Optimization of capital structure of firm to improve profitability complete deck

This template will help the organization in optimizing debt ratio to maximize firm value and reducing cost of capital. The current scenario of firm depicts various sources of capital funding such as debt, equity capital, etc. The firms capital structure is analyzed on the basis of debt equity ratio, WACC, cost of equity and debt, present debt and equity pattern, etc. The debt equity ratio of the firm determines that firm is aggressively financed through debt which puts the firm in potential risk of financial distress or bankruptcy. The Chief Financial Officer will present this template to higher level management. The over levered firm will search different ways to shift to optimal debt ratio at minimum cost of capital by estimating optimal debt ratio on different rates with respect to cost of capital and firm value. The firm can alter its financial mix through ways such as equity recapitalization, divestiture and use of proceeds, new investment financing. The firm will raise capital funding through equity by initial public offerings process and leveraged buyout process. The alteration of financial mix will impact debt and equity pattern by reducing debt and increasing equity resulting lower debt equity ratio at minimum cost of capital.

You must be logged in to download this presentation.

PowerPoint presentation slides

This complete presentation has PPT slides on wide range of topics highlighting the core areas of your business needs. It has professionally designed templates with relevant visuals and subject driven content. This presentation deck has total of fourty eight slides. Get access to the customizable templates. Our designers have created editable templates for your convenience. You can edit the colour, text and font size as per your need. You can add or delete the content if required. You are just a click to away to have this ready-made presentation. Click the download button now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Optimization of Capital Structure of Firm to Improve Profitability. State your Company name and begin.

Slide 2: This slide displays Agenda for Capital Structure.

Slide 3: This slide displays Table of Contents

Slide 4: This slide displays Table of Contents.

Slide 5: This slide displays Source of Capital Structure Funding.

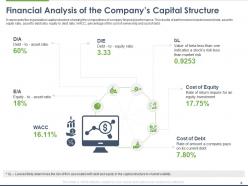

Slide 6: This slide represents the organization capital structure showing the compositions of company financial performance. The results of performance include levered beta, asset to equity ratio, asset to debt ratio, equity to debt ratio, WACC, percentage of the cost of ownership and cost of debt.

Slide 7: This slide will help in Analyzing Debt Equity Ratio

Slide 8: This slide shows Table of Contents.

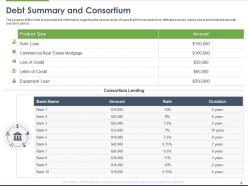

Slide 9: This slide displays Debt Summary and Consortium. The purpose of this slide is to provide the information regarding the various kinds of loans that firm has taken from different sources, banks and at what interest rate with loan term period.

Slide 10: This slide Presents Debt Situation of Company

Slide 11: This slide displays Table of Content contaning- Equity Capital Structure, Current Equity Situation.

Slide 12: This slide shows Current Equity Situation of Firm

Slide 13: This slide displays Table of Contents contaning- Capital Structure Analysis, Analyzing Financial Leverage of Firm, Cost of Equity vs Debt.

Slide 14: This slide describes about Analyzing Financial Leverage of Firm

Slide 15: This slide determines the pattern of cost of equity vs debt. The firm is experiencing decrease in cost of equity as firm’s value is decreasing. The cost of debt is increasing due to increment in borrowings and high interest rate.

Slide 16: This slide displays Table of Contents.

Slide 17: This slide describes about Estimating Optimal Debt Ratio

Slide 18: This slide shows Selection Criteria for Optimal Financing Mix.

Slide 19: This slide explains How Firm can Alter Financial Mix. The slide provides information about the various options through which firm can achieve optimal financial mix.

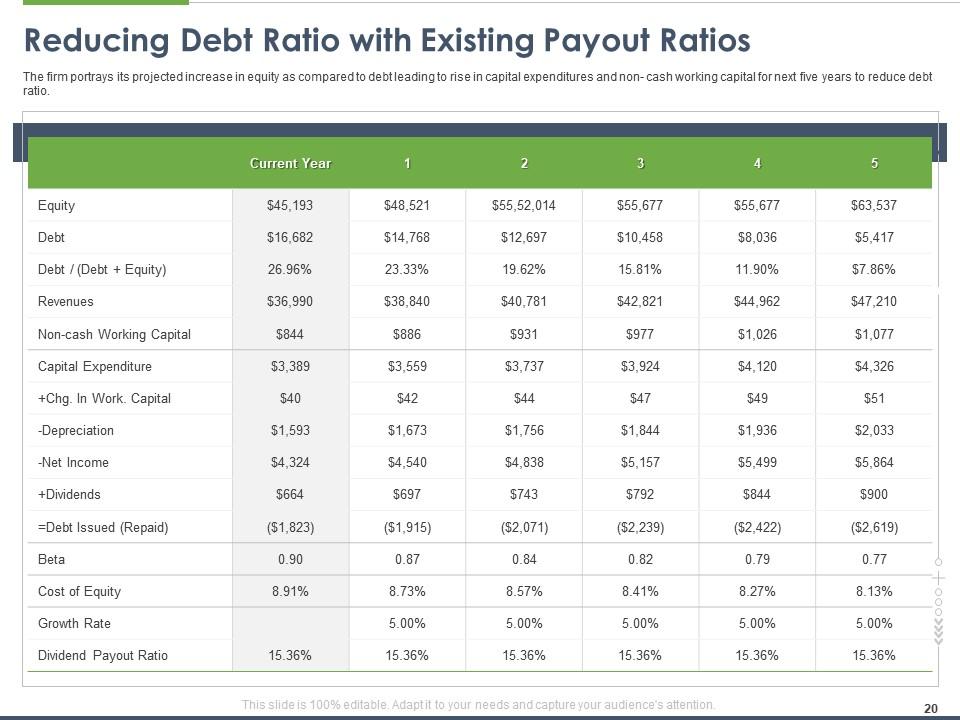

Slide 20: This slide describes Reducing Debt Ratio with Existing Payout Ratios

Slide 21: This slide shows Table of Contents.

Slide 22: This slide shows Initial Public Offering Summary.

Slide 23: This slide shows Initial Public Offering Process. This slide provides information about IPO process that firm can use to raise funding through equity. It is the first sale of company’s share to the public and listing of shares on stock exchange. It will allow firm to raise capital by creating newly issued and selling existing shares.

Slide 24: This slide shows Initial Public Offering Process Timeline

Slide 25: This slides provides information about way through which firm can reduce its outstanding debt and significantly increase in equity returns.

Slide 26: The slide displays Table of Contents.

Slide 27: This slide determines the relation between net debt and asset trend. The netblock is increasing and so is the debt, so the new assets added to the system, are being financed through Debt and Internal financing

Slide 28: This slide depicts the Impact on Firm Equity Pattern

Slide 29: This slide determines how firm will gradually reach to the optimal financial mix of debt and equity to incur minimum cost of capital in next year. The firm will have lowest cost of capital with 19% debt and 81% equity.

Slide 30: This slide determines the increase in shareholder’s funds as compared to long term debt in next four quarters. Thus, debt equity ratio will gradually decrease which is favorable for firm as it has lowered firm’s capital dependence on debt.

Slide 31: This slide shows Table of Contents.

Slide 32: This slide depicts Balance Sheet Statement FY 2019 - 2020

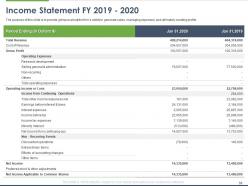

Slide 33: This slide shows Income Statement FY 2019 - 2020.

Slide 34: This slide highlights Cash Flow Statement FY 2019 - 2020

Slide 35: This slide showcases Optimization of Capital Structure of Firm to Improve Profitability Icons Slide

Slide 36: This slide is titled as Additional Slides for moving forward.

Slide 37: This slide describes about Analyzing Dividend Policy

Slide 38: This slide showcases Achieving Optimal Debt Situation

Slide 39: This slide showcases 30 60 90 Days Plan

Slide 40: This is Weekly Timeline slide with Task Name

Slide 41: This slide shows Roadmap for Process Flow

Slide 42: This slide shows Our Mission, Vision, Mission and Goal.

Slide 43: This slide displays Our Awesome Team with Names and Designations.

Slide 44: This is About us slide to showcase Company specifications.

Slide 45: This slide displays Clustered Chart with product specifications.

Slide 46: This slide displays Quotes.

Slide 47: This is Financial slide.

Slide 48: This is Thank you slide with Address, Email address and Contact number.

Optimization of capital structure of firm to improve profitability complete deck with all 48 slides:

Use our Optimization Of Capital Structure Of Firm To Improve Profitability Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Nice and innovative design.

-

Excellent design and quick turnaround.

-

Designs have enough space to add content.