Strategic Improvement In Banking Operations Powerpoint Presentation Slides

Check out our professionally designed Strategic Improvement in Banking Operations PowerPoint Presentation. This deck comprehensively addresses a range of tactics to bolster the operational efficiency of banking activities. Enhancing banking operations involves utilizing diverse strategies and integrating innovative technologies to optimize efficiency, security, and the overall customer experience within the banking sector. Additionally, the Digital Banking template encompasses technology and automation, including mobile and internet banking applications, boosting workforce productivity, delivering customer-centric services, and redefining the operational banking model, among other aspects. Furthermore, it delves into cybersecurity techniques for safeguarding bank assets and counteracting security threats, alongside an exploration of cost management strategies tailored for the banking industry. Lastly, the Banking Automation slides examine the tangible outcomes of implementing these strategies, encompassing enhanced banking operations, technological initiatives, and dashboards for monitoring operational performance. It presents two illustrative case studies from the banking sector. Get access to this 100 percent editable template now.

Check out our professionally designed Strategic Improvement in Banking Operations PowerPoint Presentation. This deck compre..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Deliver an informational PPT on various topics by using this Strategic Improvement In Banking Operations Powerpoint Presentation Slides. This deck focuses and implements best industry practices, thus providing a birds-eye view of the topic. Encompassed with seventy one slides, designed using high-quality visuals and graphics, this deck is a complete package to use and download. All the slides offered in this deck are subjective to innumerable alterations, thus making you a pro at delivering and educating. You can modify the color of the graphics, background, or anything else as per your needs and requirements. It suits every business vertical because of its adaptable layout.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Strategic Improvement in Banking Operations. State your company name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide shows title for topics that are to be covered next in the template.

Slide 5: This slide showcases the various challenges associated with the functioning of banking operations. It includes cyber security threats, client retention etc.

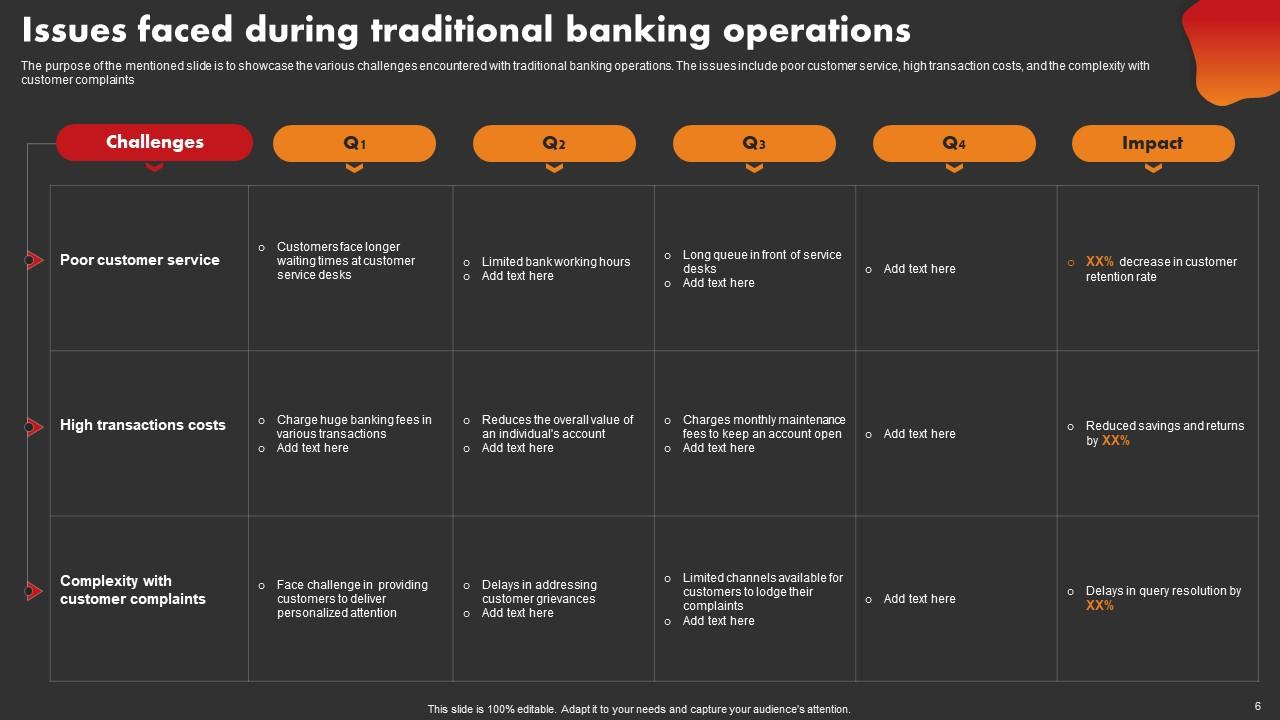

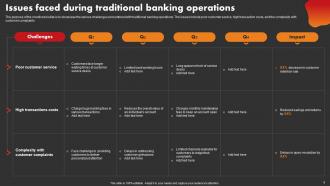

Slide 6: This slide presents various challenges encountered with traditional banking operations.

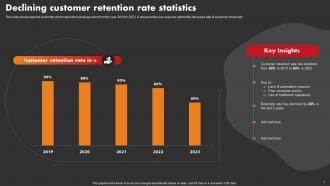

Slide 7: This slide showcases the customer churn rate in the banking sector from the year 2019 to 2023. it also provides key reasons behind the decrease rate of customer churn rate.

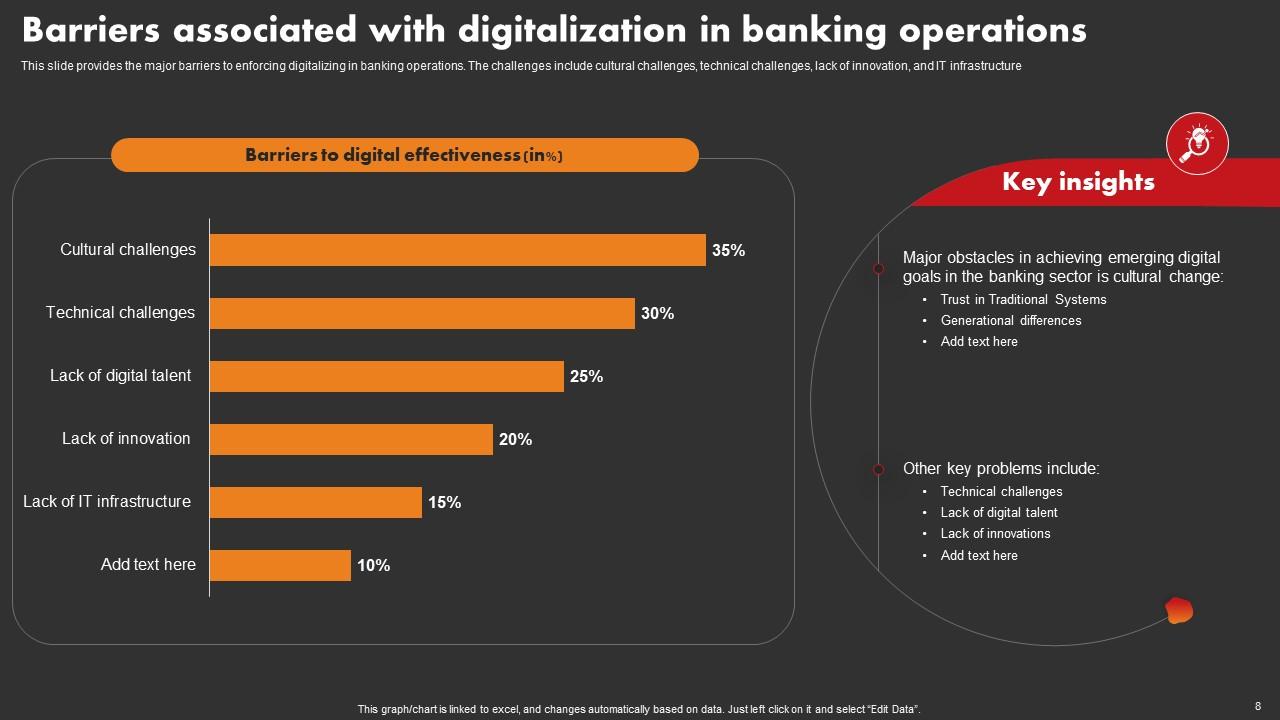

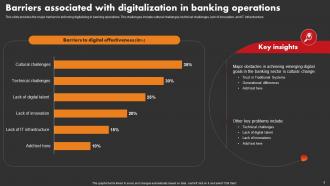

Slide 8: This slide provides major barriers to enforcing digitalizing in banking operations. The challenges include cultural challenges, technical challenges etc.

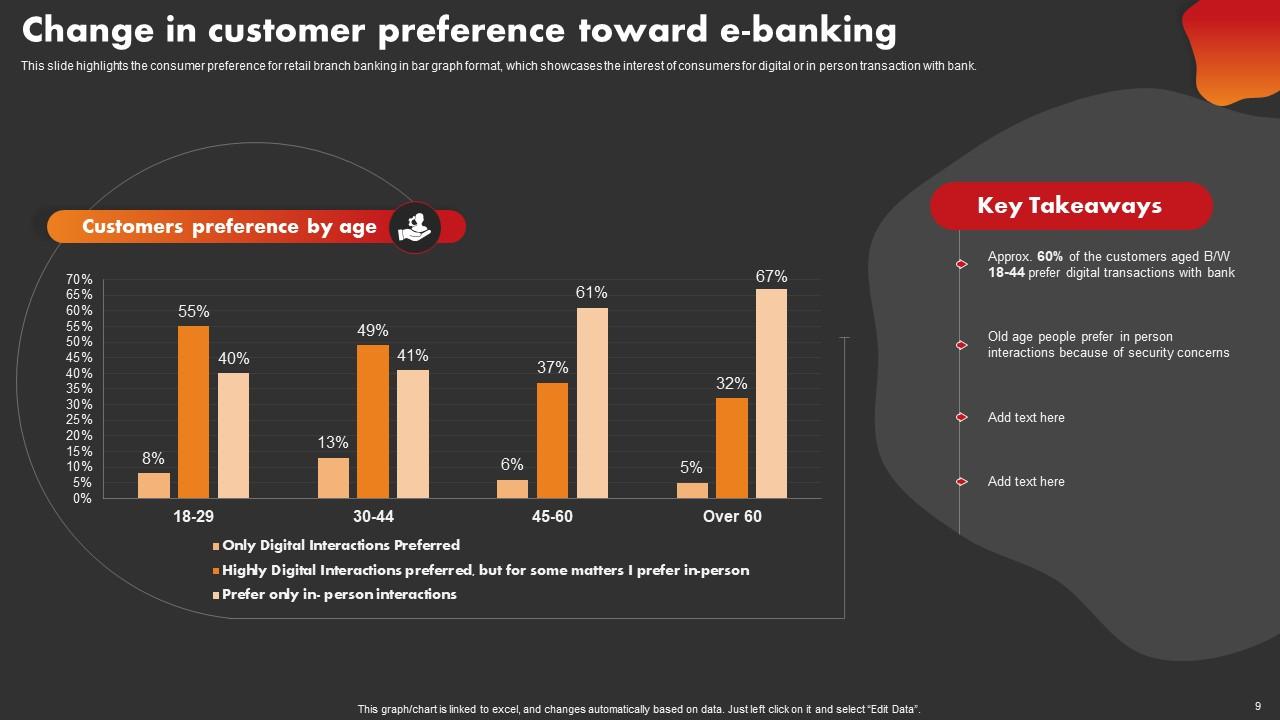

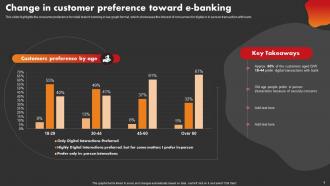

Slide 9: This slide highlights the consumer preference for retail branch banking in bar graph format, which showcases the interest of consumers.

Slide 10: This slide shows title for topics that are to be covered next in the template.

Slide 11: This slide showcases the banking operations transformation strategy by outlining various strategies, missions, and visions along with KPIs to track the overall performance.

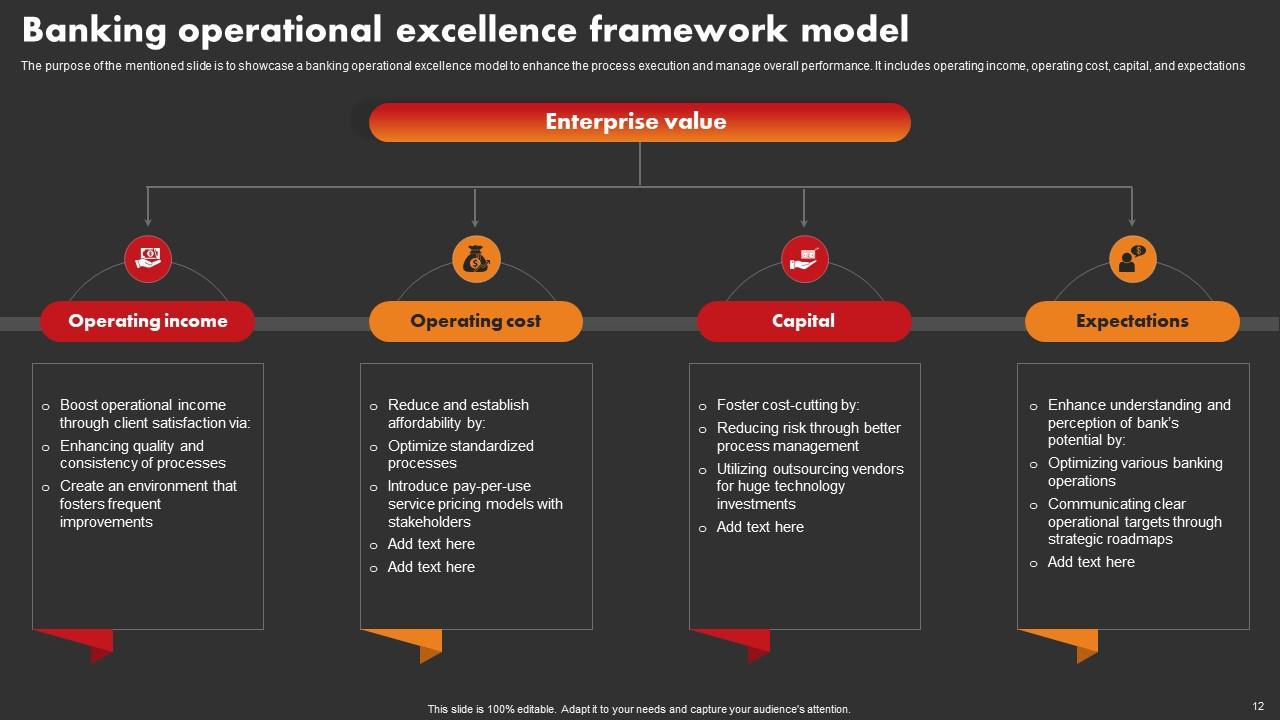

Slide 12: This slide presents a banking operational excellence model to enhance the process execution and manage overall performance.

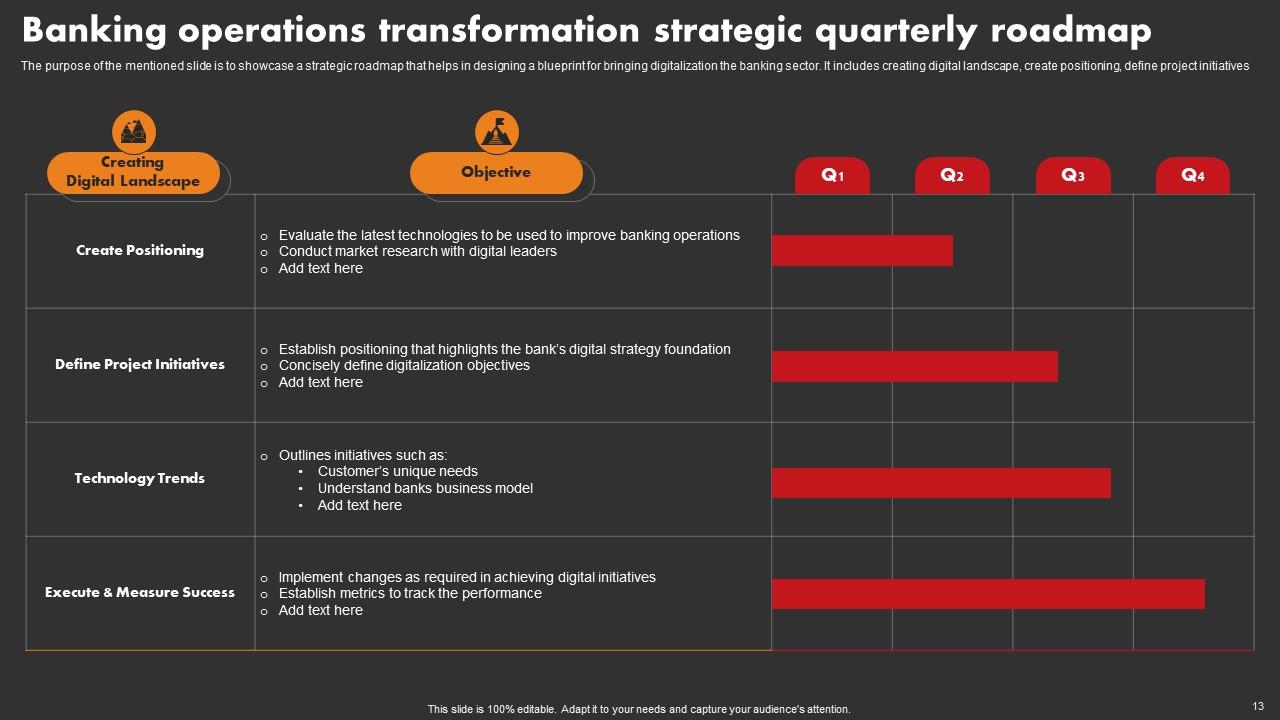

Slide 13: This slide displays a strategic roadmap that helps in designing a blueprint for bringing digitalization the banking sector.

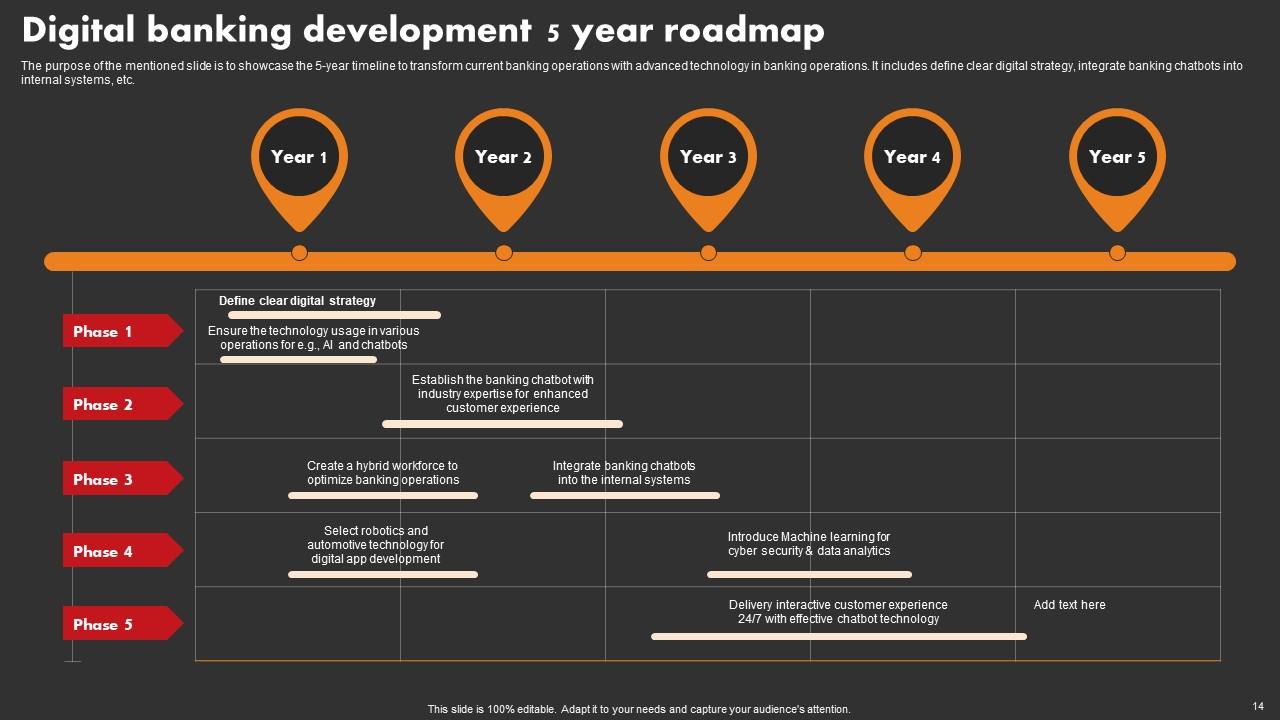

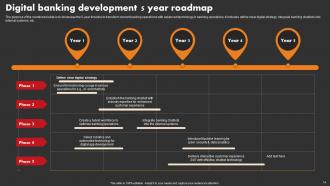

Slide 14: This slide presents the 5-year timeline to transform current banking operations with advanced technology in banking operations.

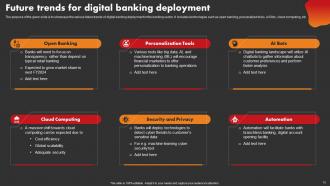

Slide 15: This slide displays the various future trends of digital banking deployment in the banking sector. It includes technologies such as open banking etc.

Slide 16: This slide shows title for topics that are to be covered next in the template.

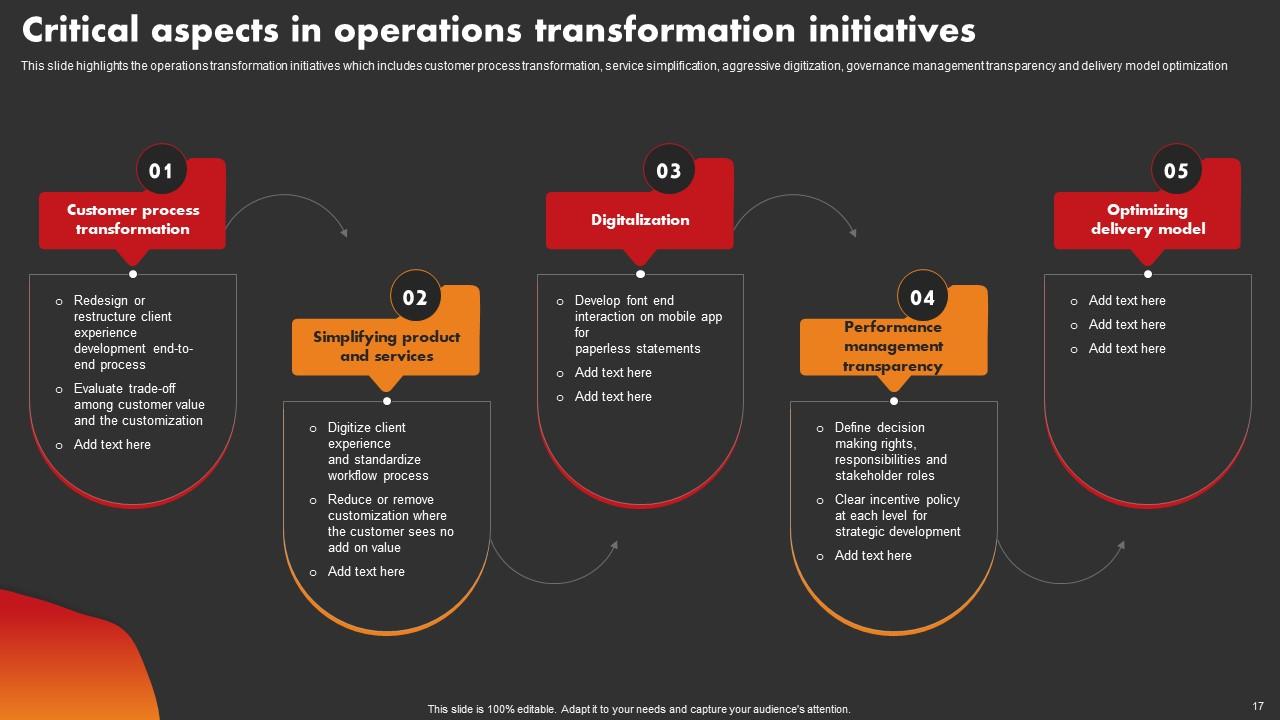

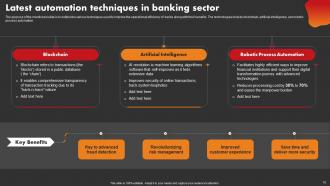

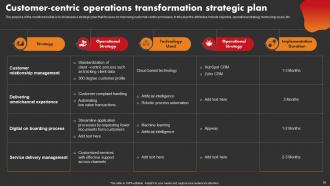

Slide 17: This slide highlights the operations transformation initiatives which includes customer process transformation, service simplification etc.

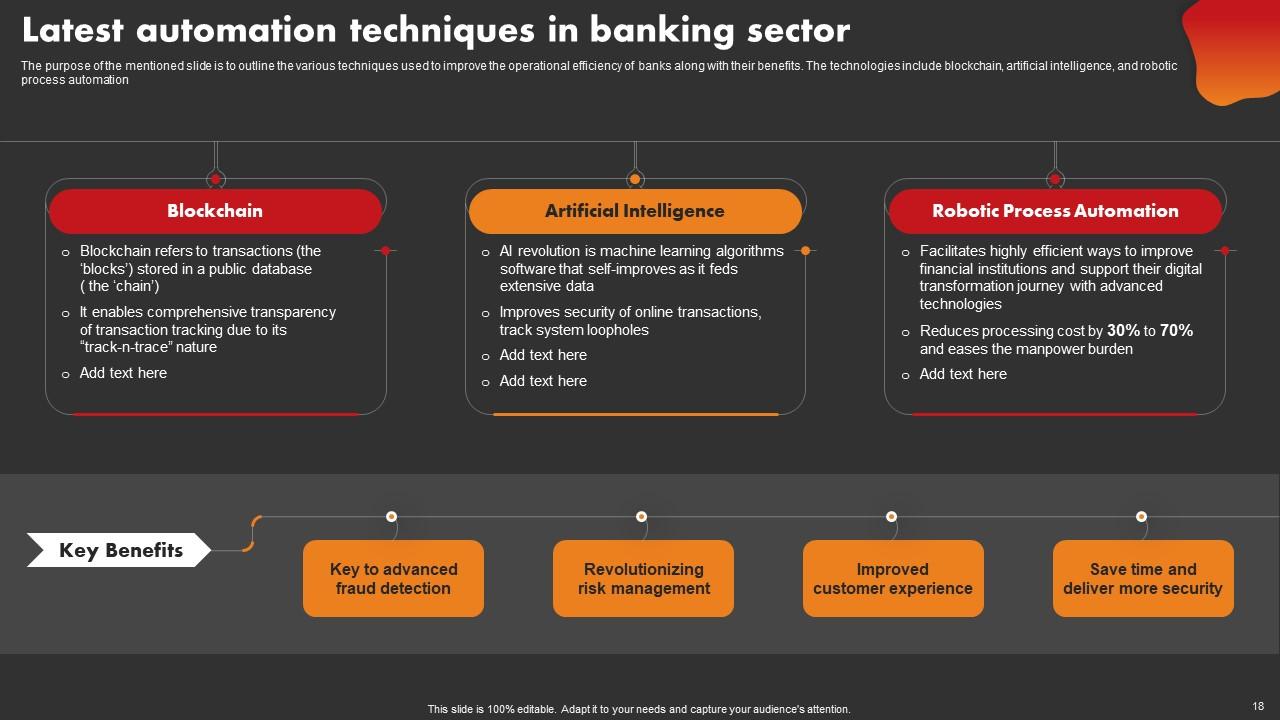

Slide 18: This slide outlines various techniques used to improve the operational efficiency of banks along with their benefits. The technologies include blockchain etc.

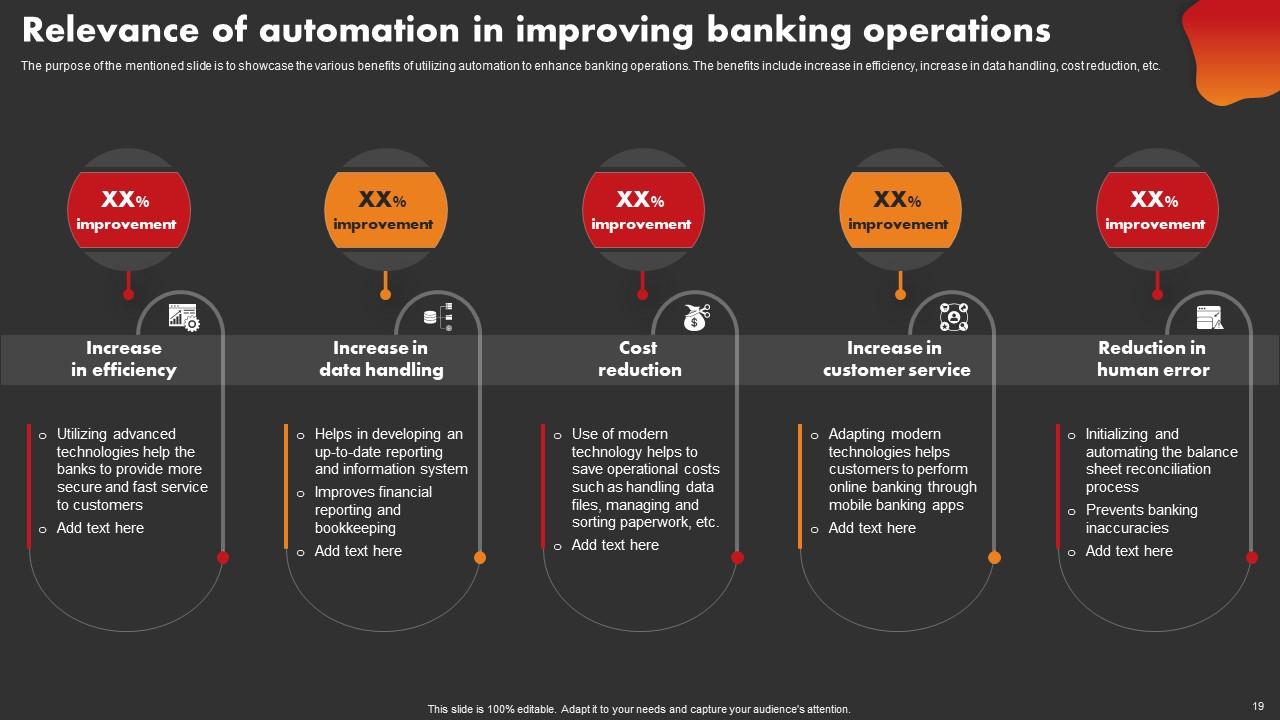

Slide 19: This slide presents the various benefits of utilizing automation to enhance banking operations.

Slide 20: This slide shows title for topics that are to be covered next in the template.

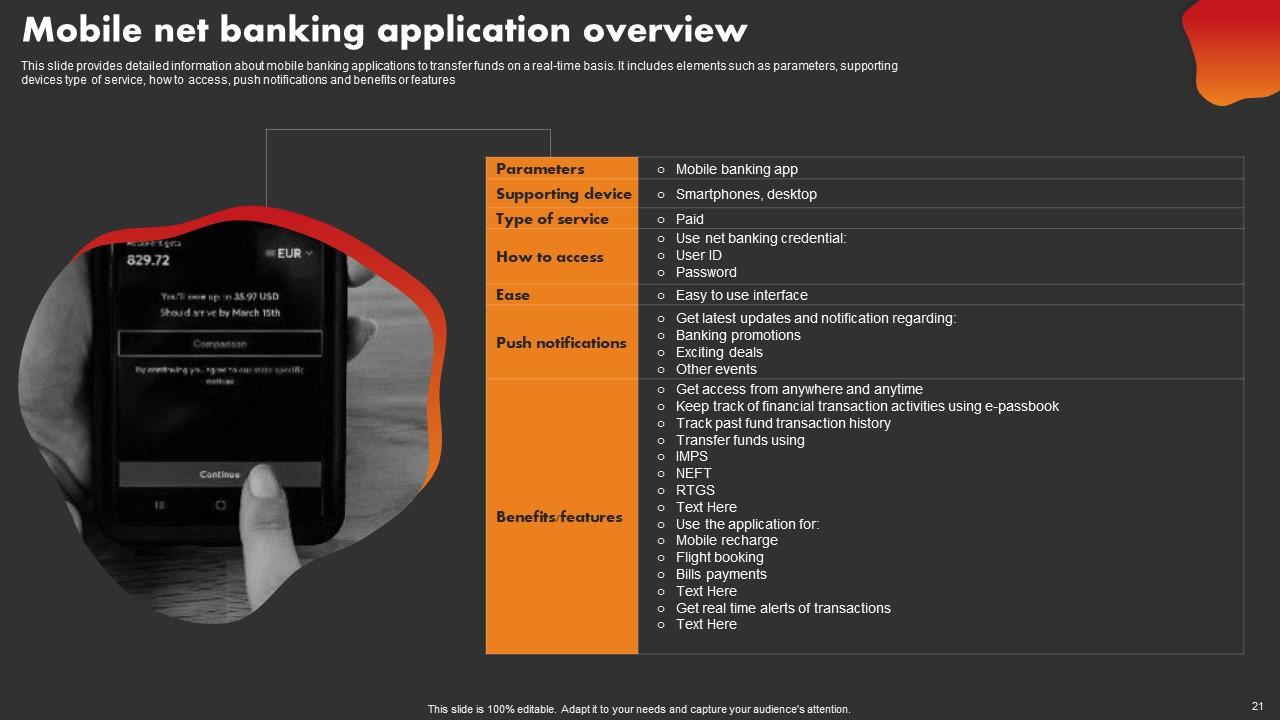

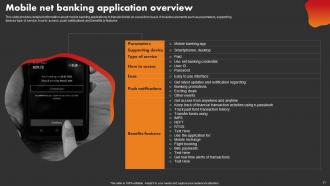

Slide 21: This slide provides detailed information about mobile banking applications to transfer funds on a real-time basis.

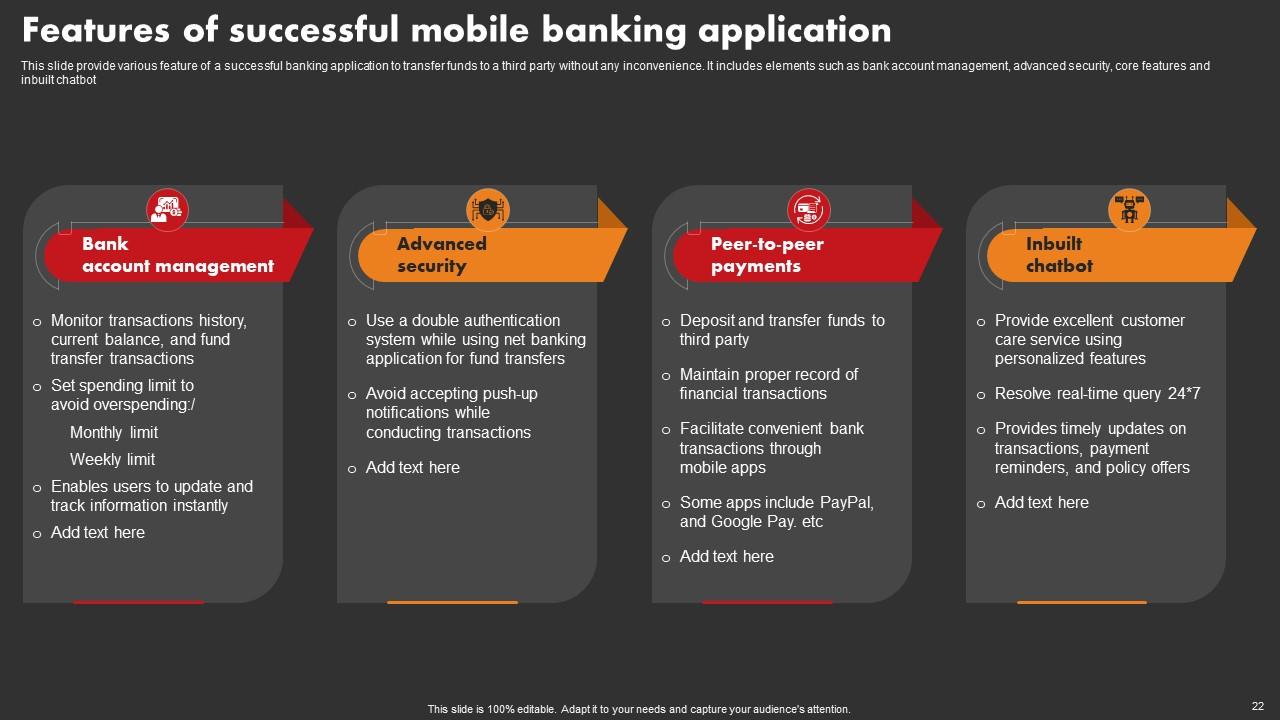

Slide 22: This slide displays various feature of a successful banking application to transfer funds to a third party without any inconvenience.

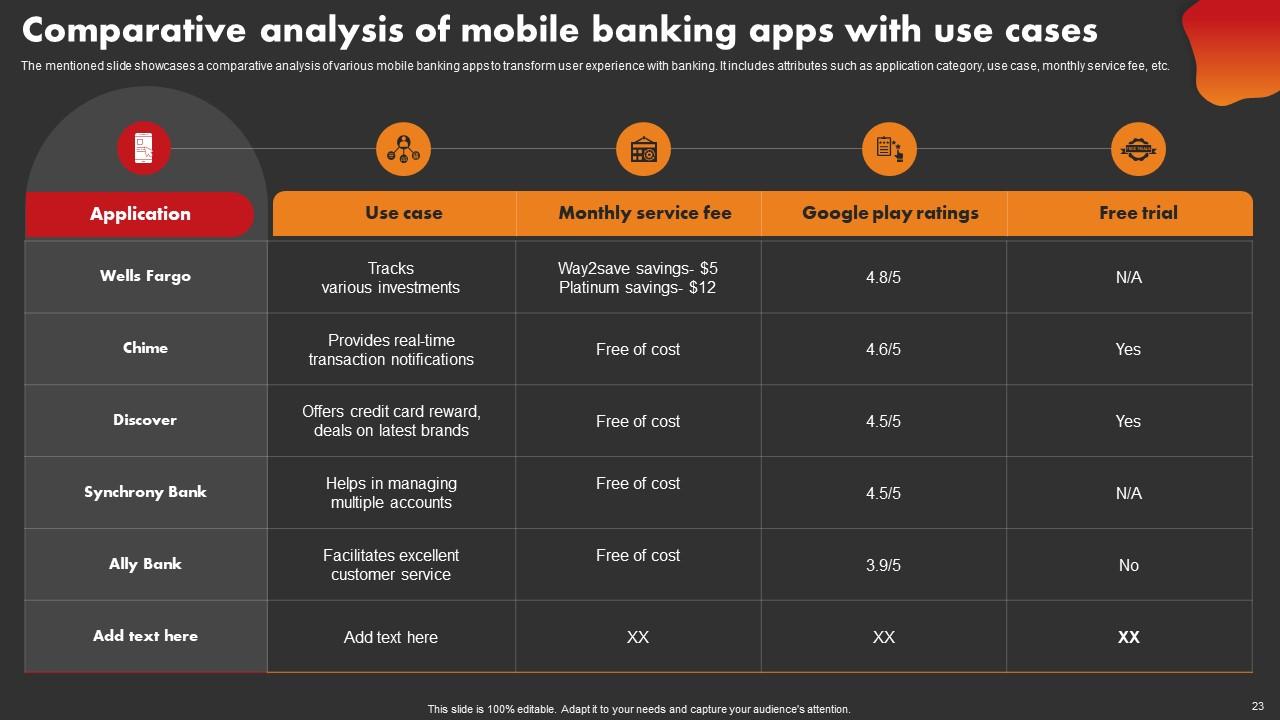

Slide 23: This slide showcases a comparative analysis of various mobile banking apps to transform user experience with banking.

Slide 24: This slide shows title for topics that are to be covered next in the template.

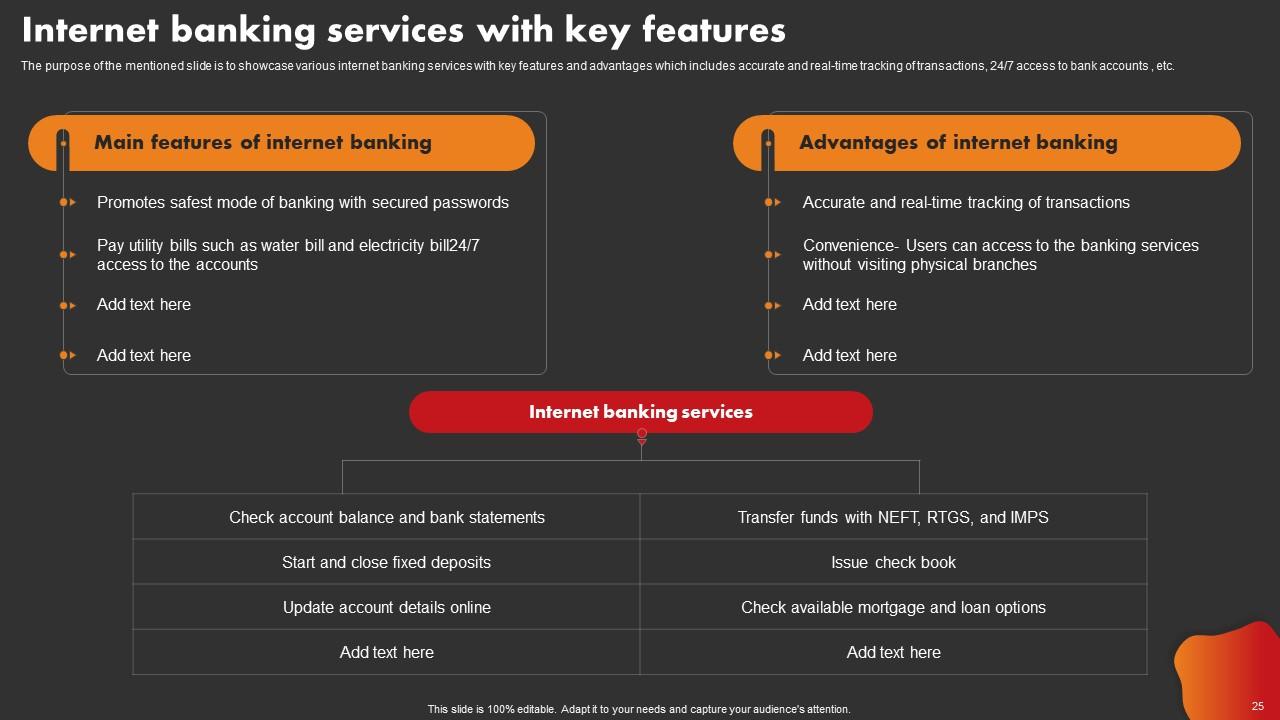

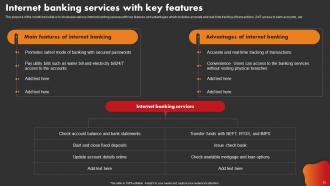

Slide 25: This slide presents various internet banking services with key features and advantages which includes accurate and real-time tracking of transactions etc.

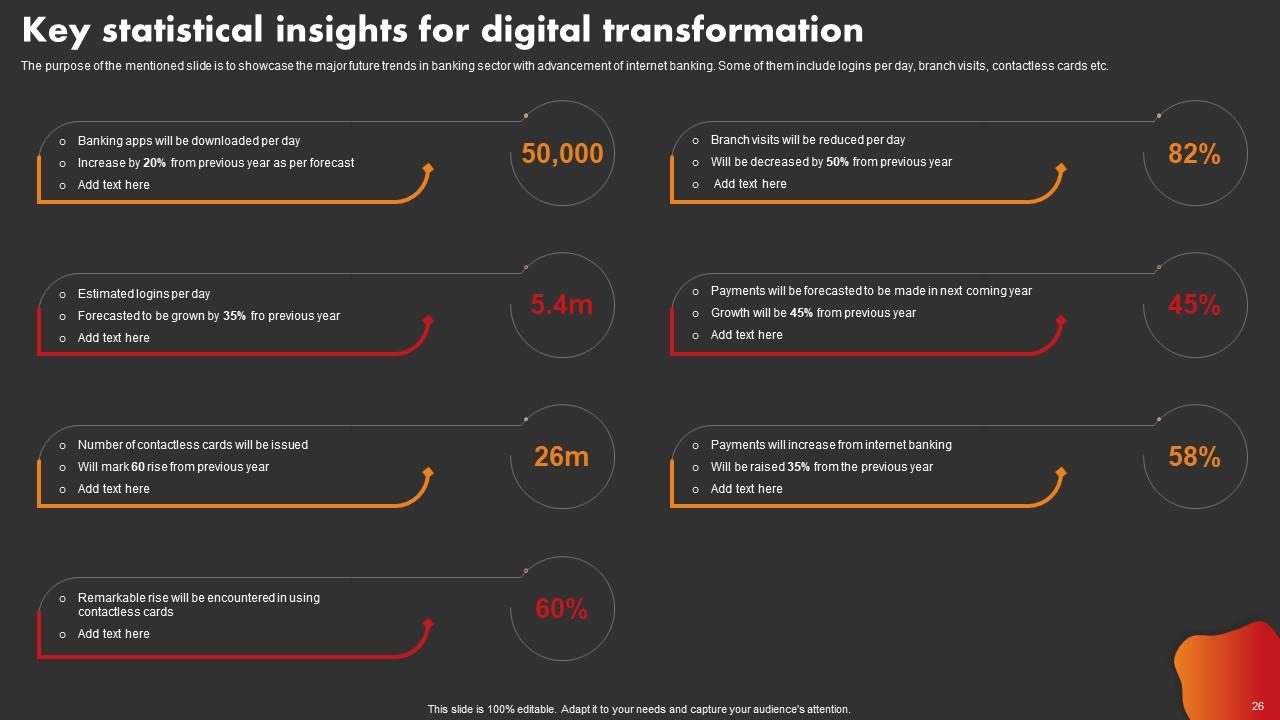

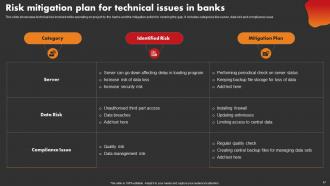

Slide 26: This slide displays the major future trends in banking sector with advancement of internet banking. Some of them include logins per day, branch visits etc.

Slide 27: This slide presents online banking approach as per customer segments and generations. The segments include baby boomers, Gen X, Millennials, and Gen Z.

Slide 28: This slide shows title for topics that are to be covered next in the template.

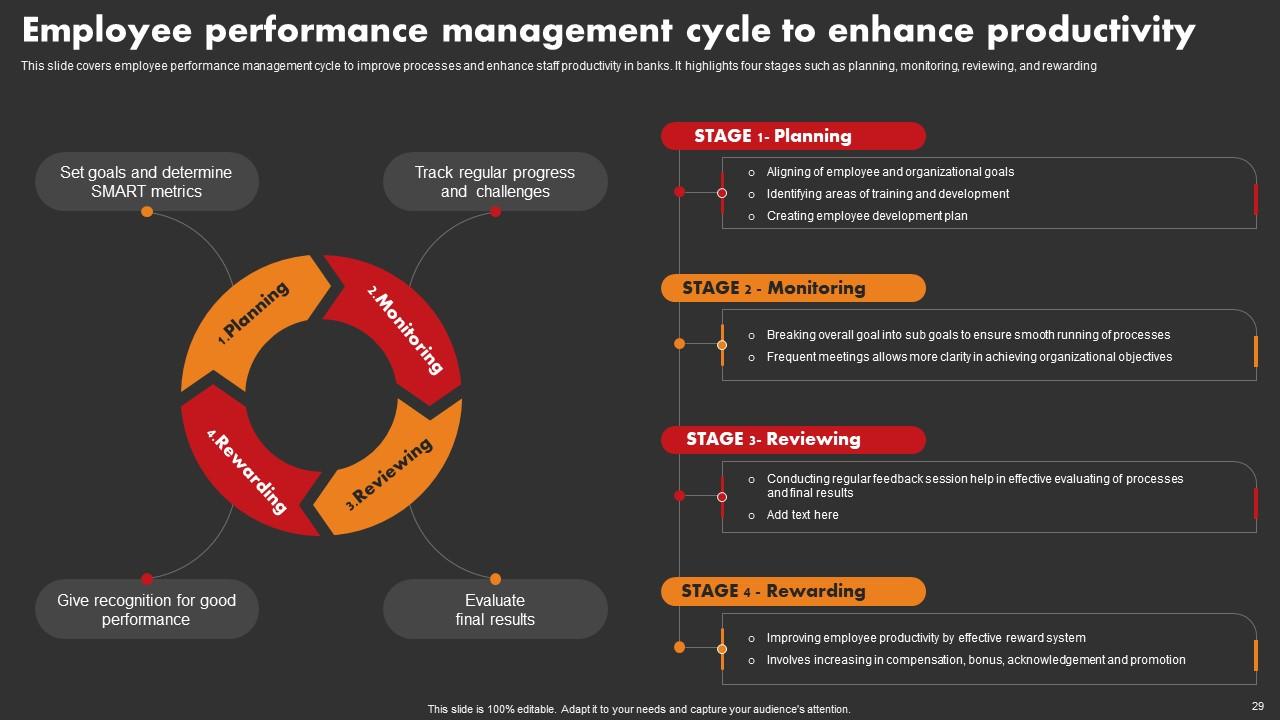

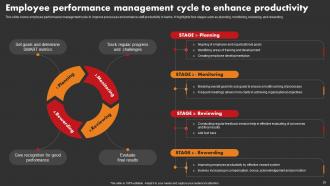

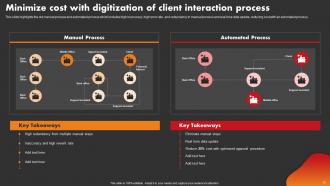

Slide 29: This slide covers employee performance management cycle to improve processes and enhance staff productivity in banks. It highlights four stages.

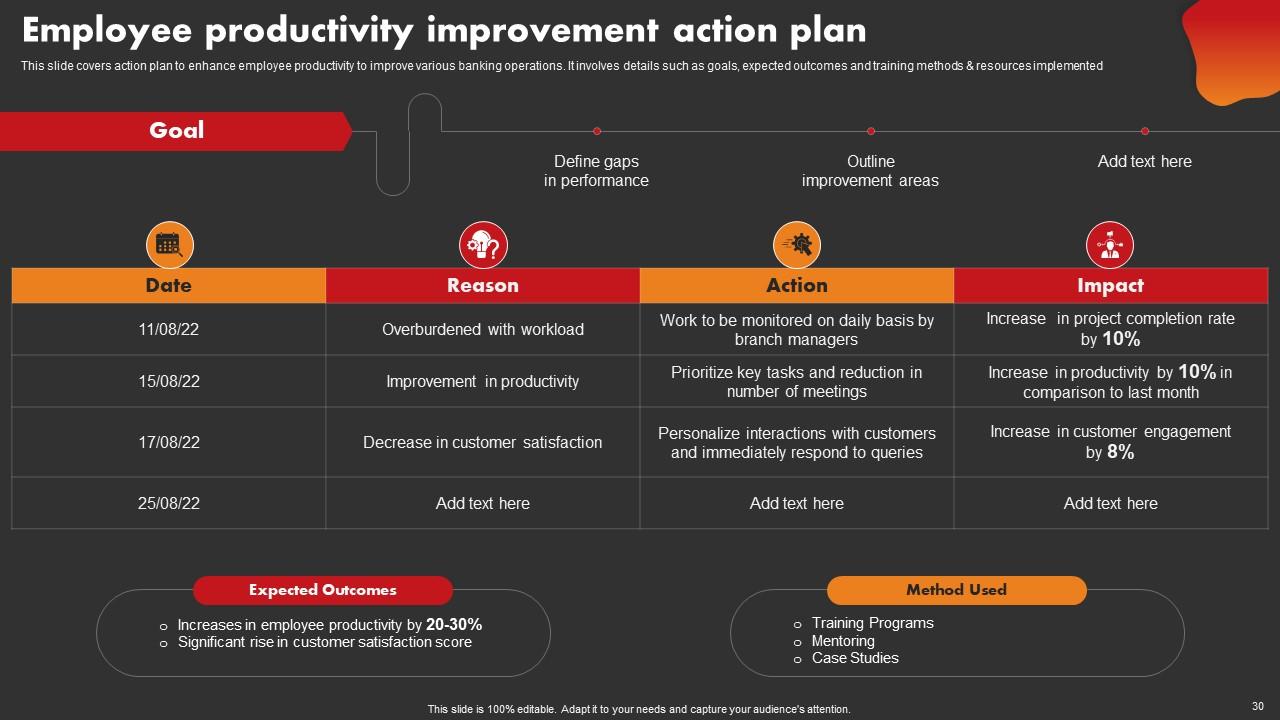

Slide 30: This slide displays action plan to enhance employee productivity to improve various banking operations. It involves details such as goals etc.

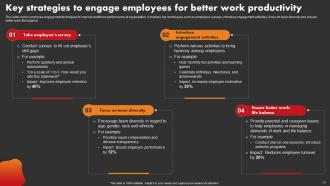

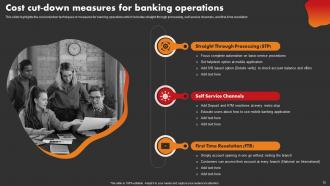

Slide 31: This slide covers employee engagement techniques to improve workforce performance at organization. It involves key techniques such as employees surveys etc.

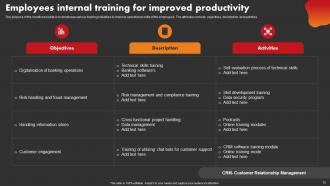

Slide 32: This slide presents various training initiatives to improve operational skills of the employees. The attributes include objectives, description etc.

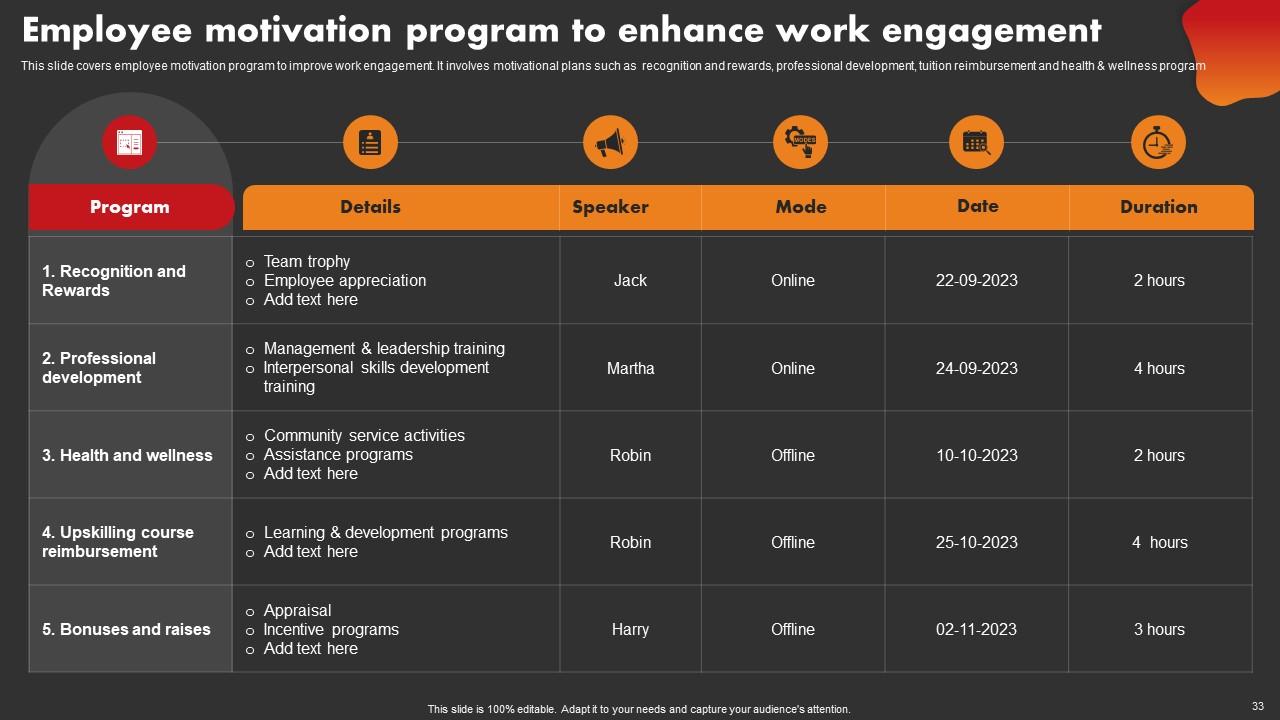

Slide 33: This slide covers employee motivation program to improve work engagement. It involves motivational plans such as recognition and rewards etc.

Slide 34: This slide shows title for topics that are to be covered next in the template.

Slide 35: This slide presents various strategies which can be used for customer loyalty program. It include discount, loyalty points program etc.

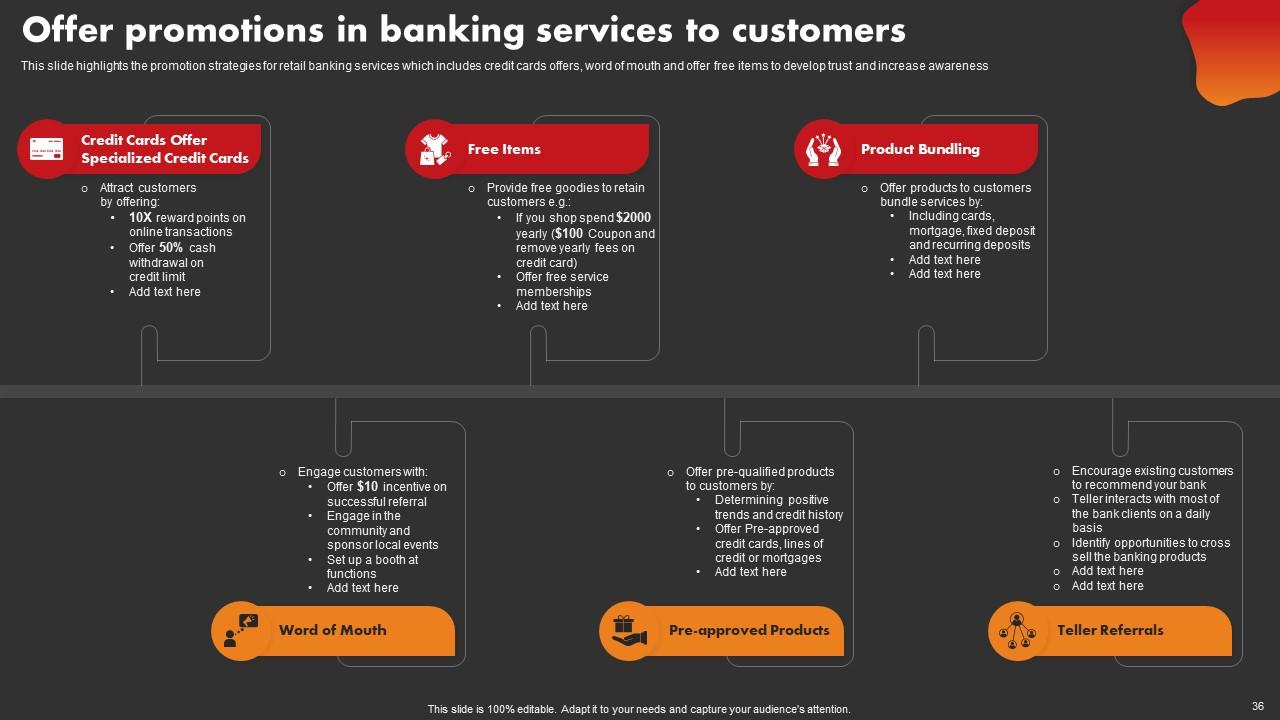

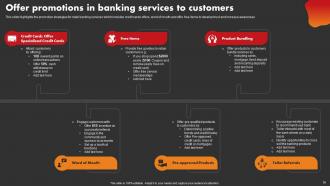

Slide 36: This slide highlights the promotion strategies for retail banking services which includes credit cards offers, word of mouth etc.

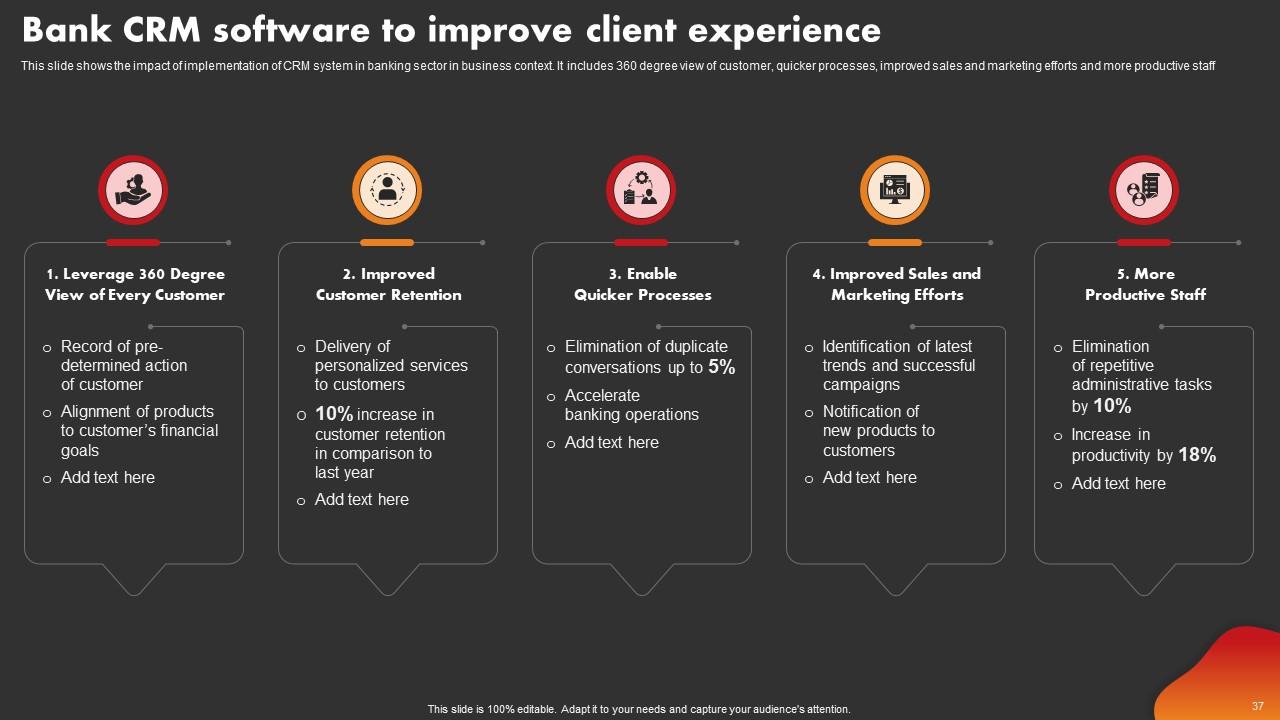

Slide 37: This slide shows the impact of implementation of CRM system in banking sector in business context. It includes 360 degree view of customer etc.

Slide 38: This slide presents a strategic plan that focuses on improving customer-centric processes.

Slide 39: This slide shows title for topics that are to be covered next in the template.

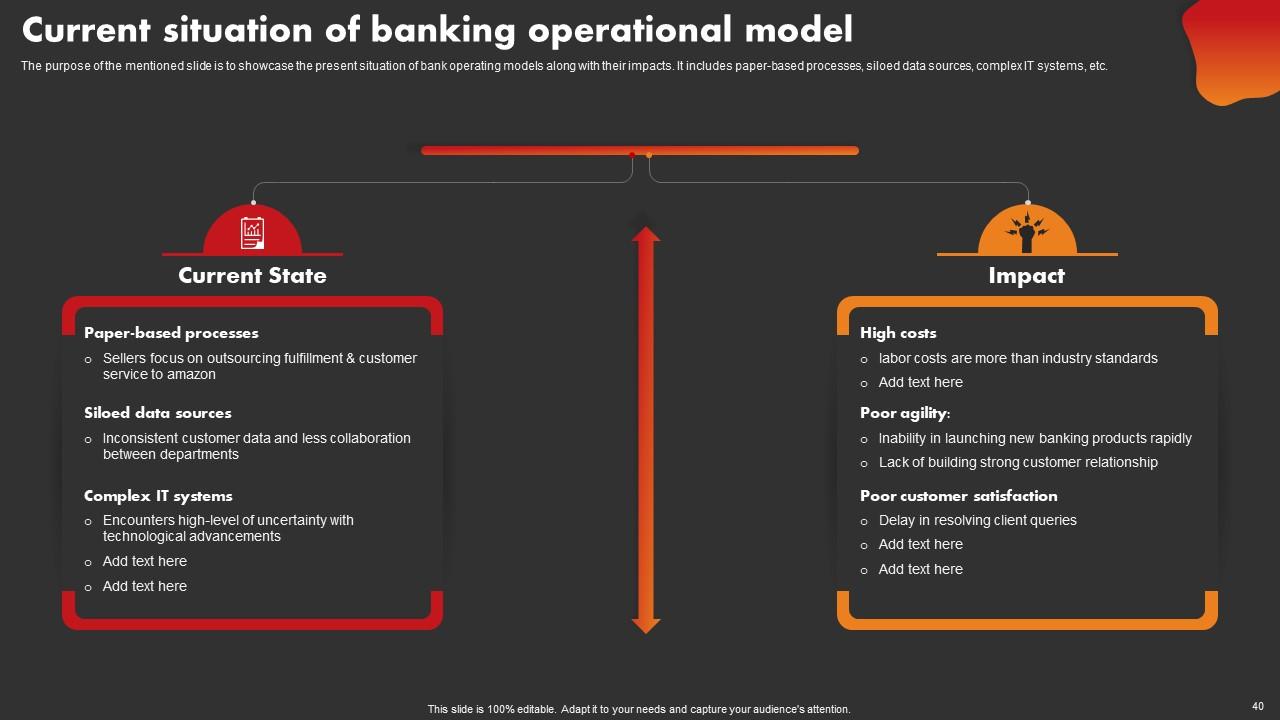

Slide 40: This slide presents the present situation of bank operating models along with their impacts. It includes paper-based processes etc.

Slide 41: This slide is to showcase the operations transformation initiatives to improve banking models. It includes customer process transformation.

Slide 42: This slide highlights the service operating strategy which showcases key objectives or business purposes.

Slide 43: This slide presents a strategic plan to optimize the traditional banking operations model to simplify the various tasks.

Slide 44: This slide shows title for topics that are to be covered next in the template.

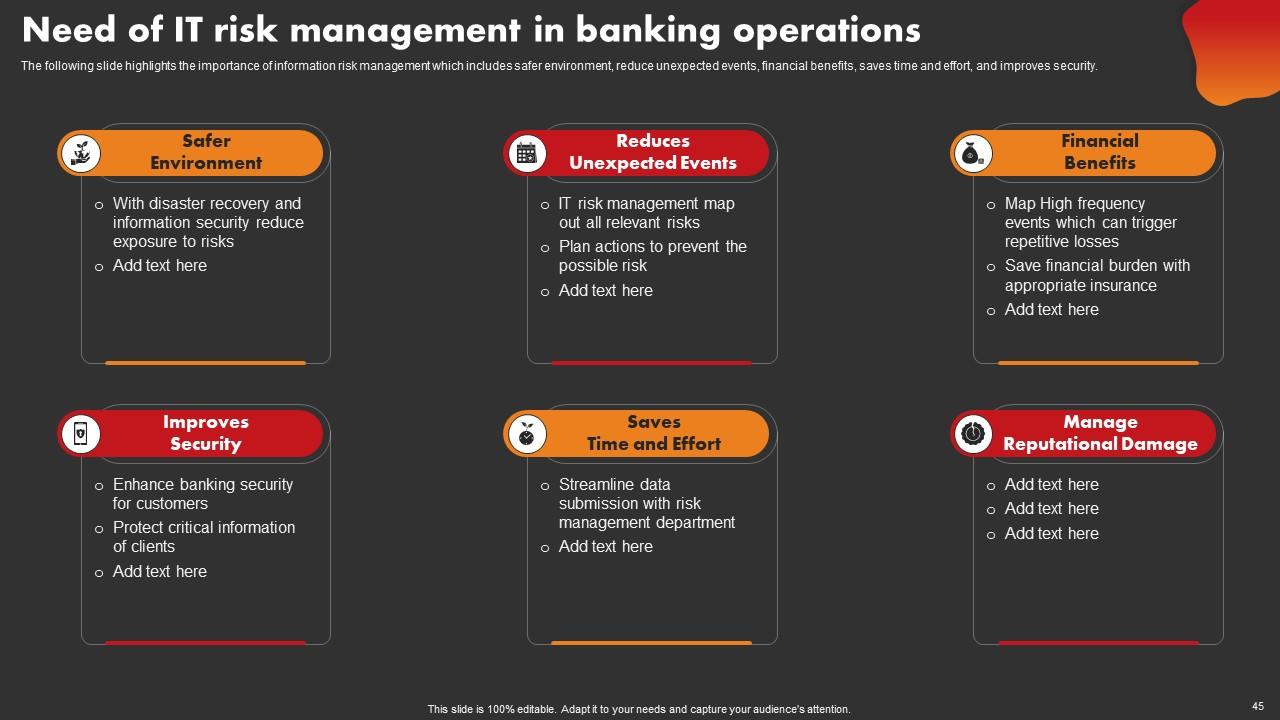

Slide 45: This slide highlights the importance of information risk management which includes safer environment, reduce unexpected events etc.

Slide 46: This slide presents the various ways to improve Internet banking security from hackers and fraudants.

Slide 47: This slide showcases technical risk involved while operating on project by the banks and the mitigation action for covering the gap.

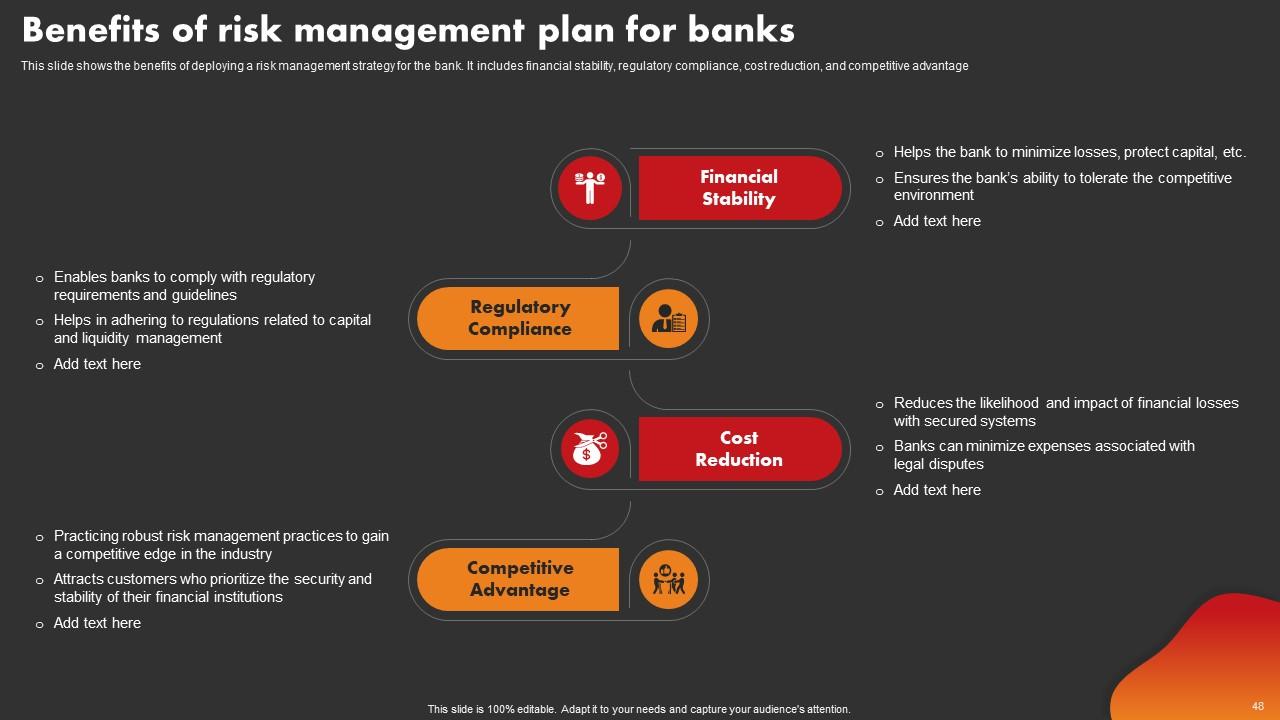

Slide 48: This slide presents the benefits of deploying a risk management strategy for the bank. It includes financial stability, regulatory compliance etc.

Slide 49: This slide shows title for topics that are to be covered next in the template.

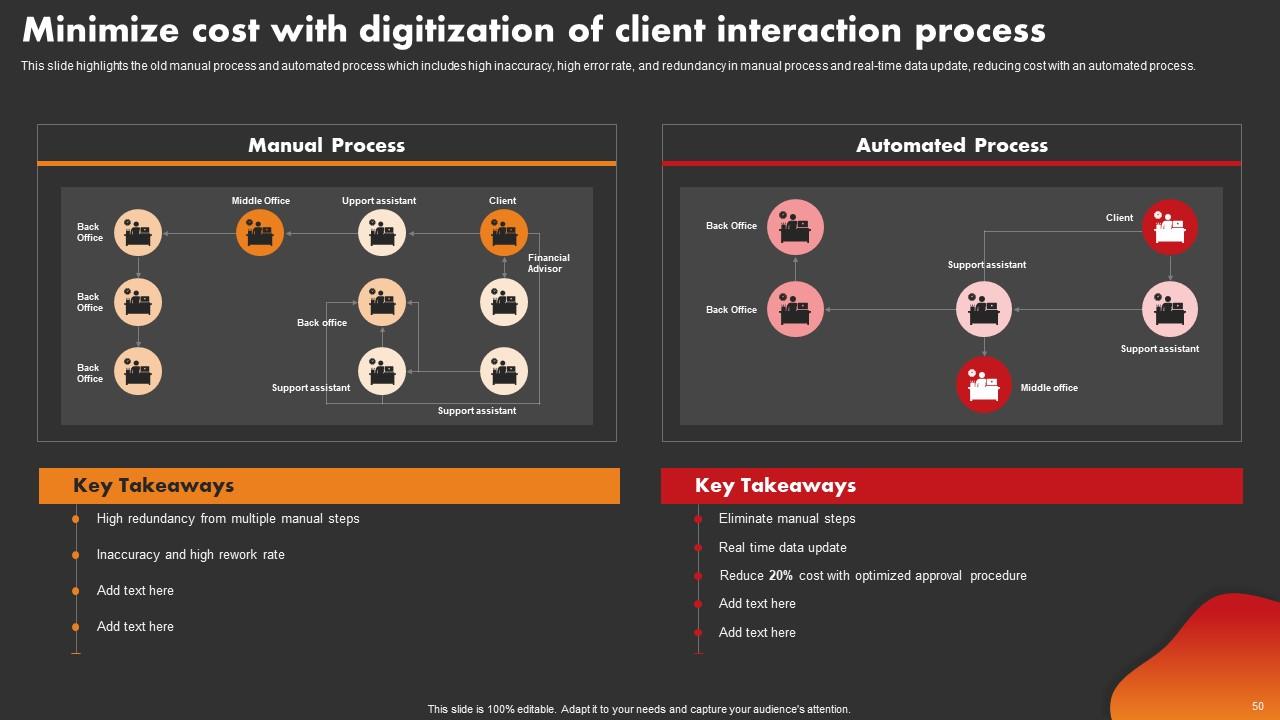

Slide 50: This slide highlights the old manual process and automated process which includes high inaccuracy, high error rate, and redundancy.

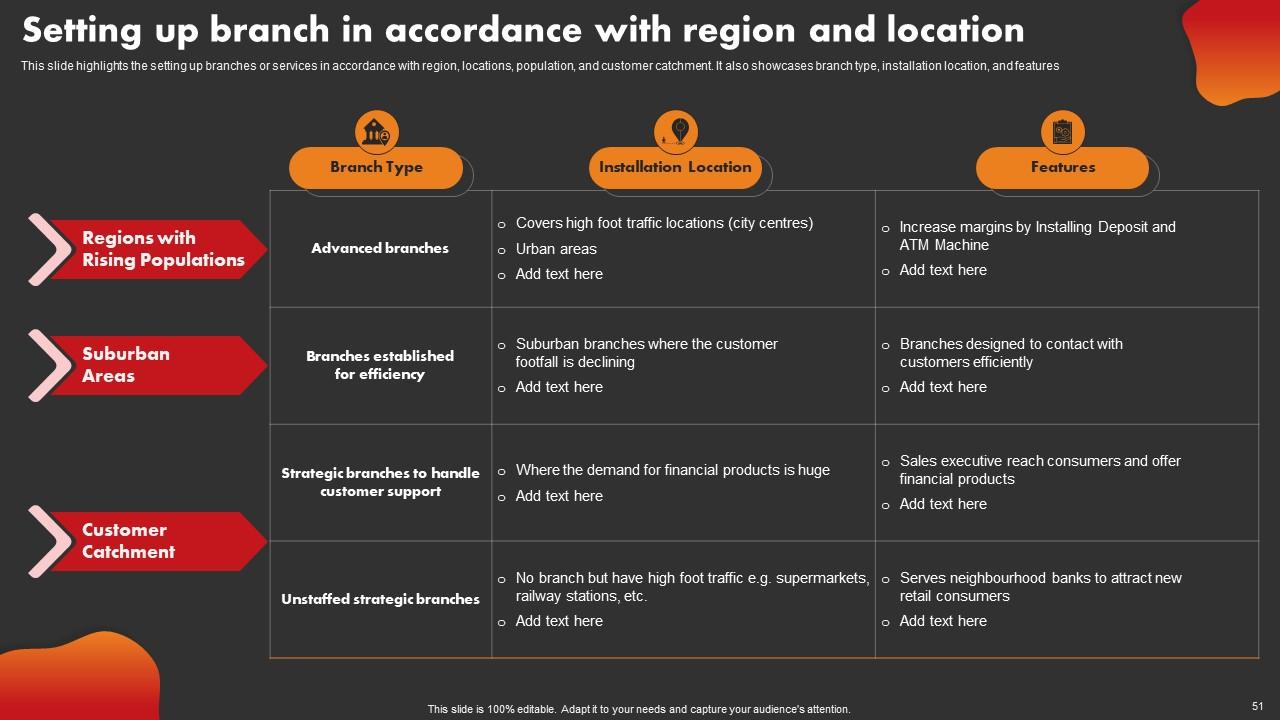

Slide 51: This slide presents the setting up branches or services in accordance with region, locations, population, and customer catchment.

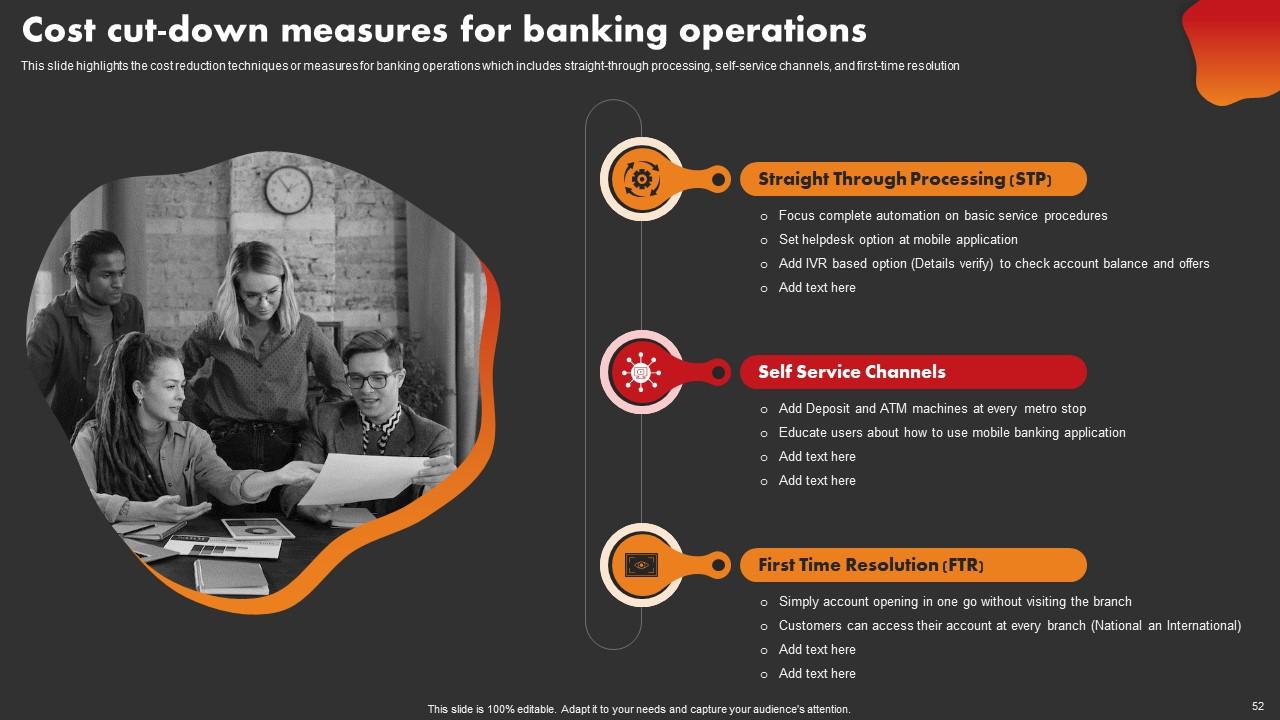

Slide 52: This slide highlights the cost reduction techniques or measures for banking operations which includes straight-through processing etc.

Slide 53: This slide shows title for topics that are to be covered next in the template.

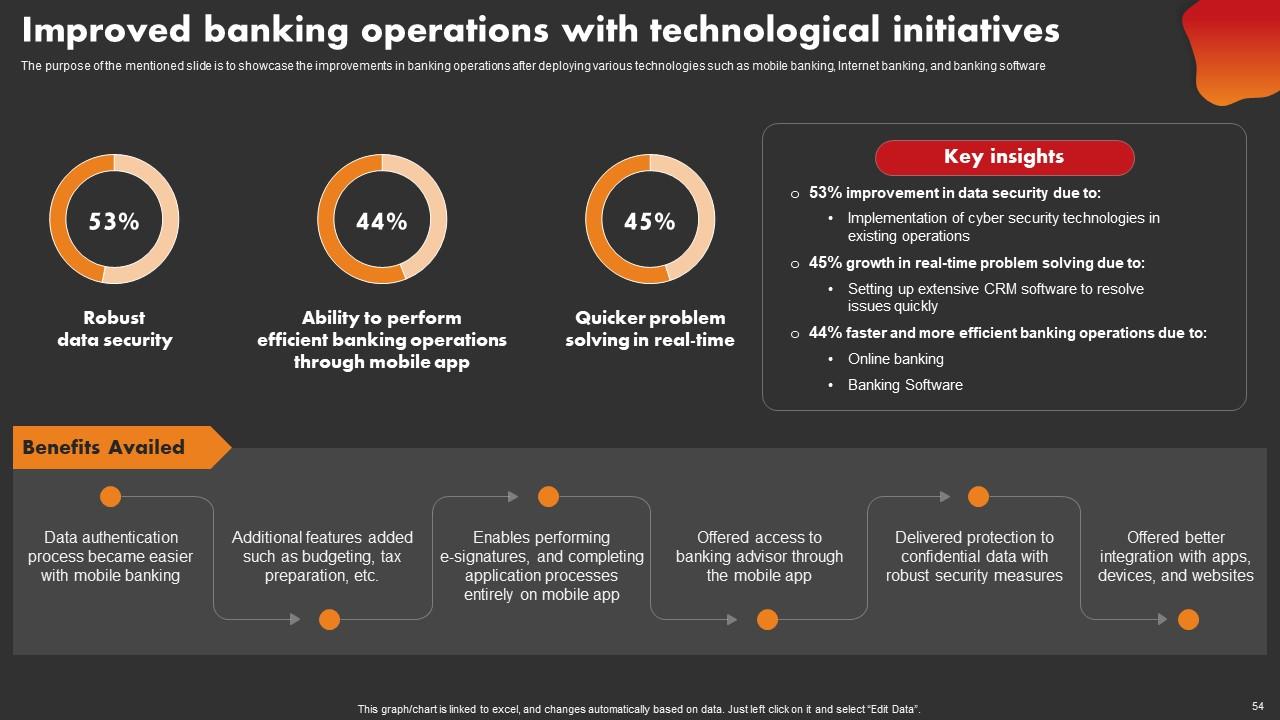

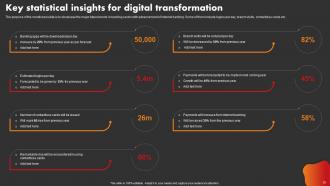

Slide 54: This slide presents the improvements in banking operations after deploying various technologies such as mobile banking, Internet banking, and banking software.

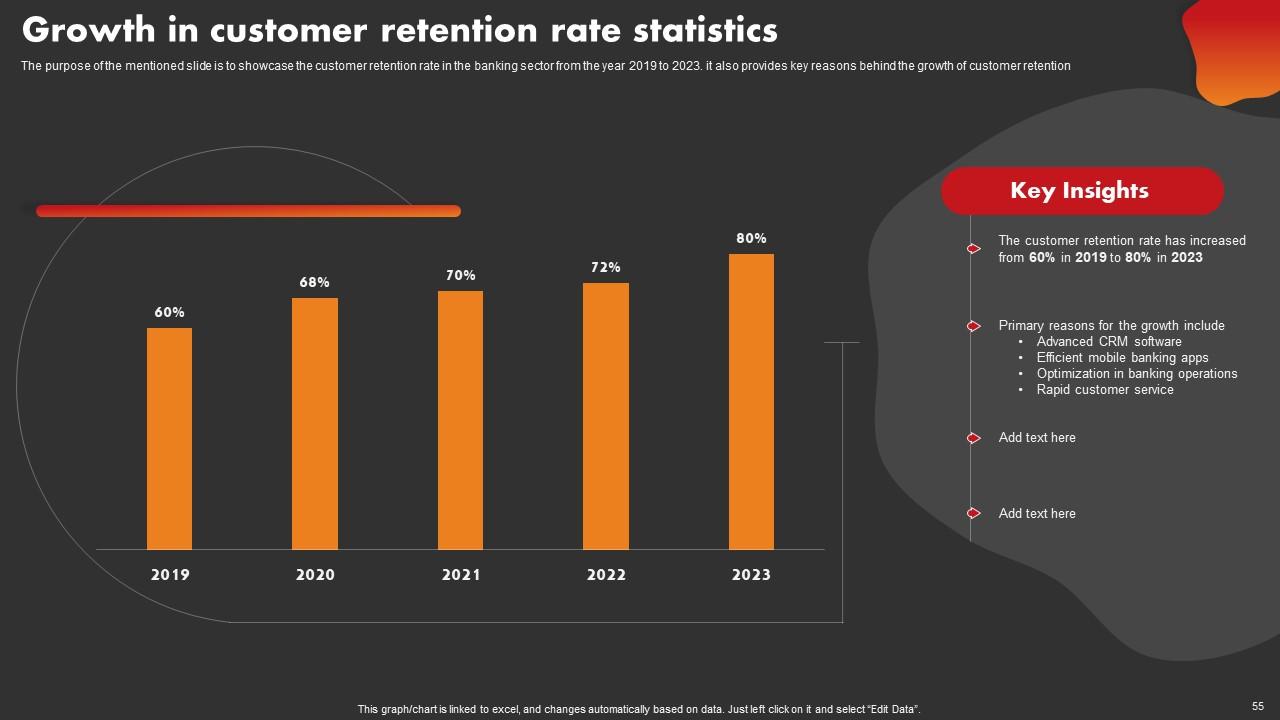

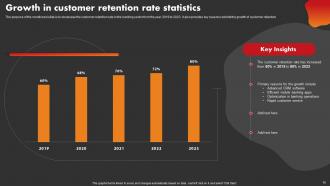

Slide 55: This slide displays the customer retention rate in the banking sector from the year 2019 to 2023. It also provides key reasons behind the growth of customer retention.

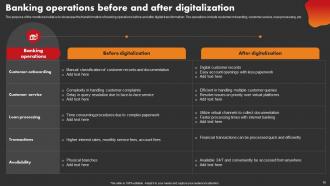

Slide 56: This slide presents the transformation of banking operations before and after digital transformation.

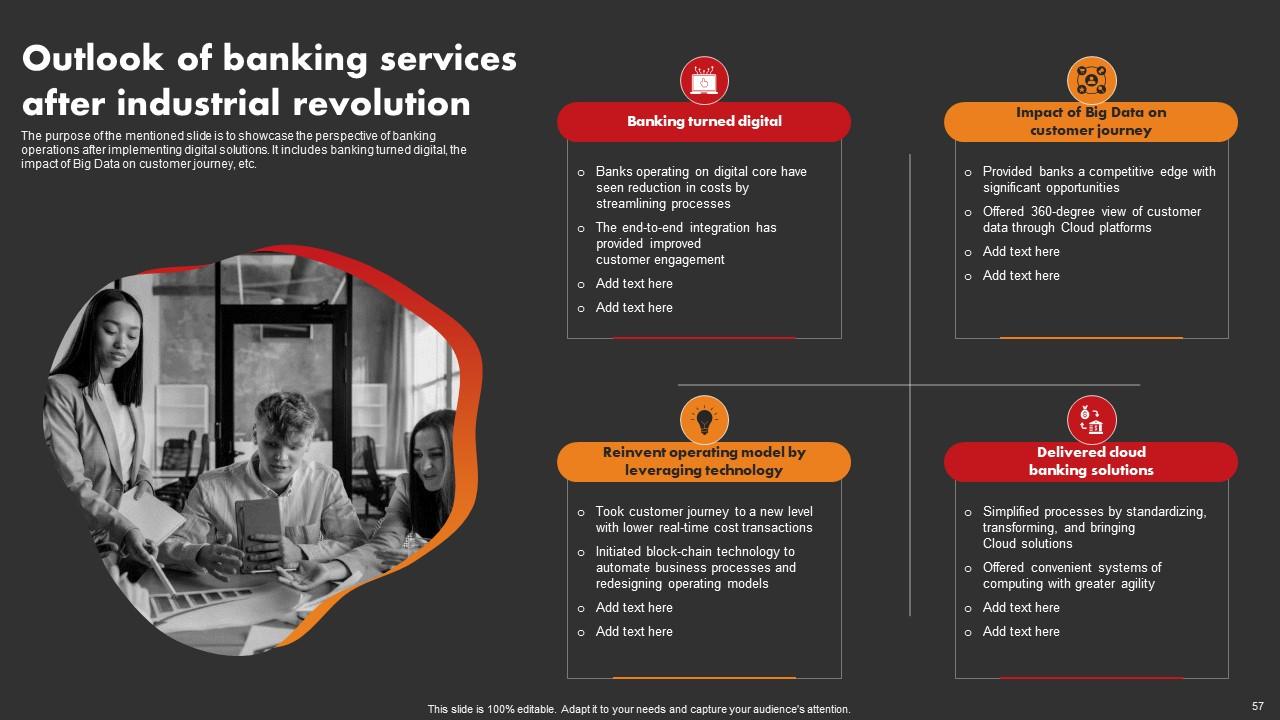

Slide 57: This slide displays the perspective of banking operations after implementing digital solutions. It includes banking turned digital etc.

Slide 58: This slide shows title for topics that are to be covered next in the template.

Slide 59: This slide presents a performance tracking dashboard of banking operations. It includes metrics such as accounts opened and closed, referrals by product, etc.

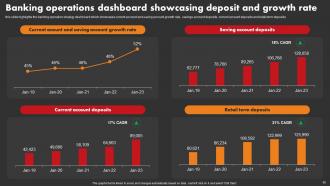

Slide 60: This slide highlights the banking operation strategy dashboard which showcases current account and saving account growth rate, savings account deposits etc.

Slide 61: This slide shows title for topics that are to be covered next in the template.

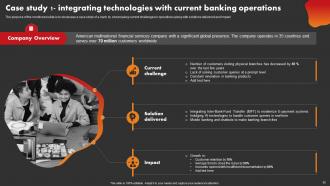

Slide 62: This slide presents a case study of a bank by showcasing current challenges in operations along with solutions delivered and impact.

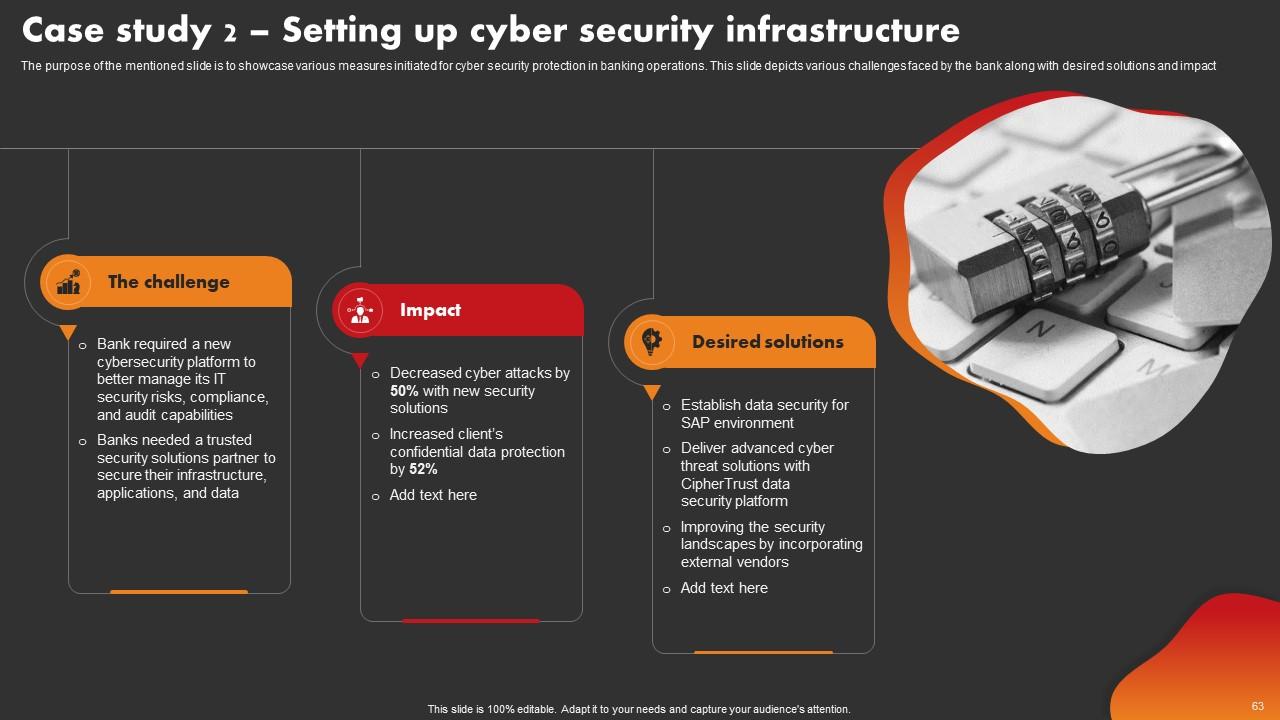

Slide 63: This slide displays various measures initiated for cyber security protection in banking operations.

Slide 64: This slide shows all the icons included in the presentation.

Slide 65: This slide is titled as Additional Slides for moving forward.

Slide 66: This slide depicts Venn diagram with text boxes.

Slide 67: This slide provides 30 60 90 Days Plan with text boxes.

Slide 68: This slide contains Puzzle with related icons and text.

Slide 69: This is an Idea Generation slide to state a new idea or highlight information, specifications etc.

Slide 70: This slide presents Roadmap with additional textboxes.

Slide 71: This is a Thank You slide with address, contact numbers and email address.

Strategic Improvement In Banking Operations Powerpoint Presentation Slides with all 80 slides:

Use our Strategic Improvement In Banking Operations Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Helpful product design for delivering presentation.

-

One-stop solution for all presentation needs. Great products with easy customization.