Digitalising Customer Onboarding Journey In Banking Complete Deck

Bank digital customer onboarding is a process of automating banking operations to improve banking activities through using automated software and tools. Check out our meticulously crafted PowerPoint Presentation titled, Digitalising Customer Onboarding Journey in Banking which provides a comprehensive overview of the digitalizing customer onboarding process and its importance in enhancing bank processes. Additionally, this Client Onboarding Process Deck showcases challenges faced by banks while onboarding potential customers and solutions to overcome these barriers. Moreover, It also includes assessing the need for digitalizing the onboarding process and identifying various challenges in customer onboarding. Furthermore, this Digital Banking shows techniques that can be used to optimize the onboarding process such as artificial intelligence, robotic process automation, predictive analytics, and mobile banking. Lastly, the Mobile Banking Application module follows the implementation and management of digitalization techniques with their impact on the customer onboarding process in banks. Get access now.

Bank digital customer onboarding is a process of automating banking operations to improve banking activities through using ..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Digitalising Customer Onboarding Journey In Banking Complete Deck is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the eighty five slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Digitalising Customer Onboarding Journey in Banking. State Your Company Name and begin.

Slide 2: This slide is an Agenda slide. State your agendas here.

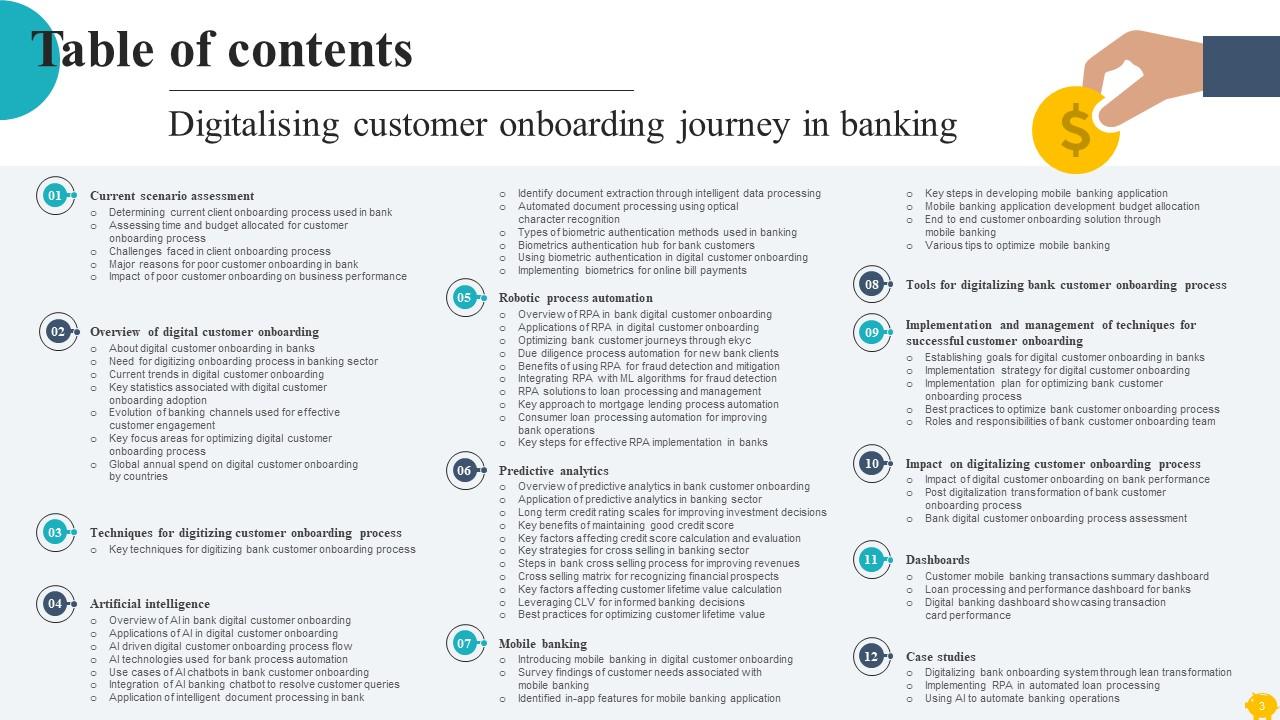

Slide 3: This slide shows a Table of Contents for the presentation.

Slide 4: This slide is an introductory slide.

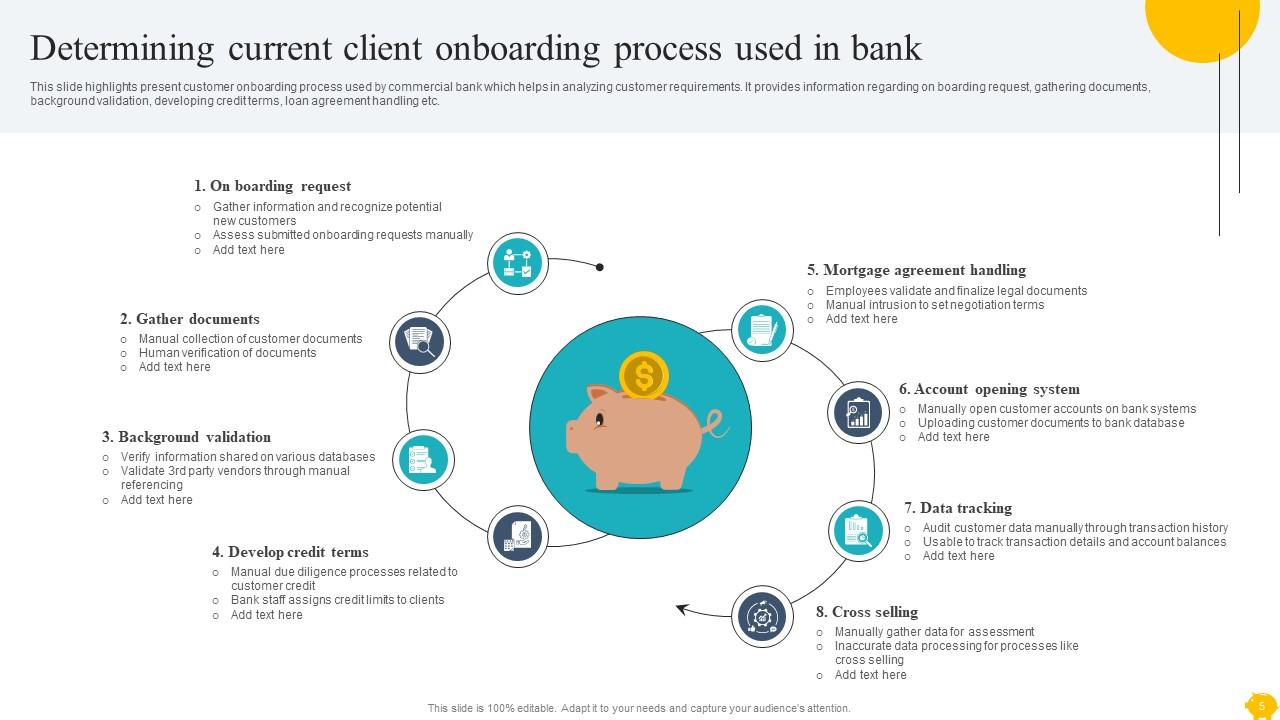

Slide 5: This slide highlights present customer onboarding process used by commercial bank which helps in analyzing customer requirements.

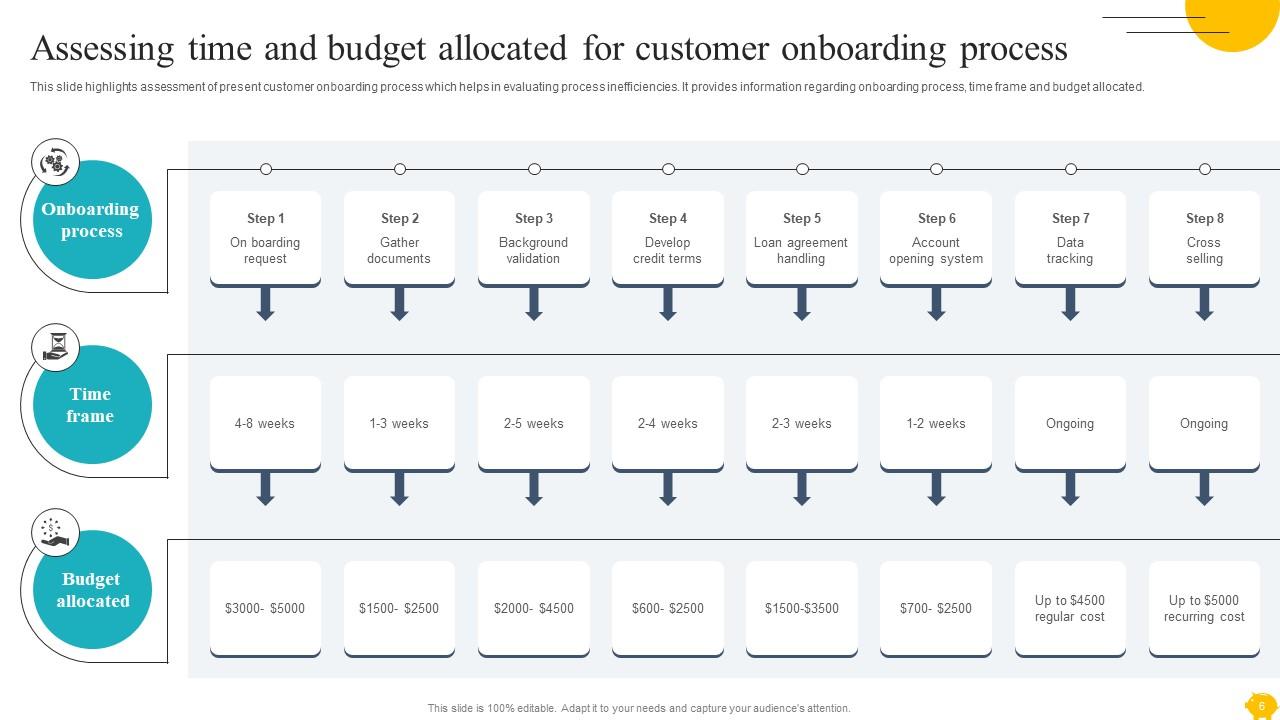

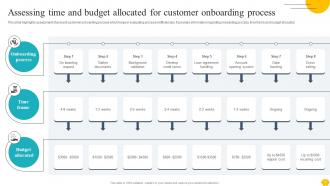

Slide 6: This slide illustrates assessment of present customer onboarding process which helps in evaluating process inefficiencies.

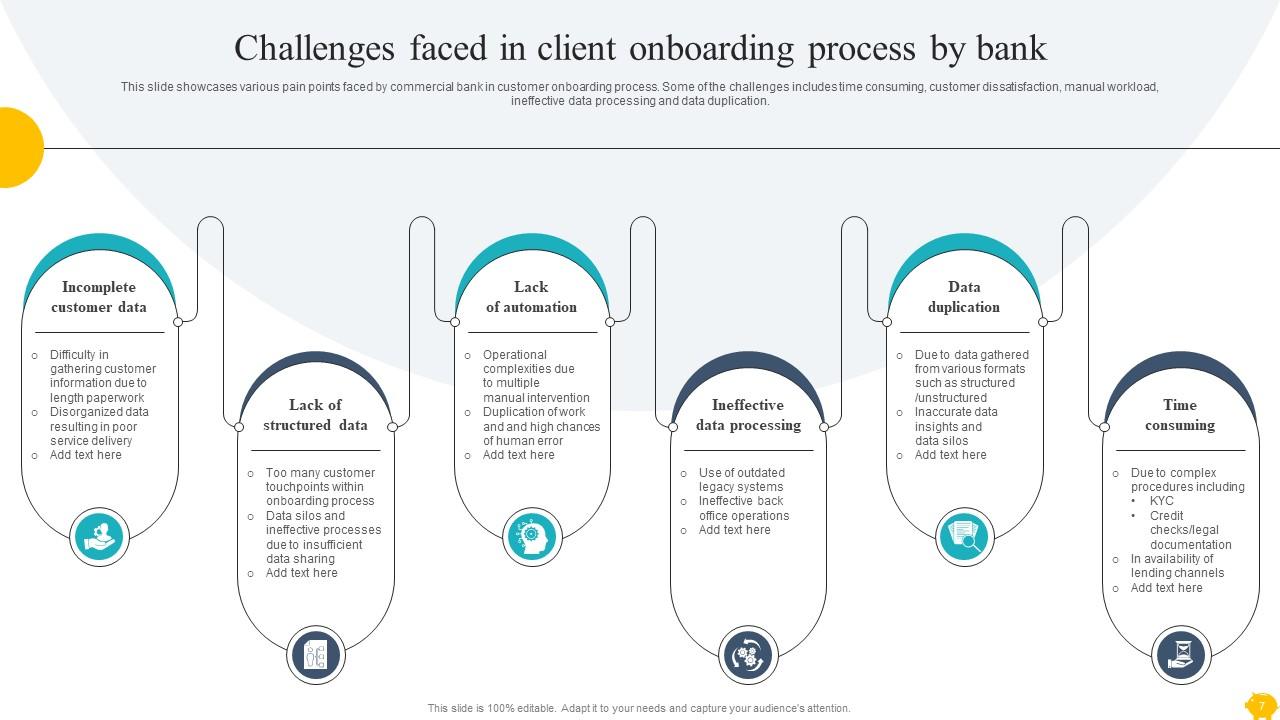

Slide 7: This slide showcases various pain points faced by commercial bank in customer onboarding process.

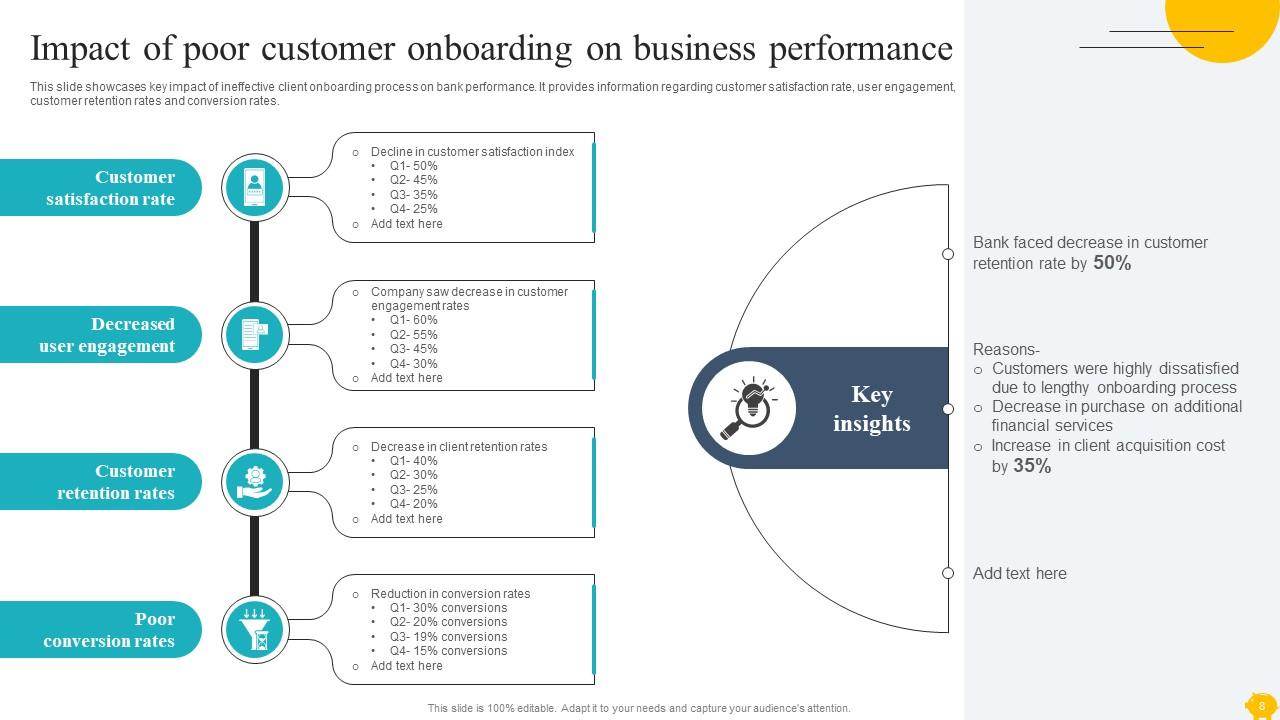

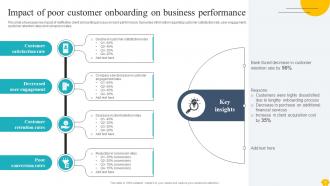

Slide 8: This slide presents key impact of ineffective client onboarding process on bank performance.

Slide 9: This slide is an introductory slide.

Slide 10: This slide provides an overview of digital customer onboarding process that can be adopted by banks which helps in improving process efficiency.

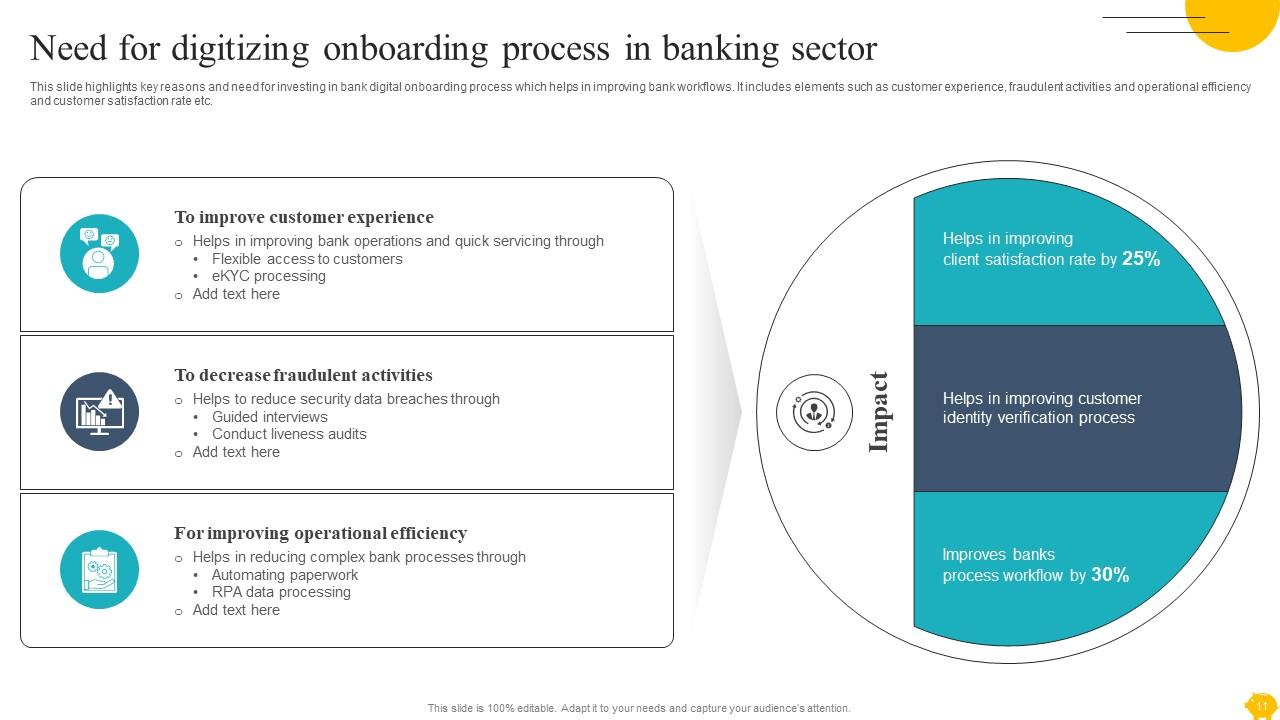

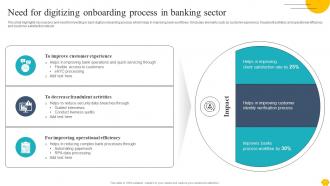

Slide 11: This slide includes key reasons and need for investing in bank digital onboarding process which helps in improving bank workflows.

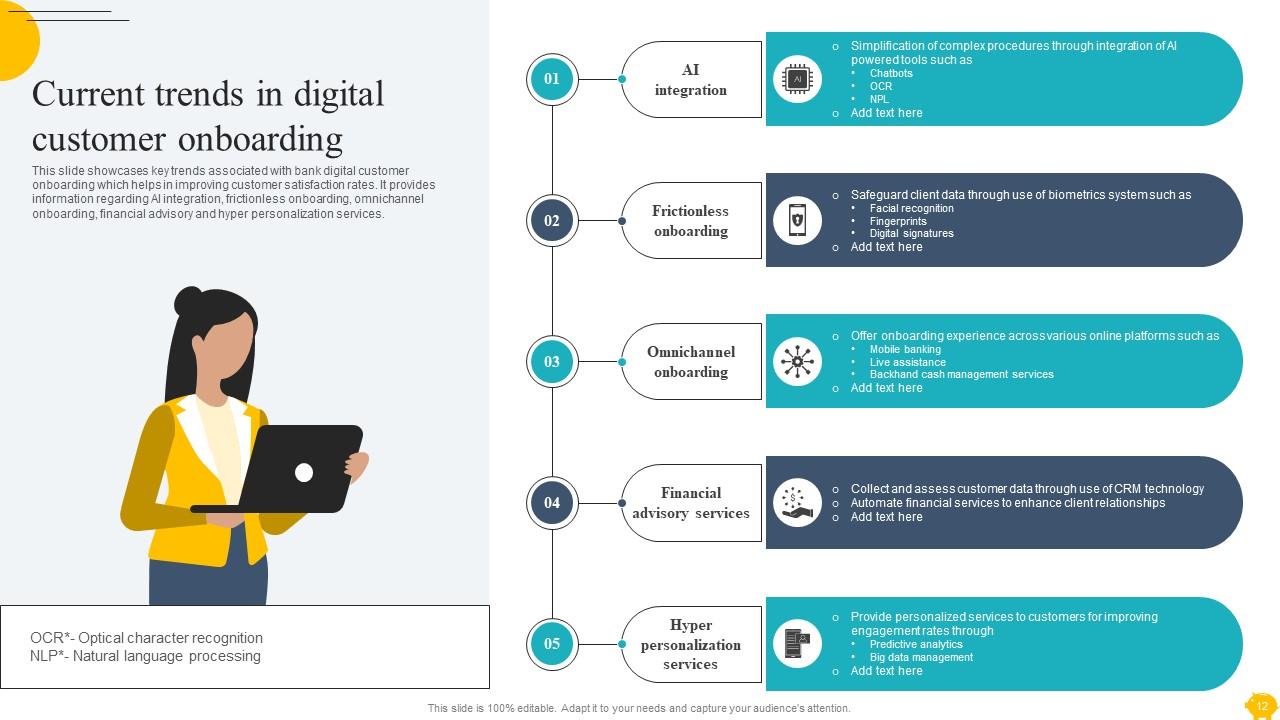

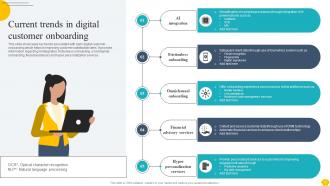

Slide 12: This slide entails key trends associated with bank digital customer onboarding which helps in improving customer satisfaction rates.

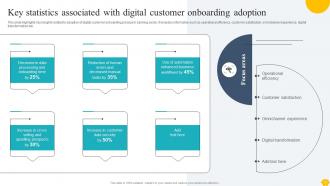

Slide 13: This slide portrays key insights related to adoption of digital customer onboarding process in banking sector.

Slide 14: This slide showcases extent of customer interaction across various omnichannel which helps in assessing current banking trends.

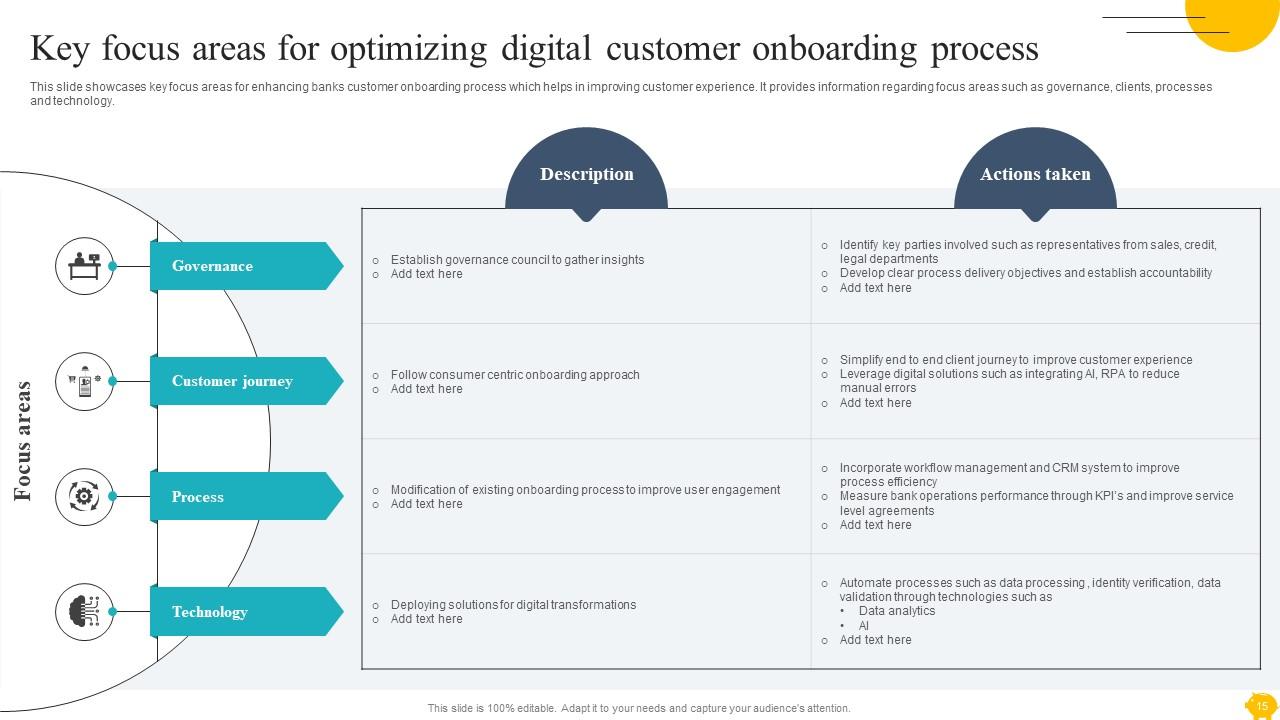

Slide 15: This slide shows key focus areas for enhancing banks customer onboarding process which helps in improving customer experience.

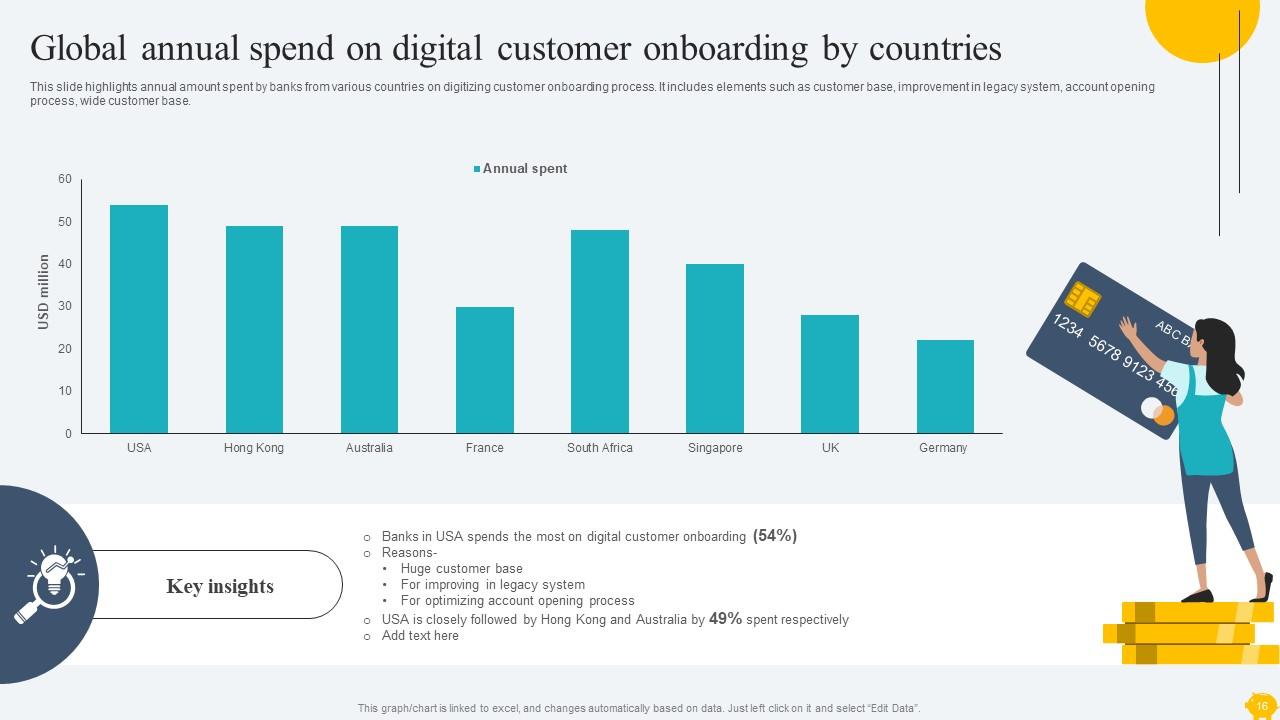

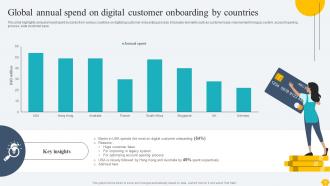

Slide 16: This slide highlights annual amount spent by banks from various countries on digitizing customer onboarding process.

Slide 17: This slide is an introductory slide.

Slide 18: This slide mentions various techniques which can be used to automate bank’s customer onboarding process which helps in enhancing customer engagement.

Slide 19: This slide is an introductory slide.

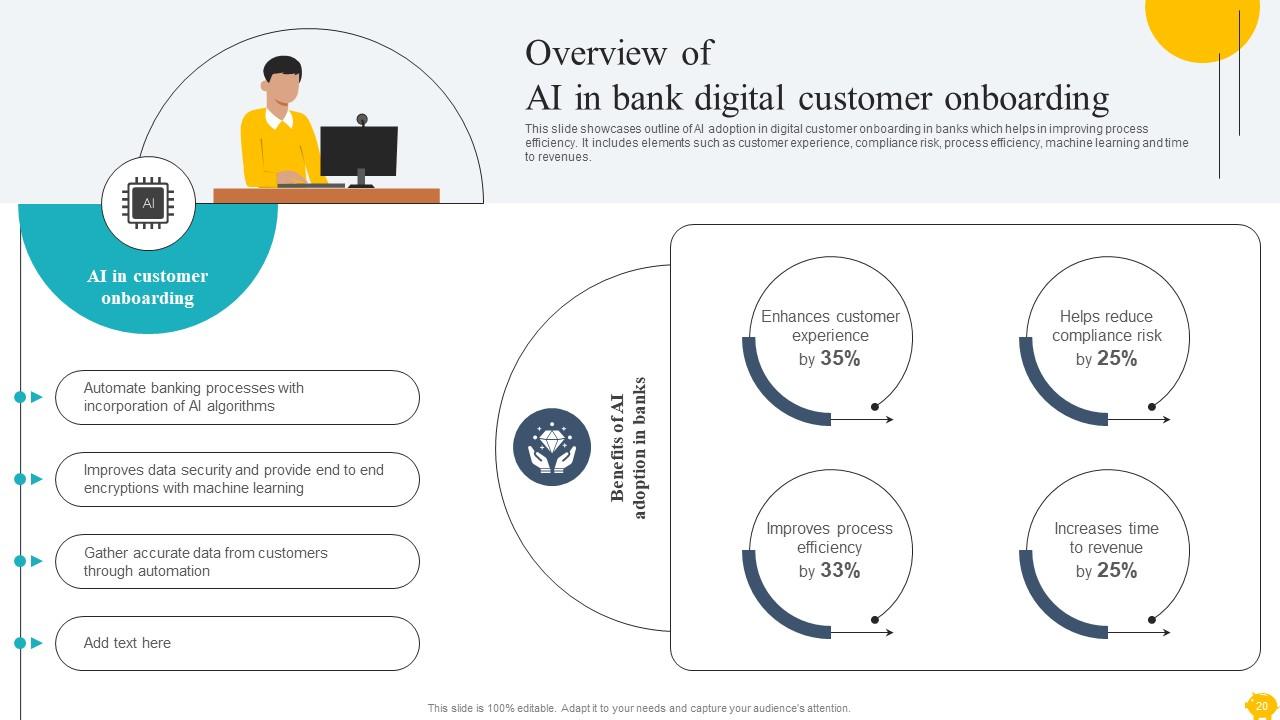

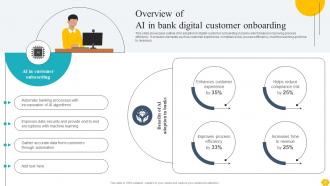

Slide 20: This slide outlines an overview of AI adoption in digital customer onboarding in banks which helps in improving process efficiency.

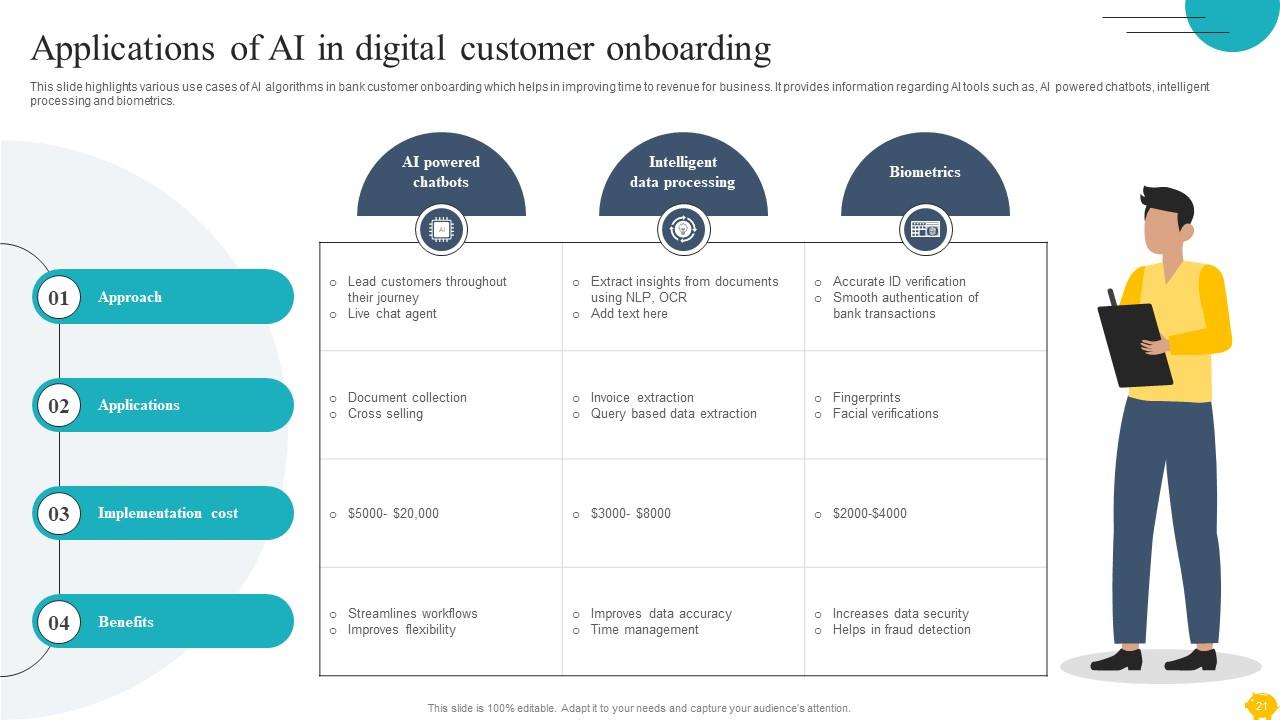

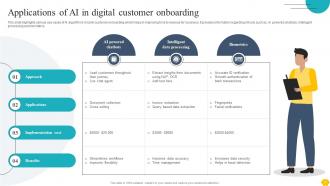

Slide 21: This slide highlights various use cases of AI algorithms in bank customer onboarding which helps in improving time to revenue for business.

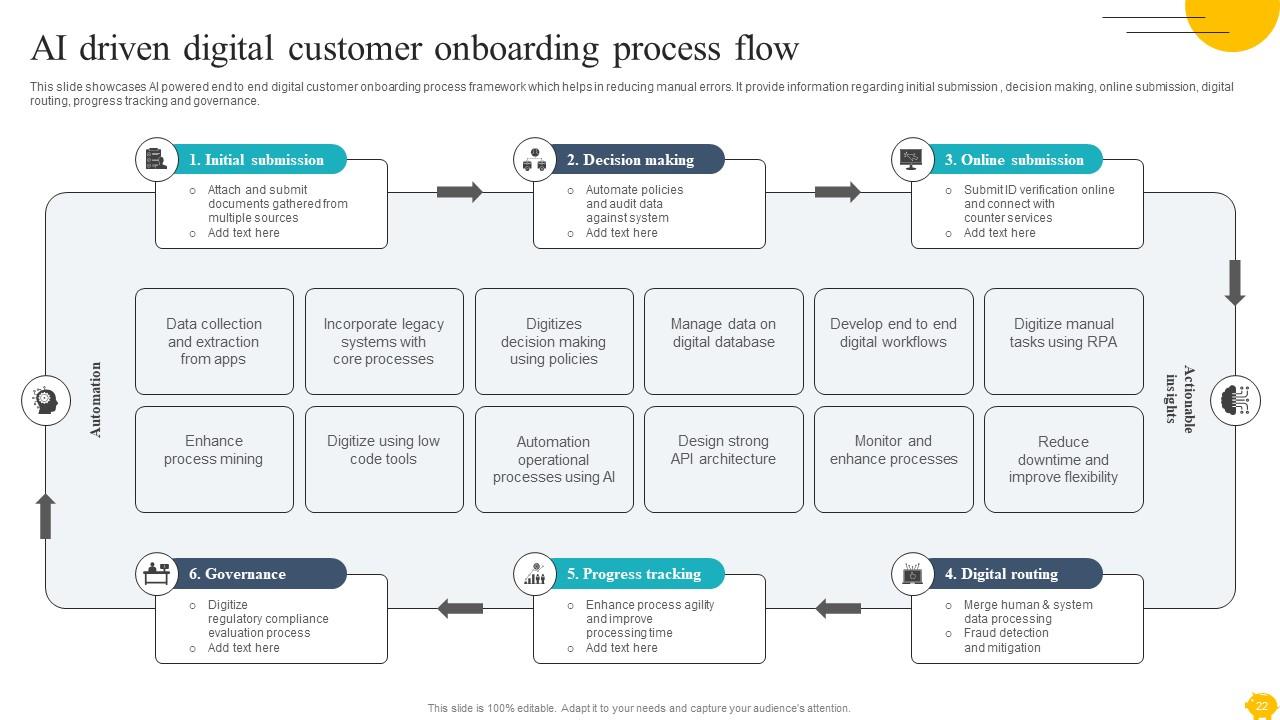

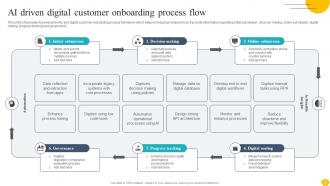

Slide 22: This slide pertains to AI powered end to end digital customer onboarding process framework which helps in reducing manual errors.

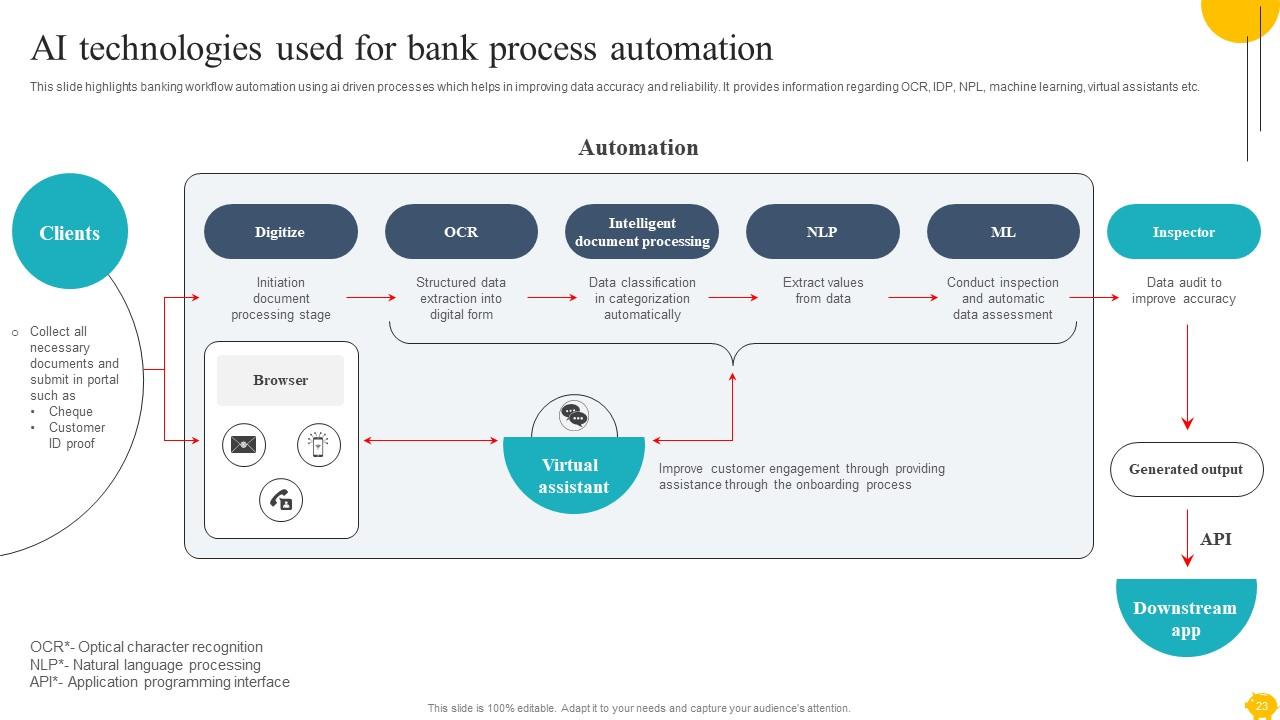

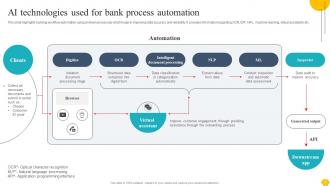

Slide 23: This slide illustrates banking workflow automation using ai driven processes which helps in improving data accuracy and reliability.

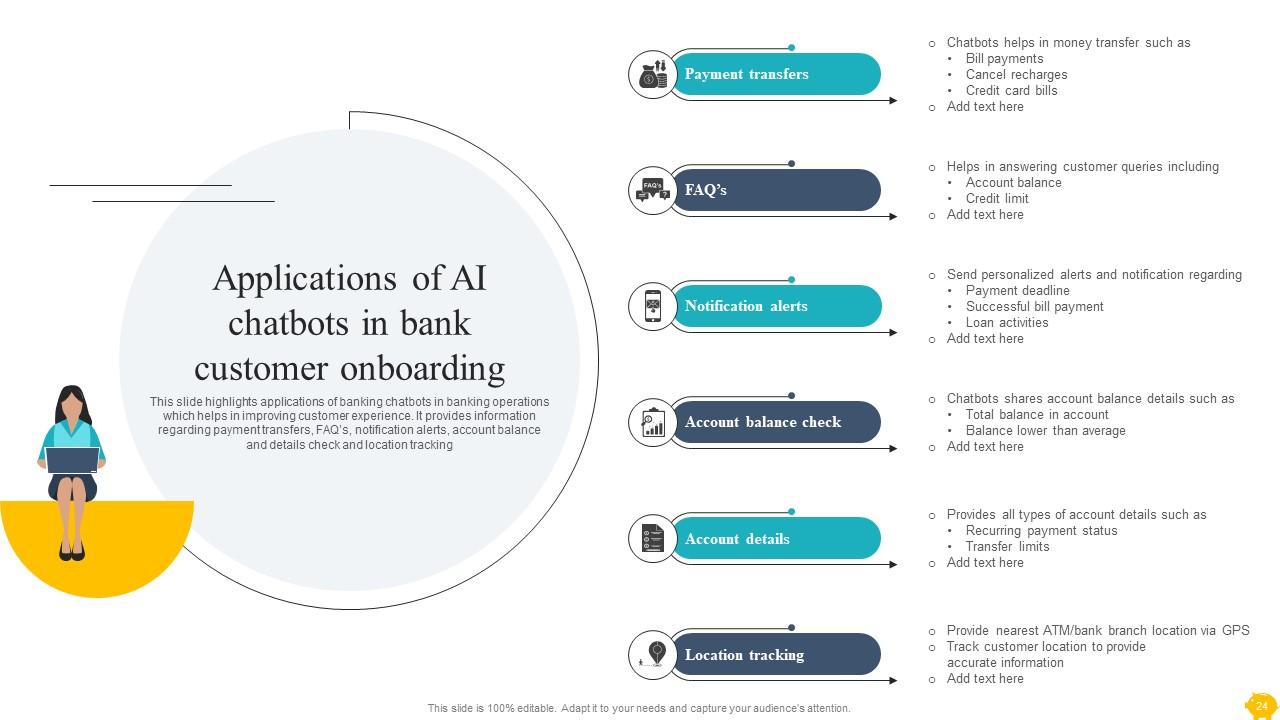

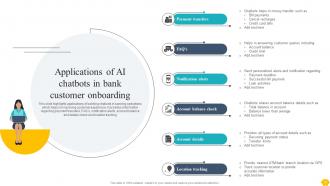

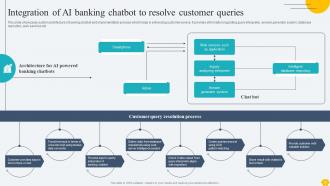

Slide 24: This slide refers to applications of banking chatbots in banking operations which helps in improving customer experience.

Slide 25: This slide marks system architecture of banking chatbot and implementation process which helps in enhancing customer service.

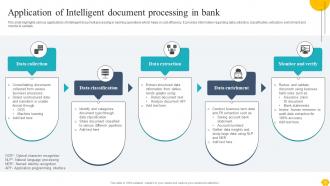

Slide 26: This slide puts various applications of intelligent document processing in banking operations which helps in cost efficiency.

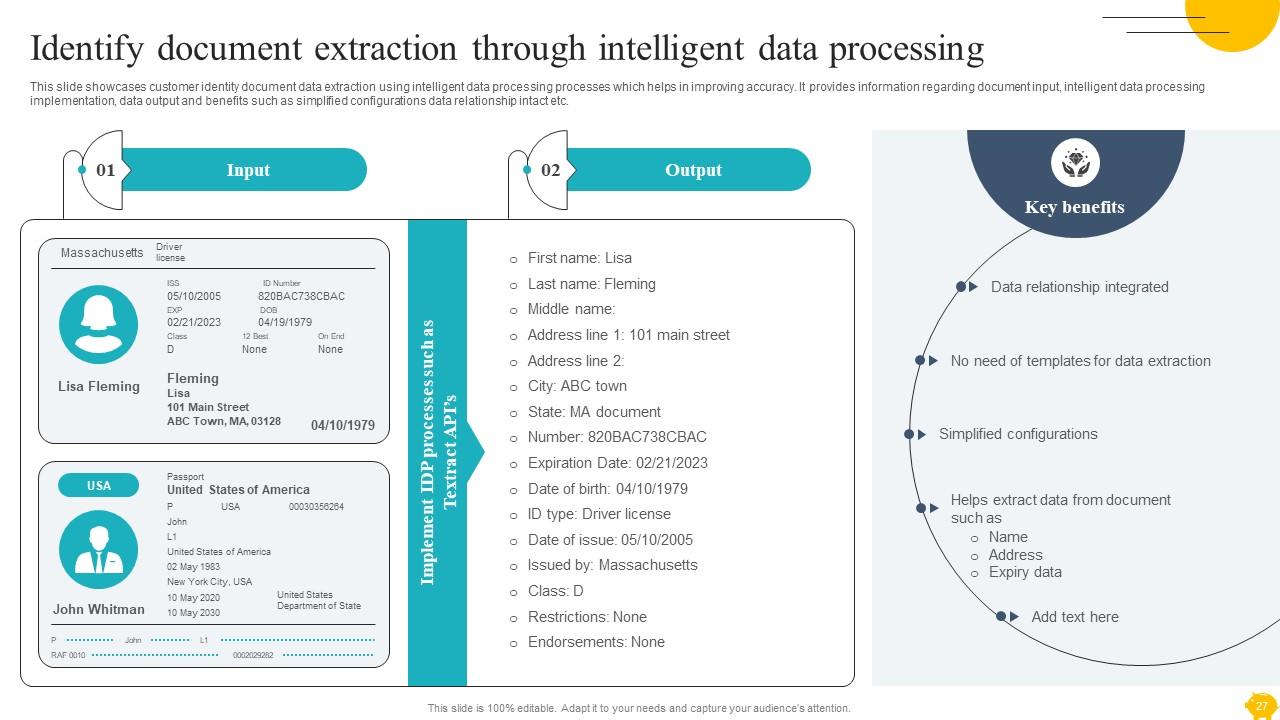

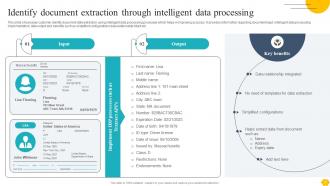

Slide 27: This slide elucidates customer identity document data extraction using intelligent data processing processes which helps in improving accuracy.

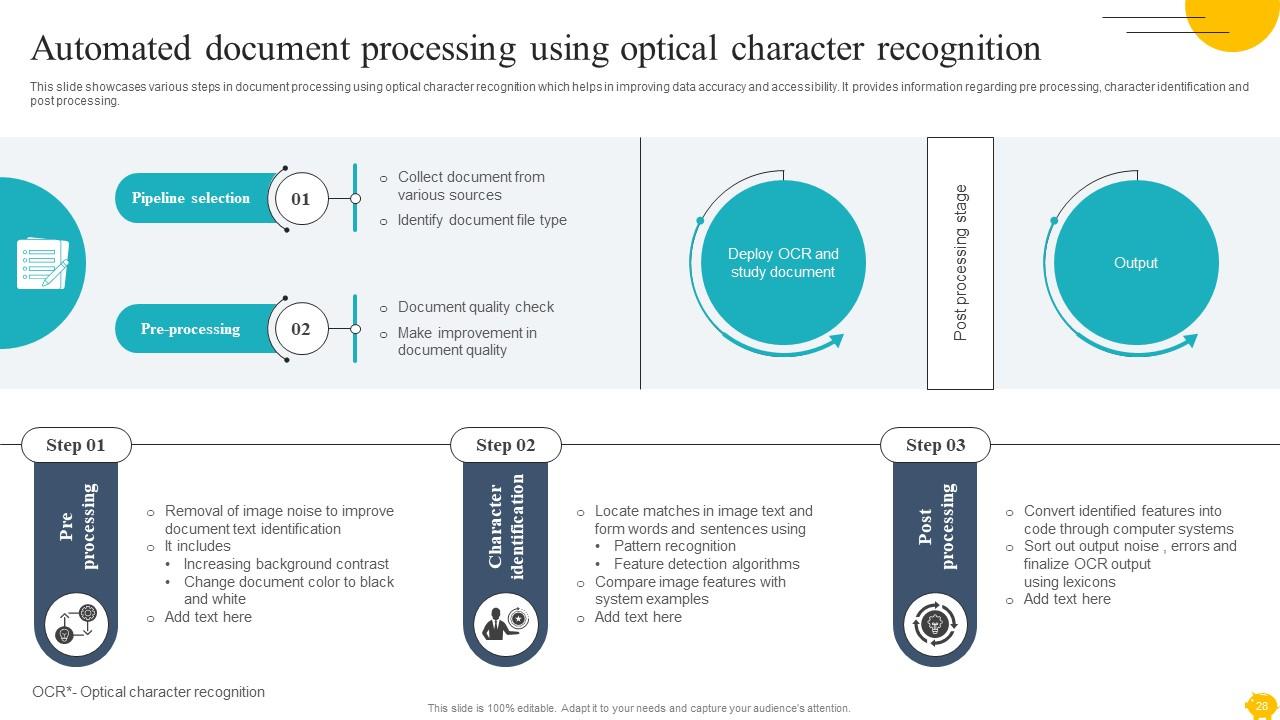

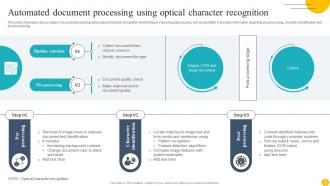

Slide 28: This slide presents various steps in document processing using optical character recognition which helps in improving data accuracy and accessibility.

Slide 29: This slide highlights various types of biometric authentication technologies used in making services which helps in improving data identification processes.

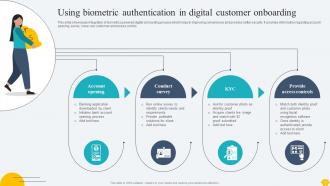

Slide 30: This slide pertains to authentication hub for various data validation method across various banking channels.

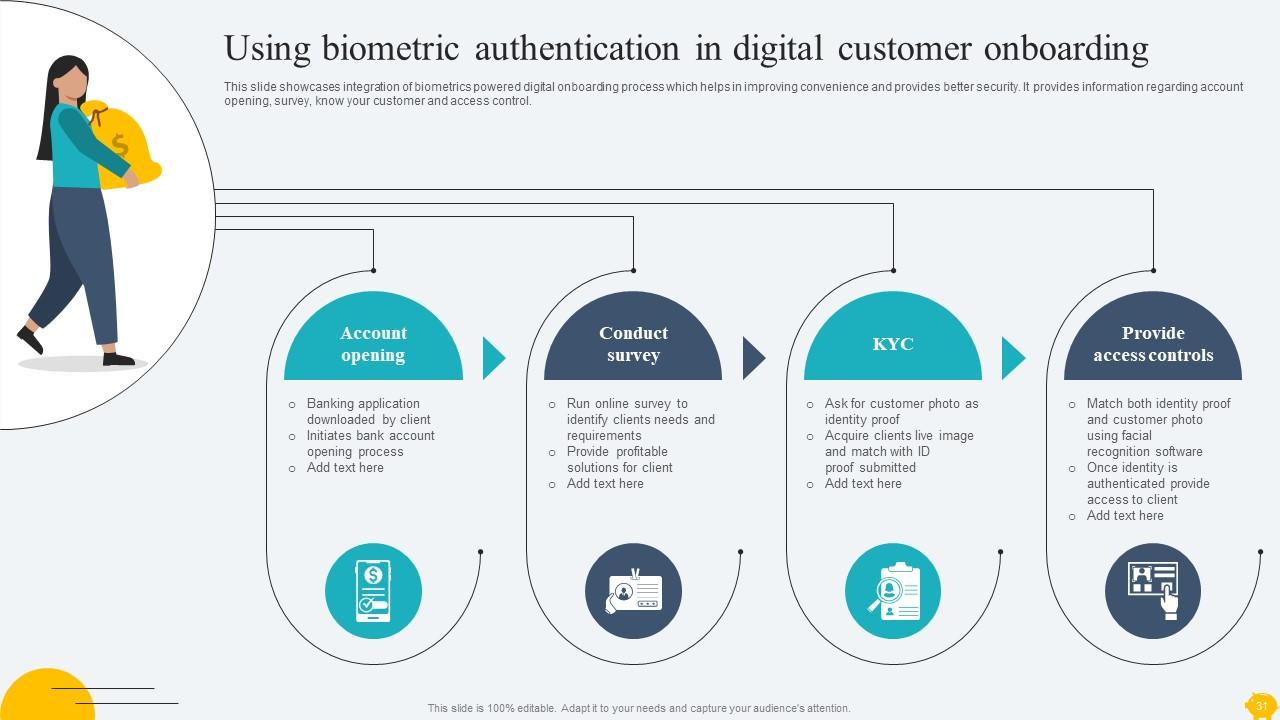

Slide 31: This slide cates to integration of biometrics powered digital onboarding process which helps in improving convenience and provides better security.

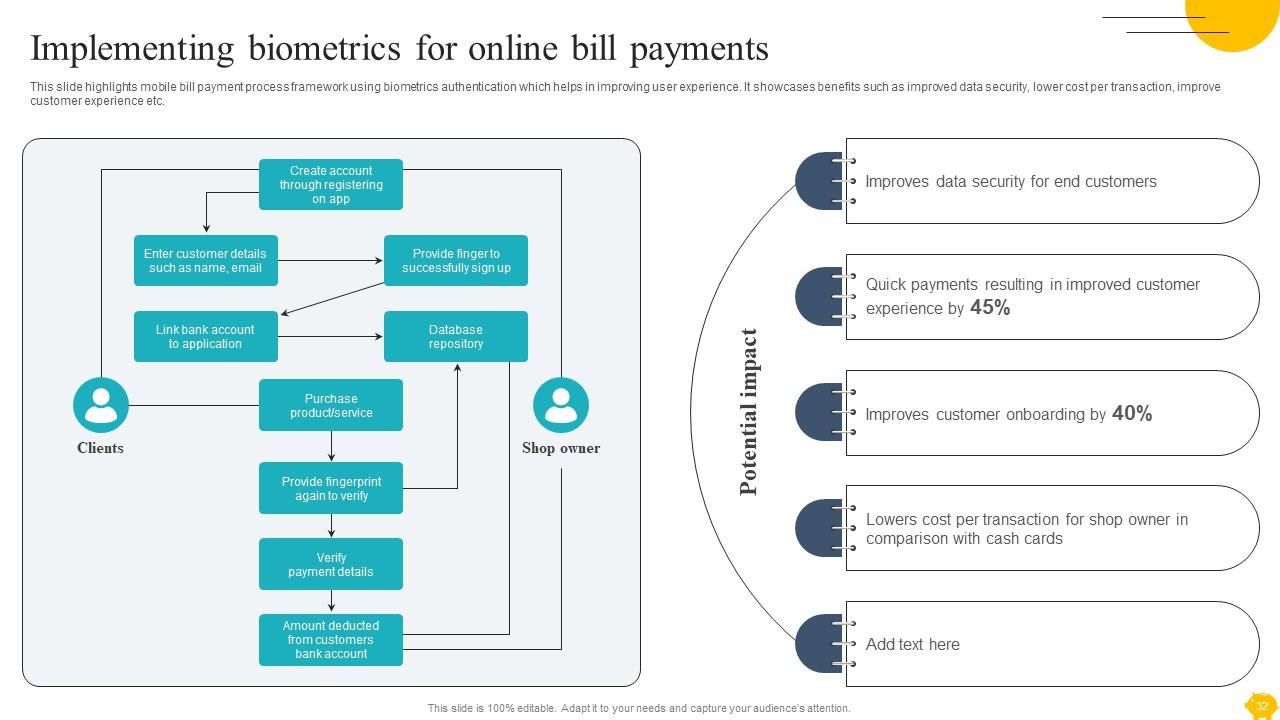

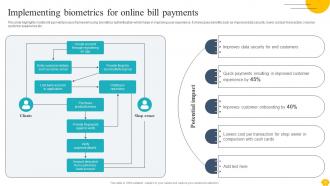

Slide 32: This slide contains mobile bill payment process framework using biometrics authentication which helps in improving user experience.

Slide 33: This slide is an introductory slide.

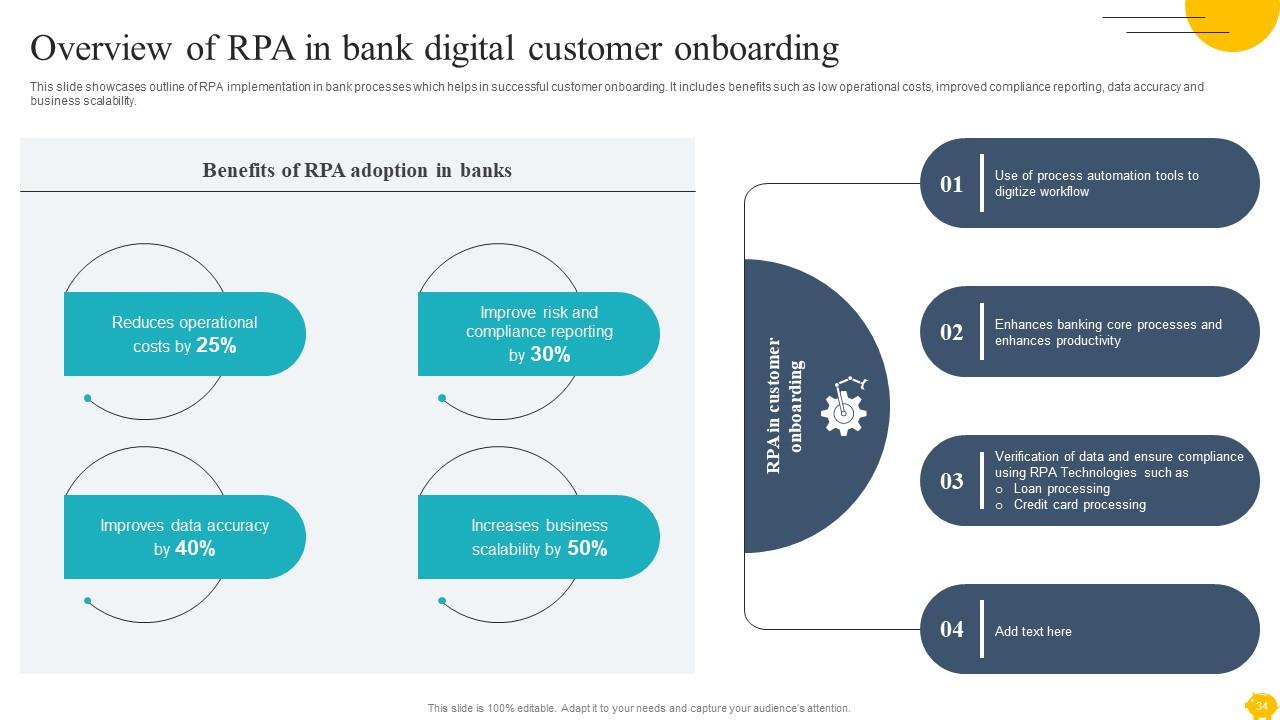

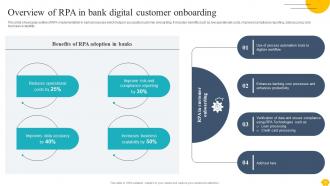

Slide 34: This slide provides an outline of RPA implementation in bank processes which helps in successful customer onboarding.

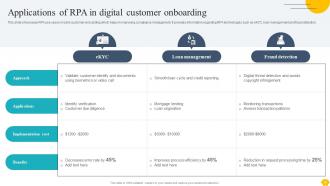

Slide 35: This slide includes RPA use cases in bank customer onboarding which helps in improving compliance management.

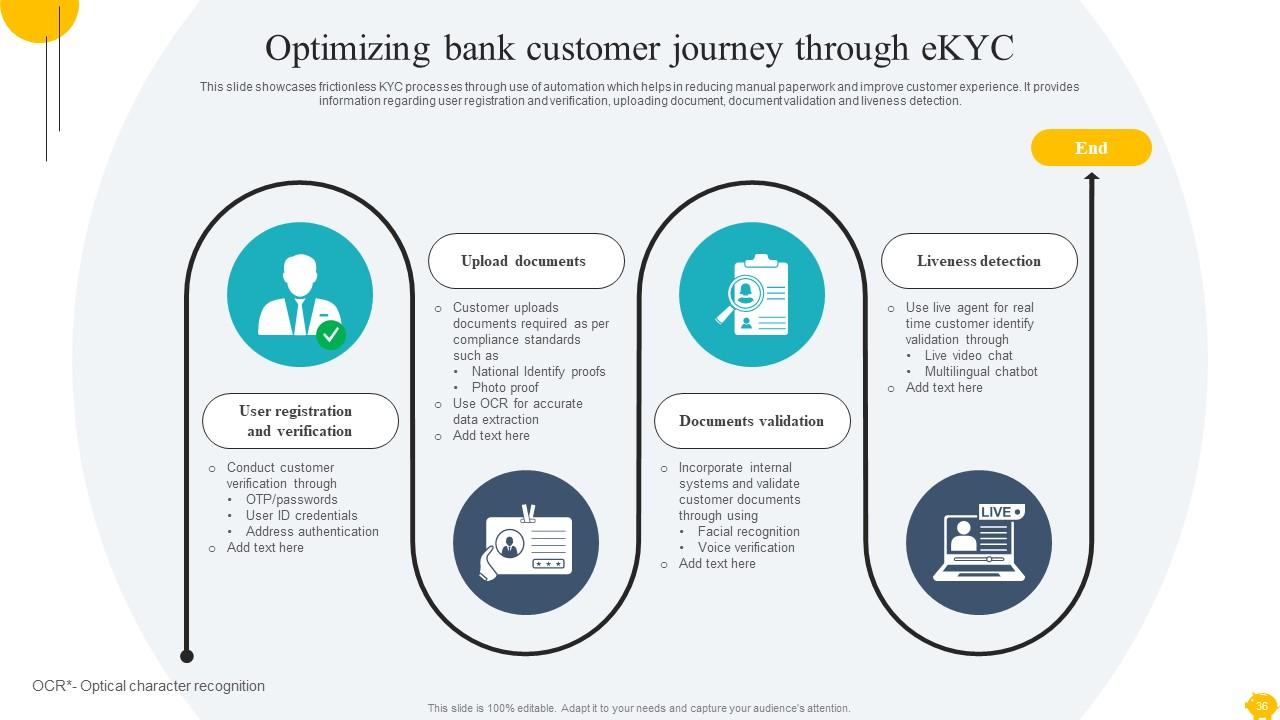

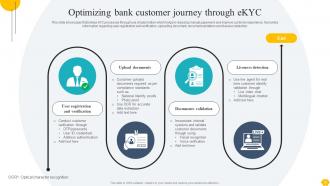

Slide 36: This slide showcases frictionless KYC processes through use of automation which helps in reducing manual paperwork and improve customer experience.

Slide 37: This slide shows automation of customer due diligence process using RPA platforms which helps in reducing compliance burdens.

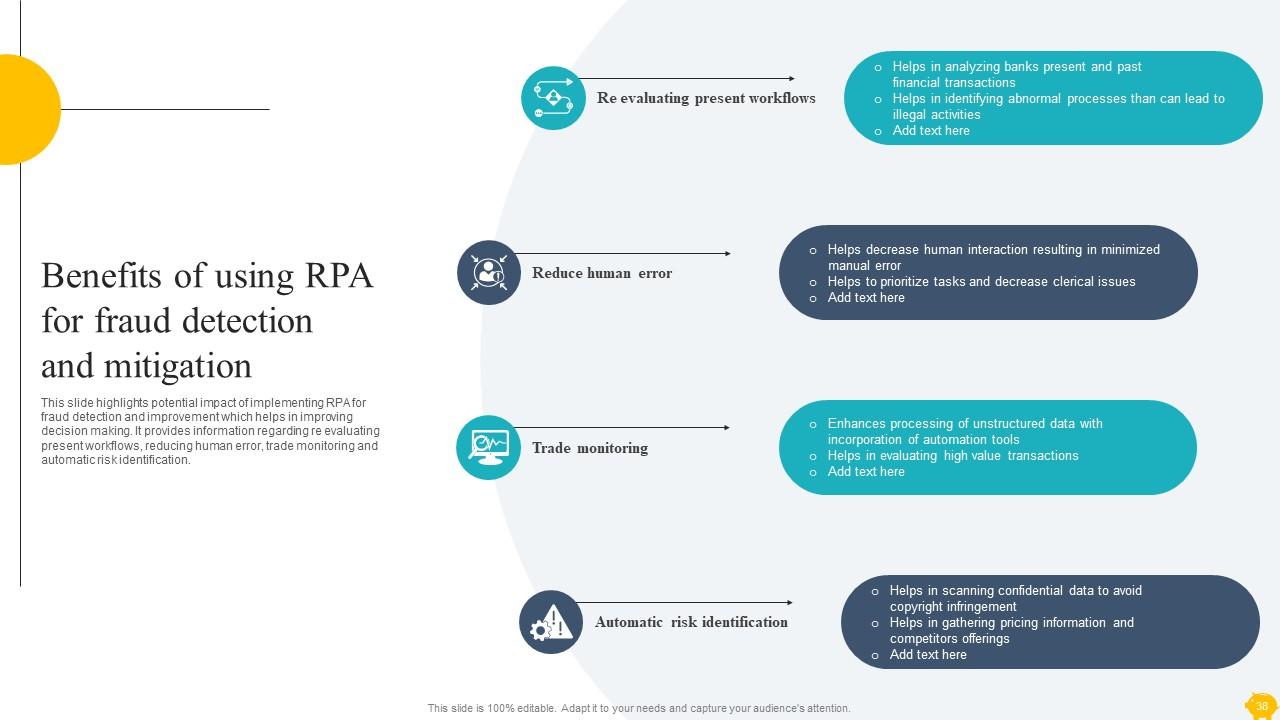

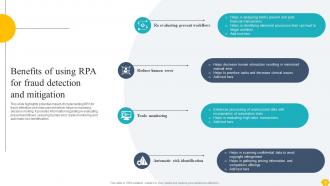

Slide 38: This slide covers potential impact of implementing RPA for fraud detection and improvement which helps in improving decision making.

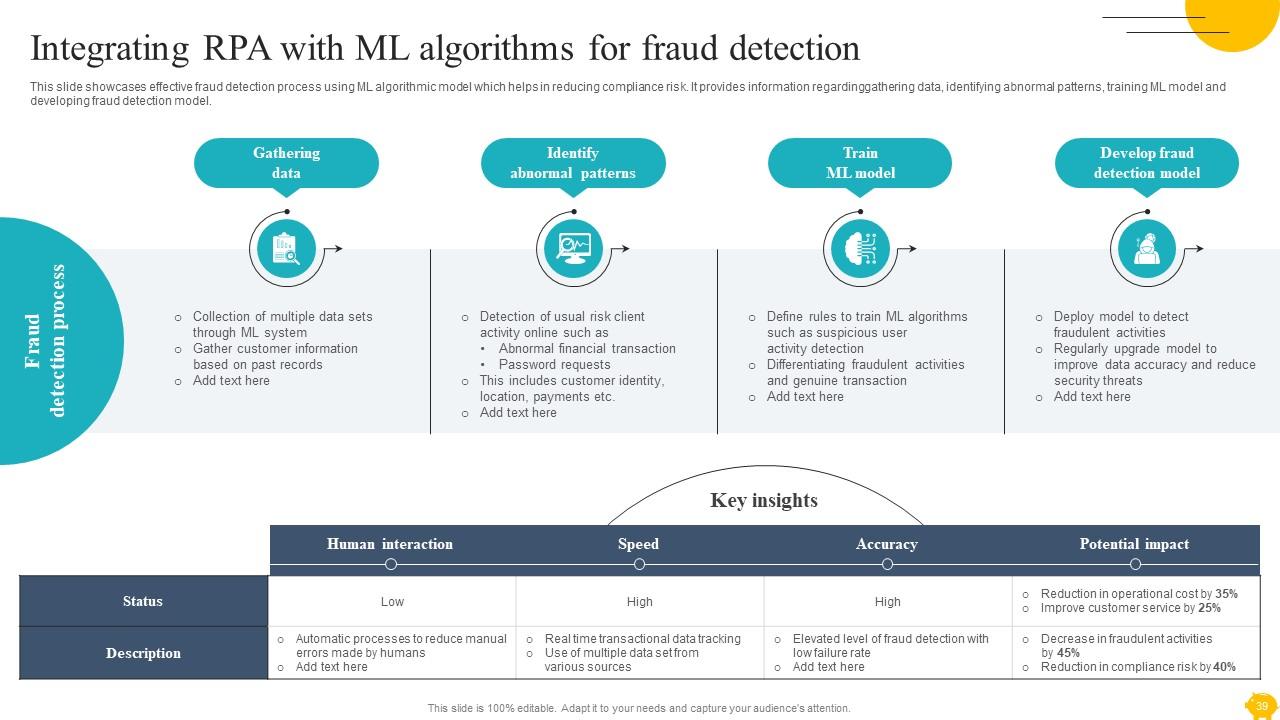

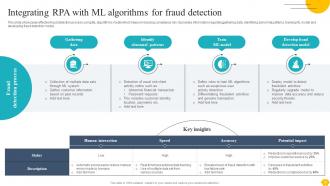

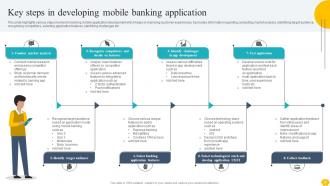

Slide 39: This slide contains effective fraud detection process using ML algorithmic model which helps in reducing compliance risk.

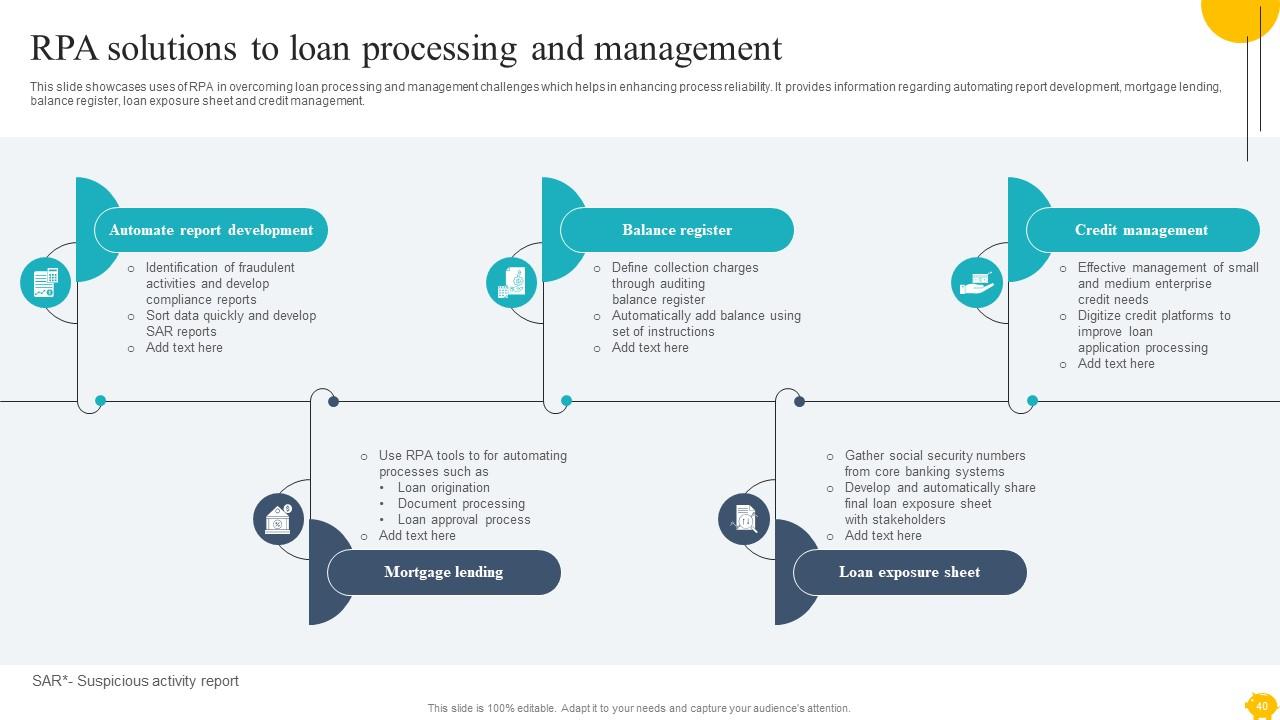

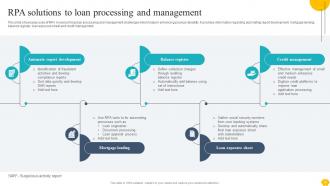

Slide 40: This slide caters to the uses of RPA in overcoming loan processing and management challenges which helps in enhancing process reliability.

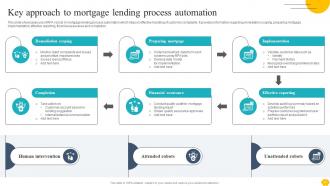

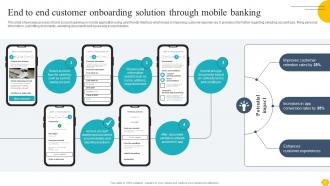

Slide 41: This slide elucidates use of RPA robots in mortgage lending process automation which helps in effective handling of customer complaints.

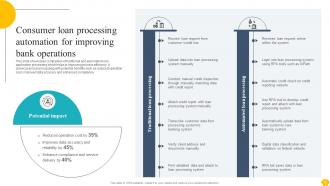

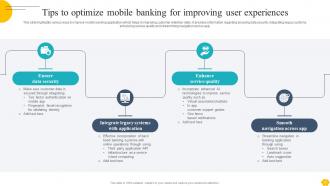

Slide 42: This slide pertains to the comparison of traditional and automated loan application processing which helps in improving process efficiency.

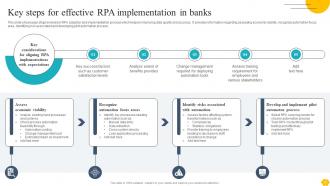

Slide 43: This slide showcases steps involved in RPA adoption and implementation process which helps in improving data quality and accuracy.

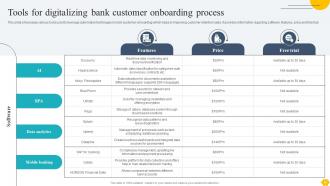

Slide 44: This slide is an introductory slide.

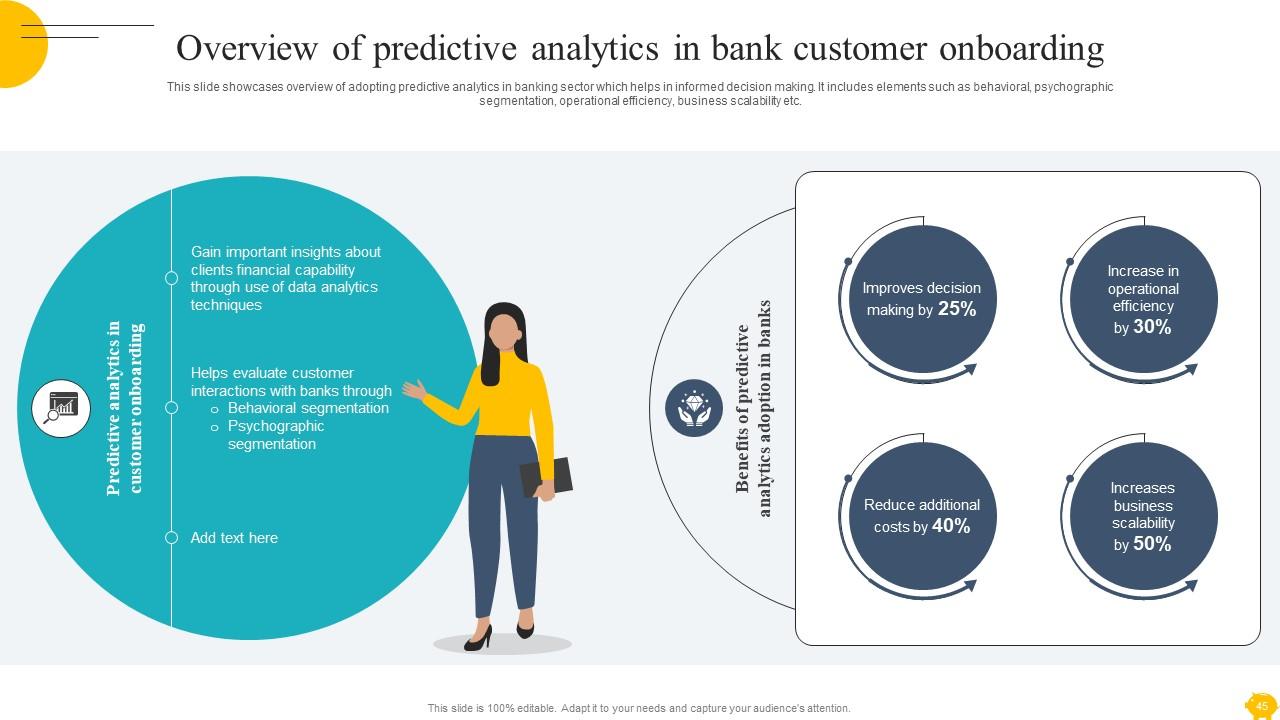

Slide 45: This slide shows overview of adopting predictive analytics in banking sector which helps in informed decision making.

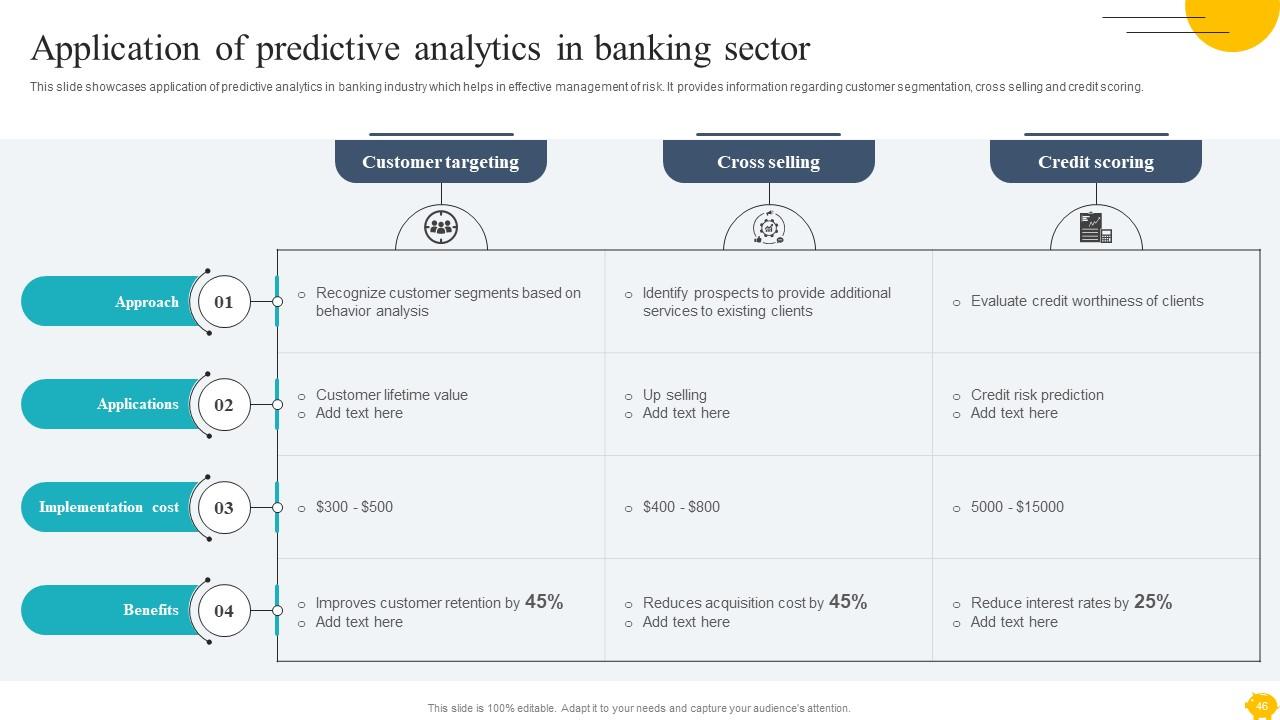

Slide 46: This slide highlights application of predictive analytics in banking industry which helps in effective management of risk.

Slide 47: This slide presents rating scales for long term credit which helps in assessing credit worthiness of companies.

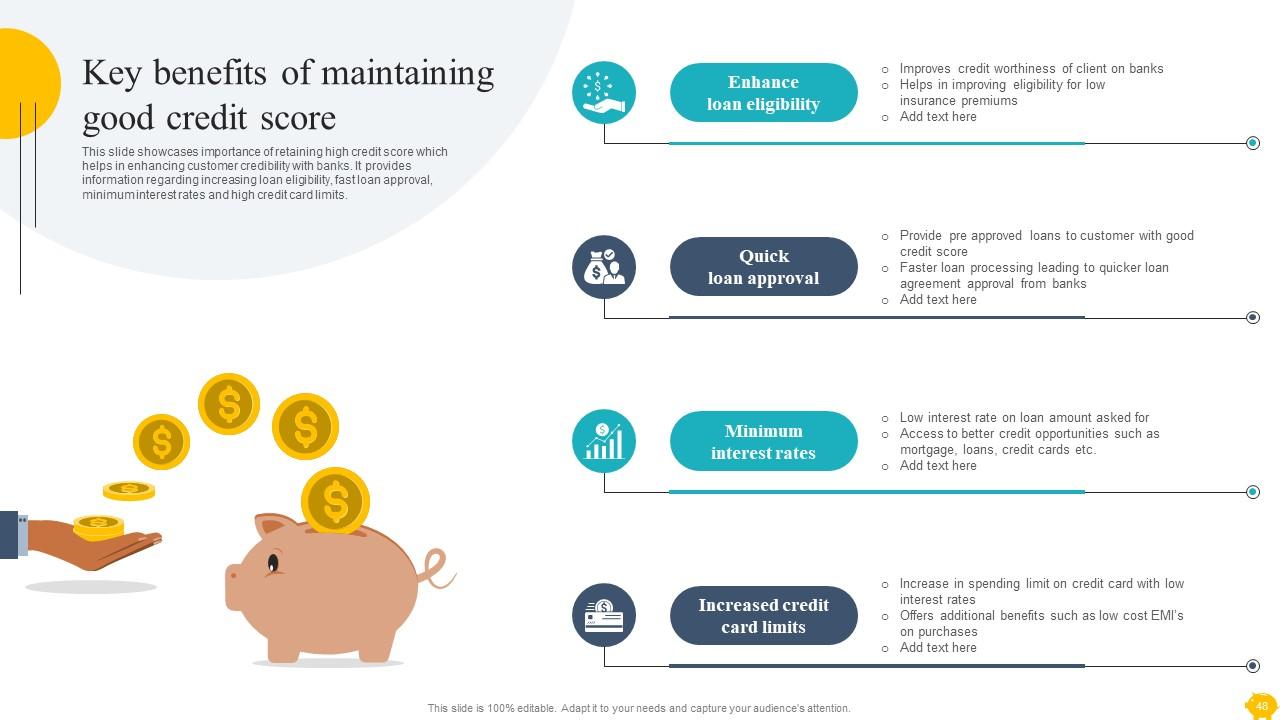

Slide 48: This slide represents importance of retaining high credit score which helps in enhancing customer credibility with banks.

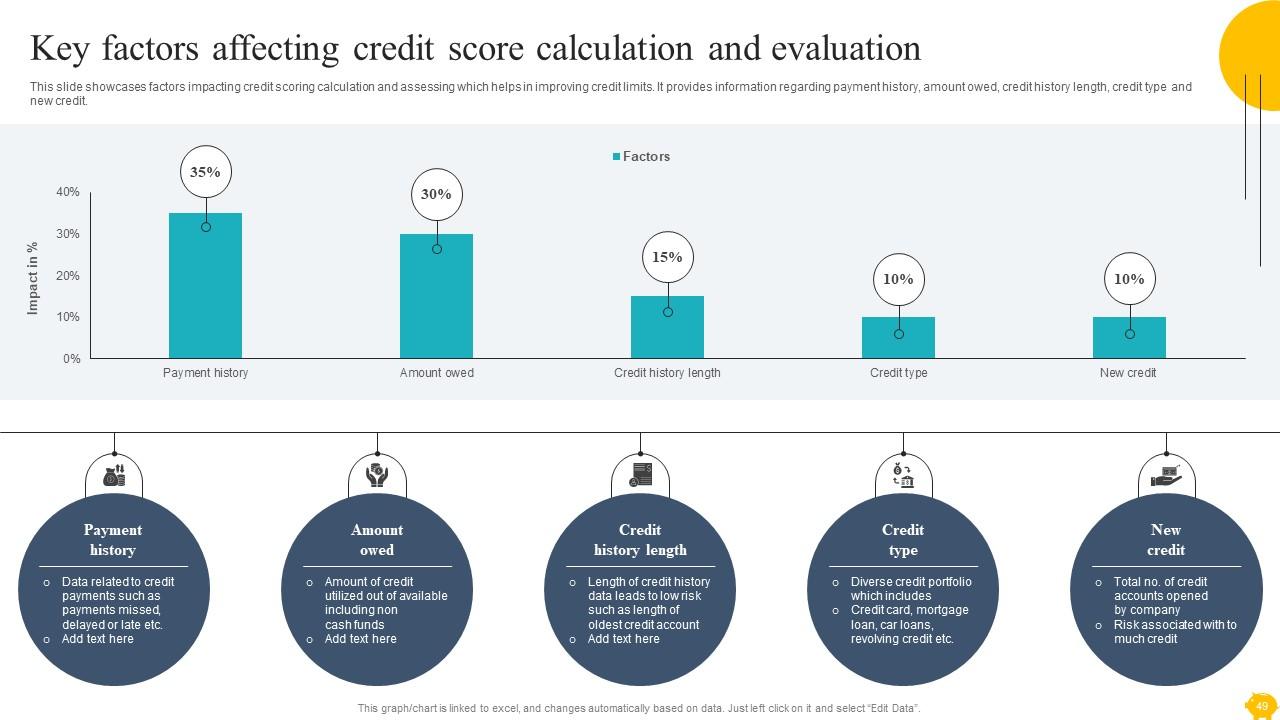

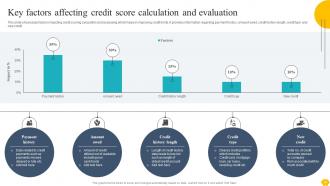

Slide 49: This slide elucidates factors impacting credit scoring calculation and assessing which helps in improving credit limits.

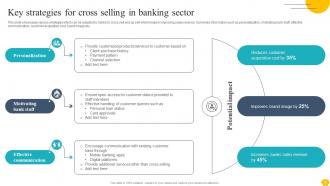

Slide 50: This slide portrays various strategies which can be adopted by banks to cross sell and up sell which helps in improving sales revenue.

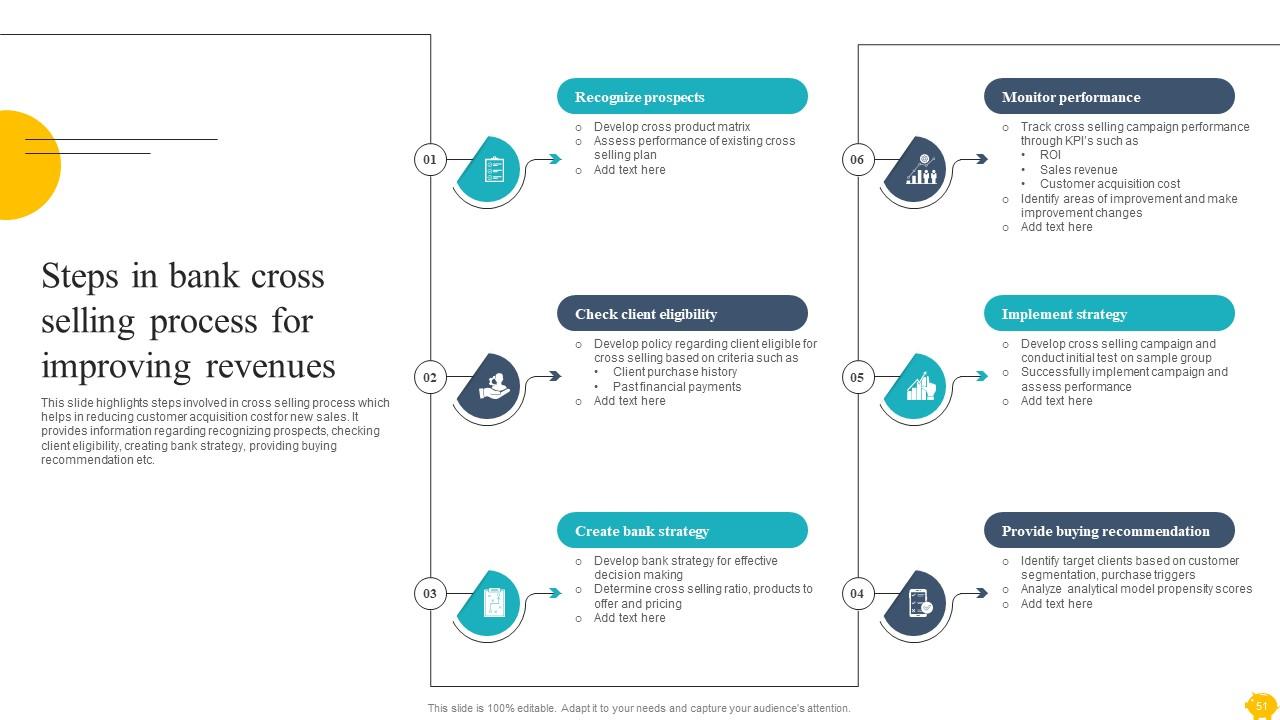

Slide 51: This slide highlights steps involved in cross selling process which helps in reducing customer acquisition cost for new sales.

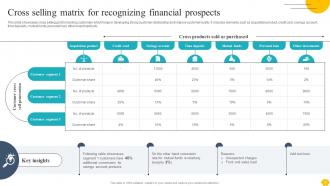

Slide 52: This slide showcases cross selling grid for banking customers which helps in developing strong customer relationship and improve customer loyalty.

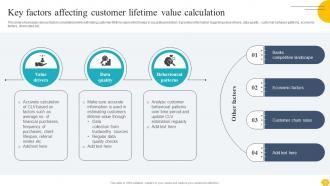

Slide 53: This slide shows various factors considered while estimating customer lifetime value which helps in accurate prediction.

Slide 54: This slide contains use of customer lifetime value for improving banking decisions and customer loyalty with banks.

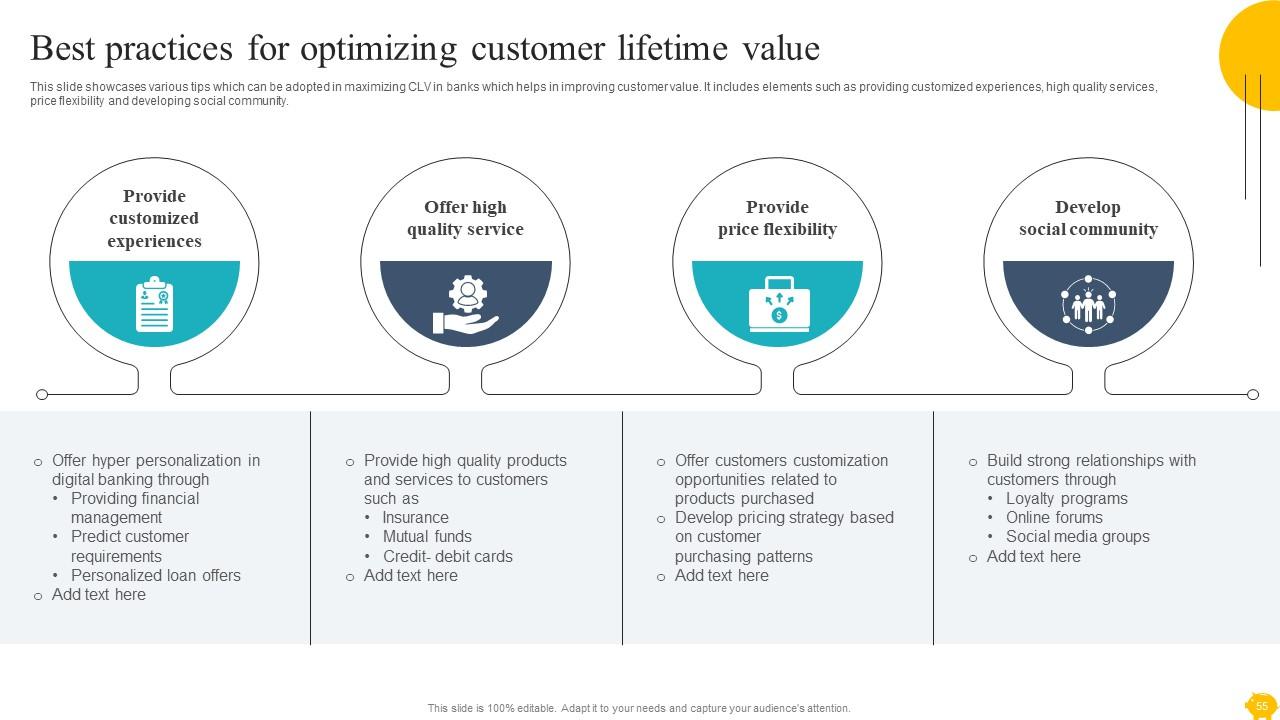

Slide 55: This slide caters to various tips which can be adopted in maximizing CLV in banks which helps in improving customer value.

Slide 56: This slide is an introductory slide.

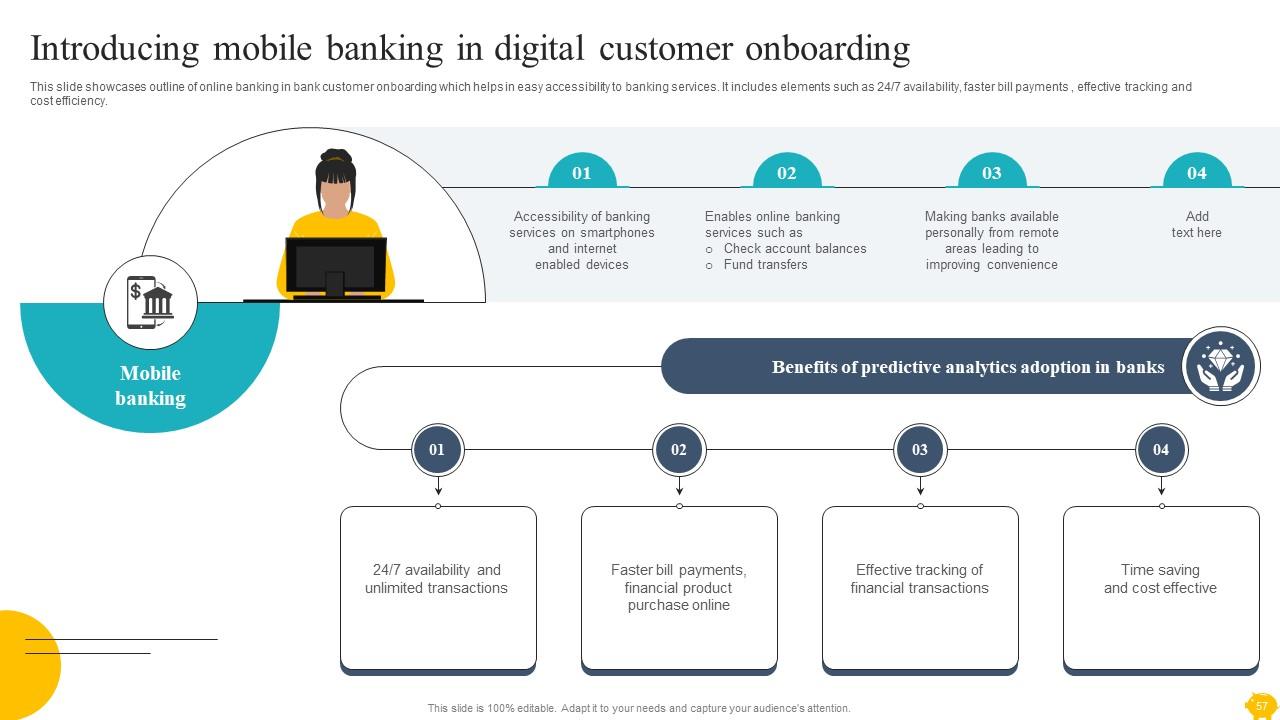

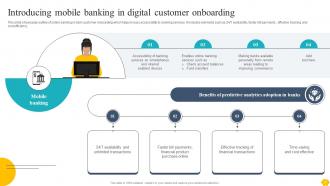

Slide 57: This slide showcases outline of online banking in bank customer onboarding which helps in easy accessibility to banking services.

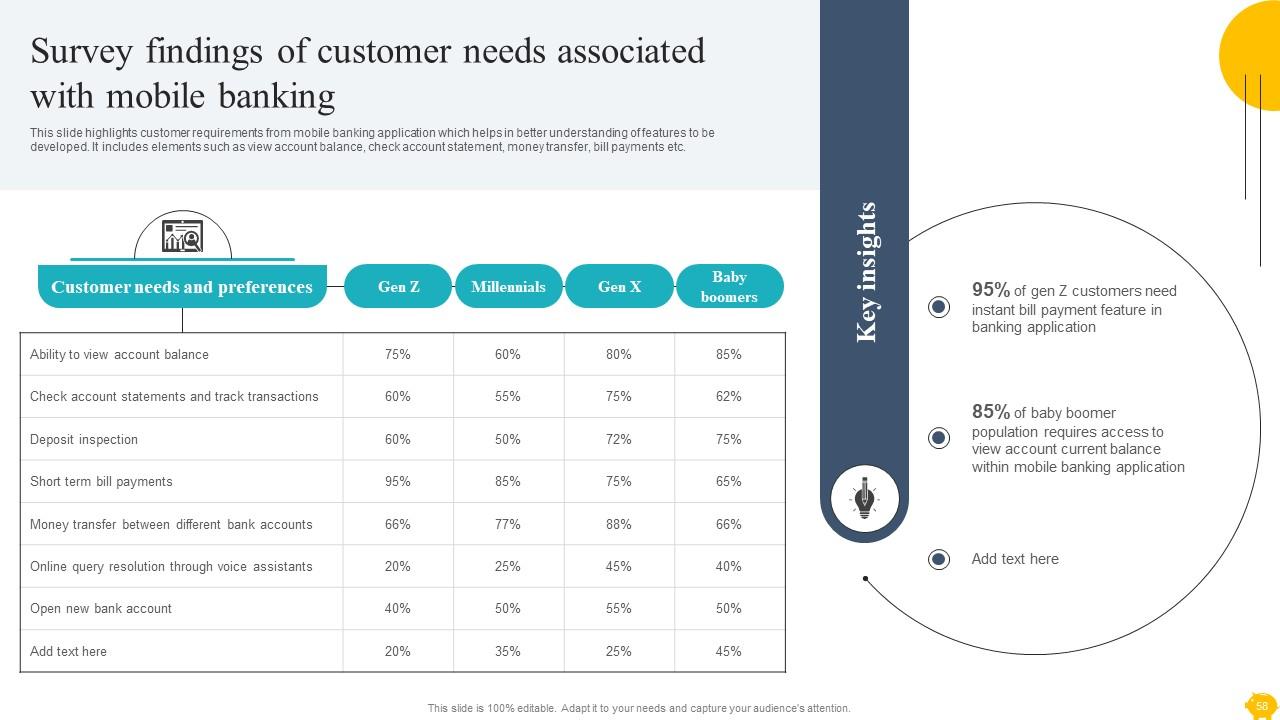

Slide 58: This slide includes customer requirements from mobile banking application which helps in better understanding of features to be developed.

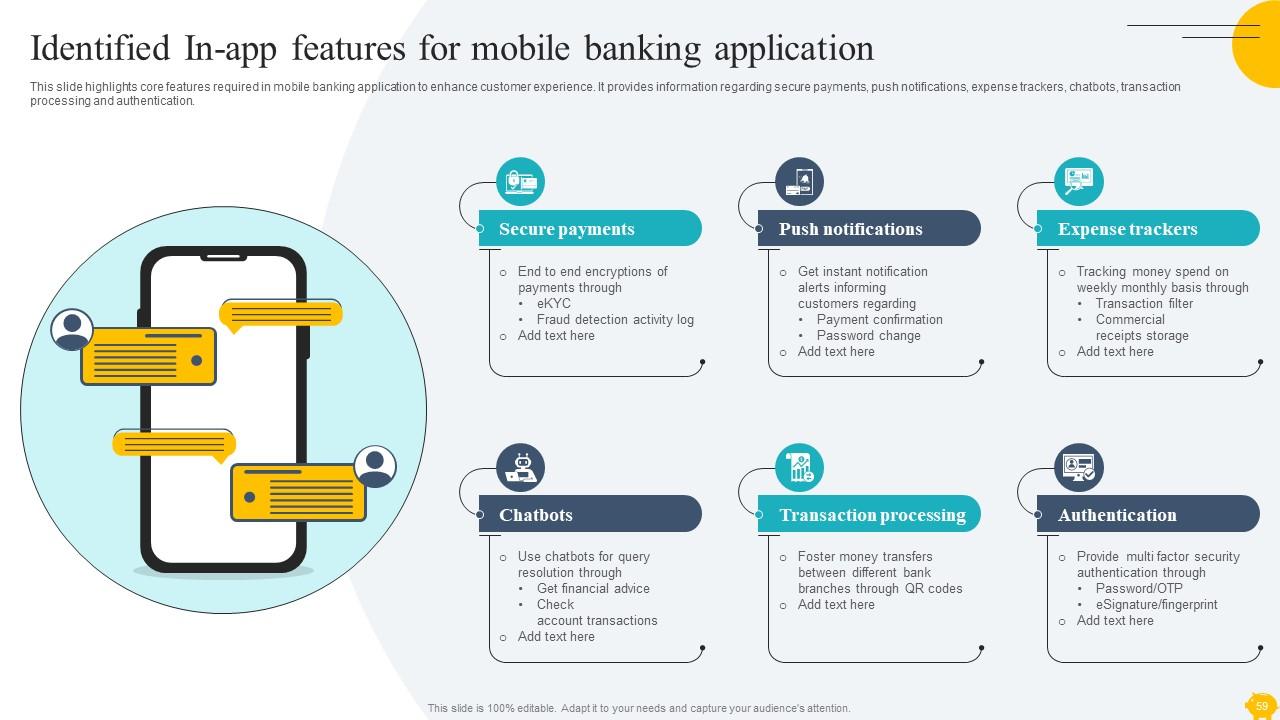

Slide 59: This slide presents core features required in mobile banking application to enhance customer experience.

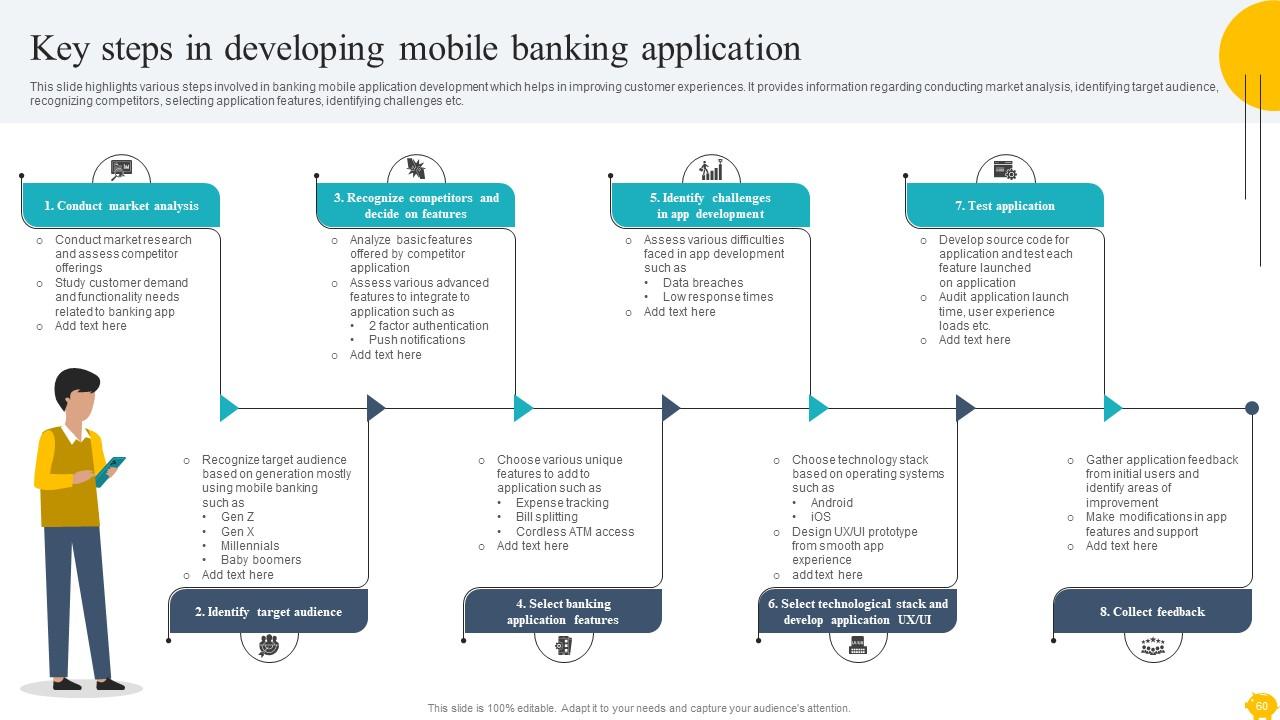

Slide 60: This slide represents various steps involved in banking mobile application development which helps in improving customer experiences.

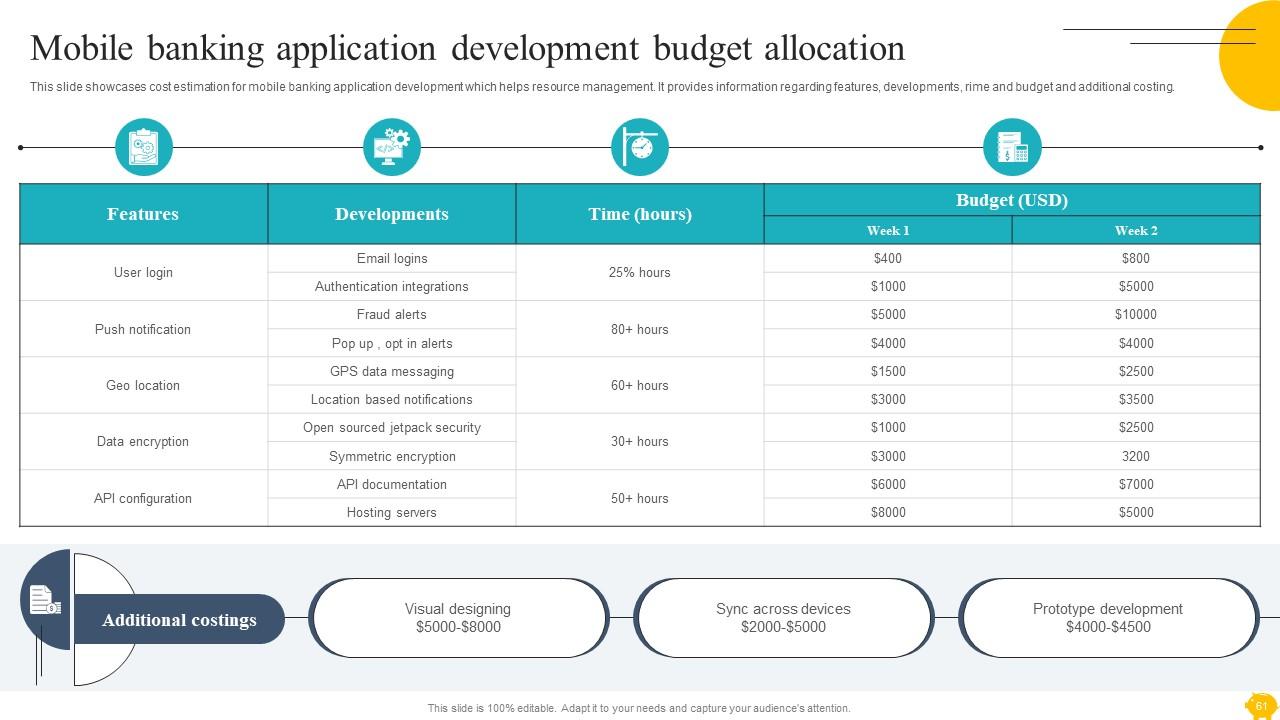

Slide 61: This slide elucidates cost estimation for mobile banking application development which helps resource management.

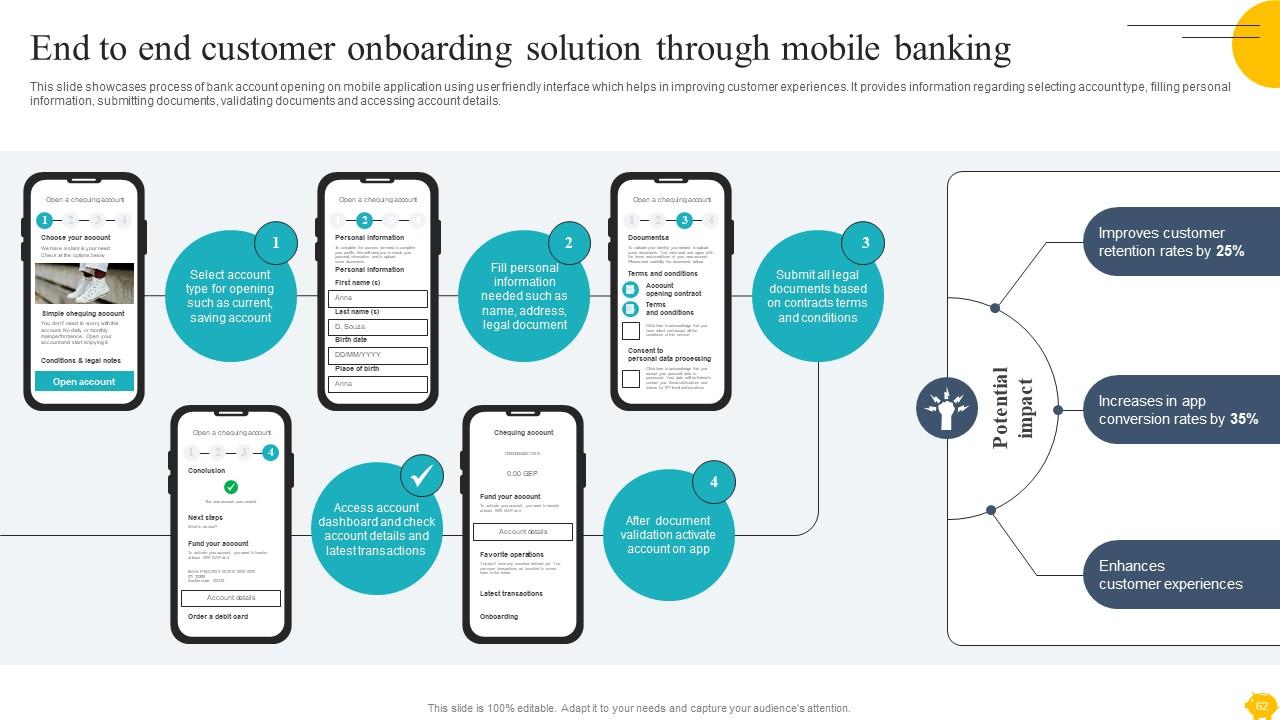

Slide 62: This slide showcases process of bank account opening on mobile application using user friendly interface which helps in improving customer experiences.

Slide 63: This slide depicts various ways to improve mobile banking application which helps in improving customer retention rates.

Slide 64: This slide is an introductory slide.

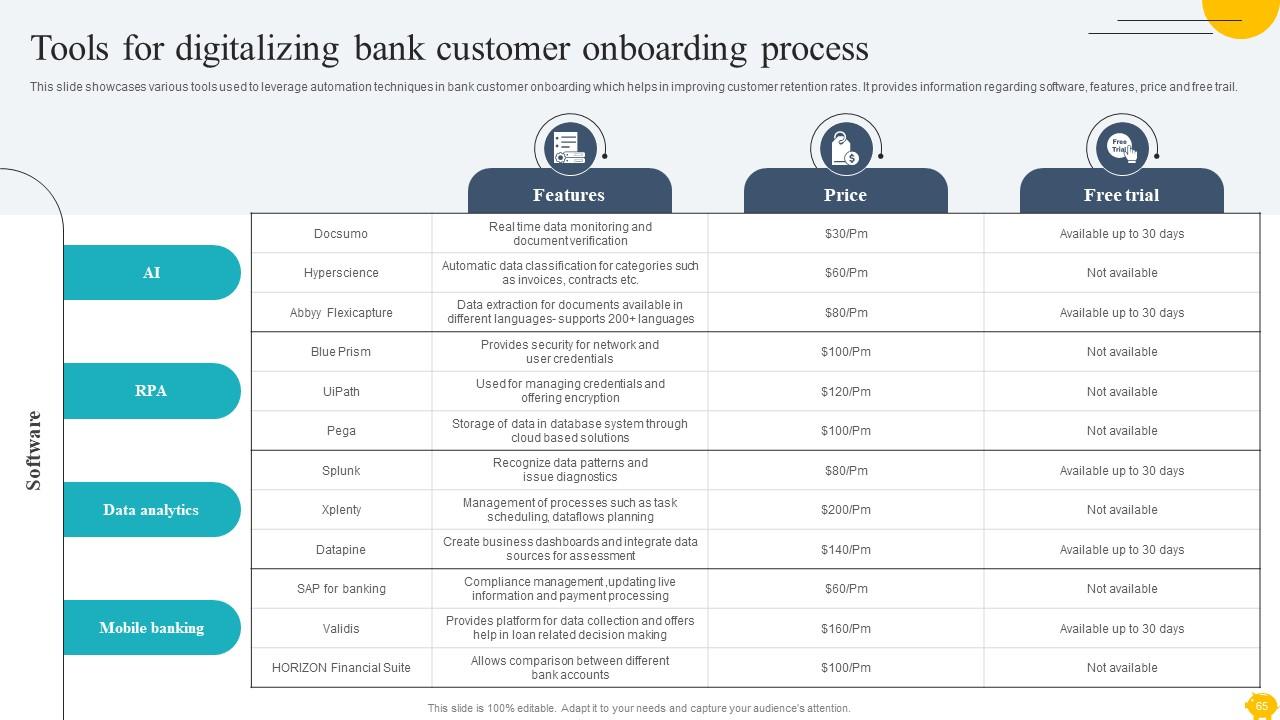

Slide 65: This slide demonstrates various tools used to leverage automation techniques in bank customer onboarding which helps in improving customer retention rates.

Slide 66: This slide is an introductory slide.

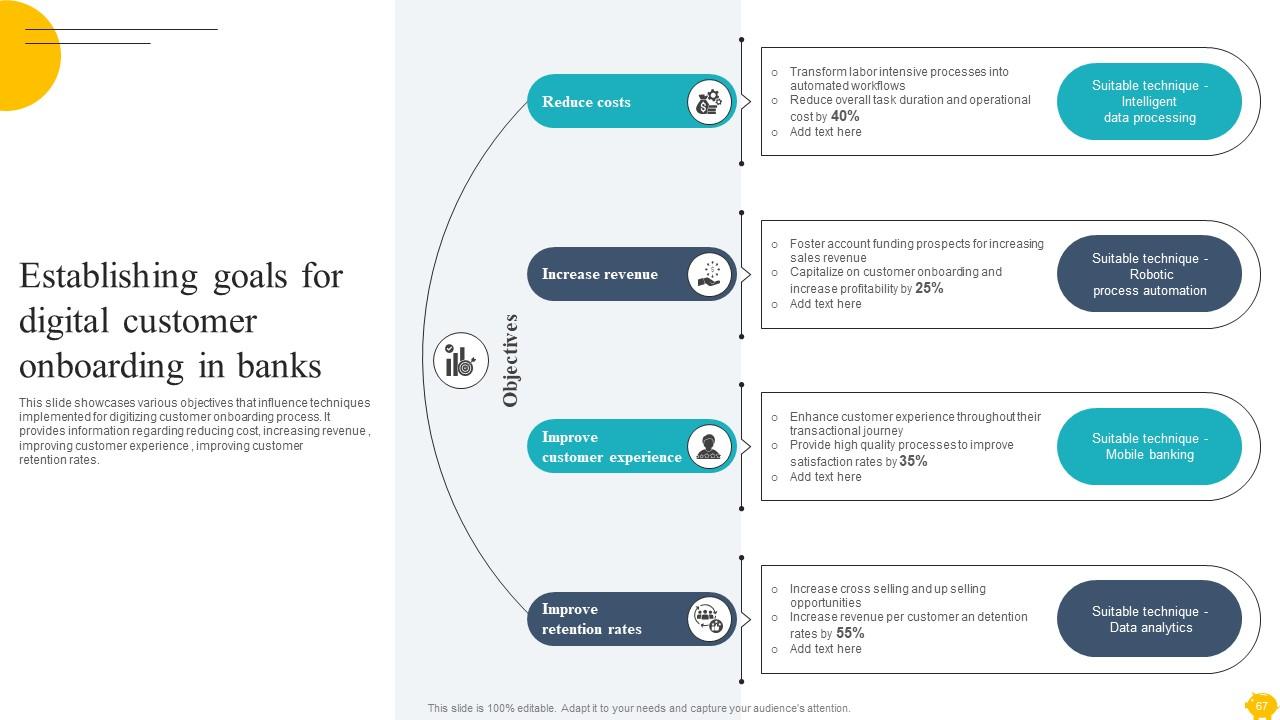

Slide 67: This slide elucidates various objectives that influence techniques implemented for digitizing customer onboarding process.

Slide 68: This slide provides customer communication strategy implementation for successful client onboarding in banks.

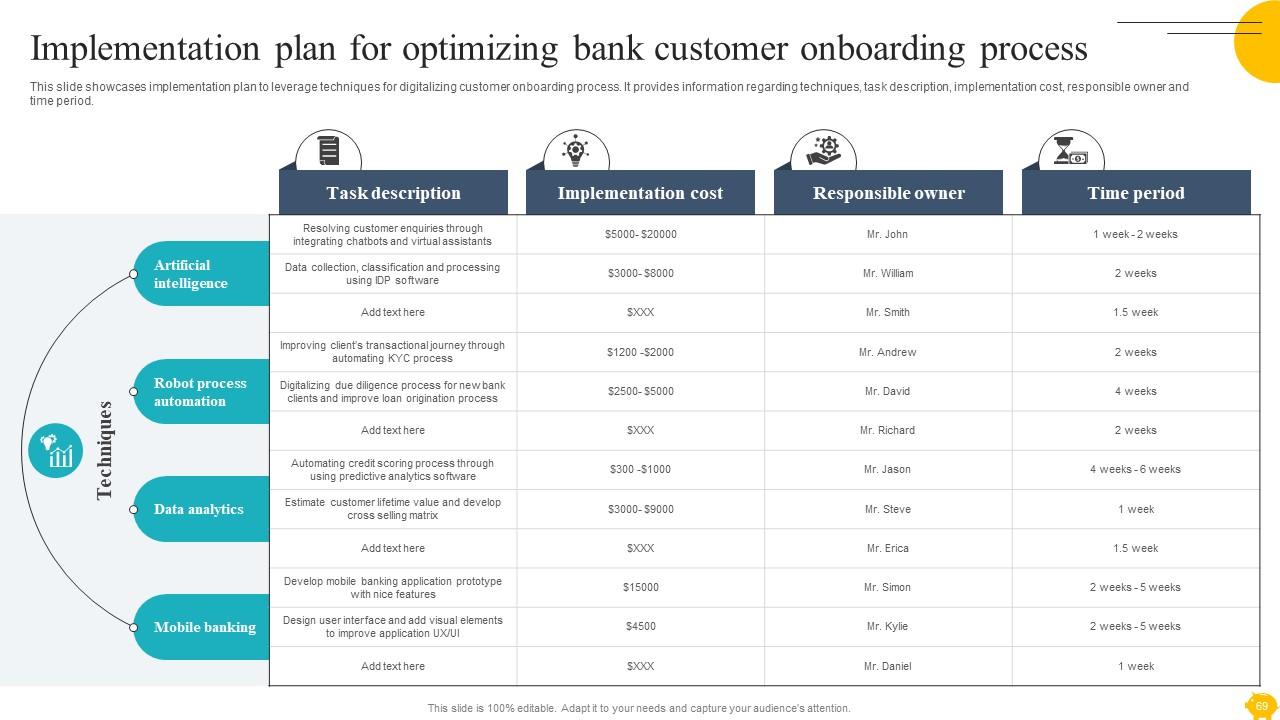

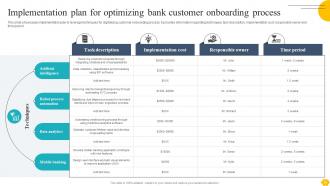

Slide 69: This slide pertains to implementation plan to leverage techniques for digitalizing customer onboarding process.

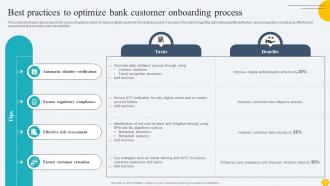

Slide 70: This slide provides various tips which can be adopted by banks to improve digital customer onboarding process.

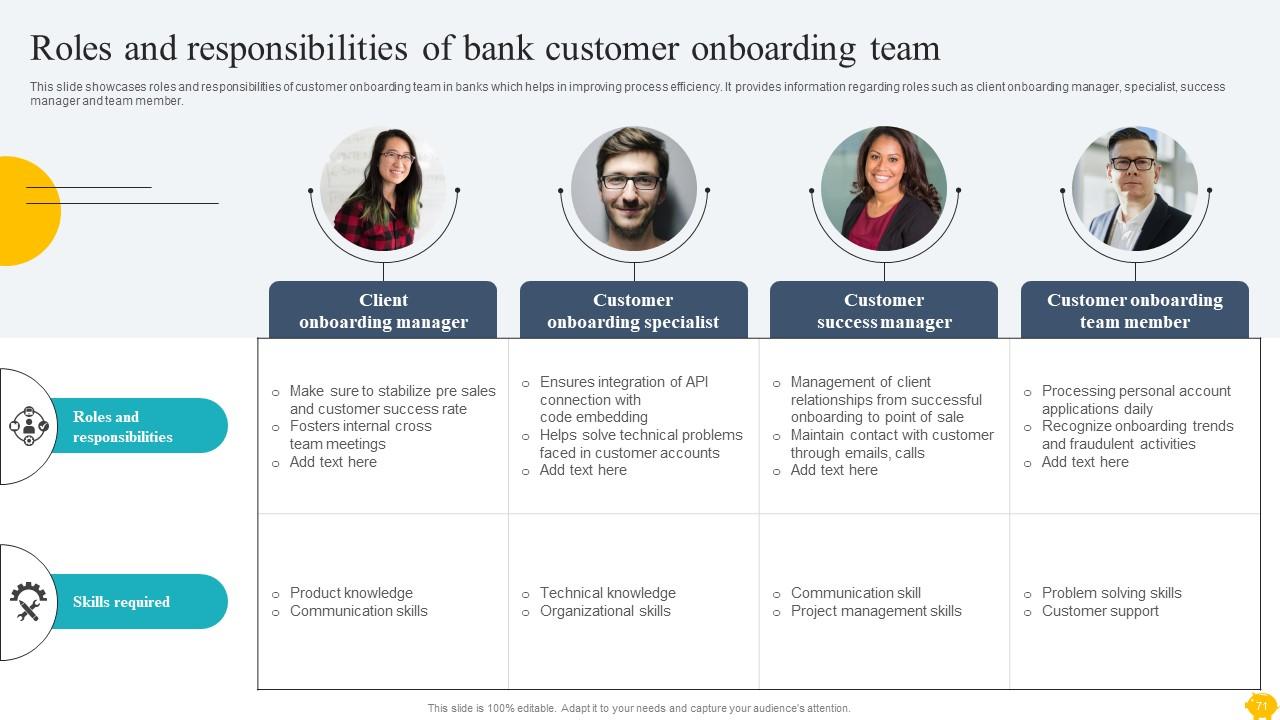

Slide 71: This slide showcases roles and responsibilities of customer onboarding team in banks which helps in improving process efficiency.

Slide 72: This slide is an introductory slide.

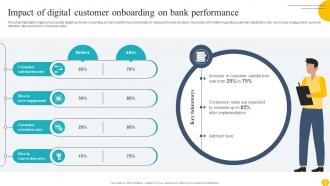

Slide 73: This slide highlights impact of successful digital customer onboarding on banks performance that helps in making informed decisions.

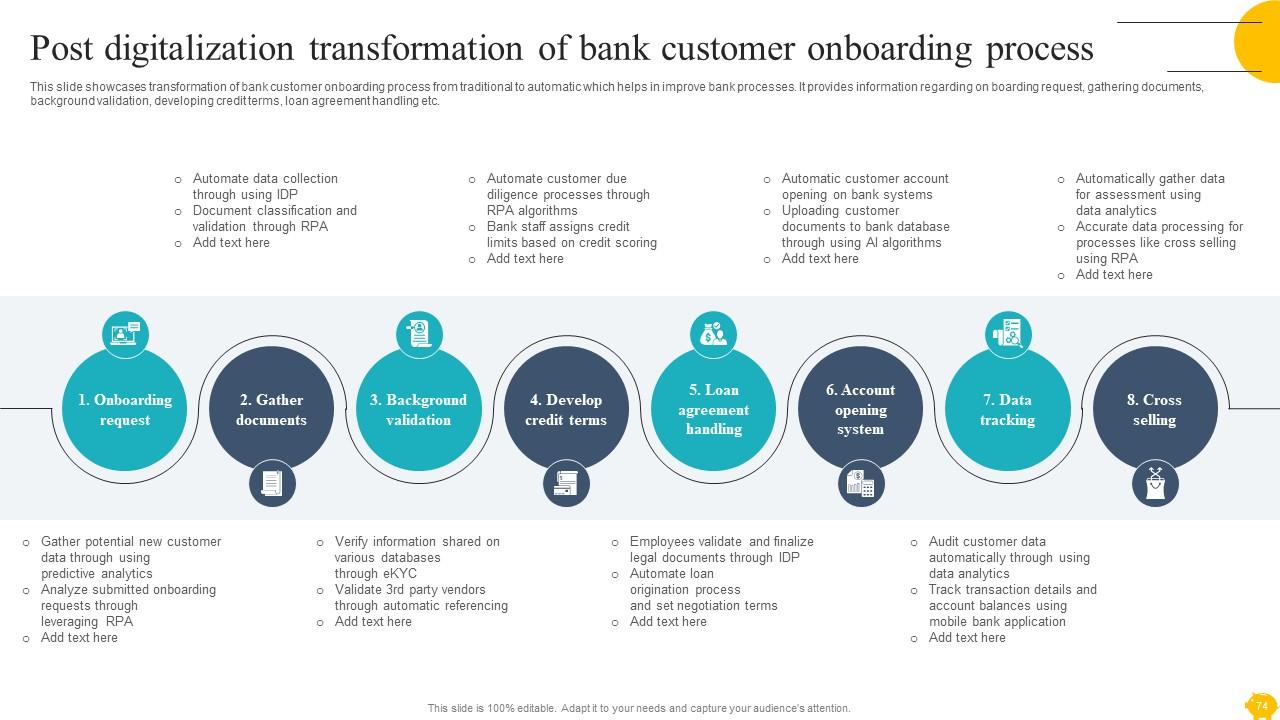

Slide 74: This slide contains transformation of bank customer onboarding process from traditional to automatic which helps in improve bank processes.

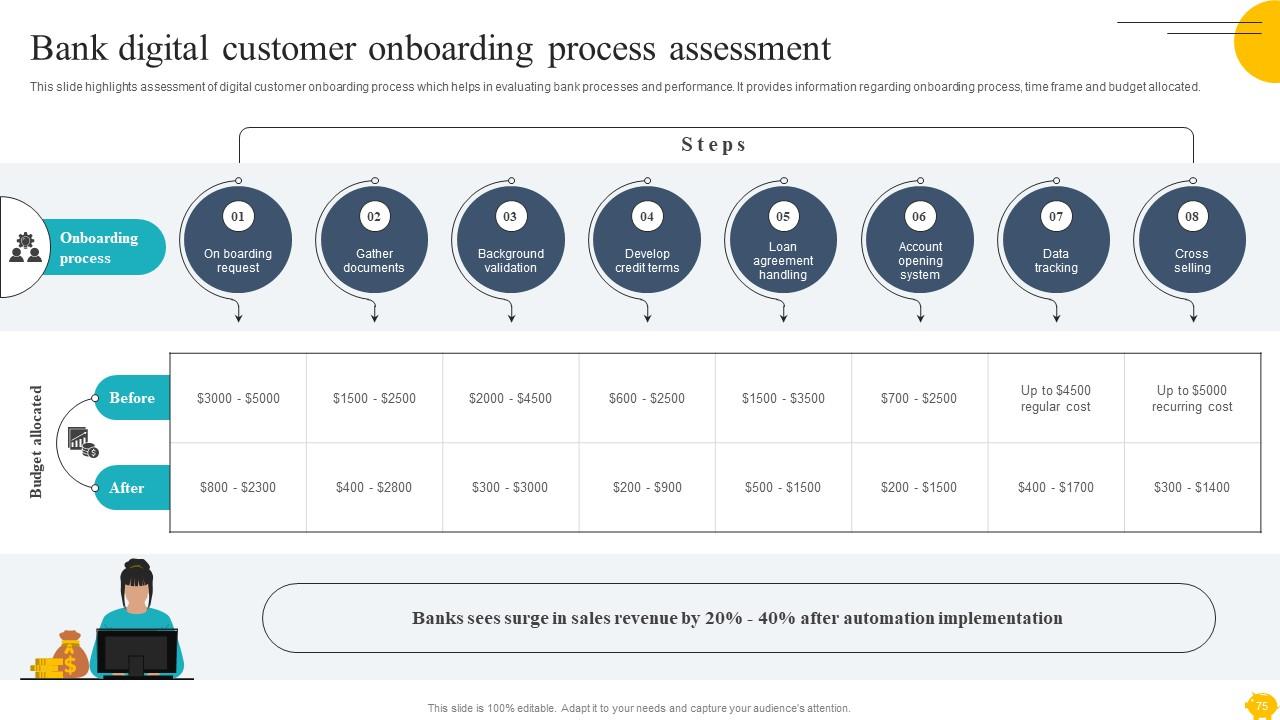

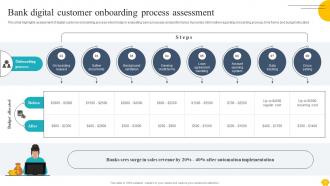

Slide 75: This slide caters to assessment of digital customer onboarding process which helps in evaluating bank processes and performance.

Slide 76: This slide is an introductory slide.

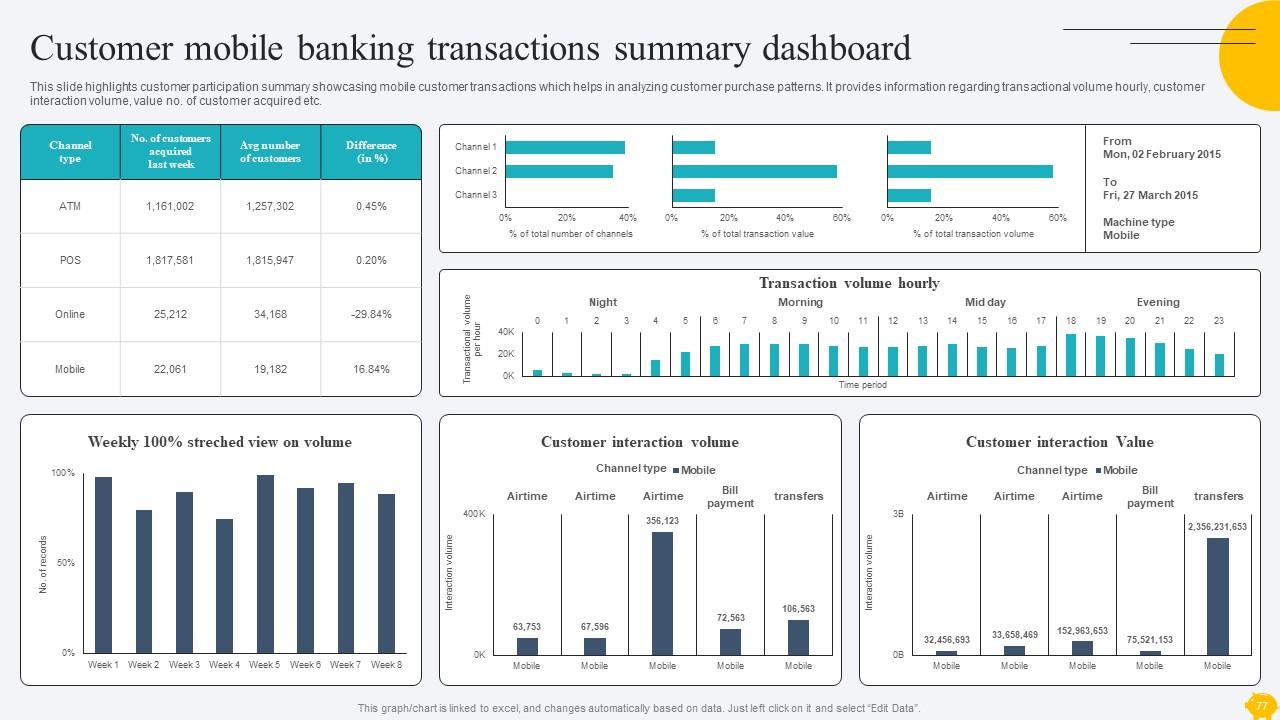

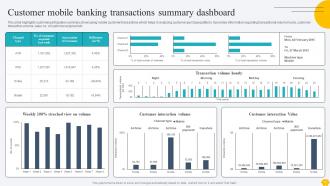

Slide 77: This slide represents customer participation summary showcasing mobile customer transactions which helps in analyzing customer purchase patterns.

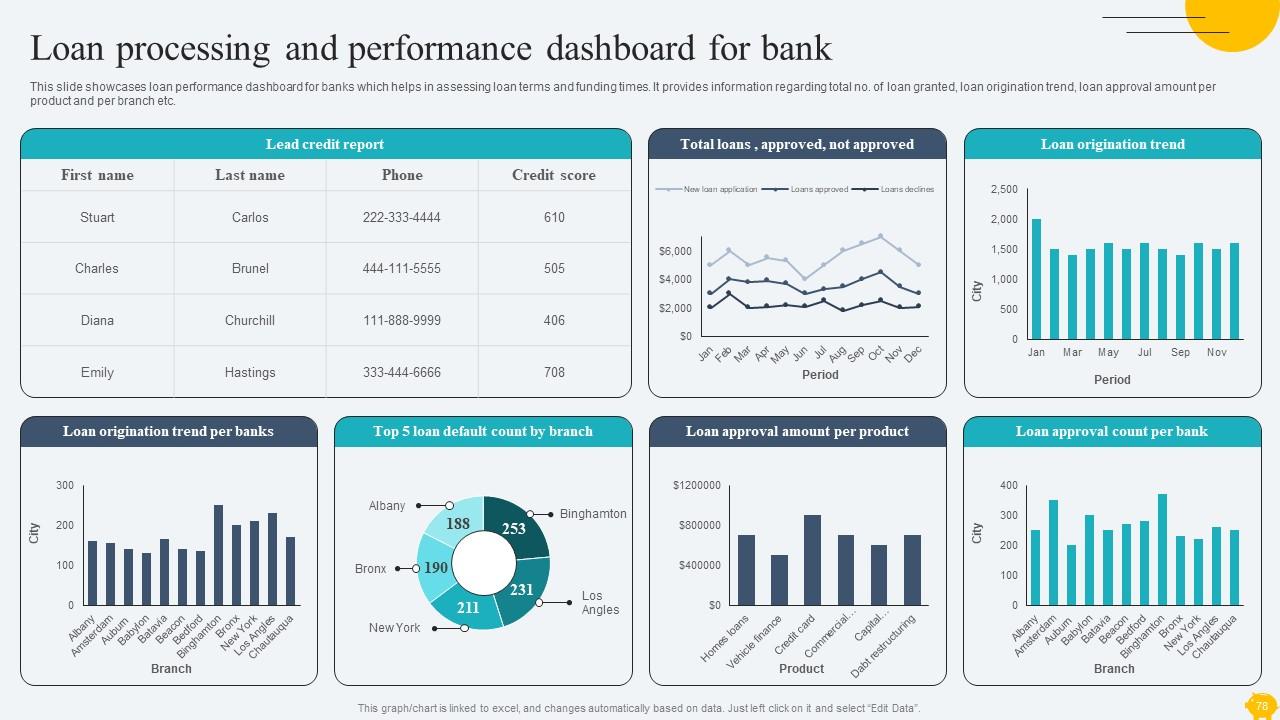

Slide 78: This slide mentions loan performance dashboard for banks which helps in assessing loan terms and funding times.

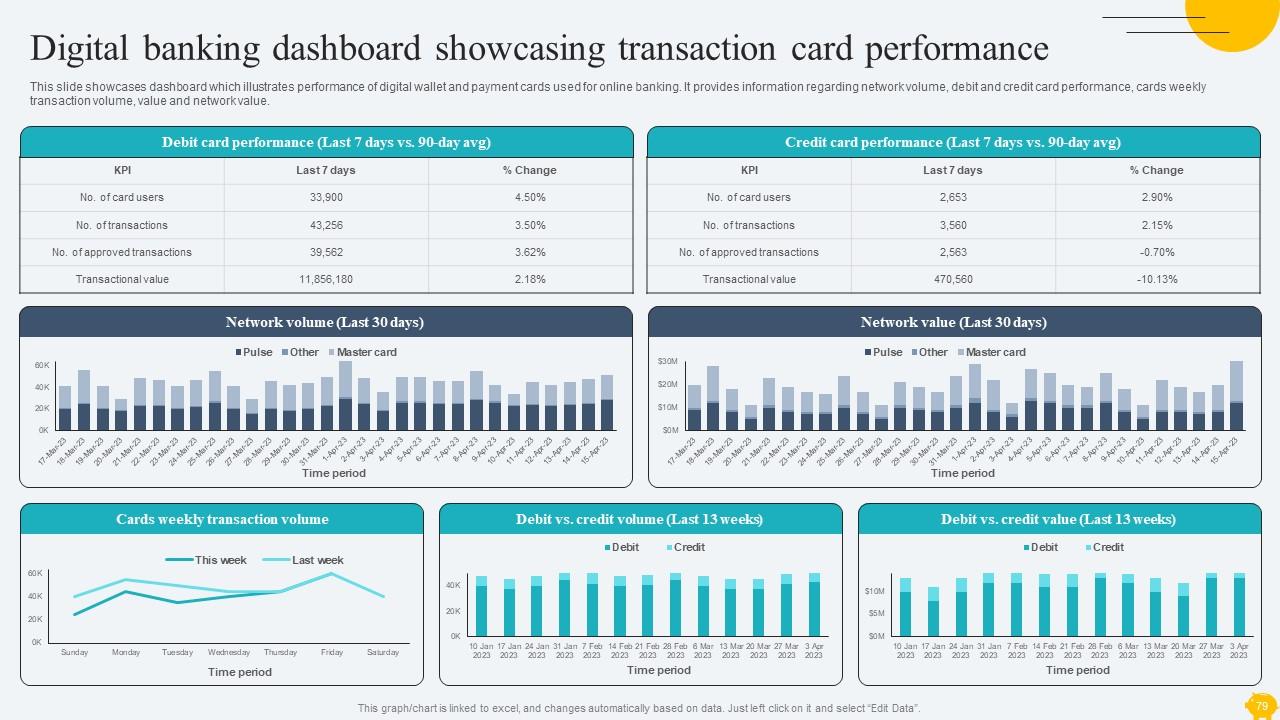

Slide 79: This slide elucidates dashboard which illustrates performance of digital wallet and payment cards used for online banking.

Slide 80: This slide is an introductory slide.

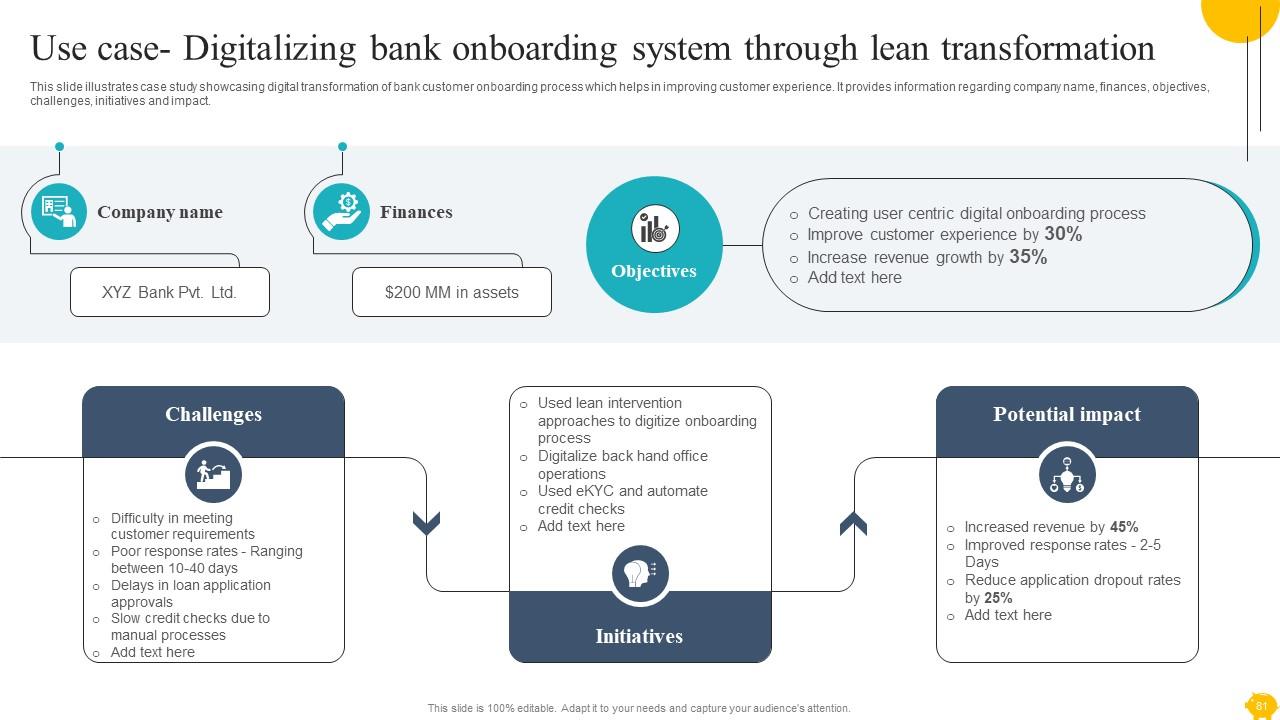

Slide 81: This slide illustrates case study showcasing digital transformation of bank customer onboarding process which helps in improving customer experience.

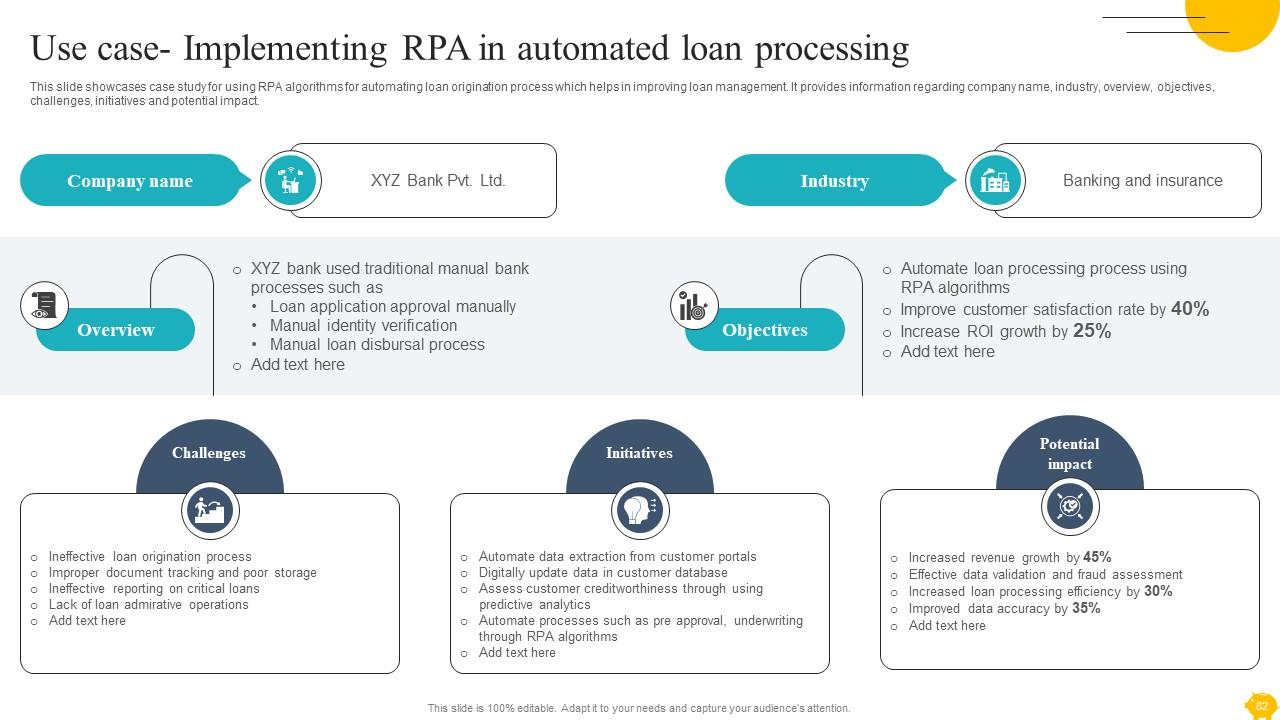

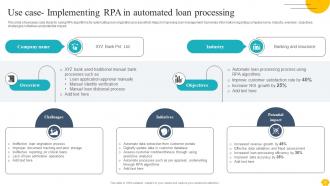

Slide 82: This slide enables case study for using RPA algorithms for automating loan origination process which helps in improving loan management.

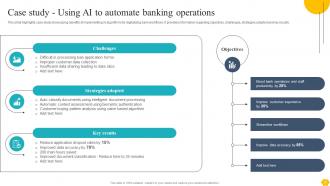

Slide 83: This slide puts case study showcasing benefits of implementing AI algorithms for digitalizing bank workflows.

Slide 84: This slide shows all the icons included in the presentation.

Slide 85: This slide is a thank-you slide with address, contact numbers, and email address.

Digitalising Customer Onboarding Journey In Banking Complete Deck with all 94 slides:

Use our Digitalising Customer Onboarding Journey In Banking Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

A library of engaging, customizable and content-ready templates.

-

Kudos to SlideTeam for achieving the high success rate in delivering the top-notch slides.