Money Laundering in Banking Sector Training Ppt

The PPT Training Module on Money Laundering in the Banking Sector offers a comprehensive analysis of money laundering mechanisms within the banking industry and the importance of Anti Money Laundering AML regulations. The Deck begins by addressing How does Money Laundering happen in Banking and then introduces What is AML explaining the concept and framework of Anti Money Laundering measures. A critical section, Why is AML Regulation important to the Banking Industry follows, highlighting the significance of AML in maintaining the integrity and stability of financial institutions. This part also examines the Regulatory, Reputational, and Legal Risks and Damages associated with money laundering, demonstrating the potential consequences for banks that fail to comply with AML regulations. The PowerPoint Deck then delves into ML TF Money Laundering Terrorist Financing Vulnerabilities in Banking, breaking down various risk categories such as Product or Service Risk, Delivery or Distribution Risk, Business Risk, Customer Risk, Country Risk, and Environmental Risk. The Presentation also has Key Takeaways and Discussion Questions related to the topic to make the training session more interactive. The Deck contains PPT slides on About Us, Vision, Mission, Goal, 30 60 90 Days Plan, Timeline, Roadmap, Training Completion Certificate, Energizer Activities, Client Proposal, and Assessment Form.

The PPT Training Module on Money Laundering in the Banking Sector offers a comprehensive analysis of money laundering mecha..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Training Deck on Money Laundering in Banking Sector. This deck comprises of 20 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 3

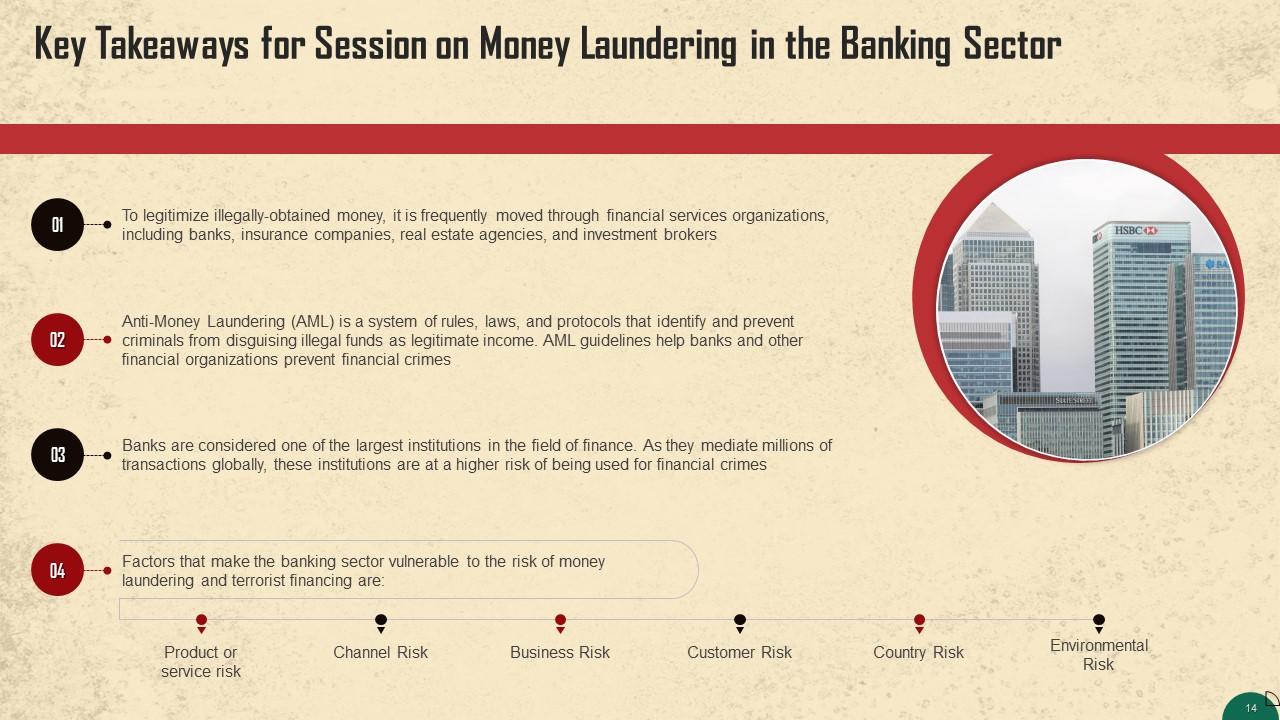

This slide discusses how the banking sector is vulnerable to money laundering. To legitimize the illegally obtained money, it is frequently moved through financial services organizations, including banks, insurance companies, real estate agencies, and investment brokers.

Slide 4

This slide gives us he definition of anti-money laundering. Anti-Money Laundering (AML) is a system of rules, laws, and protocols that identify and prevent criminals from disguising illegal funds as legitimate income. AML guidelines help banks and other financial organizations prevent financial crimes.

Slide 5

This slide discusses the importance AML Regulation in the banking sector. Banks are considered one of the largest institutions in the field of finance. As they daily mediate millions of transactions globally, these institutions are at a higher risk of being used for financial crimes.

Instructor’s Notes: Additionally, the advent of online payments and the technological transformation of the financial sector have amplified the need for more stringent customer identity protection.

Slide 6

This slide discusses regulatory, reputational, and legal risks & damages caused to organizations due to money laundering. These risks and damages make implementing AML regulation in an organization essential.

Instructor’s Notes:

- Regulatory: Regulatory rules evolve fast, and people have higher expectations of an acceptable risk-based AML program. Enforcing the rule of law has become a high priority for regulators worldwide. As per an analysis conducted by the Encompass Corporation, US regulators imposed 25 AML-related penalties in 2019, adding up to 2.3 billion USD

- Reputational: Senior executives understand the value of their organizations' reputations. Strongly reputable companies attract better clients. Their customers are loyal and purchase a wider variety of goods and services. An inquiry into money laundering that involves clients, transactions, or business operations can have a negative impact on the reputation

- Legal: Legal liability concerns are the third factor influencing the high priority that institutions accord to AML. This includes civil & criminal liabilities. With more civil class action lawsuits being filed regularly, the likelihood of suffering legal damages is high

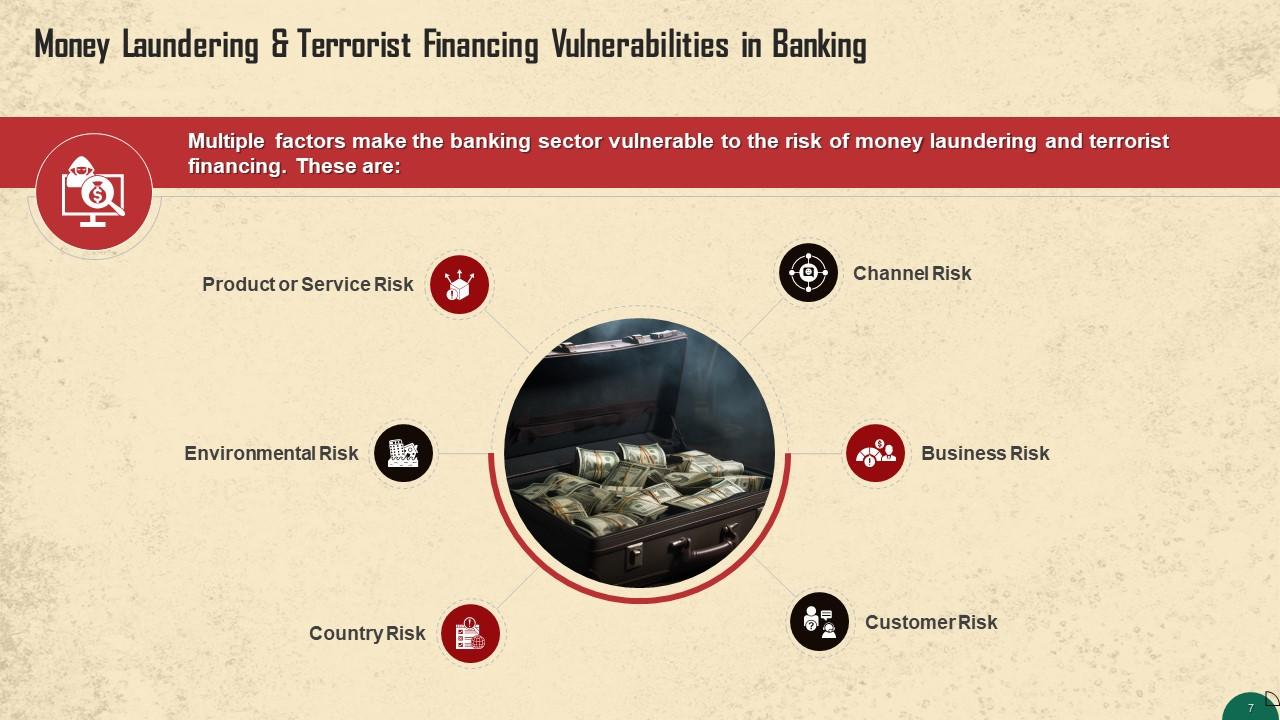

Slide 7

This slide highlights multiple factors that make the banking sector vulnerable to the risk of money laundering and terrorist financing. These are product or service risk, channel risk, business risk, customer risk, country risk, and environmental risk.

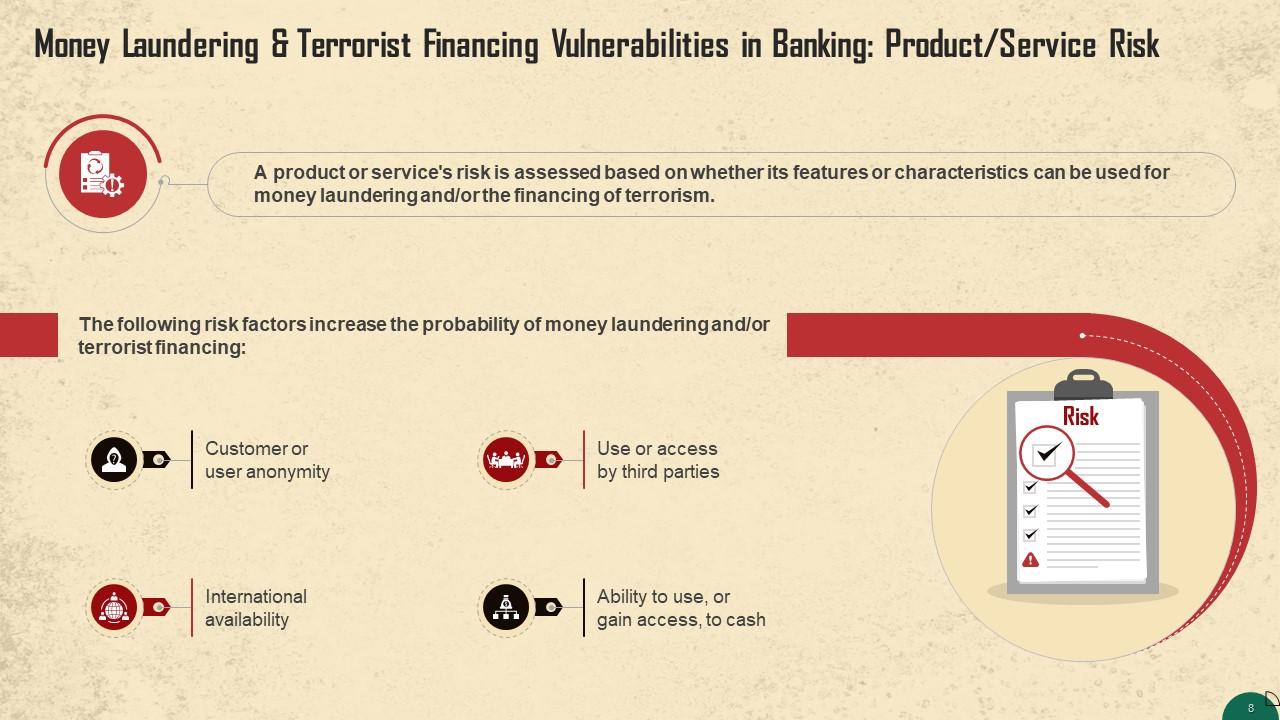

Slide 8

This slide discusses the risk posed by a product or service of it to be used for money laundering and financing of terrorism. These risk factors increase the likelihood of laundering money. These are user anonymity, international availability, use or access by third parties, ability to use or gain access to cash

Slide 9

This slide talks about the channel risk that may lead to money laundering or the financing of terrorism. Money Laundering and Terrorist Financing risks are significantly influenced by the nature and attributes of the channels used to deliver or distribute goods and services to customers.

Slide 10

This slide discusses the business risk that may aid money laundering and the financing of terrorism. Business risk is substantially influenced by where the business operations are located, the use of third parties, and the ML/TF risks that employees pose.

Slide 11

This slide talks about the customer risk that facilitates money laundering and the financing of terrorism. The vulnerability that clients may be involved in money laundering or terrorist financing operations is taken into account while calculating ML/TF customer risk

Slide 12

This slide discusses the country risk that may encourage money laundering and terrorist financing. Country risk can be defined as the assessment of a country's or jurisdiction's susceptibility to money laundering, terrorist financing, and targeted financial sanctions.

Slide 13

This slide talks about the environmental risk that may facilitate money laundering and/or the financing of terrorism. Environmental risk considers the internal and external environment in which an organization operates.

Slide 32 to 47

These slides contain energizer activities that a trainer can employ to make the training session interactive and engage the audience.

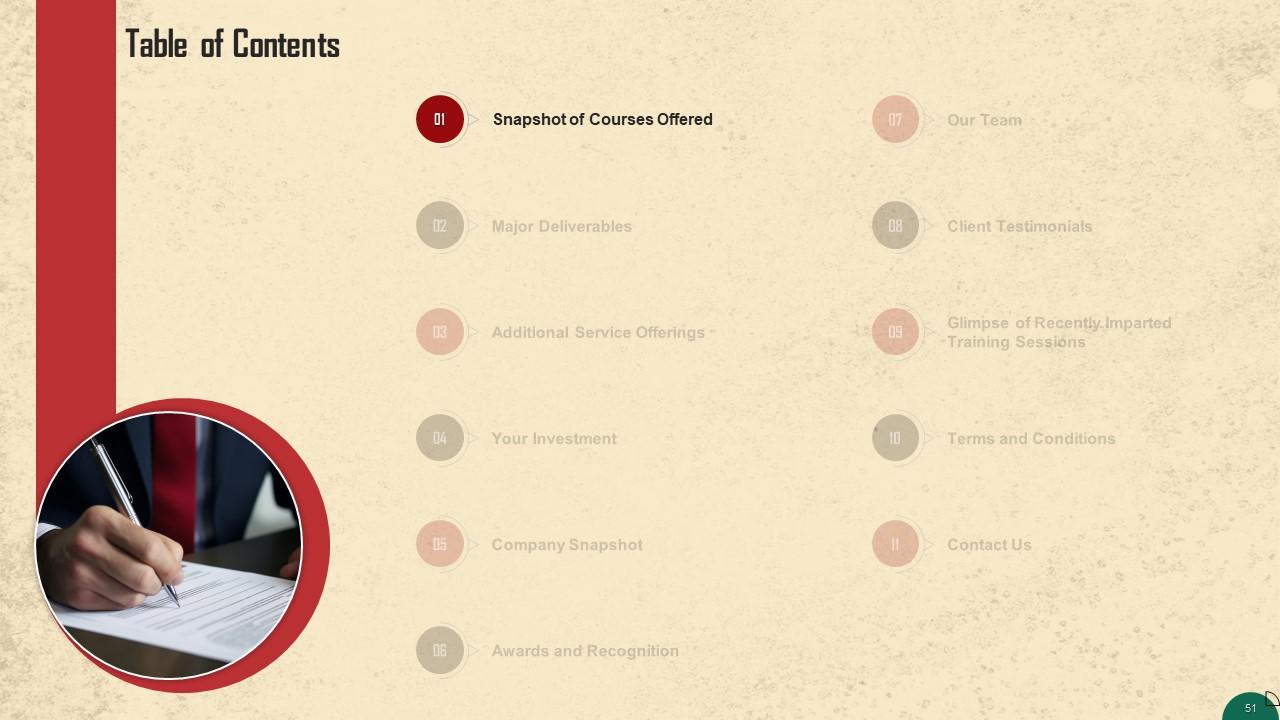

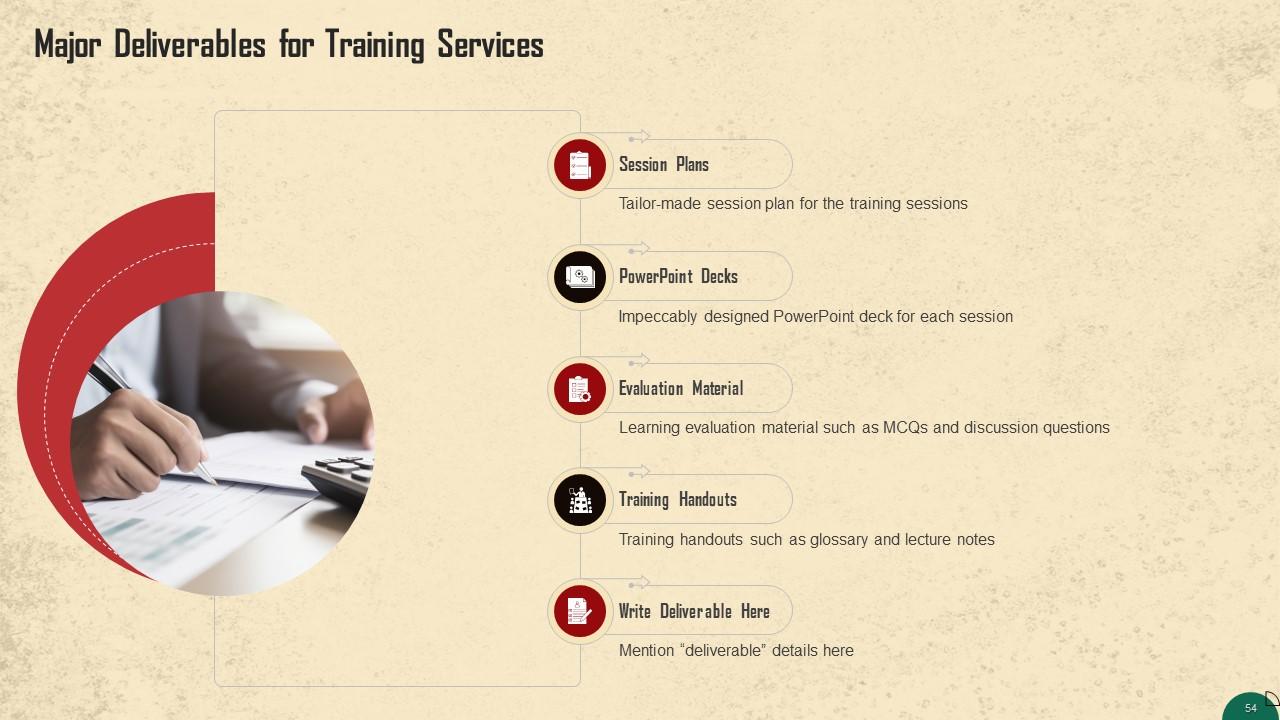

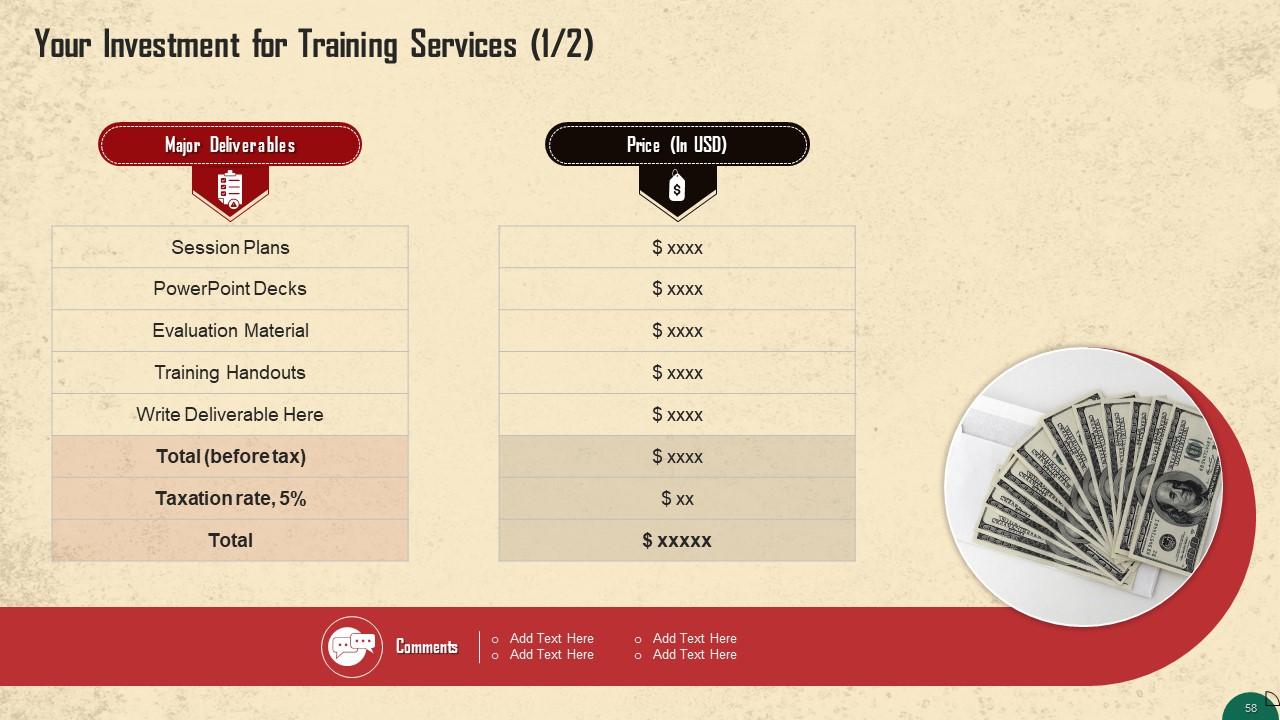

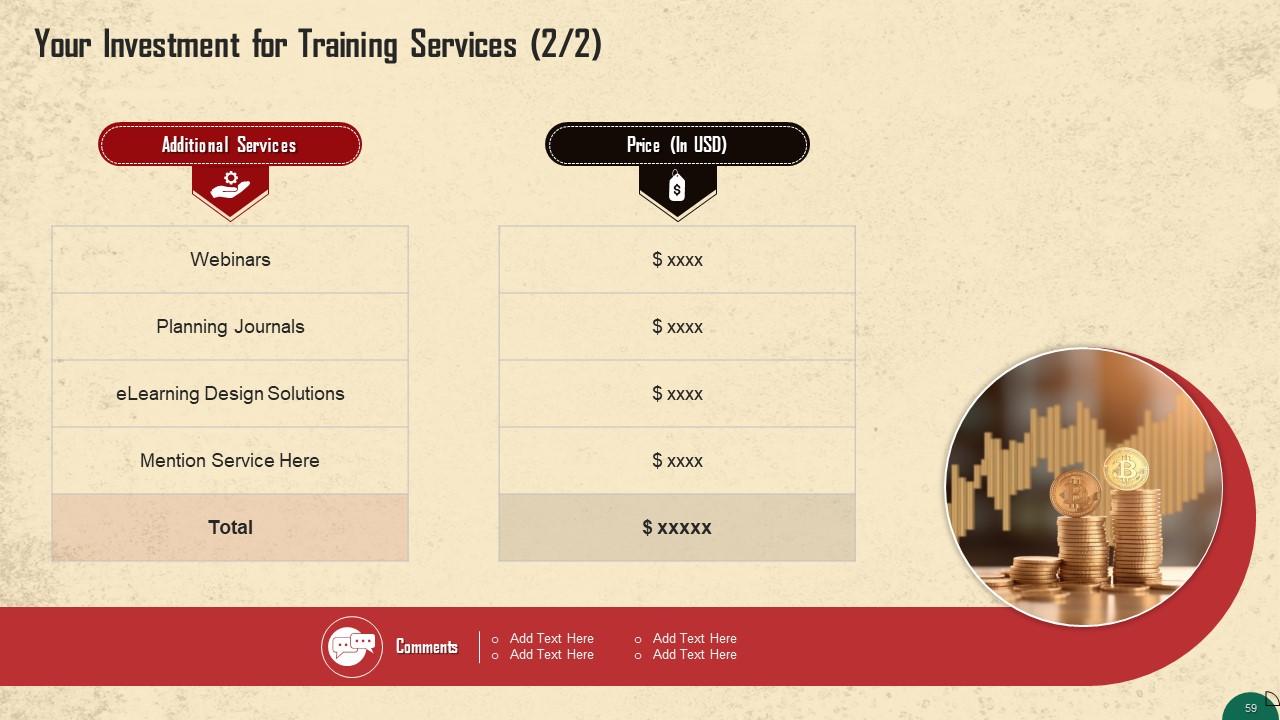

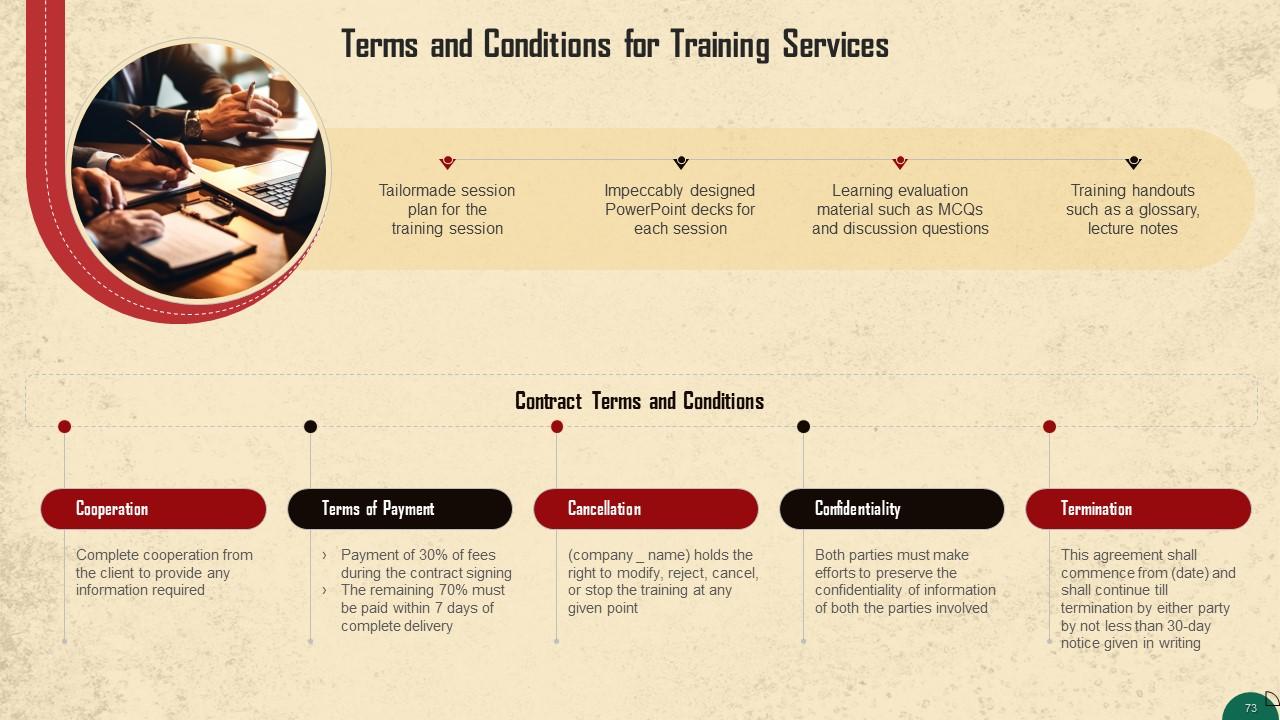

Slide 48 to 75

These slides contain a training proposal covering what the company providing corporate training can accomplish for prospective clients.

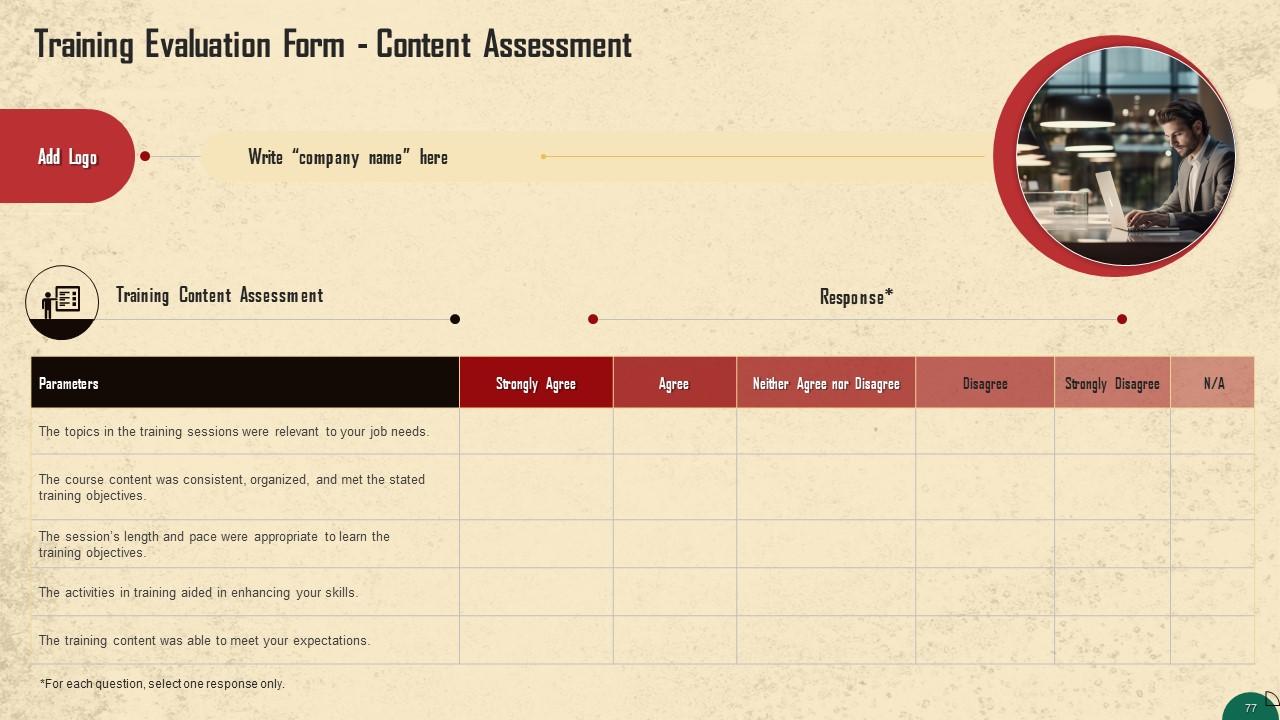

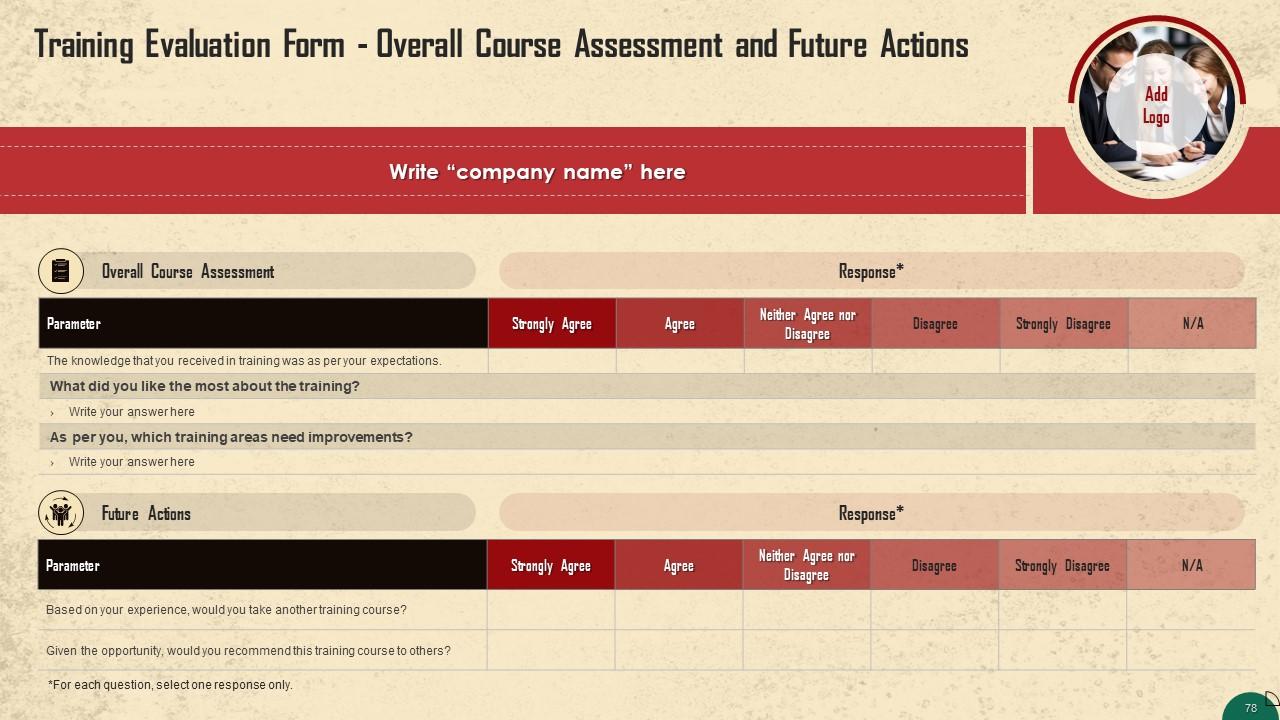

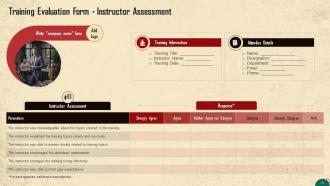

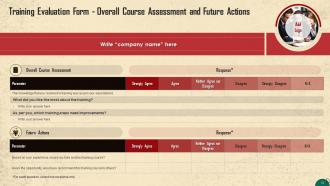

Slide 76 to 78

These slides include a training evaluation form for the instructor, content, and course assessment to assess the effectiveness of the coaching program.

Money Laundering in Banking Sector Training Ppt with all 87 slides:

Use our Money Laundering in Banking Sector Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

The best collection of PPT templates!! Totally worth the money.

-

I've been looking for a good template source for some time. I'm happy that I discovered SlideTeam. Excellent presentations must try!