: This slide shows title for topics that are to be covered next in the template.

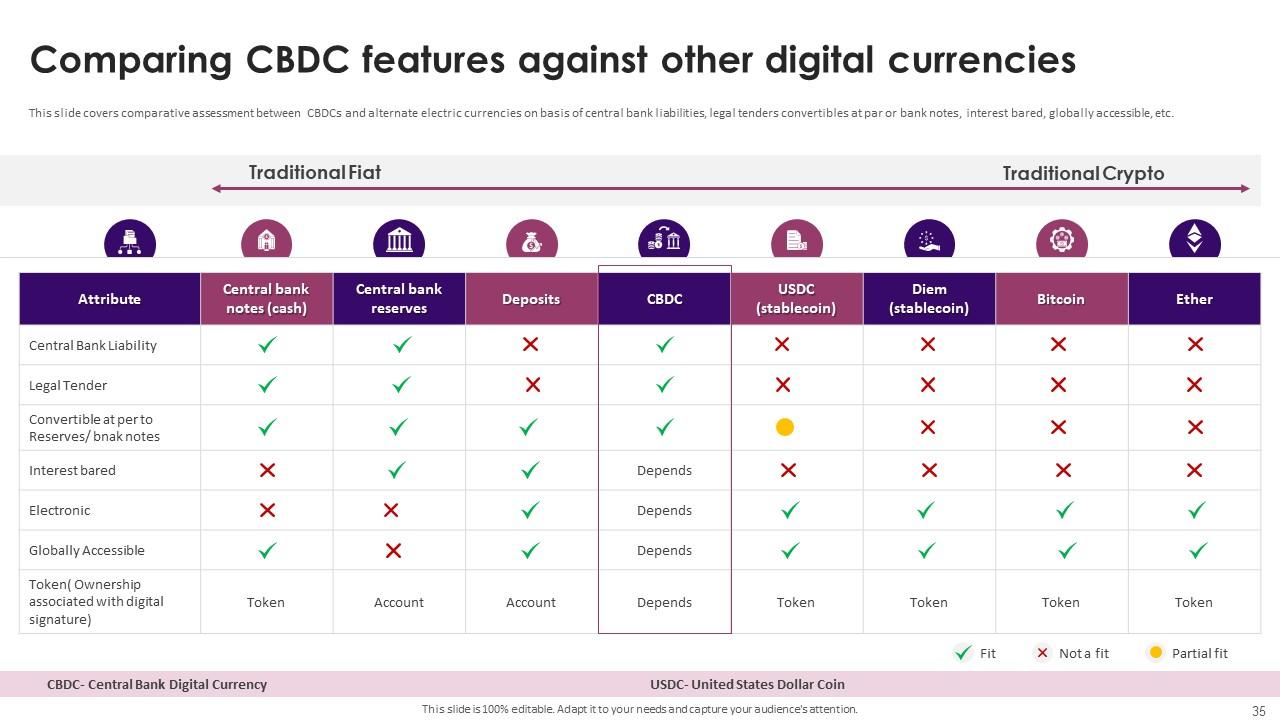

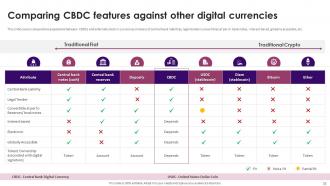

Slide 35: This slide covers comparative assessment between CBDCs and alternate electric currencies on basis of central bank liabilities and more.

Slide 36: This slide displays a comparative assessment between crypto coins and CBDCs on basis of centralization & decentralization, issuance, reserves etc.

Slide 37: This slide covers comparative assessment between stablecoins and CBDCs on basis of issuer, regulations, backing, purpose, control & authority etc.

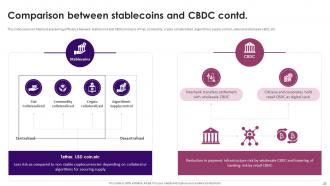

Slide 38: This slide presents architecture explaining difference between stablecoins and CBDCs on basis of Fiat, commodity, crypto collateralized etc.

Slide 39: This slide is titled as Additional Slides for moving forward.

Slide 40: This slide shows all the icons included in the presentation.

Slide 41: This slide provides 30 60 90 Days Plan with text boxes.

Slide 42: This is a Timeline slide. Show data related to time intervals here.

Slide 43: This slide shows Post It Notes for reminders and deadlines. Post your important notes here.

Slide 44: This slide contains Puzzle with related icons and text.

Slide 45: This slide depicts Venn diagram with text boxes.

Slide 46: This is an Idea Generation slide to state a new idea or highlight information, specifications etc.

Slide 47: This is a Thank You slide with address, contact numbers and email address.

Guide On Defining Roles Of Stablecoins And Central Bank Digital Currencies CBDC Complete Deck BCT CD with all 56 slides:

Use our Guide On Defining Roles Of Stablecoins And Central Bank Digital Currencies CBDC Complete Deck BCT CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Delighted to see unique and eye-catching PowerPoint designs that are so easy to customize.

-

Definitely recommend SlideTeam to all who need help with PowerPoint presentations. Their design team can create anything you need.