Implementing Financial Asset Management Strategy To Assess Portfolio Risk And Maximize Wealth Complete Deck

Check out our professionally designed Implementing Financial Asset Management Strategy to Assess Portfolio Risk and Maximize Wealth PowerPoint Presentation. Financial asset management refers to the strategic allocation of funds into various financial instruments, such as investment funds, stocks, and bonds. This PowerPoint highlights challenges faced by organizations, such as inadequate asset visibility, risk management gaps, and ineffective asset allocation. Moreover, the Portfolio Management PPT templates involve implementing portfolio analysis and rebalancing strategies to assess risk and maximize return. Additionally, the Automated portfolio management software PPT slides display automated solutions to analyze assets with high and low risks. It also adopts risk management strategies to assess different types of risks and approaches to mitigate them. Furthermore, it involves a training plan, roles and responsibilities, and budget analysis for implementing strategy effectively. Lastly, the impact of implementing portfolio rebalancing on ROI and a companys case study incorporating an asset allocation strategy is also included. Download now.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Enthrall your audience with this Implementing Financial Asset Management Strategy To Assess Portfolio Risk And Maximize Wealth Complete Deck. Increase your presentation threshold by deploying this well-crafted template. It acts as a great communication tool due to its well-researched content. It also contains stylized icons, graphics, visuals etc, which make it an immediate attention-grabber. Comprising sixty five slides, this complete deck is all you need to get noticed. All the slides and their content can be altered to suit your unique business setting. Not only that, other components and graphics can also be modified to add personal touches to this prefabricated set.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Implementing Financial Asset Management Strategy to Assess Portfolio Risk and Maximize Wealth. State your company name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide shows title for topics that are to be covered next in the template.

Slide 5: This slide covers overview to financial asset management to mitigate risks. It involves key features such as asset allocation, portfolio monitoring etc.

Slide 6: This slide presents need of effective financial asset management in enterprise. It involves key benefits such as risk mitigation, funding business operations etc.

Slide 7: This slide shows title for topics that are to be covered next in the template.

Slide 8: This slide covers key challenges organization faced in managing financial assets effectively. It involves obstacles such as inadequate asset visibility etc.

Slide 9: This slide presents challenges associated with utilizing traditional financial asset management methods. It involves manual verification etc.

Slide 10: This slide displays evolving asset management trends to reduce shortcomings and maximize financial growth.

Slide 11: This slide shows title for topics that are to be covered next in the template.

Slide 12: This slide covers key strategies for managing organizational assets effectively. It involves approaches such as portfolio growth and management etc.

Slide 13: This slide shows title for topics that are to be covered next in the template.

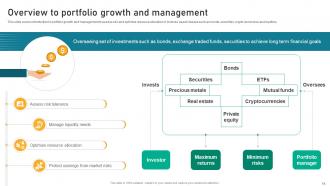

Slide 14: This slide covers introduction to portfolio growth and management to assess risk and optimize resource allocation.

Slide 15: This slide displays assessing current scenario of project portfolio performance to implement appropriate strategies.

Slide 16: This slide presents portfolio management and governance framework to improve financial stability and asset management.

Slide 17: This slide covers four steps process to construct diversified portfolio. It involves key steps such as determining asset allocation etc.

Slide 18: This slide represents asset class classification in investment portfolio. It covers stocks, bonds and alternative investment that enables user to invest in business.

Slide 19: This slide covers portfolio diversification to assess risk exposure. It covers risk level such as very conservative, conservative moderately aggressive etc.

Slide 20: This slide shows title for topics that are to be covered next in the template.

Slide 21: This slide presents how technology helps in managing financial assets effectively. It involves integration of data analytics and AI, robo advisors etc.

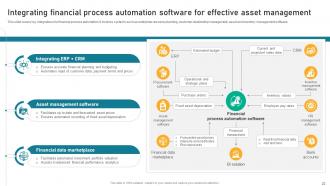

Slide 22: This slide covers key integrations for financial process automation. It involves systems such as enterprise resource planning, customer relationship management etc.

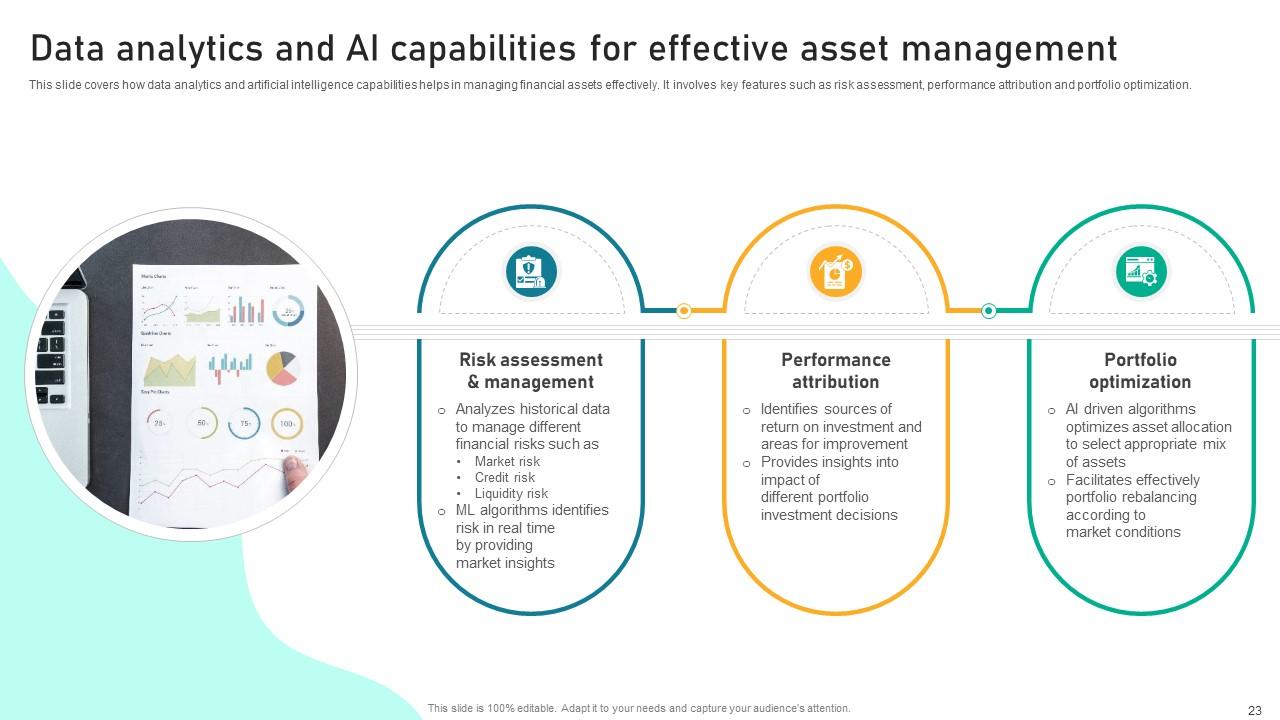

Slide 23: This slide displays how data analytics and artificial intelligence capabilities helps in managing financial assets effectively.

Slide 24: This slide covers using online trading platforms for effective sales and purchase of financial assets.

Slide 25: This slide presents utilizing portfolio and risk management software to generate market data for informed and strategic decision making.

Slide 26: This slide shows title for topics that are to be covered next in the template.

Slide 27: This slide covers overview to financial risk management in organization. It involves implementing strategies such as hedging, diversification etc.

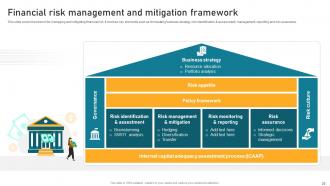

Slide 28: This slide displays framework for managing and mitigating financial risk. It involves key elements such as formulating business strategy etc.

Slide 29: This slide covers key strategies to mitigate financial risk of enterprise. It involves strategies such as hedging, diversification and risk transfer etc.

Slide 30: This slide presents various categories of risks occurring due to possibility of losing money on an investment or business venture.

Slide 31: This slide covers techniques to mitigate financial risk in enterprise. It involves approaches such as putting amount of insurance at backend etc.

Slide 32: This slide presents strategies to mitigate financial risk of enterprise. It involves risks such as cost overrun, increase in interest rates etc.

Slide 33: This slide shows title for topics that are to be covered next in the template.

Slide 34: This slide covers implementing asset allocation strategy to lower investment risk and effective health management.

Slide 35: This slide displays steps to formulate asset allocation strategy effectively. It involves key steps such as setting investment objectives, identify assets etc.

Slide 36: This slide covers different types of asset allocation strategies for effective wealth management.

Slide 37: This slide presents allocating investment among different asset classes to maximizing returns. It involves subclasses such as corporate bonds etc.

Slide 38: This slide covers building portfolios and allocating risk to different asset classes on basis of risk tolerance capabilities.

Slide 39: This slide displays analysis of different asset allocation strategies and risk associated with them.

Slide 40: This slide shows title for topics that are to be covered next in the template.

Slide 41: This slide covers comparison of asset management strategies for selecting suitable one for organization.

Slide 42: This slide shows title for topics that are to be covered next in the template.

Slide 43: This slide covers roles and responsibilities associated with finance team. It involves key people such as analyst, portfolio manger, investment and asset manager.

Slide 44: This slide displays training program to allocate assets and manage wealth portfolio effectively to attain growth and maximize returns.

Slide 45: This slide presents budget analysis for adopting asset management strategy effectively. It involves parameters such employee training, insurance etc.

Slide 46: This slide shows title for topics that are to be covered next in the template.

Slide 47: This slide represents impact of portfolio management post implementation. It covers operational efficiency, time spend for project scheduling, budget variance etc.

Slide 48: This slide presents key impact of portfolio and investment management. It includes decrease in portfolio risk and increase in portfolio ROI.

Slide 49: This slide covers the impact of appropriate allocation strategy in identifying assets that results in decrease in portfolio losses volatility etc.

Slide 50: This slide shows title for topics that are to be covered next in the template.

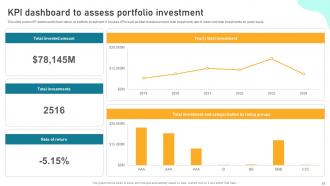

Slide 51: This slide covers KPI dashboard to track return on portfolio investment. It involves KPIs such as total invested amount, total investment etc.

Slide 52: This slide displays dashboard to analyze financial asset information effectively. It involves details such as total assets, total revenue generated and sales.

Slide 53: This slide shows title for topics that are to be covered next in the template.

Slide 54: This slide covers case study of company implementing portfolio management strategy to improve resource allocation. It involves challenges, solutions and impact.

Slide 55: This slide shows all the icons included in the presentation.

Slide 56: This slide is titled as Additional Slides for moving forward.

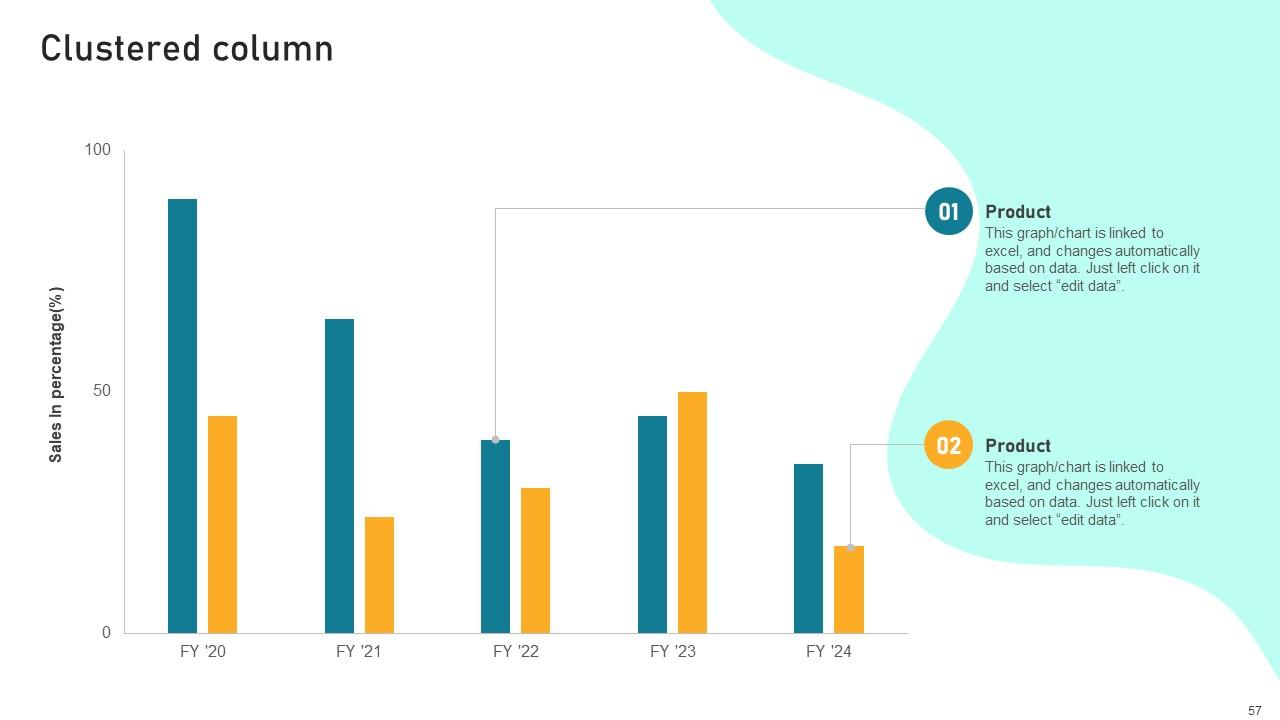

Slide 57: This slide provides Clustered Column chart with two products comparison.

Slide 58: This slide displays 30 60 90 Days Plan with text boxes.

Slide 59: This is an Idea Generation slide to state a new idea or highlight information, specifications etc.

Slide 60: This is a financial slide. Show your finance related stuff here.

Slide 61: This slide contains Puzzle with related icons and text.

Slide 62: This slide displays SWOT analysis describing- Strength, Weakness, Opportunity, and Threat.

Slide 63: This slide shows Post It Notes for reminders and deadlines. Post your important notes here.

Slide 64: This slide presents Roadmap with additional textboxes. It can be used to present different series of events.

Slide 65: This is a Thank You slide with address, contact numbers and email address.

Implementing Financial Asset Management Strategy To Assess Portfolio Risk And Maximize Wealth Complete Deck with all 74 slides:

Use our Implementing Financial Asset Management Strategy To Assess Portfolio Risk And Maximize Wealth Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

SlideTeam never fails to surprise me with its amazing PPT designs. Thanks team for providing me with your constant support!

-

Thank you for offering such fantastic custom design services. The team is really helpful and innovative. In a very short time, I received my personalized template.