Overview of Money Laundering and its Impact Training Ppt

The PowerPoint Training Deck on Overview of Money Laundering and its Impact offers an in depth exploration of money laundering, its mechanisms, and wide ranging impacts. It commences with an Introduction to Money Laundering, followed by Important Statistics Around Money Laundering, which provides a quantitative view of its extent and influence. The PPT Deck then covers the Stages of Money Laundering, comprising Placement, Layering, and Integration. The Relationship between Corruption and Money Laundering elucidates the intricate links between these two phenomena. Further, it examines the Impact of Money Laundering, covering its economic, business, and social repercussions, including its adverse effects on economies. The Money Laundering Methods in Practice section delves into specific techniques used in both financial and non financial sectors, enriched with case studies. It also discusses trade based laundering and the use of shell, shelf, and front companies and practical guidelines on How to Identify Money Laundering The Red Flags. The Presentation also has Key Takeaways and Discussion Questions related to the topic to make the training session more interactive. The deck contains PPT slides on About Us, Vision, Mission, Goal, 30 60 90 Days Plan, Timeline, Roadmap, Training Completion Certificate, Energizer Activities, Client Proposal, and Assessment Form.

The PowerPoint Training Deck on Overview of Money Laundering and its Impact offers an in depth exploration of money launder..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Training Deck on Overview of Money Laundering and its Impact. This deck comprises of 43 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

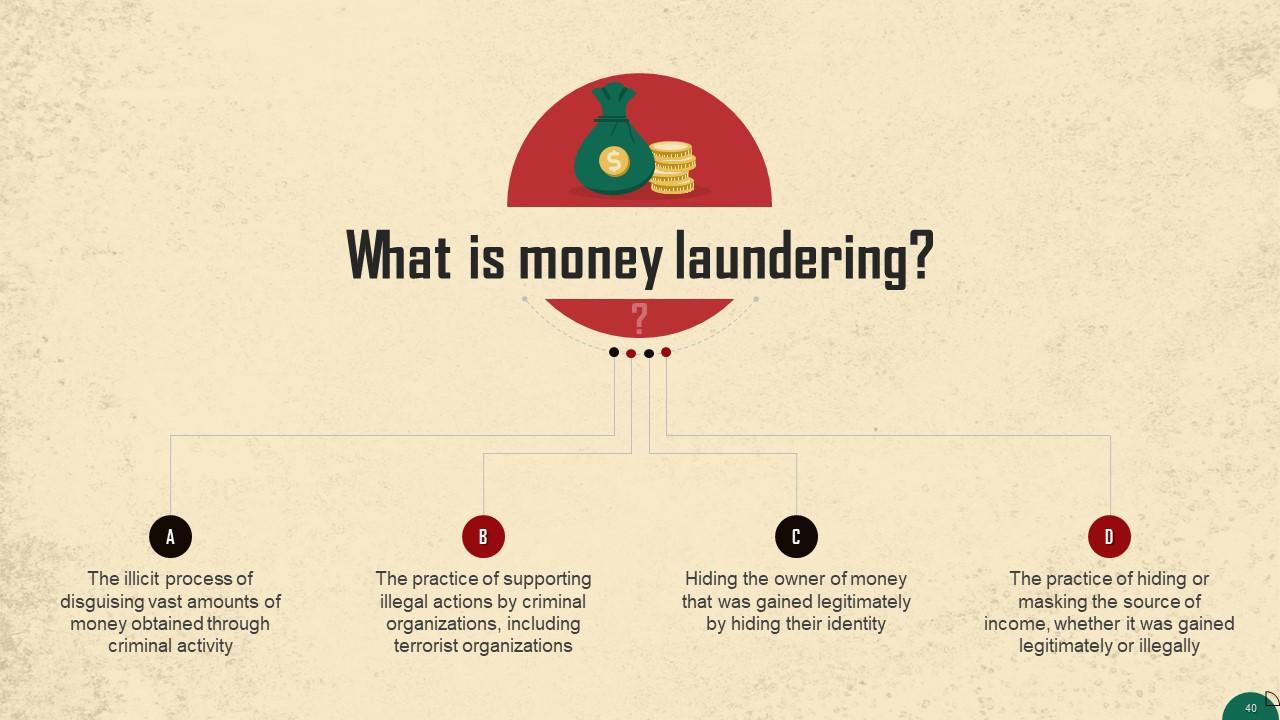

Slide 3

This slide gives the definition of money laundering. It is the illicit process of disguising vast amounts of money obtained through criminal activity, like drug trafficking or the financing of terrorism, as originating from a legitimate source.

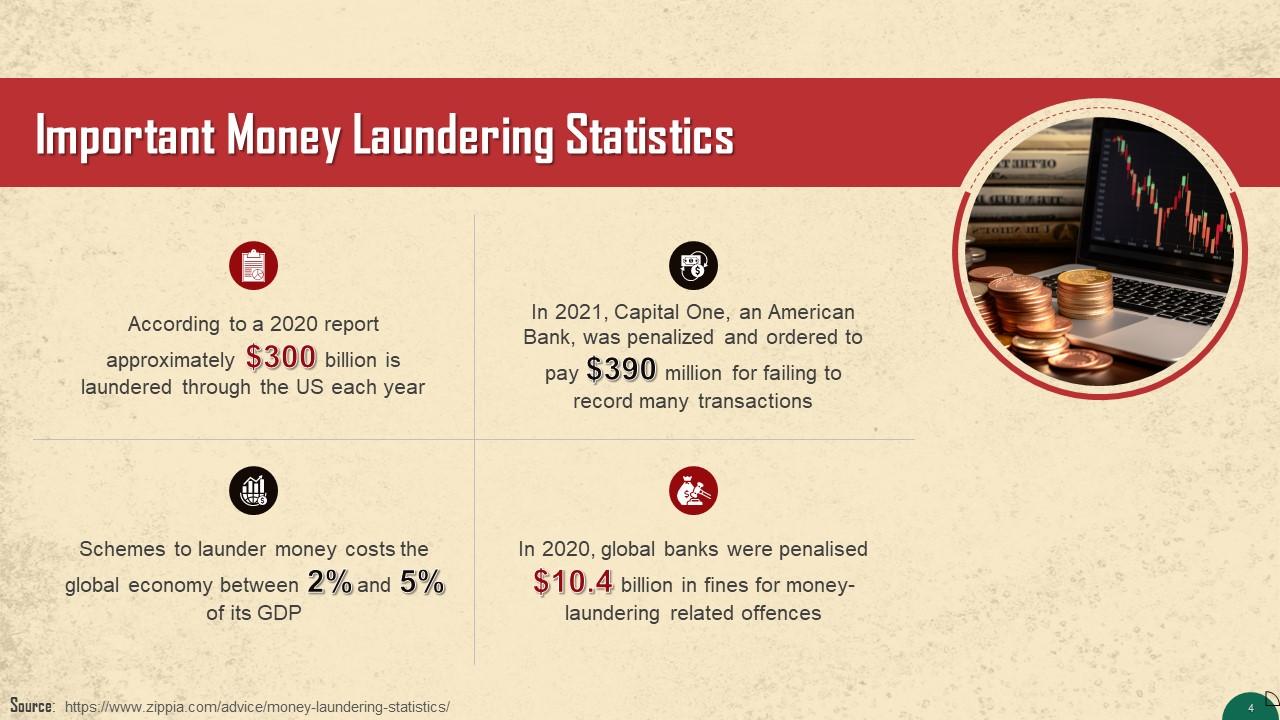

Slide 4

This slide depicts some crucial statistics around money laundering. Approximately $300 billion is laundered through the US each year. Schemes to launder money costs the global economy between 2% and 5% of its GDP.

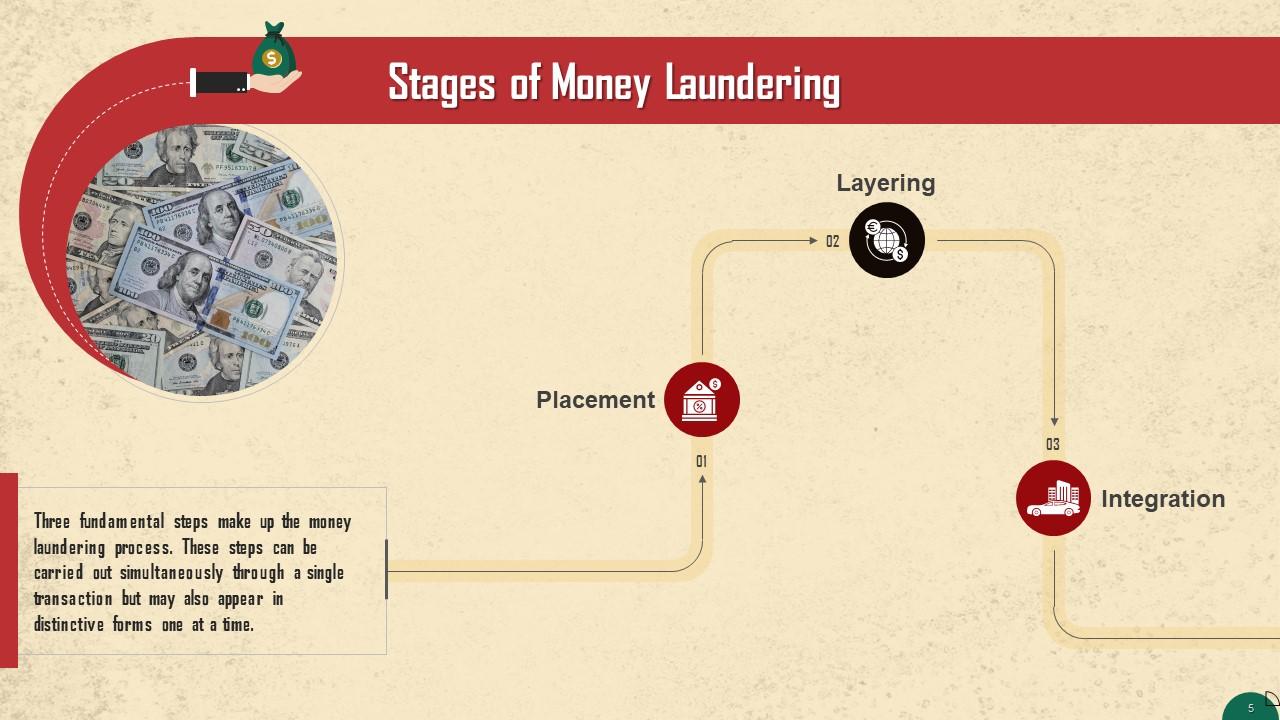

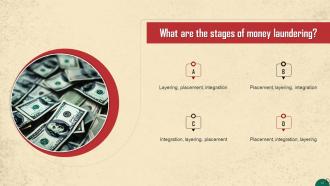

Slide 5

This slide showcases stages of the money laundering process. Three fundamental steps make up the money laundering process. These are placement, layering, and integration.

Slide 6

This slide discusses the first stage of the money laundering process known as placement. The placement stage is where "dirty" money or the proceeds of crime are first introduced into the legal financial system.

Instructor’s Notes:

- Currency Smuggling: Cash can be stored in a suitcase and transported to another country illegally

- Repayment of Loans/Credit Cards: Payment of a credit card bill or loan proceeds with illicit money

- Blending Funds: Another method of money laundering is using a cash-based business to combine illicit funds with legitimate sale receipts

- Smurfing: The "smurf" method entails the use a number of people, known as smurfs, who exchange illicit funds (in smaller and less conspicuous amounts) for highly liquid items such as traveler cheques, bank drafts, or deposited directly into savings accounts

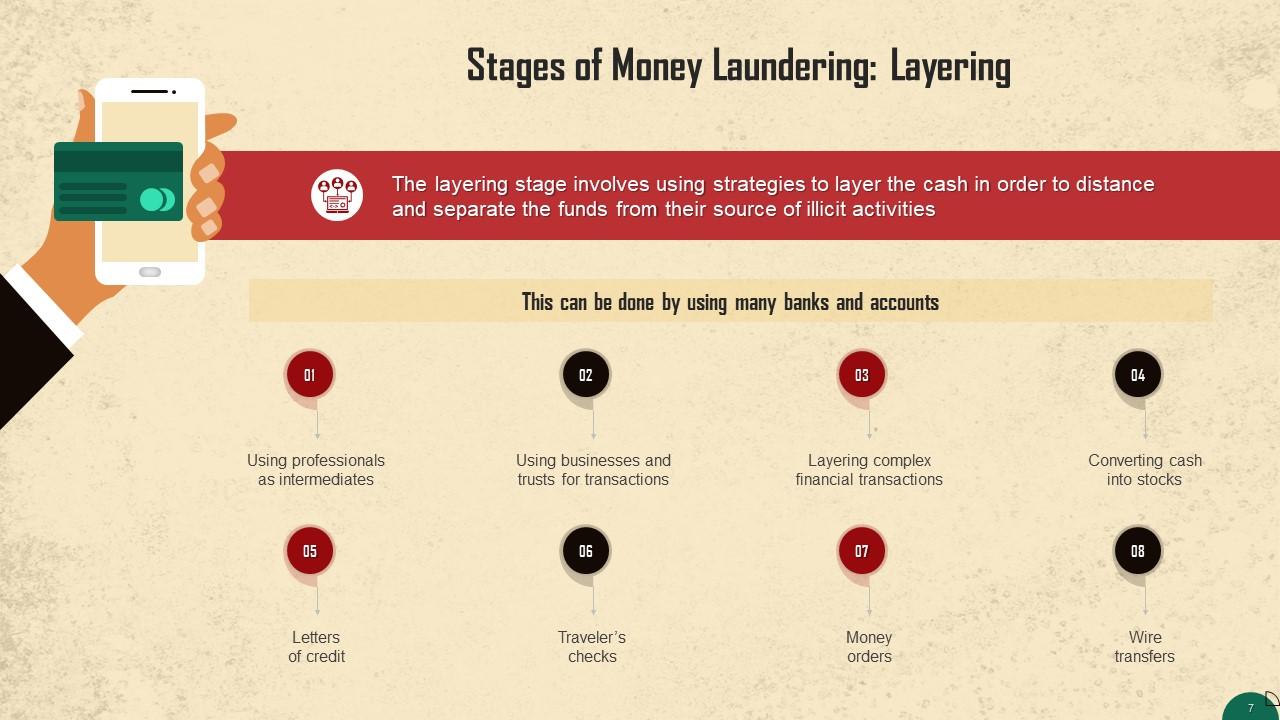

Slide 7

This slide talks about the second stage of the money laundering process known as layering. The layering stage involves using strategies to layer the cash to separate funds from their source of illicit activities.

Instructor’s Notes: One of the main goals of the layering stage is to confuse any investigation. Money launderers try and position themselves far away from the place where the illicit gains were sourced from.

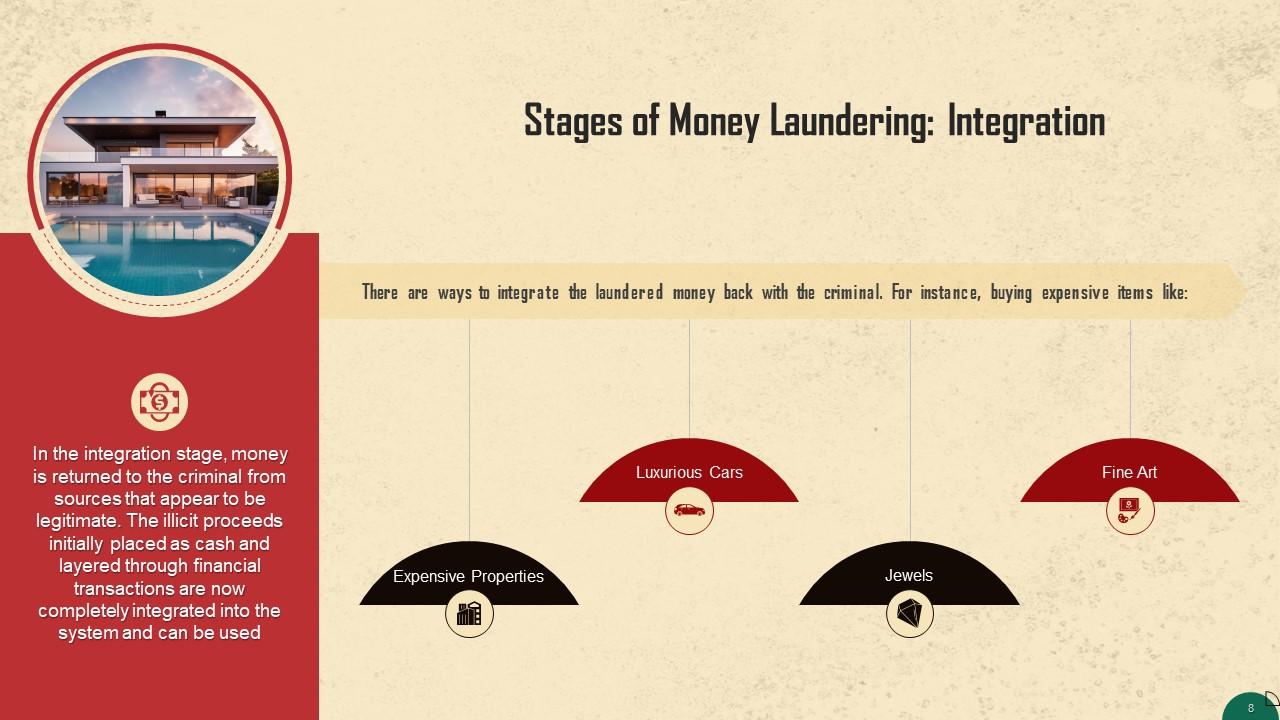

Slide 8

This slide discusses the third stage of the money laundering process known as integration. In the integration stage, the aim is to reunite the money with criminals in a way that does not attract attention and seems to originate from a legitimate source.

Slide 9

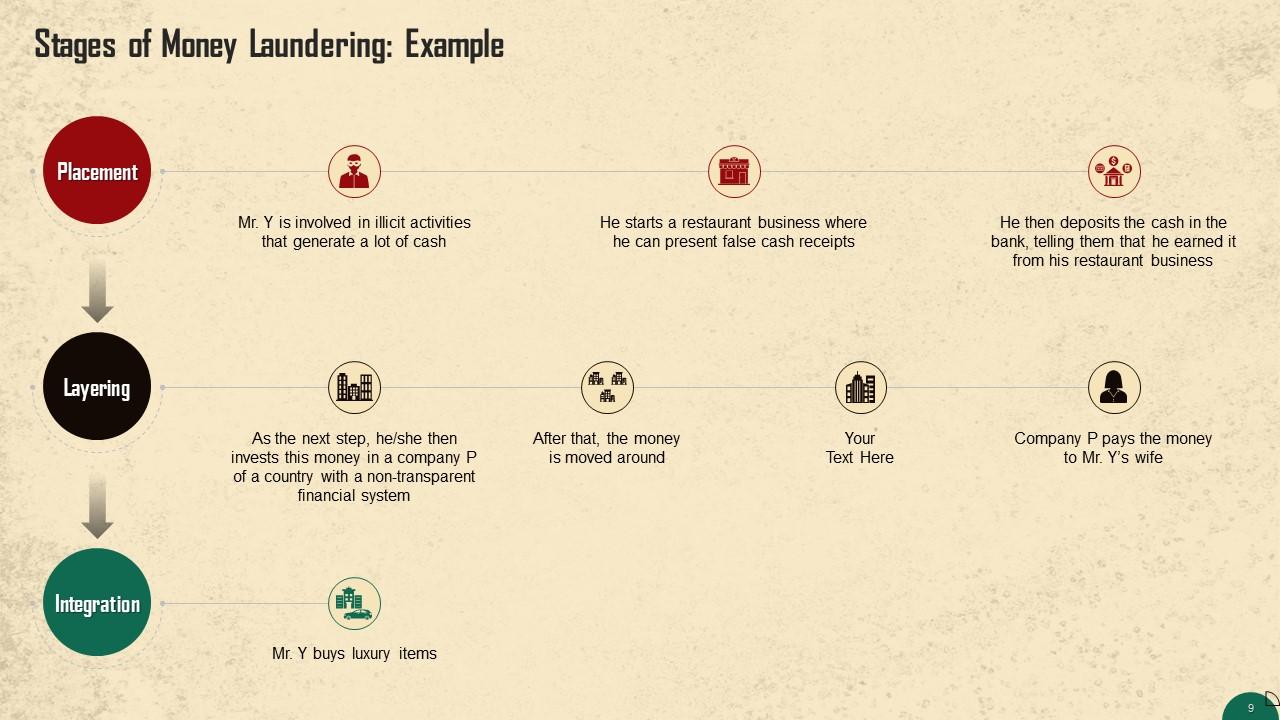

This slide illustrates an example of money laundering through its stages of placement, layering, and integration.

Slide 10

This slide discusses about the relationship between money laundering and corruption. To benefit effectively from public goods, the source of all illegal gains must be hidden or concealed. Therefore, corrupt officials use the technique of money laundering to add layers to these stolen or illegally obtained assets to avoid their confiscation.

Slide 11

This slide discusses the impact of money laundering across the globe on economic, business, and social sectors.

Slide 12

This slide talks about the economic consequences of money laundering. Money launderers like to operate in emerging economies since these nations' governments are preoccupied in managing growing industries, businesses, etc.

Instructor’s Notes: Ultimately, foreign investments and enterprises become extremely cautious and eventually decide against opening up operations in these economies. Building a business-friendly atmosphere is difficult once money launderers have taken over an economy.

Slide 13

This slide highlights the negative effects of money laundering on an economy. Money laundering can adversely hit growth rates, money demand, tax revenues, income distribution, and financial institutions of an economy.

Instructor’s Notes:

- Growth Rates: The price instability due to black money in the financial system affects a country's credibility internationally; businessmen find it challenging to invest in such countries because they consider it risky. Investment rates won't rise if legal funds fear from entering a country, thereby adversely impacting long-term sustainable growth

- Tax Revenues: Tax revenues account for the most significant share in public revenue. If this income is low, there is a greater chance that public revenues may fall short of public expenditure, which could result in budget deficits. Governments can’t tax black money income; this lowers tax revenue

- Income Distribution: The circulation of black money in the legitimate financial system creates income disparity. This difference in income distribution and enrichment of certain people and groups can also cause social degeneration. Ultimately, crime rates are likely to rise

- Financial Institutions: Abrupt and unexpected changes can occur in the assets & liabilities of financial institutions that get tangled in money laundering, creating a risk for the institutions. The news of money laundering in such financial institutions damages public perception of the institution

Slide 14

This slide discusses the impact of money laundering on businesses. The growth of the legitimate private sector is hindered by money laundering. Money launderers can sell their goods at lower prices since they operate in many business environments

Instructor’s Notes: Criminals may also buy previously profitable companies and turn these into partners in crime to launder their money. Due to this, the productivity of these companies declines, which, on a larger scale, lowers the productivity of the economy.

Slide 15

This slide talks about the social impact of money laundering. Money laundering encourages crime and corruption, weakens democracy, and compromises the integrity of the society.

Slide 16

This slide highlights the usual methods of money laundering. These are financial businesses, non-financial businesses, trade-based methods, black market peso exchange, and unconventional methods.

Slide 17

This slide discusses how money can be laundered through financial businesses. These are wire transfers, money services, credit cards, and private banking.

Instructor’s Notes:

- Wire Transfer: Wire transfer is a simple and everyday banking product but is the most common method criminals use to launder money. For instance, by taking cash advances on a stolen credit card, criminals can initiate unauthorized domestic or international wire transfers and deposit the money into an account set up to receive such transfers. It is generally used in the layering stage to move the funds around to make it difficult to track

- Money Services: These businesses generally provide forex exchange services, money transfers, or check-cashing. For instance, money launderers make funds available to the criminal organization in the target country in the local currency with the use of money remitters and currency exchangers. The money-launderer or broker then trades the stolen funds for genuine export-related purchases from overseas businessmen

- Credit Cards: Since the industry typically restricts cash payments, credit card accounts are used in the layering or integration stages, not the initial placement stage. For instance, money launderers use funds they have previously placed in the financial system to prepay credit cards, creating a balance on them. Then, they request a refund of the advance payment, thereby creating a layer. These funds can then be used to purchase goods

- Private Banking: Private banking is subject to money laundering risks since a typical client is fairly affluent and is powerful economically, socially, or politically. Banks profit significantly from private banking clients and may not pay close attention to the source of such funds

Slide 18

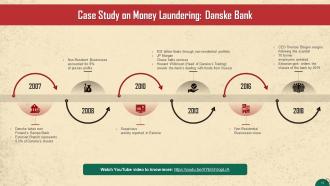

This slide gives information about one of the biggest money laundering scandals in world history. In 2017-2018, it was discovered that from 2007 to 2015, around €200 billion of suspicious transactions from Estonia, Russia, Latvia, and other sources had passed through a branch of Denmark-based Danske Bank in Estonia.

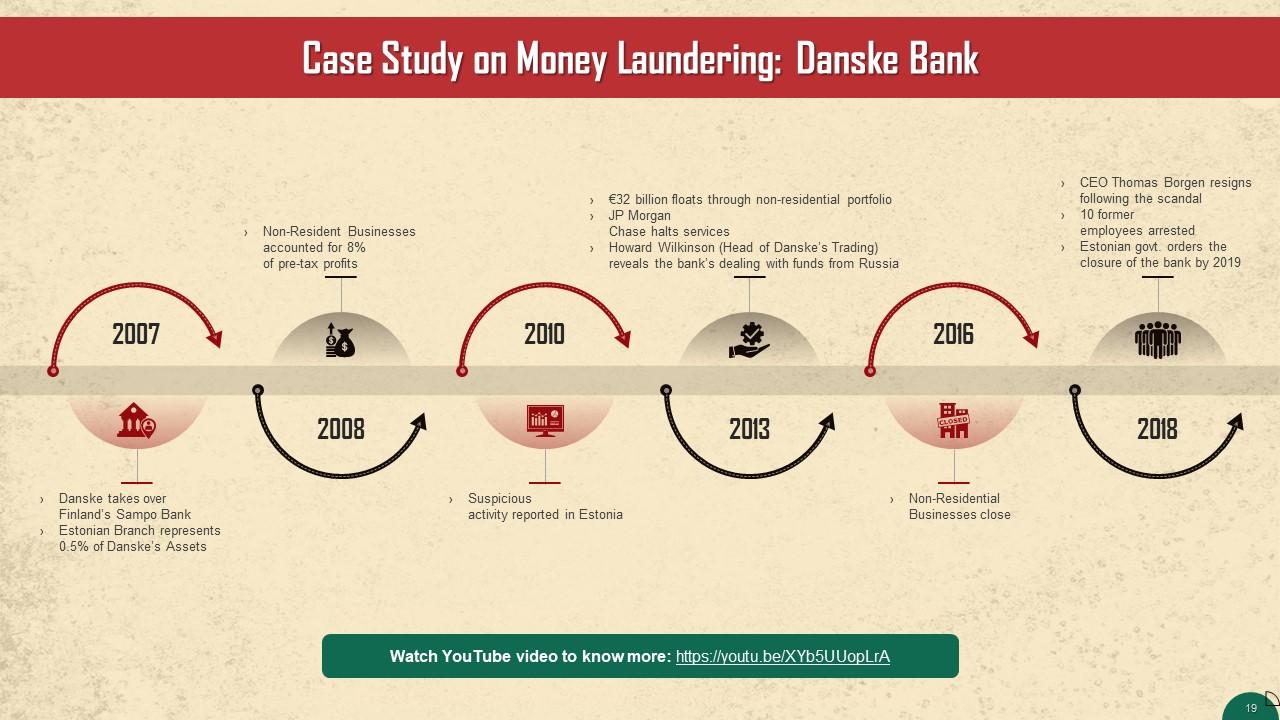

Slide 19

This slide showcases the timeline of Danske Bank Money Laundering Scandal.

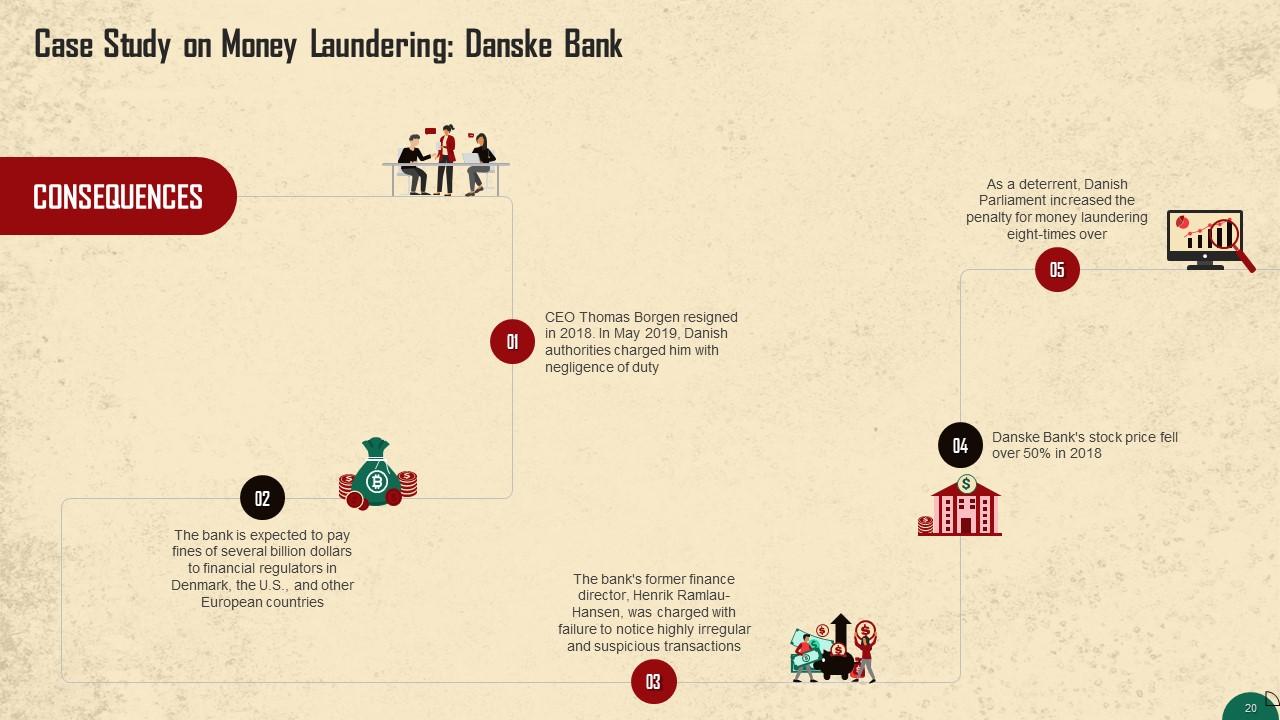

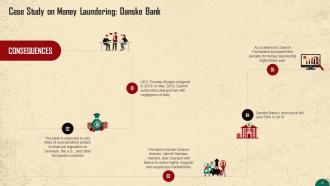

Slide 20

This slide illustrates the consequences of Danske Bank money laundering scandal. As a deterrent, Danish Parliament increased the penalty for money laundering eight-times over.

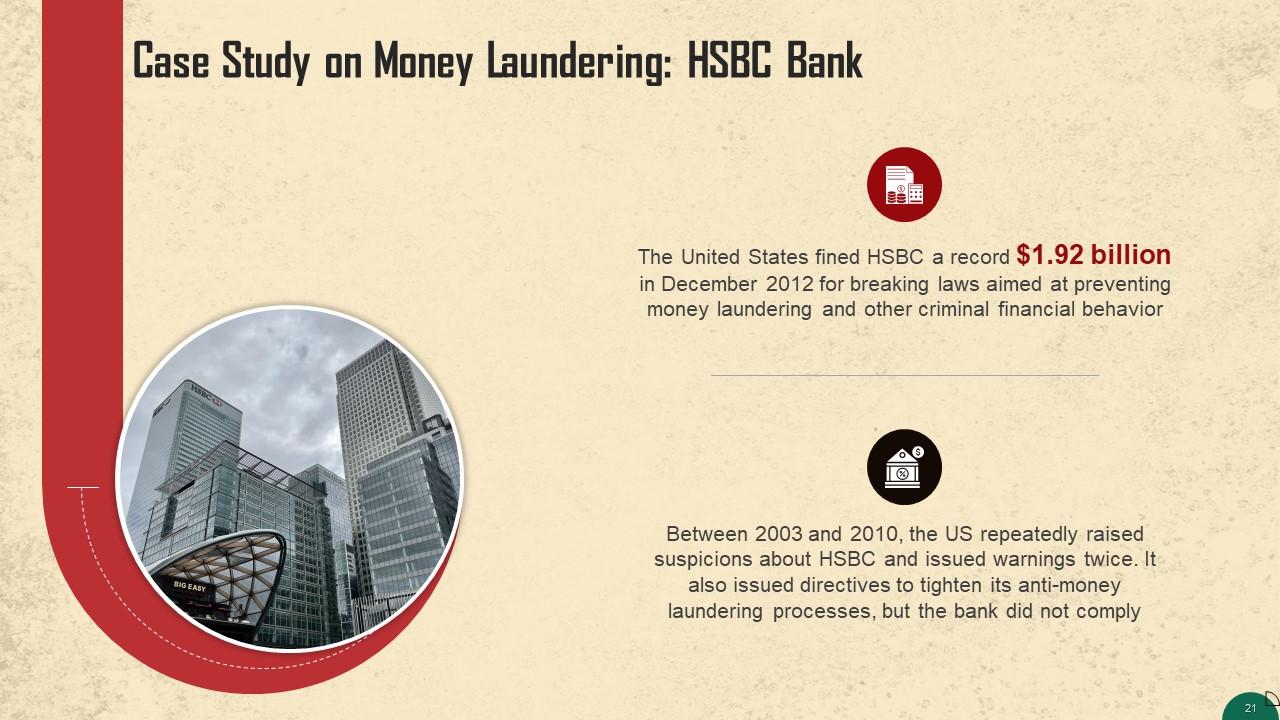

Slide 21

This slide gives an overview of the HSBC bank money laundering scandal. The United States fined HSBC a record $1.92 billion in December 2012 for breaking laws aimed at preventing money laundering and other criminal financial behavior.

Instructor’s Notes: Executives from HSBC's banking division admitted laundering up to $881 billion.

Slide 22

This slide lists the four major failures of HSBC Bank, USA. HSBC failed to do any due diligence on affiliates of the group.

Slide 23

This slide tells us about the fine imposed on HSBC Bank for laundering money. The fine consisted of $1.256 billion in the forfeiture and $665 million in civil penalties. This allowed HSBC to evade criminal prosecution while undergoing a probationary term during which it had to adhere to specific and tougher anti-money laundering regulations.

Slide 24

This slide discusses how money is laundered through non-financial businesses. The conduits in most such cases are casinos, real estate, car dealerships, and cash-intensive businesses.

Instructor’s Notes:

- Casinos: One way to launder money through casinos is when a criminal walks into a casino and buys chips with illegal cash. The criminal then plays for a brief period, loses some money, wins some money, and finally cashes in the chips. The criminal then receives a check and a receipt so that the proceeds can be claimed as gambling winnings

- Real Estate: Money laundering through real estate allows illegal cash to be incorporated into the legitimate economy. It helps criminals to benefit from assets and derived funds while disguising the source of the funds used for payment. This can be done through cash payments, excessively high or low pricing, or non-transparent businesses, trusts, and other third parties that act as legal owners on behalf of the criminals

- Car Dealerships: In this method, a money launderer would generally visit a car dealership and offer to give cash to buy cars, usually at the asking price. Then, the money launderer can resell the vehicle to imply that the money came from selling the vehicle

- Cash-Intensive Businesses: In this kind of fraud, a company that generally expects to receive a significant amount of its revenue in cash also uses its accounts to deposit money obtained illegally. Such businesses frequently conduct their operations openly, generating legal and illegal cash. Parking structures, arcades, pubs, restaurants, etc. are a few examples of these enterprises

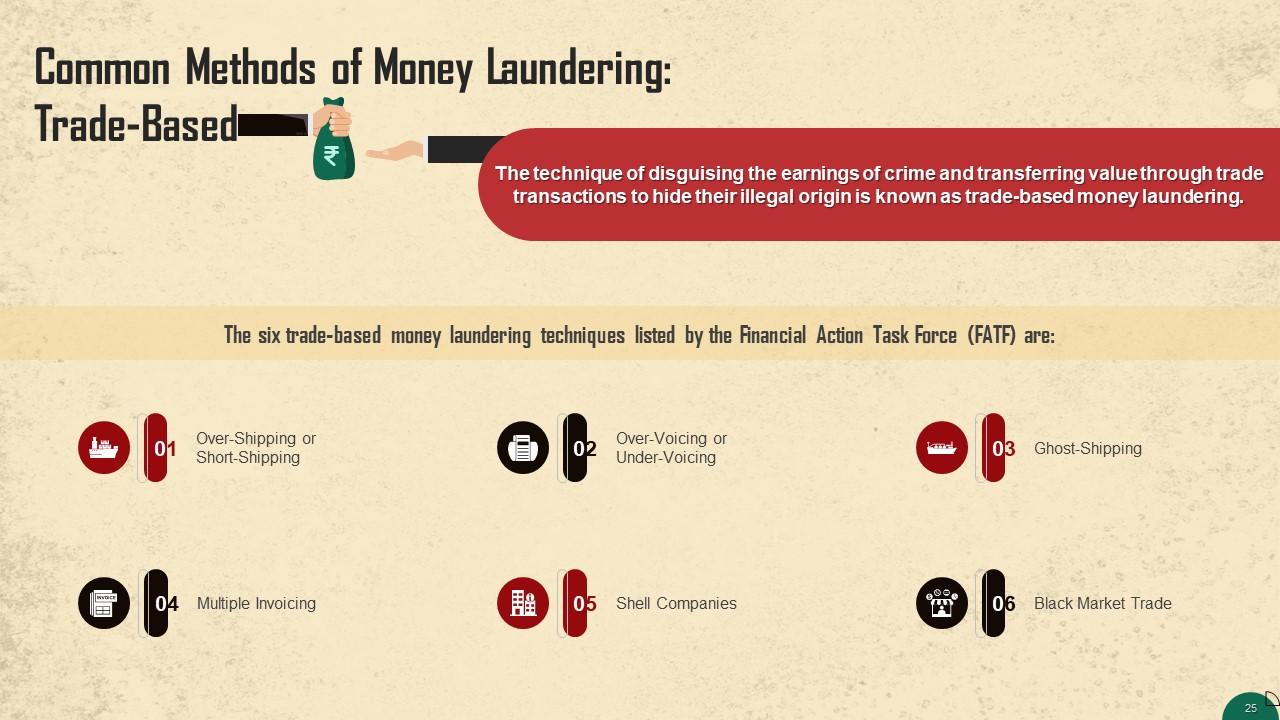

Slide 25

This slide highlights the trade-based methods of money laundering. The technique of disguising the proceeds of crime and transferring value through trade transactions to hide their illegal origin is known as trade-based money laundering.

Instructor’s Notes:

- Over-shipping or short-shipping: This process involves a discrepancy between the number of items billed and shipped, so the customer or seller receives excess value depending on the payment made

- Over-voicing or under-voicing: In the event of over-invoicing, the product or service is priced higher than its actual market cost, allowing the seller to profit from the sale. In contrast, when goods are under-invoiced, the seller can transfer value to the buyer because the goods are priced below the fair market value

- Ghost-shipping: When a buyer and seller work together to produce paperwork stating that products were sold, shipped, and payments were made when no goods were ever shipped, is known as ghost-shipping

- Multiple invoicing: Multiple invoicing refers to the issuance of multiple invoices for the same shipment of goods, giving the potential for money launderers to make multiple payments and use such invoices as documentary evidence to support them

- Shell companies: Shell companies are primarily used to reduce the transparency of ownership in the transaction

- Black market trades: Black market transactions, often known as the Black-Market Peso Exchange, occur when a foreign importer uses a domestic money transfer to pay for goods

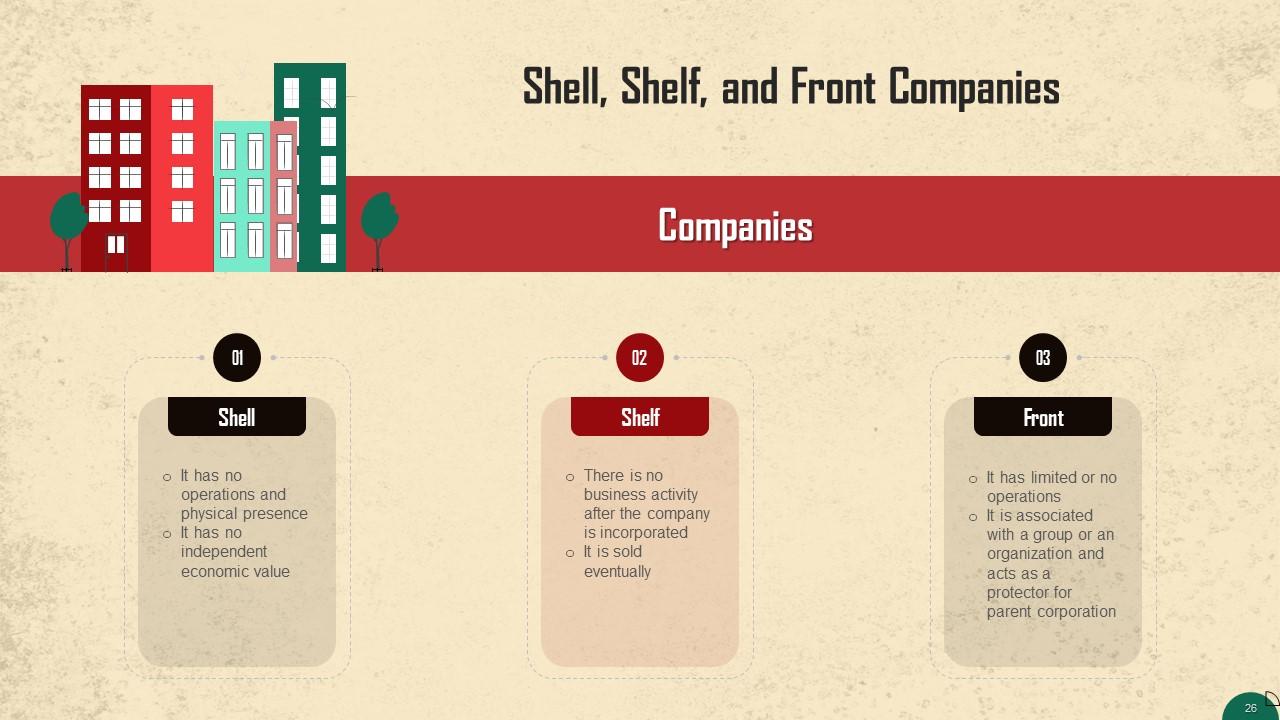

Slide 26

This slide introduces the concept of shell, shelf, and front companies that can be used to launder money. Shell companies are generally non-publicly traded companies, limited liability companies, and trusts. These have emerged as tools for financial crimes such as money laundering since these are easy and inexpensive to form and operate.

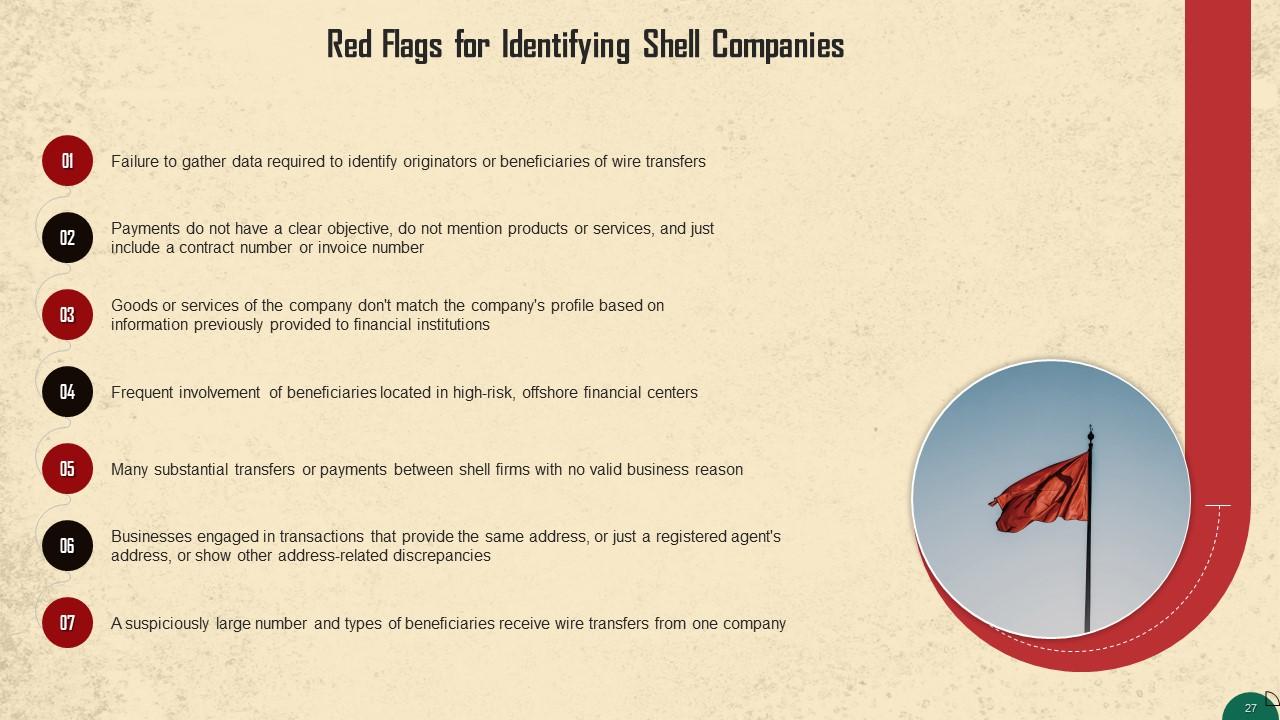

Slide 27

This slide lists the red flags for identifying shell companies.

Slide 28

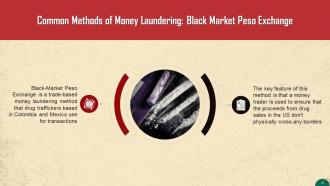

This slide introduces the concept of Black Market Peso Exchange. It is a trade-based money laundering method used by drug traffickers based in Colombia and Mexico.

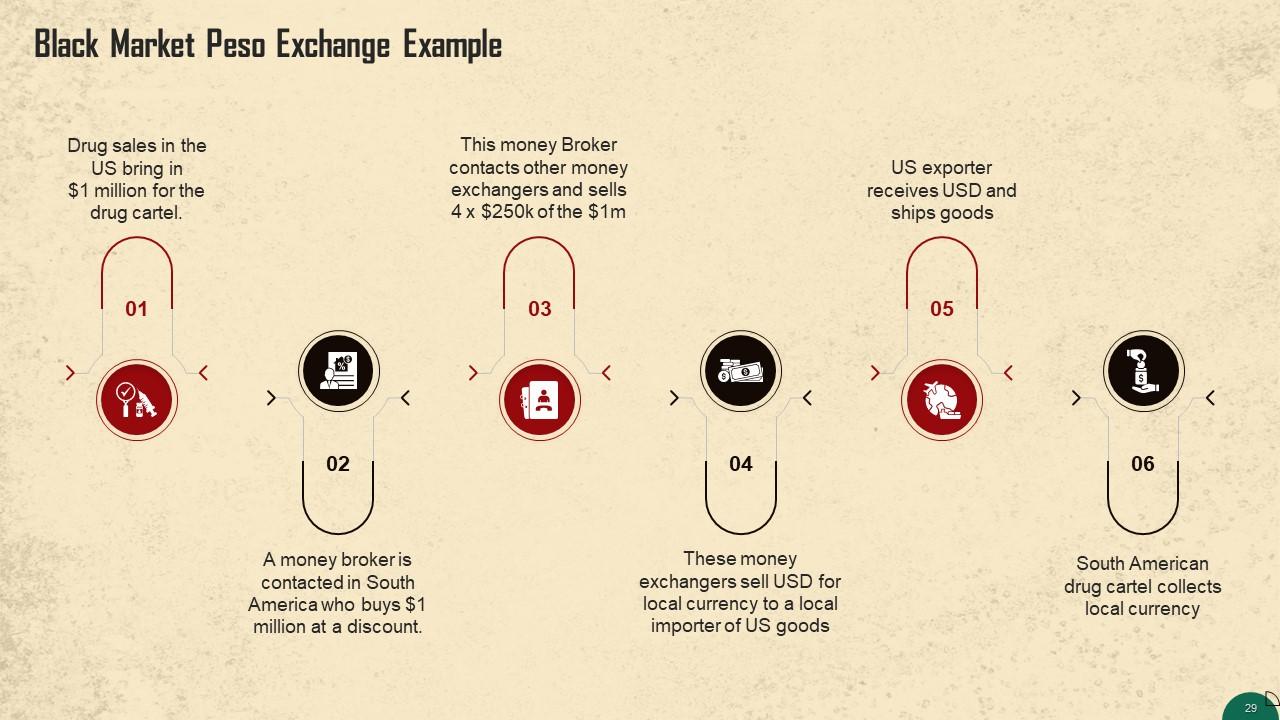

Slide 29

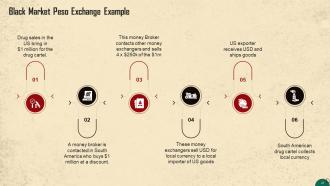

This slide showcases an example of the working of the black market peso exchange. The process is explained by showing the drug cartel making $1 million in drug sales in the US and ends with them being able to convert it to the local currency.

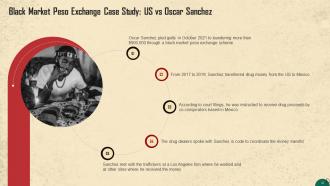

Slide 30

This slide discusses the case of US vs Oscar Sanchez who laundered over $900,000 through a black market peso exchange scheme.

Slide 31

This slide lists some unconventional ways of money laundering. In today’s digital world, several unconventional ways of money laundering have emerged that leverage the opportunities of modern technologies, unfortunately, for illegal purposes.

Instructor’s Notes:

- Online Marketplaces: Numerous online marketplaces have emerged in recent years, enabling people to earn additional income from their resources. Micro merchants or individuals who offer their goods or services through an online marketplace have also increased, which has resulted in a massive economy with vast transaction volume. This is an appealing target for money launderers

- Cryptocurrencies: Cryptocurrencies, which are digital currencies created to function as a medium of exchange, give criminals another way to legalize their money. The US Drug Enforcement Administration has said that manufacturers with operations in China were using bitcoin, a cryptocurrency as a means of evading capital regulations

- Gift & Prepaid Cards: Another method criminals use to generate untraceable funds is by using gift and prepaid cards. They buy prepaid cards in bulk and can then sell them for hard cash

- Peer-to-Peer Payments & Messaging Apps: Peer-to-peer payments are available in many mobile apps due to the expansion of instant messaging and direct communication. For instance, WeChat, PayPal, MasterCard, American Express, Facebook Messenger, etc. This gives criminals another way to launder money

Slide 32

This slide discusses how money can be laundered in the cryptocurrency industry. Criminals launder money by moving digital assets across blockchains, bypassing a centralized service that can track and freeze transactions.

Slide 33

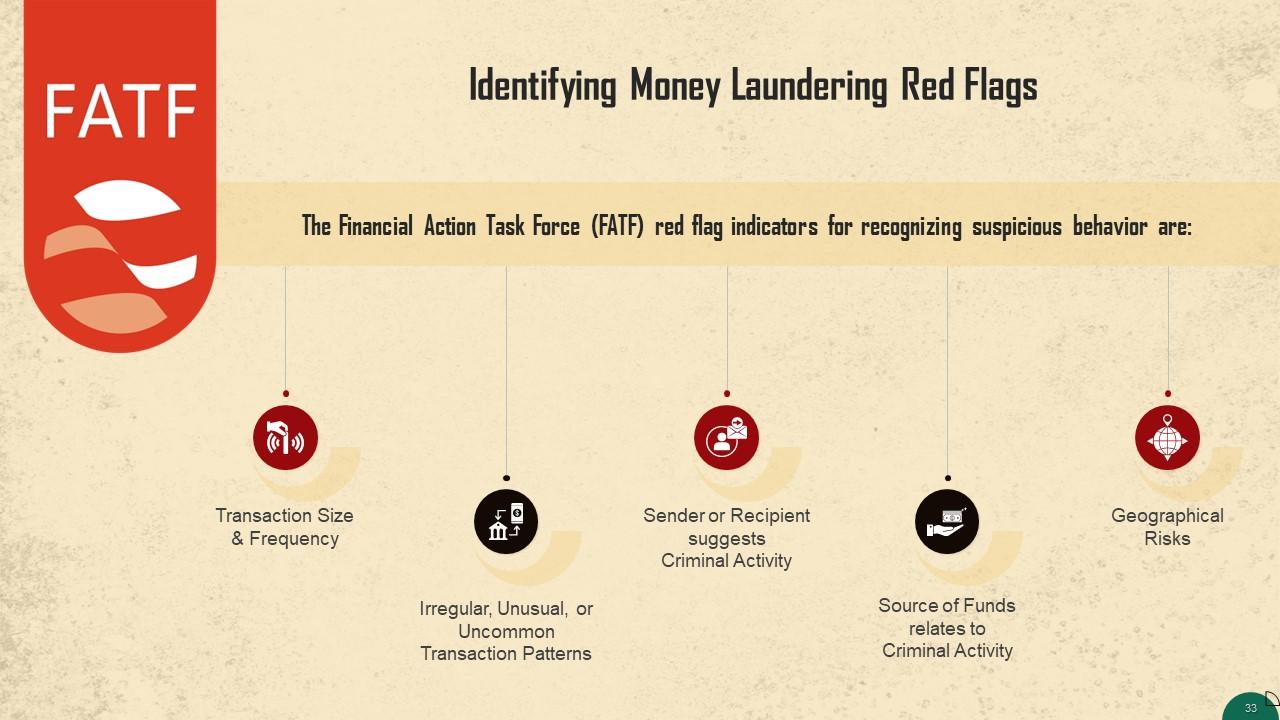

This slide lists the red flag parameters recognized by the Financial Action Task Force (FATF) for identifying money laundering. These can be transaction size & frequency, irregular/unusual/uncommon transaction patterns, sender or recipient suggesting a criminal activity, source of funds relates to criminal activity, and geographical risks.

Slide 34

This slide discusses about transaction size & frequency and irregular, unusual, or uncommon transaction patterns as common indicators to identify money laundering.

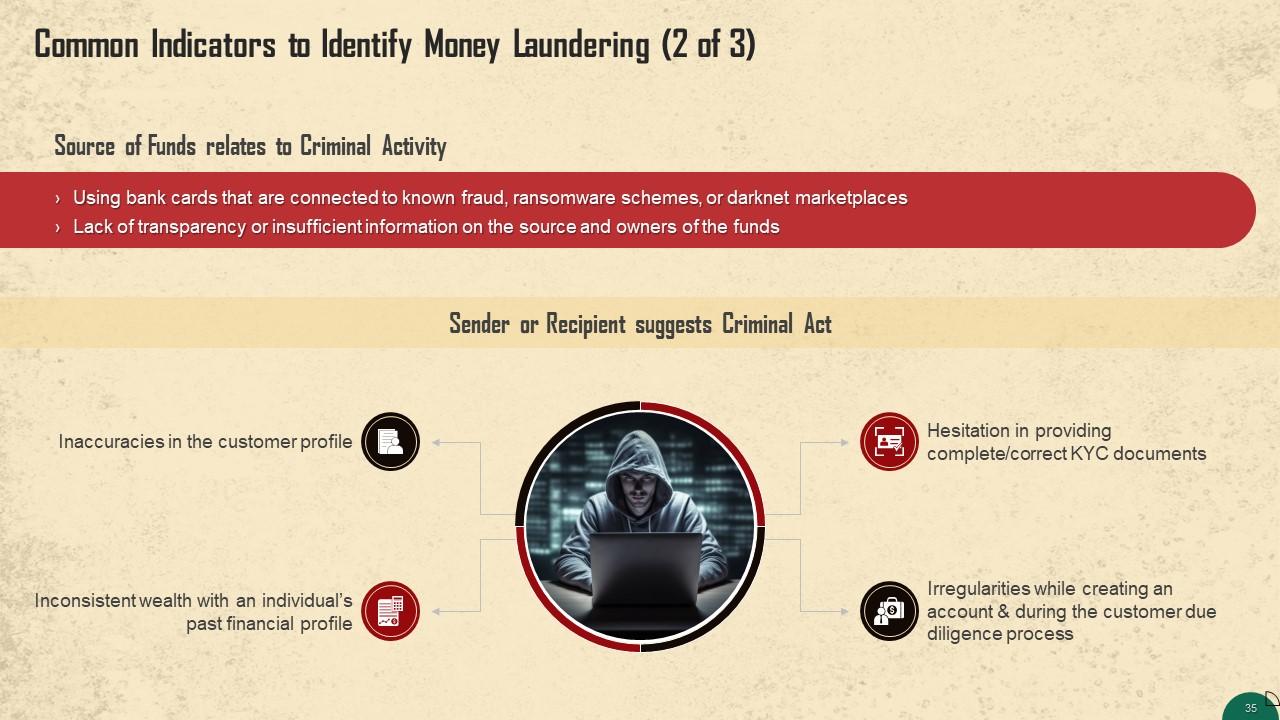

Slide 35

This slide discusses the scenario when the sender or the receiver involved in fund transfer suggest criminal activity. It also highlights source of funds relating to criminal activity as a tell-tale sign of money laundering.

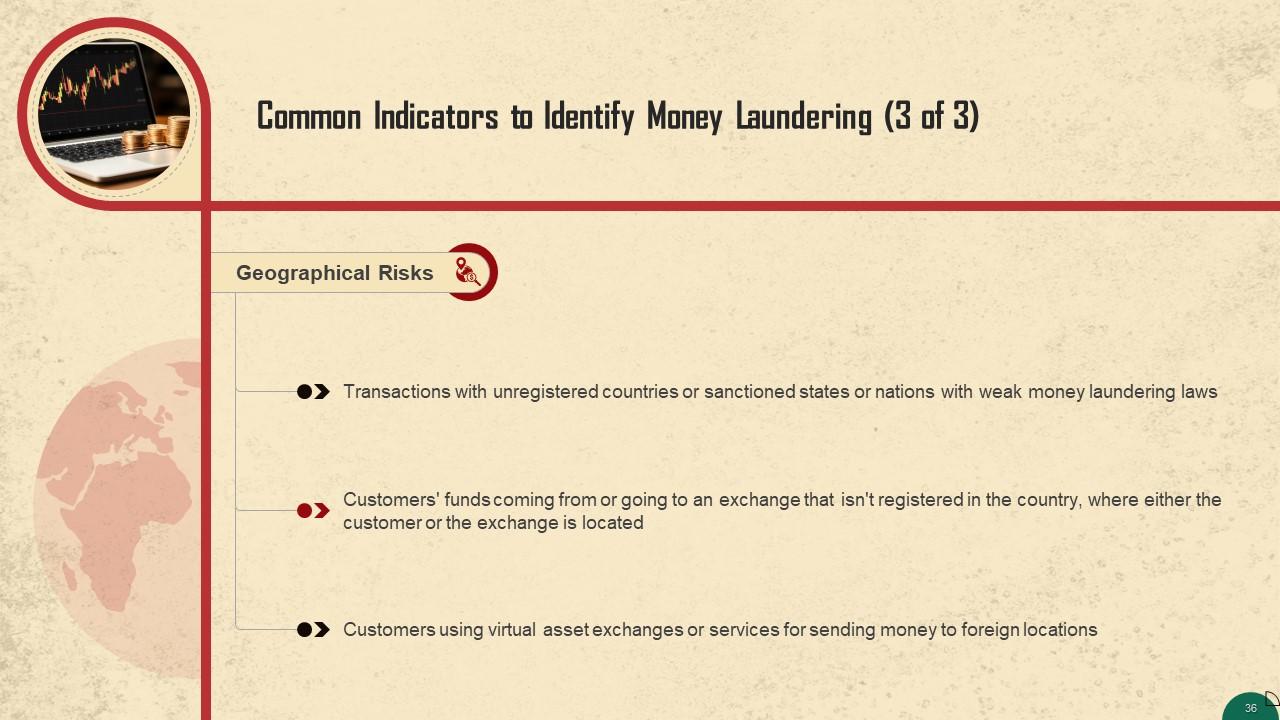

Slide 36

This slide talks about geographical risks as a common indicator to identify money laundering.

Slide 55 to 70

These slides contain energizer activities that a trainer can employ to make the training session interactive and engage the audience.

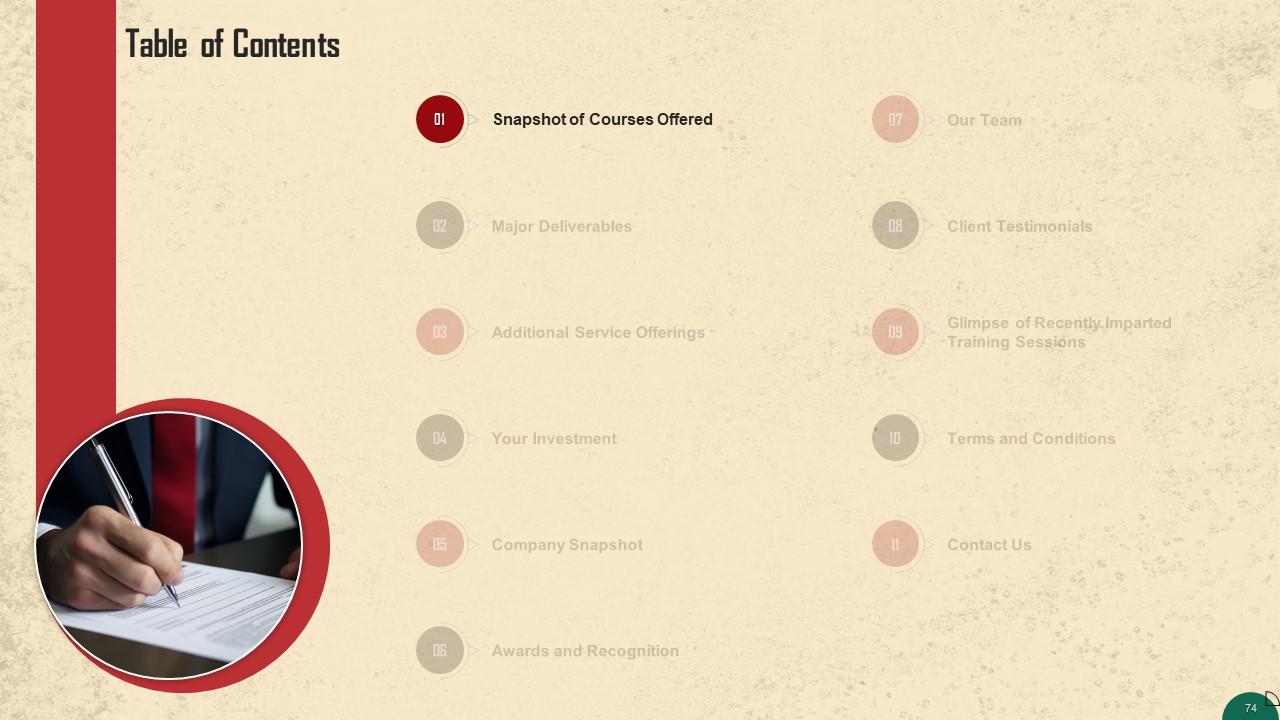

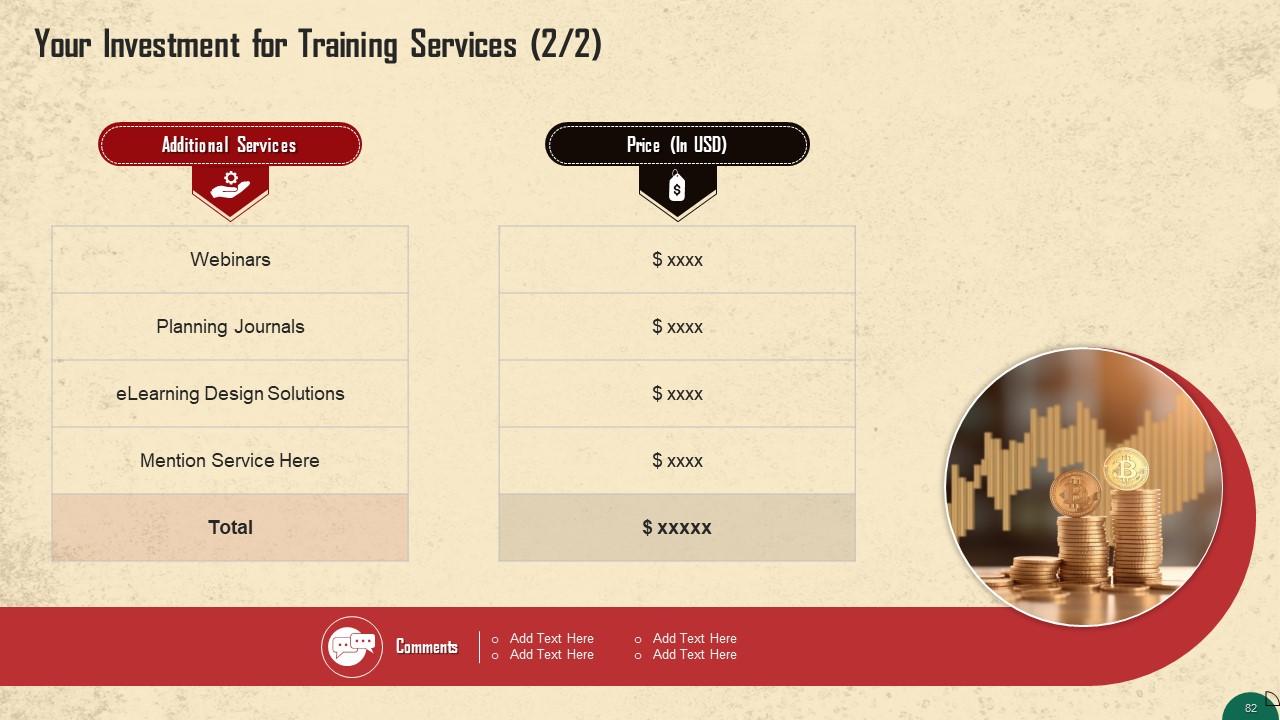

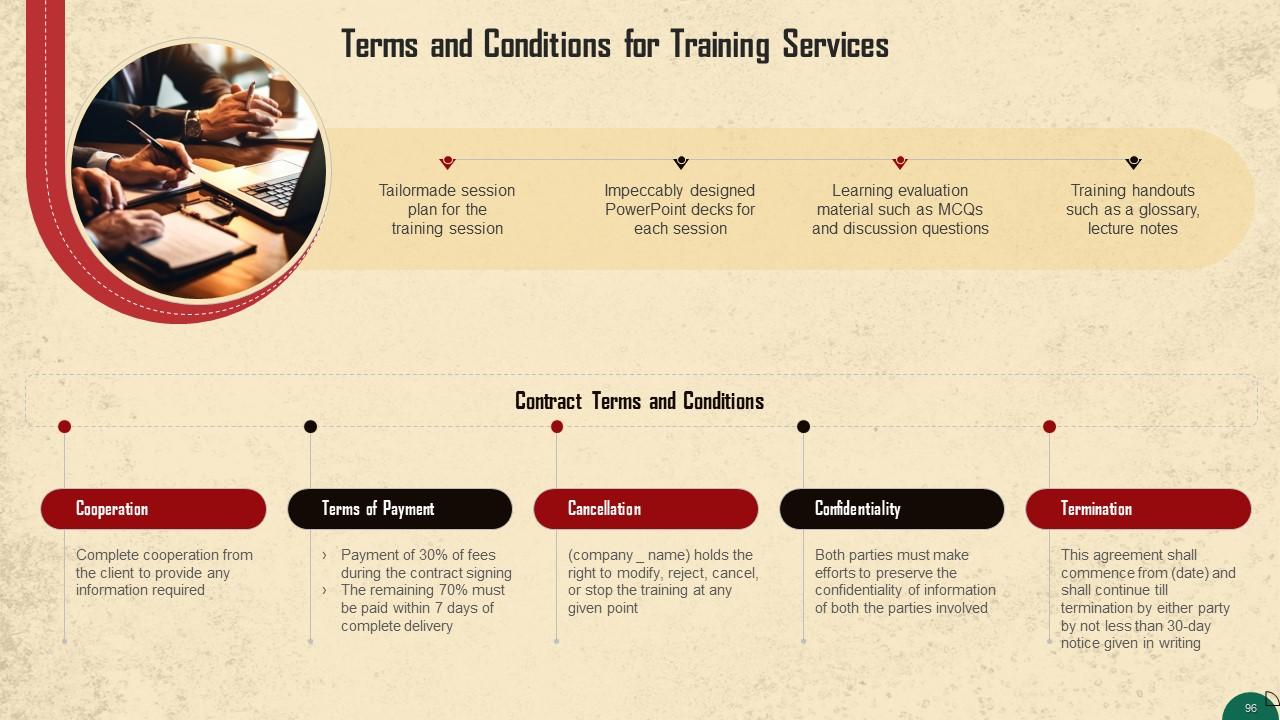

Slide 71 to 98

These slides contain a training proposal covering what the company providing corporate training can accomplish for prospective clients.

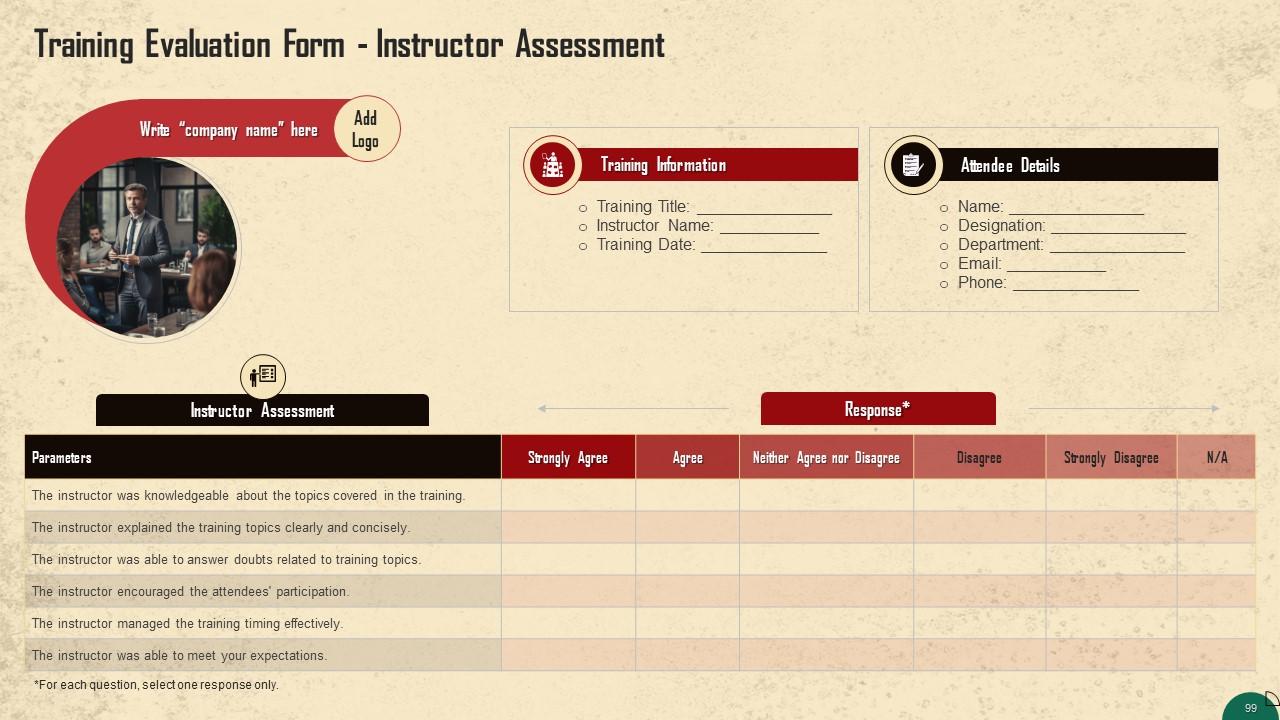

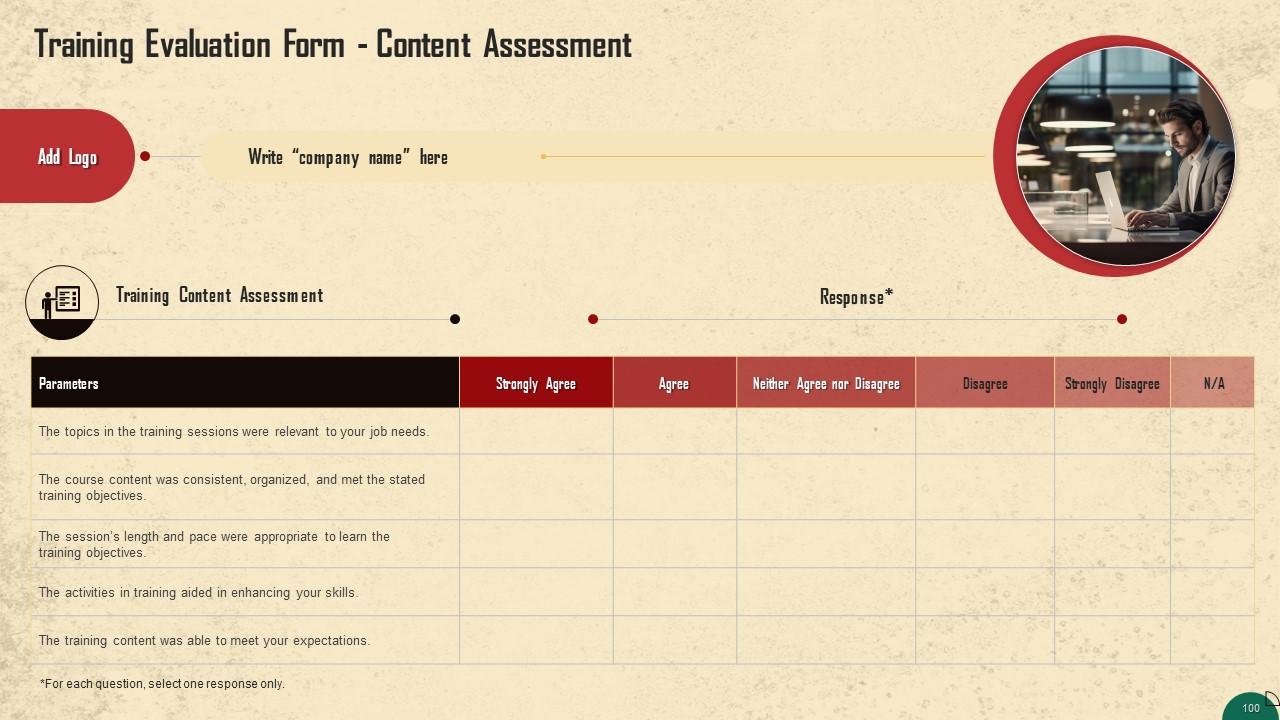

Slide 99 to 101

These slides include a training evaluation form for the instructor, content, and course assessment to assess the effectiveness of the coaching program.

Overview of Money Laundering and its Impact Training Ppt with all 110 slides:

Use our Overview of Money Laundering and its Impact Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Extensive range of templates! Highly impressed with the quality of the designs.

-

Fantastic and innovative graphics with useful content. The templates are the best and latest in the industry.