Green Finance Fostering Sustainable Development CRP CD

Grab our insightfully designed Green Finance Fostering Sustainable Development PowerPoint Presentation. Dive into the future of finance through our PPT bundle and explore sustainable finance, green bonds, and environmentally conscious investment strategies. This comprehensive deck delves into the intricacies of environmental banking and climate finance. Additionally, the Green Investment PPT templates provide insights into navigating the evolving landscape of responsible financial practices. Moreover, the Environmental Banking PPT slides display the potential of green investments and describe how to align financial goals with environmental sustainability. Whether you are a seasoned industry professional or new to green finance, this PPT equips you with the knowledge and strategies essential for success in the era of eco-conscious finance. Harness the power of responsible financial decision-making and contribute to building a sustainable and resilient future. Download our 100 percent editable and customizable PowerPoint, compatible with Google Slides, to streamline your presentation process.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Green Finance Fostering Sustainable Development CRP CD is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the sixty slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces GREEN FINANCE - Fostering Sustainable Development. State your company name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide shows title for topics that are to be covered next in the template.

Slide 5: This slide offers a comprehensive overview of green finance, encompassing goals, financial products, and service categories.

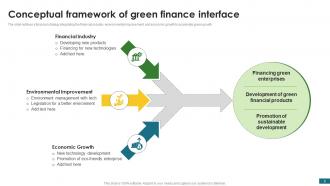

Slide 6: This slide outlines a financial strategy integrating the financial industry, environmental improvement, and economic growth to accelerate green growth

Slide 7: This slide conducts a comparative analysis of green and sustainable finance, examining key components such as scope, project types, etc.

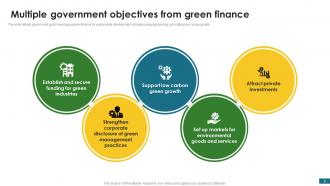

Slide 8: This slide details government goals leveraging green finance for sustainable development, including securing funding, promoting low-carbon growth etc.

Slide 9: This slide spotlights eco-friendly green finance products such as: retail finance, investment, asset management, etc.

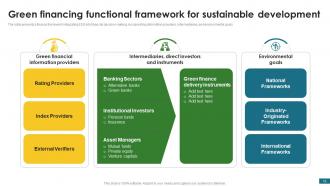

Slide 10: This slide presents a finance framework integrating ESG into financial decision-making, incorporating information providers, intermediaries, and environmental goals.

Slide 11: This slide outlines the challenges and impacts of private investment hindering green growth in developing countries, including mispricing, etc.

Slide 12: This slide also outlines the challenges and impacts of private investment hindering green growth in developing countries, including mispricing, etc.

Slide 13: This slide emphasizes green finance benefits: tech diffusion, comparative advantage, business value addition, and economic prospects boost

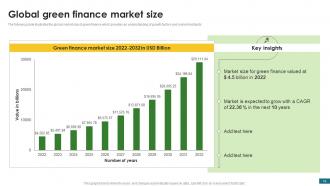

Slide 14: This slide illustrates the global market size of green finance which provides an understanding of growth factors and market restraints.

Slide 15: This slide shows title for topics that are to be covered next in the template.

Slide 16: This slide underscores financial instruments fostering environmental sustainability goals: green bonds, sustainability bonds, green loans, blue bonds, etc.

Slide 17: This slide compares financial instruments based on factors like sustainability impact, use of proceeds, and application year.

Slide 18: This slide presents an overview of carbon credits and offsets, elucidating their meaning and key differences in mitigating climate change.

Slide 19: This slide illustrates the carbon credit workflow, encompassing project developers, investors, carbon exchanges, and credit buyers to elucidate the operational system.

Slide 20: This slide outlines the carbon credit framework: assessment, engagement, due diligence, and other key components for understanding functionality.

Slide 21: This slide also outlines the carbon credit framework: assessment, engagement, due diligence, and other key components for understanding functionality.

Slide 22: This slide illustrates global carbon credit initiatives, including the Kyoto Protocol and the Glasgow Summit, aiming for sustainable development goals.

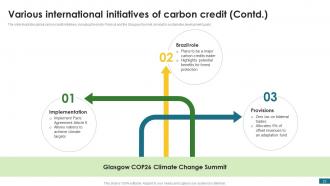

Slide 23: This slide also illustrates global carbon credit initiatives, including the Kyoto Protocol and the Glasgow Summit, aiming for sustainable development goals.

Slide 24: This slide shows title for topics that are to be covered next in the template.

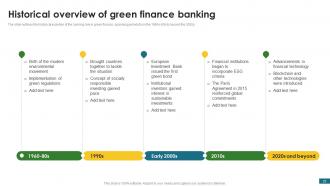

Slide 25: This slide outlines the historical evolution of the banking role in green finance, spanning periods from the 1960s-80s to beyond the 2020s.

Slide 26: This slide displays the scope of sustainable finance and investment, emphasizing factors such as sustainable financial initiatives, risk management, etc.

Slide 27: This slide addresses challenges in green finance and banking, hindering policy implementation, encompassing regulatory issues, etc.

Slide 28: This slide presents solutions to green finance and banking challenges, including regulatory, awareness for enhanced sustainable development.

Slide 29: This slide showcases sustainable banking products: green savings accounts, renewable energy loans, eco-friendly credit cards, fostering development.

Slide 30: This slide shows title for topics that are to be covered next in the template.

Slide 31: This slide stresses tech integration in green finance: sustainable investment, inclusive access, and climate-resilient solutions for development.

Slide 32: This slide showcases technologies for green environmental development, detailing their descriptions, workings, and implementation advantages.

Slide 33: This slide outlines risks in fintech and green finance integration such as: data privacy, and regulatory compliance challenges.

Slide 34: This slide highlights fintech opportunities in green banking for environment development such as: impact investing, green banking, sustainable lending, etc.

Slide 35: This slide presents cutting-edge technological trends in emphasizing the future potential of blockchain, AI, and IoT monitoring for sustainable development.

Slide 36: This slide introduces risk management technologies in green finance, incorporating predictive analytics, blockchain, and artificial intelligence.

Slide 37: This slide shows title for topics that are to be covered next in the template.

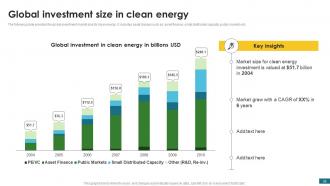

Slide 38: This slide provides the global investment market size for clean energy. It includes asset classes such as: asset finance, small distributed capacity, public markets etc.

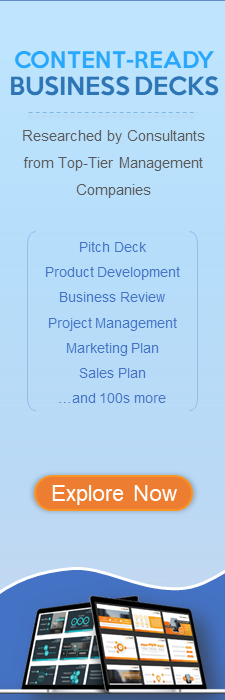

Slide 39: This slide underscores climate financing importance: low carbon economy transition, global environment protection, and social sustainability benefits.

Slide 40: This slide outlines diverse climate financing sources, including infrastructure finance, and industrial assistance promoting global sustainability.

Slide 41: This slide presents challenges to climate financing and investment, including uncertain policy landscape, financial instrument gaps, and verification challenges.

Slide 42: This slide depicts policy measures addressing climate financing investment challenges, encompassing information building, environmental regulations, etc.

Slide 43: This slide shows title for topics that are to be covered next in the template.

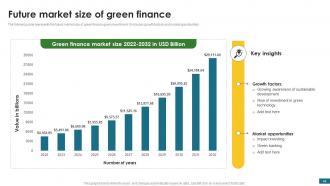

Slide 44: This slide represents the future market size of green finance green investment. It includes growth factors and market opportunities.

Slide 45: This slide outlines growth factors driving the rise in green finance and investment, including regulatory support, investments, corporate sustainability, etc.

Slide 46: This slide details market opportunities for green finance which include growing demand for sustainable products, a focus on sustainability.

Slide 47: This slide shows title for topics that are to be covered next in the template.

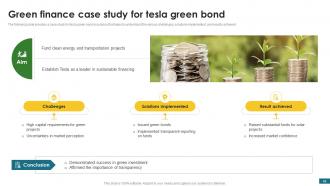

Slide 48: This slide provides a case study for tesla green bond insurance that helps to understand the various challenges, solutions implemented, and results achieved.

Slide 49: This slide presents a case study for green climate fund that helps to understand the various challenges, solutions implemented, and results achieved.

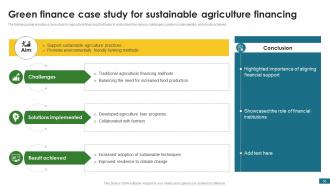

Slide 50: This slide provides a case study for agriculture financing that helps to understand the various challenges, solutions implemented, and results achieved. Solutions implemented

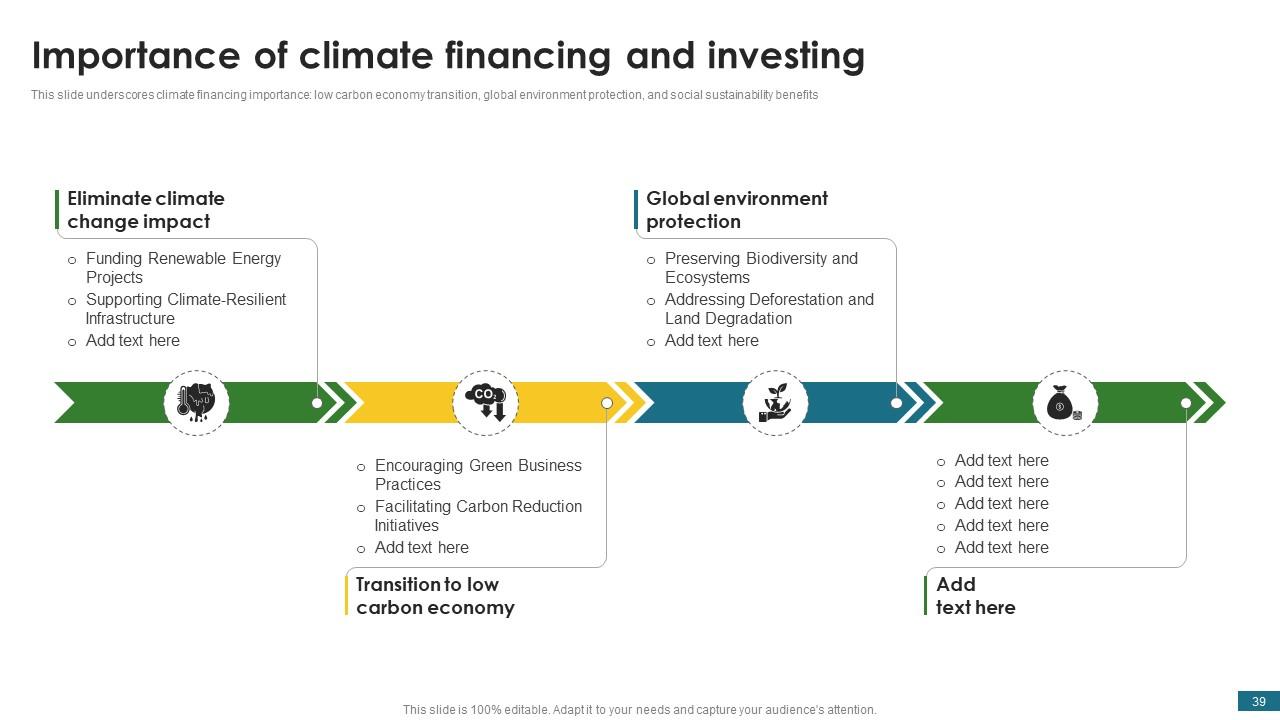

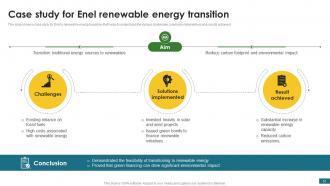

Slide 51: This slide shows a case study for Enel’s renewable energy transition that helps to understand the various challenges, solutions implemented, and results achieved.

Slide 52: This slide shows all the icons included in the presentation.

Slide 53: This slide is titled as Additional Slides for moving forward.

Slide 54: This is a financial slide. Show your finance related stuff here.

Slide 55: This slide provides 30 60 90 Days Plan with text boxes.

Slide 56: This is a Quotes slide to convey message, beliefs etc.

Slide 57: This slide contains Puzzle with related icons and text.

Slide 58: This slide shows SWOT analysis describing- Strength, Weakness, Opportunity, and Threat.

Slide 59: This is a Timeline slide. Show data related to time intervals here.

Slide 60: This is a Thank You slide with address, contact numbers and email address.

Green Finance Fostering Sustainable Development CRP CD with all 69 slides:

Use our Green Finance Fostering Sustainable Development CRP CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Awesome presentation, really professional and easy to edit.

-

Mesmerized with the fantastic collection! Super sleek, relevant infographics.