Steps for land valuation and analysis powerpoint presentation slides

Introducing our steps for land valuation and analysis PowerPoint presentation slides. Analyze the key real estate market with the help of our land investment PowerPoint deck. This estate analysis PPT theme consists of a slide that talks about client approval and valuation report schedule. Assimilating this land finance PPT layout helps you with the market survey details of the surrounding area. This ready-to-use land inspection PowerPoint design contains a slide that talks about the basis of valuation and the factors influencing market value. Incorporating this particular plot investment PPT theme in your presentation lets you describe the features of the property available for sale. This property cost inspection PowerPoint creative set contains a slide that discusses the cost approach method with evaluation details. This land analysis PPT deck lets you make required variations to icons and colors. Choose this estate funding PowerPoint design to showcase organization and assurance. Download this PPT slide to explore true perfection.

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting our steps for land valuation and analysis PowerPoint presentation slides. This PowerPoint design contains forty eight slides in it which can be completely customized and edited. It is available for both standard as well as for widescreen formats. This PowerPoint template is compatible with all the presentation software like Microsoft Office, Google Slides, etc. You can download this PPT layout from below.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This is the introductory slide of the "Steps For Land Valuation And Analysis" PowerPoint presentation. Add your company name here.

Slide 2: Use this slide to share the agenda of your PPT presentation. Identify and analyze the economic value of the real estate and identify the suitable approach as per the property type.

Slide 3: This slide contains the Table of Contents. In this key slide, highlight the categories like Company Introduction and Valuation Purpose, Property Details and Documents, SWOT and Risk Analysis, etc.

Slide 4: This PPT slide introduces the first title of your Table of Contents: Company Introduction and Valuation Purpose. Introduce your company and the key takeaways of your real estate valuation in a pointer format, among others.

Slide 5: This slide shows the key takeaways related to real estate valuation, covering difficulties in the real estate valuation process, general real estate market concepts, ascertaining fair value, etc.

Slide 6: This slide shows the basic introduction related to the company, which includes valuation type, property type, property name, location, etc. It also presents client information which provides for client name, domain, location, contact person, etc.

Slide 7: This slide shows the property details, interests, and opinions related to the client's property. It covers the detail on Interest to be valued and the idea of value.

Slide 8: This slide shows the main reasons behind the client's demand for valuation of the property, which includes acquisition purposes, selling purposes, private fundraising, public fundraising, internal decision making, etc.

Slide 9: In this slide, introduce the second title of your Table of contents, Valuation Approval, and Inspection. Focus on client approval, inspection role, marketing survey, etc..

Slide 10: This slide shows the schedule related to the valuation report's timings, including client approval date, inspection date, valuation date, report date, etc.

Slide 11: This slide shows the valuation provider's inspection role process, which includes received property information, on-site team, location analysis, general building surveying, utilities and services check-up, etc.

Slide 12: This slide shows the market survey details related to the surrounding areas such as transitions, offerings, selling prices, rental prices, surrounding facilities, infrastructure, demand drivers, etc..

Slide 13: This slide shows the valuation provider's inspection role process, which includes received property information, on-site team, location analysis, general building surveying, utilities and services check-up, etc.

Slide 14: Use this slide to introduce the third heading of the Table of contents: Approaches and Valuation Factors. Identify the basics, valuation approaches, and the methods used by the real estate valuation company here.

Slide 15: This slide shows the basis for valuation, such as market value, exchange of assets, etc. It also presents the factors influencing the market value, including supply, demand, economy, purpose, location, and specifications.

Slide 16: This slide shows the various valuation approaches related to real estate, including cost approach, comparable approach, income approach, etc.

Slide 17: This slide shows the various methods used by the real estate valuation company, including Depreciated Replacement Cost (DRC), comparable, income cap, (Discounted Cash Flow) DCF, Residual Land Value (RLV), etc.

Slide 18: This slide introduces the fourth heading of the Table of contents: Property Details and Documents. In this PPT slide, highlight property description, deed, ownership, construction, and land specifications, among other details.

Slide 19: This slide shows the description of the property to be valued, such as the land details, infrastructural facilities details, building specifications, property images, etc.

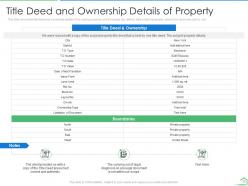

Slide 20: This slide shows the title deed and ownership details of the valuing property, including the city, district, date of the last transaction, issue from, land area, plot no. etc.

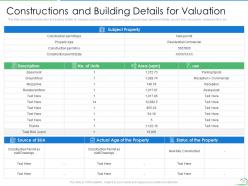

Slide 21: This slide shows the construction and building details for valuation, such as the construction permit type, property type, basement details, ground floor, mezzanine, restaurant floor, etc.

Slide 22: This slide shows the land specification details and infrastructural facilities, including the current land status, current land use, current land grading, current surrounding property, etc.

Slide 23: This slide shows the main property location and nearby landmarks such as the east side details, west side details, etc.

Slide 24: This slide shows the main documents received by the valuation company, such as the title deed copy, construction permit, master plan, layout, etc.

Slide 25: Use this slide to bring attention to the fifth title of your Table of Contents: SWOT and Risk Analysis related to the real estate valuation.

Slide 26: This slide shows the strengths, weaknesses, opportunities, and threats related to the real estate company's valuation, including the good quality finishing, high demand, etc.

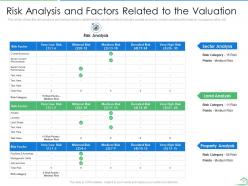

Slide 27: This slide shows the risk analysis and various valuation factors, including the overall economy, sector current performance, occupancy rates, etc.

Slide 28: This slide shows the various risk analysis factors with descriptions such as the locality and land including the title, planning resource, improvements, market risks, etc.

Slide 29: Bring focus to the sixth and last title of this PPT presentation, Valuation Details and Conclusion, in this slide. It introduces the concepts of cost approach methods and income approach market rate, leasing, and contract methods.

Slide 30: This slide can be used to demonstrate the cost approach method along with the details of its evaluation. Perform the land valuation based on comparable method and construction valuation based on the depreciated cost of replacement in this slide.

Slide 31: This slide shows the cost approach of real estate valuation, including the calculations related to the area, completion rate, total costs, land value, property value details, rounded value, etc.

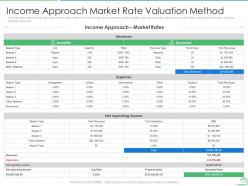

Slide 32: This slide shows the income approach market value method, including various seasons, units, quantity, rate, revenue type, total revenue, total days, net operating income, cap rate, property value, etc.

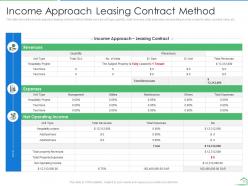

Slide 33: This slide shows the income approach leasing contract method details such as the unit type, quantity, total revenues, total expenses, net operating income, property value, rounded value, etc.

Slide 34: This slide shows the real estate calculated values in different approaches such as the income-market methodology, DRC approach, Income-contract method, etc.

Slide 35: This slide shows the conclusion details related to the real estate valuation, such as the fulfillment of the requirement of the instructions, methodology, criteria outlined, etc.

Slide 36: This slide presents the Icons for quick accessibility and usage related to real estate valuation.

Slide 37: This slide marks the beginning of additional slides.

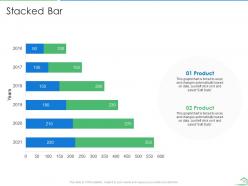

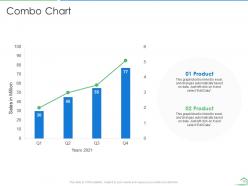

Slide 38: This slide comprises an excel-linked stacked bar to compare the value of two properties over the years.

Slide 39: This slide comprises an excel-linked combo chart to compare sales of two properties over the years.

Slide 40: This slide provides the mission of the real estate company. This includes the vision, mission, and goal.

Slide 41: Share your company goals using the unique infographics of this slide.

Slide 42: This slide provides a Venn diagram that can show interconnectedness and overlap between various properties, projects, etc.

Slide 43: Demonstrate your financial performance diagrammatically with this unique infographic. Measure your company's revenue, deposits, and net income with this PPT slide.

Slide 44: This slide contains Post It Notes that can express any brief thoughts or ideas.

Slide 45: This is the comparison slide to contrast male and female clients present on the social media channels relevant to your work area.

Slide 46: This is the idea generation slide to share any additional trade tactics.

Slide 47: This is another handy additional slide to highlight the four essential aspects of your real company that complete it in a creative puzzle format.

Slide 48: This is a "Thank You for watching" slide where details such as the address, contact number, email address are added.

Steps for land valuation and analysis powerpoint presentation slides with all 48 slides:

Use our Steps For Land Valuation And Analysis Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Easily Understandable slides.

-

Enough space for editing and adding your own content.

-

Professional and unique presentations.

-

Innovative and Colorful designs.

-

Very unique and reliable designs.