Money Laundering Risks In Banking Training Ppt

These slides, in detail, cover the facets that make the banking sector vulnerable to the risk of money laundering. These are product or service risk, channel risk, business risk, customer risk, country risk, and environmental risk.

These slides, in detail, cover the facets that make the banking sector vulnerable to the risk of money laundering. These ar..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Money Laundering Risks in Banking. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

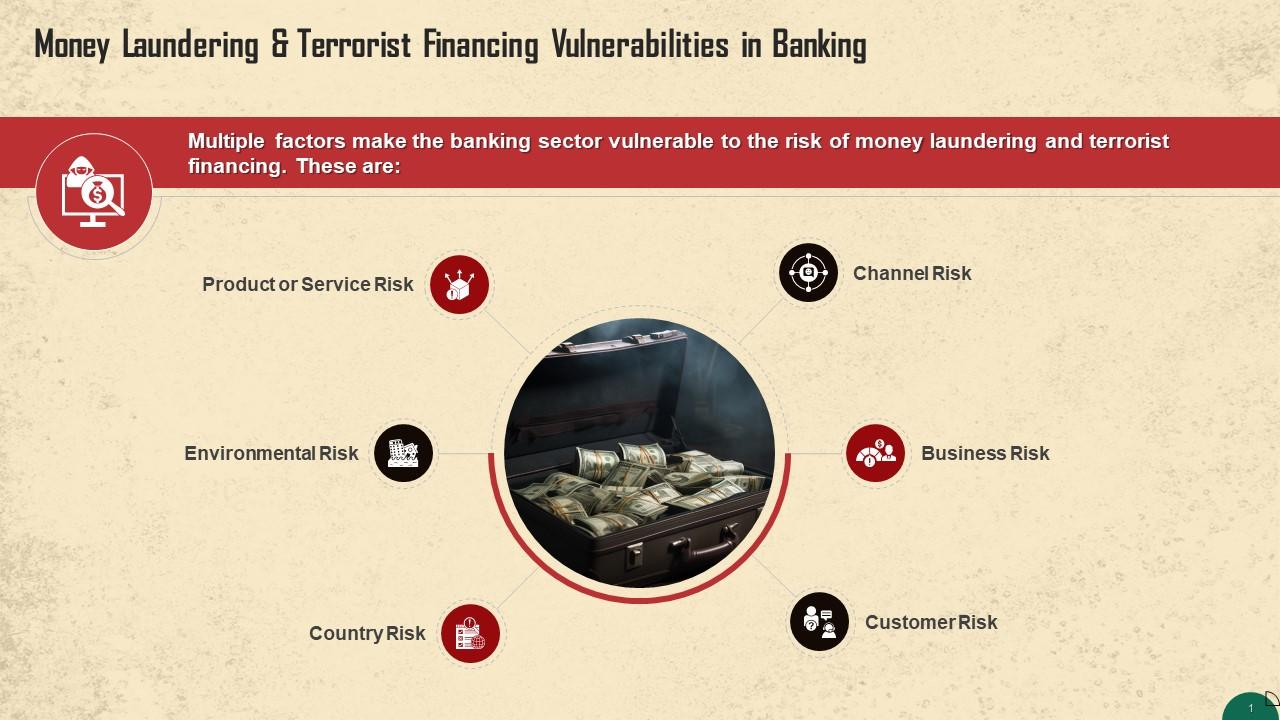

This slide highlights multiple factors that make the banking sector vulnerable to the risk of money laundering and terrorist financing. These are product or service risk, channel risk, business risk, customer risk, country risk, and environmental risk.

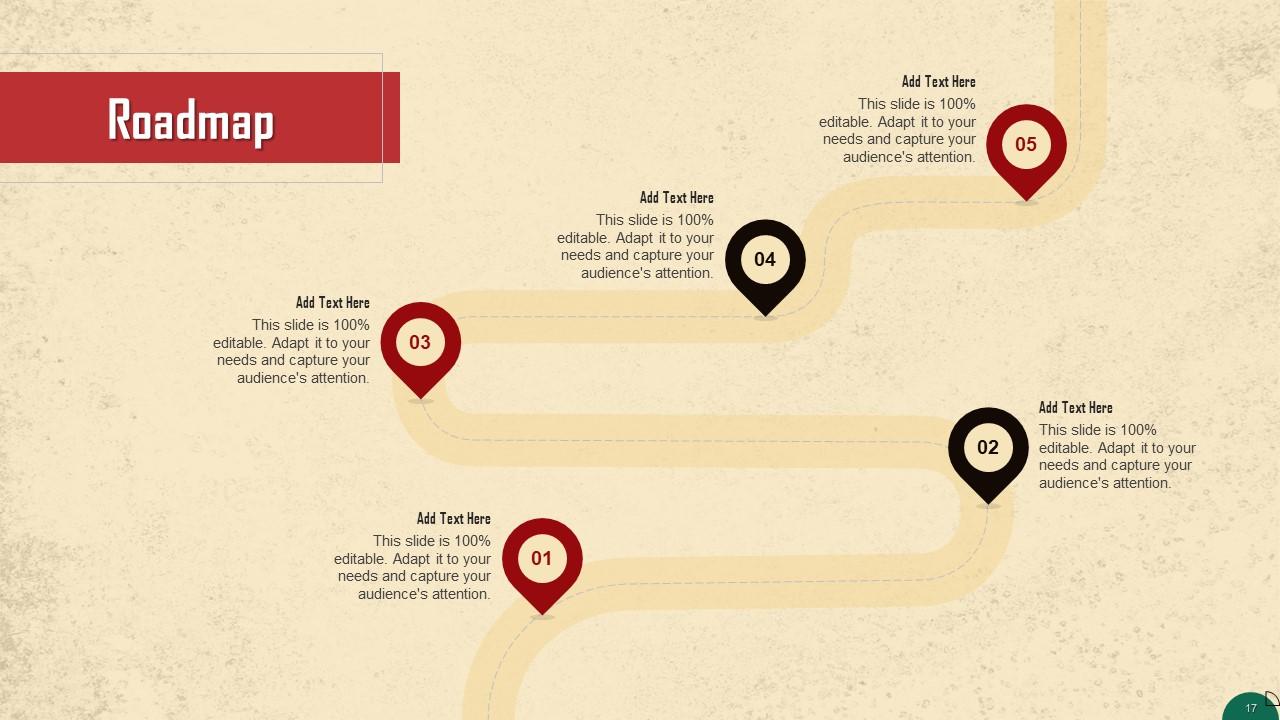

Slide 2

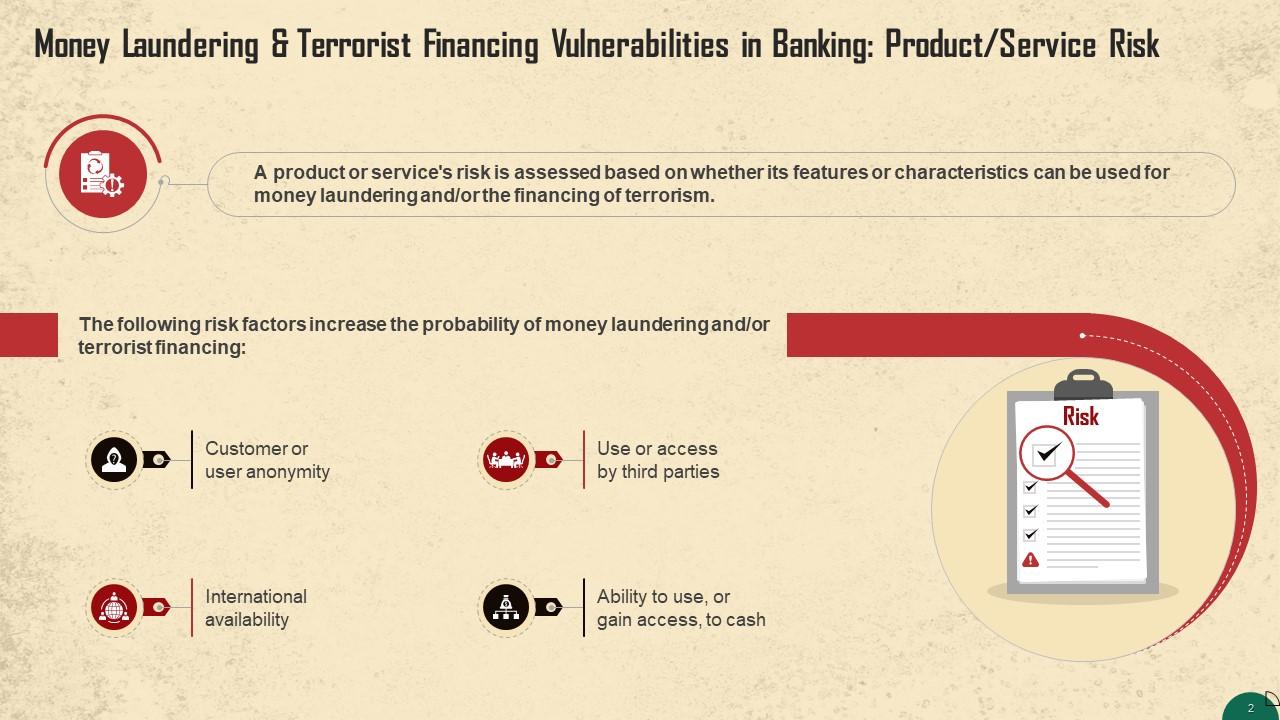

This slide discusses the risk posed by a product or service of it to be used for money laundering and financing of terrorism. These risk factors increase the likelihood of laundering money. These are user anonymity, international availability, use or access by third parties, ability to use or gain access to cash

Slide 3

This slide talks about the channel risk that may lead to money laundering or the financing of terrorism. Money Laundering and Terrorist Financing risks are significantly influenced by the nature and attributes of the channels used to deliver or distribute goods and services to customers.

Slide 4

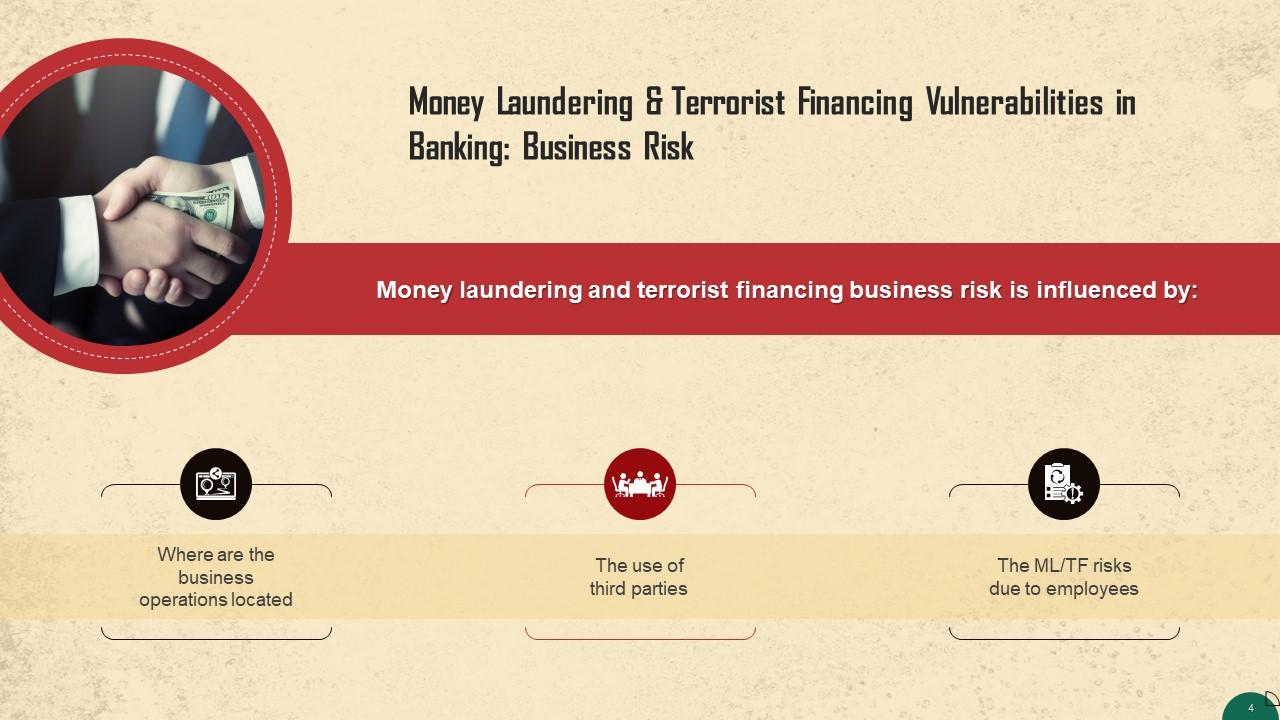

This slide discusses the business risk that may aid money laundering and the financing of terrorism. Business risk is substantially influenced by where the business operations are located, the use of third parties, and the ML/TF risks that employees pose.

Slide 5

This slide talks about the customer risk that facilitates money laundering and the financing of terrorism. The vulnerability that clients may be involved in money laundering or terrorist financing operations is taken into account while calculating ML/TF customer risk.

Slide 6

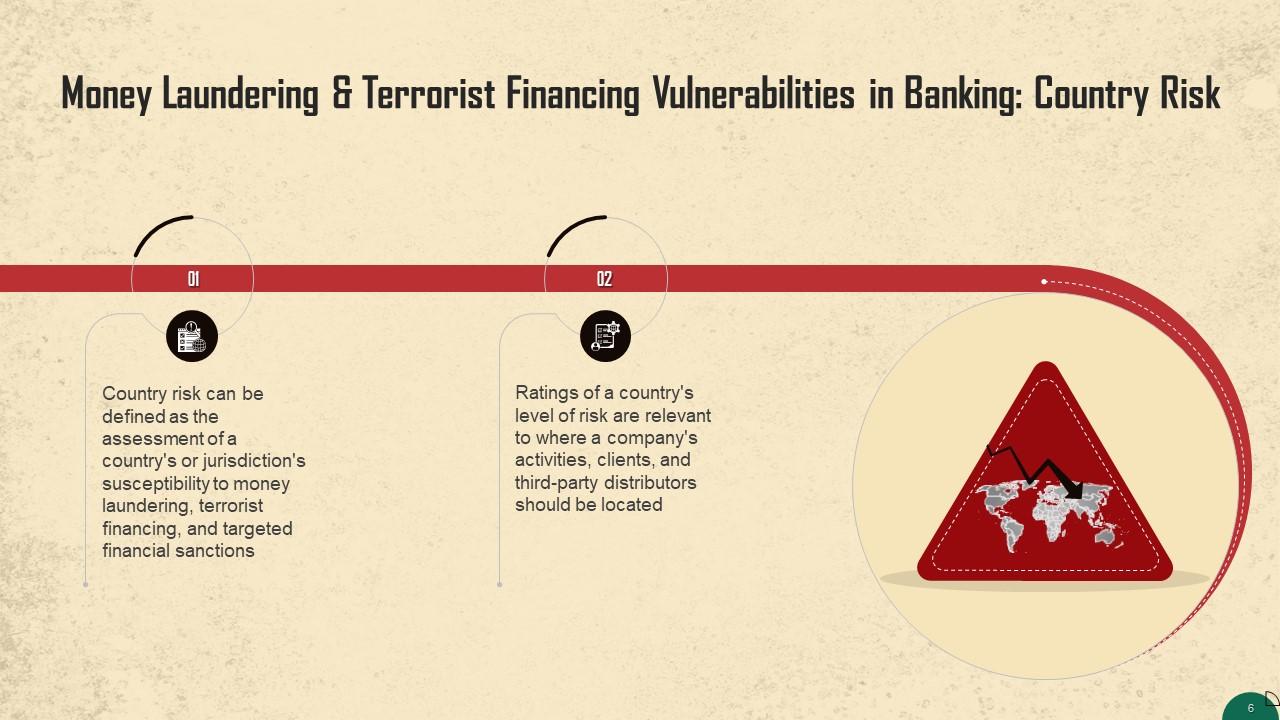

This slide discusses the country risk that may encourage money laundering and terrorist financing. Country risk can be defined as the assessment of a country's or jurisdiction's susceptibility to money laundering, terrorist financing, and targeted financial sanctions.

Slide 7

This slide talks about the environmental risk that may facilitate money laundering and/or the financing of terrorism. Environmental risk considers the internal and external environment in which an organization operates.

Money Laundering Risks In Banking Training Ppt with all 27 slides:

Use our Money Laundering Risks In Banking Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Topic best represented with attractive design.

-

Informative design.