Impact Cryptocurrency On Banking Sector Training Ppt

These slides, in detail, cover the adoption of cryptocurrency in the banking sector. The multiple use cases are KYC and AML regulations, payments, smart contracts, easy onboarding, and expert assistance.

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Impact Cryptocurrency on Banking Sector. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. You can add or delete the content as per your need.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

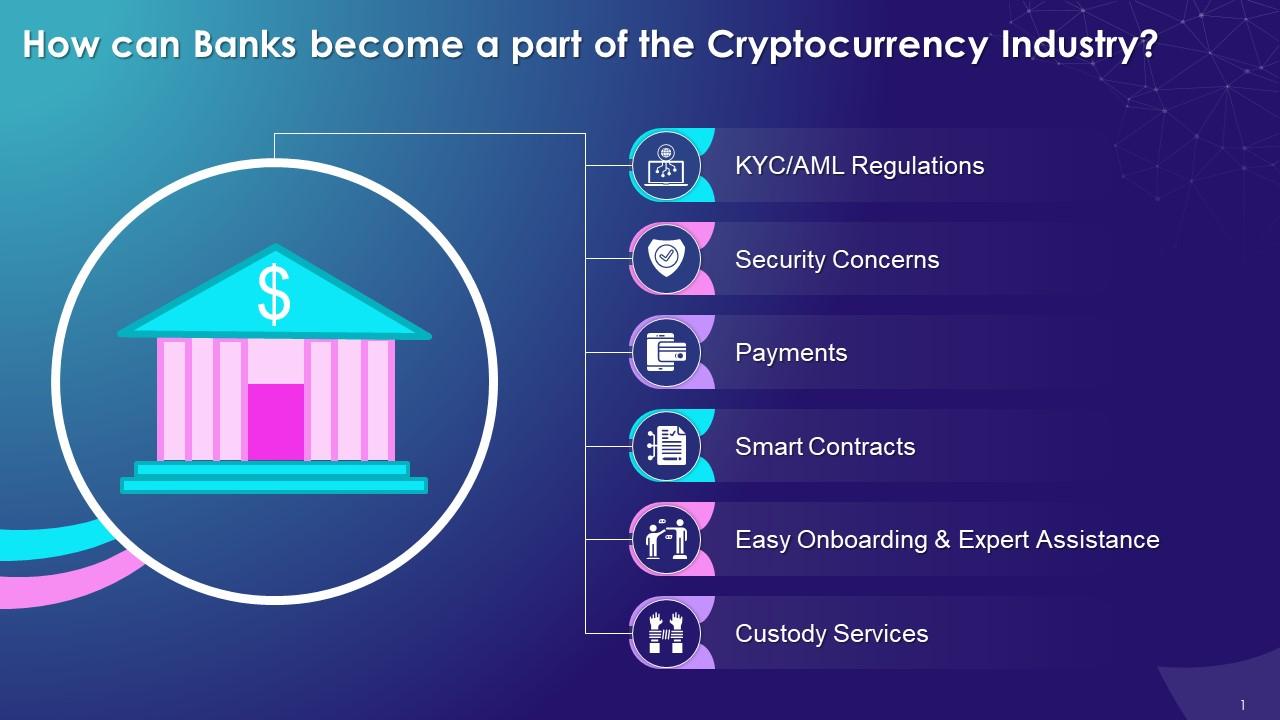

Slide 1

This slide highlights the ways in which banks can be involved in the cryptocurrency industry. Cryptocurrency adoption can streamline, enhance, and modernize financial services. Some recent industry breakthroughs have alleviated banks' fears about the risks and allowed them to explore the potential benefits of cryptocurrency.

Slide 2

This slide discusses how banks can help in implementing KYC/AML regulations as a way to be part of the cryptocurrency industry. In 2019, Financial Crimes Enforcement Network (FinCEN) concluded that any cryptocurrency transactions and custody services provided through crypto companies must still comply with AML/KYC laws.

Instructor’s Notes: Banks, loan officers, and other institutions could benefit from a streamlined view of shared data on individuals due to blockchain. This means that all client data may someday be stored on a single blockchain. All financial institutions might use this blockchain data, allowing for quick customer reviews and identifying any red flags that signal illicit or criminal behavior.

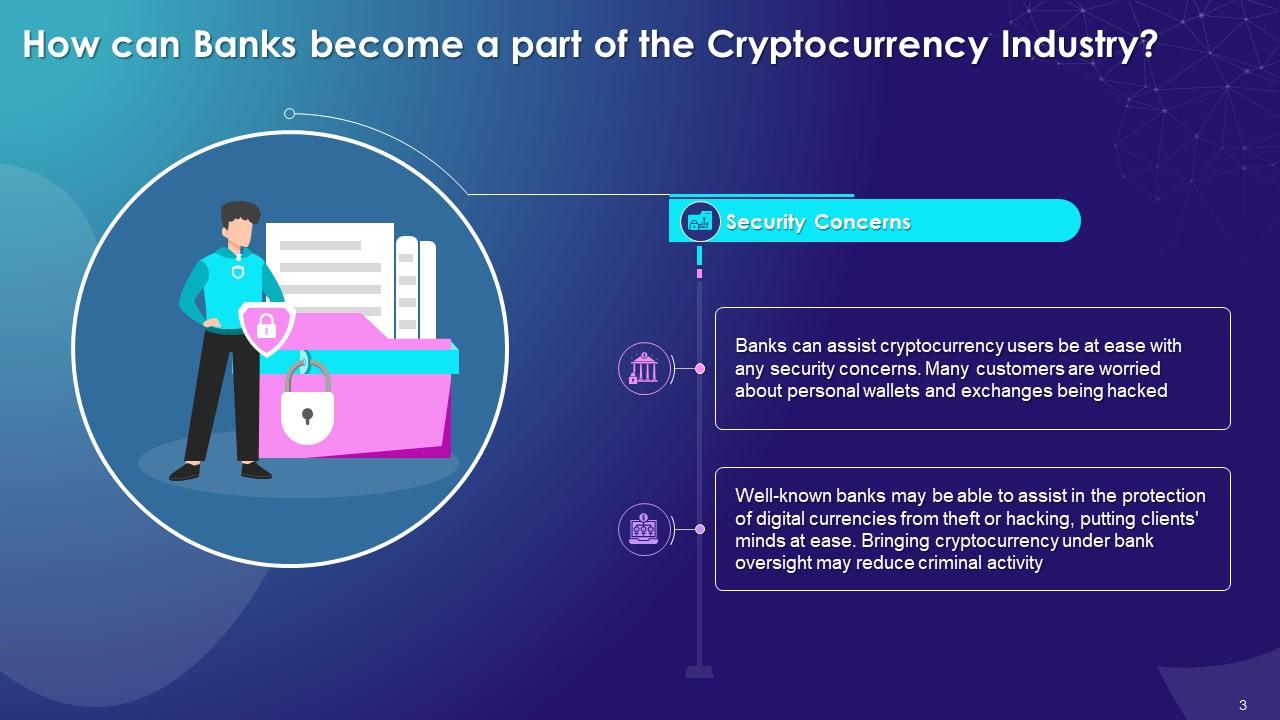

Slide 3

This slide discusses how banks can help in mitigating security concerns around cryptocurrency. Banks can assist cryptocurrency users be at ease with any security concerns. Many customers are worried about personal wallets and exchanges being hacked. Well-known banks may be able to assist in the protection of digital currencies from theft or hacking, putting clients' minds at ease.

Slide 4

This slide discusses how cryptocurrency can help banks in payment systems. As per the Office of the Comptroller of the Currency (OCC), banks can use public blockchains, including stablecoins, to speed up their payment operations.

Slide 5

This slide discusses how banks can help in setting up smart contracts and be part of the cryptocurrency industry. As the completion of the transactions is dependent on a computer code rather than an individual's behaviour, there is a reduced level of trust between the parties while entering into a smart contract arrangement. Banks could bridge this gap in trust by acting as a dependable third party for smart contracts used in commercial loans, mortgages, letters of credit, and other transactions..

Slide 6

This slide discusses how banks can help in providing easy onboarding services and expert assistance for the cryptocurrency industry. Banks might be able to help bring in new, less experienced individual investors by offering tools that make it easier for their clients to accept cryptocurrency. By acting as a responsible third party that is well-respected in the finance business and can keep clients' funds safe, banks may reduce some of the burdens of investors who aren't specialists in the nuances of crypto.

Slide 7

This slide discusses how banks can help in providing custody services for the cryptocurrency industry. According to OCC or the Office of the Comptroller of the Currency, banks and savings associations could provide crypto custody services for customers, including keeping unique cryptographic keys for accessing private wallets.

Impact Cryptocurrency On Banking Sector Training Ppt with all 23 slides:

Use our Impact Cryptocurrency On Banking Sector Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Commendable slides with attractive designs. Extremely pleased with the fact that they are easy to modify. Great work!

-

Mesmerized with the fantastic collection! Super sleek, relevant infographics.