Credit Scoring And Reporting Complete Guide Fin CD

The Credit Scoring and Reporting A Complete Guide is the ultimate resource for anyone who wants to gain a deep understanding of credit scoring and reporting. This Credit score guide covers everything from the basics of credit reports to the details of credit scores and their calculation methods. Additionally, our credit report PowerPoint presentation is written in clear and concise language, making it easy for beginners and experts to understand. It covers various topics, such as the different types of credit scores, how credit reports are created, etc. Our Credit report template also includes helpful tips on how to improve your credit score and maintain a healthy credit profile. Furthermore, the credit history previews various strategies to reduce debt, pay bills on time, and avoid common credit mistakes. Lastly, our Payment History module helps those who want to take control of their credit and financial future. Get our 100 percent editable template right now.

The Credit Scoring and Reporting A Complete Guide is the ultimate resource for anyone who wants to gain a deep understandin..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Enthrall your audience with this Credit Scoring And Reporting Complete Guide Fin CD. Increase your presentation threshold by deploying this well-crafted template. It acts as a great communication tool due to its well-researched content. It also contains stylized icons, graphics, visuals etc, which make it an immediate attention-grabber. Comprising one hundred seven slides, this complete deck is all you need to get noticed. All the slides and their content can be altered to suit your unique business setting. Not only that, other components and graphics can also be modified to add personal touches to this prefabricated set.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Credit Scoring and Reporting Complete Guide. State Your Company Name and begin.

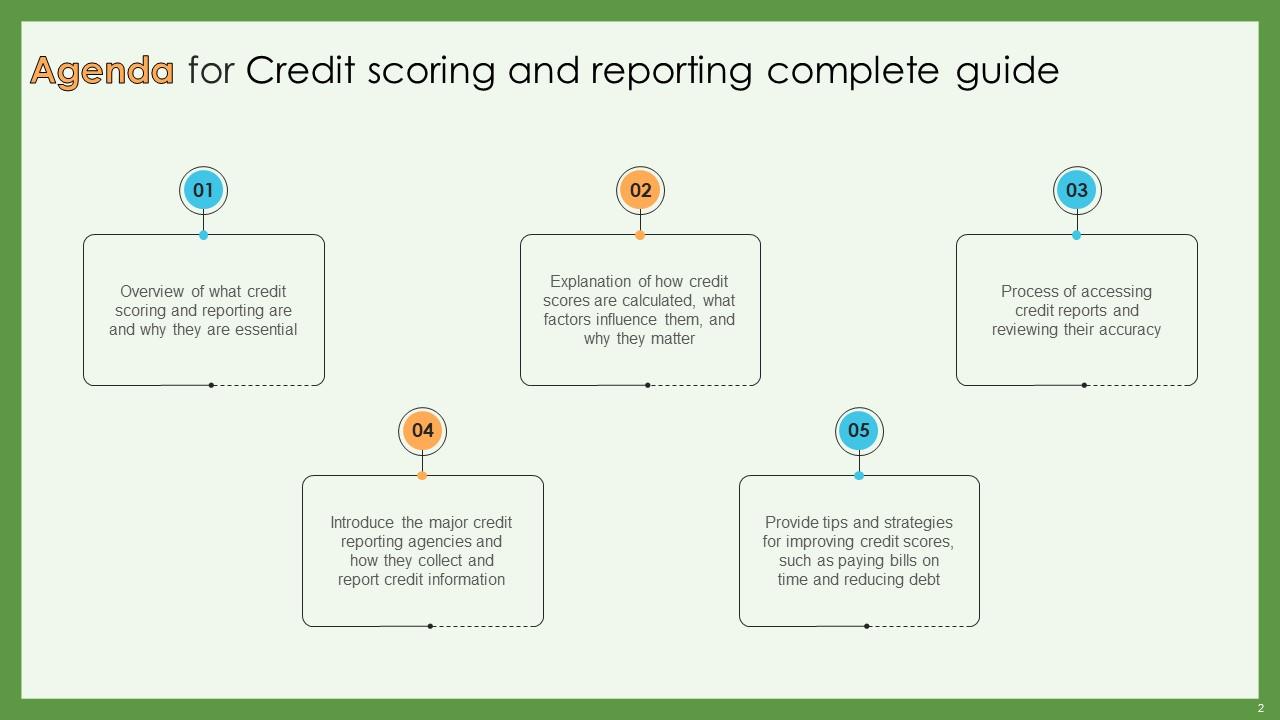

Slide 2: This slide is an Agenda slide. State your agendas here.

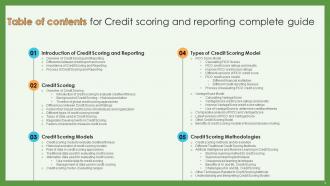

Slide 3: This slide shows a Table of Contents for the presentation.

Slide 4: This slide is in continuation with the previous slide.

Slide 5: This slide is an introductory slide.

Slide 6: This slide covers the details related to the overview of what credit scoring and reporting are and why they are important.

Slide 7: This is in continuation with the previous slide.

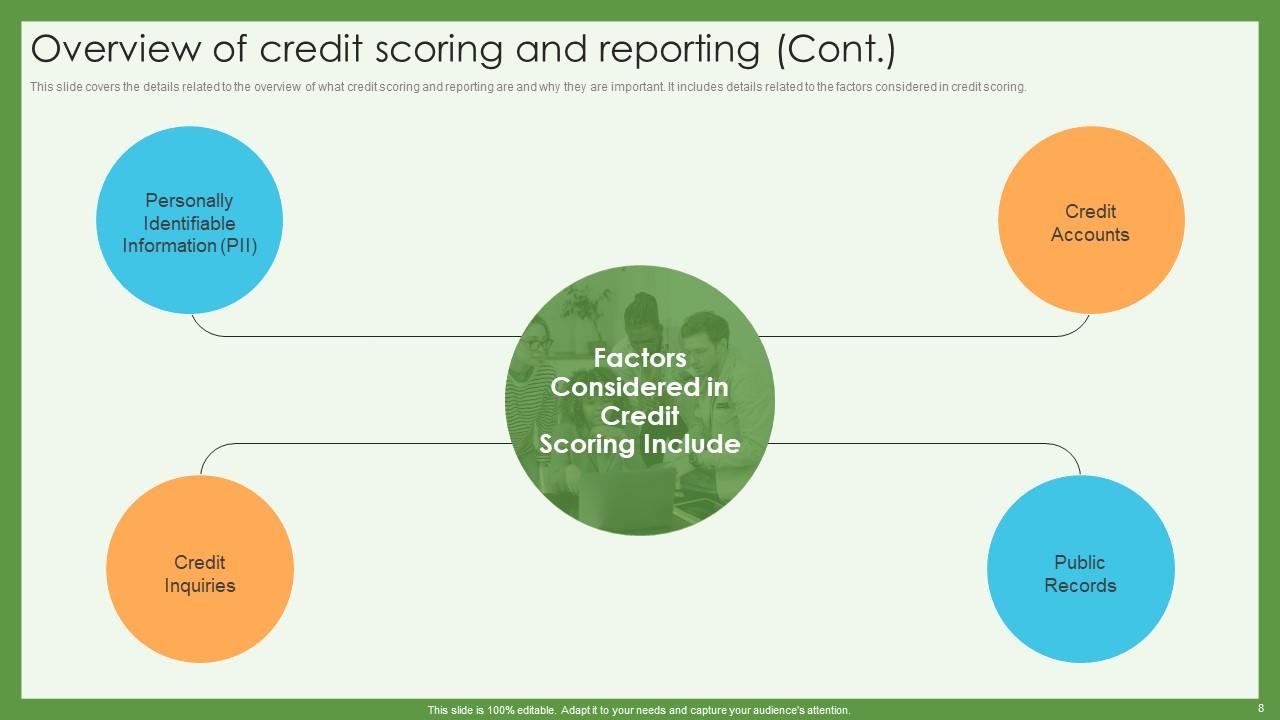

Slide 8: This is in continuation with the previous slide.

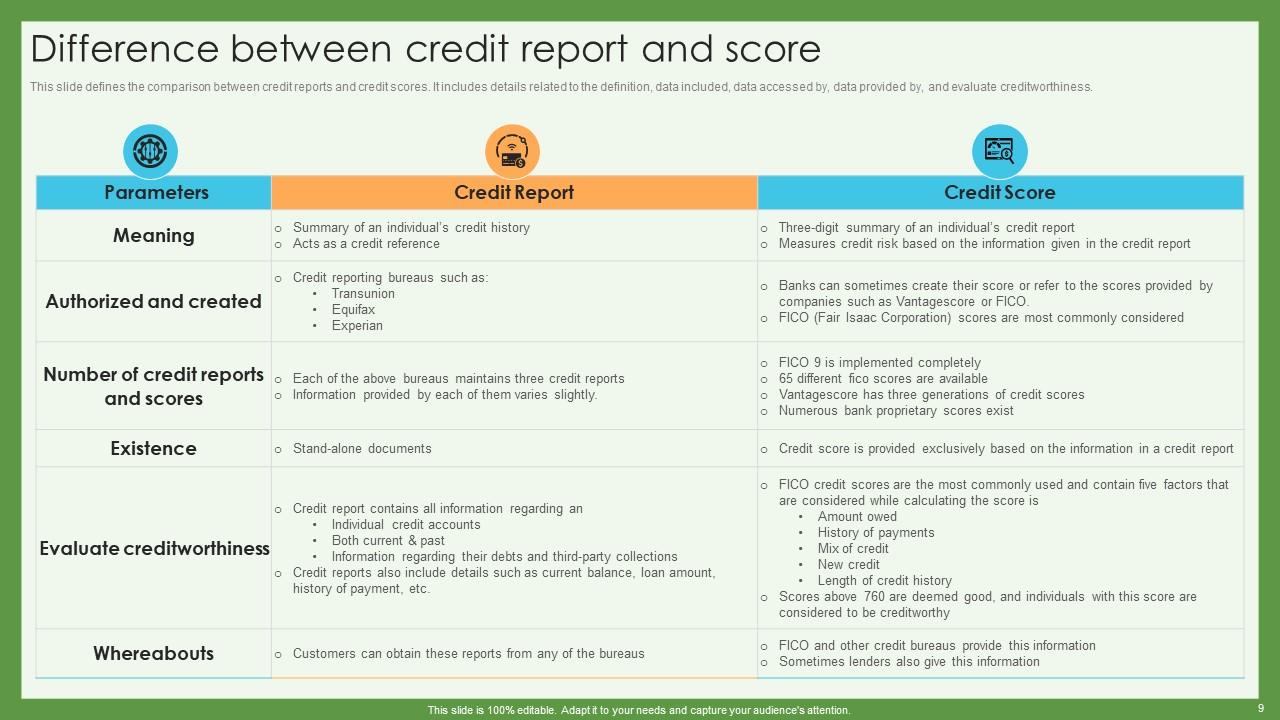

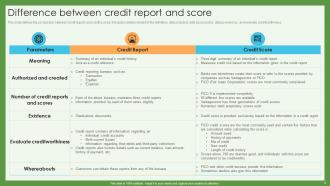

Slide 9: This slide defines the comparison between credit reports and credit scores.

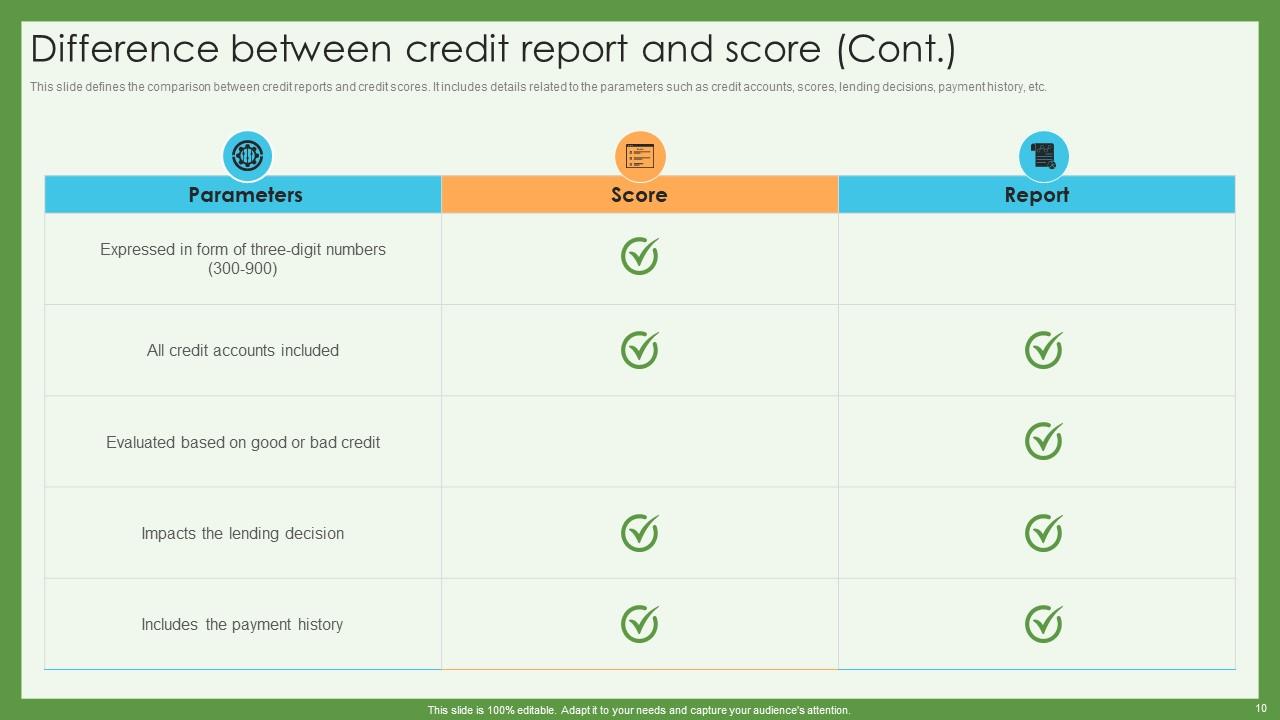

Slide 10: This slide demonstrates the comparison between credit reports and credit scores.

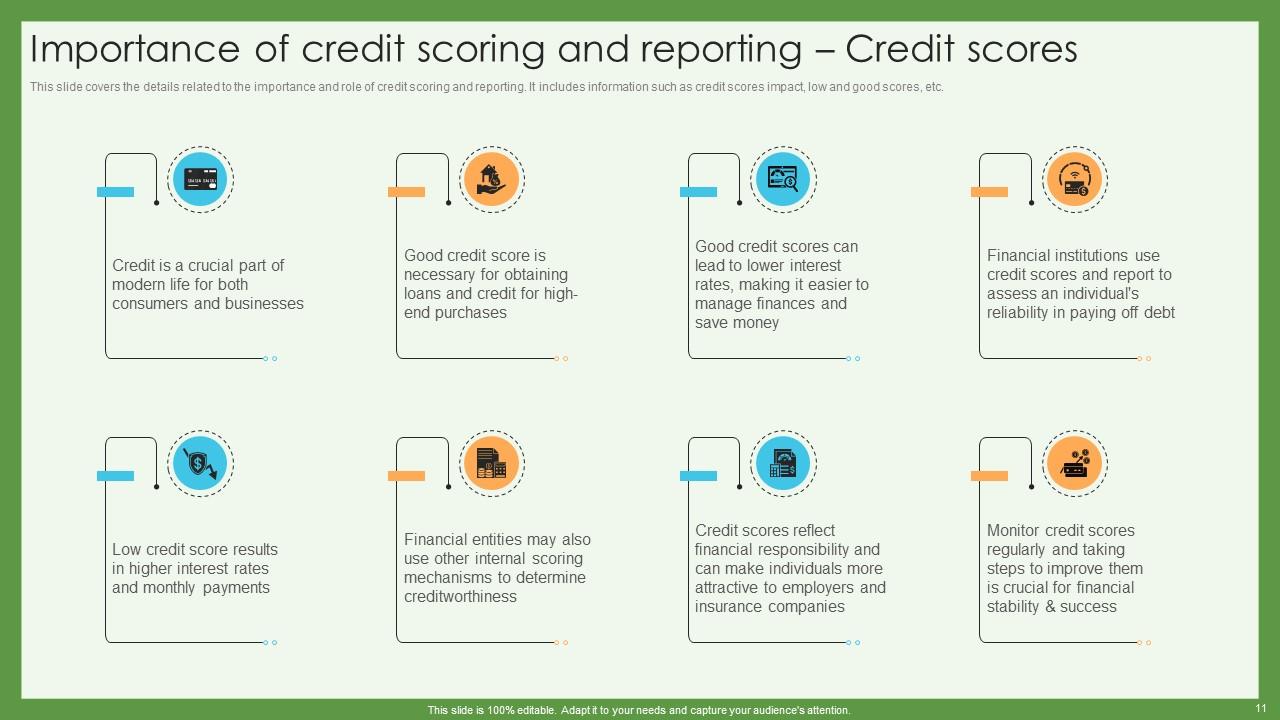

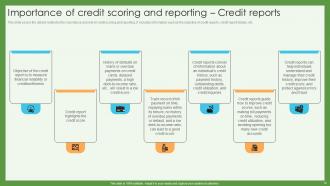

Slide 11: This slide portrays the details related to the importance and role of credit scoring and reporting.

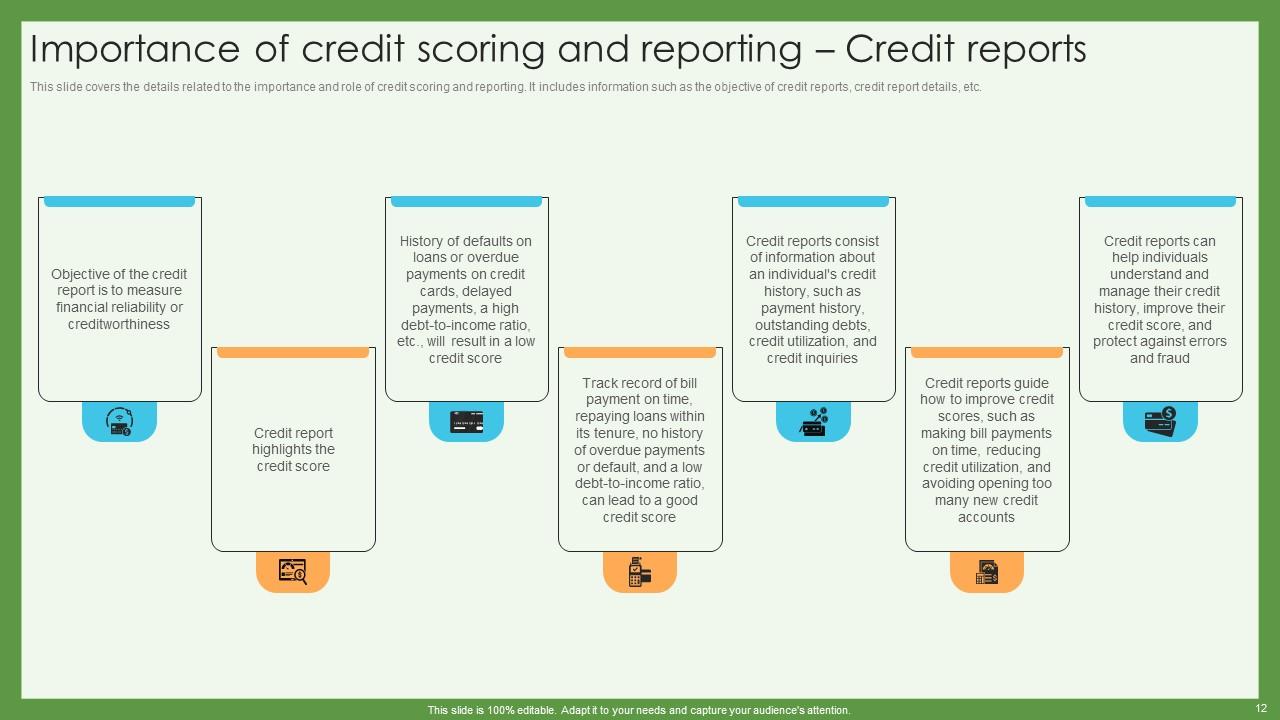

Slide 12: This slide showcases the details related to the importance and role of credit scoring and reporting.

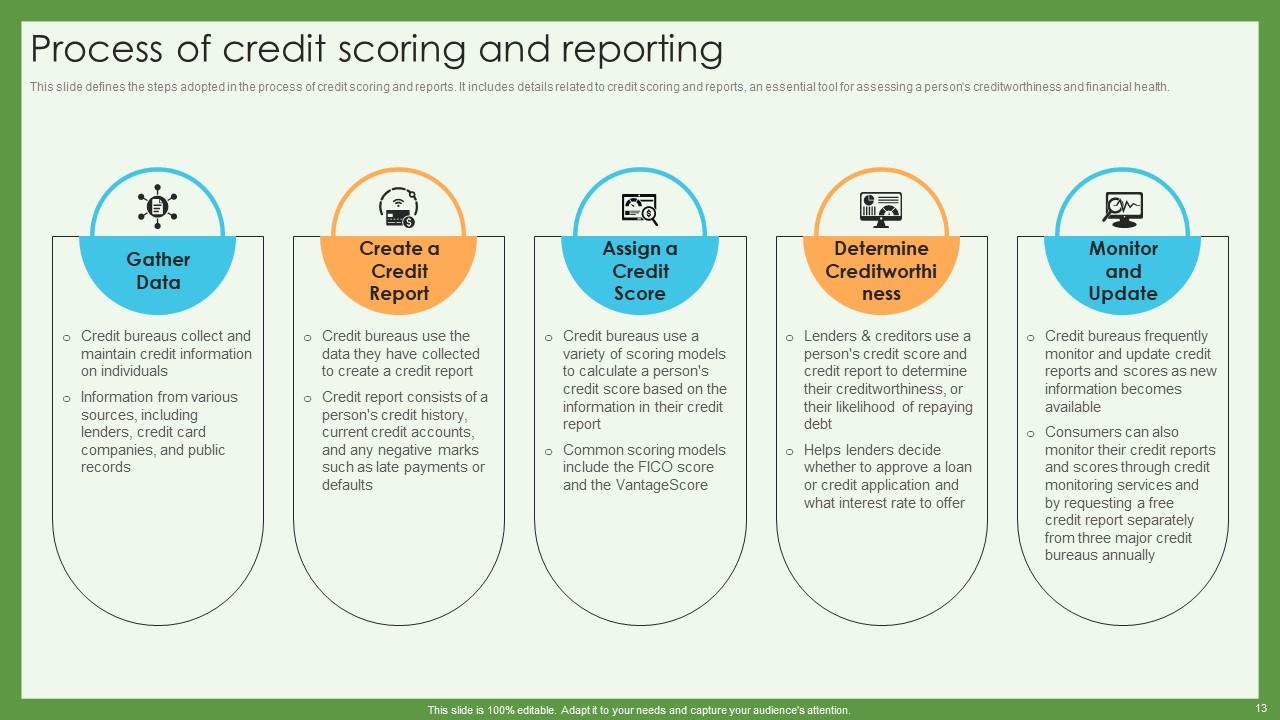

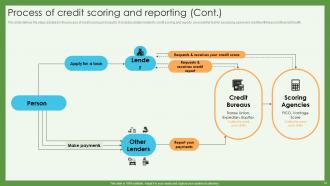

Slide 13: This slide shows the steps adopted in the process of credit scoring and reports.

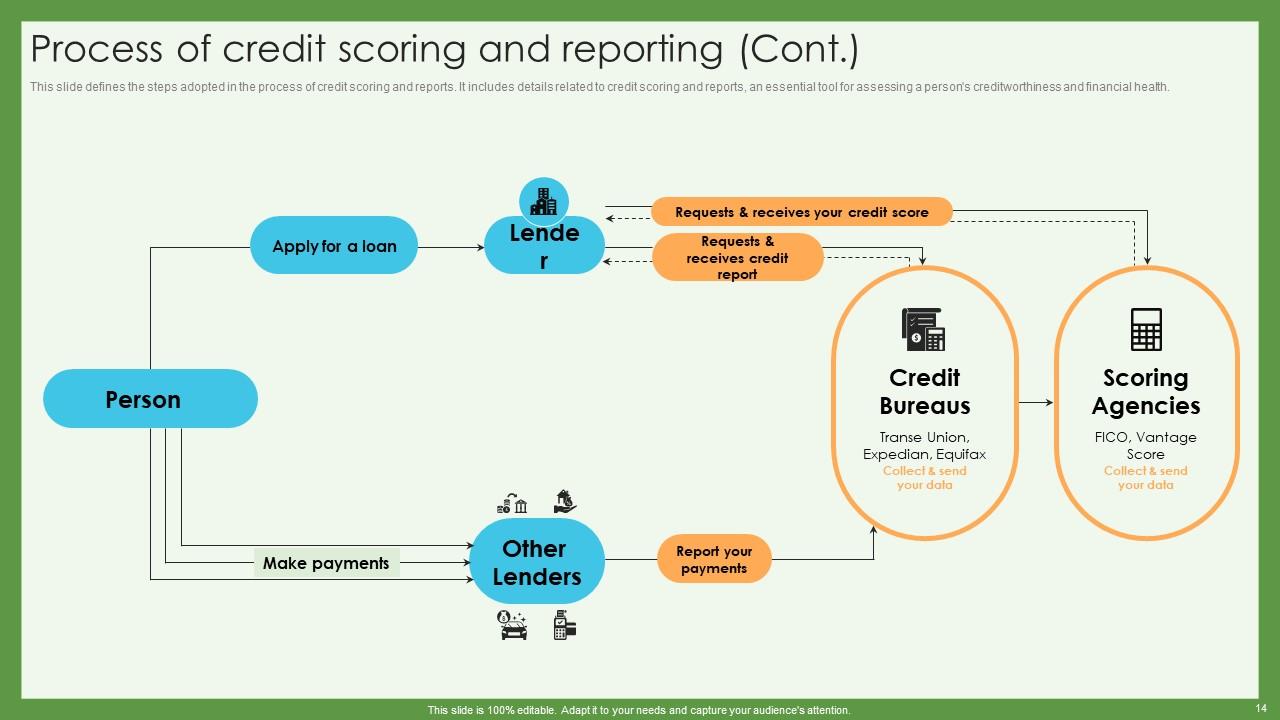

Slide 14: This slide illustrates the steps adopted in the process of credit scoring and reports.

Slide 15: This slide is an introductory slide.

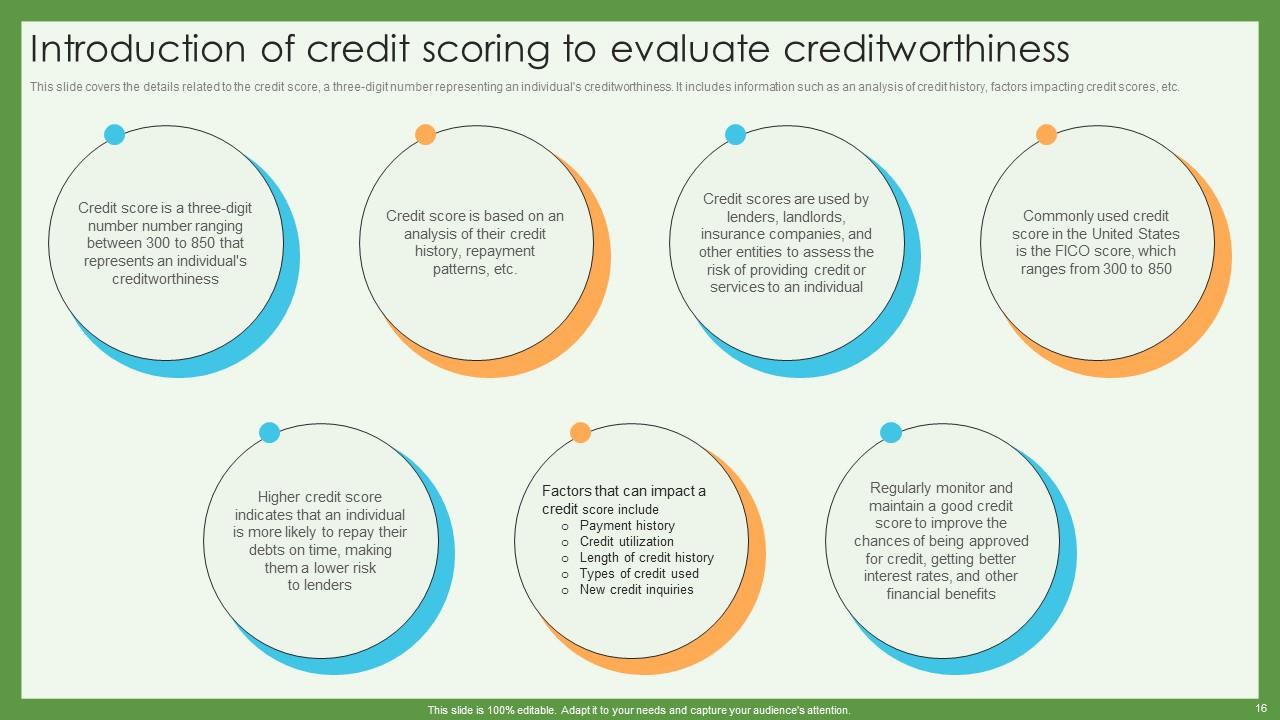

Slide 16: This slide covers the details related to the credit score, a three-digit number representing an individual's creditworthiness.

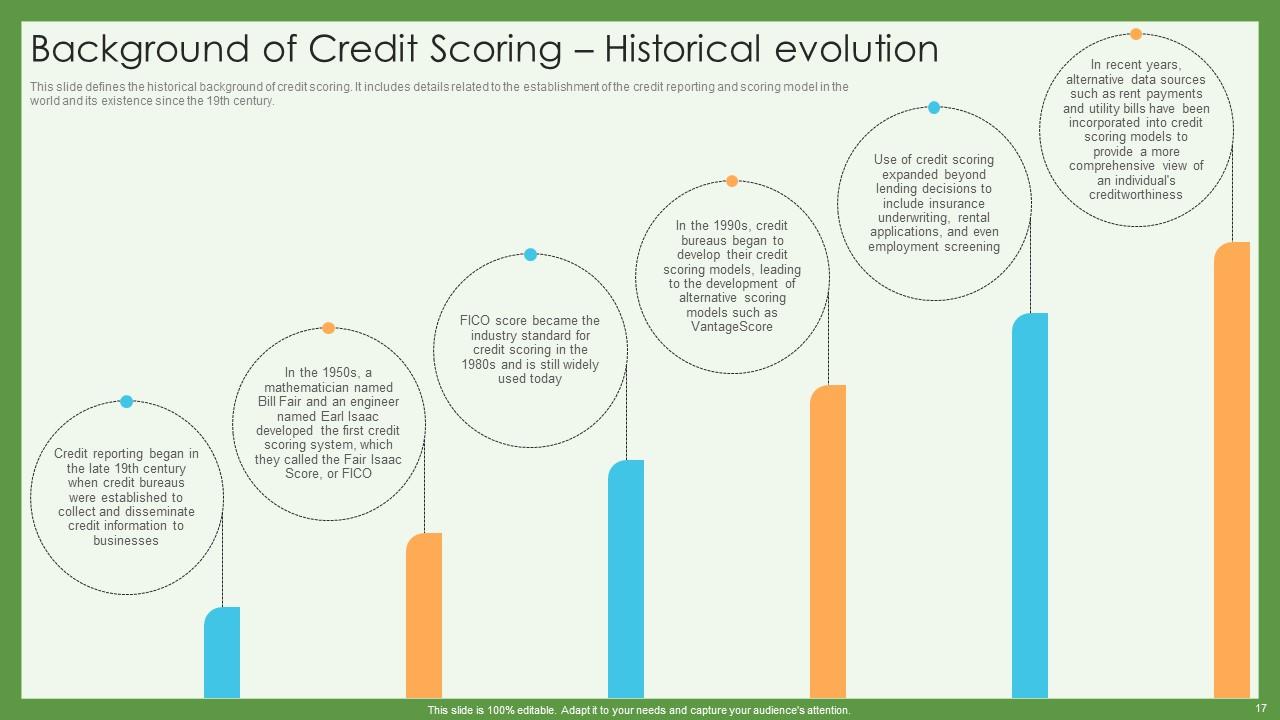

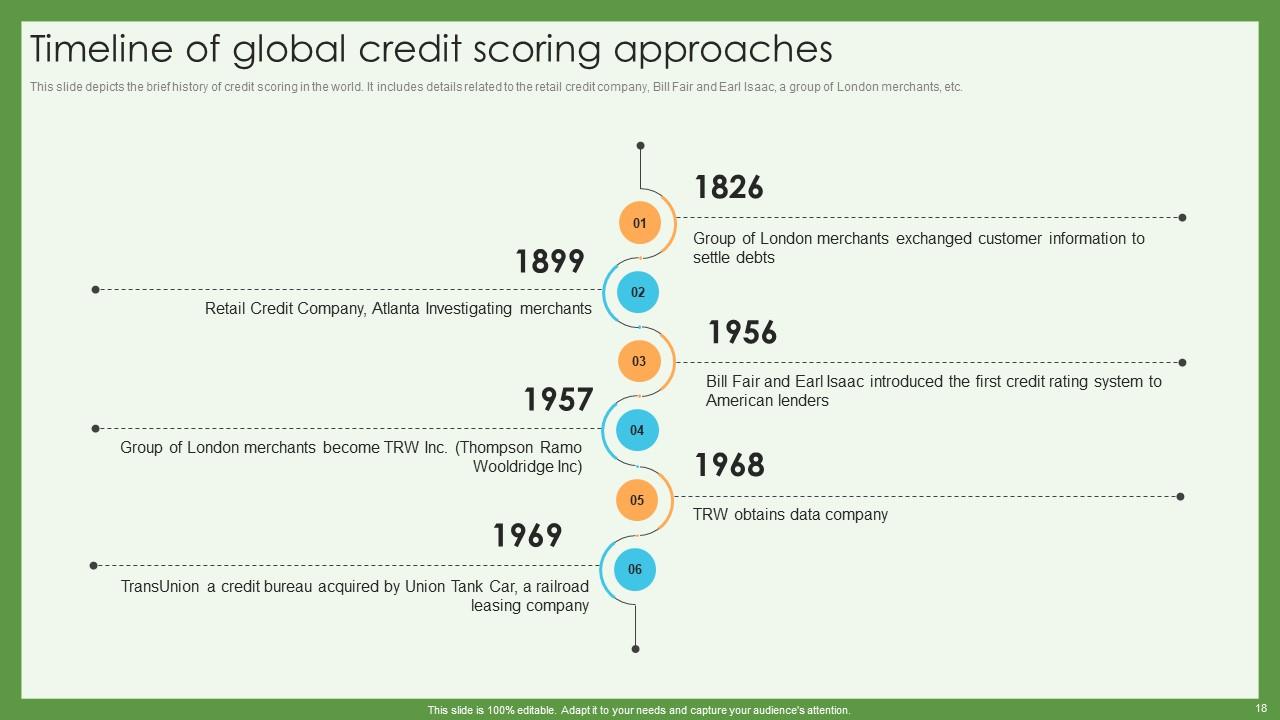

Slide 17: This slide entails the historical background of credit scoring.

Slide 18: This slide depicts the brief history of credit scoring in the world.

Slide 19: This slide depicts the brief history of credit scoring in the world.

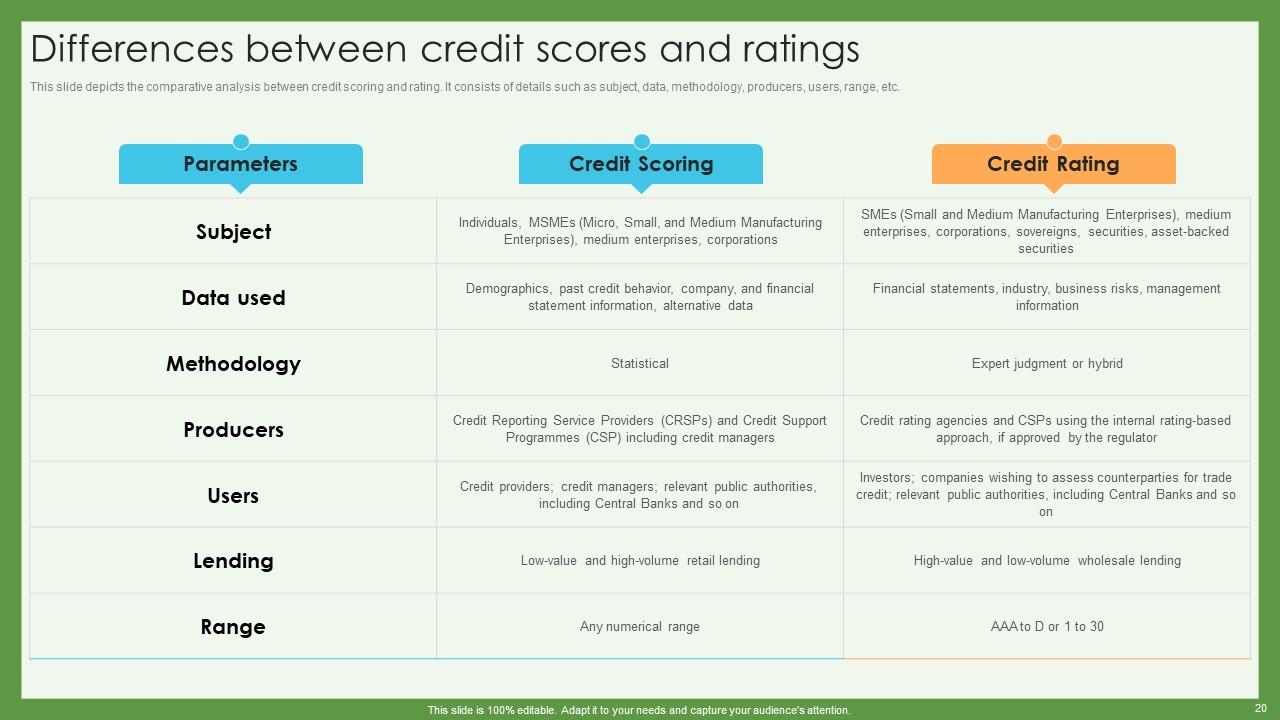

Slide 20: This slide outlines the comparative analysis between credit scoring and rating.

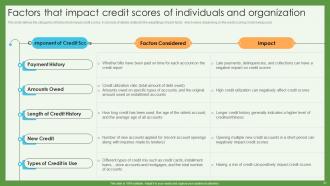

Slide 21: This slide defines the categories of factors that impact credit scores.

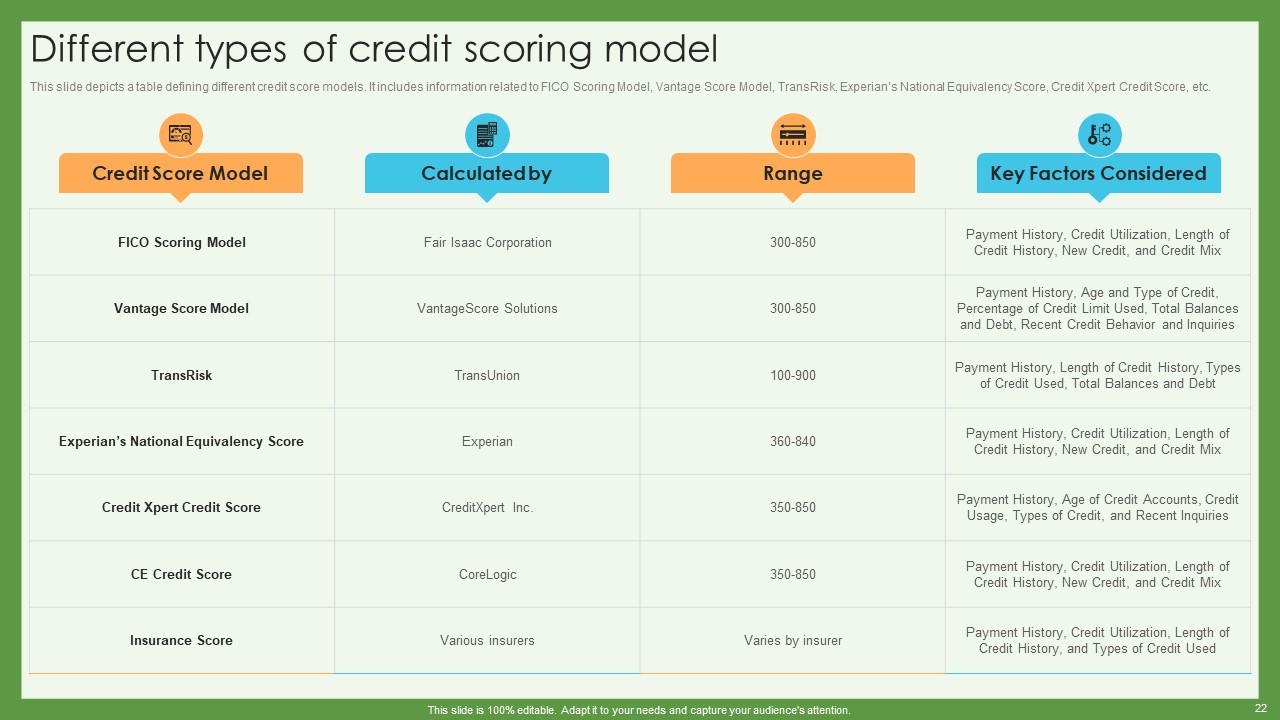

Slide 22: This slide offers a table defining different credit score models.

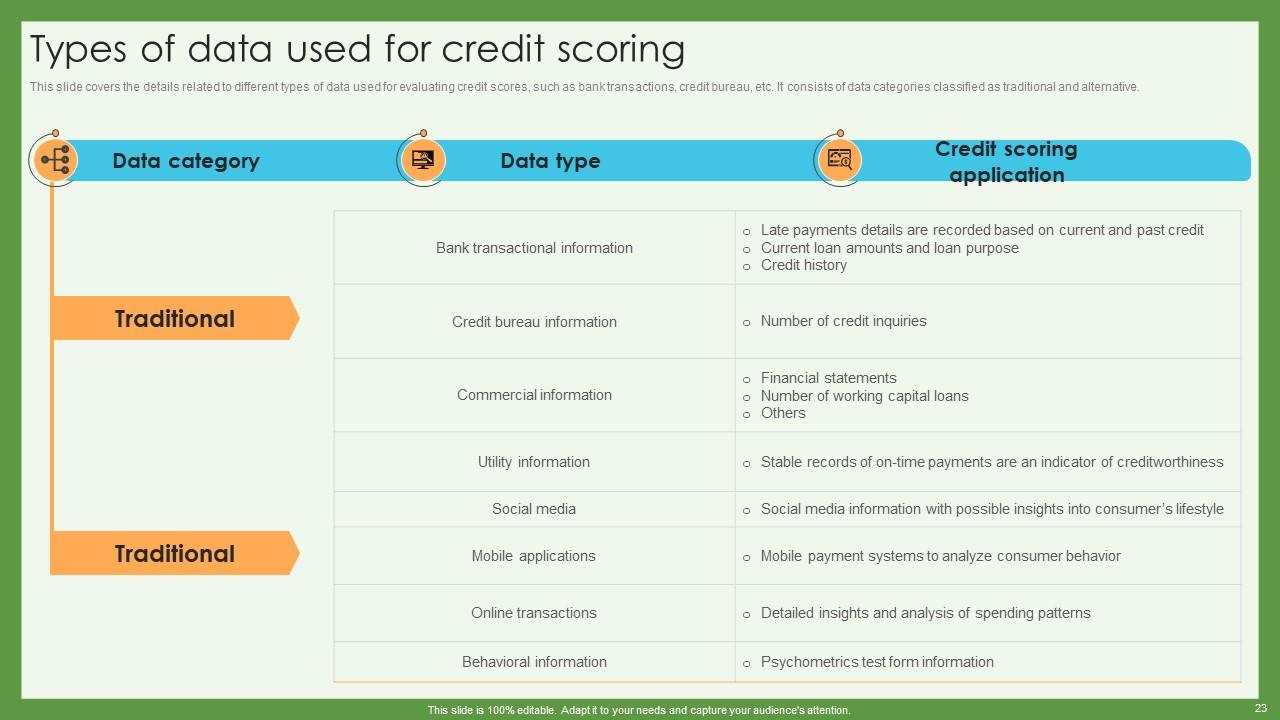

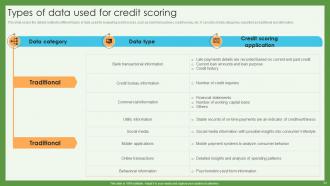

Slide 23: This slide covers the details related to different types of data used for evaluation.

Slide 24: This slide details the regulatory developments in credit risk modeling.

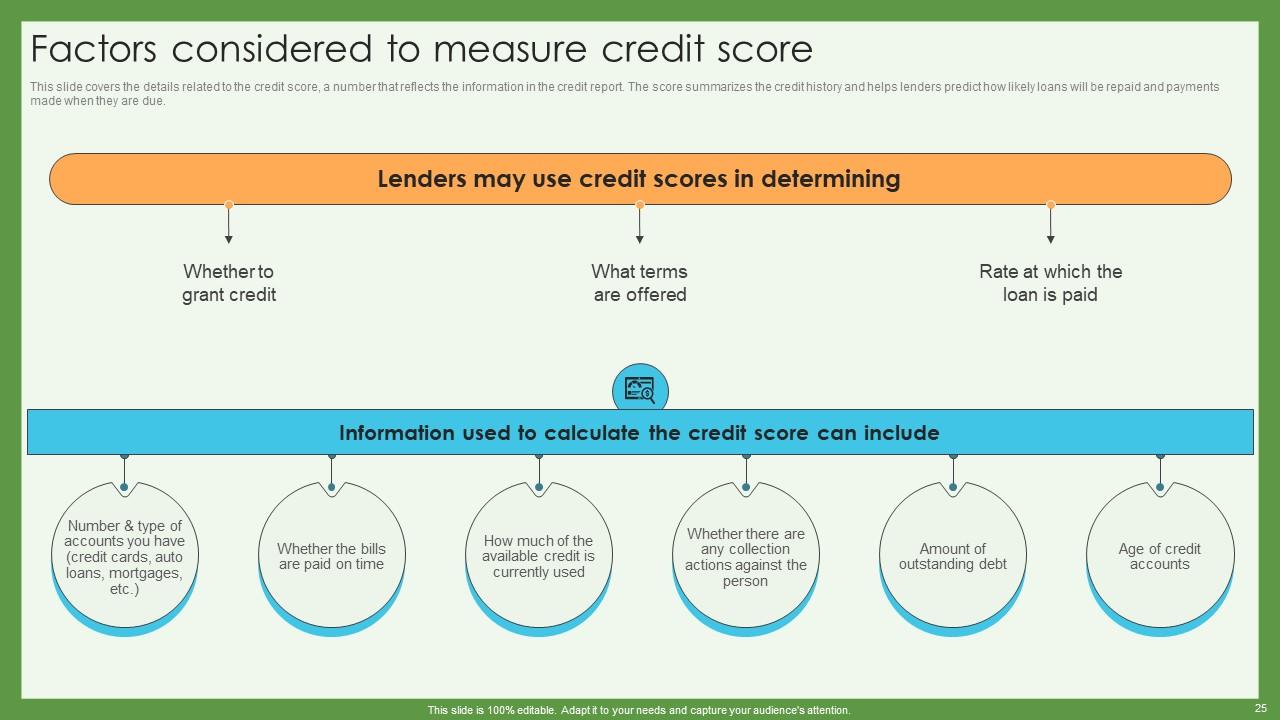

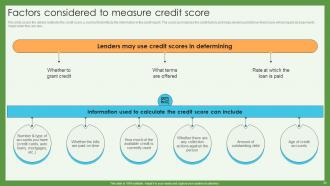

Slide 25: This slide illustrates the details related to the credit score, a number that reflects the information in the credit report.

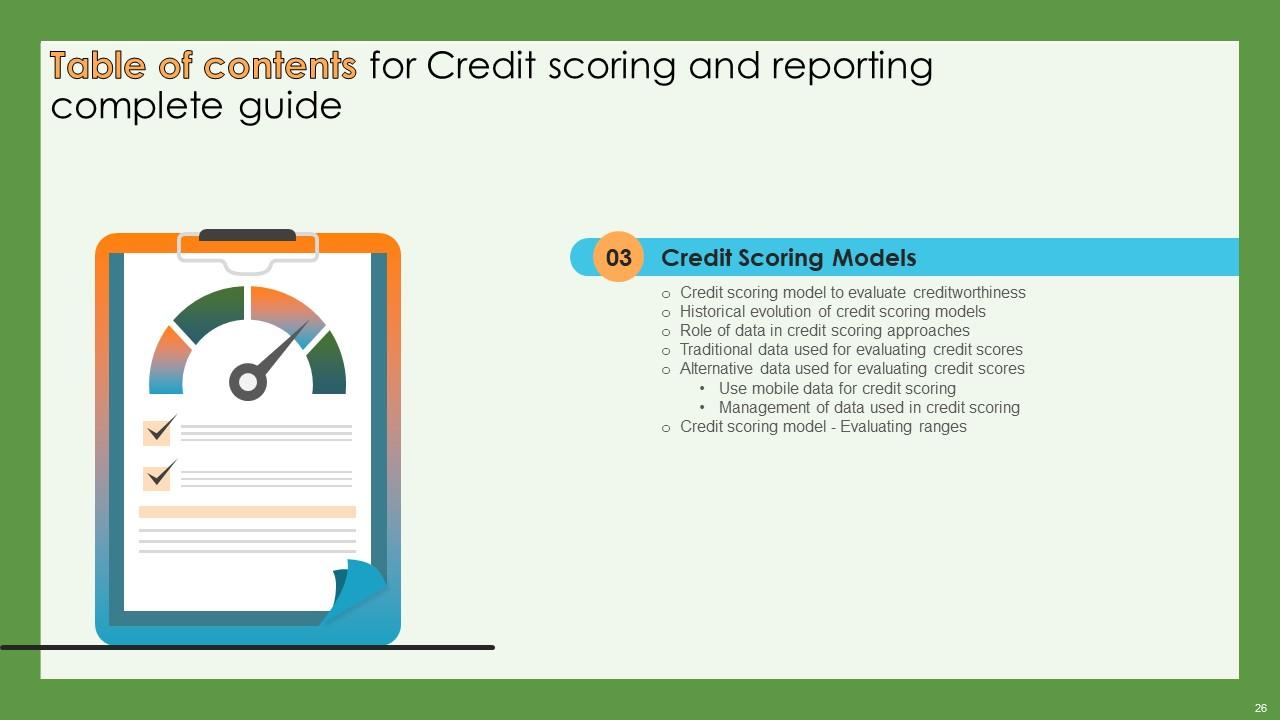

Slide 26: This slide is an introductory slide.

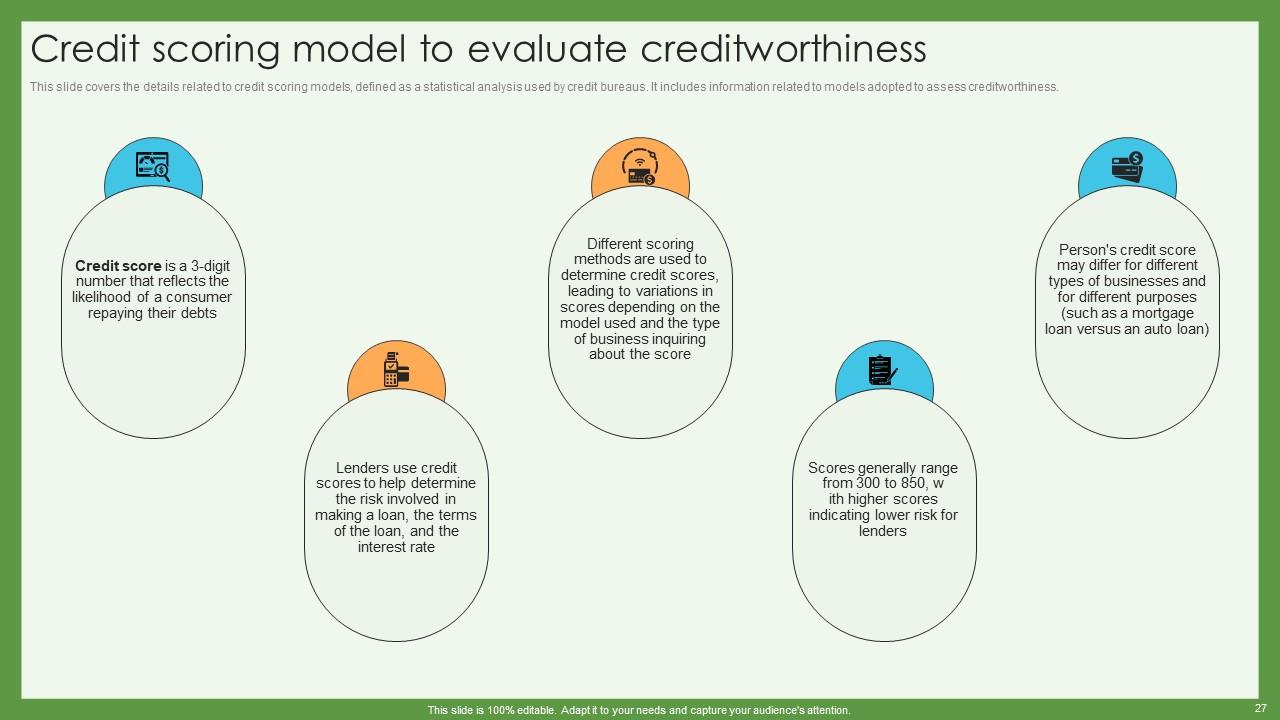

Slide 27: This slide covers the details related to credit scoring models, defined as a statistical analysis used by credit bureaus.

Slide 28: This slide caters to the details related to credit scoring models, defined as a statistical analysis used by credit bureaus.

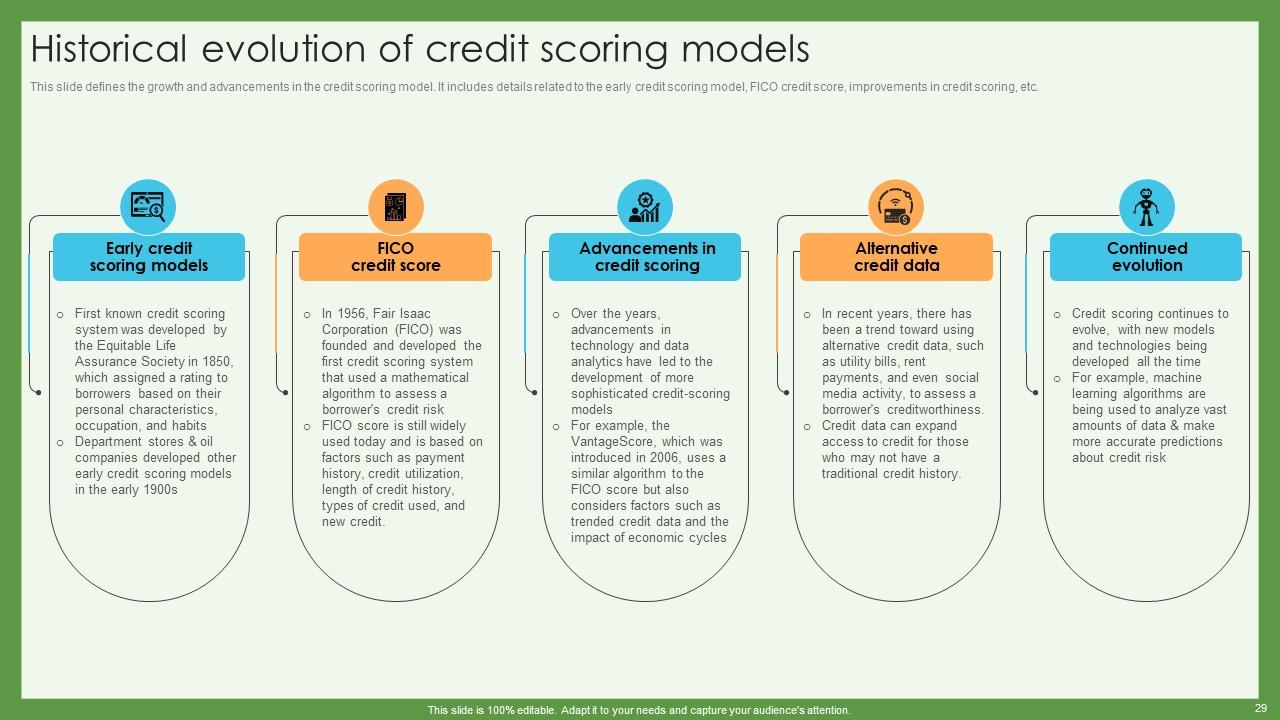

Slide 29: This slide defines the growth and advancements in the credit scoring model.

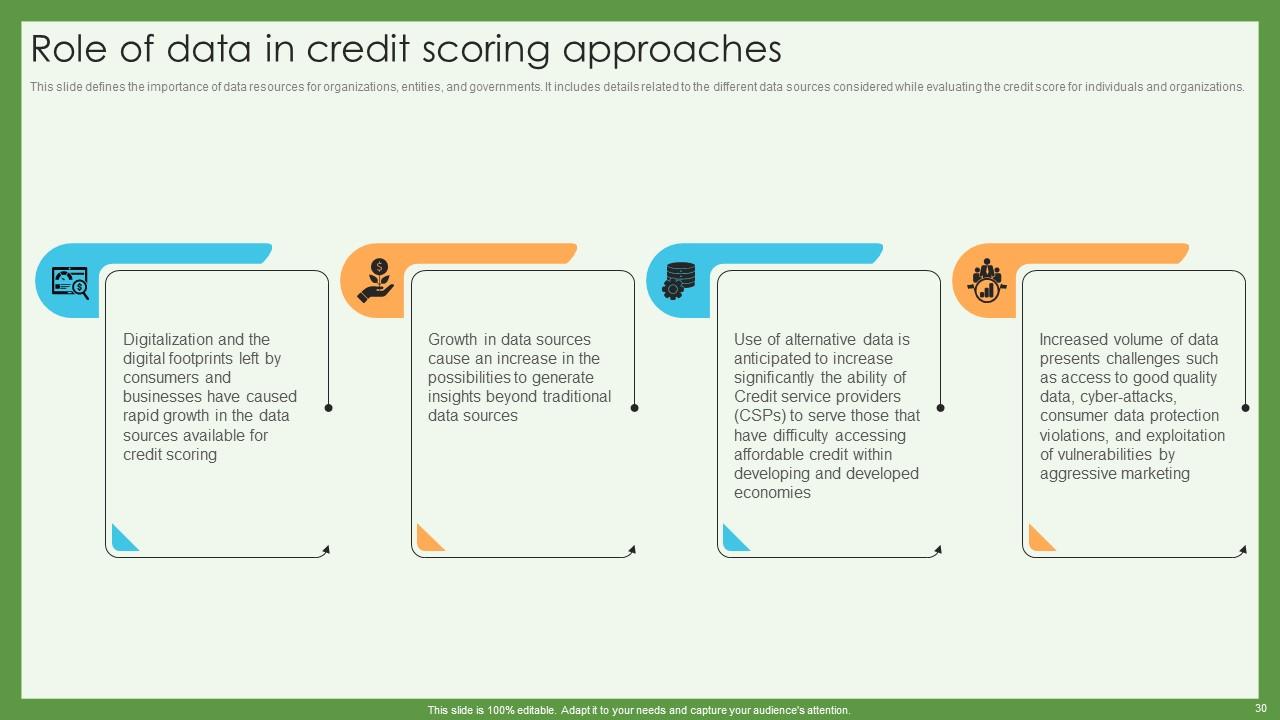

Slide 30: This slide defines the importance of data resources for organizations, entities, and governments.

Slide 31: This slide demonstrates the importance of data resources for organizations, entities, and governments.

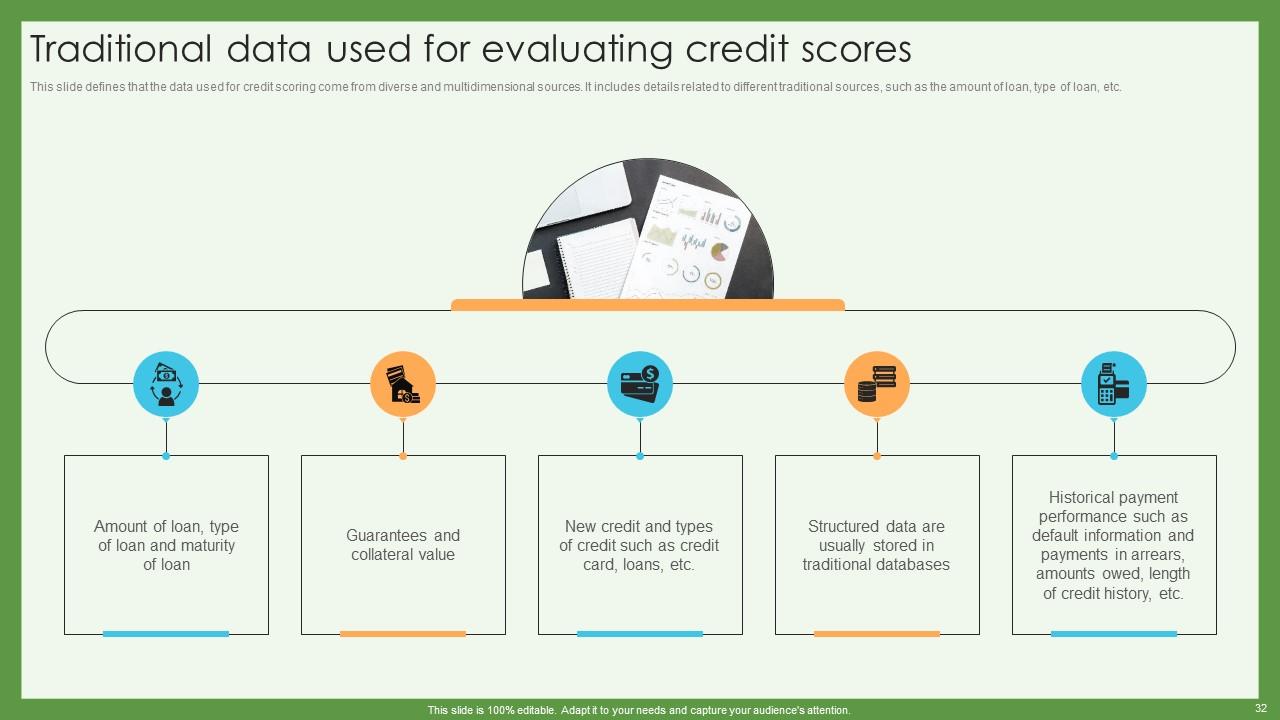

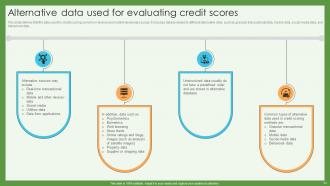

Slide 32: This slide entails that the data used for credit scoring come from diverse and multidimensional sources.

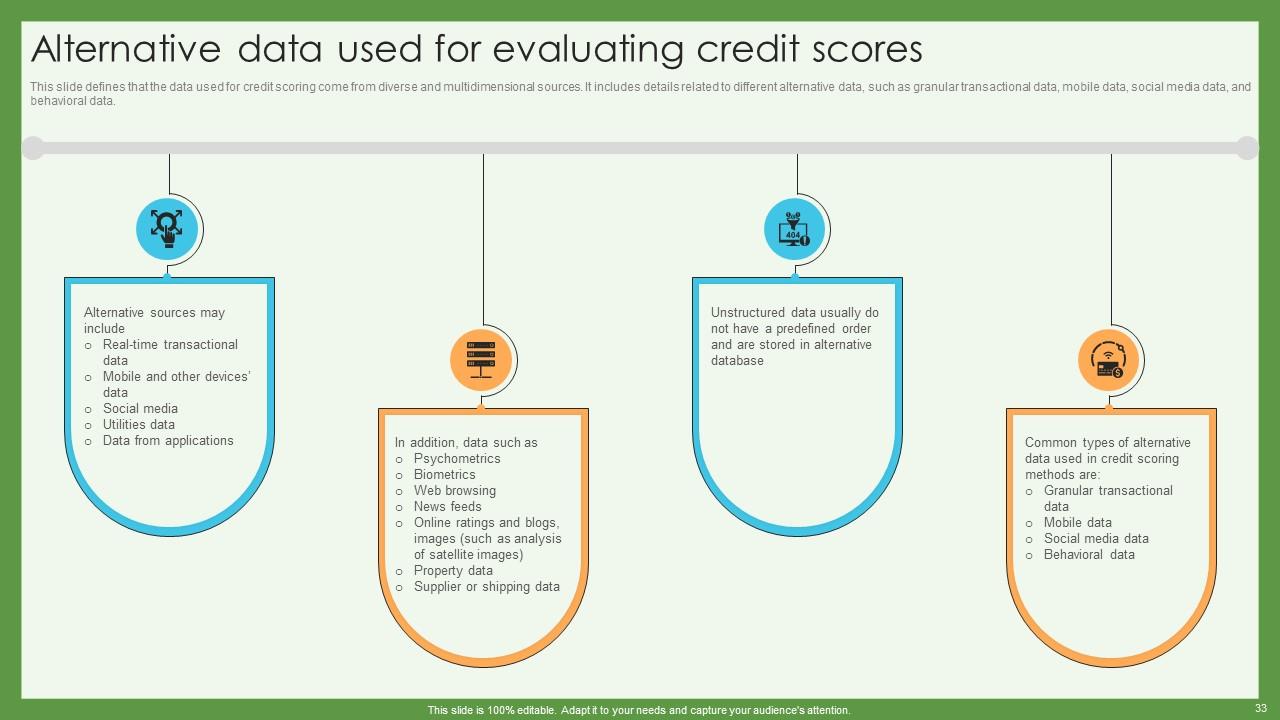

Slide 33: This is in continuation with the previous slide.

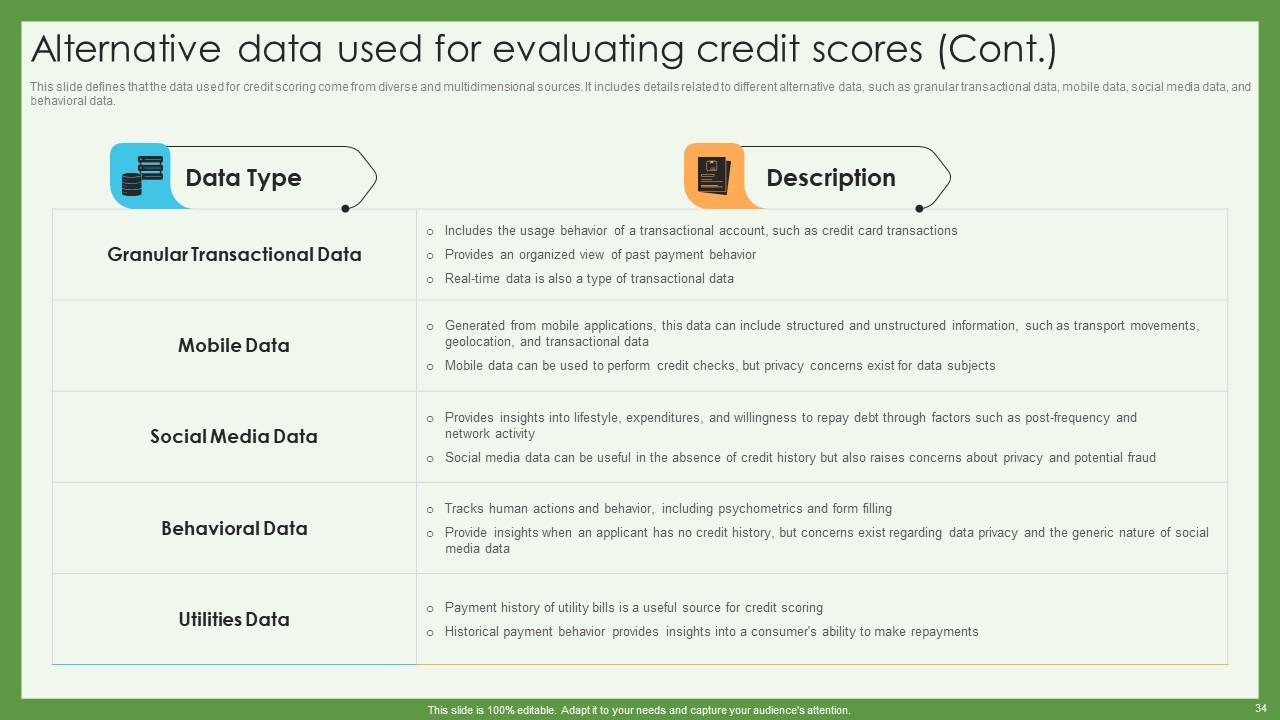

Slide 34: This is in continuation with the previous slide.

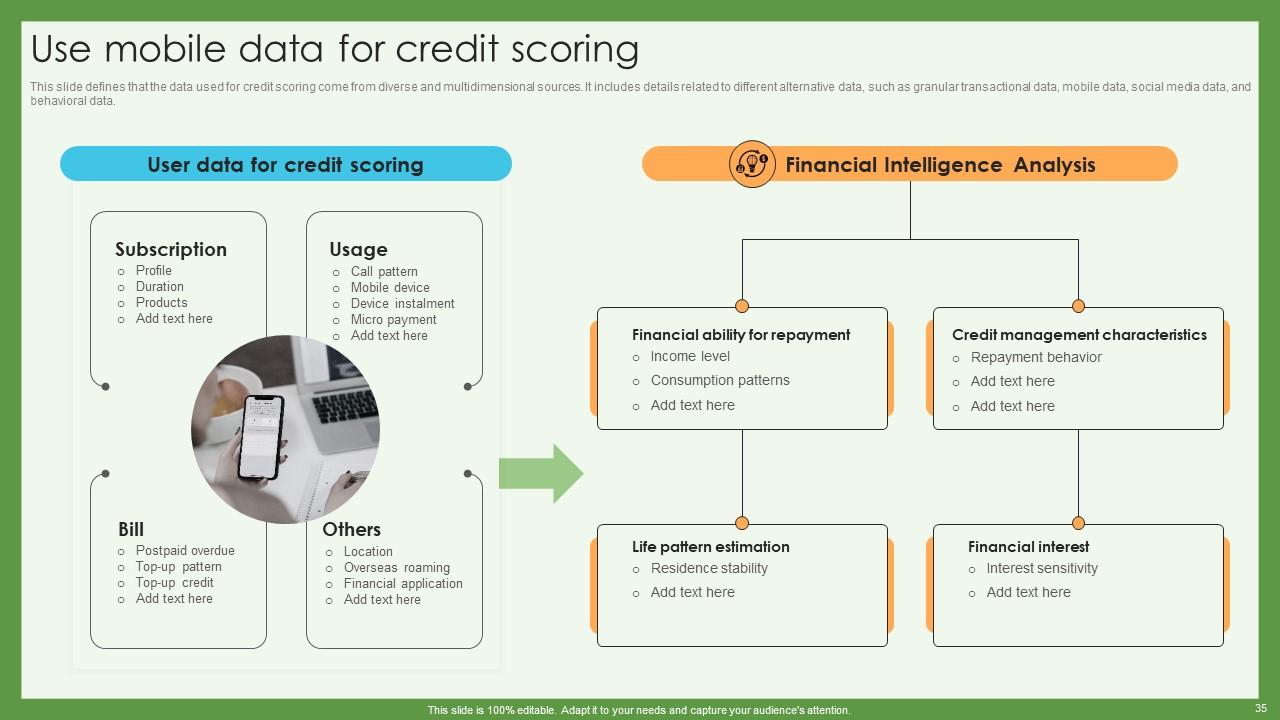

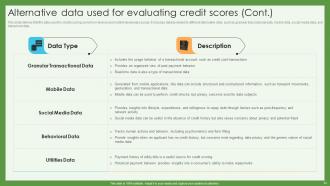

Slide 35: This slide defines that the data used for credit scoring come from diverse and multidimensional sources.

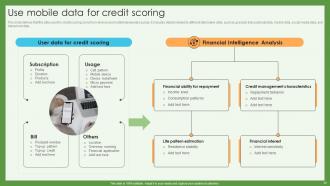

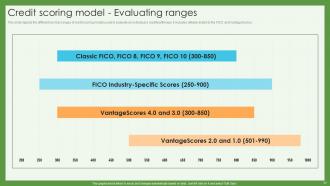

Slide 36: This slide defines the management of data used for credit scoring.

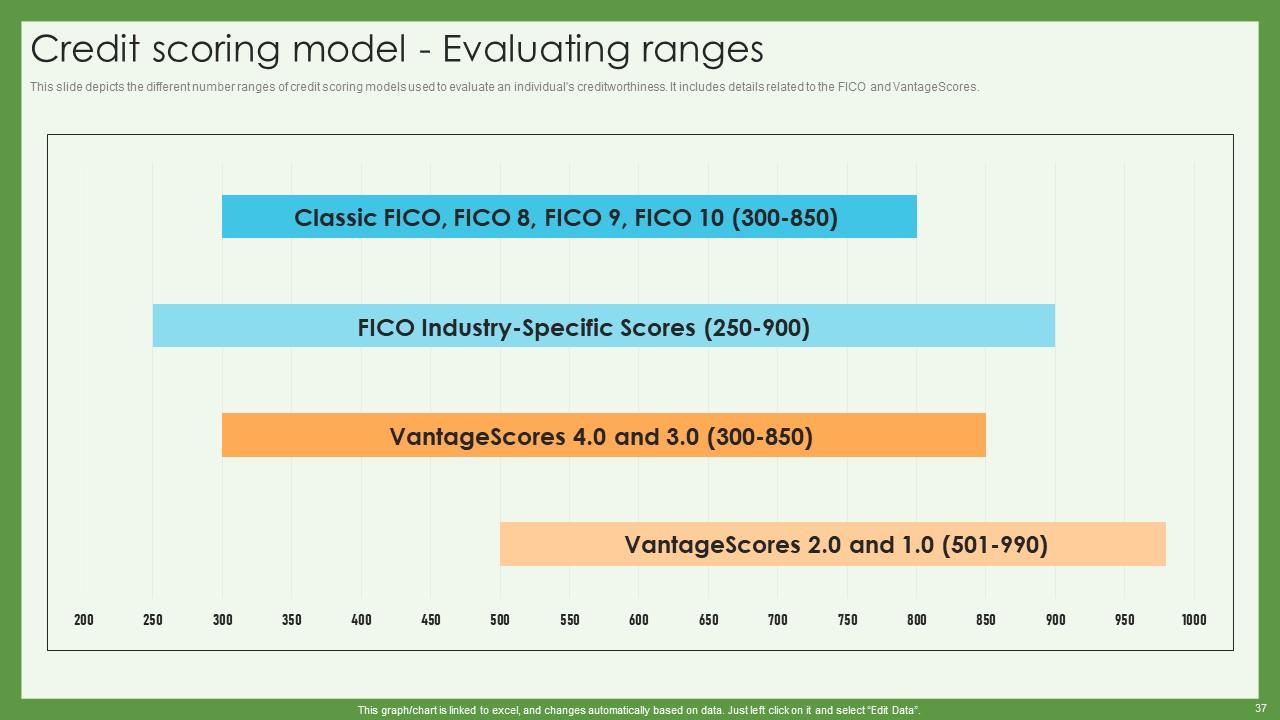

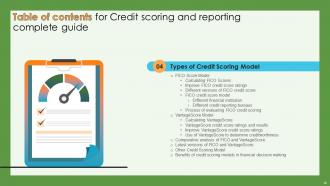

Slide 37: This slide depicts the different number ranges of credit scoring models used to evaluate an individual's creditworthiness.

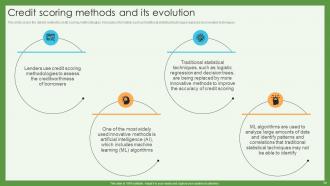

Slide 38: This slide is an introductory slide.

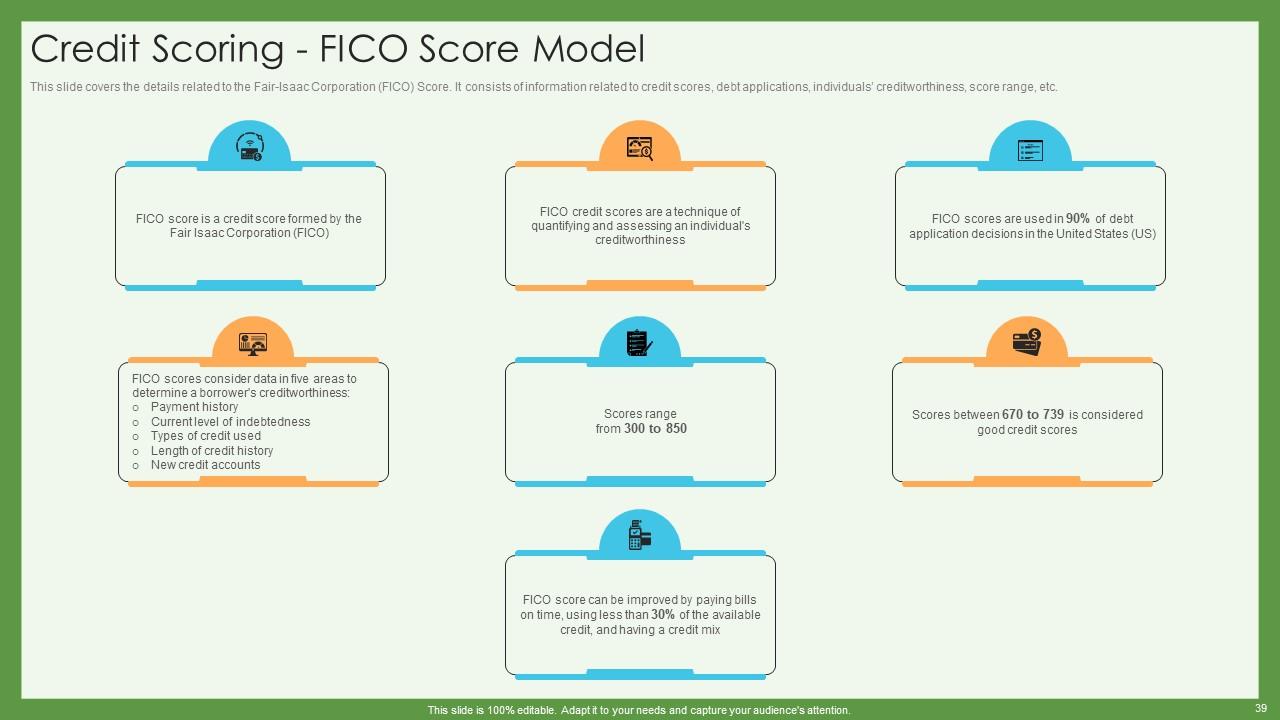

Slide 39: This slide covers the details related to the Fair-Isaac Corporation (FICO) Score.

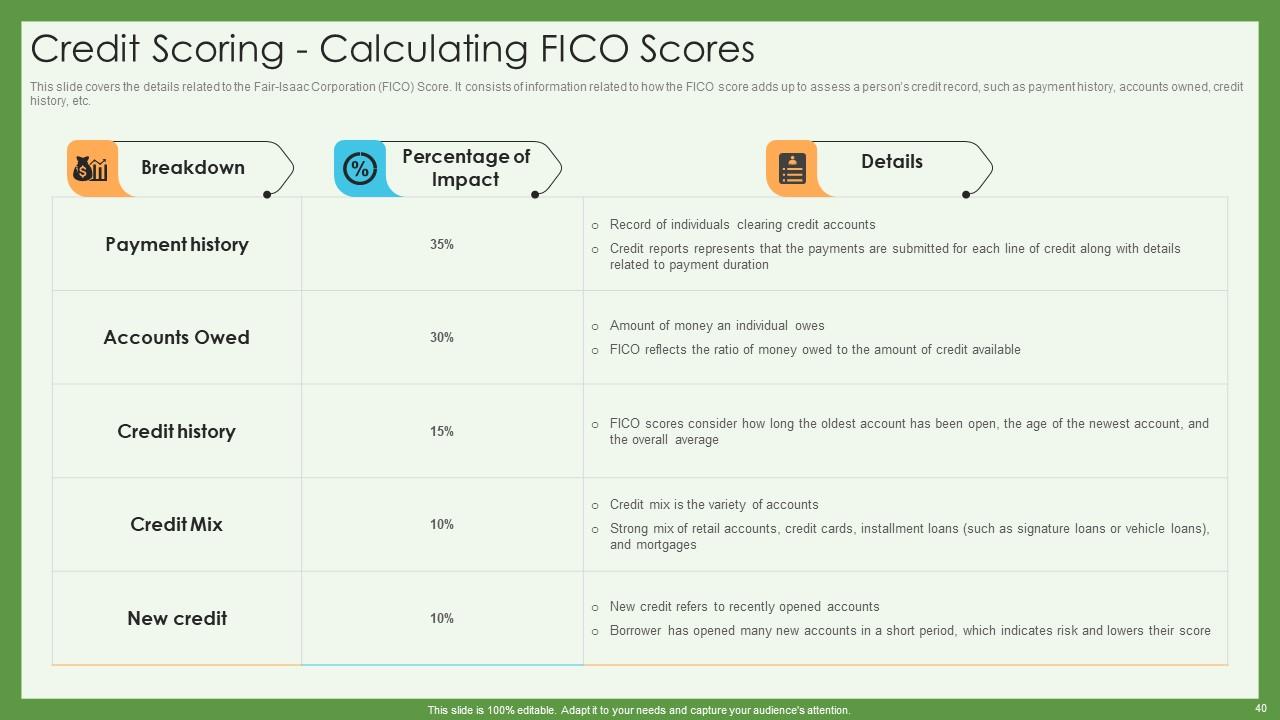

Slide 40: This slide deals with the details related to the Fair-Isaac Corporation (FICO) Score.

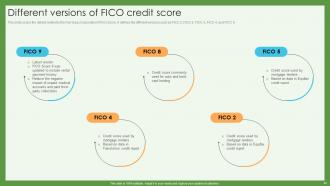

Slide 41: This slide showcases the details related to the Fair-Isaac Corporation (FICO) Score.

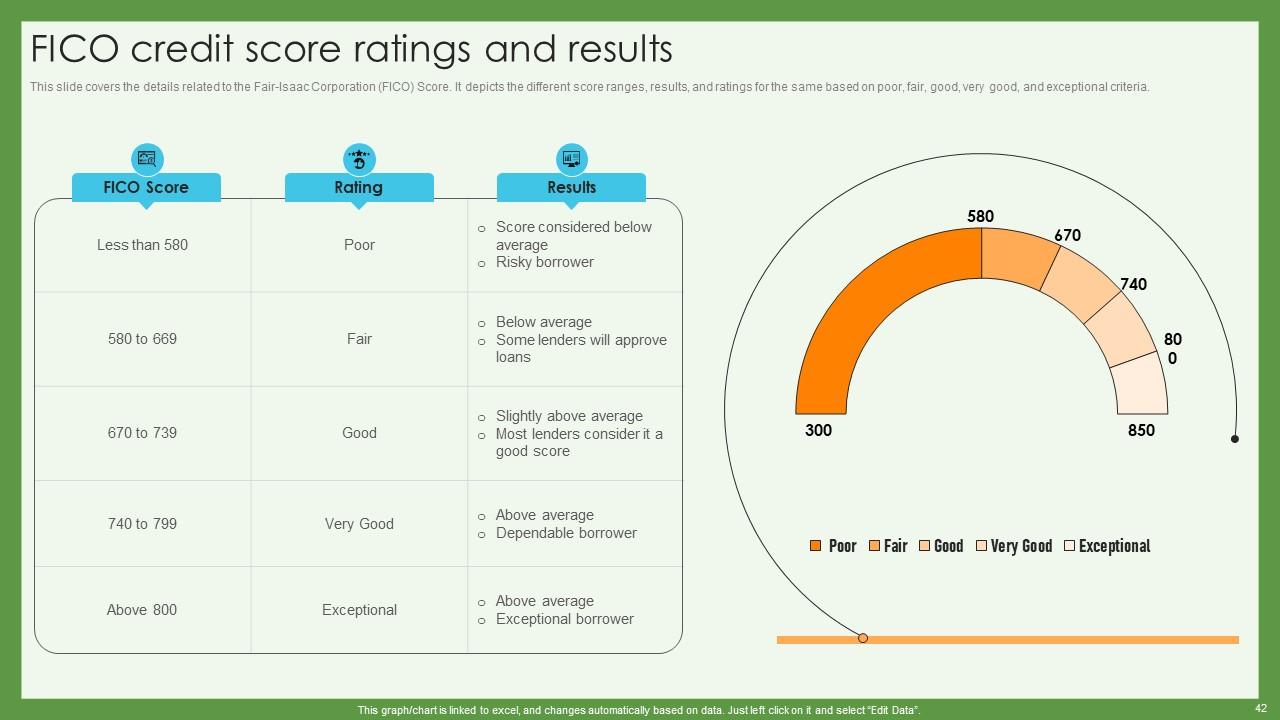

Slide 42: This slide puts the details related to the Fair-Isaac Corporation (FICO) Score.

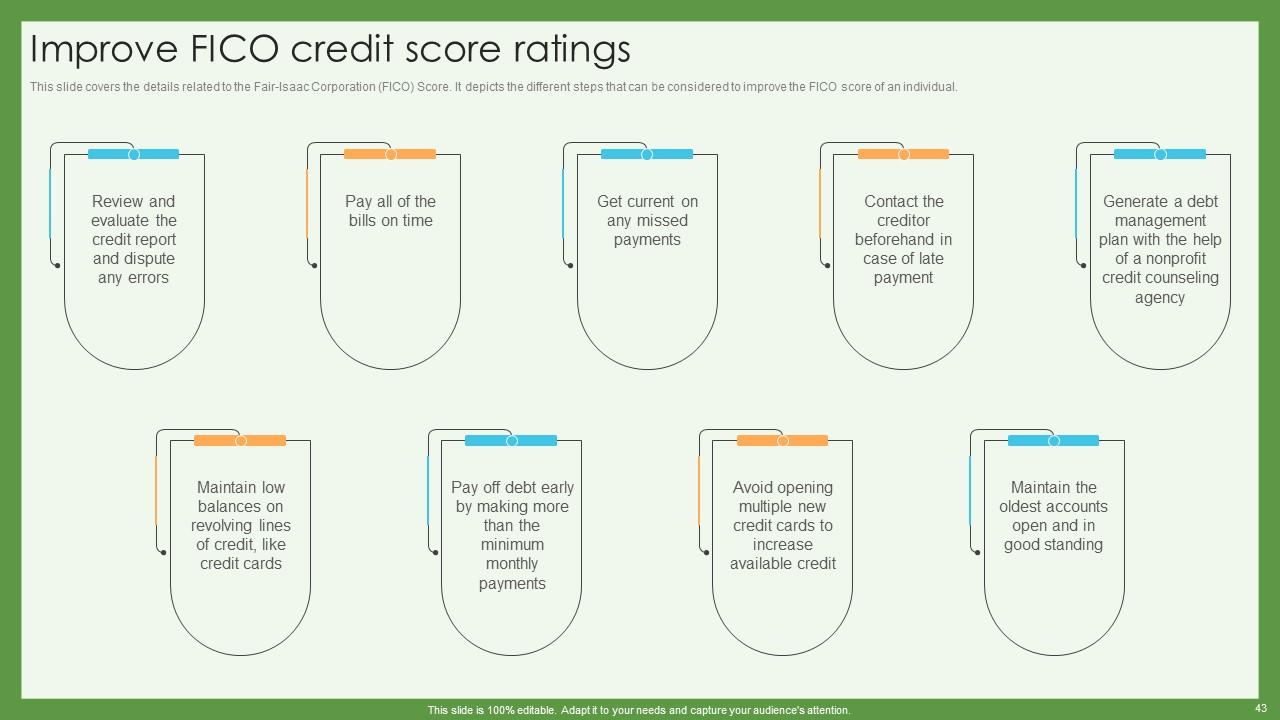

Slide 43: This slide entails the details related to the Fair-Isaac Corporation (FICO) Score.

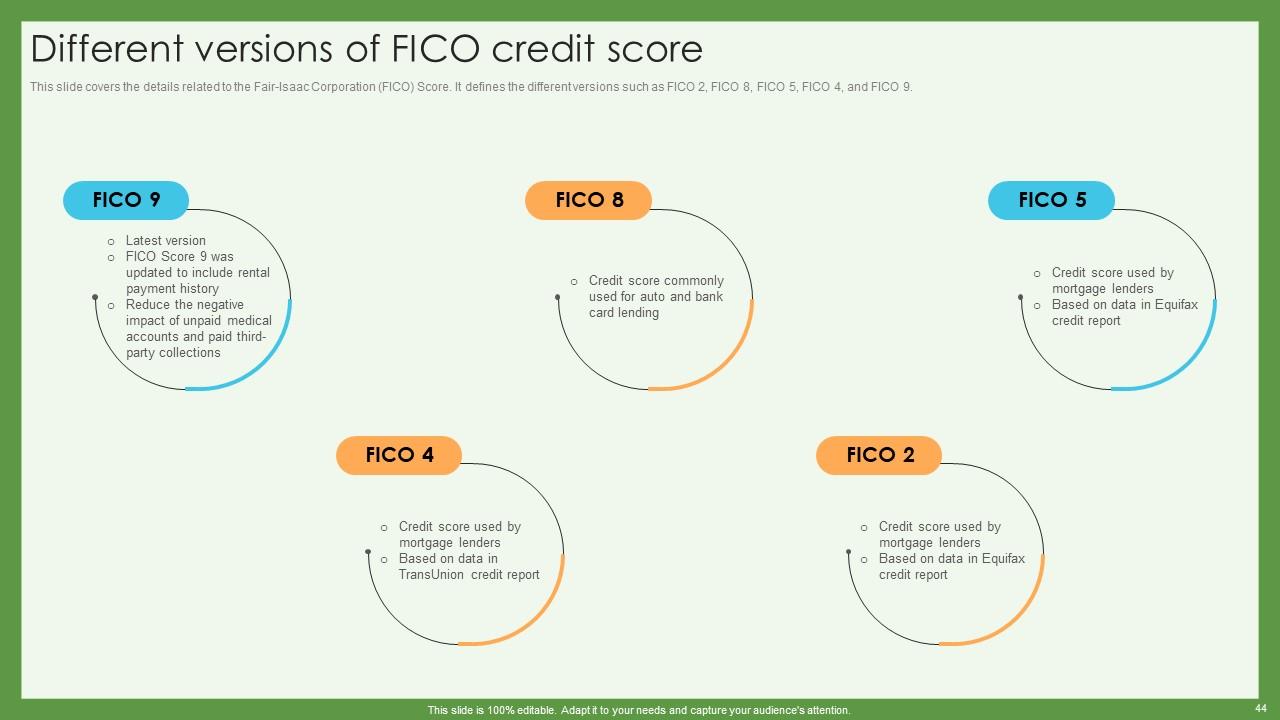

Slide 44: This slide puts the details related to the Fair-Isaac Corporation (FICO) Score.

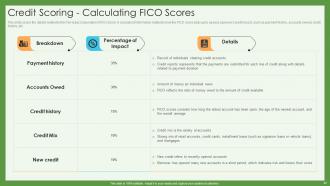

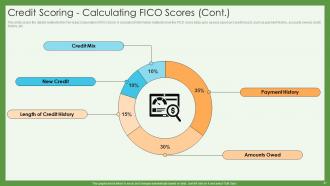

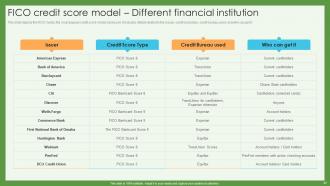

Slide 45: This slide depicts the FICO model, the most popular credit score model banks use.

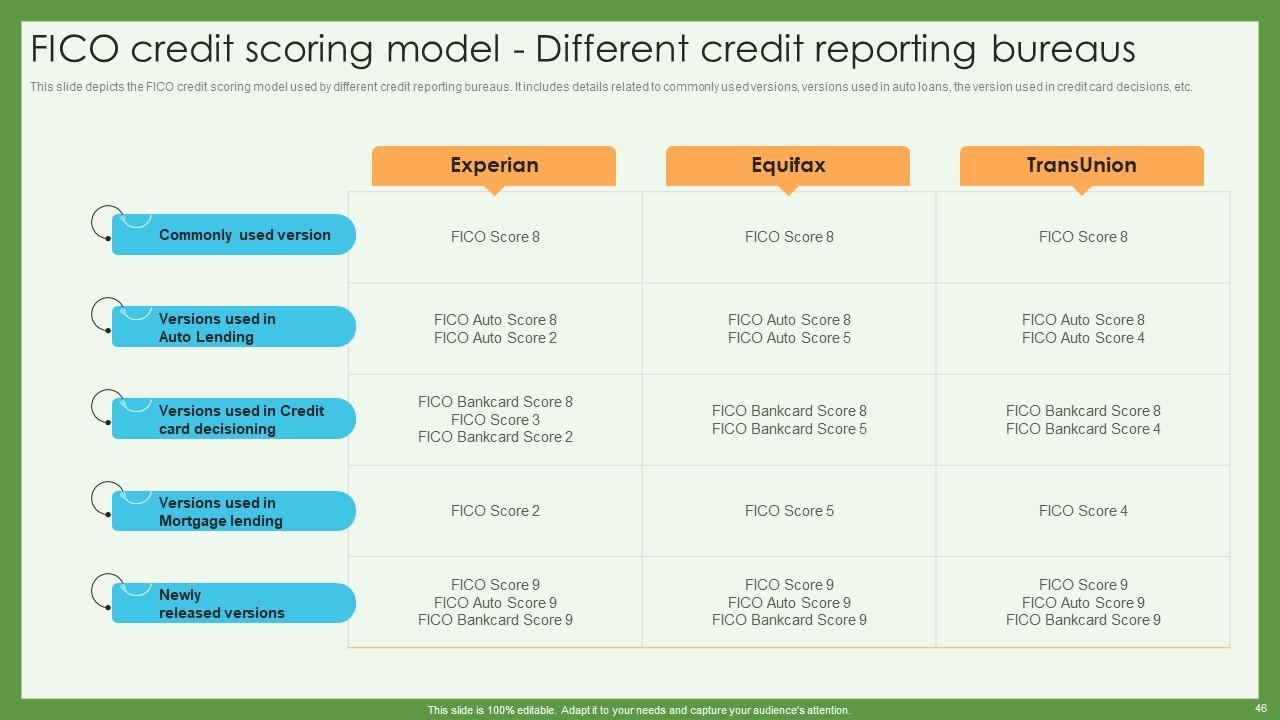

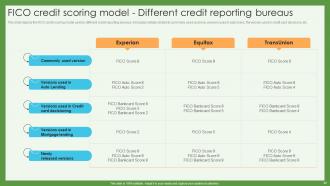

Slide 46: This slide describes the FICO credit scoring model used by different credit reporting bureaus.

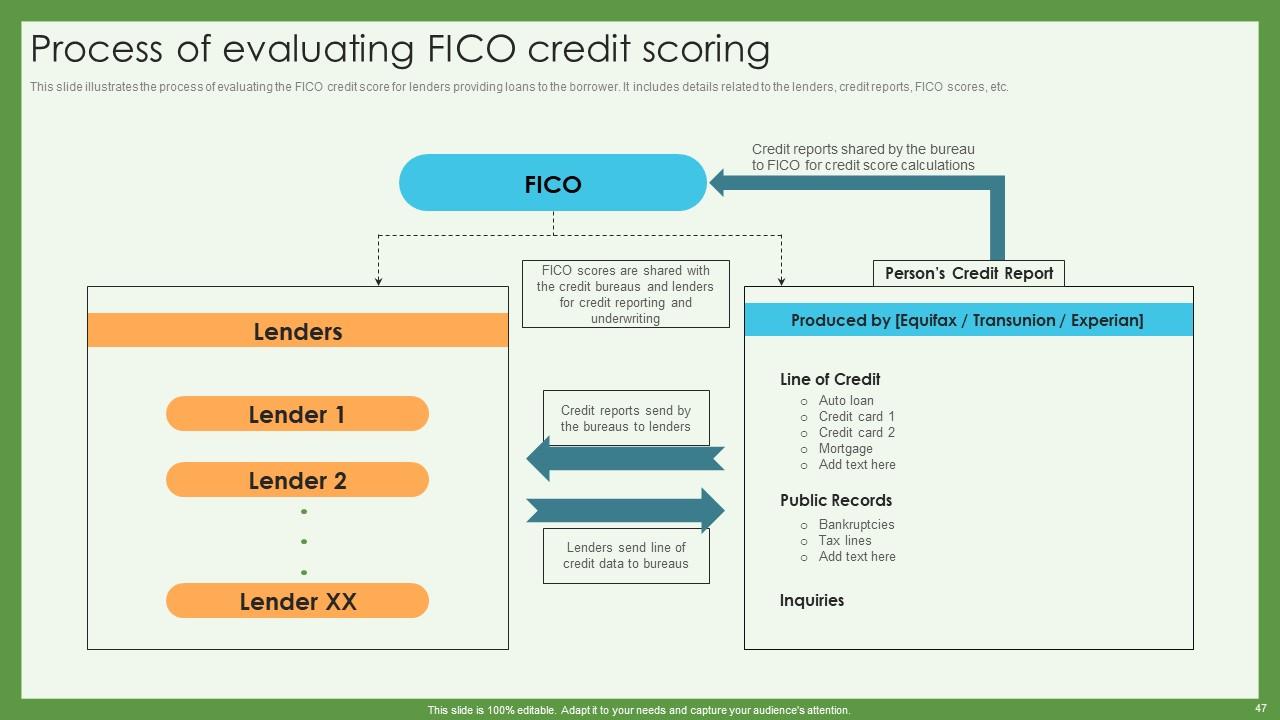

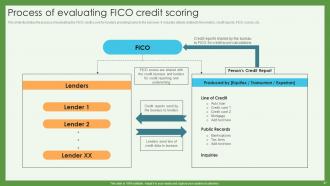

Slide 47: This slide illustrates the process of evaluating the FICO credit score for lenders providing loans to the borrower.

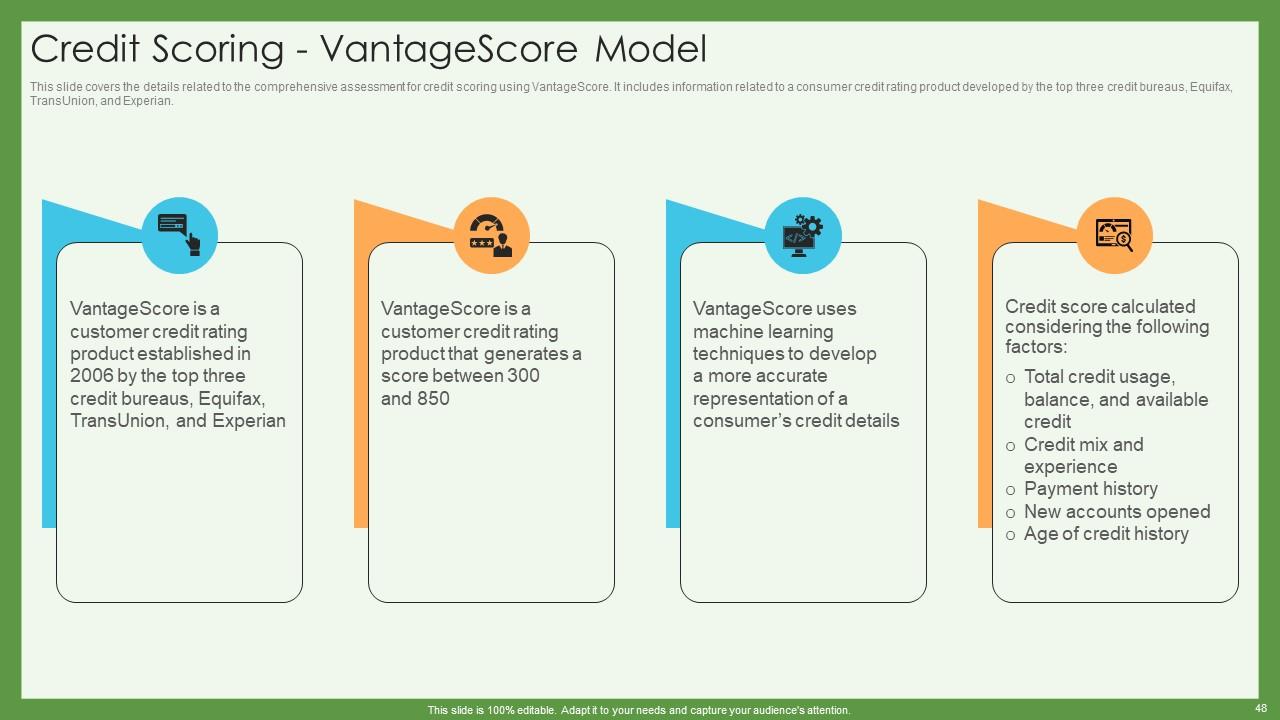

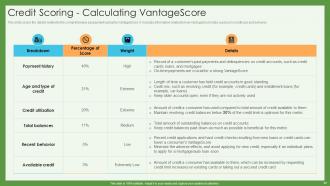

Slide 48: This slide covers the details related to the comprehensive assessment for credit scoring using VantageScore.

Slide 49: This slide highlights the details related to the comprehensive assessment using the VantageScore.

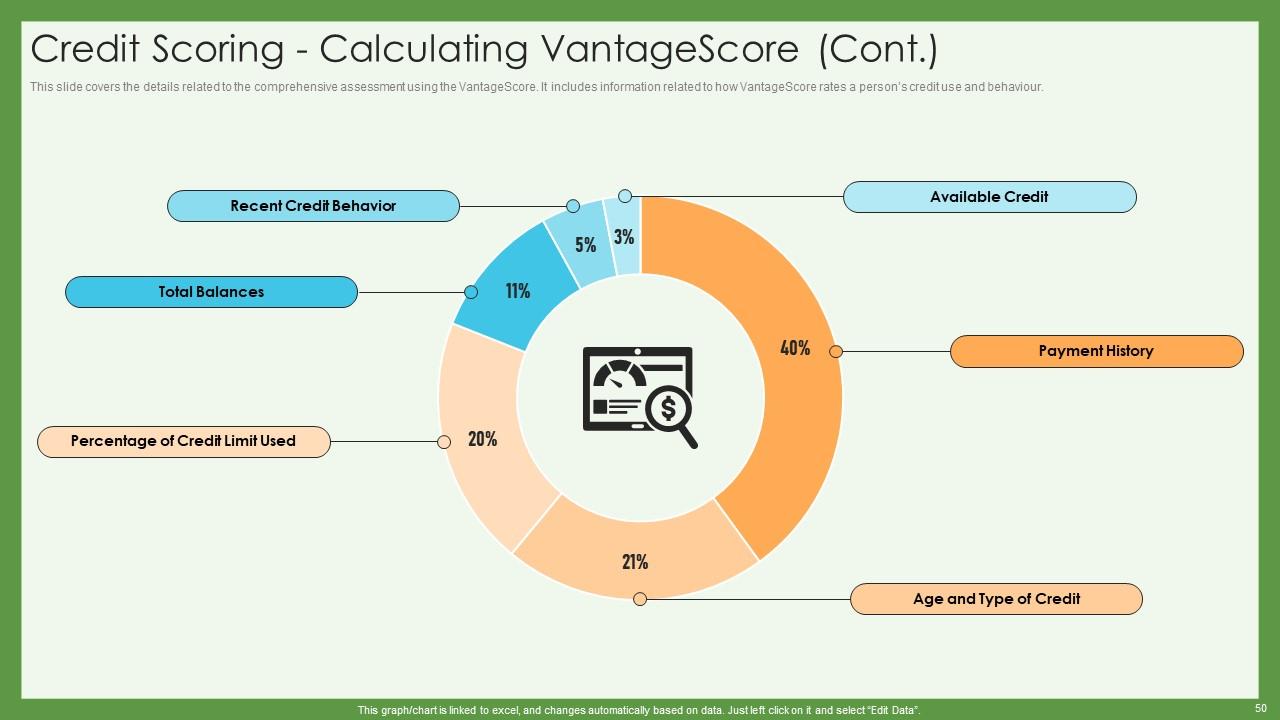

Slide 50: This slide puts the details related to the comprehensive assessment using the VantageScore.

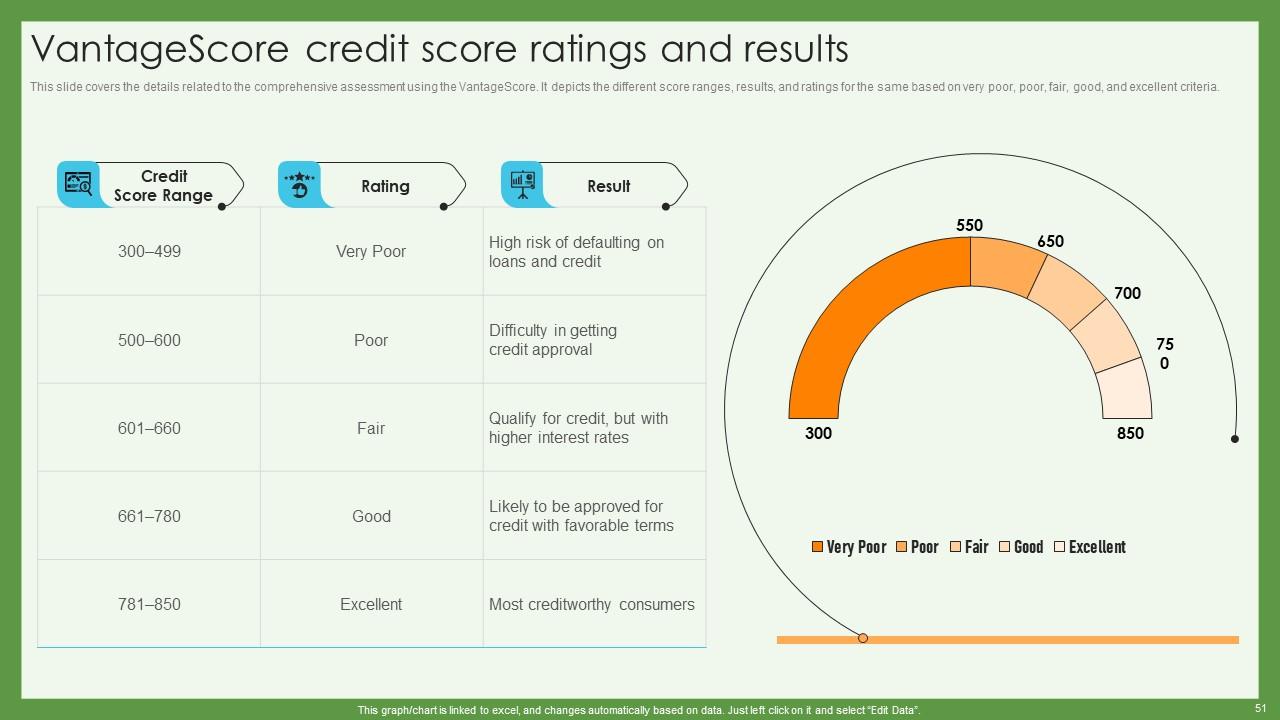

Slide 51: This slide shows the details related to the comprehensive assessment using the VantageScore.

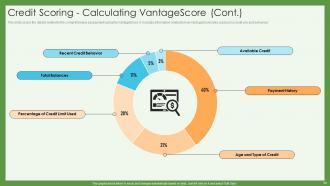

Slide 52: This slide includes the details related to the VantageScore.

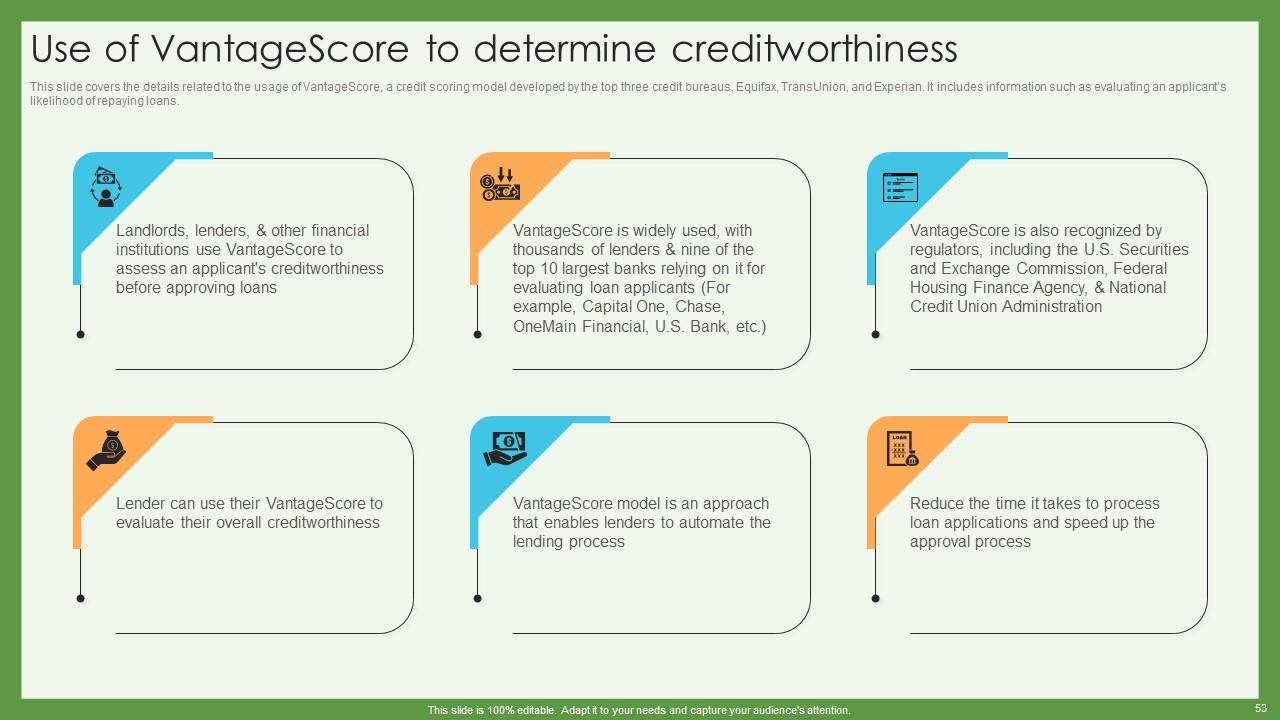

Slide 53: This slide mentions the details related to the usage of VantageScore, a credit scoring model developed by the top three credit bureaus, Equifax, TransUnion, and Experian.

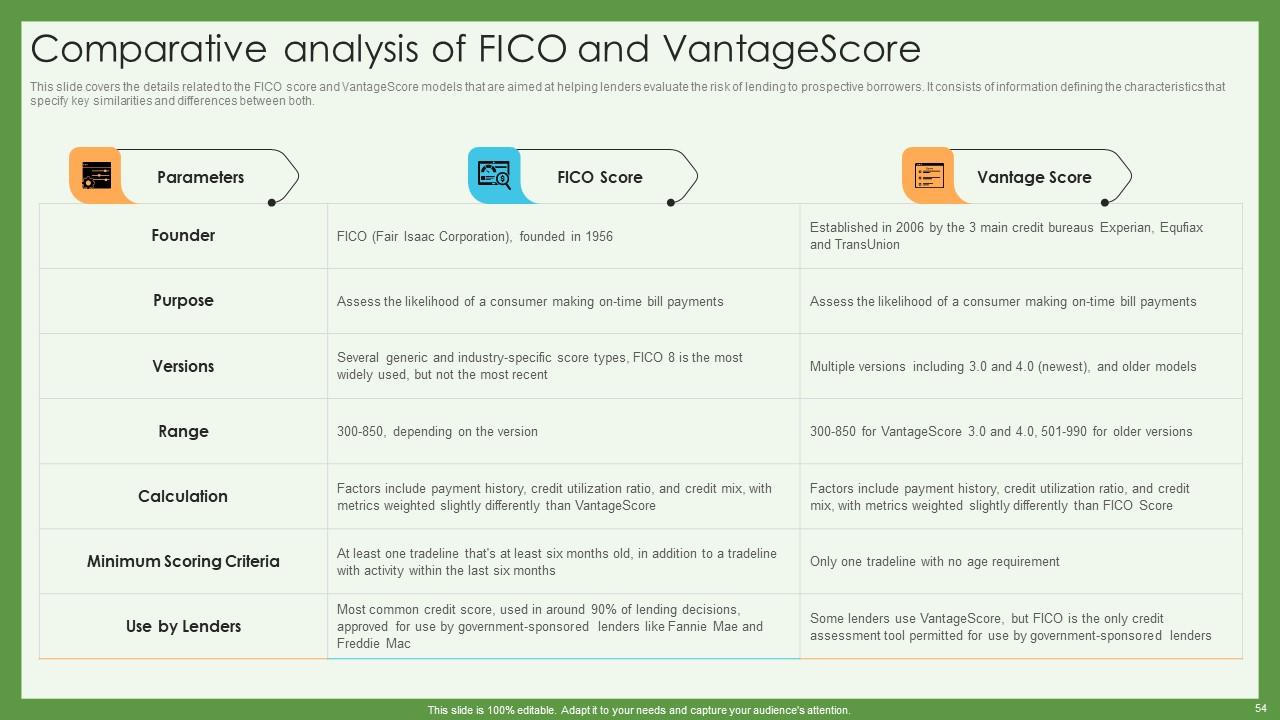

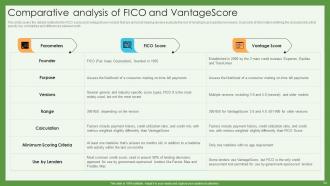

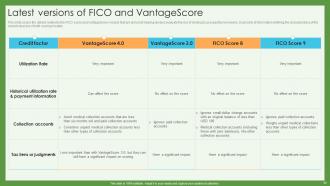

Slide 54: This slide portrays the details related to the FICO score and VantageScore models that are aimed at helping lenders evaluate the risk of lending to prospective borrowers.

Slide 55: This is in continuation with the previous slide.

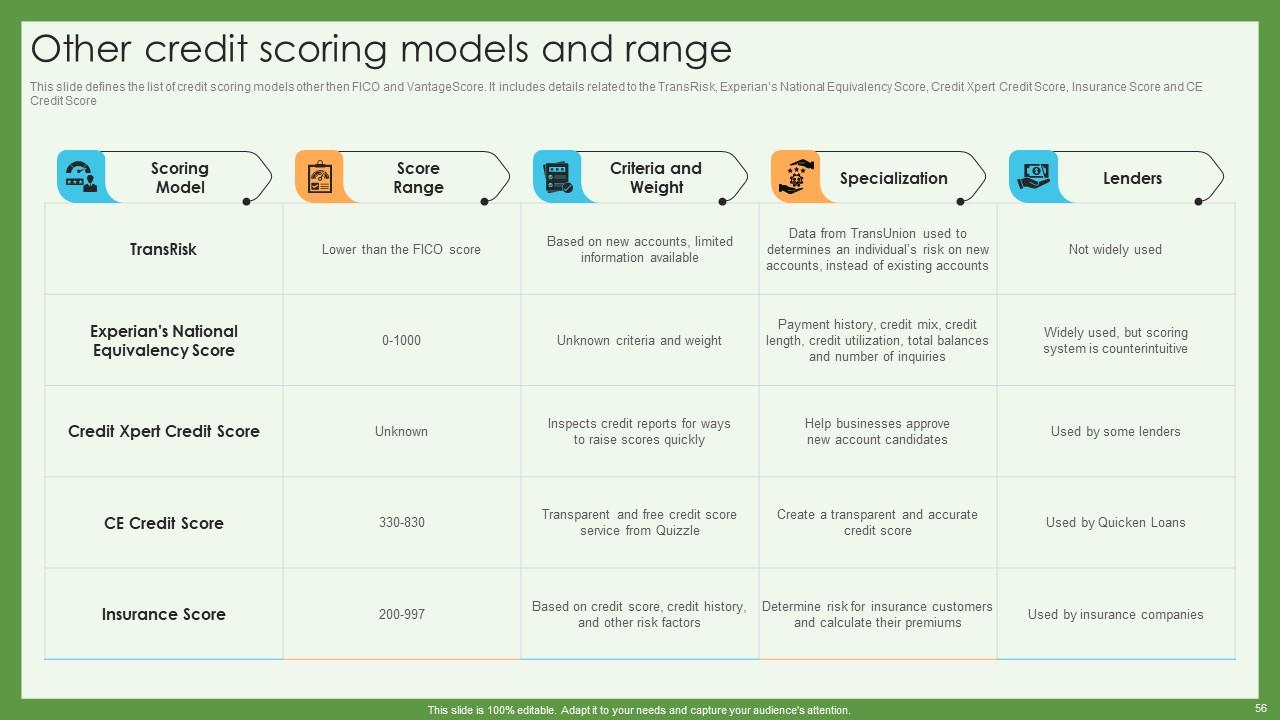

Slide 56: This slide defines the list of credit scoring models other then FICO and VantageScore.

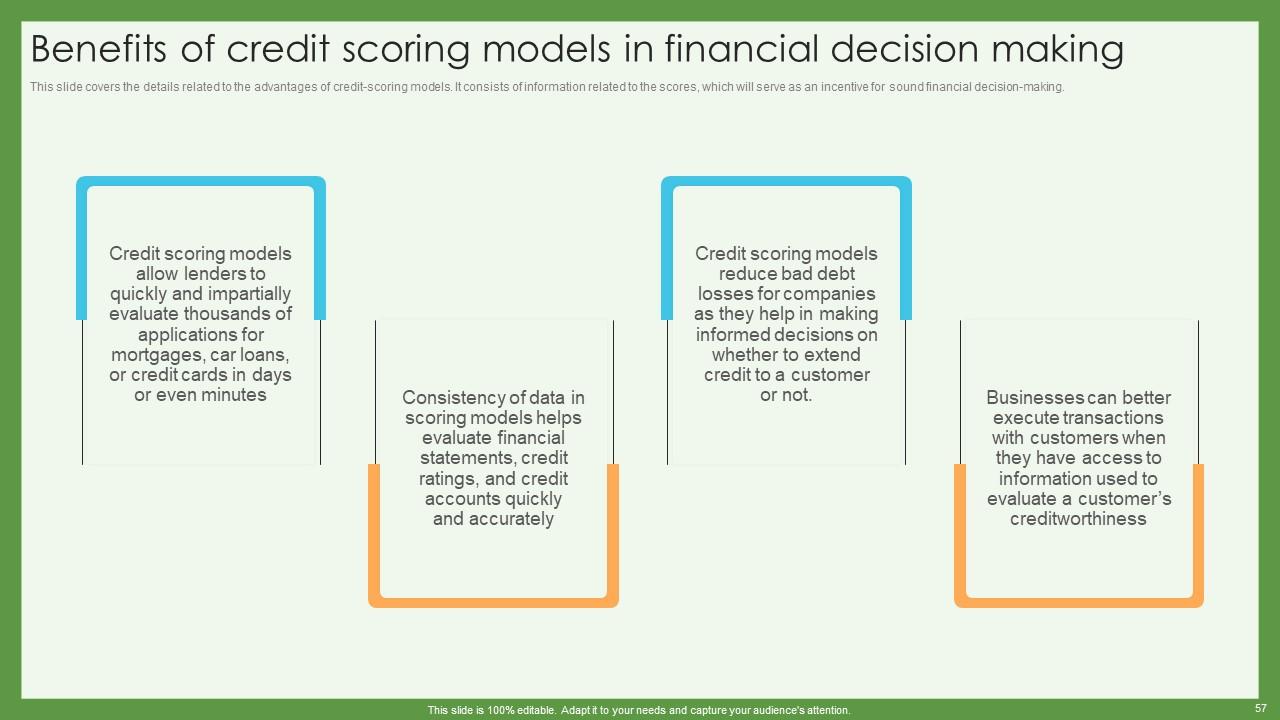

Slide 57: This slide covers the details related to the advantages of credit-scoring models.

Slide 58: This slide shows a Table of Contents for the presentation.

Slide 59: This slide illustrates the details related to credit scoring methodologies.

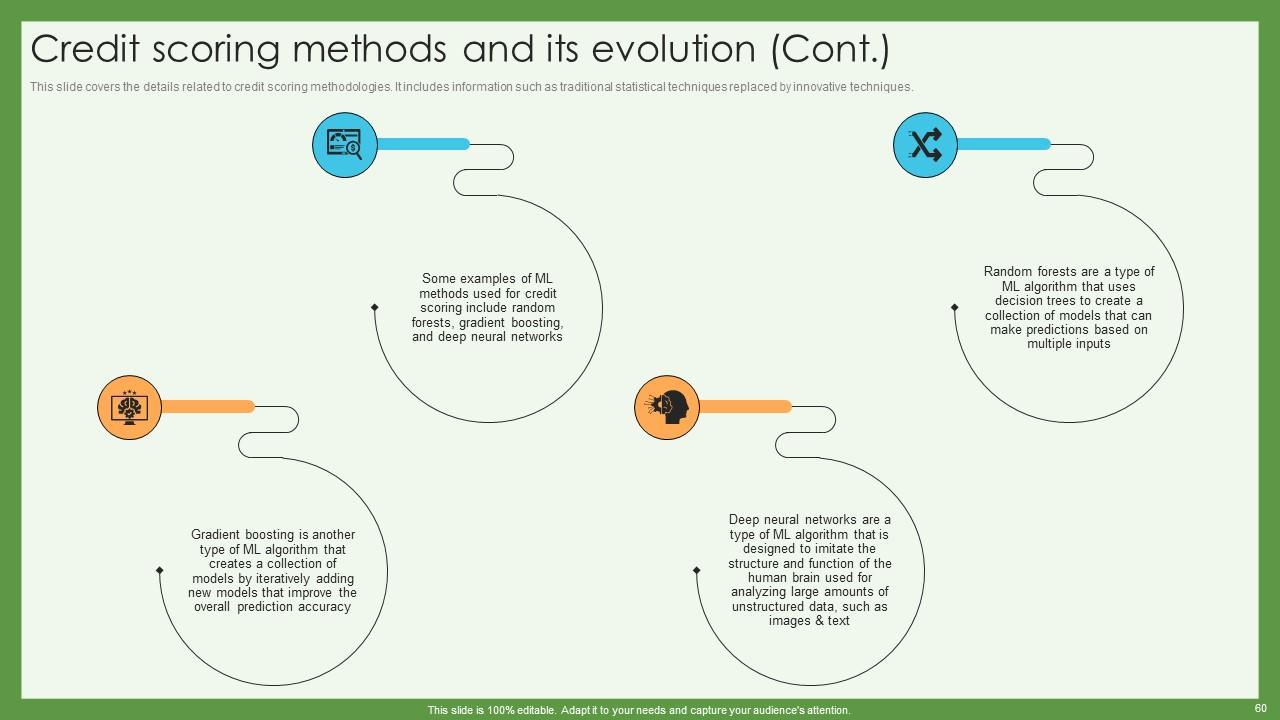

Slide 60: This slide highlights the details related to credit scoring methodologies.

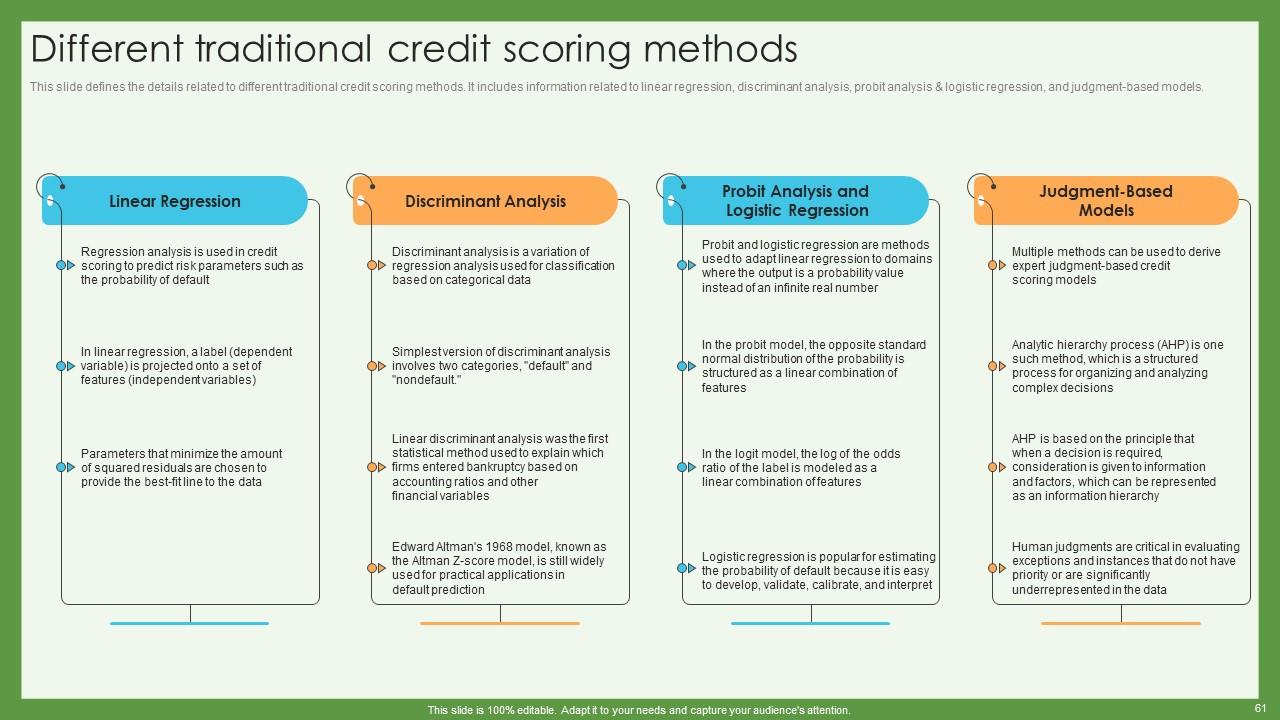

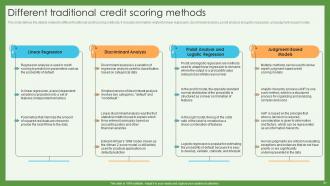

Slide 61: This slide entails the details related to different traditional credit scoring methods.

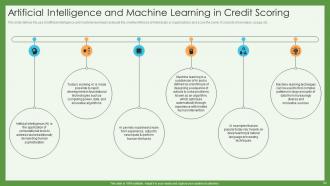

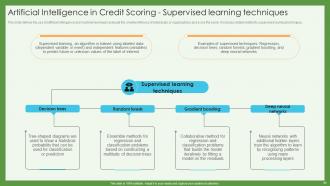

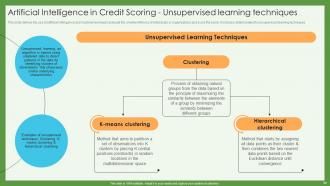

Slide 62: This slide showcases the use of artificial intelligence and machine learning.

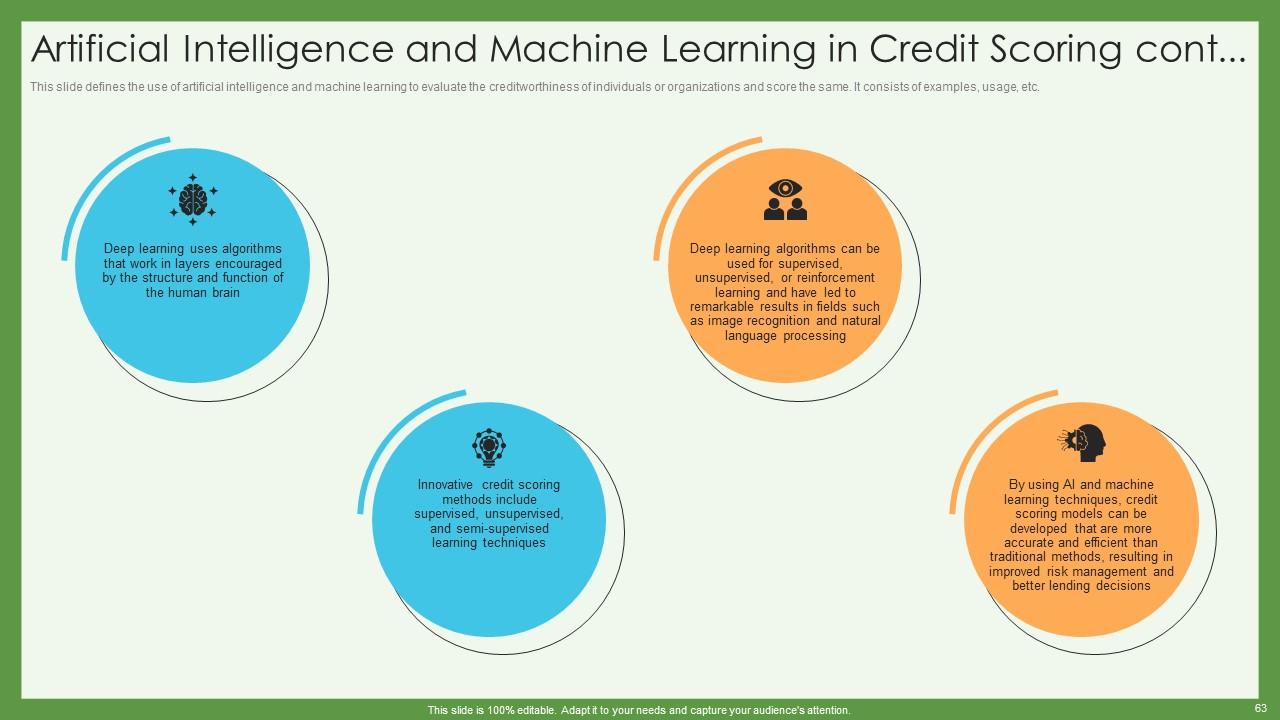

Slide 63: This slide defines the use of artificial intelligence and machine learning.

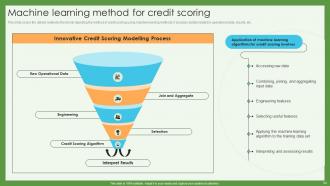

Slide 64: This slide covers the details related to the funnel depicting the method of credit scoring using machine learning methods.

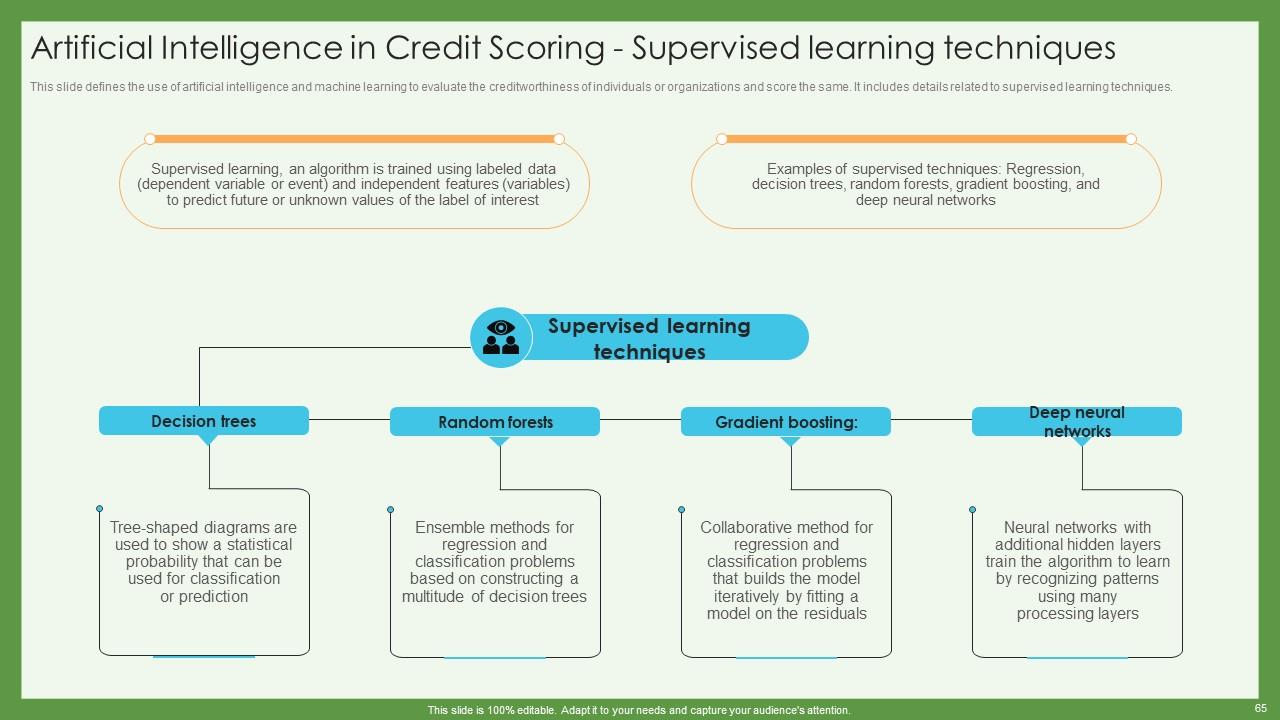

Slide 65: This slide defines the use of artificial intelligence and machine learning.

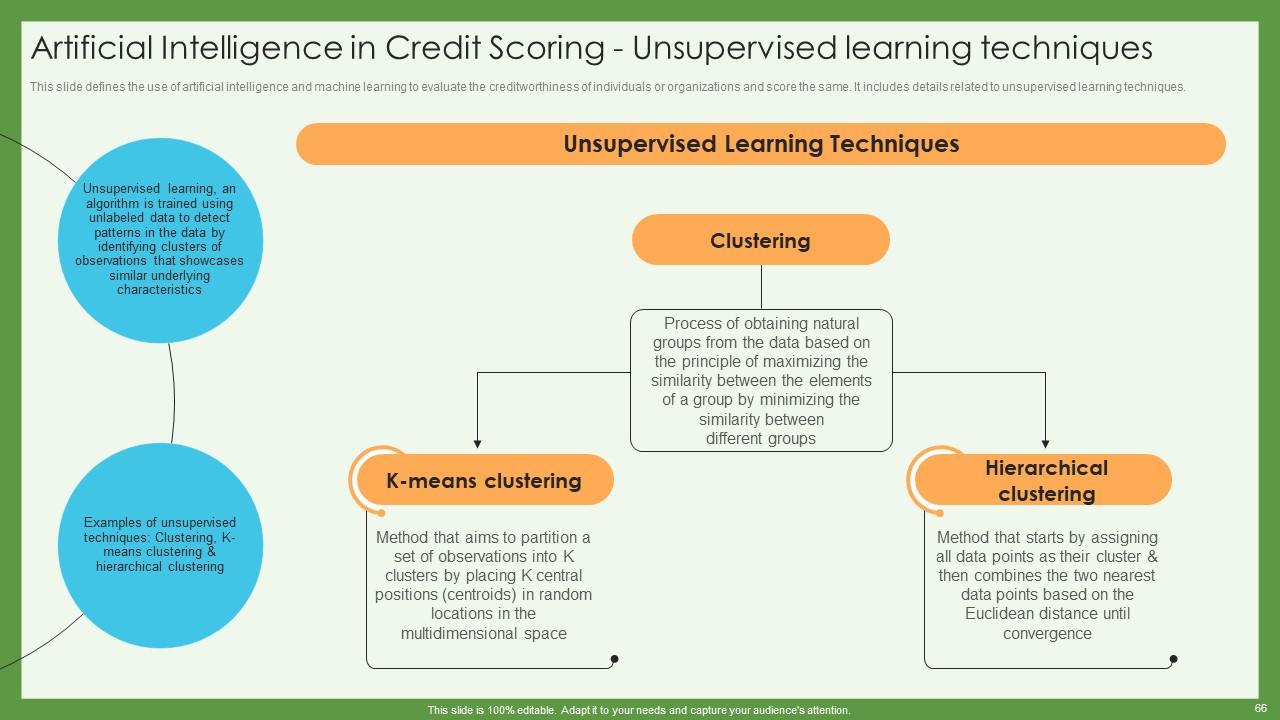

Slide 66: This slide highlights the use of artificial intelligence and machine learning.

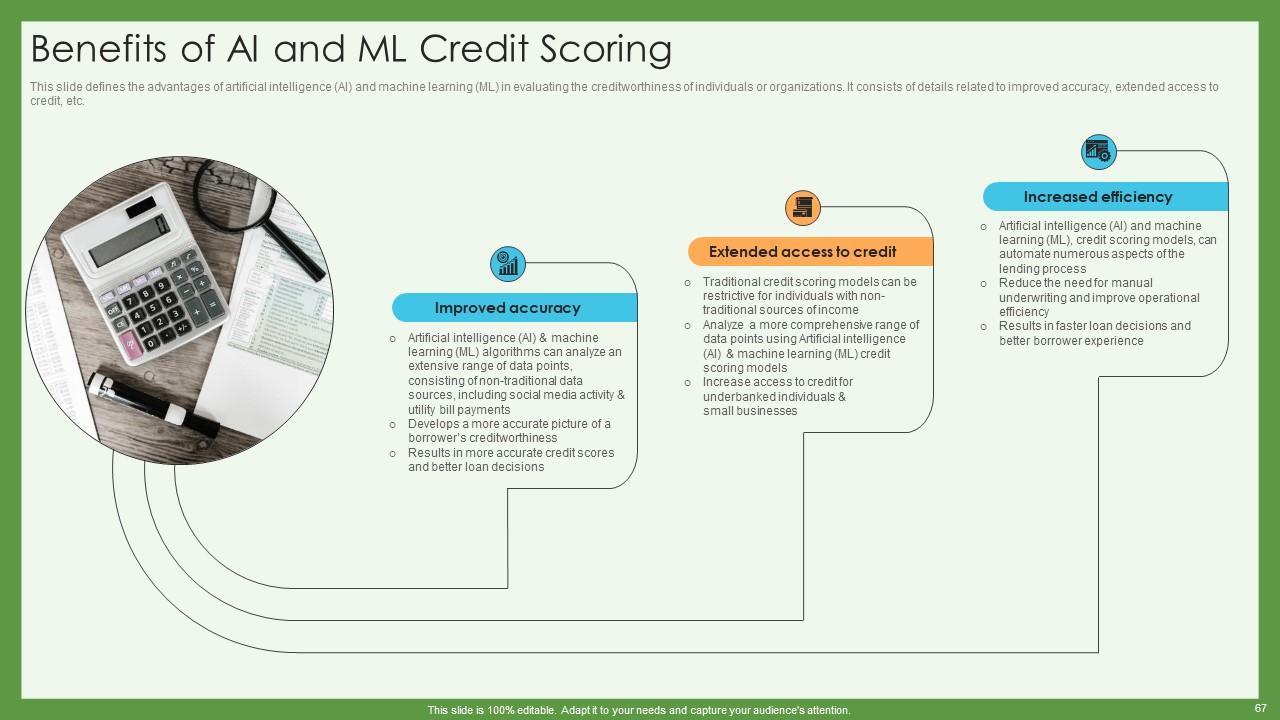

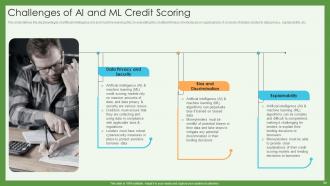

Slide 67: This slide demonstrates the advantages of artificial intelligence (AI) and machine learning (ML).

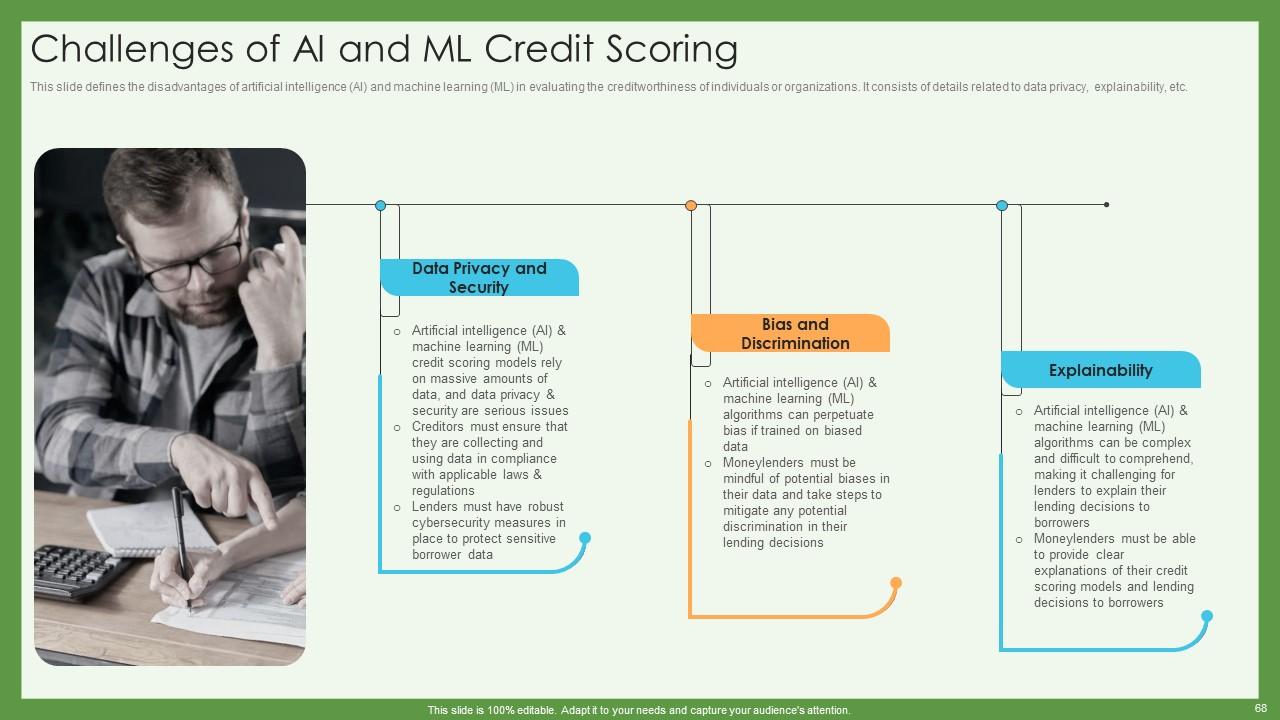

Slide 68: This slide provides the disadvantages of artificial intelligence (AI) and machine learning (ML).

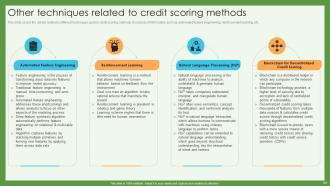

Slide 69: This slide covers the details related to different techniques used in credit scoring methods.

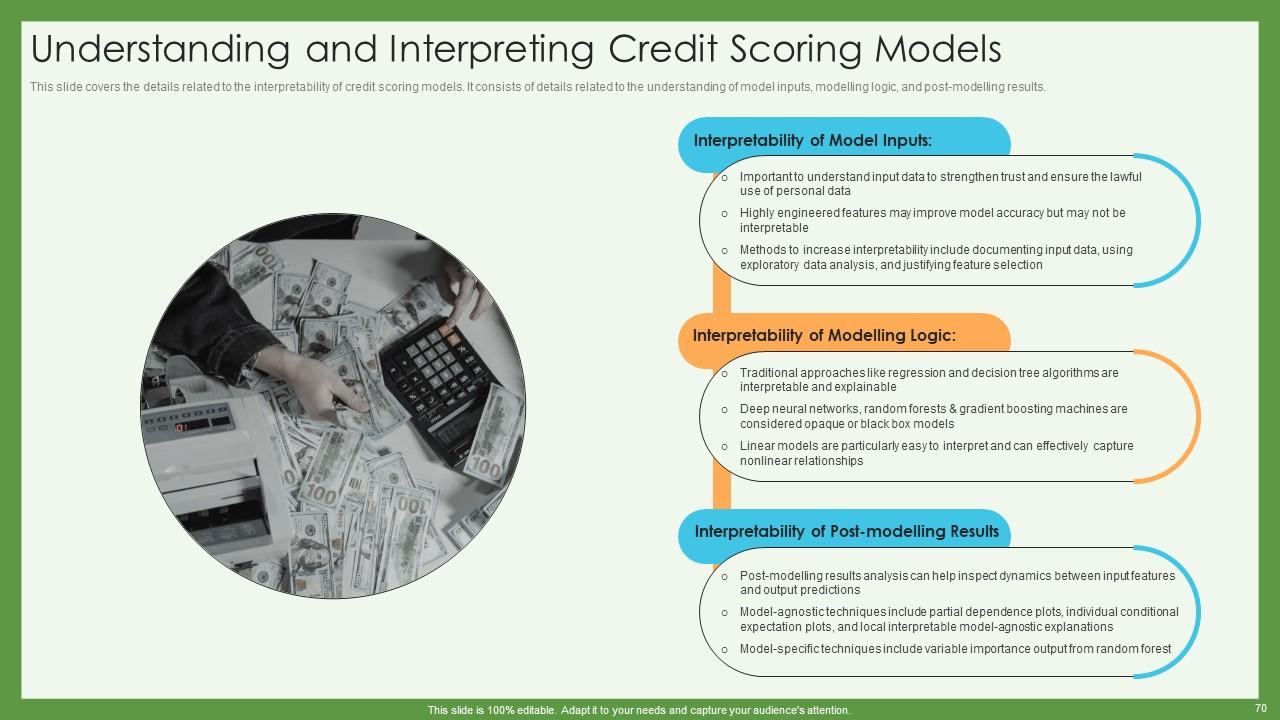

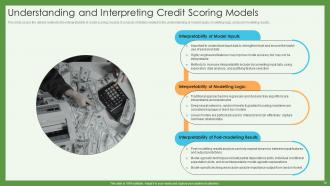

Slide 70: This slide covers the details related to the interpretability of credit scoring models.

Slide 71: This slide shows a Table of Contents for the presentation.

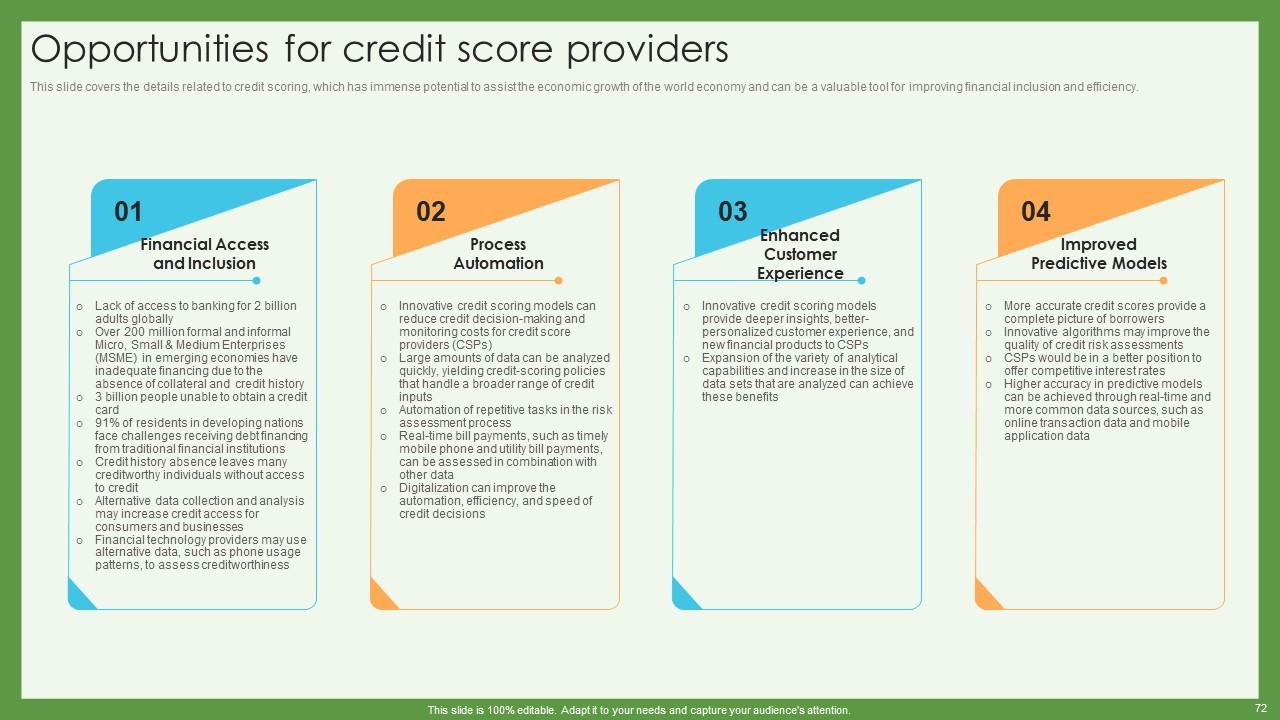

Slide 72: This slide outlines the details related to credit scoring, which has immense potential.

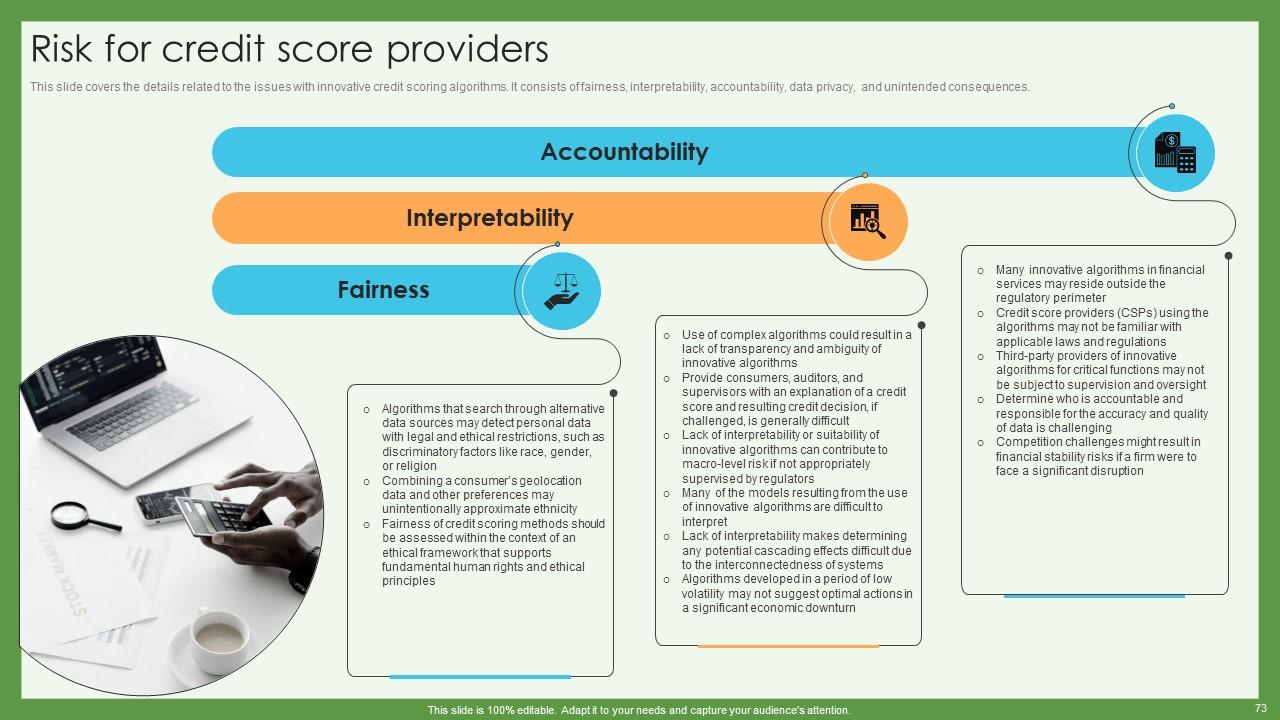

Slide 73: This slide goves the details related to the issues with innovative credit scoring algorithms.

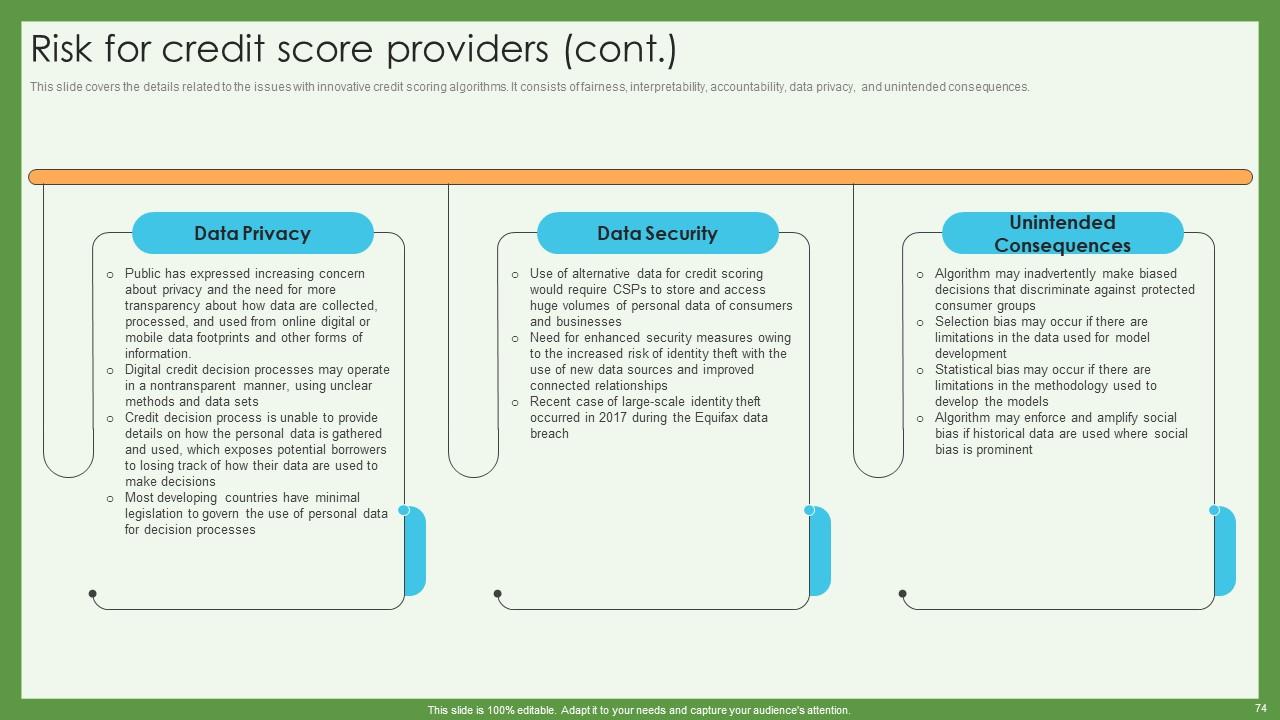

Slide 74: This slide portrays the details related to the issues with innovative credit scoring algorithms.

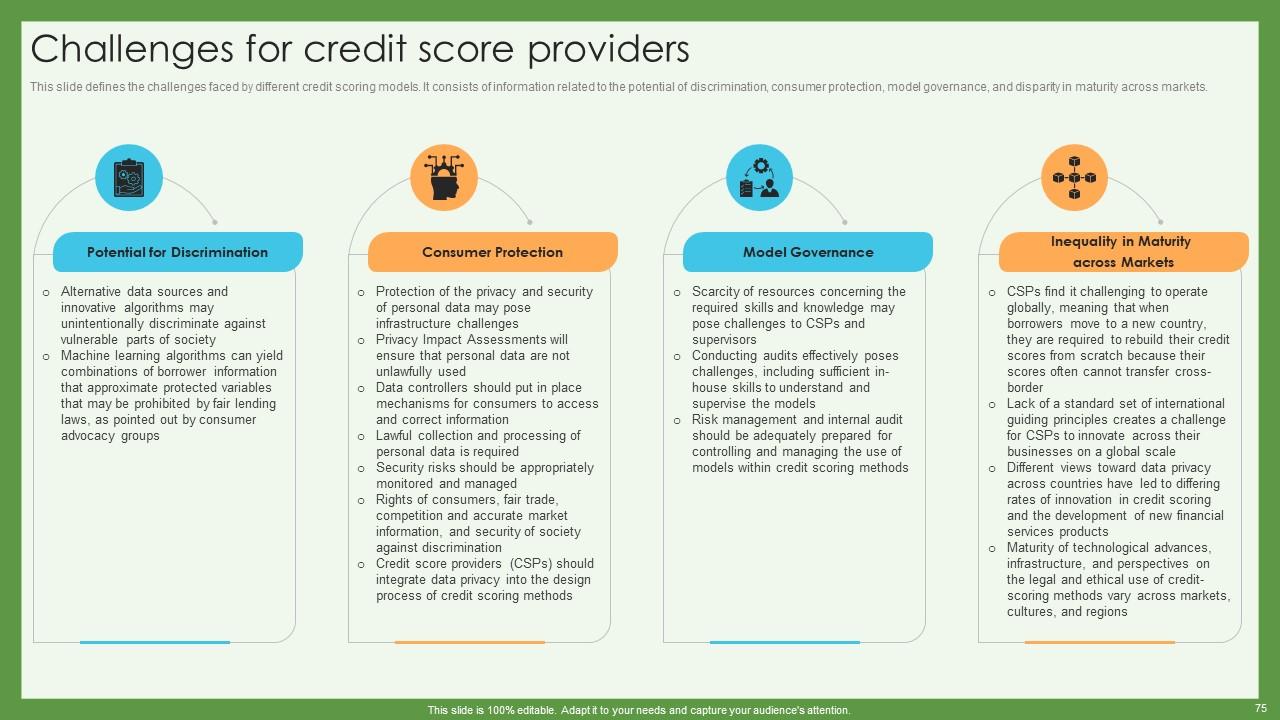

Slide 75: This slide defines the challenges faced by different credit scoring models.

Slide 76: This slide shows a Table of Contents for the presentation.

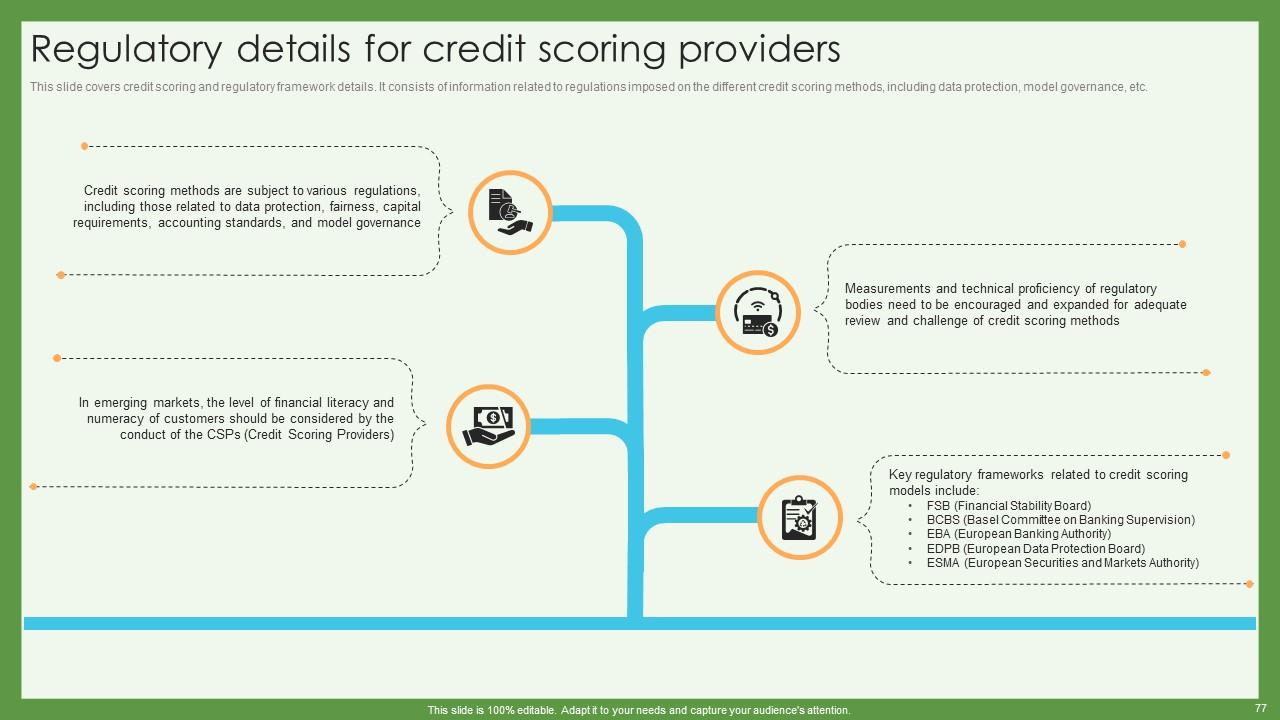

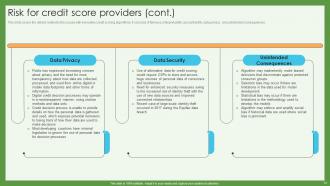

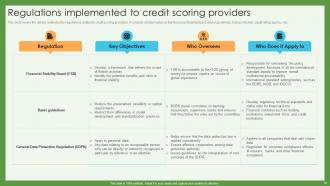

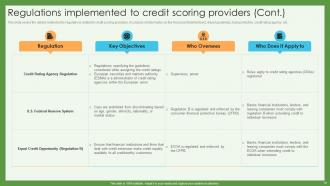

Slide 77: This slide covers credit scoring and regulatory framework details.

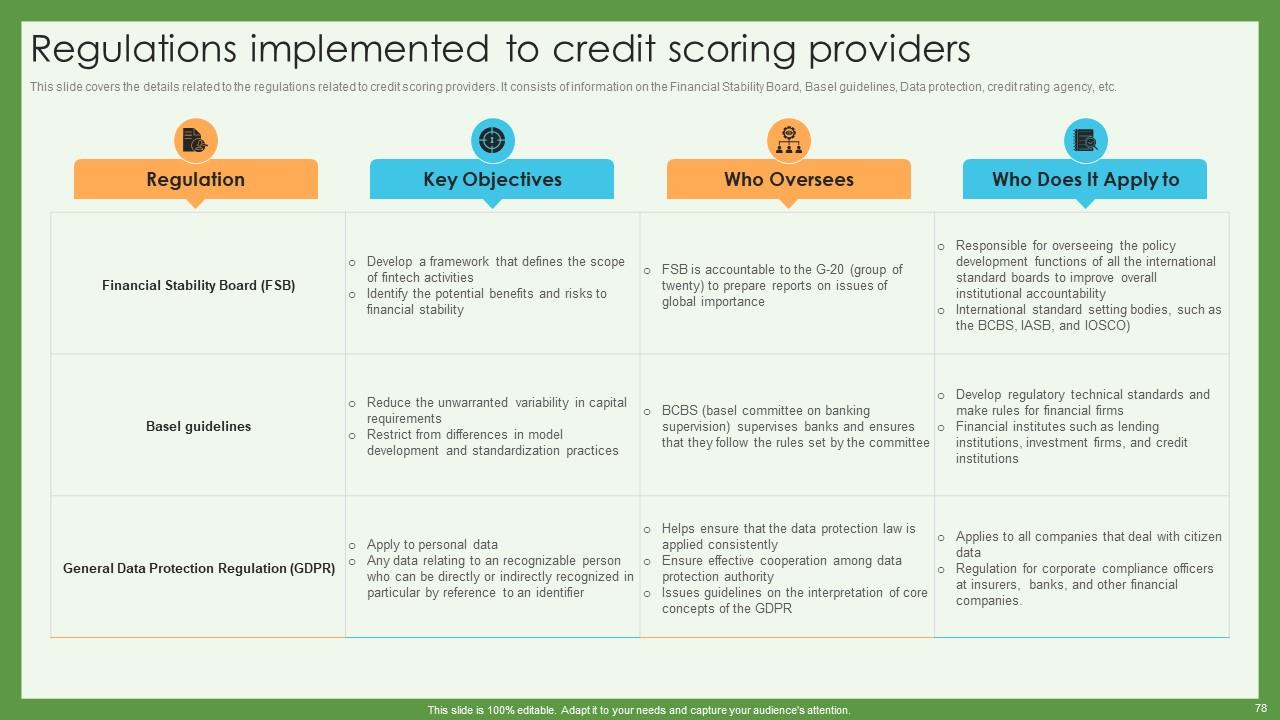

Slide 78: This slide puts the details related to the regulations related to credit scoring providers.

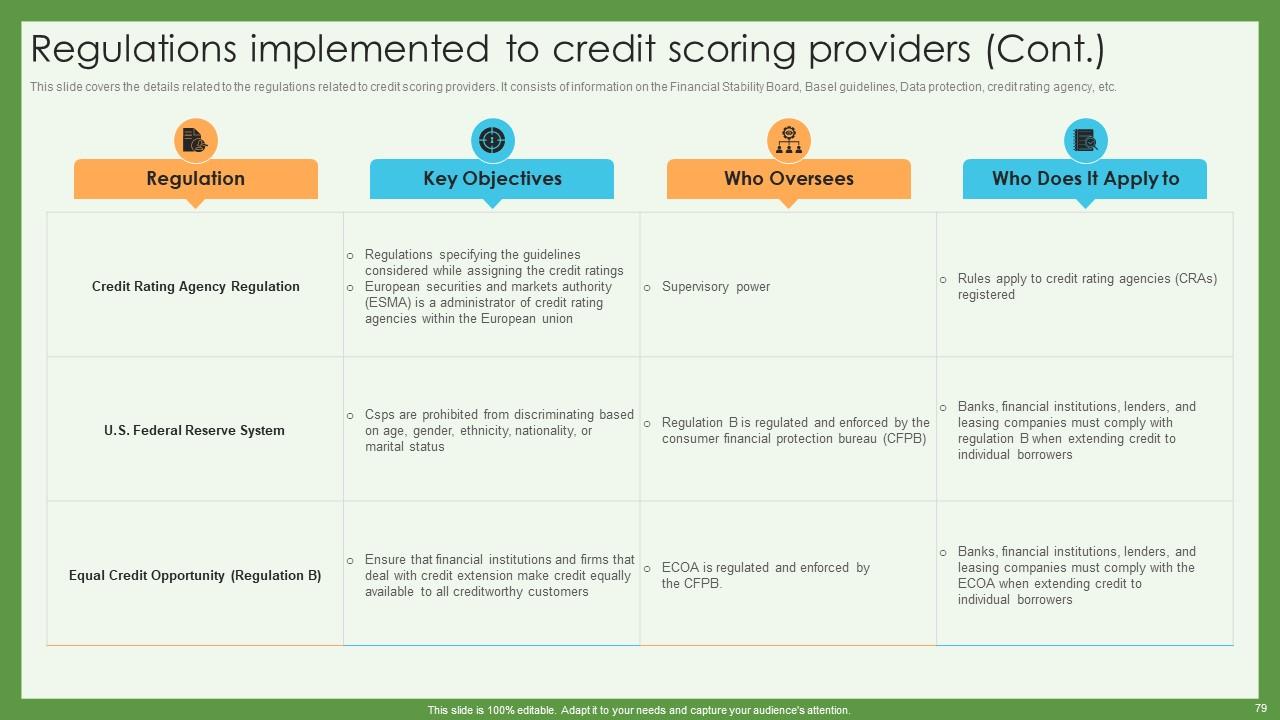

Slide 79: This slide covers the details related to the regulations related to credit scoring providers.

Slide 80: This slide shows a Table of Contents for the presentation.

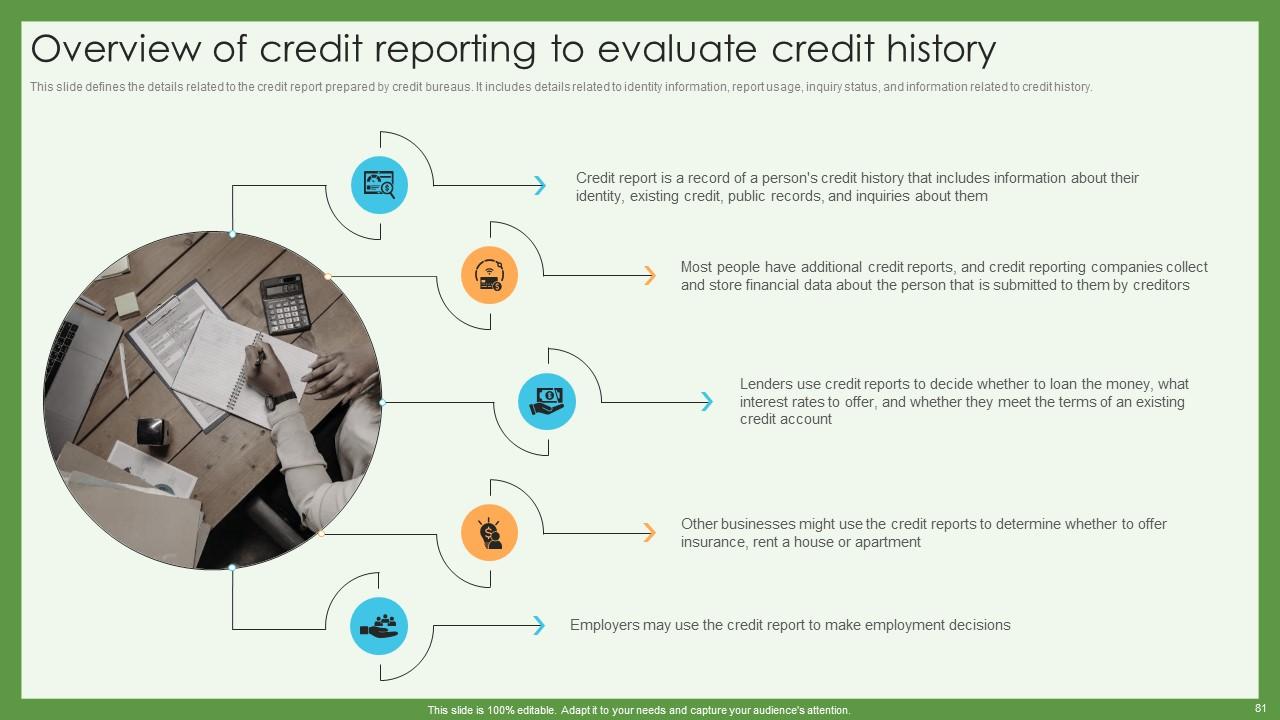

Slide 81: This slide defines the details related to the credit report prepared by credit bureaus.

Slide 82: This slide defines the details related to the credit report prepared by credit bureaus.

Slide 83: This slide demonstrates the details related to credit reports, often containing personal information used to determine creditworthiness.

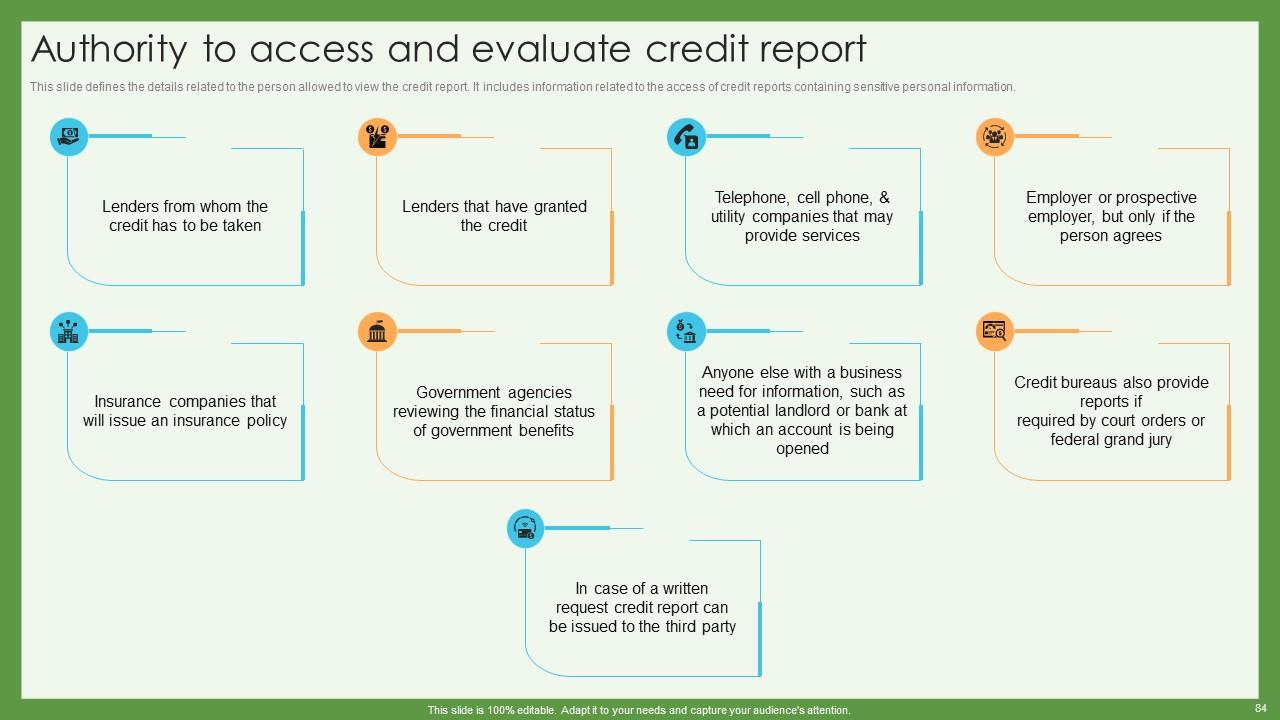

Slide 84: This slide illustrates the details related to the person allowed to view the credit report.

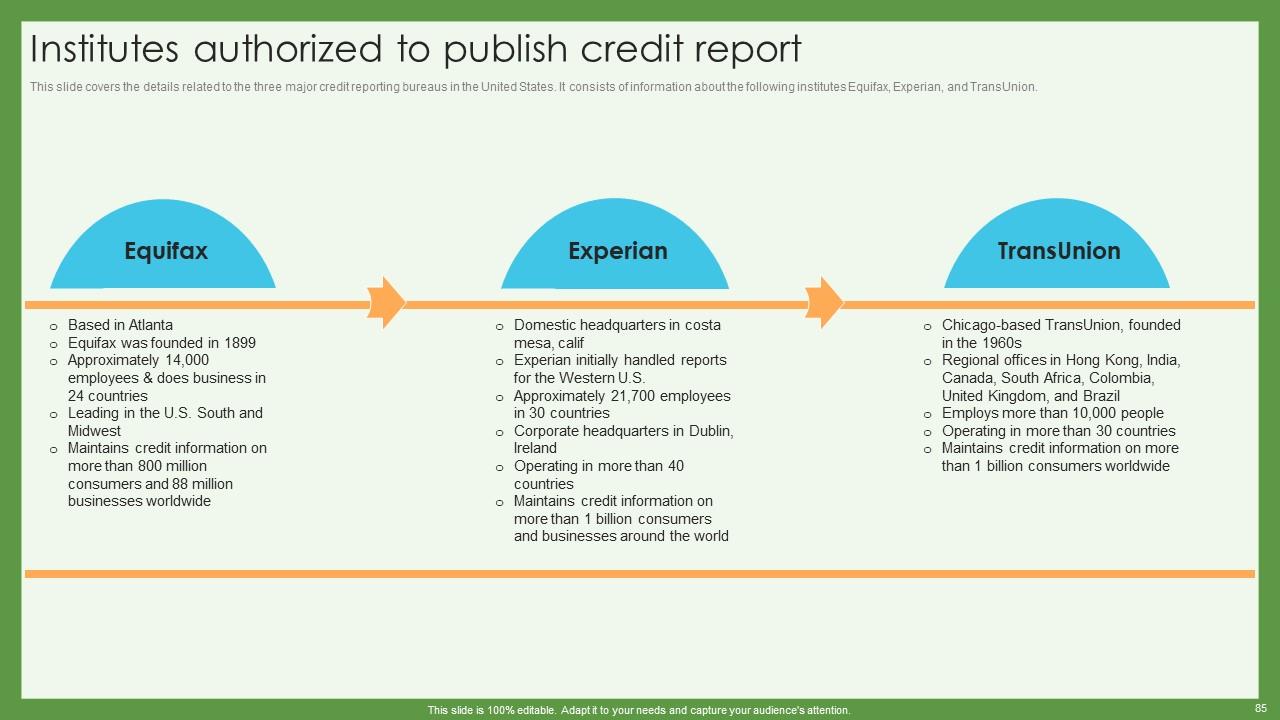

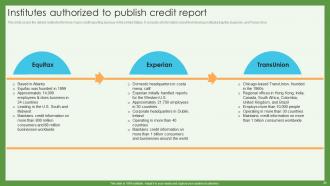

Slide 85: This slide covers the details related to the three major credit reporting bureaus in the United States.

Slide 86: This slide shows a Table of Contents for the presentation.

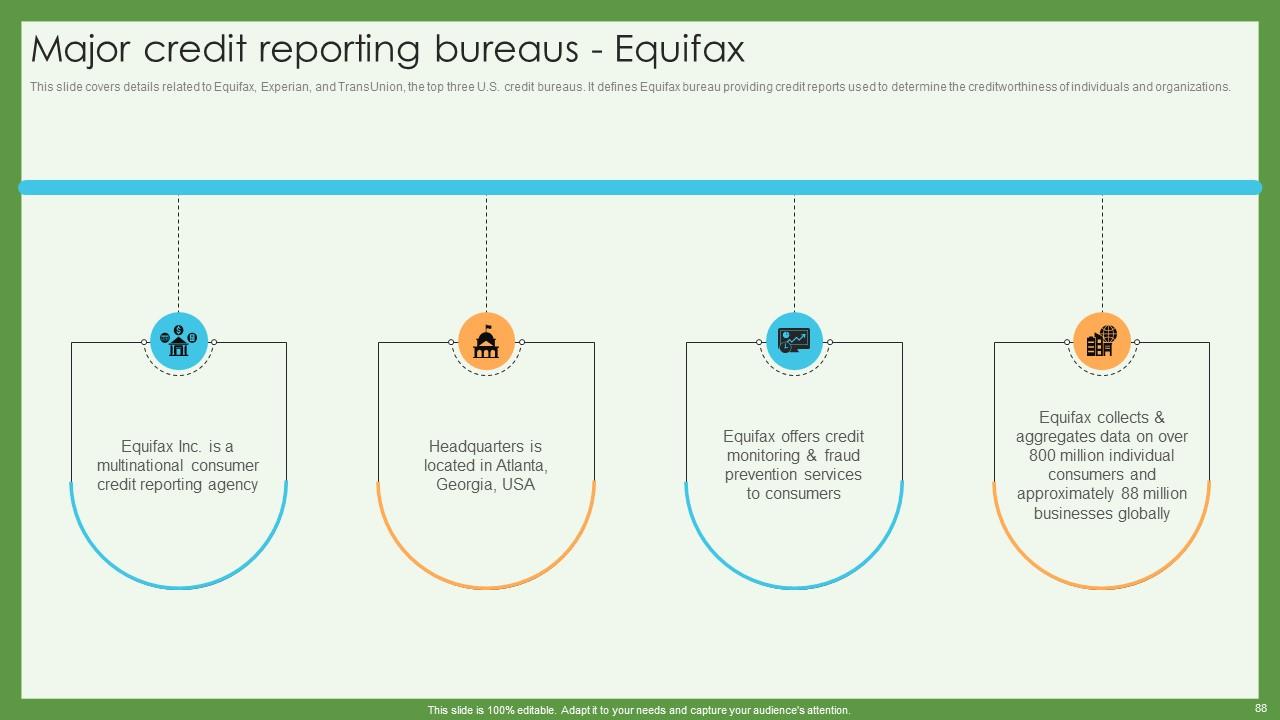

Slide 87: This slide covers details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

Slide 88: This slide highlights details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

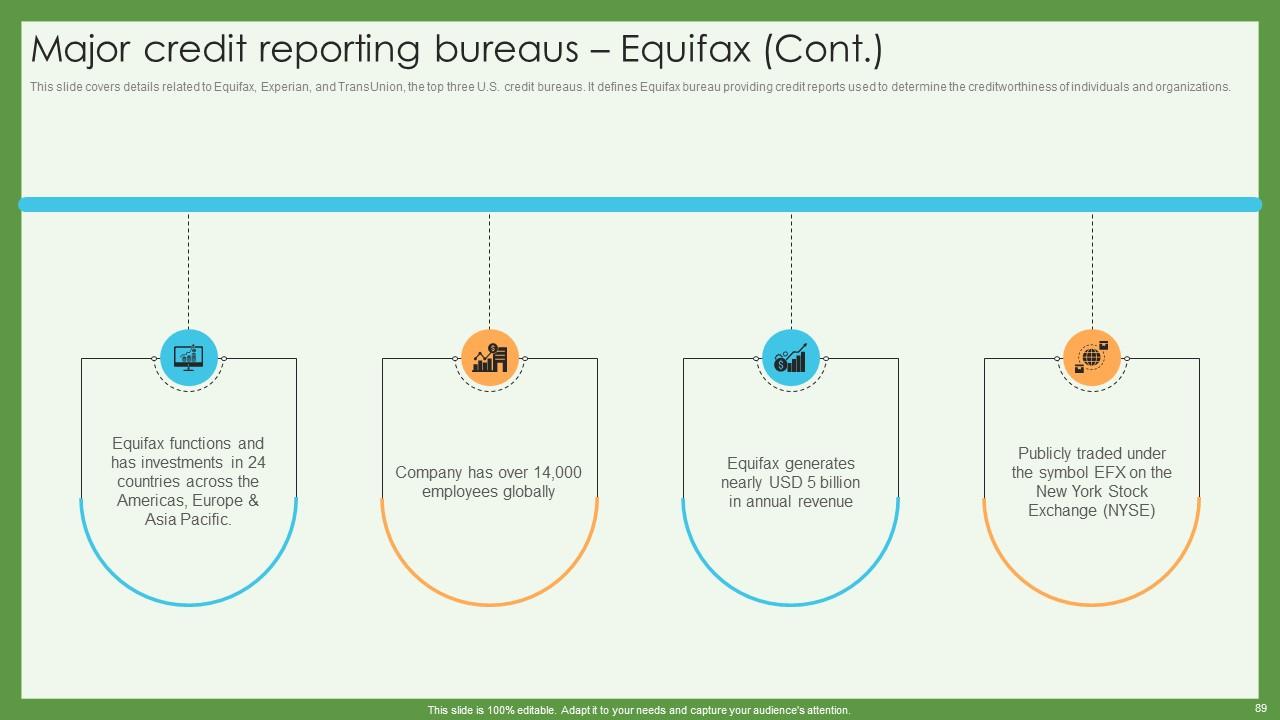

Slide 89: This slide defines details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

Slide 90: This slide illustrtes details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

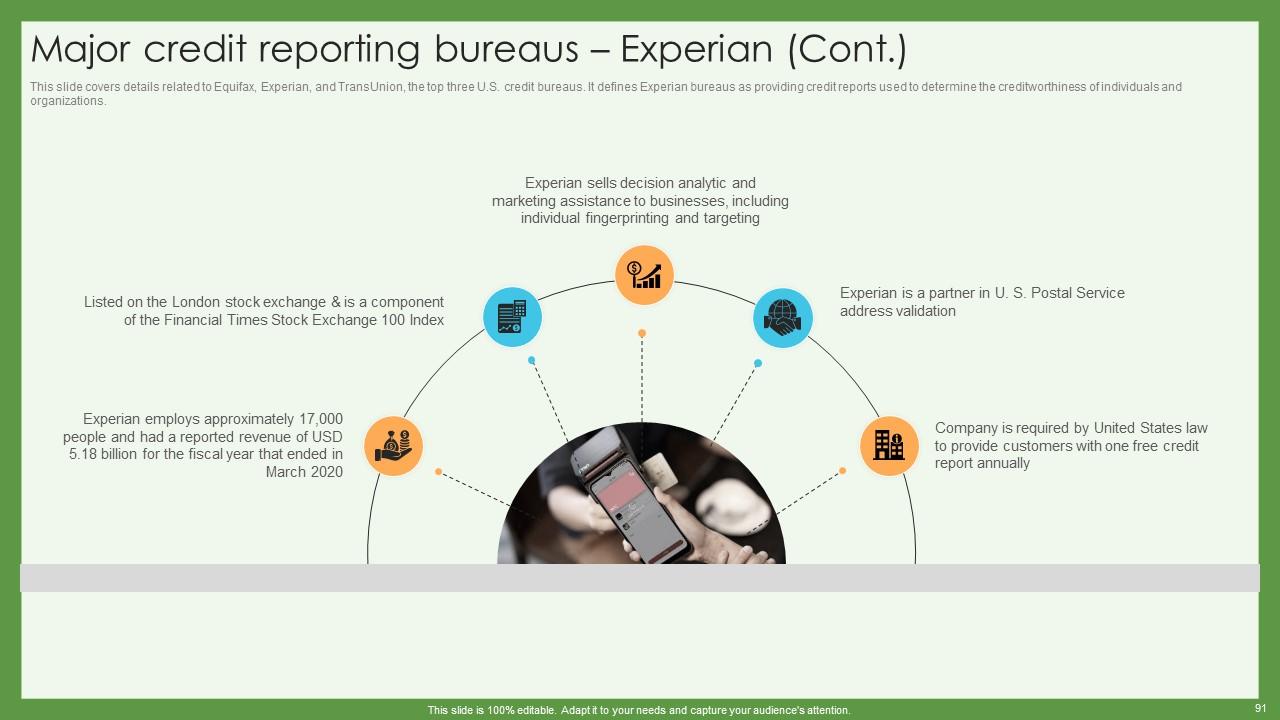

Slide 91: This slide covers details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

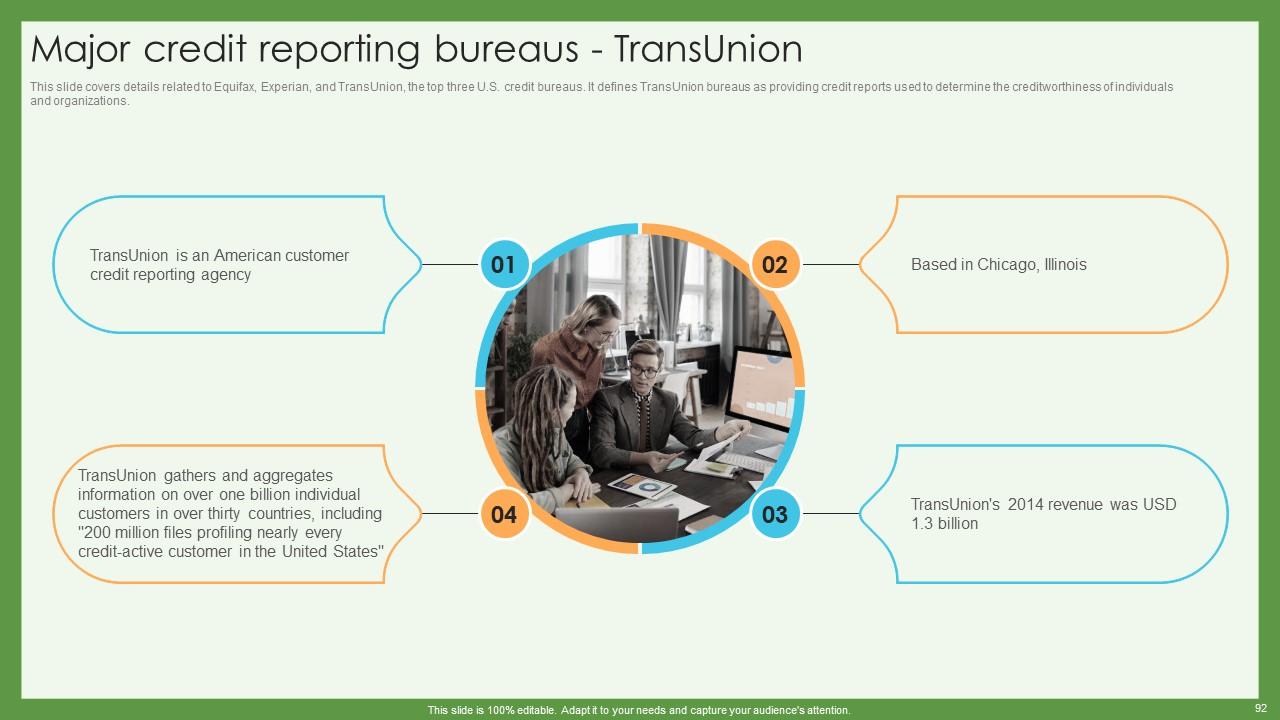

Slide 92: This slide portrays details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

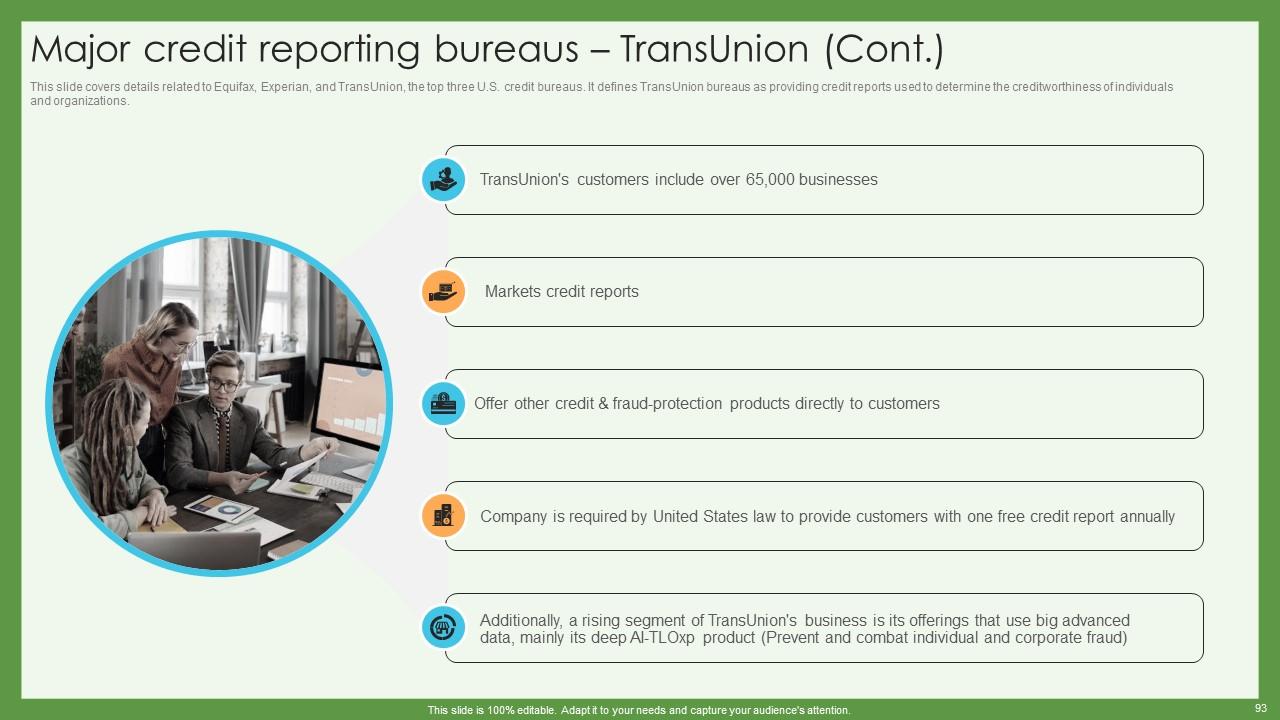

Slide 93: This slide covers details related to Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

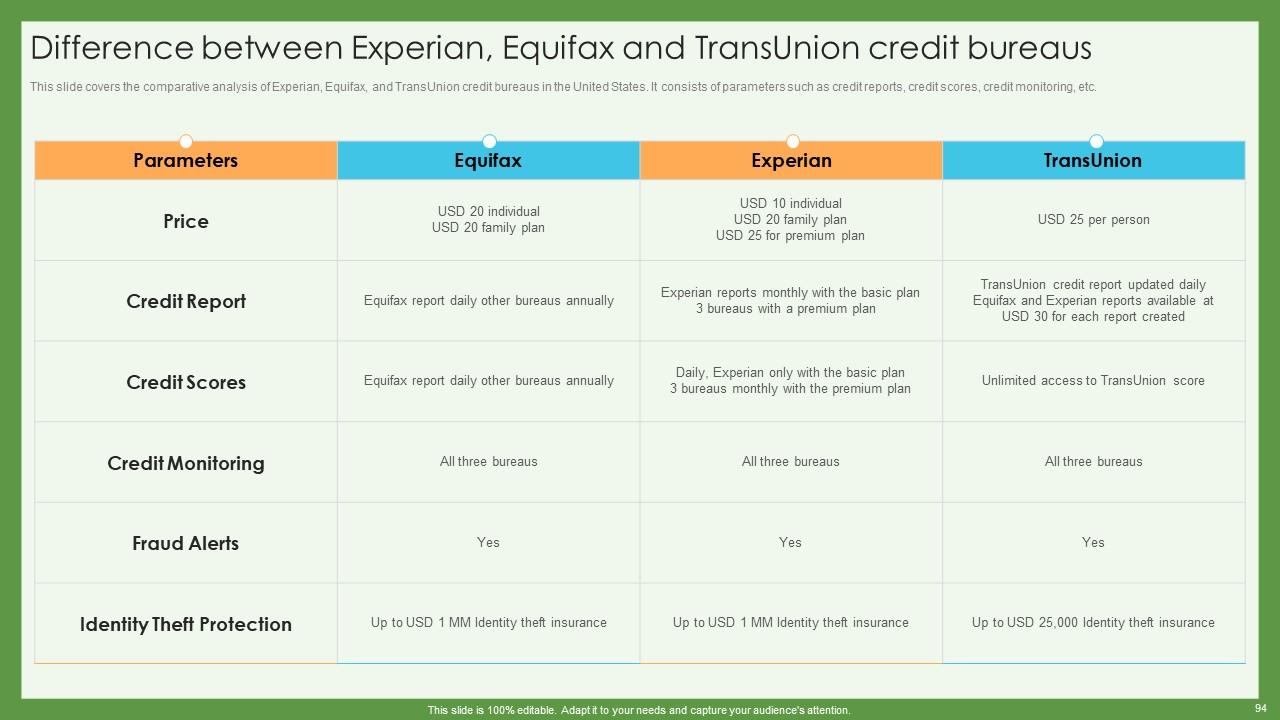

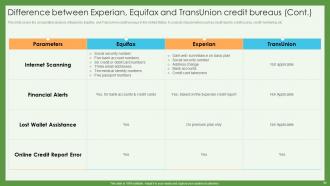

Slide 94: This slide shows the comparative analysis of Experian, Equifax, and TransUnion credit bureaus in the United States.

Slide 95: This slide covers the comparative analysis of Experian, Equifax, and TransUnion credit bureaus in the United States.

Slide 96: This slide shows a Table of Contents for the presentation.

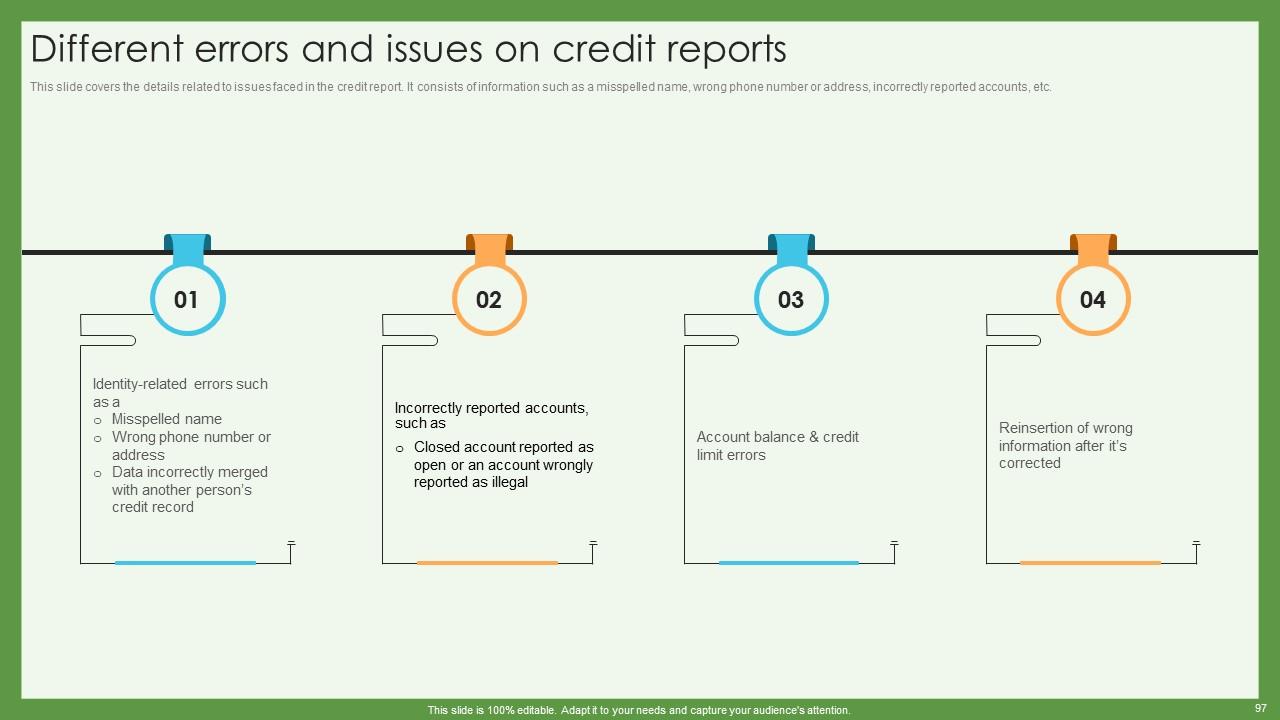

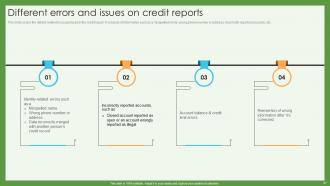

Slide 97: This slide showcases the details related to issues faced in the credit report.

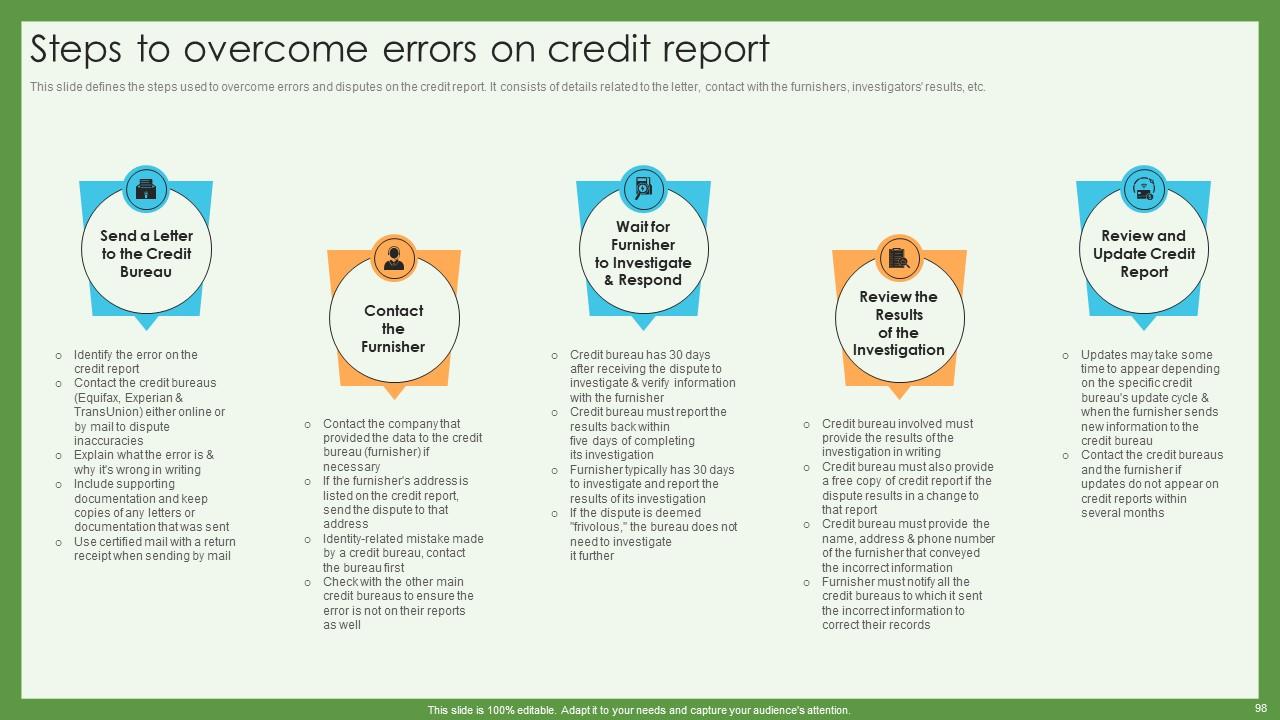

Slide 98: This slide defines the steps used to overcome errors and disputes on the credit report.

Slide 99: This slide shows a Table of Contents for the presentation.

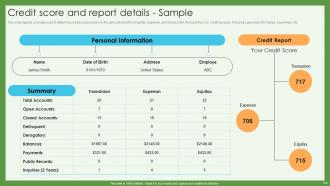

Slide 100: This slide depicts a sample used to determine credit scores based on the data collected from Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

Slide 101: This slide shows a Table of Contents for the presentation.

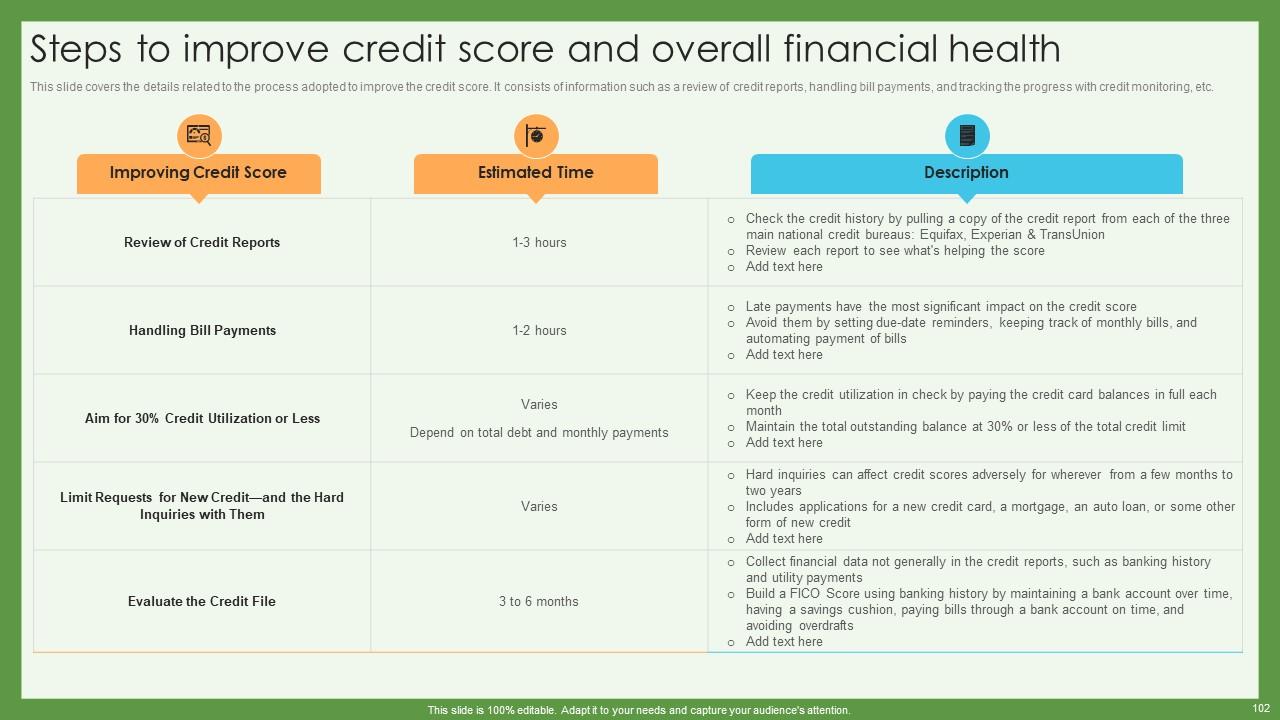

Slide 102: This slide covers the details related to the process adopted to improve the credit score.

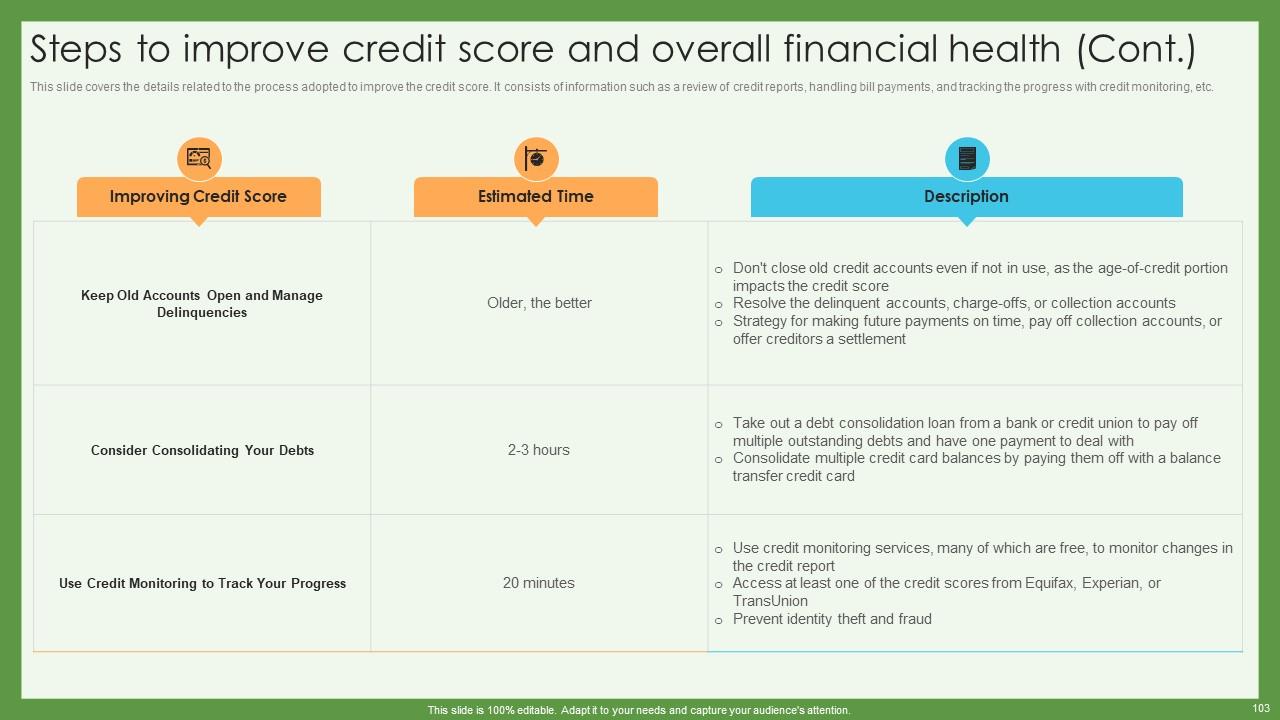

Slide 103: This slide entails the details related to the process adopted to improve the credit score.

Slide 104: This slide shows a Table of Contents for the presentation.

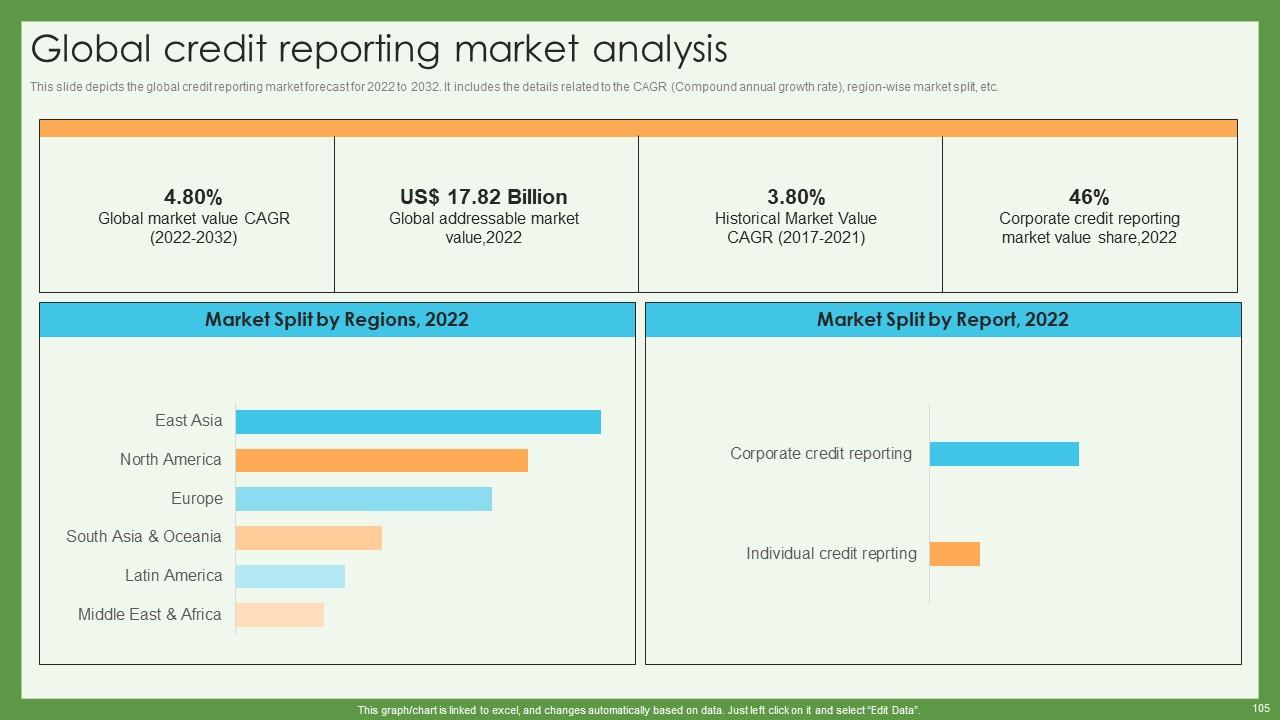

Slide 105: This slide depicts the global credit reporting market forecast for 2022 to 2032.

Slide 106: This slide shows all the icons included in the presentation.

Slide 107: This slide is a thank-you slide with address, contact numbers, and email address.

Credit Scoring And Reporting Complete Guide Fin CD with all 116 slides:

Use our Credit Scoring And Reporting Complete Guide Fin CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Thank you for showering me with discounts every time I was reluctant to make the purchase.

-

I joined SlideTeam last month and there’s no doubt that I tend to find our bond only strengthening over time. Best place to find world-class themes, templates, and icons.