Corporate Finance Mastery Maximizing Financial Performance Fin CD

Dive into the intricacies of corporate financial excellence with our comprehensive module, Corporate Finance Mastery Maximizing Financial Performance. This meticulously designed program is your gateway to mastering the essentials of financial management, capital budgeting, and risk assessment. Uncover the nuances of determining the cost of capital and optimizing working capital management strategies for operational efficiency. Explore the depths of financial analysis, capital structure dynamics, and the strategic intricacies of mergers and acquisitions. Delve into valuation techniques that decode a companys worth and strategic tax planning that ensures fiscal efficiency. Navigate the complexities of cash flow management and refine your prowess in making informed investment decisions. Elevate your understanding and expertise in corporate finance to drive financial success in todays competitive business landscape.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Corporate Finance Mastery Maximizing Financial Performance Fin CD is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the ninety six slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Corporate Finance Mastery: Maximizing Financial Performance. State Your Company Name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: The slide renders Table of contents for the presentation.

Slide 4: The slide continues Table of Contents.

Slide 5: The slide again shows Table of Contents.

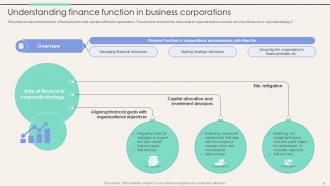

Slide 6: This slide consists of brief overview of finance function that operates within the organizations.

Slide 7: This slide consists of an exploration of the major types and approaches to financial management within organizations.

Slide 8: This slide continues of an exploration of the major types and approaches to financial management within organizations.

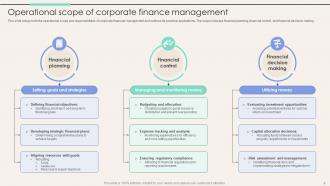

Slide 9: This slide brings forth the operational scope and responsibilities of corporate financial management and outlines its practical applications.

Slide 10: The slide outlines the top objectives that financial management aims to achieve within organizations.

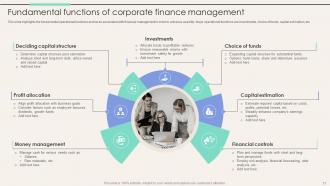

Slide 11: This slide highlights the fundamental operational functions and tasks associated with financial management in order to enhance usability.

Slide 12: This slide emphasizes the importance of integrating financial management practices within the corporate.

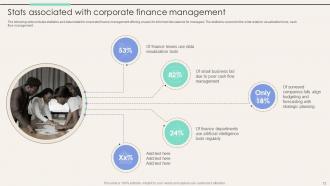

Slide 13: The slide includes statistics and data related to corporate finance management offering a basis for informed discussions for managers.

Slide 14: The slide again shows Title of contents.

Slide 15: This slide includes information on how a balance sheet portrays a company's financial position.

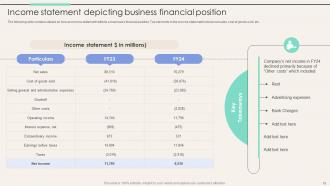

Slide 16: The slide contains details on how an income statement reflects a business's financial position.

Slide 17: The slide presents a representation of financial statement which can be used by finance managers to manage the cash flows of the enterprise.

Slide 18: This slide focuses on financial metrics that are indicative of a company's financial health.

Slide 19: This slide continues on financial metrics that are indicative of a company's financial health.

Slide 20: The slide shows another Title of contents.

Slide 21: This slide offers an introduction of investment and capital budgeting decisions, relevant for managers involved in project financing.

Slide 22: This slide contains a simplified capital budgeting technique that is net present value for managers in project analysis.

Slide 23: This slide continues a simplified capital budgeting technique that is the internal rate of return for managers in project analysis.

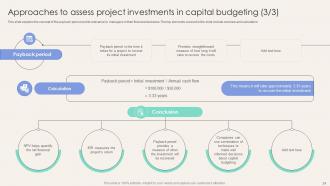

Slide 24: This slide explains the concept of the payback period and its relevance to managers in their financial decisions.

Slide 25: The slide again shows Title of contents.

Slide 26: This slide provides insights into various types of financial risks and their implications for managers.

Slide 27: This slide continues insights into various types of financial risks and their implications for managers.

Slide 28: This slide offers strategies to help businesses mitigate financial risk, providing managers with risk management tools.

Slide 29: The slide displays Title of contents further.

Slide 30: This slide introduces the concept of capital structure decisions, relevant for managers involved in financing decisions.

Slide 31: This slide contains information on major types of debt business finance, an important consideration for managers.

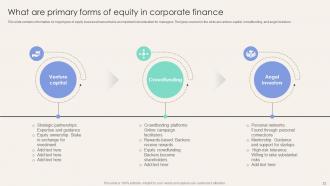

Slide 32: This slide contains information on major types of equity business finance that is an important consideration for managers.

Slide 33: This slide differentiates between debt and equity financing options, providing managers with insights for funding decisions.

Slide 34: The slide represents Title of contents.

Slide 35: The slide defines corporate cost of capital and its impact on financial decision-making.

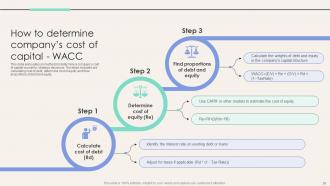

Slide 36: This slide elaborates on methods to determine a company's cost of capital crucial for strategic decisions.

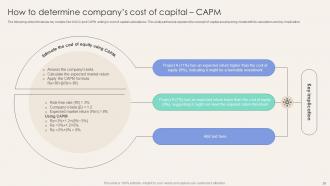

Slide 37: The slide introduces key models like WACC and CAPM aiding in cost of capital calculations.

Slide 38: The slide introduces key models like WACC and CAPM aiding in cost of capital calculations.

Slide 39: The slide depicts Title of contents which is to be discussed further.

Slide 40: The slide contains an introduction to the concept of working capital, which is vital for business management.

Slide 41: This slide brings forth major types of long and short-term considerations that need to be taken care of by the manager.

Slide 42: This slide brings forth the factors that have a significant impact on a company's working capital which is a crucial aspect of business operations.

Slide 43: This slide again shows the factors that have a significant impact on a company's working capital which is a crucial aspect of business operations.

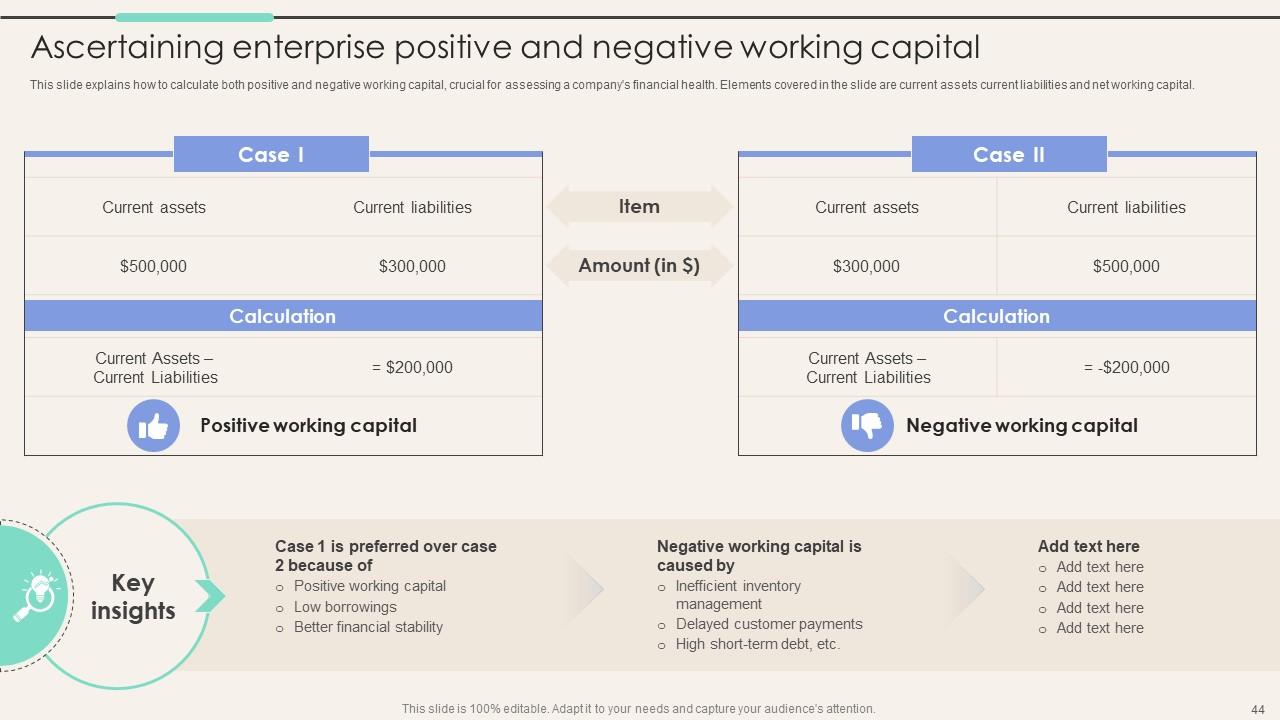

Slide 44: This slide explains how to calculate both positive and negative working capital, crucial for assessing a company's financial health.

Slide 45: The following slide depicts a process of optimizing working capital for short and long-term success by the business firms.

Slide 46: This slide presents the framework of the working capital conversion cycle that can be used by managers to understand the model.

Slide 47: This slide represents various strategies for optimizing the working capital conversion cycle in order to enhance efficiency.

Slide 48: The following slide presents metrics like cash conversion cycle vital for evaluating financial efficiency.

Slide 49: The slide again shows Title of contents.

Slide 50: This slide analyzes factors affecting various types of corporate finance risks influencing returns.

Slide 51: This slide again analyzes factors affecting various types of corporate finance risks influencing returns.

Slide 52: The slide explores the impact of risks on potential returns and strategies to manage them that will assist managers in taking informed decisions.

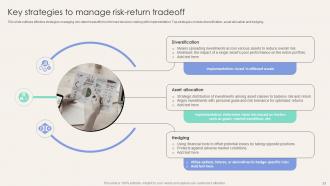

Slide 53: This slide outlines effective strategies managing risk-return tradeoffs for informed decision-making with implementation.

Slide 54: The slide shows Title of contents which is to be discussed further.

Slide 55: The following slide provides an overview of corporate valuation methods aiding managers in taking strategic decisions.

Slide 56: This slide consists of major factors that impact the financial value of company that will be used by stakeholders in making informed decisions.

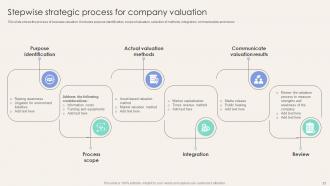

Slide 57: This slide shows the process of business valuation.

Slide 58: This slide shows checklist of performance evaluation to measure company valuation.

Slide 59: The slide shows another Title of contents.

Slide 60: This slide differentiates between horizontal, vertical, and conglomerate mergers and their impact on valuation.

Slide 61: This slide presents the characteristics of various types of corporate acquisitions.

Slide 62: The following slide contains the top factors that impact the process of company valuation.

Slide 63: This slide outlines corporate valuation approaches that should be understood by managers as essential in mergers and acquisitions strategies.

Slide 64: The slide again displays Title of contents.

Slide 65: This slide highlights the significance of tax compliance for organizations, a critical consideration for managers.

Slide 66: This slide contains effective strategies in corporate tax planning, relevant for managers responsible for tax compliance.

Slide 67: The slide again depicts Title of contents.

Slide 68: This slide offers insights into the essential functions performed by FP&A teams, guiding managers in their interactions with these teams.

Slide 69: This slide explains the responsibilities and key skills of FP&A professionals that will serve as valuable information for managers.

Slide 70: The slide shows another Title of contents.

Slide 71: The following slide presents an employee training plan that can be implemented by managers to improve the skill set of the existing workforce.

Slide 72: The slide brings forth an employee performance, tracking scorecard that can be used by managers.

Slide 73: The slide highlights another Title of contents.

Slide 74: This slide provides insights into the comparison of different working capital finance management tools.

Slide 75: The following slide presents a comparative matrix of cash flow management tools which are available in the market.

Slide 76: The slide represents another Title of contents.

Slide 77: This slide provides a dedicated dashboard for monitoring the organization's cash flow position.

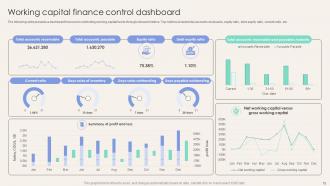

Slide 78: The following slide presents a dashboard focused on controlling working capital funds through relevant metrics.

Slide 79: The slide highlights Title of contents which is to be discussed further.

Slide 80: The following slide elaborates on various applications of blockchain technology in fintech that will assist decision-makers in making decisions accordingly.

Slide 81: This slide explains the significance of AI and machine learning in enhancing financial analysis to be used by managers effectively.

Slide 82: The slide describes another Title of contents.

Slide 83: This case study discusses strategies for improving working capital management to enhance overall operations.

Slide 84: This slide contains a case study on tech software company’s financial revival strategies, valuable for managers and stakeholders seeking real-world examples.

Slide 85: This slide shows all the icons included in the presentation.

Slide 86: This slide is titled as Additional Slides for moving forward.

Slide 87: The slide displays major types of financial risks faced by enterprises.

Slide 88: The slide highlights Roadmap to optimize business financial position.

Slide 89: The slide renders the difference between temporary and permanent working capital.

Slide 90: The slide represents Types of working capital management strategies.

Slide 91: The slide displays Strategies for improving cash flow management of enterprise.

Slide 92: This slide provides 30 60 90 Days Plan with text boxes.

Slide 93: This is an Idea Generation slide to state a new idea or highlight information, specifications etc.

Slide 94: This slide depicts Venn diagram with text boxes.

Slide 95: This slide displays Mind Map with related imagery.

Slide 96: This is a Thank You slide with address, contact numbers and email address.

Corporate Finance Mastery Maximizing Financial Performance Fin CD with all 105 slides:

Use our Corporate Finance Mastery Maximizing Financial Performance Fin CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

“I really like the convenient operation and professionalism I saw on the SlideTeam website. I want to express my regards and appreciation to the team.”

-

Excellent design and quick turnaround.